Market Overview

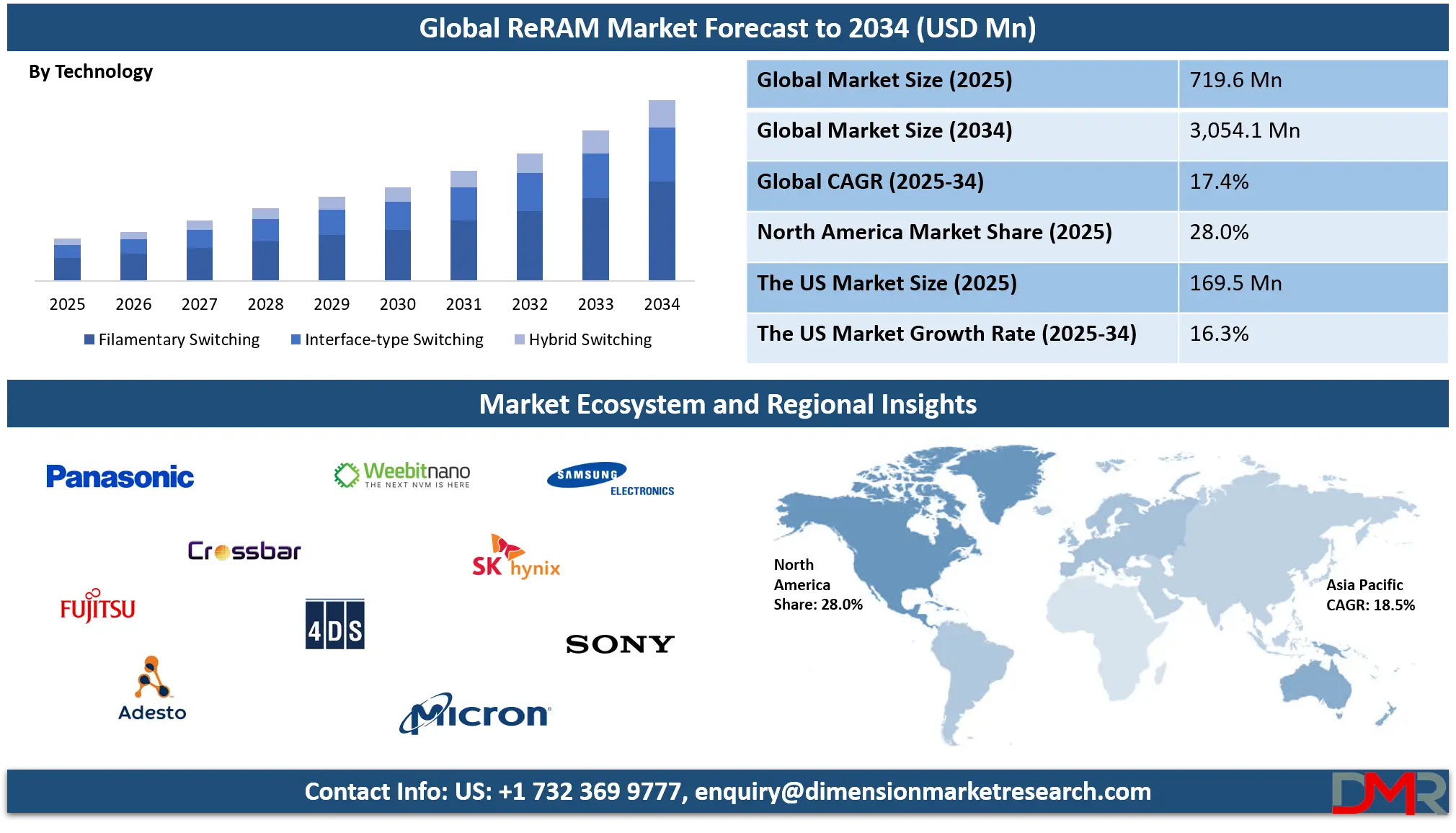

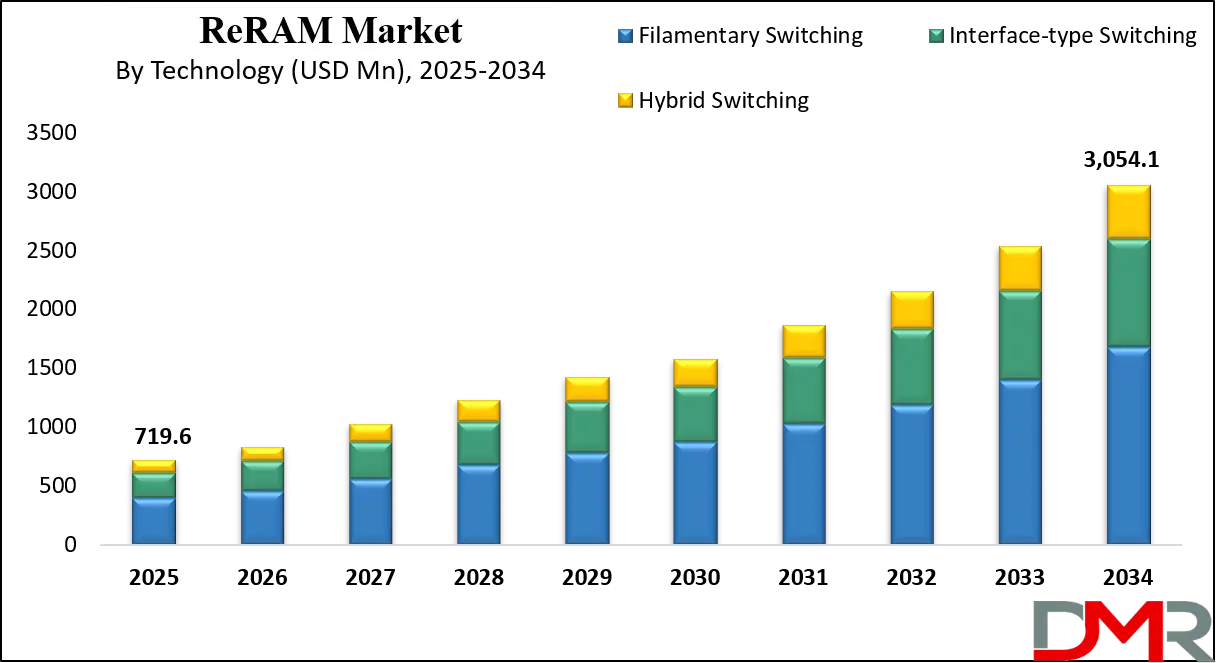

The global resistive random access memory (ReRAM) market is projected to reach USD 719.6 million in 2025 and is expected to grow at a CAGR of 17.4% to attain USD 3,054.1 million by 2034, driven by rising adoption in consumer electronics, automotive electronics, AI hardware, and IoT-enabled devices.

Resistive Random Access Memory or ReRAM is a type of non-volatile memory technology that stores data by changing the resistance of a material layer sandwiched between two electrodes. Unlike traditional flash memory, it operates through a mechanism known as resistive switching, which allows it to achieve faster read and write speeds, lower power consumption, and higher endurance.

This technology is scalable to smaller nodes, making it suitable for advanced semiconductor manufacturing processes, and it also supports 3D stacking for higher density. Its ability to retain data without power and function efficiently under varying temperatures positions it as a promising alternative for next-generation storage and computing applications, particularly in fields like artificial intelligence, edge devices, and the Internet of Things.

