Market Overview

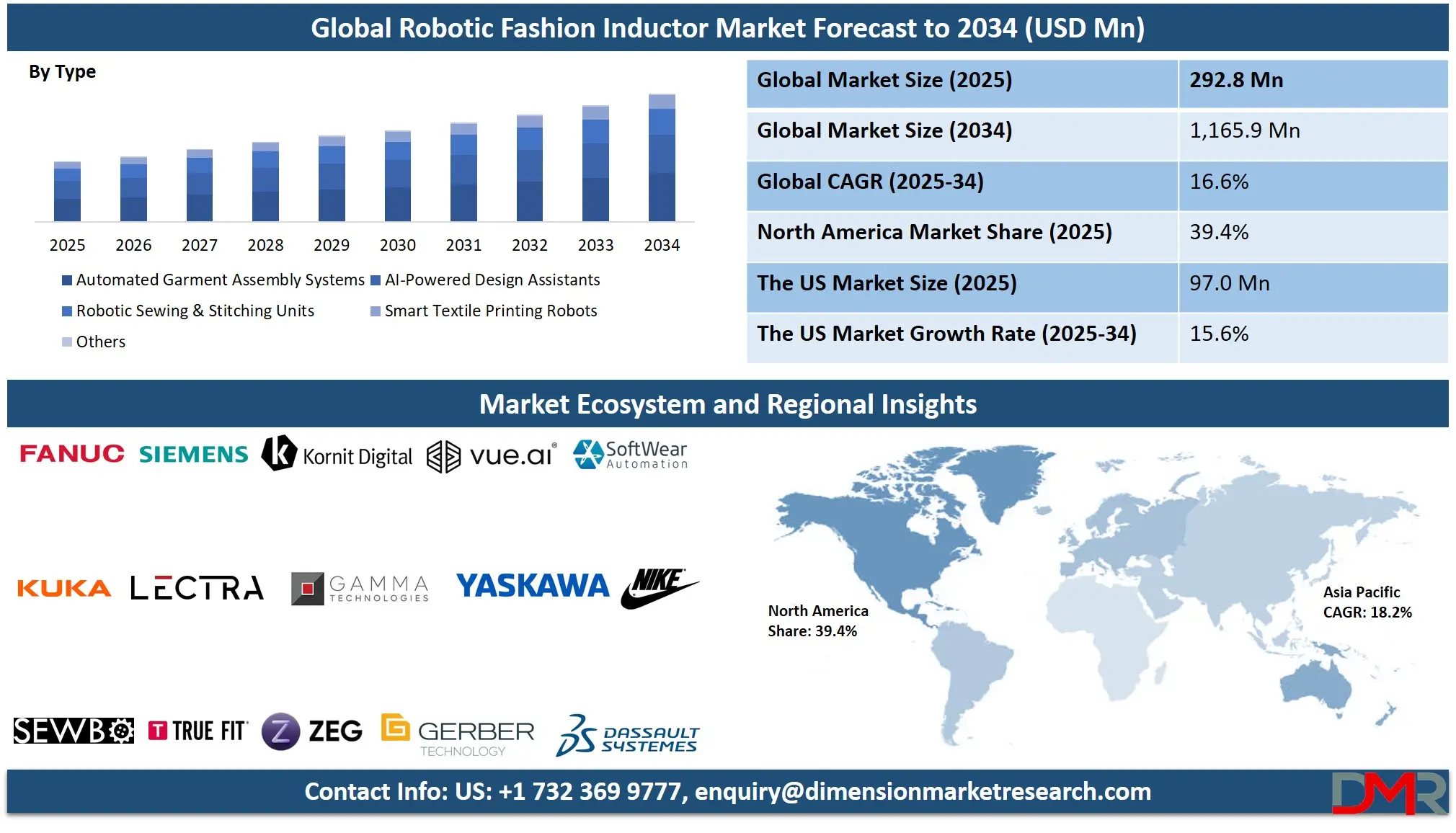

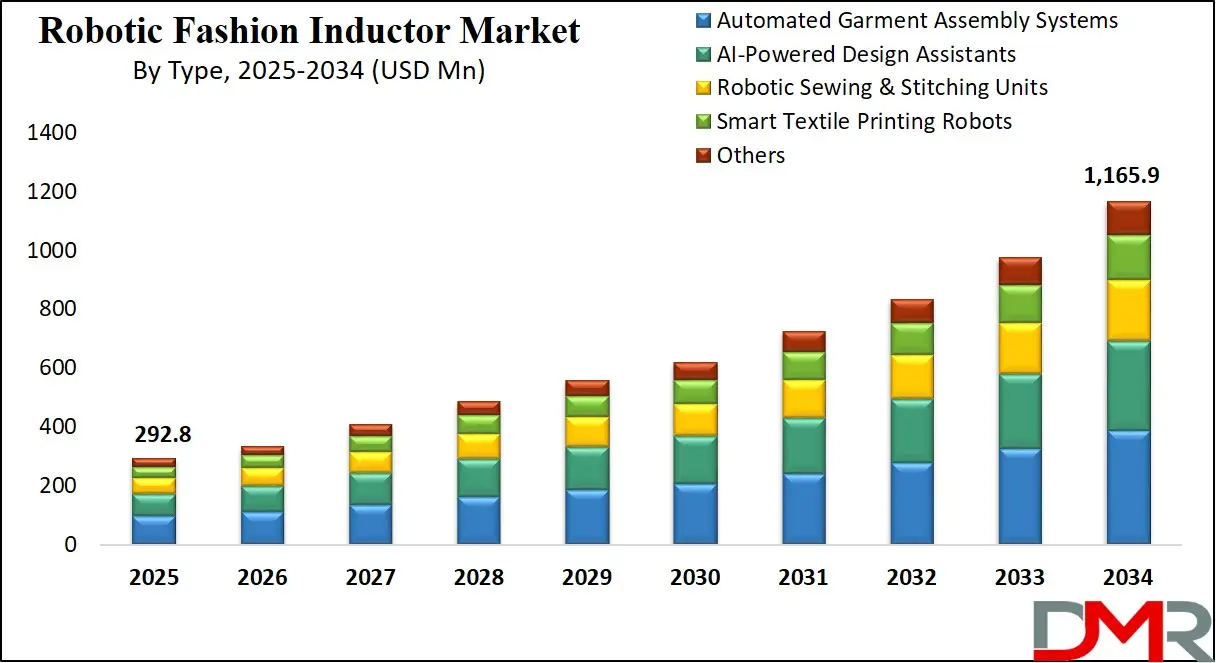

The Global Robotic Fashion Inductor Market is estimated to be valued USD 292.8 million in 2025 and is expected to grow at a CAGR of 16.6% from 2025 to 2034, attaining a value of USD 1,165.9 million by 2034. The market's rapid growth is driven by the increasing demand for automated, on-demand production, the rise of personalized and sustainable fashion, and the global shift toward Industry 4.0 smart manufacturing.

ℹ

To learn more about this report –

Download Your Free Sample Report Here

Robotic inductors enable fully automated garment handling, precision sewing, AI-driven pattern cutting, and smart textile manipulation, supporting brands in achieving faster time-to-market, reduced labor costs, and minimized waste. The model addresses global challenges related to supply chain inefficiency, skilled labor shortages, and the need for agile, responsive production.

Technological advancements, including AI-integrated design software, collaborative robots (cobots), 3D robotic knitting, automated quality inspection systems, and IoT-enabled production lines, are transforming the market into a scalable and highly efficient ecosystem. Integration of machine learning algorithms for predictive maintenance, material optimization, and adaptive manufacturing is reshaping production accuracy and flexibility.

ℹ

To learn more about this report –

Download Your Free Sample Report Here

Growing industry initiatives promoting automation, sustainable fast-fashion alternatives, and digital twin integration further accelerate global adoption. However, barriers such as high initial investment, integration complexity with legacy systems, and the need for skilled technicians remain. Despite these limitations, the convergence of AI, advanced robotics, and smart textile innovation positions robotic fashion inductors as a central driver of global apparel manufacturing transformation through 2034.

