Market Overview

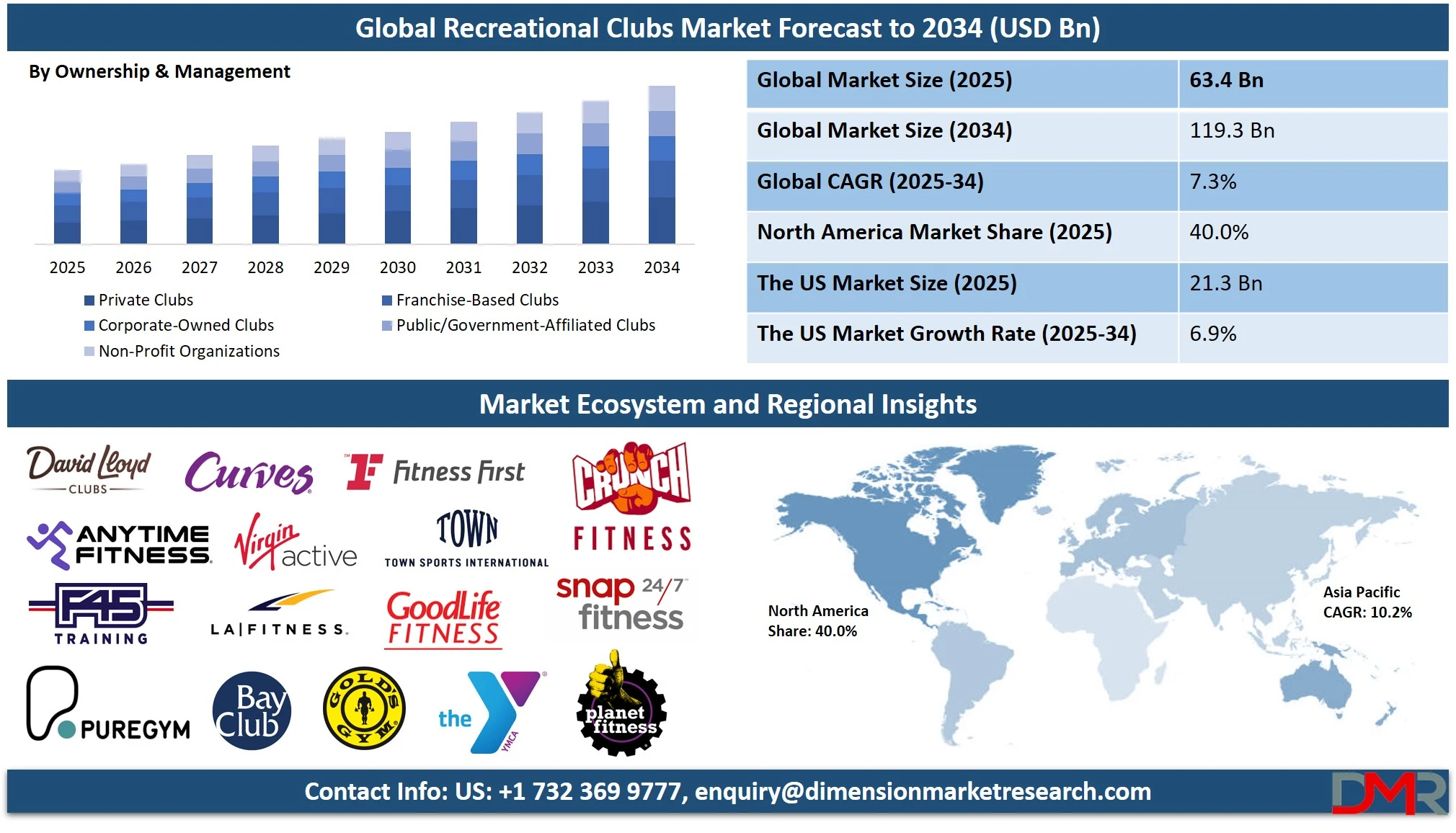

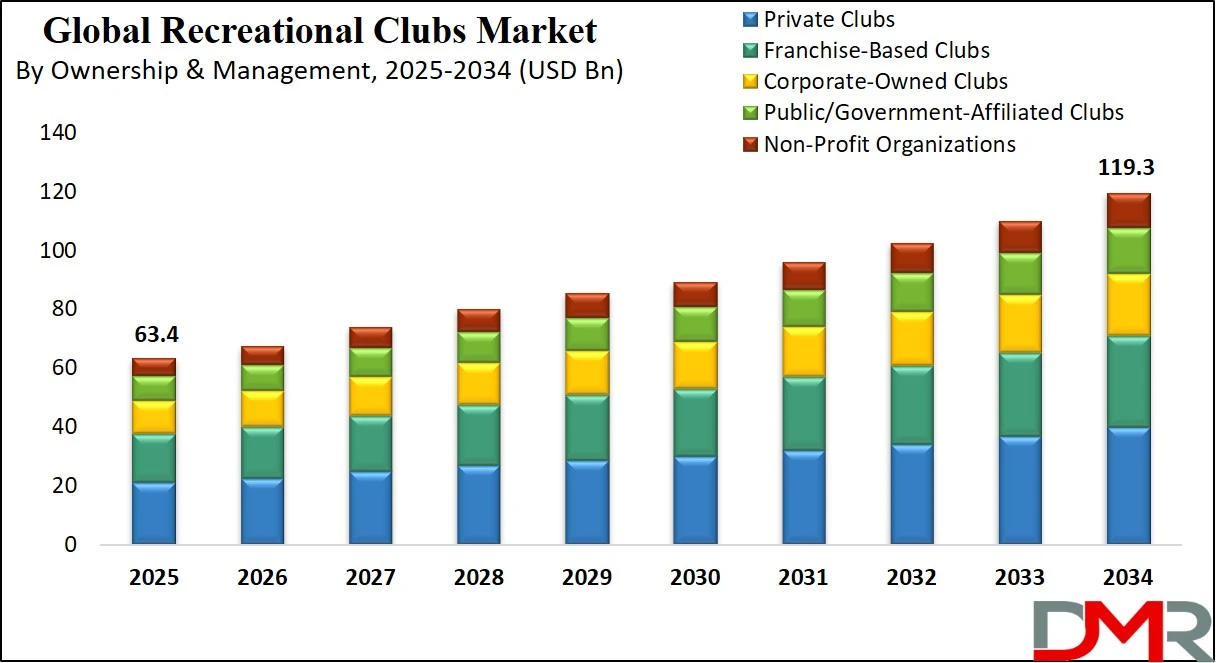

The Global Recreational Clubs Market is projected to reach USD 63.4 billion in 2025 and grow at a compound annual growth rate of 7.3% from there until 2034 to reach a value of USD 119.3 billion.

The global recreational clubs market is undergoing significant evolution, driven by rising health consciousness, urban lifestyle expansion, and demand for social engagement experiences. The market is experiencing strong momentum across segments such as fitness clubs, sports associations, wellness retreats, and outdoor adventure clubs. Digital integration and hybrid offerings combining on-site and virtual services have transformed member engagement, creating new pathways for recurring revenue through digital subscriptions and wellness platforms.

