Pulmonary Arterial Hypertension Market Overview

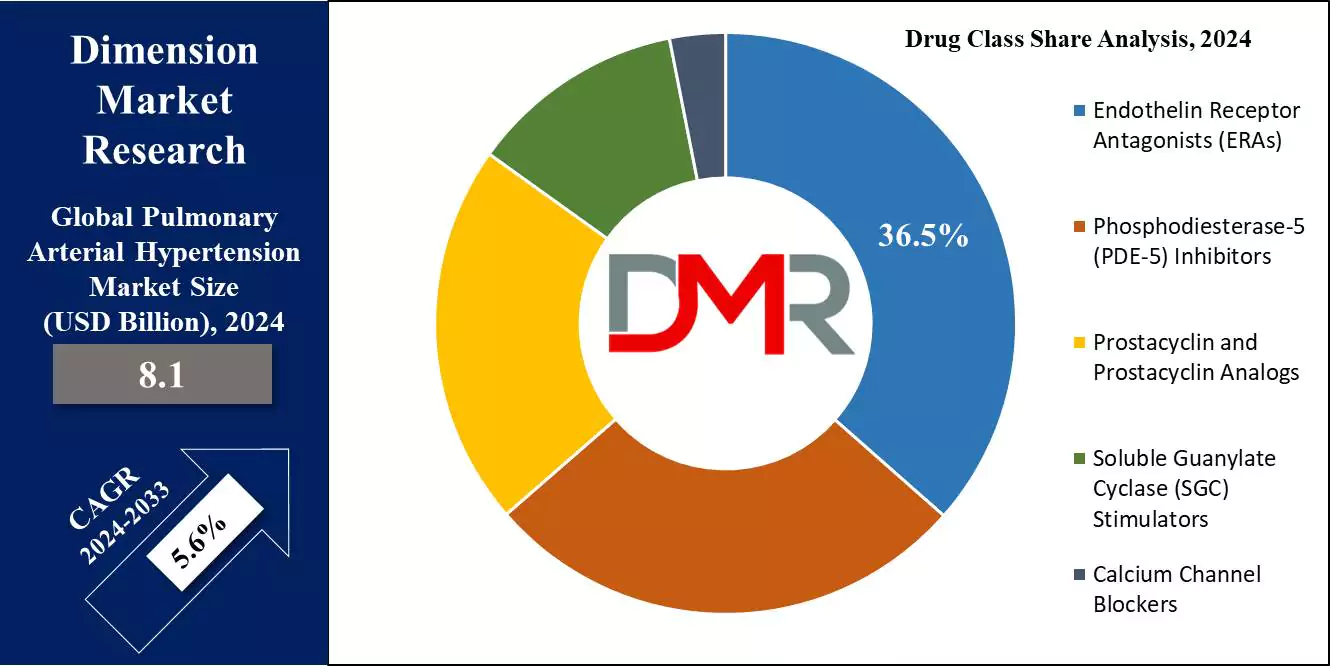

The Global Pulmonary Arterial Hypertension Market size is expected to reach a value of USD 8.1 billion in 2024, and it is further anticipated to reach a market value of USD 13.2 billion by 2033 at a CAGR of 5.6%.

Government support for drug development of pulmonary arterial hypertension (PAH), a serious condition affecting 32.5 per million in the US and Europe (American Journal of Managed Care 2021), is crucial. Government agencies work collaboratively with pharmaceutical companies, research institutions, healthcare organizations, and non-profits providing financial aid, regulatory guidance, and incentives such as grants, thereby fostering growth in the PAH therapeutics market.

Grants enable preclinical trials while supporting innovative therapies; one example being the National Institutes of Health providing USD 2.7 million funding to Eko in 2022. Regulatory bodies like FDA and EMA offer fast track designations or priority reviews which allow expedited approvals with Merck's Sotatercept receiving FDA priority review status in 2023.

The global pulmonary arterial hypertension (PAH) market involves the treatment and management of a specific indicated disease, which is a chronic and gradually worsening condition that results in increased pressure in the pulmonary arteries. This therapeutic domain is a key segment of the broader rare cardiovascular disease market, highlighting its specialized nature.

PAH reduces the blood flow and may cause heart failure if not treated on time. One trend influencing market growth is the growth in the high incidence of pulmonary arterial hypertension as the disease is steadily progressing, more and more patients are receiving treatment due to increased recognition and developed diagnostic tools.

