Market Overview

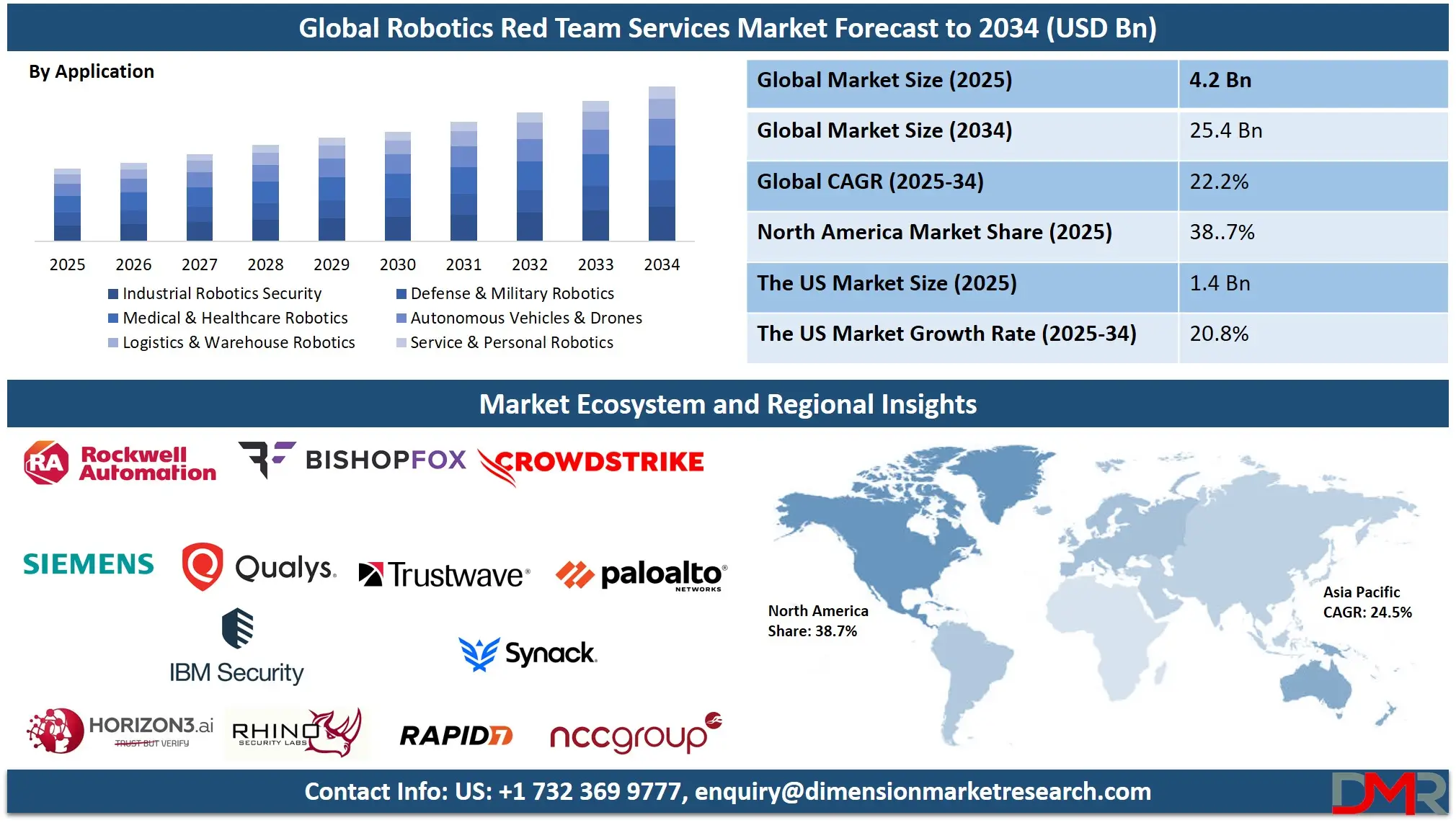

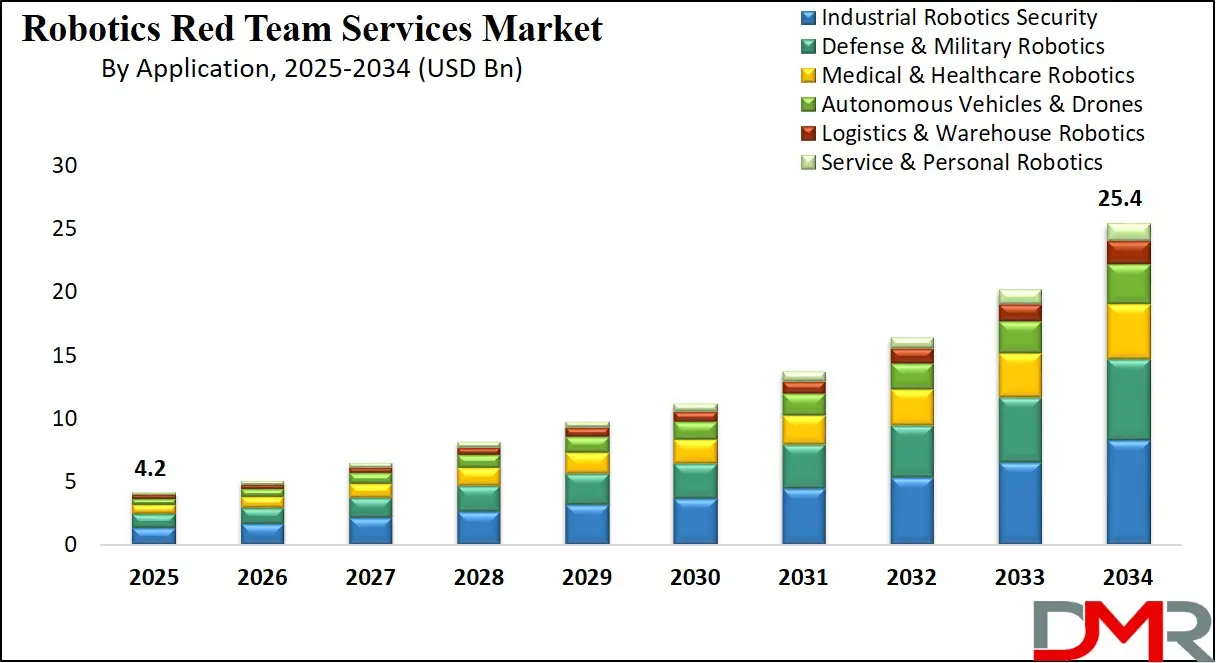

The Global Robotics Red Team Services Market is valued at USD 4.2 billion in 2025 and is expected to grow at a CAGR of 22.4% from 2025 to 2034, attaining a value of USD 25.4 billion by 2034. The market's rapid growth is driven by the escalating sophistication of cyber-physical threats, increasing integration of robotics in critical infrastructure, and stringent regulatory mandates for security validation.

ℹ

To learn more about this report –

Download Your Free Sample Report Here

Robotics Red Team services enable proactive security assessment through simulated adversarial attacks, vulnerability discovery, and resilience testing of robotic systems, supporting organizations in manufacturing, healthcare, logistics, and defense where operational continuity is paramount. The model addresses global challenges related to ransomware, data exfiltration, and operational sabotage, affecting over 70% of industrial organizations worldwide, and helps prevent catastrophic failures through rigorous security hardening.

Technological advancements, including AI-driven attack simulation, autonomous penetration testing platforms, IoT/OT security convergence tools, and cloud-based threat intelligence feeds, are transforming the market into a scalable and essential security ecosystem. Integration of machine learning algorithms for anomaly detection, behavioral analysis, and predictive threat modeling is reshaping defensive postures.

ℹ

To learn more about this report –

Download Your Free Sample Report Here

Growing government initiatives promoting critical infrastructure protection, national cybersecurity strategies, and industry-specific compliance frameworks further accelerate global adoption. However, barriers such as shortage of skilled red team professionals, high cost of advanced testing platforms, evolving regulatory landscapes, and integration complexities with legacy systems remain. Despite these limitations, the convergence of cybersecurity, AI innovation, and robotic system modernization positions Robotics Red Team services as a central driver of global operational resilience through 2034.