The global ReRAM market is experiencing robust growth as demand for high-performance memory solutions increases across sectors such as consumer electronics, data centers, automotive systems, and industrial automation. With the rising complexity of applications requiring faster processing speeds and lower latency, ReRAM’s advantages in speed, durability, and scalability make it a competitive choice compared to NAND flash and other emerging memory technologies. The ongoing shift toward AI-driven workloads and real-time analytics further accelerates adoption, especially in edge computing environments where efficiency and compactness are essential.

In addition to technological benefits, the market is being propelled by advancements in semiconductor fabrication, strategic collaborations between chip manufacturers and technology providers, and the growing penetration of IoT devices that require energy-efficient, high-density memory.

Asia Pacific dominates production due to strong semiconductor manufacturing ecosystems in countries like Japan, South Korea, and Taiwan, while North America and Europe are leveraging the technology for innovations in AI hardware, automotive electronics, and aerospace applications. Continuous R&D investments and the integration of ReRAM into neuromorphic computing and embedded memory systems are expected to expand its commercial reach and long-term market potential.

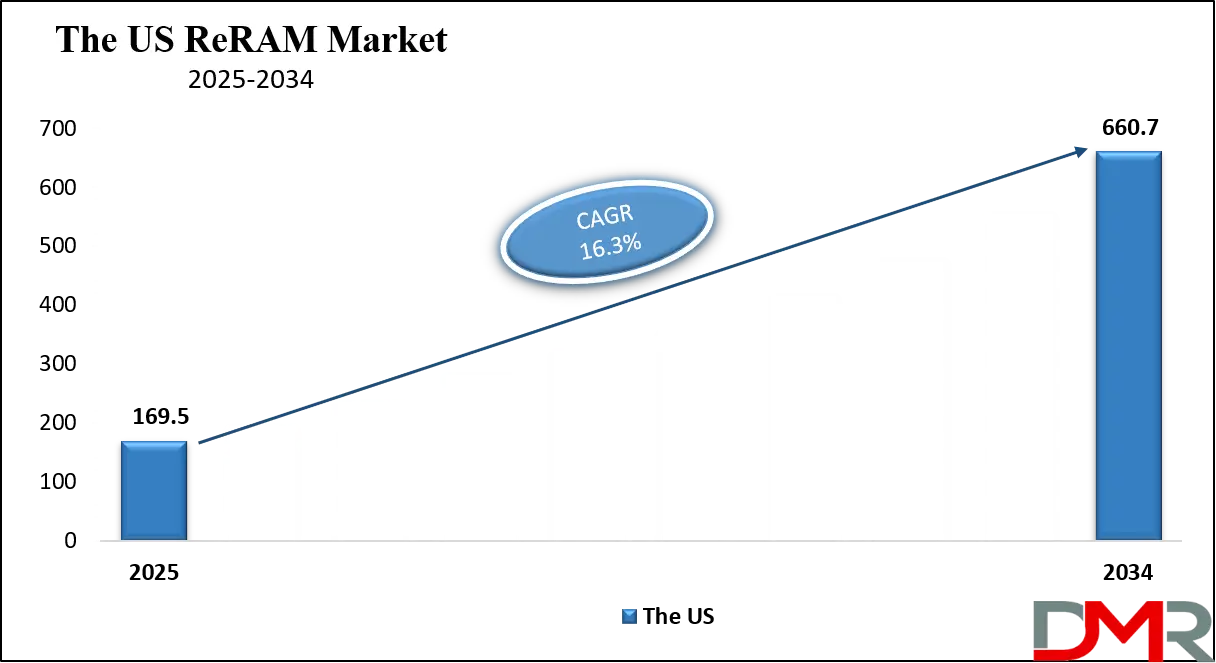

The US ReRAM Market

The U.S. ReRAM market size is projected to be valued at USD 169.5 million by 2025. It is further expected to witness subsequent growth in the upcoming period, holding USD 660.7 million.

