Market Overview

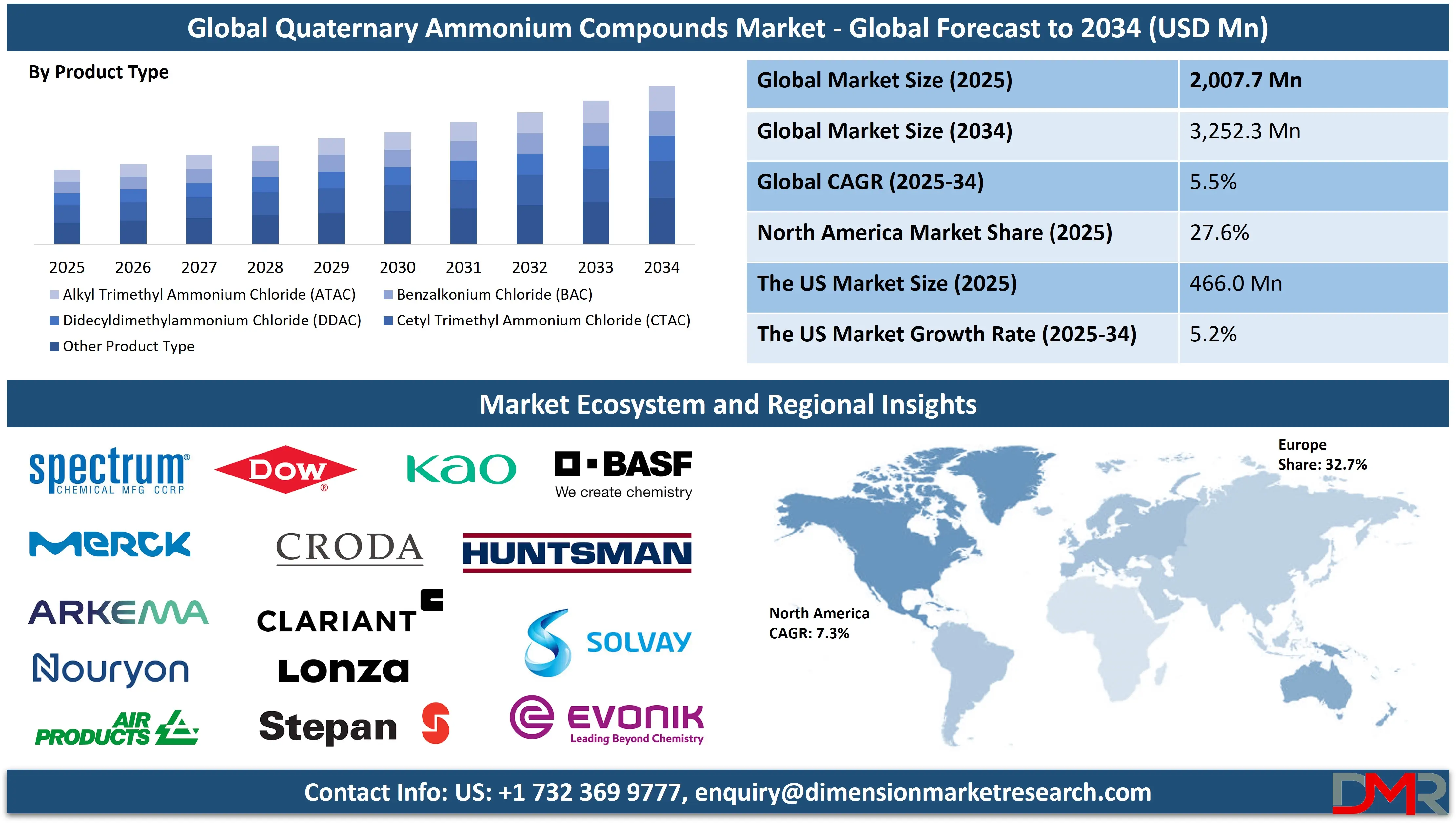

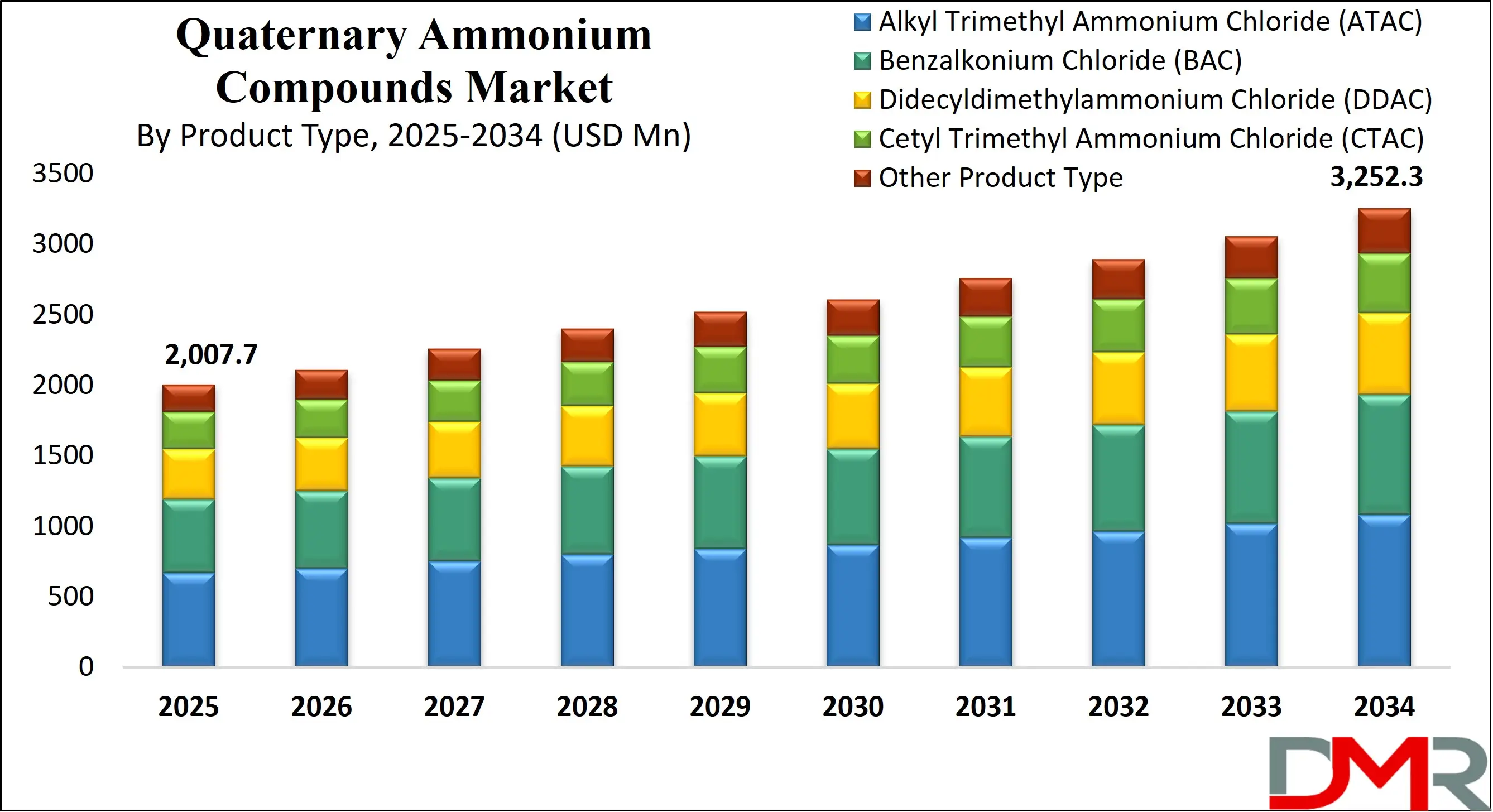

The Global Quaternary Ammonium Compounds Market is projected to reach USD 2,007.7 million in 2025 and grow at a compound annual growth rate of 5.5% from there until 2034 to reach a value of USD 3,252.3 million.

