Market Overview

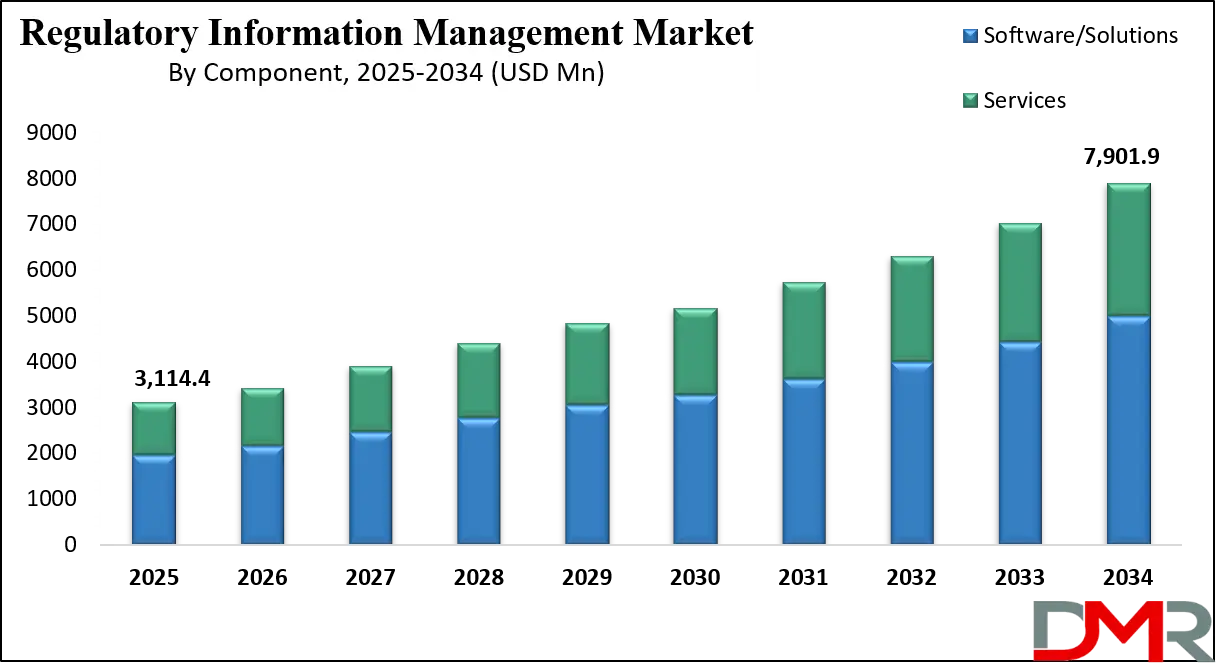

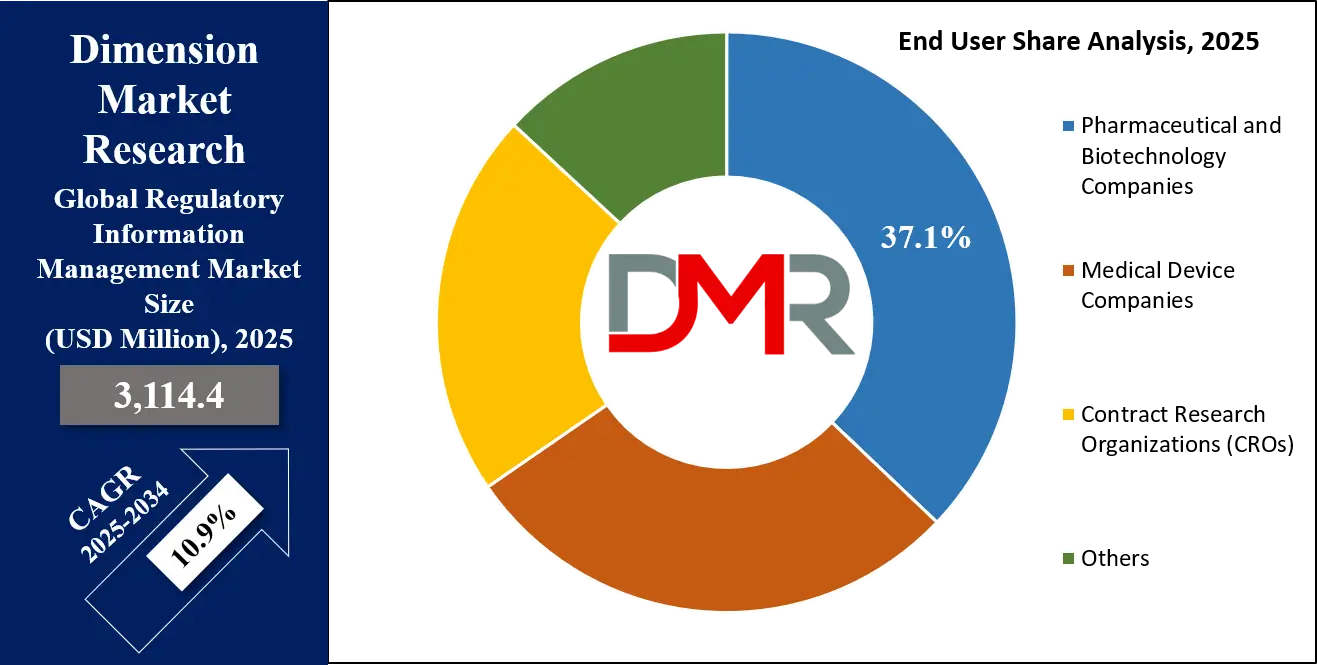

The Global Regulatory Information Management (RIM) Market is projected to be valued at USD 3,114.4 million in 2025 and is expected to grow at a compound annual growth rate (CAGR) of 10.9% through 2034, reaching approximately USD 7,901.9 million.

