Market Overview

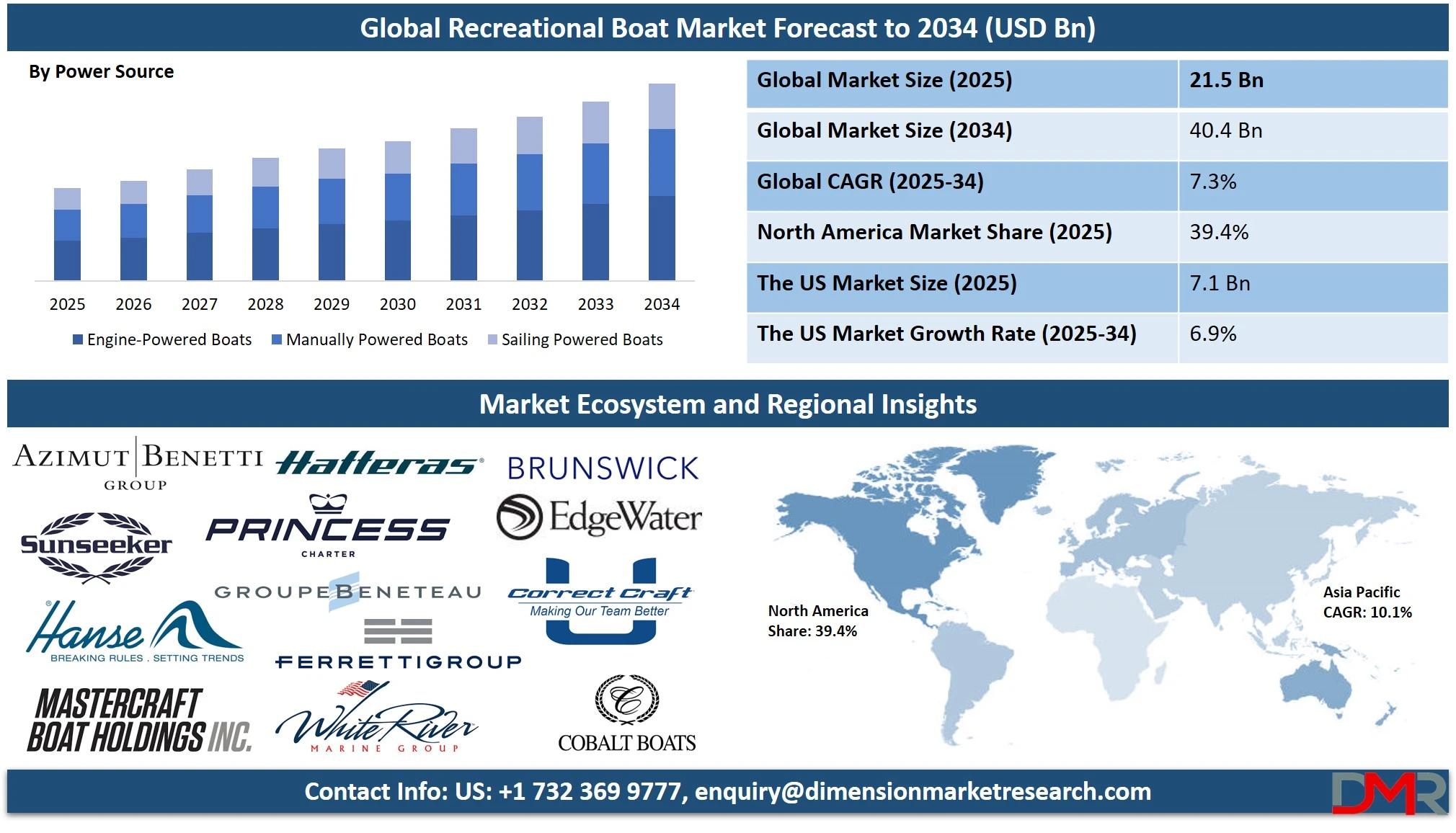

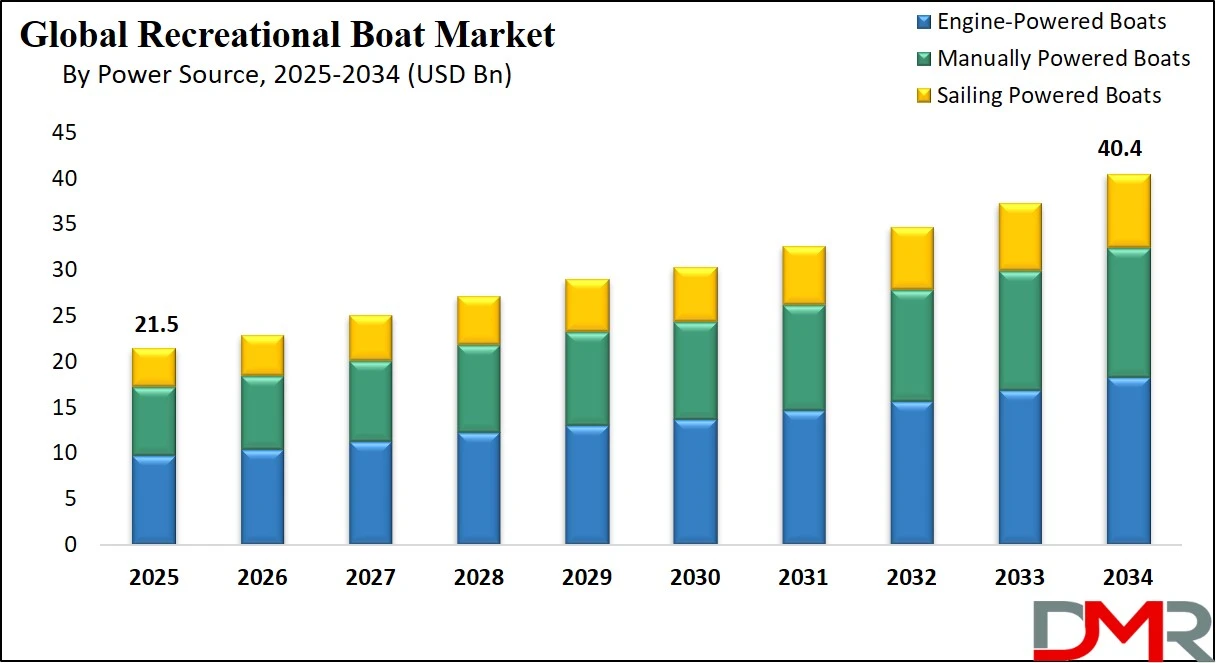

The Global Recreational Boat Market is projected to reach USD 21.5 billion in 2025 and grow at a compound annual growth rate of 7.3% from there until 2034 to reach a value of USD 40.4 billion.

The global recreational boat market is witnessing a robust transformation driven by rising disposable income, evolving lifestyles, and increased participation in water-based leisure activities. This has led to the growing interest in Adventure Sports and Activities, particularly in regions with an expanding hospitality industry that caters to tourists seeking water-based leisure experiences. With rapid urbanization and an expanding upper-middle-class population in emerging economies like India and Southeast Asia, the demand for yachts, personal watercraft, and motorboats is surging.

ℹ

To learn more about this report –

Download Your Free Sample Report Here

Integration of advanced marine technologies like GPS navigation, autopilot systems, hybrid engines, and eco-friendly hull materials (including Fiber-reinforced Plastic (FRP)) are also enhancing user experiences and broadening appeal. These innovations have a direct impact on related industries like Marine Adhesive and Marine Lubricants, contributing to the development of high-performance vessels suited for global tourism guidance services and luxury marine tourism.

