Risk analytics is the process of extracting the essence of risks that may hit a business or organization from statistical data. It integrates technology, data science, and statistical instruments in its threat assessment. These threats may arise from the financial markets, or market security issues, or supply chain disruption, or shifts in customer habits. Risk analytics are used by companies to prepare for these eventualities, minimize possible losses, and influence better decisions. This custom has become inevitable in the modern fast-moving world in which the risks are changing quickly and are beyond control.

ℹ

To learn more about this report –

Download Your Free Sample Report Here

In the recent past, the market for risk analytics has sharply risen. Companies are experiencing complexities in operation, and a rise in uncertainty in the world economy. Further, companies are using risk analytics to keep ahead. They want to understand how changes on the market occur, prevent financial losses, and remain compliant with regulations. Risk analytics further helps them stay free from fraud, detect early security breaches, and plan better. Insurance companies, banks, manufacturers, and even retailers are now pouring more money into this area to bolster decision-making.

Using

artificial intelligence and machine learning in risk models is one of the key trends. These technologies allow firms to identify patterns and dangers more quickly than ever before. Another trend is the reactive to predictive risk management. Organisation no longer waits for problems to occur, but rather, they are using real-time data to forecast and avert problems. Cloud-based platforms are growing in popularity as the number of businesses that have access to advanced risk tools is also growing. Finally, we see an emerging emphasis on cybersecurity risk analysis as increasing levels of data and systems go online.

Several incidents in the last few years have demonstrated the relevance of risk analytics. For example, many deficiencies in supply chains and continuity plans at businesses were revealed during the COVID-19 pandemic. Firms with good risk analytics systems were able to react and adjust for the better quickly.

Other developments, such as the increase in cyberattacks, global inflation and geopolitical tensions have driven companies to develop their risk analysis. Amounts also encourage organizations to invest in better tools and processes because of the changes in regulatory sectors such as finance and healthcare.

Although risk analytics is increasingly gaining prominence, some companies struggle. A problem is the lack of quality data. Without proper data, we cannot expect good results.

The other problem lies with incorporating risk analytics into the day-to-day operations. It usually involves a cultural change and employee training. Small businesses may also have problems with the cost or difficulty of sophisticated tools. These are, however, issues that many companies appreciate in the long run and are working round these limitations to embrace the future of risk analytics.

The US Risk Analytics Market

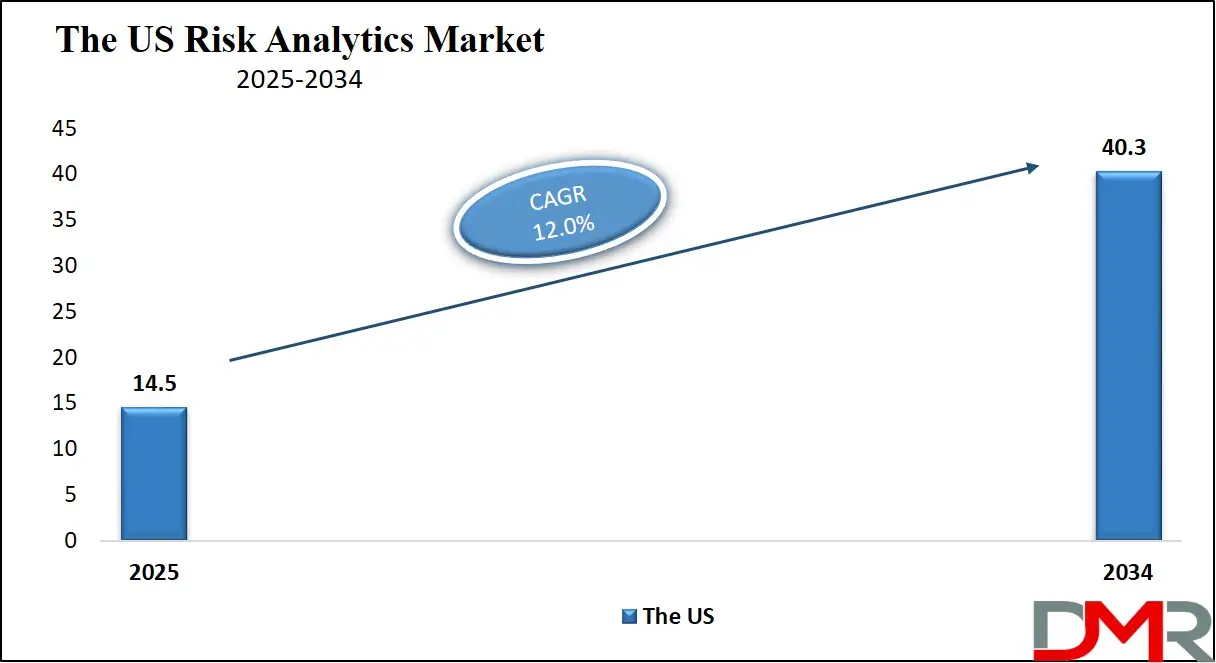

The US Risk Analytics Market size is projected to reach USD 14.5 billion in 2025 at a compound annual growth rate of 12.0% over its forecast period.

