Market Overview

The Global

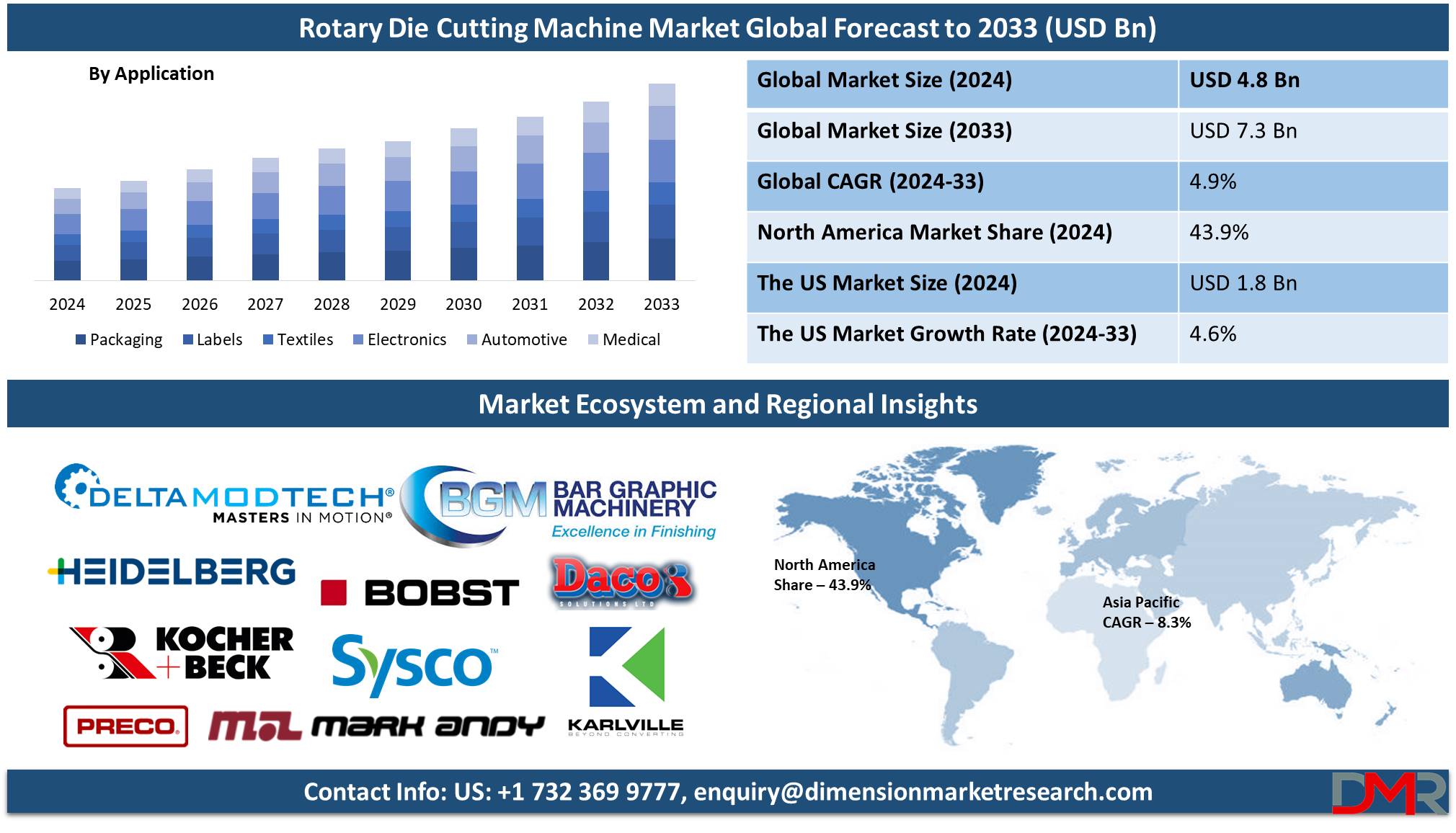

Rotary Die Cutting Machine Market size is expected to reach a value of

USD 4.8 billion in 2024, and it is further anticipated to reach a market value of

USD 7.3 billion by 2033 at a

CAGR of 4.9%.