The global Regulatory Information Management (RIM) market has emerged as an indispensable pillar of the life sciences industry, providing structured and standardized systems to manage regulatory submissions, compliance documentation, and lifecycle activities across increasingly complex jurisdictions. Market expansion is driven by the rising complexity of regulatory requirements, growing biologic and specialty drug approvals, and the globalization of clinical trials, which demand harmonized compliance systems.

A defining trend is the integration of artificial intelligence (AI),

natural language processing (NLP), and robotic process automation (RPA) into RIM platforms, enhancing regulatory intelligence, submission planning, and change management. Cloud-based solutions are gaining preference over legacy on-premise models due to their scalability, real-time collaboration, and improved cybersecurity measures an essential features in hybrid and remote work settings.

Emerging economies represent a significant opportunity for RIM adoption, as regulatory authorities in Asia-Pacific, Latin America, and the Middle East are pursuing harmonization initiatives and digital modernization programs that accelerate regulatory transformation. At the same time, challenges remain. High implementation and maintenance costs restrict adoption by smaller enterprises. Integration with existing legacy IT infrastructure often creates interoperability bottlenecks, while the shortage of skilled professionals trained in both regulatory science and advanced technologies adds to execution hurdles.

Moreover, evolving data integrity mandates and stringent cybersecurity requirements demand continual investment from vendors and life science companies. Nevertheless, the continuous expansion of global therapeutic pipelines, coupled with increasing reliance on efficient regulatory intelligence and lifecycle management, ensures sustained growth. RIM solutions remain critical to improving compliance efficiency, reducing time-to-market, and maintaining competitiveness in a rapidly evolving healthcare environment.

The US Regulatory Information Management Market

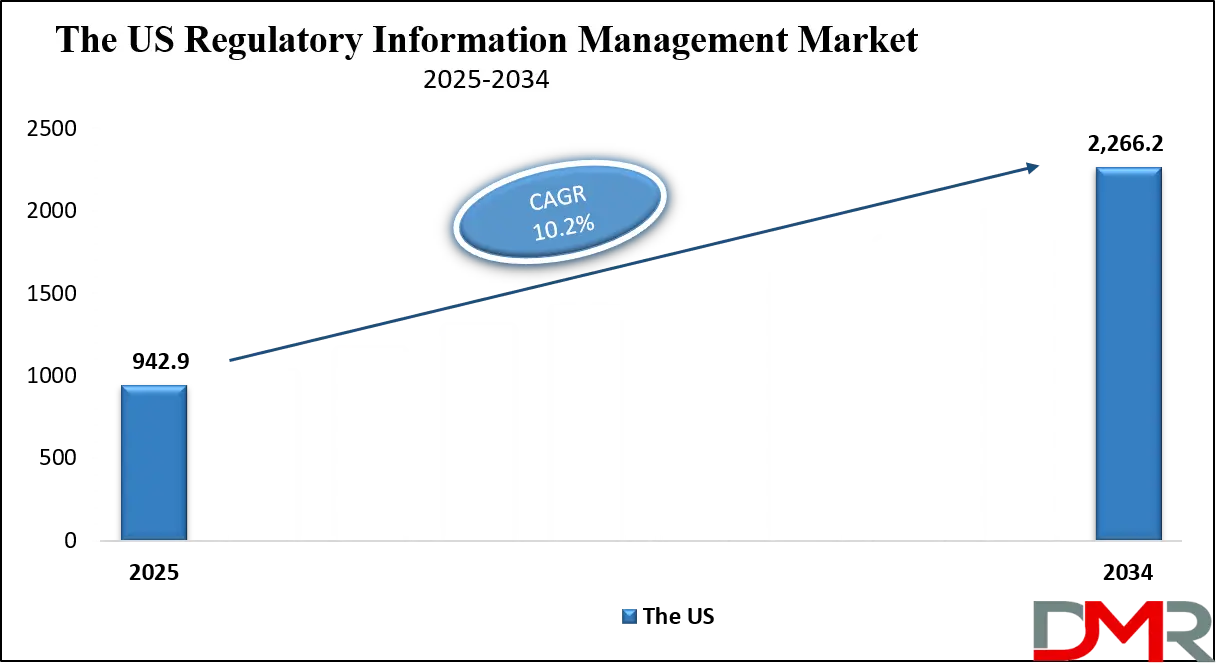

The US Regulatory Information Management Market is projected to reach USD 942.9 million in 2025 at a compound annual growth rate of 10.2% over its forecast period.

The U.S. Regulatory Information Management (RIM) market is heavily shaped by the regulatory rigor of the Food and Drug Administration (FDA), which enforces some of the world’s most comprehensive requirements for electronic submissions, structured product labeling, and post-market safety monitoring. The FDA’s Centers for Drug Evaluation and Research (CDER) and Biologics Evaluation and Research (CBER) oversee thousands of annual submissions, driving life sciences companies to adopt advanced RIM platforms that guarantee compliance and streamline complex documentation processes.

Initiatives such as the FDA’s Digital Transformation Action Plan and its emphasis on electronic Common Technical Document (eCTD) submissions have accelerated the adoption of automated, cloud-based RIM solutions that improve submission quality and ensure regulatory readiness.

Demographic factors further reinforce U.S. market demand. According to the U.S. Census Bureau, individuals aged 65 and above are projected to account for nearly a quarter of the population by 2060. Combined with Centers for Disease Control and Prevention (CDC) reports highlighting the rising prevalence of chronic conditions such as cardiovascular disease, diabetes, and cancer, this demographic shift fuels the urgent need for efficient regulatory processes that accelerate drug approvals and enable safe post-market surveillance.

The U.S. market also benefits from its global leadership in biologics, cell and gene therapies, and digital therapeutics, which require sophisticated RIM tools capable of handling complex and evolving regulatory requirements. Despite challenges such as high compliance costs and interoperability with existing IT ecosystems, the U.S. remains the most influential RIM market, setting industry benchmarks and driving innovations that influence global regulatory practices.

The Europe Regulatory Information Management Market

The Europe Regulatory Information Management Market is estimated to be valued at USD 467.1 million in 2025 and is further anticipated to reach USD 1,106.6 million by 2034 at a CAGR of 9.0%.

