Market Overview

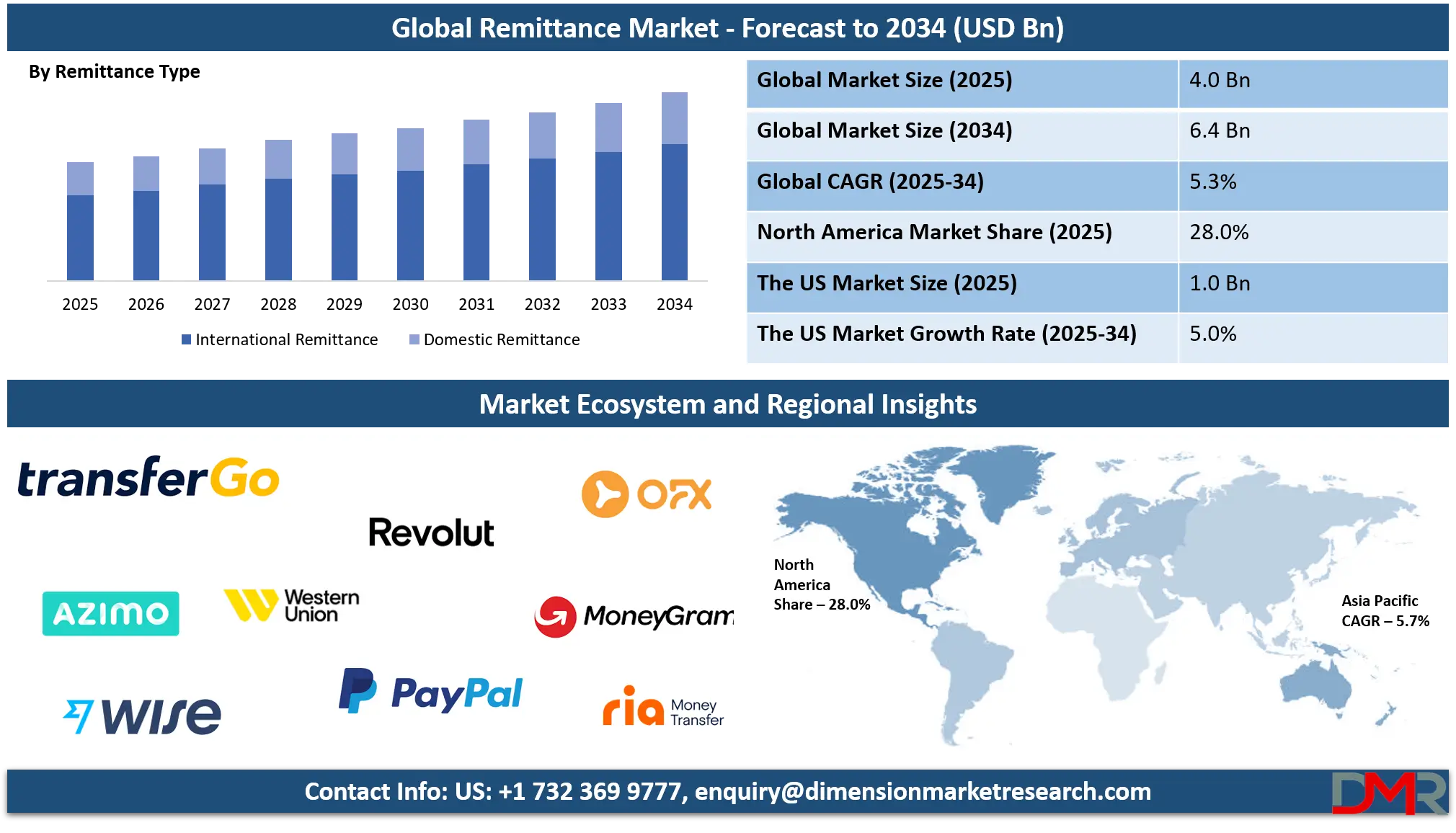

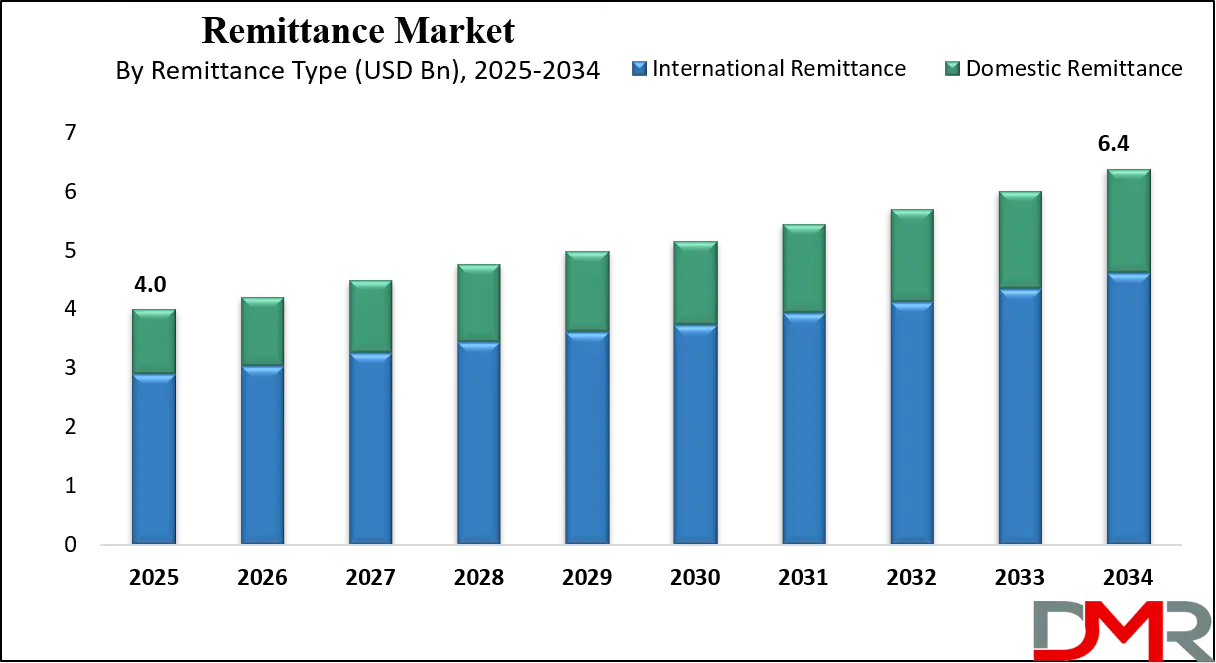

The Global Remittance Market size is projected to reach USD 4.0 billion in 2025 and grow at a compound annual growth rate of 5.3% to reach a value of USD 6.4 billion in 2034.

Remittance refers to the transfer of money by individuals from one location to another, primarily across borders, to support families, savings, investments, or business activities. It encompasses domestic and international money transfers facilitated through banks, money transfer operators, and increasingly through digital and mobile platforms. The remittance ecosystem includes payment infrastructure, settlement systems, regulatory compliance frameworks, and customer-facing technologies. Within the broader financial services industry, remittance plays a critical role in promoting financial inclusion, stabilizing household incomes, and supporting foreign exchange reserves in many developing economies. Its economic importance is particularly high in migrant-dependent nations where remittance inflows form a substantial share of GDP.

Remittance activity is being shaped by strong global migration patterns, rising employment levels in developed economies, and a structural shift toward digital financial services. Mobile wallets, app-based transfers, and web platforms are reducing dependency on cash-based channels while improving speed, transparency, and affordability. Regulatory encouragement of formal transfer mechanisms and financial inclusion initiatives has further accelerated adoption. The market has progressed from a fragmented, cash-intensive phase toward a more mature, technology-driven stage characterized by platform scalability and cross-border interoperability.

Recent market evolution reflects intensified investment in digital infrastructure, strategic collaborations between legacy institutions and fintech providers, and modernization of settlement processes. Providers are prioritizing compliance automation, fraud prevention, and customer experience enhancements. Consolidation activity and cross-border partnerships are reshaping competitive positioning, while regulatory harmonization efforts are influencing future market direction and long-term sustainability.

