Market Overview

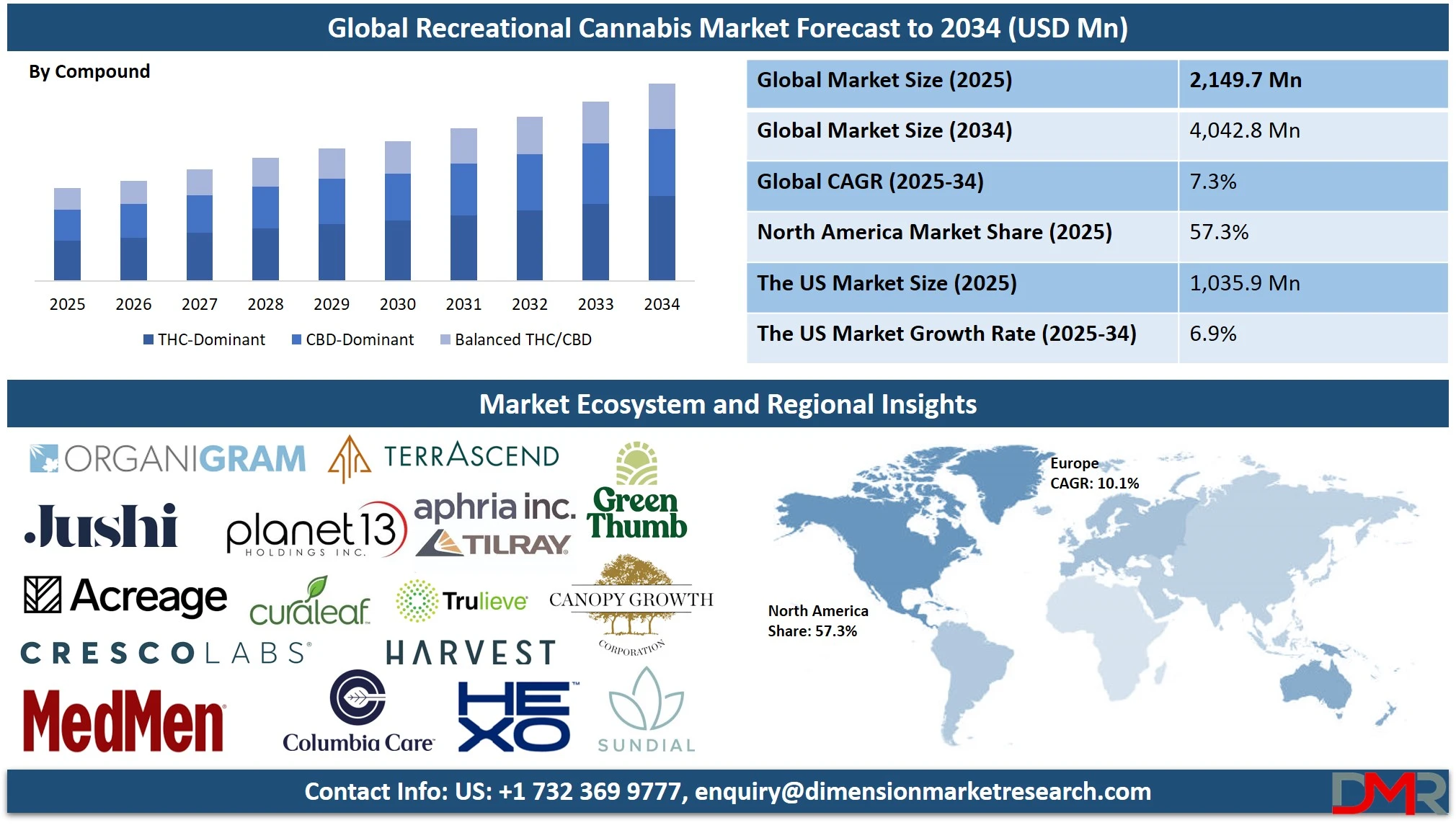

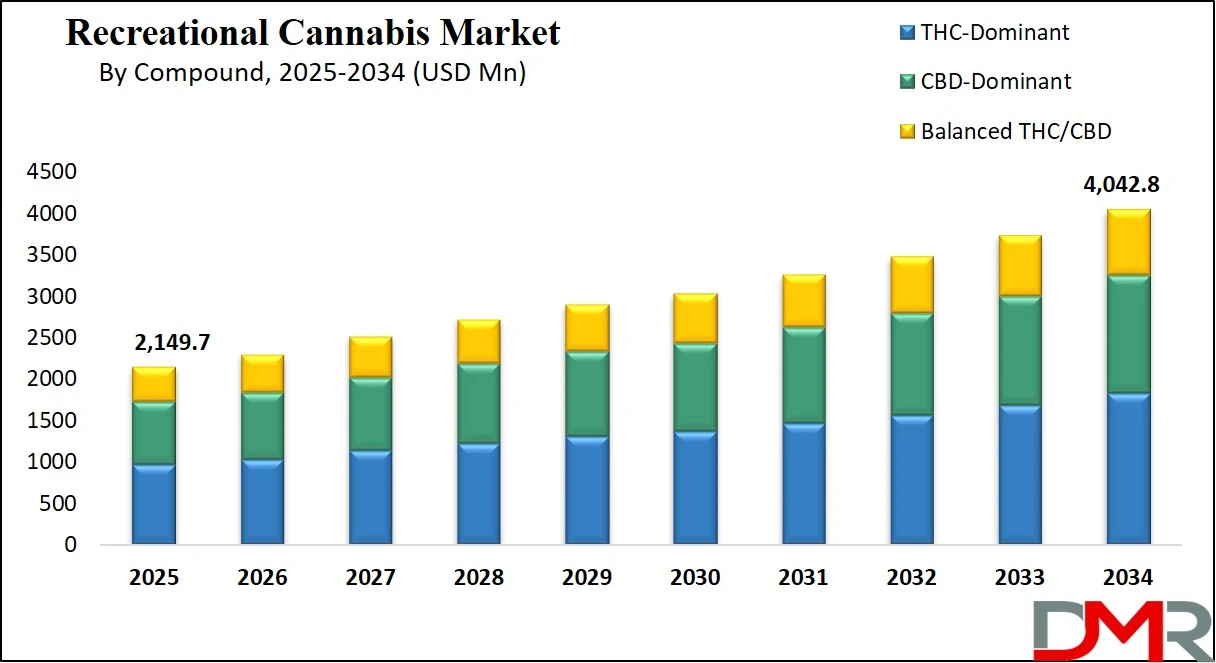

The Global Recreational Cannabis Market is poised for steady expansion, with projections indicating it will attain a valuation of USD 2,149.7 million by 2025. Driven by evolving consumer preferences, progressive legalization frameworks, and the rising adoption of cannabis for lifestyle and wellness purposes, the market is expected to register a compound annual growth rate (CAGR) of 7.3% from 2025 through 2034. By the end of the forecast period, the market is anticipated to reach approximately USD 4,042.8 million.