The US Robotic Fashion Inductor Market

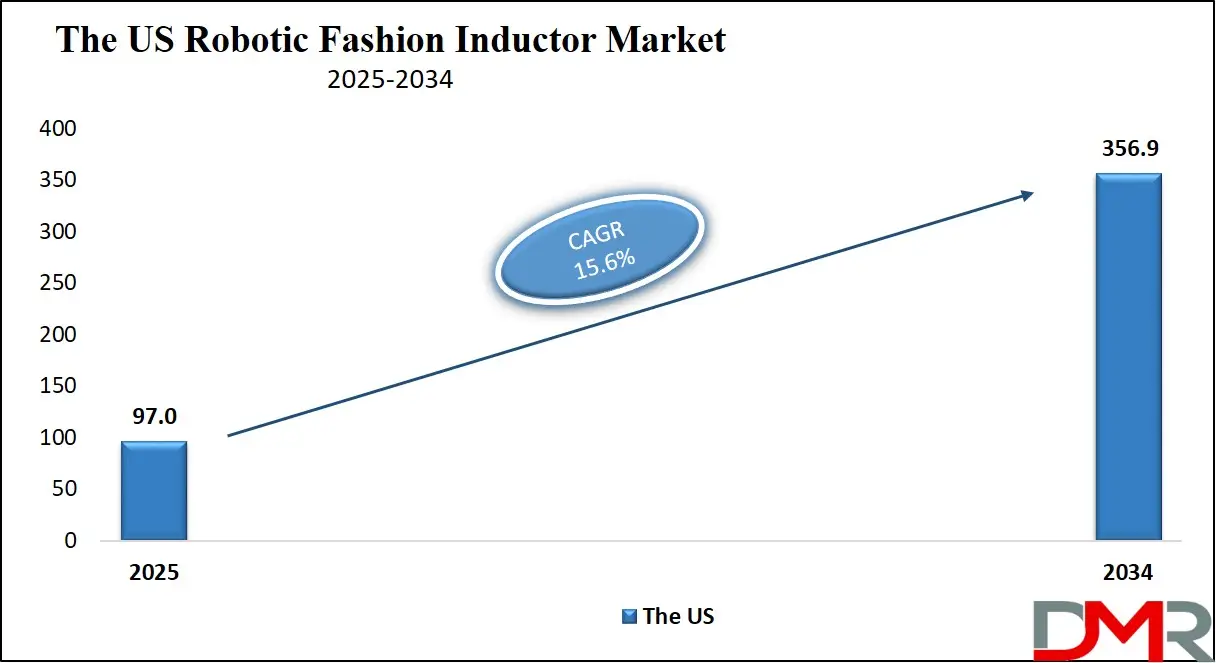

The U.S. Robotic Fashion Inductor Market is projected to reach USD 97.0 million in 2025 and grow at a CAGR of 15.6%, reaching USD 356.9 million by 2034. The U.S. leads global adoption due to its advanced manufacturing ecosystem, strong presence of tech-driven fashion brands, and significant investment in reshoring and automated production.

Major apparel brands and manufacturers are integrating robotic sewing cells, automated fabric cutters, and AI-assisted design platforms to enhance agility and reduce dependency on overseas labor. Initiatives by companies such as GAP, Nike, and Levi's, alongside tech partnerships with Siemens, Fanuc, and Boston Dynamics, are accelerating the deployment of fully automated fashion production lines.

ℹ

To learn more about this report –

Download Your Free Sample Report Here

U.S. market growth is fueled by federal and state incentives for smart manufacturing, the Make it in America campaign, and increasing consumer demand for customized, locally-produced apparel. The rapid adoption of 3D robotic knitting for seamless garments and AI-driven inventory management systems continues to redefine the U.S. fashion manufacturing landscape, positioning the country as a global leader in automated apparel innovation.

The Europe Robotic Fashion Inductor Market

The Europe Robotic Fashion Inductor Market is projected to be valued at approximately USD 87.8 million in 2025 and is projected to reach around USD 333.0 million by 2034, growing at a CAGR of about 15.8% from 2025 to 2034. Europe's leadership is anchored by strong sustainability mandates, luxury brand adoption, and government-supported initiatives for circular fashion and digital manufacturing.

Countries such as Germany, Italy, France, the U.K., and the Netherlands are at the forefront, driven by luxury houses and fast-fashion giants integrating robotic automation to ensure precision, quality, and reduced environmental impact. The EU’s Circular Economy Action Plan and Horizon Europe funding actively support the adoption of AI and robotics in textile production.

Europe's emphasis on high-mix, low-volume production, customization, and ethical manufacturing further drives robotic inductor uptake. Deployment of AI-powered cobots in knitting and embroidery, automated fabric inspection systems, and digital twin-enabled production floors is widespread. With strong regulatory support for sustainable tech and digital maturity in manufacturing, Europe remains one of the most advanced regions in robotic fashion penetration.

The Japan Robotic Fashion Inductor Market

The Japan Robotic Fashion Inductor Market is anticipated to be valued at approximately USD 35.1 million in 2025 and is expected to attain nearly USD 123.0 million by 2034, expanding at a CAGR of about 14.9% during the forecast period. Japan's expertise in robotics, precision engineering, and techno-textiles drives high demand for automated fashion solutions, particularly in high-end apparel and technical wearables.

The Ministry of Economy, Trade and Industry (METI) actively supports Society 5.0 initiatives, promoting the integration of AI and robotics in traditional industries including textiles. Japan's leadership in robotic actuation, sensory feedback systems, and miniaturized automation accelerates innovation in seamless assembly robots, smart textile printers, and adaptive mannequin systems.

Japan's concept of "Monozukuri" (craftsmanship through automation), driven by companies like Toyota, Juki, and Shima Seiki, integrates IoT-enabled robotic cells with AI design platforms. Urban manufacturing hubs and rural tech-integrated factories are deploying robotic inductors to address labor shortages and enable mass customization. Japan's focus on precision, quality, and innovation positions the country as a high-growth leader in robotic fashion inductors.

Global Robotic Fashion Inductor Market: Key Takeaways

- Strong Global Market Growth Outlook: The Global Robotic Fashion Inductor Market is expected to be valued at USD 292.8 million in 2025 and is projected to reach USD 1,165.9 million by 2034, showcasing rapid expansion supported by the demand for automated, agile, and sustainable apparel production.

- High CAGR Driven by Industry 4.0 Adoption: The market is expected to grow at an impressive CAGR of 16.6% from 2025 to 2034, fueled by accelerated smart manufacturing adoption, AI-integrated design and production, and the global shift toward on-demand fashion.

- Strong Growth Trajectory in the United States: The U.S. Robotic Fashion Inductor Market stands at USD 97.0 million in 2025 and is projected to reach USD 356.9 million by 2034, expanding at a CAGR of 15.6% due to robust reshoring trends, tech investments, and consumer demand for customization.

- North America Maintains Innovation Leadership: North America is expected to capture approximately 39.4% of the global market share in 2025, supported by strong sustainability regulations, luxury brand automation, and advanced research in smart textiles and circular production.