The US Remittance Market

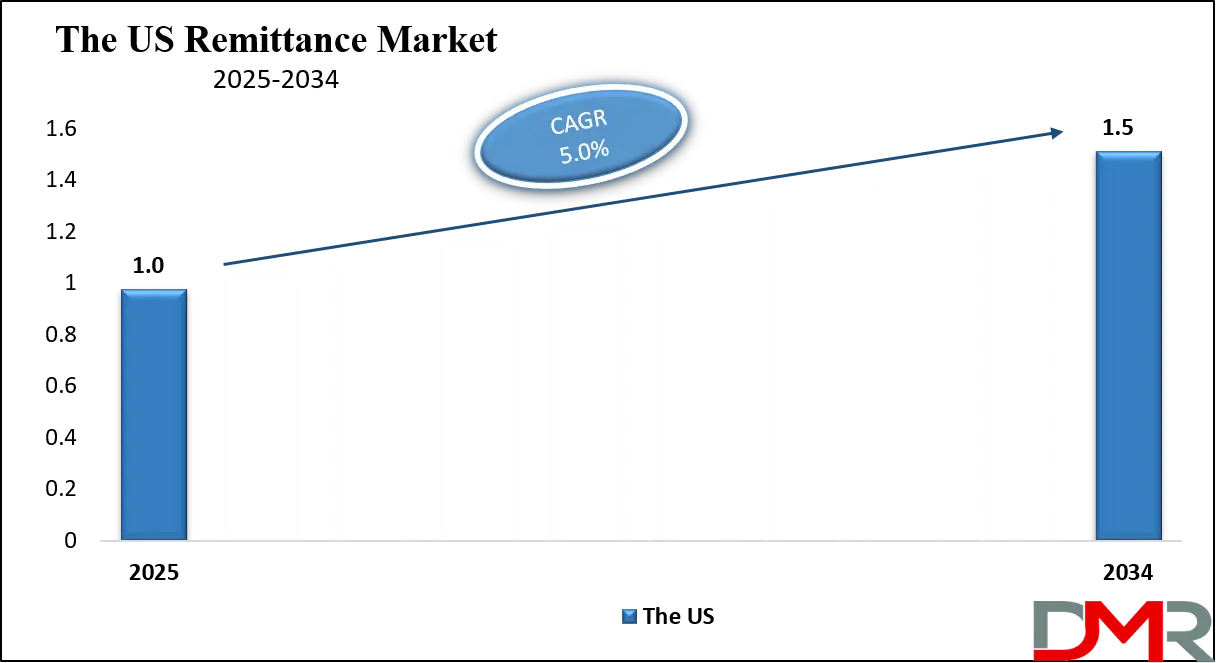

The US Remittance Market size is projected to reach USD 1.0 billion in 2025 at a compound annual growth rate of 5.0% over its forecast period.

The United States represents one of the largest outbound remittance markets globally due to its sizable migrant workforce and strong income levels. Transfers are largely directed toward Latin America and Asia, supported by a mature banking ecosystem and widespread digital payment adoption. Market growth is influenced by fintech penetration, declining digital transaction costs, and consumer preference for mobile-based services.

Regulatory oversight focused on transparency and anti-money laundering compliance shapes operational strategies. Government policies supporting financial inclusion and competition indirectly promote innovation, allowing digital platforms to gain market share alongside established institutions.

Europe Remittance Market

Europe Remittance Market size is projected to reach USD 880 million in 2025 at a compound annual growth rate of 5.1% over its forecast period.

Europe’s remittance market is driven by cross-border labor mobility, intra-EU migration, and international transfers to Africa and Eastern Europe. The region benefits from harmonized payment regulations and strong digital infrastructure. Policies encouraging open banking and cross-border interoperability have intensified competition and accelerated innovation. Sustainability and transparency requirements influence service design, while instant payment frameworks improve transaction speed. Adoption rates are high among digitally literate consumers, and remittance services are increasingly integrated with broader financial products.

Japan Remittance Market

Japan Remittance Market size is projected to reach USD 280 million in 2025 at a compound annual growth rate of 4.7% over its forecast period.

