Market Overview

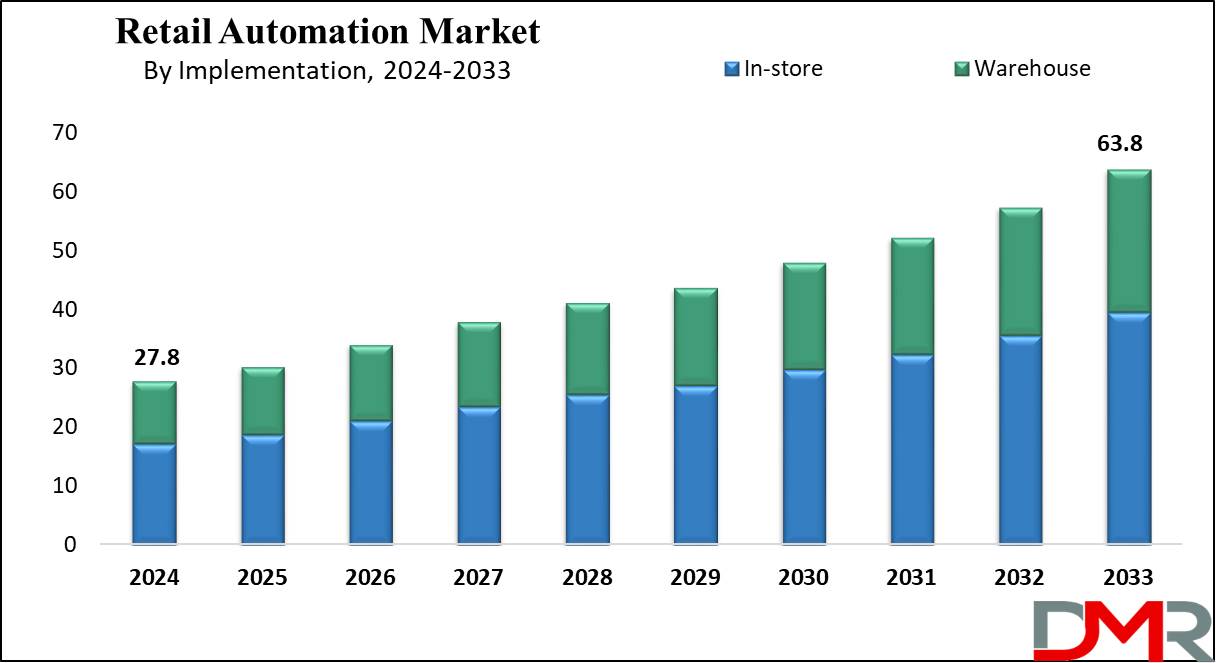

The Global Retail Automation Market is expected to reach a value of USD 27.8 billion by the end of 2024, and it is further anticipated to reach a market value of USD 63.8 billion by 2033 at a CAGR of 9.7%.

Retail automation runs processes using technology like self-checkouts, robotics, & AI to replace traditional tasks. The main focus is on enhancing operational efficiency, cutting costs, and improving customer experiences. Like, self-checkout kiosks allow independent purchases, while robotics & AI manage inventory & customer service. Driven by factors like labor costs &consumer demands, retailers adopt automation to stay competitive and adapt to changing expectations.

As per Finances Online, the Retail Automation Market is witnessing robust growth, driven by evolving consumer behaviors and digital adoption. Approximately 25% of American adults shop online monthly, reflecting a shift toward convenience.

Notably, 69% of Americans have engaged in online shopping, while 20% of buyers who return purchases in-store proceed with additional purchases, showcasing the potential of omnichannel strategies. Social media influences 84% of U.S. online buyers, with 30% actively posting feedback. Additionally, mobile devices account for 65% of all e-commerce traffic, underscoring the critical role of mobile-first strategies in enhancing customer experiences and driving retail automation adoption. This trend is further supported by the increasing demand in the

Retail Analytics, helping brands understand and react to shopper behavior in real time.

Key Takeaways

- The Global Healthcare Retail Automation Market is expected to increase by 36.0 billion, at a CAGR of 9.7% during the forecasted period.

- By Product, the point-of-sale (POS) segment is expected to lead in 2024 & is anticipated to dominate throughout the forecasted period.

- By Implementation, the in-store segment is expected to have a lead throughout the forecasted period.

