Market Overview

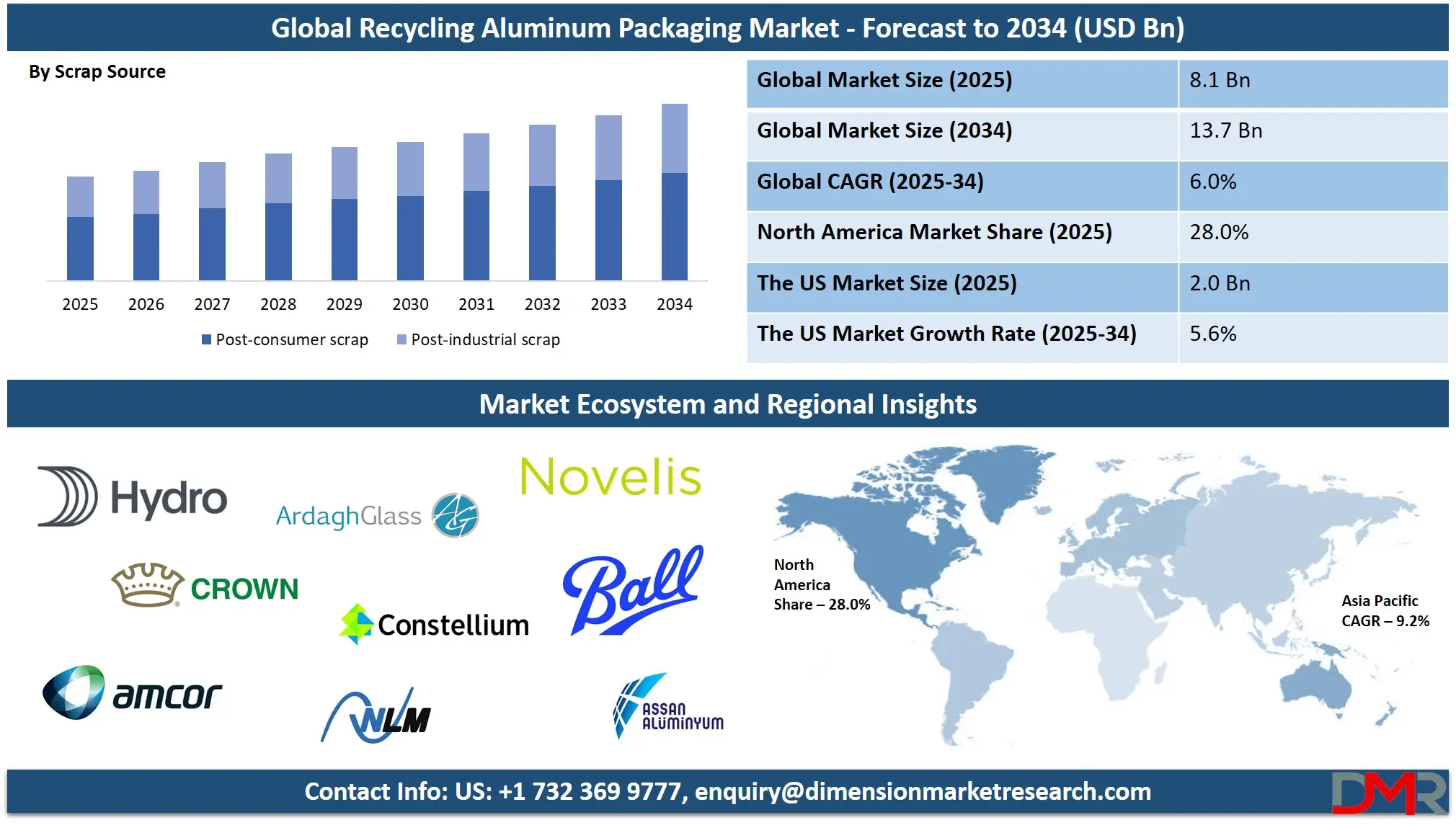

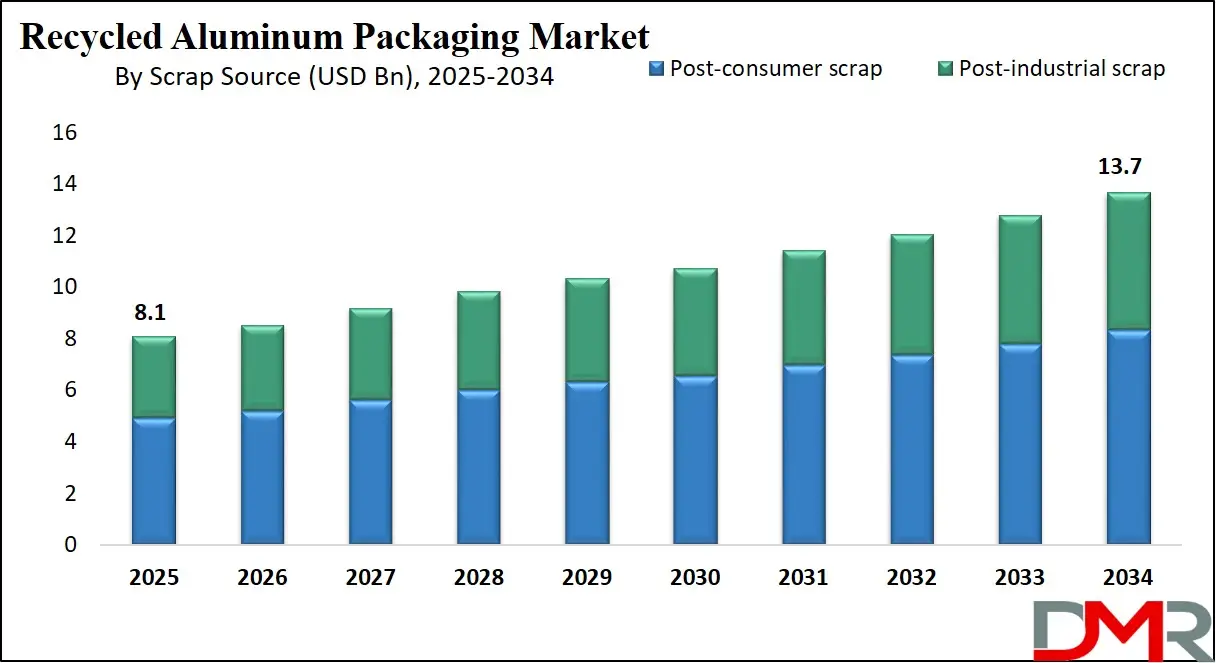

The Global Recycled Aluminium Packaging Market size is projected to reach USD 8.1 billion in 2025 and grow at a compound annual growth rate of 6.0% to reach a value of USD 13.7 billion in 2034.

The recycled aluminium packaging market comprises the collection, processing, remelting, and conversion of aluminium scrap into packaging formats such as beverage cans, food cans, foils, aerosols, and pharmaceutical-grade laminates. This market integrates recycling technologies, closed-loop systems, materials recovery facilities, and lightweight packaging solutions.

Its significance lies in aluminium’s infinite recyclability, low carbon footprint, and its pivotal role in circular economy initiatives across food, beverage, pharmaceuticals, personal care, and household products. As sustainability mandates tighten globally, industries increasingly prefer recycled aluminium due to its energy efficiency—requiring up to 95% less energy than primary aluminium. The shift toward environmentally responsible packaging is driving a major transformation across supply chains.

Further advancements in scrap-sorting automation, AI-enabled quality detection, and high-speed melting technologies are accelerating market maturation. Regulations such as extended producer responsibility (EPR), carbon taxation, and mandatory recycled-content targets are reshaping packaging strategies. Consumer preference is also changing, favoring recyclable and low-impact packaging. Several milestones, such as the adoption of closed-loop beverage can recycling systems and the expansion of green aluminium certification programs, have pushed the market toward higher sophistication and traceability. The market is moving beyond basic recycling toward complete sustainability integration.

Moreover, there are investments in high-grade recycling plants, mergers between recycling companies and packaging converters, and collaborations focused on circular material flows. Producers are also securing long-term scrap supply agreements to ensure stable input costs. Governments across major regions are strengthening circular economy policies, contributing to new infrastructure development. Meanwhile, companies are launching lightweight, high-strength alloy packaging formats that further enhance aluminium’s appeal. These combined influences are shaping a robust future trajectory for the recycled aluminium packaging market.