The increasing popularity of boat rental and fractional ownership models is opening new opportunities for consumers who prefer access over ownership, which is particularly attractive to millennials and Gen Z consumers who prioritize experiences over possessions. This trend, often facilitated by E-Commerce Platforms, is particularly prominent in regions like the U.S., where access to Outdoor Power Equipment and boat-sharing services is growing.

ℹ

To learn more about this report –

Download Your Free Sample Report Here

Governments across coastal and lake-rich nations are investing in waterfront infrastructure and marina development, supporting recreational boating tourism and long-term market expansion. The growth of marine tourism, particularly in Southeast Asia, the Mediterranean, and the Caribbean, is further fueling market potential. These regions are benefiting from an expanding tourism guidance service network to enhance the experience of tourists.

Despite optimistic growth, the market faces challenges such as high ownership and maintenance costs, stringent environmental regulations, and seasonality in boating activities. Additionally, limited access to public docks and waterways in some regions restricts mass adoption.

Retail analytics have shown that consumers are more likely to invest in boats when there is significant government investment in infrastructure and support for marine tourism. Supply chain disruptions and rising raw material costs have also impacted production timelines for boat manufacturers in recent years.

The US Recreational Boat Market

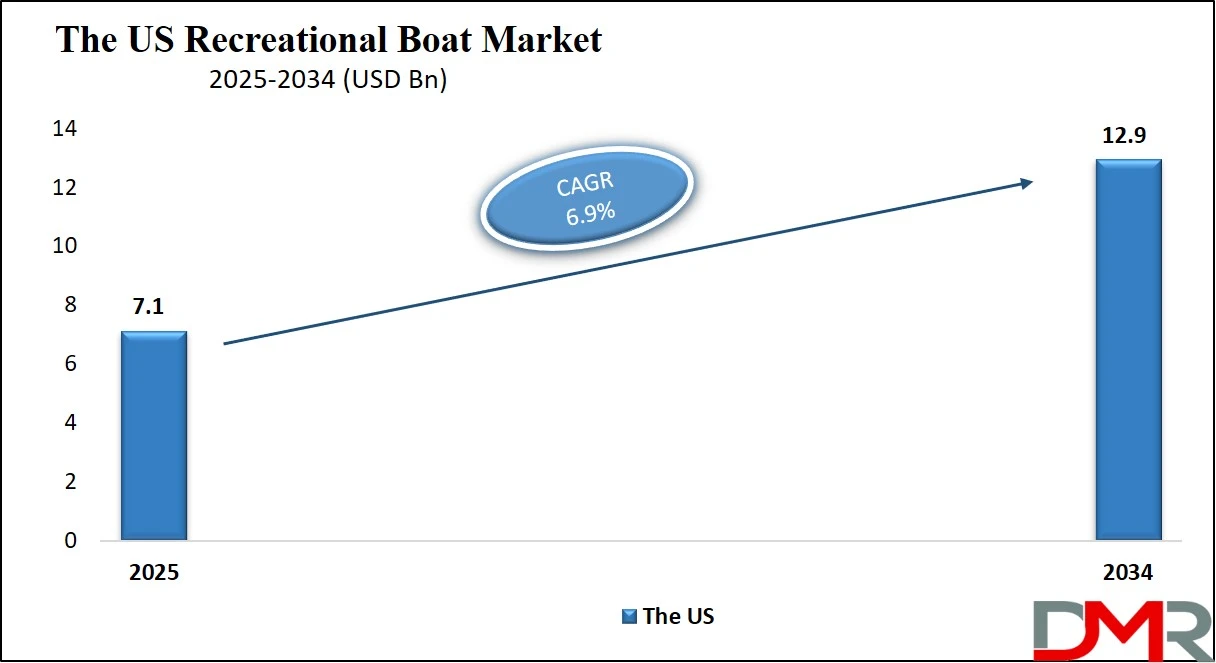

The US Recreational Boat Market is projected to reach USD 7.1 billion in 2025 at a compound annual growth rate of 6.9% over its forecast period.

The United States has long been one of the largest and most mature recreational boat markets globally, supported by vast inland waterways, coastal shorelines, and a robust boating culture. According to the National Marine Manufacturers Association (NMMA), over 87 million adults in the U.S. participate in recreational boating annually.

ℹ

To learn more about this report –

Download Your Free Sample Report Here

The U.S. Census Bureau highlights population growth in lakefront and coastal states like Florida, Texas, and Michigan, regions with high recreational boat ownership per capita. Furthermore, the U.S. Coast Guard supports safe recreational boating through its Boat Safety Resource Center, which promotes education and access to watercraft services. With approximately 11 million registered recreational boats across the country, the U.S. market benefits from diverse product demand ranging from personal watercraft and inflatables to high-end yachts.

The Department of Commerce has indicated a steady rise in marine exports, underscoring the global competitiveness of American boat manufacturers. Moreover, several U.S. states offer tax incentives for boat purchases, and the development of marinas and dock facilities is accelerating under public-private partnerships.

The U.S. also shows a demographic advantage with a large base of middle- and upper-income households, which supports the growth of luxury boating and water sports. Recreational fishing remains one of the top boating activities, with data from the U.S. Fish and Wildlife Service showing consistent participation among all age groups.

Additionally, younger consumers are driving interest in boat-sharing platforms and electric watercraft, supported by local sustainability mandates and incentives for green marine propulsion. Altogether, the U.S. recreational boat market is poised for steady expansion.

The Europe Recreational Boat Market

The Europe Recreational Boat Market is estimated to be valued at USD 3.2 billion in 2025 and is further anticipated to reach USD 5.9 billion by 2034 at a CAGR of 7.0%.

Europe’s recreational boat market is characterized by a rich maritime culture, extensive coastal zones, and a growing appetite for leisure boating and yacht tourism. According to the European Boating Industry (EBI), there are over 6 million boats in European waters, with significant activity in France, Italy, Germany, and the Netherlands. The European Commission’s Blue Economy initiative promotes sustainable maritime sectors, supporting investment in marina infrastructure, electrification of vessels, and digital innovation in marine navigation and safety.

The Mediterranean basin, in particular, plays a central role in driving yacht and sailing boat demand. According to Eurostat, Southern Europe continues to attract both residents and tourists for nautical tourism, boosting seasonal rentals and luxury yacht charters. As of recent European Environmental Agency (EEA) data, there is rising consumer interest in eco-friendly and hybrid vessels, especially in countries like Norway and Sweden that are investing heavily in low-emission marine technology.

Europe also benefits from a mature network of boat clubs, sailing schools, and inland waterways, including popular boating destinations along the Danube, Rhine, and Canal du Midi. The European Free Trade Association (EFTA) provides favorable import-export policies for manufacturers, contributing to steady production and export growth.

Demographically, an aging but affluent population is driving interest in comfortable, tech-enhanced motorboats, while younger boaters are fueling demand for personal watercraft and inflatables. As the continent focuses on digital transformation and climate goals, Europe’s recreational boat industry is aligning with clean energy transitions, smart boating systems, and marine tourism growth, all signaling promising long-term prospects.

The Japan Recreational Boat Market

The Japan Recreational Boat Market is projected to be valued at USD 1.2 billion in 2025. It is further expected to witness subsequent growth in the upcoming period, holding USD 2.2 billion in 2034 at a CAGR of 6.6%.