The global quaternary ammonium compounds (QACs) market is gaining strong momentum due to rising hygiene standards across industries. The COVID-19 pandemic significantly increased awareness about surface disinfection, which elevated the usage of QAC-based sanitizers, cleaners, and disinfectants.

ℹ

To learn more about this report –

Download Your Free Sample Report Here

Their wide-spectrum antimicrobial action against bacteria, viruses, and fungi makes them a preferred choice in healthcare, food processing, and water treatment. Alongside these core applications, QACs hold significant importance in the broader disinfectant chemicals industry, supporting high-demand cleaning and sterilization needs worldwide.

In addition to these conventional uses, QACs are now integrated into fabric softeners, personal care products, and coatings due to their surfactant and antistatic properties. The industry is expected to witness a moderate yet stable growth rate as sectors prioritize health safety, public cleanliness, and infection control.

Innovation is opening doors to biodegradable and eco-friendly QAC formulations like ester quats, which offer lower toxicity and better environmental compatibility. These alternatives cater to growing consumer demand for sustainable cleaning solutions. Expanding applications in agriculture, especially disinfectants for livestock facilities and crop protection agents, also provide untapped opportunities for manufacturers.

ℹ

To learn more about this report –

Download Your Free Sample Report Here

However, the market faces limitations due to growing concerns about bioaccumulation and the potential for antimicrobial resistance. Regulatory scrutiny, especially in Europe and North America, is increasing pressure on manufacturers to adopt safer ingredients and minimize environmental impact.

Despite these challenges, consistent demand from institutional, industrial, and residential sectors ensures robust future prospects. Continued investment in R&D and eco-compliance will define market leaders. As economies transition toward sustainable chemical usage and stricter compliance norms, the global QACs market is poised to evolve into a more regulated and innovation-driven sector.

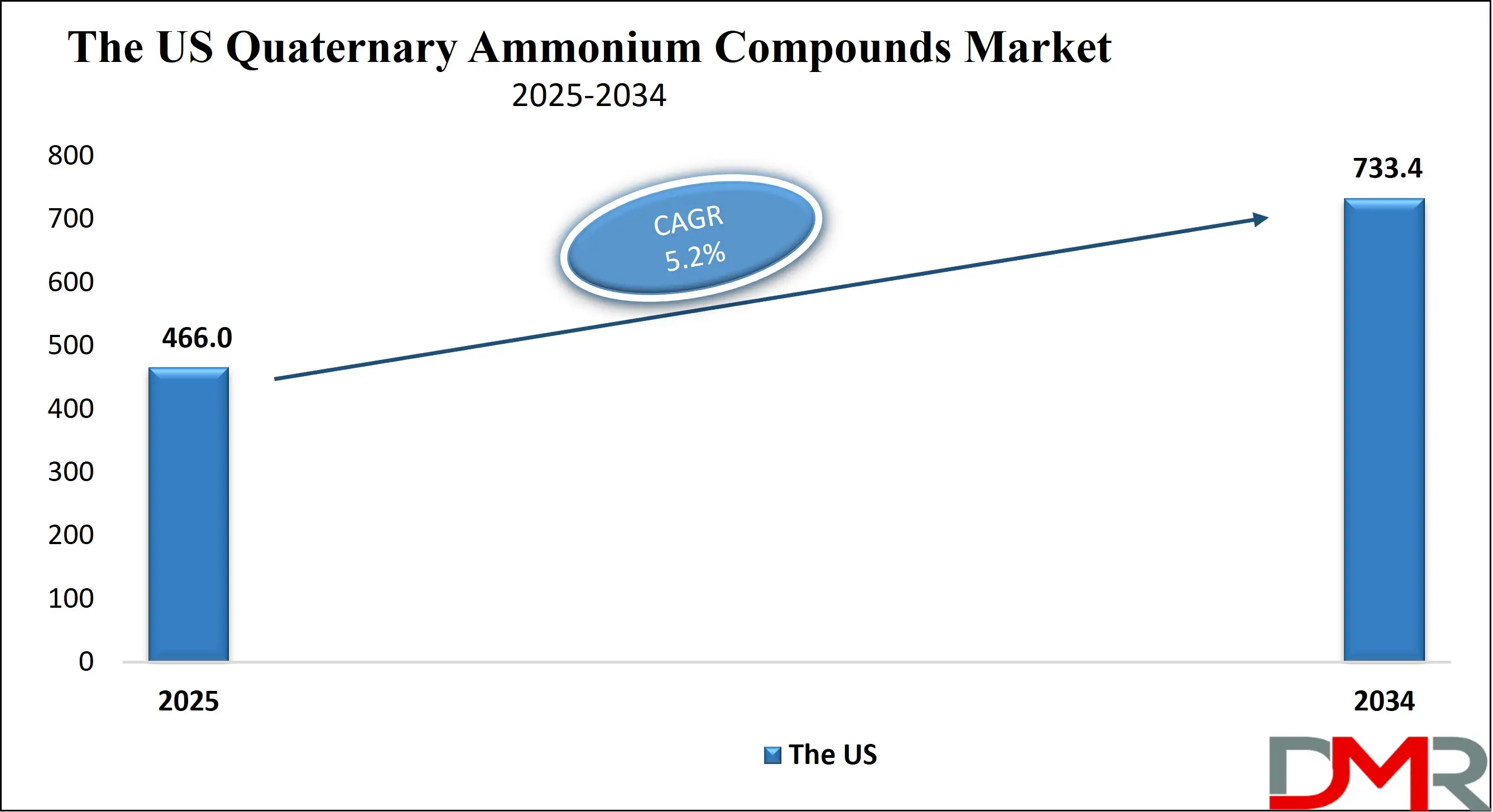

The US Quaternary Ammonium Compounds Market

The US Quaternary Ammonium Compounds Market is projected to reach USD 466.0 million in 2025 at a compound annual growth rate of 5.2% over its forecast period.

In the United States, quaternary ammonium compounds play a critical role in maintaining public health across healthcare, food processing, and sanitation industries. These compounds are regulated as active ingredients under the Environmental Protection Agency’s (EPA) Federal Insecticide, Fungicide, and Rodenticide Act (FIFRA).

ℹ

To learn more about this report –

Download Your Free Sample Report Here

The EPA mandates stringent safety evaluations, including toxicity and efficacy studies, before QACs can be approved for commercial disinfectants and biocidal products. Many QAC-based cleaners are recognized by federal health bodies for their effectiveness against disease-causing pathogens and are increasingly benchmarked alongside modern Food Pathogen Testing technologies to ensure comprehensive safety in the food supply chain.

The Centers for Disease Control and Prevention (CDC) promotes the use of QACs in healthcare cleaning protocols, especially in high-risk environments like intensive care units and surgical theaters. Hospitals use them to disinfect patient rooms, equipment, and surfaces to control infection spread. The U.S. Department of Agriculture also permits limited QAC use in food-contact applications, ensuring facility hygiene and compliance with food safety laws.

The country benefits from advanced industrial infrastructure and widespread public hygiene initiatives. Demographically, high urbanization, a strong healthcare system, and frequent institutional sanitation requirements support continuous demand. Public awareness around infection prevention has increased post-pandemic, pushing households and institutions to adopt QAC-based disinfectants for everyday cleaning.

