Market Overview

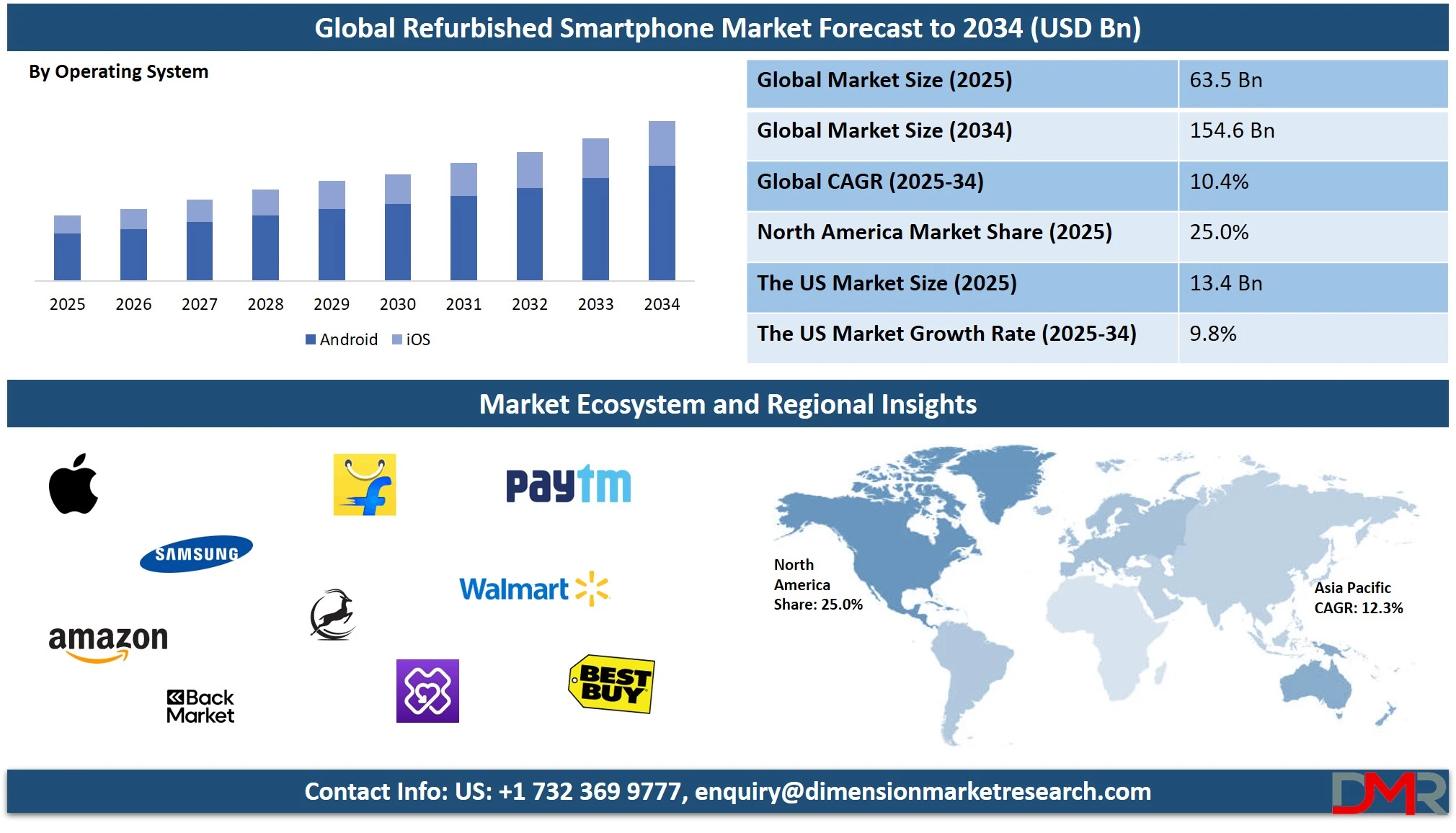

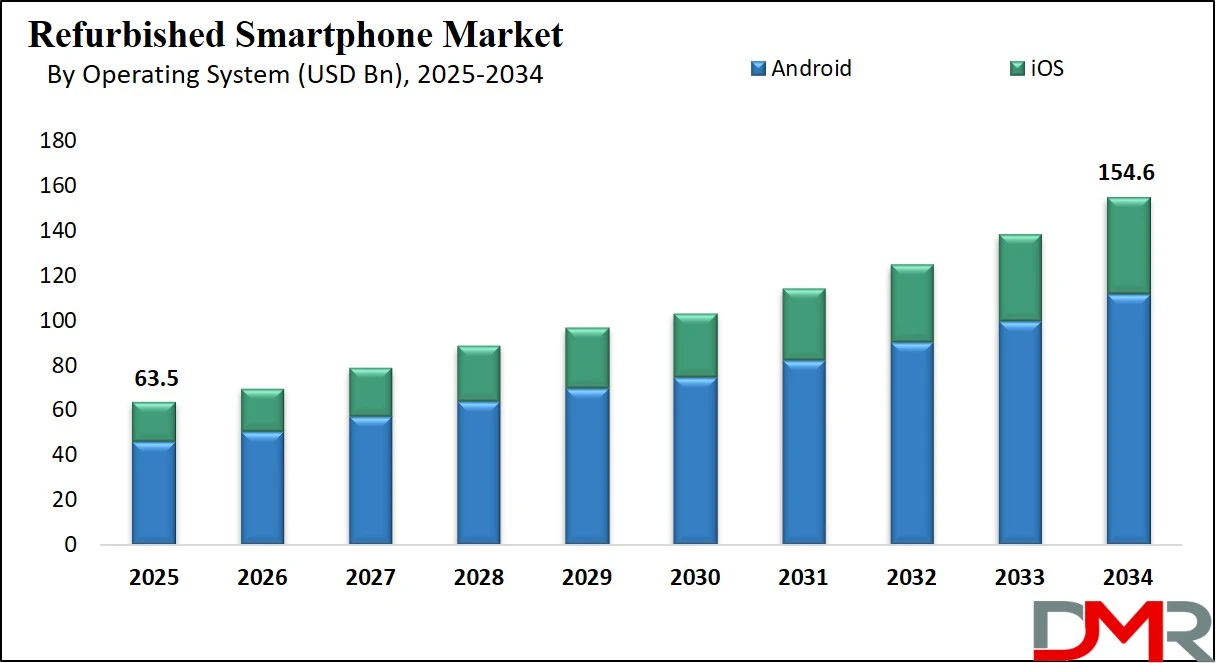

The global refurbished smartphone market is projected to reach USD 63.5 billion in 2025 and is expected to grow to USD 154.6 billion by 2034, expanding at a CAGR of 10.4%. This growth is driven by rising demand for affordable smartphones, increased adoption of certified pre-owned devices, and the shift toward sustainable consumer electronics.

ℹ

To learn more about this report –

Download Your Free Sample Report Here

A refurbished smartphone is a pre-owned mobile device that has been returned to the manufacturer, retailer, or third-party refurbisher due to defects, trade-ins, or customer dissatisfaction. After undergoing a rigorous inspection, repair, and quality assurance process, these devices are restored to full functionality and resold at a lower price than their brand-new counterparts.

Often, refurbished phones are reconditioned with genuine parts, cleaned, tested for performance, and packaged with a limited warranty. These smartphones offer consumers access to popular models at reduced prices, making them a viable option for budget-conscious users or environmentally conscious buyers seeking sustainable alternatives to new electronics.

ℹ

To learn more about this report –

Download Your Free Sample Report Here

The global refurbished smartphone market has experienced significant growth in recent years, driven by growing consumer demand for affordable, high-performance devices and growing environmental awareness. With technological advancements and the saturation of new smartphone sales in mature markets, refurbished devices have emerged as a lucrative segment.