A prominent trend involves lifestyle-based memberships, where clubs cater to niche interests like eco-fitness, yoga collectives, culinary experiences, and creative arts. Social clubs with networking facilities are gaining traction among urban millennials and Gen Z professionals seeking both wellness and community. As hybrid work models flourish, consumers are investing more time in local club memberships offering flexible schedules and diverse programming.

Growth prospects are particularly strong in emerging economies with expanding middle-class populations, such as India, Brazil, and Southeast Asia, where wellness, recreation, and preventive healthcare are gaining policy focus. In advanced markets, club digitization, sustainable facility design, and boutique models (e.g., HIIT-only clubs or women-exclusive wellness centers) are reshaping value propositions.

However, high operational costs, seasonality, and space constraints in urban areas pose significant restraints. Retention challenges, especially post-COVID, highlight the need for adaptive pricing models and personalized member experiences. Another concern is regulatory oversight for safety, data protection, and labor compliance, which vary across geographies and club types.

Nevertheless, the market continues to expand with cross-sector collaborations, such as fitness brands partnering with hotels, universities, and healthcare providers. Integration of AI-driven analytics, gamified fitness, and wellness tracking further enriches user engagement and brand loyalty. The future of recreational clubs lies in adaptive, inclusive, and tech-enabled ecosystems that align with evolving urban consumer aspirations.

The US Recreational Clubs Market

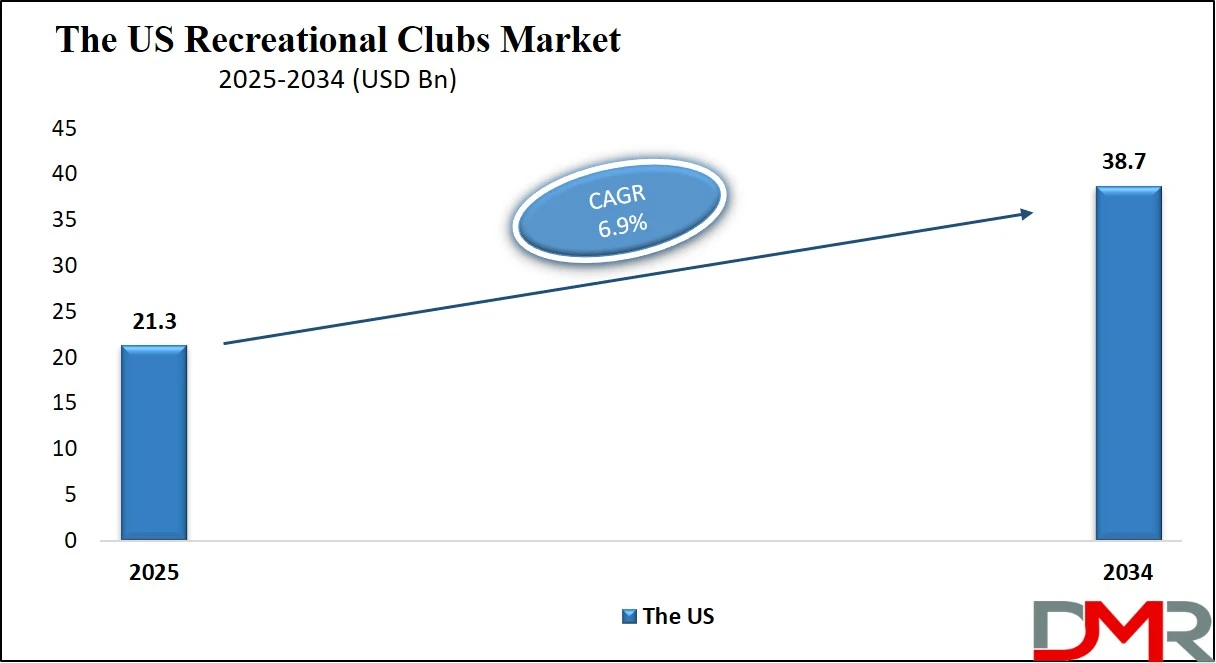

The US Recreational Clubs Market is projected to reach USD 21.3 billion in 2025 at a compound annual growth rate of 6.9% over its forecast period.

The U.S. recreational clubs market benefits from a uniquely structured ecosystem supported by strong institutional presence, a high-income urban population, and substantial infrastructure. According to the U.S. Census Bureau, over 82% of Americans live in urban and suburban areas, creating ideal conditions for the proliferation of local fitness centers, community clubs, social clubs, and sports organizations. The Centers for Disease Control and Prevention (CDC) notes that nearly 53% of U.S. adults engage in physical activity outside work, indicating a strong cultural orientation toward recreational wellness.

The United States Department of Agriculture (USDA) also reports that recreational access contributes to community resilience and well-being, particularly in underserved areas. Public-private partnerships involving parks departments, local governments, and non-profits play a vital role in the promotion of affordable community-based fitness and recreation programs. YMCA, Boys & Girls Clubs of America, and municipal fitness centers are examples of high-impact initiatives offering scalable and inclusive services.

The U.S. Department of Health and Human Services (HHS) emphasizes preventive healthcare, and recreational clubs have become key intermediaries in delivering mental health and physical wellness programming. Suburban club memberships are increasing due to migration from urban cores, with families seeking lifestyle-oriented clubs that offer multigenerational engagement.

Demographically, the aging population is leading to the emergence of senior-focused wellness centers and fitness clubs integrated with healthcare services. Educational institutions are also contributing to demand through campus wellness programs. The tax structure, supportive zoning laws, and employer wellness incentives provided under federal wellness initiatives further aid sector growth. The U.S. market's maturity and integration with social, health, and community priorities position it as a global leader in recreational club innovation.

The Europe Recreational Clubs Market

The Europe Recreational Clubs Market is estimated to be valued at USD 9.5 billion in 2025 and is further anticipated to reach USD 17.4 billion by 2034 at a CAGR of 7.0%.

Europe’s recreational clubs market is shaped by a cultural emphasis on balanced lifestyles, social cohesion, and public health access. According to Eurostat, over 60% of EU citizens participate in recreational or sporting activities at least once per week, highlighting a strong demand base for community centers, sports clubs, wellness retreats, and cultural societies.

The European Commission’s Sport Unit supports funding for grassroots recreational projects through programs like Erasmus+ Sport and HealthyLifestyle4All, aiming to integrate physical activity into daily life across age groups.

Countries such as Germany, Sweden, and the Netherlands exhibit high participation rates in outdoor recreation, while Mediterranean regions favor community-driven wellness activities. Municipal support for public recreational spaces and infrastructure, ranging from gyms to cycling trails, has been essential in facilitating growth. Local governments collaborate with non-profits and cooperatives to maintain inclusive access to sports, fitness, and arts-based recreational clubs.

Europe's aging population also influences club structures, with tailored programming for seniors becoming a defining trend. According to the European Environment Agency (EEA), urban green spaces and wellness amenities are increasingly recognized for their role in mental health and urban sustainability. This supports demand for clubs offering holistic wellness, combining physical activity, social engagement, and mental well-being.

