Market Overview

The Global Remote Operation Platform Market is estimated to be valued at approximately USD 7.4 billion in 2025 and is projected to reach USD 24.4 billion by 2034, growing at a CAGR of 14.1%, driven by increasing adoption of industrial automation cloud based remote monitoring platforms industrial IoT integration and real time operational control across manufacturing energy utilities and infrastructure sectors.

A Remote Operation Platform is a digital system that enables centralized monitoring control and optimization of assets processes and operations from a distant location using real time data connectivity and automation technologies. It integrates software interfaces communication networks sensors and control systems to allow operators to supervise equipment performance execute commands and respond to operational issues without being physically present on site.

These platforms are widely used to enhance operational efficiency improve safety reduce downtime and support decision making by combining capabilities such as remote monitoring predictive analytics asset management industrial automation and secure data visualization across geographically distributed environments.

The global Remote Operation Platform market represents the collective demand and supply of solutions that support remote monitoring control and management across multiple industries including manufacturing energy utilities oil and gas mining transportation and healthcare. Market growth is driven by rapid digital transformation increasing adoption of industrial IoT cloud computing and advanced connectivity technologies such as 5G.

Organizations are increasingly investing in remote operation platforms to manage complex operations reduce operational risks optimize workforce utilization and ensure business continuity particularly in remote hazardous or large scale industrial environments.

From a broader perspective the global Remote Operation Platform market is evolving toward intelligent and autonomous operations through the integration of artificial intelligence, machine learning and digital twin technologies. Enterprises are shifting from traditional on site control systems to cloud based and hybrid platforms that enable scalability real time collaboration and data driven insights across global operations.

As industries focus on cost efficiency sustainability and resilience the market continues to expand with rising demand for software centric platforms service based deployment models and end to end remote operational ecosystems that support long term industrial modernization.

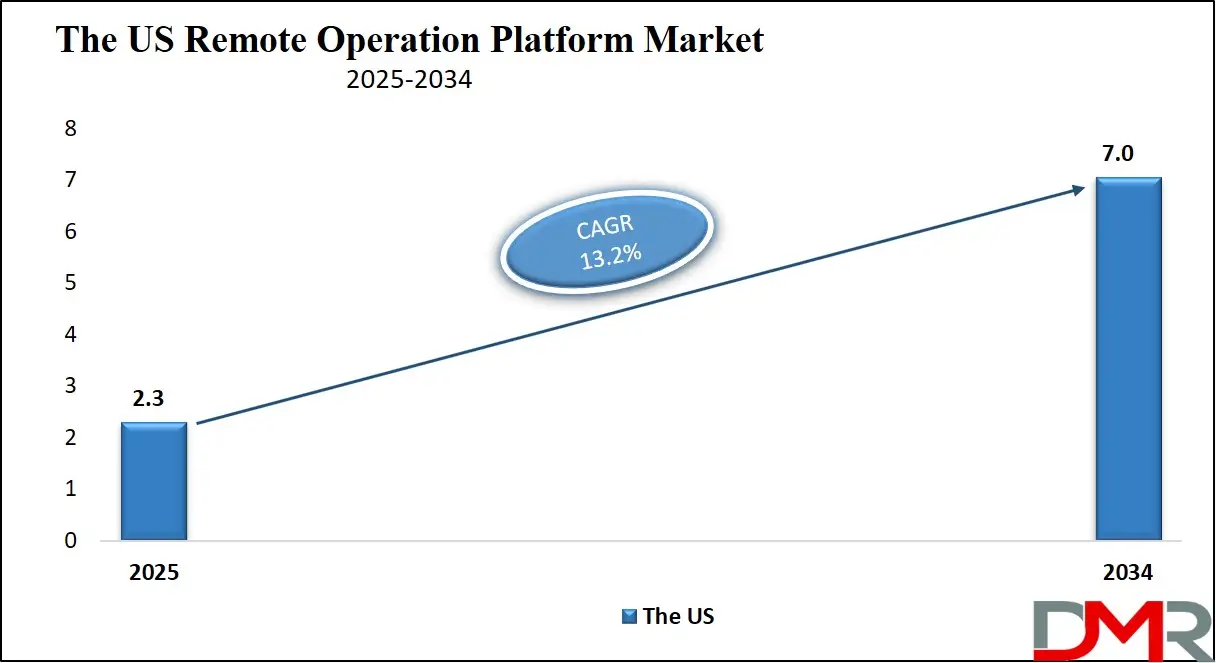

The US Remote Operation Platform Market

The U.S. Remote Operation Platform market size is projected to be valued at USD 2.3 billion by 2025. It is further expected to witness subsequent growth in the upcoming period, holding USD 7.0 billion in 2034 at a CAGR of 13.2%.