Environmental concerns, however, are becoming more prominent. U.S. agencies are initiating studies to monitor QAC accumulation in water systems and evaluate long-term ecological impact. Despite this, the American QAC market remains robust due to its regulatory clarity, technological advancements, and commitment to public health. With increasing demand from healthcare, water treatment, and institutional cleaning sectors, the market is poised for steady long-term growth.

The Japan Quaternary Ammonium Compounds Market

The Japan Quaternary Ammonium Compounds Market is projected to be valued at USD 27.96 million in 2025. It is further expected to witness subsequent growth in the upcoming period, holding USD 40.05 million in 2034 at a CAGR of 4.0%.

Japan’s market for quaternary ammonium compounds is influenced by stringent national standards and a cultural emphasis on cleanliness. Regulatory oversight is provided by the Ministry of Health, Labour and Welfare and the Ministry of the Environment, which govern QAC use in disinfectants, water treatment, and consumer products. Under Japan’s Pharmaceutical Affairs Law and Water Pollution Control Act, QACs must meet safety and biodegradability criteria to ensure public health and environmental protection.

The country’s aging population significantly drives demand for disinfectants in hospitals, nursing homes, and eldercare facilities. These institutions use QAC-based cleaners to maintain hygiene and reduce infection risks, particularly in densely populated urban centers like Tokyo and Osaka. Additionally, QACs are incorporated in air purifiers, face masks, and hand sanitizers as part of post-pandemic hygiene routines.

Japanese manufacturers are at the forefront of green chemistry, developing low-residue and biodegradable QAC formulations to align with eco-label standards. Public sector agencies promote eco-friendly sanitation through municipal contracts and green procurement policies. Innovations in packaging, such as refillable disinfectant pouches and concentrated QAC tablets, are helping reduce plastic waste.

In agriculture, QACs are used in animal husbandry to disinfect tools, stalls, and feeding systems. Regulatory bodies ensure these compounds do not exceed maximum residue limits in food production, preserving consumer safety. Here, complementary chemicals such as Sulfuric Acid and Acrylic Acid also play a role in sanitization and material processing, supporting QAC performance in agrochemical formulations.

Japan’s commitment to high-quality healthcare, environmental sustainability, and product innovation makes it a stable and forward-looking market for QACs. Despite tight environmental restrictions, opportunities are growing in sectors like smart surface coatings, textile softeners, and advanced sterilization technologies.

Global Quaternary Ammonium Compounds Market: Key Takeaways

- Global Market Size Insights: The Global Quaternary Ammonium Compounds Market size is estimated to have a value of USD 2,007.7 million in 2025 and is expected to reach USD 3,252.3 million by the end of 2034.

- The Global Market Growth Rate: The market is growing at a CAGR of 5.5 percent over the forecasted period of 2025.

- The US Market Size Insights: The US Quaternary Ammonium Compounds Market is projected to be valued at USD 466.0 million in 2025. It is expected to witness subsequent growth in the upcoming period as it holds USD 733.4 million in 2034 at a CAGR of 5.2%.

- Regional Insights: Europe is expected to have the largest market share in the Global Quaternary Ammonium Compounds Market with a share of about 32.7% in 2025.

- Key Players: Some of the major key players in the Global Quaternary Ammonium Compounds Market are BASF SE, The Dow Chemical Company, Evonik Industries AG, Clariant AG, Huntsman Corporation, Stepan Company, Croda International Plc, and many others.

Global Quaternary Ammonium Compounds Market: Use Cases

- Hospital Surface Sterilization: Quaternary ammonium compounds are widely used in hospital disinfectant wipes and sprays to sanitize high-touch surfaces like bed rails and surgical tables. These compounds effectively eliminate pathogens such as MRSA, C. difficile, and enveloped viruses, maintaining hygiene standards and reducing hospital-acquired infections in critical healthcare environments.

- Laundry and Fabric Softeners: Cationic surfactants like ester quats derived from QACs are integral in household and industrial fabric softeners. These agents reduce static cling and improve softness by bonding to textile fibers during rinse cycles, enhancing user comfort while also offering biodegradable options that appeal to environmentally conscious consumers.

- Agricultural Biosecurity: In livestock farms, QACs are applied as disinfectants in animal shelters, feeding equipment, and processing units. Their biocidal properties help control outbreaks of pathogens like avian influenza and E. coli, promoting herd health, minimizing economic losses, and supporting biosecurity compliance in agriculture-intensive economies.

- Industrial Water Treatment: Quaternary ammonium compounds serve as biocides in cooling towers and closed water systems to prevent microbial slime and biofilm formation. Their use ensures smooth system performance, extends equipment life, and supports regulatory compliance related to safe and clean industrial wastewater management in manufacturing plants.

- Personal Care Formulations: QACs, especially cetyl derivatives, are utilized in cosmetics like mouthwashes and nasal sprays as preservatives. These agents prevent microbial growth in water-based formulations, enhancing product shelf life and safety. They also contribute conditioning benefits in shampoos and conditioners, improving hair texture and detangling efficiency.

Global Quaternary Ammonium Compounds Market: Stats & Facts

U.S. Environmental Protection Agency (EPA)

- EPA QAC Cluster Classification: The EPA has organized quaternary ammonium compounds into four separate clusters to streamline toxicity testing and regulatory approvals. This clustering approach helps identify similar modes of action and exposure profiles among various QAC formulations, ensuring consistent safety standards across structurally related substances.

- Volume in Commerce: The EPA’s chemical inventory and commerce data reveal that over 800 distinct quaternary ammonium compounds are listed as active in the U.S. marketplace. These substances are used in applications ranging from surface disinfectants and water treatments to antistatic agents in fabric care.

- High Production Volume Status: A significant number of QACs are designated as High Production Volume (HPV) chemicals, meaning they are manufactured or imported into the U.S. in quantities exceeding 1 million pounds annually. This classification reflects their widespread use and importance in industrial and household settings.

- Presence in EPA List N: During the COVID-19 pandemic, the EPA’s List N identified over 500 disinfectants approved for use against SARS-CoV-2, with about half containing QACs as active ingredients. Their broad-spectrum antimicrobial properties make them essential in public health interventions.

- Inclusion in EPA List Q: QACs also appear on EPA List Q, which includes disinfectants effective against emerging viral pathogens. This underlines their utility beyond COVID-19, preparing for potential future outbreaks and biological threats.

- Pesticide Tolerance in Agriculture: The EPA grants pesticide tolerance exemptions for certain QACs used in food production, allowing residual levels up to 2% in specific formulations. These exemptions are based on toxicity evaluations that confirm minimal risk to human health.

- Low Toxicity Thresholds: Toxicological assessments conducted for clay-bound QACs report No Observed Adverse Effect Levels (NOAELs) above 1,000 mg/kg/day, suggesting low acute toxicity from oral, dermal, or inhalation exposure in mammals.

- Rapid Elimination from the Body: According to EPA data, most QAC salts are poorly absorbed and are rapidly excreted from the body, minimizing concerns around bioaccumulation through standard exposure routes such as skin contact or inhalation.

U.S. National Pesticide Information Center (NPIC)

- Human Blood Detection Study: A university-affiliated NPIC study found QACs in the blood samples of 35 out of 43 college volunteers, confirming widespread exposure in daily environments. This exposure likely results from contact with household cleaners, sanitizers, and treated textiles.

- Residue Clearance Timeline: Follow-up blood testing in the same study showed that QAC residues in participants' systems became undetectable within seven days, indicating quick clearance after cessation of exposure.

- Environmental Persistence – Soil Half-Life: QACs show variable persistence in soil. Didecyldimethylammonium chloride (DDAC) has a half-life of over 1,000 days in dry soil, while alkyl dimethyl benzyl ammonium chloride (ADBAC) has a half-life of 13 days in dry conditions but can persist up to 1,800 days in flooded soil, reflecting high environmental stability under specific conditions.