E-commerce platforms, trade-in programs, and certified refurbishment services have played a crucial role in expanding access to these devices. Additionally, smartphone lifecycle extension initiatives and government regulations promoting the reduction of electronic waste have further fueled the adoption of refurbished phones across diverse customer segments.

This market is also experiencing traction due to the rising popularity of flagship models being resold after minor use, offering high specifications at nearly half the original price. With a growing ecosystem of online refurbishing platforms and increased trust in certified pre-owned devices, the refurbished smartphone industry is evolving rapidly.

Key factors such as lower carbon footprints, growing smartphone penetration in developing economies, and shifting user preferences toward cost-efficient alternatives continue to shape the dynamics of this market. The segment is poised for further expansion as brands and retailers align with circular economy principles and offer warranties and after-sale support to enhance consumer confidence.

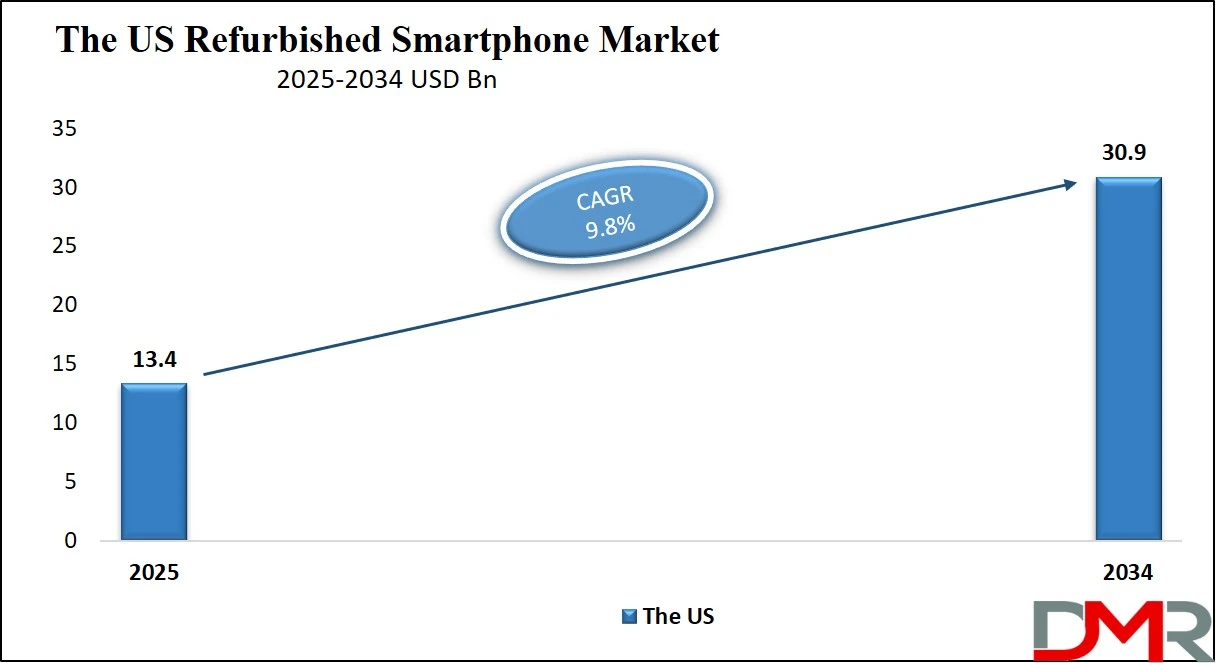

The US Refurbished Smartphone Market

The U.S. Refurbished Smartphone Market size is projected to be valued at USD 13.4 billion in 2025. It is further expected to witness subsequent growth in the upcoming period, holding USD 30.9 billion in 2034 at a CAGR of 9.8%.