The US Remote Operation Platform market is witnessing strong expansion due to the widespread adoption of advanced industrial automation digital control systems and remote monitoring solutions across key industries such as manufacturing energy utilities oil and gas and transportation. Enterprises in the US are increasingly deploying cloud based remote operation platforms integrated with industrial IoT sensors SCADA systems and real time data analytics to enhance operational visibility reduce equipment downtime and improve asset performance management.

High investment in smart factories critical infrastructure modernization and connected industrial ecosystems continues to drive demand for software centric platforms that enable centralized operational control secure data transmission and predictive maintenance capabilities.

In addition the growing focus on workforce optimization operational safety and business continuity is accelerating the adoption of AI enabled remote operation platforms across the US. Companies are leveraging machine learning driven analytics digital twin technology and advanced visualization tools to remotely manage complex industrial processes and geographically distributed assets.

Strong presence of leading technology providers favorable regulatory support for digital transformation and increasing deployment of private 5G and edge computing infrastructure further strengthen the US market outlook making it a key contributor to global revenue growth in remote operations and industrial connectivity solutions.

Europe Remote Operation Platform Market

The Europe Remote Operation Platform market is projected to reach approximately USD 1.5 billion in 2025, reflecting strong adoption across manufacturing, energy, utilities, and transportation sectors. Growth in the region is fueled by increasing digital transformation initiatives, deployment of industrial IoT devices, and integration of AI enabled remote monitoring platforms. European organizations are investing heavily in cloud based solutions, predictive maintenance, and centralized operational control systems to enhance efficiency, reduce downtime, and improve asset management across geographically distributed facilities.

The market in Europe is also supported by government policies promoting smart infrastructure, energy efficiency, and Industry 4.0 adoption. Companies are leveraging advanced analytics, digital twins, and real time monitoring capabilities to optimize industrial processes and utility management. The region’s CAGR of 12.9% indicates steady expansion driven by the need for scalable, flexible, and intelligence driven remote operation solutions, making Europe a key contributor to the global market growth.

Japan Remote Operation Platform Market

The Japan Remote Operation Platform market is projected to reach approximately USD 500 million in 2025, driven by the country’s advanced manufacturing base, energy sector modernization, and growing adoption of industrial automation technologies. Japanese organizations are increasingly deploying cloud based remote monitoring systems, industrial IoT devices, and AI enabled platforms to optimize operational efficiency, enhance asset performance, and enable predictive maintenance across manufacturing, utilities, and transportation sectors. The emphasis on smart factories and connected infrastructure further supports the demand for remote operation solutions.

With a robust CAGR of 14.7%, the Japan market is experiencing rapid growth as companies focus on digital transformation and real time operational control. The integration of advanced analytics, digital twin technologies, and high speed connectivity such as 5G enables organizations to remotely manage complex industrial operations and distributed assets. Strong government support for industrial innovation and efficiency improvements, integrated with rising investments in automation and remote operational capabilities, positions Japan as a high growth market within the global Remote Operation Platform landscape.

Global Remote Operation Platform Market: Key Takeaways

- Robust Market Expansion: The global Remote Operation Platform market is projected to grow from USD 7.4 billion in 2025 to USD 24.4 billion by 2034, driven by growing adoption of digitalized, automated, and cloud-based industrial operations.

- Software and Cloud Lead Adoption: Software platforms and cloud-based deployments dominate the market, enabling real-time monitoring, predictive maintenance, and centralized operational control across industries.

- Wireless and IoT Integration Accelerates Operations: Wireless connectivity and IoT-enabled platforms are adopted to manage distributed assets efficiently, supporting scalability, operational resilience, and smart industrial processes.

- Large Enterprises Drive Adoption: Large enterprises account for the majority of market share due to complex operations, geographically distributed assets, and extensive IT infrastructure, while SMEs are gradually adopting cloud-based solutions.

- Regional Leadership and Growth Hotspots: North America leads the market with 37% share, while Asia Pacific is the fastest-growing region, fueled by industrialization, smart manufacturing initiatives, and government-backed Industry 4.0 adoption.

Global Remote Operation Platform Market: Use Cases

- Industrial Automation and Smart Manufacturing: Remote operation platforms enable centralized monitoring and control of manufacturing processes using industrial IoT real time analytics and automation software. These platforms help improve production efficiency reduce downtime support predictive maintenance and enhance asset performance across smart factories and digitally connected industrial environments.

- Energy and Utilities Infrastructure Management: In the energy and utilities sector remote operation platforms support real time monitoring of power grids renewable energy systems and water infrastructure. Cloud based remote monitoring solutions improve grid reliability enable faster fault detection and optimize asset management across geographically distributed utility networks.