The US ReRAM market is witnessing steady expansion, fueled by the nation’s strong semiconductor manufacturing capabilities, advanced R&D infrastructure, and early adoption of emerging memory technologies. The growing demand for high-speed, low-latency, and energy-efficient memory solutions in sectors such as data centers, AI-driven computing, defense electronics, and next-generation consumer devices is accelerating the integration of resistive random access memory into various applications. With its high endurance, faster write and read speeds, and scalability for smaller process nodes, ReRAM is being positioned as a viable alternative to NAND flash and DRAM in performance-critical environments.

The US is also leveraging its leadership in AI hardware development, neuromorphic computing, and embedded memory solutions, creating a favorable environment for domestic ReRAM innovation and commercialization.

Government support for semiconductor supply chain resilience, integrated with private sector investments from technology giants and fabless chipmakers, is further strengthening the market outlook. US-based companies are collaborating with global foundries and research institutes to refine resistive switching mechanisms, improve 3D stacking capabilities, and enhance device reliability for automotive, aerospace, and industrial IoT applications.

The integration of ReRAM into advanced computing architectures, such as in-memory processing for AI and machine learning, is opening new growth avenues. As the US continues to invest in chip manufacturing capacity under initiatives like the CHIPS and Science Act, the domestic ReRAM industry is expected to play a pivotal role in shaping the country’s position in next-generation non-volatile memory technologies.

Europe ReRAM Market

Europe’s ReRAM market is projected to reach approximately USD 86.3 million in 2025, reflecting its growing role in the global resistive random access memory landscape. This market size is driven by the region’s strong emphasis on technological innovation, particularly in sectors such as industrial automation, aerospace, automotive, and telecommunications. European countries have been investing significantly in semiconductor research and development, fostering collaborations between technology companies, academic institutions, and government agencies.

These efforts are helping to accelerate the adoption of advanced memory technologies like ReRAM, which offer benefits such as high endurance, low power consumption, and fast data processing that are crucial for modern applications in smart manufacturing and connected systems.

The market in Europe is expected to grow steadily at a compound annual growth rate of 15.0% through the forecast period, supported by ongoing investments in semiconductor fabrication and innovation. Additionally, the region’s focus on sustainability and energy-efficient technologies aligns well with ReRAM’s low power requirements, making it an attractive option for next-generation memory solutions.

As European industries continue to adopt AI, IoT, and edge computing technologies, demand for reliable, high-performance non-volatile memory is anticipated to rise. This growth is further boosted by initiatives aimed at strengthening the local semiconductor supply chain and reducing dependence on imports, positioning Europe as a key player in the evolving ReRAM market.

Japan ReRAM Market

Japan’s ReRAM market is expected to reach approximately USD 35.9 million in 2025, reflecting the country’s strong presence in semiconductor manufacturing and advanced memory technology development. Japan has long been a leader in electronics innovation, with major companies focusing on next-generation memory solutions to meet the demands of consumer electronics, AI hardware, and industrial applications.

The country’s well-established semiconductor ecosystem, supported by skilled research institutions and technology firms, plays a significant role in driving the adoption of ReRAM. This technology’s advantages, such as fast switching speeds, high endurance, and low power consumption, align well with Japan’s focus on creating efficient, reliable memory for compact and high-performance devices.

The Japanese ReRAM market is projected to grow at a robust compound annual growth rate of 16.0% over the coming years, fueled by continuous advancements in material science and semiconductor fabrication techniques. Government initiatives aimed at supporting innovation and strengthening domestic semiconductor production further enhance market growth prospects.

Additionally, Japan’s emphasis on integrating ReRAM into embedded systems, automotive electronics, and AI-driven applications is driving increased investment and commercial adoption. As demand for smarter, faster, and more energy-efficient memory solutions grows, Japan is poised to maintain a key role in the global ReRAM market through its combination of technological expertise, strategic investments, and strong industrial collaboration.

Global ReRAM Market: Key Takeaways

- Market Value: The global ReRAM market size is expected to reach a value of USD 3,054.1 million by 2034 from a base value of USD 719.6 million in 2025 at a CAGR of 17.4%.

