Market Overview

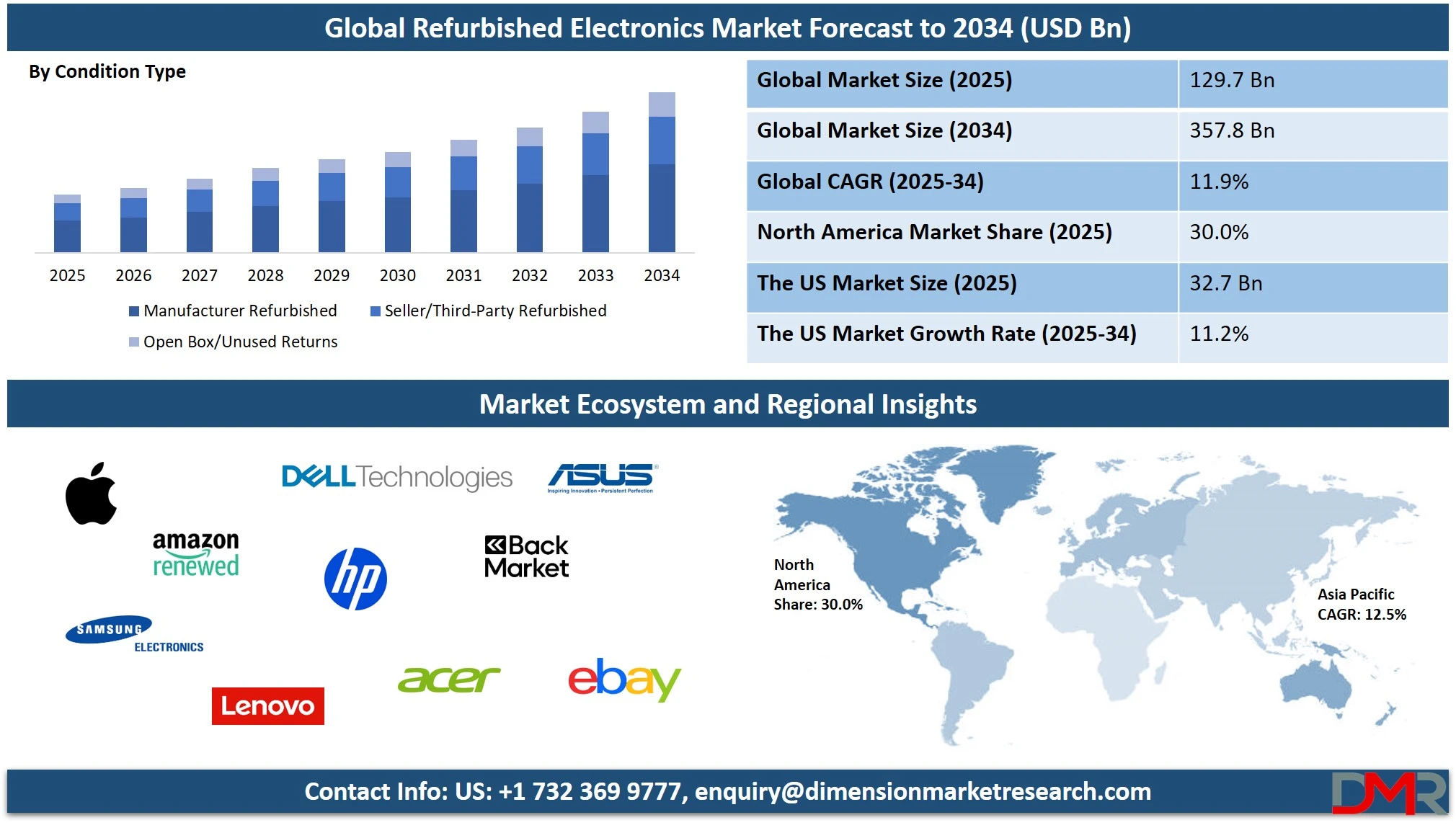

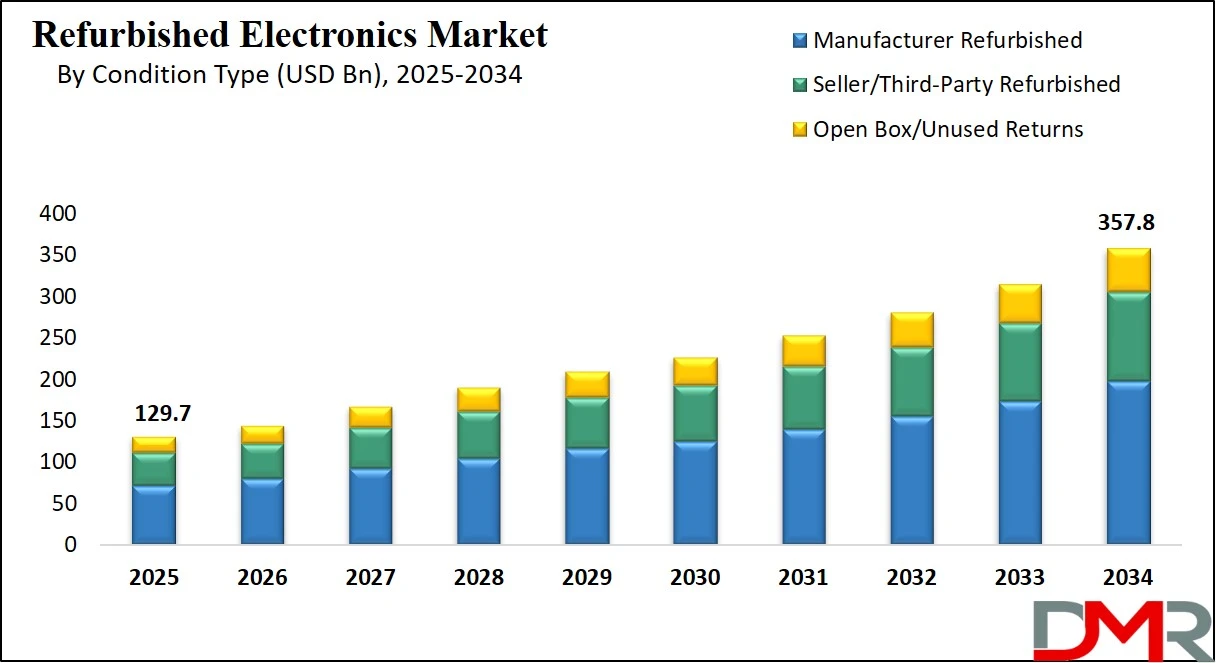

The global refurbished electronics market is projected to reach USD 129.7 billion in 2025 and is expected to grow to USD 357.8 billion by 2034, registering a CAGR of 11.9%. This growth is driven by growing demand for cost-effective consumer electronics, rising e-waste concerns, and the expanding circular economy across smartphones, laptops, tablets, and other reconditioned devices.

ℹ

To learn more about this report –

Download Your Free Sample Report Here

Refurbished electronics refer to pre-owned devices that have been restored to a like-new condition through professional inspection, repair, and testing processes. Customers typically return these products due to minor defects, cosmetic damage, or simply because the buyer changed their mind. Unlike used electronics sold by individuals, refurbished devices undergo rigorous quality checks, hardware replacement if needed, and software reinstallation to meet original manufacturer standards.

They are often resold with limited warranties and offer a cost-effective and sustainable alternative to new gadgets. This category includes smartphones, laptops, desktops, tablets, monitors, gaming consoles, and home appliances, which are reconditioned by original equipment manufacturers or certified third-party refurbishers to ensure optimal performance and safety.

ℹ

To learn more about this report –

Download Your Free Sample Report Here