The US plays a major role in the global risk analytics market due to its strong technological infrastructure, early adoption of advanced analytics, and presence of major solution providers. US-based organizations across finance, healthcare, insurance, and technology heavily invest in risk analytics to manage growing uncertainties, regulatory demands, and cybersecurity threats. The US is also a hub for innovation in artificial intelligence and

machine learning, which are mainly integrated into risk analytics tools.

Moreover, the country’s strict regulatory environment pushes companies to adopt advanced systems for compliance and risk management. With its large market size, skilled workforce, and continuous innovation, the US not only drives demand but also sets global trends in how risk analytics is developed and applied across sectors.

ℹ

To learn more about this report –

Download Your Free Sample Report Here

Europe Risk Analytics Market

Europe Risk Analytics Market size is projected to reach

USD 11.0 billion in 2025 at a compound annual growth rate of

11.9% over its forecast period.

Europe holds a significant position in the global risk analytics market, driven by its strong regulatory framework, growing focus on data protection, and demand for operational resilience. European companies across sectors like banking, manufacturing, and energy are adopting risk analytics to comply with complex regulations like GDPR and Basel III.

The region places high importance on transparency, sustainability, and ethical risk management, encouraging the use of analytics for both compliance and strategic planning. Additionally, Europe is investing in digital transformation, AI, and cloud technologies, which support the expansion of advanced risk tools. Collaborative efforts between governments, industries, and research institutions also promote innovation in risk analytics, positioning Europe as a key contributor to shaping global risk management practices.

Japan Risk Analytics Market

Japan Risk Analytics Market size is projected to reach USD 6.7 billion in 2025 at a compound annual growth rate of 13.9% over its forecast period.

Japan significantly drives the risk analytics market through its focus on technology, precision, and risk-aware business culture. Japanese companies, mainly in sectors like finance, manufacturing, and electronics, actively use risk analytics to manage supply chain disruptions, financial uncertainties, and operational risks. The country’s strong focus on quality control and long-term planning aligns well with data-driven risk management strategies.

Japan’s government also promotes digital transformation and data security, further supporting the growth of analytics adoption. As natural disasters are a frequent concern, Japanese firms use risk analytics for disaster preparedness and continuity planning. With its advanced infrastructure, skilled workforce, and focus on innovation, Japan continues to influence the regional and global development of risk analytics solutions.

