Market Overview

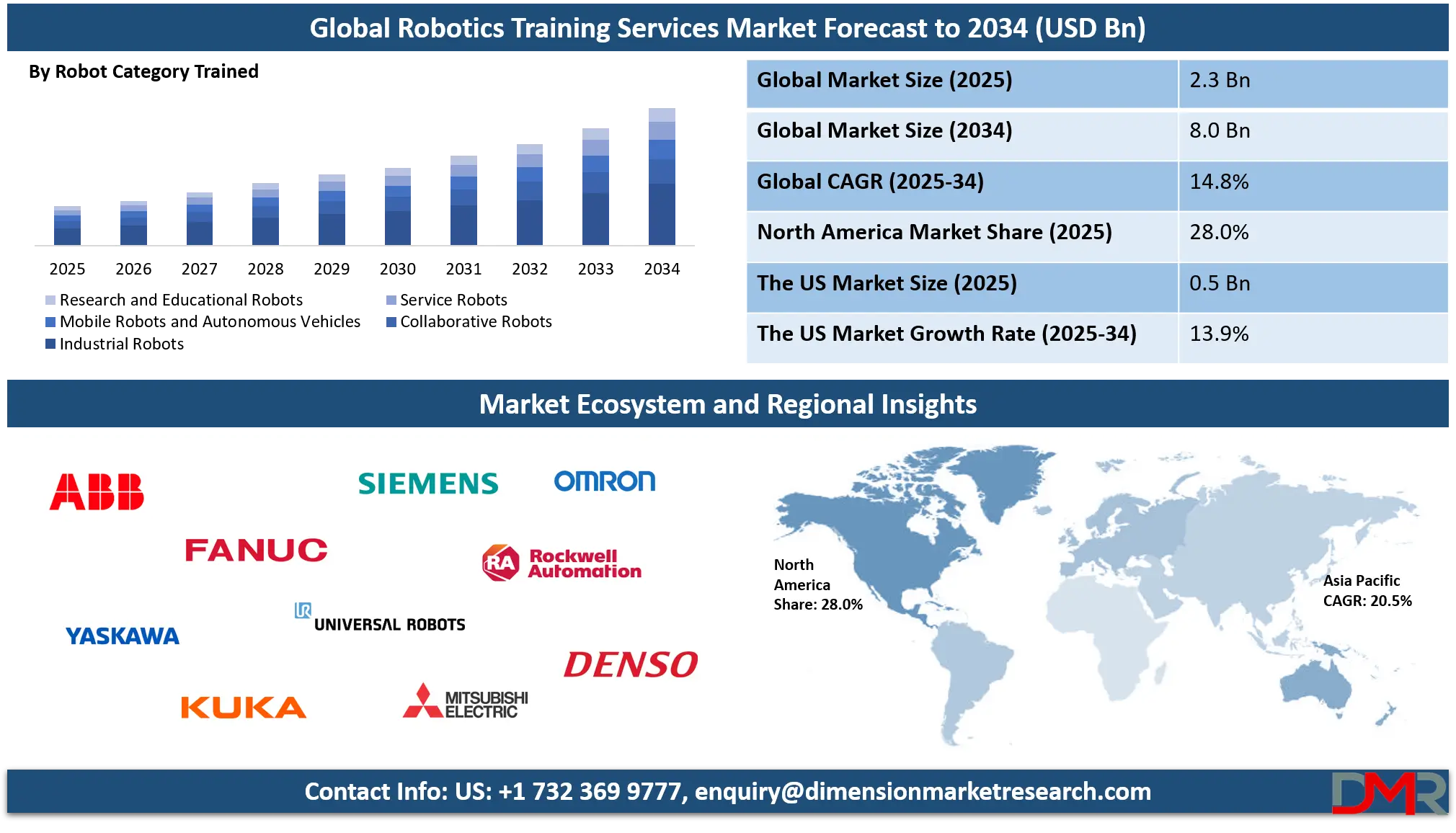

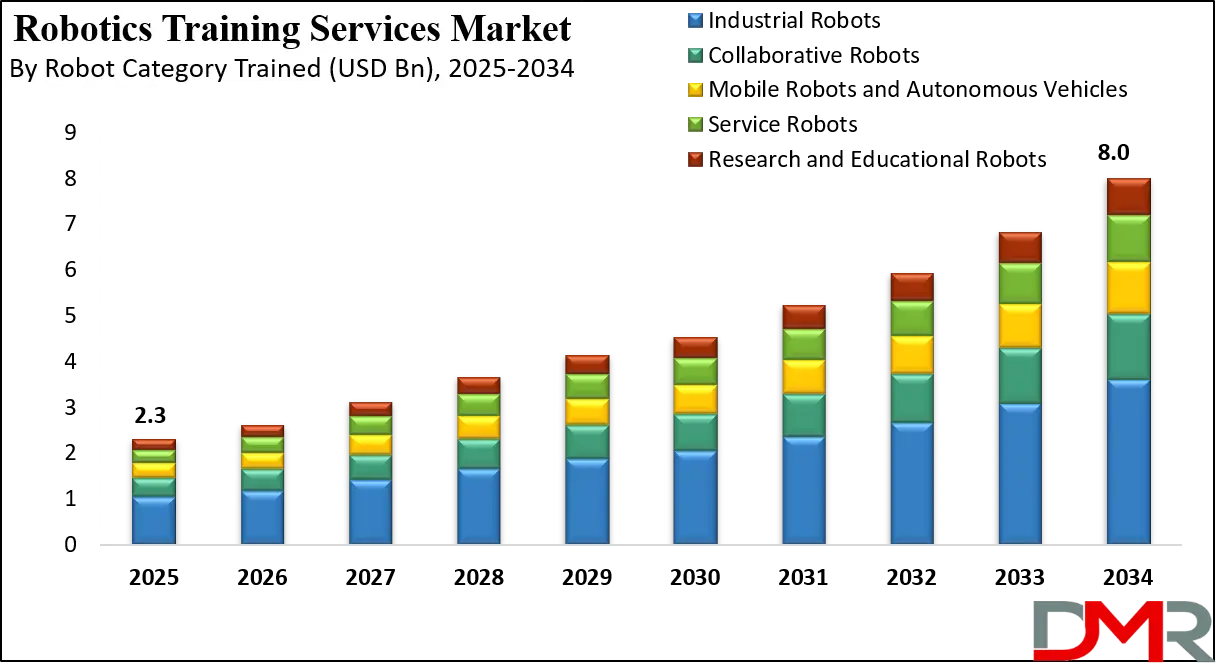

The Global Robotics Training Services Market was valued at USD 2.3 billion in 2025 and is projected to reach USD 8.0 billion by 2034, growing at a CAGR of 14.8%, driven by rising industrial automation, robotics skill development, digital learning platforms, and increasing adoption of collaborative and industrial robots worldwide.

Robotics Training Services refers to the professional education, skill development, and hands on instruction provided to individuals and organizations for the effective use, programming, maintenance, and optimization of robotic systems across industrial and service environments. These services cover a wide range of learning formats including classroom instruction, digital learning platforms, simulation based training, and onsite operational coaching. The objective is to ensure that operators, technicians, engineers, and system integrators can safely deploy robots, manage automated workflows, troubleshoot performance issues, and maximize productivity while complying with safety and quality standards across manufacturing, logistics, healthcare, and research applications.

ℹ

To learn more about this report –

Download Your Free Sample Report Here

The global Robotics Training Services Market represents the combined demand and supply of structured learning programs that support the worldwide deployment of robotic automation across industries. As companies increasingly adopt industrial robots, collaborative robots, and autonomous systems, the need for skilled personnel has become critical to avoid operational downtime and inefficiencies.

This market includes training delivered by robot manufacturers, automation solution providers, specialized training institutes, and digital learning platforms that focus on robotics programming, control systems, machine vision, and automation software. Growth is driven by rapid factory automation, smart manufacturing initiatives, and the rising use of robotics in non-industrial sectors such as healthcare, retail, and warehousing.

At a global level, the Robotics Training Services Market is shaped by technological advancements in artificial intelligence, machine learning, and industrial internet of things which require continuous workforce upskilling. Regions with strong manufacturing bases and logistics networks are investing heavily in workforce development to support robotics driven transformation.

The market also benefits from government backed skill development programs, partnerships between educational institutions and robotics companies, and the expansion of online training platforms that make robotics education more accessible worldwide. As automation becomes a core part of business operations, robotics training is evolving into a long term strategic investment rather than a one time learning activity.