The global refurbished electronics market has emerged as a dynamic and rapidly growing sector driven by increasing consumer demand for affordable devices and the rising awareness of electronic waste reduction. Market expansion is largely attributed to the widespread acceptance of refurbished smartphones and laptops among cost-sensitive consumers, small businesses, and educational institutions.

As technology lifecycles shorten and upgrade cycles accelerate, the volume of gently-used electronics entering the refurbishing stream continues to rise. Additionally, government regulations and environmental sustainability programs are encouraging circular economy practices, further fueling growth in this segment.

Regionally, Asia Pacific dominates the market, led by high smartphone penetration, a thriving e-commerce ecosystem, and rising demand in emerging economies like India, China, and Southeast Asia. North America and Europe follow closely, supported by robust online retail platforms and consumer preference for certified refurbished gadgets.

Leading players in the refurbished electronics market are also leveraging AI-based diagnostic tools, blockchain for supply chain transparency, and cloud-based resale platforms to improve product tracking and enhance customer trust. As resale infrastructure and reverse logistics improve globally, the refurbished electronics industry is set to play a critical role in reshaping the consumer electronics landscape.

The US Refurbished Electronics Market

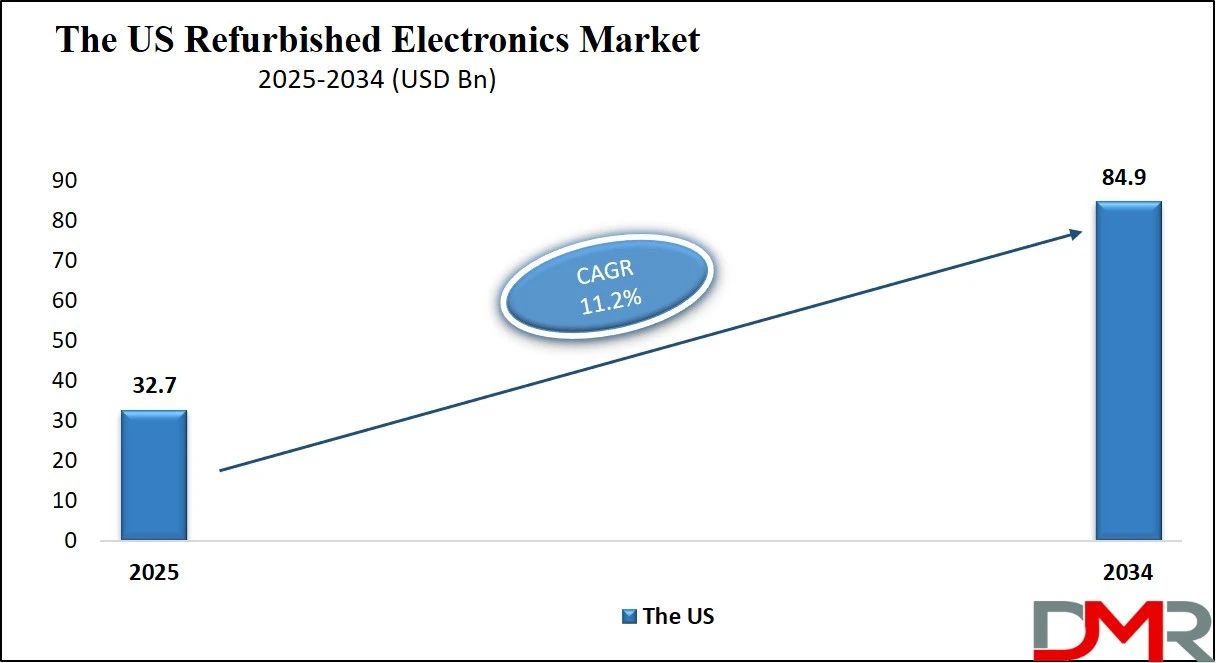

The U.S. Refurbished Electronics Market size is projected to be valued at USD 32.7 billion in 2025. It is further expected to witness subsequent growth in the upcoming period, holding USD 84.9 billion in 2034 at a CAGR of 11.2%.