Japan’s remittance market is supported by its growing foreign workforce in manufacturing, construction, and services. Outbound remittances are primarily directed toward Southeast Asia. Government initiatives aimed at improving digital payments and supporting migrant workers have enhanced formal transfer usage. While regulatory rigor and conservative financial practices present entry challenges, opportunities exist in mobile-enabled services and multilingual platforms. Urbanization and industrial labor demand continue to expand the user base, positioning Japan as a steadily growing remittance hub.

Remittance Market: Key Takeaways

- Market Growth: The Remittance Market size is expected to grow by USD 2.2 billion, at a CAGR of 5.3%, during the forecasted period of 2026 to 2034.

- By Remittance Type: The international remittance segment is anticipated to get the majority share of the Remittance Market in 2025.

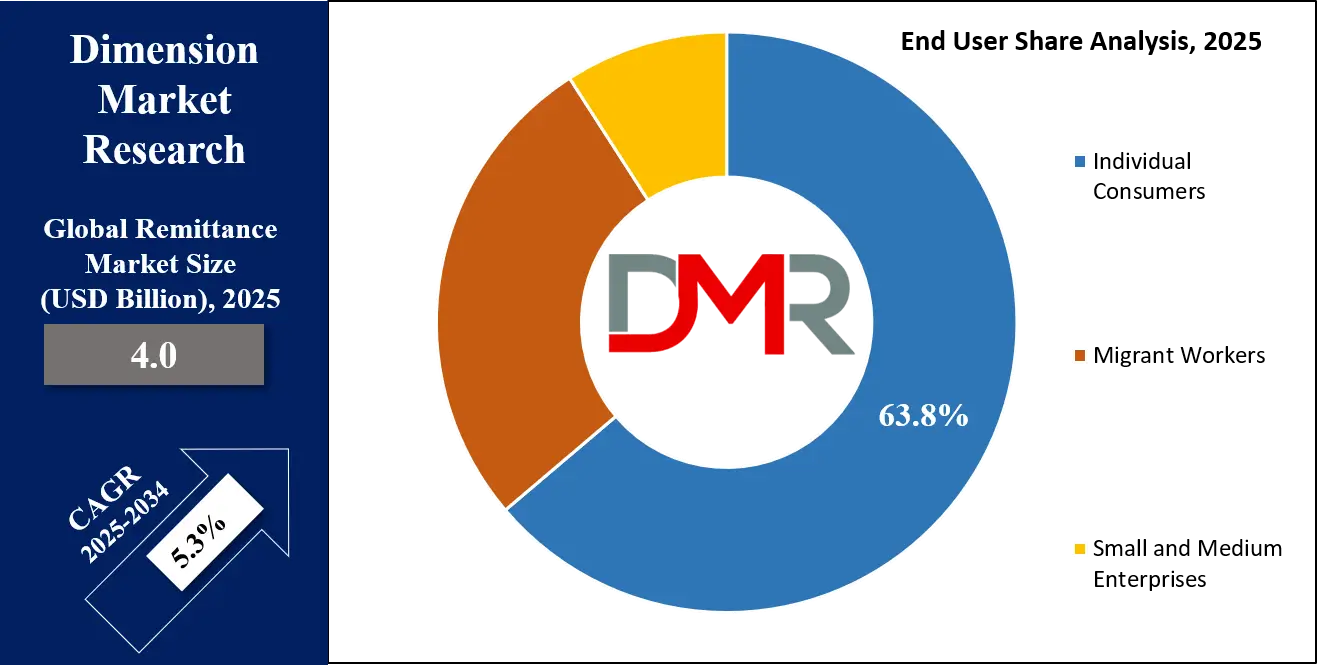

- By End User: The individual consumers segment is expected to get the largest revenue share in 2025 in the Remittance Market.

- Regional Insight: Asia Pacific is expected to hold a 41.5% share of revenue in the Global Remittance Market in 2025.

- Use Cases: Some of the use cases of Remittance include SME Transaction, Household Support, and more.

