Market Overview

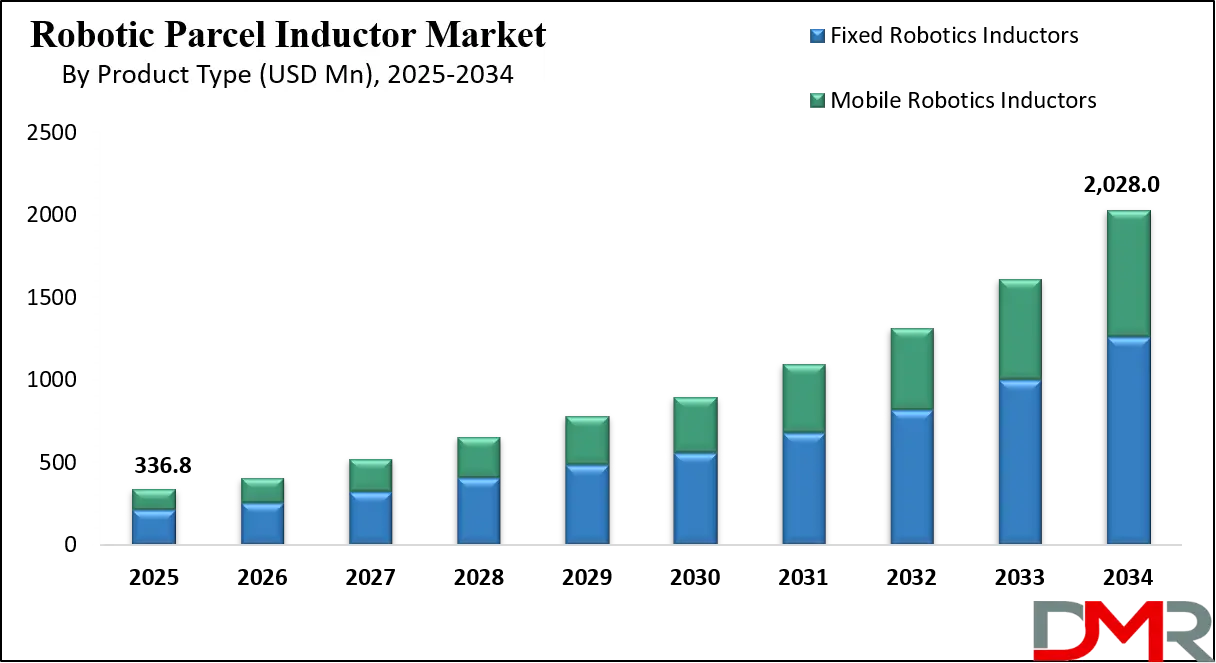

The Global Robotic Parcel Inductor Market size is projected to reach USD 336.8 million in 2025 and grow at a compound annual growth rate of 22.1% to reach a value of USD 2,028.0 million in 2034.

Robotic parcel inductor systems consist of robotics, sensors, and intelligent software that place parcels onto conveyor-based sortation lines with high speed and precision. These systems typically use fixed or mobile robotic arms combined with AI-enabled vision and automated gripping technologies to handle parcels of varying sizes, weights, and orientations. They form a critical component of modern warehouse automation and logistics operations by enabling consistent, high-throughput parcel induction while minimizing errors and manual handling, particularly in facilities managing large and diverse parcel flows.

ℹ

To learn more about this report –

Download Your Free Sample Report Here

Further, market expansion is driven by the growing need to reduce labor dependency, enhance worker safety, and improve operational efficiency within logistics and fulfillment centers. Continuous advancements in

artificial intelligence, machine learning-based path planning, and sensor-guided manipulation have significantly improved induction accuracy and cycle times. At the same time, rising labor costs and stricter workplace safety regulations are encouraging logistics operators to move beyond pilot projects toward full-scale deployment of robotic parcel inductor solutions across distribution networks.