ℹ

To learn more about this report –

Download Your Free Sample Report Here

The global market for rotary die-cutting machines is experiencing significant growth on account of increasing demand from different verticals of industries such as packaging, automotive, and electronics. The rotary cutting machines share a formidable degree of efficiency in precision cutting resulting in high volume jobs. Thus, they become the preferred choice over the traditional flatbed die cutters on account of getting work done at a rapid rate in industries that require consistent output.

Automation and precision technologies must have influenced the growth of the market to a great extent, as rotary die-cutters are available for processing plastics, papers, and metals. One of the chief drivers behind the demand for the machine is the packaging industry, used for creating customized packaging solutions to meet both branding and functional requirements. Besides, the growing adoption of semi-automatic and fully automatic rotary die-cutting machines helps a company streamline its operational activities, reduce labor costs, and improve the quality of the product.

It is dominated by North America and the Asia-Pacific region, which receive considerable contributions from the U.S. and China in turn. Due to the growing rates of e-commerce, increasing demand for consumer goods, and demand for packaging innovations in these economies, this segment is expected to further facilitate demand for rotary die-cutting machines. Along with continuous market drivers and growing technological advancements, the global rotary die-cutting machine market is very well-placed for remarkable growth, while trying to adapt itself to the changing requirements of a wide range of sectors.

The US Rotary Die Cutting Machine Market

The US Rotary Die Cutting Machine Market is projected to be valued at USD 1.8 billion in 2024. It is expected to witness subsequent growth in the upcoming period as it holds USD 2.7 billion in 2033 at a CAGR of 4.6%.

The U.S. rotary die-cutting machine market is growing steadily on the back of demand from industries such as packaging, automotive, and electronics. They prefer rotary die-cutting machines to be used in the U.S. due to their efficiency, reliability, and ability to produce high-quality precision cuts for various applications.

As a consequence, the packaging sector remains the largest end-user of rotary die cutters in the U.S. and uses these machines to meet growing demands for customized and sustainable packaging solutions. Further, it is also spurred by an uptick in demand for e-commerce and consumer goods due to the crucial role that packaging solutions play in the safe delivery of goods. Besides this, the U.S. market is also gaining momentum with an increased adoption of automated and semi-automated die-cutting machines, thus enabling a company to enhance operational efficiencies and reduce labor costs.

Key attractants for growth in the US would be technological development related to automation and the versatility of materials. Additionally, North American manufacturers are assisted by favorable policies for industrial automation and innovation. By the time the US rotary die-cutting machine market continues to develop, the country will retain its position in the global outlook due to further investments and research in die-cutting technology to cater to all the needs of the country's diverse industrial sectors.

Key Takeaways

- Global Market Value: The Global Rotary Die Cutting Machine Market size is estimated to have a value of USD 4.8 billion in 2024 and is expected to reach USD 7.3 billion by the end of 2033.

- The US Market Value: The US Rotary Die Cutting Machine Market is projected to be valued at USD 2.7 billion in 2033 from a base value of USD 1.8 billion in 2024 at a CAGR of 4.6%.

- Regional Analysis: North America is expected to have the largest market share in the Global Rotary Die Cutting Machine Market with a share of about 43.9% in 2024.

- Key Players: Some of the major key players in the Global Rotary Die Cutting Machine Market are BOBST Group, Heidelberg Druckmaschinen AG, Delta ModTech, Daco Solutions Ltd., Preco, Inc., Spartanics, Sysco Machinery Corporation, and many others.

- Global Growth Rate: The market is growing at a CAGR of 4.9 percent over the forecasted period.