ℹ

To learn more about this report –

Download Your Free Sample Report Here

The United States' refurbished electronics market has seen significant expansion over the past few years, driven by growing consumer interest in affordable and sustainable alternatives to new devices. Increasing adoption of refurbished smartphones, laptops, and tablets among cost-conscious individuals, educational institutions, and small businesses is fueling market growth. With rising inflation and changing consumer buying behavior, more Americans are turning to certified refurbished gadgets that offer near-new performance at a fraction of the cost.

Key e-commerce platforms like Amazon Renewed, Back Market, and Best Buy Certified Refurbished have made it easier for consumers to access verified and warranty-backed reconditioned electronics. Additionally, OEMs such as Apple, Dell, and HP are strengthening their refurbishment programs in the US, contributing to product quality assurance and boosting customer confidence in refurbished electronics.

Environmental sustainability and e-waste reduction efforts are also playing a pivotal role in shaping the US refurbished electronics landscape. With electronic waste being one of the fastest-growing waste streams in the country, there is increased regulatory and social pressure to extend product lifecycles through repair and refurbishment.

Government initiatives promoting green electronics, along with the rise of the circular economy, are encouraging consumers and enterprises to embrace refurbished desktops, monitors, wearables, and gaming devices.

The US market is also benefiting from technological advancements in diagnostic tools, reverse logistics systems, and resale platforms, which are improving refurbishment efficiency and supply chain transparency. As digital transformation continues across sectors, the demand for reliable yet affordable refurbished tech is expected to grow steadily, solidifying the US as one of the key contributors to the global refurbished electronics industry.

Europe Refurbished Electronics Market

Europe’s refurbished electronics market is projected to reach USD 35.0 billion in 2025, accounting for a significant portion of the global market share. This strong performance is driven by growing consumer preference for affordable, high-quality electronic devices and growing awareness around sustainable consumption. Major countries such as Germany, the United Kingdom, France, and the Nordics are at the forefront of this growth, supported by well-established e-commerce infrastructure and a cultural shift toward environmentally conscious buying habits.

The demand for refurbished smartphones, laptops, tablets, and wearable devices has surged, especially among students, freelancers, and budget-focused consumers looking for reliable alternatives to new products. Additionally, platforms like Back Market and Refurbed, headquartered in Europe, are playing a pivotal role by offering certified refurbished products with warranties, transparent quality grading, and customer-friendly policies.

A key factor supporting Europe’s growth is the region's regulatory environment, which actively promotes circular economy practices and e-waste reduction. The European Union has introduced initiatives encouraging device reuse, repairability, and right-to-repair legislation, all of which align with the core principles of the refurbished electronics market. Moreover, OEMs and third-party refurbishers in Europe are investing in advanced reverse logistics, AI-powered diagnostics, and local repair networks to meet rising demand while maintaining product quality. With a projected CAGR of 11.1% from 2025 to 2034, the European market is set to expand steadily, reflecting both strong consumer demand and a mature ecosystem that supports sustainable electronics consumption at scale.

Japan Refurbished Electronics Market

Japan’s refurbished electronics market is estimated to reach USD 6.3 billion in 2025, reflecting its growing importance within the global circular economy. The country's high-tech infrastructure, strong consumer electronics culture, and growing awareness of sustainability are driving demand for refurbished smartphones, tablets, laptops, and gaming devices. Japanese consumers are becoming more receptive to certified refurbished products, especially as they seek cost-effective alternatives without compromising on quality.

Major retailers and mobile carriers in Japan now offer structured trade-in and resale programs, often bundled with extended warranties and quality assurance standards. The rise of domestic e-commerce platforms and improved logistics is further making refurbished devices more accessible across the country.

Despite traditionally favoring new products, Japanese buyers are gradually embracing refurbished electronics, aided by the country's meticulous approach to quality and reliability. Strict standards in refurbishment, integrated with AI-based diagnostics and detailed cosmetic grading, have increased consumer trust in pre-owned electronics.

Moreover, Japan’s commitment to reducing e-waste through recycling laws and green procurement initiatives is aligning closely with the growth of this market segment. With a projected CAGR of 9.2% between 2025 and 2034, the Japanese refurbished electronics market is expected to witness steady, sustainable expansion, particularly in urban centers where demand for eco-conscious and budget-friendly technology is on the rise.

Global Refurbished Electronics Market: Key Takeaways

- Market Value: The global refurbished electronics market size is expected to reach a value of USD 357.8 billion by 2034 from a base value of USD 129.7 billion in 2025 at a CAGR of 11.9%.

