Market Overview

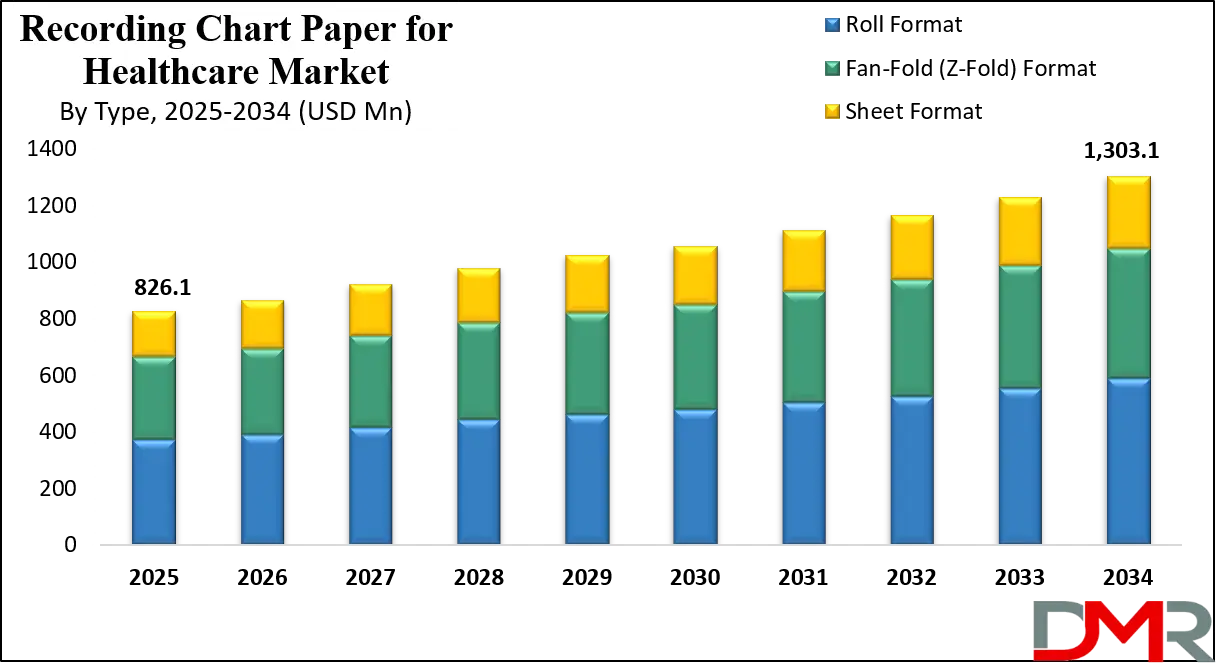

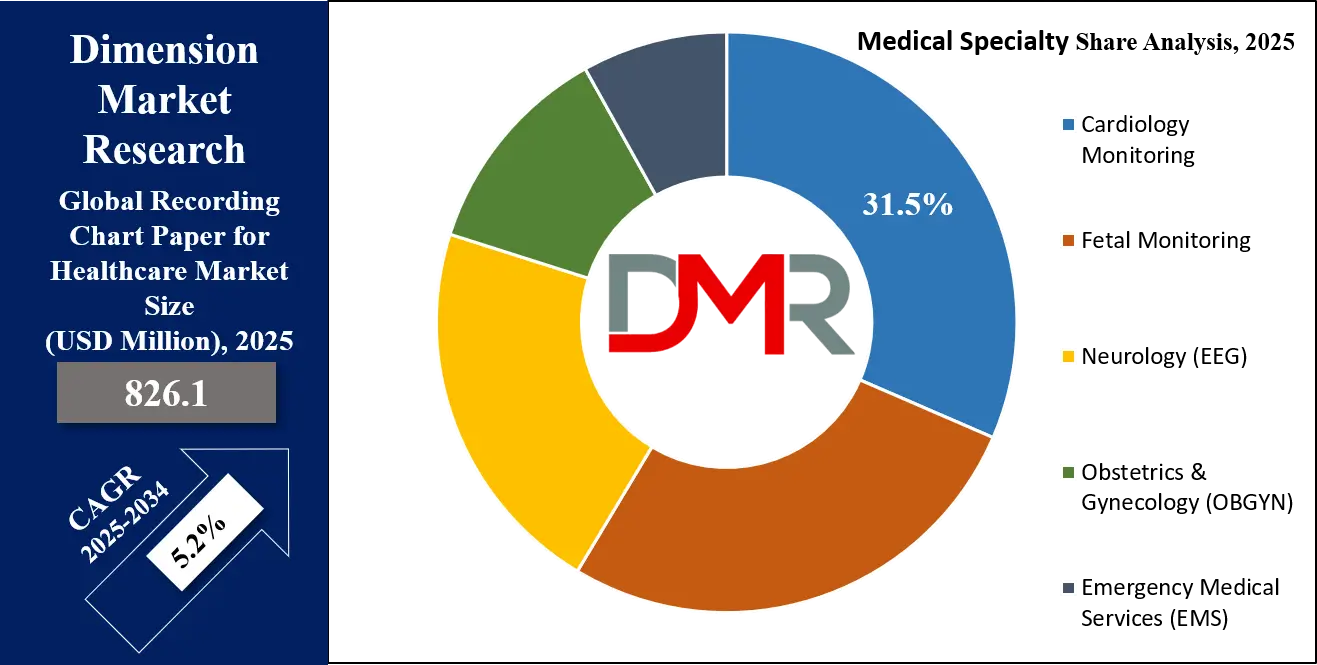

The global recording chart paper for healthcare market is projected to experience steady growth, with its value expected to rise from USD 826.1 million in 2025 to approximately USD 1,303.1 million by 2034. This represents a compound annual growth rate (CAGR) of 5.2% throughout the forecast period. This sustained expansion reflects the ongoing, essential demand for physical chart paper alongside the gradual integration of digital technologies in healthcare systems worldwide.

