Market Overview

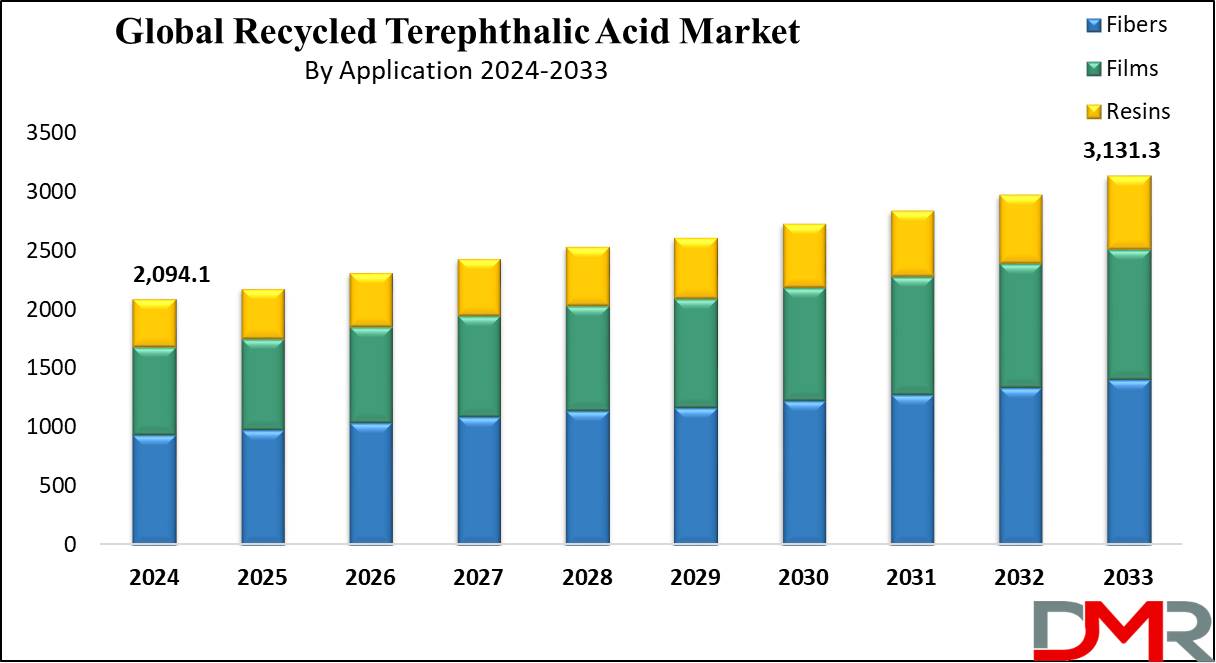

The Global

Recycled Terephthalic Acid Market size is expected to reach a

value of USD 2,094.1 million in 2024, and it is further anticipated to reach a market

value of USD 3,131.3 million by 2033 at a

CAGR of 4.6%.

The global r-PTA market, being the material, is growing so fast due to the influx of industries that have started to seek more sustainable alternatives for their conventional materials. R-PTA manufactured from recycled polyethylene terephthalate has wide applications, from packaging plastic bottles to polyester textiles. Chemical recycling is the final transformation of post-consumer waste into high-quality r-PTA, paving a competitive pathway toward virgin PTA concerning economic and ecological viability in textiles, packaging, and automotive, among others.

The global drive toward sustainable practices and circular economy models has played a very important role in accelerating the adoption of r-PTA. Companies are actively pursuing ways to reduce their carbon footprint, hence adopting r-PTA as a substitute for virgin materials. Governments and environmental agencies, especially those in North America and Europe, have enacted stringent regulations and provided incentives that encourage the adoption of recycled products. This regulatory environment, together with consumer awareness regarding plastic waste and pollution, tends to boost the growth of the r-PTA market remarkably.

Advanced chemical recycling technologies have been able to realize high-purity output, whose quality has matched the industry standard quality criteria through processes such as hydrolysis. This quality of output has made r-PTA a resource worthy of being utilized by any given manufacturer who is keen on performance and durability for the product without reverting to fossil-fuel-based PTA. Giant participants in the industry invest a lot in these technologies while scaling up production capacities to meet improved demand across the globe.