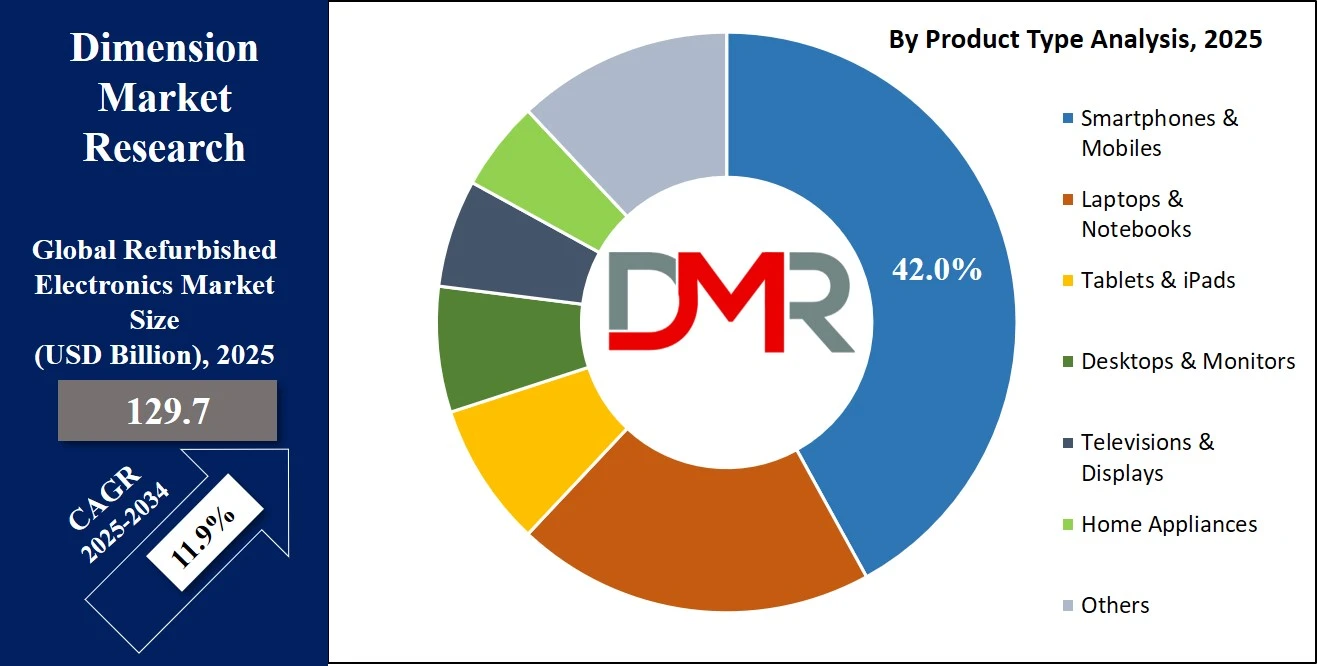

- By Product Type Segment Analysis: Smartphones & Mobiles are anticipated to dominate the product type segment, capturing 42.0% of the total market share in 2025.

- By Source of Refurbishment Segment Analysis: OEM is expected to maintain its dominance in the source of refurbishment segment, capturing 60.0% of the total market share in 2025.

- By Price Range Segment Analysis: Low (< USD 200) is poised to consolidate its dominance in the price range segment, capturing 50.0% of the total market share in 2025.

- By Sales Channel Segment Analysis: Online Platforms will dominate the sales channel segment, capturing 65.0% of the market share in 2025.

- By End-User Segment Analysis: Individual Consumers will dominate the end-user segment, capturing 70.0% of the market share in 2025.

- Regional Analysis: Asia Pacific is anticipated to lead the global refurbished electronics market landscape with 38.0% of total global market revenue in 2025.

- Key Players: Some key players in the global refurbished electronics market are Apple Inc., Amazon Renewed, Samsung Electronics, Lenovo Group, Dell Technologies, HP Inc., Acer Inc., ASUS, Back Market, eBay Inc., Walmart, Best Buy Co., Inc., Reboxed, and Others.

Global Refurbished Electronics Market: Use Cases

- Affordable Technology Access for Students and Educational Institutions: Refurbished electronics provide a practical solution for educational institutions and students seeking budget-friendly devices without compromising on quality. Schools, colleges, and training centers often face budget constraints while trying to ensure digital inclusion for all learners. Certified refurbished laptops, tablets, and desktops allow these institutions to deploy large-scale digital infrastructure at a fraction of the cost of new hardware. Programs like one-to-one laptop initiatives or remote learning rollouts benefit immensely from cost-effective and tested devices, often backed by limited warranties. In developing regions, refurbished tablets and notebooks serve as essential tools for bridging the digital divide in rural education systems. This use case supports both affordability and sustainability by promoting device reuse within the education sector.

- Sustainable Procurement for Enterprises and Startups: Startups and small-to-medium enterprises (SMEs) rely on refurbished electronics to reduce operational costs while aligning with their sustainability goals. Many early-stage companies adopt refurbished desktops, monitors, servers, and office peripherals to equip their teams efficiently without the high capital expenditure associated with new IT infrastructure. Additionally, large corporations aiming to meet ESG (Environmental, Social, and Governance) targets are integrating refurbished IT assets into their procurement policies as part of green technology adoption. This practice helps reduce their carbon footprint and electronic waste generation. Combined with reverse logistics and IT asset disposition (ITAD) services, businesses can also ensure secure data wiping and responsible recycling, reinforcing a circular economy approach to technology use.

- Expanding Access to Technology in Emerging Markets: In regions like Africa, Southeast Asia, and Latin America, refurbished electronics play a crucial role in growing consumer access to modern technology. Brand-new devices often remain unaffordable for large segments of the population due to import taxes and limited purchasing power. Refurbished smartphones, smartwatches, and laptops offer a viable entry point for first-time tech users and small business owners. Local refurbishing hubs and resale platforms also support economic development by creating jobs in repair, quality control, and logistics. With rising mobile penetration and digital banking, the availability of reconditioned smartphones helps drive mobile commerce, e-learning, and access to essential services in underserved regions. This democratization of technology also reduces the influx of e-waste by extending device life cycles.

- Consumer Demand for Eco-Friendly and Certified Electronics: Environmentally conscious consumers are choosing refurbished electronics as a way to reduce their carbon footprint and avoid contributing to e-waste. Buying reconditioned devices such as smartphones, tablets, and audio gadgets aligns with circular consumption habits that prioritize reuse over disposal. Platforms like Back Market and Refurbed promote certified refurbished products with transparent quality checks and warranties, which instill confidence in customers. As awareness around electronic waste and resource depletion grows, more individuals are opting for sustainable alternatives that deliver the same utility as new devices. Moreover, the integration of AI diagnostics, cloud-based resale systems, and blockchain for product tracking is enhancing the overall reliability and traceability of refurbished electronics in the consumer market.

