Market Overview

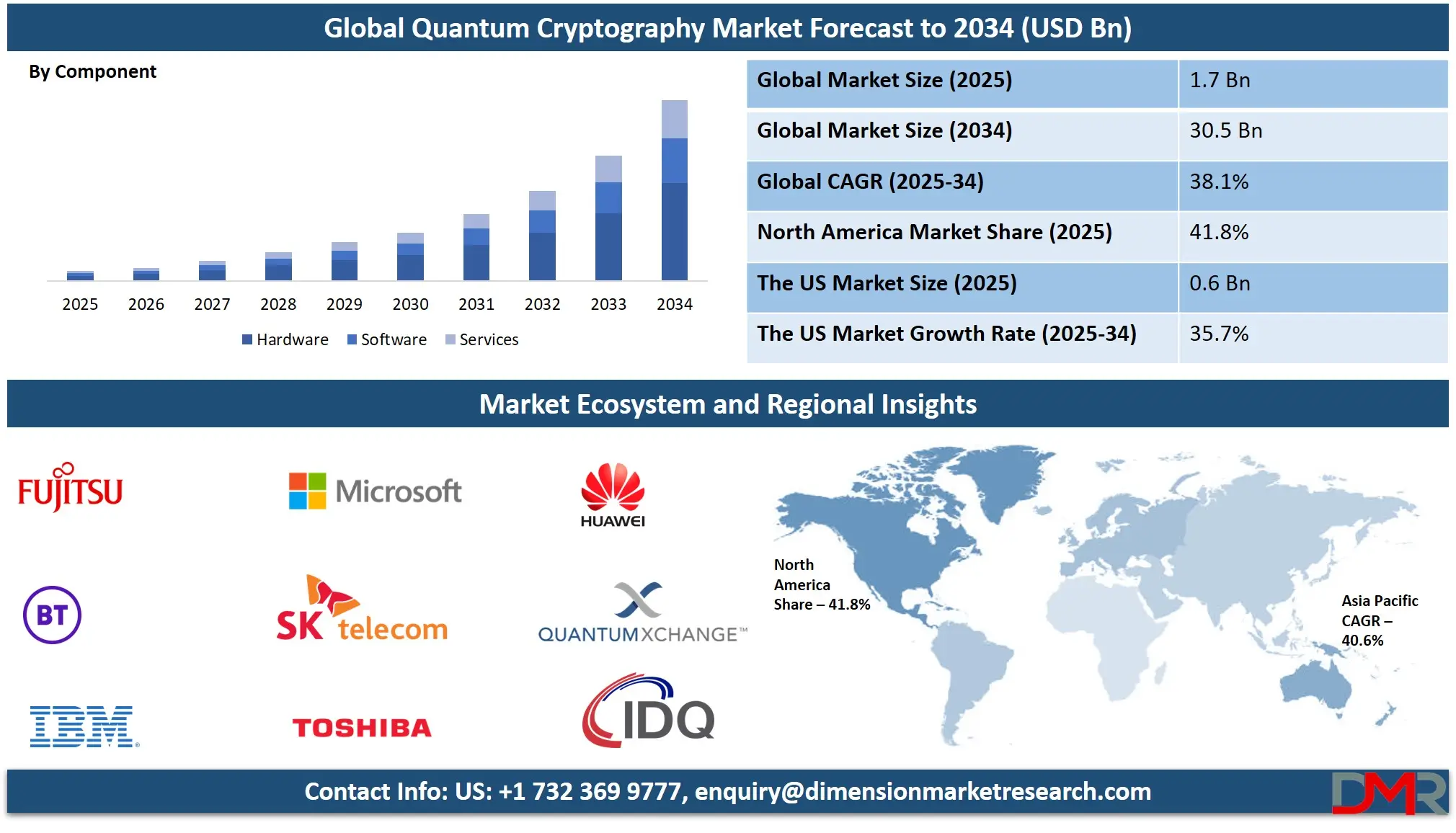

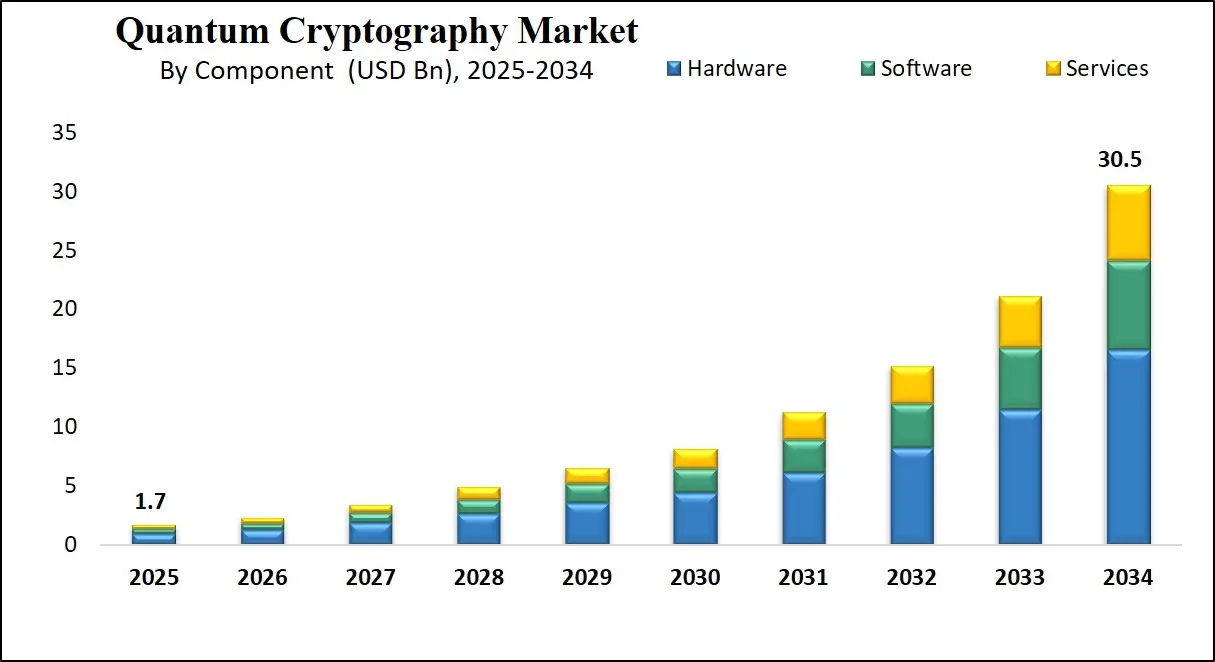

The Global Quantum Cryptography Market size is projected to reach USD 1.7 billion in 2025 and grow at compound annual growth rate of 38.1% from there until 2034 to reach a value of USD 30.5 billion.

Quantum cryptography is a method of securing information using the principles of quantum mechanics, a branch of physics that deals with very small particles like photons. The most common technique in quantum cryptography is Quantum Key Distribution (QKD). QKD allows two parties to share a secret encryption key with complete security. If anyone tries to spy on the key during transmission, the laws of quantum physics will reveal the intrusion, making it highly secure.

ℹ

To learn more about this report –

Download Your Free Sample Report Here

Interest in quantum cryptography has grown rapidly due to increasing cyber threats and the future risk posed by quantum computers. Traditional encryption methods, like RSA, are expected to become vulnerable to attacks from quantum computers. Quantum cryptography is seen as a possible solution because it is based on the laws of physics, not on the difficulty of solving mathematical problems. This means it remains secure even against future powerful machines.

Over the last few years, several countries and companies have launched quantum communication projects. For example, China has successfully tested quantum satellites and built a long-distance quantum communication network. In Europe and North America, governments and tech firms have started developing secure quantum communication networks for military, finance, and critical infrastructure. These efforts are building the foundation for a global quantum-safe communication system.

Recent trends show a growing shift toward hybrid systems that combine quantum and classical encryption to create stronger protection during the transition period. Researchers are also working to make quantum cryptographic devices smaller, cheaper, and easier to integrate into existing systems. Additionally, post-quantum cryptography, a separate approach, is being developed alongside quantum cryptography to offer different layers of security.

Major challenges still exist. Quantum cryptography requires special hardware like photon detectors and optical fibers, which can be expensive and hard to scale over long distances. It also needs a secure environment for transmission, which may not be available everywhere. Overcoming these challenges is a key focus for researchers and companies.

ℹ

To learn more about this report –

Download Your Free Sample Report Here

Despite these hurdles, quantum cryptography is becoming a key area in cybersecurity. As digital infrastructure expands and quantum computing advances, the demand for quantum-safe solutions is expected to grow. Continued investment in this field could shape the future of how sensitive data is protected in both public and private sectors.