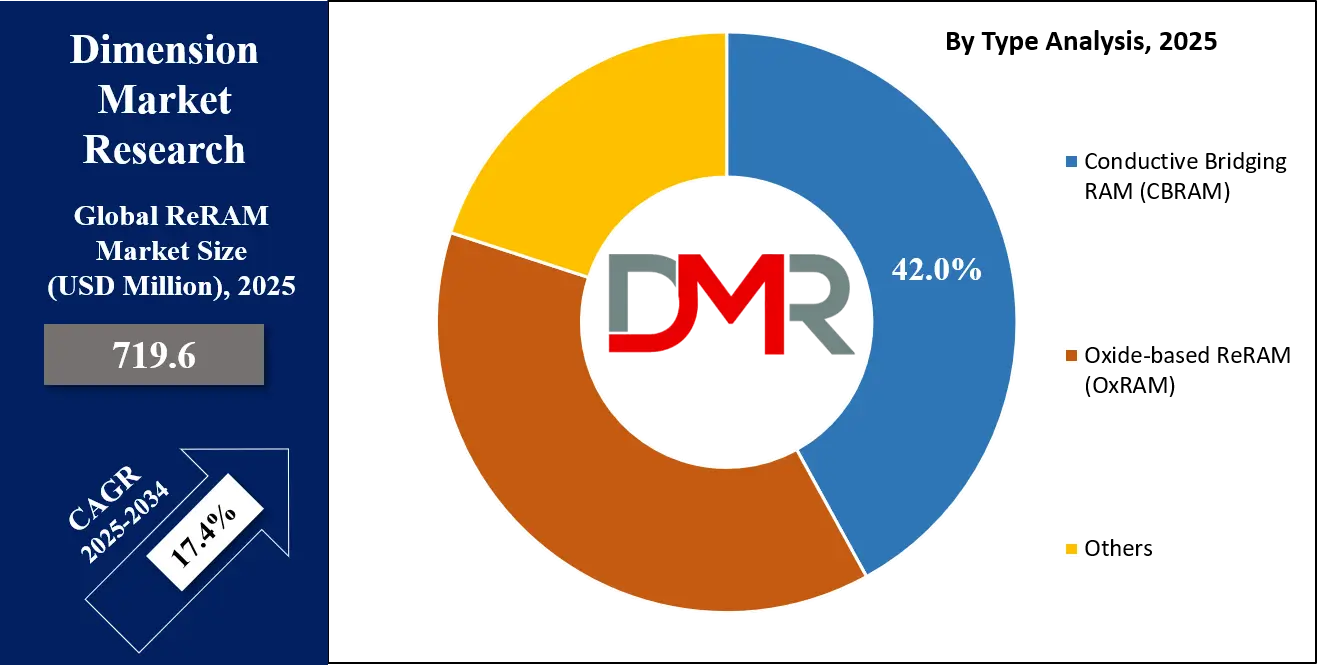

- By Type Segment Analysis: Conductive Bridging RAM (CBRAM) is anticipated to dominate the type segment, capturing 42.0% of the total market share in 2025.

- By Technology Segment Analysis: Filamentary Switching is expected to maintain its dominance in the technology segment, capturing 55.0% of the total market share in 2025.

- By Application Segment Analysis: Consumer Electronics are poised to consolidate their dominance in the application segment, capturing 40.0% of the market share in 2025.

- By End-User Industry Segment Analysis: Electronics & Semiconductor Manufacturing industry will hold the maximum market share in the end-user industry segment, capturing 45.0% of the market share in 2025.

- Regional Analysis: Asia Pacific is anticipated to lead the global ReRAM market landscape with 45.0% of total global market revenue in 2025.

- Key Players: Some key players in the global ReRAM market are Panasonic Corporation, Crossbar Inc., Fujitsu Limited, Adesto Technologies (now part of Dialog Semiconductor), Weebit Nano Ltd., 4DS Memory Limited, Micron Technology Inc., Samsung Electronics Co. Ltd., SK Hynix Inc., Sony Corporation, Hewlett Packard Enterprise (HPE), Intel Corporation, Western Digital Corporation, and Others.

Global ReRAM Market: Use Cases

- Consumer Electronics and Smartphones: ReRAM’s high-speed performance, low power consumption, and ability to retain data without power make it an ideal fit for smartphones, tablets, wearables, and other portable consumer electronics. Its compact form factor and scalability enable manufacturers to design slimmer devices with faster app loading and better multitasking capabilities. As mobile devices integrate AI-driven features and augmented reality applications, ReRAM’s fast read/write cycles and endurance offer a significant edge over traditional NAND flash.

- Automotive Electronics and ADAS: In the automotive sector, ReRAM is gaining traction for use in advanced driver-assistance systems (ADAS), infotainment, and electric vehicle (EV) control units. Its high reliability under extreme temperature ranges and resistance to radiation make it suitable for mission-critical automotive electronics. The ability to handle frequent data writes without degradation supports real-time decision-making for autonomous driving and advanced vehicle connectivity solutions.

- Industrial IoT and Edge Computing: Industrial automation and edge devices demand memory solutions that can process and store data with minimal latency and high durability. ReRAM’s energy efficiency, scalability for embedded applications, and rapid access times make it ideal for IoT gateways, factory automation systems, and smart sensors. It enables predictive maintenance, real-time analytics, and operational efficiency in harsh industrial environments.

- AI Hardware and Neuromorphic Computing: ReRAM’s unique architecture allows in-memory computing, where data processing occurs within the memory itself, drastically reducing latency and energy usage. This capability is crucial for AI accelerators, deep learning models, and neuromorphic chips designed to mimic human brain functionality. Its parallel processing potential supports faster neural network training and inference, making it valuable for next-generation AI hardware solutions.

Impact of Artificial Intelligence on the ReRAM Market

Artificial intelligence is playing a pivotal role in shaping the growth trajectory of the global resistive random access memory market by accelerating demand for high-speed, energy-efficient, and scalable memory technologies. AI-driven workloads, such as deep learning, computer vision, and natural language processing, require memory solutions that can handle vast volumes of data with minimal latency.

ReRAM’s fast read/write speeds, low power consumption, and ability to support in-memory processing make it a natural fit for AI hardware, enabling faster model training and inference compared to conventional NAND or DRAM. This compatibility with AI accelerators and edge devices positions ReRAM as a key enabler in applications ranging from real-time analytics to autonomous decision-making.