Risk Analytics Market: Key Takeaways

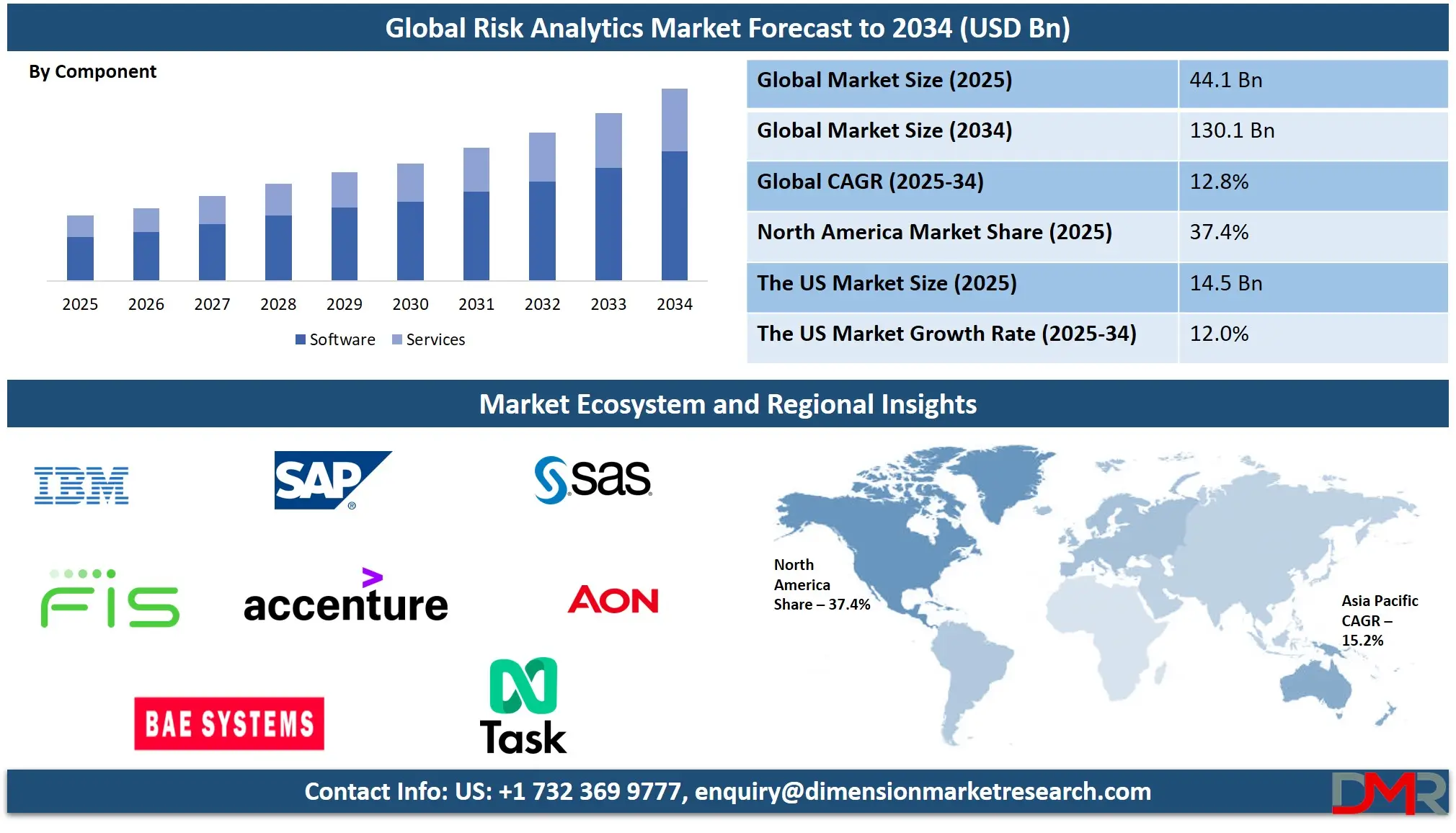

- Market Growth: The Risk Analytics Market size is expected to grow by USD 80.9 billion, at a CAGR of 12.8%, during the forecasted period of 2026 to 2034.

- By Component: The software segment is anticipated to get the majority share of the Risk Analytics Market in 2025.

- By Risk type: The financial risk is expected to get the largest revenue share in 2025 in the Risk Analytics Market.

- Regional Insight: North America is expected to hold a 37.4% share of revenue in the Global Risk Analytics Market in 2025.

- Use Cases: Some of the use cases of Risk Analytics include fraud detection, credit risk assessment, and more.

Risk Analytics Market: Use Cases:

- Fraud Detection: Risk analytics helps spot unusual patterns in financial transactions or customer behavior that may signal fraud. By analyzing large volumes of data in real time, businesses can easily detect suspicious activity, which reduces losses and protects customer trust.

- Supply Chain Risk Management: Companies use risk analytics to monitor suppliers, delivery routes, and market conditions. It helps them identify delays, shortages, or geopolitical risks early. With this insight, businesses can make quicker decisions to avoid disruptions.

- Credit Risk Assessment: Financial institutions apply risk analytics to assess the likelihood of a borrower defaulting on a loan. By analyzing credit history, income patterns, and market trends, they make more accurate lending decisions, which lowers bad debts and improves portfolio quality.

- Cybersecurity Risk Monitoring: Risk analytics tools analyze network activity to detect threats like hacking attempts or malware. These tools provide early warnings and help prioritize risks based on severity. As cyber threats grow, this use case is becoming critical for all industries.

Market Dynamic

Driving Factors in the Risk Analytics Market

Digital Transformation and Data Explosion

One of the main growth drivers of the risk analytics market is the rapid digital transformation happening across industries. As businesses move their operations online, they generate massive volumes of data every day, which includes customer behavior, financial transactions, supply chain details, and social media activity.

Risk analytics tools help companies make sense of this data to spot threats early and make informed decisions. The more digital data businesses have, the bigger the demand for smart tools to analyze and manage risk, which is especially strong in sectors like banking, insurance, healthcare, and retail. As companies continue to digitize, demand for advanced risk analytics solutions is expected to rise steadily in the coming years.

Growing Focus on Regulatory Compliance and Risk Management

Another key driver of market growth is the major pressure on businesses to comply with strict regulations. Industries like finance, energy, and healthcare are under constant watch from regulators who require accurate reporting and strong risk controls. Risk analytics tools help organizations meet these requirements by providing clear, real-time visibility into their risk exposure.

They also support audits and internal controls, reducing the chance of penalties or reputation damage. In addition, growing concerns around cybersecurity, climate risks, and operational disruptions have pushed risk management to the top of the agenda. Companies are now investing in smarter analytics to not only meet legal standards but also build long-term resilience.

Restraints in the Risk Analytics Market

High Implementation Costs and Complexity

One major restraint in the risk analytics market is the high cost and complexity involved in setting up advanced analytics systems. Many businesses, especially small and mid-sized ones, find it difficult to afford the tools, infrastructure, and skilled personnel required. Implementing risk analytics often needs major changes in IT systems and workflows, which can be time-consuming and expensive.

There may also be hidden costs like staff training, data migration, and software upgrades. For organizations without strong technical expertise, the process can seem overwhelming. This discourages adoption, particularly in regions or sectors with tight budgets. As a result, some businesses continue using traditional risk management methods, slowing down the market’s overall growth.

Lack of Quality Data and Skilled Talent

Another key challenge holding back the risk analytics market is the shortage of clean, structured data and skilled professionals. Risk analytics depends heavily on high-quality data from various sources, but many organizations struggle with inconsistent or incomplete data. Poor data leads to weak insights, making the analytics less reliable.

