Market Overview

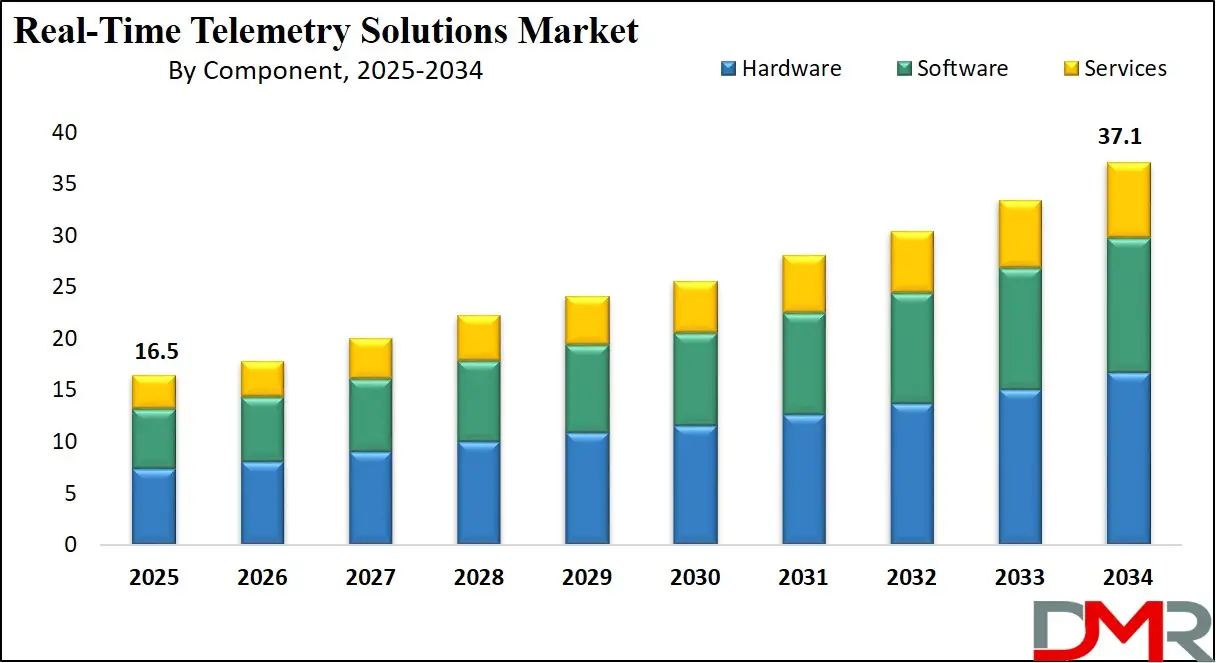

The Global Real-Time Telemetry Solutions Market is projected to reach

USD 16.5 billion in 2025 and grow at a compound annual growth rate of

9.4% from there until 2034 to reach a value of

USD 37.1 billion.

The global real-time telemetry solutions market is witnessing significant growth due to rising demand for instantaneous data monitoring, analytics, and decision-making capabilities across industries. The evolution of smart systems and the proliferation of connected devices have accelerated the need for real-time data flow and analysis. Advancements in wireless communication protocols, including 5G and low-latency IoT connectivity, are strengthening telemetry’s role in enabling predictive analytics, proactive maintenance, and real-time feedback loops in critical applications such as aerospace, defense, healthcare, automotive, and energy.

However, the market faces a few notable restraints. High installation and maintenance costs, especially for satellite-based and mission-critical systems, are a barrier for smaller enterprises. Interoperability challenges between legacy systems and modern telemetry frameworks, as well as increasing concerns over cybersecurity risks and data integrity, are also hindering widespread deployment.

Opportunities lie in the expansion of telemetry in remote operations, particularly in emerging economies and hard-to-access geographies. The integration of AI with telemetry analytics is enabling faster anomaly detection and automated response mechanisms. Furthermore, the surge in unmanned systems like UAVs,

autonomous vehicles, and smart infrastructure has created new avenues for telemetry deployments.

Global growth prospects remain optimistic, supported by the rising adoption of telemetry in space exploration missions, offshore drilling, and cross-border defense collaborations. Cloud-based telemetry solutions are gaining traction due to their scalability and lower upfront investment. As organizations strive for operational efficiency, safety, and sustainability, real-time telemetry is becoming a core enabler of data-driven transformation across verticals worldwide.