The US Recycled Aluminum Packaging Market

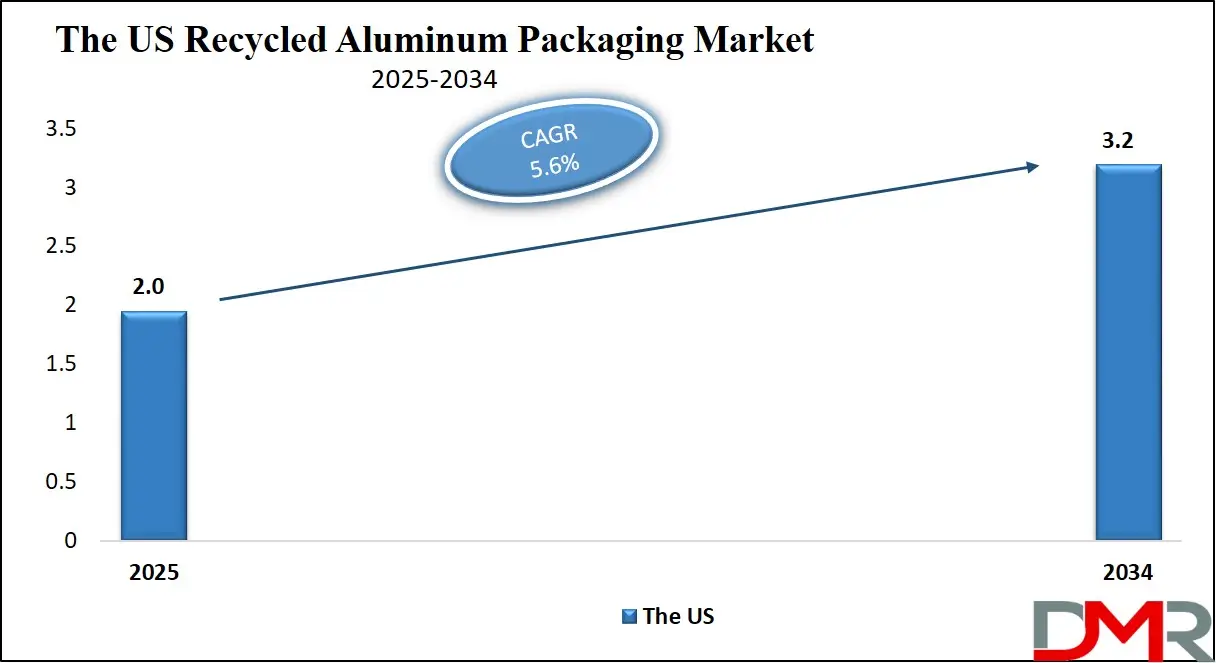

The US Recycled Aluminium Packaging Market size is projected to reach USD 2.0 billion in 2025 at a compound annual growth rate of 5.6% over its forecast period.

The US recycled aluminium packaging market is driven by strong beverage can demand, well-established recycling infrastructure, and supportive federal sustainability initiatives. Growth is encouraged by rising adoption of circular-economy principles among major packaging manufacturers and consumer goods companies.

The Environmental Protection Agency (EPA) supports aluminum recovery through national recycling strategies, while state-level container deposit laws significantly improve scrap availability. Key players in the US operate high-capacity remelting facilities, forming a mature ecosystem that efficiently processes post-consumer scrap, especially used beverage cans. The market also benefits from investments in advanced sorting technologies that reduce contamination and improve recovery rates. As consumer brands push for higher recycled content, the US is positioned as a demand leader due to its strong domestic supply chain integration.

Europe Recycled Aluminum Packaging Market

Europe Recycled Aluminium Packaging Market size is projected to reach USD 3.7 billion in 2025 at a compound annual growth rate of 5.4% over its forecast period.

Europe represents one of the most progressive regions in recycled aluminium packaging thanks to strict sustainability regulations, high recycling rates, and ambitious targets under the European Green Deal. Key mandates such as the Packaging and Packaging Waste Regulation (PPWR) are accelerating adoption of high-recycled-content packaging. The region benefits from strong producer responsibility systems and advanced materials recovery facilities, making scrap availability relatively stable. Countries such as Germany, the UK, Italy, and the Netherlands lead in closed-loop beverage can recycling and industrial scrap recovery. European industries also prioritize carbon reduction, making recycled aluminium a preferred packaging solution due to its low environmental impact. Innovation is particularly strong in foil-based pharmaceutical and food packaging. Collectively, Europe maintains rapid innovation and high compliance, positioning it at the forefront of sustainable aluminium packaging adoption.

Japan Recycled Aluminum Packaging Market

Japan Recycled Aluminium Packaging Market size is projected to reach USD 324 million in 2025 at a compound annual growth rate of 6.8% over its forecast period.

Japan’s recycled aluminium packaging market is characterized by strong urbanization, advanced waste-management systems, and high consumer awareness of sustainability. Government policies supporting recycling efficiency and material circularity have contributed to a stable supply of high-quality scrap, particularly from beverage cans and food packaging. Japan's industrial sector is investing in improved remelting technologies and smart waste-sorting systems, enabling extremely high recovery rates. Growth is strongest in the personal care, cosmetics, and ready-meal packaging segments due to rising urban lifestyles and demand for convenience packaging. Despite space constraints and limited landfill capacity, Japan has turned these challenges into strengths, prioritizing recycling and resource efficiency. Continuous government initiatives and strong collaboration among manufacturers, municipalities, and recycling associations offer significant opportunities for expansion.

Recycled Aluminum Packaging Market: Key Takeaways

- Market Growth: The Recycled Aluminium Packaging Market size is expected to grow by USD 5.2 billion, at a CAGR of 6.0%, during the forecasted period of 2026 to 2034.

