Market Overview

The Global Recycled Ocean Plastics Market is projected to reach

USD 2.3 billion in 2025, growing at a robust

CAGR of 10.0% to hit

USD 5.4 billion by 2034, driven by rising demand for sustainable materials, circular economy initiatives, and marine plastic recovery efforts.

Recycled ocean plastics refer to plastic waste materials that have been collected from marine environments such as oceans, seas, rivers, and coastal areas, then processed and repurposed into usable raw materials. These plastics originate from various sources, including discarded fishing nets, single-use packaging, plastic bottles, and consumer products that end up in waterways due to poor waste management, littering, or illegal dumping.

Once retrieved, these materials undergo cleaning, sorting, and recycling processes, such as mechanical or chemical recycling, to convert them into new polymers that can be used in the production of sustainable goods. Recycled ocean plastics are gaining importance as a critical solution to reducing marine pollution, conserving biodiversity, and promoting a circular economy.

The global recycled ocean plastics market is witnessing significant momentum due to rising environmental awareness, regulatory initiatives targeting plastic waste, and growing demand for sustainable materials in industries such as textiles, packaging, automotive, and consumer goods. As major corporations commit to reducing their carbon footprints and adopting eco-friendly raw materials, the demand for recycled marine plastics continues to grow.

Public-private collaborations and nonprofit organizations are actively participating in waste retrieval and supply chain integration, ensuring that recovered plastics are effectively utilized in manufacturing. Additionally, consumer preferences are shifting toward brands that prioritize ocean-friendly and ethically sourced materials, creating a strong market pull for products derived from ocean-bound plastics.

This market is characterized by innovations in recycling technologies, strategic partnerships, and heightened focus on traceability and quality assurance. Europe and North America currently lead the global landscape due to supportive legislation, advanced recycling infrastructure, and a mature sustainability culture. Meanwhile, Asia Pacific holds immense potential, especially as countries in the region begin to strengthen their waste interception and recycling systems.

Companies in this sector are investing in advanced sorting, blockchain tracking systems, and scalable processing facilities to enhance material recovery and value. As circular economy principles gain traction, the global recycled ocean plastics market is positioned to play a key role in reducing plastic leakage into marine ecosystems while supporting sustainable development goals.

The US Recycled Ocean Plastics Market

The U.S. Recycled Ocean Plastics Market size is projected to be valued at USD 0.5 billion in 2025. It is further expected to witness subsequent growth in the upcoming period, holding USD 1.2 billion in 2034 at a CAGR of 9.4%.

The U.S. Recycled Ocean Plastics Market is experiencing strong growth momentum, backed by increased environmental regulations, corporate sustainability commitments, and heightened consumer awareness about marine pollution. As one of the largest contributors to global plastic consumption, the United States is also emerging as a key player in ocean plastic recovery and reuse. Federal and state-level policies, such as the Save Our Seas Act and extended producer responsibility (EPR) initiatives, are promoting investments in waste collection, ocean plastic recycling infrastructure, and circular economy practices. Additionally, major brands in the apparel, packaging, and consumer goods sectors are incorporating post-consumer ocean plastics into their supply chains to meet ESG goals and appeal to eco-conscious consumers.

Market growth is further fueled by advanced mechanical and chemical recycling technologies, along with increased collaboration between NGOs, recycling startups, and public agencies. Coastal states such as California, Florida, and New York are leading efforts in marine plastic waste interception and integrating recycled marine polymers into manufacturing.

The fashion and packaging sectors remain the dominant end-users, with companies like Adidas, Unifi (Repreve), and Method leveraging ocean-bound plastic materials for high-visibility product lines. With growing pressure to reduce virgin plastic usage and limit ocean plastic leakage, the U.S. market is positioned to play a crucial role in the global shift toward sustainable materials and marine pollution mitigation.

The European Recycled Ocean Plastics Market

In 2025, Europe’s recycled ocean plastics market is projected to reach a valuation of approximately USD 0.8 billion, of the global market share. This strong positioning is primarily driven by stringent regulatory frameworks, such as the EU Plastics Strategy and Circular Economy Action Plan, which mandate increased use of recycled materials and reduced marine litter. The region also benefits from robust collection infrastructure, active NGO participation, and widespread corporate commitment to sustainability targets. Countries like Germany, the Netherlands, and France are leading adopters, with major fashion, automotive, and consumer goods companies integrating recycled ocean plastics into their supply chains.