Japan’s recreational boat market is shaped by a blend of tradition, innovation, and a well-established maritime infrastructure. With over 30,000 kilometers of coastline and access to the Pacific and Sea of Japan, the country offers ample opportunities for boating, fishing, and marine leisure.

According to Japan’s Ministry of Land, Infrastructure, Transport and Tourism (MLIT), recreational boating activities are strongly supported by public marina development and stringent maritime safety standards. The Japan Boating Industry Association (JBIA) reports gradual increases in recreational boat registrations, particularly in urban coastal regions like Kanagawa, Osaka, and Fukuoka.

The popularity of small motorboats and personal watercraft is rising among younger consumers, while retirees often gravitate toward mid-sized sailboats and fishing cruisers. Japan’s aging but wealthy population provides a strong consumer base for premium vessels and yacht charters. Additionally, local governments are promoting marine tourism and water sports in port cities to boost domestic travel and economic revitalization in coastal areas.

Japan’s emphasis on technology and innovation is evident in the development of hybrid engines and AI-powered navigation systems, supported by R&D initiatives from the Ministry of Economy, Trade and Industry (METI). The nation’s strong boat manufacturing base, including brands like Yamaha and Suzuki Marine, positions it competitively in both domestic and export markets.

Demographic trends and coastal development strategies indicate steady long-term growth. Despite space constraints and limited marina capacity in some areas, Japan is expanding floating docks and small-boat harbors. With an eye on sustainability and compact design, Japan's recreational boating sector is charting a growth-oriented course into the next decade.

Global Recreational Boat Market: Key Takeaways

- Global Market Size Insights: The Global Recreational Boat Market size is estimated to have a value of USD 21.5 billion in 2025 and is expected to reach USD 40.4 billion by the end of 2034.

- The Global Market Growth Rate: The market is growing at a CAGR of 7.3 percent over the forecasted period of 2025.

- The US Market Size Insights: The US Recreational Boat Market is projected to be valued at USD 7.1 billion in 2025. It is expected to witness subsequent growth in the upcoming period as it holds USD 12.9 billion in 2034 at a CAGR of 6.9%.

- Regional Insights: North America is expected to have the largest market share in the Global Recreational Boat Market with a share of about 39.4% in 2025.

- Key Players: Some of the major key players in the Global Recreational Boat Market are Brunswick Corporation, Groupe Beneteau, Yamaha Motor Co. Ltd., Malibu Boats Inc., Ferretti Group, Azimut-Benetti Group, Sunseeker International, and many others.

Global Recreational Boat Market: Use Cases

- Luxury Yachting for Coastal Tourism: Tourism operators use high-end yachts to offer coastal cruising experiences in destinations like the Mediterranean, Caribbean, and Southeast Asia. These boats come equipped with luxury cabins, onboard chefs, and water toys, attracting affluent travelers seeking bespoke marine leisure.

- Boat Clubs and Shared Ownership Models: Urban residents without storage access are joining boat clubs that provide scheduled access to various boats. These models allow flexible, affordable boating with maintenance included, enabling younger consumers to engage in recreational boating without full ownership costs.

- Electric-Powered Day Boats for Eco-Tourism: In sustainability-driven regions, tour operators use electric boats for nature exploration in protected waters. These silent, emission-free boats allow closer wildlife observation and are increasingly adopted in eco-sensitive zones like the Norwegian fjords and Florida Everglades.

- Sport Fishing Charter Services: Entrepreneurs leverage center-console motorboats to offer guided sport fishing excursions. These trips attract both locals and tourists, often in freshwater lakes or nearshore coastal zones, contributing to regional recreation economies and marina traffic growth.

- Water Sports and Adventure Parks: Recreational boats such as wakeboarding boats and personal watercraft are central to water sports facilities and marine parks. These high-performance boats are optimized for towing and thrill-based experiences, appealing to active families and adventure-seeking tourists worldwide.

Global Recreational Boat Market: Stats & Facts

U.S. Coast Guard (USCG)

- Over 11.9 million recreational vessels were registered in the U.S. as of 2023: This includes motorboats, sailboats, and personal watercraft, showing the U.S. as the world’s largest recreational boat market in terms of ownership and registration activity.

- Florida leads with the highest number of registered recreational boats: nearly 1 million. Florida’s extensive coastlines, marina infrastructure, and culture of marine tourism make it the top state for boat ownership and usage.

- The number of recreational boating accidents in the U.S. in 2022 was 4,040, a 1.7% decrease from 2021: USCG data indicates improving safety practices and the effectiveness of boating safety awareness campaigns and licensing programs.

- Alcohol use was the leading contributing factor in fatal boating accidents in 2022: Approximately 16% of boating fatalities involved alcohol consumption, underscoring the need for continued education and law enforcement on waterway safety.

National Marine Manufacturers Association (NMMA) – via U.S. Government Reports

- 87 million adults in the U.S. participate in recreational boating annually: This figure represents about 1 in 3 American adults, highlighting how deeply ingrained boating is in U.S. recreational culture.

- Pontoon boats and personal watercraft are the fastest-growing segments in new powerboat sales: Consumers are increasingly opting for versatile and family-friendly boats, such as pontoons, for leisure, while younger audiences are drawn to the thrill of personal watercraft.

- There are 35,000 recreational boating businesses in the U.S., employing over 691,000 people: These include manufacturers, marina operators, service providers, and dealers, showing the industry's strong contribution to employment and regional economies.

- Recreational boating contributes over USD 230 billion annually to the U.S. economy: This includes direct and indirect economic activity such as boat manufacturing, tourism, maintenance services, and accessories.

U.S. Department of Commerce

- U.S. marine exports exceeded USD 2 billion in 2022: The export of recreational boats and marine components, such as engines and electronics, continues to grow as U.S. brands remain globally competitive.

- The U.S. is a net exporter of outboard engines and marine electronics: High-quality, innovative engine technologies produced in the U.S. are in strong demand globally, particularly in Europe and Asia.

U.S. Fish and Wildlife Service (USFWS)

- In 2022, more than 50 million people participated in recreational fishing in the U.S.:Fishing is one of the top uses of recreational boats, often influencing boat design and accessories such as sonar, rod holders, and bait wells.

- Recreational fishing contributes over USD 125 billion annually to the U.S. economy: This includes expenses related to boat rentals, fuel, tackle, licenses, and accommodation, reinforcing its economic relevance.

- Fishing is the top activity associated with recreational boat usage in the U.S.: Boat ownership often correlates with fishing interests, making it a primary motivator for marine leisure investment.

Transport Canada

- Canada has over 2.6 million registered pleasure craft vessels: A strong national registry reflects a vibrant marine recreational culture across its coastal and inland waterways.

- Ontario accounts for nearly 40% of Canada’s recreational boat registrations. With thousands of lakes, Ontario is the hub of recreational boating activity in Canada, home to a mix of fishing boats, pontoons, and cruisers.

- Boating fatalities in Canada decreased by 23% from 2015 to 2020 due to enhanced safety programs: National safety initiatives, stricter licensing requirements, and mandatory PFD usage have reduced incidents on Canadian waters.

European Boating Industry (EBI)

- There are over 6 million boats in European waters: Europe is home to a diverse range of recreational boats, from compact inflatables in northern rivers to mega-yachts in the Mediterranean.

- Europe has more than 4,500 marinas, offering over 1.75 million berths. This extensive marina network supports both local and tourist marine traffic, creating ideal conditions for growth in sailing and yachting.