Europe’s Regulatory Information Management (RIM) market is characterized by its multi-tiered regulatory framework involving the European Medicines Agency (EMA), national health authorities, and the European Commission. The implementation of the Clinical Trials Regulation and its centralized Clinical Trials Information System (CTIS) has intensified the need for robust RIM platforms capable of managing complex cross-border submissions and ensuring compliance across multiple jurisdictions.

Additionally, the Medical Device Regulation (MDR) and In Vitro Diagnostic Regulation (IVDR) have significantly expanded compliance demands for medical device and diagnostic companies, further driving adoption of advanced RIM solutions across the region.

Demographic trends strengthen demand. Eurostat reports that more than 20% of the European Union’s population is aged 65 or older, with projections indicating continued growth in this share. Europe’s aging population, combined with universal healthcare systems and high pharmaceutical consumption, underpins a steady demand for innovative therapies that necessitate efficient regulatory oversight. The EMA’s initiatives, such as electronic product information (ePI) projects and efforts to improve data transparency, are further stimulating the transition toward digitalized, cloud-based RIM systems that enhance regulatory intelligence and lifecycle management.

Challenges persist, particularly regarding harmonization across diverse national regulatory authorities and integration with legacy IT systems. Smaller life sciences firms may face high cost barriers when transitioning to advanced RIM platforms. However, Europe’s robust research ecosystem, strong pharmaceutical base, and growing emphasis on digital health and medical technology innovation sustain long-term growth potential. As regulatory modernization accelerates, Europe’s RIM market will increasingly prioritize automation, interoperability, and cross-border collaboration, reinforcing its role as a pivotal hub for regulatory technology adoption.

The Japan Regulatory Information Management Market

The Japan Regulatory Information Management Market is projected to be valued at USD 186.8 million in 2025. It is further expected to witness subsequent growth in the upcoming period, holding USD 440.7 million in 2034 at a CAGR of 10.0%.

Japan’s Regulatory Information Management (RIM) market is governed by the Pharmaceuticals and Medical Devices Agency (PMDA), which enforces rigorous requirements for electronic submissions, eCTD compliance, and alignment with global International Council for Harmonisation (ICH) standards. The PMDA’s acceptance of foreign clinical trial data and its focus on global harmonization demand that multinational and domestic life sciences companies implement sophisticated RIM systems capable of managing cross-border submissions and integrating international regulatory standards. In addition, Japan’s regulatory focus on regenerative medicine, digital health, and personalized therapies necessitates advanced platforms that can efficiently manage evolving compliance frameworks.

Japan’s demographic profile creates a strong structural demand for RIM. Data from the Ministry of Health, Labour and Welfare (MHLW) shows that over 28% of Japan’s population is aged 65 and older, making it one of the world’s most aged societies. This aging population, supported by universal healthcare and high per capita pharmaceutical spending, fuels the development and approval of new therapies, thus intensifying the demand for efficient regulatory processes and lifecycle management solutions. The PMDA’s push for electronic submissions, structured product labeling, and greater reliance on digital transformation initiatives has made cloud-based RIM platforms an attractive choice for both domestic and multinational companies.

While challenges exist, including high implementation costs and integration with older IT systems, the opportunity landscape is significant. Japan’s leadership in regenerative medicine, coupled with its focus on rapid therapeutic approvals and international regulatory alignment, ensures strong long-term growth. Consequently, Japan remains a vital market for regulatory technology innovation, with RIM solutions playing a critical role in advancing drug safety, compliance, and market access.

Global Regulatory Information Management Market: Key Takeaways

- Global Market Size Insights: The Global Regulatory Information Management Market size is estimated to have a value of USD 3,114.4 million in 2025 and is expected to reach USD 7,901.9 million by the end of 2034.

- The Global Market Growth Rate: The market is growing at a CAGR of 10.9 percent over the forecasted period of 2025.

- The US Market Size Insights: The US Regulatory Information Management Market is projected to be valued at USD 942.9 million in 2025. It is expected to witness subsequent growth in the upcoming period as it holds USD 2,266.2 million in 2034 at a CAGR of 10.2%.