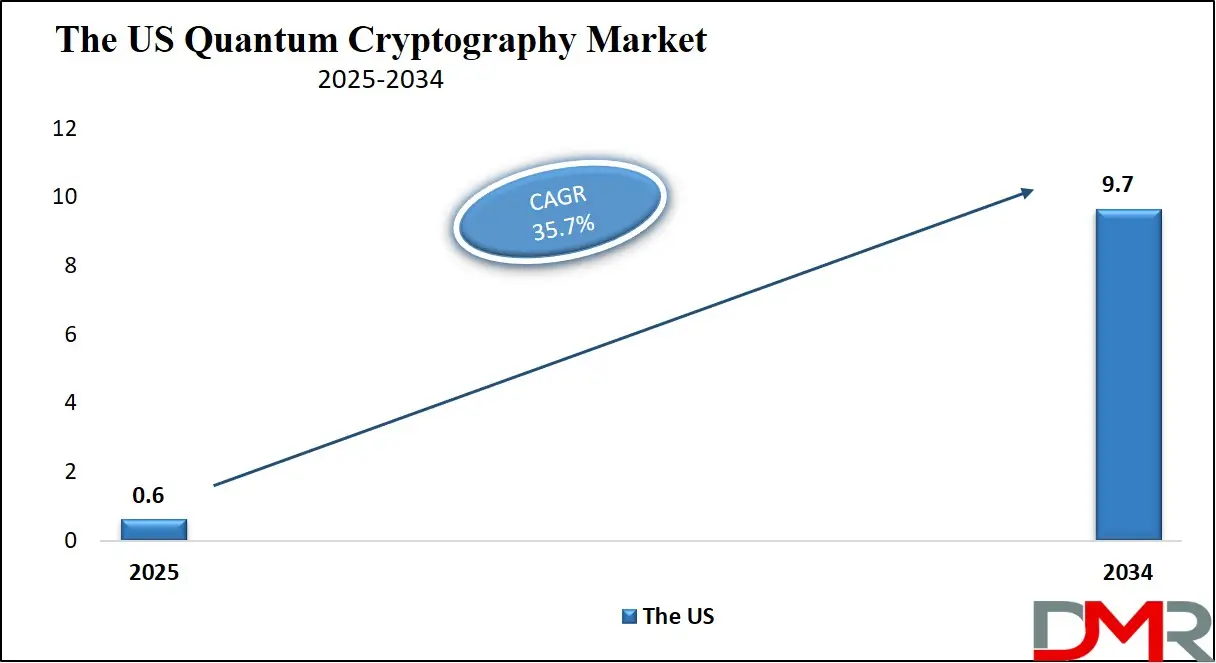

The US Quantum Cryptography Market

The US Quantum Cryptography Market size is projected to reach USD 600 million in 2025 at a compound annual growth rate of 35.7% over its forecast period.

The US plays a leading role in the quantum cryptography market through strong government support, active research institutions, and advanced tech companies. With growing concerns over cyber threats and future quantum computing risks, the US is investing heavily in quantum-safe communication systems. Government agencies, including defense and intelligence, are funding projects to develop secure quantum networks. Major universities and national labs are also working on innovations in quantum key distribution and related technologies. The US is fostering public-private partnerships to accelerate commercialization and deployment.

Additionally, American companies are filing patents, launching pilot projects, and collaborating globally to shape standards and ensure global leadership. This comprehensive approach positions the US as a major driver of growth and innovation in the quantum cryptography space.

ℹ

To learn more about this report –

Download Your Free Sample Report Here

Europe Quantum Cryptography Market

Europe Quantum Cryptography Market size is projected to reach USD 425.0 million in 2025 at a compound annual growth rate of 36.9% over its forecast period.

Europe plays a significant role in the quantum cryptography market by fostering strong collaboration between governments, research institutions, and private companies. The region is investing in building secure quantum communication infrastructure across multiple countries, with a focus on cross-border networks to support data privacy and cybersecurity. European Union programs are funding large-scale projects to advance quantum key distribution and develop trusted nodes for secure data transfer.

Countries like Germany, France, and the Netherlands are leading research in quantum communication technologies. Europe is also working toward setting global standards and ensuring interoperability among quantum systems. With a focus on technological sovereignty and digital security, Europe is positioning itself as a key region in the development and adoption of quantum cryptography solutions.

Japan Quantum Cryptography Market

Japan Quantum Cryptography Market size is projected to reach USD 107.1 million in 2025 at a compound annual growth rate of 40.1% over its forecast period.

Japan is deeply involved in advancing quantum cryptography through a strong national strategy and long-term technology development. The government-designated innovation hub leads major research efforts and collaborates with universities, public institutes, and private partners. A flagship urban fiber network built in Tokyo serves as a testbed for secure quantum communication experiments and real-world trials.

Demonstrations include high-speed, low‑latency data transmission tailored for financial systems, proving quantum cryptography works in practical scenarios. Japan is also testing satellite-to-ground quantum links and moving toward global network applications. With active work on standards, workforce training, and infrastructure scale‑up, the country is positioning itself as a key innovator in building the future of quantum‑secure communications.

Quantum Cryptography Market: Key Takeaways

- Market Growth: The Quantum Cryptography Market size is expected to grow by USD 28.3 billion, at a CAGR of 38.1%, during the forecasted period of 2026 to 2034.

- By Component: The hardware is anticipated to get the majority share of the Quantum Cryptography Market in 2025.