The global market for recording chart paper used in healthcare settings is influenced by the enduring need for physical documentation in medical devices. Despite the digital transition, analog devices like electrocardiograms (ECGs), fetal monitors, and patient vital signs monitors continue to be prevalent worldwide, ensuring a steady demand for compatible paper. This creates a consistent, albeit niche, market driven by the installed base of these legacy machines. The market is not experiencing high growth but remains stable, supported by the critical need for reliable, immediate hard copy records in various clinical scenarios where digital systems may be prone to failure or cyber threats.

ℹ

To learn more about this report –

Download Your Free Sample Report Here

A significant opportunity for this market lies in emerging economies where healthcare infrastructure is still developing. In many regions, the cost of replacing functional analog equipment with fully digital systems is prohibitive. Therefore, the continued use of existing devices necessitates a reliable supply of specialty papers.

Furthermore, specific applications, such as long-term ambulatory monitoring, often prefer physical charts for their tangibility and legal admissibility, presenting a sustained niche for manufacturers who can provide high-quality, sensitive papers that produce clear and archival-quality records.

A primary restraint is the overarching trend toward healthcare digitization. The adoption of Electronic Health Records (EHRs) and digital output devices directly reduces the volume of paper-based recording. Hospitals are increasingly investing in integrated digital systems that streamline data flow, minimizing the role of physical chart paper. This digital transformation is the most potent factor limiting the market's expansion, pushing it towards a gradual, long-term decline as older analog machines are eventually phased out and replaced.

ℹ

To learn more about this report –

Download Your Free Sample Report Here

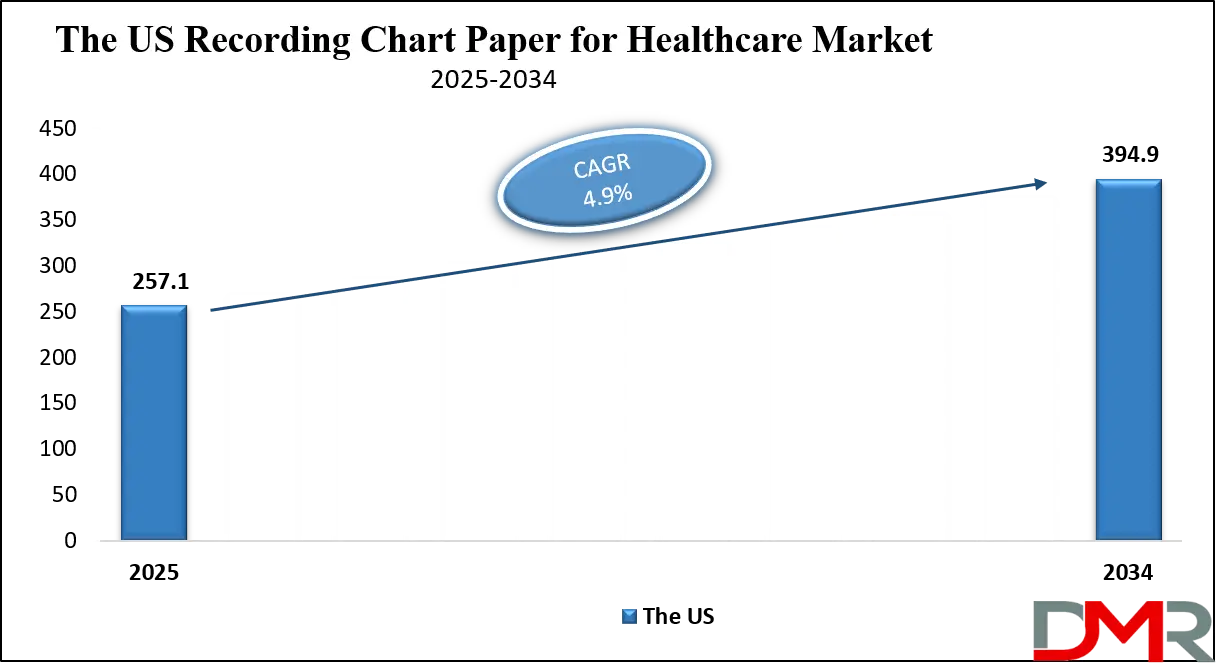

The US Recording Chart Paper for Healthcare Market

The US Recording Chart Paper for Healthcare Market is projected to reach USD 257.1 million in 2025 at a compound annual growth rate of 4.9% over its forecast period.

The demand for recording chart paper in the United States healthcare sector is intrinsically linked to the extensive installed base of legacy medical monitoring devices. Federal agencies highlight the scale of this installed base. The Centers for Medicare & Medicaid Services (CMS) administers coverage and reimbursement for a vast array of medical services, many of which still utilize equipment requiring physical chart paper, particularly in outpatient and ambulatory settings.

Furthermore, the U.S. Food and Drug Administration (FDA) maintains databases of cleared medical devices, which include numerous models of analog chart recorders that remain in active clinical use, underscoring the ongoing need for compatible supplies.