Looking ahead, Europe’s recycled ocean plastics market is expected to grow at a steady CAGR of 9.2% from 2025 to 2034. This growth will be supported by continued innovation in recycling technologies, especially in mechanical and chemical processing, alongside rising demand for traceable, eco-friendly materials across industries. Government incentives, extended producer responsibility (EPR) schemes, and consumer pressure are pushing brands to shift away from virgin plastics. Additionally, regional collaboration across the EU and alignment with global climate and marine protection goals will sustain investment flows and reinforce Europe's leadership in the circular marine plastics economy.

The Japanese Recycled Ocean Plastics Market

Japan’s recycled ocean plastics market is estimated to be valued at around USD 0.1 billion in 2025, capturing a modest share of the global market. Despite its smaller size compared to regions like Europe or North America, Japan remains a critical player due to its advanced waste management infrastructure, strong public awareness of marine pollution, and government-backed environmental policies. Initiatives such as the Marine Plastic Litter Countermeasures Act and active participation in the G20 Osaka Blue Ocean Vision reflect the country’s strategic commitment to reducing ocean plastic waste. Key domestic companies in the packaging, FMCG, and textile sectors are adopting recycled ocean plastics to meet sustainability goals and consumer expectations.

Looking forward, Japan's market is projected to grow at a CAGR of 8.1% through 2034, supported by technological innovation in recycling processes, particularly chemical recycling and pyrolysis, that enable higher-quality output from degraded marine plastics. Rising corporate ESG commitments and alignment with international environmental standards are expected to accelerate demand for marine-sourced recycled materials across sectors like electronics, apparel, and automotive. Furthermore, partnerships between private companies, local municipalities, and research institutions are fostering scalable models for ocean plastic recovery and reuse, helping Japan steadily expand its footprint in the global circular plastics economy.

Global Recycled Ocean Plastics Market: Key Takeaways

- Market Value: The global recycled ocean plastics market size is expected to reach a value of USD 5.4 billion by 2034 from a base value of USD 2.3 billion in 2025 at a CAGR of 10.0%.

- By Source of Collection Segment Analysis: Beach & Shoreline Cleanup is anticipated to dominate the source of collection segment, capturing 38.0% of the total market share in 2025.

- By Polymer Type Segment Analysis: Polyethylene Terephthalate (PET) is poised to consolidate its dominance in the polymer type segment, capturing 32.5% of the total market share in 2025.

- By Processing Method Segment Analysis: Mechanical Recycling methods are expected to maintain their dominance in the processing method segment, capturing 62.0% of the total market share in 2025.

- By Distribution Channel Analysis: Direct Sales to Manufacturers are anticipated to dominate the distribution channel segment, capturing 58.0% of the market share in 2025.

- By Application Segment Analysis: Textiles & Fashion applications will lead in the application segment, capturing 34.0% of the market share in 2025.

- By End-User Industry Segment Analysis: The Textile & Apparel Industry will dominate the end-user industry segment, capturing 32.0% of the market share in 2025.