Remittance Market: Use Cases

- Household Support: Regular transfers for food, education, healthcare, and living expenses in recipient countries.

- Savings and Investment: Funds sent for property purchases, savings accounts, or small business investments.

- Emergency Assistance: Rapid transfers during medical emergencies or natural disasters.

- SME Transactions: Cross-border payments supporting trade and service payments for small enterprises.

Stats & Facts

- World Bank reports global remittance flows to low- and middle-income countries reached approximately USD 685 billion in 2024.

- World Bank notes that digital remittance costs averaged around 4.6% for USD 200 transfers in 2025.

- The International Monetary Fund states remittances contribute over 10% of GDP in more than 30 countries as of 2024.

- The United Nations Department of Economic and Social Affairs estimates that international migrants exceeded 281 million globally in 2024.

- World Bank identifies India as the largest remittance recipient with inflows exceeding USD 130 billion in 2025.

Market Dynamic

Driving Factors in the Remittance Market

Technological Advancement and Digitalization

Rapid digitalization is a primary force shaping the remittance market. Mobile applications, cloud-based platforms, and real-time payment systems have transformed how money is transferred across borders. These technologies significantly reduce transaction time and operational costs while improving transparency and traceability. Increased smartphone penetration and internet access have expanded reach among underserved populations. Providers leveraging digital onboarding, automated compliance checks, and seamless user interfaces are better positioned to scale operations and attract younger, digitally native users.

Migration and Global Workforce Expansion

Sustained international migration continues to drive remittance volumes. Economic disparities between regions encourage labor mobility, while developed economies rely heavily on migrant workers across construction, healthcare, and service sectors. Stable employment conditions in host countries support consistent outbound transfers. Additionally, diaspora communities maintain long-term financial ties with home countries, reinforcing structural demand. This dynamic directly influences corridor growth and strengthens the long-term stability of remittance flows.

Restraints in the Remittance Market

High Transaction Costs

Despite progress, high transfer fees remain a constraint, particularly in cash-based and low-competition corridors. Infrastructure inefficiencies, correspondent banking dependencies, and compliance expenses contribute to elevated costs. These barriers disproportionately affect low-income senders and may push users toward informal channels, limiting formal market penetration. Providers must balance cost reduction with regulatory compliance, which continues to challenge profitability and expansion in certain regions.

Regulatory Fragmentation

Inconsistent regulatory requirements across jurisdictions hinder scalability. Licensing procedures, data localization laws, and compliance standards vary significantly, increasing operational complexity. Smaller providers face difficulties expanding internationally due to compliance costs and administrative burdens. Regulatory uncertainty may delay innovation and restrict market entry, particularly in emerging economies with evolving financial regulations.

Opportunities in the Remittance Market

Expansion in Emerging Markets

Emerging economies present significant growth opportunities due to rising migration, increasing digital literacy, and expanding mobile money ecosystems. Africa and Southeast Asia offer untapped potential where traditional banking penetration is limited. Digital-first remittance models can capture these markets by offering affordable, accessible services tailored to local needs. Government support for digital finance further strengthens this opportunity.

Value-Added Financial Services

The integration of remittance services with savings, credit, and insurance products represents a major opportunity. Bundled offerings enhance customer lifetime value and promote financial inclusion. Providers can leverage transaction data to offer personalized financial solutions, transforming remittance platforms into comprehensive financial service ecosystems.

Trends in the Remittance Market

Shift Toward Digital and Mobile Channels

Consumers increasingly favor mobile and web-based remittance platforms due to convenience and speed. Digital channels dominate new user acquisition, while cash-based services gradually decline. This trend encourages providers to invest in user experience design, cybersecurity, and platform scalability to remain competitive.

Platform Partnerships and Ecosystems

Strategic partnerships among banks, fintechs, telecom operators, and payment networks are reshaping the market. These collaborations enable interoperability, broader geographic reach, and shared infrastructure, reducing costs and accelerating innovation across remittance corridors.

Impact of Artificial Intelligence in Remittance Market

- Fraud Detection: AI identifies abnormal transaction patterns to prevent fraud and financial crime.

- Automated Compliance: Machine learning streamlines KYC and AML verification processes.