- The Mediterranean region represents 70% of Europe’s boating activity: Countries such as Italy, Spain, France, and Greece dominate this sector due to ideal climate, coastlines, and tourism development.

Eurostat

- In 2022, maritime tourism in the EU employed over 350,000 people: Jobs span boat rentals, yacht maintenance, marina services, and marine hospitality, underscoring the sector’s labor intensity.

- Countries like Italy, France, and Spain accounted for over 65% of recreational boat tourism in the EU: These southern European countries benefit from high tourist inflow, attractive coastlines, and favorable weather for boating.

Japan Boating Industry Association (JBIA)

- Japan has over 180,000 registered recreational boats as of 2022: The market is mature, with consistent ownership and participation rates, largely centered around fishing and coastal cruising.

- The majority of boat owners in Japan are aged 50 and above: Reflecting demographic trends, Japan’s boating market is supported by an older population with disposable income and leisure time.

- Over 90% of recreational boats in Japan are under 10 meters in length: Compact, trailerable boats are favored due to limited marina space and narrow coastal infrastructure.

Japan Ministry of Land, Infrastructure, Transport and Tourism (MLIT)

- Japan has more than 400 public and private marinas: Coastal infrastructure investments support both recreational and small commercial marine operations.

- The government allocated over ¥5.4 billion (approx. USD 40 million) in 2023 for marina development and recreational boating infrastructure. National funding initiatives are aimed at promoting domestic tourism, safety, and sustainable coastal development.

Australia Maritime Safety Authority (AMSA)

- Over 850,000 recreational boats are registered in Australia: Recreational boating is a widespread activity, especially in coastal states like Queensland and New South Wales.

- New South Wales has the highest number of recreational boat registrations: With its long coastline and abundant water access, NSW dominates boat ownership and marina density in the country.

- The average Australian recreational vessel is around 5.5 meters in length. Reflecting trends in small motorboats, tinnies, and day cruisers, these boats are suited to fishing, sports, and day trips.

Global Recreational Boat Market: Market Dynamic

Driving Factors in the Global Recreational Boat Market

Rising Disposable Income and Marine Leisure Participation

A key driver fueling growth in the recreational boat market is the global rise in disposable income and lifestyle-oriented spending. As more consumers attain higher income levels, especially in emerging economies such as China, India, and Southeast Asian nations, the demand for marine leisure activities is accelerating.

Recreational boating is increasingly seen not only as a status symbol but also as a family-centric outdoor lifestyle choice. In developed countries, high-income groups are investing in yachts, motorboats, and advanced personal watercraft for leisure, fishing, or coastal cruising.

In parallel, government efforts to boost marine tourism, including subsidies for coastal development and marina infrastructure, are fostering a supportive ecosystem. The post-pandemic surge in outdoor activities has further popularized boating as a private, socially distanced leisure option. Combined with the growing availability of financing options and rental services, this rise in income-driven recreational demand is creating long-term consumption and ownership patterns favorable to market expansion.

Expansion of Boat Rental, Charter, and Boat Club Models

Alternative ownership models such as boat rentals, peer-to-peer sharing, and fractional ownership are driving demand among consumers who seek flexible and low-commitment access to recreational boating. Boat clubs, which offer members access to fleets across multiple locations, are expanding rapidly in urban and tourist-centric regions.

These models appeal to younger consumers, such as millennials and Gen Z, who prioritize access and experience over asset ownership. They also mitigate traditional ownership barriers like high upfront costs, maintenance responsibilities, and docking fees. Technological platforms now enable real-time booking, GPS tracking, and online payments, making it easier for operators and users to interact efficiently.

The rise of tourism-led boating services, especially in Europe, North America, and coastal Asia-Pacific regions, has led to the proliferation of yacht charter businesses targeting both domestic and international travelers. This growing segment is making recreational boating more inclusive, seasonal, and adaptive to consumer preferences, thus broadening the market’s reach and contributing to consistent growth.

Restraints in the Global Recreational Boat Market

High Initial Ownership Cost and Ongoing Maintenance Expenses

Owning a recreational boat remains a significant financial undertaking due to the high upfront cost of acquisition and recurring expenses associated with maintenance, docking, fuel, insurance, and seasonal storage. Even entry-level boats can cost thousands of dollars, excluding fees for registration, trailer purchase, and safety equipment.

For larger boats or yachts, the cost can escalate substantially with luxurious interiors, engine capacity, and navigation systems. Additionally, maintenance needs such as hull cleaning, engine servicing, and part replacements are ongoing and can be unpredictable.

Insurance premiums vary by boat type, region, and usage frequency, adding to annual ownership costs. Many first-time buyers are discouraged by the realization that a boat is not a one-time expense but a recurring financial commitment. Furthermore, limited financing options in certain regions and rising interest rates may reduce affordability and restrict access to credit. These cost-related barriers are slowing down boat adoption, especially among price-sensitive demographics, despite growing interest in marine recreation.

Environmental Regulations and Navigational Restrictions

Environmental compliance is becoming more stringent globally, placing pressure on recreational boat manufacturers and owners. Governments are implementing tougher laws related to engine emissions, fuel usage, waste disposal, and noise pollution in marine environments. For instance, bans on two-stroke engines in some U.S. states and European coastal regions limit the use of older boats, impacting resale value and usability. Similarly, eco-sensitive zones and protected waterways may impose navigational restrictions that limit where and when recreational boats can operate.

Owners are increasingly required to adopt eco-friendly systems like marine sanitation devices, non-toxic hull paints, and fuel-efficient engines, adding to overall costs. Regulatory requirements can also vary widely across countries and regions, complicating operations for boat charter companies and cross-border usage.

While these regulations are essential for environmental protection, they present compliance challenges and limit market flexibility. For manufacturers, meeting these evolving standards requires continuous R&D investment, thus constraining profit margins and increasing product development timelines.

Opportunities in the Global Recreational Boat Market

Development of Emerging Boating Markets in Asia-Pacific and Latin America

Emerging economies such as India, China, Brazil, and Indonesia present massive untapped potential for the recreational boat industry. These countries are experiencing rapid urbanization, increasing coastal and lake-based tourism, and a growing middle-class population with higher spending power.

Governments in these regions are recognizing the economic potential of marine leisure and are investing in boating infrastructure, including marinas, boat ramps, and navigable inland waterways. For example, India’s Sagarmala project and Indonesia’s marine tourism expansion are laying the groundwork for long-term recreational boating ecosystems.

Local manufacturers are beginning to enter the market with cost-effective vessels tailored to regional needs. International brands are also forming partnerships and joint ventures to gain access to these high-growth markets.

Furthermore, the growing popularity of water sports and fishing among youth populations is fueling interest in affordable personal watercraft and entry-level motorboats. These emerging markets are expected to be key contributors to global recreational boating growth over the next decade.

Advancement in Modular and Customizable Boat Designs

The demand for modular and customizable boats is rising as consumers seek vessels tailored to specific lifestyle preferences and activities. Boat manufacturers are increasingly offering customizable layouts, removable seating, fishing kits, and convertible deck arrangements that enhance utility and comfort.

These designs allow consumers to use the same boat for multiple purposes, such as family cruising during the day and fishing trips on weekends. Modular boats also reduce production costs and lead times, enabling manufacturers to offer faster delivery and localized customization.

Furthermore, 3D printing and computer-aided design tools are streamlining the prototyping and personalization process. This flexibility is especially important in the yacht and pontoon segments, where luxury buyers expect bespoke experiences.