ℹ

To learn more about this report –

Download Your Free Sample Report Here

The global recreational cannabis market is undergoing rapid transformation due to shifting consumer behavior, expanding legalization, and diversification in product offerings. As more countries and jurisdictions move toward cannabis decriminalization or full legalization, the demand for non-medical cannabis use is accelerating.

Innovations in product development, ranging from edibles, vapes, tinctures, and infused beverages to topicals, are reshaping how consumers interact with cannabis, offering discreet and novel consumption formats. Technological advancements in cultivation and extraction techniques are improving quality and consistency, while automated processing is driving down production costs.

ℹ

To learn more about this report –

Download Your Free Sample Report Here

One of the most significant trends is the normalization of cannabis in mainstream wellness and lifestyle culture. Influencer marketing, celebrity brand endorsements, and cannabis tourism are helping to destigmatize its use, particularly among millennials and Gen Z. Social equity programs and corporate social responsibility initiatives are also gaining traction to address historical injustices tied to cannabis prohibition.

However, strict and inconsistent regulations across countries remain a critical barrier, particularly around cross-border trade, product standards, and advertising restrictions. Banking limitations and high tax burdens in certain regions also constrain profitability for businesses. Moreover, societal resistance in more conservative cultures continues to hinder legal reforms.

Opportunities abound in the luxury cannabis and infused beverage segments, with companies launching high-end cannabis offerings targeted at wellness-focused, affluent consumers. Cannabis cafes, wellness spas, and infused dining experiences are emerging as experiential retail models. Growth is further supported by rising disposable incomes and increasing demand for alternatives to alcohol, especially among younger, health-conscious consumers. The outlook remains optimistic as markets mature and global supply chains evolve.

The US Recreational Cannabis Market

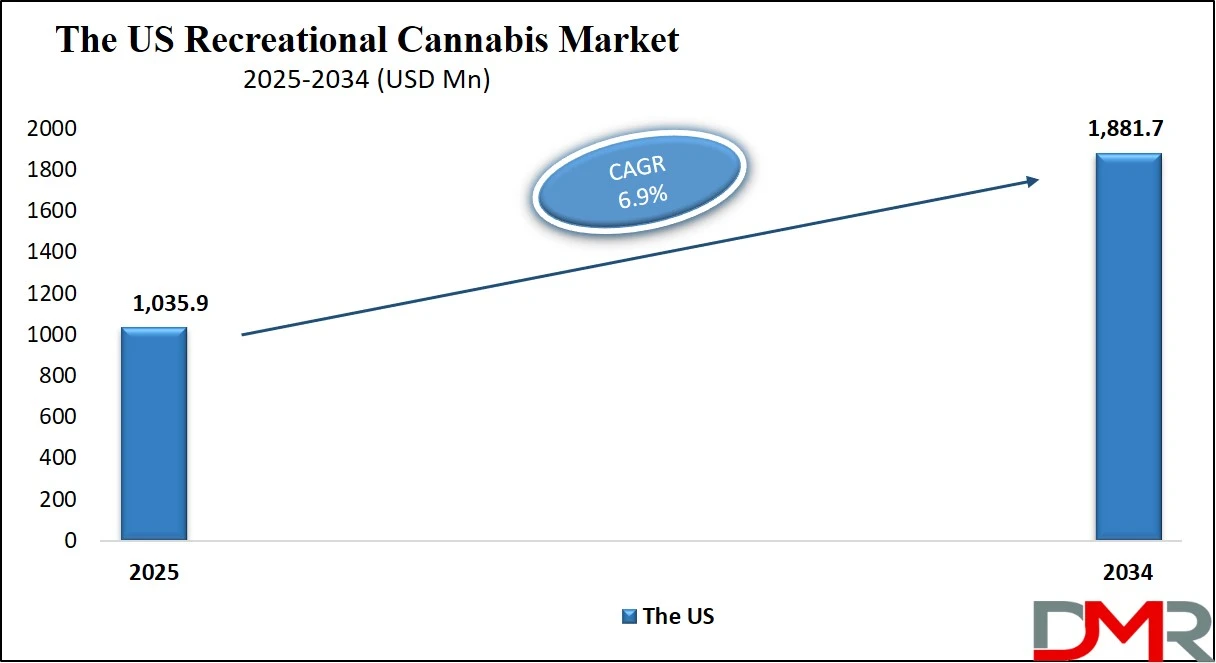

The US Recreational Cannabis Market is projected to reach USD 1,035.9 million in 2025 at a compound annual growth rate of 6.9% over its forecast period.

The U.S. recreational cannabis market is the most established globally, bolstered by progressive state-level legalization, growing public support, and shifting demographics. According to the Centers for Disease Control and Prevention (CDC), over 18% of Americans reported cannabis use in the past year, reflecting increasing normalization. The U.S. Census Bureau indicates strong population growth in states like Texas, Florida, and California, where legalization or proposed reform is expected to expand the addressable consumer base significantly.

ℹ

To learn more about this report –

Download Your Free Sample Report Here

The demographic advantage lies in the young, urbanized population, with adults aged 21–35 forming the core consumer group. These users tend to favor convenient, socially acceptable formats like gummies, vape pens, and pre-rolls. Policy frameworks such as those under the Office of Cannabis Management in New York and California’s Department of Cannabis Control aim to ensure compliance and expand access while supporting small businesses.

According to the National Conference of State Legislatures (NCSL), over 20 states and Washington, D.C. have legalized recreational cannabis use, with more states debating bills in legislative sessions. The DEA's recent moves to consider reclassifying cannabis under federal law are also expected to improve banking access and research funding. The USDA’s role in regulating hemp has indirectly influenced THC standardization across cannabis-based products.

The U.S. market is driven by innovation, including cannabis delivery services, AI-based inventory management, and data-driven consumer targeting. Consumption lounges, culinary cannabis, and THC-infused beverages are rising in popularity. High product diversity, a mature dispensary network, and growing acceptance among senior citizens highlight the sector's maturity and growth potential.

The Europe Recreational Cannabis Market

The Europe Recreational Cannabis Market is estimated to be valued at USD 322.5 million in 2025 and is further anticipated to reach USD 544.8 million by 2034 at a CAGR of 6.0%.

Europe’s recreational cannabis landscape is in a transitional phase, marked by legal experimentation, cultural shifts, and expanding public discourse. Countries like Germany, Malta, and the Netherlands are at the forefront, implementing trial models for legal possession and consumption. The European Monitoring Centre for Drugs and Drug Addiction (EMCDDA) reports a rise in cannabis use among young adults aged 15–34, a key demographic fueling demand.