Impact of Artificial Intelligence on the Refurbished Electronics Market

Artificial Intelligence (AI) is transforming the refurbished electronics market by optimizing processes across the product lifecycle, from diagnostics and quality assessment to resale and customer service. AI-driven tools allow refurbishers to conduct deep diagnostics on returned or used electronic devices, identifying both visible and hidden faults with precision.

This significantly reduces manual inspection errors and speeds up the turnaround time for refurbishing. AI-powered software can also automate grading systems for refurbished smartphones, laptops, and tablets, classifying devices based on their cosmetic and functional conditions. This standardization improves transparency and consumer trust, especially in high-volume online marketplaces.

On the supply chain side, AI enhances reverse logistics by predicting return patterns, optimizing inventory management, and forecasting demand for refurbished electronics across regions and sales channels. Refurbishers can better plan procurement of used devices and replacement parts based on AI-driven market analytics. Additionally, AI-enabled chatbots and virtual assistants are improving customer engagement by providing instant support, guiding buyers on certified refurbished product options, and streamlining the returns process.

Some leading players are also experimenting with AI and machine learning for pricing optimization, helping platforms dynamically adjust refurbished product prices based on device condition, market trends, and competitor activity. Overall, AI is strengthening the refurbished electronics ecosystem by improving efficiency, quality assurance, customer satisfaction, and profitability.

Global Refurbished Electronics Market: Stats & Facts

UN Statistics Division / Global E-Waste Monitor (UNITAR, ITU)

- By 2030, e-waste is projected to reach 82 million metric tons globally.

- High-income regions generate approximately 10 kg of e-waste per capita, compared to less than 5 kg in low-income regions.

- Less than 1% of rare earth elements are currently recovered from e-waste.

- E-waste is growing almost five times faster than formal recycling capacity.

- Only 35% of the 5.1 billion kg of EEE/e-waste traded across borders is controlled under Basel Convention guidelines.

- If 60% global collection is achieved by 2030, 30 million tons of metals could be recovered.

Government of Canada (Innovation, Science and Economic Development Canada)

- Electronics contain valuable recoverable materials, including aluminum, copper, plastics, steel, and precious metals.

- Proper e-waste recycling helps reduce the need for virgin resource extraction.

- Refurbishers must follow legal procedures for handling data security and hazardous components.

- Licensed processors must meet environmental standards for handling cathode-ray tubes and batteries.

South Korea Ministry of Environment

- South Korea’s Producer Recycling system mandates 55–70% recycling targets by weight for appliances.

- 40% of e-waste is collected through municipal systems, while 50% is returned via company logistics centers.

- Of the appliances collected, 12% are reused, 69% are recycled, and 19% are incinerated or landfilled.

European Commission – Circular Economy Action Plan

- The EU mandates that electronics manufacturers make products easier to repair and recycle under the Right to Repair directive.

- Products must carry labels disclosing repairability and expected product lifespan.

- Circular electronics initiatives in the EU have reduced landfill waste and improved refurbishment rates across member states.

- The European Green Deal prioritizes product longevity and reuse across all electronics sectors.

Global Refurbished Electronics Market: Market Dynamics

Global Refurbished Electronics Market: Driving Factors

Increasing Demand for Cost-Effective Electronics

The rising global demand for affordable devices is a key factor propelling the refurbished electronics market. With new smartphones, laptops, and tablets becoming expensive, both individuals and businesses are turning to refurbished alternatives that offer similar functionality at a significantly reduced cost. Consumers in emerging markets, students, and small businesses are especially drawn to certified refurbished gadgets due to budget constraints. This shift in consumer behavior is supported by improvements in quality assurance, extended warranties, and easy access through online platforms like Amazon Renewed and Back Market.

Growing Emphasis on E-Waste Management and Circular Economy

Governments and organizations are actively pushing for sustainable electronic consumption through policies that encourage recycling and reuse. Refurbished electronics directly support circular economy goals by extending the lifecycle of devices and reducing electronic waste. Initiatives promoting responsible consumption and sustainable production, such as the EU Green Deal and India's e-waste regulations, are incentivizing both OEMs and third-party refurbishers to invest in efficient refurbishment and reverse logistics systems. As environmental awareness grows, more consumers are choosing refurbished products as part of eco-conscious buying decisions.

Global Refurbished Electronics Market: Restraints

Lack of Standardization in Refurbishing Processes

One of the biggest challenges in the refurbished electronics market is the absence of universal quality and grading standards. Different sellers and refurbishers follow varied procedures for testing, repairing, and certifying electronics, which leads to inconsistencies in product quality. This lack of standardization can create trust issues among consumers, particularly when purchasing from third-party platforms. Without unified benchmarks, it becomes difficult to guarantee the reliability of reconditioned electronics, affecting consumer confidence and slowing market adoption.

Limited Availability of High-Quality Used Devices

Although demand for refurbished devices is rising, the supply of high-quality used electronics remains a constraint. Not all returned or second-hand products are suitable for refurbishment, and access to devices in good working condition can be inconsistent. This scarcity affects inventory levels, particularly for popular models of smartphones and laptops. Moreover, intense competition for sourcing used electronics between OEMs, retailers, and independent refurbishers may further strain supply chains, resulting in higher procurement costs and lower profit margins.

Global Refurbished Electronics Market: Opportunities

Expansion of Online Refurbished Marketplaces

The rise of digital platforms offering refurbished electronics is opening up new growth opportunities. E-commerce sites like Refurbed, Swappa, and Flipkart Renewed are enhancing the visibility and accessibility of certified refurbished products across global markets. These platforms are incorporating AI-based quality control systems, transparent return policies, and customer reviews to improve buyer trust. As online shopping continues to dominate, especially in emerging economies, digital marketplaces are becoming a crucial channel for expanding the reach of refurbished electronics.