Moreover, the integration of ReRAM into neuromorphic computing architectures is enhancing AI’s ability to replicate brain-like processing. Its non-volatile nature, high endurance, and parallel processing capabilities allow AI chips to perform more computations directly within the memory, reducing data transfer bottlenecks and improving system efficiency.

As industries like autonomous vehicles, robotics, smart manufacturing, and healthcare increasingly adopt AI-driven solutions, ReRAM is expected to see widespread adoption as a next-generation memory solution that bridges the gap between performance and energy efficiency in intelligent computing systems.

Global ReRAM Market: Stats & Facts

U.S. Department of Energy (DOE)

- In 2023, the DOE allocated USD 300 million to semiconductor research, including emerging memory technologies such as ReRAM.

- By 2025, the DOE aims to increase funding to USD 450 million, focusing on energy-efficient memory for AI and high-performance computing.

- The Energy Efficiency and Renewable Energy division reported that ReRAM devices can reduce power consumption by up to 60% compared to traditional flash memory.

National Institute of Standards and Technology (NIST), USA

- NIST published in 2023 that ReRAM switching speeds can achieve under 10 nanoseconds in laboratory settings.

- The agency’s 2024 roadmap highlights ReRAM as a key technology to enable next-generation AI accelerators with projected adoption in US semiconductor fabs by 2025.

- NIST’s 2025 benchmark study projects a 25% improvement in data retention for ReRAM over existing NAND technologies under industrial operating conditions.

European Commission (EC)

- The EC’s Horizon Europe program invested EUR 200 million in 2023 to support semiconductor innovations including ReRAM for IoT and automotive sectors.

- In 2024, EC reports indicated that ReRAM could increase data processing speeds by up to 30% in edge computing applications across EU member states.

- By 2025, the European Chips Act aims to boost the continent’s memory manufacturing capacity by 40%, with a focus on emerging technologies such as ReRAM.

Japan Ministry of Economy, Trade and Industry (METI)

- METI data from 2023 shows Japan’s investment in semiconductor R&D reached JPY 50 billion, prioritizing non-volatile memories including ReRAM.

- The 2024 METI report forecasts that ReRAM adoption in industrial electronics will grow by 18% annually through 2025.

- In 2025, Japan’s Strategic Innovation Promotion Program (SIP) plans to double funding for AI hardware development that integrates ReRAM technology.

China Ministry of Industry and Information Technology (MIIT)

- MIIT announced in 2023 a 5-year plan allocating CNY 3 billion to advanced memory technologies, emphasizing ReRAM for AI and 5G infrastructure.

- By 2024, Chinese semiconductor fabs had increased ReRAM production capacity by 35%, according to MIIT data.

- The 2025 MIIT report highlights that ReRAM is expected to contribute to a 20% reduction in power consumption for data centers nationwide.

Korea Ministry of Science and ICT

- In 2023, the Korean government invested KRW 400 billion in semiconductor R&D, focusing on memory technologies such as ReRAM.

- A 2024 Ministry report noted that ReRAM demonstrated a 10x improvement in endurance cycles compared to conventional flash memory in domestic tests.

- The 2025 plan includes scaling ReRAM integration in automotive electronics with an expected market growth rate of 22% annually.

Taiwan Ministry of Economic Affairs (MOEA)

- MOEA funding for semiconductor innovation reached TWD 15 billion in 2023, with a dedicated portion for ReRAM and related memory research.

- Reports in 2024 show Taiwan’s ReRAM pilot production lines achieved a 95% yield rate, improving commercialization prospects.

- By 2025, MOEA targets a 30% increase in export volume of ReRAM-based memory modules, enhancing Taiwan’s global market share.

Indian Ministry of Electronics and Information Technology (MeitY)

- MeitY’s 2023 budget allocated INR 1,500 crore for emerging semiconductor technologies including ReRAM development.

- The 2024 Digital India initiative incorporated plans to deploy ReRAM-enhanced IoT devices for smart city projects.

- By 2025, India aims to establish at least three ReRAM pilot fabrication units under the Semiconductor Mission.

U.S. National Science Foundation (NSF)

- NSF funded USD 120 million in 2023 for projects advancing non-volatile memory technologies, with ReRAM receiving significant attention.

- In 2024, NSF-supported research demonstrated ReRAM’s potential to reduce AI training time by up to 40%.

- By 2025, NSF expects at least 15 academic-industry partnerships focusing on ReRAM commercialization to be established.

European Space Agency (ESA)

- ESA’s 2023 report highlights ReRAM’s radiation hardness as critical for space applications, with performance improvements of 35% over flash memory.

- By 2024, ESA invested EUR 50 million in ReRAM technology to enhance satellite data storage reliability.

- The 2025 roadmap includes plans to integrate ReRAM into deep-space missions to withstand extreme environmental conditions.

Global ReRAM Market: Market Dynamics

Global ReRAM Market: Driving Factors

Rising Demand for High-Performance Memory in AI and Edge Computing

The growing adoption of artificial intelligence, machine learning, and edge computing is driving the need for faster, more energy-efficient memory technologies. ReRAM’s high-speed read/write capabilities, low latency, and compatibility with in-memory computing make it ideal for AI accelerators, IoT gateways, and real-time analytics systems, giving it a competitive edge over NAND and DRAM in performance-critical applications.