ℹ

To learn more about this report –

Download Your Free Sample Report Here

The US Robotics Training Services Market

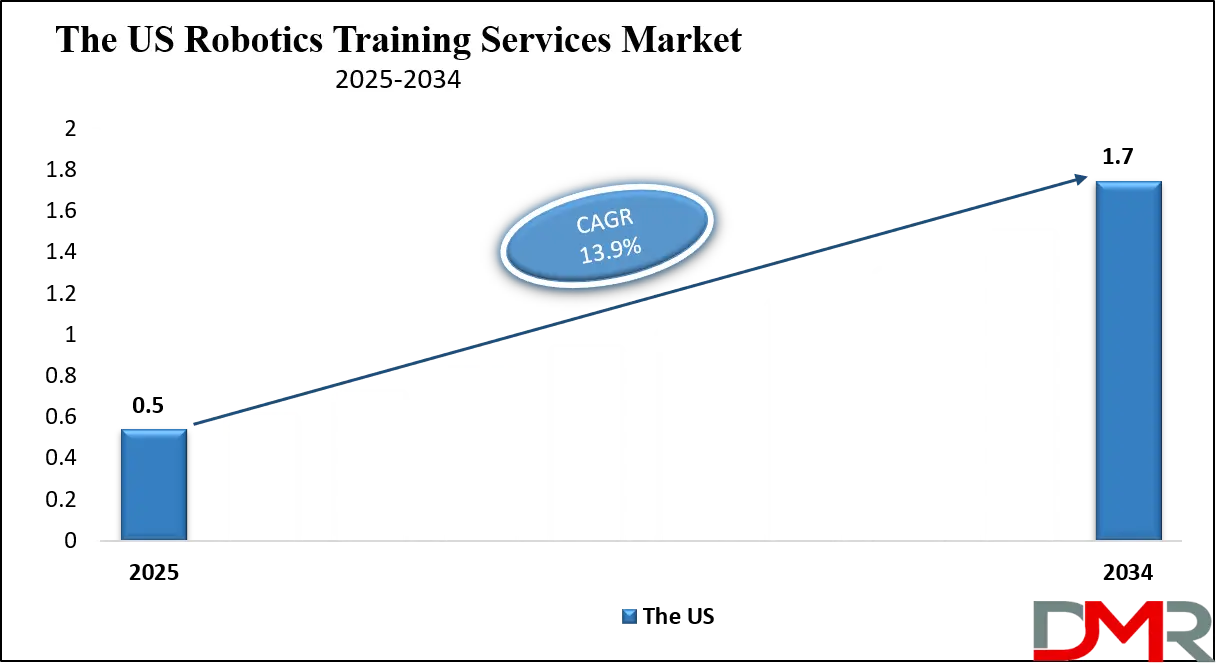

The U.S. Robotics Training Services market size was valued at USD 0.5 billion in 2025. It is further expected to witness subsequent growth in the upcoming period, holding USD 1.7 billion in 2034 at a CAGR of 13.9%.

The US Robotics Training Services market is driven by rapid adoption of automation across manufacturing, logistics, healthcare, and defense sectors, creating a strong demand for skilled robotics professionals. As companies deploy industrial robots, collaborative robots, and autonomous systems to improve productivity and operational efficiency, the need for structured training programs has become essential. Training providers in the US offer a mix of classroom based learning, online platforms, and hands on workshops that focus on robot programming, safety compliance, maintenance, and system integration, enabling organizations to reduce downtime and improve automation performance.

The market also benefits from strong government and private sector investments in workforce development and advanced manufacturing initiatives. Universities, technical institutes, and robotics manufacturers collaborate to deliver certification programs and specialized courses in areas such as artificial intelligence, machine vision, and industrial automation software. The presence of leading robotics suppliers and technology companies further strengthens the ecosystem by providing updated training aligned with the latest robotic platforms. As automation expands into warehouses, medical facilities, and smart factories, robotics training services in the US continue to gain strategic importance.

ℹ

To learn more about this report –

Download Your Free Sample Report Here

Europe Robotics Training Services Market

The Europe Robotics Training Services market was valued at USD 368 million in 2025, reflecting strong adoption of industrial automation and workforce upskilling initiatives across the region. Countries such as Germany, France, and the UK are leading the demand due to their advanced manufacturing bases, widespread deployment of industrial robots, and emphasis on smart factory solutions. Training programs in Europe focus on operator skills, maintenance, programming, and safety compliance, ensuring that employees can effectively manage and optimize automated production processes while adhering to stringent regulatory standards.

The market is projected to grow at a compound annual growth rate of 13.6%, driven by increasing investments in Industry 4.0, collaborative robots, and digital learning platforms. European companies are also leveraging AI-enabled simulators and online training solutions to scale workforce development efficiently. Partnerships between robotics manufacturers, educational institutions, and training providers further enhance skill development opportunities, supporting the region’s long-term competitiveness in industrial automation and robotics deployment.

Japan Robotics Training Services Market

The Japan Robotics Training Services market was valued at USD 276 million in 2025, reflecting the country’s strong robotics manufacturing ecosystem and early adoption of automation technologies. Japanese industries, particularly automotive, electronics, and precision manufacturing, rely heavily on industrial robots, collaborative robots, and advanced automation systems, creating substantial demand for operator, technician, and programming training. Robotics training programs in Japan focus on safety, maintenance, system integration, and programming skills to ensure high productivity, minimal downtime, and adherence to strict operational standards across factories and logistics centers.

The market is expected to grow at a compound annual growth rate of 12.5%, supported by continued investment in smart factories, AI-enabled automation, and workforce upskilling initiatives. Training providers are increasingly offering simulation-based learning, digital platforms, and corporate on-site programs to meet evolving industry requirements. Collaboration between robotics manufacturers, academic institutions, and industrial training organizations is further enhancing skill development, ensuring that Japan remains a global leader in efficient and technologically advanced robotics deployment.

Global Robotics Training Services Market: Key Takeaways

- Market Growth: Global market to grow from USD 2.3 Bn in 2025 to USD 8.0 Bn in 2034 due to rising adoption of industrial and collaborative robots.