ℹ

To learn more about this report –

Download Your Free Sample Report Here

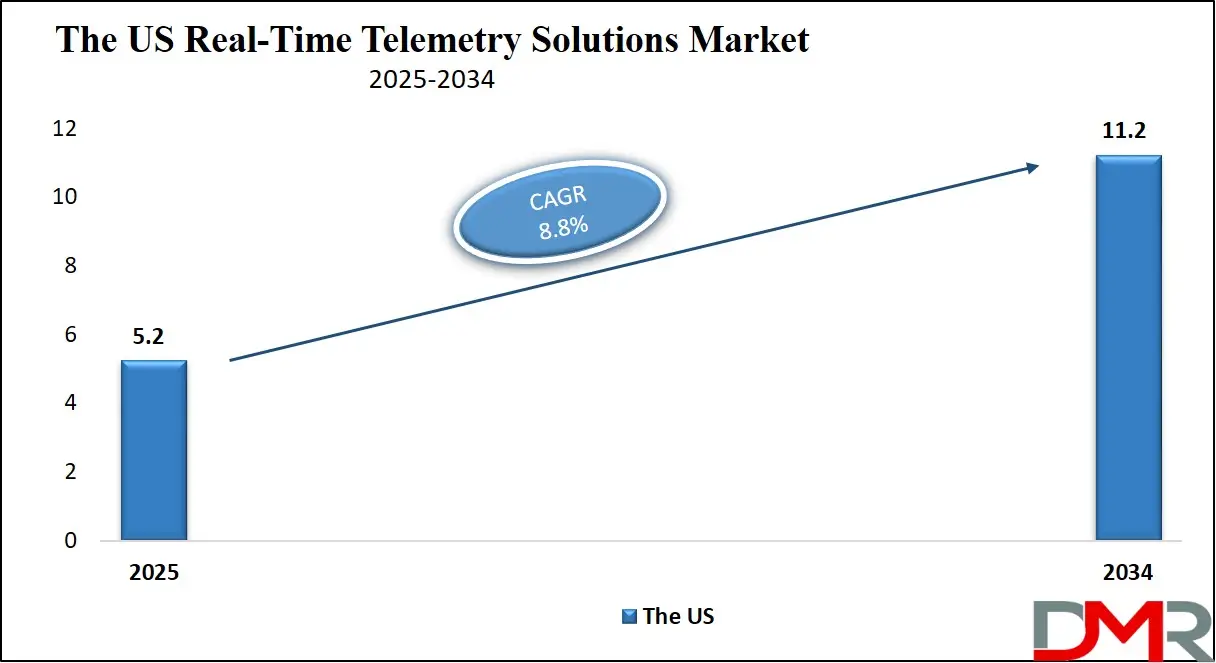

The US Real-Time Telemetry Solutions Market

The US Real-Time Telemetry Solutions Market is projected to reach

USD 5.2 billion in 2025 at a compound annual growth rate of

8.8% over its forecast period.

The United States remains a frontrunner in the global real-time telemetry solutions market, driven by robust technological infrastructure and heavy investments in defense, aerospace, and smart infrastructure development. The presence of major aerospace hubs, cutting-edge research institutions, and innovation-friendly regulatory policies gives the U.S. a clear advantage in advancing telemetry applications across sectors.

In defense, telemetry is critical for weapon systems testing, satellite surveillance, and UAV control. The Department of Defense has invested heavily in telemetry for range instrumentation and battlefield situational awareness. Meanwhile, the U.S. space program has historically been a major contributor to the evolution of telemetry systems for real-time spaceflight tracking and mission analysis.

Healthcare has seen exponential growth in real-time telemetry for

remote patient monitoring. With growing support from federal programs and insurance reimbursements for telehealth services, telemetry-based medical solutions are increasingly deployed in hospitals, clinics, and at home.

Demographically, the U.S. benefits from a large, connected, and tech-savvy population, which facilitates the deployment and adoption of digital telemetry applications. Its aging population and rural communities further drive the demand for remote monitoring in healthcare and utilities. The U.S. electric grid modernization efforts also integrate telemetry systems for load balancing and outage detection.

In manufacturing and transportation, real-time telemetry solutions are streamlining equipment diagnostics and fleet operations. With the rise of electric vehicles, autonomous transportation, and smart cities, the U.S. market is expected to maintain strong momentum. National-level strategies to promote digital transformation and security in critical infrastructure continue to act as catalysts for market expansion.

ℹ

To learn more about this report –

Download Your Free Sample Report Here

The European Real-Time Telemetry Solutions Market

The Europe Real-Time Telemetry Solutions Market is estimated to be valued at

USD 2.9 billion in 2025 and is further anticipated to reach

USD 6.3 billion by 2034 at a

CAGR of 9.0%.

Europe’s real-time telemetry solutions market is expanding steadily, supported by cross-border infrastructure development, environmental sustainability goals, and investments in aerospace and defense modernization. Countries like Germany, France, the UK, and Sweden are heavily integrating telemetry into their digital transition plans, especially in sectors like clean energy, automotive diagnostics, and space exploration.

The European automotive industry, home to several premium OEMs, relies on telemetry for in-vehicle diagnostics, telematics services, and over-the-air updates. Telemetry is a foundational technology in autonomous driving systems, where real-time feedback is critical for vehicle safety and operational performance.

Environmental agencies in Europe increasingly use telemetry to monitor air pollution, greenhouse gas emissions, and water quality. Smart grid initiatives are also deploying telemetry to manage real-time energy distribution, demand forecasting, and fault detection, further aligning with Europe’s climate neutrality ambitions.

The European Space Agency (ESA) is at the forefront of using telemetry for satellite and spacecraft operations. Data received from multiple Earth observation missions is used for weather forecasting, disaster management, and climate science.

From a demographic and regulatory perspective, Europe benefits from a highly urbanized population, widespread broadband connectivity, and a strong emphasis on data privacy and security. The EU’s emphasis on digital sovereignty is prompting member states to localize data infrastructure, thereby accelerating investments in cloud-integrated telemetry systems.

With increasing adoption in industrial automation, smart transportation, and border security, Europe's telemetry market is poised for long-term growth. The convergence of sustainability, safety, and data-driven governance makes real-time telemetry indispensable for future-ready infrastructure.

The Japan Real-Time Telemetry Solutions Market

The Japan Real-Time Telemetry Solutions Market is projected to be valued at USD 990.0 million in 2025. It is further expected to witness subsequent growth in the upcoming period, holding USD 2.3 billion in 2034 at a CAGR of 10.0%.

Japan’s real-time telemetry solutions market is deeply rooted in its technological excellence and focus on resilience, automation, and environmental monitoring. As one of the world’s most technologically advanced nations, Japan integrates telemetry across its infrastructure, transportation, healthcare, and aerospace sectors to maintain efficiency and safety in real-time.

Japan’s space program relies extensively on telemetry for spacecraft command, control, and data transmission. The Japan Aerospace Exploration Agency (JAXA) uses telemetry to monitor onboard systems, adjust orbital parameters, and ensure mission integrity for satellites and space probes. This emphasis has positioned Japan as a key contributor to space-based telemetry innovations.