A key demographic advantage sustaining this market is the nation's aging population. Data from the U.S. Census Bureau projects a significant increase in the population aged 65 and older. This demographic is a major consumer of healthcare services, including diagnostic procedures like electrocardiograms and polysomnograms, which frequently use chart recorders. The Administration for Community Living, under the U.S. Department of Health and Human Services, provides reports on the growing older American population, which correlates directly with higher volumes of medical testing and monitoring, thereby supporting continued demand for the consumable paper these tests require.

ℹ

To learn more about this report –

Download Your Free Sample Report Here

The Europe Recording Chart Paper for Healthcare Market

The Europe Recording Chart Paper for Healthcare Market is estimated to be valued at USD 123.9 million in 2025 and is further anticipated to reach USD 176.3 million by 2034 at a CAGR of 4.0%.

The European market for healthcare recording chart paper is shaped by the region's diverse healthcare infrastructure and stringent regulatory framework. The European Centre for Disease Prevention and Control (ECDC) and the European Medicines Agency (EMA) oversee public health and medical standards, which include the use of various medical devices. While promoting digital health initiatives, these bodies also recognize the current reliance on established medical equipment. The presence of a large number of public hospitals and clinics across member states, documented by the European Commission's health policy reports, indicates a substantial installed base of functional analog devices that will require consumable paper for years to come.

A significant demographic factor influencing demand is Europe’s rapidly aging society. Eurostat, the statistical office of the European Union, consistently reports data showing one of the highest old-age dependency ratios in the world. This demographic trend, detailed in their population projections and ageing reports, points to an increasing prevalence of age-related chronic conditions such as cardiovascular diseases. This necessitates more frequent medical monitoring and diagnostic procedures, often performed on equipment that uses physical chart paper, particularly in settings where immediate access to digital systems is not available or is cost-prohibitive to implement immediately.

The Japan Recording Chart Paper for Healthcare Market

The Japan Recording Chart Paper for Healthcare Market is projected to be valued at USD 49.6 million in 2025. It is further expected to witness subsequent growth in the upcoming period, holding USD 76.8 million in 2034 at a CAGR of 5.2%.

The market for recording chart paper in Japan's healthcare system is uniquely sustained by the country's status as the world's most aged society. Official statistics from the Ministry of Health, Labour and Welfare (MHLW) consistently show a super-aged population structure, with a very high proportion of citizens over 65. This demographic reality, detailed in the MHLW's annual reports on ageing, creates immense and sustained demand for medical care, including a high volume of diagnostic tests. Many clinics and smaller hospitals continue to use reliable, older-generation equipment like chart-output ECGs and recorders for vital signs, ensuring a consistent need for compatible paper.

Government policy further influences this market. Japan’s robust universal health insurance system, administered under the MHLW, ensures broad access to medical services, including diagnostic procedures. This system supports the widespread use of medical monitoring devices across the country.

Additionally, the Pharmaceuticals and Medical Devices Agency (PMDA), which regulates medical equipment, has cleared a significant number of analog devices that remain in operation. The need to maintain these devices with appropriate consumables, as part of a reliable healthcare delivery system, provides a stable foundation for the chart paper market despite global digital trends.

Global Recording Chart Paper for Healthcare Market: Key Takeaways

- Global Market Size Insights: The Global Recording Chart Paper for Healthcare Market size is estimated to have a value of USD 826.1 million in 2025 and is expected to reach USD 1,303.1 million by the end of 2034.

- The Global Market Growth Rate: The market is growing at a CAGR of 5.2 percent over the forecasted period of 2025.

- The US Market Size Insights: The US Recording Chart Paper for Healthcare Market is projected to be valued at USD 257.1 million in 2025. It is expected to witness subsequent growth in the upcoming period as it holds USD 394.9 million in 2034 at a CAGR of 4.9%.