Some of the major market players in this market are United Therapeutics, Johnsons & Johnson, and Pfizer which are investing in research and development of new as well as enhanced treatment types of PAH that focus on prostacyclin and prostacyclin analogs, endothelin receptor antagonists, and phosphodiesterase-5 inhibitors.

In addition, more selective pulmonary arterial hypertension therapeutic interventions, focusing on oral and inhaled therapies, have further provided better results and higher compliance levels for the patients. It has been established that market expansion is caused by high investments in research and development initiatives, as well as stronger regulatory clearances. Moreover, a greater understanding of PAH treatments and improved reimbursement policies is expected to bolster market growth in the upcoming years.

The US Pulmonary Arterial Hypertension Market

The US Pulmonary Arterial Hypertension Market is projected to be valued at USD 2.5 billion in 2024, which is further expected to grow up to USD 4.0 billion in 2033 at a CAGR of 5.3%. The U.S. Pulmonary Artery Hypertension Market is one of the major contributors to global pulmonary arterial hypertension market growth due to increased awareness, advances in diagnostic technologies, and strong ventures into research and development within this region.

One trend that has contributed significantly to U.S. market expansion includes an increasing preference for novel drug delivery methods like oral and inhaled therapies that increase patient compliance. Increased use of prostacyclin, prostacyclin analogs, and endothelin receptor antagonists has dramatically enhanced treatment results and greatly contributed to increasing survival rates among patients.

Other key trends include an increasing number of

clinical trials conducted using early-stage drug candidates in Phase I and II trials specifically, which aim to expand therapeutic avenues for PAH patients. United Therapeutics and other top companies, such as Prostracyclin Analogs Inc., are actively engaging in developing novel treatments designed to slow progression.

Increased diagnostic capabilities and healthcare provider awareness regarding early diagnosis and symptomatic treatment have contributed to an increasing diagnosed prevalence of PAH in the U.S. Favorable reimbursement policies and government initiatives designed to bring advanced treatments for pulmonary arterial hypertension to patients also play a pivotal role in increasing market growth in the U.S. These aspects serve to augment its growth potential further and strengthen its market position, highlighting its importance within the cardiopulmonary therapeutics landscape.

Pulmonary Arterial Hypertension Market Key Takeaways

- Global Market Value: The size of the Global Pulmonary Arterial Hypertension market is estimated to be USD 8.1 billion in 2024 and is expected to reach USD 13.2 billion in 2033.

- The US Market Share: The US pulmonary arterial hypertension market is projected to be valued at USD 4.0 billion in 2033 from a base value of USD 2.5 billion in 2024 at a CAGR of 5.3%.

- By Drug Class Segment Analysis: The drug class segment is expected to be led by endothelin receptor antagonists (ERAs) that are expected to account for 36.5% of the market share by 2024.

- By Pipeline Analysis: The pipeline analysis segment in the early-stage drug candidates are expected to majorly engage Phase I & II drug candidates and is projected to have a 63.1% market share in 2024.

