Market Overview

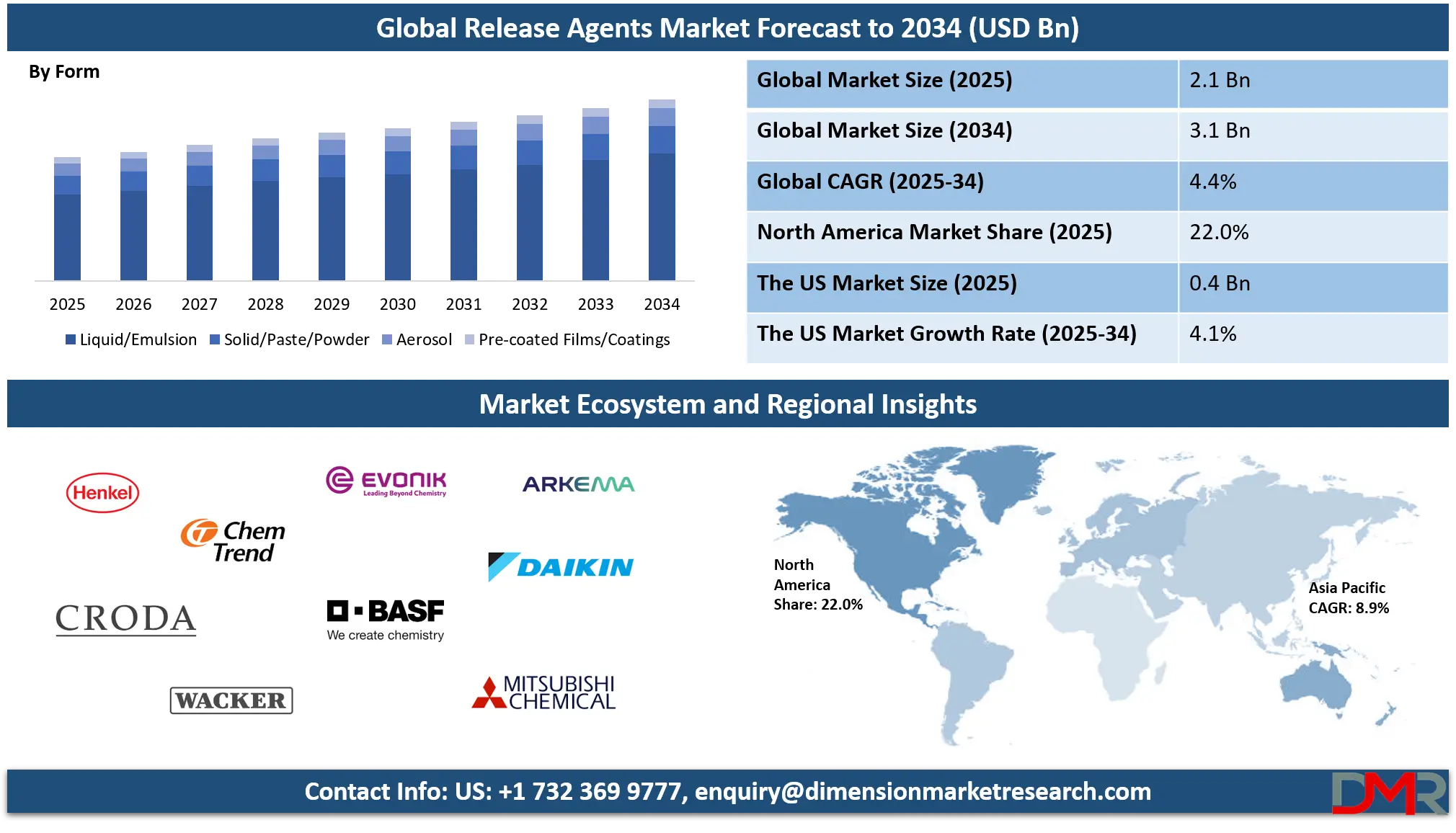

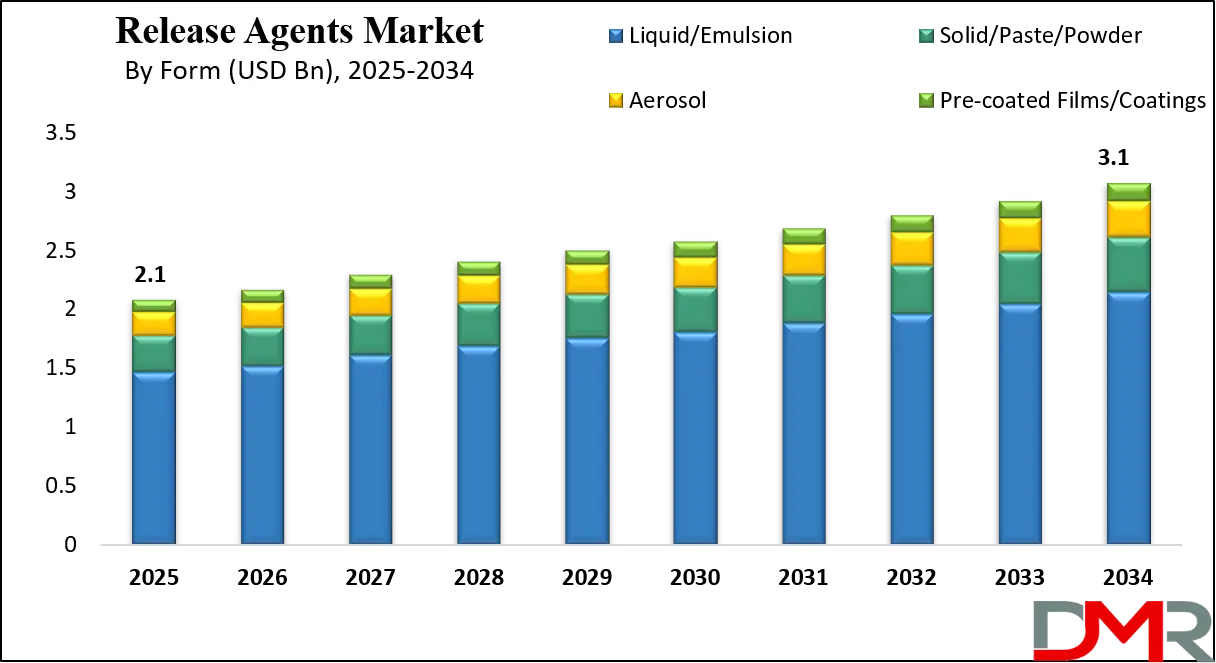

The global release agents market is projected to reach USD 2.1 billion in 2025 and is expected to grow to USD 3.1 billion by 2034, advancing at a CAGR of 4.4%, driven by rising demand across die casting, composites, packaging, and food processing industries.

Release agents are specialized chemical substances or formulations that create a temporary barrier between a surface and a material being processed, preventing them from bonding during manufacturing operations. They play a crucial role in enabling the smooth separation of molded parts, baked goods, castings, composites, and other finished products from their molds, trays, or processing equipment. By reducing friction and minimizing surface defects, release agents enhance product quality, extend equipment life, and improve production efficiency across a wide range of industrial and food processing applications. These agents can be formulated as water-based, solvent-based, silicone, wax, or polymer blends depending on the specific requirements of heat resistance, cleanliness, or regulatory compliance.

The global release agents market refers to the collective industry that produces, distributes, and innovates these formulations to meet the diverse needs of manufacturing and food sectors globally. The market has