The European Union also promotes environmental sustainability in urban planning, encouraging recreational clubs to adopt green design and operations. Urban revitalization programs and cultural preservation initiatives often incorporate community clubs, strengthening local identities. With its emphasis on inclusivity, health, and lifestyle quality, Europe’s demographic advantage lies in its institutional frameworks and public policy support that drive recreational engagement.

The Japan Recreational Clubs Market

The Japan Recreational Clubs Market is projected to be valued at USD 3.8 billion in 2025. It is further expected to witness subsequent growth in the upcoming period, holding USD 7.2 billion in 2034 at a CAGR of 7.2%.

Japan's recreational clubs market is guided by deep-rooted cultural values around group participation, longevity, and physical discipline. As per Japan’s Ministry of Health, Labour and Welfare, over 28% of the population is aged 65 or above, spurring demand for wellness-oriented clubs that provide low-impact activities, social interaction, and rehabilitation services.

Public health campaigns and government-backed initiatives such as Health Japan 21 promote community-based physical activity and preventive health, which significantly shape the recreational landscape.

Japan Sports Agency under MEXT (Ministry of Education, Culture, Sports, Science and Technology) runs programs to integrate sports and fitness into education, urban planning, and senior citizen wellness. The “Sport for Life” policy supports the development of fitness clubs and sports facilities for lifelong engagement. In schools and universities, club participation is a cultural norm, fostering early engagement in group recreation and wellness.

Urban centers like Tokyo, Osaka, and Nagoya are seeing a rise in boutique fitness studios, community wellness clubs, and mixed-use recreational facilities. Meanwhile, rural revitalization programs include subsidies for building multipurpose sports and cultural centers to combat depopulation and foster community well-being.

Japan’s demographic transition has led to the popularity of specialized wellness clubs offering yoga, tai chi, dance, and functional fitness for older adults. Regional governments also promote eco-tourism and mountain sports to leverage Japan’s geography for outdoor recreation. With an infrastructure-rich, health-conscious, and disciplined population, Japan’s market continues to expand through synergy between public institutions, education systems, and localized health promotion efforts.

Global Recreational Clubs Market: Key Takeaways

- Global Market Size Insights: The Global Recreational Clubs Market size is estimated to have a value of USD 63.4 billion in 2025 and is expected to reach USD 119.3 billion by the end of 2034.

- The Global Market Growth Rate: The market is growing at a CAGR of 7.3 percent over the forecasted period of 2025.

- The US Market Size Insights: The US Recreational Clubs Market is projected to be valued at USD 21.3 billion in 2025. It is expected to witness subsequent growth in the upcoming period as it holds USD 38.7 billion in 2034 at a CAGR of 6.9%.

- Regional Insights: North America is expected to have the largest market share in the Global Recreational Clubs Market with a share of about 40.0% in 2025.

- Key Players: Some of the major key players in the Global Recreational Clubs Market are Life Time, Inc., Equinox Holdings, Inc., Planet Fitness, Inc., LA Fitness International LLC, Virgin Active Ltd., YMCA, Gold’s Gym International, Inc., and many others.

Global Recreational Clubs Market: Use Cases

- Corporate Wellness Partnerships: Recreational clubs are collaborating with large corporations to provide employee wellness programs. These include on-site fitness classes, mental health workshops, and subsidized memberships, reducing absenteeism and improving productivity through structured well-being initiatives.

- University Campus Integrations: Educational institutions are embedding recreational clubs within campus facilities, offering students access to gyms, sports leagues, and arts programs. This fosters physical health, social integration, and emotional resilience, especially for international or first-year students.

- Digital Fitness Subscriptions: Clubs are launching app-based platforms for remote fitness training, live classes, and wellness coaching. This model extends club reach globally, serving members in remote or underserved locations while enabling personalized health tracking and habit formation.

- Retirement Community Clubs: Senior-living communities are integrating on-site recreational clubs with physiotherapy, aqua fitness, and cognitive activities. These clubs enhance mobility, mental engagement, and social bonding, reducing healthcare costs and enhancing residents’ quality of life.

- Tourism-Driven Wellness Retreats: Destination resorts and tourism boards partner with recreational clubs to offer temporary memberships or wellness retreats. These provide curated experiences of yoga, meditation, and hiking for tourists seeking rejuvenation, merging hospitality and recreational service models.

Global Recreational Clubs Market: Stats & Facts

U.S. Bureau of Labor Statistics (BLS)

- In 2023, over 361,000 people were employed in fitness and recreational sports centers across the United States, reflecting a steady post-pandemic recovery in health and wellness club staffing levels.

- The median hourly wage for fitness trainers and instructors at recreational facilities stood at $22.19 in May 2023, suggesting healthy employment conditions within the gym and wellness segment of the sector.

U.S. Census Bureau

- The 2022 Economic Census recorded over 38,000 registered recreational clubs in the U.S., covering gyms, golf clubs, sports organizations, and community clubs with combined revenues surpassing $40 billion.

- Between 2018 and 2022, the number of yoga and pilates studios in the U.S. increased by 22%, indicating a rising preference for mind-body fitness and boutique recreational services.

National Golf Foundation (NGF)

- As of 2023, there are approximately 15,980 golf courses in the U.S., making it the country with the highest number of golf clubs and facilities globally, dominating recreational land use.

- In 2022, over 25.6 million Americans played golf, with over 40% of participants under 35, showcasing growing interest among younger demographics in golf club memberships and casual play.

Sports & Fitness Industry Association (SFIA)

- The SFIA 2023 report highlights that over 67 million Americans participate in health club-related activities, including gym workouts, group fitness, and personal training, up 7% year-over-year.

- Pickleball participation grew by 158.6% from 2019 to 2022, making it the fastest-growing sport in recreational clubs and increasing the demand for court facilities in private and municipal clubs.

International Health, Racquet & Sportsclub Association (IHRSA)

- The U.S. had over 32,000 health clubs in operation as of 2022, with more than 64 million members, reinforcing America’s dominant market in global fitness and wellness club infrastructure.

- The average U.S. health club member attended their club 100 times per year, indicating high engagement frequency and supporting recurring revenue models in fitness and recreation clubs.

National Recreation and Park Association (NRPA)

- 9 in 10 U.S. residents live within 10 miles of a public park or recreation facility, which often includes community recreation centers offering organized clubs, leagues, and fitness classes.

- Publicly funded recreation programs account for over 25% of total club-based youth sports participation, demonstrating the essential role of government-funded facilities in grassroots sports development.

USA Swimming

- As of 2023, over 3,000 swim clubs are registered with USA Swimming, with more than 360,000 active members, including youth and adult participants involved in competitive and recreational swimming.

- Youth swimming club participation grew by 11% in 2022, post-COVID, especially in states like California and Texas, showing regional recovery in aquatic club activity and memberships.

United States Tennis Association (USTA)

- There are more than 17,000 tennis facilities across the United States affiliated with USTA, many operating as part of private or community recreational clubs offering both lessons and tournaments.