Ongoing evolution in this space is supported by growing investments in smart logistics infrastructure and tighter integration of robotic parcel inductors with warehouse management and control systems. Collaboration between automation technology providers and logistics operators is accelerating system optimization and deployment efficiency. Increased research and development activity, along with government-backed digital infrastructure initiatives, is further strengthening the long-term adoption of robotic parcel inductor solutions within automated logistics ecosystems.

ℹ

To learn more about this report –

Download Your Free Sample Report Here

The US Robotic Parcel Inductor Market

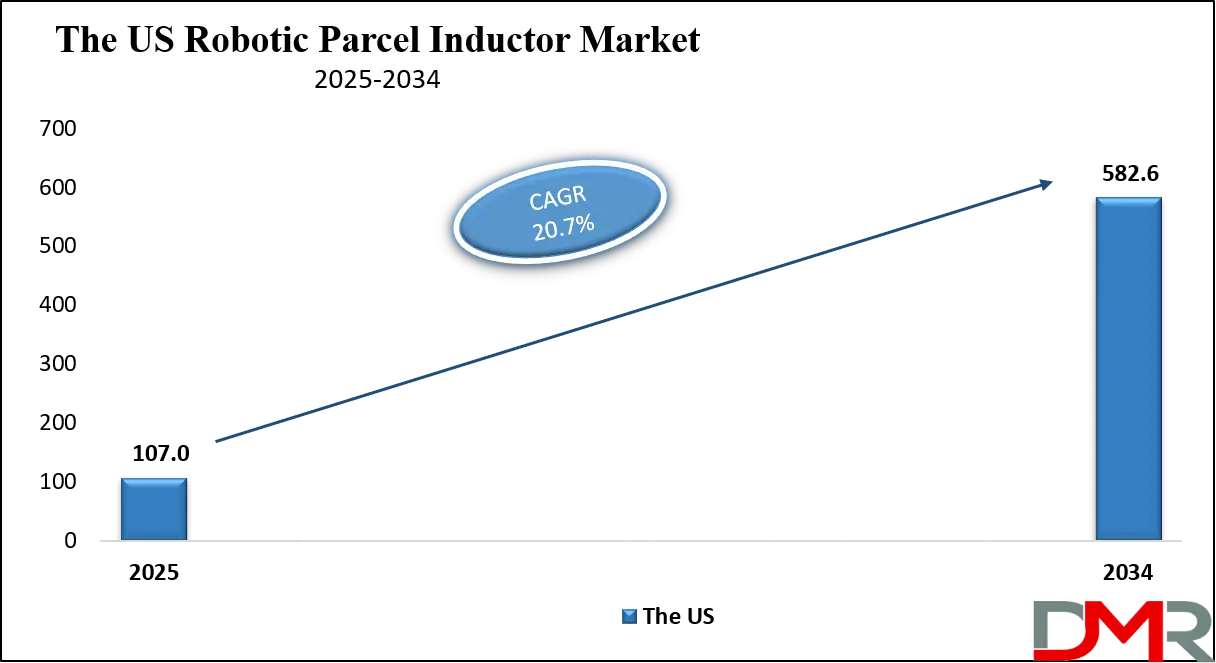

The US Robotic Parcel Inductor Market size is projected to reach USD 107.0 million in 2025 at a compound annual growth rate of 20.7% over its forecast period.

The US Robotic Parcel Inductor market is driven by a mature e-commerce ecosystem, high parcel volumes, and strong adoption of warehouse automation technologies. Large distribution centers and fulfillment hubs are increasingly deploying robotic inductors to manage peak-season demand and reduce reliance on manual labor. Government incentives for advanced manufacturing and automation, combined with rising minimum wages, further accelerate adoption. The presence of advanced logistics infrastructure, early technology adoption, and strong private-sector investment positions the US as a key contributor to market growth.

ℹ

To learn more about this report –

Download Your Free Sample Report Here

Europe Robotic Parcel Inductor Market

Europe Robotic Parcel Inductor Market size is projected to reach USD 84.2 million in 2025 at a compound annual growth rate of 21.3% over its forecast period.