The European Parliament and the European Commission are gradually recognizing the need for regulatory coherence across member states, particularly for THC thresholds and quality controls. Countries such as Switzerland are launching pilot projects to monitor the societal and economic impacts of legal recreational cannabis use. This evolving regulatory framework is enabling more private sector engagement and supply chain development.

One of the region's demographic advantages is its dense urban population, which facilitates retail distribution and localized delivery networks. As per Eurostat, urban areas in countries like France, Spain, and Italy house over 70% of their populations, supporting high product accessibility. Educational campaigns and harm-reduction strategies led by health ministries are gradually shifting perceptions, particularly among middle-aged and senior users.

Social clubs, vapor lounges, and cannabis cafés are forming in more liberal jurisdictions, pointing toward a future of regulated public consumption. Moreover, EU-funded research and innovation programs are exploring the intersection of cannabis and neuropsychology, broadening scientific acceptance. The market is set to benefit from growing consumer awareness, diverse cultural openness, and progressive policymaking despite existing restrictions in most countries.

The Japan Recreational Cannabis Market

The Japan Recreational Cannabis Market is projected to be valued at USD 129.0 million in 2025. It is further expected to witness subsequent growth in the upcoming period, holding USD 229.3 million in 2034 at a CAGR of 6.6%.

Japan’s recreational cannabis market remains highly restricted under current laws, but social and regulatory winds are shifting subtly. Cannabis is regulated under the Cannabis Control Act, which strictly prohibits possession and use. However, public discourse is evolving, especially among younger generations influenced by Western trends and pop culture. Japan's National Police Agency has noted a rise in cannabis-related offenses among individuals in their 20s and 30s, suggesting growing underground interest.

The Ministry of Health, Labour and Welfare is reportedly reviewing cannabis policy, particularly around THC vs. CBD distinctions. Recent amendments now allow the medical use of cannabis-derived pharmaceuticals, hinting at a more nuanced regulatory future. The Japan External Trade Organization (JETRO) and the Pharmaceuticals and Medical Devices Agency (PMDA) are both closely monitoring global cannabis policy trends, laying the groundwork for future market shifts.

Culturally, Japan places a high value on social harmony and lawfulness, which makes regulatory reform slow but deliberate. However, urban hubs like Tokyo and Osaka are witnessing a slow surge in cannabis-derived wellness products, particularly CBD-based tinctures and balms. With high disposable incomes and a deeply rooted wellness culture, Japan holds significant long-term potential for premium cannabis experiences.

The demographic profile reveals a large aging population facing rising cases of chronic pain and insomnia, conditions often managed through medical cannabis elsewhere. As the legal narrative evolves, early mover advantages may arise for firms that engage in research, education, and advocacy. Japan’s proximity to emerging markets like Thailand and its strong retail infrastructure enhance its readiness for future legalization paths.

Global Recreational Cannabis Market: Key Takeaways

- Global Market Size Insights: The Global Recreational Cannabis Market size is estimated to have a value of USD 2,149.7 million in 2025 and is expected to reach USD 4,042.8 million by the end of 2034.

- The Global Market Growth Rate: The market is growing at a CAGR of 7.3 percent over the forecasted period of 2025.

- The US Market Size Insights: The US Recreational Cannabis Market is projected to be valued at USD 1,035.9 million in 2025. It is expected to witness subsequent growth in the upcoming period as it holds USD 1,881.7 million in 2034 at a CAGR of 6.9%.

- Regional Insights: North America is expected to have the largest market share in the Global Recreational Cannabis Market with a share of about 57.3% in 2025.

- Key Players: Some of the major key players in the Global Recreational Cannabis Market are Canopy Growth, Aurora Cannabis, Tilray, Curaleaf, Green Thumb Industries, Cresco Labs, Trulieve, Aphria, Cronos Group, and many others.

Global Recreational Cannabis Market: Use Cases

- Alternative to Alcohol Consumption: Recreational cannabis, especially low-dose edibles and beverages, is increasingly being used as a healthier alternative to alcohol. Social users prefer THC-infused drinks or gummies during events, viewing them as less likely to cause hangovers or liver damage, aligning with wellness-driven lifestyles.

- Cannabis Tourism: Destinations like Amsterdam and certain U.S. states attract tourists seeking legal cannabis experiences. Tourists participate in guided consumption tours, infused cooking classes, or cannabis-friendly spas, driving revenue and supporting local cannabis-friendly hospitality businesses.

- Creative Stimulation: Artists, musicians, and writers often use recreational cannabis to enhance creativity. Sativa strains are particularly favored for their uplifting and energizing effects, which aid in brainstorming sessions, design thinking, and immersive content creation processes.

- Sleep Enhancement: Consumers facing mild insomnia or irregular sleep patterns turn to THC-dominant or balanced edibles as natural sleep aids. Cannabis provides a relaxing, non-habit-forming alternative to prescription sleeping pills, especially in wellness-centric consumer segments.

- Social Bonding & Entertainment: Recreational cannabis is increasingly normalized in group settings, whether movie nights, game sessions, or casual hangouts. Vape pens, pre-rolls, and infused snacks serve as communal products that promote relaxation and foster interpersonal connections in a low-pressure environment.

Global Recreational Cannabis Market: Stats & Facts

United Nations Office on Drugs and Crime (UNODC)

- An estimated 200 million people worldwide used cannabis in the past year, making it the most commonly used drug globally.

- Cannabis consumption among adults has increased by nearly 18% over the past decade.

- North America accounted for over 40% of global cannabis seizures, reflecting high usage and enforcement levels.

- In legalized regions, THC concentrations in cannabis products have doubled on average in the last 10 years.

European Monitoring Centre for Drugs and Drug Addiction (EMCDDA)

- In the EU, approximately 8% of adults (15–64 years) have used cannabis in the past year.

- Among youth (15–34 years), 15.4% reported cannabis use in the past year, with rates as high as 22% in some countries.

- Cannabis edibles and vaping products are gaining popularity in Western European markets, especially among urban youth.

- Over 50% of drug-related offenses in Europe are linked to cannabis possession or trafficking.

U.S. Centers for Disease Control and Prevention (CDC)

- Around 18% of Americans aged 12 and older reported using cannabis in the past year.

- Among pregnant women, cannabis use increased from 3.4% in 2002 to 7% in 2017, particularly in recreationally legal states.

- Emergency room visits linked to cannabis use increased by 34% from 2016 to 2021.

- Cannabis vaping has surged 63% among U.S. high school students in the last three years.

National Institute on Drug Abuse (NIDA), USA

- Nearly 11% of Americans who use cannabis develop a use disorder, especially when use begins in adolescence.

- Daily or near-daily cannabis use has risen to 4.8 million Americans aged 12 or older.

- Cannabis consumption is significantly associated with mental health disorders, particularly anxiety and psychosis in high-THC users.