ℹ

To learn more about this report –

Download Your Free Sample Report Here

The US refurbished smartphone market has evolved into a robust and dynamic segment within the broader consumer electronics industry. Driven by rising smartphone replacement cycles, cost-conscious consumers, and increased environmental awareness, demand for certified pre-owned smartphones has surged across the country. Major players such as Apple, Amazon Renewed, and Best Buy have enhanced their refurbishment programs, offering thoroughly inspected, tested, and warranty-backed devices that appeal to both budget-focused buyers and those seeking premium features at lower costs.

The availability of flagship models from leading brands, combined with flexible return policies and online accessibility, has made refurbished smartphones a mainstream alternative to new devices. Additionally, trade-in programs and buyback initiatives from carriers and retailers are fueling a steady supply of high-quality refurbished stock in the US market.

Another key factor contributing to the expansion of the US refurbished mobile phone market is the growing emphasis on sustainability and the circular economy. Consumers are opting for eco-friendly tech solutions, reducing electronic waste, and extending the lifespan of mobile devices. Educational institutions, enterprises, and low-income groups are also adopting refurbished devices due to budget constraints and value-for-money considerations.

The presence of certified refurbishers, stringent quality control standards, and government encouragement of e-waste recycling are further strengthening this market. With improved resale infrastructure, rising smartphone penetration, and a maturing online ecosystem, the US refurbished smartphone market is expected to continue its upward trajectory, setting the pace for other developed economies.

Europe Refurbished Smartphone Market

In 2025, the refurbished smartphone market in Europe is estimated to be valued at USD 14.0 billion. This robust position is driven by the region’s heightened consumer awareness around sustainability, growing acceptance of circular economy practices, and a mature e-commerce infrastructure. European consumers are opting for certified pre-owned devices as a cost-effective and environmentally conscious alternative to new smartphones.

Platforms like Back Market, Swappie, and Refurbed have played a critical role in shaping this behavior by offering professionally refurbished smartphones with warranties, flexible return policies, and quality assurance. The presence of stringent environmental regulations and favorable consumer protection laws further encourages the adoption of second-hand mobile devices in both Western and Northern Europe.

Looking ahead, the European refurbished smartphone market is expected to grow at a steady CAGR of 9.5% from 2025 to 2030. This growth will be supported by the growing number of trade-in and buyback programs offered by OEMs and telecom operators, as well as the rising prices of new flagship models that push consumers toward more affordable alternatives. Additionally, government initiatives aimed at reducing electronic waste and promoting product lifecycle extension are expected to further accelerate market expansion.

The business-to-business (B2B) segment is also gradually growing in the region, with enterprises and institutions embracing refurbished smartphones as a viable cost-saving measure. As digital adoption continues across underserved and sustainability-minded demographics, Europe is set to remain a key growth hub for the global refurbished smartphone ecosystem.

Japan Refurbished Smartphone Market

Japan’s refurbished smartphone market is projected to reach USD 2.9 billion in 2025. Japan has shown a gradual yet consistent shift toward embracing refurbished mobile devices. This is largely driven by the growing popularity of SIM-free smartphones, rising digital adoption among younger and cost-conscious users, and increased awareness of sustainable consumption. The demand for refurbished iPhones remains particularly high due to Apple’s strong brand loyalty in Japan.

Additionally, domestic platforms and electronic chains have begun expanding their certified refurbishment services, offering quality-checked devices with warranty and after-sales support, which is steadily building consumer trust in the segment.

The Japanese market is expected to grow at a CAGR of 7.8% from 2025 to 2030, fueled by supportive government policies on e-waste reduction and the increased presence of e-commerce platforms specializing in pre-owned electronics. With a high smartphone penetration rate and consumers frequently upgrading to newer models, a healthy supply of gently used devices feeds the refurbishment cycle.

Furthermore, as economic uncertainty and inflation concerns grow, more consumers and small businesses are opting for cost-effective refurbished alternatives over premium-priced new models. While cultural preferences for brand-new products still pose a challenge, shifting attitudes among the tech-savvy younger generation are positioning Japan as an emerging opportunity in the global refurbished smartphone landscape.

Global Refurbished Smartphone Market: Key Takeaways

- Market Value: The global refurbished smartphone market size is expected to reach a value of USD 154.6 billion by 2034 from a base value of USD 63.5 billion in 2025 at a CAGR of 10.4%.

