Market Overview

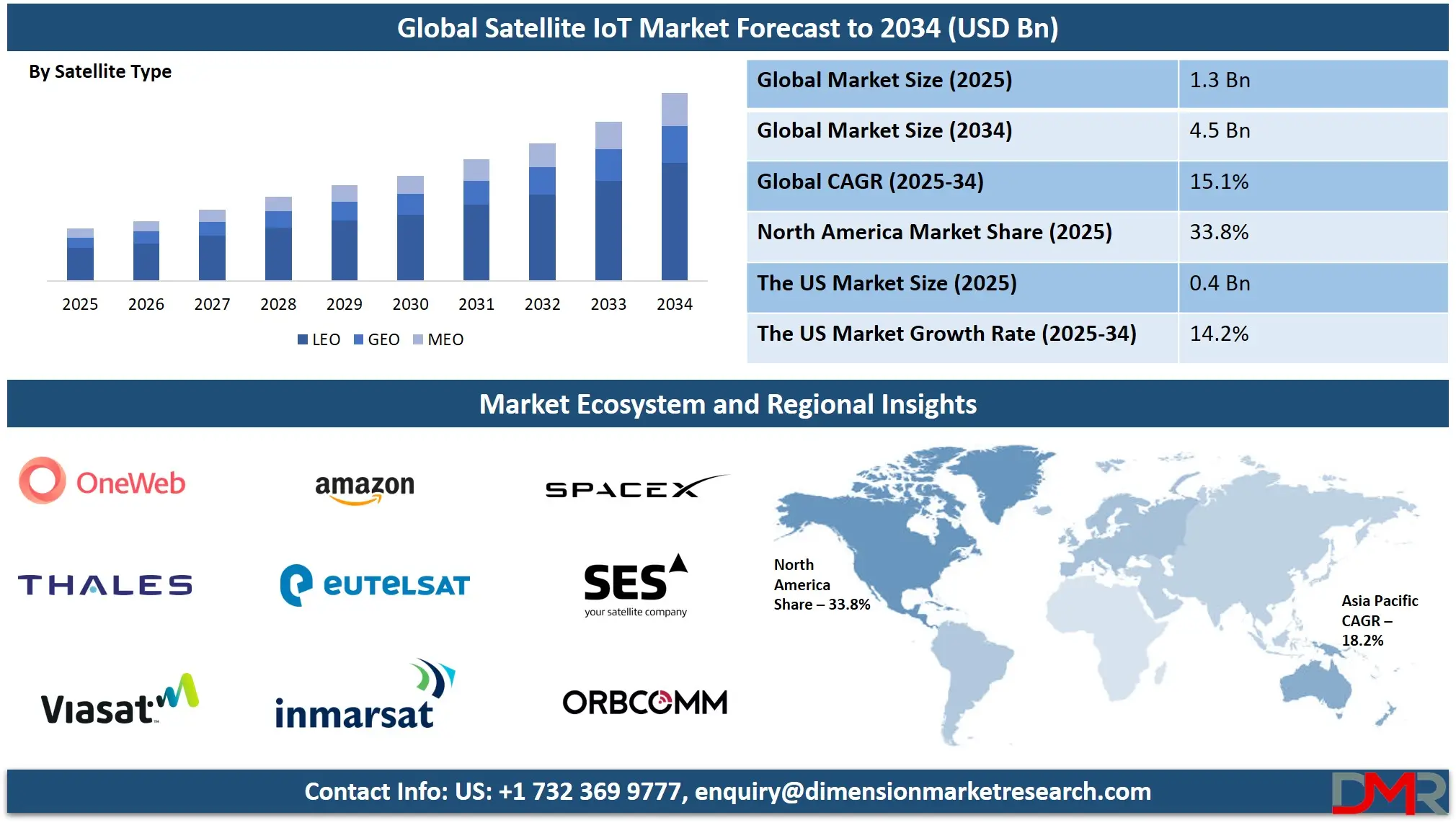

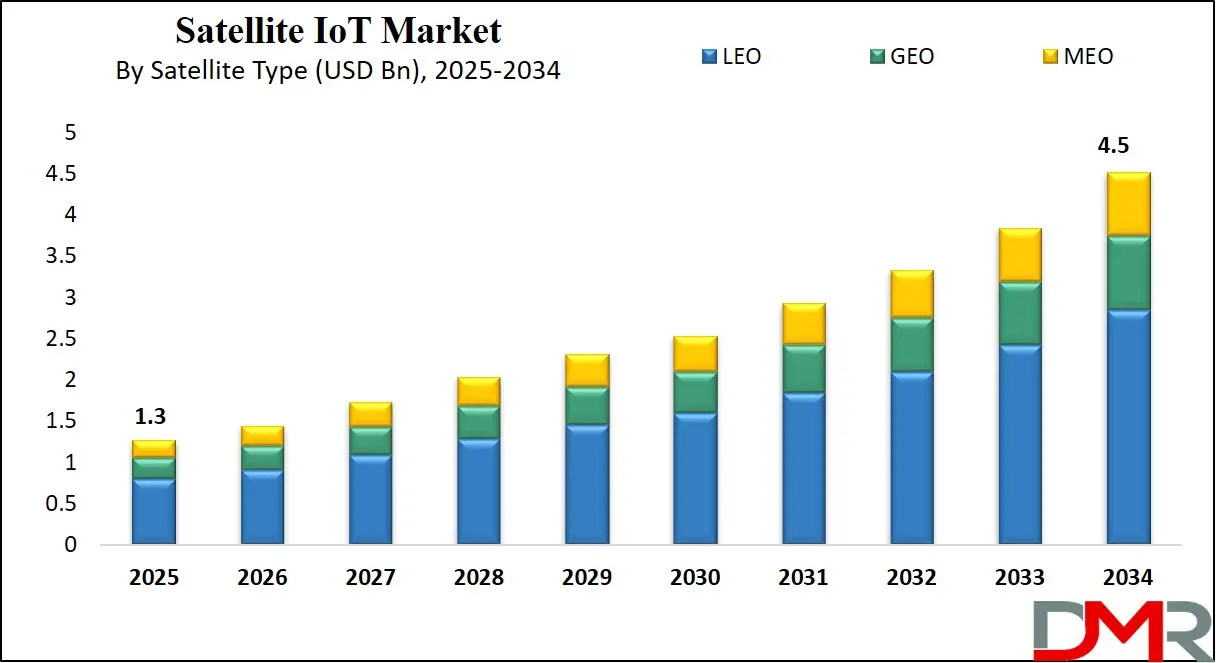

The Global Satellite IoT Market size is projected to reach USD 1.3 billion in 2025 and grow at a compound annual growth rate of 15.1% from there until 2034 to reach a value of USD 4.5 billion.

Satellite IoT, or Satellite Internet of Things, refers to using satellites in space to connect IoT devices that are located in remote, hard-to-reach, or mobile areas. Traditional IoT depends on ground-based networks like Wi-Fi or cellular. But these networks don't cover the entire Earth, especially oceans, deserts, forests, and mountains. That’s where satellites come in—they provide wide-area coverage to track, monitor, and manage assets like ships, trucks, pipelines, and weather stations in places where normal signals can’t reach.

ℹ

To learn more about this report –

Download Your Free Sample Report Here

The demand for Satellite IoT is growing due to several reasons. First, industries such as agriculture, shipping, oil & gas, and defense need to monitor equipment and assets in remote areas. Second, climate change and natural disasters have increased the need for real-time monitoring of environmental data. Third, as more devices connect to the internet, many of them require constant updates and data tracking—no matter where they are. Satellites make this possible without the need for cables or towers.

Several trends are shaping the Satellite IoT landscape. Miniaturized satellites known as CubeSats are becoming more common due to their low cost and fast deployment. Satellite constellations—groups of small satellites working together—are being launched to improve signal strength and coverage. Low Earth Orbit (LEO) satellites are especially popular for IoT because they orbit closer to Earth, allowing for faster data transmission. There’s also a growing interest in hybrid systems that combine satellite and terrestrial networks.