The country’s highly urbanized and earthquake-prone geography necessitates telemetry use in disaster management systems. Telemetry-enabled early warning systems track seismic activity, tsunami threats, and volcanic behavior, enabling timely public alerts and responses. The Japan Meteorological Agency depends on telemetry networks for real-time environmental and geophysical data gathering.

In industrial settings, Japanese manufacturers use telemetry to optimize robotic assembly lines, monitor machine health, and enable predictive maintenance. The automotive sector—led by companies like Toyota and Honda—integrates telemetry into connected vehicle platforms for diagnostics, driver behavior monitoring, and navigation.

Healthcare in Japan also benefits from real-time telemetry through wearable health devices, elderly care systems, and telemedicine platforms, especially in rural or aging populations. The demographic shift toward a super-aged society fuels the need for remote patient monitoring solutions.

Overall, Japan’s telemetry market thrives on precision, innovation, and automation, with continued growth expected from smart infrastructure initiatives and next-generation space and robotics programs.

Global Real-Time Telemetry Solutions Market: Key Takeaways

- The Global Market Size Insights: The Global Real-Time Telemetry Solutions Market size is estimated to have a value of USD 16.5 billion in 2025 and is expected to reach USD 37.1 billion by the end of 2034.

- The U.S. Market Size Insights: The US Real-Time Telemetry Solutions Market is projected to be valued at USD 5.2 billion in 2025. It is expected to witness subsequent growth in the upcoming period as it holds USD 11.2 billion in 2034 at a CAGR of 8.8%.

- Japan Market Size Insights: Japan’s market is estimated at USD 990.0 million in 2025, forecasted to grow to USD 2.3 billion by 2034, with a CAGR of 10.0%.

- Europe Market Size Insights: The European market is projected to reach USD 2.9 billion in 2025, expanding to USD 6.3 billion by 2034, at a CAGR of 9.0%.

- By Component Segment Analysis: In 2025, hardware is expected to dominate this segment as it holds the highest portion of the global revenue share.

- Region with the Largest Share: North America is expected to have the largest market share in the Global Real-Time Telemetry Solutions Market with a share of about 37.8% in 2025.

- Key Players Insights: Some of the major key players in the Global Real-Time Telemetry Solutions Market are L3Harris Technologies, Honeywell International Inc., Thales Group, Northrop Grumman Corporation, Raytheon Technologies Corporation, Leonardo S.p.A., Curtiss-Wright Corporation, Safran S.A., Kratos Defense & Security Solutions Inc., Collins Aerospace, and many others.

- Global Market Growth Rate Insights: The market is growing at a CAGR of 9.4 percent over the forecasted period of 2025.

Global Real-Time Telemetry Solutions Market: Use Cases

- Defense and Missile Systems: Real-time telemetry supports missile guidance, navigation, and performance tracking in military operations. It enables defense forces to gather live mission data, assess flight trajectories, and monitor subsystem health, ensuring precision and safety in high-risk environments.

- Spacecraft and Satellite Communication: Space agencies use telemetry to maintain communication with orbiting satellites and deep-space probes. It enables real-time health monitoring of onboard instruments, fuel systems, and orbital adjustments, ensuring mission continuity and scientific data retrieval.

- Oil & Gas Remote Pipeline Monitoring: Telemetry systems help monitor pressure levels, flow rates, and leak detection in long-distance oil and gas pipelines. Remote insights enable operators to respond swiftly to anomalies, minimize downtime, and prevent environmental damage.

- Smart Agriculture and Irrigation: Telemetry allows farmers to monitor weather conditions, soil moisture, and crop health. Data-driven irrigation scheduling and pesticide application improve resource efficiency and crop yields while minimizing labor and input costs.

- Fleet Telematics in Logistics: Commercial transportation companies use telemetry for vehicle tracking, fuel consumption monitoring, engine diagnostics, and route optimization. It enhances logistics efficiency, driver safety, and compliance with operational standards.

Global Real-Time Telemetry Solutions Market: Stats & Facts

Centers for Disease Control and Prevention (CDC) – United States

- In 2022, heart disease was the leading cause of death in the U.S., with 702,880 fatalities, including 371,506 from coronary artery disease, highlighting the critical need for cardiac monitoring technologies.

- Annually, approximately 805,000 Americans suffer heart attacks, increasing the demand for cardiac telemetry units that provide real-time monitoring of vital signs such as heart rate and blood pressure.

- The increasing prevalence of cardiovascular diseases drives healthcare providers to adopt telemetry systems for continuous, remote monitoring to detect early warning signs and improve patient outcomes.

American Heart Association (AHA)

- A 2018 review revealed only 24% of telemetry monitoring days met AHA’s appropriate use criteria, signaling widespread overuse and potential inefficiencies in patient care practices.

- Inappropriate use of telemetry monitoring results in unnecessary healthcare expenses without corresponding improvements in patient outcomes, emphasizing the need for stricter adherence to guidelines.

- Minimizing overuse of telemetry can enhance patient safety by reducing false alarms and unnecessary interventions, while simultaneously decreasing avoidable costs in healthcare settings

National Institutes of Health (NIH)

- Telemetry is vital for continuous monitoring of cardiac patients, enabling timely detection of arrhythmias and other life-threatening abnormalities.

- Technological advancements in telemetry systems have significantly improved patient prognosis by allowing rapid clinical responses to detected abnormalities.

- Incorporating telemetry into critical care units facilitates ongoing observation of vital parameters, ensuring prompt intervention in acute cardiac conditions.

European Space Agency (ESA)

- Telemetry systems are indispensable for satellite mission control, providing live data on spacecraft health and status to ground stations.