expanded steadily in response to stricter environmental standards that encourage the adoption of water-based solutions, along with rapid industrialization and rising demand for high-performance materials. Industries such as automotive, construction, aerospace, packaging, and electronics increasingly rely on release technologies to optimize large scale molding and casting processes, while the food and beverage sector uses them to streamline baking and confectionery production.

The market landscape is shaped by ongoing technological developments in nonstick chemistry, eco-friendly release coatings, and multi-functional formulations that reduce downtime while ensuring consistent quality. Growth is further accelerated by the expansion of composite manufacturing in wind energy and aerospace, along with heightened demand in Asia Pacific due to strong industrial bases in China, India, and Southeast Asia. Leading companies are investing in R&D to create products with low VOC content and improved thermal stability, enabling them to address both regulatory requirements and sustainability goals.

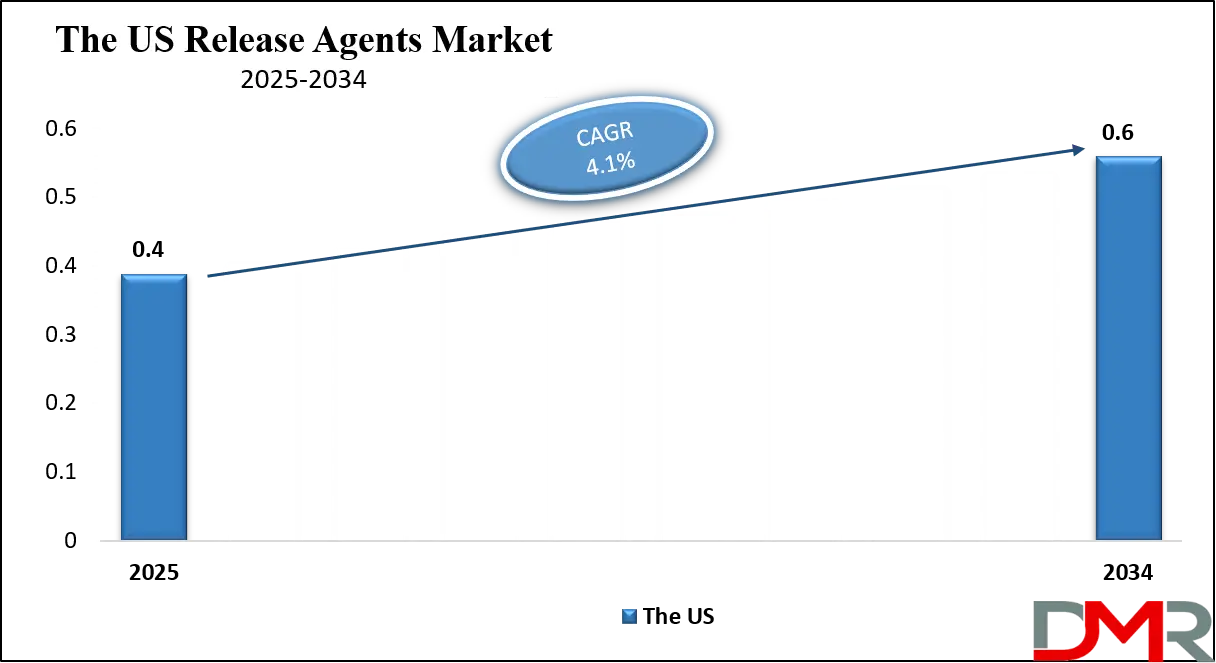

The US Release Agents Market

The U.S. Release Agents market size is projected to be valued at USD 400 million by 2025. It is further expected to witness subsequent growth in the upcoming period, holding USD 600 million in 2034 at a CAGR of 4.1%.