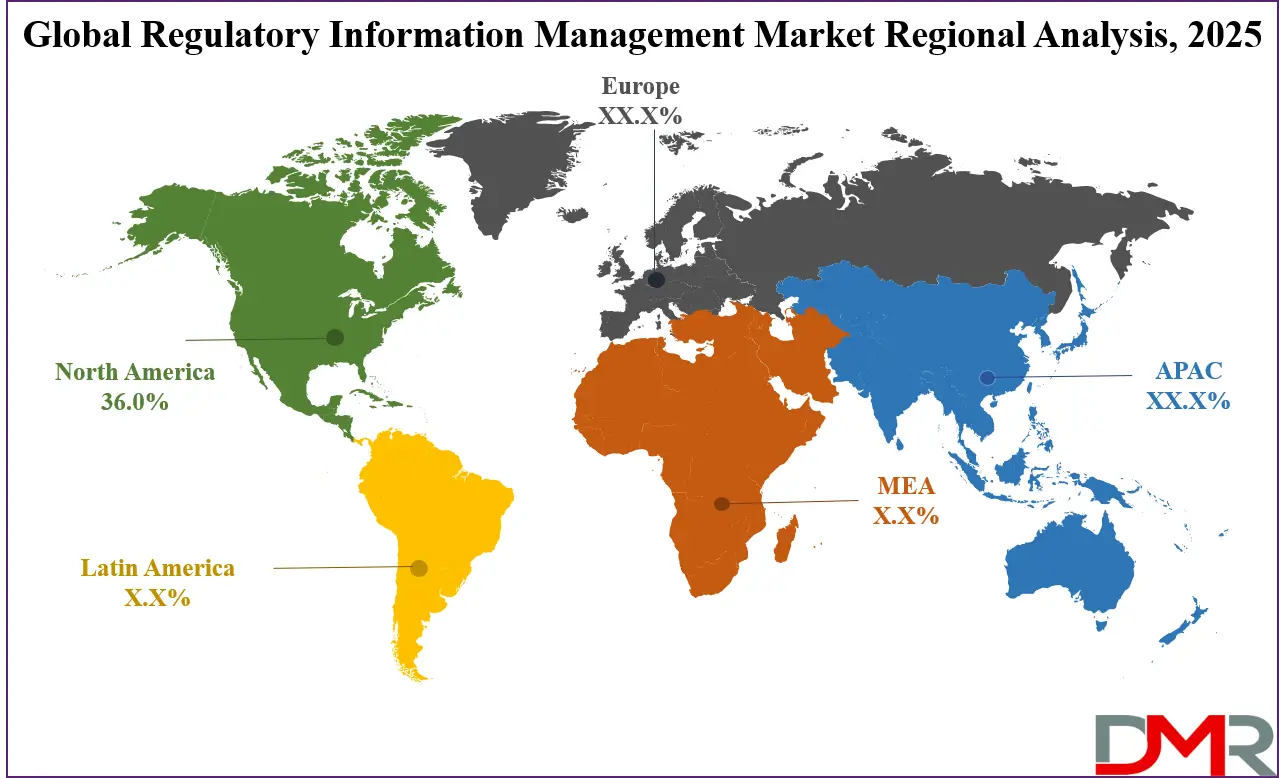

- Regional Insights: North America is expected to have the largest market share in the Global Regulatory Information Management Market with a share of about 36.0% in 2025.

- Key Players: Some of the major key players in the Global Regulatory Information Management Market are Veeva Systems, IQVIA, Dassault Systèmes (Medidata), Parexel, Oracle, ArisGlobal, Sparta Systems (a Honeywell company), Extedo GmbH, and many others.

Global Regulatory Information Management Market: Use Cases

- Regulatory Submission Management: RIM platforms streamline preparation, tracking, and submission of electronic Common Technical Documents (eCTD) across multiple jurisdictions, ensuring faster approvals, minimizing errors, and maintaining compliance with evolving global regulatory standards while reducing administrative burdens on pharmaceutical, biotechnology, and medical device companies.

- Labeling and Packaging Compliance: RIM solutions manage global labeling requirements by standardizing product information, tracking country-specific regulations, and ensuring updates reach all markets quickly. This reduces compliance risks, prevents recalls, and enables efficient global distribution of biologics, generics, and innovative therapeutic products.

- Regulatory Intelligence and Monitoring: Through integration of AI and analytics, RIM systems provide real-time monitoring of global regulatory changes, enabling companies to anticipate shifts, adapt strategies, and ensure ongoing compliance. This supports proactive decision-making, reducing risks of non-compliance penalties and approval delays.

- Lifecycle Management of Products: RIM platforms facilitate complete regulatory lifecycle management, from clinical trial applications to post-market surveillance. By maintaining centralized records, automating renewals, and tracking variations, they help companies manage product portfolios efficiently while ensuring consistent compliance throughout the lifecycle.

- Collaboration and Data Transparency: Cloud-based RIM solutions enable seamless collaboration among global regulatory teams, contract research organizations, and health authorities. They provide transparent, audit-ready documentation with secure access, strengthening trust, accelerating submission approvals, and supporting global harmonization in the pharmaceutical and medical device industries.

Global Regulatory Information Management Market: Stats & Facts

U.S. Food and Drug Administration (FDA)

- FDA’s Center for Drug Evaluation and Research (CDER) approved 55 novel drugs in 2023, one of the highest totals in recent years.

- FDA received over 2.6 million adverse event reports through FAERS in 2022.

- FDA requires electronic Common Technical Document (eCTD) submissions for all NDAs, ANDAs, and BLAs since 2017.

- Structured Product Labeling (SPL) is mandated for all prescription drug labeling in the U.S.

European Medicines Agency (EMA)

- EMA recommended 39 new medicines for marketing authorization in 2023.

- EMA manages the Clinical Trials Information System (CTIS), mandatory for all new trial applications since January 2023.

- Over 4,400 clinical trial applications were submitted via CTIS in its first operational year.

- EMA’s electronic product information (ePI) initiative aims for EU-wide harmonized digital labeling.

Pharmaceuticals and Medical Devices Agency (PMDA – Japan)

- Japan’s PMDA approved 55 new drugs in 2022, including 23 for rare diseases.

- Over 28% of Japan’s population is aged 65+, driving regulatory workload for drug and device approvals.

- Japan adopted ICH E6(R3) and E17 guidelines for global harmonization of clinical trials.

- PMDA has mandated eCTD submissions for new drug applications since 2016.

World Health Organization (WHO)

- WHO lists over 130 national regulatory authorities worldwide, with only about 30 classified as stringent regulatory authorities (SRAs).

- WHO’s Prequalification Program has evaluated 700+ medicines and vaccines for global use.

- WHO estimates that 50% of regulatory authorities in low-income countries lack full operational capacity.

Eurostat

- 20.8% of the EU population was aged 65+ in 2023.

- The EU is the second-largest pharmaceutical market globally, after the U.S.

U.S. Census Bureau

- The U.S. population aged 65+ is projected to reach 95 million by 2060, nearly 1 in 4 Americans.

- The working-age population (18–64) will decline to 56% by 2060, intensifying healthcare needs.

Centers for Disease Control and Prevention (CDC)

- 6 in 10 adults in the U.S. have at least one chronic disease.

- Chronic diseases account for 90% of U.S. healthcare expenditures.

- The U.S. sees 1.7 million new cancer diagnoses annually, requiring robust regulatory oversight.

OECD (Organisation for Economic Co-operation and Development)

- OECD reports average pharmaceutical spending at 1.5% of GDP across member nations.

- Regulatory compliance costs add up to 5–10% of R&D budgets for drugmakers.

- Average time to regulatory approval for new medicines in OECD countries is 12–15 months.