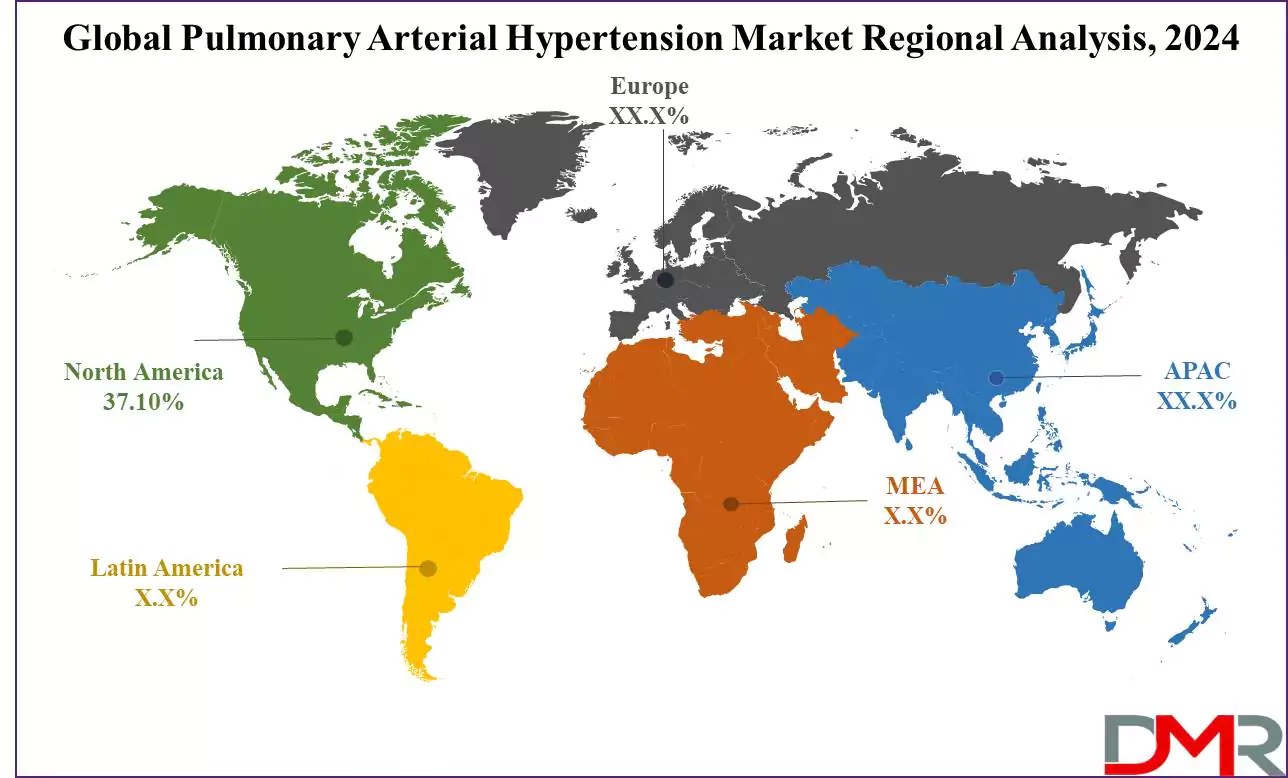

- Regional Analysis: North America is likely to remain the largest consumer in this market taking a market share of approximately 37.10% in 2024.

- Key Players: Top companies in the Global Pulmonary Arterial Hypertension market include Actelion Pharmaceuticals Inc (Johnson & Johnson), United Therapeutics Corporation, Bayer AG, GlaxoSmithKline Plc., Gilead Sciences Inc., Pfizer Inc., Bristol Myers Squibb among others.

- Global Growth Rate: The market is increasing at a compound annual growth rate (CAGR) of 5.6 percent in the course of the forecasted period.

Pulmonary Arterial Hypertension Market Use Cases

- Targeted Drug Therapies: The Pulmonary Arterial Hypertension Market is focused on targeted drug therapy, such as endothelin receptor antagonists and prostacyclin analogs. These have made treatment for PAH patients possible due to better management of their pathophysiology, offering life-extending options in extreme cases.

- Combination Therapies: Various combination therapies by physicians are practiced nowadays that involve a mixture of prostacyclin analogs, phosphodiesterase-5 inhibitors, and endothelin receptor antagonists for better treatment outcomes. These combinations result in better responses associated with delaying disease progression and reducing hospital admissions.

- Early Diagnosis with Biomarkers: Global demand for advanced PAH therapies as well as PDE5 inhibitors and new drug candidates is expected to persist over the long-term, overwhelmingly driving the incremental market growth. The market majors are also considering combination therapies in response to prevalence rates to assure the efficiency of PAH drug regimens.

- Telemedicine for Remote Monitoring: There is higher utilization of sophisticated biomarkers in PAH that enhance identification of the disease in the early stage. The timely diagnosis offers prospects to enhance the quality and a long time of patients with PH through diagnostic and therapeutic intervention in the early stages of PAH.

Pulmonary Arterial Hypertension Market Dynamic

Trends

Shift Toward Personalized Medicine

There is considerable movement in the direction of personalized medicine within the pulmonary arterial hypertension market. The advances in genetic testing and biomarkers have enabled a better understanding of the disease at a molecular level, therefore permitting customized treatment methods. Personalized therapies, targeting selected mechanisms of PAH-like endothelin receptor antagonists, or prostacyclin analogs, tend to become more effective in subpopulations.

This growth in such therapies should improve patient outcomes and decrease the adverse effects. During the forecast period, this trend may drive the market, with more companies focusing on therapies that best suit individual PAH patients' needs, hence doing better segmentation and holding higher market shares for precision drugs.

Growth of Oral Therapies

A key trend to watch out for is the increased leaning toward oral therapies in the pulmonary arterial hypertension treatment market. Traditional therapies, most of which come as intravenous or subcutaneous formulations, are very invasive, though effective, and tend to impact quality of life. Novel oral medications, such as macitentan and sildenafil, present an easier and less invasive alternative for the patient and therefore enhance compliance and long-term outcomes.