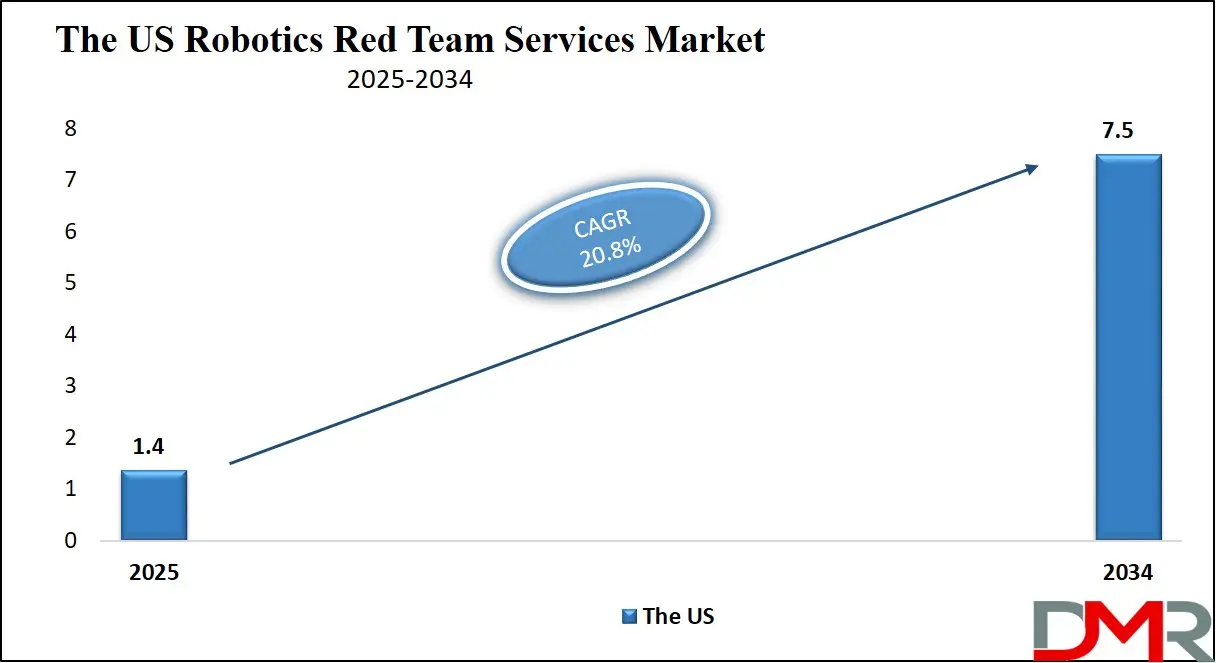

The US Robotics Red Team Services Market

The U.S. Robotics Red Team Services Market is estimated to be valued USD 1.4 billion in 2025 and grow at a CAGR of 20.8%, reaching USD 7.5 billion by 2034. The U.S. leads global adoption due to its advanced cybersecurity ecosystem, high concentration of robotic deployments in defense and industry, and stringent regulatory requirements from entities like CISA, NIST, and DoD.

More than 60% of U.S. manufacturing and logistics firms now utilize industrial robots, fueling demand for security validation against supply chain attacks and ransomware. Federal agencies and defense contractors are scaling red team assessments across autonomous systems, drones, and robotic process automation (RPA). Major corporations and system integrators such as Boston Dynamics, Lockheed Martin, and Amazon Robotics have integrated continuous adversarial testing into their development lifecycles.

ℹ

To learn more about this report –

Download Your Free Sample Report Here

U.S. regulatory and compliance pressure is expanding, with frameworks like NIST SP 800-53, CMMC, and FDA guidelines for medical robots mandating independent security assessments. National initiatives such as the DoD’s "Hack the Pentagon" and similar bug bounty programs have demonstrated the effectiveness of adversarial simulations in identifying critical vulnerabilities.

The rapid rise of autonomous red teaming platforms, AI-fuzzing tools, and integrated DevSecOps pipelines continues to redefine the U.S. robotics security landscape, positioning the country as a global leader in cyber-physical security innovation.

The Europe Robotics Red Team Services Market

The Europe Robotics Red Team Services Market is projected to be valued at approximately USD 520 million in 2025 and is projected to reach around USD 3,150 million by 2034, growing at a CAGR of about 22.0% from 2025 to 2034. Europe's leadership is anchored by strong regulatory frameworks like the EU Cybersecurity Act, NIS2 Directive, and GDPR, alongside region-wide initiatives for industrial and healthcare robotics security.

Countries such as Germany, the U.K., France, Italy, and the Nordic region have widely adopted red teaming programs, driven by national cybersecurity agencies and insurance mandates. The German BSI and ENISA actively promote red team exercises for critical infrastructure operators, including automotive and pharmaceutical robotics.

Europe’s advanced manufacturing base (Industry 4.0), increasing adoption of surgical and service robots, and shortage of cybersecurity talent in the robotics domain further drive red team services uptake. Funding through the Digital Europe Programme, Horizon Europe, and national cyber strategies supports the adoption of AI in threat simulation and automated penetration testing.

Industrial and healthcare organizations increasingly deploy specialized red teams to test collaborative robots (cobots), autonomous guided vehicles (AGVs), and robotic surgical systems. With strong regulatory governance, digital maturity, and investment in cyber resilience, Europe remains one of the most advanced regions in proactive robotics security.

The Japan Robotics Red Team Services Market

The Japan Robotics Red Team Services Market is anticipated to be valued at approximately USD 185 million in 2025 and is expected to attain nearly USD 1,250 million by 2034, expanding at a CAGR of about 23.8% during the forecast period. Japan's leadership in robotics manufacturing and adoption from industrial automation to humanoid robots drives high demand for security assurance against nation-state and cybercriminal threats.

The Ministry of Economy, Trade and Industry (METI) and National Center of Incident Readiness and Strategy for Cybersecurity (NISC) actively support red teaming adoption through national robotics security guidelines, enabling adversarial testing of critical systems. Japan's leadership in robotics hardware, AI, and IoT accelerates innovation in specialized testing tools for robotic operating systems (ROS) and embedded controllers.

Japan's concept of "Society 5.0", driven by companies like FANUC, Yaskawa, and SoftBank Robotics, integrates robotics deeply into social infrastructure, necessitating robust security validation. Urban smart city projects and rural automation initiatives use red team services to stress-test public-facing robotic systems. Japan's cultural emphasis on precision engineering and risk mitigation, combined with cutting-edge robotics, positions the country as a high-growth innovator in red team security services.

Global Robotics Red Team Services Market: Key Takeaways

- Strong Global Market Growth Outlook: The Global Robotics Red Team Services Market is expected to be valued at USD 4.2 billion in 2025 and is projected to reach USD 25.4 billion by 2034, showcasing rapid expansion supported by rising cyber-physical threats and regulatory compliance demands.

- High CAGR Driven by Security Validation Needs: The market is expected to grow at an impressive CAGR of 22.2% from 2025 to 2034, fueled by accelerated robotics integration, AI-driven attack sophistication, and mandatory security assessment requirements worldwide.