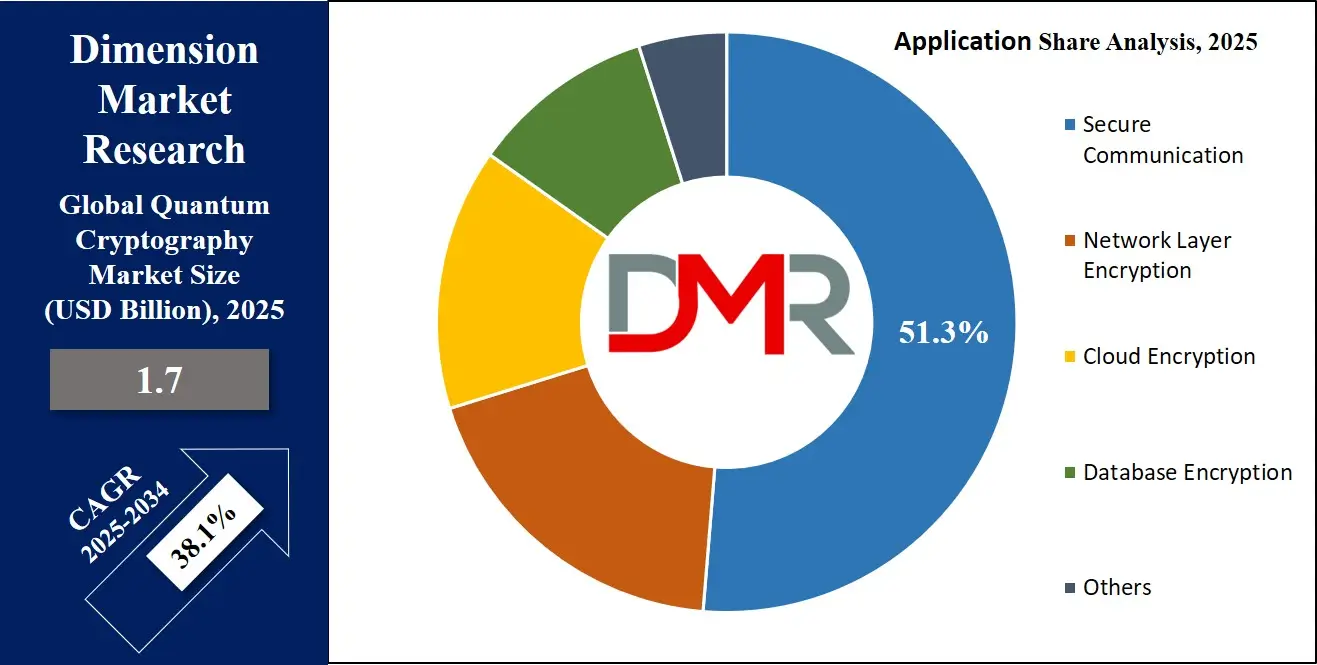

- By Application: The secure communications segment is expected to get the largest revenue share in 2025 in the Quantum Cryptography Market.

- Regional Insight: North America is expected to hold a 41.8% share of revenue in the Global Quantum Cryptography Market in 2025.

- Use Cases: Some of the use cases of Quantum Cryptography include healthcare data protection, critical infrastructure security, and more.

Quantum Cryptography Market: Use Cases

- Secure Government Communication: Governments use quantum cryptography to protect classified information and sensitive diplomatic exchanges. Quantum key distribution ensures that any attempt to eavesdrop is immediately detected, making it ideal for national defense. It adds a layer of unbreakable security to data transfers across departments and agencies.

- Banking and Financial Transactions: Banks and financial institutions use quantum cryptography to secure transactions, customer data, and inter-bank communications. It protects against future threats from quantum computers that could break traditional encryption. This helps maintain trust and security in digital finance.

- Healthcare Data Protection: Hospitals and medical research centers use quantum cryptography to safeguard patient records, research data, and remote consultations. This prevents breaches of highly sensitive personal and genetic information. It ensures data privacy even when stored or shared across networks.

- Critical Infrastructure Security: Power grids, transportation systems, and communication networks use quantum cryptography to protect control systems and operational data. It prevents cyberattacks that could disrupt services or cause damage. The technology ensures reliable and tamper-proof communication for vital infrastructure.

Market Dynamic

Driving Factors in the Quantum Cryptography Market

Increasing Demand for Data Privacy and Cybersecurity

As digital transformation spreads across industries, the need to protect sensitive information has become more critical than ever. From personal data in healthcare and finance to corporate secrets and government records, the volume of confidential data is rising rapidly. Traditional encryption methods are under constant threat from advanced cyberattacks, making them less reliable over time.

Quantum cryptography provides a level of security based on quantum mechanics, which is fundamentally resistant to hacking and interception. This makes it highly attractive to organizations aiming for long-term data protection. As privacy regulations tighten and data breaches become more costly, businesses are actively exploring quantum-safe alternatives. This growing awareness is pushing the adoption of quantum cryptographic solutions across both public and private sectors.

Expansion of Quantum Communication Infrastructure

The ongoing development and deployment of quantum communication networks is a major factor fueling market growth. Governments and private organizations are investing in infrastructure such as quantum satellites, secure fiber-optic lines, and quantum repeaters to enable large-scale use of quantum cryptography. These networks are being designed to connect cities, countries, and eventually continents with ultra-secure communication channels.

This infrastructure serves as the backbone for quantum key distribution (QKD) and other quantum encryption applications. As pilot projects prove successful and real-world use cases grow, the technology is becoming more viable and scalable. The expansion of this physical and technological ecosystem is directly supporting the commercial adoption of quantum cryptographic solutions across various domains.