- Low Groundwater Migration Risk: Due to strong ionic bonding with sediment particles, QACs like ADBAC demonstrate low leaching potential, making groundwater contamination unlikely even with high usage in agricultural and industrial zones.

- Aquatic Organism Toxicity Testing: Aquatic toxicity studies involving fish exposed to ADBAC at concentrations of approximately 113 micrograms per liter showed no observable impact on growth, reproduction, or survival. However, gene-level responses were triggered, suggesting sublethal effects that warrant long-term ecological surveillance.

European Commission & SCENIHR

- Biocide Resistance Concerns: The Scientific Committee on Emerging and Newly Identified Health Risks (SCENIHR) under the European Commission has identified QACs, alongside triclosan, as key contributors to microbial resistance development in both healthcare and environmental settings.

- Gene Expression Studies: European food safety bodies have found clear evidence of increased expression of bacterial efflux pump genes when exposed to sub-inhibitory concentrations of QACs. These genes enable bacteria to resist not just QACs but also antibiotics, raising public health concerns.

- Cross-Sector Exposure: QACs are used across multiple industries in Europe, including food processing, hospitals, water treatment, and agriculture, leading to an increase in their environmental footprint. This ubiquitous usage makes it harder to control long-term ecological and resistance risks.

- Call for Standardized Resistance Monitoring: SCENIHR has emphasized the urgent need for harmonized protocols to assess the link between QAC use and antibiotic resistance. This would involve environmental monitoring and microbial genomics to identify and trace resistance pathways more accurately.

Academic & Environmental Data (USA & Europe)

- Historical Sediment Concentration – ATMAC: In urban estuarine sediment studies conducted in the U.S., concentrations of alkyltrimethylammonium compounds (ATMAC) increased from 2,820 nanograms per gram in 1998 to 6,750 nanograms per gram by 2008, indicating rising environmental accumulation tied to urban growth.

- Sediment Load – BAC Compounds: In tested locations, BAC-C12 levels ranged from 40 to nearly 700 nanograms per gram, while BAC-C16 and BAC-C18 concentrations ranged from 1 to 190 nanograms per gram. These levels suggest substantial environmental persistence, especially near industrial and municipal discharge sites.

- Dominance of BAC-C12: Among benzalkonium homologues found in sediment, BAC-C12 accounted for about 70% of total BAC compounds detected. This predominance aligns with its widespread use in surface disinfectants and hard surface cleaners.

- DADMAC Proportions: In samples containing dialkyldimethylammonium chloride (DADMAC), the C16-C18 homologues represented over 90% of the total, reinforcing the widespread industrial use of long-chain QACs in oil and gas, coatings, and heavy-duty sanitation.

- Bioaccumulation Risk: QACs exhibit strong adsorption to organic matter in sediments and low biodegradability, leading to their frequent detection in aquatic ecosystems and making them a focus of concern for long-term environmental impact.

Microbial Resistance Trends

- Adaptation in Listeria monocytogenes: Repeated exposure to low concentrations of QACs causes Listeria monocytogenes to adapt by altering cell wall proteins and increasing efflux pump activity. These adaptations reduce QAC effectiveness and raise the risk of foodborne outbreaks.

- Enhanced Biofilm Formation: QAC-resistant Listeria strains demonstrate increased capacity to form biofilms, which protect bacteria from cleaning agents and allow them to persist in food-processing environments for extended periods.

- Diversity of Resistance Genes: A wide array of qac genes has been documented in both environmental and clinical bacterial isolates. These include qacA, qacB, qacC through qacJ, qacZ, and the widespread qacEΔ1 variant, each linked to reduced susceptibility to various QAC types.

- Link to Class 1 Integrons: The qacEΔ1 gene variant is frequently found in class 1 integrons, genetic elements known to carry multiple antimicrobial resistance genes, suggesting QACs may inadvertently co-select for antibiotic resistance.

- Emergence of qrg Gene: A novel efflux pump gene named qrg has been detected in Streptococcus oralis isolates, conferring resistance specifically to cetyl-based QACs used in oral care and mouthwashes, signaling new resistance pathways in commensal bacteria.

Clinical & One-Health Insights

- ESCMID Observations on Cross-Resistance: The European Society of Clinical Microbiology and Infectious Diseases (ESCMID) warns that excessive QAC use in community and hospital settings contributes to resistance patterns in Enterococcus species, which are increasingly difficult to treat with standard antibiotics.

- Integron Prevalence Rise in E. coli: Longitudinal studies on clinical E. coli isolates show an increase in class 1 integron prevalence from 3% in the 1980s to 26% by the 2010s. This correlates with the rise in antimicrobial and QAC use over the same period.

- Antibiotic Resistance Gene Surge: In the same E. coli samples, the presence of antibiotic resistance genes rose from 19% to 55% over three decades, indicating a steep increase in multidrug resistance, potentially exacerbated by widespread use of QACs in healthcare environments.

Global Quaternary Ammonium Compounds Market: Market Dynamics

Driving Factors in the Global Quaternary Ammonium Compounds Market

Rising Global Demand for Hospital and Institutional Hygiene Solutions

The global healthcare and institutional sector has become a major growth engine for the QAC market due to the increasing focus on disinfection and infection control. The COVID-19 pandemic acted as a catalyst, dramatically increasing the use of disinfectants and hand sanitizers across hospitals, eldercare homes, schools, and other public facilities. QACs, with their proven effectiveness against enveloped viruses and a wide range of bacteria, were among the most relied-upon biocides during this period.

Many government health bodies across the U.S., Europe, and Asia included QAC-based disinfectants in their recommended lists for virus containment. Even in the post-pandemic world, the heightened awareness around cleanliness and sanitation is expected to sustain elevated demand levels. Hospitals are expanding their hygiene protocols, incorporating QACs not only for surface cleaning but also in air filters, wound dressings, and surgical instrument maintenance.

Additionally, the rise in antimicrobial resistance (AMR) has led to increased cleaning frequency in healthcare settings, further reinforcing demand. Regulations mandating routine disinfection of public spaces, especially in transport, hospitality, and healthcare, are also fueling consumption. Institutional buyers are increasingly investing in products that provide rapid, broad-spectrum action, low surface corrosion, and residual antimicrobial effect, all characteristics where QACs excel. This growth trajectory is being amplified by government funding for infection control programs and public health modernization across emerging economies.

Expansion of Urban Infrastructure and Commercial Facilities

Urbanization and commercial infrastructure development are serving as powerful growth drivers for the quaternary ammonium compounds market. As cities expand and urban populations grow, the need for routine sanitation in commercial, industrial, and residential settings increases significantly. Shopping malls, office buildings, hotels, schools, and transportation terminals are high-footfall zones that require regular disinfection to mitigate the spread of infectious diseases.

QAC-based cleaners and surface sanitizers are commonly used in these areas due to their cost-efficiency, effectiveness, and compatibility with various surfaces. Countries in Asia-Pacific, Latin America, and the Middle East are witnessing rapid urban growth, with government programs focused on smart cities and public health safety, thereby boosting demand for QACs in building maintenance.

Moreover, the hospitality and tourism industries recovering strongly post-pandemic, are relying heavily on QAC products to meet hygiene certifications and restore customer confidence. As more countries introduce hygiene rating systems for commercial spaces, facility managers are investing in professional-grade disinfectants, many of which are QAC-based. Additionally, QACs are increasingly being integrated into HVAC systems and air purification units used in commercial buildings to improve indoor air quality.

With more people living, working, and commuting in dense urban environments, the pressure to maintain clean and safe public spaces will keep fueling the demand for QAC-based solutions in urban infrastructure for years to come.