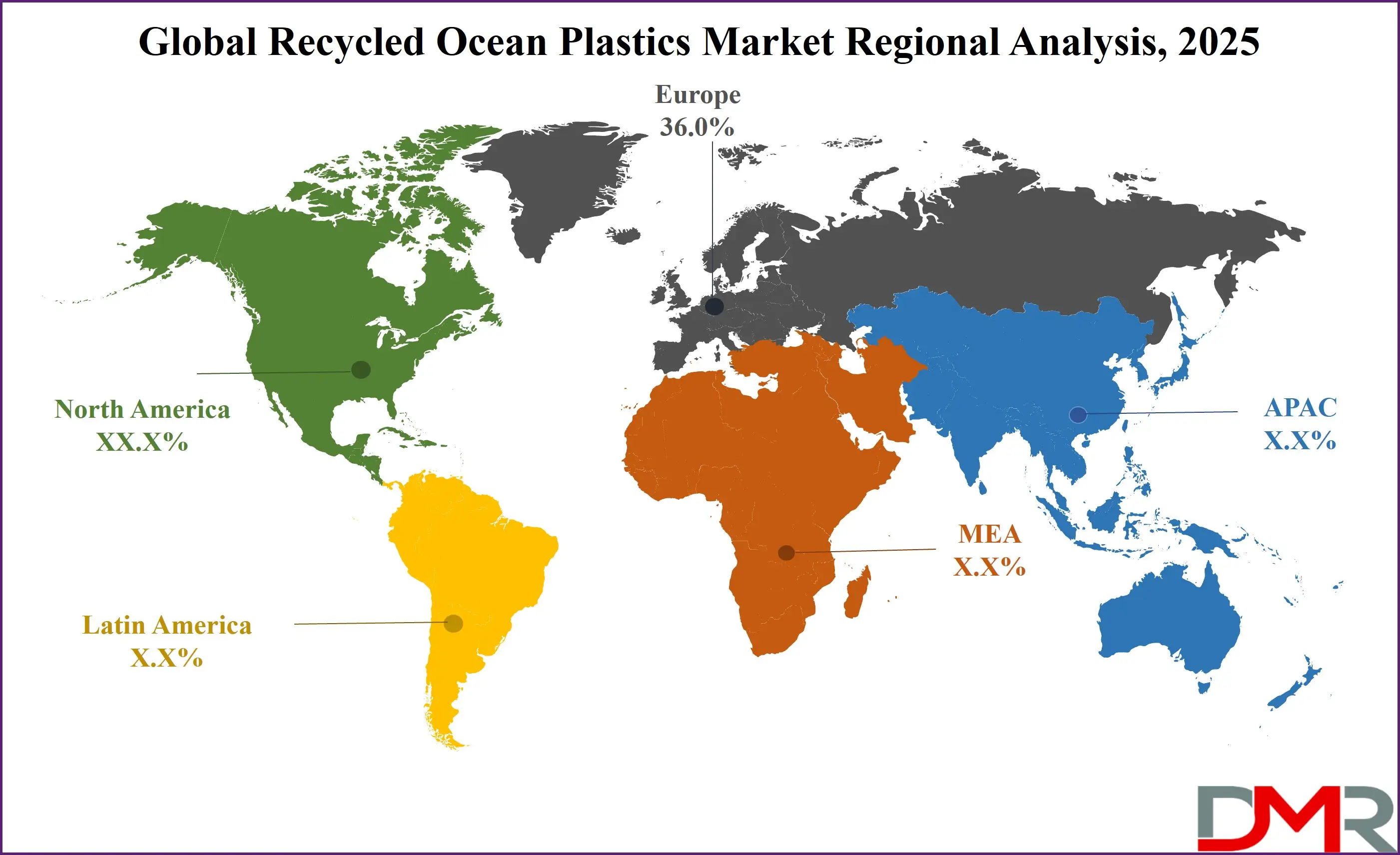

- Regional Analysis: Europe is anticipated to lead the global recycled ocean plastics market landscape with 36.0% of total global market revenue in 2025.

- Key Players: Some key players in the global recycled ocean plastics market are The Ocean Cleanup, Bureo, Parley for the Oceans, Seaqual Initiative, Oceanworks, Plastix, Aquafil, Tide Ocean SA (#tide), Ecoalf, 4ocean, Interface Inc., Adidas, and Other Key Players.

Global Recycled Ocean Plastics Market: Use Cases

- Application in Sustainable Textile Manufacturing: The textile industry has become a key end-user of recycled ocean plastics, particularly polyethylene terephthalate (PET) collected from coastal and marine environments. Recycled PET is processed into polyester fibers used for manufacturing clothing, footwear, bags, and outdoor gear. The demand is driven by growing consumer awareness, regulatory mandates on sustainable production, and environmental certifications that promote the use of eco-friendly raw materials. This segment supports the circular economy by diverting marine waste into high-performance textile applications.

- Integration into Eco-Conscious Packaging Solutions: Recycled ocean plastics, particularly high-density polyethylene (HDPE) and polypropylene (PP), are widely used in the production of rigid and flexible packaging materials. These include bottles, caps, containers, and films used across personal care, food and beverage, and household product segments. The packaging sector adopts recycled marine plastics to meet corporate sustainability targets and comply with extended producer responsibility (EPR) laws. Recycled content labeling and plastic neutrality commitments further accelerate the incorporation of ocean plastics in primary packaging formats.

- Utilization in Automotive Components and Interiors: Recycled ocean plastics are being utilized by automotive manufacturers for non-structural components such as floor carpets, interior trims, seat covers, and dashboard materials. Nylon and polypropylene recovered from discarded fishing gear and marine litter are processed into performance-grade materials suitable for interior applications. This use case aligns with the automotive industry’s broader push toward lightweight, sustainable, and low-emission vehicles. Integration of marine-sourced recycled polymers supports the industry’s environmental, social, and governance (ESG) benchmarks and aligns with green mobility regulations.