- ESA employs telemetry to monitor environmental parameters and support scientific experiments conducted in orbit, ensuring data integrity and mission success.

- Continued investment in telemetry technology enhances mission reliability, enabling ESA to conduct complex space operations with reduced risk.

Japan Aerospace Exploration Agency (JAXA)

- JAXA uses telemetry to monitor spacecraft subsystems, enabling real-time assessment and ensuring mission safety and effectiveness.

- Telemetry data allows mission controllers to make informed decisions during space missions, optimizing operational outcomes.

- JAXA’s commitment to advancing telemetry technology reinforces Japan’s competitive edge in global space exploration endeavors.

Environmental Protection Agency (EPA) – United States

- The EPA leverages telemetry to continuously monitor air and water quality, facilitating the timely detection of pollutants and environmental hazards.

- Real-time telemetry data supports efficient pollution control strategies and sustainable resource management initiatives.

- Deploying telemetry systems strengthens the EPA’s ability to safeguard environmental health and comply with regulatory standards.

World Health Organization (WHO)

- WHO recognizes the growing global burden of non-communicable diseases, including cardiovascular disorders, which necessitate advanced monitoring solutions such as telemetry.

- Telemetry enhances chronic disease management worldwide by enabling continuous patient monitoring, leading to improved clinical decision-making.

- Integrating telemetry into healthcare infrastructure is crucial for improving patient outcomes and reducing morbidity on a global scale.

National Aeronautics and Space Administration (NASA)

- NASA relies extensively on telemetry for transmitting critical spacecraft data to Earth, ensuring constant communication during missions.

- Telemetry systems enable real-time monitoring of spacecraft systems and environmental conditions, crucial for mission safety and success.

- Ongoing advancements in telemetry technology underpin NASA’s ability to conduct increasingly complex and distant space explorations.

United Nations Office for Outer Space Affairs (UNOOSA)

- UNOOSA promotes the responsible and sustainable use of outer space through the development and implementation of telemetry systems.

- Telemetry supports safe space activities by providing vital real-time data on spacecraft health and environmental conditions.

- The organization facilitates global cooperation to standardize telemetry technology use, ensuring safety and sustainability in space governance.

International Telecommunication Union (ITU)

- The ITU establishes global standards for telemetry communication to ensure interoperability and reliable data transmission across diverse platforms.

- Telemetry is a cornerstone of worldwide communication networks, including satellite systems and terrestrial infrastructure.

- ITU regulations foster efficient and secure telemetry system operation, supporting various industrial and scientific applications globally.

Global Real-Time Telemetry Solutions Market: Market Dynamics

Driving Factors in the Global Real-Time Telemetry Solutions Market

Proliferation of Internet of Things (IoT) Devices Across IndustriesThe exponential growth of IoT devices across various industries is a major driver for the telemetry market. These devices generate vast amounts of data that need to be collected, transmitted, and analyzed. Telemetry systems provide the infrastructure and tools to capture this data from sensors embedded in everything from industrial equipment to wearables. By enabling real-time monitoring and remote data visualization, telemetry helps businesses optimize operations, improve product performance, and gain valuable insights for data-driven decision-making.

The integration of telemetry with

Internet of Things (IoT) platforms enhances the ability to perform predictive maintenance, reduce operational costs, and improve customer experiences. For instance, in the manufacturing sector, telemetry data from IoT devices can be used to monitor equipment health, predict failures, and schedule maintenance activities proactively, thereby minimizing downtime and extending equipment life.

Advancements in Communication Infrastructure

The development of robust wireless communication infrastructure, including 4G and 5G networks, satellite communication, and Low-Power Wide-Area Networks (LPWAN), has significantly improved data transmission capabilities. This has contributed to the widespread adoption of telemetry systems across various sectors. Enhanced communication infrastructure ensures reliable and efficient data transfer, which is critical for real-time monitoring and control applications.

Furthermore, the advent of LPWAN technologies like LoRaWAN and Sigfox provides cost-effective solutions for long-range, low-power telemetry applications. These networks are particularly useful in sectors like agriculture and environmental monitoring, where devices may need to operate over extended periods without frequent maintenance. As communication technologies continue to evolve, they will further enhance the capabilities and reach of telemetry systems, driving their adoption across diverse industries.

Restraints in the Global Real-Time Telemetry Solutions Market

Data Security and Privacy Concerns

As telemetry systems collect and transmit vast amounts of data, concerns regarding data security and privacy are a major challenge. Breaches or unauthorized access to sensitive data can have significant consequences for businesses and individuals. The telemetry market needs robust security protocols and compliance with evolving data privacy regulations to ensure user trust and encourage wider adoption.

The increasing sophistication of cyber threats necessitates the implementation of advanced security measures, including encryption, authentication, and intrusion detection systems, to protect telemetry data. Additionally, organizations must navigate complex regulatory landscapes, such as the General Data Protection Regulation (GDPR) and the California Consumer Privacy Act (CCPA), which impose strict requirements on data handling and protection.

High Implementation and Maintenance Costs

Deploying telemetry systems often requires significant upfront investment in infrastructure, sensors, and communication devices. Moreover, ongoing maintenance and operational costs can be substantial, particularly for large-scale deployments. These financial considerations can be a barrier to entry for small and medium-sized enterprises (SMEs) and organizations operating with limited budgets.

The cost of hardware components, such as sensors and data acquisition systems, along with the expenses associated with software development, integration, and personnel training, contribute to the overall implementation costs. Additionally, maintaining and upgrading telemetry systems to keep pace with technological advancements and changing operational requirements can incur further expenses. To mitigate these challenges, organizations may explore cost-effective solutions, such as cloud-based telemetry services, which can reduce the need for extensive on-premises infrastructure.