- Rapid Advancement in Robotic Induction Technologies: Innovations including AI-driven pattern generation, collaborative sewing robots, 3D robotic knitting, and automated quality assurance systems are significantly accelerating flexibility, efficiency, and scalability in fashion manufacturing.

- Growing Demand for Sustainable and Customized Fashion Boosts Adoption: Rising consumer preference for personalized apparel, ethical production, and fast turnaround times is driving sustained demand for robotic systems that enable small-batch production, reduced waste, and supply chain resilience.

Global Robotic Fashion Inductor Market: Use Cases

- Automated High-Precision Cutting: Robotic laser cutters and AI-vision systems execute complex pattern cuts with minimal fabric waste, optimizing material usage for high-end and technical apparel.

- Robotic Sewing and Assembly Cells: Collaborative robots handle repetitive stitching, seam sealing, and garment assembly tasks, increasing throughput and consistency while reducing labor-intensive processes.

- On-Demand 3D Knitted Apparel: Fully automated 3D knitting machines produce seamless garments on-demand, enabling mass customization and reducing inventory overhead for brands.

- Smart Textile Printing and Embroidery: Robotic arms equipped with digital printers or embroidery heads apply intricate designs adaptively, supporting small-batch, customized production runs.

- Automated Quality Inspection and Finishing: AI-powered vision robots inspect garments for defects, perform finishing touches, and prepare products for packaging, ensuring high quality standards.

Global Robotic Fashion Inductor Market: Stats & Facts

- The International Federation of Robotics (IFR) states that over 45,000 industrial robots were deployed in the textile and apparel sector in 2024, a number projected to grow by over 25% annually, as brands seek to automate labor-intensive processes amidst global skilled worker shortages exceeding 30% in key manufacturing regions.

- The Ellen MacArthur Foundation reports that automation and on-demand production can reduce fashion waste by up to 40%, with robotic systems enabling precise material usage and circular design principles, critical as the industry faces pressure to minimize its 10% share of global carbon emissions.

- Walmart and Amazon have integrated robotic induction in their private-label apparel lines, achieving 30–50% faster production cycles and reducing time-to-market by up to 60%, validating robotics as essential for competitive, agile supply chains.

- According to Global Smart Manufacturing Surveys, adoption of AI-assisted robotic design is growing over 35% annually among leading fashion houses, as systems like Lectra's Fashion On Demand and Kornit's Atlas MAX enable mass customization where 70% of consumers now demand personalized options.

- The World Economic Forum highlights that over 50% of fashion manufacturers plan to integrate robotic automation by 2030 to address supply chain volatility, with robotic inductors mitigating risks by enabling localized, responsive production hubs.

Global Robotic Fashion Inductor Market: Market Dynamic

Driving Factors in the Global Robotic Fashion Inductor Market

Rising Demand for Agile and Sustainable Manufacturing

The growing consumer and regulatory pressure for sustainable, ethical, and fast-fashion alternatives is a major driver for robotic inductor adoption. Brands are transitioning to on-demand production models to reduce overstock, minimize waste, and offer personalized products. Robotic systems enable precise, small-batch manufacturing, adaptive material handling, and efficient resource use. This reduces the carbon footprint of production and aligns with global sustainability goals. Automation also allows brands to reshore production, shortening supply chains and increasing responsiveness to market trends.

Technological Innovation and Integration

Robotic fashion inductors benefit heavily from advancements in AI, computer vision, IoT, and collaborative robotics. Modern systems feature AI-driven design-to-production software, robotic arms with tactile sensing for delicate fabrics, and fully integrated digital twin platforms that simulate and optimize production lines. Innovations in 3D robotic knitting, automated seam sealing, and smart textile manipulation allow for complex garment construction without human intervention. These technologies greatly enhance production speed, customization capability, and operational scalability, making robotic inductors essential for the future of fashion manufacturing.

Restraints in the Global Robotic Fashion Inductor Market

High Initial Investment and Integration Complexity

The significant capital required for robotic induction systems, including hardware, software, and facility retrofitting, poses a major barrier, especially for SMEs. Integration with existing legacy machinery and enterprise software (ERP, PLM) can be complex and costly. Furthermore, the need for specialized technicians to program, maintain, and operate advanced robotic cells limits widespread adoption in regions with skill gaps. Without accessible financing models, modular systems, and streamlined integration protocols, the transition to automated fashion production may remain gradual.

Regulatory and Workforce Transition Challenges

Industrial robotics regulations vary significantly across regions, affecting standardization and cross-border deployment. Safety certifications, ethical guidelines for workforce displacement, and intellectual property concerns around AI-generated designs create ambiguity. Additionally, the transition of human workers to new roles as robot supervisors or technicians requires substantial retraining programs and social support systems. In regions with strong labor protections, resistance to automation can slow adoption. For the market to scale globally, harmonized safety standards and inclusive workforce transition strategies are essential.