Use Cases

- Packaging Industry: Rotary die-cutting machines are employed largely in custom packaging solutions. Their ability to make precise, repetitive cuts at high speeds enables meeting several demands for customized and high-quality packaging solutions, mainly for the e-commerce and retail sectors.

- Automotive Industry: Rotary die cutters are used in automotive industries for interior components, gasket productions, and protective films. The precision of the machines and versatility during the making of complex automotive parts create a huge demand for them because they call for exact measurement and durability.

- Electronics Industry: Rotary die-cutting machines are well-suited for the precision cuts of fragile and intricate materials required by electronic devices, including conductive films and adhesive tapes. Their accuracy with thin materials makes them indispensable in high-tech manufacturing processes.

- Medical Industry: Rotary die-cutting machines have been employed within the healthcare industry in the production of medical-grade components, including adhesive patches and products in the Medical Tapes and Bandages Market. These machines ensure that all regulatory strict standards within this industry are adhered to while still maintaining high-speed and highly voluminous production, which is a necessity in the medical field.

Market Dynamic

Trends in the Rotary Die Cutting Machine Market

Automation in die-cuttingAutomation is one of the strategic integrations that have changed the face of rotary die-cutting machines: it allows companies to make their production process easier, less labor-intensive, and more valid. Automatic rotary die cutters assume all tedious jobs hitherto commanded by manual operations in the die-cutting process, with operators setting up machines and monitoring them with minimum direct intervention.

This level of automation not only enhances the speed of production but also reduces the possibility of errors, hence allowing for more consistent output quality. The trend for the adoption of automated solutions is found to be increasing in manifold industries that require high efficiency and precision, such as packaging, electronics, and automotive.

Adoption of Sustainable Practices

Due to growing ecological concerns, sustainability has emerged as one of the big Trends in the rotary die-cutting machine market. Greener materials and processes are in use that minimize the carbon footprint of manufacturing.

As a key example, rotary die cutters are being designed to handle biodegradable and recyclable materials so companies can answer both consumer and regulatory concerns for greener operations. In this respect, packaging, especially, has got to meet this trend toward sustainability since consumers would rather have their products packed in environmentally responsible materials.

Growth Drivers in the Rotary Die Cutting Machine Market

E-commerce Boom

The rapid expansion of e-commerce is significantly driving the demand for rotary die-cutting machines, The fastest growth of e-commerce is one of the chief factors contributing a great deal to the demand for rotary die-cutting machines, particularly in the packaging industry. Due to the enormous demand for shopping online, customized and high-quality packaging solutions have come into great demand, as these help protect merchandise while in transit.

This demand is well catered for by the rotary die-cutting machines due to their precision and flexibility needed in the generation of special, brand-oriented packaging designs in scale. This is so especially given that companies are increasingly beginning to seek unique packaging designs that would enhance brand visibility and consumer interaction. Apart from that, the increasing count of pouches, corrugated boxes, and flexible packaging materials brought by e-commerce growth can be efficiently processed with the help of rotary die-cutters.

Technological Advancements

The advancement of technology in rotary die-cutters is also one of the prominent growth factors. Returning manufacturers with advanced features are coming up with servo-driven systems, digital control interfaces, and machine learning integrations. Such features enhance machine precision, speed, and adaptability: it creates a full application in the rotary die-cutting machines for effectiveness, more appropriately required for industries.

First is servo-driven technology, which gives more control to the process of cutting by manufacturing smooth and accurate cuts even over-complicated shapes. Besides, digital control interfaces make the operation and maintenance of the machine simpler as operators can easily program complicated cutting tasks and view real-time machine performance.

Growth Opportunities in the Rotary Die Cutting Machine Market

Emerging Markets in Asia-Pacific

The Asia-Pacific region is considered to offer a promising growth opportunity to the rotary die-cutting machine market propelled by rapid industrialization and increasing manufacturing capacities. With high demand for rotary die-cutting machines, industries related to electronics, automobiles, and various types of packaging show significant growth in China, India, and Southeast Asia.