Opportunities in the Global Real-Time Telemetry Solutions Market

Integration of Telemetry with Artificial Intelligence and Machine LearningThe integration of telemetry solutions with artificial intelligence (AI) and

machine learning (ML) algorithms presents exciting opportunities. AI and ML can analyze telemetry data to identify patterns, predict failures, and automate decision-making, leading to proactive maintenance and improved operational efficiency. This synergy enables organizations to transition from reactive to predictive maintenance strategies, reducing downtime and maintenance costs.

In sectors like healthcare, AI-enhanced telemetry can facilitate early detection of patient health issues, allowing for timely interventions and improved patient outcomes. In manufacturing, ML algorithms can analyze telemetry data to optimize production processes, enhance quality control, and reduce waste. The ability to derive actionable insights from telemetry data through AI and ML is transforming how businesses operate, making them more agile and responsive to changing conditions.

Expansion of Smart Cities and Infrastructure ProjectsThe rapid urbanization and the concept of smart cities create immense opportunities for telemetry solutions. By integrating telemetry with various urban systems such as transportation, energy management, and

waste management, cities can optimize resource utilization, improve sustainability, and enhance citizens’ quality of life. Telemetry enables real-time monitoring and control of city infrastructure, facilitating efficient service delivery and rapid response to issues.

In transportation, telemetry systems can monitor traffic flow, vehicle locations, and public transit operations, enabling dynamic traffic management and reducing congestion. In energy management, telemetry allows for the monitoring of electricity consumption and grid performance, supporting the integration of renewable energy sources and enhancing grid stability. Waste management systems can use telemetry to monitor bin levels and optimize collection routes, reducing operational costs and environmental impact.

Trends in the Global Real-Time Telemetry Solutions Market

Integration of

Artificial Intelligence (AI) and Machine Learning (ML) in Telemetry Systems

The integration of AI and ML into telemetry systems is revolutionizing the way data is analyzed and utilized. By leveraging these technologies, telemetry solutions can now offer predictive analytics, enabling proactive maintenance and real-time decision-making. AI algorithms can process vast amounts of telemetry data to identify patterns and anomalies that might be missed by traditional analysis methods. This leads to improved operational efficiency, reduced downtime, and enhanced system reliability.

Moreover, ML models can continuously learn from new data, refining their predictive capabilities over time. This dynamic learning process allows for more accurate forecasting of system behaviors and potential failures. Industries such as manufacturing, healthcare, and transportation are increasingly adopting AI-enhanced telemetry to optimize their operations and gain a competitive edge.

Expansion of 5G Networks Enhancing Telemetry Capabilities

The global rollout of 5G networks is significantly enhancing the capabilities of telemetry systems. With higher data speeds, lower latency, and increased connectivity, 5G technology enables real-time data transmission and processing, which is critical for applications requiring immediate feedback and control. This advancement is particularly beneficial for sectors like healthcare, where real-time patient monitoring can be life-saving, and in industrial automation, where immediate system responses are necessary.

The increased bandwidth of 5G allows for the transmission of larger volumes of telemetry data, facilitating more comprehensive monitoring and analysis. This is essential for complex systems such as smart grids and autonomous vehicles, where vast amounts of data need to be processed in real-time to ensure optimal performance and safety.

Global Real-Time Telemetry Solutions Market: Research Scope and Analysis

By Component Analysis

Hardware is projected to dominate the Real-Time Telemetry Solutions market’s component segment due to its fundamental role as the backbone of telemetry systems. Telemetry hardware includes sensors, data acquisition devices, transmitters, receivers, and antennas that are essential for capturing, transmitting, and receiving data in real time. Without robust and reliable hardware, the entire telemetry system cannot function effectively.

The increasing demand for precision and accuracy in data collection across industries such as aerospace, defense, automotive, and healthcare drives the need for advanced hardware components. High-quality sensors capable of capturing minute details and rugged transmitters designed to operate in harsh environments ensure data integrity and continuous operation, even under extreme conditions. This reliability is critical for mission-critical applications where data loss or delay could result in significant operational risks or safety hazards.

Additionally, hardware advancements continue to evolve rapidly, integrating capabilities such as miniaturization, energy efficiency, and enhanced wireless connectivity. These improvements not only boost performance but also expand the range of telemetry applications, enabling use in remote or inaccessible locations, such as deep space or underwater explorations.

Furthermore, hardware investments are often higher than software or service components, contributing to its larger market share. Many industries prioritize upfront capital expenditure on dependable hardware to establish a strong telemetry infrastructure before layering software analytics and services on top. The rising complexity of telemetry hardware, coupled with its indispensability for data acquisition and transmission, firmly establishes hardware as the dominant component in the market.

By Technology Analysis

Wired telemetry technology is anticipated to continue to dominate the market because of its inherent reliability, security, and stability in data transmission. Wired telemetry uses physical cables, such as coaxial, fiber optic, or twisted pair wires, to transmit data from sensors to monitoring systems in real time. This direct, stable connection reduces the risks of data loss, interference, or latency, which are critical factors in high-stakes industries.

One major advantage of wired telemetry is its immunity to electromagnetic interference (EMI) and radio frequency interference (RFI), which can severely impact wireless communications. This makes wired telemetry indispensable in environments with high electrical noise, such as aerospace and defense applications, where data accuracy and integrity cannot be compromised.

The high bandwidth capacity of wired telemetry systems also supports the transmission of large volumes of data at very high speeds, which is essential for real-time monitoring of complex systems. In applications such as aircraft monitoring or space telemetry, the ability to handle continuous streams of high-resolution data with minimal delay is vital for safe and effective operations.