With a large manufacturing industry and demand for textiles and packaging materials, the Asia-Pacific region leads in terms of both production and consumption. North America and Europe remain key markets, however, driven by regulatory compliance and customer demands for more eco-friendly alternatives. Overall, these put together drive strong growth in the global r-PTA market.

The US Recycled Terephthalic Acid Market

The US Recycled Terephthalic Acid Market is projected to be valued at USD 597.0 million in 2024. It is expected to witness subsequent growth in the upcoming period as it holds USD 873.8 million in 2033 at a CAGR of 4.3%.

The U.S. recycled terephthalic acid (r-PTA) market continues to forge ahead, mainly underpinned by regulatory support, corporate focus on sustainability, and strong consumer demand for 'green' products. Expected federal policy and state policies related to waste reduction and incentives for building recycling infrastructure will set the stage for future capacity in the production and use of textiles, packaging, automotive, and other industries that utilize r-PTA.

Major US companies are incorporating r-PTA into their supply chains to reduce use of virgin plastics, meet regulatory requirements, and appeal to consumer interest in sustainable products. Large brands, ranging from Coca-Cola to Nike, are increasing their usage of r-PTA toward ambitious targets for sustainability; this drives huge demand for high-quality recycled materials. This trend has manifested in the packaging industry, where there is an increased use of r-PTA to produce recyclable and reusable packaging solutions.

The U.S. also holds an added advantage in terms of well-established infrastructure in PET recycling, which provides the feedstock for r-PTA production and thus a stable supply chain for the manufacturers. Yet, advanced recycling technologies raise certain worries, as well as the competition for PET waste, tests the production capacity limit. Nonetheless, the market growth potential remains great, as several industries increasingly use r-PTA to comply with government regulations and help achieve the concept of a circular economy and tackle environmental issues, therefore putting the United States in a better position in the global r-PTA market.

Key Takeaways

- Global Market Value: The Global Recycled Terephthalic Acid Market size is estimated to have a value of USD 2,094.1 million in 2024 and is expected to reach USD 3,131.3 million by the end of 2033.

- The US Market Value: The US Recycled Terephthalic Acid Market is projected to be valued at USD 873.8 million in 2033 from a base value of USD 597.0 million in 2024 at a CAGR of 4.3%.