In rental and charter markets, modular designs allow fleet operators to serve diverse client needs more efficiently. The growing consumer desire for personalized and multifunctional boats presents manufacturers with a valuable opportunity to differentiate their offerings and capture niche segments across price tiers.

Trends in the Global Recreational Boat Market

Rise of Sustainable and Electric Recreational Boats

One of the most significant trends in the recreational boat market is the shift toward sustainability and electrification. Increasing environmental concerns and stricter emission norms imposed by maritime authorities have prompted boat manufacturers to integrate electric and hybrid propulsion systems. Countries across Europe and North America are promoting green boating through incentives and clean marina programs.

Battery technology advancements have made electric boats more viable for short-distance cruising, fishing, and leisure activities. Startups and established players alike are introducing fully electric day boats and solar-assisted yachts that offer reduced operational costs and minimal environmental impact.

Additionally, marine battery systems are becoming lighter, more durable, and capable of supporting high-performance needs. Boaters are also increasingly demanding vessels made from recyclable materials and featuring eco-friendly hull coatings. This shift is redefining product development priorities and prompting marina operators to install charging infrastructure. As the recreational boating industry moves toward carbon neutrality, electric boats are positioned as a long-term solution for eco-conscious consumers, coastal tourism operators, and regulators alike.

Integration of Smart Boating Technology and Automation

Digital transformation in recreational boating is becoming increasingly prominent with the integration of smart onboard technologies. Boat manufacturers are embedding GPS navigation, remote monitoring, AI-powered autopilot systems, and real-time diagnostics into vessels to enhance user convenience and safety.

These innovations allow owners to monitor engine performance, battery status, weather conditions, and fuel consumption through smartphone apps or digital dashboards. Smart connectivity also enables predictive maintenance, alerting users to potential issues before they escalate. Furthermore, automation is making docking and anchoring easier for novice users, expanding the appeal of boating to a younger, tech-savvy demographic.

In larger yachts, advanced systems can automate climate control, entertainment, and lighting, enhancing the luxury experience. The adoption of Internet of Things (IoT) devices on boats is also fostering better fleet management for rental and charter companies. As digital tools become standard across boat sizes and types, the recreational boating experience is evolving into a more intuitive, connected, and data-driven ecosystem.

Global Recreational Boat Market: Research Scope and Analysis

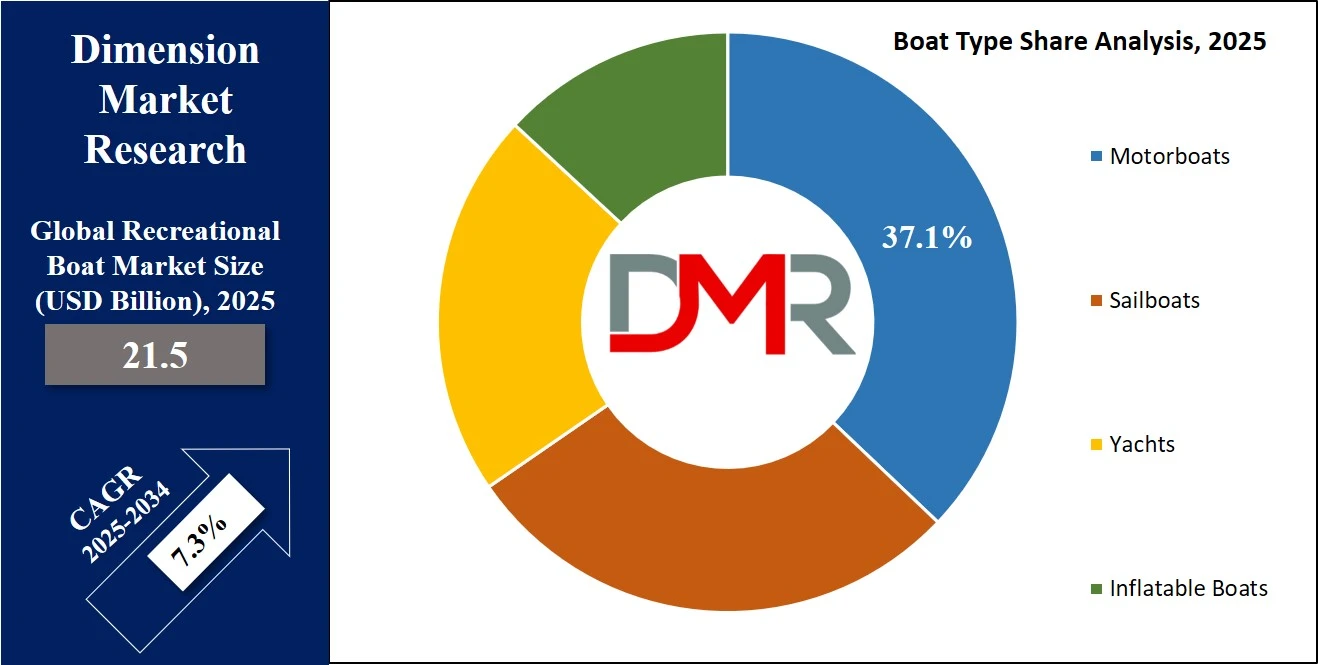

By Boat Type Analysis

Motorboats are expected to be the dominant sub-segment within the recreational boat market, driven by their widespread use in diverse activities such as fishing, water sports, and cruising. Unlike sailboats or yachts, motorboats are easier to operate, faster, and require less training, making them suitable for both novice and experienced boaters.

They come in various sizes from small outboard motorboats to larger inboard vessels offering flexibility for inland, coastal, or offshore recreational activities. Their relatively affordable cost of ownership, maintenance, and fuel efficiency make them an appealing choice for the middle-income recreational boating segment.

Additionally, motorboats benefit significantly from technological enhancements such as GPS integration, electric propulsion, and joystick controls, which further improve user experience and performance. With a global rise in leisure boating, weekend getaways, and individual recreational pursuits, motorboats fulfill the increasing demand for private, convenient watercraft.

Furthermore, boat-sharing platforms and rental services have included a large number of motorboats due to their user-friendliness, boosting their accessibility and usage. They also serve as a bridge to other categories; many first-time boat buyers start with motorboats before progressing to yachts.

Their versatility enables their deployment in multiple applications, and their ability to navigate shallow waters makes them particularly attractive for inland and coastal waterways. Compared to sailboats and yachts, which often require more skill or crew, motorboats deliver a high degree of autonomy and spontaneity.

As emerging economies with vast coastlines continue to invest in marina infrastructure and water-based tourism, the demand for motorboats is expected to further increase. This combination of performance, affordability, and accessibility positions motorboats as the most dominant segment in the global recreational boat market.

ℹ

To learn more about this report –

Download Your Free Sample Report Here

By Power Source Analysis

Engine-powered boats are expected to dominate the recreational boat market due to their superior speed, maneuverability, and suitability for various marine activities. Whether gasoline or diesel-powered, these boats enable fast cruising, making them ideal for water sports, long-distance leisure trips, and sportfishing.

Compared to manually or sail-powered boats, engine-powered vessels provide enhanced user control and require less physical effort or sailing expertise, widening their appeal among recreational users. Innovations like outboard motors, hybrid engines, and electric propulsion systems are increasingly integrated, improving efficiency while addressing environmental concerns.

Their widespread availability across multiple boat types, motorboats, rigid inflatables, and cabin cruisers strengthens their market dominance. Engine-powered boats are also the preferred choice for rental operators and tour services due to ease of operation and quick turnaround.