Restraints in the Global Quaternary Ammonium Compounds Market

Environmental Persistence and Ecotoxicological Concerns

One of the foremost challenges facing the QACs market is the increasing scrutiny over their environmental persistence and ecotoxicity. Several studies have indicated that certain QACs, particularly long-chain derivatives like DDAC and ADBAC, exhibit low biodegradability and can accumulate in soil and sediment. These compounds bind tightly to organic matter and resist breakdown, leading to long-term residues in aquatic environments.

Their presence has been linked to toxic effects on aquatic organisms, including algae and invertebrates, which can disrupt entire ecosystems. Regulatory bodies in the EU, Japan, and the U.S. are now reassessing permissible usage levels and discharge thresholds for QACs in industrial wastewater. This has led to tighter controls in high-volume applications like industrial cleaning, car washes, and agricultural sanitation.

Furthermore, consumer advocacy groups are raising awareness about the potential impact of QAC residues on biodiversity and water quality. Companies that rely heavily on QACs for product efficacy are being forced to invest in costly reformulations and waste management systems.

The need for advanced water treatment and sediment removal technologies further increases operational costs for manufacturers and end users. As environmental legislation tightens and public concern escalates, reliance on non-biodegradable QACs poses a reputational and financial risk, particularly for global companies aiming to comply with sustainability goals and ESG frameworks.

Rising Antimicrobial Resistance and Regulatory Pushback

Another major restraint impacting the quaternary ammonium compounds market is the growing global concern over antimicrobial resistance (AMR). Excessive and indiscriminate use of QACs in hospitals, households, agriculture, and consumer products has been linked to the development of resistant microbial strains.

Bacteria such as Listeria monocytogenes, E. coli, and Pseudomonas aeruginosa have demonstrated increased resistance due to prolonged QAC exposure, which in turn can compromise the effectiveness of disinfection protocols. Scientific bodies, including the WHO and EU health committees, have raised alarms about biocide overuse contributing to cross-resistance with clinically important antibiotics. As a result, regulatory agencies in Europe and North America are considering stricter labeling, usage limitations, and reformulation mandates for QAC-based products.

Several hospitals are also re-evaluating their disinfection regimens, replacing QACs with alternative agents such as hydrogen peroxide and UV-based systems. Consumer safety organizations are advocating for more transparent ingredient disclosure and risk communication on cleaning product labels.

Additionally, export-oriented manufacturers are facing barriers in international markets where biocide restrictions are more stringent. The risk of QACs being classified as endocrine disruptors or priority pollutants in future regulatory frameworks could impose severe usage curbs. This growing resistance narrative may compel companies to reduce their QAC dependency or shift to more novel, less resistance-prone disinfectant chemistries.

Opportunities in the Global Quaternary Ammonium Compounds Market

Product Innovation in Biodegradable and Next-Gen QAC Formulations

An emerging opportunity in the QAC market lies in the development of next-generation, environmentally sustainable formulations. Traditional QACs have been scrutinized for their low biodegradability and potential to disrupt aquatic ecosystems. This has created a demand gap for new, innovative QACs that retain antimicrobial efficacy while offering improved environmental profiles.

Companies are now investing in research focused on ester quats, amino-acid-based cationic surfactants, and hybrid molecules that degrade faster without compromising functionality. This green chemistry approach aligns with global regulatory developments such as the EU’s Green Deal and chemical strategy for sustainability. Consumer brands in fabric care, air fresheners, and hard surface cleaners are particularly eager to source greener quats to align with eco-label requirements.

Partnerships between chemical companies and academic institutions are also accelerating innovations like microencapsulated QACs and controlled-release biocidal systems. These can provide longer-lasting effects with smaller dosages, thus reducing environmental load. Additionally, industries like agriculture and water treatment are exploring biodegradable QACs that maintain biocidal efficacy while minimizing bioaccumulation in soil and aquatic systems.

This opens new market segments where regulatory limitations previously restricted QAC use. As sustainability moves from optional to mandatory across value chains, innovators who develop environmentally friendly QAC alternatives will be well-positioned to capture premium market share and long-term contracts.

Expanding Applications in Agriculture and Food Processing Hygiene

The agriculture and food processing sectors present significant untapped potential for QAC-based hygiene solutions. In livestock farming, quaternary ammonium compounds are increasingly used to disinfect housing units, feed storage areas, and equipment surfaces to control the spread of zoonotic diseases and prevent cross-contamination.

Their broad-spectrum antimicrobial efficacy, stability in hard water, and compatibility with organic loads make QACs ideal for rural biosecurity systems. Governments in countries like China, Brazil, and India are emphasizing food safety compliance and modern farm hygiene, creating robust demand for registered disinfectants. In food processing facilities, QACs are utilized for cleaning conveyor belts, storage containers, meat slicers, and walls, where microbial contamination is a constant threat.

Their non-corrosive nature and low residue profile are key benefits, enabling them to meet food-contact material regulations set by global bodies. Moreover, QACs are also used in post-harvest treatments of fruits and vegetables to extend shelf life and reduce spoilage.

As foodborne illness remains a major public health concern, the need for consistent, reliable sanitization will increase. Additionally, climate change is intensifying pest and disease outbreaks, which increases dependency on preventive disinfection. Emerging technologies in spray systems and drone-based farm sanitation are further expected to enhance QAC application efficiencies in rural areas, opening new revenue streams for producers and distributors.

Trends in the Global Quaternary Ammonium Compounds Market

Increasing Shift Toward Biodegradable and Eco-Friendly QACs

With the growing global emphasis on sustainability, the quaternary ammonium compounds market is witnessing a shift toward biodegradable and environmentally friendly formulations. Traditional QACs have raised concerns due to their persistence in aquatic ecosystems and potential to contribute to antimicrobial resistance. In response, manufacturers are investing in developing ester-based QACs (ester quats), which offer superior biodegradability and lower aquatic toxicity compared to conventional variants like ADBAC and DDAC.

Regulatory bodies, especially in Europe and North America, are encouraging this transition through updated biocide directives and green labeling requirements. These trends align with broader chemical safety initiatives such as REACH in the EU and the EPA’s Safer Choice Program in the U.S. Consumer brands in fabric softeners, personal care, and institutional cleaning are increasingly marketing “eco-safe” QAC-based products.

This trend is especially pronounced in developed economies, where green chemistry adoption is becoming a market differentiator. Additionally, organizations implementing ESG (Environmental, Social, and Governance) frameworks are showing a preference for suppliers that integrate eco-friendly QACs in their product offerings. The rising use of naturally derived feedstocks like fatty alcohols for QAC synthesis further supports this trend. Overall, the drive toward environmental responsibility is not only a compliance factor but also an avenue for competitive advantage, as sustainable QACs find greater traction in regulatory-sensitive and environmentally conscious markets.

Adoption of QACs in Advanced Surface Coatings and Smart Materials

A major trend shaping the QACs market is their incorporation into advanced surface coatings and multifunctional materials designed for self-disinfecting properties. These materials are gaining popularity in healthcare, public transportation, education, and food-service sectors, where continuous microbial control is essential.

Unlike conventional disinfectants that require regular application, QAC-infused coatings provide long-lasting antimicrobial activity by embedding quaternary ammonium molecules directly into the surface polymer matrix. Hospitals are using these coatings on high-touch surfaces such as doorknobs, railings, and bed rails to minimize the risk of hospital-acquired infections. This trend is further supported by the growing interest in “touchless” hygiene systems in post-pandemic facility design.

The coatings are also being applied in commercial aviation, retail, and mass transit systems as part of new safety protocols. Additionally, nanotechnology is being used to enhance QAC efficacy by increasing surface area and enabling slow-release mechanisms. Academic collaborations and government grants are supporting R&D in this area, particularly in countries like Japan, South Korea, and Germany.