Recent years have seen many key developments in this field. Multiple space-tech companies have launched new constellations focused solely on IoT applications. Some telecom operators have started partnering with satellite firms to offer seamless coverage. Governments are also investing in satellite networks to boost rural connectivity and disaster response capabilities. Private companies are testing global tracking for containers, animals, and weather balloons using satellite links.

ℹ

To learn more about this report –

Download Your Free Sample Report Here

Another important shift is the falling cost of launching and building satellites. Innovations in reusable rockets, lighter materials, and smarter software are making satellite IoT more accessible than before. This has allowed even small startups to enter the market and offer niche solutions for specific sectors like wildlife conservation, mining, or polar shipping routes.

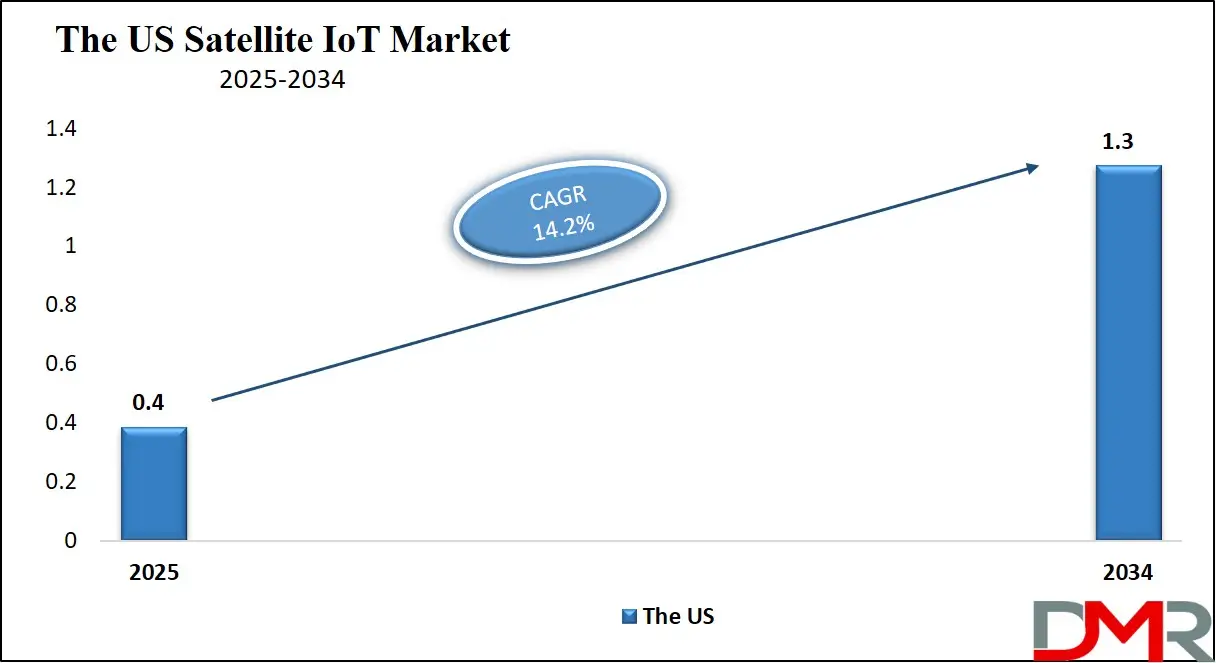

The US Satellite IoT Market

The US Satellite IoT Market size is projected to reach USD 400 million in 2025 at a compound annual growth rate of 14.2% over its forecast period.

The US plays a major role in the Satellite IoT market due to its advanced space technology, strong private sector, and supportive regulatory environment. It is home to many companies that build, launch, and manage satellite constellations, as well as developers of IoT devices and platforms. The US also leads in innovation, with significant investments in small satellites, low-orbit systems, and hybrid connectivity solutions.