Furthermore, engine manufacturers continuously collaborate with boatbuilders to integrate smart controls, noise-reduction technologies, and automated diagnostics, enhancing the end-user experience. Marinas and docking facilities are better equipped to support engine-powered vessels, improving convenience for owners. While sailing boats still hold cultural and sport significance, the broader demographic, including younger users and first-time boaters, favors engine-powered boats for recreational convenience.

As disposable incomes rise and tourism recovers post-pandemic, especially in coastal economies, the uptake of engine-powered boats for both personal and charter use is accelerating. The versatility of engine-powered craft, ranging from small lake boats to powerful offshore cruisers, further reinforces their leadership.

Governments also favor engine-based models for patrols and rescue services under recreational classification, boosting secondary market growth. Given their integration of comfort, speed, and modern tech, engine-powered boats will likely continue to lead the market’s growth curve.

By Activity/Application Analysis

Fishing is expected to remain the dominant application in the recreational boat market, backed by a strong cultural tradition, increasing licenses, and technological innovations enhancing the fishing experience. From angling in inland lakes to deep-sea fishing excursions, this activity draws consistent consumer interest across geographies. Fishing-specific boats are often outfitted with specialized equipment such as fish finders, live wells, GPS plotters, and trolling motors, ensuring functionality and comfort.

North America, particularly the United States and Canada, accounts for a significant share of recreational fishing licenses annually, highlighting the scale of participation in the activity. Governments actively promote fishing as a leisure activity through conservation programs and permits, encouraging safe and sustainable practices. Meanwhile, boat manufacturers develop purpose-built fishing boats catering to both casual and professional anglers, from bass boats to sportfishing yachts.

The rise of weekend leisure culture and growing demand for personalized outdoor activities, especially post-COVID, further elevate fishing's appeal. Compared to high-speed water sports or long-haul cruising, fishing offers a meditative, family-friendly experience that appeals to a broader age demographic, including retirees and youth groups. Regions such as Europe and Asia-Pacific are also witnessing growth in coastal and inland sport fishing, backed by organized tournaments and community events.

Social media and video-sharing platforms contribute to the popularity of fishing, encouraging amateur users to invest in entry-level boats. In emerging markets, fishing also serves as a hybrid activity offering leisure and subsistence, fueling boat ownership. This strong emotional, recreational, and lifestyle connection solidifies fishing as the most prominent and enduring application in the recreational boat market.

By Material Analysis

Fiberglass is anticipated to be the most dominant material in recreational boat construction due to its ideal blend of durability, corrosion resistance, and design flexibility. Unlike wood or aluminum, fiberglass offers a smooth, easily moldable surface that allows boat manufacturers to produce sleek hull shapes with advanced hydrodynamics. Its non-reactive nature ensures minimal maintenance and a longer lifespan in both freshwater and saltwater conditions. Boats made of fiberglass are lightweight yet structurally robust, making them suitable for motorboats, yachts, and inflatables alike.

Fiberglass also provides excellent thermal insulation and sound dampening, enhancing passenger comfort, an important criterion in the luxury boating segment. Its ease of repair and modular production capabilities reduce long-term ownership and repair costs, increasing buyer confidence. Additionally, fiberglass boats can be mass-produced efficiently using molds, thereby supporting economies of scale and meeting growing global demand.

Regulatory bodies often approve fiberglass hulls for recreational use due to their compliance with safety standards and environmental performance. Manufacturers now incorporate high-grade composites and gel coats to reinforce strength while improving aesthetics. Compared to steel or carbon fiber, fiberglass is more cost-effective and widely available, which also makes it the go-to material for entry- and mid-level recreational boats.

In the charter and rental segments, fiberglass boats dominate due to their resilience against impact, scratches, and constant marine exposure. This material’s popularity also stems from continuous innovation, such as infusion molding and sustainable resin technologies, making fiberglass not only dominant but also future-ready. Its combination of performance, cost efficiency, and versatility secures its leading position in recreational boat construction.

By Power Range Analysis

The 100–200 kW power range is poised to dominates the recreational boat market due to its perfect balance between power output and operational efficiency, making it ideal for a broad class of boats, including motorboats, cabin cruisers, and mid-sized yachts. This range supports versatile applications such as cruising, fishing, and water sports, without excessive fuel consumption or maintenance overhead. Boats in this category typically offer speeds suitable for most leisure activities and can sustain longer operations compared to lower-powered boats.

The increasing preference for multi-purpose boats, especially among family and group users, has bolstered the demand for 100–200 kW engines. Moreover, electric and hybrid propulsion systems in this power bracket are rapidly gaining popularity due to government emissions regulations and user interest in quieter, eco-friendly boating. Manufacturers offer innovative solutions in this category with enhanced torque, integrated smart controls, and fuel-efficient propulsion systems.

Additionally, the 100–200 kW segment caters to both inboard and outboard configurations, increasing its adaptability across boat types. It is also the preferred choice among rental fleets, marinas, and charter services, which seek a combination of performance and lower lifecycle costs.

As battery technology improves and infrastructure for electric charging develops at marinas globally, this segment is expected to expand further. From inland lakes to coastal waters, this power range provides reliable and robust boating without pushing engine or structural limits, enhancing both safety and experience. The growing number of recreational boaters seeking premium performance without luxury-level investment continues to drive the dominance of the 100–200 kW power range in the global market.

By Ownership Analysis

Personal/recreational use is anticipated to be the dominant ownership segment in the recreational boat market, propelled by rising disposable incomes, lifestyle shifts, and a growing interest in personalized outdoor leisure. Individual ownership offers autonomy, flexibility, and convenience, making it the most preferred format for water-based recreation.

In North America and Europe, boat ownership is often perceived as a status symbol and an expression of individual freedom, especially among the upper-middle class. The COVID-19 pandemic further accelerated interest in private recreation, with boating emerging as a socially distanced, family-safe activity. With improved financing, leasing options, and trade-in programs, purchasing a personal boat has become more accessible than ever.

Technological advancements such as remote diagnostics, autopilot features, and app-based monitoring have reduced the complexity of boat ownership, attracting first-time buyers. Moreover, manufacturers are offering compact, entry-level models tailored for occasional weekend use, further increasing adoption. Compared to rental or club ownership, personal boats allow for greater customization, storage of personal gear, and spontaneous trip planning.

Governments in coastal and lake regions are also promoting boating through license reforms and marina development, encouraging citizens to invest in personal crafts. As online marketplaces and second-hand platforms flourish, resale and upgrade options have become easier, enhancing asset value.

The sentimental and lifestyle appeal of boat ownership continues to be a strong psychological factor as well. While charter services are gaining momentum in urban areas, the scale and global spread of personal ownership make it the leading format in the recreational boat industry, with a solid growth trajectory across developed and emerging economies alike.

By Sales Channel Analysis

Dealership sales are projected to dominate the recreational boat market as they provide consumers with a comprehensive and trustworthy buying experience that includes consultation, financing, customization, and after-sales service.

Dealerships function as vital intermediaries between manufacturers and end users, offering personalized product guidance and test rides critical in a high-value, technical purchase such as a boat. These outlets are well-equipped to explain complex specifications, compare models, and handle trade-ins, making them a preferred channel for both first-time and seasoned buyers.

Authorized dealers also offer certified boats, warranty coverage, and maintenance packages, which enhance buyer confidence and security. In addition to sales, dealerships often maintain service bays and spare parts inventory, enabling ongoing support something online platforms typically lack. Dealer networks are particularly robust in countries like the U.S., Canada, Germany, France, and Australia, where boating culture is well-established.