- Oil and Gas Remote Asset Operations: Oil and gas operators use remote operation platforms to monitor and control offshore rigs pipelines and production facilities from centralized locations. These platforms enhance operational safety reduce on site workforce requirements and improve efficiency through real time data analytics secure connectivity and predictive maintenance.

- Transportation and Fleet Operations Management: Remote operation platforms are used in transportation and logistics to manage fleets infrastructure and operational performance remotely. By leveraging cloud platforms real time data visualization and connectivity solutions organizations improve fleet efficiency reduce operational costs and support proactive maintenance across large scale transport networks.

Impact of Artificial Intelligence on the global Remote Operation Platform market

- Enhanced Predictive Analytics and Asset Intelligence: Artificial intelligence significantly improves remote operation platforms by enabling predictive analytics anomaly detection and condition based monitoring. AI powered models analyze real time and historical operational data to predict equipment failures optimize maintenance schedules and reduce unplanned downtime across industrial and infrastructure operations.

- Increased Automation and Autonomous Operations: AI integration allows remote operation platforms to move beyond manual control toward intelligent and autonomous operations. Machine learning algorithms support adaptive process control automated decision making and self-optimizing systems which enhance operational efficiency reduce human intervention and improve safety in complex remote environments.

- Advanced Data Insights and Digital Twin Integration: Artificial intelligence strengthens remote operation platforms by enabling advanced data visualization digital twin modeling and performance optimization. AI driven insights help organizations simulate operational scenarios improve remote asset management and support strategic decision making across manufacturing energy utilities and transportation sectors.

Global Remote Operation Platform Market: Stats & Facts

NIST (U.S. National Institute of Standards and Technology) IoT Advisory Board Report

- The U.S. government recognizes IoT technology deployment and operation as strategic for national innovation and infrastructure modernization, recommending increased adoption across sectors including smart transit, agriculture, healthcare and public safety to improve operational efficiency.

France Digital Economy (official government‑referenced export guide)

- IoT sector growth in France recorded approximately 19 % growth in 2022, highlighting national digital transformation emphasis in industrial, energy and infrastructure domains.

IoT Analytics / NCCoE (NIST National Cybersecurity Center of Excellence)

- Estimates indicated more than 75 billion IoT devices globally by 2025, underscoring the massive scale of connected systems that underpin remote operation and automation technologies.

U.S. Federal Strategic Priorities (State.gov Digital Policy Strategy)

- The U.S. federal strategy prioritizes cyber and digital infrastructure modernization, including IoT and connected technologies, as core to future economic competitiveness and operational resilience.

U.S. Advisory Board Recommendations (NIST IoT Advisory Board)

- U.S. government entities including NIST, FTC, and DOE are advised to encourage interoperable IoT adoption and secure connectivity policies to support expanded use of connected devices across industries.

Global Remote Operation Platform Market: Market Dynamics

Global Remote Operation Platform Market: Driving Factors

Rising Adoption of Industrial Automation and Digital Transformation

The growing shift toward industrial automation smart manufacturing and digitally connected operations is a major driver of the remote operation platform market. Organizations are increasingly adopting cloud based remote monitoring solutions industrial IoT integration and real time operational control to improve productivity reduce operational costs and enhance asset performance across manufacturing energy utilities and transportation sectors.

Demand for Operational Efficiency and Workforce Optimization

Enterprises are prioritizing remote operation platforms to manage geographically distributed assets with fewer on site personnel. Remote monitoring software predictive analytics and centralized control systems help improve workforce efficiency enhance operational visibility and ensure business continuity particularly in hazardous or remote industrial environments.

Global Remote Operation Platform Market: Restraints

High Implementation and Integration Costs

The deployment of remote operation platforms often requires significant upfront investment in software integration industrial connectivity infrastructure sensors and cybersecurity systems. For small and mid-sized enterprises these costs can limit adoption especially in legacy environments that require extensive system upgrades.

Data Security and Cybersecurity Concerns

Remote operation platforms rely heavily on real time data transmission cloud connectivity and remote access which increases exposure to cyber threats. Concerns related to data privacy network security and unauthorized system access continue to restrain adoption particularly in critical infrastructure energy and defense related applications.

Global Remote Operation Platform Market: Opportunities

Integration of Artificial Intelligence and Advanced Analytics

The incorporation of artificial intelligence machine learning and predictive analytics presents significant growth opportunities for the remote operation platform market. AI enabled platforms offer intelligent asset monitoring digital twin modeling and autonomous operational capabilities which enhance decision making and expand use cases across industries.

Expansion of 5G and Edge Computing Infrastructure

The rapid rollout of 5G networks and edge computing solutions creates new opportunities for real time remote operations. Enhanced connectivity supports low latency communication high data throughput and improved reliability enabling advanced remote control systems in manufacturing utilities transportation and smart infrastructure projects.