- Recreational cannabis users often report use for stress, anxiety relief, and sleep improvement, beyond just social or euphoric purposes.

Health Canada

- Over 14% of Canadians aged 15 and older reported using cannabis in the past 12 months for recreational reasons.

- Cannabis edibles and extracts now account for over 20% of all legal recreational cannabis sales in Canada.

- Following legalization, youth cannabis use has not increased significantly, but adult consumption continues to rise.

- The average age of new cannabis users in Canada post-legalization is 32 years, indicating growth among older adults.

Australian Institute of Health and Welfare (AIHW)

- Around 11.6% of Australians aged 14 and over reported cannabis use in the past year, with males using more than females.

- In legal territories like the ACT, personal possession laws have not led to significant rises in use among youth.

- Cannabis-related hospitalizations in Australia grew by 19% from 2013 to 2021, driven by edibles and synthetic variants.

Japanese Ministry of Health, Labour and Welfare

- Cannabis-related arrests in Japan hit a record high of over 5,700 cases in 2021, mostly among individuals aged under 30.

- Japan strictly prohibits cannabis for recreational use, yet arrests of youth have increased 3.5 times since 2010.

- Despite strict laws, surveys show that 1.8% of Japanese adults have experimented with cannabis at least once.

World Health Organization (WHO)

- WHO identifies cannabis as the most widely cultivated, trafficked, and abused illicit drug globally.

- Cannabis use disorders account for 13.1 million disability-adjusted life years (DALYs), making it a significant contributor to the global mental health burden.

Global Recreational Cannabis Market: Market Dynamics

Driving Factors in the Global Recreational Cannabis Market

Accelerating Legalization and Policy Reform Worldwide

One of the most powerful forces driving the recreational cannabis market forward is the accelerating pace of legalization across various global jurisdictions. Countries such as Germany, Canada, Uruguay, and Thailand, along with multiple U.S. states, have adopted frameworks that regulate the cultivation, distribution, and consumption of cannabis for adult use. Legalization brings legitimacy to the sector, encourages foreign direct investment, and boosts job creation, tourism, and tax revenues. It also leads to better quality control, consumer education, and access to product variety.

Governments are increasingly seeing the economic benefits and public support for reform, particularly in post-pandemic contexts where alternative revenue streams are critical. Legal frameworks further reduce stigma, facilitate data collection, and set the stage for international cannabis trade. As more regions align cannabis laws with public sentiment and evidence-based policymaking, the global market is poised for accelerated and sustained expansion.

Shifting Societal Attitudes and Cultural Normalization

Cannabis is undergoing a major rebranding from an illicit drug to a socially accepted recreational substance akin to alcohol. This cultural shift is driven by education, advocacy, and exposure to legal markets where cannabis is regulated and accessible. Public awareness campaigns, scientific publications on cannabis safety, and endorsements by celebrities and influencers have reduced the stigma and fueled demand. Today’s consumers are not just stereotypical “stoners” but include professionals, parents, athletes, and seniors.

Cultural depictions in film, music, and media portray cannabis use as normal and even aspirational. This shift is reflected in the growth of cannabis events, lounges, festivals, and even canna-weddings. The normalization of cannabis has also influenced employers, landlords, and insurers to adopt more progressive policies. As recreational use becomes woven into daily lifestyle patterns, demand is expected to surge in both mature and emerging markets.

Restraints in the Global Recreational Cannabis Market

Regulatory Fragmentation and Compliance Challenges

One of the greatest barriers to the expansion of the recreational cannabis market is the lack of regulatory harmonization both within and across countries. While some jurisdictions have legalized recreational use, others maintain strict prohibitions or allow only medical access. Even within countries like the United States, state laws vary widely on permissible products, dosage limits, advertising rules, and taxation. This patchwork of regulations creates confusion for businesses and consumers alike, hindering interstate commerce, complicating supply chains, and increasing compliance costs.

Furthermore, many countries still classify cannabis as a Schedule I substance under international drug conventions, impeding global trade and research. Compliance with testing, labeling, and reporting standards can be especially burdensome for smaller operators who lack legal and financial resources. Regulatory delays in licensing and zoning approvals can also lead to bottlenecks and market entry barriers.

Limited Access to Banking and Financial Services

Despite rapid legalization, recreational cannabis businesses continue to face significant restrictions when accessing traditional banking services. In many countries, especially where cannabis remains federally illegal (e.g., the U.S.), banks are reluctant to offer loans, credit card processing, or even basic checking accounts to cannabis companies due to fear of federal penalties. This forces many operators to rely on cash transactions, which increase security risks, hinder transparency, and limit scalability. The absence of a robust financial infrastructure also curbs investment opportunities, as venture capital firms and institutional investors remain cautious.

Limited access to insurance and asset management further exacerbates operational risk. The lack of federal banking reform stalls innovation and slows down market maturation. Unless there is regulatory action such as the passage of the SAFE Banking Act in the U.S. this remains a significant impediment to the healthy functioning and long-term sustainability of the industry.

Opportunities in the Global Recreational Cannabis Market

Integration with the Wellness, Beverage, and Hospitality Sectors

Recreational cannabis is increasingly intersecting with adjacent industries such as wellness, functional beverages, and boutique hospitality. Companies are leveraging the therapeutic and experiential qualities of cannabis to develop premium offerings like infused sparkling waters, mood-enhancing teas, and low-dose wellness shots. Spas and wellness retreats are introducing cannabis massage oils, CBD facials, and meditation-enhancing edibles. Similarly, high-end resorts and cafes in jurisdictions like Canada and parts of the U.S. now offer curated cannabis experiences.

The hospitality industry is also capitalizing on canna-tourism, with guided dispensary tours, bud-and-breakfasts, and culinary cannabis classes becoming popular. This cross-industry integration provides opportunities for cannabis businesses to access broader consumer markets while offering diversified experiences that command premium pricing. Such positioning not only enhances brand perception but also fosters long-term loyalty among consumers who value holistic health and mindful leisure.

Advancements in E-Commerce and Direct-to-Consumer Delivery

E-commerce and direct-to-consumer (DTC) platforms represent one of the most promising growth frontiers for the recreational cannabis industry. As more regions allow online sales and at-home delivery, brands can reach consumers more efficiently while bypassing many of the logistical and overhead challenges associated with physical retail. Sophisticated websites, personalized subscription boxes, and mobile apps now allow users to browse, compare, and order cannabis products in a manner akin to mainstream retail.

These platforms offer age verification, real-time inventory updates, loyalty rewards, and educational resources, enhancing both safety and customer experience. Artificial intelligence is also being deployed for predictive analytics, personalized product recommendations, and inventory optimization. In states and provinces where delivery is permitted, third-party logistics networks are rapidly scaling to support last-mile delivery. The growth of this digital ecosystem enables brands to scale geographically while maintaining consistent engagement and service quality.