- Training Demand: Operator and technician training dominate, reflecting critical need for skilled robotics workforce.

- Digital Learning: Online platforms and AI-enabled simulators are driving scalable, flexible, and cost-effective training.

- Regional Leadership: Asia Pacific leads with 46.0% market share, driven by industrialization and government skill programs.

- AI Integration: AI enhances personalized learning, faster upskilling, and higher workforce productivity.

Global Robotics Training Services Market: Use Cases

- Industrial Manufacturing Automation Training: Robotics training services are widely used in industrial manufacturing to equip operators and technicians with the skills required to manage automated production lines. Companies use these services to train staff in robot programming, machine vision systems, and safety compliance for welding, assembly, and packaging robots. Proper training helps reduce downtime, improve production accuracy, and support smart manufacturing initiatives as factories adopt advanced industrial robots and automation software.

- Logistics and Warehouse Robotics Enablement: In the logistics sector, robotics training services support the deployment of autonomous mobile robots and robotic picking systems in warehouses and distribution centers. Training programs focus on robot operation, fleet management, and system integration with warehouse management software. This enables logistics companies to improve order fulfillment speed, enhance inventory accuracy, and maintain smooth automated material handling operations in high volume e commerce and retail supply chains.

- Healthcare and Medical Robotics Training: Healthcare providers use robotics training services to ensure safe and effective operation of surgical robots, rehabilitation systems, and hospital automation tools. These programs train medical staff on robotic control systems, precision handling, and maintenance procedures. With the growing adoption of medical robotics and artificial intelligence in healthcare, structured training helps improve patient outcomes, reduce procedural risks, and ensure compliance with healthcare safety standards.

- Education and Workforce Skill Development: Educational institutions and corporate academies rely on robotics training services to prepare students and employees for careers in automation and robotics engineering. These programs cover robotics software, coding, system integration, and real world simulation based learning. By building a skilled workforce, organizations can support long term digital transformation, industrial automation growth, and innovation across manufacturing, logistics, and service robotics applications.

Impact of Artificial Intelligence on the global Robotics Training Services market

Artificial Intelligence is transforming the global Robotics Training Services market by making learning more adaptive, efficient, and aligned with real world automation needs. AI powered training platforms use data analytics and machine learning to personalize learning paths based on a trainee’s skill level, job role, and performance. This allows operators, technicians, and engineers to focus on the exact robotics skills they need, such as robot programming, vision systems, or predictive maintenance. AI based simulators also create realistic virtual environments where users can practice working with industrial robots, collaborative robots, and autonomous systems without risking equipment damage or production downtime.

AI is also improving the effectiveness of corporate and industrial robotics training by enabling intelligent assessment and continuous improvement. Training systems can track user behavior, identify skill gaps, and recommend targeted modules for automation software, system integration, and safety compliance. This leads to faster onboarding, reduced training costs, and higher workforce productivity. As factories, warehouses, and healthcare facilities deploy more AI enabled robots, the demand for advanced, data driven training solutions continues to rise, making artificial intelligence a core driver of growth in the Robotics Training Services market.

Global Robotics Training Services Market: Stats & Facts

International Federation of Robotics (IFR) Official Statistics

- Operational stock of industrial robots globally was 4,281,585 units in 2023, up about 9.7% from the previous year.

- Annual robot unit sales volume reached 541,302 units in 2023, despite a slight year‑on‑year decline.

- Robot density (industrial robots per 10,000 manufacturing workers) increased from 151 to 162 globally in 2023.

- Europe’s robot density was 219 robots per 10,000 workers in the latest statistical report.

- Japan’s robot density stood at 419 robots per 10,000 workers, ranking among the top density countries.

- Germany’s robot density reached 429 robots per 10,000 workers, the highest in Europe.

Bureau of Labor Statistics (BLS), United States Government

- Employment of software developers is projected to grow 17.9% from 2023 to 2033, faster than the average for all occupations.

- Employment of aerospace engineers is projected to grow 6.0% from 2023 to 2033.

- Employment of electrical and electronics engineers is projected to grow 9.1% from 2023 to 2033.

- Electrical and electronic engineering technologists and technicians are expected to grow by 3.0% through 2033.

- Bureau of Labor Statistics reports from 2024 show increasing demand for training and development specialists as part of workforce upskilling efforts.

- Occupational Requirements Survey data from 2024 shows about 32% of U.S. workers are in roles requiring no formal education, relevant to baseline robotics and automation training.

- ORS indicates about 40% of U.S. roles require a high school education, indicating broad foundational training needs for automation roles.

- Around 25% of U.S. jobs require an Associate’s or Bachelor’s degree, critical for advanced robotics and programming training.

European Union / Government Sources

- 62% of Europeans view robots and AI positively at work, indicating cultural acceptance of automation and related workforce training needs.