The United States release agents market plays a significant role in the overall industry landscape due to the country’s strong base in automotive manufacturing, aerospace, packaging, construction, and food processing. Demand is primarily driven by the adoption of advanced molding and casting technologies, where release agents ensure seamless part separation, reduced surface defects, and improved equipment longevity.

The shift toward eco-friendly and water based formulations has gained momentum in the U.S. as regulatory frameworks like EPA standards push industries to minimize volatile organic compound emissions. Moreover, the U.S. food and beverage sector, particularly large scale commercial bakeries and confectionery producers, has been increasingly adopting specialty release agents to enhance production efficiency, maintain product quality, and comply with FDA food contact safety regulations.

In addition to environmental compliance, innovation in specialty chemicals has boosted the U.S. release agents market by offering high-performance solutions tailored for industries such as composites, die casting, and advanced manufacturing. The country’s strong emphasis on lightweight automotive components and aerospace composites has increased the demand for silicone, PTFE, and polymer based release formulations that provide superior thermal stability and non-stick performance. With the growing penetration of automation and smart manufacturing, U.S. producers are also adopting release systems that support spray application and automated coating technologies, thereby reducing downtime and improving productivity.

Continuous investments in research and development, combined with the presence of global chemical companies and local niche suppliers, ensure that the U.S. remains a hub for innovation and a key contributor to the growth of the global release agents industry.

Europe Release Agents Market

The Europe release agents market is projected to reach approximately USD 525 million in 2025, reflecting the region’s strong industrial base and mature manufacturing ecosystem. The market growth is primarily driven by growing demand from the automotive, aerospace, construction, and food processing sectors, where high performance release agents are essential for ensuring smooth demolding, superior surface finish, and reduced cycle times.

European manufacturers are increasingly adopting water based and eco friendly formulations to comply with stringent environmental regulations on volatile organic compounds, making sustainable products a key factor in market expansion. Additionally, the emphasis on lightweight materials in automotive and aerospace applications, such as aluminum and composite components, is fueling demand for silicone, PTFE, and polymer based release agents.

Over the forecast period, the European market is expected to grow at a CAGR of 3.8%, indicating steady and consistent expansion. Growth is supported by continuous investments in research and development by major chemical companies to create innovative, multifunctional, and low emission release agents. Regions like Germany, France, and Italy are contributing significantly to this growth due to advanced industrial infrastructure, a high level of automation in manufacturing processes, and the presence of leading automotive and aerospace players.

Moreover, growing adoption of automated spraying and coating technologies enhances efficiency and reduces material waste, further strengthening market adoption. As industries in Europe continue to prioritize both performance and sustainability, the release agents market is poised for steady growth over the coming years.

Japan Release Agents Market

The Japan release agents market is projected to reach approximately USD 80 million in 2025, driven by growing demand from industries such as automotive, electronics, aerospace, and food processing. In Japan, high precision manufacturing and strict quality standards make the use of release agents critical for ensuring smooth demolding, superior surface finishes, and enhanced mold longevity.

Water based, silicone, and PTFE based formulations are widely adopted, particularly in environmentally conscious production setups where compliance with stringent VOC regulations is essential. The automotive and electronics sectors are key contributors, as manufacturers seek lightweight materials and complex components that require high performance release agents for efficiency and reliability.

The market in Japan is expected to grow at a CAGR of 4.3% during the forecast period, reflecting steady expansion fueled by industrial innovation and process optimization. Continuous investment in research and development has led to multifunctional and eco friendly release agents that meet both performance and sustainability requirements.

Additionally, the adoption of automated application systems, such as spray and dip technologies, is enhancing operational efficiency while minimizing material waste. As Japanese industries continue to prioritize high quality standards, precision manufacturing, and environmentally friendly production, the release agents market is poised for consistent growth over the coming years.

Global Release Agents Market: Key Takeaways

- Market Value: The global Release Agents market size is expected to reach a value of USD 3.1 billion by 2034 from a base value of USD 2.1 billion in 2025 at a CAGR of 4.4%.