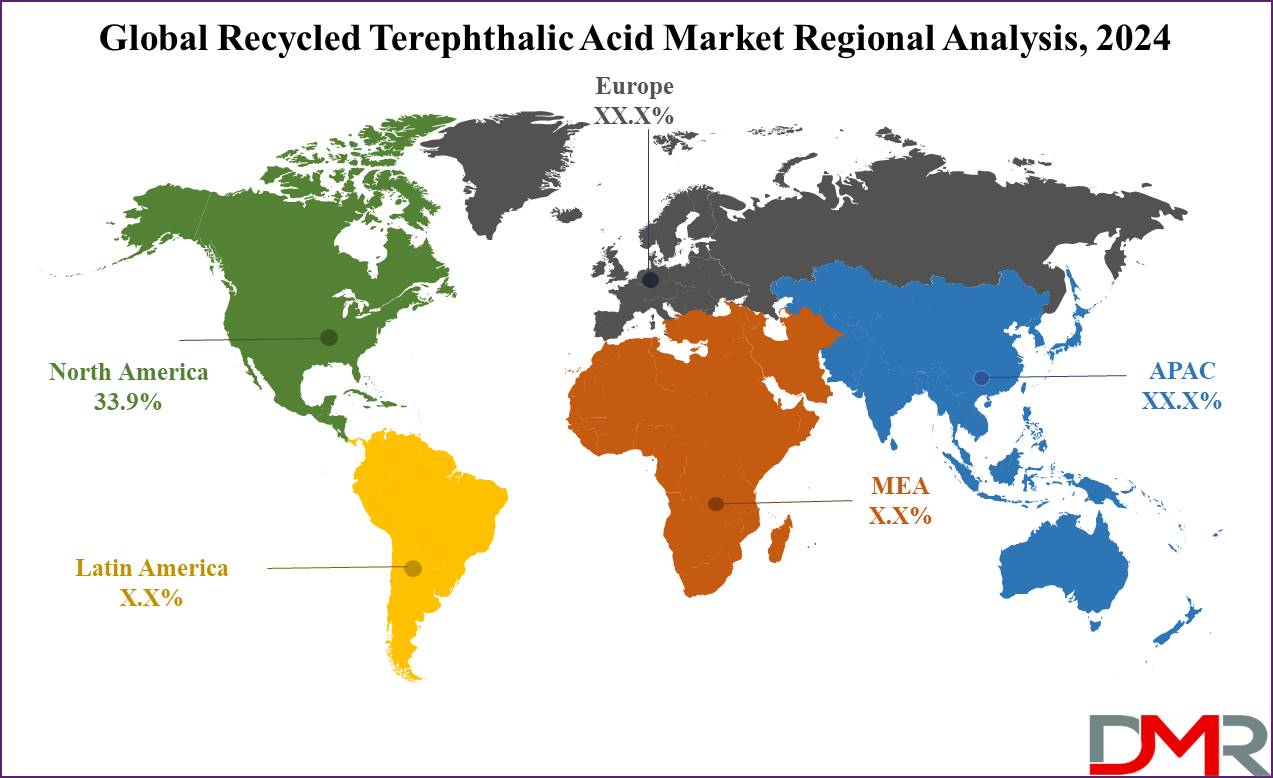

- Regional Analysis: North America is expected to have the largest market share in the Global Recycled Terephthalic Acid Market with a share of about 33.9% in 2024.

- Key Players: Some of the major key players in the Global Recycled Terephthalic Acid Market are Indorama Ventures Public Company Limited, Far Eastern New Century Corporation, Zhejiang Haili Environmental Technology Co., Ltd., Reliance Industries Limited, and many others.

- Global Growth Rate: The market is growing at a CAGR of 4.6 percent over the forecasted period.

Use Cases

- Textiles Manufacturing: r-PTA finds its application in the manufacture of polyester fibers within the textile industry assigned to fabrics. This reduces the requirement for virgin material, hence complementing sustainable fashion trends.

- Plastic Packaging: r-PTA normally finds its application in PET bottles and containers; this is where various manufacturers can provide eco-friendly packaging solutions, demand for which is on the rise for environmentally friendly products, with strict packaging regulations in place.

- Automotive Interiors: Most automotive manufacturers use r-PTA in upholstery and carpeting of cars to have a lower carbon footprint and also to meet the growing demand for 'green' vehicles from consumers.

- Construction Materials: r-PTA is used in the production of insulation and other non-load-bearing construction components out of recycled PET material. These make the building durable and help in green building practices.

Market Dynamic

Trends

Shift Toward Circular EconomyThe more the concept of the circular economy model is adopted, wherein minimum waste is generated with reduced dependence on virgin resources through recycling and reusing materials, by various industries worldwide. From the perspective of r-PTA, this model offers substantial growth opportunities with its substitution for conventional terephthalic acid.

R-PTA thus evolves as a preferred choice for companies that are now focusing hard on adopting sustainable business practices and reducing their environmental footprint within sectors such as textiles, packaging, and consumer goods. In addition, this trend of circular economy meets the corporate environmental goals and positions r-PTA as an integral contributor to a company's circular strategy creates value for closed-loop recycling, and adds value to the brand reputation.

Technological Innovations in Recycling

It is also expected that rapid technological improvements in the hydrolysis and enzymatic processes will also help advance the recycling methodologies in the r-PTA industry. These innovations efficiently degrade PET wastes, and the r-PTA that is finally produced meets the strict material quality standards for commercial use by the respective industries.

Equipped with this new technology, manufacturers can produce r-PTA on a mass scale and with much-needed purity, opening up its usage in high-demand application areas that place stringent specifications on materials. This trend is critical because the achievement of such a trend not only optimizes resources but also makes the production process of r-PTA more viable and sustainable, developing opportunities for market entry that had not previously been accessible.

Growth Drivers

Regulatory Support and Environmental Policies

Various countries' governments enact policies and laws that encourage the use of recyclates to reduce the problems associated with pollution, such as plastic waste and greenhouse gas emissions. Most governments provide certain incentives in manufacturing products from recycled materials like r-PTA mainly in industries where ecological sensitivity is highly questioned, for example, in food packaging and garments.

These supportive policies encourage more and more companies to implement r-PTA in their growth initiatives while seeking to try and work within set regulations and improve their green image. In a region with quite high environmental standards, regulatory support is resumed as one of the key drivers for r-PTA demand.