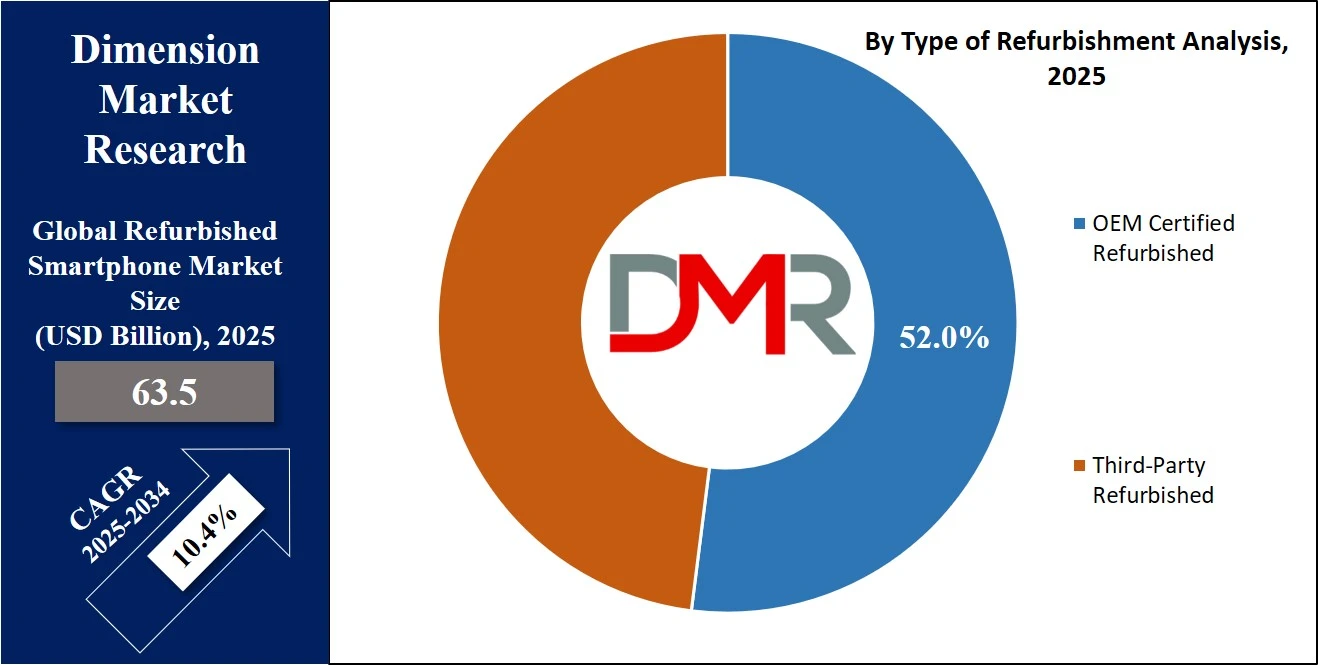

- By Type of Refurbishment Segment Analysis: OEM Certified Refurbished models are anticipated to dominate the type of refurbishment segment, capturing 52.0% of the total market share in 2025.

- By Operating System Segment Analysis: Android devices are expected to maintain their dominance in the operating system segment, capturing 72.0% of the total market share in 2025.

- By Price Range Segment Analysis: Mid-Range Devices are poised to consolidate their dominance in the price range segment, capturing 48.0% of the total market share in 2025.

- By Age of Device before Refurbishment Segment Analysis: 1–2 Years Old devices will dominate the age of device before refurbishment segment, capturing 50.0% of the market share in 2025.

- By Sales Channel Segment Analysis: The Online channel will dominate the booking mode segment, capturing 65.0% of the market share in 2025.

- By End-User Segment Analysis: Consumers will capture the highest share in the end-user segment with a share of 85.0% in 2025.

- Regional Analysis: Asia Pacific is anticipated to lead the global refurbished smartphone market landscape with 38.0% of total global market revenue in 2025.

- Key Players: Some key players in the global refurbished smartphone market are Apple, Samsung, Amazon Renewed, Back Market, Flipkart, Gazelle, Reboxed, Paytm Mall, Walmart, Best Buy, Swappa, Refurb.me, FoneGiant, Phone Daddy, TechRefurb, and Others.

Global Refurbished Smartphone Market: Use Cases

- Affordable Smartphone Access for Budget-Conscious Consumers: Refurbished smartphones serve as an ideal solution for individuals and families seeking high-performance mobile devices at a fraction of the cost of new models. In price-sensitive regions such as the Asia-Pacific, Africa, and parts of Latin America, second-hand mobile phones provide access to advanced technology that might otherwise be financially out of reach. Certified pre-owned smartphones, often backed by warranty and quality assurance, ensure users do not have to compromise on features or reliability. This segment has become especially relevant for students, gig workers, and first-time smartphone buyers who prioritize functionality, connectivity, and affordability over the prestige of owning a brand-new device.

- Sustainable Tech Adoption and E-Waste Reduction: The refurbished smartphone market plays a vital role in promoting sustainable electronics and reducing global electronic waste. By extending the lifecycle of used smartphones through professional refurbishment and resale, millions of devices are diverted from landfills each year. Environmentally conscious consumers are choosing refurbished phones to minimize their carbon footprint and support circular economy principles. Many tech giants and retailers have integrated green policies into their operations, emphasizing trade-in programs and device recycling to contribute to sustainability goals. As climate-conscious behavior becomes a global norm, refurbished smartphones offer a practical path toward eco-friendly consumerism.

- Bulk Procurement by Educational Institutions and Enterprises: Educational institutions, non-profits, and small to mid-sized enterprises (SMEs) are leveraging the refurbished smartphone market for cost-effective digital enablement. Schools and colleges are purchasing refurbished devices in bulk to support remote learning initiatives, especially in underserved areas where budget constraints limit access to new hardware. Similarly, businesses are equipping their workforce with used smartphones that are both reliable and economical. The availability of certified pre-owned smartphones with software support and warranty options makes them suitable for professional environments, contributing to operational efficiency without inflating IT budgets.

- Revenue Generation for Retailers through Trade-In and Resale Programs: Retailers and telecom providers are capitalizing on the refurbished smartphone trend by offering trade-in programs, buyback schemes, and device upgrade plans. These initiatives encourage consumers to exchange their old phones for credit toward newer models, creating a steady flow of inventory for the refurbished market. E-commerce platforms like Amazon Renewed, Flipkart, and Back Market have built strong ecosystems for grading, refurbishing, and reselling used smartphones with verified quality and warranties. This not only helps retailers attract price-sensitive customers but also boosts customer retention and drives secondary revenue streams. The robust resale infrastructure and growing trust in certified refurbishers are key enablers of this profitable business model.