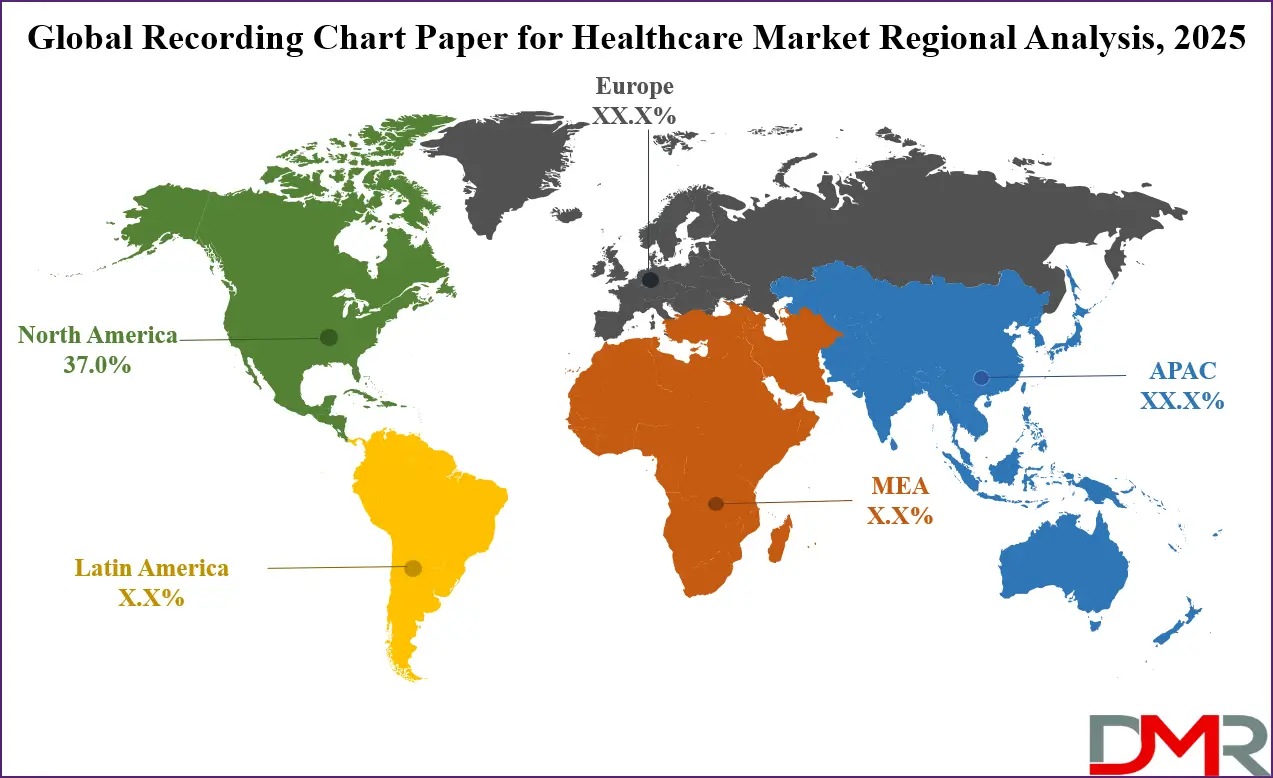

- Regional Insights: North America is expected to have the largest market share in the Global Recording Chart Paper for Healthcare Market with a share of about 37.0% in 2025.

- Key Players: Some of the major key players in the Global Recording Chart Paper for Healthcare Market are GE Healthcare, Koninklijke Philips N.V., Nihon Kohden Corporation, Schiller AG, Nissha Co., Ltd., Hill-Rom Holdings, Cardinal Health, Medline Industries, and many others.

Global Recording Chart Paper for Healthcare Market: Use Cases

- Intraoperative Anesthesia Monitoring: During surgical procedures, anesthesia workstations utilize chart paper to produce a continuous, real-time hard copy record of patient vital signs. This ensures an immutable legal document exists for the entire operative timeline, independent of digital system reliability.

- Labor and Delivery Fetal Monitoring: Obstetrics departments rely on paper tocographs from fetal monitors to track contractions and fetal heart rates during labor. This provides midwives and obstetricians with an immediate, tangible strip to review without turning away from the patient.

- Ambulatory Cardiac Telemetry: For ambulatory cardiac monitoring, compact Holter recorders use chart paper to capture 24-48 hours of ECG data. This physical recording is later scanned and analyzed by cardiologists to diagnose intermittent arrhythmias outside a clinical setting.

- Critical Care Patient Data Documentation: In emergency rooms and ICUs, multi-parameter patient monitors often have integrated printers. These generate instant, verifiable hard copies of critical vitals for rapid response teams and for inclusion in a patient’s physical file during handoffs.

- Pulmonary Function Testing (PFT): Pulmonary function testing labs use chart recorders attached to spirometers. The resulting paper tracings provide a permanent, high-resolution visual of a patient’s breathing volume and flow, which is essential for diagnosing and managing respiratory conditions.

Global Recording Chart Paper for Healthcare Market: Stats & Facts

World Health Organization (WHO)

- Cardiovascular diseases account for 17.9 million deaths annually, highlighting the ongoing demand for cardiology monitoring tools, including ECG paper.

- Global maternal mortality was estimated at 287,000 in 2020, reinforcing the need for fetal monitoring and OBGYN-related diagnostic tools.

- Neurological disorders contribute to over 9 million deaths each year, supporting consistent use of EEG monitoring and recording paper.

U.S. Food and Drug Administration (FDA)

- The FDA approves and regulates medical recording devices, with over 6,000 active device registrations in cardiology-related diagnostics as of 2023.

- Fetal monitoring systems are widely regulated, with more than 1,500 fetal monitoring devices registered in the U.S. market.

Centers for Disease Control and Prevention (CDC)

- Heart disease remains the leading cause of death in the U.S., accounting for 1 in every 5 deaths in 2022.

- Approximately 1 in 33 babies in the U.S. are born with birth defects each year, fueling demand for OBGYN and neonatal monitoring.

- Neurological conditions such as epilepsy affect 3.4 million Americans, driving EEG-based diagnostic use.

National Institutes of Health (NIH)

- NIH reports that about 795,000 people in the U.S. suffer a stroke annually, creating demand for ECG and EEG monitoring tools.

- The NIH funds over USD 2 billion annually in cardiovascular and neurology research, indirectly driving diagnostic consumables like recording papers.

European Society of Cardiology (ESC)

- Cardiovascular diseases cause over 3.9 million deaths each year in Europe, making ECG monitoring a vital diagnostic procedure.

- Around 49 million people in the EU live with cardiovascular conditions requiring continuous monitoring.

Eurostat

- Hospitals in the EU reported 7.2 million obstetric discharges in 2021, supporting OBGYN monitoring tool consumption.

- Europe records an average of 5 million annual emergency admissions, increasing EMS reliance on portable monitoring with recording papers.

Japanese Ministry of Health, Labour and Welfare

- Japan has one of the highest elderly populations, with 29% aged 65 or older in 2022, significantly raising demand for cardiology and neurology diagnostics.