- Tennis participation increased to 23.6 million players in 2022, with 5.9 million new participants, creating new demand for racquet clubs and local tennis associations nationwide.

Outdoor Industry Association (OIA)

- 168 million Americans participated in at least one outdoor recreational activity in 2022, including hiking, cycling, and skiing, many facilitated by organized adventure clubs and recreation groups.

- Cycling participation alone stood at over 54 million people in 2022, significantly increasing the scope for urban and rural biking clubs across multiple age groups and fitness levels.

Centers for Disease Control and Prevention (CDC)

- Community-based physical activity programs like recreational walking clubs are part of CDC-recommended interventions to reduce obesity, which affects over 41.9% of adults in the U.S. as of 2023.

- According to the CDC, fitness club usage among adults aged 18–34 is strongly correlated with higher cardiovascular health, placing recreational fitness clubs as crucial public health infrastructures.

U.S. Small Business Administration (SBA)

- Fitness and recreational sports centers are among the top 15 categories for small business loans under SBA 7(a) programs, highlighting steady entrepreneurial interest and franchise expansion in this segment.

- SBA data indicates that over 60% of recreational clubs (gyms, yoga, martial arts studios) are classified as small businesses, suggesting high fragmentation and localized ownership in this market.

U.S. Travel Association

- Over 20 million domestic U.S. travelers in 2022 reported participating in recreational club-based activities such as golf, spa, or wellness retreats during trips, especially in resort-based clubs.

- Wellness tourism involving club-based fitness or spa sessions grew by 14% in 2022, showing how leisure travel is increasingly tied to membership-based recreational facilities.

World Health Organization (WHO) – U.S. Country Data

- Only one in five U.S. adolescents meets recommended daily activity levels, prompting investments in youth-focused recreational clubs to provide structured sports, fitness, and social environments.

National Ski Areas Association (NSAA)

- 472 ski areas operated in the U.S. during the 2022–2023 season, many of which host ski clubs and alpine adventure programs, especially in states like Colorado, Utah, and Vermont.

USA Cycling

- There are over 2,400 registered cycling clubs under USA Cycling as of 2023, with organized races, training, and recreational rides supporting growth in outdoor recreational club participation.

Global Recreational Clubs Market: Market Dynamics

Driving Factors in the Global Recreational Clubs Market

Increasing Health Awareness and Lifestyle-Related Disorders

A significant driver in the recreational clubs market is the growing public awareness about physical and mental health, particularly in urban and aging populations. Lifestyle-related diseases such as obesity, diabetes, cardiovascular disorders, and anxiety are pushing people toward preventive health measures like regular exercise, community-based activities, and fitness programs, all of which are core offerings of recreational clubs. National and global health agencies, including the WHO and CDC, emphasize the importance of community-based movement to reduce sedentary behavior, leading to policy-level and grassroots-level initiatives that benefit recreational clubs.

This has increased demand not only for gym memberships but also for wellness-focused clubs that offer yoga, pilates, meditation, nutrition guidance, and health coaching. Employers are also integrating recreational club memberships into workplace wellness programs, adding another layer of market demand. This convergence of personal health objectives and institutional support is fostering sustained growth for recreational clubs worldwide, with demand being driven not just by athletic goals but broader lifestyle transformation.

Urbanization and Infrastructure Investment in Recreational Facilities

Rapid urbanization and local government investments in recreational infrastructure have significantly boosted the growth of clubs across both developed and emerging economies. As cities grow denser, local municipalities are investing in accessible recreational centers, sports clubs, and community spaces to address health disparities and promote social cohesion. These projects often include multi-purpose spaces for fitness classes, swimming pools, tennis courts, youth clubs, and wellness workshops, creating fertile ground for recreational club operators to offer memberships or specialized programs.

Additionally, the development of smart cities, sports hubs, and tourism zones often includes partnerships with private recreational enterprises to attract affluent residents and health-focused travelers. In emerging markets like India, China, Brazil, and Southeast Asia, there is a strong push to create structured leisure and wellness ecosystems that mimic Western models. This infrastructural momentum, combined with rising disposable incomes and shifting cultural attitudes toward leisure, creates a favorable environment for new club openings, regional expansions, and franchising opportunities.

Restraints in the Global Recreational Clubs Market

High Operating Costs and Seasonal Membership Volatility

Operating recreational clubs, especially those offering physical infrastructure like gyms, golf courses, swimming pools, or spa facilities, entails substantial fixed and variable costs. These include equipment procurement, real estate leasing or ownership, utilities, staff salaries, insurance, and maintenance. Such costs can be overwhelming for small operators, particularly during low-traffic seasons or economic downturns. Seasonal membership volatility is a major challenge, with many clubs experiencing spikes during the new year or summer periods, followed by steep drops in attendance and renewals.

Moreover, in regions with extreme weather conditions, outdoor and adventure clubs face cancellations, reduced bookings, and underutilized resources during off-seasons. This unpredictability in cash flow makes it difficult to plan long-term investments or expansions. Added to this are rising insurance premiums, regulatory compliance costs, and competitive pricing pressures, which squeeze margins and reduce financial resilience. For clubs unable to achieve economies of scale or innovate digitally, operational sustainability remains a significant restraint.

Fragmented Market and Lack of Industry Standardization

The recreational clubs market is highly fragmented, with thousands of small and mid-sized players operating in silos without standardized operating procedures, certifications, or regulatory benchmarks. This lack of uniformity in service quality, staff training, safety standards, and pricing often creates consumer trust issues and inconsistent brand experiences. Unlike sectors with centralized governance or accreditation, recreational clubs span various activities from fitness and adventure to wellness and social engagement, making it difficult to establish cohesive industry-wide protocols. This fragmentation also hinders collaboration, data sharing, and unified advocacy for policy incentives or subsidies.

Start-ups or new entrants may struggle to identify best practices or benchmark success due to this inconsistency. Furthermore, consumers frequently switch providers due to dissatisfaction with inconsistent experiences, affecting customer lifetime value. In markets where consumers are sensitive to service quality, like health and wellness, this inconsistency can impede market maturity and investor confidence. Without a unified industry framework, long-term scalability and global integration remain limited.

Opportunities in the Global Recreational Clubs Market

Integration of AI and Personalization Technologies in Fitness and Wellness

The growing adoption of AI-driven personalization tools presents a massive opportunity for recreational clubs aiming to enhance user experience, engagement, and loyalty. Technologies like AI-powered fitness coaching, biometric tracking, predictive injury prevention, and mental health monitoring can transform how clubs design and deliver their offerings. Personalized workout routines, adaptive diet plans, and behavioral nudges through apps increase member retention and outcomes. Clubs are increasingly investing in wearables integration, motion sensors, and AR/VR-assisted training, enabling hybrid and immersive experiences.

These tech-powered solutions not only elevate service delivery but also help clubs differentiate themselves in a competitive market. Moreover, data analytics tools can offer actionable insights into member behavior, enabling clubs to refine marketing strategies, adjust service hours, and tailor offers based on preferences and attendance patterns. The demand for precision wellness, especially among affluent and health-focused customers, is growing rapidly, making AI integration not just a tech upgrade but a strategic growth lever for premium positioning and revenue diversification.