Impact of Artificial Intelligence on the Refurbished Smartphone Market

Artificial Intelligence is playing a transformative role in the refurbished smartphone market, reshaping how devices are assessed, repaired, priced, and resold. One of the most notable impacts is seen in automated diagnostics and AI-based quality checks, which have significantly improved the speed and accuracy of testing pre-owned smartphones.

AI tools can now instantly evaluate key hardware and software functions, such as battery health, camera clarity, touchscreen responsiveness, and internal component wear, reducing human error and ensuring consistent product quality across large volumes of devices. This has led to faster refurbishment cycles, higher trust in certified pre-owned smartphones, and an overall improvement in customer satisfaction.

AI also contributes to dynamic pricing and inventory optimization by analyzing real-time demand, usage trends, and resale value predictions. Machine learning algorithms help refurbishers and e-commerce platforms implement predictive analytics to forecast which models will be in high demand, which components will likely fail post-resale, and how pricing should fluctuate to remain competitive.

Additionally, AI-driven grading systems are replacing subjective human inspections, offering more transparent and standardized product listings with grades like “Excellent,” “Good,” or “Acceptable,” improving buyer confidence. These innovations, combined with smart supply chain and inventory management tools, are making the global refurbished smartphone market more efficient, scalable, and responsive to consumer expectations. As AI continues to evolve, it is expected to drive further automation, cost reduction, and innovation across the refurbished mobile device lifecycle.

Global Refurbished Smartphone Market: Stats & Facts

U.S. Environmental Protection Agency (EPA)

- In 2022, the United States generated approximately 15.8 billion pounds of electronic waste, averaging 46 pounds per person, with a 52% recovery rate.

- In 2009, U.S. consumers discarded around 420 million mobile phones, but only 12 million were collected for recycling, reflecting a recycling rate of about 2.9%.

- Recycling 1 million cell phones can yield approximately 35,274 pounds of copper, 772 pounds of silver, and 75 pounds of gold, showcasing the environmental and material value of refurbished and recycled devices.

California Department of Toxic Substances Control (DTSC)

- In 2020, 8.47 million mobile phones were sold in California.

- Of these, about 1.34 million devices were returned for recycling, indicating a 15.9% collection rate, which improved from 8.6% in 2019.

- This rise in return rate reflects growing awareness about sustainable electronics use and the importance of circular practices such as refurbishment.

Global Refurbished Smartphone Market: Market Dynamics

Global Refurbished Smartphone Market: Driving Factors

Rising Demand for Affordable High-End Devices

The growing price of flagship smartphones has created a significant demand for affordable alternatives among budget-conscious consumers. Refurbished smartphones offer high-end features, like advanced cameras, OLED displays, and powerful processors, at substantially lower prices. This has fueled demand, especially in emerging markets and price-sensitive regions where access to premium mobile technology was previously limited. The availability of certified pre-owned smartphones with warranties has further boosted consumer confidence in purchasing refurbished devices.

Environmental Concerns and E-Waste Reduction Initiatives

As awareness grows around the environmental impact of electronic waste, more consumers and businesses are turning to sustainable electronics. Purchasing second-hand smartphones extends the device lifecycle, reduces landfill contributions, and supports circular economy models. Regulatory pressures and global sustainability goals are also encouraging manufacturers and retailers to establish refurbishment and buyback programs, making refurbished smartphones an environmentally responsible choice.

Global Refurbished Smartphone Market: Restraints

Perceived Lack of Reliability and Trust Issues

Despite growing acceptance, many potential buyers remain skeptical about the quality and longevity of refurbished smartphones. Concerns about hidden defects, battery performance, or outdated software can deter consumers from choosing used or pre-owned devices, especially in markets with low awareness about certified refurbishment standards. Lack of standardized quality grading across vendors also contributes to trust barriers.

Limited Availability of Spare Parts and OEM Support

One of the biggest challenges in the refurbished smartphone market is the availability of genuine replacement parts, especially for older or discontinued models. Limited access to OEM components can affect the quality of repairs and lead to inconsistent performance. Moreover, some manufacturers do not offer software updates or warranty coverage for refurbished units, reducing their appeal among tech-savvy users and corporate clients.

Global Refurbished Smartphone Market: Opportunities

Expansion in Emerging Markets

Developing economies in regions such as Africa, Southeast Asia, and Latin America present a major growth opportunity for the refurbished smartphone market. With rising mobile penetration and limited purchasing power, pre-owned smartphones can bridge the digital divide by offering affordable connectivity. Localized refurbishment centers and tailored marketing strategies can help tap into these untapped regions and meet the growing demand for low-cost smartphones.

Integration of AI and Automation in Refurbishment

The adoption of AI-powered diagnostics, machine learning-based testing, and automated grading systems offers an opportunity to scale refurbishment operations efficiently. These technologies not only improve refurbishment accuracy but also enhance inventory tracking, quality control, and customer experience. Companies leveraging intelligent repair systems and data analytics are better positioned to dominate the market with faster turnaround times and improved margins.

Global Refurbished Smartphone Market: Trends

Rise of E-commerce Platforms and Direct-to-Consumer Channels

The growing popularity of online marketplaces like Amazon Renewed, Back Market, and Flipkart 2GUD has revolutionized how refurbished smartphones are marketed and sold. These platforms provide transparent grading, verified warranties, and customer reviews, improving consumer trust. The shift toward direct-to-consumer sales is streamlining logistics and reducing costs, enabling refurbishers to serve a broader audience at competitive prices.