Government agencies and defense programs further drive demand for remote sensing and secure communication. The country’s vast landscape, including remote areas and active industrial sectors, creates a strong domestic use case. In addition, US-based partnerships and exports influence the growth of Satellite IoT services in other regions, reinforcing its global leadership in this space.

ℹ

To learn more about this report –

Download Your Free Sample Report Here

Europe Satellite IoT Market

Europe Satellite IoT Market size is projected to reach USD 299 million in 2025 at a compound annual growth rate of 13.9% over its forecast period.

Europe plays a vital role in the Satellite IoT market through strong collaboration between governments, space agencies, and private companies. The region has a well-established space ecosystem, supported by organizations focused on satellite research, development, and deployment. European countries actively promote the use of satellite-based technologies to improve agriculture, environmental monitoring, maritime operations, and public safety.

The push for sustainable development and digital transformation further boosts the demand for IoT in remote areas. Europe also supports cross-border projects and satellite constellations aimed at enhancing connectivity across the continent and beyond. With growing interest in low Earth orbit systems and hybrid networks, Europe continues to invest in modern satellite infrastructure to strengthen its presence in the global Satellite IoT market.

Japan Satellite IoT Market

Japan Satellite IoT Market size is projected to reach USD 65.0 million in 2025 at a compound annual growth rate of 14.7% over its forecast period.

Japan plays an important role in the Satellite IoT market through its focus on space innovation, advanced electronics, and industrial IoT applications. The country invests heavily in satellite technology to support sectors like agriculture, disaster management, maritime logistics, and smart cities. Japan’s geography, with many remote islands and mountainous areas, makes satellite connectivity essential for nationwide data coverage.

Its government promotes satellite IoT as part of national digital and space strategies, encouraging public-private partnerships and technology trials. Japan also supports miniaturized satellite development and launches, helping expand low-cost IoT solutions. With a strong foundation in robotics and automation, Japan is integrating Satellite IoT into smart infrastructure and emergency systems, contributing significantly to global growth and development in this field.

Satellite IoT Market: Key Takeaways

- Market Growth: The Satellite IoT Market size is expected to grow by USD 2.8 billion, at a CAGR of 15.1%, during the forecasted period of 2026 to 2034.

- By Satellite Type: The LEO antenna segment is anticipated to get the majority share of the Satellite IoT Market in 2025.