These drugs are gaining favor among physicians and patients alike due to their ease of use. The global PAH market is thus experiencing a shift in treating protocols, with the development of new oral formulations of drugs, which again contributes to the growth share of this segment in the global market.

Growth Drivers

Increasing Prevalence of PAH

The key growth drivers for the PAH market include the growing prevalence of pulmonary arterial hypertension. As more awareness and availability of better diagnostic methodologies grow, more cases of pulmonary arterial hypertension come to light, especially in older populations and populations suffering from a variety of other comorbidities, including COPD.

This further expands the patient pool for PAH drugs in several regions; more importantly, in developed markets such as North America and Europe. Thus, the prevalence of PAH remains on the rise around the world, and higher rates of diagnosis and treatment from available health services translate to greater access to advanced treatments that consequently fuel the growth in the global pulmonary arterial hypertension market.

Ongoing Research and Development Efforts

New treatments are still under investigation, and due to this fact, much growth in the global pulmonary arterial hypertension market is being driven. Pharmaceutical organizations greatly invest in research and development to find new PAH drugs targeting molecular pathways, including endothelin receptors and prostacyclin pathways. These R&D efforts have been crucial in furthering ideas for the treatment of the disease and addressing the unmet medical needs in patients with serious or refractory forms of the disease.

United Therapeutics, along with the key market participants, has been involved in the development of new therapies, considering which a strong early-stage drug candidate pipeline is evident, likely to further lead to continuous market expansion in the foreseeable years.

Growth Opportunities

Development of Combination Therapies

Combination therapies remain one of the key avenues of growth in pulmonary arterial hypertension. Since most patients with PAH require multiple drugs to keep the disease under control, combination therapies guarantee greater efficacy and convenience. Combining endothelin receptor antagonists with prostacyclin analogs or phosphodiesterase-5 inhibitors can result in better treatment outcomes owing to various pathways of the disease being targeted.

The pharmaceutical fixed-dose combinations are underscored since such products are more convenient for patients and may improve compliance. The approach contributes not only to the increase in the efficacy of treatment but also opens new opportunities for market expansion, especially in countries where access to numerous therapies remains limited.

Expanding Access to Emerging Markets

The developing markets of Asia-Pacific and Latin America, where the healthcare infrastructure is at a rapid improvement stage, have great growth prospects. Increased funding for healthcare in these regions, along with government initiatives to improve access to treatment, are thus sure to significantly expand their markets, especially as the adoption of

Healthcare IT Solutions continues to enhance patient management, diagnostics, and overall care delivery.

Besides this, increasing awareness about the prevalence of PAH, together with better diagnostic facilities in both corridors, is generating a demand for advanced therapies. Pharmaceutical companies have now started targeting these emerging markets, hence offering a significant opportunity for revenue growth during the forecast period.

Restraints

High Cost of PAH Treatments

One of the major constraints of the pulmonary arterial hypertension market is that treatments for PAH are very expensive. Many of the advanced therapies, which include prostacyclin analogs and endothelin receptor antagonists, are among the highly expensive drugs and thus impose a huge financial burden not only on the patients but also on the healthcare systems. Most of the time, such insurance does not cover treatment costs in low-income and middle-income areas, and thus these life-saving drugs are inaccessible to most people.

This cost barrier remains one of the most important challenges to market growth, since patients in resource-constrained regions may not be in a position to afford such therapies, thus leading to lower adoption rates. This, in turn, reduces the overall market share for pharmaceutical companies in those regions.

Lack of Awareness and Delayed Diagnosis

Another major restraint in the pulmonary arterial hypertension treatment market is the lack of awareness and hence delayed diagnosis. Nonspecific symptoms like PAH keep the disease further at advanced stages. Mostly, it is diagnosed incorrectly with some other diseases like COPD or general heart failure. This leads to a lack of early interventions that could improve patient outcomes and delay disease progression.

Lack of awareness among healthcare providers and the general population regarding PAH limits the pool of patients who can benefit from advanced treatments, hindering market growth and the uptake of new therapeutic options in this space.

Pulmonary Arterial Hypertension Market Research Scope and Analysis

By Drug Class

The endothelin receptor antagonists (ERAs) are projected to dominate the drug class segment in the pulmonary arterial hypertension market as it is anticipated to hold 36.5% of the market share by the end of 2024. Within the PAH market, the drug class segment is commanded by endothelin receptor antagonists because of their efficiency in treating the root vascular dysfunction of the disease.

