Market Overview

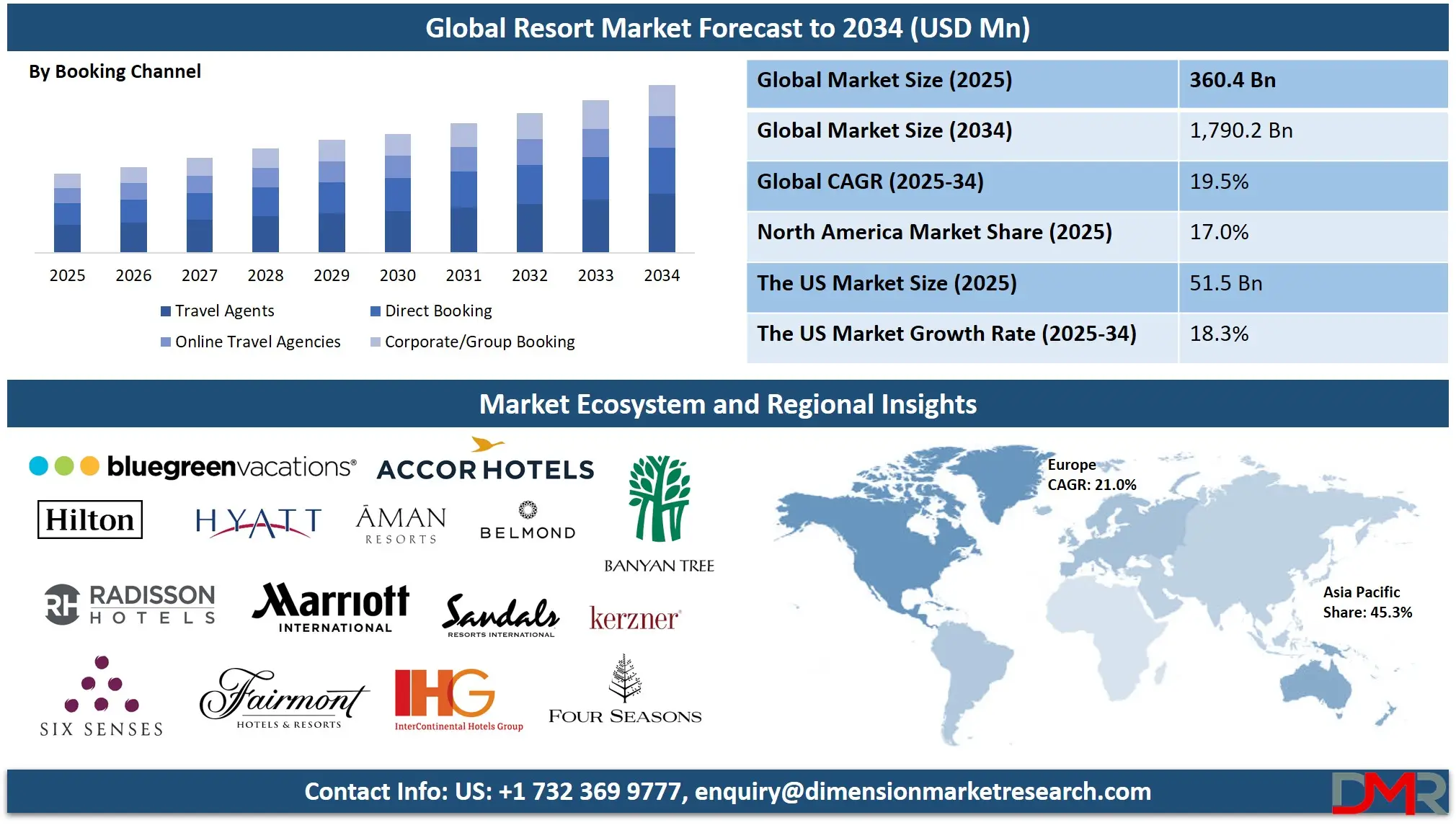

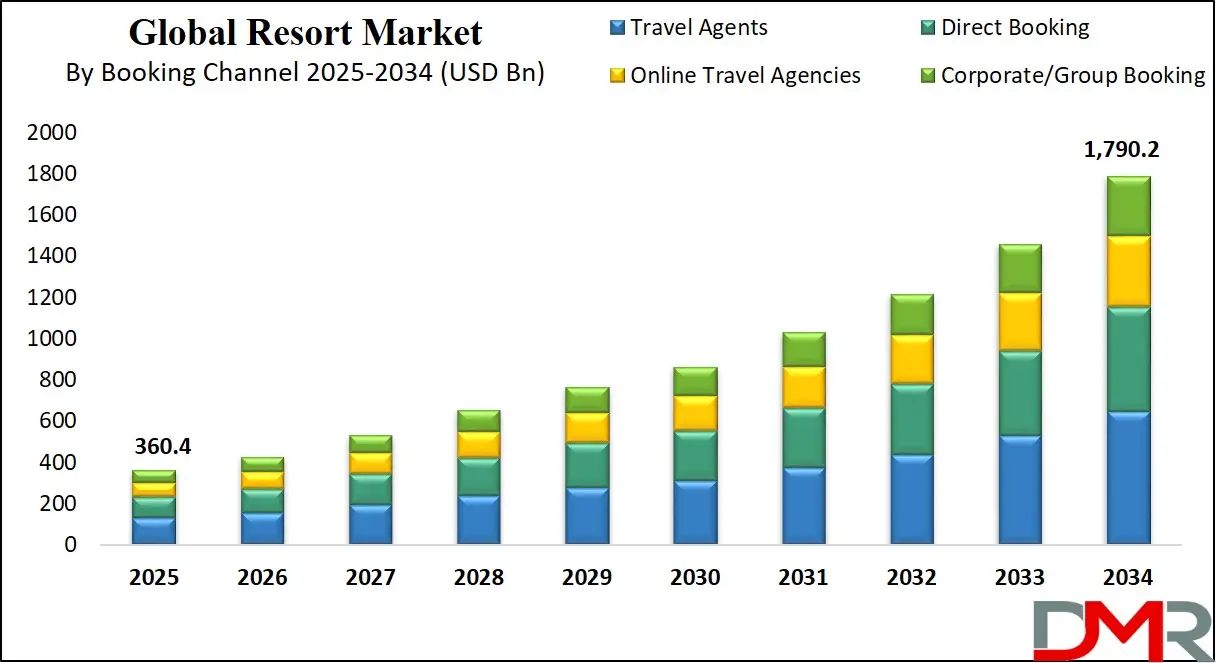

The Global Resort Market is projected to reach USD 360.4 billion in 2025 and grow at a compound annual growth rate of 19.5% from there until 2034 to reach a value of USD 1,790.2 billion.