- Japan reports 1 million annual births, supporting steady demand for fetal monitoring chart papers.

National Health Service (NHS) – UK

- The NHS conducts over 90 million outpatient appointments annually, including cardiology and neurology visits that depend on diagnostic consumables.

- In the UK, there are over 600,000 live births per year, driving fetal monitoring demand.

Indian Ministry of Health & Family Welfare

- India reports ~25 million annual births, one of the highest globally, significantly driving fetal monitoring consumables.

- Cardiovascular diseases cause over 28% of deaths annually in India, creating ongoing demand for ECG recording paper.

World Bank

- Global healthcare expenditure accounts for ~10% of global GDP, ensuring consistent investment in diagnostic consumables.

- The World Bank estimates 60% of healthcare spending in low- and middle-income countries is directed at essential diagnostics and monitoring.

Pan American Health Organization (PAHO)

- In Latin America, cardiovascular diseases cause 2 million deaths annually, supporting ECG paper demand in hospitals and clinics.

- The region also reports 10,000 maternal deaths annually, underlining the role of fetal monitoring.

Australian Institute of Health and Welfare (AIHW)

- Cardiovascular disease affects over 4 million Australians, with ECGs being a primary diagnostic tool.

- Australia reports 300,000 hospitalizations annually due to neurological conditions, driving EEG monitoring.

Global Recording Chart Paper for Healthcare Market: Market Dynamic

Driving Factors in the Global Recording Chart Paper for Healthcare Market

Extensive Installed Base of Legacy Medical Devices

The primary driver for this market is the vast global installed base of analog medical recording devices. These machines, including electrocardiogram (ECG) machines, fetal monitors, and patient vital sign monitors, represent a massive sunk investment for healthcare providers worldwide. The operational lifespan of this equipment often exceeds 15-20 years, and its replacement with digital systems is a slow, capital-intensive process. As long as these legacy devices remain in active clinical use, which is projected for many years, they will continuously drive the essential, recurring demand for compatible rolls of specialty chart paper to function.

Demographic Shift Towards Ageing Populations

A powerful macroeconomic driver is the global demographic shift towards older populations, particularly in North America, Europe, and Japan. Older demographics have a significantly higher prevalence of chronic conditions such as cardiovascular disease, respiratory illnesses, and sleep disorders. This directly correlates to a greater volume of diagnostic procedures like ECGs, electroencephalograms (EEGs), polysomnograms, and spirometry tests. A substantial portion of these tests is still conducted on devices that utilize physical chart paper, thereby driving consistent volume demand from the core customer base that requires the most frequent medical monitoring.

Restraints in the Global Recording Chart Paper for Healthcare Market

Accelerating Adoption of Digital Healthcare Infrastructure

The most formidable restraint on the market is the relentless adoption of a fully digital healthcare infrastructure. The transition to Electronic Health Records (EHRs), digital imaging, and networked patient monitoring systems eliminates the need for physical paper records. Digital data offers superior advantages: instant transmission, easy storage, advanced algorithmic analysis, and integration into a patient’s central digital record. Government incentives and hospital policies actively promote this digitization, directly reducing the volume of procedures requiring physical chart paper and constraining the market's long-term viability.

High Total Cost of Ownership and Environmental Concerns

While analog devices have a lower upfront cost, the recurring expense of proprietary chart paper creates a high total cost of ownership over time, which is a significant restraint. Hospital administrators are increasingly aware that continuous spending on consumables is less economical than investing in a digital solution. Additionally, the environmental impact of producing and disposing of single-use paper rolls is becoming a greater concern. Sustainability initiatives within healthcare systems are promoting paperless operations, creating both an economic and an ethical pressure to phase out paper-dependent technologies.

Opportunities in the Global Recording Chart Paper for Healthcare Market

Penetration and Consolidation in Emerging Economies

The most significant growth opportunity lies in expanding market penetration within emerging economies across Asia-Pacific, Latin America, and Africa. Healthcare infrastructure in these regions is developing rapidly, but it remains heavily cost-conscious. The widespread use of affordable, durable analog equipment presents a substantial and stable market for chart paper suppliers. Growth can be captured by establishing robust distribution networks, offering cost-competitive products tailored to regional needs, and potentially consolidating with local suppliers. This demographic provides a long-term opportunity as their healthcare systems expand, but they remain pragmatic about technology adoption costs.

Development of Value-Added and Application-Specific Products

Rather than competing on volume, a key opportunity is innovating value-added, high-margin specialty papers. This includes developing papers with enhanced coatings for superior trace clarity, anti-curl properties for easier handling and storage, and formulations that ensure long-term archival stability without fading.

Furthermore, opportunities exist in creating application-specific papers designed for new generations of hybrid devices that may include both digital outputs and backup analog printers, catering to healthcare providers who desire a dual-record system for redundancy and legal security.

Trends in the Global Recording Chart Paper for Healthcare Market

Coexistence with Digital Systems and Niche Specialization

A defining trend is the market's shift from a mainstream consumable to a specialized niche, coexisting alongside digital health technologies. Rather than being entirely replaced, physical chart paper is increasingly reserved for specific applications where it offers irreplaceable advantages. This includes its role as a legally admissible, tamper-evident record in surgical suites and critical care, and its use in long-term ambulatory monitoring devices like Holter monitors.