Additionally, there is a growing need for professionals who understand both data science and risk management. However, finding such talent is difficult, and competition for skilled analysts is high, which makes it hard for companies to build and maintain effective risk analytics systems. Without the right people and data in place, the full potential of risk analytics cannot be achieved.

Opportunities in the Risk Analytics Market

Expansion in Emerging Markets and Small Businesses

One promising opportunity for the risk analytics market depends on its expansion into emerging economies and small to medium-sized enterprises (SMEs). As these regions experience economic growth and higher digital adoption, their exposure to financial, operational, and cyber risks also grows.

However, many of these businesses have not yet adopted formal risk analytics tools. By providing affordable, scalable, and easy-to-use solutions customized to smaller operations, vendors can tap into a large, underserved market. Cloud-based platforms and subscription models make these tools more accessible than ever. As awareness grows, more SMEs are expected to invest in analytics to protect their operations and compete globally. This creates a strong growth path for providers in new markets.

Integration of AI and Real-Time Analytics

The integration of artificial intelligence (AI), machine learning, and real-time analytics presents a major opportunity for the risk analytics market. These technologies allow for faster, more accurate risk detection and better prediction of future threats. Real-time data processing helps organizations respond instantly to changes, minimizing losses and improving decision-making.

AI also enhances automation, reducing the need for manual monitoring and freeing up human resources. As these technologies become more advanced and widely available, businesses across all industries are likely to adopt them. This opens the door for risk analytics providers to create innovative, AI-driven solutions that offer higher value and keep up with fast-evolving business environments.

Trends in the Risk Analytics Market

Shift Toward Predictive and Prescriptive Analytics:

A major recent trend in the risk analytics market is the shift from traditional, backward-looking analysis to predictive and prescriptive analytics. Instead of simply identifying past problems, businesses now want tools that can forecast future risks and suggest proactive actions. Predictive analytics uses historical data, machine learning, and algorithms to detect patterns and predict potential threats before they occur.

Prescriptive analytics goes a step further by recommending specific strategies to reduce those risks, which assists organizations not only avoid losses but also gain a competitive edge by acting ahead of time. As more companies look for smarter decision-making tools, this trend is driving demand for advanced, forward-thinking risk analytics solutions.

Increased Focus on Cyber and Operational Risk

With the higher frequency of cyberattacks, system failures, and supply chain disruptions, organizations are emphasizing analyzing operational and cybersecurity risks more. Businesses now use risk analytics tools to monitor IT systems, detect vulnerabilities, and assess potential impacts from internal or external disruptions.

This trend is especially important as more organizations move to cloud environments and adopt remote work setups, which introduce new kinds of risks. By using real-time dashboards and scenario modeling, companies are better able to prepare for and respond to these threats. The increased focus on digital infrastructure protection is making operational and cyber risk analytics a top priority across industries.

Research Scope and Analysis

By Component Analysis

Software will be leading in 2025 with a share of

67.3%, playing a vital role in driving the growth of the risk analytics market, as it includes platforms, tools, and applications that help businesses collect, process, and analyze large volumes of data to detect risks. These solutions are increasingly being used across industries like finance, healthcare, retail, and manufacturing to manage financial threats, cyber risks, and operational uncertainties.

With the growth in digital transformation and real-time data needs, software offers advanced features like automation, dashboards, and predictive modeling. Companies prefer customizable and cloud-based software due to its flexibility, scalability, and ease of integration with existing systems. The growing need for faster decision-making and regulatory compliance is further pushing the demand for risk analytics software across both developed and emerging markets.

Further, the services segment is having significant growth over the forecast period, driven by the growth in demand for consulting, integration, and support in implementing risk analytics solutions. Many organizations lack in-house expertise to set up and manage complex analytics tools, leading to higher reliance on professional services.

These services aid in smooth deployment, system customization, and training of employees, ensuring better results from risk management platforms. As businesses constantly cloud-based and AI-driven analytics, support services become even more crucial. In addition, managed services are gaining popularity, mainly among small and mid-sized firms looking for cost-effective, outsourced solutions. The services segment is helping companies stay compliant, secure, and resilient in a rapidly changing risk environment, making it a key contributor to market expansion.

By Deployment Mode Analysis

Cloud is set to dominate with a share of

54.2% in 2025, driving the growth of the risk analytics market by offering flexible, cost-effective, and scalable solutions for businesses of all sizes. Cloud-based platforms allow organizations to access real-time risk insights without demanding heavy infrastructure or upfront investment, which makes them ideal for handling large and fast-changing datasets from different sources. With improved cybersecurity, data backup, and remote access, cloud deployment supports faster decision-making and better disaster recovery.

Companies benefit from easy integration with other systems, automatic updates, and global access, which boosts efficiency and performance. As more businesses adopt digital workflows and remote operations, cloud-based risk analytics tools are becoming the preferred choice to manage financial, operational, and cyber risks while minimizing IT burden and improving responsiveness across various sectors.

Further, the on-premises segment is expected to experience significant growth over the forecast period due to its appeal among organizations that require high levels of data control and security, which is preferred by companies in highly regulated sectors such as banking, government, and defense, where data sensitivity and compliance are critical. With on-premises risk analytics, businesses can fully manage their infrastructure, keep data within their local environment, and meet strict regulatory requirements.