The global resort market is undergoing transformative growth, driven by rising global tourism, evolving consumer preferences, and increasing disposable incomes across emerging economies. As travelers seek immersive, tailored experiences, resorts are adapting by offering a wide range of luxury, eco-conscious, and culturally rich accommodations. With global travel rebounding post-pandemic, the demand for high-quality resort experiences is surging, particularly among millennials and Gen Z who prioritize experiential travel. From island and mountain resorts to wellness and all-inclusive properties, the resort ecosystem continues to diversify.

ℹ

To learn more about this report –

Download Your Free Sample Report Here

One of the dominant trends shaping the market is the integration of sustainable practices. Eco-resorts utilizing renewable energy, organic architecture, and local community engagement are gaining popularity. In parallel, digital transformation through mobile check-ins, AI-powered concierge services, and smart room technology is enhancing the guest experience. The wellness tourism boom is another key trend, with travelers gravitating toward resorts that offer spa therapies, fitness programs, and mind-body wellness activities in serene settings.

Growth opportunities are especially strong in the Asia-Pacific region and parts of Africa and Latin America. Expanding infrastructure, supportive government tourism policies, and increased air connectivity are enabling new resort developments in previously untapped areas. Resort operators that offer flexible packages, personalized guest services, and culturally immersive programs are likely to capitalize on these growth opportunities.

However, the market is not without restraints. High capital expenditure, land acquisition challenges, regulatory compliance, and environmental concerns can impede development. Still, with continued innovation, rising tourism demand, and strategic location choices, the resort market is set for long-term, sustainable expansion worldwide.

ℹ

To learn more about this report –

Download Your Free Sample Report Here

The US Resort Market

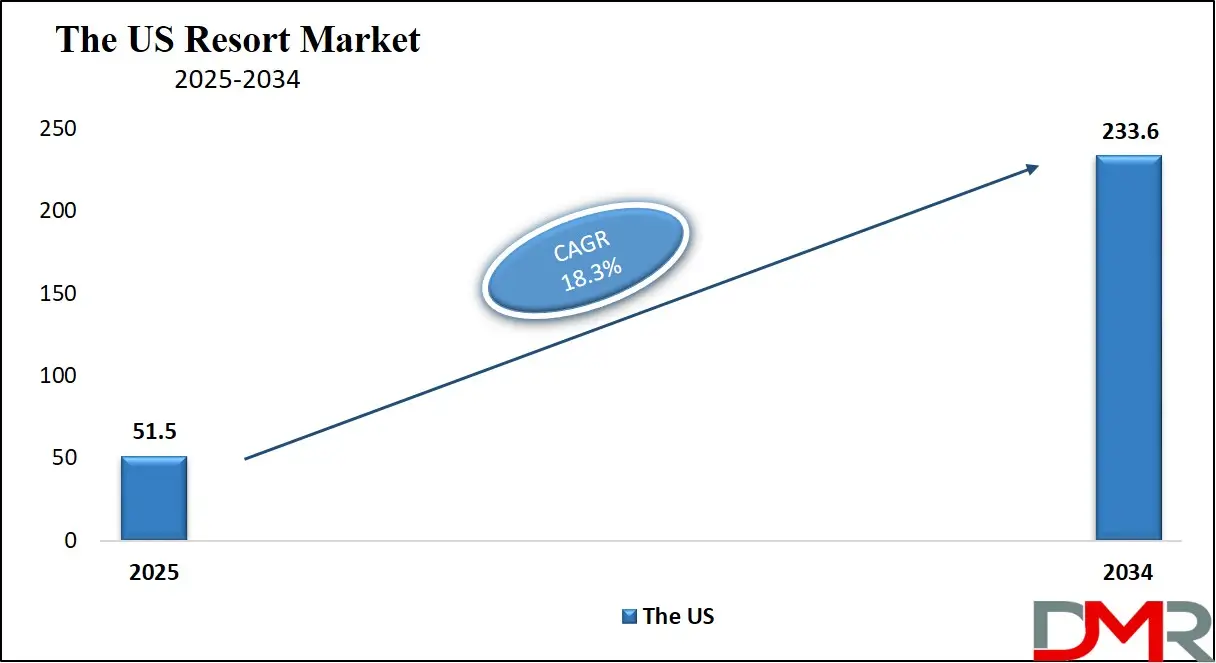

The US Resort Market is projected to reach USD 51.5 billion in 2025 at a compound annual growth rate of 18.3% over its forecast period.

The U.S. resort market remains a cornerstone of the nation's tourism economy, buoyed by diverse landscapes, strong domestic travel demand, and world-class hospitality infrastructure. The U.S. Travel Association reports that domestic travel spending continues to rise, particularly in resort-heavy states like Florida, California, Colorado, and Hawaii. From sun-soaked beach resorts to luxurious ski lodges and wellness retreats, American resorts offer year-round appeal across varied demographics.

According to U.S. Census Bureau data, over 70 million baby boomers and 65 million millennials represent a dual force driving both high-end and experience-driven resort preferences. Younger travelers tend to prioritize nature-based, Instagram-worthy getaways, while older populations seek comfort, wellness, and leisure. Family travel is another rising segment, with multigenerational vacations fueling demand for larger, all-inclusive resort packages.

The U.S. also enjoys a significant demographic advantage with a large, affluent population willing to spend on premium travel. Infrastructure support, such as an expansive network of airports and interstate highways, makes resort destinations highly accessible. Government-backed initiatives like the National Travel and Tourism Strategy aim to improve traveler experiences, promote sustainable tourism, and expand access to lesser-known destinations, further stimulating the resort sector.

Challenges include fluctuating labor markets in hospitality, supply chain disruptions, and climate-related events affecting coastal and mountainous resort locations. Yet, technology adoption and pandemic-driven operational shifts have increased resiliency. The U.S. resort market is well-positioned for sustained growth, bolstered by innovation, strong consumer spending, and the continued popularity of domestic travel experiences across all income levels.