- Adoption in Consumer Durable and Lifestyle Goods: Recycled ocean plastics are being used in the production of consumer durable goods, including eyewear, watches, mobile accessories, luggage, and kitchenware. These products often utilize a mix of post-consumer ocean-bound plastics and other recovered marine materials to create durable and aesthetically marketable goods. This application is gaining traction among environmentally conscious consumers and brands seeking to reduce virgin plastic dependency while enhancing the sustainability profile of their product portfolios.

Global Recycled Ocean Plastics Market: Stats & Facts

- United States – U.S. EPA & NOAA

- Sources: U.S. Environmental Protection Agency (EPA), National Oceanic and Atmospheric Administration (NOAA)

- In 2018, the PET bottle recycling rate was 29.1%; HDPE natural bottles were recycled at 29.3%.

- Overall plastic recycling in the U.S. was just 8.7%, amounting to 3 million tons.

- In 2019, only 5% of plastic waste was recycled; 86% went to landfills, 9% was incinerated.

- About 14 million tons of plastic enter the ocean each year.

- Up to 90% of floating marine debris and shoreline waste is plastic.

- European Union – European Environment Agency (EEA) & Plastics Europe

- Sources: EEA, Plastics Europe via European Commission reporting

- Europe’s recycled ocean plastics market is expected to grow at 9.2% CAGR.

- Plastics Europe has committed €7.2 billion for chemical recycling infrastructure by 2030.

- The EU has implemented a ban on certain single-use plastics as of 2021, impacting marine litter input.

- OECD (Organisation for Economic Co-operation and Development)

- Source: OECD Global Plastics Outlook

- Globally, only 9% of plastic waste is recycled.

- 15% is collected for recycling, but 40% of that is ultimately disposed of as residue.

- 50% of plastic waste ends up in landfills; 22% is either burned or dumped in uncontrolled settings.

- Global plastic production is projected to nearly triple by 2060 from 460 million tonnes in 2019.

- In 2019, approximately 6 million tonnes of plastic waste entered aquatic environments.

- Japan – Ministry of the Environment (MoE Japan)

- Sources: Ministry of the Environment, Japan & OECD Japan profile

- In 2019, Japan had a 27% recycling rate for plastics.

- 49% of plastic waste was incinerated, and 24% was landfilled.

- Japan’s advanced chemical recycling systems are among the most developed globally.

- Japan is a signatory to the G20 Osaka Blue Ocean Vision, aiming for zero additional marine plastic by 2050.

- Thailand – Pollution Control Department (PCD Thailand)

- Source: Thailand’s Ministry of Natural Resources and Environment

- Thailand generates 2 million tonnes of plastic waste annually.

- Only 500,000 tonnes are reused; an average Thai uses 8 plastic bags per day.

- Thailand’s 23 coastal provinces are responsible for dumping about 1 million tonnes of waste into the sea each year.

- China – Ministry of Ecology and Environment (MEE China)

- Source: China Government Reports via OECD/UNEP compilations

- China accounted for approximately 27.7% of mismanaged plastic waste entering oceans as of the last OECD report.

- Banned the import of plastic waste in 2018, triggering a global reconfiguration of plastic recycling flows.

- Germany – Federal Environment Agency (UBA Germany)

- Source: Government of Germany / OECD

- In 2010, Germany recycled 33% of its plastic waste.

- 65% was incinerated for energy recovery, and only 2% was landfilled.

- Germany leads the EU in mechanical and closed-loop recycling innovation.

- Global Treaties & UN Data – UNEP, G20, G7, Global Partnership on Marine Litter

- Sources: UNEP, UN Ocean Conference, G7 Environment Ministers’ Meetings

- An estimated 11 million metric tons of plastic enter the ocean each year.

- This figure is expected to triple by 2040 if no interventions occur.

- Only 14–18% of global plastic waste is formally collected for recycling.

Global Recycled Ocean Plastics Market: Market Dynamics

Global Recycled Ocean Plastics Market: Driving Factors

Rising Demand for Circular Economy IntegrationGovernments, corporations, and global organizations are adopting circular economy frameworks to combat the mounting issue of plastic waste, particularly in marine environments. Recycled ocean plastics play a vital role in this shift by providing a sustainable raw material alternative that supports reduced reliance on virgin petroleum-based plastics. With growing legislative support and corporate sustainability reporting requirements, businesses across industries such as fashion, packaging, and automotive are incorporating ocean-bound plastic into their sustainable supply chains, driving consistent market growth.