UN Population Division

- The global population aged 65+ will double from 761 million in 2021 to 1.6 billion by 2050.

- Asia will account for over half of the world’s elderly population by 2050.

World Bank

- Global healthcare expenditure reached 10.9% of GDP in 2022.

- Low- and middle-income countries account for 30% of global pharmaceutical consumption, creating growing regulatory demands.

Global Regulatory Information Management Market: Market Dynamic

Driving Factors in the Global Regulatory Information Management Market

Increasing Regulatory Complexity and Rising Volume of Drug Approvals

The global regulatory environment is becoming increasingly complex due to the expansion of biologics, biosimilars, personalized medicine, and advanced therapies. Each of these therapeutic areas involves unique compliance requirements, necessitating more sophisticated regulatory information management systems. For example, biologic drugs require extensive post-marketing surveillance and continuous updates to safety labeling, all of which must be tracked across multiple jurisdictions.

The FDA, EMA, and PMDA are receiving thousands of applications annually, with rising new drug approvals amplifying the demand for structured, efficient RIM platforms. Moreover, global regulatory convergence initiatives such as ICH guidelines are pushing companies to adapt RIM solutions that can manage cross-border requirements while maintaining data integrity.

Expansion of Clinical Trials and Globalization of Regulatory Submissions

The globalization of clinical trials has intensified the demand for robust regulatory information management systems. Clinical trial applications now frequently span multiple countries, each with distinct submission formats, timelines, and reporting requirements. Regulatory agencies such as EMA have enforced centralized systems like CTIS to manage cross-border submissions, while the FDA and PMDA continue to demand eCTD-compliant filings.

This creates pressure on pharmaceutical and medical device companies to implement RIM platforms capable of synchronizing data, managing documentation lifecycles, and ensuring compliance across jurisdictions. The rise of decentralized and adaptive clinical trials has added further complexity, as real-world data and remote patient monitoring systems introduce new categories of regulatory reporting.

Restraints in the Global Regulatory Information Management Market

High Implementation Costs and Integration Challenges with Legacy Systems

One of the most significant restraints for the regulatory information management market is the high cost of implementation and the difficulty of integrating modern RIM platforms with legacy IT infrastructure. Large pharmaceutical companies may have resources to adopt advanced solutions, but small and medium-sized enterprises (SMEs) often face financial and operational hurdles. Initial investments in software licensing, data migration, employee training, and ongoing maintenance are substantial.

Furthermore, many organizations operate with fragmented systems across quality, clinical, and regulatory functions, making integration a complex process. Customization for compatibility with enterprise systems such as ERP or PLM further drives up costs and timelines. In addition, regulatory updates require frequent platform modifications, adding to the total cost of ownership.

Shortage of Skilled Professionals in Regulatory Affairs and Technology

The RIM market faces a dual talent gap: regulatory professionals well-versed in compliance frameworks and technology experts capable of implementing and maintaining sophisticated RIM platforms. Regulatory affairs specialists often lack technical expertise in AI, automation, or cloud systems, while IT professionals may not fully understand regulatory submission requirements and compliance nuances. This disconnect creates bottlenecks during system deployment and operation, leading to underutilization of platform capabilities.

The problem is further exacerbated by the rapid pace of regulatory change, requiring constant reskilling and training. According to global regulatory bodies, only a limited percentage of professionals are adequately prepared to manage both regulatory compliance and digital transformation initiatives simultaneously. Without sufficient expertise, organizations risk delays in submissions, compliance failures, and inefficiencies in lifecycle management.

Opportunities in the Global Regulatory Information Management Market

Adoption of RIM in Emerging Economies through Regulatory Harmonization

Emerging economies in Asia-Pacific, Latin America, and Africa present vast opportunities for regulatory information management vendors as governments push for regulatory harmonization and digital transformation. Countries like India, Brazil, and China are modernizing their regulatory frameworks by adopting ICH-compliant processes and implementing electronic submissions to align with global standards. This modernization allows multinational pharmaceutical companies to expand their footprint into these markets while ensuring compliance with both local and international regulations.

Furthermore, the rapid rise of domestic pharmaceutical industries in these regions creates demand for cost-effective RIM platforms that can manage growing product portfolios. With healthcare digitization programs backed by World Bank and WHO initiatives, emerging economies are leapfrogging legacy systems and moving directly toward cloud-based solutions. Opportunity for expansion beyond traditional North American and European strongholds.

Rising Demand for Data Transparency, Digital Labeling, and Real-World Evidence

A major opportunity lies in the growing regulatory emphasis on data transparency, digital labeling, and integration of real-world evidence (RWE) into regulatory submissions. Agencies such as EMA are spearheading electronic product information (ePI) initiatives, while the FDA continues to advance structured product labeling (SPL). These frameworks demand digital-first capabilities, driving demand for RIM solutions that can seamlessly manage structured labeling and publish electronic documentation at scale.

Additionally, regulators are increasingly accepting real-world data (RWD) and RWE from patient registries, electronic health records, and wearables to support drug approval and post-market surveillance. Managing and validating such diverse datasets requires advanced RIM systems capable of handling non-traditional evidence alongside clinical trial data.

Trends in the Global Regulatory Information Management Market

Integration of Artificial Intelligence and Automation in RIM Systems

Artificial intelligence (AI) and automation are redefining the regulatory landscape by enabling companies to handle vast volumes of structured and unstructured regulatory data more efficiently. Natural language processing (NLP) and machine learning (ML) algorithms are being used to extract insights from regulatory guidelines, monitor compliance updates, and automate repetitive tasks like dossier preparation, change management, and lifecycle tracking.

This not only reduces manual errors but also accelerates time-to-market for drugs and medical devices. Additionally, automation tools in regulatory information management improve regulatory intelligence by predicting submission timelines and flagging compliance risks early. With regulatory authorities like the FDA, EMA, and PMDA increasingly embracing digital submission formats such as eCTD and structured product labeling, organizations are aligning their RIM platforms with advanced AI-driven modules.