Brand-Led Refurbishment Programs

Major OEMs like Apple and Samsung are launching their refurbishment initiatives, offering certified refurbished smartphones directly through official channels. These programs ensure high quality, include warranties, and promote brand loyalty among cost-sensitive buyers. The trend of manufacturers participating in the pre-owned smartphone ecosystem is expected to further legitimize and expand the market globally.

Global Refurbished Smartphone Market: Research Scope and Analysis

By Type of Refurbishment Analysis

In the type of refurbishment segment, OEM-certified refurbished smartphones are expected to lead the market in 2025, accounting for approximately 52.0% of the total market share. This dominance is primarily driven by the growing consumer preference for quality assurance, brand trust, and warranty coverage. OEM refurbished models are typically reconditioned by the original manufacturer or through authorized partners using genuine components and standardized testing protocols.

These devices often come with extended warranties and software updates, offering buyers a near-new experience at a lower price point. As consumers become more cautious about device reliability and performance, OEM-certified smartphones continue to gain traction in both developed and developing markets.

On the other hand, third-party refurbished smartphones represent a significant portion of the market as well, particularly in price-sensitive regions. These devices are refurbished by independent vendors or retailers who are not directly affiliated with the original manufacturers. While they may not always use OEM parts, many third-party refurbishers follow strict quality checks and offer competitive pricing, making refurbished phones more accessible to a broader audience.

However, the lack of consistent quality standards and limited warranty coverage can sometimes affect consumer confidence. Despite these challenges, the third-party segment plays a crucial role in expanding the availability of affordable smartphones, especially in regions where access to OEM-certified models is limited.

ℹ

To learn more about this report –

Download Your Free Sample Report Here

By Operating System Analysis

In the operating system segment of the refurbished smartphone market, Android devices are projected to maintain a strong lead, capturing around 72.0% of the total market share in 2025. This dominance can be attributed to the wide range of Android smartphone brands available globally, including Samsung, Xiaomi, OnePlus, Motorola, and others, which contribute to a large and diverse pool of pre-owned devices entering the secondary market.

The affordability, variety of models, and ease of refurbishment for Android phones make them more accessible across different price segments. Additionally, Android’s presence in both premium and budget categories ensures a continuous supply of refurbished units catering to varied consumer needs, particularly in developing regions where cost-effectiveness is a major purchasing factor.

In contrast, iOS-based devices, primarily consisting of Apple iPhones, also hold a significant share in the refurbished market, but at a lower percentage compared to Android. Refurbished iPhones are highly sought after due to their premium build quality, longer software support, and strong resale value.

Although they typically command higher prices even in the refurbished category, many consumers are willing to invest in older iPhone models for the perceived status, user experience, and consistent performance they offer. The strong brand loyalty associated with Apple and the availability of OEM-certified refurbished iPhones through official Apple programs contribute to their stable position in the segment. Despite their smaller market share, iOS devices remain highly profitable for refurbishers and retailers due to strong demand and high turnover rates.

By Price Range Analysis

In the price range segment of the refurbished smartphone market, mid-range devices are expected to solidify their dominance, accounting for 48.0% of the total market share in 2025. This category typically includes smartphones priced between USD 200 and USD 500, offering a balanced mix of performance, design, and affordability. Mid-range refurbished models often include slightly older versions of flagship devices or high-performing phones from brands like Samsung, OnePlus, Xiaomi, and Google.

These devices appeal strongly to budget-conscious users who seek reliable features such as strong processors, quality cameras, and modern displays without the high price tag of new phones. The combination of value and functionality makes mid-range refurbished smartphones the most popular choice among consumers, especially in emerging economies and among young adults, students, and first-time smartphone buyers.

Premium refurbished smartphones, usually priced above USD 500, also occupy a significant space within this segment, though with a relatively smaller share compared to mid-range devices. This category is dominated by flagship models from Apple and Samsung, such as recent-generation iPhones and Galaxy S series, which continue to retain their appeal due to high-end specifications and brand prestige.

Many consumers opt for premium refurbished phones to access top-tier technology and design at reduced prices, benefiting from the durability and long-term software support these models offer. Although the upfront cost remains higher, the value proposition is strong for users who desire a luxury smartphone experience without paying full retail prices. The demand for premium refurbished devices is growing steadily, particularly among professionals and brand-loyal customers in developed markets.

By Age of Device before Refurbishment Analysis

In the age of device before refurbishment segment, smartphones that are 1–2 years old are expected to lead the market in 2025, accounting for 50.0% of the total share. These devices are typically recent-generation models that were either returned shortly after purchase, exchanged through trade-in programs, or upgraded by users within a short timeframe.

Because they are relatively new, these phones often require minimal repairs, maintain strong hardware and software compatibility, and can still receive the latest operating system updates. Refurbishers prefer this category as it ensures faster turnaround times, lower refurbishment costs, and higher resale value. Consumers are also more inclined to purchase 1–2 year-old refurbished smartphones, as they offer a near-flagship experience with updated features at a significantly reduced price, making them a smart and reliable choice.

Smartphones that fall into the 2–3 years 3-year-old category also represent an important segment of the refurbished market. While these devices may not support the latest software updates or features, they often still perform well for general usage, such as browsing, calling, media consumption, and basic productivity tasks. This category is especially popular among users looking for ultra-affordable smartphones, including students, seniors, and those in emerging markets.