ℹ

To learn more about this report –

Download Your Free Sample Report Here

The European Resort Market

The European Resort Market is estimated to be valued at USD 67.7 billion in 2025 and is further anticipated to reach USD 376.7 billion by 2034 at a CAGR of 21.0%.

Europe’s resort market is among the most mature and diversified globally, supported by its rich history, cultural landmarks, natural beauty, and excellent transport infrastructure. Coastal retreats along the Mediterranean, alpine ski resorts, countryside estates, and historic wellness destinations make Europe a year-round resort hub. Eurostat data shows billions of overnight stays are recorded annually, with countries like Spain, France, Greece, and Italy consistently leading in resort tourism.

Europe benefits from intra-regional travel fluidity due to the Schengen Area, which allows free movement across member states. This encourages frequent short-stay resort travel, particularly among urban European populations. The demographic advantage is further amplified by a wealthy, aging population seeking wellness, luxury, and relaxation experiences, alongside a younger generation that prefers experiential travel centered on nature, gastronomy, and heritage.

Sustainability is increasingly shaping the European resort market. EU-supported programs encourage eco-friendly accommodations, digital innovation, and tourism that benefits local communities. Many resorts are integrating green building standards, electric mobility options, and waste reduction programs. Spa resorts in Germany, eco-lodges in the Alps, and agritourism resorts in Tuscany are excellent examples of this shift.

Despite its strengths, the European resort market faces constraints such as high operational costs, strict regulations, and seasonality affecting occupancy rates. Nonetheless, growing emphasis on slow travel, cultural tourism, and nature immersion presents an opportunity to innovate and diversify offerings. With supportive public policies, advanced infrastructure, and evolving traveler behavior, Europe’s resort market remains both resilient and forward-looking.

The Japan Resort Market

The Japan Resort Market is projected to be valued at USD 15.6 billion in 2025. It is further expected to witness subsequent growth of CAGR 18.0% over the forecast period.

Japan’s resort market is rapidly evolving as international arrivals and domestic tourism recover post-pandemic. According to official figures from the Japan National Tourism Organization, international visitor numbers exceeded 36 million in 2024, surpassing pre-COVID levels. Iconic destinations like Hokkaido for skiing, Okinawa for beach vacations, and traditional ryokan resorts with onsen (hot springs) continue to draw a growing number of travelers.

Demographically, Japan enjoys proximity to key outbound travel markets such as China, South Korea, Taiwan, and Southeast Asia, giving it a strategic geographic advantage. The Ministry of Internal Affairs and Communications highlights a sizable aging population within Japan, creating demand for wellness-oriented and tranquil resort experiences. Domestic travelers increasingly seek short getaways to mountainous or coastal areas, especially to access hot springs, traditional cuisine, and nature escapes.

The government’s “Tourism Vision to Support the Future of Japan” initiative emphasizes expanding resort infrastructure, promoting regional destinations, and enhancing multilingual hospitality services. Significant investments are being made in smart tourism solutions, transport integration, and digital promotion of lesser-known resort areas. The development of resort zones around World Heritage Sites and cultural landmarks is also part of the broader tourism development strategy.

Challenges for the Japanese resort sector include limited land availability, aging infrastructure in rural areas, and concerns over overtourism in cities like Kyoto. Nonetheless, Japan’s focus on cultural authenticity, hospitality excellence (omotenashi), and sustainable growth positions its resort market for continued expansion. Upcoming global events and improved international connectivity will further accelerate resort tourism in both traditional and emerging Japanese regions.

Global Resort Market: Key Takeaways

- Global Market Size Insights: The Global Resort Market size is estimated to have a value of USD 360.4 billion in 2025 and is expected to reach USD 1,790.2 billion by the end of 2034.

- The US Market Size Insights: The US Resort Market is projected to be valued at USD 51.5 billion in 2025. It is expected to witness subsequent growth in the upcoming period as it holds USD 233.6 billion in 2034 at a CAGR of 18.3%.

- Regional Insights: Asia Pacific is expected to have the largest market share in the Global Resort Market with a share of about 45.3% in 2025.

- Key Players Insights: Some of the major key players in the Global Resort Market are Marriott International, Hilton Worldwide, Hyatt Hotels Corporation, InterContinental Hotels Group (IHG), AccorHotels, Four Seasons Hotels and Resorts, Wyndham Hotels & Resorts, Melia Hotels International, and many others.

- Global Market Growth Rate Insights: The market is growing at a CAGR of 19.5 percent over the forecasted period of 2025.

Global Resort Market: Use Cases

- Luxury Wellness Retreats: Resorts offer detox, yoga, spa therapies, and meditation programs in peaceful natural environments, targeting health-conscious travelers seeking physical rejuvenation and mental wellness.

- Eco-Friendly Resorts: Built with green architecture, these resorts use solar power, rainwater harvesting, and local sourcing, attracting environmentally responsible tourists focused on sustainability.

- Adventure Resorts: Located in mountainous or forested regions, these resorts provide hiking, skiing, rafting, and ziplining activities, drawing outdoor enthusiasts and thrill-seeking vacationers.

- Family-Oriented Resorts: Designed for multigenerational travelers, these properties offer kids’ clubs, interactive activities, family suites, and theme nights to ensure inclusive, memorable vacations.

- Cultural Heritage Resorts: These resorts immerse guests in local culture through traditional design, cuisine, music, and hands-on experiences like pottery, folk art, and cooking classes.

Global Resort Market: Stats & Facts

UN Tourism (UNWTO)

- Global tourism spending reached approximately $1.9 trillion in 2024, reflecting a strong post-pandemic recovery and continued demand for leisure travel.

- The average expenditure per international tourist is projected to rise to around $1,264 by 2030, driven by longer stays and increasing demand for premium resort experiences.

U.S. Bureau of Economic Analysis (BEA)

- The U.S. travel and tourism industry’s real output grew by 7.0% in 2023, underscoring its contribution to GDP through hotel stays, resort bookings, and recreation-related expenditures.

U.S. Bureau of Labor Statistics (BLS)

- The leisure and hospitality sector employed over 16 million individuals in the United States in early 2025, encompassing roles across hotels, resorts, and travel services.

U.S. National Oceanic and Atmospheric Administration (NOAA)

- Ocean-based tourism and recreation in the U.S. support close to 2.5 million jobs.