Apart from the rise in local productions, friendly government policies concerning manufacturing have boosted companies' investment in high-precision machinery to maintain competitiveness.

Integration with Industry 4.0

The integration with Industry 4.0 technologies is considered a promising opportunity for further automation and optimization within the rotary die-cutting machine market. Industry 4.0 thus enables rotary die-cutting machines to be equipped with IoT sensors, and real-time monitoring of data analytics that help the company enhance operational efficiency while reducing production costs.

Real-time monitoring allows operators to monitor machine performance, schedule regular maintenance, and optimize energy consumption for economical production. Data analytics have the potential to make quality control more effective, as they provide insight into the cutting precision, wear and tear of parts, and consistency of output.

Restraints in the Rotary Die Cutting Machine Market

High Initial Investment

The high initial cost of advanced automated machinery has always been one of the major deterrents in the rotary die-cutting machine market. Acquiring these machines involves high investment because SMEs cannot access heavy funds for such purposes.

Though automated rotary die cutters have their advantages in the long run, like lowering labor costs and increasing production efficiency, the initial cost in itself often turns out to be beyond the reach of many small companies. It is very expensive not only for the purchase price, but also for installation, training, and maintenance costs.

Maintenance Challenges

The Rotary Die-cutting Machines demand regular maintenance and need specialist technicians for upkeep to be able to give their best performance, which may be problematic for companies that lack the technical resources needed to keep these machines running effectively. Wherever sophisticated automation features are implemented to make complex machinery, specialized knowledge becomes essentially needed for diagnosis, repair, and maintenance.

In areas where technical experience is low, searching for qualified personnel to maintain or repair rotary die cutters can be a challenge; thus, there is a possibility of creating production delays, and increasing downtime. Besides, maintenance challenges can also result in increased operational costs as companies will seek outsourced maintenance services or invest in employee training.

Research Scope and Analysis

By Speed Analysis

In the rotary die-cutting machine market, machines operating at speeds of less than 60 meters per minute (m/min) are projected to dominate the speed segment with 37.1% of the market share in 2024. More than 60 m/min is the low-speed machine that has maintained the major share in the rotary die-cutting machine market. These give the required accuracy for industries that need more precision rather than volume output.

The speed segment would relate to particular applications where quality and intricacy are higher, such as the packaging of luxury goods, specialty electronics, and medical equipment. Manufacturers are mainly intricate in design, or the materials used may be too delicate and cannot support high speed in cases where high speeds could lower the quality of the cut or even damage materials.

The manufacturers of rotary die-cutting machines understand that slower speeds mean better control, and this is one of the most vital reasons for such high standards of product consistency and aesthetic appeal that certain industries require. Also, slower speeds make operations much more gentle and the machine wears less, leading to lower costs for maintenance or longer equipment life spans. That fact makes this particular segment economically viable in the case of smaller runs of production and highly specialized markets.

Advances in machine technology have improved the performance of machines running below 60 m/min with higher cutting accuracy and versatility. This speed range has increasingly become the operating choice for industries dealing in high-value, precision-reliant merchandise. Consequent to this, machines falling in this category retain good demand within the rotary-die-cutting machine market, especially in those sectors where product integrity and cut fidelity are vital to success.

By Machine Analysis

Automatic rotary die-cutting machines are expected to dominate the machine segment within the rotary die-cutting machine market as it holds the highest market share in 2024. Fully automatic machines seize the major share in the machine segment of the rotary die-cutting machine market, as they offer ultimate efficiency, productivity, and cost-effectiveness. Automatic machines reduce human intervention to a greater extent, minimizing labor costs and error rates associated with manual or semi-automatic machines.