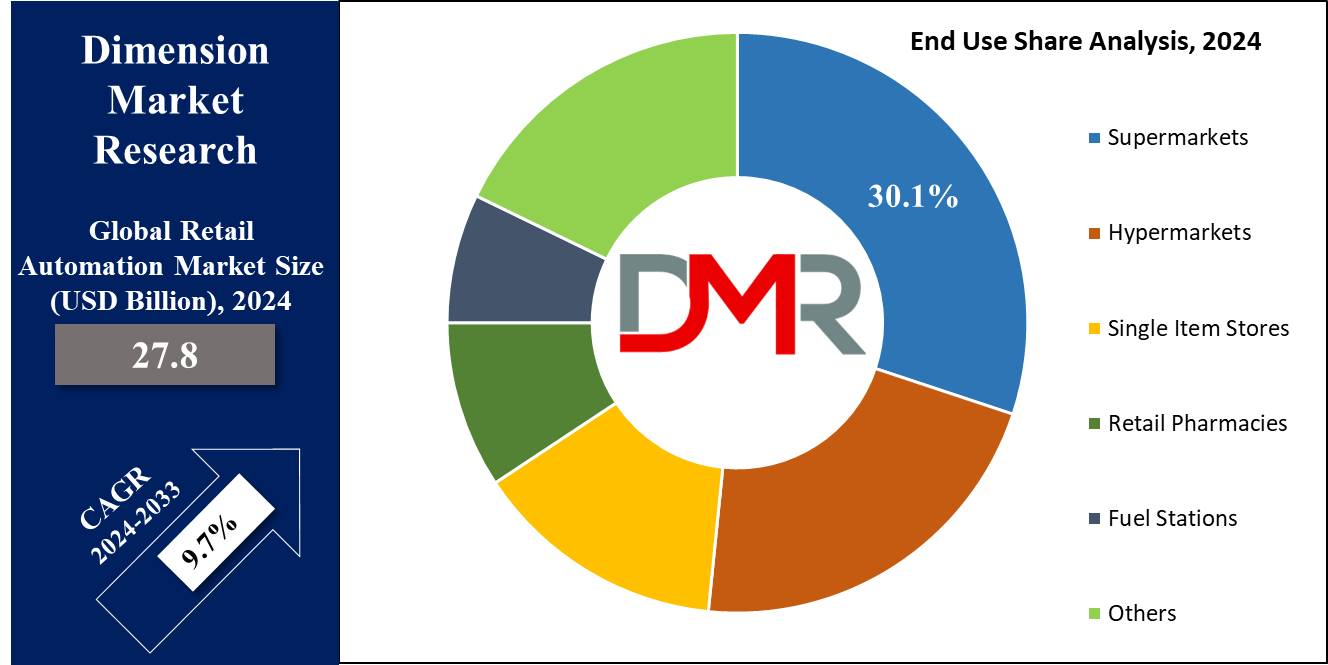

- By End Use, supermarkets are expected to be the dominant driver of the growth of the market in forecasted years.