- Strong Growth Trajectory in the United States: The U.S. Robotics Red Team Services Market stands at USD 1.4 billion in 2025 and is projected to reach USD 7.5 billion by 2034, expanding at a CAGR of 20.8% due to robust regulatory frameworks and deep integration of red teaming into defense and industrial procurement.

- North America Maintains Regional Dominance: North America is expected to capture approximately 38.7% of the global market share in 2025, supported by advanced cybersecurity infrastructure, high incident prevalence, early adoption of autonomous red teaming, and strong government contracting.

- Rapid Advancement in Red Teaming Technologies: Innovations including AI-powered attack simulation, automated vulnerability discovery, hardware-in-the-loop testing, and cloud-based adversary emulation platforms are significantly accelerating the scope, depth, and scalability of robotics security assessments.

- Growing Sophistication of Threats Boosts Adoption: Rising global prevalence of ransomware targeting OT/ICS, supply chain compromises, adversarial AI attacks, and geopolitical cyber-kinetic threats is driving sustained demand for proactive, adversarial security testing of robotic systems.

Global Robotics Red Team Services Market: Use Cases

- Industrial Robot Penetration Testing: Red teams simulate attacks on robotic arms, AGVs, and control systems in manufacturing plants to identify vulnerabilities that could cause production stoppage or safety incidents.

- Medical Robotics Security Validation: Adversarial testing of surgical robots, pharmacy automation, and diagnostic robots in healthcare settings to ensure patient safety and data integrity against cyber intrusion.

- Autonomous Vehicle Security Assessment: Red teaming of self-driving car systems, drones, and unmanned aerial vehicles (UAVs) to evaluate resilience against sensor spoofing, network attacks, and takeover attempts.

- Defense & Military Robotics Testing: Evaluation of tactical robots, unmanned ground vehicles (UGVs), and autonomous systems in simulated combat and surveillance scenarios to harden against enemy cyber capabilities.

- Logistics & Warehouse Robotics Assessment: Security testing of automated sorting, picking, and delivery robots to protect against disruptions in supply chain and e-commerce operations.

Global Robotics Red Team Services Market: Stats & Facts

- The World Economic Forum (WEF) states that cyber-physical attacks on critical infrastructure have increased by over 300% since 2020, with robotics systems being a prime target, reinforcing how red team services through simulated attacks can prevent operational disasters.

- The Industrial Cyber Threat Intelligence (ICTI) reports that over 70% of industrial organizations experienced a robotics or OT-focused cyber incident in 2024, driving red team adoption as proactive testing reduces breach likelihood by up to 65%.

- The U.S. CISA notes that red team exercises identified critical vulnerabilities in 85% of tested robotic systems, enabling pre-emptive patches and reducing potential incident response costs by up to 90%, validating red teams as essential for resilient operations.

- The International Federation of Robotics (IFR) highlights that over 3.5 million industrial robots will be operational globally by 2025, intensifying the attack surface and the need for continuous adversarial security validation.

- According to Global Cybersecurity Surveys, demand for specialized robotics red team professionals is growing over 40% annually, as 60% of organizations lack internal expertise, driving outsourced service adoption.

- The MITRE ATT&CK® for ICS framework has been expanded to include robotics-specific tactics and techniques, used by red teams globally to emulate advanced persistent threats (APTs) against automated systems.

Market Dynamic

Driving Factors in the Global Robotics Red Team Services Market

Escalating Cyber-Physical Threat Landscape

The growing sophistication of malware targeting robotic operating systems, ransomware against industrial robots, and nation-state attacks on critical automation is a major driver for red team services adoption. Increased connectivity and IT/OT convergence significantly expand the attack surface. Meanwhile, the rise of adversarial AI and swarm attack capabilities necessitates advanced offensive security testing. Red team services expand security validation capacity, enabling early vulnerability discovery via simulated attacks and adversarial analysis. This reduces the risk of operational disruption and minimizes security gaps, especially in safety-critical environments. Proactive identification of weaknesses through red teaming can prevent catastrophic failures, reduce financial losses, and ensure compliance across global industries.

Regulatory Pressure and Compliance Requirements

Robotics Red Team services benefit heavily from stringent and evolving global regulations mandating independent security assessments. Standards such as NIST CSF, IEC 62443, ISO/SAE 21434, and EU NIS2 require evidence of proactive penetration testing and resilience validation. Mandates from defense, healthcare, and automotive sectors specifically call for adversarial testing of autonomous and robotic systems. Compliance drives investment in red team engagements as a necessary cost of doing business, integrating security into the robotic system lifecycle from design through deployment. These regulatory tailwinds greatly enhance market legitimacy, urgency, and scalability, making red team services an indispensable element of modern robotics risk management.

Restraints in the Global Robotics Red Team Services Market

Shortage of Skilled Professionals and High Costs

Many organizations lack internal expertise in both robotics engineering and advanced offensive security, creating a talent gap that limits red team service scalability. Specialized red teaming requires knowledge of embedded systems, control networks, robotics software (ROS), and AI/ML security, which is rare and costly. The high expense of advanced simulation platforms, lab environments, and ongoing training further restricts adoption, particularly for SMEs. In regions where cybersecurity talent is scarce, red team programs often struggle to achieve depth and continuity. Without significant investment in education, training, and tool automation, the demand for skilled red teamers will outstrip supply, constraining market growth.