Shift Toward Cloud-Based RIM Platforms for Scalability and Collaboration

The global move toward cloud-based regulatory information management platforms is accelerating as life sciences organizations prioritize scalability, cost efficiency, and real-time data access. Cloud-based solutions, often deployed as SaaS, allow stakeholders across global regulatory, clinical, and quality teams to collaborate seamlessly without the constraints of on-premise infrastructure.This is particularly important in the context of multinational pharmaceutical companies that need harmonized submissions across diverse jurisdictions.

Furthermore, cloud adoption aligns with modern hybrid and remote work models, enabling regulatory teams to securely access data from any location. Enhanced cybersecurity frameworks, built-in compliance features, and integration capabilities with enterprise systems such as ERP and PLM further bolster the appeal of cloud deployments.

Global Regulatory Information Management Market: Research Scope and Analysis

By Component Analysis

The Software/Solutions segment is projected to dominate the component category because it serves as the technological backbone of the Regulatory Information Management market, delivering core functionalities that underpin compliance and lifecycle management across the life sciences industry. These platforms integrate critical processes such as submission planning, registration tracking, regulatory intelligence, label management, and health authority communication into a centralized, digital ecosystem.

The value proposition lies in their ability to unify fragmented regulatory data, reduce duplication, automate manual workflows, and provide real-time visibility into compliance activities. For pharmaceutical and biotechnology companies, these capabilities directly translate into faster approvals, lower compliance risks, and improved operational efficiency.

Unlike services, which include implementation, consulting, and managed support, the software itself generates recurring, high-value revenue streams through licensing and subscription fees. The Software-as-a-Service (SaaS) model has further reinforced this dominance by replacing large capital expenditures with flexible, predictable operating expenses. Vendors also ensure that their platforms remain indispensable through frequent updates aligned with evolving global regulations, guaranteeing long-term reliance by clients. Services are vital but remain tethered to software adoption, serving as complementary enablers rather than standalone revenue drivers.

Moreover, as regulatory authorities increasingly mandate digital submissions and structured reporting formats, organizations cannot meet compliance obligations without sophisticated software platforms. This necessity cements software’s position as the cornerstone of the RIM market, representing not only the primary revenue generator but also the critical foundation upon which other market segments rely. Its strategic importance ensures sustained dominance in both adoption and financial contribution.

By Deployment Mode Analysis

The Cloud-based/SaaS deployment mode has been poised to emerge as the definitive leader in the Regulatory Information Management market, largely displacing on-premise solutions as the preferred option for new implementations. Life sciences organizations are turning to SaaS models due to their superior agility, cost efficiency, and scalability compared to traditional systems. Cloud solutions reduce upfront capital expenditure, substituting it with a predictable, subscription-based model that is easier to budget and align with operating expenses. This financial flexibility is particularly attractive in an environment where regulatory compliance demands constant adaptation.

One of the most compelling advantages is the seamless, automatic update capability. Given the dynamic nature of regulatory requirements set by authorities like the FDA, EMA, and PMDA, timely platform updates are essential. Cloud providers deliver these updates without disrupting operations, ensuring organizations remain compliant at all times. Additionally, SaaS solutions enable real-time access and collaboration for global regulatory teams, which is critical as submissions increasingly span multiple jurisdictions. This model also supports decentralized teams and hybrid work environments with strong cybersecurity and data protection frameworks.

In contrast, on-premise systems are increasingly relegated to a shrinking group of large enterprises with entrenched legacy systems, rigid IT policies, or specific sovereignty concerns. While they still generate revenue, their market share is steadily declining as cloud adoption becomes mainstream. The clear advantages of SaaS in terms of accessibility, disaster recovery, security, and scalability ensure that cloud-based RIM systems will continue to dominate, making them the strategic default choice for most organizations.

By Enterprise Size Analysis

Large Enterprises are expected to dominate the Regulatory Information Management market by enterprise size, driven by their scale, resources, and regulatory obligations. These multinational pharmaceutical, biotechnology, and medical device companies operate across dozens of jurisdictions, each with its own submission formats, regulatory authorities, and compliance timelines.

A comprehensive RIM platform is indispensable for managing thousands of product registrations, ensuring timely renewals, and maintaining compliance with global health authorities. For these organizations, delays or non-compliance can result in multimillion-dollar losses, halted product launches, or significant reputational damage risks that justify heavy investment in enterprise-grade RIM solutions.

Large enterprises also have the financial capacity to absorb the high costs of licensing, implementation, customization, and ongoing upgrades. They seek advanced, feature-rich platforms that integrate seamlessly with enterprise resource planning (ERP), quality management, and product lifecycle systems, creating a unified regulatory ecosystem. This sophistication drives their disproportionate share of market revenue.

Meanwhile, Small and Medium-sized Enterprises (SMEs) are gaining momentum as cloud-based solutions reduce barriers to entry. Modular SaaS platforms allow SMEs to access core RIM functionalities without incurring the prohibitive costs of enterprise-scale systems. This democratization is driving adoption among emerging biotech firms, specialty drug developers, and medical device startups.

However, the overall revenue contribution from SMEs remains smaller due to their limited budgets, smaller portfolios, and lower regulatory complexity compared to large enterprises. As a result, while SMEs represent the fastest-growing segment, large enterprises continue to dominate in both market share and total revenue contribution.

By End User Analysis

Pharmaceutical and Biotechnology Companies are projected to be the dominant end-users of regulatory information management systems, reflecting the intense regulatory burden associated with drug and biologic development. Bringing a new therapy to market involves navigating multiple stages: Investigational New Drug (IND), New Drug Application (NDA), Biologics License Application (BLA), and Marketing Authorization Application (MAA), each requiring meticulous documentation, submission management, and compliance monitoring.

These processes generate enormous volumes of data across clinical trials, manufacturing, labeling, and post-market surveillance. Without an integrated RIM solution, managing these demands becomes error-prone and resource-intensive, risking costly delays and compliance failures.