Opportunities in the Global Robotic Fashion Inductor Market

Expansion into Emerging Manufacturing Hubs

Emerging markets in Asia-Pacific, Latin America, and Africa represent major growth opportunities due to increasing labor costs, government incentives for industrial automation, and the growth of local fashion brands. Countries such as Vietnam, Bangladesh, India, and Mexico are investing in smart textile parks and automated production zones. The development of cost-effective, modular robotic solutions tailored for smaller factories enables scalable adoption. Partnerships between global robotics firms and local manufacturers will drive the next phase of market expansion, bringing automated production closer to raw material sources and consumer markets.

AI-Driven Hyper-Personalization and Circular Production

The integration of AI with robotic systems opens new avenues for hyper-personalized apparel at scale. From body-scanning to automated garment fitting and custom production, robots enable a new era of consumer-centric manufacturing. Furthermore, robotic systems are pivotal for circular fashion, enabling automated sorting, disassembly, and recycling of textiles. Brands and governments investing in closed-loop production systems will create sustained demand for advanced robotic inductors capable of handling diverse, recycled materials and complex remanufacturing processes.

Trends in the Global Robotic Fashion Inductor Market

Collaborative Robots (Cobots) in Apparel Assembly

Cobots are increasingly deployed alongside human workers for tasks requiring dexterity and judgment, such as intricate embellishment, fabric handling, and final assembly. These robots enhance productivity without fully replacing human labor, making automation more socially acceptable and flexible. Advances in force sensing, vision guidance, and adaptive programming allow cobots to work safely with delicate materials, supporting hybrid human-robot production lines that combine efficiency with craftsmanship.

Digital Twin and Simulation-Driven Production

Digital twin technology is revolutionizing fashion manufacturing by creating virtual replicas of entire production processes. Brands simulate robotic workflows, optimize line layouts, and predict maintenance needs before physical implementation. This reduces downtime, accelerates new product introduction, and allows for rapid reconfiguration of production lines for different garment styles. Integration of digital twins with AI enables predictive analytics for quality control and supply chain synchronization, representing a paradigm shift toward fully digital, agile manufacturing and industrial automation.

Global Robotic Fashion Inductor Market: Research Scope and Analysis

By Component Analysis

Within the Global Robotic Fashion Inductor Market, the Hardware segment clearly dominates overall market value. This dominance is driven by the high capital cost of physical robots, sewing units, vision systems, sensors, and support equipment. Hardware accounts for the largest revenue share because apparel manufacturers must make upfront investments to automate traditionally labor-intensive processes. Physical robots and robotic sewing units, in particular, represent the core of automation deployment and have long operational lifecycles, reinforcing their revenue contribution.

The Software segment, while smaller in absolute value, is the fastest-growing component. AI-based control platforms and machine vision software are increasingly critical for handling fabric variability, pattern recognition, and adaptive sewing. As automation shifts from rigid systems to intelligent, flexible production, software’s strategic importance continues to rise, though it does not yet surpass hardware in revenue share.

The Services segment plays a supportive but essential role. Installation, integration, and maintenance services are required at every stage of deployment, especially as factories retrofit legacy infrastructure. However, services remain secondary in market share because they are typically bundled with hardware and software purchases rather than purchased independently. Overall, hardware dominates today, while software drives future differentiation and growth.

By Type Analysis

Among system types, Automated Garment Assembly Systems dominate the market due to their direct impact on production efficiency, labor reduction, and throughput consistency. These systems address the most expensive and labor-intensive stages of apparel manufacturing, making them the primary focus of automation investments. Their ability to scale across large production lines secures their leading position.

Robotic Sewing & Stitching Units represent the second most significant segment, particularly in standardized apparel categories. While adoption is more technically challenging due to fabric handling complexity, these systems are increasingly deployed in controlled production environments, contributing to steady growth.

AI-Powered Design Assistants dominate from a value-chain influence perspective, though not in revenue share. They are widely adopted upstream to reduce design cycles, sampling costs, and material waste. Their dominance is strategic rather than volumetric.

Smart Textile Printing Robots dominate within digital and sustainable production use cases but remain a niche compared to assembly systems. The Others category remains fragmented and experimental. Overall, automated garment assembly systems are the clear market leaders by deployment and revenue.