Expansion in Tier-2 Cities and Emerging Markets

While recreational clubs have saturated many urban and affluent areas, enormous untapped potential exists in tier-2 and tier-3 cities, especially in rapidly developing regions of Asia-Pacific, Latin America, and Eastern Europe. Rising disposable incomes, increasing health awareness, and government-led initiatives for active living are driving demand for quality fitness and recreational facilities in these locations. Unlike urban centers, these regions often lack organized wellness infrastructure, making them ripe for both domestic expansion and international franchising. Affordable real estate, low operational costs, and first-mover advantage provide ideal conditions for recreational club chains and boutique operators to establish a strong foothold.

Additionally, younger populations in these areas are increasingly exposed to global fitness trends via social media and aspire to participate in structured group activities, creating demand for contemporary wellness clubs, adventure groups, and specialized fitness studios. Government incentives for setting up sports and wellness infrastructure further sweeten the deal for private operators targeting rural and semi-urban clusters.

Trends in the Global Recreational Clubs Market

Rise of Hybrid Membership Models and Digital Integration

Recreational clubs are increasingly adopting hybrid membership models that combine physical access with digital fitness and wellness offerings. This trend is driven by consumer expectations shaped during the COVID-19 pandemic, when virtual classes, remote coaching, and digital wellness platforms became the norm. As a result, clubs are investing in mobile apps, on-demand workout libraries, live streaming sessions, and personalized fitness tracking technologies. These digital integrations enhance member engagement and retention while expanding reach to members who prefer at-home workouts or live in remote areas.

Yoga studios, fitness clubs, and wellness retreats are incorporating AI-based fitness assessments and gamified tracking features to deepen personalization and accountability. Clubs are also leveraging CRM and AI-powered scheduling tools to streamline bookings and communication. This hybrid trend is not only expanding revenue streams but also enhancing member satisfaction by offering flexibility, convenience, and more value. Clubs that fail to embrace digital components risk losing relevance among younger, tech-savvy demographics who now expect digital-native experiences alongside physical club participation.

Expansion into Niche and Lifestyle-Oriented Clubs

The market is witnessing a rise in niche recreational clubs catering to specialized interests such as rock climbing, trail running, esports fitness, wellness retreats, and holistic health. These clubs serve specific communities by focusing on lifestyle alignment rather than just physical activity, which increases customer loyalty. For instance, clubs emphasizing mental wellness, mindfulness, nature immersion, or vegan lifestyles are growing in popularity among millennials and Gen Z. This trend reflects a broader shift toward experience-based consumption where club members seek identity reinforcement and community belonging.

Additionally, gender-specific, age-specific, or values-driven clubs such as women-only fitness studios, senior wellness clubs, and eco-conscious adventure groups are scaling nationwide. These formats provide emotionally resonant environments that encourage social bonding, consistent participation, and premium pricing. With wellness increasingly perceived as a multidimensional concept (mental, emotional, and social), niche clubs are redefining value by offering highly curated services, expert-led sessions, and wellness-focused amenities. This trend also allows for efficient marketing strategies and focused branding, enabling clubs to penetrate micro-communities with precision and high engagement.

Global Recreational Clubs Market: Research Scope and Analysis

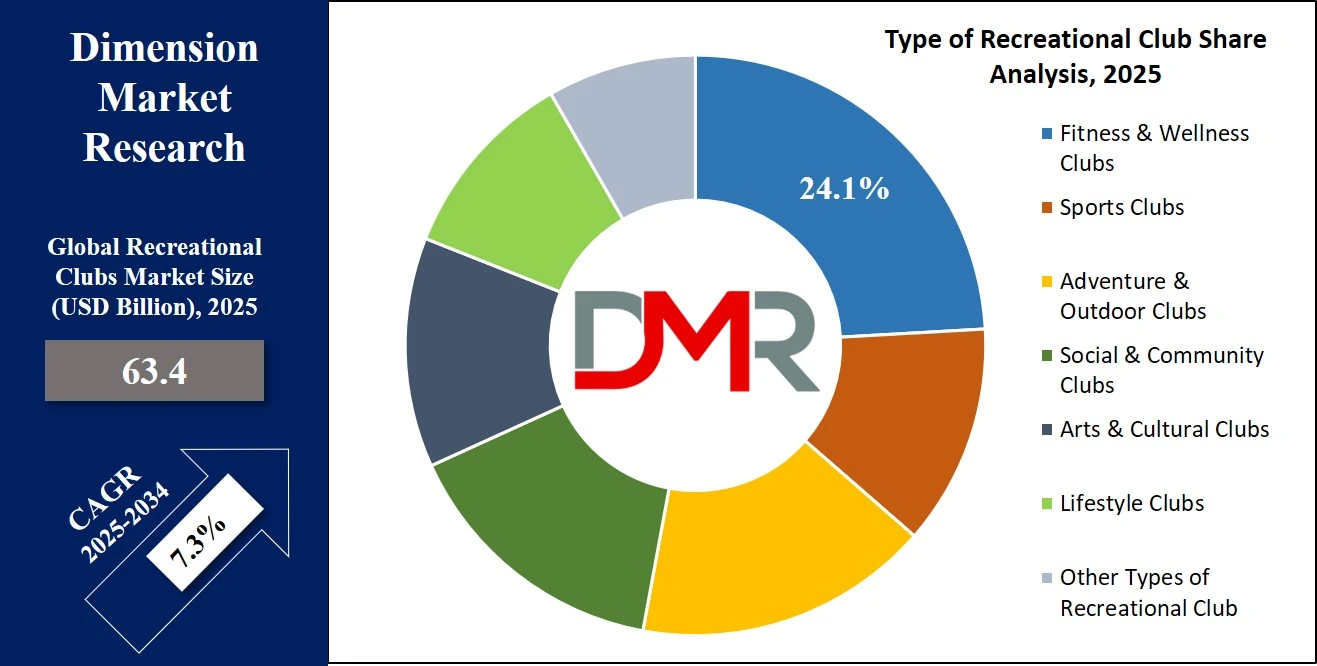

By Type of Recreational Club Analysis

Fitness and wellness clubs are projected to dominate the recreational club segment due to their universal relevance, evolving consumer preferences, and capacity to offer scalable, tech-integrated services. In a world increasingly aware of physical health, mental well-being, and disease prevention, health and wellness facilities have become essential rather than optional for many individuals. These clubs serve a wide demographic from youth and working professionals to seniors, ensuring a large, recurring customer base that spans socio-economic groups.

Unlike other recreational clubs that cater to niche interests (e.g., golf or photography), fitness and wellness clubs offer mass-market appeal. Activities such as gym workouts, yoga, Pilates, Zumba, strength training, and wellness therapies like meditation or spa treatments are accessible, flexible, and customizable to individual goals. The shift from luxury to necessity has turned these clubs into a health infrastructure for urban populations. Additionally, rising lifestyle-related conditions such as obesity, diabetes, hypertension, and anxiety are compelling individuals to adopt structured wellness routines, further boosting this segment.