- Customer Support: AI chatbots provide instant multilingual assistance and transaction tracking.

- Transaction Routing: Intelligent algorithms select optimal settlement paths to reduce delays.

- Operational Efficiency: Predictive analytics optimize liquidity management and cost structures.

Research Scope and Analysis

By Remittance Type Analysis

International remittance dominates the global market due to sustained international migration and strong dependence on cross-border income flows. In 2025, this segment accounts for approximately 72.4% of the total market share, reflecting its structural importance within the remittance ecosystem. Higher average transaction values and recurring transfer patterns from migrant workers supporting families abroad contribute significantly to its leadership. Growth is further reinforced by advancements in cross-border payment infrastructure, including real-time settlement systems and digital wallets that improve speed and reliability.

Increasing formalization of transfer channels, driven by regulatory oversight and transparency initiatives, has reduced reliance on informal networks. Government-led efforts to lower transfer costs and enhance financial inclusion also support expansion. As global labor mobility continues to rise, international remittance remains a foundational pillar of global financial flows.

Domestic remittance is the fastest-growing segment, supported by rising internal migration, urbanization, and rapid adoption of digital payment systems. Workers relocating from rural to urban areas increasingly rely on mobile wallets, instant payment platforms, and bank-linked applications to send money within national borders. Government promotion of cashless economies and implementation of real-time payment networks have significantly accelerated usage.

Lower transaction costs, faster settlement times, and improved accessibility encourage adoption among individuals and small businesses alike. Domestic remittances also benefit from simplified regulatory requirements compared to cross-border transfers, making them easier to scale. While transaction values are generally lower than international remittances, high transaction volumes and frequent usage patterns drive strong growth, positioning domestic remittance as a critical expansion area within the overall market.

By Transfer Channel Analysis

Digital and mobile remittance platforms lead the transfer channel segment, holding an estimated 58.6% market share in 2025. Their dominance is driven by convenience, cost efficiency, and widespread smartphone and internet penetration. Mobile app-based transfers are particularly popular due to intuitive interfaces, instant transaction tracking, and real-time notifications. These platforms significantly reduce dependency on physical locations and cash handling, improving accessibility for both senders and recipients.

Providers continue to invest in cybersecurity, data protection, and AI-driven personalization to enhance trust and user engagement. Regulatory support for digital finance, including open banking and fintech-friendly frameworks, further reinforces adoption. As consumers increasingly prioritize speed, transparency, and ease of use, digital and mobile platforms are expected to maintain their leadership position across global remittance corridors.

Money transfer operators are undergoing rapid transformation as they integrate digital capabilities into traditionally cash-based business models. While physical agent networks remain central to their operations, many operators are expanding app-based services and agent-assisted digital transfers to remain competitive. Their extensive global presence supports last-mile delivery, particularly in regions with limited banking infrastructure. This hybrid approach enables faster adoption in emerging markets where cash remains prevalent.

Money transfer operators benefit from established brand trust, regulatory experience, and strong corridor coverage. By digitizing front-end services while maintaining physical accessibility, these entities are bridging the gap between traditional and modern remittance models. Continued investment in technology and partnerships with fintech providers is allowing money transfer operators to retain relevance in an increasingly digital market landscape.

By Settlement Method Analysis

Account-to-account transfers represent a dominant settlement method, accounting for approximately 46.2% of the market share in 2025. This leadership reflects increased bank account penetration, digital wallet adoption, and growing consumer preference for fully electronic transactions. Faster settlement times, enhanced security, and improved traceability make this method attractive for both individual users and businesses. Account-to-account transfers also reduce cash handling risks and operational costs for providers.

Integration with instant payment systems and real-time clearing networks further strengthens performance and reliability. Regulatory support for electronic payments and financial inclusion initiatives has expanded access to accounts in developing regions. As digital financial ecosystems mature, account-to-account settlement continues to gain traction as a secure, efficient, and scalable remittance method.