Boat shows and exhibitions, while important for marketing, typically channel purchases back through dealership contacts. Even luxury buyers often finalize high-end yacht or cruiser deals through established dealer networks that offer legal support and logistics management. Manufacturers rely on their dealerships not only for regional outreach but also for brand representation, training, and compliance with safety standards.

Many dealerships also offer financing through third-party tie-ups, further easing the purchasing journey. With the recent rise of digital tools, many dealerships now incorporate online inventory previews and virtual tours, combining convenience with physical support. Despite the growth of online marketplaces, the high involvement and customization required in boat buying continue to make dealership sales the dominant channel in the recreational boating industry.

The Global Recreational Boat Market Report is segmented based on the following:

By Boat Type

- Motorboats

- Outboard Boats

- Inboard Boats

- Personal Watercraft (PWC)

- Jet Boats

- Sailboats

- Monohull

- Multihull (Catamarans, Trimarans)

- Yachts

- Sailing Yachts

- Motor Yachts

- Superyachts & Megayachts

- Inflatable Boats

- Rigid Inflatable Boats (RIBs)

- Soft Inflatable Boats

By Power Source

- Engine-Powered Boats

- Diesel

- Gasoline

- Electric/Hybrid

- Manually Powered Boats

- Sailing Powered Boats

By Activity/Application

- Fishing

- Water Sports

- Cruising/Leisure

- Travel & Tourism

- Racing/Regatta

By Material

- Aluminum

- Fiberglass

- Wood

- Steel

- Carbon Fiber/Composite

- Other Material

By Power Range

- Up to 100 kW

- 100-200 kW

- Above 200 kW

By Ownership

- Personal/Recreational Use

- Rental & Charter Services

- Government & Law Enforcement

- Fractional Ownership & Boat Clubs

By Sales Channel

- Online Sales

- Dealership Sales

- Boat Shows & Exhibitions

Impact of Artificial Intelligence in the Global Recreational Boat Market

- Autonomous Navigation and Route Optimization: AI-powered navigation systems are transforming boating experiences by enabling autonomous and semi-autonomous operation. These systems can analyze weather conditions, traffic, and underwater topography to suggest the safest and most efficient routes, enhancing user safety and fuel efficiency while reducing the reliance on skilled navigation for casual and recreational boat users.

- Predictive Maintenance and Fault Detection: Artificial Intelligence is used to monitor engine performance, battery levels, and hull conditions in real-time. Through predictive analytics, AI can alert users and service providers before mechanical failures occur, significantly reducing downtime, repair costs, and safety hazards. This ensures longer operational lifespans and increases customer satisfaction through seamless recreational boating.

- Smart Personalization of Onboard Systems: AI systems can learn user preferences related to lighting, entertainment, temperature, and seating arrangements to create a personalized onboard experience. Voice-activated assistants and adaptive system controls help boaters enjoy a more intuitive and luxurious environment. This level of customization elevates consumer expectations and contributes to product differentiation in the market.

- Enhanced Safety and Collision Avoidance: AI-driven sensors and computer vision systems are enhancing onboard safety by detecting floating debris, nearby vessels, and obstacles in real-time. This technology enables automatic braking or course correction, preventing accidents and offering peace of mind to recreational users, especially beginners or those boating in crowded waterways or poor visibility conditions.

- AI in Fleet Management for Rentals and Clubs: Rental and charter companies are leveraging AI for fleet management, using algorithms to optimize boat availability, maintenance scheduling, and customer usage patterns. AI ensures better asset utilization, reduced operational costs, and improved service quality, which boosts profitability and supports the growing trend of shared boat ownership and boat-as-a-service models.

Global Recreational Boat Market: Regional Analysis

Region with the Largest Revenue Share

North America is projected to hold a dominant position in the global recreational boat market with 39.4% of total revenue by the end of 2025, due to a combination of high disposable incomes, a deeply rooted boating culture, extensive coastlines, and favorable government initiatives supporting marine recreation. The United States alone has over 11 million registered recreational boats, according to the U.S. Coast Guard, reflecting the popularity and accessibility of recreational boating in the region.

A strong infrastructure of marinas, boatyards, and waterways allows seamless access to lakes, rivers, and coastal areas, encouraging boating among all age groups. Furthermore, the presence of several leading manufacturers such as Brunswick Corporation, MasterCraft, and Malibu Boats ensures product availability, innovation, and brand trust within the domestic market.

Government support through grants, boating safety education programs, and environmental regulations promotes responsible boating practices while enhancing market stability. The National Marine Manufacturers Association (NMMA) actively promotes boating activities, industry research, and policy advocacy, creating a robust ecosystem for manufacturers and users alike. The prevalence of recreational activities such as fishing, watersports, and weekend cruising among both urban and rural populations continues to fuel demand.

ℹ

To learn more about this report –

Download Your Free Sample Report Here

Region with the Highest CAGR

Asia Pacific is projected to exhibit the highest compound annual growth rate (CAGR) in the recreational boat market due to rapid economic development, rising disposable incomes, increasing maritime tourism, and expanding coastal infrastructure.

Countries such as China, South Korea, India, Thailand, and Indonesia are investing heavily in their marine sectors, recognizing the economic potential of water-based leisure and tourism. According to the Ministry of Transport in China, domestic yacht registrations have been increasing annually, with the country aiming to develop 100 yacht marinas in coastal and riverfront cities by 2035.

The region is also witnessing a cultural shift, where recreational activities like yachting, fishing, and marine tourism are becoming aspirational lifestyle choices among the rising middle class and high-net-worth individuals. This emerging consumer base is fueling demand for small to mid-sized powerboats and luxury yachts. Government incentives for coastal tourism, including marina development and yacht-friendly policies, are creating an enabling environment for market expansion.

Additionally, regional boat manufacturers are expanding their portfolios with more affordable and fuel-efficient models, catering to price-sensitive markets. Partnerships between global boat makers and local firms are increasing access to advanced marine technologies and creating strong distribution networks. With growing interest in electric and hybrid boats and smart features, Asia Pacific markets are rapidly evolving to meet new consumer expectations.

By Region

North America

Europe

- Germany

- The U.K.

- France

- Italy

- Russia

- Spain

- Benelux

- Nordic

- Rest of Europe

Asia-Pacific

- China

- Japan

- South Korea

- India

- ANZ

- ASEAN

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Argentina

- Colombia

- Rest of Latin America

Middle East & Africa

- Saudi Arabia

- UAE

- South Africa

- Israel

- Egypt

- Rest of MEA

Global Recreational Boat Market: Competitive Landscape

The global recreational boat market is characterized by intense competition and a wide range of offerings, from entry-level motorboats to high-end luxury yachts. Industry leaders such as Brunswick Corporation, Groupe Beneteau, Yamaha Motor Co. Ltd., and Malibu Boats Inc. dominate the market through their diversified product portfolios, global distribution networks, and consistent technological innovation. These companies continuously invest in R&D to enhance fuel efficiency, user experience, and onboard digital systems such as GPS, entertainment, and collision avoidance technologies.

Strategic collaborations, acquisitions, and product launches are common in this space. For instance, Brunswick has been expanding its Freedom Boat Club franchise, tapping into the growing sharing economy. Similarly, Groupe Beneteau has focused on sustainability through the development of electric and hybrid-powered vessels to cater to environmentally conscious consumers. Companies are also expanding their online presence and using virtual reality tools to improve boat-buying experiences and attract digitally engaged consumers.