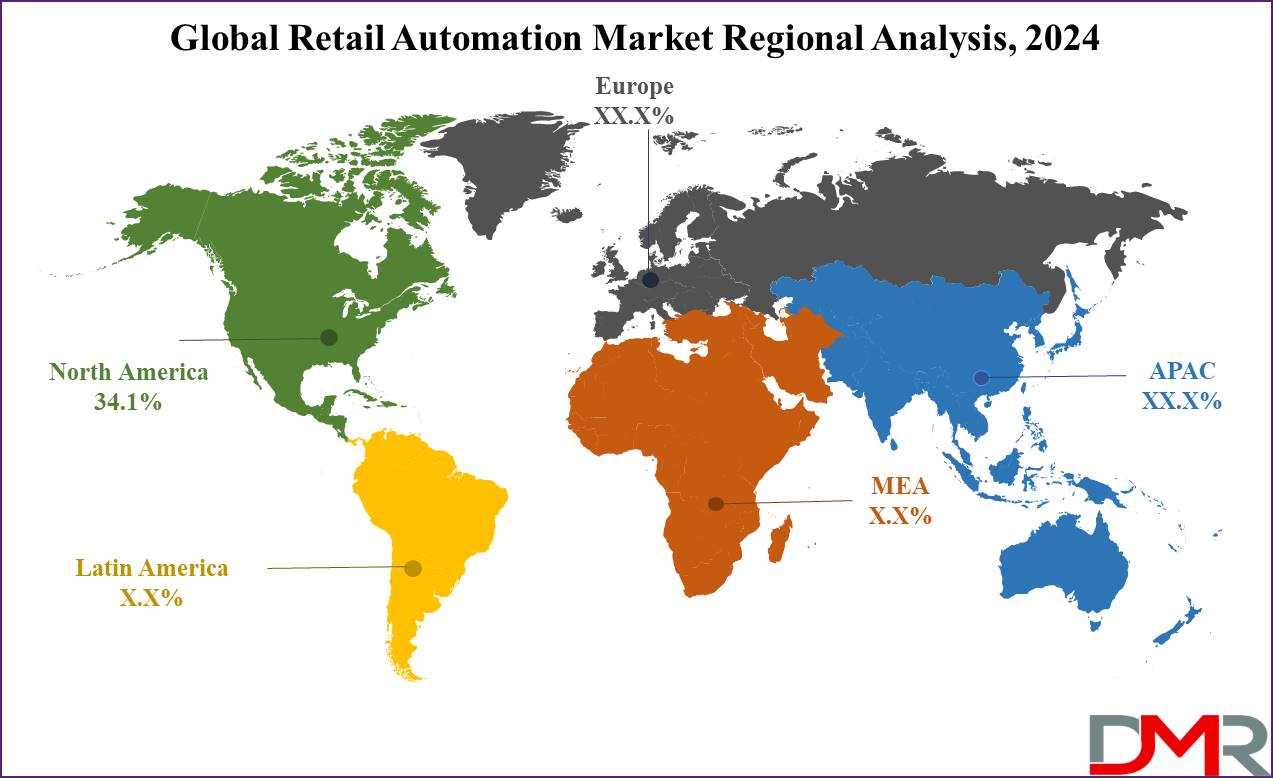

- North America is expected to hold a 34.1% share of revenue in the Global Retail Automation Market in 2024.

- Some of the use cases of retail automation include inventory management systems, self-checkout kiosks, and more.

Use Cases

- Self-Checkout Kiosks: Self-checkout kiosks allow customers to scan & pay for items themselves, minimizing wait times & improving efficiency during peak hours, which enhances the complete shopping experience by providing a convenient & hassle-free checkout process. These kiosks are central to Packaging Automation advancements, enabling smoother packaging and transactional experiences for consumers.

- Inventory Management Systems: Automated inventory management systems use sensors & software to track stock levels in real time. By automating inventory tracking, retailers can improve stock levels, minimize overstocking & stockouts, and improve overall inventory accuracy, creating better customer satisfaction & operational efficiency. These systems benefit from Generative AI in Retail innovations, which are reshaping how inventory demand is predicted and managed.

- Personalized Recommendations: AI-powered recommendation engines analyze customer data & shopping patterns to provide personalized product recommendations. By providing customized suggestions, retailers can improve the shopping experience, increase sales, and provide customer loyalty.

- Contactless Payment Options: Contactless payment solutions, like mobile payments & NFC technology, allow customers to pay for purchases quickly & securely without physical contact. These systems not only enhance transaction speed but also meet the rising demand for contactless transactions, mainly in light of health concerns, improving overall convenience & safety for customers.

Market Dynamic

Retail automation is on the rise as consumers need more convenient shopping experiences. To meet these expectations, retailers are adopting technologies like self-checkout kiosks & contactless payments, and efficient transactions. In addition, automated inventory management & AI-powered systems like smart shelves and personalized recommendations further improve convenience, driving customer satisfaction and loyalty. In tandem, the

Retail Ready Packaging is playing a larger role by simplifying shelf stocking and enhancing product visibility.

However, maintenance costs provide a challenge for the wide adoption of retail automation. While these systems improve efficiency, current expenses like maintenance & software updates can strain budgets, mainly for smaller retailers. Further, concerns regarding unexpected or recurring costs may slow down adoption as businesses weigh the benefits of automation against its long-term financial implications. Finding the correct balance between the advantages of automation & its maintenance costs is important for retailers looking into the changing landscape of technology in the retail sector.

Research Scope and Analysis

By Product

The point-of-sale (POS) segment is expected to capture the largest share of revenue in 2024, which is driven by many factors, like the rising demand for merchandise optimization & the higher adoption of technologies like the Internet of Things (IoT), application programming interface (API), & robotics process automation. In addition, the launch of logistic warehousing, along with the expanding trends of e-commerce & m-commerce retail, along with developments in live data analytics & virtual marketing, contribute to the segment's expansion.