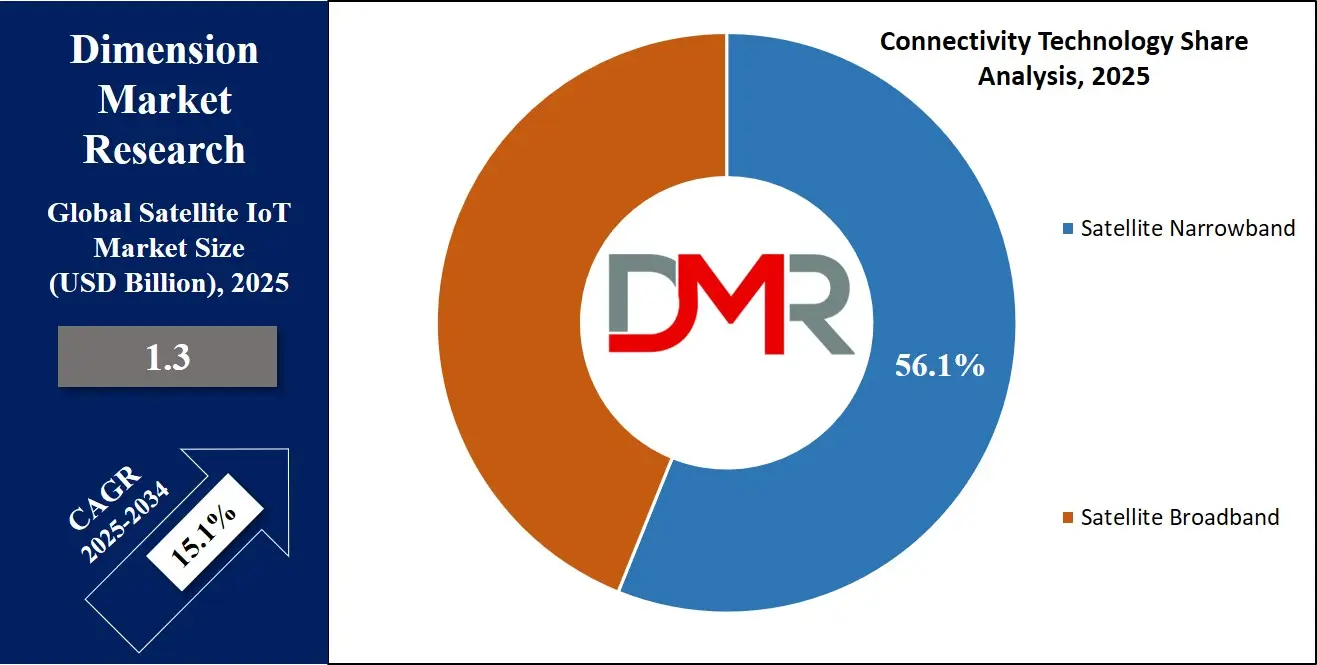

- By Connectivity Technology: The satellite narrowband segment is expected to get the largest revenue share in 2025 in the Satellite IoT Market.

- Regional Insight: North America is expected to hold a 33.8% share of revenue in the Global Satellite IoT Market in 2025.

- Use Cases: Some of the use cases of Satellite IoT include oil & gas monitoring, feet & asset tracking, and more.

Satellite IoT Market: Use Cases

- Agriculture Monitoring: Satellite IoT helps farmers monitor soil conditions, crop health, and water levels in remote fields. Devices send real-time data to improve yield and manage resources better. This is especially useful in large or hard-to-access farmland.

- Fleet and Asset Tracking: It enables constant tracking of ships, trucks, or cargo moving through remote areas with no mobile signal. This improves logistics, reduces theft, and ensures timely delivery. Companies gain better control over global supply chains.

- Oil and Gas Monitoring: Satellite-connected sensors monitor pipelines, rigs, and remote stations to detect leaks or failures early. This supports safer operations and reduces downtime. It also helps in meeting safety and environmental standards.

- Wildlife and Environmental Monitoring: Researchers use satellite IoT to track animal movements and gather environmental data from isolated locations. This supports conservation, climate studies, and disaster alerts. It allows data collection where human access is limited.

Market Dynamic

Driving Factors in the Satellite IoT Market

Expanding Need for Remote Connectivity

One of the main drivers of the Satellite IoT market is the growing demand for connectivity in remote and underserved regions. Traditional cellular networks do not cover large parts of the Earth, including oceans, mountains, forests, and deserts. Many industries such as agriculture, oil and gas, shipping, mining, and environmental research operate in these areas and need reliable data communication.

Satellite IoT provides a powerful solution by offering global coverage and continuous communication regardless of location. As the number of IoT devices increases worldwide, so does the need for reliable links in isolated areas. Satellite networks ensure that devices in the most remote places can send and receive data in real time. This growing requirement supports steady market growth.

Technological Advancements and Falling Costs

Another key driver is the rapid advancement in satellite technology and the decreasing cost of building and launching satellites. The development of mini-satellites, especially CubeSats, has made it easier and cheaper to deploy networks in space. Low Earth Orbit (LEO) satellite systems, in particular, offer low latency and high data speeds, which are ideal for IoT applications.

At the same time, reusable rockets and improved manufacturing processes have brought down launch costs significantly. These innovations lower the entry barrier for new players and make satellite IoT services more affordable for users. As more companies develop efficient and compact satellite IoT devices, the market becomes more accessible and scalable, leading to increased adoption across industries.