Though the resale price is lower, the supply of 2–3-year-old models is abundant due to frequent upgrade cycles in developed regions. Refurbishers often target this segment for bulk sales and promotional bundles, providing good value for consumers with modest requirements. However, demand may be slightly constrained by concerns over battery life, outdated components, or limited compatibility with newer apps and accessories.

By Sales Channel Analysis

In the sales channel segment, the online channel is projected to dominate the refurbished smartphone market in 2025, accounting for 65.0% of the total market share. The growing popularity of e-commerce platforms such as Amazon Renewed, Back Market, Flipkart, and others has made it easier for consumers to access a wide variety of refurbished smartphone models with transparent pricing, verified quality grades, and warranty options.

Online platforms also offer detailed product specifications, customer reviews, easy return policies, and financing options, all of which contribute to increased consumer trust and convenience. The digital-first shopping behavior of younger consumers, integrated with the rapid expansion of internet connectivity and mobile payment systems in developing regions, is further boosting online sales of pre-owned smartphones. Additionally, online marketplaces often partner with certified refurbishers, ensuring standardized refurbishment processes and consistent product quality.

Despite the dominance of online channels, the offline segment continues to play a vital role in the refurbished smartphone market, particularly in rural and semi-urban areas where internet penetration and digital literacy may be limited. Many consumers still prefer in-person interactions where they can physically inspect the device, negotiate pricing, and get immediate support. Local mobile shops, franchise stores, and retail outlets offer refurbished smartphones with instant availability and cash purchase options, catering to a customer base that values face-to-face service.

Offline channels are also important for building trust among first-time smartphone buyers or those hesitant about purchasing electronics online. In many cases, offline stores act as collection points for trade-ins and support post-sale services, reinforcing their relevance in the overall market ecosystem.

By End-User Analysis

In the end-user segment of the refurbished smartphone market, consumers are expected to account for the largest share, capturing approximately 85.0% of the total market in 2025. This dominance is primarily driven by the rising demand for affordable yet feature-rich smartphones among individual buyers, especially in emerging economies and among cost-sensitive demographics such as students, young professionals, and low-income groups. Many consumers are opting for refurbished smartphones to access premium brands and advanced features at significantly lower prices.

The availability of certified pre-owned devices with warranty coverage, combined with the convenience of online shopping and attractive financing options, has made refurbished smartphones a popular choice for personal use. Additionally, growing environmental awareness and the desire to reduce electronic waste are encouraging more consumers to choose sustainable alternatives like refurbished devices.

While consumers dominate the segment, the business-to-business (B2B) market also plays a significant role in the refurbished smartphone ecosystem. Enterprises, educational institutions, NGOs, and government organizations are procuring refurbished smartphones in bulk to equip their workforce, students, or field teams cost-effectively. These organizations often seek reliable, performance-capable devices that support essential communication and productivity tools without the high capital expenditure associated with new devices.

Refurbished smartphones serve as an economical and scalable solution for such needs, especially in remote work scenarios or digital learning environments. Although the B2B share is smaller, it is steadily growing due to growing awareness about procurement savings, sustainable sourcing, and the availability of large-volume supply chains from certified refurbishers.

The Refurbished Smartphone Market Report is segmented on the basis of the following:

By Type of Refurbishment

- OEM Certified Refurbished

- Third-party Refurbished

By Operating System

By Price Range

- Low-End

- Mid-Range

- Premium

By Age of Device before Refurbishment

- Less than 1 Year Old

- 1-2 Years Old

- 2-3 Years Old

- More than 3 Years Old

By Sales Channel

By End-User

- Consumers (B2C)

- Business (B2B)

Global Refurbished Smartphone Market: Regional Analysis

Region with the Largest Revenue Share

Asia Pacific is projected to lead the global refurbished smartphone market in 2025, accounting for 38.0% of the total global market revenue. This regional dominance is driven by a large population base, high smartphone penetration, and growing demand for affordable mobile devices among price-sensitive consumers. Countries like India, China, Indonesia, and Vietnam are witnessing rapid digital adoption, where refurbished smartphones offer a cost-effective solution for accessing modern technology.

The presence of strong e-commerce platforms, widespread trade-in programs, and a growing network of local refurbishers further supports the region’s growth. Additionally, growing awareness of sustainable consumption and support from government initiatives aimed at digital inclusion are contributing to the expanding demand for pre-owned mobile devices across Asia Pacific.

ℹ

To learn more about this report –

Download Your Free Sample Report Here

Region with significant growth

The Middle East and Africa region is expected to witness significant growth in the refurbished smartphone market over the coming years, driven by growing smartphone adoption, expanding internet access, and a rising demand for affordable mobile technology. Many consumers in this region are turning to second-hand and certified pre-owned smartphones as cost-effective alternatives to new high-end models, particularly in countries like Nigeria, South Africa, Egypt, and the UAE.

The growth is further supported by a young, tech-savvy population and the rapid development of digital infrastructure. As awareness around e-waste reduction and sustainable electronics gains momentum, the refurbished smartphone market in the Middle East and Africa is poised to emerge as one of the fastest-growing regional segments globally.

By Region

North America

Europe

- Germany

- The U.K.

- France

- Italy

- Russia

- Spain

- Benelux

- Nordic

- Rest of Europe

Asia-Pacific

- China

- Japan

- South Korea

- India

- ANZ

- ASEAN

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Argentina

- Colombia

- Rest of Latin America

Middle East & Africa

- Saudi Arabia

- UAE

- South Africa

- Israel

- Egypt

- Rest of MEA

Global Refurbished Smartphone Market: Competitive Landscape

The global competitive landscape of the refurbished smartphone market is characterized by a mix of established OEMs, specialized refurbishing companies, e-commerce giants, and regional players all vying for market share. Leading brands like Apple and Samsung continue to dominate with their certified refurbishment programs, offering high-trust devices with warranties and software support. Meanwhile, platforms like Amazon Renewed, Back Market, and Flipkart (2GUD) have created strong online ecosystems, streamlining the resale process through standardized grading and quality assurance.