Restraints in the Quantum Cryptography Market

High Cost and Infrastructure Requirements

One of the major restraints in the quantum cryptography market is the high cost of implementation and the specialized infrastructure it requires. Unlike traditional encryption, quantum cryptography needs advanced equipment such as photon detectors, quantum key distribution devices, and secure optical fiber networks. These components are expensive to develop, deploy, and maintain, making the technology less accessible for small and mid-sized organizations.

Additionally, setting up quantum communication networks over long distances involves complex integration and high operational costs. This limits scalability, especially in regions with underdeveloped digital infrastructure. Until the technology becomes more affordable and standardized, its adoption is likely to remain concentrated among large institutions and government agencies.

Limited Standardization and Technical Challenges

Another significant barrier is the lack of universal standards and unresolved technical challenges in quantum cryptography. As the technology is still evolving, there are no widely accepted protocols or frameworks to ensure interoperability between different systems and vendors. This creates compatibility issues when attempting to expand or integrate quantum cryptography with existing IT infrastructures.

Moreover, the technology is sensitive to environmental conditions like temperature and interference, which can affect performance and reliability. The need for highly trained personnel to operate and manage quantum systems also adds to the difficulty. These factors create uncertainty for potential adopters and slow down the pace of commercialization and large-scale deployment.

Opportunities in the Quantum Cryptography Market

Integration with 5G and Future Networks

The rollout of 5G and the planning of 6G networks present a major opportunity for the growth of quantum cryptography. These next-generation communication systems require ultra-secure data transmission, especially as they support applications like autonomous vehicles, smart cities, and critical healthcare services. Quantum cryptography can provide a future-proof security layer by protecting data at the hardware level using quantum key distribution (QKD).

Integrating quantum encryption into these advanced networks can help secure data against both current and future threats, including those from quantum computers. As telecom providers look to differentiate their offerings and meet regulatory demands, quantum-enhanced security can become a key selling point. This alignment opens a large commercial opportunity in the telecom and connected infrastructure space.

Commercialization of Compact and Scalable Solutions

Advancements in miniaturizing quantum cryptographic devices are opening the door to broader commercial applications. Until recently, quantum cryptography was confined to large-scale projects due to the bulky and expensive hardware it required. However, ongoing innovation is leading to the development of smaller, more affordable quantum key distribution (QKD) modules that can be integrated into standard IT systems and devices.

This shift is enabling banks, data centers, cloud providers, and even mid-sized businesses to explore quantum-safe solutions without massive infrastructure changes. As these compact technologies become more user-friendly and cost-effective, the market is expected to expand beyond government and defense into a wide range of commercial sectors, driving adoption and growth at a faster pace.

Trends in the Quantum Cryptography Market

Advancement and Practical Deployment of QKD on Commercial Networks

A major trend is the successful testing of quantum key distribution (QKD) over real-world telecom infrastructure. Researchers have recently sent quantum‑encrypted messages across hundreds of kilometers of standard fiber‑optic networks without requiring specialized cooling systems. This progress shows that QKD is becoming more practical and easier to integrate into existing communication lines. It points to a future where secure quantum communication can scale across cities and countries. By using widely available network technology, this trend paves the way for real‑world adoption of quantum encryption across industries.

Widespread Adoption of Post‑Quantum Cryptography Tools in Industry

Organizations are increasingly combining quantum cryptography with post‑quantum algorithms to create hybrid security systems. Surveys show that a large majority of businesses are preparing for so‑called “harvest now, decrypt later” attacks by adopting quantum‑safe tools now. Major cloud and cybersecurity providers are also building post‑quantum encryption into their services, aiming to make quantum‑resistant security accessible broadly. This hybrid approach is emerging as a practical path forward during the transition to fully quantum‑secure systems

Impact of Artificial Intelligence in Quantum Cryptography Market

- Enhanced Threat Detection and Network Monitoring: AI is used to detect abnormal behavior or attempted intrusions in quantum communication systems in real-time. By analyzing patterns across quantum channels, AI can quickly identify and respond to possible security breaches or disruptions.

- Optimization of Quantum Key Distribution (QKD): AI helps improve the efficiency of QKD by optimizing resource allocation, error correction, and photon transmission paths. It enhances key generation rates and overall system performance, especially in dynamic or noisy network environments.

- Automation in System Management: AI streamlines the management of complex quantum cryptographic networks by automating tasks like calibration, fault diagnosis, and performance tuning. This reduces human error and makes quantum networks more reliable and scalable.

- Predictive Maintenance of Quantum Hardware: Using AI algorithms, operators can predict potential failures or performance drops in quantum cryptographic hardware. This allows timely maintenance and improves uptime in secure communication systems.

Research Scope and Analysis

By Component Analysis

Hardware will be leading in 2025 with a share of 54.1% in the quantum cryptography market, playing a vital role in enabling secure quantum communication. Devices such as quantum key distribution systems, single-photon sources, detectors, and quantum random number generators form the core of quantum encryption technology. These components are essential for building robust and tamper-proof communication networks. The demand for high-performance, reliable, and scalable hardware is rising as organizations move toward quantum-safe solutions.