Restraints in the Satellite IoT Market

High Initial Investment and Maintenance Costs

One major restraint in the Satellite IoT market is the high cost involved in developing, launching, and maintaining satellite infrastructure. Building and deploying satellites require significant capital, and though costs have decreased in recent years, they still remain out of reach for many smaller organizations.

Additionally, ground stations, secure communication systems, and technical support require ongoing investment. Maintaining satellite networks over time also involves technical upgrades, replacements, and compliance with international regulations. These financial demands can slow down expansion, especially in developing regions or for niche service providers. As a result, cost remains a major hurdle for both providers and potential users of satellite-based IoT solutions.

Limited Bandwidth and Data Speed Constraints

Another challenge facing the Satellite IoT market is the limitation in bandwidth and data speed compared to terrestrial networks. Many satellite systems are designed to handle low data-rate applications, which can restrict their use for more complex or high-volume tasks. Latency, especially in higher-orbit systems, can also affect real-time data transmission. This is a concern for time-sensitive applications like emergency response or industrial automation.

Additionally, as more devices connect to satellite networks, managing data traffic efficiently becomes more difficult. These technical limitations can reduce performance, delay communication, and limit the overall capability of satellite IoT in certain use cases, affecting user experience and broader adoption.

Opportunities in the Satellite IoT Market

Rising Demand from Emerging Markets

Emerging economies present a major growth opportunity for the Satellite IoT market. Many rural and remote regions in these countries still lack stable internet infrastructure, making satellite-based solutions ideal for bridging the digital divide. Governments and private players in these areas are actively looking for ways to improve connectivity for agriculture, transportation, energy, and disaster response.

Satellite IoT can deliver reliable communication where mobile towers and fiber networks are not feasible. As awareness and accessibility improve, more sectors in developing regions are expected to adopt satellite IoT for essential operations. This expanding demand can unlock a large customer base and drive significant growth in the coming years.

Integration with 5G and Hybrid Networks

The integration of Satellite IoT with 5g Services and hybrid connectivity systems offers a promising opportunity for the market. As 5G networks continue to roll out globally, combining them with satellite systems can ensure seamless, continuous coverage across both urban and remote environments.

Hybrid networks allow devices to switch between terrestrial and satellite signals, enhancing reliability and performance. This approach is valuable for industries that operate in mixed terrain, such as logistics, agriculture, and defense. It also opens doors to more flexible and scalable IoT deployments. As technology standards mature and partnerships increase, the synergy between satellite and 5G could redefine global connectivity solutions.

Trends in the Satellite IoT Market

Trend Toward Integrated Hybrid Connectivity

A growing trend in the Satellite IoT market is the move toward hybrid connectivity solutions that combine satellite networks with terrestrial systems like cellular or Wi‑Fi. This integration ensures devices maintain reliable communication even when they move between connected and remote areas. With smarter software and adaptive switching algorithms, IoT devices can seamlessly shift between networks to maintain low latency and consistent performance.

This hybrid model improves resilience in challenging environments and supports industries such as logistics, farming, and emergency services. The trend reflects a stronger focus on delivering continuous coverage and optimized user experience across diverse operating conditions.

Rise of Low-Orbit and Small Satellite Deployments

Another important trend is the surge in low Earth orbit (LEO) satellites and small satellite constellations dedicated to IoT. These compact satellites are quicker and less expensive to build and launch, enabling faster deployment of global coverage networks. They deliver lower latency and faster data transmission compared to traditional higher-orbit systems, making them better suited for real‑time IoT applications. The increasing use of numerous small satellites working together boosts network reliability and scalability. This trend has spurred new services and providers, making satellite-based IoT more accessible and practical for a wider range of industries and use cases.

Impact of Artificial Intelligence in Satellite IoT Market

- Improved Data Analysis and Insights: Artificial Intelligence enables faster and smarter processing of large volumes of IoT data collected via satellites. It helps identify patterns, detect anomalies, and generate actionable insights in real time, which is especially useful in fields like weather monitoring, logistics, and agriculture.