Europe’s Robotic Parcel Inductor market is shaped by stringent labor regulations, sustainability goals, and digitalization initiatives such as the European Green Deal. Logistics providers are focusing on energy-efficient automation and space-optimized robotic systems. Countries like Germany, France, and the Netherlands lead adoption due to advanced warehousing networks and strong manufacturing bases. Regulatory emphasis on worker safety and carbon reduction has accelerated the deployment of automated parcel handling solutions across cross-border logistics and postal services.

Japan Robotic Parcel Inductor Market

Japan Robotic Parcel Inductor Market size is projected to reach USD 23.6 million in 2025 at a compound annual growth rate of 22.7% over its forecast period.

Japan’s Robotic Parcel Inductor market benefits from advanced robotics expertise, high urban parcel density, and acute labor shortages due to an aging population. The fastest-growing sectors include urban fulfillment centers and postal logistics. Government initiatives supporting smart factories and logistics automation encourage widespread adoption. While high initial costs pose challenges, Japan’s focus on precision engineering, compact system design, and reliability creates strong opportunities for robotic induction technologies.

Robotic Parcel Inductor Market: Key Takeaways

- Market Growth: The Robotic Parcel Inductor Market size is expected to grow by USD 1,624.4 million, at a CAGR of 22.1%, during the forecasted period of 2026 to 2034.

- By Product Type: The fixed robotics inductors segment is anticipated to get the majority share of the Robotic Parcel Inductor Market in 2025.

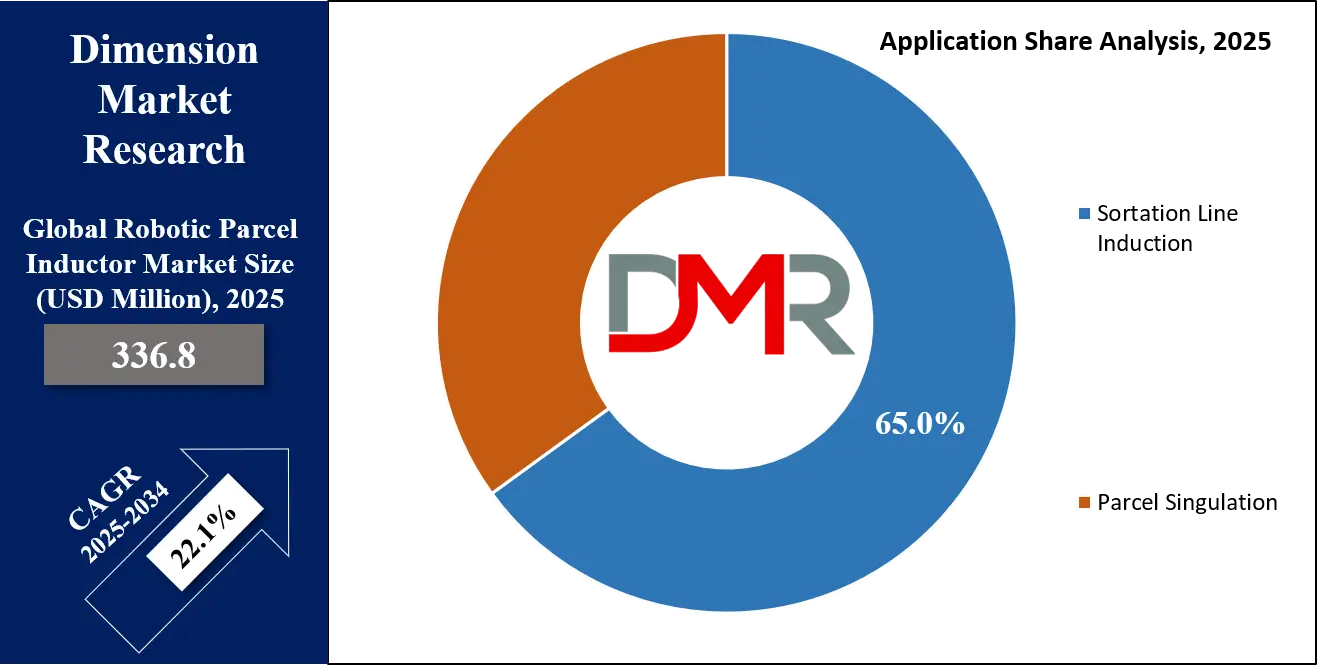

- By Application: The sortation line induction segment is expected to get the largest revenue share in 2025 in the Robotic Parcel Inductor Market.