Rising Consumer Demand for Sustainability

Increasing awareness amongst consumers concerning environmental issues is forcing brands to introduce sustainable products into the market. It therefore means that consumers are expecting brands to minimize the use of plastics in their products while increasing the usage of recyclable materials, thus making r-PTA an attractive product for companies that are willing to meet consumer expectations based on sustainability matters.

The eco-oriented trends have set a competitive environment whereby brands are incorporating r-PTA in their portfolio to meet market demand, thus pushing demand for the chemical in the textile, home goods, and packaging industries.

Growth Opportunities

Expanding Applications in Textiles and Packaging

r-PTA is becoming increasingly sought after by the textile and packaging industries as a substitute for raw material feedstock. As applications in these industries have been striving for further carbon footprint reduction, the environmental and economic merits of r-PTA look very promising. The textile application, in particular, has the highest demand for r-PTA because of the increasing number of recycled polyester fibers used in ecologically friendly apparel.

The packaging industry also pays attention to the potential of r-PTA for the production of sustainable containers for food and beverages, thus being one of the key materials in circular economy-related strategies.

Emergence of New Sectors

Besides conventional applications, r-PTA has gained interest from new industries, which include the automotive and construction industries, for its environmental benefits and durability. Automotive industries are in the process of researching the usage of r-PTA-based materials in car interiors, while construction industries are open to r-PTA regarding its usage as an environmentally friendly building material. Given that most industries in future times would have a strategic focus on sustainability along the value chain, the growth potential markets for r-PTA have been substantial with entry into the said industries.

Restraints

High Costs of Recycling Infrastructure

Establishing and operating such state-of-the-art recycling facilities is extremely capital-intensive, particularly since the processes involved are complex, such as hydrolysis used in r-PTA production. Smaller manufacturers have considerably lower capabilities for dealing with these costs, which in turn impairs their possibilities of entering the r-PTA market or expanding their production capacities. Moreover, several facility upgrade costs and strict environmental standards also add to the operational costs for the manufacturers, acting as another possible growth hindrance for the market.

Limited Supply of PET Waste

Concomitantly with this demand, a high-quality and consistent supply of PET wastes becomes much harder to secure. The global focus on recycling has brought fierce competition for PET wastes, consequently constricting the feedstock that ultimately could dampen production levels of r-PTA. An unreliable supply of PET wastes would make it tough for r-PTA manufacturers to meet specific market demands in new applications.