It also offers stable performance without relying on internet connectivity, which is important for locations with limited cloud access. Despite higher setup and maintenance costs, many enterprises continue to choose on-premises solutions for the assurance of full system control, enhanced customization, and the ability to tailor risk management frameworks to specific internal needs, supporting steady demand in this segment.

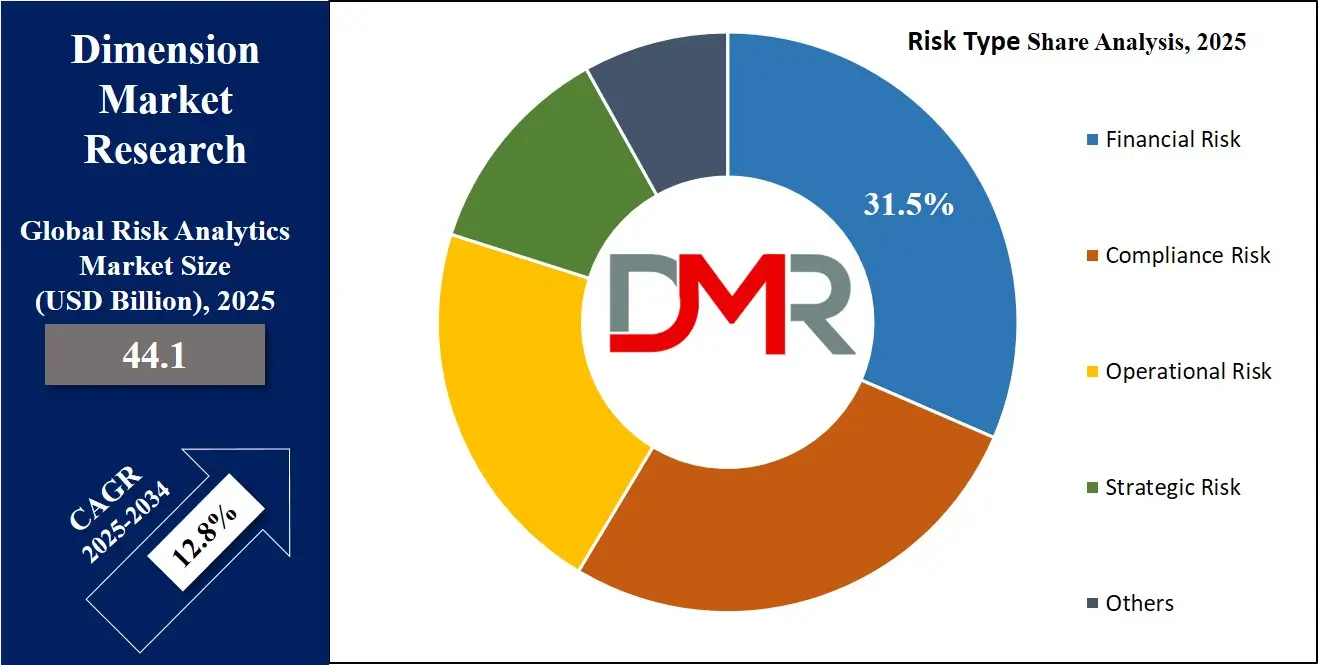

By Risk Type Analysis

Financial risk will be leading in 2025 with a share of

31.5%, playing a crucial role in the growth of the risk analytics market, as it includes factors like market volatility, credit risk, liquidity issues, and investment risk, which can have significant impacts on a company’s financial health. Financial institutions, insurance companies, and businesses rely heavily on risk analytics to assess and manage these risks.

By analyzing historical data and using predictive models, companies can anticipate potential financial losses and take action to mitigate them. With the growth in complexity of global markets and economic uncertainties, the need for financial risk analytics tools is growing rapidly. These solutions help businesses make more informed financial decisions, minimize exposure to losses, and stay resilient in a fluctuating economic environment.

Further, compliance risk is having significant growth over the forecast period due to the growth in pressure on organizations to adhere to various regulations, standards, and laws. As regulatory frameworks constantly evolve across industries like banking, healthcare, and energy, businesses need to ensure they stay compliant to avoid penalties, fines, or reputation damage.

Risk analytics tools help companies monitor their processes, identify potential compliance gaps, and ensure they meet local and international regulations. With growing focus on anti-money laundering (AML), data privacy, and corporate governance, compliance risk management has become a priority. As businesses expand globally, maintaining compliance across different regions and industries requires more sophisticated risk analytics, leading to strong growth in this segment throughout the forecast period.

ℹ

To learn more about this report –

Download Your Free Sample Report Here

By Organization Size Analysis

In terms of organization size, large enterprises are leading in 2025 with a share of

69.8%, significantly contributing to the growth of the risk analytics market. These organizations, due to their complex operations and diverse business activities, face various risks, from financial to operational and cyber threats. Large enterprises invest heavily in advanced risk analytics solutions to monitor and manage risks across multiple departments and regions.