- Regional Insight: North America is expected to hold a 38.0% share of revenue in the Global Robotic Parcel Inductor Market in 2025.

- Use Cases: Some of the use cases of Robotic Parcel Inductor include labor-constrained warehouse, and more.

Robotic Parcel Inductor Market: Use Cases

- High-Speed E-Commerce Fulfillment: Robotic inductors enable rapid parcel induction during peak sales events, reducing bottlenecks and improving order turnaround times.

- Labor-Constrained Warehouses: Facilities use robotic inductors to address labor shortages and minimize repetitive manual tasks.

- Postal & Courier Operations: Automated induction supports consistent handling of mixed parcel flows with high accuracy.

- Brownfield Warehouse Upgrades: Robotic inductors retrofit into existing sortation lines to enhance throughput without major layout changes.

Stats & Facts

- U.S. Bureau of Labor Statistics reported in 2024 that logistics automation adoption reduced manual material handling roles by 18% year-over-year.

- Eurostat stated in 2025 that automated parcel handling systems improved warehouse productivity across the EU by 22%.

- Japan Ministry of Economy, Trade and Industry indicated in 2024 that robotics deployment in logistics grew by 26% annually.

- U.S. Department of Commerce recorded in 2025 that e-commerce parcel volumes exceeded 21 million units nationwide.

- European Commission noted in 2024 that automation investments in logistics surpassed EUR 18 million.

Market Dynamic

Driving Factors in the Robotic Parcel Inductor Market

Growth of E-Commerce and Parcel Volumes

The exponential growth of e-commerce has significantly increased parcel volumes, pushing logistics operators to adopt robotic parcel inductors. Consumers demand faster deliveries, higher accuracy, and real-time tracking, which manual induction systems struggle to support. Robotic induction systems provide consistent speed, reduced error rates, and scalability during peak periods. As online retail penetration continues to rise globally, logistics networks increasingly rely on automated induction to maintain service-level agreements and operational resilience.

Labor Shortages and Rising Costs

Persistent labor shortages and rising wage pressures are major drivers of robotic parcel inductor adoption. Warehousing and logistics roles often involve repetitive tasks that lead to high turnover. Robotic inductors reduce dependency on human labor, improve worker safety, and offer predictable operational costs. Companies increasingly view automation as a long-term cost-optimization strategy, particularly in regions facing demographic shifts and workforce constraints.

Restraints in the Robotic Parcel Inductor Market

High Initial Capital Investment

Robotic parcel inductors require significant upfront investment, including hardware, software integration, and infrastructure upgrades. Small and mid-sized warehouses often struggle to justify these costs despite long-term efficiency gains. Additionally, installation downtime and integration complexity may delay return on investment, limiting adoption among cost-sensitive operators.

Technical Integration Challenges

Integrating robotic inductors with legacy warehouse management and sortation systems can be complex. Compatibility issues, customization requirements, and limited in-house technical expertise can slow deployment. These challenges may discourage operators from transitioning away from semi-automated or manual induction processes.

Opportunities in the Robotic Parcel Inductor Market

Expansion in Emerging Logistics Hubs

Emerging economies and developing logistics hubs present significant growth opportunities for robotic parcel inductors. Rapid urbanization, growing e-commerce penetration, and infrastructure investments create demand for automated parcel handling. Early adoption in these regions allows logistics providers to build scalable and future-ready operations.