Global Remote Operation Platform Market: Trends

Shift toward Cloud Based and Hybrid Deployment Models

Enterprises are increasingly adopting cloud based and hybrid remote operation platforms to gain scalability flexibility and centralized operational control. These deployment models support seamless integration with industrial IoT devices data analytics platforms and enterprise software while reducing infrastructure complexity.

Growing Use of Digital Twins for Remote Asset Management

Digital twin technology is emerging as a key trend in the remote operation platform market. By creating virtual replicas of physical assets organizations can simulate operations monitor performance remotely and optimize maintenance strategies leading to improved efficiency reduced downtime and enhanced asset lifecycle management.

Global Remote Operation Platform Market: Research Scope and Analysis

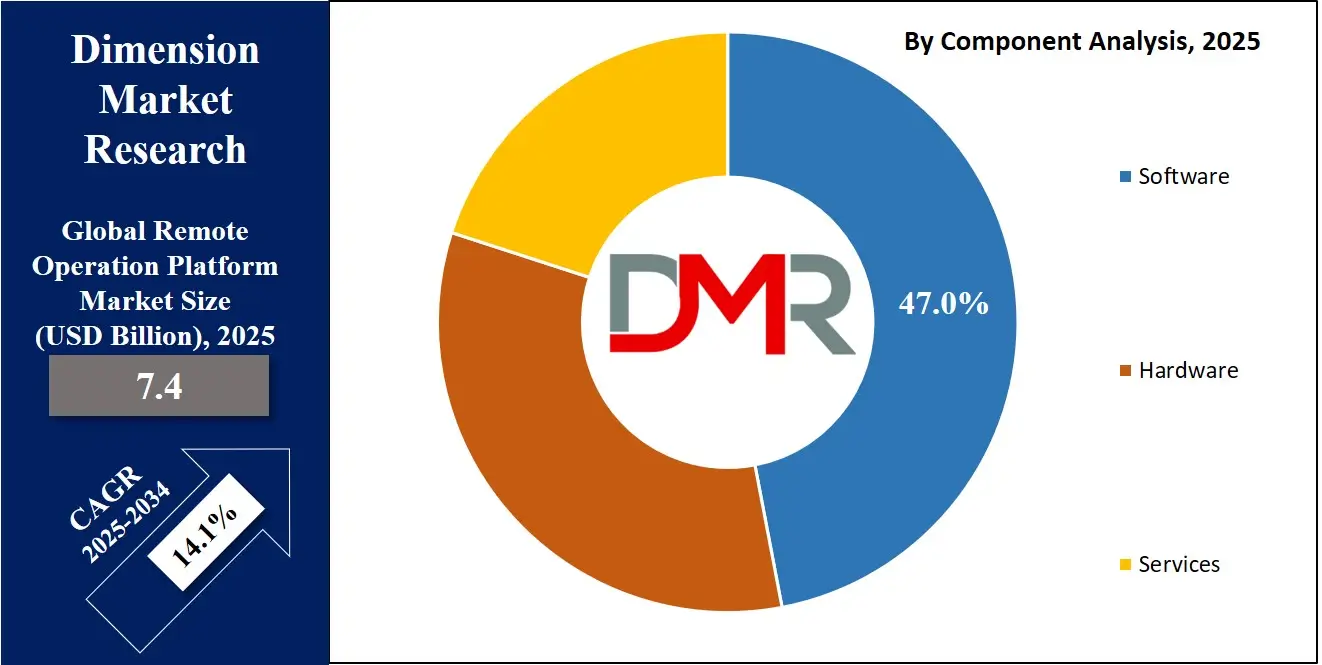

By Component Analysis

Software emerges as the backbone of remote operation platforms, capturing around 47.0% of the market share in 2025, driven by growing reliance on cloud-based remote monitoring, real-time data analytics, and centralized operational control. Software platforms enable asset visualization, process automation, predictive maintenance, and seamless integration with industrial IoT devices and enterprise systems. Increasing adoption of AI-enabled analytics, digital twins, and platform-as-a-service models further strengthens software demand as organizations prioritize scalable, flexible, and intelligence-driven solutions over hardware-heavy deployments.

Hardware continues to play a vital supporting role, enabling data acquisition, connectivity, and physical control of remote assets. This segment includes sensors, controllers, gateways, communication devices, and industrial networking equipment that facilitate real-time data transmission between field assets and centralized platforms.

Demand for robust and reliable hardware remains strong in manufacturing, energy, utilities, oil and gas, and mining environments, where harsh conditions require durable industrial-grade components. While hardware accounts for a smaller share compared to software, it remains essential for ensuring system reliability, operational accuracy, and secure remote connectivity.