Advances in miniaturization, integration with existing telecom infrastructure, and lower power consumption are helping to bring quantum cryptography closer to real-world deployment. As research institutions and tech companies invest in innovation, the availability of advanced quantum communication hardware is expected to grow. With continued support from both public and private sectors, hardware is set to remain a critical driving force behind the expansion and practical implementation of secure quantum technologies across various industries and regions.

Services are having significant growth over the forecast period in the quantum cryptography market due to increasing demand for integration, consultation, and maintenance of secure communication systems. As organizations begin adopting quantum-safe solutions, they rely heavily on service providers for end-to-end support. This includes installing quantum key distribution systems, training teams, ensuring compatibility with existing networks, and offering ongoing technical assistance. With a shortage of in-house expertise in quantum technologies, companies prefer outsourcing these tasks to specialized service firms.

The rise in managed security services and cloud-based quantum communication platforms is also contributing to the growth of this segment. As industries across finance, healthcare, and government seek long-term security strategies, the role of services in designing and sustaining quantum cryptography infrastructure is becoming more crucial, paving the way for steady market expansion throughout the forecast period.

By Technology Analysis

Quantum key distribution is set to lead in 2025 with a share of 61.4%, making it the most prominent technology in the quantum cryptography market. This method enables the secure exchange of encryption keys by using the principles of quantum mechanics, making any attempt to intercept or tamper with the key easily detectable. It provides a level of security that is impossible to achieve with traditional cryptographic systems, especially in the face of evolving cyber threats and future quantum computer attacks.

As global focus increases on data privacy and secure communication, QKD is becoming the go-to solution for governments, telecom providers, and financial institutions. Continuous improvements in performance, distance coverage, and integration with existing infrastructure are driving its adoption. With national and cross-border quantum networks being built, the demand for QKD systems is expected to grow significantly, pushing this technology to the center of secure digital communication strategies.

Further, post-quantum cryptography is having significant growth over the forecast period as organizations prepare for the risks posed by quantum computers. Unlike QKD, which relies on physics-based systems, post-quantum algorithms are designed to run on classical hardware and can resist attacks from quantum processors. This makes them easier to implement on existing digital systems without major infrastructure changes.

Businesses and government agencies are starting to adopt these algorithms to protect long-term data and ensure secure communication. Standardization bodies are also working on approving post-quantum cryptographic techniques, further encouraging adoption. As a result, this technology is gaining traction across various sectors, including cloud services, cybersecurity, and data storage. The combination of easy deployment, lower costs, and strong resistance to future threats is making post-quantum cryptography a key area of focus, supporting the broader shift toward quantum-resilient digital systems.

By Application Analysis

Secure communication is expected to lead in 2025, with a share of 51.3%, making it the most impactful application in driving the growth of the quantum cryptography market. This application is crucial for safeguarding sensitive information exchanges across military, government, financial, and enterprise networks. As cyber threats grow more advanced, organizations are turning to quantum key distribution and post-quantum encryption to ensure their communications cannot be intercepted or tampered with. Secure messaging, file transfers, and real-time data sharing are increasingly relying on quantum-safe channels.

The demand is rising from sectors that require guaranteed data confidentiality, especially with cross-border transactions and cloud services. With many countries developing quantum communication infrastructure, secure communication continues to be a top priority. Its central role in both national security and private sector data protection ensures it remains a key driver of market adoption and technological progress through the ongoing digital era.

Cloud encryption is expected to experience significant growth over the forecast period as more organizations shift their data and operations to cloud environments. With cloud platforms storing vast amounts of confidential business, customer, and personal data, the need for future-proof security is greater than ever. Quantum cryptography is being explored to protect cloud-stored information using quantum key distribution and post-quantum encryption methods.

Service providers are investing in quantum-safe technologies to offer secure data encryption and transmission between cloud users and data centers. As cyberattacks targeting cloud infrastructure increase, businesses are prioritizing solutions that protect against both current and future risks, including those posed by quantum computing. This growing demand for stronger cloud security is fueling innovation and partnerships in the field, helping cloud encryption become a prominent application area within the evolving quantum cryptography landscape.

ℹ

To learn more about this report –

Download Your Free Sample Report Here

By Industry Vertical Analysis

Government & defense will be leading in 2025 with a share of 34.8%, playing a major role in driving the quantum cryptography market. This sector handles highly sensitive information related to national security, intelligence, and critical infrastructure, which demands the strongest form of protection. Quantum key distribution and quantum-safe encryption help prevent data breaches and cyber espionage, making them essential for secure communication. Many governments are investing in building quantum communication networks for military bases, embassies, and strategic facilities.

Defense agencies are also funding research to improve the performance and reliability of quantum cryptographic systems. The urgency to stay ahead of cyber threats and maintain control over secure data flow is pushing this sector to adopt cutting-edge encryption solutions. With strong funding, infrastructure development, and dedicated pilot projects, government and defense remain key contributors to the market’s momentum and technological advancement through 2025 and beyond.