For these companies, the stakes are extraordinarily high. Accelerating time-to-market for new therapies can represent billions of dollars in competitive advantage, while non-compliance can result in regulatory penalties or product withdrawals. As a result, pharmaceutical and biotech firms allocate substantial budgets to advanced RIM platforms that centralize data, enable automated submissions, and support global compliance strategies.

Other segments, including Medical Device Companies and Contract Research Organizations (CROs), are experiencing rapid growth, especially with new regulations such as the EU Medical Device Regulation (MDR) and In Vitro Diagnostic Regulation (IVDR). These entities also benefit from RIM solutions to manage complex compliance requirements.

However, compared to pharmaceuticals and biologics, the regulatory pathways for devices are generally shorter and less data-intensive, resulting in lower system demand and investment levels. Consequently, while devices and CROs are expanding their user base, the dominance of pharmaceutical and biotechnology companies remains firmly established, driven by the scale, complexity, and financial impact of their regulatory obligations.

The Global Regulatory Information Management Market Report is segmented on the basis of the following:

By Component

- Software/Solutions

- Submission Planning & Tracking

- Product Registration & License Management

- Health Authority Communications Management

- Labeling Management

- Clinical Trial Applications (CTA) Management

- Regulatory Intelligence

- Services

- Consulting & Implementation

- Managed Services

- Support & Maintenance

By Deployment Mode

- On-premise

- Cloud-based (SaaS)

By Enterprise Size

- Large Enterprises

- Small and Medium-sized Enterprises (SMEs)

By End User

- Pharmaceutical and Biotechnology Companies

- Medical Device Companies

- Contract Research Organizations (CROs)

- Others

Impact of Artificial Intelligence in the Global Regulatory Information Management Market

- Automated Regulatory Intelligence and Change Impact Analysis: AI algorithms continuously monitor and analyze updates from global health authorities (like the FDA, EMA, and PMDA), regulatory news, and published guidelines. They can automatically categorize changes, assess their relevance to a company's specific product portfolio, and predict the potential impact of new regulations.

- Enhanced Submission Planning and Predictive Analytics: AI transforms submission planning from a manual, experience-based process to a data-driven function. By analyzing historical submission data from thousands of previous applications, AI models can predict approval timelines, identify potential bottlenecks, and recommend optimal submission pathways for different regions.

- Intelligent Document Processing and Metadata Generation: A major bottleneck in RIM is the manual preparation and tagging of thousands of documents for submissions. AI-powered Natural Language Processing (NLP) and computer vision can automatically read, classify, and extract key metadata from regulatory documents (e.g., clinical study reports, protocols).

- Optimized Post-Market Surveillance and Safety Monitoring: AI dramatically enhances pharmacovigilance and device vigilance processes integrated within RIM systems. It can rapidly analyze vast datasets of adverse event reports, electronic health records, medical literature, and social media to identify potential safety signals earlier and with greater accuracy than traditional manual methods.

- Intelligent Content Authoring and Review: AI tools are now being integrated into the authoring process for core regulatory documents. They can suggest standardized language based on previous approved submissions, check for consistency and compliance with regulatory guidelines, and perform quality checks to ensure data alignment across documents.

Global Regulatory Information Management Market: Regional Analysis

Region with the Largest Revenue Share

North America is projected to dominate the global Regulatory Information Management (RIM) market with 36.0% of market share by the end of 2025, due to its highly structured regulatory framework, advanced life sciences industry, and strong technology adoption. The U.S., led by the Food and Drug Administration (FDA), sets some of the world’s most stringent requirements for electronic submissions, structured product labeling (SPL), and electronic Common Technical Document (eCTD) compliance.

The volume of submissions processed annually by the FDA’s Centers for Drug Evaluation and Research (CDER) and Biologics Evaluation and Research (CBER) is unmatched globally, driving the widespread adoption of RIM solutions across pharmaceutical, biotechnology, and medical device companies.

The region’s dominance is also reinforced by its concentration of global pharmaceutical giants, biotechnology innovators, and contract research organizations (CROs), many of which are headquartered in the U.S. or Canada. These enterprises manage vast product portfolios across multiple jurisdictions, making RIM platforms indispensable for ensuring compliance, avoiding costly delays, and accelerating product launches.

Technological maturity further strengthens North America’s position. Cloud-based RIM platforms are widely adopted in the region, supported by strong digital infrastructure, cybersecurity frameworks, and regulatory guidance encouraging digital transformation. Additionally, demographic shifts, such as an aging population and rising chronic disease prevalence, create continuous demand for innovative therapies, further increasing regulatory workloads. The combination of regulatory rigor, industry scale, and rapid digitalization ensures that North America remains the largest and most influential market for RIM solutions.

Region with the Highest CAGR

Asia-Pacific is expected to record the highest compound annual growth rate (CAGR) in the Regulatory Information Management (RIM) market, driven by rapid healthcare expansion, regulatory harmonization, and digital transformation initiatives. Emerging economies such as China, India, and Southeast Asian nations are modernizing their regulatory frameworks, adopting international standards, and mandating electronic submissions in line with ICH guidelines. This regulatory evolution creates significant demand for advanced RIM platforms capable of handling complex submissions across multiple jurisdictions.

The region’s pharmaceutical and biotechnology sectors are also experiencing robust growth, fueled by increased R&D investment, government support, and expanding clinical trial activity. For example, China and India have become major hubs for clinical research, with multinational companies conducting cross-border trials that require sophisticated RIM systems to manage compliance.

Additionally, Japan’s Pharmaceuticals and Medical Devices Agency (PMDA) has fully mandated eCTD submissions, further strengthening the need for regulatory technology solutions. Another factor contributing to the Asia-Pacific’s high growth is the region’s demographic profile. With a rapidly growing elderly population and rising prevalence of chronic diseases, demand for new therapies and medical devices is surging. This growth fuels regulatory workloads, making streamlined RIM adoption essential. Moreover, cloud-based SaaS platforms are gaining traction, offering cost-effective, scalable solutions for both multinational corporations and local SMEs.