- The sector contributes about $143 billion annually to the U.S. gross domestic product.

- Approximately $66 billion in annual wages are paid to employees working in ocean-related tourism activities, such as beach resorts, cruise tourism, and coastal recreation.

U.S. Travel Association

- Domestic travel spending in the United States reached $1.2 trillion in 2024, fueled by strong demand for local resort destinations and regional leisure tourism.

- International inbound travel generated $155 billion in revenue, benefiting major urban and coastal resorts as top destinations for foreign tourists.

UN Tourism Data Dashboard

- International tourist arrivals globally reached 1.5 billion in 2024, indicating sustained momentum in the hospitality and resort industry.

- Europe remained the leading region for international arrivals, capturing 58% of the global share, with notable demand in countries like Spain, Italy, and France, where resort tourism thrives.

Andhra Pradesh Tourism Department (India)

- The state government identified 1,842 homestay units as part of its tourism development strategy to enhance accommodation options near cultural and spiritual destinations.

- In the temple town of Tirupati alone, 561 homestays are operational, boosting local employment and tourism services.

- The initiative is forecasted to create 18,000 direct jobs and attract 27 large-scale hotel brands, significantly strengthening the hospitality infrastructure.

Lodging Development Trends in India (Reported by National Media)

- India recorded the highest number of hotel development projects in the Asia-Pacific region during Q1 2025, with 693 active projects under construction.

- These projects account for 88,884 rooms, indicating a year-on-year growth of 19% in project count and 27% in total room capacity.

Indian Wellness Tourism Initiatives

- India’s wellness tourism sector is evolving with innovative offerings like high-altitude detox centers, forest-based retreats, and Ayurvedic spa safaris.

- These developments align with government-backed strategies to position India as a global hub for spiritual and health tourism.

Tourism Ireland

- Ireland is adopting “slow tourism” practices, promoting extended tourist stays to increase spending while minimizing ecological impact.

- The strategy aims to reduce seasonal fluctuations and distribute tourism benefits across rural and lesser-known destinations through year-round resort stays.

South African Department of Statistics

- The tourism sector contributed 3.3% to South Africa’s GDP in 2025, showing a notable increase from the pre-pandemic level of 2.3% in 2019.

- The industry’s financial impact was valued at R241 billion, underlining the importance of resort-based and heritage tourism within the national economy.

South African Tourism Budget Data

- The Department of Tourism’s total fiscal allocation for 2024–2025 stood at R2.3 billion, enabling significant investments in resort infrastructure, training, and promotional activities.

- The economic return from tourism-related spending demonstrates a multiplier effect, delivering over 100 times the government’s financial input.

Tourism Trends in Adelaide, Australia

- Adelaide recorded record-high hotel occupancy in nine of the first eleven months of 2024, indicating strong demand for city-based resort experiences and boutique hospitality.

- During a major sporting event (Adelaide Test cricket), nightly room occupancy reached 10,418 rooms, representing the city’s peak hospitality performance.

Bali Tourism Statistics (Indonesia)

- In the first half of 2024, Bali welcomed 2.9 million international tourists, contributing to 65% of Indonesia’s total inbound air travel tourism.

- The number of hotels in Bali increased from 507 in 2019 to 541 in 2023, highlighting ongoing investment in resort infrastructure to meet global travel demand.

Global Resort Market: Market Dynamic

Driving Factors in the Global Resort Market

Rapid Urbanization and Middle-Class Expansion in Emerging Economies

The global resort industry is being significantly propelled by the rapid urbanization and expanding middle class in emerging markets such as India, China, Indonesia, Brazil, and Vietnam. This demographic shift is generating a new cohort of aspirational travelers with disposable incomes and growing lifestyle aspirations. As urban dwellers increasingly seek weekend getaways and seasonal leisure escapes, domestic resort tourism is rising sharply. These new consumers are drawn to luxury amenities, all-inclusive packages, and curated resort experiences once considered exclusive to the elite. Governments in these regions are also heavily investing in tourism infrastructure airports, roads, and public transport, to facilitate easier access to resort destinations.

Additionally, national tourism boards are promoting regional attractions and encouraging public-private partnerships for resort development. Many countries offer fiscal incentives such as tax holidays, land subsidies, and single-window clearances to attract investment in hospitality projects. The proliferation of online booking platforms and social media travel inspiration further fuels interest in resort-based vacations among this demographic. Cultural shifts towards wellness, celebration tourism, and family travel are also elevating demand. As these markets mature, resorts are developing regional strategies to offer culturally aligned hospitality services, catering to local cuisines, festivals, and preferences. This structural demand surge from emerging economies is establishing them as critical engines of growth in the global resort market.

Government Policies and Infrastructure Development for Tourism Promotion

Proactive government initiatives worldwide are playing a pivotal role in accelerating resort market growth. Many countries have recognized tourism as a strategic sector due to its strong multiplier effect on employment, GDP, and rural development. To promote inbound and domestic resort tourism, governments are launching comprehensive tourism master plans, destination branding campaigns, and international road shows. Tax incentives, relaxed foreign investment norms, and tourism-specific SEZs are attracting both domestic and international developers to build new resorts. Visa liberalization efforts such as e-visa expansion, visa-on-arrival facilities, and multi-entry schemes are reducing travel barriers and encouraging international tourists to explore more resort destinations. Infrastructure development is another critical driver; governments are prioritizing the construction and modernization of airports, highways, railways, and cruise terminals to ensure seamless connectivity to resort locations.

Initiatives like India’s “Dekho Apna Desh,” Saudi Arabia’s Vision 2030, and ASEAN Tourism Strategic Plans are channeling billions into tourism infrastructure and hospitality workforce development. Public-private partnerships (PPPs) are also enabling large-scale resort projects on public land with operational excellence from private players. Additionally, governments are leveraging major global events, such as the Olympics, World Expos, and cultural festivals, to stimulate resort development around event zones. These strategic interventions are not only boosting resort occupancy rates but also improving overall destination competitiveness in the international tourism market.