Growing Consumer Awareness and Ethical Purchasing

The global rise in consumer environmental awareness has significantly influenced buying behaviors, especially among younger demographics who prioritize ethical sourcing and low environmental impact. Products made from recycled marine plastics appeal to eco-conscious consumers looking to support ocean conservation efforts through their purchases. This surge in green consumerism has pushed brands to highlight ocean plastic recovery as part of their environmental branding, leading to greater product differentiation and increased market penetration.

Global Recycled Ocean Plastics Market: Restraints

High Cost and Complexity of Ocean Plastic Collection

Unlike traditional plastic recycling, collecting plastics from marine and coastal environments involves significant logistical, operational, and financial challenges. Factors such as contamination, degradation from saltwater exposure, and retrieval from remote or deep-sea locations increase the cost per unit of usable material. These added complexities reduce profitability and scalability, limiting the participation of smaller companies and slowing down wider adoption in cost-sensitive industries.

Lack of Standardization in Quality and Certification

One of the critical barriers to mainstream use of recycled ocean plastics is the absence of universally accepted standards for product quality, traceability, and certification. Inconsistent supply chain data and varying levels of polymer purity can deter large manufacturers from incorporating marine plastics into high-spec applications. This limits integration in regulated industries such as automotive and electronics, where stringent quality controls are non-negotiable.

Global Recycled Ocean Plastics Market: Opportunities

Emerging Technologies in Marine Debris Recycling

The evolution of advanced recycling technologies, including chemical depolymerization and AI-enabled sorting systems, presents significant opportunities for enhancing the recovery and reuse of marine plastics. These innovations allow for the processing of mixed, contaminated, or degraded ocean waste into high-value resins suitable for premium applications. Investment in these solutions by the public and private sectors can unlock new revenue streams and dramatically expand the scope of marine debris recycling.

Strategic Public-Private Partnerships

Collaboration between NGOs, government bodies, and private enterprises is enabling large-scale marine waste retrieval projects and end-to-end ocean plastic recovery ecosystems. Initiatives such as plastic credit programs, localized waste interception networks, and coastal community engagement models provide a platform for sustainable collection, processing, and market integration. These partnerships foster greater access to feedstock and open new geographical markets, especially in developing coastal economies.

Global Recycled Ocean Plastics Market: Trends

Traceable and Verified Ocean Plastic Supply Chains

There is a growing emphasis on traceability and transparency in recycled plastic sourcing. Brands and consumers are demanding blockchain-verified supply chains and third-party certifications that validate the origin and environmental impact of the ocean plastic used. This trend is driving innovation in digital tracking tools and lifecycle assessments, boosting consumer trust and encouraging responsible sourcing across the industry.

Integration of Recycled Ocean Plastics in Premium Product Lines

Once limited to basic applications, recycled marine polymers are now making their way into high-end and luxury product categories. From designer apparel and sports gear to tech accessories and electric vehicle interiors, manufacturers are showcasing ocean plastics as a symbol of innovation and environmental commitment. This shift positions recycled ocean plastics as not just an eco-friendly choice but also a value-added material that supports brand prestige and environmental storytelling.

Global Recycled Ocean Plastics Market: Research Scope and Analysis

By Source of Collection Analysis

Beach and shoreline cleanup is expected to lead the source of collection segment in the recycled ocean plastics market, accounting for 38.0% of the total market share in 2025. This dominance is primarily driven by the accessibility and cost-effectiveness of collecting plastics along coastal areas, where waste tends to accumulate due to ocean currents and human activity. These locations allow for large-scale manual and mechanical collection, often supported by community clean-up initiatives, NGOs, and local governments. The relative ease of collection and lower contamination levels compared to deep-sea plastics make shoreline waste more suitable for mechanical recycling processes, further boosting its preference among recyclers.

In contrast, deep ocean and sea surface collection, while vital for long-term environmental health, hold a smaller market share due to the high operational complexity and cost involved. Plastics in these zones often degrade due to prolonged exposure to saltwater and UV radiation, making them harder to process. Moreover, retrieving materials from remote marine zones requires specialized vessels and equipment, often limiting participation to large-scale environmental organizations or technology-backed ventures. Despite these challenges, technological advancements and global marine conservation efforts are expected to slowly increase the viability of deep-sea collection over the long term.