Despite the growing adoption of wireless technology, wired telemetry remains preferred where infrastructure allows, due to its low latency and dependable performance. Additionally, wired systems often require less frequent maintenance and security interventions compared to wireless networks vulnerable to hacking or signal disruption. The established reliability, robustness, and speed advantages make wired telemetry the technology of choice for critical real-time telemetry applications, ensuring its dominance in the market.

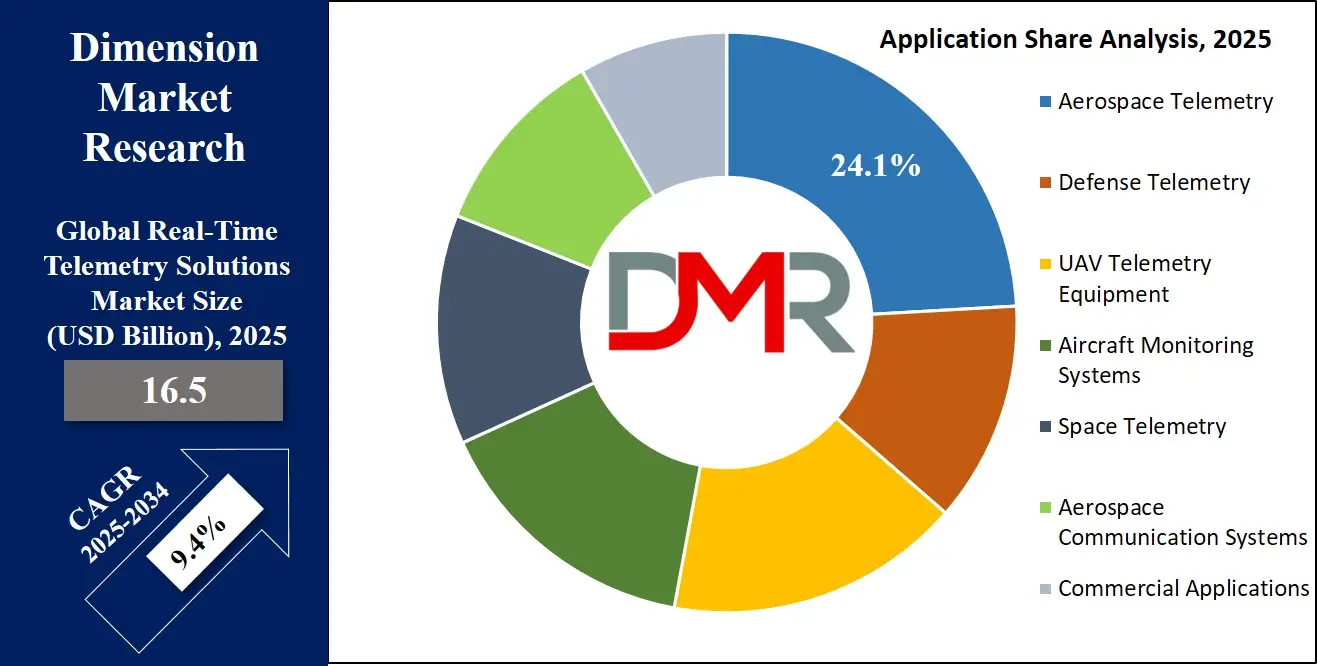

By Application Analysis

Aerospace telemetry is expected to dominate the application segment due to the critical need for real-time data monitoring and communication in aviation and space missions. Telemetry systems in aerospace collect data from aircraft and spacecraft, including flight parameters, engine performance, environmental conditions, and system health. This data is vital for ensuring safety, operational efficiency, and regulatory compliance in one of the most demanding and high-risk industries.

The aerospace sector's stringent safety standards and complex operational requirements necessitate continuous, accurate data flow from airborne platforms to ground control stations. Real-time telemetry enables immediate decision-making during flights, facilitating navigation, performance adjustments, and emergency response. It also supports predictive maintenance, reducing downtime and preventing costly failures.

Furthermore, the aerospace industry's rapid technological advancements, such as the increasing use of unmanned aerial vehicles (UAVs), commercial space flights, and smart aircraft systems, drive demand for sophisticated telemetry solutions. Aerospace telemetry supports these innovations by providing reliable, high-speed data transmission even in challenging environments, including high altitudes and space.

The aerospace industry's significant investment in research and development, along with government and defense funding, further bolsters telemetry adoption. Additionally, regulatory bodies require comprehensive telemetry data for certification and safety audits, reinforcing aerospace telemetry's pivotal role. Because aerospace telemetry is foundational to flight safety, mission success, and regulatory compliance, it remains the dominant application in the global real-time telemetry solutions market.

ℹ

To learn more about this report –

Download Your Free Sample Report Here

The Global Real-Time Telemetry Solutions Market Report is segmented on the basis of the following:

By Component

- Hardware

- Telemetry Transmitters & Receivers

- Sensors & Actuators

- Antennas

- Modems & Gateways

- Flight Data Acquisition Units (FDAUs)

- Onboard Computers

- Software

- Real-Time Data Analytics Platforms

- Mission-Critical Communication Software

- Telemetry Tracking & Command (TT&C) Software

- Signal Processing Software

- Services

- Consulting & Integration

- Maintenance & Support

- Managed Services

By Technology

- Wired Telemetry

- Ethernet

- Serial Communication

- Wireless Telemetry

- Satellite Communication

- Radio Telemetry

- Cellular (3G, 4G, 5G)

- Wi-Fi & Bluetooth

- LoRaWAN & Zigbee

By Application

- Aerospace Telemetry

- Rocket & Launch Vehicle Monitoring

- Spacecraft & Satellite Telemetry

- Missile Flight Data Telemetry

- Defense Telemetry

- Ballistic Testing Telemetry

- Combat Systems Monitoring

- UAV Telemetry Equipment

- Ground Control Data Link

- Drone Health & Navigation Monitoring

- Aircraft Monitoring Systems

- Flight Data Monitoring (FDM)