Trends in the Global Recreational Cannabis Market

Expansion of Premium and Lifestyle Cannabis Brands

One of the most prominent trends in the recreational cannabis market is the emergence and rapid expansion of premium cannabis brands tailored to lifestyle segments. Companies are differentiating themselves not just on potency but on brand story, packaging, user experience, and curated effects. This is evident in the rise of cannabis brands collaborating with fashion designers, influencers, musicians, and celebrity entrepreneurs to launch high-end product lines such as designer pre-rolls, artisanal edibles, and infused luxury beverages.

These lifestyle-oriented products target urban millennials and Gen Z users who value aesthetics, quality, and social identity as much as functionality. They also command higher margins and enable companies to cross over into mainstream retail and wellness markets. As cannabis shifts from counterculture to pop culture, lifestyle branding is transforming how cannabis is perceived, sold, and consumed across the globe.

Diversification of Consumption Methods Beyond Smoking

While traditional flower smoking remains popular, consumption patterns are increasingly shifting toward alternative formats such as vaporizers, gummies, beverages, topicals, and microdose mints. This trend is driven by health-conscious consumers seeking safer, discreet, and socially acceptable cannabis options. Vaporization, for instance, is perceived as less harmful than combustion, while edibles and tinctures provide long-lasting effects with precise dosing. This diversification is also making cannabis more approachable for first-time or casual users, especially older adults and those with wellness-oriented goals.

Innovation in nanotechnology and emulsion techniques has improved bioavailability and onset time for edibles, enhancing the consumer experience. These advancements are pushing the market toward greater segmentation and personalization, offering targeted effects like relaxation, euphoria, creativity, or sleep aid. As consumption modes evolve, so does the potential to reach untapped consumer segments and drive growth.

Global Recreational Cannabis Market: Research Scope and Analysis

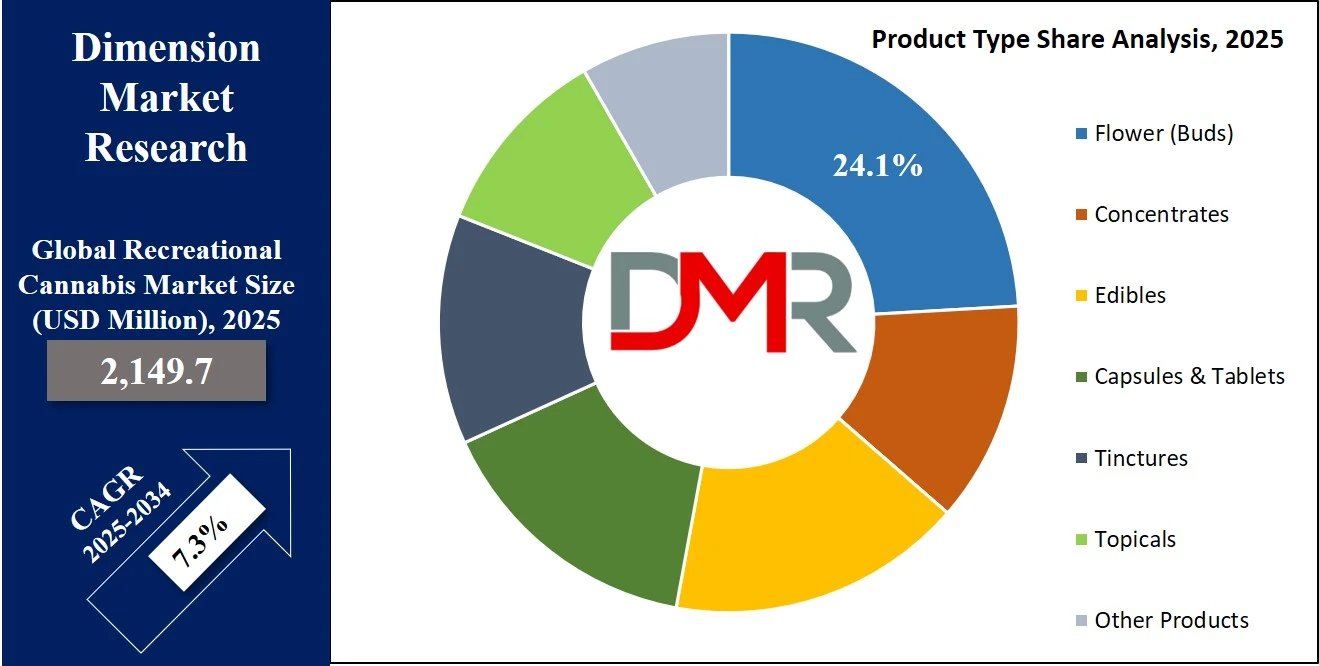

By Product Type Analysis

Flower, commonly known as buds, is the most projected to be the dominant product type in the recreational cannabis market. It represents the most traditional and widely accepted form of cannabis consumption globally. This dominance is primarily driven by its affordability, accessibility, and the cultural familiarity associated with smoking cannabis. Flowers offer users full-spectrum cannabinoids, including high levels of THC, making them attractive for those seeking immediate psychoactive effects. They can be consumed in several ways, smoked, vaporized, or used to make edibles, adding to their versatility.

Another key factor in flower’s continued dominance is its lower processing requirement compared to other formats like concentrates or edibles, which reduces production costs. In mature markets like Canada, the U.S., and parts of Europe, dried flower products account for over 45–50% of recreational cannabis sales. This is particularly true among long-time users who prefer natural and unprocessed products.

Despite the rise of edibles, concentrates, and tinctures, flower maintains popularity across all age groups, especially among Gen Z and Millennials. In legalized regions, dispensaries often stock a wide variety of strains categorized by THC/CBD content, aroma, and desired effects (relaxation, euphoria, creativity), giving consumers more control over their experience.

Furthermore, the ongoing innovation in cultivation, such as indoor hydroponic and organic outdoor growing, has improved the quality and variety of cannabis flower available, enhancing its appeal. As new consumers enter the market, flower remains a gateway product due to its simplicity and fast-acting effects. While other formats are growing fast, flower continues to dominate as the product of choice for both experienced and new users alike.

ℹ

To learn more about this report –

Download Your Free Sample Report Here

By Compound Analysis

THC-dominant formulations are overwhelmingly poised to dominate the recreational cannabis market due to their psychoactive effects, which are the primary reason consumers engage in recreational use. Tetrahydrocannabinol (THC) is the cannabinoid responsible for producing the “high” associated with cannabis, offering feelings of euphoria, relaxation, and heightened sensory perception. These characteristics make THC-rich products highly desirable among both seasoned cannabis users and new consumers seeking an enjoyable and potent experience.