By Polymer Type Analysis

Polyethylene Terephthalate (PET) is projected to maintain a leading position in the polymer type segment of the recycled ocean plastics market, accounting for 32.5% of the total market share in 2025. This dominance is primarily due to the widespread use of PET in consumer packaging, especially for bottles and food containers, which frequently end up in marine environments. PET’s recyclability, lightweight nature, and established recycling infrastructure make it a preferred material for recovery and reuse. Additionally, recycled PET (rPET) is in high demand across industries such as textiles, automotive, and packaging, as it can be easily processed into fibers and new containers without significant degradation in quality.

High-Density Polyethylene (HDPE) also plays a crucial role in this market segment, with growing applications in recycled products like detergent bottles, pipes, crates, and cosmetic packaging. HDPE is valued for its strength, resistance to moisture and chemicals, and ease of processing, making it a practical choice for a wide range of rigid packaging solutions. While it holds a smaller share compared to PET, its popularity is rising due to growing recovery from ocean-bound waste and coastal cleanups, as well as industry efforts to develop high-quality post-consumer recycled HDPE (rHDPE) suitable for both food-grade and industrial applications.

By Processing Method Analysis

Mechanical recycling is anticipated to remain the dominant processing method in the recycled ocean plastics market, securing 62.0% of the total market share in 2025. This method involves the physical processes of sorting, cleaning, shredding, and reprocessing plastic waste into usable raw materials without altering the chemical structure of the polymers. Mechanical recycling is favored due to its relatively low cost, simpler technology, and established infrastructure, particularly for common plastics like PET and HDPE retrieved from shorelines and coastal areas. Its compatibility with large-scale operations and ability to produce recycled content suitable for textiles, packaging, and other consumer goods further solidifies its market leadership.

Chemical recycling, while currently holding a smaller share, is gaining attention as a complementary solution for handling complex and contaminated ocean plastic waste. This method breaks down polymers into their original monomers or other basic chemicals, allowing for the recycling of plastics that are otherwise difficult to process mechanically, such as multi-layer packaging or degraded materials. Although chemical recycling involves higher costs and technological requirements, it offers long-term potential for improving overall recycling rates and material circularity, especially as innovations and investments in this space continue to grow.

By Distribution Channel Analysis

Direct sales to manufacturers are expected to lead the distribution channel segment in the recycled ocean plastics market, capturing 58.0% of the market share in 2025. This dominance stems from the growing preference of large-scale manufacturers, particularly in packaging, textiles, automotive, and consumer goods, for securing consistent, bulk quantities of recycled marine plastics directly from processors. Direct sales offer manufacturers greater control over material specifications, pricing, and supply chain integration, enabling them to meet sustainability goals more efficiently. It also facilitates long-term partnerships, ensuring traceability and compliance with environmental standards and certifications.

The retail and online distribution segment, although comparatively smaller, is gaining traction as consumer awareness of ocean plastic pollution rises. This channel typically caters to small and medium-sized enterprises, craft producers, and eco-conscious consumers who purchase recycled ocean plastic resins, fibers, or finished goods through e-commerce platforms or specialty stores. Online platforms also support transparent product sourcing and storytelling around ocean plastic recovery, appealing to niche markets and sustainability-focused buyers. As demand for traceable and ethical materials continues to grow, the retail and online segment is expected to play a supporting yet important role in market expansion.

By Application Analysis

Textiles and fashion are projected to dominate the application segment of the recycled ocean plastics market in 2025, holding a 34.0% share. This dominance is primarily driven by the rapid adoption of recycled polyester (rPET) derived from ocean plastics by apparel, footwear, and outdoor gear manufacturers. Increasing consumer demand for eco-friendly clothing, integrated with corporate sustainability commitments and circular economy initiatives, has led brands to integrate ocean-derived fibers into their product lines. The fashion sector also benefits from the marketing appeal of using ocean-recovered materials, making it a compelling value proposition for both premium and mass-market brands focused on environmental responsibility.

The packaging segment, while slightly behind textiles, represents a significant and fast-growing portion of the market. Recycled ocean plastics are used to produce rigid and flexible packaging solutions, particularly for personal care, food and beverage, and household products. The shift toward sustainable packaging is fueled by regulatory pressures on plastic usage, corporate commitments to recycled content, and consumer demand for environmentally responsible brands. While ocean plastics in packaging face technical challenges such as material purity and compliance for food-grade use, advancements in sorting and cleaning technologies are helping to expand their adoption, especially in non-food packaging formats.