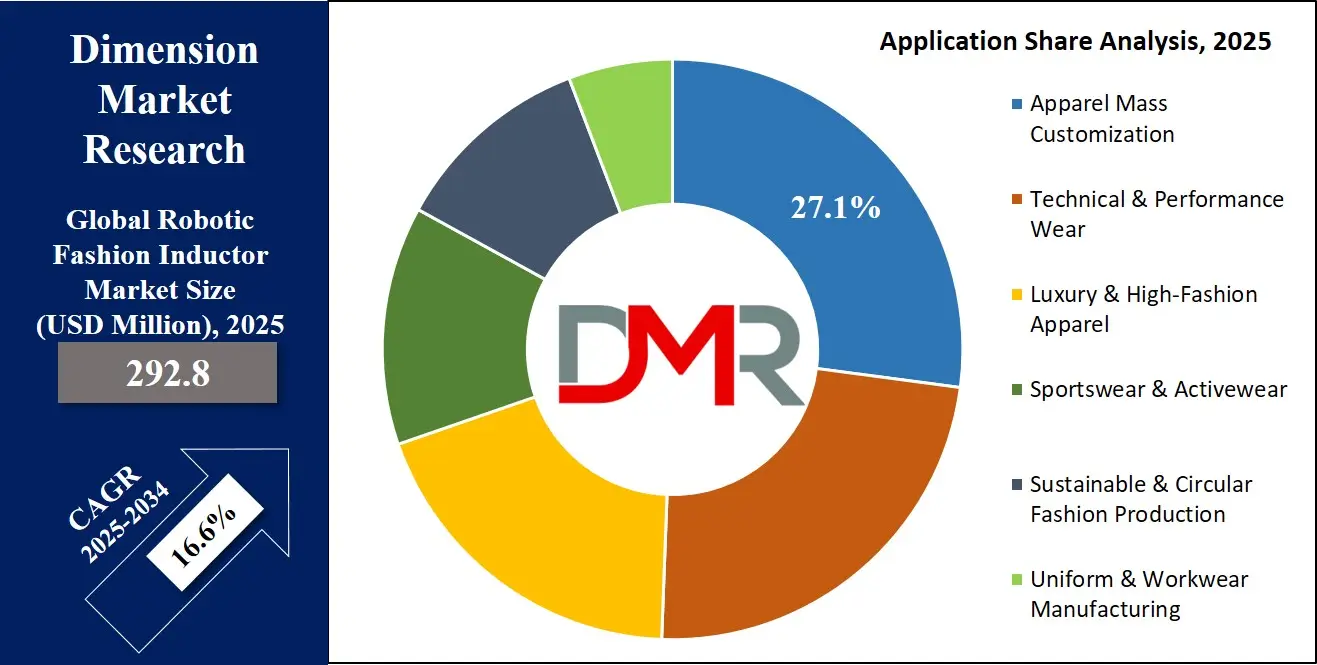

By Application Analysis

Sportswear & Activewear dominates application-level demand, driven by high production volumes, frequent design updates, and strong performance requirements. These characteristics make automation economically viable and strategically necessary. The segment’s structured designs and repeatability support faster robotic adoption.

ℹ

To learn more about this report –

Download Your Free Sample Report Here

Apparel Mass Customization is the fastest-growing application, reflecting rising consumer demand for personalized products and on-demand manufacturing. While still smaller than sportswear in revenue, it is increasingly shaping technology development priorities.

Technical & Performance Wear also commands a significant share due to precision requirements and higher margins, which justify automation investment. Luxury & High-Fashion Apparel remains selective, adopting robotics for specific processes rather than full-scale automation.

Sustainable & Circular Fashion Production is emerging rapidly, supported by regulatory pressure and ESG goals, but currently contributes a smaller share. Uniform & Workwear Manufacturing remains stable and automation-friendly due to standardization but grows at a moderate pace. Overall, sportswear and activewear dominate current demand.

By End User Analysis

Large Apparel Brands & Manufacturers dominate end-user adoption, accounting for the majority of deployed robotic fashion inductor systems. Their dominance stems from capital availability, global production networks, and long-term automation strategies focused on resilience and cost control.

Contract Manufacturers & OEMs dominate from a volume deployment perspective, as they serve multiple brands and rely on automation to maintain competitiveness. However, purchasing power and strategic direction largely remain with large brands.

Textile Mills & Integrated Producers dominate upstream adoption, particularly where vertical integration enables seamless automation across fabric and garment stages.

Fashion Tech Startups and Research Institutions & Academia play influential but limited roles, driving innovation and pilot projects rather than market volume. Overall, large apparel brands and manufacturers dominate demand and decision-making, while contract manufacturers dominate utilization.

The Global Robotic Fashion Inductor Market Report is segmented on the basis of the following:

By Component

- Hardware

- Physical Robots

- Grippers

- Sensors

- Vision Cameras

- Support Equipment

- Software

- AI-based Control Platforms

- Machine Vision

- Operating Systems

- Automation Suites

- Services

- Installation

- Integration

- Training

- Maintenance

- Consulting

By Type

- Automated Garment Assembly Systems

- AI-Powered Design Assistants

- Robotic Sewing & Stitching Units

- Smart Textile Printing Robots

- Others

By Application

- Apparel Mass Customization

- Technical & Performance Wear

- Luxury & High-Fashion Apparel

- Sportswear & Activewear

- Sustainable & Circular Fashion Production

- Uniform & Workwear Manufacturing

By End User

- Large Apparel Brands & Manufacturers

- Contract Manufacturers & OEMs

- Fashion Tech Startups

- Textile Mills & Integrated Producers

- Research Institutions & Academia

- Others

Impact of Artificial Intelligence in the Global Robotic Fashion Inductor Market

- AI for Generative Design and Pattern Optimization: AI algorithms generate efficient, waste-minimizing patterns and adapt designs based on real-time fabric properties and consumer fit data, streamlining the pre-production phase.