Restraints in the Global Resort Market

High Capital Intensity and Long ROI Cycles

One of the primary restraints hindering the expansion of the global resort market is the high capital expenditure (CapEx) required for development, paired with long return-on-investment (ROI) cycles. Building a full-service resort demands substantial upfront investments in land acquisition, construction, interior furnishing, infrastructure integration, and luxury amenities. These costs are further magnified in remote or exotic locations, where the lack of access roads, utilities, and skilled labor adds logistical complexity and expense. Even after launch, resorts face high operational expenditures, including staffing, maintenance, licensing, and marketing. Unlike business hotels that can maintain consistent weekday occupancy, resort bookings are often seasonal, influenced by holidays, weather, and tourism trends.

This results in cash flow volatility, making it difficult for operators to meet debt obligations or reinvest in upgrades. Moreover, new resort projects typically take 5–10 years to break even, which deters small- and mid-scale investors. Fluctuations in interest rates and real estate prices also affect project feasibility. Regulatory red tape and delayed approvals in many countries further elongate project timelines, increasing financial exposure. These financial barriers are especially challenging in underdeveloped regions with poor investor ecosystems. As a result, resort development remains concentrated among large hospitality chains or government-backed ventures, limiting market democratization and regional equity in tourism growth.

Climate Vulnerability and Environmental Risks

Resorts, particularly those located in coastal, forested, or high-altitude areas, are increasingly vulnerable to climate change and extreme weather events. Rising sea levels threaten beachfront resorts, while increased frequency of hurricanes, floods, and wildfires can cause severe operational disruptions, damage infrastructure, and deter tourist arrivals. For instance, tropical storm activity in the Caribbean and Pacific Islands has led to repeated resort closures, increased insurance premiums, and growing repair costs. Mountain resorts are equally affected by shrinking snow seasons and unpredictable weather patterns, undermining the viability of ski tourism. Climate-induced biodiversity loss also diminishes the natural appeal of eco-resorts and wildlife-centric experiences.

Additionally, regulatory bodies are tightening environmental laws, mandating strict impact assessments, emission controls, and carbon offset commitments for resort projects. Complying with these regulations can increase operating costs, especially for independent and legacy resorts. Travelers are also becoming more selective, preferring destinations with verified climate action records, which pressures resorts to adopt costly green certifications and reporting mechanisms. The increasing climate risk not only jeopardizes guest safety but also undermines long-term asset value, deters insurance coverage, and raises reputational risks. Addressing these environmental vulnerabilities requires significant investment in resilience planning, risk assessment, and sustainable infrastructure barriers that not all resorts can afford to overcome.

Opportunities in the Global Resort Market

Expansion of Eco-Resorts and Sustainable Hospitality

The increasing global emphasis on sustainability is creating robust growth opportunities for eco-resorts and green hospitality solutions. Travelers are becoming more environmentally conscious and prefer destinations and accommodations that reduce their ecological footprint. This shift is giving rise to eco-resorts that incorporate sustainable architecture, renewable energy, water conservation systems, and local sourcing practices. Resorts that offer immersive eco-tourism experiences, such as guided nature walks, wildlife conservation programs, and community-based cultural interactions, are seeing a surge in demand. Governments and environmental agencies are also endorsing sustainable tourism development through policy incentives, certifications (like LEED, Green Globe), and grants for eco-friendly construction.

The growth of carbon-neutral travel and regenerative tourism is further bolstering the appeal of sustainable resorts that actively contribute to biodiversity preservation and local community welfare. Developers are also exploring the rewilding of deforested areas through nature resorts that blend conservation and luxury. The hospitality industry’s push for zero-waste kitchens, biodegradable amenities, and green event management is supporting the broader transition. Destination management organizations (DMOs) and eco-travel aggregators are promoting such resorts to eco-conscious global travelers. This confluence of demand-side preferences and institutional backing presents a long-term growth opportunity for resorts that integrate sustainability as a core brand pillar, rather than a peripheral CSR strategy.

Resort Diversification into Wellness, Medical, and Digital Nomad Segments

The traditional leisure resort model is evolving into multi-functional wellness and lifestyle hubs that cater to health-conscious travelers, medical tourists, and digital nomads. With rising global awareness of mental and physical health, resorts are increasingly integrating wellness-focused offerings such as spa therapies, yoga, naturopathy, and mindfulness retreats. This creates a hybrid model between resorts and wellness centers, drawing visitors for rejuvenation and recovery rather than mere recreation. Simultaneously, medical tourism is creating demand for resorts near hospitals or recovery centers, especially in countries like Thailand, Turkey, and India, where international patients seek both affordability and comfort during post-treatment stays.

The rising trend of remote work is another massive opportunity resorts in scenic and peaceful locations are attracting digital nomads and remote workers who seek longer stays with co-working amenities, fast internet, and flexible meal plans. Some resorts are rebranding as "workation" hubs, merging productivity and leisure. This diversification not only enhances revenue per guest but also reduces seasonality risk. Strategic collaboration with health providers, telemedicine companies, and wellness coaches further enriches the guest offering. By tapping into these niche segments, resorts are transforming from passive accommodation providers into holistic well-being and lifestyle destinations, positioning themselves at the convergence of hospitality, health, and remote living.

Trends in the Global Resort Market

Rise of Experiential and Transformational Travel

The global resort market is witnessing a shift from traditional sightseeing vacations to experiential and transformational travel, where guests seek meaningful engagement, personal growth, and immersive cultural connections. Resorts are increasingly curating packages that include wellness retreats, local culinary experiences, nature excursions, and cultural interactions tailored to personal development goals. This trend is especially prevalent among millennials and Gen Z travelers, who value authenticity over luxury. Beach resorts, eco-resorts, and mountain lodges are adapting by offering storytelling-based itineraries, community immersion programs, and sustainability-led experiences. These lifestyle-oriented offerings help resorts differentiate their services in a saturated market and command premium rates while fostering guest loyalty.

The growing demand for mindfulness and well-being also aligns with this trend, giving rise to yoga retreats, spiritual escapes, and digital detox packages. Transformational travel reflects a broader global movement toward conscious tourism, where social impact and personal values influence travel decisions. Resorts that fail to cater to this evolving expectation risk losing ground to alternative lodging providers that prioritize guest transformation and holistic value. This shift is not only changing marketing strategies but also influencing resort design, employee training, and partnership development with local artisans, wellness practitioners, and conservation agencies. It’s reshaping the resort landscape into one that emphasizes depth, emotion, and purpose over conventional tourism.