IT & telecom is having significant growth over the forecast period as the need for secure and fast communication intensifies across digital infrastructure. This sector is highly dependent on reliable data transfer and network security, making it a prime adopter of quantum cryptography. With the rise of 5G, cloud computing, and connected devices, telecom operators are seeking advanced encryption to protect their systems from current and future threats, including quantum attacks.

Integrating quantum key distribution into telecom networks offers stronger protection for voice, video, and data services. IT providers are also exploring post-quantum algorithms and Post-Quantum Cryptography (PQC) to enhance their cybersecurity offerings. Growing concerns around data privacy, along with rising cyber risks, are motivating IT and telecom firms to adopt quantum-safe technologies. By upgrading their infrastructure with secure communication systems, this sector is playing an essential role in accelerating the adoption of quantum cryptographic solutions across global networks.

The Quantum Cryptography Market Report is segmented on the basis of the following

By Component

- Hardware

- Quantum Key Distribution (QKD) Systems

- Quantum Random Number Generators (QRNG)

- Photon Sources and Detectors

- Software

- Key Management Software

- Encryption Software

- Services

- Consulting

- Integration & Deployment

- Support & Maintenance

By Technology

- Quantum Key Distribution (QKD)

- Post-Quantum Cryptography (PQC)

- Quantum Random Number Generation (QRNG)

By Application

- Secure Communication

- Database Encryption

- Network Layer Encryption

- Cloud Encryption

- Others

By Industry Vertical

- BFSI

- Government & Defense

- Healthcare

- IT & Telecom

- Energy & Utilities

- Retail

- Aerospace

- Others

Regional Analysis

Leading Region in the Quantum Cryptography Market

North America, leading in 2025 with a share of 41.8%, plays a dominant role in the growth of the quantum cryptography market due to strong investments, advanced research, and early adoption of secure communication technologies. The region benefits from the presence of top universities, national laboratories, and tech innovators focused on quantum key distribution and quantum-secure networks. Government initiatives, especially in the U.S., have pushed the development of quantum-safe solutions to protect defense, critical infrastructure, and financial systems.

Ongoing collaborations between public and private sectors are speeding up the commercialization of quantum encryption tools. Canada also contributes significantly with national programs supporting quantum communication. As cybersecurity concerns grow across industries, North America is expected to maintain its leadership by continuing to invest in scalable and practical quantum cryptography systems. The region’s push for developing international standards and promoting interoperability is further strengthening its position in the global landscape, making it a key driver of market momentum in 2025.

ℹ

To learn more about this report –

Download Your Free Sample Report Here

Fastest Growing Region in the Quantum Cryptography Market

Asia Pacific is showing significant growth over the forecast period in the quantum cryptography market due to rising government support, expanding research capabilities, and increasing demand for advanced cybersecurity solutions. Countries like China, Japan, South Korea, and India are investing heavily in quantum key distribution networks and quantum-secure communication infrastructure.

The region is actively developing long-distance quantum communication and testing satellite-based quantum encryption. Rapid digital transformation, along with growing concerns over data privacy, is driving the need for quantum-resistant encryption methods across industries. With a strong focus on innovation, regional partnerships, and large-scale pilot projects, Asia Pacific is estimated to become a major contributor to the global quantum cryptography landscape.

By Region

North America

Europe

- Germany

- The U.K.

- France

- Italy

- Russia

- Spain

- Benelux

- Nordic

- Rest of Europe

Asia-Pacific

- China

- Japan

- South Korea

- India

- ANZ

- ASEAN

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Argentina

- Colombia

- Rest of Latin America

Middle East & Africa

- Saudi Arabia

- UAE

- South Africa

- Israel

- Egypt

- Rest of MEA

Competitive Landscape

The quantum cryptography market is becoming highly competitive as more players enter the space, from startups to established technology firms. Companies are racing to develop secure communication tools that use quantum technology, especially quantum key distribution. There is strong focus on building national and cross-border quantum networks, secure hardware devices, and integrated cybersecurity platforms.

Collaboration between research institutions, governments, and private firms is growing, helping to speed up innovation. Some are focusing on specialized solutions for defense or banking, while others aim to make scalable and affordable systems for broader use. The competition is also driving investments in testing, miniaturization, and real-world deployment. As threats to traditional encryption rise, the pressure to lead in this field is only increasing.

Some of the prominent players in the global Quantum Cryptography are:

- ID Quantique

- Toshiba Corporation

- IBM Corporation

- Quantum Xchange

- QuintessenceLabs

- SK Telecom

- BT Group

- Huawei Technologies

- QNu Labs

- Nokia Corporation

- MagiQ Technologies

- SeQureNet (IDQ subsidiary)

- CryptoNext Security

- NuCrypt

- NEC Corporation

- Microsoft

- Fujitsu

- Infineon Technologies

- Raytheon Technologies

- KETS Quantum Security

- Other Key Players

Recent Developments

- In June 2025, Commvault unveiled enhanced post-quantum cryptography (PQC) capabilities. Among the first vendors to support PQC, Commvault aims to help organizations safeguard long-term, sensitive data against future quantum threats. Quantum computing, while powerful, poses serious risks to traditional encryption. With growing concern among tech professionals about its impact on cybersecurity and compliance, Commvault’s updates offer an extra layer of defense in an evolving threat landscape.