Furthermore, smart textiles with QACs embedded into fibers are being explored for uniforms, curtains, and bedding in clinical environments. The trend indicates a broadening application horizon for QACs beyond their traditional roles as disinfectants and surfactants, emphasizing their role in next-generation hygiene infrastructure.

Global Quaternary Ammonium Compounds Market: Research Scope and Analysis

By Product Type Analysis

Alkyl Trimethyl Ammonium Chloride (ATAC) is projected to dominate the product type segment of the global quaternary ammonium compounds (QACs) market due to its exceptional versatility, broad-spectrum antimicrobial efficacy, and compatibility with a wide range of applications. ATAC exhibits potent cationic surfactant properties, making it highly effective in disrupting microbial membranes, which is vital for disinfectant and sanitizer formulations.

Its molecular structure, comprising a long hydrophobic alkyl chain and a trimethylammonium head group, ensures superior surface activity and persistent antimicrobial action. These characteristics make ATAC ideal for hard surface cleaners, textile softeners, emulsifiers, and emulsifying agents used in personal care products.

ATAC's dominance is further reinforced by its chemical stability and solubility across a broad pH range, making it suitable for both acidic and neutral formulations. It is widely used in institutional and healthcare disinfectants due to its ability to retain efficacy in the presence of organic matter.

Moreover, its relatively low production cost and availability of multiple feedstock routes ensure consistent supply and economic scalability. Environmental compliance standards in regions such as North America and Europe often favor ATAC over other longer-chain QACs, especially where biodegradability and aquatic toxicity are regulatory concerns.

In addition, ATAC has found increasing use in the textile and agrochemical industries, offering dual functionality as both a preservative and an antistatic agent. With its proven compatibility with other active ingredients and low corrosiveness, ATAC continues to dominate as the most commercially significant and technologically adaptable quaternary ammonium compound.

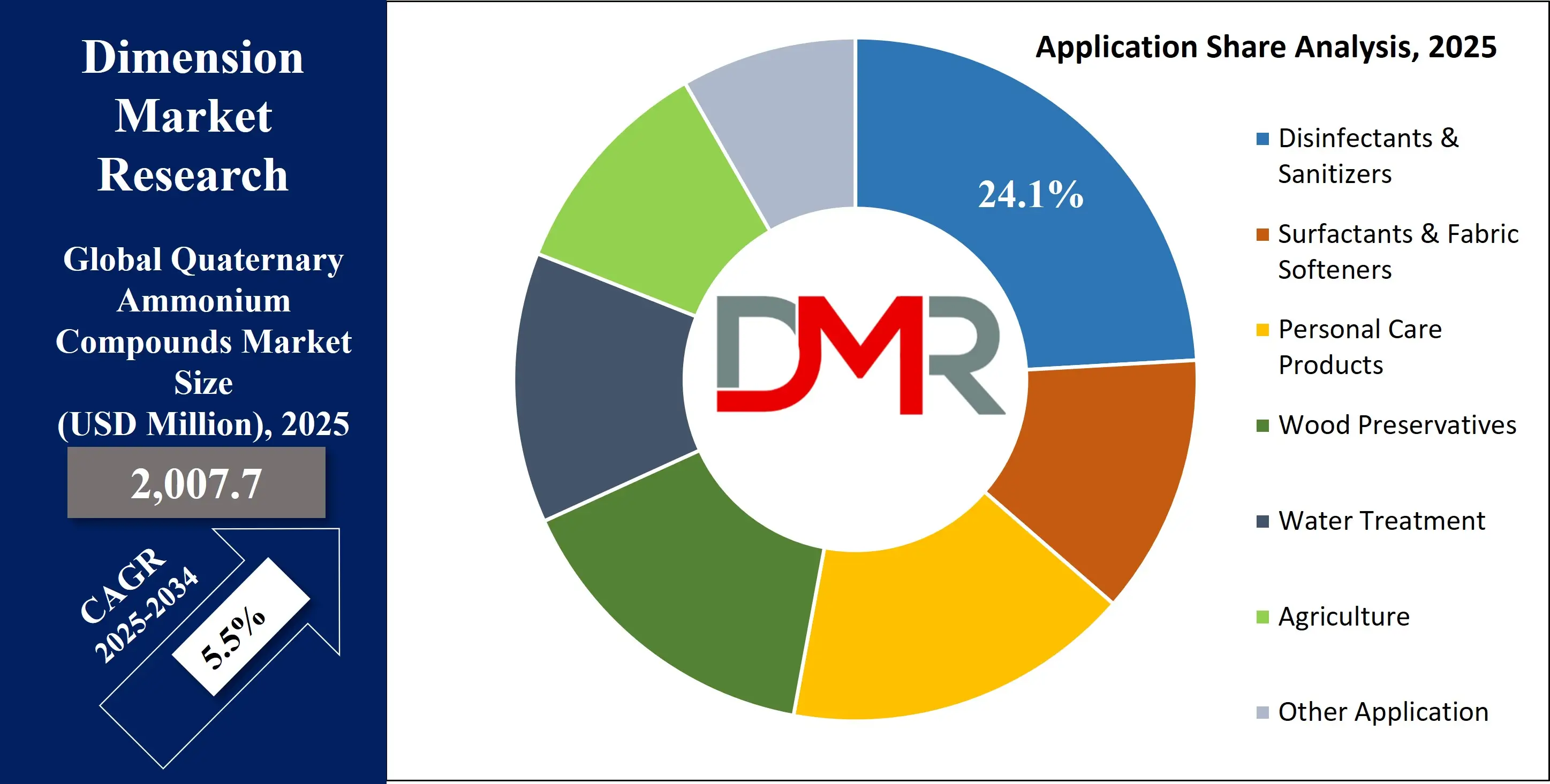

By Application Analysis

Disinfectants and sanitizers are anticipated to represent the dominant application segment in the quaternary ammonium compounds (QACs) market due to the urgent and sustained demand for infection control across diverse settings, including healthcare, institutional, industrial, and residential spaces. QACs, particularly benzalkonium chloride (BAC), didecyldimethylammonium chloride (DDAC), and ATAC, are widely used in disinfectants for their rapid action against a broad range of microorganisms, including bacteria, enveloped viruses, and fungi. These compounds disrupt cell membranes, ensuring effective microbial kill within minutes.

ℹ

To learn more about this report –

Download Your Free Sample Report Here

The COVID-19 pandemic significantly amplified the use of QAC-based disinfectants, with regulatory bodies like the U.S. EPA listing numerous QAC products for use against SARS-CoV-2. Even in the post-pandemic landscape, the heightened awareness around sanitation and hygiene has led to routine disinfection protocols in public transit systems, retail environments, hospitality venues, and educational institutions. Governments and corporations continue to invest heavily in sanitation infrastructure, ensuring sustained market demand for QAC-based formulations.

QAC-based disinfectants are preferred due to their long-lasting activity, non-corrosive nature, cost-efficiency, and compatibility with diverse surfaces. Unlike alcohol-based formulations, QAC disinfectants do not evaporate rapidly, allowing for residual antimicrobial protection. This makes them ideal for high-touch surfaces such as elevator buttons, door handles, and medical equipment.

Additionally, QACs offer synergistic benefits when combined with other biocides, enhancing performance and reducing overall chemical load. With stringent hygiene mandates, especially in food processing and healthcare environments, QACs remain indispensable in disinfectant manufacturing. Their scalable synthesis, regulatory approvals, and low toxicity to humans (at recommended levels) further ensure their continued dominance in this segment.