- Enhanced Predictive Maintenance: By analyzing satellite data from remote assets, AI can predict failures or maintenance needs before they happen. This reduces downtime, increases efficiency, and extends the life of machinery and equipment in sectors like mining, energy, and transportation.

- Optimized Network and Bandwidth Use: AI algorithms can manage data traffic, prioritize transmissions, and adapt to changing conditions, helping optimize satellite bandwidth. This ensures smoother communication and better use of limited satellite resources.

- Smarter Asset Tracking and Routing: AI supports intelligent decision-making for tracking systems, such as choosing the best routes or detecting unusual movements. It adds value to satellite-based logistics and fleet management systems by improving accuracy and responsiveness.

- Autonomous System Management: With AI, satellite IoT platforms can self-adjust to network conditions, environmental changes, or operational demands. This leads to more resilient, self-managing systems that require minimal human intervention—ideal for remote or critical applications.

Research Scope and Analysis

By Frequency Band Analysis

L-band is expected to be leading the Satellite IoT market in 2025 with a share of 28.7%, driven by its strong reliability, wide coverage, and resistance to weather disruptions. It operates at lower frequencies, allowing signals to travel longer distances and penetrate through dense environments like forests, buildings, or rough terrain. These features make L-band especially useful for critical applications such as maritime tracking, aviation monitoring, emergency services, and mobile asset tracking in remote regions.

Its ability to maintain stable communication in all weather conditions makes it a preferred choice for industries needing continuous data flow. The growing use of compact terminals and advancements in satellite communication systems further support the demand for L-band in IoT deployments. With its proven stability and strong compatibility with low-data-rate applications, L-band is set to play a vital role in expanding reliable Satellite IoT connectivity across a variety of industries and geographies.

Ka-band is expected to witness significant growth over the forecast period in the Satellite IoT market, supported by its ability to deliver high-speed data transmission and handle large volumes of information. Operating at higher frequencies, Ka-band provides increased bandwidth, which is essential for real-time communication and complex IoT use cases such as industrial automation, video surveillance, and high-resolution environmental sensing.

As low Earth orbit satellites become more common, Ka-band’s compatibility with these systems boosts its utility in delivering fast and efficient IoT services. The growing need for high-capacity satellite communication systems and advancements in antenna technology make Ka-band an attractive option for next-generation IoT networks. Its potential for supporting smart infrastructure, connected vehicles, and large-scale industrial monitoring positions it as a key frequency band driving the evolution of Satellite IoT solutions in both developed and emerging markets.

By Satellite Type Analysis

LEO Satellite is projected to lead the Satellite IoT market in 2025 with a share of 62.9%, thanks to its ability to offer low-latency, fast, and reliable communication. Orbiting closer to Earth, LEO satellites enable quicker data transfer, which is crucial for real-time monitoring and time-sensitive IoT applications. They are well-suited for connecting sensors, tracking systems, and smart devices across remote areas, including oceans, deserts, and rural landscapes.

The smaller size and lower launch cost of LEO satellites allow multiple deployments, forming constellations that ensure global coverage. These advantages make them ideal for industries like transportation, defense, agriculture, and environmental monitoring. As demand for always-on, wide-area IoT connectivity increases, LEO satellite networks are expected to become a central piece of modern communication infrastructure, offering scalable and cost-efficient solutions for businesses and governments worldwide.

MEO Satellite is anticipated to show significant growth over the forecast period in the Satellite IoT market due to its balance of coverage area and data speed. Positioned between low and high Earth orbits, MEO satellites provide broader regional coverage than LEO and lower latency than traditional GEO systems.

This makes them well-suited for regional communication needs such as navigation, maritime tracking, and aviation data exchange. With rising demand for stable and extended connectivity in sectors like logistics, defense, and energy, MEO satellites are becoming a valuable part of the satellite IoT ecosystem. Their ability to support medium-range data services while covering vast areas without the delays of higher orbits makes them appealing for mission-critical operations. As satellite technology continues to evolve, MEO systems are likely to play a growing role in supporting diverse IoT use cases across different parts of the world.