By End-User Industry Analysis

The textile and apparel industry is expected to dominate the end-user industry segment of the recycled ocean plastics market, accounting for 32.0% of the market share in 2025. This is largely due to the growing integration of recycled marine plastics, particularly rPET, into clothing, footwear, and accessories. Major global brands are adopting ocean plastics as part of their sustainable sourcing strategies, appealing to environmentally conscious consumers and complying with ESG goals. The use of ocean-derived fibers in both performance wear and everyday fashion reflects the industry's strong push toward circularity and reduced environmental impact, further accelerating demand from this sector.

The FMCG and beverage industry also represents a substantial and expanding segment in the recycled ocean plastics market. This sector utilizes recycled ocean plastics primarily in the manufacturing of bottles, containers, and caps for products such as drinks, cosmetics, and cleaning agents. With growing regulatory scrutiny on single-use plastics and rising consumer preference for sustainable packaging, companies in this industry are adopting post-consumer marine plastics to enhance brand image and reduce environmental footprints. While food-grade safety and consistency pose challenges, ongoing innovations in processing and material quality are helping facilitate broader integration of ocean plastics in FMCG packaging applications.

The Recycled Ocean Plastics Market Report is segmented on the basis of the following

By Source of Collection

- Beach & Shoreline Cleanup

- Deep Ocean & Sea Surface

- River Waste Interception

- Fishing Gear Recovery

By Polymer Type

- Polyethylene Terephthalate (PET)

- High-Density Polyethylene (HDPE)

- Polypropylene (PP)

- Low-Density Polyethylene (LDPE)

- Nylon

- Others

By Processing Method

- Mechanical Recycling

- Chemical Recycling

- Energy Recovery

By Distribution Channel

- Direct Sales to Manufacturers

- Retail/Online

- Third-Party Distributors

By Application

- Textiles & Fashion

- Packaging

- Consumer Goods

- Automotive & Transportation

- Construction Materials

- Industrial Use

By End-User Industry

- Textile & Apparel Industry

- FMCG & Beverage Industry

- Electronics & Consumer Goods

- Automotive

- Retail & Commercial Packaging

- Construction & Infrastructure

Global Recycled Ocean Plastics Market: Regional Analysis

Region with the Largest Revenue Share

Europe is expected to lead the global recycled ocean plastics market in 2025, accounting for 36.0% of total market revenue. This regional dominance is driven by the continent’s strong regulatory framework promoting plastic waste reduction, extended producer responsibility (EPR) programs, and circular economy initiatives. The European Union’s stringent environmental directives and widespread adoption of sustainable manufacturing practices have encouraged both private and public sectors to invest heavily in marine plastic recovery and recycling infrastructure. Additionally, heightened consumer awareness and demand for eco-friendly products in countries like Germany, France, and the Netherlands have further fueled the integration of recycled ocean plastics across industries such as fashion, automotive, and packaging.

ℹ

To learn more about this report –

Download Your Free Sample Report Here

Region with significant growth

The Asia Pacific region is projected to witness the highest CAGR in the global recycled ocean plastics market during the forecast period, driven by growing coastal pollution, rapid industrialization, and growing awareness of sustainable practices. Countries such as China, India, Indonesia, and the Philippines are stepping up efforts to combat marine plastic waste through national cleanup programs, waste management reforms, and partnerships with global sustainability organizations. The region’s expanding manufacturing base and rising consumer demand for eco-conscious products are encouraging both local and international companies to invest in recycled ocean plastic solutions, making Asia Pacific a key growth engine for the market.

By Region

North America

Europe

- Germany

- The U.K.

- France

- Italy

- Russia

- Spain

- Benelux

- Nordic

- Rest of Europe

Asia-Pacific

- China

- Japan

- South Korea

- India

- ANZ

- ASEAN

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Argentina

- Colombia

- Rest of Latin America

Middle East & Africa

- Saudi Arabia

- UAE

- South Africa

- Israel

- Egypt

- Rest of MEA

Global Recycled Ocean Plastics Market: Competitive Landscape

The global competitive landscape of the recycled ocean plastics market is characterized by a mix of established multinational corporations, specialized sustainability startups, and nonprofit-led initiatives, all competing to scale innovative recycling solutions and secure sustainable supply chains. Key players such as Aquafil, Oceanworks, and Plastix are leveraging advanced recycling technologies and long-term sourcing partnerships to maintain a competitive edge, while companies like Adidas and Interface are integrating marine plastics into their core product lines to strengthen ESG positioning.