OEM Involvement in Certified Refurbishment Programs

Original equipment manufacturers (OEMs) are launching their own certified refurbishment programs, offering devices that meet high-quality standards and come with official warranties. Apple, Dell, and Samsung are examples of brands that now directly offer refurbished products through their websites or authorized resellers. This OEM participation enhances the credibility of the refurbished electronics market and reduces the perceived risk for consumers. It also opens up cross-selling and upselling opportunities, allowing brands to re-engage customers who may not be ready to invest in new devices.

Global Refurbished Electronics Market: Trends

Integration of AI and Automation in Refurbishment

Artificial Intelligence is playing an important role in streamlining the refurbishment process. AI-powered diagnostic tools are being used to detect hardware and software issues with precision, allowing for faster and more accurate repairs. Automation in testing, grading, and packaging also reduces human error and accelerates turnaround times. This technological integration not only improves operational efficiency for refurbishers but also enhances the consistency and reliability of the refurbished electronics offered to end-users.

Rise of Subscription-Based Refurbished Electronics Models

An emerging trend in the market is the subscription model for refurbished devices, where users can rent or lease smartphones, laptops, or tablets for a monthly fee. This model is particularly appealing to younger consumers and gig economy workers who prefer flexibility over ownership. Companies like Grover and Rentything are pioneering this space, offering access to refurbished electronics without the burden of long-term investment. The model supports sustainable consumption, promotes device reuse, and provides refurbishers with recurring revenue streams.

Global Refurbished Electronics Market: Research Scope and Analysis

By Product Type Analysis

In the product type segment of the refurbished electronics market, smartphones and mobiles are expected to lead with a significant 42.0% share of the total market in 2025. This dominance is largely driven by the high turnover rate of mobile devices, frequent model upgrades by manufacturers, and strong consumer demand for affordable alternatives to new smartphones. With flagship models from brands like Apple, Samsung, and Xiaomi becoming expensive, many buyers are opting for certified refurbished phones that offer near-new performance at lower prices.

Additionally, the growing popularity of online resale platforms and trade-in programs has streamlined the availability and purchase of refurbished smartphones, making them more accessible across different regions and demographics. Features such as warranty support, quality testing, and attractive pricing are further accelerating the adoption of refurbished mobile devices globally.

Laptops and notebooks also form a crucial part of this market segment, driven by growing demand across educational institutions, remote working environments, and budget-conscious consumers. Refurbished laptops are particularly appealing to students, freelancers, and small businesses that require reliable computing devices without incurring the high costs associated with new models. OEMs like Dell, HP, and Lenovo are actively participating in the refurbishment ecosystem, offering their own certified programs that ensure quality assurance and product longevity.

Furthermore, the rise of e-learning, hybrid work models, and digital transformation in developing countries has contributed to the steady growth of the refurbished laptop market. Enhanced battery life, upgraded storage, and updated software features in these reconditioned devices make them an attractive and sustainable choice in the current economic and environmental landscape.

ℹ

To learn more about this report –

Download Your Free Sample Report Here

By Source of Refurbishment Analysis

In the source of refurbishment segment, original equipment manufacturers (OEMs) are projected to maintain a dominant position, accounting for 60.0% of the total market share in 2025. This dominance is driven by the growing trust consumers place in brand-authorized refurbished products, which often come with official certifications, warranties, and quality assurance directly from the manufacturer.

OEMs like Apple, Samsung, Dell, and HP have established structured refurbishment programs that ensure their reconditioned products meet stringent quality standards, making them highly appealing to customers looking for reliable and safe alternatives to new devices.

These companies also have the advantage of access to original parts, advanced diagnostic tools, and proprietary repair technologies, which further enhances the performance and lifespan of their refurbished electronics. As sustainability initiatives and circular economy practices become a greater focus for corporations and consumers alike, OEM-led refurbishment is gaining popularity due to its consistent quality and brand-backed support.

Third-party refurbishers, while accounting for a smaller share of the market, continue to play a vital role in expanding access to affordable electronics. These independent players refurbish a wide range of devices, from smartphones and laptops to gaming consoles and home appliances, often sourcing their inventory from returns, trade-ins, or lease expirations. Many third-party refurbishers focus on cost efficiency and competitive pricing, catering to value-driven consumers, schools, and small businesses.

However, the quality of refurbishment can vary significantly depending on the refurbisher’s processes and capabilities. Some well-established third-party refurbishers partner with large online marketplaces like Amazon Renewed, Back Market, and eBay Certified Refurbished to improve credibility and reach. Although they may lack the brand backing of OEMs, many third-party refurbishers are investing in standardized quality checks, warranty services, and reverse logistics systems to remain competitive in a rapidly evolving market.

By Price Range Analysis

In the price range segment of the refurbished electronics market, the low price category (below USD 200) is set to consolidate its dominance, capturing 50.0% of the total market share in 2025. This segment appeals strongly to cost-sensitive consumers, particularly in emerging economies and price-conscious demographics such as students, first-time tech users, and budget-focused households.

Devices in this range typically include older-generation smartphones, entry-level laptops, tablets, and smaller accessories like refurbished smartwatches or headphones. The combination of affordability and functionality makes these products an ideal choice for users seeking basic digital access without the financial burden of new electronics. Additionally, the rise of online marketplaces offering flexible payment options, cashback, and warranties on low-cost refurbished gadgets is further accelerating growth in this segment.

The medium price range (USD 200–500) also holds a significant share of the market and is gaining traction among consumers looking for a balance between performance and affordability. This category often includes mid-tier refurbished smartphones, laptops, and tablets that offer advanced features, better specifications, and longer usability compared to the lower-priced counterparts.

Consumers in this segment are typically more discerning, valuing higher-end processors, improved battery life, and enhanced display quality. Refurbished business laptops, premium smartphones from previous generations, and high-end tablets are commonly sold within this range.