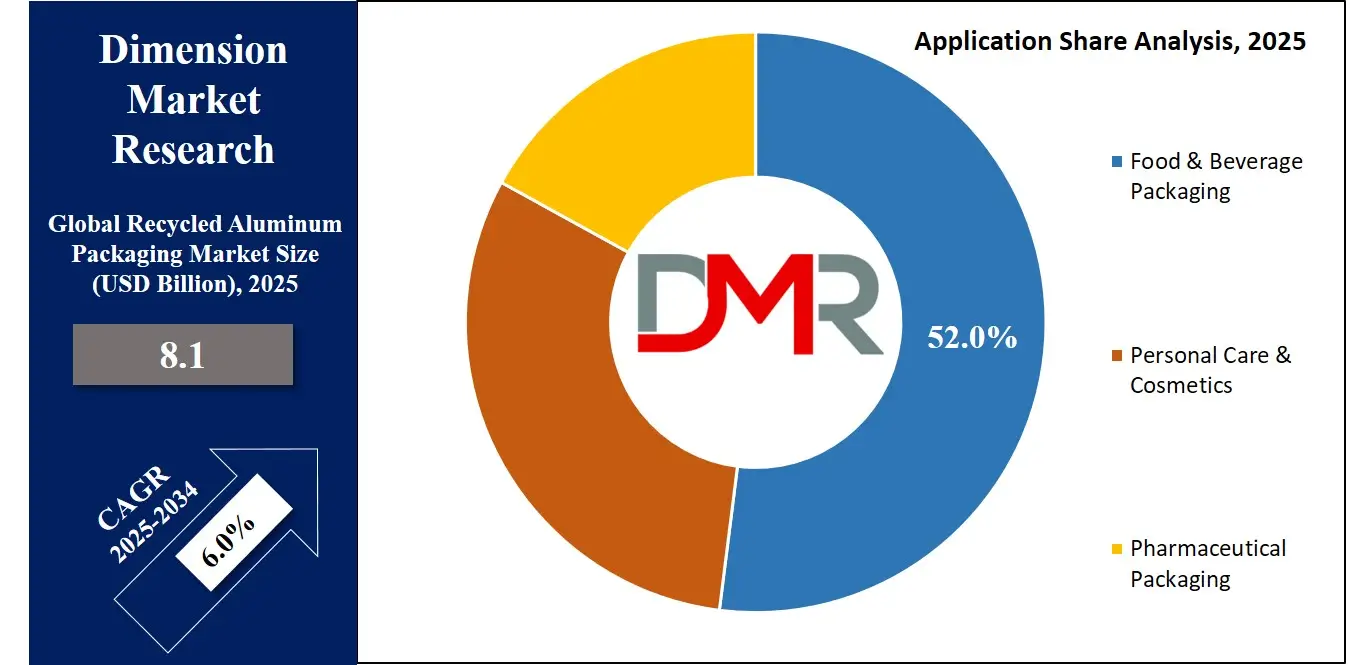

- By Application: The food & beverage packaging segment is anticipated to get the majority share of the Recycled Aluminium Packaging Market in 2025.

- By Scrap Source: The post-consumer scrap segment is expected to get the largest revenue share in 2025 in the Recycled Aluminium Packaging Market.