ERAs such as bosentan, ambrisentan, and macitentan exert their action by inhibiting the impact of a molecule, endothelin, that causes vasoconstriction and proliferation of the vessels in the pulmonary arteries. This reduces the high blood pressure associated with PAH and leads to slowing the disease progression. Due to their ability to enhance exercise capacity, delay clinical worsening, and improve survival rates in PAH patients, the use of ERAs in the global PAH market has just started to rise.

ERAs have become a cornerstone in the treatment of PAH because they target one of the key pathophysiological mechanisms of the disease, namely endothelin-1 overproduction, and thus far are much more effective than any other class of drugs.

Combination therapies including ERAs have also been a point of interest in the pulmonary arterial hypertension treatment market, hence further boosting their lead in the market share. ERA, when used in combination with either prostacyclin analogs or phosphodiesterase-5 inhibitors, offers a comprehensive approach to clinicians for addressing several pathways involved in PAH.

This significantly enhances treatment outcomes and has been responsible for the wide popularity of ERA both in monotherapy and combination regimens. Because of a greater number of clinical studies supporting the long-term benefits of ERAs, the pulmonary arterial hypertension market is expected to further depend upon them. Moreover, due to their favorable safety profile, will contribute to their market growth in the forecast period.

By Type

Branded drugs are anticipated to dominate the type segment of the pulmonary arterial hypertension market in 2024. Branded drugs comprise the major part of the type segment of the pulmonary arterial hypertension market due to certain key reasons, which include established efficacy, gains of trust among healthcare providers, and extensive clinical testing.

Key pharmaceuticals involved in the market are United Therapeutics, Pfizer, and GlaxoSmithKline, owing to the release of branded drugs such as Remodulin and Tyvaso into the market, hence giving these companies a major lead in the global pulmonary arterial hypertension market. This is also attributed to dominance in high market share, as most of them reach the market immediately after being approved by the FDA, which gives them wide adoption in the treatment protocol of pulmonary arterial hypertension.

Branded drugs are backed by extensive research and development, guaranteeing quality and standards that meet all regulatory requirements and assure efficacy in treating patients with pulmonary arterial hypertension.

Another reason is that branded drugs have very strong protection by way of patents, reducing the number of generic alternatives. Exclusivity, therefore, allows manufacturers to charge premium prices to strengthen revenues and attain the maximum market share in the global arena. Physicians also show greater preference for branded drugs since their clinical trial data is comprehensive, as are their safety profiles.

Also, most of the branded PAH drugs have patient assistance programs, which reduce the financial burden on the patients and help them to continue their use for a long period. These are acting as contributing factors to a greater market share of branded drugs in the global pulmonary arterial hypertension market.

By Pipeline Analysis

Early-stage drug candidates in Phase I and Phase II clinical trials are projected to dominate the pipeline analysis segment of the pulmonary arterial hypertension market with 63.1% of the market share in 2024. Early-stage drug candidates, in Phase I and Phase II clinical trials, dominate the pipeline analysis segment of the pulmonary arterial hypertension market due to high investment with focused efforts on novelty. These candidates represent the future of treatment options for pulmonary arterial hypertension, as pharmaceutical firms are putting heavy funding into research and developing novel treatments to fulfill unmet medical needs.

In the face of the increasing prevalence of pulmonary arterial hypertension, developers are putting emphasis on early-stage trials that investigate new pathways and drug targets that can delay the course of the disease or even reverse the disease process.

This is very important in PAH due to the fact that the available treatments just alleviate symptoms without offering a cure. Early drug candidates have the potential to revolutionize the treatment of pulmonary arterial hypertension through new mechanisms of action, such as anti-inflammatory or anti-fibrotic therapies.

Additionally, the market report highlights that early-stage drug candidates in development are focused on an oral route of therapy that may potentially gain obvious improvements in patient compliance and ease of administration. These candidates, as they progress through clinical development, can capture significant market shares, especially in regions with a rising prevalence of pulmonary arterial hypertension.

The dominant Phase I and Phase II drug candidates are driven by the unmet need for safer treatments that are more effective at improving long-term outcomes for pulmonary arterial hypertension patients. Candidates in this pipeline are the offerings of the next generation of pulmonary arterial hypertension driving market growth in coming years as new entrants progress toward regulatory approval.

By Route of Administration

The oral route of administration is anticipated to dominate the pulmonary arterial hypertension market due to ease of administration, patient preference, and convenience. Indeed, oral drugs provide substantial convenience over intravenous or inhaled therapies in simplifying the PAH treatment process and enabling self-management of patients at home without the need for special equipment or frequent visits to hospitals.