Across product types flowers, concentrates, edibles, and vape products THC-dominant offerings consistently outperform CBD or balanced formulations in terms of sales volume and consumer demand. In recreational-use regions such as California, Colorado, and Canada, products with THC content of 20% or higher are considered premium and command higher prices, reflecting strong consumer preference.

Additionally, brands leverage THC's popularity by offering diverse strain selections like Indica, Sativa, and hybrids, often with creative naming and branding strategies that resonate with young adult demographics. The ability to tailor THC levels to user tolerance levels through microdosing products and vape pens has further broadened the appeal of THC-based cannabis.

Even in markets that regulate maximum THC content, manufacturers focus on maximizing allowable potency to meet consumer expectations. While CBD-dominant products serve a wellness-oriented niche, recreational users generally prioritize the psychoactive and mood-enhancing benefits of THC. As such, THC-dominant products are expected to retain their leading market share globally over the forecast period.

The growing acceptance of cannabis for therapeutic leisure use, combined with product innovation and targeted marketing, continues to reinforce the dominance of THC-focused offerings in the recreational segment.

By Route of Administration

Inhalation is projected to remain the leading route of administration in the recreational cannabis market, with smoking and vaping accounting for the highest market share among all consumption methods. This dominance stems from inhalation’s rapid onset of effects; users typically experience the psychoactive impact of THC within minutes, making it the preferred option for immediate gratification. This fast action is especially appealing to recreational consumers seeking a quick and controllable high.

Smoking cannabis in the form of joints, pipes, or bongs is deeply rooted in cultural and social practices, particularly in North America and parts of Europe. It’s often considered a ritualistic or social activity, further cementing its relevance. Despite increasing health concerns, many users still favor combustion due to the sensory experience of the aroma, taste, and tactile engagement of handling the flower, which enhances user satisfaction.

Vaping, an alternative inhalation method, is rapidly gaining traction due to its perceived health benefits compared to smoking. Vape pens and cartridges offer portability, discretion, and precise dosing, making them especially attractive to new or casual users. These devices have evolved significantly in design and technology, offering strain-specific formulations and customizable potency levels. Additionally, vapes are less pungent and easier to use in public settings, contributing to their growing market share.

Despite the rise in edibles, tinctures, and topicals, inhalation remains unmatched in terms of immediate effect, user control, and cultural familiarity. As such, both traditional and modern inhalation methods are expected to continue leading the route-of-administration segment in the recreational cannabis market, especially among younger and urban populations seeking fast-acting relief and social engagement.

By Application

Among various recreational cannabis applications, chronic pain management is anticipated to stand out as the dominant use case, bridging both recreational and therapeutic user bases. Many consumers turn to cannabis not only for leisure but also for functional wellness purposes, primarily to alleviate persistent pain conditions such as arthritis, neuropathy, migraines, back pain, and fibromyalgia.

Even in recreational-use regions, a large portion of users cite pain relief as a key benefit, even when not purchasing under a medical license. THC and CBD, the two major cannabinoids in cannabis, interact with the body's endocannabinoid system to reduce inflammation, regulate pain signaling, and offer muscle relaxation. These effects make cannabis a favorable alternative to over-the-counter or prescription painkillers, especially in the wake of opioid concerns.

Flower and concentrate formats with high THC content are particularly preferred for pain management, as they provide immediate relief through inhalation. Meanwhile, edibles and topicals offer sustained effects and localized treatment, appealing to users with chronic conditions that affect daily function. Hybrid strains combining THC and CBD are increasingly marketed for functional daytime relief without excessive sedation.

The dominance of pain relief is further supported by the aging consumer base entering the recreational market, including middle-aged and senior users exploring cannabis for lifestyle enhancement. Moreover, recreational legalization has increased access to cannabis for users who previously self-medicated through informal channels.

As stigma fades and product education improves, chronic pain management is expected to remain a primary motivator for recreational cannabis consumption, reinforcing its role as the top application within the broader market landscape.

By Distribution Channel

Offline channels, particularly licensed dispensaries and specialty cannabis retail stores, are projected to dominate the distribution landscape of the recreational cannabis market. These physical outlets provide a regulated, secure, and user-friendly environment where consumers can interact with knowledgeable staff, explore diverse products, and receive personalized recommendations, enhancing the overall buying experience. For many users, especially first-time or casual consumers, visiting a dispensary builds trust in product quality, potency, and legal compliance.

In regions like North America, dispensaries have become key community fixtures and serve as educational hubs, offering strain-specific insights, dosing guidelines, and tailored product suggestions based on desired effects (e.g., relaxation, energy, sleep). The ability to physically inspect packaging, smell flower varieties, and consult trained budtenders gives offline channels a significant edge over online options.

Moreover, many jurisdictions with legalized recreational cannabis restrict or regulate online sales more strictly than in-store purchases. In several U.S. states and Canadian provinces, online ordering may be limited to state-run portals or select vendors, reducing accessibility and speed compared to walk-in retail options.

Offline channels also benefit from impulse purchasing behavior, especially with attractive in-store displays and promotions. Events, sampling programs, and on-site experiences such as lounges or educational seminars further attract foot traffic.

While e-commerce is growing especially post-pandemic and among tech-savvy consumers brick-and-mortar dispensaries continue to lead due to their robust regulatory presence, consumer preference for hands-on purchasing, and enhanced trust in product authenticity. As legalization spreads globally, offline channels are expected to maintain their leadership in revenue generation, especially in emerging markets transitioning from illicit to legal retail infrastructure.

By End Use

Within the end-use segmentation of the recreational cannabis market, the pharmaceutical industry is expected to hold a dominant position due to the convergence of wellness, functional health benefits, and psychoactive relief. Though recreational by definition, many consumers use cannabis to manage symptoms that traditionally fall under medical or pharmaceutical care, such as chronic pain, anxiety, insomnia, and inflammation, blurring the lines between leisure and wellness-driven consumption.

The pharmaceutical industry’s dominance is propelled by its structured approach to formulation, dosage accuracy, and safety protocols. Cannabis-based products developed by or in collaboration with pharmaceutical firms offer consistency, purity, and rigorous quality control elements that increasingly attract health-conscious consumers. These formulations may include capsules, sprays, tinctures, and soft gels with specific THC/CBD ratios designed for predictable effects.

Additionally, many pharmaceutical companies are integrating recreational cannabis into their portfolios by investing in cannabis R&D, partnering with cannabis producers, or acquiring brands to tap into the booming consumer wellness market. They focus on cannabis delivery systems that align with modern medical preferences, non-smokable, controlled-release, and condition-specific applications.

This segment also benefits from the demographic shift toward older adult consumers using cannabis to improve their quality of life. As aging populations seek alternatives to synthetic drugs, pharmaceutical-grade cannabis presents a natural, holistic option.

Regulatory support for clinical trials and therapeutic claims, particularly in North America and parts of Europe, reinforces the pharmaceutical sector’s leadership in recreational cannabis end use. While other sectors like food, beverages, and personal care are expanding, the pharmaceutical industry's credibility, innovation, and consumer trust make it the dominant force in this segment.