Further, the camera segment is anticipated to have significant growth in the forecasted period. Further, retail establishments, like stores & malls, experience growth in security risks like theft & inventory loss. Investing in camera systems provides long-term benefits, like promoting store profits, reducing retail losses, preventing theft, monitoring employee tasks, & understanding customer purchasing behaviors. Hence, end-users are largely adopting camera solutions for retail automation processes, further driving the growth of this segment

By Implementation

The in-store segment is expected to dominate the global retail automation market in terms of revenue share in 2024, which is fueled by many factors, like the growing adoption of omnichannel retail strategies, developments in robotics & AI technologies, and the growth in demand for contactless & self-service solutions. By automating retail locations & using cloud-based platforms, operators can easily reduce maintenance costs associated with routine inspections. Live notifications through cloud platforms allow quick problem-solving, further contributing to the segment's growth.

Further, the warehouse segment is expected to have significant growth in the forecast period. The retail industry's growth usage of autonomous guided vehicles (AGV) & autonomous mobile robotics (AMR) is driving automation adoption. Further, organizations are benefiting from using cognitive technologies & optimizing their warehouse storage methods, driving the demand for retail automation solutions. These combined factors are anticipated to drive significant growth within the warehouse segment.

By End Use

The supermarkets are expected to dominate the market share in the global retail automation market in 2024 using large-scale grocery stores providing diverse products. A key trend in this segment is the integration of self-checkout kiosks, allowing customers to handle transactions independently. In addition, supermarkets are using inventory management systems & smart shelving to boost efficiency. These developments focus on organizing the shopping experience, decreasing waiting times, & improving complete customer satisfaction in the ever-evolving field of supermarket retail.

Further, the hypermarket segment is expected to see rapid growth in the coming future, as these characterized by their large product offerings spanning groceries, household items, & electronics, are using automation solutions to streamline operation, which includes the adoption of self-checkout kiosks, inventory management systems, & AI-powered analytics to improve customer experiences, optimize inventory levels, & boost operational efficiency, which mirrors the industry's commitment to delivering smooth & efficient shopping journeys within vast retail environments.

The Global Retail Automation Market Report is segmented on the basis of the following:

By Product

- Point-of-Sale (POS)

- RFID & Barcode

- Camera

- Electronic Shelf Label

- Warehouse Robotics

- Others

By Implementation

By End Use

- Supermarkets

- Hypermarkets

- Single Item Stores

- Retail Pharmacies

- Fuel Stations

- Others

Regional Analysis

North America is expected to have the largest share of 34.1% in 2024, which is driven by several factors, like the broad adoption of automation technologies by major businesses, the expanding e-commerce market, & increasing labor costs. In addition, the region attracts manufacturers looking for access to a sizable customer base & economies of scale. Local retailers are largely offering tangible benefits like loyalty programs to incentivize digital payments, thus stimulating the need for retail automation platforms.

Further, Asia Pacific is expected to witness fast growth in the coming years, which is experiencing a growth in SMEs using automation technology. The proliferation of emerging technologies, from the loading dock to the checkout line, provides many opportunities to improve operational efficiency. Also, the number of mobile checkout devices in developing countries assisting in selling goods in many settings, like events, pop-up stores, and kiosks, expanding the reach of automation technologies across the retail sector in this region.

By Region

North America

Europe

- Germany

- The U.K.

- France

- Italy

- Russia

- Spain

- Benelux

- Nordic

- Rest of Europe

Asia-Pacific

- China

- Japan

- South Korea

- India

- ANZ

- ASEAN

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Argentina

- Colombia

- Rest of Latin America

Middle East & Africa

- Saudi Arabia

- UAE

- South Africa

- Israel

- Egypt

- Rest of MEA

Competitive Landscape

The global retail automation market is characterized by competition among many players providing innovative solutions to retailers. Key strategies like product differentiation, technological development, & strategic partnerships to expand market reach. Companies aim to enhance customer experience, optimize operational efficiency, and provide affordable solutions. With high demand for automation to meet changing consumer needs, competition in the retail automation market continues to intensify, driving innovation & market growth.