Research Scope and Analysis

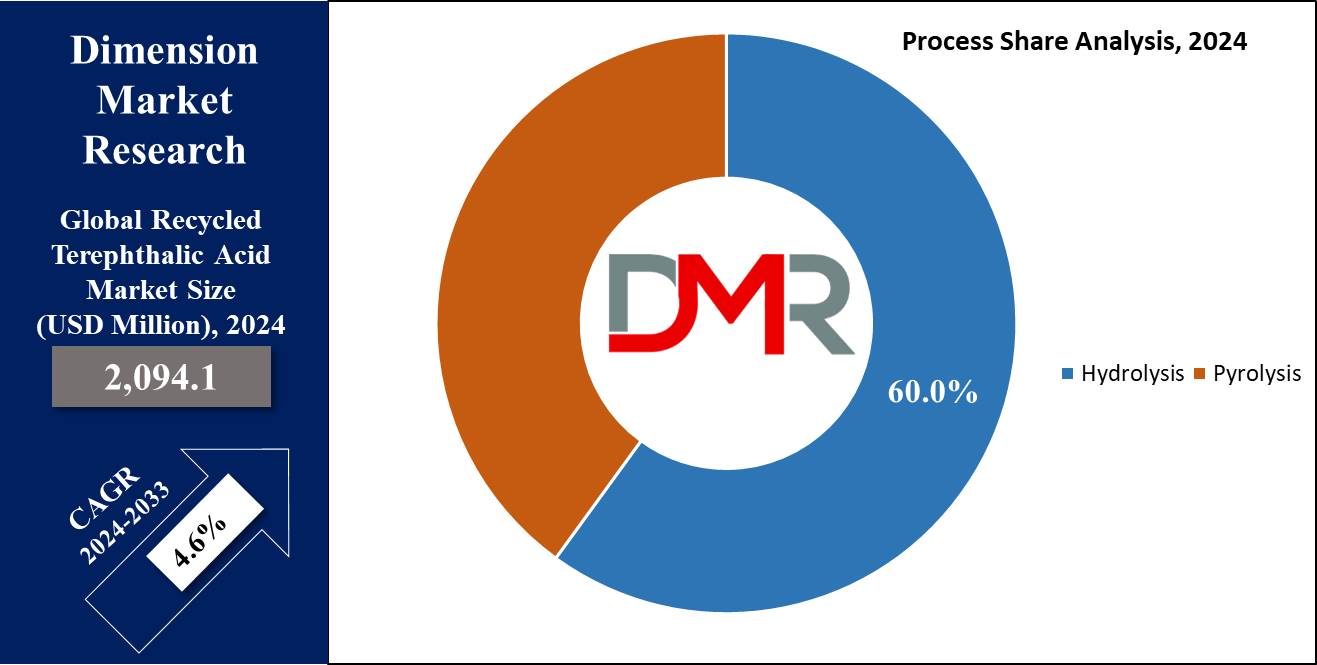

By Process

Hydrolysis is projected to lead the r-PTA market as it is anticipated to hold 60.0% of the market share in 2024. Hydrolysis is a dominant process for r-PTA and has become the preferred technology mainly because of its efficiency, with high-quality r-PTA being almost identical to virgin PTA. The hydrolysis process involves a chemical reaction wherein PET waste is depolymerized back into its virgin monomers, which then can be purified into r-PTA suitable for high-value applications.

Whereas hydrolysis reaches a far higher grade of material purity-a pretty important fact in such applications as textiles and packaging, where high-quality consistency and performance are required or methanolysis cannot compare.

Secondly, hydrolysis fits very well into production methods that have the least impact on the environment. Normally, it is less energy-intensive compared to other recycling methods; it reduces production costs and, at the same time, minimizes emission levels. In recent years, hydrolysis technology has been continuously upgraded for better scalability, hence more feasible for wider usage by manufacturers. While the demand for r-PTA is increasing, especially for high-value products in certain industries, the use of hydrolysis technology remains the best choice due to its efficiency, scalability, and quality of output.

It caters to increasing regulatory and consumer demand for green materials. Hydrolysis presents a route for manufacturers to achieve their sustainability objectives without compromising product quality, further strengthening its position as the dominant process in the r-PTA market.

By Application

The fiber is projected to dominate the application segment as it holds 44.9% of the market share in 2024. The fiber was the segment of application that held the major share in the market due to highly increased demand for r-PTA-based recycled polyester fibers in the textile industry. The r-PTA is used for manufacturing textile-grade polyester fibers, whose intention is to replace virgin polyester, the raw material used in the textile business.

The latter shift in production is very important, as consumers and regulatory bodies are demanding the need for friendlier materials, especially in the fashion industry where waste management and environmental concerns have been a polemic issue. This is driving demand for complementary sustainability commitments by brands, the use of recycled fibers in apparel, and the promotion of such materials as a responsible choice.

Polyester fibers manufactured from r-PTA offer equivalent quality, durability, and aesthetic appearance to virgin polyester, which allows textile manufacturers to feel confident in maintaining product standards while continuing to advance their sustainability objectives. Other factors contributing to the leading position of the fiber application segment include cost-efficiency reasons: r-PTA-based fibers are generally cheaper to produce than virgin polyester, which helps textile companies balance the quality, cost, and environmental responsibility of the products. The affordability, combined with the globally emerging shift in consumer behavior toward eco-friendly products, strongly positions fiber as the largest application in the r-PTA market.

By End-User

The textile industry can be estimated to be the biggest sector of end-users in the r-PTA market, mainly based on the commitment of industries to sustainable materials, as well as growing consumer demands for eco-friendly purchases. As environmental awareness increases, the textile industry, at the same time, feels increased pressure to be concerned about the environment, especially when it comes to fast fashion or high-volume manufacturing.

R-PTA is directly utilized in the manufacturing of polyester fibers, an essential constituent of fabrics, clothes, and household textiles, by textile companies. R-PTA-based polyester even opens up a vista for these firms to abide by today's environmental standards without compromising the quality of their fabrics on such key counts as durability and aesthetic properties. Large fashion brands, in response to pressure from consumers to serve them greener materials, have started considering r-PTA in their product lines to calm these consumer concerns over their sustainability pledges.