These tools help them optimize their risk management strategies, ensure regulatory compliance, and improve decision-making processes. Given their extensive data and the need for real-time risk assessments, large enterprises are increasingly adopting cloud-based, AI-driven, and predictive analytics solutions. The growing need for global risk monitoring and strategic planning ensures that large enterprises will continue to dominate the risk analytics market in the coming years.

Further, SMEs are having significant growth over the forecast period as they increasingly recognize the value of risk analytics to protect their business operations. Although historically smaller businesses have lagged in adopting advanced analytics due to cost and resource constraints, which is changing with the availability of more affordable, scalable solutions. As SMEs grow and expand, managing risks such as financial volatility, supply chain disruptions, and cybersecurity threats becomes crucial.

Many risk analytics providers now offer tailored solutions specifically designed for smaller businesses, allowing them to improve their risk management capabilities without the complexity of larger enterprise systems. As the digital transformation of SMEs accelerates, their adoption of risk analytics will continue to rise, driving strong growth in this segment.

By Application Analysis

In 2025, fraud detection & prevention will be leading with a share of

25.8%, playing a crucial role in the growth of the risk analytics market. With the rise of digital transactions, businesses face increasing threats from fraudulent activities, including financial fraud, identity theft, and cybercrimes. Risk analytics tools help companies detect and prevent fraud by analyzing large datasets, identifying suspicious patterns, and providing real-time alerts.

By using machine learning algorithms, these tools can continuously enhance their detection capabilities, making fraud prevention more efficient. Financial institutions, e-commerce platforms, and other businesses depend on advanced fraud detection systems to protect customer data, reduce financial losses, and ensure trust.

As online transactions constantly grow, the demand for fraud detection and prevention solutions will remain a key driver in the market.

Also, real-time situation awareness is experiencing significant growth over the forecast period as organizations prioritize immediate responses to risks. By offering real-time insights into various threats, such as operational disruptions, cyberattacks, and financial risks, these tools help businesses make quick decisions to minimize damage.

Real-time situation awareness is essential for industries like finance, healthcare, and manufacturing, where fast action is critical to protect assets and maintain service continuity. With the increasing complexity of risks and the need for instant mitigation, businesses are turning to advanced analytics platforms that can provide up-to-the-minute data and proactive alerts. This growing reliance on real-time risk monitoring is driving strong market growth and is expected to continue to rise in the coming years.

By End Use Industry Analysis

BFSI will dominate in 2025 with a share of

39.6%, playing a major role in the growth of the risk analytics market. The banking, financial services, and insurance sectors experience numerous risks, including market fluctuations, credit defaults, fraud, and regulatory compliance challenges. Risk analytics tools help these organizations assess and manage these risks by providing insights into potential threats, allowing better decision-making, and ensuring adherence to regulations. With the growing complexity of financial systems, data-driven solutions are crucial for monitoring and minimizing risks in real time.

As financial transactions and digital services expand, BFSI institutions are relying more on advanced analytics to protect assets, prevent fraud, and enhance customer trust, driving the growth of the risk analytics market within this sector.

Further, healthcare is having significant growth over the forecast period as the industry focuses on improving risk management to protect patient data, ensure regulatory compliance, and manage operational risks. With increasing cyber threats, patient privacy concerns, and a rise in healthcare fraud, the need for risk analytics tools in healthcare has never been greater. These tools help healthcare organizations predict and prevent data breaches, optimize patient care, and comply with complex regulations like HIPAA.

Additionally, healthcare providers are leveraging analytics to manage financial risks, streamline operations, and improve patient outcomes. As the industry adopts more digital technologies, the demand for sophisticated risk analytics solutions in healthcare will continue to rise, driving growth in this segment.

The Risk Analytics Market Report is segmented on the basis of the following:

By Component

- Software

- Risk Calculation Engines

- ETL Tools

- Scorecard and Visualization Tools

- Dashboard Analytics and Risk Reporting Tools

- Services

- Professional Services

- Managed Services

By Deployment Mode

By Risk Type

- Strategic Risk

- Operational Risk

- Financial Risk

- Compliance Risk

- Others

By Organization Size

- Large Enterprises

- Small and Medium Enterprises (SMEs)