By Deployment Mode Analysis

Cloud-based deployment continues to drive the market, projected to account for 57.0% of the segment in 2025, as organizations seek scalable, flexible, and accessible remote monitoring solutions. Cloud platforms provide centralized operational control, real-time data visibility, and seamless integration with industrial IoT and analytics platforms. Faster implementation, lower upfront costs, and continuous updates make cloud deployments attractive across manufacturing, energy, transportation, and utility sectors.

On-premises deployments retain relevance for industries requiring strict data security, regulatory compliance, and low latency operations. Critical infrastructure, oil and gas, and defense sectors prefer on-premises solutions to maintain control over sensitive data and internal networks. These deployments offer high customization, reliable performance, and greater system control, especially in locations with limited internet connectivity, ensuring mission-critical operations remain uninterrupted.

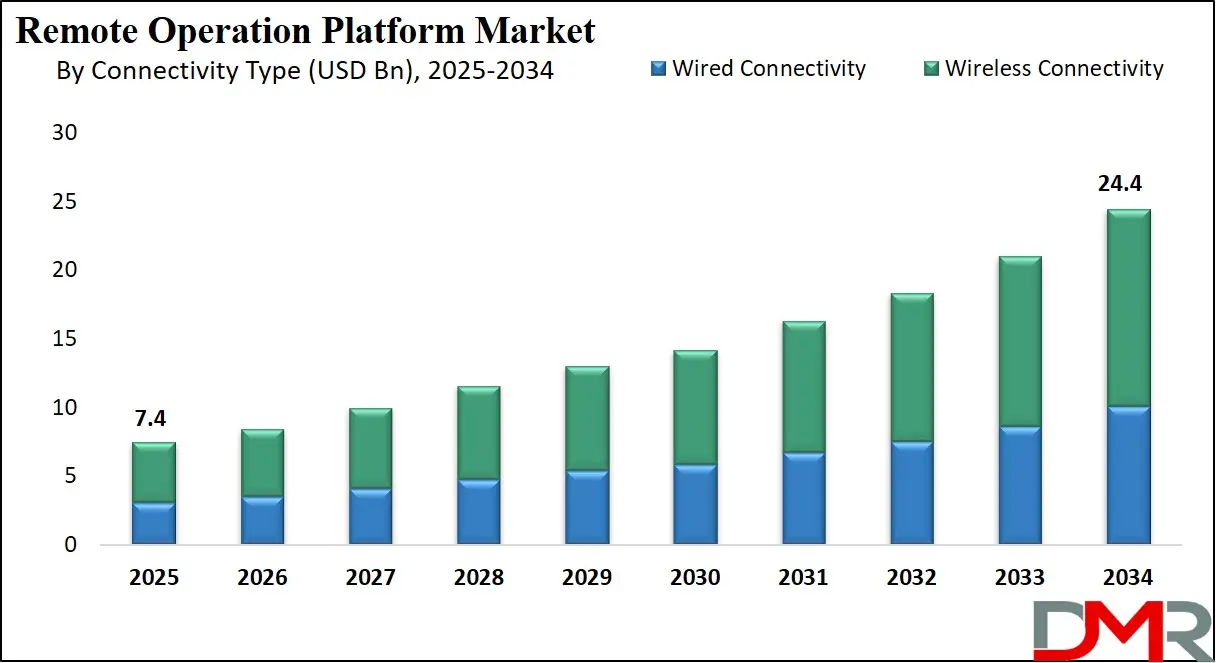

By Connectivity Type Analysis

Wireless connectivity is increasingly the preferred choice for modern remote operations, projected to lead the market with 59.0% share in 2025. Wireless systems enable real-time data transmission, remote control, and seamless integration across distributed assets, supported by industrial IoT adoption and 5G networks. Organizations benefit from enhanced flexibility, scalability, and reduced infrastructure requirements, allowing operators to manage complex operations across manufacturing facilities, energy grids, transportation networks, and utilities efficiently.

Wired connectivity remains important for sectors where reliability, low latency, and secure communication are critical. Solutions such as Ethernet and industrial networking provide high-bandwidth, stable connections, ensuring uninterrupted data flow between field devices and central control systems. Industries like manufacturing, oil and gas, and critical infrastructure rely on wired systems for mission-critical processes and harsh operational conditions.

By Technology Architecture Analysis

IoT-enabled platforms dominate the technology architecture landscape, capturing approximately 38.0% of the total market value in 2025. These platforms empower organizations with intelligent, connected, and predictive operational capabilities, enabling seamless remote monitoring, predictive maintenance, and centralized control across distributed assets. Integration with cloud computing, AI-driven analytics, and digital twin technologies further strengthens adoption, supporting scalable and intelligence-driven remote operations in manufacturing, energy, utilities, and transportation sectors.