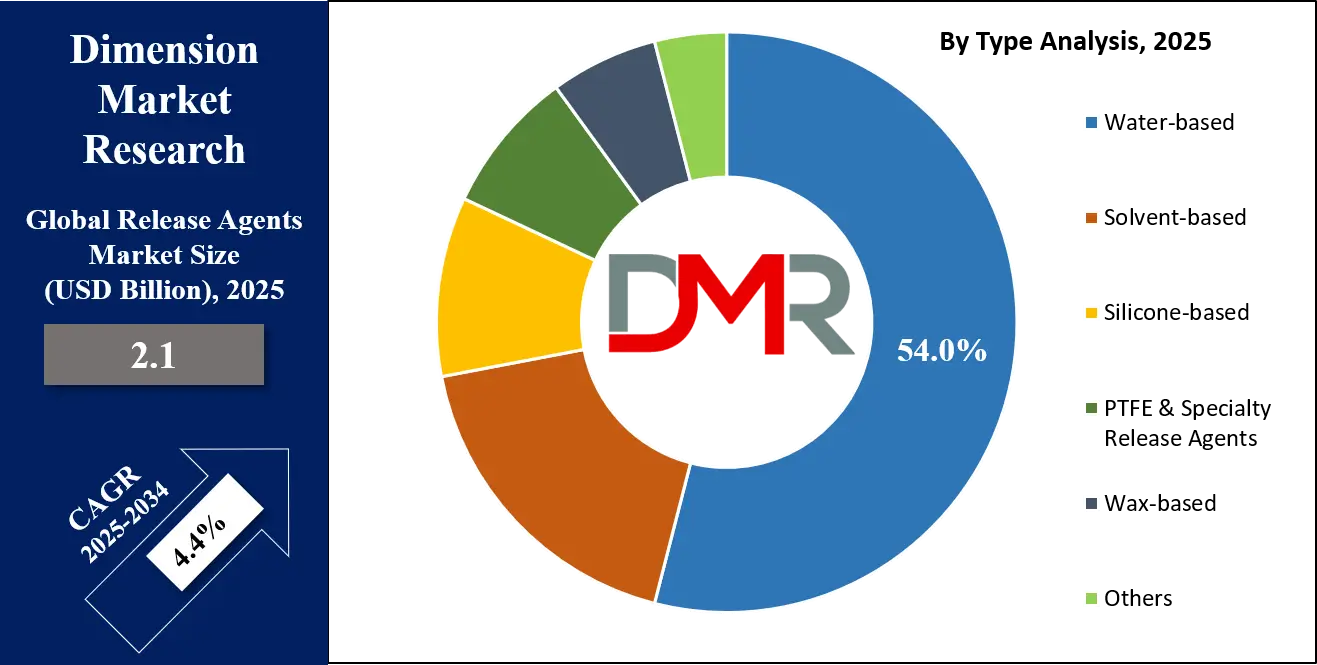

- By Type Analysis: Water-based is anticipated to dominate the type segment, capturing 54.0% of the total market share in 2025.

- By Form Segment Analysis: Liquid/Emulsion is expected to maintain its dominance in the form segment, capturing 70.0% of the total market share in 2025.

- By Industrial Use Segment Analysis: Die-casting will dominate the industrial use segment, capturing 30.0% of the market share in 2025.

- By Mode of Application Segment Analysis: Sprays will account for the maximum share in the mode of application segment, capturing 50.0% of the total market value.

- By End-Use Industry Segment Analysis: Automotive will dominate the end-use industry segment, capturing 33.0% of the market share in 2025.

- Regional Analysis: Asia Pacific is anticipated to lead the global Release Agents market landscape with 47.0% of total global market revenue in 2025.

- Key Players: Some key players in the global Release Agents market include Henkel AG & Co. KGaA, Chem-Trend L.P. (Freudenberg Group), Croda International Plc, Wacker Chemie AG, Evonik Industries AG, BASF SE, Arkema S.A., Daikin Industries Ltd., Mitsubishi Chemical Corporation, Momentive Performance Materials Inc., Hightower Products Inc., Klüber Lubrication (Freudenberg Group), McGee Industries Inc. (Mold Wiz), Marbo Italia S.p.A., Cresset Chemical Company, and Others.

Global Release Agents Market: Use Cases

- Automotive Die Casting and Component Manufacturing: Release agents are extensively used in the automotive sector for aluminum and magnesium die casting, where they enable smooth separation of complex engine blocks, transmission housings, and lightweight structural components. They help improve surface finish, reduce porosity, and extend die life, thereby ensuring higher productivity and cost efficiency. With the industry’s shift toward lightweight vehicles and electric mobility, demand for high-performance water-based and silicone release agents is growing significantly in the U.S., Europe, and the Asia Pacific.

- Composite Molding in Aerospace and Wind Energy: In aerospace and wind turbine blade manufacturing, release agents are critical for producing carbon fiber and glass fiber composites. These agents prevent bonding between resin systems and molds during processes like resin transfer molding (RTM) and sheet molding compound (SMC). The use of PTFE and fluoropolymer based formulations ensures defect free surfaces and consistent mold release, supporting stringent quality requirements in aerospace components and renewable energy infrastructure.

- Food Processing and Industrial Baking: In the food and beverage industry, release agents are widely applied to bakery pans, molds, and trays to ensure consistent product release without sticking. They maintain product integrity, improve throughput in high volume baking, and comply with strict food contact safety regulations. U.S. commercial bakeries, confectionery producers, and frozen food manufacturers increasingly prefer eco friendly, non allergenic, and FDA compliant water based release agents to optimize large scale food processing.

- Construction and Building Materials Production: Release agents are essential in construction for concrete formwork, precast structures, and wood panel manufacturing. They facilitate smooth separation of molds from concrete surfaces, reduce surface blemishes, and ensure high quality finishes. Growing infrastructure development in Asia Pacific, integrated with rising demand for sustainable building solutions, is fueling the adoption of biodegradable and low VOC release formulations in the construction sector globally.