Integration and Operational Disruption Concerns

Integrating red team exercises into live operational environments (OT) carries inherent risks of unintended downtime, system instability, or data corruption. Many organizations, especially in 24/7 manufacturing or healthcare, are hesitant to authorize invasive testing that might disrupt production or patient care. The complexity of coordinating tests across IT, OT, and engineering teams can be a significant barrier. Furthermore, the proprietary nature of many robotic systems can limit test access and the ability to deploy standard security tools. For red team services to scale without resistance, the development of safer, non-disruptive testing methodologies and clearer governance models is essential.

Opportunities in the Global Robotics Red Team Services Market

AI-Augmented Autonomous Red Teaming Platforms

The emergence of AI-driven platforms that can autonomously plan, execute, and adapt attack simulations presents a major opportunity. These platforms use machine learning to model adversary behavior, discover novel attack paths, and generate tailored exploits for specific robotic systems. They can operate at scale, continuously, and with minimal human intervention, addressing the skills shortage. Integration of these platforms into CI/CD pipelines (Robotics DevSecOps) allows for continuous security validation. As AI in offensive security matures, the market for automated, intelligent red teaming tools and managed services will see exponential growth, particularly among cloud-native robotics developers and large-scale operators.

Expansion into Emerging Robotics Verticals

Emerging markets for robotics in agriculture, construction, retail, and smart cities represent major growth opportunities due to their nascent security postures and increasing connectivity. These verticals often lack dedicated cybersecurity resources, creating demand for outsourced red team expertise. The proliferation of small and medium-sized robots (drones, service robots) in these sectors expands the need for cost-effective, scalable testing solutions. Government initiatives promoting smart infrastructure and agri-tech further drive adoption. As robotics becomes ubiquitous, red team services will expand beyond traditional industrial and defense sectors, driving the next phase of market expansion.

Trends in the Global Robotics Red Team Services Market

Convergence of IT, OT, and Physical Security Testing

Red teams are increasingly adopting a unified approach that combines traditional IT network penetration testing with OT/ICS security assessment and physical security exploitation (e.g., lock picking, badge cloning, sensor spoofing). This holistic "purple teaming" trend recognizes that attacking a robotic system often requires breaching multiple layers cyber, physical, and human. Testing scenarios now commonly involve gaining physical access to a robot, tampering with its sensors, and then moving laterally into the corporate network, or vice-versa. This trend demands broader skill sets and closer collaboration between security disciplines, making comprehensive red team services more valuable.

Threat Intelligence-Driven Red Teaming

Red team exercises are increasingly informed by and tailored to real-world threat intelligence. Instead of generic attacks, services now emulate specific adversary groups (APTs), their known tools, techniques, and procedures (TTPs), and their likely targets within the robotics domain. This intelligence-led approach ensures tests are relevant, realistic, and focused on the most probable and dangerous threats. The integration of commercial and open-source threat feeds into red team planning tools allows for dynamic scenario creation. This trend enhances the strategic value of red teaming, moving it from a compliance checkbox to a core component of threat-informed defense.