Growth of Automotive Electronics and Autonomous Systems

The rapid expansion of advanced driver-assistance systems (ADAS), electric vehicles, and autonomous driving technologies is boosting demand for memory solutions that can withstand extreme conditions and frequent data writes. ReRAM’s durability, high endurance, and ability to operate in wide temperature ranges make it highly suitable for automotive control units, infotainment systems, and vehicle connectivity solutions.

Global ReRAM Market: Restraints

High Production Costs and Limited Large-Scale Manufacturing

Despite its technological advantages, ReRAM faces adoption barriers due to high manufacturing costs and limited large-scale fabrication capabilities. The need for specialized production processes and integration challenges with existing semiconductor architectures slows down mass deployment.

Competition from Other Emerging Memory Technologies

Technologies like MRAM, PCRAM, and 3D XPoint are competing for the same market space, offering similar benefits in speed, endurance, and energy efficiency. This strong competition can impact ReRAM’s market penetration and delay widespread adoption.

Global ReRAM Market: Opportunities

Integration into Neuromorphic and Quantum Computing Architectures

ReRAM’s ability to enable in-memory computing and parallel processing makes it an attractive choice for neuromorphic chips and emerging quantum computing systems. Its potential to drastically improve AI efficiency and reduce data bottlenecks opens up new markets in advanced computing research and commercial applications.

Rising Adoption in Industrial IoT and Smart Infrastructure

With Industry 4.0 accelerating the need for connected, intelligent devices, ReRAM can serve as a reliable, energy-efficient memory solution for industrial sensors, automation systems, and predictive maintenance tools. Its resilience in harsh environments makes it ideal for long-term industrial deployments.

Global ReRAM Market: Trends

Shift Toward Embedded ReRAM Solutions in Consumer Devices

Leading semiconductor companies are increasingly embedding ReRAM into microcontrollers and system-on-chip for smartphones, wearables, and other connected devices. This trend allows manufacturers to reduce form factors while enhancing device performance and energy efficiency.

Collaborations and R&D Investments for 3D ReRAM

Major industry players are focusing on 3D ReRAM architectures to achieve higher storage densities and improved performance. Collaborations between foundries, memory manufacturers, and AI hardware developers are accelerating innovations that will make ReRAM more competitive with existing mainstream memory solutions.

Global ReRAM Market: Research Scope and Analysis

By Type Analysis

Conductive Bridging RAM (CBRAM) is projected to dominate the ReRAM type segment in 2025, capturing 42.0% of the total market share due to its unique balance of high performance and energy efficiency. This technology functions by forming and dissolving a conductive filament within a solid electrolyte to store and erase data, a process that requires significantly lower voltages compared to traditional memory types. Its fast switching speed, low power consumption, and ability to be produced at relatively lower manufacturing costs make it a preferred choice for applications where space, efficiency, and cost optimization are essential.

CBRAM is particularly attractive for integration into consumer electronics such as smartphones, tablets, and wearables, as well as in IoT devices and embedded systems that operate on limited power sources. Furthermore, its scalability to smaller semiconductor process nodes enables compact designs without compromising performance, ensuring its continued relevance in next-generation electronics and edge computing devices.

Oxide-based ReRAM (OxRAM) is also establishing a strong foothold in the market, supported by its high endurance, excellent thermal stability, and compatibility with advanced semiconductor manufacturing processes. OxRAM stores data using transition metal oxides as the resistive switching medium, allowing for consistent and reliable performance even under heavy data workloads.

This makes it well-suited for high-density storage solutions, AI accelerators, neuromorphic computing, and enterprise data centers where durability and speed are equally important. Its resistance to high temperatures and long-term stability make it a valuable choice for industrial automation, automotive electronics, and aerospace applications, where environmental conditions can be demanding. With the rise of AI-driven processing, big data analytics, and real-time computing requirements, OxRAM is positioned to grow rapidly, especially as material engineering and 3D stacking techniques further enhance its capacity, endurance, and integration potential in cutting-edge computing systems.

By Technology Analysis

Filamentary switching is anticipated to dominate the technology segment of the ReRAM market in 2025, accounting for 55.0% of the total market share. This technology relies on the formation and rupture of conductive filaments within the memory material to switch between high and low resistance states. Its widespread adoption is driven by its relatively simple mechanism, fast switching speeds, and ability to achieve high data retention and endurance.

Filamentary switching is highly effective in delivering low power consumption and scalability to smaller device geometries, making it suitable for applications such as consumer electronics, embedded systems, and IoT devices. The ease of integration with existing semiconductor manufacturing processes further supports its dominance, enabling manufacturers to produce reliable and cost-effective memory modules.

Interface-type switching, on the other hand, operates through the modulation of the interface resistance between different material layers rather than filament formation. This switching mechanism often involves charge trapping or redox reactions at the interface, resulting in changes to the device’s resistance state. Interface-type ReRAM typically offers improved device reliability and longer endurance compared to filamentary switching, as it avoids the physical formation and rupture of filaments that can cause material degradation.

Although it currently holds a smaller market share compared to filamentary switching, interface-type ReRAM is gaining interest for high-end applications such as enterprise storage, AI hardware, and industrial automation, where enhanced stability and data integrity are critical. Advances in material science and device engineering are expected to boost its adoption as manufacturers seek memory solutions with superior endurance and robustness.