Furthermore, manufacturers are trending towards specialization, producing high-sensitivity, archival-quality papers that meet stringent requirements for specific diagnostic machines, such as advanced electrocardiograms and polysomnographs, ensuring clarity and longevity for medical records.

Cost-Driven Retention in Emerging Markets and Specific Settings

A significant global trend is the bifurcated pace of adoption for digital recorders. While developed economies are gradually transitioning, emerging markets with vast, cost-sensitive healthcare systems demonstrate a strong trend of retaining analog devices. The capital expenditure required to replace fully functional analog systems with integrated digital solutions is prohibitive for many institutions. This economic reality creates a sustained trend of demand for consumable chart paper in these regions. Similarly, within advanced healthcare systems, smaller clinics, ambulances, and temporary medical facilities often rely on older, more robust, and portable analog equipment, perpetuating the need for paper.

Global Recording Chart Paper for Healthcare Market: Research Scope and Analysis

By Type Analysis

The roll format is projected to be the unequivocal leader in the recording chart paper market, a dominance rooted in its fundamental alignment with the core functionality of medical monitoring. Its supremacy is driven by the operational requirements of the most critical and widespread analog devices in healthcare settings. Electrocardiogram (ECG) machines, multi-parameter patient monitors for tracking vital signs, and ambulatory Holter monitors all depend on a continuous, uninterrupted paper feed to produce accurate, real-time graphical representations of physiological data.

This is non-negotiable during procedures like surgery or extended patient monitoring, where any interruption to the recording could mean missing a critical event. The roll mechanism is mechanically simpler and more reliable for these devices than sheet or fan-fold options, reducing the risk of jams or misfeeds during urgent situations.

Furthermore, the long length of a single roll minimizes the need for frequent paper changes, a crucial factor for busy healthcare professionals. While fan-fold formats are used in specific applications like some older-model ultrasound machines, their use is niche. The sheer volume of cardiac and vital sign monitoring performed daily across global healthcare systems ensures that the demand for roll paper is massive and continuous, solidifying its position as the dominant and most critical type by a very wide margin.

By Medical Specialty Analysis

Cardiology monitoring is anticipated to be the largest and most dominant medical specialty consumer of recording chart paper, a status directly tied to the global epidemic of cardiovascular disease and the standard procedures for its diagnosis. The volume of procedures is staggering; countless millions of electrocardiograms (ECGs) are performed annually worldwide as a first-line diagnostic tool in emergency rooms, clinics, and physicians' offices. Each of these tests, when conducted on the vast installed base of analog machines, consumes roll paper.

Beyond routine ECGs, the field relies heavily on extended monitoring solutions. Ambulatory Holter monitors, which patients wear for 24 to 48 hours to capture intermittent arrhythmias, are entirely dependent on a continuous supply of specialized roll paper to record every heartbeat over that prolonged period. Similarly, stress tests conducted on a treadmill continuously print out ECG tracings. While other specialties like obstetrics (for fetal heart rate monitoring) and neurology (for EEG) are significant users, their procedural volume does not rival the ubiquitous, high-frequency demand generated by cardiology. The combination of a high prevalence of disease and the paper-dependent nature of its primary diagnostic tools makes cardiology the undisputed driver of demand in this segment.

ℹ

To learn more about this report –

Download Your Free Sample Report Here

By Distribution Channel Analysis

Distributors and wholesalers are anticipated to dominate the distribution channel for recording chart paper because they provide the logistical and economic efficiency required by large-scale healthcare procurement. Hospitals, clinic networks, and large diagnostic centers do not purchase low-cost, high-volume consumables like paper directly from manufacturers. Instead, they rely on distributors to act as consolidated supply partners. These distributors aggregate thousands of different SKUs from chart paper and gloves to syringes and sanitizers, allowing healthcare facilities to simplify their ordering process, negotiate bulk pricing contracts, and receive single, consolidated shipments.

This model guarantees just-in-time delivery, which is critical for maintaining operations without necessitating vast on-site storage space for inventory. For manufacturers, leveraging an established distributor network provides immense market reach and penetration without the prohibitive cost of building and maintaining a direct sales force for such commoditized products.

While e-commerce platforms are growing for smaller clinics or one-off purchases, they cannot compete with the contractual pricing, reliability, and integrated supply chain solutions that major distributors offer to large institutional buyers. Therefore, the wholesale distribution channel forms the indispensable backbone of the market's supply chain.

By End User Analysis

Hospitals and clinics are expected to dominate the end-users segment of the recording chart paper market because they represent the epicenter of medical care, where the highest concentration and widest variety of analog monitoring devices are in constant operation. A single large hospital encompasses numerous departments, including the emergency room, intensive care units (ICUs), operating rooms, cardiology, obstetrics, and general patient floors, each equipped with devices that require paper. This creates an immense aggregate demand from a single facility.

The use is continuous: ICU beds have monitors running 24/7, every surgical procedure requires a paper trace from the anesthesia machine, and emergency rooms run ECGs on a majority of presenting patients. While other end-users are significant, they are more specialized. An ambulatory surgical center may only use paper for its OR monitors, and a diagnostic center might focus primarily on ECG paper.

However, a full-service hospital utilizes chart paper across its entire ecosystem of care, dealing with a much higher patient volume and acuity that necessitates constant monitoring. This comprehensive and relentless need across diverse departments makes hospitals and large clinics the primary and most critical consumers of recording chart paper globally.