Government Support for Automation

Government incentives, tax benefits, and smart infrastructure programs support automation adoption across logistics and warehousing. Policies promoting Industry 4.0, digital supply chains, and workforce safety create favorable conditions for robotic parcel inductor deployment, particularly in developed markets.

Trends in the Robotic Parcel Inductor Market

Integration of AI and Machine Learning

AI-powered vision systems and machine learning algorithms are increasingly integrated into robotic parcel inductors. These technologies enhance object recognition, adaptive gripping, and real-time decision-making, allowing systems to handle diverse parcel profiles with minimal human intervention.

Shift Toward Modular and Mobile Systems

The market is witnessing a shift toward modular and mobile robotic inductors that offer flexibility and scalability. Mobile systems allow rapid reconfiguration of warehouse layouts, while modular designs reduce installation time and costs, supporting both greenfield and brownfield deployments.

Impact of Artificial Intelligence in Robotic Parcel Inductor Market

- AI-Based Vision: Enhances parcel identification and orientation accuracy.

- Predictive Analytics: Optimizes throughput and prevents system bottlenecks.

- Adaptive Gripping: Enables handling of irregular and fragile parcels.

- Autonomous Learning: Improves system efficiency over time.

- Real-Time Monitoring: Enhances operational transparency and uptime.

Research Scope and Analysis

By Product Type Analysis

Fixed robotic inductors dominate the market because they are specifically designed for continuous, high-speed parcel handling in large-scale distribution and fulfillment centers, accounting for nearly 62% of total market share in 2025. These systems are permanently installed along sortation lines and operate with high reliability, making them suitable for environments with consistent, high parcel volumes such as e-commerce mega-fulfillment hubs and national postal sorting facilities.

Their dominance is further reinforced by advanced payload handling capabilities, AI-enabled vision systems, and precise robotic control that allow efficient induction of parcels with diverse sizes and weights. Seamless integration with conveyor systems, warehouse control software, and sortation equipment ensures minimal downtime and maximum throughput. Long operational life, predictable performance, and strong return on investment continue to make fixed robotic inductors the preferred choice for large logistics operators.

Mobile robotic inductors represent the fastest-growing segment as logistics operators increasingly seek flexibility and scalability within dynamic warehouse environments. Unlike fixed systems, these inductors can be easily redeployed across multiple induction points, making them particularly valuable for facilities experiencing seasonal demand fluctuations or frequent layout changes. Their growth is driven by lower installation complexity, reduced infrastructure modification requirements, and faster deployment timelines compared to permanently installed systems.

Mobile robotic inductors support modular automation strategies, allowing warehouses to scale capacity incrementally rather than through large upfront investments. Advances in navigation systems, sensor fusion, and battery performance have improved their reliability and operational uptime. As distribution centers prioritize agility and space optimization, mobile robotic inductors are gaining strong traction, especially among mid-sized and rapidly expanding logistics operations.

By Automation Level Analysis

Fully automated robotic parcel induction systems lead the market, capturing approximately 68% of total market share in 2025, as logistics providers increasingly pursue end-to-end automation. These systems operate with minimal human involvement, delivering consistent induction accuracy, higher throughput, and uninterrupted operations across multiple shifts. Their dominance is supported by rapid advancements in artificial intelligence, robotic precision, and system reliability, which significantly reduce operational errors and labor dependency.

Fully automated systems integrate seamlessly with warehouse management and control platforms, enabling real-time monitoring, predictive maintenance, and adaptive performance optimization. Although initial investment costs are higher, long-term operational savings, improved safety, and scalability make fully automated systems the preferred option for high-volume facilities aiming to meet tight delivery timelines and service-level agreements.

Semi-automated systems are experiencing rapid growth, particularly among mid-sized warehouses and logistics operators transitioning gradually toward full automation. These systems combine robotic assistance with human oversight, offering a balanced approach that improves productivity while keeping capital expenditure manageable. Semi-automated solutions are attractive for companies that require flexibility or are operating within existing infrastructure constraints.