By Application

- Fraud Detection and Prevention

- Credit Risk Management

- Liquidity Risk Management

- Risk Reporting and Monitoring

- Regulatory and Compliance Risk

- Real-time Situation Awareness

By End Use Industry

- BFSI

- Healthcare

- IT and Telecom

- Manufacturing

- Retail and Consumer Goods

- Energy and Utilities

- Government and Defense

- Transportation and Logistics

- Others

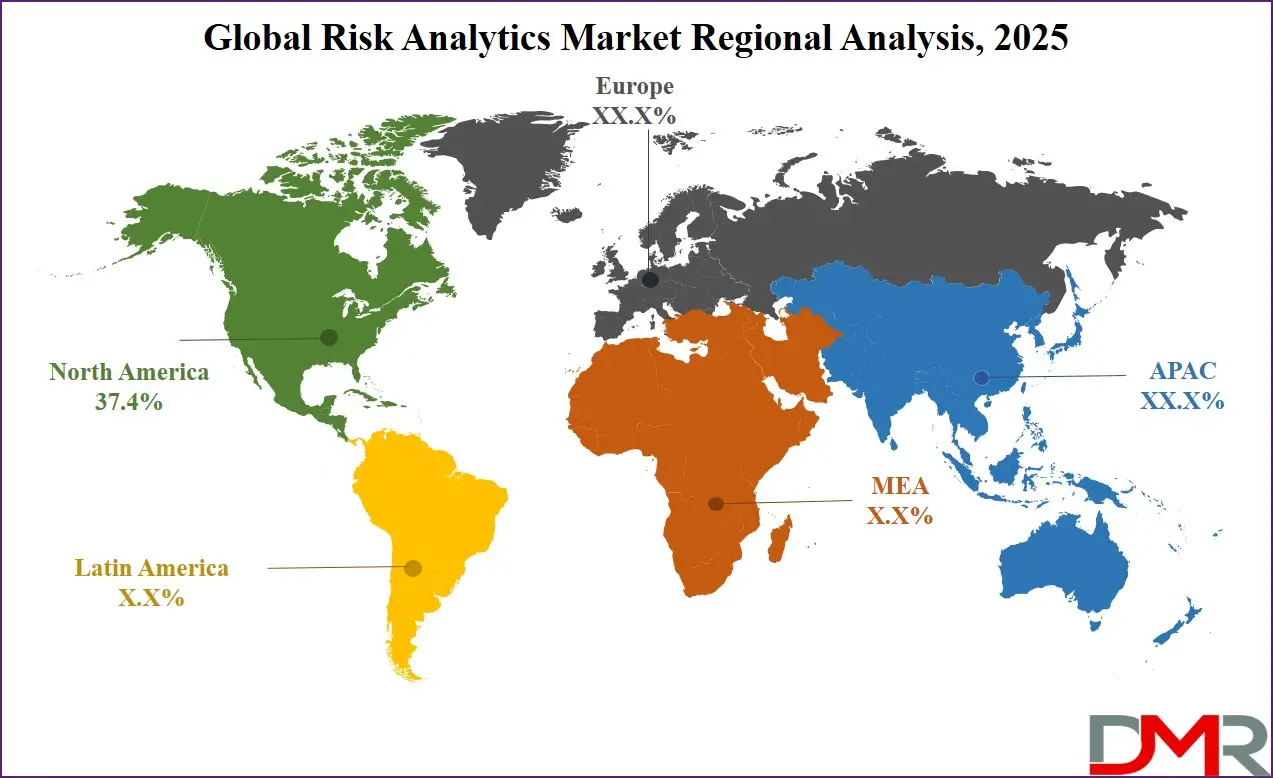

Regional Analysis

Leading Region in the Risk Analytics Market

North America is set to be leading in 2025 with a share of

37.4%, significantly driving the growth of the risk analytics market. The region is home to various industries that heavily depend on risk analytics, like finance, healthcare, manufacturing, and technology. North American companies are early adopters of advanced analytics solutions, using them to manage various risks like financial instability, cybersecurity threats, and operational disruptions. The growing digital transformation, regulatory pressures, and rise in complexity of risk environments in this region are contributing to the rising demand for risk analytics tools.

Moreover, North America's strong presence of technology giants and innovation hubs further boosts the development of advanced analytics solutions, like AI and machine learning, for real-time risk management. With constant investments in cybersecurity and risk mitigation strategies, North America remains a key region in shaping the future of the global risk analytics market.

ℹ

To learn more about this report –

Download Your Free Sample Report Here

Fastest Growing Region in the Risk Analytics Market

Asia Pacific is experiencing major growth over the forecast period in the risk analytics market, driven by rapid digital transformation and growing awareness of the importance of risk management. As businesses in countries like China, India, and Japan expand and diversify, they face major challenges in managing financial, operational, and cybersecurity risks.

Risk analytics solutions are becoming essential for industries such as banking, manufacturing, and e-commerce to protect against disruptions and fraud. The region’s growing adoption of cloud technologies, artificial intelligence, and big data analytics is further fueling the demand for advanced risk management tools. With increasing investments in digital infrastructure, Asia Pacific is poised to be a key driver in the market's expansion.

By Region

North America

Europe

- Germany

- The U.K.

- France

- Italy

- Russia

- Spain

- Benelux

- Nordic

- Rest of Europe

Asia-Pacific

- China

- Japan

- South Korea

- India

- ANZ

- ASEAN

- Rest of Asia-Pacific

Latin America

Brazil

Mexico

Argentina

Colombia

Rest of Latin America

Middle East & Africa

- Saudi Arabia

- UAE

- South Africa

- Israel

- Egypt

- Rest of MEA

Competitive Landscape

There is major competition for the risk analytics market as more firms are learning the value of using data to deal with uncertainty. A lot of the players are providing advanced tools to help in understanding the financial, operational, and cybersecurity risks for businesses. Others target large organizations with complex needs, while others target small firms that have simple platforms.