Tech-Enabled Personalization and Contactless Services

Technological integration is becoming a dominant trend in the resort market, offering enhanced personalization, operational efficiency, and guest safety. Artificial intelligence (AI), Internet of Things (IoT), and big data analytics are enabling resorts to deliver hyper-personalized experiences, from customized room settings to curated activity recommendations. Guests now expect seamless interactions across mobile apps, from check-in and service requests to smart room controls and payment processing. The rise in contactless solutions post-COVID-19 has accelerated the adoption of digital concierge services, QR-based menus, facial recognition check-ins, and mobile key access systems. Resorts are also leveraging CRM platforms to understand guest preferences, spending behavior, and feedback in real-time.

This allows staff to proactively deliver tailored amenities, loyalty rewards, and upselling opportunities. Moreover, resorts equipped with AI-powered chatbots and voice-activated assistance significantly enhance convenience, especially for international tourists with language barriers. Integration with wearable technology, such as smart wristbands, also enables room access, activity tracking, and cashless payments during the stay. These tech-driven experiences not only boost guest satisfaction but also reduce labor dependency, a critical factor amid global staff shortages in the hospitality industry. The emphasis on digitization is not limited to guest interaction; back-end systems for housekeeping, maintenance, and energy management are also becoming smarter, helping resorts optimize resources, reduce operational costs, and enhance sustainability performance.

Global Resort Market: Research Scope and Analysis

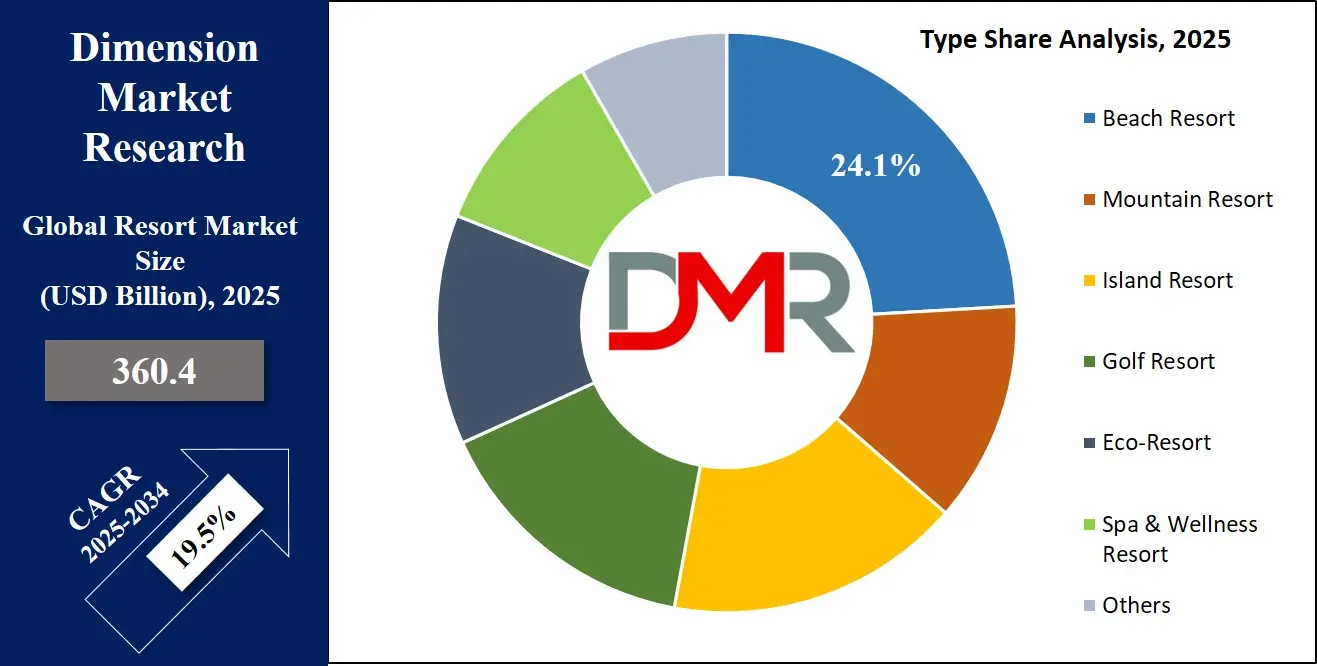

By Type Analysis

Beach resorts are projected to dominate the global resort market due to their universal appeal, year-round demand, and natural alignment with leisure, relaxation, and luxury tourism. Their proximity to coastlines, warm climates, and picturesque views makes them an ideal choice for honeymooners, families, and international travelers alike. Unlike mountain or golf resorts, beach destinations cater to a broad demographic from budget-conscious tourists seeking simple sun-and-sand experiences to high-spending luxury travelers pursuing exclusive beachfront villas. This versatility drives consistently high occupancy rates across seasons.

Moreover, beach resorts are often located in regions with strong tourism ecosystems, such as the Caribbean, Southeast Asia, the Mediterranean, and coastal U.S. states like Florida and California. These regions benefit from established air connectivity, international branding, cruise tourism, and favorable visa policies. Beach activities such as water sports, nightlife, marine tours, and beach festivals further enhance the attractiveness of these resorts, offering diverse experiences from day to night.

The dominance of beach resorts is also tied to climate preference. As travelers increasingly seek warm-weather escapes during cold seasons in their home countries, beach resorts become top choices for winter travel. Additionally, destination weddings, MICE events, and wellness retreats frequently opt for tropical beachfront settings to blend function with leisure. Global marketing campaigns by tourism boards and international hospitality chains heavily promote these destinations, sustaining demand. In an era of experiential travel, the emotional pull of the ocean, scenic sunsets, and beachside indulgence continues to make beach resorts the most desirable and economically viable segment in the resort industry.

ℹ

To learn more about this report –

Download Your Free Sample Report Here

By Ownership & Operation Analysis

Independent resorts are expected to dominate the ownership and operation segment due to their sheer volume, unique value proposition, and strong local and cultural alignment. Globally, a majority of resort properties, especially in emerging and rural markets, are independently owned rather than part of a large hotel chain. This segment encompasses boutique resorts, family-owned operations, and regionally operated properties that reflect local architecture, cuisine, traditions, and natural features, appealing to the growing base of travelers who prioritize authenticity over standardized luxury.