They help reduce repetitive manual tasks, improve induction consistency, and enhance worker safety without requiring a complete overhaul of warehouse operations. As businesses seek phased automation strategies to manage risk and costs, semi-automated systems continue to gain adoption, serving as an important stepping stone toward fully automated parcel handling environments.

By Technology Analysis

AI-based vision and object recognition technology dominates the market, holding approximately 54% share in 2025 due to its essential role in accurate parcel identification and handling. These systems enable robotic parcel inductors to recognize parcel size, shape, orientation, barcodes, and surface characteristics in real time, ensuring precise placement onto sortation lines. Enhanced vision accuracy reduces mis-induction, minimizes jams, and improves overall system throughput.

Continuous improvements in deep learning algorithms and high-resolution imaging have expanded the ability to handle irregular, damaged, or non-standard parcels. As logistics networks increasingly manage diverse parcel profiles driven by e-commerce, AI-based vision technology remains a core requirement, reinforcing its leading position in the robotic parcel inductor market.

Machine learning-based path planning is one of the fastest-growing technology segments as operators seek intelligent systems that dynamically optimize robotic movement. This technology allows robotic inductors to continuously learn from operational data, adjusting motion paths to reduce cycle times, avoid collisions, and improve overall efficiency.

It supports adaptive decision-making based on parcel flow variability, system congestion, and real-time operational conditions. As warehouses aim to maximize throughput without expanding physical footprints, machine learning path planning becomes increasingly valuable. Its ability to enhance speed, reduce mechanical wear, and improve energy efficiency makes it a critical enabler of next-generation robotic parcel induction systems.

By Deployment Analysis

Greenfield installations dominate deployment models, accounting for nearly 60% of market share in 2025, as newly built logistics facilities adopt automation-first design strategies. These projects allow robotic parcel inductors to be integrated from the initial planning stage, enabling optimal layout, system alignment, and software connectivity.

Greenfield environments support higher system efficiency, smoother commissioning, and better long-term scalability. Logistics companies increasingly favor this approach to future-proof operations, reduce retrofitting costs, and support high automation density. The ability to design facilities around robotic workflows strengthens throughput performance and ensures seamless integration with sortation, storage, and warehouse management systems.

Brownfield retrofits are expanding rapidly as existing warehouses upgrade operations to remain competitive in high-demand logistics markets. These deployments focus on integrating robotic parcel inductors into legacy infrastructure with minimal disruption. Advances in modular system design and flexible software interfaces have significantly improved retrofit feasibility. As many operators seek cost-effective modernization rather than new construction, brownfield retrofits present strong growth opportunities for robotic induction solutions.

By End Use Industry Analysis

E-commerce and online retail dominate end-use adoption, holding approximately 58% market share in 2025 due to massive parcel volumes and strict delivery timelines. Robotic parcel inductors play a critical role in managing peak demand during sales events and seasonal surges while maintaining speed and accuracy. These systems help online retailers reduce order processing time, minimize errors, and improve customer satisfaction. High SKU diversity and variable parcel profiles further drive adoption, as robotic inductors provide consistent performance where manual processes struggle. The continued expansion of online shopping ensures sustained demand from this segment.

3PL and courier services represent the fastest-growing end-use segment as service providers invest heavily in automation to meet client expectations. Robotic parcel inductors enable these operators to handle diverse parcel streams efficiently, improve service reliability, and maintain competitive pricing. Growth is driven by rising outsourcing of logistics functions and increased parcel volumes across regional and cross-border networks.

By Application Analysis

Sortation line induction dominates application usage, accounting for approximately 65% of market share in 2025, as it is central to high-speed parcel distribution operations. Robotic inductors feeding directly into sortation lines ensure consistent spacing, orientation, and flow, which is essential for cross-belt and tilt-tray sorter performance. High throughput requirements and the need to minimize downstream disruptions make robotic induction indispensable in this application. As parcel volumes continue to grow, automated sortation line induction remains the primary focus for investment.