The Global Recording Chart Paper for Healthcare Market Report is segmented on the basis of the following:

By Type

- Roll Format

- Fan-Fold (Z-Fold) Format

- Sheet Format

By Medical Specialty

- Cardiology Monitoring

- Fetal Monitoring

- Neurology (EEG)

- Obstetrics & Gynecology (OBGYN)

- Emergency Medical Services (EMS)

By Distribution Channel

- Direct Sales

- Distributors and Wholesalers

- E-Commerce Platforms

- Others

By End User

- Hospitals & Clinics

- Diagnostic Centers

- Ambulatory Surgical Centers

Impact of Artificial Intelligence on the Global Recording Chart Paper for Healthcare Market

- Enhanced Diagnostic Analytics from Analog Records: AI algorithms can digitally scan and analyze paper traces, detecting patterns and anomalies with high precision. This adds advanced diagnostic capabilities to existing analog systems, extending their functional value without immediate replacement.

- Predictive Inventory and Supply Chain Optimization: AI analyzes hospital procedure data to accurately forecast demand for chart paper. This enables optimized inventory management for distributors and healthcare providers, ensuring supply meets demand while minimizing overstock and waste.

- Automated Manufacturing Quality Control: Computer vision AI inspects paper rolls during production for coating defects, tears, or inconsistencies. This automates quality assurance, ensuring higher product reliability and reducing the risk of paper jams or failed recordings in medical devices.

- Bridging Analog and Digital Data Systems: Natural Language Processing (NLP) AI transcribes handwritten notes from paper margins into digital health records. This creates a crucial bridge, integrating data from physical charts into electronic systems for a more complete patient record.

- Facilitating the Transition to Hybrid Solutions: AI enables the development of smart devices that print a physical record while simultaneously creating a digital copy for analysis and storage. This supports a transitional market for paper alongside digital adoption.4

Global Recording Chart Paper for Healthcare Market: Regional Analysis

Region with the Largest Revenue Share

North America, led by the United States, is projected to dominate the global recording chart paper market with 37.0% of the total revenue in terms of revenue by the end of 2025, due to three primary factors. First, it possesses the world's largest installed base of advanced medical monitoring equipment. While digitization is widespread, a significant number of legacy analog devices remain in active use across vast hospital networks and clinics. This creates a substantial, recurring demand for consumables. Second, the region's healthcare expenditure is the highest globally, as reported by agencies like the Centers for Medicare & Medicaid Services (CMS).

This high spending capacity ensures that healthcare providers can continuously purchase proprietary supplies, including chart paper, for their existing equipment fleets. Finally, a stringent regulatory environment from bodies like the FDA mandates strict quality standards for medical device outputs. This necessitates the use of high-quality, approved chart paper to ensure the accuracy and legal admissibility of patient records, supporting a premium market segment that values reliability over cost.

ℹ

To learn more about this report –

Download Your Free Sample Report Here

Region with the Highest CAGR

The Asia Pacific region is expected to exhibit the highest CAGR for the recording chart paper market, driven by expansive healthcare infrastructure development. Governments in nations like India, China, and Indonesia are heavily investing in their public health systems, as outlined in their national health policies. This construction of new hospitals and clinics is often outfitted with cost-effective, durable analog monitoring equipment, creating a massive new installed base that requires paper.

Furthermore, the region's growing and aging population, facing a rising burden of chronic diseases, is increasing the volume of diagnostic procedures. The sheer scale of this patient pool, combined with the cost-sensitive nature of these developing systems, makes the continued operation of analog devices economically imperative. This convergence of booming demand, strategic investment, and fiscal pragmatism fuels rapid market growth, even as the global trend shifts toward digitization.

By Region

North America

Europe

- Germany

- The U.K.

- France

- Italy

- Russia

- Spain

- Benelux

- Nordic

- Rest of Europe

Asia-Pacific

- China

- Japan

- South Korea

- India

- ANZ

- ASEAN

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Argentina

- Colombia

- Rest of Latin America

Middle East & Africa

- Saudi Arabia

- UAE

- South Africa

- Israel

- Egypt

- Rest of MEA

Global Recording Chart Paper for Healthcare Market: Competitive Landscape

The competitive landscape for the global recording chart paper market is fragmented and characterized by the presence of both specialized manufacturers and large medical consumables conglomerates. Competition is primarily based on product quality, reliability, and deep-seated relationships with distribution networks and original equipment manufacturers (OEMs). A key strategy for leaders like Cardinal Health and Philips is offering OEM-compatible or private-label supplies that meet strict performance specifications for devices from major manufacturers, ensuring seamless functionality and preventing device voidance of warranties.

These large players leverage their extensive distribution channels to serve major hospital systems globally. Alongside them, specialized, regional companies compete by providing extremely cost-effective solutions, particularly in price-sensitive emerging markets. The market is mature, limiting disruptive innovation; instead, competition focuses on ensuring supply chain reliability, maintaining consistent paper quality for accurate trace recordings, and securing long-term contracts with healthcare group purchasing organizations (GPOs). As the market gradually declines in developed regions, competitors are also seeking growth by expanding their distributor partnerships within high-growth Asia Pacific countries.

Some of the prominent players in the Global Recording Chart Paper for Healthcare Market are:

- GE Healthcare

- Koninklijke Philips N.V.

- Nihon Kohden Corporation

- Schiller AG

- Nissha Co., Ltd.

- Hill-Rom Holdings, Inc.

- Cardinal Health, Inc.