Additionally, collaborative models involving NGOs and coastal communities, like those seen with the Seaqual Initiative and Plastic Bank, are gaining traction for their dual impact on environmental restoration and social empowerment. The market is also witnessing increased mergers, strategic alliances, and investments aimed at expanding production capacity, enhancing traceability, and meeting growing regulatory and consumer demands for ethical, ocean-friendly materials.

Some of the prominent players in the global recycled ocean plastics market are:

- The Ocean Cleanup

- Bureo

- Parley for the Oceans

- Seaqual Initiative

- Oceanworks

- Plastix

- Aquafil

- Tide Ocean SA (#tide)

- Ecoalf

- 4ocean

- Interface Inc.

- Adidas

- Patagonia

- Method Products

- Norton Point

- Resynergi

- Repreve (by Unifi, Inc.)

- Plastic Bank

- TerraCycle

- Waterhaul

- Other Key Players

Global Recycled Ocean Plastics Market: Recent Developments

- June 2025: Kia introduced a limited-edition trunk liner for its new EV3 model, crafted using ocean plastics recovered from the Great Pacific Garbage Patch by The Ocean Cleanup.

- July 2024: Method unveiled household cleaning bottles made from 100% recycled coastal plastic through a collaboration with SC Johnson and Plastic Bank.

- September 2023: Greenback Recycling Technologies acquired UK-based Enval Ltd., integrating microwave-assisted recycling technology for multi-layered plastics.

- Early 2024 (projected start in 2025): LyondellBasell acquired PreZero’s mechanical recycling assets in California, expanding its capacity for processing rigid ocean-bound plastics.

- 2021–2023: CleanHub secured over €10 million across funding rounds, including a €6.4 million Series A, to build digital traceability and collection platforms for ocean-bound plastic waste.

- June 2025: A coalition of development banks (including the EIB and Asian Development Bank) pledged €3 billion toward ocean plastic pollution prevention and recycling infrastructure by 2030.

Report Details

| Report Characteristics |

| Market Size (2025) |

USD 2.3 Bn |

| Forecast Value (2034) |

USD 5.4 Bn |

| CAGR (2025–2034) |

10.0% |

| Historical Data |

2019 – 2024 |

| The US Market Size (2025) |

USD 0.5 Bn |

| Forecast Data |

2025 – 2033 |

| Base Year |

2024 |

| Estimate Year |

2025 |

| Report Coverage |

Market Revenue Estimation, Market Dynamics, Competitive Landscape, Growth Factors, etc. |

| Segments Covered |

By Source of Collection (Beach & Shoreline Cleanup, Deep Ocean & Sea Surface, River Waste Interception, and Fishing Gear Recovery), By Polymer Type (Polyethylene Terephthalate [PET], High-Density Polyethylene [HDPE], Polypropylene [PP], Low-Density Polyethylene [LDPE], Nylon, and Others), By Processing Method (Mechanical Recycling, Chemical Recycling, and Energy Recovery), By Distribution Channel (Direct Sales to Manufacturers, Retail/Online, and Third-Party Distributors), By Application (Textiles & Fashion, Packaging, Consumer Goods, Automotive & Transportation, Construction Materials, and Industrial Use), and and By End-User Industry (Textile & Apparel Industry, FMCG & Beverage Industry, Electronics & Consumer Goods, Automotive, Retail & Commercial Packaging, and Construction & Infrastructure). |

| Regional Coverage |

North America – US, Canada;

Europe – Germany, UK, France, Russia, Spain, Italy, Benelux, Nordic, Rest of Europe;

Asia-Pacific – China, Japan, South Korea, India, ANZ, ASEAN, Rest of APAC;

Latin America – Brazil, Mexico, Argentina, Colombia, Rest of Latin America;

Middle East & Africa – Saudi Arabia, UAE, South Africa, Turkey, Egypt, Israel, Rest of MEA

|

| Prominent Players |

The Ocean Cleanup, Bureo, Parley for the Oceans, Seaqual Initiative, Oceanworks, Plastix, Aquafil, Tide Ocean SA (#tide), Ecoalf, 4ocean, Interface Inc., Adidas, and Other Key Players. |

| Purchase Options |

We have three licenses to opt for: Single User License (Limited to 1 user),

Multi-User License (Up to 5 Users), and

Corporate Use License (Unlimited User) along with free report customization equivalent to

0 analyst working days, 3 analysts working days, and 5 analysts working days respectively.

|

Frequently Asked Questions

How big is the global recycled ocean plastics market?

▾ The global recycled ocean plastics market size is estimated to have a value of USD 2.3 billion in 2025 and is expected to reach USD 5.4 billion by the end of 2034.