One key factor behind their dominance is flexibility. Independent resorts are not bound by rigid corporate policies or brand standards, allowing them to quickly adapt to market trends, guest preferences, or local conditions. This agility becomes a strategic advantage in customizing packages, pricing, design, and services that resonate with local and international guests alike. Additionally, independent ownership enables direct community involvement and local employment, which increasingly appeals to responsible and sustainability-conscious travelers.

These resorts also benefit from operational cost efficiency. Without franchise fees, brand royalties, or chain-related compliance costs, independent resorts can invest more in guest experience and staff development. Many leverage direct booking platforms, travel agent partnerships, or word-of-mouth marketing, making them competitive despite lacking large-scale marketing budgets.

Another reason for their dominance is geographic distribution. Independent resorts are often located in offbeat, exclusive, or undiscovered destinations where large chains are hesitant to invest due to scale limitations. These locations draw niche travelers who seek privacy, eco-tourism, or cultural immersion. Collectively, the independence, distinctiveness, and regional embeddedness of these resorts ensure they maintain a stronghold in the global market.

By Booking Channel Analysis

Travel agents are anticipated to dominate the booking channel segment in the global resort market due to their personalized service, in-depth destination knowledge, and strong networks with resort operators. While digital platforms have gained popularity, travel agents continue to hold a commanding presence especially for high-value, multi-generational, or complex resort vacations. They offer curated, end-to-end packages that simplify travel planning for clients, combining accommodation, transportation, meals, and activities under one reliable umbrella. This service-oriented approach is particularly vital for luxury travelers, honeymooners, senior citizens, and group tours, where assurance, customization, and concierge-style guidance are valued.

Travel agents are especially influential in emerging economies and among demographics less comfortable with digital bookings. Their dominance is further supported by preferred partnerships and exclusive deals negotiated directly with resort properties, giving them access to better pricing, upgrades, and promotional offers that aren’t always available online. Resorts also prioritize travel agent networks because these agents drive longer stays, higher per-capita spending, and repeat business.

In corporate and MICE (Meetings, Incentives, Conferences, and Exhibitions) travel, agents handle the logistical complexity of large group bookings, room blocks, and event coordination tasks difficult to manage via self-service platforms. Additionally, travel disruptions, cancellations, or rebookings are more efficiently resolved through agents, enhancing customer satisfaction.

Even in the digital age, many agents now operate hybrid models combining personal consultations with online tools to provide convenience and trust. Their human-centric expertise, cultural sensitivity, and ability to navigate ever-changing travel regulations make them indispensable. This deep-rooted influence across leisure and business travel segments secures their ongoing dominance in the resort booking ecosystem.

The Global Resort Market Report is segmented on the basis of the following

By Type

- Beach Resort

- Mountain Resort

- Island Resort

- Golf Resort

- Eco-Resort

- Spa & Wellness Resort

- Others

By Ownership & Operation

- Independent Resorts

- Chain Resorts

- Franchise Resorts

- Managed Resorts

By Booking Channel

- Travel Agents

- Direct Booking

- Online Travel Agencies

- Corporate/Group Booking

Global Resort Market: Regional Analysis

Region with the Largest Revenue Share

Asia Pacific is expected to dominate the global resort market as it commands 45.3% of the total revenue by the end of 2025, due to its expansive tourism infrastructure, diverse geography, and rapidly growing middle-class population. Countries like Thailand, Indonesia, India, China, and Vietnam boast some of the world’s most visited coastal and cultural destinations, offering a mix of beach, mountain, heritage, and wellness resorts. The region benefits from favorable tropical climates, cost-effective travel options, and widespread government support for tourism as a strategic economic sector. For instance, Thailand's "Amazing Thailand" campaign and Indonesia's "Wonderful Indonesia" initiative have significantly boosted international tourist arrivals.

Domestic tourism is also a massive driver, especially in populous nations like China and India, where rising incomes and improved connectivity have encouraged resort vacations. Furthermore, the presence of regional low-cost carriers and extensive intra-Asia travel promotes high occupancy rates. The hospitality sector has also seen substantial investments from both international hotel chains and local developers. Coupled with cultural richness, wellness tourism, and beach-driven leisure demand, Asia Pacific maintains its leadership in terms of volume, diversity, and resort infrastructure.

ℹ

To learn more about this report –

Download Your Free Sample Report Here

Region with the Highest CAGR

Europe is expected to witnessing the highest CAGR in the resort market due to a renewed focus on luxury travel, sustainable tourism, and experience-led getaways. Countries like Spain, Greece, Portugal, and Italy continue to attract both intra-European and international visitors with their iconic coastal resorts, culinary tourism, and heritage-rich destinations. European consumers are also driving demand through increased short-haul travel, enabled by budget airlines and efficient rail networks. The post-pandemic recovery has fueled interest in nature retreats, spa resorts, and wellness-based vacations across the Alps, the Mediterranean coast, and Northern Europe. Another key growth factor is the region’s aggressive push toward sustainable and eco-resort models in alignment with EU climate goals. The introduction of digital nomad visas in select countries has also led to longer stays in leisure-centric resort locations. With an affluent customer base, a shift toward experiential and wellness travel, and strong government support for green tourism, Europe is experiencing consistent expansion and holds the highest projected growth rate in the resort market.

By Region

North America

Europe

- Germany

- The U.K.

- France

- Italy

- Russia

- Spain

- Benelux

- Nordic

- Rest of Europe

Asia-Pacific

- China

- Japan

- South Korea

- India

- ANZ

- ASEAN

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Argentina

- Colombia

- Rest of Latin America

Middle East & Africa

- Saudi Arabia

- UAE

- South Africa

- Israel

- Egypt

- Rest of MEA

Global Resort Market: Competitive Landscape

The global resort market is highly competitive, featuring a mix of multinational hotel chains, independent resorts, and regional hospitality groups. Major players such as Marriott International, Hilton Worldwide, InterContinental Hotels Group (IHG), and Hyatt Hotels Corporation have established expansive resort portfolios across key global destinations, offering standardized luxury experiences, loyalty programs, and strong brand equity. These firms dominate in both developed and developing markets through owned properties, franchise models, and management agreements.

Independent resorts continue to maintain a significant market share by offering hyper-local experiences, personalized service, and unique location-based offerings. Boutique resorts, eco-lodges, and culturally immersive properties are gaining traction among travelers seeking authenticity and sustainability. In emerging economies, domestic players such as Banyan Tree (Asia), Club Mahindra (India), and Accor’s Rixos (Europe and Middle East) are intensifying regional competition.