The Global Recreational Cannabis Market Report is segmented on the basis of the following:

By Product Type

- Flower (Buds)

- Concentrates

- Edibles

- Baked Goods

- Gummies & Chews

- Beverages

- Chocolates & Mints

- Capsules & Tablets

- Tinctures

- Topicals

- Creams

- Lotions

- Transdermal Patches

- Other Products

By Compound

- THC-Dominant

- CBD-Dominant

- Balanced THC/CBD

By Route of Administration

- Inhalation

- Oral

- Edibles

- Capsules

- Tinctures

- Topical

- Sublingual

- Rectal

By Application

- Chronic Pain Management

- Mental Health Disorders

- Cancer Symptom Relief

- Sleep Disorders & Management

- Other Applications

By Distribution Channel

- Offline Channels

- Licensed Dispensaries

- Cannabis Specialty Stores

- Online Channels

- E-Commerce Platforms

- Direct-to-Consumer (DTC) Brands

By End Use

- Pharmaceutical Industry

- Food & Beverage Industry

- Tobacco Alternatives

- Personal Care & Cosmetics

- Research & Development Institutions

Impact of Artificial Intelligence in the Global Recreational Cannabis Market

- Precision Cultivation and Yield Optimization: AI-powered systems analyze real-time data (light, humidity, nutrients, temperature) to optimize cannabis growing conditions. Machine learning algorithms adjust climate controls to improve plant health, reduce waste, and maximize THC/CBD content and yield consistency, leading to higher quality recreational cannabis products.

- Consumer Behavior Analysis and Personalization: AI-driven platforms track purchasing habits, product preferences, and consumption patterns to offer tailored recommendations. This enables dispensaries and online retailers to personalize marketing, improve product suggestions, and enhance customer satisfaction with more targeted recreational experiences.

- Quality Control and Strain Consistency: AI ensures batch-to-batch consistency in cannabis products by integrating sensors and visual inspection tools during cultivation and processing. This minimizes human error, identifies suboptimal batches early, and ensures uniformity in THC/CBD levels critical for recreational use, where effects must be predictable.

- Product Development and Innovation: Natural language processing (NLP) and AI-assisted R&D platforms analyze vast medical and consumer feedback databases to identify emerging trends and unmet needs. This helps manufacturers design innovative recreational cannabis formats (e.g., AI-curated edibles, flavor-infused vapes) tailored to evolving market demand.

- Predictive Sales and Inventory Management: AI models forecast demand based on seasonality, local events, and user trends, enabling dispensaries to manage inventory efficiently. This reduces overstocking or stockouts of popular recreational cannabis products, improving operational efficiency and profitability.

- Compliance Monitoring and Fraud Detection: AI tools help businesses comply with dynamic regulatory requirements by automating recordkeeping, flagging suspicious transactions, and verifying age restrictions. This enhances transparency and trust while reducing the legal risk in the tightly regulated recreational cannabis market.

Global Recreational Cannabis Market: Regional Analysis

Region with the Largest Revenue Share

North America, particularly the United States and Canada, is projected to dominate the global recreational cannabis market with 57.3% of the total market share in 2025, due to its early legalization, established infrastructure, and supportive regulatory environment. Canada became the first G7 nation to legalize recreational cannabis at the federal level in 2018, creating a robust framework for licensed producers, dispensaries, and retail channels. In the United States, although cannabis remains federally illegal, more than 20 states, including California, Colorado, and New York, have legalized recreational use. This state-led legalization has unlocked access to a massive consumer base, driving significant market revenues.

Consumer awareness and acceptance are also remarkably high in North America, supported by widespread education campaigns and destigmatization efforts. Major brands and publicly traded cannabis companies have established strong retail networks and product portfolios, ranging from flower and concentrates to edibles and beverages. Additionally, North America leads in cannabis-related technology integration, with AI-based cultivation systems, smart dispensaries, and blockchain-backed traceability platforms enhancing product quality and compliance.

Moreover, strategic investments and M&A activities among cannabis startups and established multinationals have further consolidated the market. Favorable financial backing, strong lobbying efforts, and robust marketing strategies continue to propel North America’s dominance in the recreational cannabis landscape, both in terms of revenue and innovation.

ℹ

To learn more about this report –

Download Your Free Sample Report Here

Region with the Highest CAGR

Europe is expected to register the highest CAGR in the global recreational cannabis market, driven by the accelerating legalization momentum and shifting public attitudes toward cannabis use. While medical cannabis is already legalized in several European nations, countries like Germany, the Czech Republic, Switzerland, and Luxembourg are now actively discussing or piloting recreational cannabis programs. Germany, in particular, made headlines in 2024 by legalizing limited recreational cannabis possession and private cultivation, opening a massive market potential across the EU.

The European market’s growth is also being catalyzed by high investment activity in cannabis R&D, pharmaceutical innovation, and agritech solutions aimed at scalable, high-quality cannabis production. Several startups and established players are positioning themselves for future recreational rollouts, building infrastructure, forming distribution partnerships, and engaging in advocacy efforts. In addition, EU-wide efforts to harmonize cannabis regulations could further facilitate cross-border trade and boost market scalability.

Cultural acceptance of cannabis is also shifting positively across Western and Northern Europe, where younger demographics are increasingly open to recreational cannabis use. In countries like the Netherlands, Spain, and Portugal, existing decriminalized frameworks have created a strong foundation for commercial markets to emerge rapidly once regulatory conditions are met.

As the EU continues to balance public health, law enforcement, and economic incentives, the pace of legalization is expected to accelerate. This, coupled with strong consumer demand and progressive pilot programs, is positioning Europe as the fastest-growing region in the global recreational cannabis market.

By Region

North America

Europe

- Germany

- The U.K.

- France

- Italy

- Russia

- Spain

- Benelux

- Nordic

- Rest of Europe

Asia-Pacific

- China

- Japan

- South Korea

- India

- ANZ

- ASEAN

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Argentina

- Colombia

- Rest of Latin America

Middle East & Africa

- Saudi Arabia

- UAE

- South Africa

- Israel

- Egypt

- Rest of MEA

Global Recreational Cannabis Market: Competitive Landscape

The global recreational cannabis market is characterized by a mix of established multinational firms, state-level operators, and emerging startups, all competing across product innovation, pricing, and regional expansion. Key players such as Canopy Growth Corporation, Tilray Brands Inc., Curaleaf Holdings, Trulieve Cannabis Corp., Aurora Cannabis Inc., and Cronos Group dominate through vertically integrated operations, advanced cultivation capabilities, and diversified recreational product portfolios.