By Application Analysis

Consumer electronics are set to maintain a commanding presence in the ReRAM application segment, expected to capture 40.0% of the market share in 2025. This dominance is fueled by the growing demand for faster, more energy-efficient, and compact memory solutions in devices such as smartphones, tablets, wearables, and smart home gadgets. ReRAM’s fast read/write speeds, low power consumption, and ability to retain data without power make it an ideal choice for enhancing device performance while extending battery life.

Additionally, the scalability of ReRAM technology allows manufacturers to design smaller, more integrated components that support advanced features like AI-driven applications and augmented reality, which are increasingly prevalent in consumer electronics. The continuous evolution of portable and connected devices further amplifies the need for innovative memory solutions, solidifying ReRAM’s critical role in this sector.

Enterprise storage is another significant application segment gaining traction in the ReRAM market, driven by the need for high-density, high-performance memory capable of handling massive volumes of data in data centers and cloud computing environments. ReRAM’s high endurance, low latency, and scalability make it an attractive alternative to traditional NAND flash and DRAM for enterprise storage solutions.

It supports faster data access and improved reliability, which are crucial for real-time analytics, AI workloads, and big data processing that demand constant and efficient memory operations. As organizations increasingly adopt hybrid cloud architectures and edge computing strategies, ReRAM’s ability to deliver persistent storage with reduced power consumption positions it as a vital technology for next-generation enterprise storage infrastructure. Ongoing advancements in 3D stacking and memory integration further enhance its potential in this competitive segment.

By End-User Industry Analysis

The electronics and semiconductor manufacturing industry is expected to dominate the end-user segment of the ReRAM market, holding 45.0% of the market share in 2025. This leadership is attributed to the sector’s continuous demand for innovative memory technologies that support miniaturization, enhanced performance, and energy efficiency in semiconductor devices. ReRAM’s compatibility with advanced semiconductor fabrication processes and its scalability to smaller nodes make it an essential component for chip manufacturers focused on delivering faster, more reliable memory solutions.

The industry leverages ReRAM for embedded memory in microcontrollers, system-on-chip (SoC) designs, and AI accelerators, driving growth through applications in consumer electronics, data centers, and emerging edge devices. Additionally, investments in research and development and the integration of ReRAM into next-generation computing architectures reinforce the dominance of this industry in the market.

The automotive and transportation sector is also a rapidly growing end-user industry for ReRAM, driven by the growing incorporation of advanced electronics in vehicles. Modern vehicles rely heavily on memory solutions for various systems, including advanced driver-assistance systems (ADAS), infotainment, electric vehicle battery management, and autonomous driving technologies. ReRAM’s high endurance, reliability under extreme temperatures, and ability to handle frequent write cycles make it well-suited for these mission-critical automotive applications.

Furthermore, the push toward connected and autonomous vehicles is escalating the demand for faster, more efficient memory to process real-time data and support complex algorithms. As electric and autonomous vehicle markets expand, ReRAM is expected to play a pivotal role in enhancing the performance, safety, and connectivity of future transportation systems.

The ReRAM Market Report is segmented on the basis of the following:

By Type

- Conductive Bridging RAM (CBRAM)

- Oxide-based ReRAM (OxRAM)

- Others

By Technology

- Filamentary Switching

- Interface-type Switching

- Hybrid Switching

By Application

- Consumer Electronics

- Enterprise Storage

- Automotive Electronics

- Industrial % IoT Devices

- Others

By End-User Industry

- Electronics & Semiconductor Manufacturing

- Automotive & Transportation

- Industrial Automation & IoT

- Healthcare & Medical Devices

- Defense & Aerospace

- Others

Global ReRAM Market: Regional Analysis

Region with the Largest Revenue Share

Asia Pacific is expected to lead the global ReRAM market in 2025, capturing 45.0% of the total market revenue due to the region’s strong semiconductor manufacturing base and growing adoption of advanced memory technologies. Countries like Japan, South Korea, Taiwan, and China host some of the world’s largest semiconductor fabs and memory manufacturers, driving innovation and large-scale production of ReRAM devices. The growing demand for consumer electronics, automotive electronics, and IoT applications in these rapidly developing economies further boosts market growth.

Additionally, government initiatives supporting semiconductor research and development, along with strategic collaborations between technology companies and foundries, strengthen the region’s position as a dominant player in the ReRAM market landscape.

Region with significant growth

North America is poised for significant growth in the ReRAM market, driven by strong investments in semiconductor research, advanced AI hardware development, and the expansion of data center infrastructure. The region benefits from a robust ecosystem of technology companies, startups, and research institutions focused on next-generation memory solutions, including ReRAM. Increasing adoption of edge computing, autonomous vehicles, and industrial IoT applications is further fueling demand for high-performance, energy-efficient memory technologies. Supportive government policies and initiatives to strengthen the domestic semiconductor supply chain also contribute to North America’s rapid market expansion, making it a key growth region alongside Asia Pacific.

By Region

North America

Europe

- Germany

- The U.K.

- France

- Italy

- Russia

- Spain

- Benelux

- Nordic

- Rest of Europe

Asia-Pacific

- China

- Japan

- South Korea

- India

- ANZ

- ASEAN

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Argentina

- Colombia

- Rest of Latin America

Middle East & Africa

- Saudi Arabia

- UAE

- South Africa

- Israel

- Egypt

- Rest of MEA

Global ReRAM Market: Competitive Landscape

The global competitive landscape of the ReRAM market is characterized by intense rivalry among leading semiconductor manufacturers, technology innovators, and emerging startups focused on advancing resistive memory technology. Key players such as Panasonic, Samsung Electronics, Micron Technology, and Fujitsu are investing heavily in research and development to improve ReRAM’s performance, scalability, and integration with existing semiconductor processes. Collaboration between foundries, memory specialists, and AI hardware developers is common, accelerating innovation and commercialization efforts.