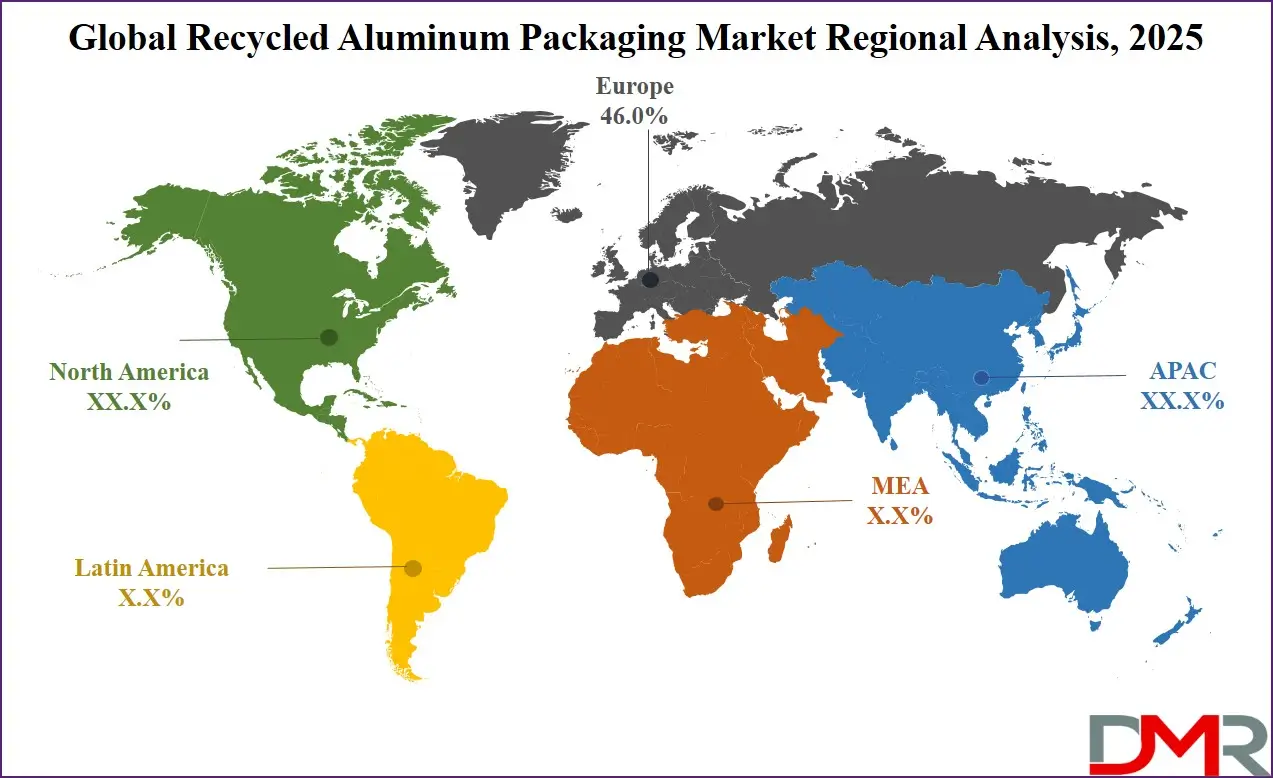

- Regional Insight: Europe is expected to hold a 46.0% share of revenue in the Global Recycled Aluminium Packaging Market in 2025.

- Use Cases: Some of the use cases of Recycled Aluminium Packaging include climate beverage packaging, sustainable food containers, and more.

Recycled Aluminum Packaging Market: Use Cases

- Circular Beverage Packaging: Closed-loop recycling of beverage cans for efficient reuse.

- Sustainable Food Containers: High-barrier recycled aluminium used in ready meals and canned foods.

- Eco-Friendly Personal Care Packaging: Aerosol and tube components made from recycled aluminium.

- Pharmaceutical-Grade Recycled Foils: Blister packs and sterile wraps produced from purified recycled feedstock.

Stats & Facts

- The U.S. Environmental Protection Agency reports rising national aluminium container recycling activity in 2024 as part of its circular materials strategy.

- The European Commission highlights an increase in recycled-content usage in aluminium packaging across EU member states during 2024–2025.

- Japan’s Ministry of the Environment indicates consistently high beverage-can recycling performance in its 2024 waste management review.

- The International Aluminium Institute notes global growth in closed-loop aluminium packaging systems in 2024.

- The United Nations Environment Programme states that recycled materials are becoming central to packaging decarbonization efforts in 2025.

- The UK Department for Environment, Food & Rural Affairs confirms expanded compliance measures for recycled aluminium packaging under EPR regulations in 2024.

Market Dynamic

Driving Factors in the Recycled Aluminum Packaging Market

Regulatory Sustainability Push

Stringent global policies supporting recycling, circular economy initiatives, and carbon reduction are the strongest drivers of the recycled aluminium packaging market. Governments are mandating higher recycled content in packaging, implementing carbon taxes, and enforcing EPR legislation that holds producers responsible for material recovery. These policies create a favorable environment for aluminium recyclers and packaging manufacturers to invest in technological upgrades. Regulations also incentivize the establishment of urban recycling hubs and reduce reliance on primary aluminium, which has a higher environmental impact. As corporations align with ESG targets, demand for low-carbon packaging materials continues to rise. This regulatory momentum ensures long-term market stability and encourages suppliers to innovate and scale operations.

Technological Advancements in Scrap Processing

Innovations in automated scrap sorting, AI-powered metal detection, and energy-efficient melting technologies are accelerating market expansion. Modern recycling plants can process mixed scrap with greater precision, reducing impurities and increasing yield. Digital traceability systems help manufacturers verify recycled content, which is increasingly important for compliance and brand transparency. Additionally, improvements in alloy recovery enable recycled aluminium to meet high-performance requirements for pharmaceuticals, food packaging, and aerosols. These advancements lower operating costs, enhance output quality, and reduce energy consumption, making recycled aluminium more competitive against virgin materials. As technology continues to evolve, processing efficiency and production capacity will further increase, strengthening the market’s long-term growth outlook.