- 70% of Europeans believe robots and AI improve productivity, supporting ongoing skills development.

- EU Member States reported 154 national measures to boost AI skills, including robotics‑related education and training.

- More than half of EU Member States introduced digital upskilling strategies incorporating AI skills as part of workforce readiness by 2025.

- Seven EU States reported expanding structured AI/robotics degree programs at higher education levels.

- AI training initiatives in primary and secondary schools were reported in 26 EU programmes reflecting early digital literacy efforts.

- Germany allocated €92 million for digital educational materials, including robotics and AI training under national plans.

Global Robotics Training Services Market: Market Dynamics

Global Robotics Training Services Market: Driving Factors

Rising adoption of industrial and collaborative robots

The increasing use of industrial robots and collaborative robots across manufacturing, logistics, and healthcare is a major driver of the Robotics Training Services market. As automation becomes more advanced, organizations need skilled professionals who can handle robot programming, system integration, and safety compliance. This pushes companies to invest in structured robotics training, simulation based learning, and certification programs to ensure smooth deployment and optimal performance of automated systems.

Expansion of smart factories and digital manufacturing

The global shift toward smart manufacturing and Industry 4.0 is accelerating demand for robotics skill development. Modern production facilities rely on robotics software, machine vision, and connected automation platforms that require specialized technical knowledge. Robotics training services help workers adapt to these digital environments, enabling higher efficiency, predictive maintenance, and better control over robotic operations in advanced manufacturing and warehouse automation.

Global Robotics Training Services Market: Restraints

High cost of advanced robotics training programs

Many robotics training services involve expensive equipment, simulation platforms, and expert instructors, which increases overall training costs. Small and medium enterprises often struggle to afford advanced robotics education and continuous upskilling, limiting wider adoption. This cost barrier slows the penetration of high end training solutions for industrial robots and automation systems in developing markets.

Shortage of qualified robotics trainers

The rapid evolution of robotics technology has created a gap between industry needs and available trainers. Advanced topics such as artificial intelligence integration, robot vision, and automation software require highly skilled instructors. The limited availability of such experts restricts the scalability of robotics training services and affects the quality of training delivered to end users.

Global Robotics Training Services Market: Opportunities

Growth of online and simulation based learning platforms

The rise of digital learning platforms and virtual robotics labs is creating new opportunities in the Robotics Training Services market. These solutions allow learners to practice robot programming, system configuration, and troubleshooting in a simulated environment, reducing dependency on physical hardware. This makes robotics education more accessible, scalable, and cost effective for enterprises and educational institutions worldwide.

Increasing demand from emerging automation markets

Emerging economies in Asia Pacific, Latin America, and the Middle East are rapidly adopting robotics in manufacturing and logistics. This creates strong demand for workforce training in robotics operation, maintenance, and automation software. Training providers that offer localized and industry specific programs can capture significant growth as these regions build their automation capabilities.

Global Robotics Training Services Market: Trends

Integration of artificial intelligence in robotics training

AI driven training platforms are becoming a major trend in the market. These systems use machine learning to personalize learning paths, assess performance, and recommend targeted skill modules. This improves training efficiency and helps workers master complex robotics technologies such as autonomous systems and smart factory applications.

Focus on continuous upskilling and certification programs

Companies are increasingly adopting continuous learning models rather than one time training. Certification based programs in robotics programming, safety compliance, and system integration are gaining popularity. This trend reflects the need to keep the workforce updated as robotic platforms, automation tools, and industrial software continue to evolve.