Parcel singulation is growing rapidly as automation expands upstream in warehouse workflows. Robotic singulation systems separate parcels from bulk flows before induction, improving overall system efficiency. Increasing adoption reflects the push toward fully automated, end-to-end parcel handling environments.

ℹ

To learn more about this report –

Download Your Free Sample Report Here

The Robotic Parcel Inductor Market Report is segmented on the basis of the following:

By Product Type

- Fixed Robotics Inductors

- Mobile Robotics Inductors

By Automation Level

- Semi-Automated Systems

- Fully Automated Systems

By Technology

- AI-Based Vision & Object Recognition

- Sensor-Guided Manipulation

- Machine Learning Path Planning

By Deployment

- Greenfield Installations

- Brownfield Retrofits

By End-Use Industry

- E-Commerce & Online Retail

- 3PL & Courier Services

- Warehousing & Distribution Centers

- Postal Services

By Application

- Parcel Singulation

- Sortation Line Induction

- Cross-Belt Sorters

- Tilt-Tray Sorters

Regional Analysis

Leading Region in the Robotic Parcel Inductor Market

North America leads the robotic parcel inductor market, accounting for approximately 38% of global market share in 2025, driven by its advanced logistics infrastructure and high level of automation adoption. The region benefits from a well-established e-commerce ecosystem that generates massive parcel volumes requiring fast, accurate, and scalable handling solutions. Strong investment in warehouse automation, early adoption of AI-driven robotics, and widespread integration of smart warehouse technologies support market leadership.

Supportive government policies promoting advanced manufacturing, digital infrastructure, and workplace safety further encourage automation deployment. In addition, the availability of a skilled technical workforce enables rapid system implementation and maintenance. Logistics operators in North America prioritize efficiency, operational resilience, and scalability, ensuring continued dominance as parcel volumes and customer delivery expectations continue to rise.

ℹ

To learn more about this report –

Download Your Free Sample Report Here

Fastest Growing Region in the Robotic Parcel Inductor Market

Asia-Pacific represents the fastest-growing region in the robotic parcel inductor market due to rapid e-commerce expansion, accelerating urbanization, and strong government-backed automation initiatives. Countries across the region are witnessing sharp increases in online shopping, resulting in rising parcel volumes and the need for high-throughput logistics infrastructure.

Significant investments in smart logistics hubs, automated distribution centers, and digital supply chain platforms are driving demand for robotic parcel inductors. Government programs supporting Industry 4.0, robotics adoption, and smart cities further accelerate growth. Additionally, increasing labor shortages in urban areas and rising wage levels are pushing logistics operators toward automation. The combination of scale, speed of adoption, and infrastructure development positions Asia-Pacific as the key growth engine for the market.

By Region

North America

Europe

- Germany

- The U.K.

- France

- Italy

- Russia

- Spain

- Benelux

- Nordic

- Rest of Europe

Asia-Pacific

- China

- Japan

- South Korea

- India

- ANZ

- ASEAN

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Argentina

- Colombia

- Rest of Latin America

Middle East & Africa

- Saudi Arabia

- UAE

- South Africa

- Israel

- Egypt

- Rest of MEA

Competitive Landscape

The competitive landscape is characterized by high entry barriers due to technological complexity and capital requirements. Market participants focus on continuous innovation, modular system design, and long-term service contracts to maintain market position. Strategic partnerships, R&D investments, and system customization are key strategies to address diverse operational needs and enhance customer retention.

Some of the prominent players in the global Robotic Parcel Inductor are:

- Dematic

- Vanderlande Industries

- Honeywell

- Beumer Group

- Siemens

- Daifuku

- Interroll Group

- ABB

- KUKA

- FANUC

- Yaskawa Electric

- Swisslog

- SSI Schaefer

- KNAPP

- TGW Logistics

- Körber

- Fives Group

- Murata Machinery

- Amazon

- Geek+

- Other Key Players

Recent Developments

- In September 2024, SSI Schaefer reaffirmed its focus on innovation by announcing significant strategic investments into advanced robotics research and development, particularly emphasizing modular automation platforms that enhance flexibility across warehouse operations. While detailed financial terms and specific product plans were not publicly disclosed, the initiative aligns with the company’s broader strategy of enabling scalable, customer-centric automation solutions that can be tailored to dynamic fulfillment requirements.