By Region

North America

Europe

- Germany

- The U.K.

- France

- Italy

- Russia

- Spain

- Benelux

- Nordic

- Rest of Europe

Asia-Pacific

- China

- Japan

- South Korea

- India

- ANZ

- ASEAN

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Argentina

- Colombia

- Rest of Latin America

Middle East & Africa

- Saudi Arabia

- UAE

- South Africa

- Israel

- Egypt

- Rest of MEA

Global Regulatory Information Management Market: Competitive Landscape

The competitive landscape of the Regulatory Information Management (RIM) market is highly consolidated, with a mix of established enterprise vendors and specialized regulatory technology providers driving innovation. Key players such as Veeva Systems, IQVIA, Oracle, ArisGlobal, and Dassault Systèmes (Medidata) dominate through comprehensive, cloud-based RIM platforms that integrate submission planning, lifecycle management, and compliance tracking. These companies leverage strong global client bases, continuous innovation, and robust compliance support to maintain leadership positions.

Veeva Systems leads with its Vault RIM suite, offering end-to-end solutions tailored to pharmaceutical and biotech companies. IQVIA combines regulatory expertise with advanced analytics, enabling data-driven compliance strategies. Oracle leverages its enterprise software capabilities to provide scalable RIM solutions with seamless integration into broader IT ecosystems. ArisGlobal emphasizes automation and AI-enabled regulatory intelligence, while Dassault Systèmes (Medidata) focuses on aligning RIM platforms with clinical development systems.

In addition to these leaders, niche vendors such as Extedo GmbH, Ennov, and Phlexglobal cater to specific client needs with modular and flexible solutions, particularly appealing to SMEs and regional players. Partnerships, mergers, and acquisitions are frequent strategies in this market, as vendors aim to expand product portfolios and enhance global reach. For instance, Pharmalex’s acquisition by Cencora strengthened its service-based regulatory support.

Some of the prominent players in the Global Regulatory Information Management Market are:

- Veeva Systems

- IQVIA

- Dassault Systèmes (Medidata)

- Parexel

- Oracle

- ArisGlobal

- Sparta Systems (a Honeywell company)

- Extedo GmbH

- Ennov

- CSC (Corporate Service Company)

- Freyr

- Instem

- Lasonix

- Pharmalex (acquired by Cencora)

- RegDesk

- Scendea

- UL Solutions

- Phlexglobal

- LabWare

- DXC Technology

- Other Key Players

Recent Developments in the Global Regulatory Information Management Market

- May 2024: Veeva Systems announced the general availability of Veeva RIM to unify registration, submission, and commitment tracking, further integrating its clinical and commercial cloud offerings.

- April 2024: ArisGlobal announced a strategic collaboration with a leading cloud provider to enhance the scalability and AI capabilities of its LifeSphere platform.

- March 2024: The DIA Europe 2024 conference in Brussels featured significant focus on AI-driven regulatory transformation and the implementation of the EU CTR.

- February 2024: Oracle further integrated AI features into its Oracle Health Sciences Argus Safety platform to enhance predictive safety analytics.

- November 2023: The FDA and MHRA participated in the RAPS Regulatory Convergence 2023 conference, emphasizing the need for advanced digital tools for regulatory harmonization.

- October 2023: IQVIA launched a new AI-powered Regulatory Compliance Suite, focusing on automated intelligence and submission forecasting.

- September 2023: Parexel and Google Cloud expanded their collaboration to develop AI and machine learning solutions to accelerate clinical and regulatory timelines.

- June 2023: Dassault Systèmes (Medidata) integrated AI capabilities into its platform to streamline clinical trial application processes and regulatory document management.

- May 2023: The DIA Global Annual Meeting 2023 in Boston served as a key platform for unveiling new RIM solutions and discussing the impact of the FDA's Digital Transformation Action Plan.

Report Details

| Report Characteristics |

| Market Size (2025) |

USD 3,114.4 Mn |

| Forecast Value (2034) |

USD 7,901.9 Mn |

| CAGR (2025–2034) |

10.9% |

| The US Market Size (2025) |

USD 10.9 Mn |

| Historical Data |

2019 – 2024 |

| Forecast Data |

2026 – 2034 |

| Base Year |

2024 |

| Estimate Year |

2025 |

| Report Coverage |

Market Revenue Estimation, Market Dynamics, Competitive Landscape, Growth Factors, etc. |

| Segments Covered |

By Component (Software/Solutions, Services), By Deployment Mode (On-premise, Cloud-based (SaaS)), By Enterprise Size (Large Enterprises, Small and Medium-sized Enterprises (SMEs)), By End User (Pharmaceutical and Biotechnology Companies, Medical Device Companies, Contract Research Organizations (CROs), Others) |

| Regional Coverage |

North America – US, Canada; Europe – Germany, UK, France, Russia, Spain, Italy, Benelux, Nordic, Rest of Europe; Asia-Pacific – China, Japan, South Korea, India, ANZ, ASEAN, Rest of APAC; Latin America – Brazil, Mexico, Argentina, Colombia, Rest of Latin America; Middle East & Africa – Saudi Arabia, UAE, South Africa, Turkey, Egypt, Israel, Rest of MEA |

| Prominent Players |

Veeva Systems, IQVIA, Dassault Systèmes (Medidata), Parexel, Oracle, ArisGlobal, Sparta Systems (a Honeywell company), Extedo GmbH, Ennov, CSC (Corporate Service Company), Freyr, Instem, Lasonix, Pharmalex (acquired by Cencora), RegDesk, Scendea, UL Solutions, Phlexglobal, LabWare, DXC Technology, and Other Key Players |

| Purchase Options |

We have three licenses to opt for: Single User License (Limited to 1 user), Multi-User License (Up to 5 Users), and Corporate Use License (Unlimited User) along with free report customization equivalent to 0 analyst working days, 3 analysts working days, and 5 analysts working days respectively. |