Emerging players, particularly in Asia and Eastern Europe, are gaining traction by offering cost-competitive boats with decent customization and smart features. These entrants are increasingly focusing on lightweight materials such as composites and carbon fiber, as well as integrating AI-based systems for navigation and maintenance.

In the rental and charter segment, digital startups are reshaping the customer journey through seamless mobile apps and subscription models. The competitive landscape is expected to intensify as new technologies and business models reshape how boats are purchased, shared, and enjoyed globally, offering consumers more choice and convenience.

Some of the prominent players in the Global Recreational Boat Market are:

- Brunswick Corporation

- Groupe Beneteau

- Yamaha Motor Co., Ltd.

- Malibu Boats, Inc.

- Ferretti Group

- Azimut-Benetti Group

- Sunseeker International Ltd.

- Princess Yachts Limited

- HanseYachts AG

- MasterCraft Boat Holdings, Inc.

- White River Marine Group

- Correct Craft, Inc.

- Hatteras Yachts

- Ranger Boats

- Sea Ray Boats

- Boston Whaler

- Cobalt Boats LLC

- Lund Boats

- Tracker Boats

- EdgeWater Boats

- Other Key Players

Recent Developments in the Global Recreational Boat Market

- July 2025: HanseYachts, one of Europe’s largest yacht manufacturers, underwent an ownership transition in July 2025. This change is expected to bring fresh capital investment and a strategic redirection toward expanding its sailing yacht and motor yacht portfolios. The acquisition could also lead to improved technological innovation and geographic expansion, particularly in emerging markets.

- July 2025: The National Marine Manufacturers Association (NMMA) delivered an updated "State of the Recreational Boating Industry" presentation during its mid-year event. This conference addressed key performance indicators, demand forecasts, and post-pandemic recovery trends, while also showcasing policy changes and consumer behavior influencing the U.S. market.

- June 2025: Electric boat manufacturer Vision Marine Technologies announced the acquisition of Nautical Ventures, a Florida-based dealer and marina operator. The move aims to expand Vision Marine’s sales and service footprint while solidifying its electric propulsion boat segment through a stronger distribution network and retail presence in key North American markets.

- June 2025: Twin Vee introduced new models under the Bahama Boat Works brand, targeting offshore fishing and leisure segments. The expansion reflects growing demand for customizable, high-performance center console boats suitable for both sport and luxury use.

- June 2025: RS Sailing announced the inclusion of the compact Aira 22 keelboat to its product offerings. This lightweight, user-friendly sailboat is aimed at training schools, club racing, and beginner sailors, enhancing RS Sailing’s market in entry-level and recreational sailing categories.

- June 2025: RINA, a global marine engineering company, completed the acquisition of Foreship, a Finnish yacht design firm. The deal is set to boost RINA’s naval architecture capabilities and foster innovation in luxury and sustainable yacht design.

- June 2025: Safe Harbor Marinas, a major marina services provider, entered exclusive discussions to acquire Monaco Marine. This potential merger would strengthen Safe Harbor’s footprint in the luxury European marina market, catering to the expanding demand for premium boat docking and service facilities.

- May 2025: Dutch yacht builder Heesen Yachts announced its withdrawal from the 2025 Monaco Yacht Show and Fort Lauderdale International Boat Show. The move indicates a strategic pivot toward direct client engagement and digital marketing, reducing dependency on large-scale expos for sales conversions.

- March 2025: The Ferretti Group revealed plans to execute a share buyback program and pursue new acquisitions in 2025. These strategic moves aim to consolidate its leadership in the yacht manufacturing sector and support its expansion into hybrid propulsion and sustainable luxury vessels.

- February 2025: Blackstone Group completed the acquisition of Safe Harbor Marinas in a landmark USD 5.65 billion deal. The transaction represents one of the largest investments in the marine infrastructure space and reflects institutional interest in recurring marina-based revenue and recreational boating growth.

Report Details

| Report Characteristics |

| Market Size (2025) |

USD 21.5 Bn |

| Forecast Value (2034) |

USD 40.4 Bn |

| CAGR (2025–2034) |

7.3% |

| Historical Data |

2019 – 2024 |

| The US Market Size (2025) |

USD 7.1 Bn |

| Forecast Data |

2025 – 2033 |

| Base Year |

2024 |

| Estimate Year |

2025 |

| Report Coverage |

Market Revenue Estimation, Market Dynamics, Competitive Landscape, Growth Factors, etc. |

| Segments Covered |

By Boat Type (Motorboats, Sailboats, Yachts, Inflatable Boats), By Power Source (Engine-Powered Boats, Manually Powered Boats, Sailing Powered Boats), By Activity/Application (Fishing, Water Sports, Cruising/Leisure, Travel & Tourism, Racing/Regatta) By Material (Aluminum, Fiberglass, Wood, Steel, Carbon Fiber/Composite, Other Material), By Power Range (Up to 100 kW, 100–200 kW, Above 200 kW), By Ownership (Personal/Recreational Use, Rental & Charter Services, Government & Law Enforcement, Fractional Ownership & Boat Clubs), By Sales Channel (Online Sales, Dealership Sales, Boat Shows & Exhibitions) |

| Regional Coverage |

North America – US, Canada; Europe – Germany, UK, France, Russia, Spain, Italy, Benelux, Nordic, Rest of Europe; Asia-Pacific – China, Japan, South Korea, India, ANZ, ASEAN, Rest of APAC; Latin America – Brazil, Mexico, Argentina, Colombia, Rest of Latin America; Middle East & Africa – Saudi Arabia, UAE, South Africa, Turkey, Egypt, Israel, Rest of MEA |

| Prominent Players |

Brunswick Corporation, Groupe Beneteau, Yamaha Motor Co. Ltd., Malibu Boats Inc., Ferretti Group, Azimut-Benetti Group, Sunseeker International, Princess Yachts, HanseYachts AG, MasterCraft Boat Holdings, White River Marine Group, Correct Craft, Hatteras Yachts, Ranger Boats, Sea Ray Boats, Boston Whaler, Cobalt Boats, Lund Boats, Tracker Boats, EdgeWater Boats., and Other Key Players |

| Purchase Options |

We have three licenses to opt for: Single User License (Limited to 1 user), Multi-User License (Up to 5 Users), and Corporate Use License (Unlimited User) along with free report customization equivalent to 0 analyst working days, 3 analysts working days, and 5 analysts working days respectively. |

Frequently Asked Questions

How big is the Global Recreational Boat Market?

▾ The Global Recreational Boat Market size is estimated to have a value of USD 21.5 billion in 2025 and is expected to reach USD 40.4 billion by the end of 2034.

What is the growth rate in the Global Recreational Boat Market in 2025?

▾ The market is growing at a CAGR of 7.3 percent over the forecasted period of 2025.

What is the size of the US Recreational Boat Market?

▾ The US Recreational Boat Market is projected to be valued at USD 7.1 billion in 2025. It is expected to witness subsequent growth in the upcoming period as it holds USD 12.9 billion in 2034 at a CAGR of 6.9%.

Which region accounted for the largest Global Recreational Boat Market?

▾ North America is expected to have the largest market share in the Global Recreational Boat Market with a share of about 39.4% in 2025.

Who are the key players in the Global Recreational Boat Market?

▾ Some of the major key players in the Global Recreational Boat Market are Brunswick Corporation, Groupe Beneteau, Yamaha Motor Co. Ltd., Malibu Boats Inc., Ferretti Group, Azimut-Benetti Group, Sunseeker International, and many others.