- Engine & Fuel System Monitoring

- Structural Health Monitoring (SHM)

- Space Telemetry

- Deep Space Communication

- Satellite Health Monitoring

- Ground Station Telemetry Integration

- Aerospace Communication Systems

- Line-of-Sight Communications

- Beyond-Line-of-Sight (BLOS) Systems

- Voice & Data Transmission in Aircraft

- Commercial Applications

- Environmental & Climate Monitoring

- Smart Agriculture (Agri-Telemetry)

- Remote Industrial Automation

- Real-Time Transportation Tracking

Global Real-Time Telemetry Solutions Market: Regional Analysis

Region with the Largest Revenue Share

North America is projected to dominate the global real-time telemetry solutions market as it commands over 37.8% of market share by the end of 2025, primarily due to its advanced technological infrastructure, strong aerospace and defense sectors, and significant government investments in research and innovation. The presence of major industry players and established supply chains further solidifies the region’s leadership. The U.S., in particular, boasts a large number of aerospace and defense contractors, space exploration agencies, and advanced manufacturing hubs that drive continuous demand for sophisticated telemetry systems. Government initiatives focused on enhancing national security, air traffic control modernization, and space missions that rely heavily on telemetry solutions, fostering robust market growth.

Additionally, North America benefits from a highly skilled workforce and cutting-edge R&D centers that facilitate the development and deployment of next-generation telemetry technologies. The region’s regulatory environment also encourages adoption by enforcing stringent safety and performance standards in aerospace, defense, and commercial aviation sectors. These factors collectively create a mature and innovation-driven market ecosystem that supports the widespread integration of real-time telemetry solutions, maintaining North America’s dominant market position.

Region with the Highest CAGR

Asia Pacific is expected to witness the highest CAGR in the real-time telemetry solutions market due to rapid industrialization, increasing aerospace and defense budgets, and expanding commercial aviation activities in emerging economies such as China, India, South Korea, and Japan. The region’s expanding space programs, rising adoption of unmanned aerial vehicles (UAVs), and investments in smart city projects fuel demand for advanced telemetry systems.

Furthermore, growing collaborations between local companies and global telemetry technology providers accelerate technology transfer and market penetration. Asia Pacific’s focus on enhancing infrastructure and expanding telecommunication networks also supports telemetry adoption across diverse applications. Increasing government initiatives to modernize air traffic management and strengthen defense capabilities are additional growth catalysts. Moreover, rising awareness about operational efficiency and safety across industries encourages telemetry solution deployment. The combination of expanding aerospace sectors, evolving technology ecosystems, and favorable government policies positions Asia Pacific as the fastest-growing regional market with substantial growth opportunities.

By Region

North America

Europe

- Germany

- The U.K.

- France

- Italy

- Russia

- Spain

- Benelux

- Nordic

- Rest of Europe

Asia-Pacific

- China

- Japan

- South Korea

- India

- ANZ

- ASEAN

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Argentina

- Colombia

- Rest of Latin America

Middle East & Africa

- Saudi Arabia

- UAE

- South Africa

- Israel

- Egypt

- Rest of MEA

Global Real-Time Telemetry Solutions Market: Competitive Landscape

The competitive landscape of the global real-time telemetry solutions market is characterized by the presence of several well-established multinational corporations alongside emerging innovative startups. Leading companies such as Honeywell International Inc., Thales Group, Collins Aerospace, Curtiss-Wright Corporation, and Teledyne Technologies dominate due to their extensive product portfolios, strong R&D capabilities, and global distribution networks. These firms consistently invest in technological advancements, including miniaturized sensors, enhanced wireless telemetry, and cloud-based telemetry analytics, to maintain a competitive edge.

Strategic partnerships, mergers, and acquisitions are common to expand market reach and integrate complementary technologies. For instance, collaborations between aerospace manufacturers and telemetry solution providers help tailor offerings to specific industry needs. Additionally, companies focus on providing end-to-end solutions, combining hardware, software, and services to deliver integrated telemetry systems.

Smaller players and regional vendors differentiate through specialization in niche applications such as UAV telemetry or space telemetry, often providing customized, cost-effective solutions for specific market segments. The rising demand for real-time monitoring in commercial aviation, defense modernization, and space exploration drives competition to innovate and scale solutions globally.

Overall, the competitive environment emphasizes innovation, customer-centricity, and strategic alliances, which are critical to capturing market share and addressing the evolving needs of aerospace, defense, and commercial telemetry users worldwide.

Some of the prominent players in the Global Real-Time Telemetry Solutions Market are:

- L3Harris Technologies

- Honeywell International Inc.

- Lockheed Martin Corporation

- BAE Systems

- Thales Group

- Northrop Grumman Corporation

- Raytheon Technologies

- Leonardo S.p.A.

- Curtiss-Wright Corporation

- Safran S.A.

- Kratos Defense & Security Solutions

- Collins Aerospace

- Siemens AG

- General Dynamics Corporation

- Teletronics Technology Corporation (TTTech)

- Orbital ATK (now part of Northrop Grumman)

- Teledyne Technologies Incorporated

- GE Aerospace

- Cobham Limited

- IAI (Israel Aerospace Industries)

- Other Key Players

Recent Developments in Global Real-Time Telemetry Solutions Market

- May 2025: Honeywell International Inc. announced a strategic investment to expand its telemetry hardware manufacturing facilities in the U.S., aiming to enhance production capacity for aerospace and defense telemetry systems. This move addresses the rising demand for real-time data acquisition in critical environments, emphasizing scalability and low-latency transmission capabilities.