Restraints in the Recycled Aluminum Packaging Market

Scrap Supply Limitations

One of the primary restraints is the inconsistent availability of clean, high-quality aluminium scrap. While demand for recycled aluminium packaging is rising, collection systems in many regions remain underdeveloped. Contamination, improper sorting, and insufficient consumer participation weaken scrap supply reliability. Industrial scrap offers higher purity but is limited in volume. These constraints lead to pricing volatility, forcing manufacturers to rely on imports or maintain blends with primary aluminium. As a result, companies face supply chain uncertainties that may hinder capacity expansion. Without significant improvements in collection infrastructure, scrap supply limitations may continue to challenge the market’s ability to meet growing demand.

High Initial Investment Costs

Establishing state-of-the-art recycling facilities requires large capital investments, particularly for advanced sorting systems, melting furnaces, and emission-control technologies. Smaller companies often struggle to justify these costs, especially when recycling margins fluctuate due to scrap price volatility. Regulatory compliance adds additional financial pressure, as companies must meet strict environmental and quality standards. Technical expertise is also required to operate sophisticated equipment, increasing operational expenses. These factors can delay new facility development or modernization efforts. Consequently, although long-term returns from recycling are strong, the high upfront financial burden acts as a significant barrier to market entry and slows overall capacity expansion.

Opportunities in the Recycled Aluminum Packaging Market

Rising Demand for Low-Carbon Packaging

Growing consumer concern for sustainability and increasing corporate commitments to carbon neutrality are creating major opportunities for recycled aluminium packaging. Brands in food, beverage, and personal care sectors are actively replacing plastics with recyclable aluminium formats, driven by both environmental benefits and brand reputation. Recycled aluminium’s low-energy profile makes it ideal for companies targeting greener supply chains. Expanding e-commerce and convenience-food trends further contribute to packaging demand. As more companies adopt carbon disclosure practices, recycled-content packaging becomes a competitive advantage. This rising preference opens vast opportunities for suppliers to develop new products, secure long-term contracts, and expand production.

Growth of Closed-Loop Recycling System

The shift toward closed-loop recycling models presents substantial expansion potential. Partnerships between beverage manufacturers, waste management firms, and recyclers enable rapid recovery of used cans and foils for reuse. These loops ensure consistent scrap supply and reduce dependence on primary aluminium. Governments are supporting such systems through recycling incentives and infrastructure funding. New deposit-return programs across regions further increase collection rates. Closed-loop systems also create opportunities for technology providers offering AI sorting, data analytics, and automated material recovery. With more manufacturers seeking verified circular supply chains, closed-loop recycling is emerging as a highly profitable growth avenue.

Trends in the Recycled Aluminum Packaging Market

Digitalization and Traceability

Digital transformation is becoming a defining trend in the recycled aluminium packaging market. Blockchain-based traceability tools, IoT-enabled recycling bins, and AI-powered sorting lines are improving transparency, allowing manufacturers to verify recycled content percentages and track scrap origins. These innovations support compliance with emerging regulations that require demonstrable sustainability performance. Consumer brands are also using traceability data to strengthen marketing claims and build trust. Digital solutions reduce inefficiencies, optimize scrap supply chains, and enhance plant productivity. As circular economy commitments grow, digitalization will remain a major trend shaping operational strategies and sustainability reporting.

Lightweighting and High-Performance Recycled Alloys

Manufacturers are developing advanced lightweight aluminium alloys that retain high strength despite using recycled feedstock. This trend is particularly strong in beverage cans, aerosols, pharmaceutical foils, and ready-meal trays. Lightweighting reduces material consumption and transportation emissions, delivering cost and sustainability benefits. Innovations in alloy formulation now enable recycled aluminium to meet stringent barrier and purity requirements previously achievable only with primary aluminium. These advancements expand its application scope and drive greater adoption across consumer goods industries. As companies prioritize eco-efficient packaging, the push for high-performance recycled aluminium will continue transforming product design and material engineering.

Impact of Artificial Intelligence in Recycled Aluminum Packaging Market

- AI-powered sorting systems improve scrap purity by accurately distinguishing aluminium from mixed waste streams.

- Predictive maintenance enhances recycling plant efficiency by reducing downtime in melting and processing equipment.

- Demand forecasting algorithms help manufacturers optimize inventory and production planning.

- AI-driven quality control ensures consistent alloy composition and compliance with packaging standards.

- Automated logistics optimization streamlines scrap collection routes and reduces operational costs.

Research Scope and Analysis

By Product Type Analysis

Cans represent the leading segment with 48% market share in 2025, driven by the exceptionally high recycling rates of beverage cans and continuous investments in closed-loop recycling systems. Beverage cans are favored for their durability, lightweight nature, and fast recyclability, making them an essential packaging format for carbonated drinks, energy beverages, and alcoholic beverages. Food cans also contribute significantly due to the rising demand for shelf-stable products and ready-meal formats. Manufacturers are adopting high-recycled-content aluminium cans to meet sustainability targets, while consumers increasingly prefer recyclable packaging. This segment’s leadership is also reinforced by strong collection networks, deposit-return schemes, and the rapid turnaround time from recycling to re-manufacturing, positioning it as the most dominant product category.