By End User Analysis

The healthcare sector is poised to dominate the end-user segment of the global quaternary ammonium compounds (QACs) market due to its critical need for high-level disinfection and infection control. QACs are widely utilized across hospitals, diagnostic labs, clinics, eldercare facilities, and ambulatory care centers to prevent healthcare-associated infections (HAIs).

These compounds are integral in surface disinfection, surgical instrument sterilization, hand hygiene products, air filtration systems, and laundry sanitization. The effectiveness of QACs against a broad spectrum of pathogens, including Gram-positive and Gram-negative bacteria, enveloped viruses, and some fungi, makes them ideal for stringent medical hygiene standards.

Regulatory endorsements from bodies such as the U.S. Centers for Disease Control and Prevention (CDC) and the European Centre for Disease Prevention and Control (ECDC) have further solidified QACs’ role in healthcare disinfection protocols.

Their residual antimicrobial effect provides added protection on high-touch surfaces such as bed rails, IV poles, and operating tables, where pathogen transmission risks are high. Additionally, QAC-based products are used in preoperative skin prepping solutions and antimicrobial wound dressings.

Post-COVID-19, hospitals worldwide have significantly expanded their sanitation budgets and adopted advanced QAC-based products for continuous cleaning routines. The increasing prevalence of antibiotic-resistant bacteria has also pushed the healthcare industry to adopt more aggressive and frequent disinfection practices, where QACs serve as first-line agents.

Furthermore, healthcare environments require non-corrosive, low-odor, and low-toxicity disinfectants that QACs meet effectively. Their ability to integrate into both manual and automated cleaning systems makes them the preferred solution in healthcare, ensuring their continued dominance in this end-user segment.

The Global Quaternary Ammonium Compounds Market Report is segmented on the basis of the following

By Product Type

- Alkyl Trimethyl Ammonium Chloride (ATAC)

- Benzalkonium Chloride (BAC)

- Didecyldimethylammonium Chloride (DDAC)

- Cetyl Trimethyl Ammonium Chloride (CTAC)

- Other Product Type

By Application

- Disinfectants & Sanitizers

- Surfactants & Fabric Softeners

- Personal Care Products

- Wood Preservatives

- Water Treatment

- Agriculture

- Other Application

By End-User

- Healthcare

- Food & Beverage

- Household & Consumer

- Textile & Apparel

- Industrial

- Other End User

Impact of Artificial Intelligence in the Global Quaternary Ammonium Compounds Market

- Smart Manufacturing Optimization: AI-powered predictive analytics and digital twin technology are revolutionizing QAC production. By analyzing real-time data from sensors, AI optimizes reaction parameters, reduces energy consumption by 8-10%, and minimizes raw material waste by 12%. Machine learning algorithms also predict equipment maintenance needs, cutting unplanned downtime by 15-20% and boosting overall plant efficiency.

- Enhanced Quality Control & Safety: Advanced AI vision systems and spectroscopic tools now detect microscopic impurities in QAC batches with 99.5% accuracy. AI continuously monitors production lines, automatically flagging deviations from safety standards. This has reduced product recalls by 30% while ensuring consistent compliance with strict EPA and EU biocidal regulations.

- Demand Forecasting & Supply Chain Efficiency: AI analyzes global disinfectant demand patterns, weather data, and disease outbreaks to predict regional QAC needs with 35% greater accuracy. This prevents both shortages and overproduction, optimizing inventory costs by 18-22%. Smart logistics algorithms also reduce shipping delays by 15% through dynamic route planning.

- Accelerated Sustainable Product Development: Generative AI models can design and simulate new QAC molecular structures in days instead of months. These systems prioritize biodegradable formulations, helping companies develop eco-friendly disinfectants 50% faster. AI also predicts regulatory approval likelihood, saving millions in R&D costs for non-viable compounds.

- Automated Regulatory Compliance: AI compliance platforms track evolving chemical regulations across 30+ countries in real-time. Natural language processing scans thousands of regulatory documents daily, alerting manufacturers to needed formulation changes. This proactive approach has helped companies avoid an average of $500,000 in annual fines while maintaining global market access.

- Smart Market Adaptation & Strategy: AI tools analyze social media, research papers, and patent filings to identify emerging QAC applications. This intelligence helps manufacturers pivot production toward high-growth segments like healthcare disinfectants or agricultural biocides 3-6 months ahead of competitors, securing first-mover advantages in niche markets.

Global Quaternary Ammonium Compounds Market: Regional Analysis

Region with the Largest Revenue Share

Europe is projected to hold the dominant position in the global quaternary ammonium compounds market as it commands over 32.7% of the total market revenue by the end of 2025, due to stringent hygiene regulations, well-developed healthcare systems, and a highly organized institutional cleaning infrastructure.

Regulatory bodies such as the European Chemicals Agency (ECHA) and the European Centre for Disease Prevention and Control (ECDC) have set rigorous standards for disinfectants, surface sanitizers, and personal care formulations, many of which rely heavily on QACs like BAC, DDAC, and ATAC for compliance. The EU Biocidal Products Regulation (BPR) framework has standardized QAC usage across member states, ensuring consistent demand in clinical, commercial, and residential sectors.

ℹ

To learn more about this report –

Download Your Free Sample Report Here

Moreover, Europe's large aging population increases demand for QAC-based cleaning solutions in hospitals, nursing homes, and assisted-living facilities. Countries like Germany, France, and the UK invest significantly in public health safety, incorporating QACs into national disinfection strategies. The growing emphasis on sustainable chemistry in Europe has also prompted manufacturers to develop eco-friendly QAC variants, driving innovation and product diversification.

Additionally, Europe's strong industrial base and emphasis on high-quality textile and personal care production further fuel the use of QACs as antistatic agents and preservatives. These combined factors, strict regulation, demographic demand, and innovation, secure Europe’s leadership in both volume and revenue share in the global QAC market.

Region with the Highest CAGR

North America, particularly the U.S., is projected to record the highest CAGR in the global QAC market due to rapidly expanding demand across medical, consumer, and industrial sectors, combined with technological advancements and evolving hygiene behavior.

Post-COVID-19, institutions such as schools, public transit systems, airports, and workplaces have significantly upgraded disinfection protocols, increasingly relying on QAC-based products for their broad-spectrum antimicrobial effectiveness and residual activity. The U.S. Environmental Protection Agency (EPA) included over 500 QAC-based disinfectants on its List N for use against SARS-CoV-2, creating a surge in both production and usage.

Additionally, North America’s expanding geriatric population and rise in healthcare-associated infections have heightened the demand for medical-grade sanitation, where QACs are a core active ingredient in hospital-grade disinfectants, skin antiseptics, and surgical instrument cleaners. Strong research infrastructure and manufacturing capabilities enable domestic companies to innovate faster, launching QAC formulations with enhanced biodegradability and lower toxicity, aligned with EPA Safer Choice guidelines.

Moreover, growth in sectors like food processing, agriculture, HVAC systems, and personal care is driving diversified QAC use cases. The convergence of policy incentives, public health funding, and corporate ESG initiatives is propelling a shift toward sustainable disinfection technologies, contributing to North America's robust CAGR in the QAC market through 2034.

By Region

North America

Europe

- Germany

- The U.K.

- France

- Italy

- Russia

- Spain

- Benelux

- Nordic

- Rest of Europe

Asia-Pacific

- China

- Japan

- South Korea

- India

- ANZ

- ASEAN

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Argentina

- Colombia

- Rest of Latin America

Middle East & Africa

- Saudi Arabia

- UAE

- South Africa

- Israel

- Egypt

- Rest of MEA

Global Quaternary Ammonium Compounds Market: Competitive Landscape

The global quaternary ammonium compounds market is moderately consolidated, with key players focusing on mergers, capacity expansions, green chemistry innovations, and strategic regional penetrations to strengthen their market position. Major players include Evonik Industries, Lonza Group, Nouryon, BASF SE, Solvay, Kao Chemicals, and Stepan Company, who collectively dominate the market with extensive portfolios of QAC variants tailored for healthcare, industrial, and personal care applications.