Smaller companies like Weebit Nano and Crossbar Inc. are also making significant strides by developing specialized ReRAM solutions and forging strategic partnerships to expand their market presence. The competition is further intensified by the emergence of alternative non-volatile memory technologies, prompting companies to differentiate through cost-efficiency, endurance, speed, and energy consumption. This dynamic environment fosters continuous technological advancements and drives the overall growth of the ReRAM market globally.

Some of the prominent players in the global ReRAM market are:

- Panasonic Corporation

- Crossbar Inc.

- Fujitsu Limited

- Adesto Technologies (now part of Dialog Semiconductor)

- Weebit Nano Ltd.

- 4DS Memory Limited

- Micron Technology, Inc.

- Samsung Electronics Co., Ltd.

- SK Hynix Inc.

- Sony Corporation

- Hewlett-Packard Enterprise (HPE)

- Intel Corporation

- Western Digital Corporation

- IBM Corporation

- TSMC (Taiwan Semiconductor Manufacturing Company)

- Renesas Electronics Corporation

- Infineon Technologies AG

- Rambus Inc.

- Toshiba Corporation

- Nantero, Inc.

- Other Key Players

Global ReRAM Market: Recent Developments

- August 2025: Panasonic Corporation announced the launch of its next-generation ReRAM chip designed for AI accelerators and edge computing devices, featuring enhanced endurance and faster switching speeds to support real-time data processing in low-power environments.

- June 2025: Weebit Nano Ltd. unveiled a new ReRAM memory module optimized for IoT applications, offering improved scalability and reduced energy consumption aimed at extending battery life in connected sensors and wearable technology.

- July 2025: Dialog Semiconductor completed the acquisition of Adesto Technologies, expanding its portfolio to include advanced ReRAM solutions and strengthening its position in the non-volatile memory market for embedded and industrial applications.

- March 2025: Micron Technology announced the merger with a leading AI hardware startup to jointly develop ReRAM-based memory solutions tailored for high-performance computing and machine learning workloads.

Report Details

| Report Characteristics |

| Market Size (2025) |

USD 719.6 Mn |

| Forecast Value (2034) |

USD 3,054.1 Mn |

| CAGR (2025–2034) |

17.4% |

| The US Market Size (2025) |

USD 169.5 Mn |

| Historical Data |

2019 – 2024 |

| Forecast Data |

2026 – 2034 |

| Base Year |

2024 |

| Estimate Year |

2025 |

| Report Coverage |

Market Revenue Estimation, Market Dynamics, Competitive Landscape, Growth Factors, etc. |

| Segments Covered |

By Type (Conductive Bridging RAM (CBRAM), Oxide-based ReRAM (OxRAM), Others), By Technology (Filamentary Switching, Interface-type Switching, Hybrid Switching), By Application (Consumer Electronics, Enterprise Storage, Automotive Electronics, Industrial & IoT Devices, Others), and By End-User Industry (Electronics & Semiconductor Manufacturing, Automotive & Transportation, Industrial Automation & IoT, Healthcare & Medical Devices, Defense & Aerospace, Others) |

| Regional Coverage |

North America – US, Canada; Europe – Germany, UK, France, Russia, Spain, Italy, Benelux, Nordic, Rest of Europe; Asia-Pacific – China, Japan, South Korea, India, ANZ, ASEAN, Rest of APAC; Latin America – Brazil, Mexico, Argentina, Colombia, Rest of Latin America; Middle East & Africa – Saudi Arabia, UAE, South Africa, Turkey, Egypt, Israel, Rest of MEA |

| Prominent Players |

Panasonic Corporation, Crossbar Inc., Fujitsu Limited, Adesto Technologies (now part of Dialog Semiconductor), Weebit Nano Ltd., 4DS Memory Limited, Micron Technology Inc., Samsung Electronics Co. Ltd., SK Hynix Inc., Sony Corporation, Hewlett Packard Enterprise (HPE), Intel Corporation, Western Digital Corporation, and Others. |

| Purchase Options |

We have three licenses to opt for: Single User License (Limited to 1 user), Multi-User License (Up to 5 Users), and Corporate Use License (Unlimited User) along with free report customization equivalent to 0 analyst working days, 3 analysts working days, and 5 analysts working days respectively. |

Frequently Asked Questions

The global ReRAM market size is estimated to have a value of USD 719.6 million in 2025 and is expected to reach USD 3,054.1 million by the end of 2034.

The US ReRAM market is projected to be valued at USD 169.5 million in 2025. It is expected to witness subsequent growth in the upcoming period as it holds USD 660.7 million in 2034 at a CAGR of 16.3%.

Asia Pacific is expected to have the largest market share in the global ReRAM market, with a share of about 45.0% in 2025.

Some of the major key players in the global ReRAM market are Panasonic Corporation, Crossbar Inc., Fujitsu Limited, Adesto Technologies (now part of Dialog Semiconductor), Weebit Nano Ltd., 4DS Memory Limited, Micron Technology Inc., Samsung Electronics Co. Ltd., SK Hynix Inc., Sony Corporation, Hewlett Packard Enterprise (HPE), Intel Corporation, Western Digital Corporation, and Others.

The market is growing at a CAGR of 17.4 percent over the forecasted period.