- In March 2024, Daifuku Co., Ltd. launched an AI-enabled robotic parcel induction solution tailored for high-speed sortation environments, aiming to boost throughput and cut error rates at major distribution centers. This system integrates advanced vision technologies and intelligent control software to rapidly and accurately place parcels onto sortation lines, addressing operational bottlenecks common in large e-commerce and logistics facilities. The launch emphasizes better proved adaptability to diverse parcel types and enhanced interaction with warehouse control systems, making it suitable for complex sorting tasks that demand precision and scalability.

Report Details

| Report Characteristics |

| Market Size (2025) |

USD 336.8 Mn |

| Forecast Value (2034) |

USD 2,028.0 Mn |

| CAGR (2025–2034) |

22.1% |

| The US Market Size (2025) |

USD 107.0 Mn |

| Historical Data |

2019 – 2023 |

| Forecast Data |

2026 – 2034 |

| Base Year |

2024 |

| Estimate Year |

2025 |

| Report Coverage |

Market Revenue Estimation, Market Dynamics, Competitive Landscape, Growth Factors, etc. |

| Segments Covered |

By Product Type (Fixed Robotics Inductors and Mobile Robotics Inductors), By Automation Level (Semi-Automated Systems and Fully Automated Systems), By Technology (AI-Based Vision & Object Recognition, Sensor-Guided Manipulation, and Machine Learning Path Planning), By Deployment (Greenfield Installations, and Brownfield Retrofits), By End-Use Industry (E-Commerce & Online Retail, 3PL & Courier Services, Warehousing & Distribution Centers, and Postal Services), By Application (Parcel Singulation and Sortation Line Induction) |

| Regional Coverage |

North America – US, Canada; Europe – Germany, UK, France, Russia, Spain, Italy, Benelux, Nordic, Rest of Europe; Asia-Pacific – China, Japan, South Korea, India, ANZ, ASEAN, Rest of APAC; Latin America – Brazil, Mexico, Argentina, Colombia, Rest of Latin America; Middle East & Africa – Saudi Arabia, UAE, South Africa, Turkey, Egypt, Israel, Rest of MEA |

| Prominent Players |

Dematic, Vanderlande Industries, Honeywell, Beumer Group, Siemens, Daifuku, Interroll Group, ABB, KUKA, FANUC, Yaskawa Electric, Swisslog, SSI Schaefer, KNAPP, TGW Logistics, Körber, Fives Group, Murata Machinery, Amazon, Geek+, and Other Key Players |

| Purchase Options |

We have three licenses to opt for: Single User License (Limited to 1 user), Multi-User License (Up to 5 Users), and Corporate Use License (Unlimited User) along with free report customization equivalent to 0 analyst working days, 3 analysts working days, and 5 analysts working days respectively. |

Frequently Asked Questions

How big is the Global Robotic Parcel Inductor Market?

▾ The Global Robotic Parcel Inductor Market size is expected to reach a value of USD 336.8 million in 2025 and is expected to reach USD 2,028.0 million by the end of 2034.

Which region accounted for the largest Global Robotic Parcel Inductor Market?

▾ North America is expected to have the largest market share in the Global Robotic Parcel Inductor Market, with a share of about 38.0% in 2025.

How big is the Robotic Parcel Inductor Market in the US?

▾ The Robotic Parcel Inductor Market in the US is expected to reach USD 107.0 million in 2025.

Who are the key players in the Robotic Parcel Inductor Market?

▾ Some of the major key players in the Global Robotic Parcel Inductor Market include Siemens, ABB, KUKA, and others

What is the growth rate in the Global Robotic Parcel Inductor Market?

▾ The market is growing at a CAGR of 22.1 percent over the forecasted period.