- AI-Driven Predictive Maintenance: AI monitors robotic cell performance, predicts component failures, and schedules maintenance, reducing unplanned downtime and extending equipment life in continuous production environments.

- Computer Vision for Automated Quality Control: AI-powered vision systems inspect fabrics for defects, verify stitch quality, and ensure color consistency at high speeds, surpassing human accuracy and reducing returns.

- AI-Enhanced Supply Chain Synchronization: AI analyzes sales data, trend forecasts, and production capacity to optimize robotic production scheduling, material procurement, and inventory levels, enabling a truly responsive supply chain.

- Adaptive Robotics through Machine Learning: Robotic systems learn from production data to improve handling techniques for new materials, adjust sewing parameters dynamically, and optimize movement paths for increased efficiency.

Global Robotic Fashion Inductor Market: Regional Analysis

Region with the Largest Revenue Share

North America is projected to dominate the Global Robotic Fashion Inductor Market, accounting for approximately 39.4% of market share by the end of 2025, driven by early adoption of advanced automation technologies, strong investment in AI-driven manufacturing, and the presence of large-scale apparel and sportswear brands. The region’s emphasis on supply-chain resilience, reshoring of apparel manufacturing, and labor cost optimization has accelerated the deployment of robotic fashion inductor systems across production facilities.

ℹ

To learn more about this report –

Download Your Free Sample Report Here

The United States leads regional adoption, supported by federal and state-level initiatives promoting smart manufacturing, digital transformation, and advanced robotics under broader Industry 4.0 and manufacturing-innovation frameworks. North America’s mature technology ecosystem enables faster integration of AI, machine vision, and robotics into apparel design, cutting, and assembly processes. Additionally, rising demand for mass customization and on-demand production among direct-to-consumer brands strengthens the business case for automation.

Region with the Highest CAGR

Asia-Pacific holds the highest CAGR and is poised to achieve significant market share growth due to its position as the world's apparel manufacturing hub, rising labor costs, and strong government pushes toward industrial automation. The region accounts for over 60% of global garment production. Countries like China, Vietnam, Bangladesh, and India are actively incentivizing smart manufacturing upgrades to maintain competitiveness. Government initiatives such as China's "Made in China 2025", India's "Make in India", and Vietnam's "Industry 4.0 Strategy" are driving massive investments in robotic production lines. The vast manufacturing base, coupled with the urgent need for efficiency and skill gap mitigation, positions APAC for explosive growth in robotic fashion inductor adoption.

By Region

North America

Europe

- Germany

- The U.K.

- France

- Italy

- Russia

- Spain

- Benelux

- Nordic

- Rest of Europe

Asia-Pacific

- China

- Japan

- South Korea

- India

- ANZ

- ASEAN

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Argentina

- Colombia

- Rest of Latin America

Middle East & Africa

- Saudi Arabia

- UAE

- South Africa

- Israel

- Egypt

- Rest of MEA

Global Robotic Fashion Inductor Market: Competitive Landscape

The Global Robotic Fashion Inductor Market is moderately fragmented, featuring a mix of established industrial robotics giants, specialized fashion tech firms, and AI software providers. Leading robotics companies Fanuc, ABB, Yaskawa, and KUKA dominate the hardware landscape with versatile robotic arms and cells increasingly tailored for textile handling. Specialized apparel automation leaders Lectra, Gerber Technology, and Shima Seiki provide integrated solutions from design to cutting and sewing.

AI-focused innovators such as Zeg.ai, Vue.ai, and True Fit influence market dynamics by offering intelligence layers for design, fit prediction, and demand forecasting that optimize robotic production. Tech giants like Siemens (with MindSphere) and Dassault Systèmes provide the digital twin and PLM backbones for automated factories.

Emerging players like Sewbo, SoftWear Automation, and Gamma Technologies are gaining traction with disruptive technologies such as water-soluble fabric stiffening for robotic handling and fully automated sewing workstations.

Some of the prominent players in the Global Robotic Fashion Inductor Market are:

- Fanuc Corporation

- ABB Ltd.

- KUKA AG

- Yaskawa Electric Corporation

- Lectra S.A.

- Gerber Technology

- Shima Seiki Mfg., Ltd.

- Siemens AG

- Dassault Systèmes

- Zeg.ai

- Vue.ai

- True Fit Corporation

- Sewbo, Inc.

- SoftWear Automation, Inc.

- Gamma Technologies

- Brother Industries, Ltd.

- Juki Corporation

- Nike, Inc. (Nike Advanced Manufacturing)

- Kornit Digital Ltd.

- Other Key Players

Recent Developments in the Global Robotic Fashion Inductor Market

- November 2025: Lectra launches "Fashion on Demand 4.0"

Lectra introduced its next-generation automated cutting and design platform, integrating deeper AI for material optimization and seamless data flow to robotic sewing cells, enhancing agility for made-to-order production.

- October 2025: Fanuc and Levi's announce pilot smart factory

Fanuc collaborated with Levi's to deploy a pilot robotic sewing line in the U.S., focusing on automated jean assembly, showcasing scalability and precision for durable apparel.