Global Robotics Training Services Market: Research Scope and Analysis

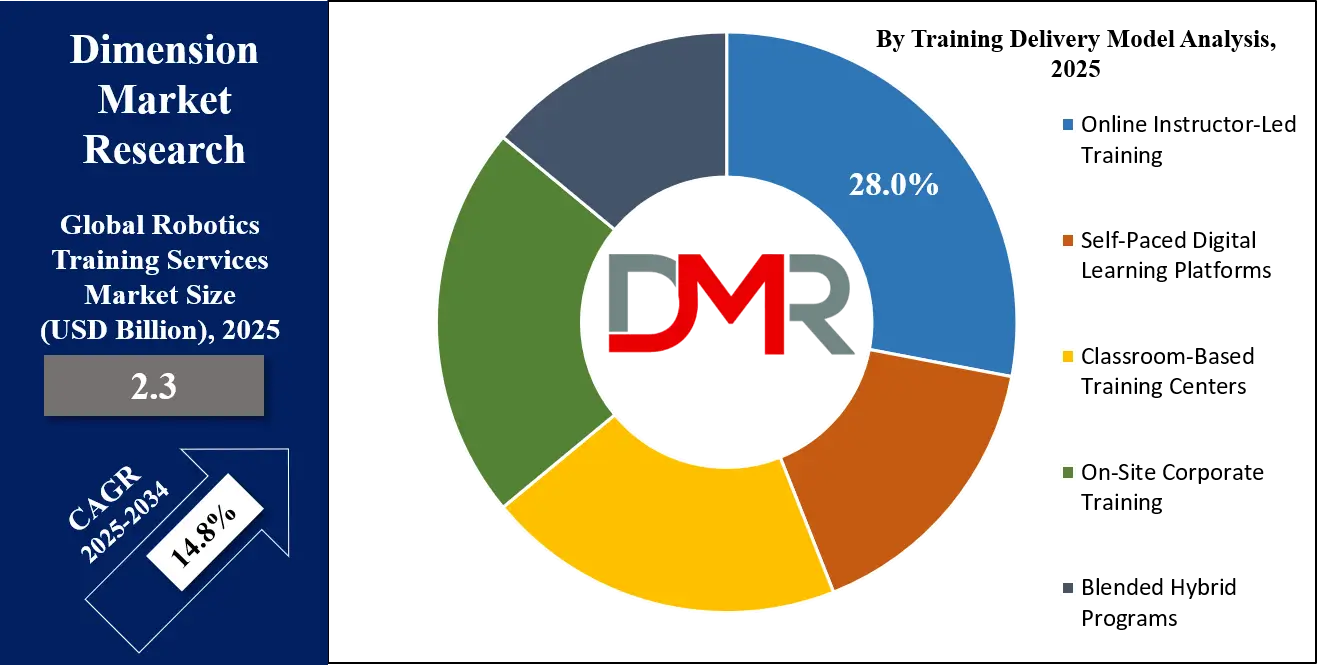

By Training Delivery Model Analysis

Online instructor led training is anticipated to dominate the training delivery model segment by capturing 28.0% of the total market share in 2025 because it combines expert led instruction with the scalability of digital platforms. This delivery model allows robotics professionals to receive real time guidance on robot programming, automation software, system integration, and safety protocols without the need for physical attendance. It is especially attractive to global manufacturers and logistics operators who need to train distributed teams quickly and consistently while minimizing travel costs and production downtime, making it the preferred choice for large scale robotics skill development.

On site corporate training remains a critical part of this market segment because it delivers practical, hands on learning in real operating environments. Trainers work directly with deployed industrial robots, collaborative robots, and automated production lines, enabling employees to understand real workflow challenges, safety risks, and maintenance requirements. This format is essential for complex installations, factory commissioning, and troubleshooting tasks where physical interaction with robotics systems is required. Although it has higher delivery costs, it provides deeper operational impact and long term efficiency gains.

ℹ

To learn more about this report –

Download Your Free Sample Report Here

By Robot Category Trained Analysis

Industrial robots are anticipated to dominate the robot category trained segment by capturing 45.0% of the total market share in 2025 because they remain the backbone of automation across manufacturing, automotive, electronics, and heavy industrial sectors. These robots perform high volume tasks such as welding, material handling, assembly, and packaging, which require extensive training in robot programming, safety procedures, preventive maintenance, and automation software. As factories continue to invest in smart manufacturing and production efficiency, demand for skilled operators and technicians who can manage complex industrial robotic systems continues to rise, driving strong demand for industrial robotics training services.

Collaborative robots also play an increasingly important role in this market segment because they are designed to work safely alongside human workers in flexible production environments. Training for collaborative robots focuses on intuitive programming, human machine interaction, and safety configuration, making them attractive to small and medium enterprises and mixed production lines. As companies adopt cobots to improve productivity without fully automating entire processes, the need for user friendly robotics training, rapid deployment skills, and system integration knowledge continues to grow, supporting steady expansion of this segment.

By Skill Level Covered Analysis

Operator level training is anticipated to dominate the skill level covered segment by capturing 34.0% of the total market share in 2025 because most robots across manufacturing, logistics, and healthcare environments are handled daily by shop floor operators rather than engineers. These workers need practical knowledge of robot operation, safety procedures, basic troubleshooting, and production workflow integration. As companies deploy more industrial robots, collaborative robots, and autonomous systems, the demand for large scale workforce training at the operator level continues to grow, making this the largest and most essential segment within robotics training services.

Technician and maintenance training also holds a significant position in this market segment because reliable robot performance depends on regular servicing, diagnostics, and component replacement. Technicians require specialized skills in electrical systems, controllers, sensors, and automation software to prevent breakdowns and minimize downtime. As robotic installations become more complex and widely deployed across factories and warehouses, companies increasingly invest in maintenance focused robotics training to ensure long term system reliability, operational efficiency, and lower lifecycle costs.

By Training Objective Analysis

Robot operation and safety training is anticipated to dominate the training objective segment by capturing 32.0% of the total market share in 2025 because it addresses the fundamental need for safe and efficient handling of industrial robots, collaborative robots, and autonomous systems on the shop floor. This type of training focuses on understanding robot controls, emergency protocols, hazard prevention, and adherence to workplace safety standards. As companies increase automation in manufacturing, logistics, and healthcare, ensuring that operators can safely manage robotic systems is critical to minimizing accidents, reducing downtime, and maintaining smooth production workflows.