This increased demand has clearly reflected in the growing market share of drugs such as sildenafil, sold under the brand name Revatio, and macitentan, sold under the brand name Opsumit, among others, which are some of the most prescribed drugs due to their efficacy as well as easy administration.

The oral route ensures better patient compliance - an important fact in chronic conditions such as pulmonary arterial hypertension. Patients will most likely comply with a once-daily oral regimen, thereby increasing the success rate in the long run and assuring a better quality of life.

Also, with the gradual rise in demand for less invasive therapies, pharmaceutical companies are involved in the development of new oral therapies for PAH.

Most of the early-stage drug candidates under clinical trial studies are for oral administration, thus further establishing the lead taken by the oral segment. Oral therapies also prove to be cost-effective in the long run; they reduce the burden on the healthcare system as they minimize hospitalization and intravenous administration. It is expected that the oral route of administration will remain dominant in the PAH market, with companies developing more advanced formulations offering sustained release and improved bioavailability so as to remain a preferred choice both for patients and healthcare providers.

By Distribution Channel

Hospital pharmacies are projected to hold the dominant position in the distribution channel of the pulmonary arterial hypertension (PAH) market in 2024.

The nature of the disease, treatment complexity, and health infrastructure are some factors that will continue to make hospital pharmacies the dominant distribution channel in the PAH market. Treatments for PAH include highly specialized drugs, such as prostacyclin analogs and endothelin receptor antagonists, which are often administered clinically under the supervision of healthcare professionals.

For example, intravenous or subcutaneous prostacyclin therapies require very cautious management, which is mostly carried out in the hospital and specialty care institutions. Such therapies involve correct handling, adjustment of dosing, and continuous monitoring of patients, which is well organized through systems based in hospitals.

Moreover, a new range of PAH treatments, namely injectable, intravenous, and inhaled formulations, will be better positioned to stock up with hospital pharmacies. Therefore, they have emerged as a favorable option for those patients suffering from grave or advanced stages of the disease. In particular, this holds true for patients who need instant initiation of treatment after diagnosis or at the time of worsening of the disease, where the availability of critical drugs is guaranteed in the hospital pharmacies.

The high cost and specialized nature of PAH therapies further lead to a concentrated distribution of these therapies in hospitals, where insurance coverage and reimbursement systems are better integrated. Hospital pharmacies do have the infrastructures and expertise to navigate complex reimbursement processes that secure patients' access to very expensive treatments such as macitentan and riociguat. This situation makes the hospital pharmacies very important in ensuring patient compliance and continuity of care, which secures their dominant position in the PAH market distribution channel.

The Pulmonary Arterial Hypertension Market Report is segmented based on the following

By Drug Class

- Endothelin Receptor Antagonists (ERAs)

- Phosphodiesterase-5 (PDE-5) Inhibitors

- Prostacyclin and Prostacyclin Analogs

- Soluble Guanylate Cyclase (SGC) Stimulators

- Calcium Channel Blockers

By Type

By Pipeline Analysis

- Early-stage Drug Candidates (Phase I & Phase II)

- Late-stage Drug Candidates (Phase III & Registration Phase)

By Route of Administration

- Oral

- Intravenous/ subcutaneous

- Inhalational

By Distribution Channel

- Hospital Pharmacies

- Retail Pharmacies

- Online Pharmacies

How Does Artificial Intelligence Contribute To Improve Pulmonary Arterial Hypertension Market ?

- Early Detection and Diagnosis: AI-powered tools analyze medical data, such as imaging, electronic health records, and biomarkers, enabling earlier and more accurate identification of PAH. Machine learning algorithms help identify subtle patterns often missed by conventional methods.

- Personalized Treatment: AI facilitates precision medicine by analyzing patient-specific data to tailor therapies. Predictive analytics optimize drug efficacy, reducing adverse effects and improving outcomes.

- Drug Discovery: AI accelerates drug development by identifying potential therapeutic targets, predicting compound behavior, and optimizing clinical trial designs, saving time and costs.

- Remote Monitoring: AI-integrated wearable devices and sensors track vital signs and symptoms in real time, providing actionable insights to healthcare providers and empowering proactive care.

- Improved Efficiency: Artificial Intelligence enhances clinical workflows, from automating administrative tasks to supporting clinicians with decision-making tools, enabling more efficient management of PAH patients.