Global Robotics Red Team Services Market: Research Scope and Analysis

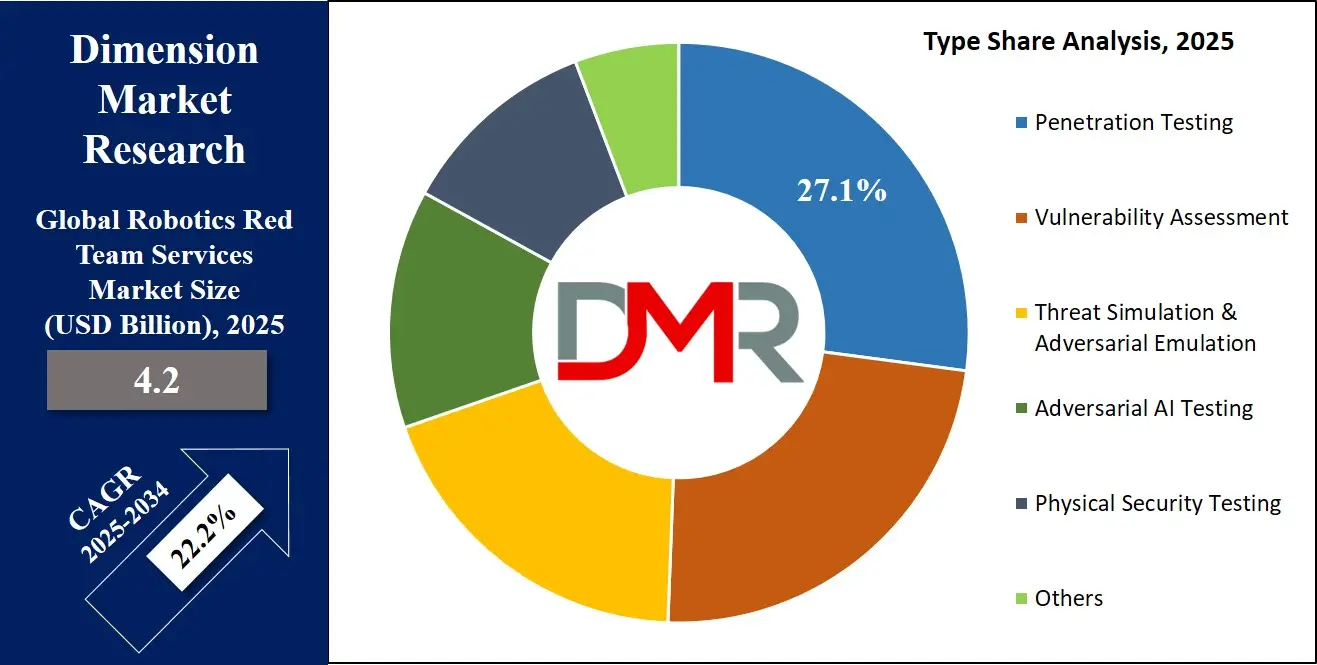

By Type Analysis

Penetration Testing is projected to dominate the global market due to its fundamental role in identifying exploitable vulnerabilities in robotic software, networks, and firmware. It involves active exploitation attempts to gauge real-world attack impact, making it a cornerstone of security validation. This service is mandated by numerous compliance frameworks and is integral to security lifecycles across defense, manufacturing, and healthcare. Its dominance is reinforced by the widespread need to test robotic applications, APIs, control interfaces, and communication protocols against common and advanced attack vectors.

ℹ

To learn more about this report –

Download Your Free Sample Report Here

Because it provides actionable findings and proof-of-concept exploits, penetration testing directly informs remediation priorities. AI-enabled platforms further enhance this segment by automating vulnerability discovery and exploitation, scaling testing coverage. Its essential role in procurement acceptance testing and periodic security audits strengthens its market leadership. As robotics systems grow in complexity and connectivity, the demand for deep, adversarial penetration testing will continue to hold the largest market share through 2034.

By Application Analysis

Industrial Robotics Security is poised to be the largest and most dominant application segment, accounting for the highest share globally. With millions of industrial robots deployed in automotive, electronics, and logistics, the financial and operational impact of a breach is immense. Security testing here focuses on preventing production sabotage, safety system manipulation, and intellectual property theft. This segment's dominance is reinforced by stringent industry standards (IEC 62443), high attack frequency, and the critical nature of manufacturing continuity.

AI solutions capable of fuzzing PLC code and simulating supply chain attacks dramatically increase testing efficiency. Because a compromise can lead to physical damage and extended downtime, industrial operators prioritize rigorous red teaming, making it a major focus within security budgets. The synergy between specialized OT red team skills, automated testing tools, and integrated safety-security workflows ensures Industrial Robotics Security retains the largest market share through the forecast period.

Defense & Military Robotics ranks as the second-largest application segment due to the sensitive nature of the systems and the advanced capabilities of threat actors. Red teaming here is vital for ensuring mission resilience against adversarial nation-states.

By End User Analysis

Manufacturing & Industrial is anticipated to dominate the market because it is the primary adopter of robotics and faces acute cyber-physical risks. This sector houses complex automated production lines, cobots, and AGVs whose disruption causes immediate financial loss. Red team services integrate into plant security programs, safety certifications, and global supply chain security mandates. Manufacturing firms frequently serve as the initial adopters and reference cases for advanced red teaming methodologies.

The need for compliance with industry-specific regulations, protection of proprietary processes, and prevention of catastrophic safety incidents further strengthens this sector's dominance. With increasing digital transformation and the rise of smart factories, industrial networks are expanding their red team programs to cover entire production ecosystems, making Manufacturing & Industrial the largest and most essential end-user segment.

Healthcare & Medical Devices is the second-largest end-user segment due to the life-critical nature of surgical robots, lab automation, and patient-assistive robots. Security failures can directly impact patient safety and data privacy.

The Global Robotics Red Team Services Market Report is segmented on the basis of the following:

By Type

- Penetration Testing

- Vulnerability Assessment

- Threat Simulation & Adversarial Emulation

- Adversarial AI Testing

- Physical Security Testing

- Others

By Application

- Industrial Robotics Security

- Defense & Military Robotics

- Medical & Healthcare Robotics

- Autonomous Vehicles & Drones

- Logistics & Warehouse Robotics

- Service & Personal Robotics

By End User

- Manufacturing & Industrial

- Healthcare & Medical Devices

- Defense & Government

- Logistics & E-commerce

- Automotive & Transportation

- Technology & Service Providers

Impact of Artificial Intelligence in the Global Robotics Red Team Services Market

- AI for Automated Attack Path Discovery: AI analyzes system architectures and configurations to automatically identify and chain vulnerabilities, generating novel attack paths that human testers might overlook, drastically improving test coverage and efficiency.

- AI-Driven Adversarial Simulation: AI models emulate sophisticated adversary behaviors, adapting tactics in real-time during exercises to mimic APTs, making red team engagements more realistic and challenging for defenders.