SCADA-integrated platforms continue to hold a key position, particularly in industries requiring robust process control and reliable monitoring of critical infrastructure. These platforms combine supervisory control, data acquisition, and industrial automation to provide real-time insights and operational oversight of machinery, pipelines, grids, and production systems. SCADA remains indispensable in energy, utilities, oil and gas, and manufacturing sectors, where precision, reliability, and low-latency communication are critical.

By Enterprise Size Analysis

Large enterprises lead the adoption of remote operation platforms, accounting for 68.0% of market share in 2025, driven by complex operations, geographically distributed assets, and substantial IT budgets. These organizations deploy advanced platforms to enhance operational efficiency, implement predictive maintenance, optimize resource utilization, and enable centralized monitoring across multiple facilities. Integration with industrial IoT devices, AI analytics, cloud computing, and digital twin technologies enables real-time operational control and improved productivity.

Small and medium enterprises (SMEs) are gradually increasing adoption through cloud-based remote operation platforms and software-as-a-service solutions. These platforms allow SMEs to manage limited resources, streamline operations, and monitor distributed assets efficiently without heavy upfront infrastructure investments. Challenges such as budget constraints, technical expertise, and legacy system integration can limit rapid deployment, but cloud-based scalability supports incremental adoption.

By Application Analysis

Industrial automation and process control remain the primary applications for remote operation platforms, capturing 34.0% of the market share in 2025. These platforms enable centralized monitoring, real-time process optimization, and predictive maintenance of machinery and equipment. Integration with industrial IoT devices, AI-driven analytics, and automation software enhances operational efficiency, reduces unplanned downtime, and improves product quality. Demand is especially strong in smart factories, automotive, electronics, and heavy manufacturing sectors, where continuous supervision and data-driven decision-making are critical.

Utilities and energy management also represent significant applications, leveraging remote platforms to monitor and control power grids, renewable energy assets, and water infrastructure. Cloud-based monitoring, real-time analytics, and predictive maintenance tools improve grid reliability, optimize energy distribution, and respond rapidly to operational disruptions. These platforms enhance asset management, fault detection, and load balancing, supporting operational efficiency, regulatory compliance, and sustainability objectives.

By End-User Industry Analysis

Manufacturing continues to be the largest end-user segment, accounting for 29.0% of the market in 2025. Remote operation platforms allow manufacturers to monitor production lines, optimize processes, and implement predictive maintenance across multiple facilities. Integration with industrial IoT, automation software, and real-time analytics enhances operational efficiency, reduces downtime, improves product quality, and supports cost savings.

Energy and utilities are another key end-user segment, leveraging platforms for centralized control, real-time insights, and predictive maintenance of power generation, transmission, and water systems. Integration with cloud computing, industrial IoT, and analytics tools helps manage dispersed assets efficiently, optimize resource utilization, ensure regulatory compliance, and support sustainability initiatives while minimizing operational costs.

The Remote Operation Platform Market Report is segmented on the basis of the following:

By Component

- Software

- Hardware

- Services

By Deployment Mode

By Connectivity Type

- Wired Connectivity

- Wireless Connectivity

By Technology Architecture

- IoT-Enabled Platforms

- SCADA-Integrated Platforms

- AI/ML-Enabled Operation Platforms

- Digital Twin–Based Platforms

By Enterprise Size

By Application

- Industrial Automation & Process Control

- Utilities & Energy Management

- Oil & Gas Operations

- Mining Operations

- Transportation & Fleet Operations

- Healthcare & Medical Device Operations

- Others

By End-User Industry

- Manufacturing

- Energy & Utilities

- Oil & Gas

- Transportation & Logistics

- Healthcare

- Others

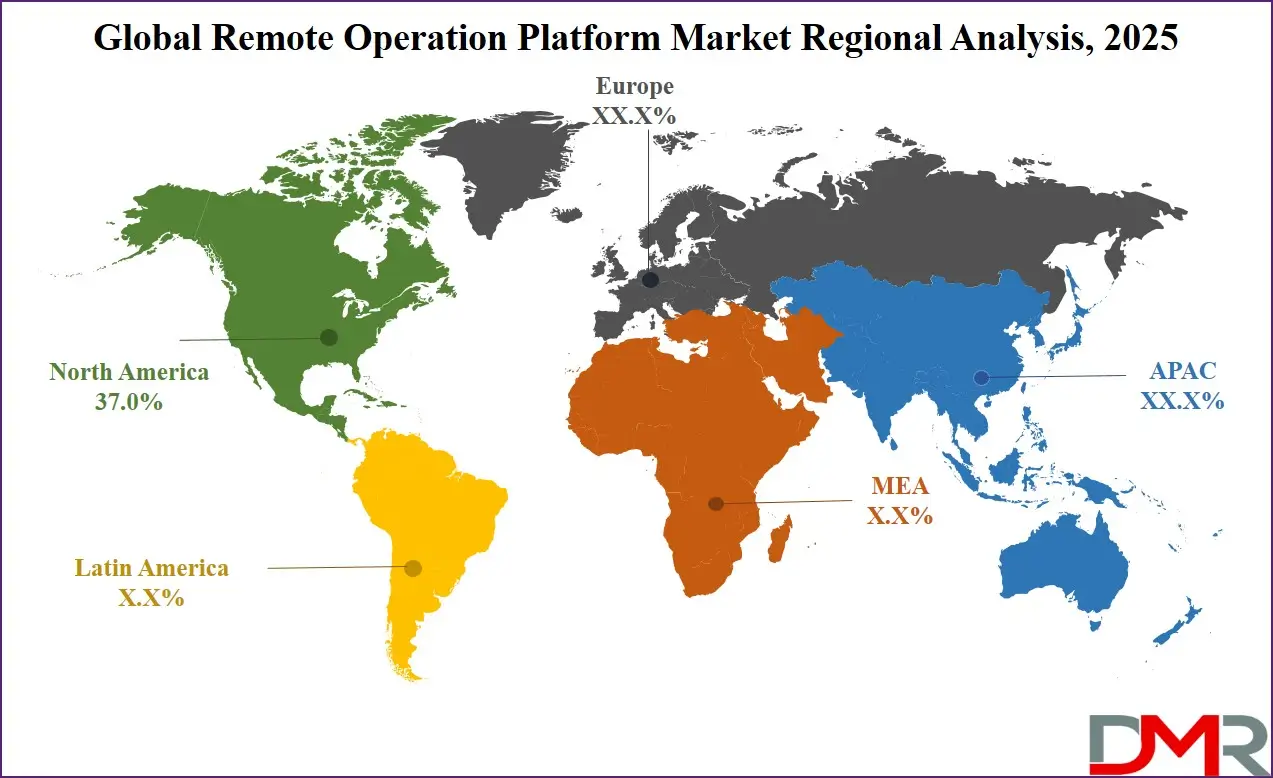

Global Remote Operation Platform Market: Regional Analysis

Region with the Largest Revenue Share

North America is expected to lead the global Remote Operation Platform market, accounting for approximately 37.0% of the total market revenue in 2025. The region’s dominance is driven by early adoption of industrial automation, advanced digital infrastructure, and widespread deployment of cloud based remote monitoring and control solutions.

Strong presence of key technology providers, investment in smart factories, energy grids, and transportation networks, along with integration of industrial IoT, AI analytics, and predictive maintenance tools, supports the region’s leadership. Additionally, favorable regulatory frameworks, focus on operational efficiency, and demand for real time remote asset management further strengthen North America’s position in the global market.

Region with significant growth

Asia Pacific is expected to witness the highest growth in the Remote Operation Platform market over the coming years, driven by rapid industrialization, increasing adoption of smart manufacturing, and expansion of digital infrastructure across countries such as China, India, Japan, and South Korea.

The region’s growth is fueled by rising investments in industrial IoT, cloud based monitoring solutions, and AI enabled remote operation platforms that enhance operational efficiency and predictive maintenance capabilities. Strong government initiatives supporting Industry 4.0, growing energy and utility infrastructure, and increasing demand for connected transportation and logistics systems further contribute to the rapid market expansion in the Asia Pacific region.

By Region

North America

Europe

- Germany

- The U.K.

- France

- Italy

- Russia

- Spain

- Benelux

- Nordic

- Rest of Europe

Asia-Pacific

- China

- Japan

- South Korea

- India

- ANZ

- ASEAN

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Argentina

- Colombia

- Rest of Latin America

Middle East & Africa

- Saudi Arabia

- UAE

- South Africa

- Israel

- Egypt

- Rest of MEA

Global Remote Operation Platform Market: Competitive Landscape

The competitive landscape of the global Remote Operation Platform market is characterized by intense innovation and strategic investments in advanced technologies such as cloud based solutions, artificial intelligence, industrial IoT integration, and real time analytics. Market players are focusing on enhancing platform capabilities through partnerships, product enhancements, and expansion into new geographic and industry verticals to meet the growing demand for scalable remote monitoring and control solutions.

Emphasis on service offerings, customer support, and cybersecurity further differentiates providers, while ongoing developments in digital twin, edge computing, and predictive maintenance technologies continue to shape competitive dynamics and drive overall market evolution.

Some of the prominent players in the global Remote Operation Platform market are

- Siemens AG

- ABB Ltd.

- Schneider Electric SE

- Honeywell International Inc.