Pulmonary Arterial Hypertension Market Regional Analysis

North America is projected to dominate the pulmonary arterial hypertension market as it is anticipated to account for

37.10% of the total revenue by the end of 2024. North America dominates the pulmonary arterial hypertension market share due to several key factors like the well-developed healthcare infrastructure in the region, raised awareness of PAH, and the high prevalence of the disease.

Its leading positions are further strengthened with the presence of top pharmaceutical players like United Therapeutics, Pfizer, and Johnson & Johnson, who represent the front in the development and innovation of PAH drugs. The main factor driving the market growth is probably due to the increasing prevalence of pulmonary arterial hypertension, especially in developed North American states such as the United States of America.

Early stages of impending disease are indeed being diagnosed with biomarkers in advanced diagnostic technologies using genetic testing to help in the effective management of PAH. Early diagnosis demands the various therapies available to treat PAH, thus urging the market growth further.

The favorable reimbursement policies have, besides, made treatments available to a great number of citizens; hence, favorable reimbursement policies prevail in the U.S. pulmonary arterial hypertension market.

The insurance coverage for highly-priced PAH drugs, such as prostacyclin analogs and endothelin receptor antagonists, has given favor to patient uptake, further cementing the leading position of the region in the market under consideration. That North America holds the leading position is also supported by the strong research and development the region possesses.

This is mainly due to heavy investments by regional pharmaceutical companies in clinical trials targeted at the discovery of new therapies for PAH, with an emphasis on early-stage drug candidates targeting unmet medical needs because of the disease condition.

Government initiatives in the region also go further than raising awareness about PAH to promote treatment for the condition, which is another force driving the growth of the market. Further, the established healthcare infrastructure in North America provides easy accessibility to innovative PAH therapeutics and technologies to patients.

This positions North America as the undisputed leader in the global pulmonary arterial hypertension market. The dominance of the region is expected to persist for the whole of the forecast period due to continuous innovation and demand from patients.

By Region

North America

Europe

- Germany

- The U.K.

- France

- Italy

- Russia

- Spain

- Benelux

- Nordic

- Rest of Europe

Asia-Pacific

- China

- Japan

- South Korea

- India

- ANZ

- ASEAN

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Argentina

- Colombia

- Rest of Latin America

Middle East & Africa

- Saudi Arabia

- UAE

- South Africa

- Israel

- Egypt

- Rest of MEA

Pulmonary Arterial Hypertension Market Competitive Landscape

The nature of competition is very high in the PAH market, with a few leading players in the field of innovation, development of drugs, and holding the highest market shares. United Therapeutics, Pfizer, Johnson & Johnson, and GlaxoSmithKline are some leading companies that have established a strong presence within the global PAH market due to their extensive portfolios of branded drugs and treatments regarding PAH.

United Therapeutics is also at the forefront of activities within the PAH space, responsible for treatments widely used in advanced stages of the disease, including Remodulin and Tyvaso. The company lays heavy emphasis on research and development, focusing on several early-stage candidates within its product portfolio. While Pfizer is well known for its oral therapy commonly referred to as Revatio-sildenafil, which has become a key player within this field of PAH.

Some of the key therapies in the PAH drug market are provided by Johnson & Johnson with its subsidiary Actelion Pharmaceuticals, including Opsumit, an endothelin receptor antagonist. The acquisition of Actelion by Johnson & Johnson strengthened the latter's position in the PAH drug market. GlaxoSmithKline is also one of the key players with its Flolan therapeutic option within epoprostenol. These companies perform clinical trials throughout to come up with new PAH therapies or enhance the existing ones in their competition to outcompete each other.

With new drug candidates targeting unmet medical needs, the competition is likely to grow as small companies make their entry into the market. While the demand for PAH innovative therapies is on the rise, these companies are now focusing on clinical advancements to grab the market share.

Some of the prominent players in the Global Pulmonary Arterial Hypertension Market are

- Johnson & Johnson (Actelion Pharmaceuticals)

- United Therapeutics Corporation

- Bayer AG

- GlaxoSmithKline plc

- Gilead Sciences, Inc.

- Pfizer Inc.

- Bristol Myers Squibb

- Merck & Co., Inc.

- AbbVie Inc.

- Novartis AG

- Arena Pharmaceuticals, Inc.

- Liquidia Corporation

- Other Key Players

Pulmonary Arterial Hypertension Market Recent Developments

- October 2024: United Therapeutics announced the FDA approval of an expanded indication for Tyvaso DPI, making it available for pediatric patients diagnosed with PAH. The new approval is expected to improve treatment options for younger patients.