- AI-Powered Fuzzing for Robotic Software: AI enhances fuzzing tools to intelligently generate malformed inputs for robotic APIs, control messages, and sensor data streams, discovering deeper, more complex software flaws.

- Autonomous Red Teaming Agents: AI agents conduct continuous, autonomous security testing in development and staging environments, integrating security validation directly into the Robotics DevSecOps pipeline.

- AI for Post-Exploitation Analysis & Reporting: AI assists in correlating findings, prioritizing risks based on impact and exploitability, and automatically generating detailed, actionable reports, reducing analyst workload.

Robotics Red Team Services Market: Regional Analysis

Region with the Largest Revenue Share

North America is projected to dominate the Global Robotics Red Team Services Market with 38.7% of market share by the end of 2025, owing to a powerful combination of advanced robotics adoption, mature cybersecurity industry, strong regulatory pressure, and significant defense spending. The United States and Canada have deeply integrated security testing into technology procurement and operational risk management, supported by national cybersecurity strategies, sector-specific mandates, and a high concentration of robotics innovators and end-users.

ℹ

To learn more about this report –

Download Your Free Sample Report Here

The region has one of the highest rates of industrial and military robotics deployment, driving demand for adversarial security validation. Red team services allow manufacturers, healthcare providers, and government agencies to proactively manage escalating threats, supported by a vast ecosystem of specialized cybersecurity firms. North America's strong culture of bug bounty programs and government-contracted red teaming (e.g., through DoD and DHS) is one of the most significant reasons for dominance. A well-developed market for managed security services, including red teaming, makes adoption operationally and financially viable for organizations of all sizes.

Region with the Highest CAGR

Asia-Pacific holds the highest CAGR and is poised to achieve the largest market share in red team services due to its massive and rapid robotics industrialization, increasing cybersecurity awareness, and strong government-driven digital security initiatives. The region accounts for over 70% of the world's industrial robot installations, with China, Japan, and South Korea leading global manufacturing automation. This creates enormous demand for security validation to protect economic assets.

Asia-Pacific faces critical shortages of cybersecurity talent, especially for specialized OT/ICS and robotics security, driving demand for expert managed services. Many countries are implementing national cybersecurity laws and promoting public-private partnerships to secure critical infrastructure, including automated systems.

Government programs significantly accelerate adoption. China's cybersecurity law and focus on industrial internet security, Japan's NISC directives, and India's National Cybersecurity Strategy promote proactive testing. APAC governments increasingly endorse red team exercises as a cornerstone of cyber resilience for national infrastructure projects and smart city initiatives.

By Region

North America

Europe

- Germany

- The U.K.

- France

- Italy

- Russia

- Spain

- Benelux

- Nordic

- Rest of Europe

Asia-Pacific

- China

- Japan

- South Korea

- India

- ANZ

- ASEAN

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Argentina

- Colombia

- Rest of Latin America

Middle East & Africa

- Saudi Arabia

- UAE

- South Africa

- Israel

- Egypt

- Rest of MEA

Robotics Red Team Services Market: Competitive Landscape

The Global Robotics Red Team Services Market is moderately fragmented, driven by a diverse ecosystem of pure-play cybersecurity firms, specialized offensive security boutiques, robotics integrators, and broad-spectrum consulting firms. Leading cybersecurity technology firms CrowdStrike, Palo Alto Networks, IBM Security, and Secureworks dominate the landscape with advanced threat intelligence platforms, managed detection and response (MDR) services, and expanding red team offerings tailored for OT and robotics.

Specialized offensive security innovators such as Synack, Bishop Fox, Cobalt.io, and NCC Group significantly influence market dynamics by offering crowdsourced penetration testing, adversarial emulation, and dedicated IoT/OT red team services. Their solutions provide scalable, on-demand expertise, making them essential partners for organizations lacking internal capabilities.

Robotics and industrial automation leaders like Siemens, Rockwell Automation, and ABB are expanding their service portfolios to include security assessment and red teaming for their own platforms and customer deployments. Meanwhile, emerging niche players Rhino Security Labs, Horizon3.ai, and SCADAfence strengthen market penetration with automated attack simulation platforms and deep expertise in industrial and robotic system security.

Some of the prominent players in the Global Robotics Red Team Services Market are:

- CrowdStrike Holdings, Inc.

- Palo Alto Networks, Inc.

- IBM Security

- Secureworks (Dell Technologies)

- Synack, Inc.

- Bishop Fox

- NCC Group plc

- Rapid7, Inc.

- Trustwave Holdings, Inc.

- Qualys, Inc.

- Rhino Security Labs

- Horizon3.ai

- SCADAfence

- Siemens AG

- Rockwell Automation, Inc.

- ABB Ltd.

- Kaspersky Lab

- FireEye, Inc. (Trellix)

- Bugcrowd Inc.

- Cobalt.io

- Other Key Players

Recent Developments in the Global Robotics Red Team Services Market

- November 2025: CrowdStrike introduced Falcon OverWatch for Robotics, a managed threat hunting and red team service specifically for autonomous and robotic systems. The AI-enabled platform supports continuous adversary emulation, improving threat detection in industrial and healthcare robotic environments.