- Rockwell Automation Inc.

- Emerson Electric Co.

- Yokogawa Electric Corporation

- General Electric Company (GE)

- Mitsubishi Electric Corporation

- Cisco Systems Inc.

- AVEVA Group plc

- Hitachi Ltd.

- Bosch Rexroth AG

- Omron Corporation

- FANUC Corporation

- Toshiba Corporation

- IBM Corporation

- Oracle Corporation

- SAP SE

- Halliburton Company

- Other Key Players

Global Remote Operation Platform Market: Recent Developments

- Dec 2025: TeamViewer unveils Agentless Access feature for industrial remote operations, introducing a new capability within its enterprise platform that allows manufacturers and machine builders to securely access and troubleshoot OT systems without installing software on each device, enhancing remote maintenance and operational control.

- Dec 2025: Iris launches a cloud‑connected camera control platform, enabling any PTZ camera to become remotely controlled and AI automated for real‑time monitoring and collaboration from wherever operations are managed, expanding remote device control capabilities.

- Oct 2025: CLS completes acquisition of Ground Control, integrating the UK and US satellite IoT and cloud monitoring specialist to strengthen its global satellite‑based remote connectivity solutions and expand its capability to deliver end‑to‑end monitoring for critical infrastructure and environmental assets.

Report Details

| Report Characteristics |

| Market Size (2025) |

USD 7.4 Bn |

| Forecast Value (2034) |

USD 24.4 Bn |

| CAGR (2025–2034) |

14.1% |

| The US Market Size (2025) |

USD 2.3 Bn |

| Historical Data |

2019 – 2024 |

| Forecast Data |

2026 – 2034 |

| Base Year |

2024 |

| Estimate Year |

2025 |

| Report Coverage |

Market Revenue Estimation, Market Dynamics, Competitive Landscape, Growth Factors and etc. |

| Segments Covered |

By Component (Software, Hardware, Services); By Deployment Mode (Cloud-Based, On-Premises); By Connectivity Type (Wired Connectivity, Wireless Connectivity); By Technology Architecture (IoT-Enabled Platforms, SCADA-Integrated Platforms, AI/ML-Enabled Operation Platforms, Digital Twin–Based Platforms); By Enterprise Size (Large Enterprises, SMEs); By Application (Industrial Automation & Process Control, Utilities & Energy Management, Oil & Gas Operations, Mining Operations, Transportation & Fleet Operations, Healthcare & Medical Device Operations, Others); By End-User Industry (Manufacturing, Energy & Utilities, Oil & Gas, Transportation & Logistics, Healthcare, Others). |

| Regional Coverage |

North America – The US and Canada; Europe – Germany, The UK, France, Russia, Spain, Italy, Benelux, Nordic, & Rest of Europe; Asia-Pacific – China, Japan, South Korea, India, ANZ, ASEAN, Rest of APAC; Latin America – Brazil, Mexico, Argentina, Colombia, Rest of Latin America; Middle East & Africa – Saudi Arabia, UAE, South Africa, Turkey, Egypt, Israel, & Rest of MEA |

| Prominent Players |

Siemens AG, ABB Ltd., Schneider Electric SE, Honeywell International Inc., Rockwell Automation Inc., Emerson Electric Co., Yokogawa Electric Corporation, General Electric Company (GE), Mitsubishi Electric Corporation, Cisco Systems Inc., AVEVA Group plc, Hitachi Ltd., Bosch Rexroth AG, Omron Corporation, FANUC Corporation, and Others. |

| Purchase Options |

We have three licenses to opt for: Single User License (Limited to 1 user), Multi-User License (Up to 5 Users), and Corporate Use License (Unlimited User) along with free report customization equivalent to 0 analyst working days, 3 analysts working days, and 5 analysts working days respectively. |

Frequently Asked Questions

The global Remote Operation Platform market size is estimated to have a value of USD 7.4 billion in 2025 and is expected to reach USD 24.4 billion by the end of 2034.

The US Remote Operation Platform market is projected to be valued at USD 2.3 billion in 2025. It is expected to witness subsequent growth in the upcoming period as it holds USD 7.0 billion in 2034 at a CAGR of 13.2%.

North America is expected to have the largest market share in the global Remote Operation Platform market, with a share of about 37.0% in 2025.

Some of the major key players in the global Remote Operation Platform market are Siemens AG, ABB Ltd., Schneider Electric SE, Honeywell International Inc., Rockwell Automation Inc., Emerson Electric Co., Yokogawa Electric Corporation, General Electric Company (GE), Mitsubishi Electric Corporation, Cisco Systems Inc., AVEVA Group plc, Hitachi Ltd., Bosch Rexroth AG, Omron Corporation, FANUC Corporation, and Others.