Another justification for the wide-scale adoption in textiles is the economic advantage of using r-PTA-based polyester over virgin polyester. Cost-effective sourcing and production can be enabled through propulsion with r-PTA, and allow textile companies to show sustainability while keeping profitability intact. The dual pressures of consumer preference and regulatory standards place the textile industry as the main utilization of r-PTA, which cements its undisputed dominance in the market.

The Recycled Terephthalic Acid Market Report is segmented on the basis of the following

By Process

By Application

By End-Use Industry

- Textiles

- Automotive

- Construction

- Packaging

Regional Analysis

North America is projected to dominate the global recycled terephthalic acid market as it

holds 33.9% of market share in 2024. It has been carved as a prime destination in North America for r-PTA, keeping in mind proper mixing with regulatory support for good infrastructure of recycling processes and environmental awareness amongst consumers and businesses. The government in both Canada and the United States is fully supportive of their jurisdictions to promote sustainability initiatives through incentives for recycling, the mandatory usage of recycled materials, and the establishment of environmental policy targets in various industries.

This will help create a congenial environment for r-PTA. The textile, packaging, car, and consumables industries will most likely try on the utilization of recycled materials in their production; therefore making r-PTA part of the operational standards where they belong. Another reason for the strength of this market region is the well-established infrastructure for collecting and recycling PET within North America. This extended network of recycling centers with high-tech facilities ensures correct treatments of PET wastes into high-quality r-PTA, thus assuring constant and reliable sourcing of raw materials.

This will meet today's industry demand and is sturdy enough to expand the market once r-PTA becomes well-known in different industries where the value material is put to use-from automotive interiors, and construction materials, to high-performance textiles. Yet another critical driver in the growth of the North American r-PTA market is consumer expectation. The ecologically conscious consumers of the U.S. and Canada are demanding sustainable products. Recycled content for brands is now a pre-requisite if they want to maintain their lead in the market.

Well-established brands such as Coca-Cola Nike, and Unilever have taken respectable pledges toward the addition of r-PTA in their value chains to ensure less plastic waste, reduced carbon emissions, and meeting the growing demand for sustainability. Using r-PTA, these companies align their consumer values, create brand loyalty, and also nail the leading situation in North America in the r-PTA market globally by setting an influential example where sustainability is concerned for other regions.

By Region

North America

Europe

- Germany

- The U.K.

- France

- Italy

- Russia

- Spain

- Benelux

- Nordic

- Rest of Europe

Asia-Pacific

- China

- Japan

- South Korea

- India

- ANZ

- ASEAN

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Argentina

- Colombia

- Rest of Latin America

Middle East & Africa

- Saudi Arabia

- UAE

- South Africa

- Israel

- Egypt

- Rest of MEA

Competitive Landscape

The key players in the competitive landscape of North America's r-PTA market focus on technological innovation, partnerships, and capacity expansions given the growing demand for sustainable materials. It is driven by major firms such as Indorama Ventures, Loop Industries, and Unifi, leading the transformation with top recycling technologies. High-quality production uses of r-PTA are coming up in various applications, from textiles to packaging and auto-component manufacturing.

Indorama Ventures has greatly increased its presence in North America with investments in new recycling plants and strategic acquisitions. In the process, it is in a better position to become a leading supplier of r-PTA due to consolidation. Loop Industries has attracted attention because of its proprietary depolymerization technology, which degrades the molecules of PET into r-PTA of nearly virgin quality fact quite desirable to high-end brands seeking sustainable products at premium quality.

Moreover, strategic partnerships by r-PTA manufacturers with major consumerist firms like Coca-Cola and Nike further underscore the importance of partnership in the industry. These alliances help the brands achieve their goals of sustainability and a consistent supply of r-PTA. The competition notwithstanding, high infrastructural costs and restricted availability of PET continue to act as a stumbling block to the entry of small players.

However, with the growing demand for recycled materials, established companies are apt to lead the fray by enhancing the technological capabilities and partnerships that are imperative in giving strength to North America's r-PTA market.

Some of the prominent players in the Global Recycled Terephthalic Acid Market are

- Indorama Ventures Public Company Limited

- Alpek S.A.B. de C.V.

- Far Eastern New Century Corporation

- Zhejiang Haili Environmental Technology Co., Ltd.

- Reliance Industries Limited

- Sinopec Group

- Lotte Chemical Corporation

- JBF Petrochemicals Ltd.

- SABIC

- Loop Industries, Inc.