Fitness and wellness clubs also benefit from a strong digital transition. From app-based personal training and online workout classes to integrated wearables and fitness tracking, these clubs are at the forefront of hybrid physical-digital service models. The operational scalability of gym franchises like Anytime Fitness or F45 Training allows quick expansion with low overheads compared to golf resorts or country clubs.

Moreover, corporate wellness programs increasingly partner with gyms and wellness centers, reinforcing consistent institutional demand. As health continues to align with productivity, social capital, and longevity, fitness and wellness clubs remain the most relevant and resilient choice in the recreational ecosystem, thus dominating the type of recreational club segment.

By Membership Type Analysis

Individual memberships are poised to represent the largest and most consistent revenue segment for recreational clubs across all categories. Whether it's a gym, golf club, yoga studio, or a country club, individual memberships are designed for single-user access and are tailored to suit varying levels of commitment, daily, monthly, annual, or pay-as-you-go. Their flexibility and affordability make them attractive to a broad customer base, including students, professionals, travelers, and retirees.

The dominance of individual memberships is reinforced by changing consumer behavior that prioritizes personal wellness, customization, and convenience. Unlike group or family plans, individual memberships allow users to choose their preferred programs, workout schedules, or recreational services. These memberships are easier to administer and market, enabling clubs to maintain simple pricing structures and collect recurring revenue reliably.

The rise of mobile app integration and digital platforms has further enhanced the value of individual memberships. Users can now book classes, track workouts, make payments, and even join virtual communities from their phones, creating a personalized and tech-friendly user experience. This self-directed approach suits the modern consumer’s preference for independence and control.

Additionally, introductory offers, trial periods, loyalty programs, and referral bonuses are most effective in this category, making individual plans highly scalable. Even for clubs that serve families or corporations, individual memberships are often sold as base units. With relatively low acquisition costs and high renewal potential, individual memberships form the financial backbone of many recreational club models and are expected to continue dominating this segment globally.

By Revenue Source Analysis

Membership fees are expected to be the dominant revenue source across all types of recreational clubs. This predictable, recurring revenue stream provides financial stability and allows operators to cover fixed costs, plan budgets, and forecast future earnings. Whether the club is a gym, golf resort, tennis facility, or social clubhouse, membership fees often constitute over 50–70% of their total income.

The structure of these fees, ranging from basic monthly access plans to premium annual packages, allows clubs to offer tiered services and upsell additional features such as VIP access, guest passes, exclusive classes, or off-peak discounts. As recreational needs become more diversified, many clubs now offer flexible payment plans, digital subscriptions, and hybrid memberships (on-site + virtual), all of which feed into this revenue stream.

Technology has made fee collection seamless. With automated billing, mobile payment apps, and integration with healthcare CRM platforms, clubs can reduce administrative costs and minimize payment delays. Additionally, the psychological effect of recurring payments encourages users to regularly attend, ensuring better usage and retention.

From a strategic standpoint, stable membership fees attract investors and franchisees. Clubs can use projected revenue from memberships as leverage for expansion or improvement. Moreover, during economic downturns or off-seasons, this revenue cushion helps clubs survive reduced event participation or lower merchandise sales.

As consumers focus on wellness, work-life balance, and social engagement increase, membership fee models continue to evolve, but their dominance as the primary revenue pillar of the recreational club ecosystem remains unshaken.

By Ownership & Management Analysis

Private clubs are expected to dominate the recreational club market by offering exclusive services, upscale facilities, and premium member experiences. Owned and operated by private individuals, corporations, or franchise chains, these clubs are driven by profit, making them more aggressive and innovative in capturing market share and delivering value. Examples include Life Time, Inc., Equinox, and ClubCorp (now Invited), all of which run extensive private club networks focused on fitness, golf, and social engagement.

Unlike public or nonprofit organizations, private clubs have greater autonomy in setting prices, selecting amenities, and introducing value-added services like concierge, spa treatments, elite coaching, or members-only events. Their ability to constantly upgrade facilities and launch new programs gives them a competitive edge in attracting high-income individuals and families seeking exclusivity and personalization.

Revenue generation is also more diverse and optimized. Apart from membership fees, private clubs actively monetize event spaces, offer branded merchandise, operate restaurants or lounges, and collaborate with luxury brands. Their focus on aesthetics, ambiance, and premium service helps build strong brand loyalty and drives word-of-mouth referrals.

Furthermore, private ownership allows quicker decision-making and adaptability. Clubs can pivot services in response to trends such as integrating wellness therapies, launching digital apps, or adopting eco-friendly infrastructure without bureaucratic delays. Investors also favor private clubs for their profit potential, driving further expansion and acquisitions.

Given their premium positioning, service quality, and business agility, private clubs remain the dominant force in recreational club ownership and management worldwide.

By End User Analysis

Individuals are anticipated to be the primary drivers of demand in the recreational clubs market, accounting for the largest user base across all sub-categories, from fitness and sports clubs to arts, adventure, and lifestyle clubs. As lifestyles evolve and awareness around personal wellness and enrichment grows, more individuals seek recreation not just as a leisure activity but as an essential part of physical and mental well-being.

This user group spans all age demographics, young professionals pursuing fitness goals, students joining clubs for extracurricular activities, retirees seeking social engagement, and even digital nomads accessing short-term club memberships during travel. Individual users are also more likely to explore niche recreational services such as photography clubs, cycling groups, yoga retreats, and music societies, thereby broadening the club’s market scope.

From a revenue standpoint, individuals contribute consistently through monthly or annual memberships, class fees, and merchandise purchases. They are highly responsive to personalization, loyalty rewards, and tech-enhanced services such as mobile apps for booking, progress tracking, or virtual access. This behavior provides rich data for clubs to refine offerings and improve retention.

Additionally, individuals are more likely to drive organic growth through referrals, reviews, and social media engagement, making them valuable marketing assets. Recreational clubs also tailor most of their communication, branding, and service design to appeal directly to individual decision-makers, reinforcing this segment’s dominance.

With growing urbanization, rising disposable incomes, and increased focus on self-care and hobby development, individuals will continue to be the central consumer base powering the recreational clubs market.

The Global Recreational Clubs Market Report is segmented on the basis of the following:

By Type of Recreational Club

- Fitness & Wellness Clubs

- Gyms

- Yoga Studios

- Wellness Retreats

- Sports Clubs

- Adventure & Outdoor Clubs

- Social & Community Clubs

- Country Clubs

- City Clubs

- Alumni Associations

- Arts & Cultural Clubs

- Photography

- Music

- Dance

- Literature

- Lifestyle Clubs

- Travel

- Wine Tasting

- Luxury Lifestyle

- Other Types of Recreational Clubs

By Membership Type

- Individual Memberships

- Family Memberships

- Corporate Memberships

- Student/Youth Memberships

- Senior Memberships

- Short-Term/Seasonal Memberships

- Lifetime Memberships

By Revenue Source

- Membership Fees

- Event Hosting & Facility Rentals

- Food & Beverage Sales

- Merchandise & Equipment Rentals

- Sponsorships & Partnerships

- Training & Coaching Services

- Digital Subscriptions & Online Services

By Ownership & Management

- Private Clubs

- Franchise-Based Clubs

- Corporate-Owned Clubs

- Public/Government-Affiliated Clubs

- Non-Profit Organizations

By End User

- Individuals

- Families

- Corporates & Institutions

- Schools & Universities

- Tourists & Travelers

Impact of Artificial Intelligence in the Global Recreational Clubs Market

- Personalized Member Experiences: AI analyzes user preferences, activity patterns, and health data to deliver tailored fitness plans, club recommendations, and wellness routines, enhancing user satisfaction, retention, and engagement across gyms, yoga centers, and wellness retreats.