Robot programming and configuration training is also a key part of this market segment as it equips technicians and engineers with the skills to set up, customize, and optimize robotic systems according to specific operational requirements. Training covers areas such as automation software, motion control, sensor integration, and system calibration, enabling organizations to improve productivity, accuracy, and flexibility. As robotics applications become more complex and integrated with artificial intelligence and machine vision, programming and configuration training ensures that companies can fully leverage their automation investments while adapting to evolving production needs.

By End-Use Industry Analysis

Manufacturing and industrial production are anticipated to dominate the end-use industry segment by capturing 49.0% of the total market share in 2025 because these sectors represent the largest adopters of industrial robots, collaborative robots, and automation systems. Training services in this segment focus on robot operation, maintenance, process optimization, and safety compliance to ensure smooth production workflows. As factories adopt smart manufacturing technologies, machine vision, and automation software, the demand for skilled operators and technicians rises, making manufacturing the primary driver of global robotics training services.

Automotive and electric vehicle production is another important segment because these industries rely heavily on high precision, repetitive, and automated processes such as welding, assembly, painting, and battery module handling. Robotics training services for this sector focus on programming, system integration, and real-time troubleshooting to enhance production efficiency and minimize errors. As electric vehicle adoption grows and automotive factories become more automated, the need for specialized robotics training to support complex robotic platforms and flexible manufacturing lines continues to expand steadily.

The Robotics Training Services Market Report is segmented on the basis of the following:

By Training Delivery Model

- Online Instructor-Led Training

- Self-Paced Digital Learning Platforms

- Classroom-Based Training Centers

- On-Site Corporate Training

- Blended Hybrid Programs

By Robot Category Trained

- Industrial Robots

- Collaborative Robots

- Mobile Robots and Autonomous Vehicles

- Service Robots

- Research and Educational Robots

By Skill Level Covered

- Operator Level Training

- Technician and Maintenance Training

- Programming and Software Training

- Advanced Engineering and System Integration

By Training Objective

- Robot Operation and Safety Training

- Robot Programming and Configuration

- Maintenance, Repair, and Diagnostics

- Process Optimization and Automation Design

- Compliance, Certification, and Standards

By End-Use Industry

- Manufacturing and Industrial Production

- Automotive and Electric Vehicle Production

- Logistics and Warehousing

- Healthcare and Medical Robotics

- Electronics and Semiconductor Manufacturing

- Defense, Aerospace, and Research

Global Robotics Training Services Market: Regional Analysis

Region with the Largest Revenue Share

Asia Pacific is anticipated to lead the global Robotics Training Services market landscape by capturing 46.0% of the total global market revenue in 2025 due to the region’s rapid industrialization, high adoption of automation, and strong manufacturing base in countries like China, Japan, South Korea, and India. The growing deployment of industrial robots, collaborative robots, and autonomous systems across factories, warehouses, and logistics hubs has driven demand for operator, technician, and programming training. Additionally, government initiatives, smart factory programs, and investments in workforce skill development further strengthen the region’s dominance in robotics training services.

ℹ

To learn more about this report –

Download Your Free Sample Report Here

Region with significant growth

The Middle East and Africa region is witnessing significant growth in the Robotics Training Services market due to increasing investments in industrial automation, smart manufacturing initiatives, and logistics infrastructure development. Countries in this region are adopting industrial robots, collaborative robots, and warehouse automation systems at a rapid pace, creating strong demand for operator, technician, and programming training. The expansion of digital learning platforms and partnerships with global robotics training providers is also enabling local workforces to upskill efficiently, making the region one of the fastest growing markets for robotics education and skill development services.

By Region

North America

Europe

- Germany

- The U.K.

- France

- Italy

- Russia

- Spain

- Benelux

- Nordic

- Rest of Europe

Asia-Pacific

- China

- Japan

- South Korea

- India

- ANZ

- ASEAN

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Argentina

- Colombia

- Rest of Latin America

Middle East & Africa

- Saudi Arabia

- UAE

- South Africa

- Israel

- Egypt

- Rest of MEA

Global Robotics Training Services Market: Competitive Landscape

The global Robotics Training Services market is highly competitive, characterized by the presence of numerous established and emerging training providers offering a range of solutions, from classroom-based programs to online platforms and simulation-based learning. Companies compete on the basis of training quality, technology integration, customization, and industry-specific expertise, while also focusing on expanding their geographic reach and digital offerings. Strategic partnerships with educational institutions, automation solution providers, and industrial clients are common to enhance credibility and market presence. Continuous innovation in course content, AI-enabled learning, and certification programs further intensifies competition across the market.