In addition, foils are the fastest-growing segment due to rising demand in pharmaceutical, household, and ready-meal applications. Packaging foils are increasingly produced using recycled aluminium to meet eco-friendly packaging mandates and reduce procurement costs. Technological improvements now allow recycled aluminium to meet the purity standards needed for blister packs and sterile wraps. Growth in the ready-meals sector, driven by urban lifestyles and convenience trends, also supports expansion. As brands seek to replace plastic laminates with recyclable aluminium foils, the segment is expected to continue growing rapidly.

By Scrap Source Analysis

Post-consumer scrap accounts for 61% of the market in 2025, driven by the strong recovery of used beverage cans and household packaging waste. Deposit-return schemes and municipal recycling programs significantly enhance scrap collection rates. This segment is vital for achieving circular-economy objectives, as it directly diverts waste from landfills. Post-consumer scrap is cost-effective and widely available, making it an essential feedstock for recycled aluminium packaging. As consumer brands commit to higher recycled content, demand for post-consumer scrap continues to increase. Advancements in sorting technology further improve recovery efficiency, bolstering this segment's dominance.

Post-industrial scrap is the fastest-growing segment due to its high purity and predictable supply. Manufacturing scraps and offcuts allow recyclers to produce consistent-quality recycled aluminium with minimal contamination. As packaging converters increase production to meet demand, the volume of industrial scrap rises correspondingly. This segment is particularly attractive for high-performance applications such as sterile pharmaceutical packaging. Enhanced traceability systems and manufacturer partnerships are further accelerating growth.

By Application Analysis

Food and beverage packaging dominates with 52% share in 2025, supported by strong global demand for canned beverages, ready meals, and long-shelf-life food products. Aluminium’s exceptional barrier properties, lightweight design, and recyclability make it ideal for this sector. Growing consumer preference for sustainable packaging is prompting beverage companies to transition to high-recycled-content cans. The ready-meals sector, particularly in urban regions, is seeing increased use of recycled aluminium trays and foils. Manufacturers value aluminium for its heat resistance, safety, and compatibility with eco-friendly sealing technologies. As sustainability regulations tighten, this application category will continue to lead the market.

Further, the personal care and cosmetics segment is expanding rapidly due to the rising use of aluminium aerosols, sprays, and tubes. Consumers prefer premium metal packaging that is recyclable and visually appealing. Brands are integrating recycled aluminium to meet their sustainability goals, particularly in deodorants, hair sprays, and skincare products. The transition away from plastic tubes and containers is accelerating growth.

The Recycled Aluminum Packaging Market Report is segmented on the basis of the following:

By Product Type

- Cans

- Foils

- Household foil

- Packaging foil

- Aerosol Containers

- Personal care

- Household products

By Scrap Source

- Post-Consumer Scrap

- Used beverage cans

- Used food packaging

- Post-Industrial Scrap

- Manufacturing scrap

- Offcuts

By Application

- Food & Beverage Packaging

- Personal Care & Cosmetics

- Pharmaceutical Packaging

- Blister components

- Sterile wraps

Regional Analysis

Leading Region in the Recycled Aluminum Packaging Market

Europe leads the global recycled aluminium packaging market with 46% share, driven by strict sustainability regulations, high recycling rates, and advanced infrastructure. The European Green Deal and Packaging Waste Directive enforce ambitious recycled-content targets, compelling industries to adopt circular-material strategies. Europe’s strong collection systems, including deposit-return schemes and producer responsibility networks, ensure a steady supply of high-quality post-consumer scrap.

Robust industrial capabilities allow rapid processing and conversion of scrap into cans, foils, and pharmaceutical packaging. Collaboration between governments, recyclers, and manufacturers accelerates innovation in low-carbon aluminium production and closed-loop recycling initiatives. As consumer demand for sustainable packaging grows, Europe continues to strengthen its leadership position with significant investments in modern recycling technologies.

Fastest Growing Region in the Recycled Aluminum Packaging Market

Asia-Pacific is the fastest-growing region, driven by rapid urbanization, strong industrial expansion, and increasing sustainability commitments among governments and corporations. Countries such as China, India, Japan, and South Korea are investing heavily in recycling infrastructure and promoting circular economy policies. Rising consumption of packaged foods, beverages, and personal care products boosts demand for aluminium packaging. Government-backed initiatives to reduce plastic waste are pushing manufacturers to adopt recyclable materials. As consumer awareness of sustainability increases, companies are transitioning to recycled aluminium as a preferred packaging material. Growing foreign investments and modernized manufacturing facilities further support regional expansion.

By Region

North America

Europe

- Germany

- The U.K.