- October 2025: Siemens presented its expanded industrial red team service and automated penetration testing platform at the S4x25 conference. Demonstrations emphasized adversarial simulation against PLCs, robotic cells, and OT networks, aimed at transforming security validation for critical infrastructure.

- October 2025: Black Hat Europe 2025 featured major discussions on offensive security for robotics, covering adversarial AI, firmware exploitation, and safety system bypasses. Global experts emphasized the growing role of specialized red teams in securing the cyber-physical convergence.

- September 2025: Synack's crowdsourced security platform received a pivotal contract with the U.S. Department of Defense for adversarial testing of tactical unmanned systems. The deployment strengthens the security of deployed military robotics through scalable, elite researcher-based assessments.

- August 2025: Palo Alto Networks completed the acquisition of a specialized robotics security startup to expand its Unit 42 threat intelligence and consulting services. The merger integrates advanced robotic OS testing tools and expertise, reinforcing leadership in OT/IoT offensive security.

- July 2025: IBM Security partnered with Boston Dynamics to integrate continuous red team testing into the development lifecycle of its Spot and Stretch robots. The collaboration enables proactive vulnerability discovery and strengthens security posture for enterprise deployments.

- June 2025: RSA Conference 2025 highlighted emerging trends in autonomous red teaming agents, hardware security testing for robots, and regulations driving market growth. Industry leaders and government officials discussed scaling security validation for next-generation autonomous systems.

Report Details

| Report Characteristics |

| Market Size (2025) |

USD 4.2 Bn |

| Forecast Value (2034) |

USD 25.4 Bn |

| CAGR (2025–2034) |

22.2% |

| The US Market Size (2025) |

USD 1.4 Bn |

| Historical Data |

2019 – 2024 |

| Forecast Data |

2026 – 2034 |

| Base Year |

2024 |

| Estimate Year |

2025 |

| Report Coverage |

Market Revenue Estimation, Market Dynamics, Competitive Landscape, Growth Factors and etc. |

| Segments Covered |

By Type (Penetration Testing, Vulnerability Assessment, Threat Simulation & Adversarial Emulation, Adversarial AI Testing, Physical Security Testing, Others), By Application (Industrial Robotics Security, Defense & Military Robotics, Medical & Healthcare Robotics, Autonomous Vehicles & Drones, Logistics & Warehouse Robotics, Service & Personal Robotics), By End User (Manufacturing & Industrial, Healthcare & Medical Devices, Defense & Government, Logistics & E-commerce, Automotive & Transportation, Technology & Service Providers) |

| Regional Coverage |

North America – The US and Canada; Europe – Germany, The UK, France, Russia, Spain, Italy, Benelux, Nordic, & Rest of Europe; Asia-Pacific – China, Japan, South Korea, India, ANZ, ASEAN, Rest of APAC; Latin America – Brazil, Mexico, Argentina, Colombia, Rest of Latin America; Middle East & Africa – Saudi Arabia, UAE, South Africa, Turkey, Egypt, Israel, & Rest of MEA |

| Prominent Players |

CrowdStrike Holdings, Inc., Palo Alto Networks, Inc., IBM Security, Secureworks (Dell Technologies), Synack, Inc., Bishop Fox, NCC Group plc, Rapid7, Inc., Trustwave Holdings, Inc., Qualys, Inc., Rhino Security Labs, Horizon3.ai, SCADAfence, Siemens AG, Rockwell Automation, Inc., ABB Ltd., Kaspersky Lab, FireEye, Inc. (Trellix), Bugcrowd Inc., Cobalt.io, and Other Key Players |

| Purchase Options |

We have three licenses to opt for: Single User License (Limited to 1 user), Multi-User License (Up to 5 Users) and Corporate Use License (Unlimited User) along with free report customization equivalent to 0 analyst working days, 3 analysts working days and 5 analysts working days respectively. |

Frequently Asked Questions

How big is the Global Robotics Red Team Services Market?

▾ The Global Robotics Red Team Services Market size is estimated to have a value of USD 4.2 billion in 2025 and is expected to reach USD 25.4 billion by the end of 2034.

What is the growth rate in the Global Robotics Red Team Services Market in 2025?

▾ The market is growing at a CAGR of 22.4 percent over the forecasted period of 2025.

What is the size of the US Robotics Red Team Services Market?

▾ The US Robotics Red Team Services Market is projected to be valued at USD 1.4 billion in 2025. It is expected to witness subsequent growth in the upcoming period as it holds USD 7.5 billion in 2034 at a CAGR of 20.8%.

Which region accounted for the largest Global Robotics Red Team Services Market?

▾ North America is expected to have the largest market share in the Global Robotics Red Team Services Market with a share of about 38.7% in 2025.

Who are the key players in the Global Robotics Red Team Services Market?

▾ Some of the major key players in the Global Robotics Red Team Services Market are CrowdStrike Holdings, Inc., Palo Alto Networks, Inc., IBM Security, Secureworks, Synack, Inc., NCC Group plc, and many others.