- In June 2025, F5 introduced post-quantum cryptography (PQC) readiness within its Application Delivery and Security Platform. This integration enables organizations to prepare for future cryptographic threats while maintaining high performance and scalability. The new PQC capabilities offer advanced tools to protect applications and APIs against potential quantum-based cyber risks. With this enhancement, F5 continues to support secure digital transformation by ensuring that businesses can adopt stronger cryptographic protections without sacrificing operational efficiency or application speed.

- In May 2025, China Telecom Quantum Group launched the world’s first distributed cryptography system that combines two advanced technologies. As part of this breakthrough, the company completed the world’s first cross-regional quantum-encrypted phone call using the integrated system. The call covered a distance of over 1,000 kilometers between Beijing and Hefei, marking a major milestone in secure communications. This achievement highlights China’s progress in quantum technology and its efforts to strengthen long-distance encrypted communication across regions using cutting-edge cryptographic methods.

- In August 2024, IBM supported in official release of the first three post-quantum cryptography standards announced by NIST. Among them are ML-KEM (formerly CRYSTALS-Kyber) and ML-DSA (formerly CRYSTALS-Dilithium), developed by IBM researchers with industry and academic collaborators. The third, SLH-DSA (initially SPHINCS+), was co-developed by a researcher now with IBM. A fourth IBM-developed algorithm, FN-DSA (formerly FALCON), has also been selected for future standardization. These milestones mark a major step toward securing global encrypted data against the future threat of quantum-powered cyberattacks.

Report Details

| Report Characteristics |

| Market Size (2025) |

USD 1.7 Bn |

| Forecast Value (2034) |

USD 30.5 Bn |

| CAGR (2025–2034) |

38.1%

|

| Historical Data |

2019 – 2023 |

| The US Market Size (2025) |

USD 0.6 Bn |

| Forecast Data |

2026 – 2034 |

| Base Year |

2024 |

| Estimate Year |

2025 |

| Report Coverage |

Market Revenue Estimation, Market Dynamics, Competitive Landscape, Growth Factors, etc. |

| Segments Covered |

By Component (Hardware, Software and Services) By Technology (Quantum Key Distribution (QKD), Post-Quantum Cryptography (PQC), Quantum Random Number Generation (QRNG)), By Application (Secure Communication, Database Encryption, Network Layer Encryption, Cloud Encryption, and Others), By Industry Vertical (BFSI, Government & Defense, Healthcare, IT & Telecom, Energy & Utilities, and Retail, and Aerospace) |

| Regional Coverage |

North America – US, Canada; Europe – Germany, UK, France, Russia, Spain, Italy, Benelux, Nordic, Rest of Europe; Asia-Pacific – China, Japan, South Korea, India, ANZ, ASEAN, Rest of APAC; Latin America – Brazil, Mexico, Argentina, Colombia, Rest of Latin America; Middle East & Africa – Saudi Arabia, UAE, South Africa, Turkey, Egypt, Israel, Rest of MEA |

| Prominent Players |

ID Quantique, Toshiba Corporation, IBM Corporation, Quantum Xchange, QuintessenceLabs, SK Telecom, BT Group, Huawei Technologies, QNu Labs, Nokia Corporation, MagiQ Technologies, SeQureNet, CryptoNext Security, NuCrypt, NEC Corporation, Microsoft, Fujitsu, Infineon Technologies, Raytheon Technologies, KETS Quantum Security, and Other Key Players |

| Purchase Options |

We have three licenses to opt for: Single User License (Limited to 1 user), Multi-User License (Up to 5 Users), and Corporate Use License (Unlimited User) along with free report customization equivalent to 0 analyst working days, 3 analysts working days, and 5 analysts working days respectively. |

Frequently Asked Questions

How big is the Global Quantum Cryptography Market?

▾ The Global Quantum Cryptography Market size is expected to reach a value of USD 1.7 billion in 2025 and is expected to reach USD 30.5 billion by the end of 2034.

Which region accounted for the largest Global Quantum Cryptography Market?

▾ North America is expected to have the largest market share in the Global Quantum Cryptography Market, with a share of about 41.8% in 2025.

How big is the Quantum Cryptography Market in the US?

▾ The Quantum Cryptography Market in the US is expected to reach USD 0.6 billion in 2025.

Who are the key Quantum Cryptography Market?

▾ Some of the major key players in the Global Quantum Cryptography Market ID Quantique, Toshiba Corporation, IBM Corporation, and others

What is the growth rate in the Global Quantum Cryptography Market?

▾ The market is growing at a CAGR of 38.1 percent over the forecasted period.