Impact of Artificial Intelligence on the global Release Agents market

Artificial intelligence is beginning to reshape the global release agents market by enabling smarter product formulation, predictive maintenance, and optimized production processes. AI driven data analytics allows chemical manufacturers to design eco friendly and performance oriented release agents with improved thermal stability and lower VOC levels. In industrial applications such as die casting, composites, and food processing, AI powered monitoring systems help optimize spray patterns, dosing accuracy, and equipment maintenance, reducing waste and enhancing efficiency.

Moreover, AI based demand forecasting supports supply chain resilience and helps leading companies align product development with evolving regulatory and sustainability trends, thereby accelerating innovation and competitiveness in the release agents industry.

Global Release Agents Market: Stats & Facts

United States Environmental Protection Agency (EPA)

- 2023: The EPA reported that approximately 25% of industrial facilities in the U.S. utilized release agents in their manufacturing processes.

- 2024: The EPA initiated a program to promote the use of low-VOC (volatile organic compound) release agents, aiming for a 15% reduction in VOC emissions from industrial processes by 2025.

- 2025: The EPA's annual report indicated a 10% increase in the adoption of water-based release agents among U.S. manufacturers, aligning with environmental sustainability goals.

European Chemicals Agency (ECHA)

- 2023: ECHA identified that 30% of chemical substances registered in the EU were used in the formulation of release agents.

- 2024: ECHA proposed new regulations requiring all release agents sold in the EU to have a reduced environmental impact, targeting a 20% decrease in hazardous substance content by 2026.

- 2025: ECHA reported that 40% of release agents in the EU market were compliant with the new sustainability standards, marking significant progress.

Japan Ministry of Economy, Trade and Industry (METI)

- 2023: METI conducted a survey revealing that 18% of Japanese manufacturing plants employed release agents in their production lines.

- 2024: METI launched an initiative to encourage the adoption of biodegradable release agents, aiming for a 10% market share by 2026.

- 2025: METI's annual review indicated a 5% increase in the use of eco-friendly release agents in Japan's manufacturing sector.

U.S. Department of Agriculture (USDA)

- 2023: The USDA reported that 12% of food processing facilities in the U.S. utilized release agents to prevent food sticking during production.

- 2024: The USDA introduced guidelines recommending the use of plant-based release agents in food processing to align with organic certification standards.

- 2025: The USDA's annual report highlighted a 7% increase in the adoption of plant-based release agents among certified organic food producers.

Global Release Agents Market: Market Dynamics

Global Release Agents Market: Driving Factors

Rising Demand for High-Performance Manufacturing Processes

The growing adoption of advanced molding and casting techniques in automotive, aerospace, and packaging industries is fueling the need for reliable release agents. These formulations reduce cycle times, enhance surface quality, and prolong mold life, directly supporting large scale production efficiency. With industries shifting toward lightweight composites and precision die casting, demand for silicone, PTFE, and polymer based release agents continues to expand globally.

Stringent Environmental Regulations and Sustainable Solutions

Global regulations on volatile organic compounds (VOC) are driving the transition from solvent based systems to eco friendly water based release agents. Manufacturers are focusing on low emission, biodegradable, and non toxic formulations to meet environmental compliance. This regulatory push not only stimulates product innovation but also accelerates the adoption of sustainable release technologies in both industrial and food processing sectors.

Global Release Agents Market: Restraints

Fluctuating Raw Material Costs

Volatility in the prices of raw materials such as silicone oils, specialty waxes, and fluoropolymers creates uncertainty in production costs. These fluctuations affect profitability for manufacturers and may lead to pricing pressures across the supply chain, particularly in cost sensitive industries like packaging and construction.

Limited Awareness in Emerging Economies

Although industrialization is expanding in Asia Pacific, Latin America, and Africa, awareness about advanced release agents remains limited. Small and medium enterprises often continue to rely on low cost alternatives or traditional lubricants, hindering the broader adoption of specialized release technologies in these regions.

Global Release Agents Market: Opportunities

Growth in Renewable Energy and Composite Materials

The rapid expansion of wind energy, aerospace, and electric mobility sectors presents lucrative opportunities for release agents. Composite blades, carbon fiber parts, and lightweight vehicle components require advanced non stick formulations to ensure consistent demolding and high quality finishes. This creates strong demand for innovative water based and fluoropolymer release agents tailored to renewable and high tech industries.

Expansion in Food Processing Applications

The rising demand for processed and packaged foods is boosting the use of release agents in bakery, confectionery, and frozen food manufacturing. Food grade, FDA compliant formulations are increasingly preferred to ensure hygiene, efficiency, and scalability. As global food producers adopt automation, specialty release agents designed for high volume industrial baking are expected to gain significant traction.

Global Release Agents Market: Trends

Digitalization and Smart Application Technologies

The integration of automation, robotics, and AI powered monitoring in manufacturing is transforming the way release agents are applied. Smart spraying systems, automated dosing units, and predictive analytics optimize usage, reduce waste, and improve product consistency, making digitalization a growing trend in this market.

Innovation in Eco-Friendly and Multifunctional Formulations

Manufacturers are investing in research to develop bio based, non allergenic, and multifunctional release agents that not only provide superior release properties but also reduce environmental impact. The trend toward green chemistry and sustainability is driving innovations that align with regulatory frameworks while meeting customer demand for safer and cleaner industrial solutions.