Independent refurbishers and startups such as Gazelle, Reboxed, and Cashify are also expanding rapidly, targeting niche segments and regional markets with aggressive pricing and buyback programs. The competition is further intensified by retailers like Best Buy, Walmart, and eBay, which provide accessible refurbished options to mass consumers. As the market matures, differentiation is being driven by quality control, post-sale service, AI-driven diagnostics, and sustainable business models, creating a dynamic and fast-evolving competitive environment.

Some of the prominent players in the global refurbished smartphone market are:

- Apple Inc.

- Samsung Electronics

- Amazon Renewed

- Back Market

- Flipkart (2GUD)

- Gazelle

- Reboxed

- Paytm Mall

- Walmart

- Best Buy

- Swappa

- Refurb.me

- FoneGiant

- Phone Daddy

- TechRefurb

- The iOutlet

- Togofogo

- Cashify

- eBay

- Decluttr

- Other Key Players

Global Refurbished Smartphone Market: Recent Developments

Product Launches

- May 2025: Nothing unveiled its new mid-range models, Phone (3a) and Phone (3a) Pro, powered by Snapdragon 7s Gen 3 and featuring the AI “Essential Space” tool, enhancing organization and productivity.

- April 2025: Finland-based Swappie announced a €17 million loan from the European Investment Bank to expand its refurbished iPhone offerings and scale operations across Europe.

Mergers & Acquisitions

- October 2024: Back Market expanded its market presence through a strategic partnership with Verizon subsidiary Visible and telecom operator Bouygues Telecom, integrating trade-in processes into their platforms.

- March 2023: Geely’s subsidiary, DreamSmart, acquired a 79.09% stake in Meizu, initiating a strategic merger to diversify its tech portfolio, including second-hand mobile devices.

Funding Rounds

- March 2025: Kenyan re-commerce startup Badili secured a USD 400 K debt facility from Proparco to support local refurbishment, digital inclusion, and e‑waste reduction efforts in East Africa.

- February 2025: Ecogem launched its smartphone refurbishment unit in France, backed by internal investment, featuring robot‑assisted diagnostics and a goal to refurbish over 250 phones daily

Report Details

| Report Characteristics |

| Market Size (2025) |

USD 63.5 Bn |

| Forecast Value (2034) |

USD 154.6 Bn |

| CAGR (2025–2034) |

10.4% |

| Historical Data |

2019 – 2024 |

| The US Market Size (2025) |

USD 13.4 Bn |

| Forecast Data |

2025 – 2033 |

| Base Year |

2024 |

| Estimate Year |

2025 |

| Report Coverage |

Market Revenue Estimation, Market Dynamics, Competitive Landscape, Growth Factors, etc. |

| Segments Covered |

By Type of Refurbishment (OEM Certified Refurbished and Third-party Refurbished), By Operating System (Android and iOS), By Price Range (Low-End, Mid-Range, and Premium), By Age of Device before Refurbishment (Less than 1 Year Old, 1–2 Years Old, 2–3 Years Old, and More than 3 Years Old), By Sales Channel (Online and Offline), and By End-User (Consumers (B2C) and Business (B2B)) |

| Regional Coverage |

North America – US, Canada; Europe – Germany, UK, France, Russia, Spain, Italy, Benelux, Nordic, Rest of Europe; Asia-Pacific – China, Japan, South Korea, India, ANZ, ASEAN, Rest of APAC; Latin America – Brazil, Mexico, Argentina, Colombia, Rest of Latin America; Middle East & Africa – Saudi Arabia, UAE, South Africa, Turkey, Egypt, Israel, Rest of MEA |

| Prominent Players |

Apple, Samsung, Amazon Renewed, Back Market, Flipkart, Gazelle, Reboxed, Paytm Mall, Walmart, Best Buy, Swappa, Refurb.me, FoneGiant, Phone Daddy, TechRefurb, and Others |

| Purchase Options |

We have three licenses to opt for: Single User License (Limited to 1 user), Multi-User License (Up to 5 Users), and Corporate Use License (Unlimited User) along with free report customization equivalent to 0 analyst working days, 3 analysts working days, and 5 analysts working days respectively. |

Frequently Asked Questions

How big is the global refurbished smartphone market?

▾ The global refurbished smartphone market size is estimated to have a value of USD 63.5 billion in 2025 and is expected to reach USD 154.6 billion by the end of 2034.

What is the size of the US refurbished smartphone market?

▾ The US refurbished smartphone market is projected to be valued at USD 13.4 billion in 2025. It is expected to witness subsequent growth in the upcoming period as it holds USD 30.9 billion in 2034 at a CAGR of 9.8%.

Which region accounted for the largest global refurbished smartphone market?

▾ Asia Pacific is expected to have the largest market share in the global refurbished smartphone market, with a share of about 38.0% in 2025.

Who are the key players in the global refurbished smartphone market?

▾ Some of the major key players in the global refurbished smartphone market are Apple, Samsung, Amazon Renewed, Back Market, Flipkart, Gazelle, Reboxed, Paytm Mall, Walmart, Best Buy, Swappa, Refurb.me, FoneGiant, Phone Daddy, TechRefurb, and Others.

What is the growth rate of the global refurbished smartphone market?

▾ The market is growing at a CAGR of 10.4 percent over the forecasted period.