- France

- Italy

- Russia

- Spain

- Benelux

- Nordic

- Rest of Europe

Asia-Pacific

- China

- Japan

- South Korea

- India

- ANZ

- ASEAN

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Argentina

- Colombia

- Rest of Latin America

Middle East & Africa

- Saudi Arabia

- UAE

- South Africa

- Israel

- Egypt

- Rest of MEA

Competitive Landscape

The competitive landscape of the recycled aluminum packaging market is shaped by strategies focused on technological innovation, circular supply chain integration, and sustainability leadership. Companies aim to secure access to high-quality scrap through long-term contracts, partnerships with collection agencies, and investments in closed-loop recycling systems. Many players are upgrading facilities to include AI sorting, automated inspection, and energy-efficient melting technologies to improve yield and reduce costs. Strategic expansion into emerging regions, increased R&D spending, and collaborations with packaging manufacturers help companies maintain an edge. Market entry barriers such as high capital investment and stringent regulatory requirements further consolidate competitive positioning among established market participants.

Some of the prominent players in the global Recycled Aluminum Packaging are:

- Novelis

- Constellium

- Hydro Aluminium

- Ardagh Group

- Ball Corporation

- Crown Holdings

- Amcor

- Reynolds Consumer Products

- AptarGroup

- CCL Industries

- Silgan Holdings

- UACJ Corporation

- Nippon Light Metal

- Assan Alüminyum

- Hulamin

- Kaiser Aluminum

- Speira

- Alcoa

- Emirates Global Aluminium

- Matalco

- Other Key Players

Recent Developments

- In July 2025, GreenLoop Materials completed a strategic acquisition of Urban Scrap Network, a regional scrap collection and processing company. The deal enhances GreenLoop’s access to high-quality post-consumer aluminium scrap and strengthens its urban recycling footprint. The acquisition supports the company’s goal of building a tightly integrated circular supply chain.

- In March 2025, EcoMetals Corp. introduced a new pharmaceutical-grade recycled aluminium foil designed for blister packs and sterile applications. The product utilizes advanced purification and alloy stabilization technologies that allow recycled feedstock to meet stringent medical safety standards. The launch supports increasing industry demand for sustainable pharmaceutical packaging and aligns with regulatory pushes for lower carbon-intensity materials.

Report Details

| Report Characteristics |

| Market Size (2025) |

USD 8.1 Bn |

| Forecast Value (2034) |

USD 13.7 Bn |

| CAGR (2025–2034) |

6.0% |

| The US Market Size (2025) |

USD 2.0 Bn |

| Historical Data |

2019 – 2024 |

| Forecast Data |

2026 – 2034 |

| Base Year |

2024 |

| Estimate Year |

2025 |

| Report Coverage |

Market Revenue Estimation, Market Dynamics, Competitive Landscape, Growth Factors and etc. |

| Segments Covered |

By Product Type (Cans, Foils, and Aerosol Containers), By Scrap Source (Post-Consumer Scrap and Post-Industrial Scrap), By Application (Food & Beverage Packaging, Personal Care & Cosmetics, and Pharmaceutical Packaging) |

| Regional Coverage |

North America – The US and Canada; Europe – Germany, The UK, France, Russia, Spain, Italy, Benelux, Nordic, & Rest of Europe; Asia-Pacific – China, Japan, South Korea, India, ANZ, ASEAN, Rest of APAC; Latin America – Brazil, Mexico, Argentina, Colombia, Rest of Latin America; Middle East & Africa – Saudi Arabia, UAE, South Africa, Turkey, Egypt, Israel, & Rest of MEA |

| Prominent Players |

Novelis, Constellium, Hydro Aluminium, Ardagh Group, Ball Corporation, Crown Holdings, Amcor, Reynolds Consumer Products, AptarGroup, CCL Industries, Silgan Holdings, UACJ Corporation, Nippon Light Metal, Assan Alüminyum, Hulamin, Kaiser Aluminum, Speira, Alcoa, Emirates Global Aluminium, Matalco, and Other Key Players |

| Purchase Options |

We have three licenses to opt for: Single User License (Limited to 1 user), Multi-User License (Up to 5 Users), and Corporate Use License (Unlimited User) along with free report customization equivalent to 0 analyst working days, 3 analysts working days, and 5 analysts working days respectively. |

Frequently Asked Questions

The Global Recycled Aluminium Packaging Market size is expected to reach a value of USD 8.1 billion in 2025 and is expected to reach USD 13.7 billion by the end of 2034.

Europe is expected to have the largest market share in the Global Recycled Aluminium Packaging Market, with a share of about 46.0% in 2025.

The Recycled Aluminium Packaging Market in the US is expected to reach USD 2.0 billion in 2025.

Some of the major key players in the Global Recycled Aluminium Packaging Market include Ball Corp, Novelis, Amcor and others.

The market is growing at a CAGR of 6.0 percent over the forecasted period.