- October 2025: Siemens showcases digital twin for fashion at ITMA

Siemens presented a comprehensive digital twin solution for end-to-end robotic apparel production at ITMA 2025, emphasizing simulation, real-time monitoring, and sustainable process optimization.

- September 2025: Shima Seiki releases "WholeGarment® 3D Knit AI"

Shima Seiki launched an AI-powered 3D knitting system that autonomously adapts patterns based on yarn properties and design parameters, reducing sampling time by 70%.

- August 2025: ABB acquires SoftWear Automation

ABB completed the acquisition of SoftWear Automation to strengthen its portfolio in vision-guided robotic sewing technology, aiming to offer complete automated sewing workcells.

- July 2025: Nike expands its "Nike Advanced Manufacturing" network

Nike announced the expansion of its automated, localized manufacturing hubs incorporating robotic induction for faster sneaker and apparel production across North America and Europe.

- June 2025: ITMA Asia highlights robotic textile innovation

ITMA Asia 2025 featured extensive exhibitions on robotic fabric handling, AI-driven quality inspection, and collaborative robots for finishing, underscoring Asia's push toward fully automated mills.

- April 2025: Major brands form "Automated Fashion Alliance"

Leading brands and tech firms formed an alliance to standardize communication protocols between different robotic systems and AI platforms, promoting interoperability in smart factories.

- March 2025: EU funds "Re-Fashion" robotic recycling project

The EU launched a funded project deploying robotic arms with AI vision to autonomously sort, disassemble, and prepare post-consumer textiles for recycling, advancing circular fashion.

Report Details

| Report Characteristics |

| Market Size (2025) |

USD 292.8 Mn |

| Forecast Value (2034) |

USD 1,165.9 Mn |

| CAGR (2025–2034) |

16.6% |

| The US Market Size (2025) |

USD 97.0 Mn |

| Historical Data |

2019 – 2024 |

| Forecast Data |

2026 – 2034 |

| Base Year |

2024 |

| Estimate Year |

2025 |

| Report Coverage |

Market Revenue Estimation, Market Dynamics, Competitive Landscape, Growth Factors and etc. |

| Segments Covered |

By Component (Hardware, Software, Services), By Type (Automated Garment Assembly Systems, AI-Powered Design Assistants, Robotic Sewing & Stitching Units, Smart Textile Printing Robots, Others), By Application (Apparel Mass Customization, Technical & Performance Wear, Luxury & High-Fashion Apparel, Sportswear & Activewear, Sustainable & Circular Fashion Production, Uniform & Workwear Manufacturing), By End User (Large Apparel Brands & Manufacturers, Contract Manufacturers & OEMs, Fashion Tech Startups, Textile Mills & Integrated Producers, Research Institutions & Academia, Others) |

| Regional Coverage |

North America – The US and Canada; Europe – Germany, The UK, France, Russia, Spain, Italy, Benelux, Nordic, & Rest of Europe; Asia-Pacific – China, Japan, South Korea, India, ANZ, ASEAN, Rest of APAC; Latin America – Brazil, Mexico, Argentina, Colombia, Rest of Latin America; Middle East & Africa – Saudi Arabia, UAE, South Africa, Turkey, Egypt, Israel, & Rest of MEA |

| Prominent Players |

Fanuc Corporation, ABB Ltd., KUKA AG, Yaskawa Electric Corporation, Lectra S.A., Gerber Technology, Shima Seiki Mfg., Ltd., Siemens AG, Dassault Systèmes, Zeg.ai, Vue.ai, True Fit Corporation, Sewbo, Inc., SoftWear Automation, Inc., Gamma Technologies, Brother Industries, Ltd., Juki Corporation, Nike, Inc. (Nike Advanced Manufacturing), Kornit Digital Ltd., and Other Key Players |

| Purchase Options |

We have three licenses to opt for: Single User License (Limited to 1 user), Multi-User License (Up to 5 Users) and Corporate Use License (Unlimited User) along with free report customization equivalent to 0 analyst working days, 3 analysts working days and 5 analysts working days respectively. |

Frequently Asked Questions

How big is the Global Robotic Fashion Inductor Market?

▾ The Global Robotic Fashion Inductor Market size is estimated to have a value of USD 292.8 million in 2025 and is expected to reach USD 1,165.9 million by the end of 2034.

What is the growth rate in the Global Robotic Fashion Inductor Market?

▾ The market is growing at a CAGR of 16.6 percent over the forecasted period of 2025 to 2034.

What is the size of the US Robotic Fashion Inductor Market?

▾ The US Robotic Fashion Inductor Market is projected to be valued at USD 97.0 million in 2025. It is expected to reach USD 356.9 million in 2034 at a CAGR of 15.6%.

Which region accounted for the largest Global Robotic Fashion Inductor Market?

▾ North America is expected to have the largest market share in the Global Robotic Fashion Inductor Market with a share of about 39.4% in 2025.

Who are the key players in the Global Robotic Fashion Inductor Market?

▾ Some of the major key players are Fanuc Corporation, ABB Ltd., KUKA AG, Lectra S.A., Gerber Technology, Siemens AG, and many others.