Global Release Agents Market: Research Scope and Analysis

By Type Analysis

Water based release agents are projected to capture 54.0% of the global market share in 2025, establishing themselves as the dominant type within the industry. Their leadership is largely supported by the growing preference for eco friendly and regulatory compliant solutions, as global industries seek to minimize environmental impact. These agents are designed with lower volatile organic compounds, making them safer for workers and compliant with strict environmental policies in regions like North America and Europe.

Beyond compliance, water based release agents provide excellent surface quality, uniform coating, and consistent release properties that are ideal for high volume production. Industries such as automotive and aerospace are particularly reliant on these formulations to meet lightweighting goals, while food and beverage manufacturers favor them for their food contact safety and hygiene standards. Their compatibility with automated application systems also reduces material waste and enhances productivity, ensuring that water based agents remain the go to choice for large scale, sustainable manufacturing.

Solvent based release agents, while not as dominant, continue to hold a critical role in specific industrial applications where high performance is non negotiable. They are favored in operations that demand fast evaporation rates, superior thermal stability, and strong non stick properties, such as metal die casting, rubber molding, and complex composite manufacturing. In these environments, water based formulations may struggle to deliver the same level of durability or efficiency under extreme conditions, making solvent based products indispensable.

However, their reliance on volatile organic compounds has drawn regulatory scrutiny, which poses a challenge for long term growth. To adapt, manufacturers are investing in reformulated solvent based systems with reduced VOC content or hybrid blends that balance performance with environmental considerations. This has kept solvent based agents relevant in niche markets where high temperature resistance and rapid mold turnaround are essential, even as the industry at large shifts toward greener alternatives.

By Form Analysis

Liquid and emulsion based release agents are expected to maintain their dominance in the form segment, capturing 70.0% of the total market share in 2025. Their strong position in the market is primarily due to their versatility, ease of application, and ability to deliver consistent performance across a wide variety of industrial processes. These formulations are widely used in die casting, composite molding, food processing, and construction because they can be easily sprayed, brushed, or dipped, providing uniform coverage on molds and surfaces.

Their compatibility with automated systems also makes them highly efficient for large scale manufacturing environments, reducing downtime and ensuring repeatable product quality. Moreover, the growing demand for water based emulsions, driven by sustainability initiatives and stricter environmental regulations, further enhances their adoption. Their ability to balance efficiency, cost effectiveness, and eco friendly performance positions them as the preferred choice for manufacturers globally.

Solid, paste, and powder based release agents hold a smaller share of the market but remain essential for specific applications where durability and strong release performance are required. These forms are commonly used in industries such as rubber processing, wood panel production, and certain specialized molding processes where liquid or emulsion systems may not provide sufficient resistance under high pressure or high temperature conditions.

Solid and paste release agents are valued for their ability to form a long lasting barrier on molds, reducing the need for frequent reapplication and ensuring smooth part release in demanding environments. Powdered formulations, in particular, are often chosen in situations where precise application is needed or where liquid carriers may be undesirable. While their overall share is limited compared to liquid systems, these forms continue to serve niche markets where performance under challenging conditions outweighs the convenience of liquid alternatives.

By Industrial Use Analysis

Die casting is projected to dominate the industrial use segment, capturing 30.0% of the market share in 2025. The strong presence of die casting is attributed to the rising demand for lightweight metal components in the automotive, aerospace, and electronics industries. Release agents are essential in this process as they provide a barrier between molten metals like aluminum or magnesium and the die surface, preventing sticking and extending mold life.

Their use ensures smooth ejection of complex parts, reduces porosity, and improves surface finish, which is critical for precision components such as engine blocks, housings, and transmission parts. As automotive manufacturers push for greater fuel efficiency and the shift toward electric vehicles accelerates, the need for high quality die cast parts is growing rapidly. This trend, combined with advancements in water based and silicone enhanced release formulations, will continue to reinforce the importance of die casting as the leading industrial application in the global release agents market.

Composite molding is another major segment where release agents play a vital role, particularly in industries such as aerospace, wind energy, marine, and automotive manufacturing. The use of composites like carbon fiber and glass fiber has surged due to their high strength to weight ratio, and release agents are critical in ensuring these advanced materials can be efficiently processed.

In molding methods such as resin transfer molding (RTM) or sheet molding compound (SMC), release agents prevent adhesion between the resin matrix and the mold, producing defect free surfaces and reducing cycle times. With the growing use of composites in aircraft structures, wind turbine blades, and lightweight vehicle parts, demand for specialized formulations such as fluoropolymer and semi permanent release coatings is expanding. This ensures consistency, reduces mold maintenance, and supports the production of large, complex components that are central to the growth of renewable energy and advanced mobility solutions.

By Mode of Application Analysis

Sprays will account for the maximum share in the mode of application segment, capturing 50.0% of the total market value in 2025. Spray application has become the most widely adopted method because it offers uniform coverage, quick application, and compatibility with automated systems in large scale manufacturing. In industries such as die casting, composites, and food processing, spraying ensures precise dosing of release agents, reducing waste while maintaining consistent product quality.

Automated spray systems also enhance worker safety by minimizing direct chemical handling and improve operational efficiency by cutting down on downtime between production cycles. The growing trend toward high throughput production lines in automotive, aerospace, and packaging has further accelerated the adoption of sprays as the preferred mode of applying release agents, especially for water based and eco friendly formulations that require fine misting for optimal performance.