This is going to be crucial in industries like packaging, automotive, and electronics, where high-speed production needs better quality and precision. This is where automatic rotary die-cutting machines, for instance, start to be interesting: programmable settings, servo-driven technology, and integrated monitoring. These upgrades enable operators to set exact parameters that ensure consistent output over a large batch of production. Automated machinery also improves workplace safety by reducing the need for manual handling feature key for those manufacturers focused on adherence to strict safety standards.

Automation also enables companies to achieve much faster turnaround times, with such machines thus being very suitable for high-volume production. The fact that complex tasks can be done with little supervision makes automatic rotary die cutters especially excellent in industries' relentless move toward digitalization and smart manufacturing techniques according to Industry 4.0.

This is likely to increase the market share of automatic machines within this category as these firms strive to promote the effectiveness of production, and scalability, and to cater to the growing demand. The domination of this particular automatic machine in this class indicates a greater drift toward technology-driven solutions, which allow continuous high-precession production.

By Application Analysis

The packaging industry is a leading application for rotary die-cutting machines with 32.2% of the market share in 2024. The packaging industry is one of the top application areas for rotary die-cutting machines, hence driving high demand in the market for rotary die-cutting machines. This is possible because, with rising e-shopping and retail globally, there is more need for efficient, low-cost packaging solutions without compromising on quality.

In today's age, when aesthetic and functional demands that consumers place on packaging are increasing, rotary die cutters finally allow manufacturers to create complex patterns at high speeds without sacrificing any accuracy. Besides aesthetics, one of the strong points of rotary die-cutting machines is their ability to work with a wide variety of materials, ranging from paper and plastic to cardboard, offering variant fields of packaging for different products. These machines have become a necessity in consumer good branding, as their increasing adaptability to handling complicated shapes and designs gives companies distinctive packaging, which increases the appeal of a product.

Besides, packaging industries have also embraced automation quite early; for this reason, many packaging companies have engaged themselves in purchasing semi-automatic and fully automatic rotary die cutters to improve productivity. These machines lend assistance to operational efficiency since they reduce interference by a human being, thereby reducing time and cost.

This further strengthens the reliance of the industry on these machines since the industry packaging is focused on sustainable materials and environmentally friendly processes, which are also in line with advancements in rotary die-cutting technology. Growth in demand for consumer-centric and eco-friendly packaging solutions will continue to make the role of rotary die-cutting machines vital in the packaging segment.

By End User Analysis

Food and beverages constitute one of the major end-users of the rotary die-cutting machine market due to the high demand in this industry segment for customized, reliable, and appealing packaging. As a result of the nature of food items, which mostly are in a state prone to spoilage, and because of strict regulatory requirements, effective and protective packaging is necessarily required in this industry segment, which is grossly achieved using rotary die cutters.

The available machines can enable the production of everything from flexible pouches to sturdy containers, which meet quality and safety standards. With materials of variable types such as plastic films and even food-grade paper, rotary die cutters can provide the required precision for their use in food packaging applications that demand high-quality seals to prevent contamination. Besides, food and beverage firms strongly focus on branding, and rotary die-cutting machines enable them to make branded packaging shapes attractive to consumers and marketing demands.

Besides this, increased online delivery of food and ready-to-eat food products also demand packaging, hence making the food and beverage industry a dominating end user in the market. Owing to prevailing trends of sustainability and eco-friendly packaging as a factor affecting customer trends, the trend for food and beverage companies toward rotary die-cutting machines is on the rise to manufacture recyclable and biodegradable packaging. Accordingly, the segment's growth in terms of high-volume, high-quality, and customized packaging solutions cements its position as one of the leading end-user segments within the rotary die-cutting machine market.

The Rotary Die Cutting Machine Market Report is segmented on the basis of the following:

By Speed

- Less than 60 Meters/Min

- 60 - 80 Meters/Min

- 81-100 Meters/Min

- Above 100 Meters/Min

By Machine

By Application

- Packaging

- Labels

- Textiles

- Electronics

- Automotive

- Medical

By End User Industry

- Food & Beverage

- Pharmaceuticals

- Consumer Goods

- Electronics

- Others

Regional Analysis

North America is projected to dominates the rotary die-cutting machine market as it is anticipated to

hold 43.9% of market share by the end of 2024. The factors contributing to the fact that North America dominates the rotary die-cutting machine market include an advanced manufacturing sector in the region, widespread adoption of automation, and demand for high-quality packaging across diverse industries.