The segment benefits from strong demand among remote workers, students in higher education, and tech-savvy buyers who want reliable performance without the premium price tag of new devices. As technology evolves and high-spec devices become more widely available for refurbishment, the medium price range is expected to see sustained interest and steady growth.

By Sales Channel Analysis

Online platforms are projected to dominate the sales channel segment in the refurbished electronics market, capturing 65.0% of the total market share in 2025. This dominance is largely driven by the convenience, wider product selection, and competitive pricing offered by e-commerce websites and digital marketplaces. Consumers prefer purchasing refurbished smartphones, laptops, tablets, and accessories through platforms like Amazon Renewed, Back Market, eBay, and Flipkart Renewed due to the availability of verified sellers, customer reviews, and easy return policies.

Additionally, these platforms often feature certified refurbished products with warranties and transparent grading systems, which enhance consumer trust and satisfaction. The rise of digital payment systems, mobile shopping apps, and targeted online marketing has further expanded the reach of refurbished electronics, especially in regions with high internet penetration and growing demand for cost-effective tech solutions.

Offline or retail stores, while accounting for a smaller portion of the market, continue to play a significant role in driving refurbished electronics sales, especially among consumers who prefer physical inspection before purchase. Brick-and-mortar stores offer the advantage of hands-on experience, immediate product availability, and personalized assistance from sales staff. These outlets are particularly popular in developing regions, where trust in online transactions may still be growing or where internet access is limited.

Moreover, many large retailers such as Best Buy, Walmart, and Target have established in-store sections for certified refurbished devices, leveraging their physical presence to attract walk-in customers. Service centers and local refurbishing shops also contribute to this segment by offering refurbished gadgets along with repair and exchange services. Although offline sales may face slower growth compared to digital channels, they remain vital for building trust, especially in first-time buyers and non-digital native demographics.

By End-User Analysis

In the end-user segment of the refurbished electronics market, individual consumers are expected to dominate with a substantial 70.0% share of the total market in 2025. This dominance is driven by the growing demand for affordable and accessible technology among a wide range of users, including students, remote workers, young professionals, and budget-conscious families. With the high cost of new electronics and frequent product upgrades, many individuals are choosing refurbished smartphones, laptops, tablets, and wearables that offer reliable performance at a fraction of the price.

The availability of certified refurbished products through trusted online platforms, complete with warranties and quality guarantees, has boosted consumer confidence. Additionally, rising environmental awareness is encouraging more consumers to opt for reconditioned devices as a sustainable alternative, aligning their buying behavior with circular economy practices.

Enterprises and small to medium-sized businesses (SMEs) also form an important part of the refurbished electronics market, although their share is comparatively smaller. These organizations are turning to refurbished IT equipment such as desktops, monitors, laptops, and networking hardware to reduce capital expenditures while maintaining operational efficiency. For startups and SMEs operating with limited budgets, refurbished electronics provide a cost-effective way to equip teams with the necessary technology without compromising on functionality.

Many companies are also incorporating sustainable procurement policies into their operations, making refurbished devices an attractive choice from both a financial and environmental perspective. In sectors such as education, healthcare, and logistics, where bulk purchasing of equipment is common, refurbished solutions offer scalability and value. The integration of IT asset disposition (ITAD) services and certified data wiping further enhances the appeal of refurbished electronics for business use, ensuring security and compliance with data protection standards.

The Refurbished Electronics Market Report is segmented based on the following:

By Product Type

- Smartphones & Mobiles

- Laptops & Notebooks

- Tablets & iPads

- Desktops & Monitors

- Televisions & Displays

- Home Appliances

- Audio Devices

- Cameras & Imaging Devices

- Gaming Consoles & Accessories

- Others

By Source of Refurbishment

- OEM

- Third-party Refurbishers

By Price Range

- Low (<USD 200)

- Medium (USD 200-500)

- High (> USD 500)

By Sales Channel

- Online Platforms

- Offline/Retail Stores

By End-User

- Individual Consumers

- Enterprises/SMEs

- Educational Institutions

- Government/NGOs

Global Refurbished Electronics Market: Regional Analysis

Region with the Largest Revenue Share

Asia Pacific is expected to lead the global refurbished electronics market in 2025, capturing 38.0% of the total global market revenue. This regional dominance is fueled by a combination of high smartphone and internet penetration, a growing middle-class population, and strong demand for affordable technology across emerging economies such as India, China, Indonesia, and the Philippines. Rapid digital transformation, the rise of e-commerce platforms, and increased awareness of sustainable consumption are driving consumer preference for certified refurbished electronics.

Additionally, local refurbishing hubs and a robust reverse logistics infrastructure are making it easier for manufacturers and third-party players to collect, repair, and redistribute used devices efficiently. Government initiatives promoting digital access and electronic waste reduction are also contributing to the growth of this segment, making Asia Pacific a critical engine for expansion in the global refurbished electronics landscape.

ℹ

To learn more about this report –

Download Your Free Sample Report Here

Region with significant growth

The Middle East & Africa and Latin America are emerging as regions with significant growth potential in the refurbished electronics market. Rising smartphone adoption, growing internet accessibility, and a growing demand for affordable digital devices are fueling interest in refurbished products across these regions.

In many countries within these markets, high import duties and limited purchasing power make new electronics less accessible, positioning refurbished alternatives as a practical solution for both consumers and small businesses.

Additionally, the expansion of e-commerce platforms and partnerships with local refurbishers is improving product availability and trust. As awareness around sustainability and electronic waste management increases, refurbished electronics are becoming a preferred choice, driving steady growth and making these regions attractive for future market expansion.

By Region

North America

Europe

- Germany

- The U.K.