Technology adoption is reshaping the landscape, with digital booking platforms, AI-driven personalization, and contactless services becoming critical differentiators. Moreover, partnerships with travel agents, OTAs, and destination management companies enhance visibility and occupancy.

The resort market's competitive environment is further intensified by the post-pandemic surge in leisure travel, growing demand for wellness tourism, and the rise of hybrid travelers. Players that innovate, localize, and invest in sustainability are best positioned for future leadership.

Some of the prominent players in the Global Resort Market are

- Marriott International

- Hilton Worldwide

- Hyatt Hotels Corporation

- InterContinental Hotels Group (IHG)

- AccorHotels

- Four Seasons Hotels and Resorts

- Wyndham Hotels & Resorts

- Melia Hotels International

- Kerzner International (One&Only Resorts)

- Aman Resorts

- Belmond Ltd.

- Banyan Tree Holdings

- Rosewood Hotel Group

- Sandals Resorts International

- Club Med

- Six Senses Hotels Resorts Spas

- Fairmont Hotels & Resorts

- Bluegreen Vacations

- Rixos Hotels

- Other Key Players

Recent Developments in Global Resort Market

February 2025

- Hospitality Innovation Summit (Saudi Arabia & UAE): Held on February 26–27, 2025, at Hilton Dubai Al Habtoor City, this summit attracted over 600 industry leaders. A notable event was the signing ceremony between Hilton and OSUS for a new resort project in Riyadh, aligning with Saudi Arabia's Vision 2030.

October 2024

- Baha Mar Expansion in The Bahamas: Baha Mar announced plans to add a fourth luxury resort on Cable Beach, featuring 350 rooms, 50 branded residences, and extensive amenities, with a projected opening in 2029.

- Four Seasons Resort in Mykonos, Greece: Four Seasons, in partnership with AGC Equity Partners, unveiled plans for a new beachside resort in Kalo Livadi Bay, offering 94 rooms, villas, and suites, set to open in summer 2025.

- Wyndham's Microtel Brand Enters India: Wyndham Hotels & Resorts signed an exclusive development agreement with NILE Hospitality LLP to introduce the Microtel by Wyndham brand to India, aiming to open 40 hotels by 2031.

May 2024

- Mohari Hospitality Acquires Tao Group Hospitality: Mohari Hospitality acquired Tao Group Hospitality for $550 million, expanding its luxury lifestyle and hospitality portfolio.

April 2024

- IHG Expands in Saudi Arabia: IHG Hotels & Resorts entered a management agreement to launch Holiday Inn Express in Riyadh, aligning with Saudi Vision 2030.

January 2024

- Choice Hotels and Wyndham Merger Discussions: Throughout 2023, Choice Hotels International and Wyndham Hotels & Resorts engaged in merger discussions, marked by multiple proposals and rejections, reflecting the complexities of deal-making in the hospitality industry.

Report Details

| Report Characteristics |

| Market Size (2025) |

USD 360.4 Bn |

| Forecast Value (2034) |

USD 1,790.2 Bn |

| CAGR (2025–2034) |

19.5% |

| Historical Data |

2019 – 2024 |

| The US Market Size (2025) |

USD 51.5 Bn |

| Forecast Data |

2025 – 2033 |

| Base Year |

2024 |

| Estimate Year |

2025 |

| Report Coverage |

Market Revenue Estimation, Market Dynamics, Competitive Landscape, Growth Factors, etc. |

| Segments Covered |

By Type (Beach Resort, Mountain Resort, Island Resort, Golf Resort, Eco-Resort, Spa & Wellness Resort, Others), By Ownership & Operation (Independent Resorts, Chain Resorts, Franchise Resorts, Managed Resorts), By Booking Channel (Travel Agents, Direct Booking, Online Travel Agencies, Corporate/Group Booking) |

| Regional Coverage |

North America – US, Canada; Europe – Germany, UK, France, Russia, Spain, Italy, Benelux, Nordic, Rest of Europe; Asia-Pacific – China, Japan, South Korea, India, ANZ, ASEAN, Rest of APAC; Latin America – Brazil, Mexico, Argentina, Colombia, Rest of Latin America; Middle East & Africa – Saudi Arabia, UAE, South Africa, Turkey, Egypt, Israel, Rest of MEA |

| Prominent Players |

Marriott International, Hilton Worldwide, Hyatt Hotels Corporation, InterContinental Hotels Group (IHG), AccorHotels, Four Seasons Hotels and Resorts, Wyndham Hotels & Resorts, Melia Hotels International, Kerzner International, Aman Resorts, Belmond Ltd., Banyan Tree Holdings, Rosewood Hotel Group, Sandals Resorts International, Club Med, Six Senses Hotels Resorts Spas, Fairmont Hotels & Resorts, Bluegreen Vacations, Rixos Hotels, and Other Key Players |

| Purchase Options |

We have three licenses to opt for: Single User License (Limited to 1 user), Multi-User License (Up to 5 Users), and Corporate Use License (Unlimited User) along with free report customization equivalent to 0 analyst working days, 3 analysts working days, and 5 analysts working days respectively. |

Frequently Asked Questions

How big is the Global Resort Market?

▾ The Global Resort Market size is estimated to have a value of USD 360.4 billion in 2025 and is expected to reach USD 1,790.2 billion by the end of 2034.

What is the size of the US Resort Market?

▾ The US Resort Market is projected to be valued at USD 51.5 billion in 2025. It is expected to witness subsequent growth in the upcoming period as it holds USD 233.6 billion in 2034 at a CAGR of 18.3%.

Which region accounted for the largest Global Resort Market?

▾ Asia Pacific is expected to have the largest market share in the Global Resort Market with a share of about 45.3% in 2025.

Who are the key players in the Global Resort Market?

▾ Some of the major key players in the Global Resort Market are Marriott International, Hilton Worldwide, Hyatt Hotels Corporation, InterContinental Hotels Group (IHG), AccorHotels, Four Seasons Hotels and Resorts, Wyndham Hotels & Resorts, Melia Hotels International, and many others.

What is the growth rate in the Global Resort Market in 2025?

▾ The market is growing at a CAGR of 19.5 percent over the forecasted period of 2025.