Account-to-cash settlement is growing rapidly, particularly in regions with limited banking penetration and high cash dependency. This method allows digitally enabled senders to transfer funds to recipients who prefer or require cash payouts. Agent networks, retail outlets, and mobile cash-out points play a crucial role in supporting this model. Account-to-cash transfers promote financial inclusion by bridging the gap between digital financial systems and unbanked populations.

Growth is especially strong in rural areas and emerging markets where access to formal banking services remains uneven. Providers are investing in expanded agent networks and partnerships to improve reach and payout convenience. As digital adoption increases on the sender side, account-to-cash remains a vital settlement option supporting inclusive remittance growth.

By End User Analysis

Migrant workers constitute the leading end-user segment, holding an estimated 63.8% market share in 2025. Regular income transfers to support household expenses, education, healthcare, and savings drive consistent demand. This segment benefits from stable employment opportunities in host countries and long-term financial obligations in home countries. Digital accessibility, multilingual interfaces, and simplified onboarding processes enhance adoption among migrant populations.

Providers increasingly tailor services to this group by offering competitive pricing, transparent exchange rates, and corridor-specific solutions. Economic stability in destination countries sustains outbound remittance volumes, reinforcing dominance. As global migration continues and labor mobility expands, migrant workers remain the primary foundation of remittance market demand.

Small and medium enterprises represent the fastest-growing end-user segment within the remittance market. Increasing cross-border trade, freelance payments, supplier settlements, and service outsourcing have driven SME reliance on remittance platforms. Digital invoicing, transparent pricing, and faster settlement times attract SMEs seeking efficient international payment solutions.

Compared to traditional banking channels, remittance platforms offer lower costs and greater flexibility, supporting cash flow management. SMEs also benefit from integrated features such as transaction tracking, currency conversion, and payment scheduling. As globalization of small businesses accelerates and digital commerce expands, SME adoption of remittance services continues to rise, positioning this segment as a key driver of future market growth.

The Remittance Market Report is segmented on the basis of the following:

By Remittance Type

- Domestic Remittance

- International Remittance

By Transfer Channel

- Bank-Based Remittance

- Money Transfer Operators

- Digital and Mobile Remittance Platforms

- Web-Based Transfers

- Mobile App–Based Transfers

- Agent-Assisted Digital Transfers

By Settlement Method

- Account-to-Account

- Account-to-Cash

- Cash-to-Account

By End User

- Individual Consumers

- Migrant Workers

- Small and Medium Enterprises

Regional Analysis

Leading Region in the Remittance Market

Asia-Pacific leads the global remittance market with an estimated 41.5% share in 2025, driven by its large migrant population, high remittance dependency, and strong adoption of digital payment technologies. The region includes some of the world’s largest remittance-receiving countries such as India, China, the Philippines, Vietnam, and Bangladesh. Significant outbound migration to North America, Europe, and the Middle East sustains high transaction volumes.

Government initiatives promoting financial inclusion, digital banking, and real-time payment infrastructure have strengthened formal remittance channels. Widespread smartphone penetration and mobile wallet usage accelerate the shift toward digital and mobile transfers. Expanding cross-border payment corridors and regional payment integration further enhance efficiency, enabling Asia-Pacific to maintain its dominant position in the global remittance market.

Fastest Growing Region in the Remittance Market

The Middle East & Africa region is the fastest-growing remittance market due to increasing labor migration, rapid digital payment adoption, and improving regulatory frameworks. The Middle East serves as a major source region, with large expatriate workforces sending money to Asia and Africa, while Africa represents a high-growth destination market. Mobile money platforms and agent-assisted networks play a critical role in expanding access, particularly in areas with limited banking infrastructure. Governments across MEA are promoting financial inclusion, interoperability, and digital finance initiatives, supporting formal remittance growth. Rising intra-regional migration, expanding mobile connectivity, and investments in payment infrastructure continue to accelerate transaction volumes, positioning MEA as the most rapidly expanding regional market.

By Region

North America

Europe

- Germany

- The U.K.