- August 2024: Pfizer initiated a Phase II clinical trial for a new oral prostacyclin receptor agonist to improve long-term outcomes for PAH patients. The study will evaluate the safety and efficacy of the drug in a diverse patient population.

- June 2024: Johnson & Johnson's Actelion Pharmaceuticals received EMA approval for a new fixed-dose combination therapy that includes macitentan and a phosphodiesterase-5 inhibitor for PAH treatment.

- April 2024: GlaxoSmithKline announced positive results from a Phase III trial for a novel inhaled therapy designed to improve exercise capacity and delay disease progression in patients with advanced pulmonary arterial hypertension.

- March 2024: Arena Pharmaceuticals announced that its new early-stage drug candidate targeting pulmonary fibrosis-related PAH has successfully moved into Phase I clinical trials.

- January 2024: Merck entered the PAH market by acquiring a biotech company focused on developing oral PAH therapies. It plans to launch a new Phase I/II clinical trial for its lead candidate.

- December 2023: Bayer AG released long-term study results for Adempas (riociguat), highlighting its potential in reducing hospitalizations and improving survival rates in PAH patients over five years of treatment.

Pulmonary Arterial Hypertension Market Report Details

|

Report Characteristics

|

| Market Size (2024) |

USD 8.1 Bn |

| Forecast Value (2033) |

USD 13.2 Bn |

| CAGR (2024-2033) |

5.6% |

| Historical Data |

2018 – 2023 |

| The US Market Size (2024) |

USD 2.5 Bn |

| Forecast Data |

2025 – 2033 |

| Base Year |

2023 |

| Estimate Year |

2024 |

| Report Coverage |

Market Revenue Estimation, Market Dynamics, Competitive Landscape, Growth Factors and etc. |

| Segments Covered |

By Drug Class (Endothelin Receptor Antagonists (ERAs), Phosphodiesterase-5 (PDE-5) Inhibitors, Prostacyclin and Prostacyclin Analogs, Soluble Guanylate Cyclase (SGC) Stimulators, and Calcium Channel Blockers), By Type (Branded, and Generics, By Pipeline Analysis (Early-stage Drug Candidates (Phase I & Phase II), and Late-stage Drug Candidates (Phase III & Registration Phase)), By Route of Administration (Oral, Intravenous/ subcutaneous, and Inhalational), By Distribution Channel (Hospital Pharmacies, Retail Pharmacies, and Online Pharmacies) |

| Regional Coverage |

North America – The US and Canada; Europe – Germany, The UK, France, Russia, Spain, Italy, Benelux, Nordic, & Rest of Europe; Asia- Pacific– China, Japan, South Korea, India, ANZ, ASEAN, Rest of APAC; Latin America – Brazil, Mexico, Argentina, Colombia, Rest of Latin America; Middle East & Africa – Saudi Arabia, UAE, South Africa, Turkey, Egypt, Israel, & Rest of MEA |

| Prominent Players |

Johnson & Johnson (Actelion Pharmaceuticals), United Therapeutics Corporation, Bayer AG, GlaxoSmithKline plc, Gilead Sciences Inc., Pfizer Inc., Bristol Myers Squibb, Merck & Co. Inc., AbbVie Inc., Novartis AG, Arena Pharmaceuticals Inc., Liquidia Corporation, and Other Key Players |

| Purchase Options |

We have three licenses to opt for: Single User License (Limited to 1 user), Multi-User License (Up to 5 Users) and Corporate Use License (Unlimited User) along with free report customization equivalent to 0 analyst working days, 3 analysts working days and 5 analysts working days respectively. |

Frequently Asked Questions

The Global Pulmonary Arterial Hypertension Market size is estimated to have a value of USD 8.1 billion in 2024 and is expected to reach USD 13.2 billion by the end of 2033.

The US Pulmonary Arterial Hypertension Market is projected to be valued at USD 2.5 billion in 2024. It is expected to witness subsequent growth in the upcoming period as it holds USD 4.0 billion in 2033 at a CAGR of 5.3%.

North America is expected to have the largest market share in the Global Pulmonary Arterial Hypertension Market with a share of about 37.10% in 2024.

Some of the major key players in the Global Pulmonary Arterial Hypertension market are Johnson & Johnson (Actelion Pharmaceuticals), United Therapeutics Corporation, Bayer AG, GlaxoSmithKline plc, Gilead Sciences Inc., Pfizer Inc., Bristol Myers Squibb, and many others.

The market is growing at a CAGR of 5.6 percent over the forecasted period.