- March 2025: Collins Aerospace entered into a global collaboration with a leading AI-based analytics software provider to integrate advanced machine learning capabilities into its real-time telemetry solutions. This partnership aims to provide predictive maintenance and anomaly detection for aerospace telemetry, enhancing operational efficiency and safety.

- January 2025: Teledyne Technologies showcased its latest wireless telemetry platform at the International Aerospace Expo in Paris, highlighting improvements in secure data transmission for UAV telemetry and space telemetry applications. The platform integrates encrypted communication protocols tailored for defense telemetry use cases.

- November 2024: Curtiss-Wright Corporation completed the acquisition of a European telemetry sensor specialist to strengthen its portfolio in wired and wireless telemetry hardware. The merger is expected to accelerate innovation in ruggedized aircraft monitoring systems for both commercial and military aviation sectors.

- September 2024: Thales Group hosted the Annual Global Telemetry Solutions Conference in London, gathering industry leaders to discuss emerging trends such as 5G-enabled telemetry and cloud integration for aerospace communication systems. Key sessions focused on interoperability standards and cybersecurity enhancements.

- May 2024: Lockheed Martin unveiled a new real-time telemetry service designed for its UAV telemetry equipment, featuring enhanced signal resilience and extended operational range. This product launch was part of a broader strategy to capture growing defense telemetry contracts in North America and the Asia Pacific region.

- March 2024: Honeywell and a major commercial airline signed a long-term collaboration agreement to deploy integrated real-time telemetry solutions for aircraft monitoring systems, aiming to optimize fleet maintenance schedules and improve flight safety metrics.

- January 2024: The Global Aerospace Telemetry Summit in Singapore emphasized innovations in telemetry technologies for space exploration missions. Participants highlighted advances in wired telemetry protocols and real-time data visualization platforms as key enablers for upcoming lunar and Mars projects.

- November 2023: Curtiss-Wright Corporation expanded its telemetry solutions portfolio by launching a new suite of hardware-software integrated products targeting defense telemetry applications, focusing on ruggedized, secure telemetry in harsh battlefield conditions.

Report Details

| Report Characteristics |

| Market Size (2025) |

USD 16.5 Bn |

| Forecast Value (2034) |

USD 37.1 Bn |

| CAGR (2025–2034) |

9.4% |

| Historical Data |

2019 – 2024 |

| The US Market Size (2025) |

USD 5.2 Bn |

| Forecast Data |

2025 – 2033 |

| Base Year |

2024 |

| Estimate Year |

2025 |

| Report Coverage |

Market Revenue Estimation, Market Dynamics, Competitive Landscape, Growth Factors, etc. |

| Segments Covered |

By Component (Hardware, Software, Services), By Technology (Wired Telemetry, Wireless Telemetry), By Application (Aerospace Telemetry, Defense Telemetry, UAV Telemetry Equipment, Space Telemetry, Aircraft Monitoring Systems, Aerospace Communication Systems, Commercial Applications) |

| Regional Coverage |

North America – US, Canada;

Europe – Germany, UK, France, Russia, Spain, Italy, Benelux, Nordic, Rest of Europe;

Asia-Pacific – China, Japan, South Korea, India, ANZ, ASEAN, Rest of APAC;

Latin America – Brazil, Mexico, Argentina, Colombia, Rest of Latin America;

Middle East & Africa – Saudi Arabia, UAE, South Africa, Turkey, Egypt, Israel, Rest of MEA

|

| Prominent Players |

L3Harris Technologies, Honeywell International Inc., Lockheed Martin Corporation, BAE Systems plc, Thales Group, Northrop Grumman Corporation, Raytheon Technologies Corporation, Leonardo S.p.A., Curtiss-Wright Corporation, Safran S.A., Kratos Defense & Security Solutions Inc., Collins Aerospace, Siemens AG, General Dynamics Corporation, Teletronics Technology Corporation, Orbital ATK Inc. (Northrop Grumman Innovation Systems), Teledyne Technologies Incorporated, GE Aerospace, Cobham Limited, Israel Aerospace Industries Ltd., and Other Key Players |

| Purchase Options |

We have three licenses to opt for: Single User License (Limited to 1 user),

Multi-User License (Up to 5 Users), and

Corporate Use License (Unlimited User) along with free report customization equivalent to

0 analyst working days, 3 analysts working days, and 5 analysts working days respectively.

|

Frequently Asked Questions

How big is the Global Real-Time Telemetry Solutions Market?

▾ The Global Real-Time Telemetry Solutions Market size is estimated to have a value of USD 16.5 billion in 2025 and is expected to reach USD 37.1 billion by the end of 2034.

What is the size of the US Real-Time Telemetry Solutions Market?

▾ The US Real-Time Telemetry Solutions Market is projected to be valued at USD 5.2 billion in 2025. It is expected to witness subsequent growth in the upcoming period as it holds USD 11.2 billion in 2034 at a CAGR of 8.8%.

Which region accounted for the largest Global Real-Time Telemetry Solutions Market?

▾ Which region accounted for the largest Global Real-Time Telemetry Solutions Market?

Who are the key players in the Global Real-Time Telemetry Solutions Market?

▾ Some of the major key players in the Global Real-Time Telemetry Solutions Market are L3Harris Technologies, Honeywell International Inc., Lockheed Martin Corporation, BAE Systems plc, Thales Group, Northrop Grumman Corporation, Raytheon Technologies Corporation, Leonardo S.p.A., Curtiss-Wright Corporation, Safran S.A., Kratos Defense & Security Solutions Inc., Collins Aerospace, and many others.

What is the growth rate in the Global Real-Time Telemetry Solutions Market in 2025?

▾ The market is growing at a CAGR of 9.4 percent over the forecasted period of 2025.