Some of the prominent players in the Global Retail Automation Market are

- ECR Software Corp

- Casio Computer Co Ltd

- 6 River Systems

- Kuka AG

- Pricer AB

- Wincor Nixdorf AG

- Amazon Web Services

- Honeywell Scanning & Mobility

- Zebra Technologies Corp

- NCR Corp

- Other Key Players

Recent Developments

- In January 2024, Google Cloud introduced a conversational commerce solution that helps retailers personalize online shopping, update operations, and revamp in-store technology. It allows easy integration of AI-powered virtual agents on websites & apps, facilitating refined conversations with shoppers. Retailers can quickly deploy these agents, providing tailored product suggestions based on individual preferences.

- In January 2024, SAP SE introduced the latest AI-driven capabilities to assist retailers to optimize business processes and drive profitability & customer loyalty. These innovative capabilities, from planning to personalization, and provide retailers with complete customer insights & data analysis to adapt and expand during rapid market changes.

- In June 2023, Centific Global Solutions launched Pitaya.AI, a SaaS platform for retailers that provides a suite of intelligent store solutions, which uses AI to tackle industry-wide business challenges like workplace safety, shrinkage, stockout, and lack of customer behavior visibility. It also addresses the rising theft in the retail industry by preventing theft at cashier-assisted & self-checkout lanes and preventing retail organized crime by detecting delays and rapid pickup of multiple items.

- In January 2023, EY organization launched EY Retail Intelligence, using Microsoft Cloud & Cloud for Retail to deliver a smooth shopping journey, which integrates all customer touchpoints, allowing access to real-time data across channels. Using AI, image recognition, and analytics, it provides valuable insights and can be extended with Microsoft Dynamics 365 tools for better functionality.

- In August 2022, Meta launched a new tool named Advantage+ Meta Advantage to help every advertiser use the power of AI & automation maximizing the performance of their ad spend. Advantage+ shopping campaigns assist advertisers get smarter & faster on which campaigns are converting. Further, it removes the manual steps of ad creation & automates up to 150 creative combinations at once, which assists advertisers more quickly learn what ads are working, while making the most of their advertising budget.

Report Details

| Report Characteristics |

| Market Size (2024) |

USD 27.8 Bn |

| Forecast Value (2033) |

USD 63.8 Bn |

| CAGR (2023-2032) |

9.7% |

| Historical Data |

2018 – 2023 |

| Forecast Data |

2024 – 2033 |

| Base Year |

2023 |

| Estimate Year |

2024 |

| Report Coverage |

Market Revenue Estimation, Market Dynamics, Competitive Landscape, Growth Factors and etc. |

| Segments Covered |

By Product (Point-of-Sale (POS), RFID & Barcode, Camera, Electronic Shelf Label, Warehouse Robotics, and Others), By Implementation (In-store and Warehouse), By End Use (Supermarkets, Hypermarkets, Single Item Stores, Retail Pharmacies, Fuel Stations, and Others) |

| Regional Coverage |

North America – The US and Canada; Europe – Germany, The UK, France, Russia, Spain, Italy, Benelux, Nordic, & Rest of Europe; Asia- Pacific– China, Japan, South Korea, India, ANZ, ASEAN, Rest of APAC; Latin America – Brazil, Mexico, Argentina, Colombia, Rest of Latin America; Middle East & Africa – Saudi Arabia, UAE, South Africa, Turkey, Egypt, Israel, & Rest of MEA |

| Prominent Players |

ECR Software Corp, Casio Computer Co Ltd, 6 River Systems, Kuka AG, Pricer AB, Wincor Nixdorf AG, Amazon Web Services, Honeywell Scanning & Mobility, Zebra Technologies Corp, NCR Corp, and Other Key Players |

| Purchase Options |

We have three licenses to opt for: Single User License (Limited to 1 user), Multi-User License (Up to 5 Users), and Corporate Use License (Unlimited User) along with free report customization equivalent to 0 analyst working days, 3 analysts working days and 5 analysts working days respectively. |

Frequently Asked Questions

The Global Retail Automation Market size is estimated to have a value of USD 27.8 billion in 2024 and is expected to reach USD 63.8 billion by the end of 2033.

North America is expected to have the largest market share in the Global Retail Automation Market with a share of about 34.1% in 2024.

Some of the major key players in the Global Retail Automation Market are ECR Software Corp, Casio Computer Co Ltd, 6 River Systems, and many others.

The market is growing at a CAGR of 9.7 percent over the forecasted period.