The U.S. also happens to be a major economic hub with wide-ranging industries, from automotive to electronics to consumer goods, commanding substantially higher demand for these machines. Besides, North American companies give priority to automation to be able to ensure more efficiency and lower labor costs with accurate production. Such a focus on advanced technology goes in line with the capabilities of rotary die cutters which cannot be avoided when high-volume and complicated manufacturing is required.

Besides, strong investments in the field of research and development empower continuous innovation in technology related to die-cutting. Further, there is continuous equipment performance and sustainability, which enables North America to keep the lead further within the global outlook.

In addition, the regulatory environment supports high standards concerning the quality and safety of products, thus pushing industries to adopt machinery that can be reliable and precise; examples are rotary die cutters. With all these factors put together, along with a well-established network of suppliers and skilled technicians, North America is one of the major markets for rotary die-cutting machines. With the rise in demand for automation and eco-friendly solutions, further strong growth is to be expected.

By Region

North America

Europe

- Germany

- The U.K.

- France

- Italy

- Russia

- Spain

- Benelux

- Nordic

- Rest of Europe

Asia-Pacific

- China

- Japan

- South Korea

- India

- ANZ

- ASEAN

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Argentina

- Colombia

- Rest of Latin America

Middle East & Africa

- Saudi Arabia

- UAE

- South Africa

- Israel

- Egypt

- Rest of MEA

Competitive Landscape

The competitive nature of the rotary die-cutting machine market reflects the key players that may be deliberately participating in technological development, product innovation, and strategic partnerships to attain leading positions in the market. Major firms such as BOBST, Sysco Machinery, and Duplo Corporation provide high-speed, customized rotary die-cutting solutions to various industries such as packaging, automotive, and electronics. They make heavy R&D investments to develop machines that integrate higher speed, precision, and automation capability, which can fulfill growing demands for advanced and reliable equipment.

Besides this, joint ventures and mergers among the players are quite frequent, which further help them improve their product portfolio and geographical presence. Companies aim to target emerging markets and increase their clientele base through partnerships with local distributors and service providers. Small-scale companies and new entrants play their role, particularly in introducing niche products for specialized requirements, such as 'compact' die-cutting solutions for small businesses.

The other aspect of the market trend is towards sustainability and energy efficiency, whereby companies deplete themselves in putting in place eco-friendly designs to go in the same direction with the changing industry trends towards more 'green' ways. All in all, this fast, dynamic environment will spur further innovation that could be advantageous to industries dependent on the technology of die-cutting.

Some of the prominent players in the Global Rotary Die Cutting Machine Market are:

- BOBST Group

- Heidelberg Druckmaschinen AG

- Delta ModTech

- Daco Solutions Ltd.

- Preco, Inc.

- Spartanics

- Sysco Machinery Corporation

- Karlville Development Group

- Bar Graphic Machinery Ltd. (BGM)

- Mark Andy Inc.

- Kocher+Beck GmbH + Co. KG

- RotoMetrics (part of Maxcess)

- Other Key Players

Recent Developments

- October 2024: BOBST launched a new high-speed rotary die-cutting machine with integrated servo-driven technology, enhancing production speeds by 20% while reducing energy consumption.

- August 2024: Duplo Corporation announced a partnership with Sysco Machinery to co-develop advanced rotary die cutters aimed at the e-commerce packaging sector, focusing on automation and sustainable material compatibility.

- June 2024: Sysco Machinery introduced an IoT-enabled rotary die cutter model designed for real-time monitoring and predictive maintenance, targeting Industry 4.0-oriented manufacturers.