- France

- Italy

- Russia

- Spain

- Benelux

- Nordic

- Rest of Europe

Asia-Pacific

- China

- Japan

- South Korea

- India

- ANZ

- ASEAN

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Argentina

- Colombia

- Rest of Latin America

Middle East & Africa

- Saudi Arabia

- UAE

- South Africa

- Israel

- Egypt

- Rest of MEA

Competitive Landscape

The remittance market is characterized by intense competition driven by pricing pressure, technological innovation, and regulatory compliance. Providers focus on digital transformation, cost efficiency, and corridor specialization to maintain market position. Strategic partnerships, infrastructure sharing, and continuous investment in security and user experience are common approaches. Entry barriers include licensing requirements, compliance costs, and trust establishment, favoring players with scalable platforms and strong regulatory expertise.

Some of the prominent players in the global Remittance are:

- Western Union

- MoneyGram

- PayPal

- Wise

- Ria Money Transfer

- Remitly

- WorldRemit

- Xoom

- Euronet Worldwide

- OFX

- Skrill

- Neteller

- Payoneer

- Revolut

- Azimo

- TransferGo

- XE Money Transfer

- Travelex

- Ant International

- Alipay

- Other Key Players

Recent Developments

- In September 2024, Wise announced a major investment to expand its cross-border payment infrastructure, targeting faster settlement and lower fees in high-volume corridors. The investment included new regional hubs and enhanced API integrations for partner institutions. This move reinforced Wise’s position in transparent, low-cost international remittances.

- In March 2024, Western Union enhanced its digital remittance platform by integrating advanced AI-driven fraud detection and expanding mobile wallet partnerships across Asia and Africa. The initiative focused on reducing transaction times and improving customer verification processes. This expansion strengthened the company’s digital footprint while supporting regulatory compliance across multiple jurisdictions.

Report Details

| Report Characteristics |

| Market Size (2025) |

USD 4.0 Bn |

| Forecast Value (2034) |

USD 6.4 Bn |

| CAGR (2025–2034) |

5.3% |

| The US Market Size (2025) |

USD 1.0 Bn |

| Historical Data |

2019 – 2023 |

| Forecast Data |

2026 – 2034 |

| Base Year |

2024 |

| Estimate Year |

2025 |

| Report Coverage |

Market Revenue Estimation, Market Dynamics, Competitive Landscape, Growth Factors, etc. |

| Segments Covered |

By Remittance Type (Domestic Remittance and International Remittance), By Transfer Channel (Bank-Based Remittance, Money Transfer Operators, and Digital and Mobile Remittance Platforms), By Settlement Method (Account-to-Account, Account-to-Cash, and Cash-to-Account), By End User (Individual Consumers, Migrant Workers, and Small and Medium Enterprises) |

| Regional Coverage |

North America – US, Canada; Europe – Germany, UK, France, Russia, Spain, Italy, Benelux, Nordic, Rest of Europe; Asia-Pacific – China, Japan, South Korea, India, ANZ, ASEAN, Rest of APAC; Latin America – Brazil, Mexico, Argentina, Colombia, Rest of Latin America; Middle East & Africa – Saudi Arabia, UAE, South Africa, Turkey, Egypt, Israel, Rest of MEA |

| Prominent Players |

Western Union, MoneyGram, PayPal, Wise, Ria Money Transfer, Remitly, WorldRemit, Xoom, Euronet Worldwide, OFX, Skrill, Neteller, Payoneer, Revolut, Azimo, TransferGo, XE Money Transfer, Travelex, Ant International, Alipay, and Other Key Players |

| Purchase Options |

We have three licenses to opt for: Single User License (Limited to 1 user), Multi-User License (Up to 5 Users), and Corporate Use License (Unlimited User) along with free report customization equivalent to 0 analyst working days, 3 analysts working days, and 5 analysts working days respectively. |

Frequently Asked Questions

The Global Remittance Market size is expected to reach a value of USD 4.0 billion in 2025 and is expected to reach USD 6.4 billion by the end of 2034.

Asia Pacific is expected to have the largest market share in the Global Remittance Market, with a share of about 41.5% in 2025.

The US Remittance market is expected to reach USD 1.0 billion by 2025.

Some of the major key players in the Global Remittance Market include PayPal, Wise, OFX, and others

The market is growing at a CAGR of 5.3 percent over the forecasted period.

Contents