- France

- Italy

- Russia

- Spain

- Benelux

- Nordic

- Rest of Europe

Asia-Pacific

- China

- Japan

- South Korea

- India

- ANZ

- ASEAN

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Argentina

- Colombia

- Rest of Latin America

Middle East & Africa

- Saudi Arabia

- UAE

- South Africa

- Israel

- Egypt

- Rest of MEA

Global Refurbished Electronics Market: Competitive Landscape

The global competitive landscape of the refurbished electronics market is characterized by a mix of established OEMs, major e-commerce platforms, and specialized third-party refurbishers, all competing to capture a growing consumer base seeking affordable and sustainable technology solutions. Leading brands such as Apple, Samsung, Dell, and HP are strengthening their presence through certified refurbishment programs, offering high-quality reconditioned devices with official warranties to build consumer trust.

Simultaneously, online platforms like Amazon Renewed, Back Market, and Flipkart Renewed are scaling rapidly by offering wide product selections, transparent grading systems, and easy returns, making refurbished devices more accessible to mainstream consumers.

Specialized players like Gazelle, Refurbed, and Swappa cater to niche segments with curated offerings and value-added services. As competition intensifies, companies are investing in AI-based diagnostics, reverse logistics optimization, and sustainability initiatives to differentiate their offerings and expand market share in a quality- and value-driven landscape.

Some of the prominent players in the global refurbished electronics market are:

- Apple Inc.

- Amazon Renewed

- Samsung Electronics

- Lenovo Group

- Dell Technologies

- HP Inc.

- Acer Inc.

- ASUS

- Back Market

- eBay Inc.

- Walmart

- Best Buy Co., Inc.

- Reboxed

- Gazelle

- Refurbed

- Swappa

- Flipkart Renewed

- Xiaomi (Mi Refurb)

- Target (Certified Refurbished)

- OLX Group

- Other Key Players

Global Refurbished Electronics Market: Recent Developments

- July 2025: Samsung Electronics officially launched its Certified Re‑Newed Galaxy lineup in the US, offering refurbished Galaxy S24 and S24 Ultra models complete with 147‑point quality testing, genuine replacement parts, and a one‑year warranty as part of its eco-friendly initiative in the refurbished electronics market.

- June 2025: Back Market raised a substantial USD 335 million in its latest funding round, aimed at scaling its marketplace globally and reinforcing its position within the circular economy for renewed electronics.

- April 2025: Best Buy introduced Geek Squad Certified Refurbished Galaxy S25 Ultra devices in select stores and on its website, featuring high-end specifications and rigorous in‑store testing to meet customer demand for premium refurbished smartphones.

- April 2025: Swappie secured €17 million in funding from the European Investment Bank to expand its iPhone refurbishment operations across Europe, supporting sustainable growth and growing supply of certified pre‑owned smartphones.

Report Details

| Report Characteristics |

| Market Size (2025) |

USD 129.7 Bn |

| Forecast Value (2034) |

USD 357.8 Bn |

| CAGR (2025–2034) |

11.9% |

| Historical Data |

2019 – 2024 |

| The US Market Size (2025) |

USD 32.7 Bn |

| Forecast Data |

2025 – 2033 |

| Base Year |

2024 |

| Estimate Year |

2025 |

| Report Coverage |

Market Revenue Estimation, Market Dynamics, Competitive Landscape, Growth Factors, etc. |

| Segments Covered |

By Product Type (Smartphones & Mobiles, Laptops & Notebooks, Tablets & iPads, Desktops & Monitors, Televisions & Displays, Home Appliances, Audio Devices, Cameras & Imaging Devices, Gaming Consoles & Accessories, and Others), By Source of Refurbishment (OEM and Third-party Refurbishers), By Price Range (Low (<USD 200), Medium (USD 200–500), and High (>USD 500)), By Sales Channel (Online Platforms and Offline/Retail Stores), and By End-User (Individual Consumers, Enterprises/SMEs, Educational Institutions, and Government/NGOs) |

| Regional Coverage |

North America – US, Canada; Europe – Germany, UK, France, Russia, Spain, Italy, Benelux, Nordic, Rest of Europe; Asia-Pacific – China, Japan, South Korea, India, ANZ, ASEAN, Rest of APAC; Latin America – Brazil, Mexico, Argentina, Colombia, Rest of Latin America; Middle East & Africa – Saudi Arabia, UAE, South Africa, Turkey, Egypt, Israel, Rest of MEA |

| Prominent Players |

Apple Inc., Amazon Renewed, Samsung Electronics, Lenovo Group, Dell Technologies, HP Inc., Acer Inc., ASUS, Back Market, eBay Inc., Walmart, Best Buy Co., Inc., Reboxed, and Others. |

| Purchase Options |

We have three licenses to opt for: Single User License (Limited to 1 user), Multi-User License (Up to 5 Users), and Corporate Use License (Unlimited User) along with free report customization equivalent to 0 analyst working days, 3 analysts working days, and 5 analysts working days respectively. |

Frequently Asked Questions

How big is the global refurbished electronics market?

▾ The global refurbished electronics market size is estimated to have a value of USD 129.7 billion in 2025 and is expected to reach USD 357.8 billion by the end of 2034.

What is the size of the US refurbished electronics market

▾ The US refurbished electronics market is projected to be valued at USD 32.7 billion in 2025. It is expected to witness subsequent growth in the upcoming period as it holds USD 84.9 billion in 2034 at a CAGR of 11.2%.

Which region accounted for the largest global refurbished electronics market

▾ Asia Pacific is expected to have the largest market share in the global refurbished electronics market, with a share of about 38.0% in 2025.

Who are the key players in the global refurbished electronics market?

▾ Some of the major key players in the global refurbished electronics market are Apple Inc., Amazon Renewed, Samsung Electronics, Lenovo Group, Dell Technologies, HP Inc., Acer Inc., ASUS, Back Market, eBay Inc., Walmart, Best Buy Co., Inc., Reboxed, and Others.

What is the growth rate of the global refurbished electronics market?

▾ The market is growing at a CAGR of 11.9 percent over the forecasted period.