- Biffa

- Plastipak Holdings, Inc.

- Other Key Players

Recent Developments

- In October 2024, Nike partnered with Indorama Ventures, a major player in the recycling sector, to scale the use of recycled PET in its textile production, particularly focusing on r-PTA-based fibers for athletic wear. This collaboration aims to increase the recycled content in Nike’s products by 30%, aligning with Nike’s commitment to circular design and sustainability.

- In August 2024, Loop Industries, an innovator in PET recycling, launched a high-purity r-PTA product targeting the automotive and construction industries. This new product, branded as “Loop Ultra-Pure r-PTA,” enables automotive and construction companies to incorporate recycled content without compromising quality, expanding Loop Industries’ reach into new markets and emphasizing its leadership in sustainable solutions.

- In May 2024, In response to new European Union regulations on single-use plastics, Coca-Cola Europe announced a shift toward using 100% recycled content for its PET bottles by 2030, including increased reliance on r-PTA. The company is working with local recycling partners, such as Plastic Energy and Carbios, to develop innovative recycling methods and secure a sustainable supply chain for r-PTA, reflecting Coca-Cola’s commitment to a closed-loop plastic economy.

- In November 2023, Unilever revealed its plans to invest in Eastman Chemical Company’s molecular recycling technology to produce r-PTA for its personal care packaging. This investment aims to support Unilever’s pledge to halve its use of virgin plastic and increase recycled plastic content by 2025, particularly in European and North American markets where consumer demand for sustainable products is high.

Report Details

| Report Characteristics |

| Market Size (2024) |

USD 2,094.1 Mn |

| Forecast Value (2033) |

USD 3,131.3 Mn |

| CAGR (2024-2033) |

4.6% |

| Historical Data |

2018 – 2023 |

| The US Market Size (2024) |

USD 597.0 Mn |

| Forecast Data |

2025 – 2033 |

| Base Year |

2023 |

| Estimate Year |

2024 |

| Report Coverage |

Market Revenue Estimation, Market Dynamics, Competitive Landscape, Growth Factors and etc. |

| Segments Covered |

By Process (Hydrolysis, and Pyrolysis), By Application (Fiber, Films, and Resins), By End-Use Industry (Textiles, Automotive, Construction, and Packaging) |

| Regional Coverage |

North America – The US and Canada; Europe – Germany, The UK, France, Russia, Spain, Italy, Benelux, Nordic, & Rest of Europe; Asia- Pacific– China, Japan, South Korea, India, ANZ, ASEAN, Rest of APAC; Latin America – Brazil, Mexico, Argentina, Colombia, Rest of Latin America; Middle East & Africa – Saudi Arabia, UAE, South Africa, Turkey, Egypt, Israel, & Rest of MEA

|

| Prominent Players |

Indorama Ventures Public Company Limited, Alpek S.A.B. de C.V., Far Eastern New Century Corporation, Zhejiang Haili Environmental Technology Co., Ltd., Reliance Industries Limited, Sinopec Group, Lotte Chemical Corporation, JBF Petrochemicals Ltd. SABIC, Loop Industries Inc., Biffa, Plastipak Holdings Inc., and Other Key Players |

| Purchase Options |

We have three licenses to opt for: Single User License (Limited to 1 user), Multi-User License (Up to 5 Users) and Corporate Use License (Unlimited User) along with free report customization equivalent to 0 analyst working days, 3 analysts working days and 5 analysts working days respectively. |

Frequently Asked Questions

The Global Recycled Terephthalic Acid Market size is estimated to have a value of USD 2,094.1 million in 2024 and is expected to reach USD 3,131.3 million by the end of 2033.

The US Recycled Terephthalic Acid Market is projected to be valued at USD 597.0 million in 2024. It is expected to witness subsequent growth in the upcoming period as it holds USD 873.8 million in 2033 at a CAGR of 4.3%.

North America is expected to have the largest market share in the Global Recycled Terephthalic Acid Market with a share of about 33.9% in 2024.

Some of the major key players in the Global Recycled Terephthalic Acid Market are Indorama Ventures Public Company Limited, Alpek S.A.B. de C.V., Far Eastern New Century Corporation, Zhejiang Haili Environmental Technology Co., Ltd., Reliance Industries Limited, and many others.

The market is growing at a CAGR of 4.6 percent over the forecasted period.