Some of the prominent players in the global Robotics Training Services market are:

- ABB Ltd

- FANUC Corporation

- Yaskawa Electric Corporation

- KUKA AG

- Siemens AG

- Universal Robots

- Mitsubishi Electric Corporation

- Omron Corporation

- Rockwell Automation

- Denso Robotics

- Stäubli International

- Kawasaki Robotics

- SoftBank Robotics

- Robotiq

- Rethink Robotics

- ARM Holdings

- Epson Robots

- Honeywell International

- Toshiba Machine

- SIASUN Robot and Automation

- Other Key Players

Global Robotics Training Services Market: Recent Developments

- January 2026: At CES 2026, robotics industry players unveiled next‑generation robotic solutions and training‑relevant AI tools that support simulation and real‑world robot learning workflows, signaling expanded capabilities for robotics education and skill development globally.

- January 2026: A major autonomous vehicle and robotics technology firm announced a strategic acquisition of a robotics startup to enhance physical AI competencies and accelerate deployment of humanoid and autonomous robotic platforms across industries.

- December 2025: A surgical robotics training platform was launched globally to improve accessibility and quality of medical robotics education, enabling broader adoption of surgical simulation and skills development.

- October 2025: Investors poured capital into China’s robotics sector with a notable financing round for a humanoid robotics firm, reflecting increasing investor confidence in robots and associated training applications.

Report Details

| Report Characteristics |

| Market Size (2025) |

USD 2.3 Bn |

| Forecast Value (2034) |

USD 8.0 Bn |

| CAGR (2025–2034) |

14.8% |

| The US Market Size (2025) |

USD 0.5 Bn |

| Historical Data |

2019 – 2024 |

| Forecast Data |

2026 – 2034 |

| Base Year |

2024 |

| Estimate Year |

2025 |

| Report Coverage |

Market Revenue Estimation, Market Dynamics, Competitive Landscape, Growth Factors, etc. |

| Segments Covered |

By Training Delivery Model (Online Instructor-Led Training, Self-Paced Digital Learning Platforms, Classroom-Based Training Centers, On-Site Corporate Training, Blended Hybrid Programs), By Robot Category Trained (Industrial Robots, Collaborative Robots, Mobile Robots and Autonomous Vehicles, Service Robots, Research and Educational Robots), By Skill Level Covered (Operator Level Training, Technician and Maintenance Training, Programming and Software Training, Advanced Engineering and System Integration), By Training Objective (Robot Operation and Safety Training, Robot Programming and Configuration, Maintenance, Repair, and Diagnostics, Process Optimization and Automation Design, Compliance, Certification, and Standards), and By End-Use Industry (Manufacturing and Industrial Production, Automotive and Electric Vehicle Production, Logistics and Warehousing, Healthcare and Medical Robotics, Electronics and Semiconductor Manufacturing, Defense, Aerospace, and Research) |

| Regional Coverage |

North America – US, Canada; Europe – Germany, UK, France, Russia, Spain, Italy, Benelux, Nordic, Rest of Europe; Asia-Pacific – China, Japan, South Korea, India, ANZ, ASEAN, Rest of APAC; Latin America – Brazil, Mexico, Argentina, Colombia, Rest of Latin America; Middle East & Africa – Saudi Arabia, UAE, South Africa, Turkey, Egypt, Israel, Rest of MEA |

| Prominent Players |

ABB Ltd, FANUC Corporation, Yaskawa Electric Corporation, KUKA AG, Siemens AG, Universal Robots, Mitsubishi Electric Corporation, Omron Corporation, Rockwell Automation, Denso Robotics, Stäubli International, Kawasaki Robotics, SoftBank Robotics, Robotiq, and Others. |

| Purchase Options |

We have three licenses to opt for: Single User License (Limited to 1 user), Multi-User License (Up to 5 Users), and Corporate Use License (Unlimited User) along with free report customization equivalent to 0 analyst working days, 3 analysts working days, and 5 analysts working days respectively. |

Frequently Asked Questions

How big is the global Robotics Training Services market?

▾ The global Robotics Training Services market size was valued at USD 2.3 billion in 2025 and is expected to reach USD 8.0 billion by the end of 2034.

What is the size of the US Robotics Training Services market?

▾ The US Robotics Training Services market was valued at USD 0.5 billion in 2025. It is expected to witness subsequent growth in the upcoming period as it holds USD 1.7 billion in 2034 at a CAGR of 13.9%.

Which region accounted for the largest global Robotics Training Services market?

▾ Asia Pacific is expected to have the largest market share in the global Robotics Training Services market, with a share of about 46.0% in 2025.

Who are the key players in the global Robotics Training Services market?

▾ Some of the major key players in the global Robotics Training Services market are ABB Ltd, FANUC Corporation, Yaskawa Electric Corporation, KUKA AG, Siemens AG, Universal Robots, Mitsubishi Electric Corporation, Omron Corporation, Rockwell Automation, Denso Robotics, Stäubli International, Kawasaki Robotics, SoftBank Robotics, Robotiq, and Others.