- Medline Industries, LP

- Recorders & Medicare Systems Pvt. Ltd. (RMS)

- AME Instruments

- Richard Allan Scientific (Thermo Fisher Scientific brand)

- Advanced Media

- Beijing M&B Electronic Instruments Co., Ltd.

- Intermed Systems, Inc.

- Vyaire Medical, Inc.

- Covidien (part of Medtronic)

- Boston Scientific (chart paper accessories division)

- Bionet Co., Ltd.

- Beecare Medical

- Laxmi Electronic Industries

- Other Key Players

Recent Developments in the Global Recording Chart Paper for Healthcare Market

- May 2024: Cardinal Health announced a strategic expansion of its distribution agreement with a major medical device OEM (name typically confidential) to include a broader range of consumables, including specialty diagnostic papers, for the North American market.

- February 2024: PHG Technologies, a key US-based manufacturer of ECG and chart paper, highlighted its investment in a new, fully automated packaging line at its manufacturing facility to increase output and meet sustained demand for legacy device supplies.

- November 2023: Papertech, Inc. (South Korea) exhibited its full range of OEM-compatible ultrasound and ECG paper at MEDICA 2023 in Düsseldorf, Germany, focusing on attracting new distributor partners in Eastern Europe and the Middle East.

- July 2023: Amplitude Médical (France) completed the acquisition of a smaller, regional supplier of consumables in Benelux, a move aimed at consolidating its distribution network and customer base within Western Europe.

- March 2023: Konica Minolta (Japan), through its healthcare division, emphasized its " legacy support services" at MEDICAL JAPAN 2023, promoting the continued availability of paper and parts for its entire installed base of analog and digital output devices.

- September 2022: Richel Group (a major European paper manufacturer) and a leading German medical device service company announced a collaboration to provide bundled equipment maintenance and consumable supply contracts to public hospital networks, ensuring a guaranteed supply of quality paper.

Report Details

| Report Characteristics |

| Market Size (2025) |

USD 826.1 Mn |

| Forecast Value (2034) |

USD 1,303.1 Mn |

| CAGR (2025–2034) |

5.2% |

| The US Market Size (2025) |

USD 257.1 Mn |

| Historical Data |

2019 – 2024 |

| Forecast Data |

2026 – 2034 |

| Base Year |

2024 |

| Estimate Year |

2025 |

| Report Coverage |

Market Revenue Estimation, Market Dynamics, Competitive Landscape, Growth Factors, etc. |

| Segments Covered |

By Type (Roll Format, Fan-Fold (Z-Fold) Format, Sheet Format), By Medical Specialty (Cardiology Monitoring, Fetal Monitoring, Neurology (EEG), Obstetrics & Gynecology (OBGYN), Emergency Medical Services (EMS)), By Distribution Channel (Direct Sales, Distributors and Wholesalers, E-Commerce Platforms, Others), and By End User (Hospitals & Clinics, Diagnostic Centers, Ambulatory Surgical Centers) |

| Regional Coverage |

North America – US, Canada; Europe – Germany, UK, France, Russia, Spain, Italy, Benelux, Nordic, Rest of Europe; Asia-Pacific – China, Japan, South Korea, India, ANZ, ASEAN, Rest of APAC; Latin America – Brazil, Mexico, Argentina, Colombia, Rest of Latin America; Middle East & Africa – Saudi Arabia, UAE, South Africa, Turkey, Egypt, Israel, Rest of MEA |

| Prominent Players |

GE Healthcare, Koninklijke Philips N.V., Nihon Kohden Corporation, Schiller AG, Nissha Co., Ltd., Hill-Rom Holdings, Cardinal Health, Medline Industries, RMS, AME Instruments, Richard Allan Scientific, Advanced Media, Beijing M&B Electronic Instruments, Intermed Systems, Vyaire Medical, Covidien (Medtronic), Boston Scientific, Bionet Co., Ltd., Beecare Medical, and Laxmi Electronic Industries, and Other Key Players |

| Purchase Options |

We have three licenses to opt for: Single User License (Limited to 1 user), Multi-User License (Up to 5 Users), and Corporate Use License (Unlimited User) along with free report customization equivalent to 0 analyst working days, 3 analysts working days, and 5 analysts working days respectively. |

Frequently Asked Questions

How big is the Global Recording Chart Paper for Healthcare Market?

▾ The Global Recording Chart Paper for Healthcare Market size is estimated to have a value of USD 826.1 million in 2025 and is expected to reach USD 1,303.1 million by the end of 2034.

What is the growth rate in the Global Recording Chart Paper for Healthcare Market in 2025?

▾ The market is growing at a CAGR of 5.2 percent over the forecasted period of 2025.

What is the size of the US Recording Chart Paper for Healthcare Market?

▾ The US Recording Chart Paper for Healthcare Market is projected to be valued at USD 257.1 million in 2025. It is expected to witness subsequent growth in the upcoming period as it holds USD 394.9 million in 2034 at a CAGR of 4.9%.

Which region accounted for the largest Global Recording Chart Paper for Healthcare Market?

▾ North America is expected to have the largest market share in the Global Recording Chart Paper for Healthcare Market with a share of about 37.0% in 2025.

Who are the key players in the Global Recording Chart Paper for Healthcare Market?

▾ Some of the major key players in the Global Recording Chart Paper for Healthcare Market are GE Healthcare, Koninklijke Philips N.V., Nihon Kohden Corporation, Schiller AG, Nissha Co., Ltd., Hill-Rom Holdings, Cardinal Health, Medline Industries, and many others.