Dip and immersion methods, while less dominant, remain an important part of the market for specific applications where complete and thorough coating of molds or components is essential. This approach is particularly useful in industries like rubber processing, woodworking, and small scale composite manufacturing, where immersion ensures that every surface is fully treated to prevent sticking.

Although dipping can be more labor intensive and may result in higher consumption of release agents compared to sprays, it provides a reliable and uniform barrier for intricate molds and parts with complex geometries. Manufacturers continue to rely on dip and immersion techniques when precision and total surface coverage outweigh efficiency concerns, making it a niche but steady contributor to the global release agents market.

By End-Use Industry Analysis

Automotive will dominate the end use industry segment, capturing 33.0% of the market share in 2025. The automotive sector relies heavily on release agents for the production of lightweight components through processes such as die casting, rubber molding, and composite manufacturing. With the shift toward electric vehicles and stricter fuel efficiency regulations, automakers are increasingly adopting aluminum, magnesium, and composite materials that require high performance release formulations to ensure defect free parts and extended mold life.

Release agents help reduce porosity, enhance surface finish, and improve cycle efficiency, which is essential for large scale production of engine parts, transmission housings, interior trims, and structural components. The integration of eco friendly, water based, and silicone enhanced release agents is also gaining momentum in this sector, as automotive manufacturers seek to align with sustainability goals while maintaining precision and productivity in global supply chains.

Construction and building materials represent another major application area where release agents are critical, particularly in concrete formwork, precast products, and wood panel manufacturing. In this industry, release agents prevent molds and formwork from bonding with concrete, ensuring smooth finishes, reduced surface blemishes, and easier demolding of large structures.

They also help extend the life of formwork and equipment, reducing costs in large construction projects and prefabricated housing. With the rise of infrastructure development across Asia Pacific, the Middle East, and Latin America, demand for effective and environmentally safe release formulations is growing rapidly.

Biodegradable and low VOC products are increasingly preferred, especially in markets where sustainable building practices are gaining regulatory and commercial importance. This positions release agents as an indispensable element of modern construction workflows, supporting both quality output and operational efficiency.

The Release Agents Market Report is segmented on the basis of the following:

By Type

- Water-based

- Solvent-based

- Silicone-based

- PTFE & Specialty Release Agents

- Wax-based

- Others

By Form

- Liquid/Emulsion

- Solid/Paste/Powder

- Aerosol

- Pre-coated Films/Coatings

By Industrial Use

- Die-casting

- Composite Molding

- Extrusion & Calendaring

- Food Processing & Bakery

- Wood & Panel Production

- Other Industrial Processes

By Mode of Application

- Spray

- Dip/Immersion

- Roll/Coating Line

- Brush/Manual

- Pre-coated/Cured Treatments

By End-Use Industry

- Automotive

- Construction & Building Materials

- Packaging

- Electronics & Electrical

- Aerospace & Defense

- Food & Beverage

- Others

Global Release Agents Market: Regional Analysis

Region with the Largest Revenue Share

Asia Pacific is anticipated to lead the global release agents market, accounting for 47.0% of total market revenue in 2025. The region’s dominance is driven by rapid industrialization, growing automotive and aerospace manufacturing, and the expansion of construction and packaging sectors. Countries like China, India, and Japan are investing heavily in advanced die casting, composite molding, and large scale food processing, all of which rely on high performance release agents for efficiency, surface quality, and mold longevity.

The growing adoption of eco friendly and water based formulations, supported by regional environmental regulations, further strengthens the market. Additionally, the presence of both multinational chemical manufacturers and emerging local players ensures strong product availability and innovation, making Asia Pacific the leading hub for global release agent demand.

Region with significant growth

The Middle East and Africa region is expected to witness significant growth in the global release agents market over the coming years. This growth is driven by expanding construction activities, rising infrastructure investments, and growing adoption of modern manufacturing processes in countries such as the United Arab Emirates, Saudi Arabia, and South Africa.

The push toward industrial automation, integrated with the demand for high quality die casting, composites, and precast construction materials, is fueling the adoption of advanced release agents. Additionally, awareness of sustainable and low VOC formulations is gradually growing, creating opportunities for manufacturers to introduce eco friendly solutions and capture a growing share of this emerging market.

By Region

North America

Europe

- Germany

- The U.K.

- France

- Italy

- Russia

- Spain

- Benelux

- Nordic

- Rest of Europe

Asia-Pacific

- China

- Japan

- South Korea

- India

- ANZ

- ASEAN

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Argentina

- Colombia

- Rest of Latin America

Middle East & Africa

- Saudi Arabia

- UAE

- South Africa

- Israel

- Egypt

- Rest of MEA

Global Release Agents Market: Competitive Landscape

The global release agents market features a highly competitive landscape with a mix of multinational chemical giants and specialized regional players striving to innovate and expand their market presence. Leading companies such as Henkel AG & Co. KGaA, Chem-Trend L.P., BASF SE, Wacker Chemie AG, Evonik Industries AG, and Croda International Plc dominate through extensive R&D investments, strategic partnerships, and product diversification across water based, silicone, PTFE, and solvent based formulations.

Competition is further intensified by the rise of niche and regional manufacturers offering customized solutions for specific applications like die casting, composite molding, food processing, and construction. Companies are increasingly focusing on eco friendly, low VOC, and multifunctional release agents to comply with environmental regulations and meet growing demand for sustainable and high performance products across automotive, aerospace, packaging, and industrial sectors globally.