These companies are investing heavily in technology integration using AI for predictive cultivation, automation for post-harvest processing, and data analytics for consumer behavior insights. They also lead in creating branded consumer experiences, focusing on flavor-infused edibles, premium flower strains, and vaporizer products that appeal to recreational users seeking lifestyle alignment and quality.

Strategic M&As and multi-state partnerships are central to gaining geographic dominance, particularly in the U.S., where state-level legalization creates fragmented market conditions. Canadian companies continue to leverage international licenses and partnerships to prepare for expansion in Europe and Latin America as regulations evolve.

New market entrants, including beverage and tobacco giants like Altria and Constellation Brands, are forming joint ventures or acquiring cannabis firms to diversify their product offerings. Furthermore, the increasing participation of luxury wellness and personal care brands in cannabis-infused products is broadening consumer demographics.

The competitive landscape is also shaped by compliance and branding capabilities. firms with strong legal teams, regulatory agility, and compelling storytelling are better positioned to succeed in this dynamic and rapidly evolving industry.

Some of the prominent players in the Global Recreational Cannabis Market are:

- Canopy Growth Corporation

- Aurora Cannabis Inc.

- Tilray Brands, Inc.

- Curaleaf Holdings, Inc.

- Green Thumb Industries Inc.

- Cresco Labs Inc.

- Trulieve Cannabis Corp.

- Aphria Inc. (merged with Tilray)

- Cronos Group Inc.

- Harvest Health & Recreation Inc. (acquired by Trulieve)

- MedMen Enterprises Inc.

- Columbia Care Inc.

- TerrAscend Corp.

- HEXO Corp.

- Planet 13 Holdings Inc.

- Acreage Holdings, Inc.

- Jushi Holdings Inc.

- Organigram Holdings Inc.

- Sundial Growers Inc. (now SunStream Bancorp)

- Village Farms International, Inc.

- Other Key Players

Recent Developments in the Global Recreational Cannabis Market

- July 2025: Aurora Cannabis Inc. announced a new partnership with a European distributor to expand its recreational cannabis portfolio in Germany and the Netherlands, aligning with regulatory liberalization.

- June 2025: Tilray Brands Inc. revealed a USD 75 million investment to scale its cannabis-infused beverage production in North America, targeting Gen Z and millennial consumers.

- May 2025: The 2025 Global Cannabis Business Expo was held in Barcelona, Spain, with participation from over 40 countries. It focused on sustainable cultivation, AI-integrated cannabis processing, and cross-border recreational product launches.

- April 2025: Canopy Growth Corporation merged with Jetty Extracts, a leading California-based vape and concentrate brand, aiming to strengthen its U.S. recreational market footprint.

- March 2025: Curaleaf Holdings Inc. invested USD 20 million into a new product development center in Colorado focused on nano-emulsion edibles and water-soluble cannabinoids for recreational users.

- February 2025: Trulieve Cannabis Corp. expanded its Florida recreational dispensary chain with the opening of 12 new locations, emphasizing personalized product experiences using AI-based recommendation systems.

- January 2025: The Cannabis World Congress and Business Exposition took place in Los Angeles, spotlighting blockchain for cannabis supply chain transparency and AI in customer engagement.

- December 2024: Green Thumb Industries acquired Rythm Botanicals, a boutique recreational brand known for premium flower and terpene-rich concentrates, for an undisclosed sum.

- November 2024: Columbia Care signed a strategic alliance with beverage conglomerate Mosaic Group to co-develop cannabis-infused ready-to-drink (RTD) beverages targeting the European market.

Report Details

| Report Characteristics |

| Market Size (2025) |

USD 2,149.7 Mn |

| Forecast Value (2034) |

USD 4,042.8 Mn |

| CAGR (2025–2034) |

7.3% |

| Historical Data |

2019 – 2024 |

| The US Market Size (2025) |

USD 1,035.9 Mn |

| Forecast Data |

2025 – 2033 |

| Base Year |

2024 |

| Estimate Year |

2025 |

| Report Coverage |

Market Revenue Estimation, Market Dynamics, Competitive Landscape, Growth Factors, etc. |

| Segments Covered |

By Product Type (Flower, Concentrates, Edibles, Capsules, Tinctures, Topicals, Others), By Compound (THC-Dominant, CBD-Dominant, Balanced THC/CBD), By Route Of Administration (Inhalation, Oral, Topical, Sublingual, Rectal), By Application (Chronic Pain, Mental Health, Cancer Relief, Sleep Disorders, Others), By Distribution Channel (Offline, Online), And By End Use (Pharmaceuticals, Food & Beverage, Tobacco Alternatives, Personal Care, R&D Institutions) |

| Regional Coverage |

North America – US, Canada; Europe – Germany, UK, France, Russia, Spain, Italy, Benelux, Nordic, Rest of Europe; Asia-Pacific – China, Japan, South Korea, India, ANZ, ASEAN, Rest of APAC; Latin America – Brazil, Mexico, Argentina, Colombia, Rest of Latin America; Middle East & Africa – Saudi Arabia, UAE, South Africa, Turkey, Egypt, Israel, Rest of MEA |

| Prominent Players |

Canopy Growth, Aurora Cannabis, Tilray, Curaleaf, Green Thumb Industries, Cresco Labs, Trulieve, Aphria, Cronos Group, Harvest Health, MedMen, Columbia Care, TerrAscend, HEXO, Planet 13, Acreage Holdings, Jushi, Organigram, Sundial Growers, and Village Farms, and Other Key Players |

| Purchase Options |

We have three licenses to opt for: Single User License (Limited to 1 user), Multi-User License (Up to 5 Users), and Corporate Use License (Unlimited User) along with free report customization equivalent to 0 analyst working days, 3 analysts working days, and 5 analysts working days respectively. |

Frequently Asked Questions

How big is the Global Recreational Cannabis Market?

▾ The Global Recreational Cannabis Market size is estimated to have a value of USD 2,149.7 million in

2025 and is expected to reach USD 4,042.8 million by the end of 2034.

What is the growth rate in the Global Recreational Cannabis Market in 2025?

▾ The market is growing at a CAGR of 7.3 percent over the forecasted period of 2025.

What is the size of the US Recreational Cannabis Market?

▾ The US Recreational Cannabis Market is projected to be valued at USD 1,035.9 million in 2025. It is

expected to witness subsequent growth in the upcoming period as it holds USD 1,881.7 million in 2034

at a CAGR of 6.9%.

Which region accounted for the largest Global Recreational Cannabis Market?

▾ North America is expected to have the largest market share in the Global Recreational Cannabis Market

with a share of about 57.3% in 2025.

Who are the key players in the Global Recreational Cannabis Market?

▾ Some of the major key players in the Global Recreational Cannabis Market are Canopy Growth, Aurora

Cannabis, Tilray, Curaleaf, Green Thumb Industries, Cresco Labs, Trulieve, Aphria, Cronos Group, and

many others.