- Smart Facility Management: AI-powered systems optimize energy usage, automate lighting and HVAC systems, and schedule equipment maintenance, reducing operational costs while improving facility safety, cleanliness, and user comfort across fitness and country clubs.

- Predictive Analytics for Member Retention: AI models forecast member churn by analyzing usage frequency, payment behavior, and feedback, allowing clubs to proactively offer incentives, adjust services, or re-engage at-risk members to maintain consistent revenue streams.

- Virtual Coaching & Training Assistants: AI enables digital personal trainers and wellness bots to guide members through workouts, meditation, and nutrition programs, ensuring 24/7 accessibility, consistency, and cost-effective service delivery without always requiring human staff.

- Dynamic Pricing & Membership Optimization: Using demand forecasting and user segmentation, AI helps recreational clubs set flexible pricing, promotional offers, and tiered memberships that maximize revenue and attract varied customer demographics, especially during peak and off-peak seasons.

- Enhanced Security & Access Control: Facial recognition and biometric-based AI systems improve club security, monitor access in real time, and streamline check-ins, boosting user convenience while preventing unauthorized entry in private or premium recreational facilities.

Global Recreational Clubs Market: Regional Analysis

Region with the Largest Revenue Share

North America, particularly the United States, is projected to dominate the global recreational clubs market as it holds 40.0% of total revenue by the end of 2025, due to its established culture of organized fitness, wellness, sports, and social club participation. With a high percentage of urban dwellers prioritizing work-life balance and wellness routines, recreational clubs have become an integral part of daily life. The region hosts a significant number of high-profile and diversified recreational chains such as Life Time, Inc., Equinox Holdings, Planet Fitness, ClubCorp (Invited), LA Fitness, and YMCA, all of which offer services ranging from fitness and yoga to social networking and golf.

The high disposable income levels, corporate wellness programs, and aging population interested in lifestyle enrichment further bolster membership numbers. Additionally, government support for active lifestyles and preventive healthcare indirectly promotes the growth of fitness and wellness clubs. Technology adoption is also more advanced in this region. AI-powered apps, smart equipment, biometric check-ins, and virtual fitness services have become standard across many clubs.

Moreover, the franchising model is highly developed, allowing rapid and efficient expansion of gym and wellness club chains across suburban and rural areas. The social club segment is also deeply rooted in American culture, with alumni associations, country clubs, and lifestyle-focused communities maintaining steady popularity.

The integration of digital wellness, hybrid fitness services, and luxury lifestyle offerings continues to drive market leadership. North America’s consumer willingness to invest in holistic wellness, combined with robust infrastructure, brand maturity, and innovation, cements its position as the most dominant region in the global recreational clubs market.

Region with the Highest CAGR

Asia-Pacific is poised to be the fastest-growing region in the global recreational clubs market, expected to witness the highest compound annual growth rate (CAGR) over the next decade. This growth is fueled by an expanding urban population, a rapidly rising middle class, and increasing awareness about health, fitness, and lifestyle enhancement. Countries such as China, India, Indonesia, Vietnam, Thailand, and Malaysia are leading this transformation, supported by a young, aspirational demographic.

Rising concerns over lifestyle diseases such as obesity, diabetes, and hypertension, especially in urban centers, are pushing individuals toward structured recreational and wellness routines. In response, there has been a surge in the development of fitness clubs, yoga centers, wellness retreats, and sports-based clubs tailored to local preferences. Affordable membership pricing, social media fitness influencers, and government health awareness campaigns further contribute to this momentum.

The region is also seeing increased foreign investment and global brand expansion. Fitness giants like Anytime Fitness, F45, Gold’s Gym, and Celebrity Fitness are opening franchises in major Asian cities. At the same time, local brands are innovating with culturally tailored offerings such as Ayurvedic wellness retreats in India and Tai Chi clubs in China. Mobile-based fitness apps, AI-powered personal trainers, and subscription models are gaining traction due to high smartphone penetration and digital literacy.

Moreover, tourism and hospitality sectors in countries like Thailand, Bali (Indonesia), and Sri Lanka are increasingly integrating luxury wellness clubs and recreational services, boosting growth in both local and international segments.

With supportive government policies, evolving consumer behavior, and digital innovation, Asia-Pacific is poised to maintain the highest growth rate, making it the most dynamic region in the recreational clubs market.

By Region

North America

Europe

- Germany

- The U.K.

- France

- Italy

- Russia

- Spain

- Benelux

- Nordic

- Rest of Europe

Asia-Pacific

- China

- Japan

- South Korea

- India

- ANZ

- ASEAN

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Argentina

- Colombia

- Rest of Latin America

Middle East & Africa

- Saudi Arabia

- UAE

- South Africa

- Israel

- Egypt

- Rest of MEA

Global Recreational Clubs Market: Competitive Landscape

The global recreational clubs market is moderately fragmented, with a mix of large international chains, regional players, and niche community-based clubs competing across fitness, wellness, sports, social, and lifestyle categories. Key players are leveraging technology integration, member-centric services, and strategic expansion to gain a competitive edge.

Major fitness and wellness chains such as Life Time, Inc., Equinox Holdings, Planet Fitness, Anytime Fitness, and LA Fitness dominate in North America and Europe with extensive networks, diversified offerings, and hybrid models (physical + digital). These players emphasize personalization, AI-enabled training, and app-based service delivery to drive engagement and retention.

Social and country club providers like ClubCorp (Invited) and Soho House & Co lead in the premium segment, offering exclusive services, elite networking, and luxury amenities. Meanwhile, companies like Virgin Active, David Lloyd Leisure, and Gold’s Gym are expanding in emerging markets through franchising, targeting Asia-Pacific’s growing middle class.

Technological innovation, especially AI, biometrics, and mobile platforms, is reshaping user experience and operational efficiency. Strategic partnerships, mergers, and acquisitions, such as wellness brands acquiring boutique studios or hotels integrating fitness clubs, are common growth tactics.

While large brands dominate urban centers, local clubs and nonprofit associations like the YMCA retain strong footholds in community-based and affordable recreation services. Competition remains intense, driven by evolving consumer expectations and digital transformation.

Some of the prominent players in the Global Recreational Clubs Market are:

- Life Time, Inc.

- Equinox Holdings, Inc.

- Planet Fitness, Inc.

- LA Fitness International LLC

- Town Sports International Holdings, Inc.