- March 2024: Bograma AG expanded its North American operations by opening a new service center to enhance after-sales support and reduce maintenance downtime for customers in the U.S. and Canada.

- December 2023: Morgana Systems Ltd released a rotary die-cutting machine featuring environmentally friendly design elements, including energy-efficient motors and a recyclable materials kit.

- October 2023: Therm-O-Type Corporation upgraded its popular die-cutting model, incorporating faster processing capabilities and improved software for more precise control over complex cutting tasks.

Report Details

| Report Characteristics |

| Market Size (2024) |

USD 4.8 Bn |

| Forecast Value (2033) |

USD 7.3 Bn |

| CAGR (2024-2033) |

4.9% |

| Historical Data |

2018 – 2023 |

| The US Market Size (2024) |

USD 1.8 Bn |

| Forecast Data |

2025 – 2033 |

| Base Year |

2023 |

| Estimate Year |

2024 |

| Report Coverage |

Market Revenue Estimation, Market Dynamics, Competitive Landscape, Growth Factors and etc. |

| Segments Covered |

By Speed (Less than 60 Meters/Min, 60 - 80 Meters/Min, 81-100 Meters/Min, and Above 100 Meters/Min), By Machine (Automatic, and Semi-Automatic), By Application (Packaging, Labels, Textiles, Electronics, Automotive, and Medical), By End User Industry (Food & Beverage, Pharmaceuticals, Consumer Goods, Electronics, and Others) |

| Regional Coverage |

North America – The US and Canada; Europe – Germany, The UK, France, Russia, Spain, Italy, Benelux, Nordic, & Rest of Europe; Asia- Pacific– China, Japan, South Korea, India, ANZ, ASEAN, Rest of APAC; Latin America – Brazil, Mexico, Argentina, Colombia, Rest of Latin America; Middle East & Africa – Saudi Arabia, UAE, South Africa, Turkey, Egypt, Israel, & Rest of MEA

|

| Prominent Players |

BOBST Group, Heidelberg Druckmaschinen AG, Delta ModTech, Daco Solutions Ltd., Preco, Inc., Spartanics, Sysco Machinery Corporation, Karlville Development Group, Bar Graphic Machinery Ltd. (BGM), Mark Andy Inc., Kocher+Beck GmbH + Co. KG, RotoMetrics (part of Maxcess), and Other Key Players |

| Purchase Options |

We have three licenses to opt for: Single User License (Limited to 1 user), Multi-User License (Up to 5 Users) and Corporate Use License (Unlimited User) along with free report customization equivalent to 0 analyst working days, 3 analysts working days and 5 analysts working days respectively. |

Frequently Asked Questions

How big is the Global Rotary Die Cutting Machine Market?

▾ The Global Rotary Die Cutting Machine Market size is estimated to have a value of USD 4.8 billion in 2024 and is expected to reach USD 7.3 billion by the end of 2033.

What is the size of the US Rotary Die Cutting Machine Market?

▾ The US Rotary Die Cutting Machine Market is projected to be valued at USD 1.8 billion in 2024. It is expected to witness subsequent growth in the upcoming period as it holds USD 2.7 billion in 2033 at a CAGR of 4.6%.

Which region accounted for the largest Global Rotary Die Cutting Machine Market?

▾ North America is expected to have the largest market share in the Global Rotary Die Cutting Machine Market with a share of about 43.9% in 2024.

Who are the key players in the Global Rotary Die Cutting Machine Market?

▾ Some of the major key players in the Global Rotary Die Cutting Machine Market are BOBST Group, Heidelberg Druckmaschinen AG, Delta ModTech, Daco Solutions Ltd., Preco, Inc., Spartanics, Sysco Machinery Corporation, and many others.

What is the growth rate in the Global Rotary Die Cutting Machine Market?

▾ The market is growing at a CAGR of 4.9 percent over the forecasted period.