These companies are investing in sustainable QAC formulations with improved biodegradability and lower ecotoxicity, aligning with tightening regulations in Europe and North America. Evonik and Nouryon, for example, are pioneering ester-based QACs and collaborating with academic institutions for greener alternatives. Lonza and BASF have ramped up antimicrobial product lines to support the healthcare sector, particularly during and after the COVID-19 pandemic.

Regional players in Asia-Pacific, such as Jiangsu Qingquan Chemical and Hefei TNJ Chemical, are expanding production capacities to serve growing domestic demand while entering export markets. Competitive strategies also include securing regulatory approvals for new product lines under frameworks like the EU Biocidal Product Regulation and the U.S. EPA's List N. As hygiene demands evolve, the industry is witnessing increased patent activity, vertical integration, and global partnerships, solidifying a robust, innovation-driven competitive landscape.

Some of the prominent players in the Global Quaternary Ammonium Compounds Market are

- BASF SE

- The Dow Chemical Company

- Evonik Industries AG

- Clariant AG

- Huntsman Corporation

- Stepan Company

- Croda International Plc

- Solvay S.A.

- Lonza Group AG

- Nouryon

- Arkema S.A.

- KAO Corporation

- Air Products and Chemicals, Inc.

- Merck KGaA

- Spectrum Chemical Manufacturing Corp.

- Merichem Company

- Novo Nordisk Pharmatech A/S

- Mitsubishi Chemical Group

- Induchem AG

- Other Key Players

Recent Developments in the Global Quaternary Ammonium Compounds Market

- June 2024: BASF and Solvay partnered to develop sustainable QACs with lower environmental impact, targeting disinfectants and industrial biocides. The collaboration focuses on reducing toxicity while maintaining efficacy, aligning with stricter EU and US regulations.

- May 2024: Evonik invested USD 50M in its Alabama QAC plant, boosting production capacity by 30% to meet rising demand in healthcare and water treatment. The expansion supports EPA-approved disinfectant formulations.

- April 2024: Lonza acquired Dishman Carbogen Amcis for USD 550M, enhancing its QAC portfolio for pharmaceutical and biocide applications. The deal strengthens Lonza’s presence in Asia and Europe.

- March 2024: Croda International unveiled "EcoQuat", a biodegradable QAC line, at ACHEMA 2024. The products cater to food-safe disinfectants and comply with the EU’s Biocidal Products Regulation (BPR).

- February 2024: Stepan-Clariant alliance aims to create QAC-based antimicrobial coatings for medical textiles. The partnership leverages Stepan’s surfactant expertise and Clariant’s specialty chemicals portfolio.

- January 2024: The Global QACs Expo in Dubai featured 50+ exhibitors, highlighting innovations in disinfection, agriculture, and personal care. Key topics included regulatory challenges and green alternatives.

- November 2023: Dow Chemical introduced "Aegis QAC-30", a long-lasting disinfectant for food processing plants, meeting FDA and EPA standards for microbial control in high-risk environments.

- October 2023: Kao Corporation expanded its Thailand QAC facility, increasing output by 15,000 tons/year. The investment supports Asia-Pacific demand for household and industrial disinfectants.

- September 2023: PCC Group-Italmatch merger created a USD 1.2 Bn specialty chemicals giant, strengthening QAC supply chains in Europe and North America for water treatment and oilfield applications.

- July 2023: The International Biocides Conference (Amsterdam) addressed QAC resistance in bacteria and regulatory shifts, with presentations from EPA, ECHA, and industry leaders.

- May 2023: Lanxess-Nouryon collaboration developed "BioQuat", a plant-derived QAC for eco-friendly disinfectants, responding to consumer demand for sustainable antimicrobials.

- March 2023: Huntsman’s acquisition of Gabriel Performance Products added high-purity QACs for cosmetics and pharmaceuticals, expanding its life sciences division.

Report Details

| Report Characteristics |

| Market Size (2025) |

USD 2,007.7 Mn |

| Forecast Value (2034) |

USD 3,252.3 Mn |

| CAGR (2025–2034) |

5.5% |

| Historical Data |

2019 – 2024 |

| The US Market Size (2025) |

USD 466.0 Mn |

| Forecast Data |

2025 – 2033 |

| Base Year |

2024 |

| Estimate Year |

2025 |

| Report Coverage |

Market Revenue Estimation, Market Dynamics, Competitive Landscape, Growth Factors, etc. |

| Segments Covered |

By Product Type (Alkyl Trimethyl Ammonium Chloride (ATAC), Benzalkonium Chloride (BAC), Didecyldimethylammonium Chloride (DDAC), Cetyl Trimethyl Ammonium Chloride (CTAC), Other Product Type), By Application (Disinfectants & Sanitizers, Surfactants & Fabric Softeners, Personal Care Products, Wood Preservatives, Water Treatment, Agriculture, Other Application), By End-User (Healthcare, Food & Beverage, Household & Consumer, Textile & Apparel, Industrial, Other End User) |

| Regional Coverage |

North America – US, Canada; Europe – Germany, UK, France, Russia, Spain, Italy, Benelux, Nordic, Rest of Europe; Asia-Pacific – China, Japan, South Korea, India, ANZ, ASEAN, Rest of APAC; Latin America – Brazil, Mexico, Argentina, Colombia, Rest of Latin America; Middle East & Africa – Saudi Arabia, UAE, South Africa, Turkey, Egypt, Israel, Rest of MEA |

| Prominent Players |

BASF SE, The Dow Chemical Company, Evonik Industries AG, Clariant AG, Huntsman Corporation, Stepan Company, Croda International Plc, Solvay S.A., Lonza Group AG, Nouryon, Arkema S.A., KAO Corporation, Air Products and Chemicals Inc., Merck KGaA, Spectrum Chemical Manufacturing Corp., Merichem Company, Novo Nordisk Pharmatech A/S, Mitsubishi Chemical Group, Induchem AG, Kao Chemicals Europe, and Other Key Players |

| Purchase Options |

We have three licenses to opt for: Single User License (Limited to 1 user), Multi-User License (Up to 5 Users), and Corporate Use License (Unlimited User) along with free report customization equivalent to 0 analyst working days, 3 analysts working days, and 5 analysts working days respectively. |

Frequently Asked Questions

How big is the Global Quaternary Ammonium Compounds Market?

▾ The Global Quaternary Ammonium Compounds Market size is estimated to have a value of USD 2,007.7 million in 2025 and is expected to reach USD 3,252.3 million by the end of 2034.

What is the growth rate in the Global Quaternary Ammonium Compounds Market in 2025?

▾ The market is growing at a CAGR of 5.5 percent over the forecasted period of 2025.

What is the size of the US Quaternary Ammonium Compounds Market?

▾ The US Quaternary Ammonium Compounds Market is projected to be valued at USD 466.0 million in 2025. It is expected to witness subsequent growth in the upcoming period as it holds USD 733.4 million in 2034 at a CAGR of 5.2%.

Which region accounted for the largest Global Quaternary Ammonium Compounds Market?

▾ Europe is expected to have the largest market share in the Global Quaternary Ammonium Compounds Market with a share of about 32.7% in 2025.

Who are the key players in the Global Quaternary Ammonium Compounds Market?

▾ Some of the major key players in the Global Quaternary Ammonium Compounds Market are BASF SE, The Dow Chemical Company, Evonik Industries AG, Clariant AG, Huntsman Corporation, Stepan Company, Croda International Plc, and many others.