Some of the prominent players in the global Release Agents market are:

- Henkel AG & Co. KGaA

- Chem-Trend L.P.

- Croda International Plc

- Wacker Chemie AG

- Evonik Industries AG

- BASF SE

- Arkema S.A.

- Daikin Industries, Ltd.

- Mitsubishi Chemical Corporation

- Momentive Performance Materials Inc.

- Hightower Products, Inc.

- Klüber Lubrication (Freudenberg Group)

- McGee Industries, Inc. (Mold Wiz)

- Marbo Italia S.p.A.

- Cresset Chemical Company

- Parker Hannifin Corporation

- Münch Chemie International GmbH

- Ambersil (part of CRC Industries)

- OKS Spezialschmierstoffe GmbH

- Chemlease (part of Chem-Trend/Freudenberg Group)

- Other Key Players

Global Release Agents Market: Recent Developments

- July 2025: Henkel acquired the South Africa-based Nordbak (Pty) Ltd, a specialist provider of maintenance, repair, and overhaul (MRO) solutions. This acquisition strengthens Henkel’s MRO offering in a strategically important and fast-growing regional market.

- April 2025: Henkel and Synthomer partnered to cut carbon emissions in adhesives. They jointly developed a framework that links renewable energy use directly to specific adhesive products, enabling measurable reductions in carbon emissions.

- March 2025: Chem-Trend introduced SL-10187, a new release agent designed for high-pressure aluminum casting. This product enhances performance and operational efficiency by offering improved biostability, delivering a superior finish and greater uniformity in aluminum injection molded parts.

Report Details

| Report Characteristics |

| Market Size (2025) |

USD 2.1 Bn |

| Forecast Value (2034) |

USD 3.1 Bn |

| CAGR (2025–2034) |

4.4% |

| The US Market Size (2025) |

USD 0.4 Bn |

| Historical Data |

2019 – 2024 |

| Forecast Data |

2026 – 2034 |

| Base Year |

2024 |

| Estimate Year |

2025 |

| Report Coverage |

Market Revenue Estimation, Market Dynamics, Competitive Landscape, Growth Factors, etc. |

| Segments Covered |

By Type (Water-based, Solvent-based, Silicone-based, PTFE & Specialty Release Agents, Wax-based, Others), By Form (Liquid/Emulsion, Solid/Paste/Powder, Aerosol, Pre-coated Films/Coatings), By Industrial Use (Die-casting, Composite Molding, Extrusion & Calendaring, Food Processing & Bakery, Wood & Panel Production, Other Industrial Processes), By Mode of Application (Spray, Dip/Immersion, Roll/Coating Line, Brush/Manual, Pre-coated/Cured Treatments), and By End-Use Industry (Automotive, Construction & Building Materials, Packaging, Electronics & Electrical, Aerospace & Defense, Food & Beverage, Others). |

| Regional Coverage |

North America – US, Canada; Europe – Germany, UK, France, Russia, Spain, Italy, Benelux, Nordic, Rest of Europe; Asia-Pacific – China, Japan, South Korea, India, ANZ, ASEAN, Rest of APAC; Latin America – Brazil, Mexico, Argentina, Colombia, Rest of Latin America; Middle East & Africa – Saudi Arabia, UAE, South Africa, Turkey, Egypt, Israel, Rest of MEA |

| Prominent Players |

Henkel AG & Co. KGaA, Chem-Trend L.P. (Freudenberg Group), Croda International Plc, Wacker Chemie AG, Evonik Industries AG, BASF SE, Arkema S.A., Daikin Industries Ltd., Mitsubishi Chemical Corporation, Momentive Performance Materials Inc., Hightower Products Inc., Klüber Lubrication (Freudenberg Group), McGee Industries Inc. (Mold Wiz), Marbo Italia S.p.A., Cresset Chemical Company, and Others. |

| Purchase Options |

We have three licenses to opt for: Single User License (Limited to 1 user), Multi-User License (Up to 5 Users), and Corporate Use License (Unlimited User) along with free report customization equivalent to 0 analyst working days, 3 analysts working days, and 5 analysts working days respectively. |

Frequently Asked Questions

The global Release Agents market size is estimated to have a value of USD 2.1 billion in 2025 and is expected to reach USD 3.1 billion by the end of 2034.

The US Release Agents market is projected to be valued at USD 400 million in 2025. It is expected to witness subsequent growth in the upcoming period as it holds USD 600 million in 2034 at a CAGR of 4.1%.

Asia Pacific is expected to have the largest market share in the global Release Agents market, with a share of about 47.0% in 2025.

Some of the major key players in the global Release Agents market are Henkel AG & Co. KGaA, Chem-Trend L.P. (Freudenberg Group), Croda International Plc, Wacker Chemie AG, Evonik Industries AG, BASF SE, Arkema S.A., Daikin Industries Ltd., Mitsubishi Chemical Corporation, Momentive Performance Materials Inc., Hightower Products Inc., Klüber Lubrication (Freudenberg Group), McGee Industries Inc. (Mold Wiz), Marbo Italia S.p.A., Cresset Chemical Company, and Others.

The market is growing at a CAGR of 4.4 percent over the forecasted period