New start-ups are also coming up with new ideas, especially in artificial intelligence and cloud technology. At the same time, older firms are upgrading their systems to remain relevant. With the growth in demand in industries like finance, insurance, health, and manufacturing, the competition is rising. Companies operating in this space are trying hard to provide better insight into the data, faster processing, and user-friendly tools, to make a statement in this rapidly changing marketplace.

Some of the prominent players in the Global Risk Analytics are:

- SAS

- SAP

- IBM

- FIS

- MSCI

- BAE Systems

- Accenture

- Aon

- Experian

- Resolver

- ZRisk

- n Task

- Kyriba

- LogicGate

- CloudRisk

- CubeLogic

- Finastra

- VComply

- Riskalyze

- Other Key Players

Recent Developments

- In May 2025, Behavox launched its Data Risk Controls and Reconciliation Program to strengthen organizational data risk management amid growing regulatory pressure. Over the past four years, Behavox has partnered with Global Systemically Important Banks and Commodities Traders to improve data controls in line with global regulations. As scrutiny from internal and external bodies like the SEC, FCA, ASIC, and FINRA intensifies, firms are increasingly focused on data integrity and governance. Behavox has helped clients successfully meet audit and remediation requirements.

- In May 2025, KatRisk acquired Gamma, a leader in location intelligence and property-level risk assessment, which strengthens KatRisk’s capabilities in delivering advanced risk analytics and innovative technologies for better decision-making. Gamma is known for its trusted property risk data and its flagship platform, Perilfinder™, which provides detailed address-level risk assessment and exposure management. The solution is widely used by major global insurers for underwriting and risk evaluation.

- In January 2025, Moody’s Corporation announced its plans to acquire CAPE Analytics, a leading provider of geospatial AI for residential and commercial property risk analysis, which will merge Moody’s Intelligent Risk Platform and catastrophe risk modeling expertise with CAPE’s AI-driven property insights, creating a powerful, address-specific property risk database. Further, the integration responds to customer demand for more precise and actionable risk data, enhancing property risk analytics and improving decision-making across the entire insurance value chain.

- In October 2024, Duck Creek Technologies acquired Risk Control Technologies, Inc. (RCT), a Toronto-based provider of risk management and loss control solutions, to enhance how insurers prevent losses and manage risk, which integrates advanced AI and machine learning to address growing global threats like climate change and cyber risks. Further, the partnership aims to help insurers collaborate more closely with policyholders to improve safety and future preparedness.

- In October 2024, NASDAQ launched a new machine learning-based methodology for calculating investment portfolio risk and generating predictive analytics. This advanced capability will be embedded into NASDAQ’s Calypso platform, which aids banks, insurers, and financial institutions in managing capital markets access, treasury operations, risk, and regulatory compliance. XVA, a group of Value Adjustments, modifies derivative values to account for trading costs like risk, funding, and capital, such as Credit Valuation Adjustment, which adjusts for counterparty credit risk in bilateral OTC transactions.

Report Details

| Report Characteristics |

| Market Size (2025) |

USD 44.1 Bn |

| Forecast Value (2034) |

USD 130.1 Bn |

| CAGR (2025–2034) |

12.8% |

| Historical Data |

2019 – 2024 |

| The US Market Size (2025) |

USD 14.5 Bn |

| Forecast Data |

2025 – 2033 |

| Base Year |

2024 |

| Estimate Year |

2025 |

| Report Coverage |

Market Revenue Estimation, Market Dynamics, Competitive Landscape, Growth Factors, etc. |

| Segments Covered |

By Component (Software and Services), By Deployment Mode (On-Premise and Cloud), By Risk Type (Strategic Risk, Operational Risk, Financial Risk, Compliance Risk, and Others), By Organization Size (Large Enterprises and Small and Medium Enterprises (SMEs)), By Application(Fraud Detection and Prevention, Credit Risk Management, Liquidity Risk Management, Risk Reporting and Monitoring, Regulatory and Compliance Risk, and Real-time Situation Awareness), By End Use Industry (BFSI, Healthcare, IT and Telecom, Manufacturing, Retail and Consumer Goods, Energy and Utilities, Government and Defense, Transportation and Logistics, and Others) |

| Regional Coverage |

North America – US, Canada;

Europe – Germany, UK, France, Russia, Spain, Italy, Benelux, Nordic, Rest of Europe;

Asia-Pacific – China, Japan, South Korea, India, ANZ, ASEAN, Rest of APAC;

Latin America – Brazil, Mexico, Argentina, Colombia, Rest of Latin America;

Middle East & Africa – Saudi Arabia, UAE, South Africa, Turkey, Egypt, Israel, Rest of MEA

|

| Prominent Players |

SAS, SAP, IBM, FIS, MSCI, BAE Systems, Accenture, Aon, Experian, Resolver, ZRisk, n Task, Kyriba, LogicGate, CloudRisk, CubeLogic, Finastra, VComply, Riskalyze, and Other Key Players |

| Purchase Options |

We have three licenses to opt for: Single User License (Limited to 1 user),

Multi-User License (Up to 5 Users), and

Corporate Use License (Unlimited User) along with free report customization equivalent to

0 analyst working days, 3 analysts working days, and 5 analysts working days respectively.

|