- Virgin Active Ltd.

- YMCA

- Gold’s Gym International, Inc.

- The Bay Club Company

- ClubCorp (Invited)

- Soho House & Co Inc.

- David Lloyd Leisure Ltd.

- Crunch Fitness

- Anytime Fitness, LLC

- Snap Fitness, Inc.

- GoodLife Fitness

- PureGym Ltd.

- F45 Training Holdings Inc.

- Curves International, Inc.

- Fitness First Ltd.

- Other Key Players

Recent Developments in the Global Recreational Clubs Market

June 2024

- Investment: Life Time Group's $200M expansion targets affluent suburbs with resort-style clubs featuring co-working spaces, pickleball courts, and IV therapy lounges, responding to growing demand for multifunctional wellness destinations beyond traditional gyms.

- Merger: The potential Equinox-SoulCycle merger aims to create a premium lifestyle ecosystem, combining Equinox's luxury facilities with SoulCycle's cult following, potentially offering bundled memberships and shared loyalty programs to boost revenue streams.

May 2024

- Expo: IHRSA 2024 highlighted biometric tracking systems that analyze member performance in real-time, along with recovery tech like hydrotherapy pods, reflecting the industry's shift toward data-driven, recovery-focused fitness experiences.

- Collaboration: The Planet Fitness-Apple Fitness+ partnership introduces tiered memberships, allowing budget-conscious consumers to access premium digital content, potentially disrupting the traditional boutique fitness pricing model.

April 2024

- Investment: Virgin Active's funding will retrofit Asian locations with climate-responsive designs and smart locker systems, while European clubs will incorporate medical wellness programs, partnering with local healthcare providers.

- Conference: Discussions at the Global Wellness Summit revealed that top-tier clubs are incorporating longevity clinics with genetic testing and hyper-personalized training regimens supervised by sports medicine specialists.

March 2024

- Merger: The transatlantic merger enables shared European R&D in sustainable gym design with American operational expertise, creating a template for energy-efficient clubs with dynamic pricing models based on usage patterns.

- Collaboration: Gold's Gym's MyFitnessPal integration goes beyond tracking, offering AI-generated meal plans that sync with workout schedules and adjust based on member progress and feedback.

February 2024

- Expo: FIBO's standout innovations included AI-powered mirrors that correct form autonomously and EMS (electrical muscle stimulation) suits that deliver full-body workouts in 20 minutes, appealing to time-constrained professionals.

- Investment: PureGym's Middle East push adapts its low-cost model to local preferences, incorporating gender-segregated workout areas and prayer spaces while maintaining 24/7 access through facial recognition entry systems.

January 2024

- Conference: CES fitness tech reveals included haptic feedback wearables that guide workouts through vibration cues and equipment that automatically adjusts resistance based on real-time muscle fatigue detection via embedded sensors.

- Collaboration: The Anytime Fitness-Strava integration creates location-based challenges where members can compete in neighborhood leaderboards, blending digital community features with physical club access.

December 2023

- Merger: The potential 24 Hour-VASA merger focuses on optimizing real estate footprints, converting underperforming locations into hybrid facilities that combine traditional gym spaces with boutique-style specialty training zones.

November 2023

- Expo: LIW's sustainability focus showcased carbon-negative flooring made from recycled shoes, HVAC systems powered by member workouts, and water-recycling showers that reduce club utility costs by up to 40%.

Report Details

| Report Characteristics |

| Market Size (2025) |

USD 63.4 Bn |

| Forecast Value (2034) |

USD 119.3 Bn |

| CAGR (2025–2034) |

7.3% |

| Historical Data |

2019 – 2024 |

| The US Market Size (2025) |

USD 21.3 Bn |

| Forecast Data |

2025 – 2033 |

| Base Year |

2024 |

| Estimate Year |

2025 |

| Report Coverage |

Market Revenue Estimation, Market Dynamics, Competitive Landscape, Growth Factors, etc. |

| Segments Covered |

By Type (Fitness & Wellness Clubs, Sports Clubs, Adventure & Outdoor Clubs, Social & Community Clubs, Arts & Cultural Clubs, Lifestyle Clubs, Other Types of Recreational Club), By Membership Type (Individual Memberships, Family Memberships, Corporate Memberships, Student/Youth Memberships, Senior Memberships, Short-Term/Seasonal Memberships, Lifetime Memberships), By Revenue Source (Membership Fees, Event Hosting & Facility Rentals, Food & Beverage Sales, Merchandise & Equipment Rentals, Sponsorships & Partnerships, Training & Coaching Services, Digital Subscriptions & Online Services), By Ownership & Management (Private Clubs, Franchise-Based Clubs, Corporate-Owned Clubs, Public/Government-Affiliated Clubs, Non-Profit Organizations), By End User (Individuals, Families, Corporates & Institutions, Schools & Universities, Tourists & Travelers |

| Regional Coverage |

North America – US, Canada; Europe – Germany, UK, France, Russia, Spain, Italy, Benelux, Nordic, Rest of Europe; Asia-Pacific – China, Japan, South Korea, India, ANZ, ASEAN, Rest of APAC; Latin America – Brazil, Mexico, Argentina, Colombia, Rest of Latin America; Middle East & Africa – Saudi Arabia, UAE, South Africa, Turkey, Egypt, Israel, Rest of MEA |

| Prominent Players |

Life Time, Inc., Equinox Holdings, Inc., Planet Fitness, Inc., LA Fitness International LLC, Town Sports International Holdings, Inc., Virgin Active Ltd., YMCA, Gold’s Gym International, Inc., The Bay Club Company, ClubCorp (Invited), Soho House & Co Inc., David Lloyd Leisure Ltd., Crunch Fitness, Anytime Fitness, LLC, Snap Fitness, Inc., GoodLife Fitness, PureGym Ltd., F45 Training Holdings Inc., Curves International, Inc., Fitness First Ltd., and Other Key Players |

| Purchase Options |

We have three licenses to opt for: Single User License (Limited to 1 user), Multi-User License (Up to 5 Users), and Corporate Use License (Unlimited User) along with free report customization equivalent to 0 analyst working days, 3 analysts working days, and 5 analysts working days respectively. |

Frequently Asked Questions

How big is the Global Recreational Clubs Market?

The Global Recreational Clubs Market size is estimated to have a value of USD 63.4 billion in 2025 and is expected to reach USD 119.3 billion by the end of 2034.

The market is growing at a CAGR of 7.3 percent over the forecasted period of 2025.

The US Recreational Clubs Market is projected to be valued at USD 21.3 billion in 2025. It is expected to witness subsequent growth in the upcoming period as it holds USD 38.7 billion in 2034 at a CAGR of 6.9%.

North America is expected to have the largest market share in the Global Recreational Clubs Market with a share of about 40.0% in 2025.

Some of the major key players in the Global Recreational Clubs Market are Life Time, Inc., Equinox Holdings, Inc., Planet Fitness, Inc., LA Fitness International LLC, Town Sports International Holdings, Inc., Virgin Active Ltd., YMCA, Gold’s Gym International, Inc., and many others.