By Service Type Analysis

Direct to Satellite is forecasted to lead the Satellite IoT market in 2025 with a share of 51.3%, driven by its ability to connect IoT devices straight to satellites without the need for ground-based infrastructure. This approach simplifies deployment, lowers setup costs, and enables communication in remote or hard-to-reach locations. It’s especially valuable for applications in areas with no cellular coverage, such as oceans, deserts, forests, and polar regions.

Direct to Satellite services support low-power, long-life IoT devices, making them ideal for asset tracking, agriculture, environmental monitoring, and emergency response. With the expansion of low Earth orbit satellite networks and advancements in compact satellite terminals, more industries are adopting this service model. Its plug-and-play convenience, scalability, and global reach make Direct to Satellite a popular choice for businesses looking to extend IoT capabilities beyond traditional network boundaries.

Satellite Backhaul is projected to experience significant growth over the forecast period in the Satellite IoT market due to its ability to extend network coverage in underserved regions. By linking remote IoT gateways to the main internet through satellite links, backhaul services help maintain reliable data flow in areas with limited or no fiber or cellular infrastructure. This is especially important for industries like mining, oil and gas, and rural utilities that rely on uninterrupted communication.

Satellite Backhaul supports high-capacity transmission and allows integration with existing terrestrial networks. As demand for always-connected systems rises, backhaul becomes essential for enabling seamless connectivity across diverse environments. Its role in bridging connectivity gaps makes it a critical part of expanding IoT access in challenging or temporary locations.

By Connectivity Technology Analysis

Satellite Narrowband is projected to lead the Satellite IoT market in 2025 with a share of 56.1%, mainly due to its efficiency in supporting low-power, low-data-rate applications across wide and remote areas. This connectivity type is ideal for simple IoT tasks like sensor monitoring, asset tracking, smart metering, and weather observation, where only small amounts of data need to be transmitted regularly.

Satellite Narrowband consumes less power, allowing devices to run for years on a single battery, which is perfect for hard-to-reach or unattended sites. It enables reliable communication even in extreme weather or terrain, making it well-suited for industries like agriculture, utilities, and environmental research. With the growing number of connected devices worldwide and a need for cost-effective communication, this technology is expected to play a key role in expanding global Satellite IoT networks.

Satellite Broadband is anticipated to grow significantly over the forecast period in the Satellite IoT market due to its ability to support high-speed, data-rich applications. This technology allows for large file transfers, real-time video feeds, and faster communication between connected systems. It is particularly useful for use cases in remote healthcare, emergency response, industrial automation, and surveillance, where detailed or continuous data is essential.

Satellite Broadband can handle more complex IoT setups, supporting a larger number of devices and providing stronger network performance. As low Earth orbit satellite networks expand and become more affordable, broadband connections are becoming more accessible in rural and offshore locations. This growing demand for bandwidth-heavy applications across remote and isolated regions is helping Satellite Broadband become an important part of the evolving IoT ecosystem.

ℹ

To learn more about this report –

Download Your Free Sample Report Here

By Application Analysis

Asset Tracking & Monitoring is projected to lead the Satellite IoT market in 2025 with a share of 31.5%, driven by the rising need to manage and secure valuable resources across remote and global operations. This application allows businesses to track the real-time location, movement, and condition of assets such as vehicles, shipping containers, equipment, and livestock, even in areas with no cellular coverage. Satellite connectivity ensures constant communication, reducing risks like theft, delays, or damage.

Industries such as transportation, logistics, mining, and maritime heavily rely on this capability to maintain operational efficiency and supply chain visibility. As businesses seek better control over widely distributed resources, Satellite IoT solutions for tracking and monitoring are becoming essential tools. Their ability to provide accurate, uninterrupted data in any environment makes this segment a key driver of market expansion across multiple sectors.

Smart Agriculture is expected to witness significant growth over the forecast period in the Satellite IoT market, supported by the increasing need for efficient and data-driven farming practices. By using satellite-connected sensors and devices, farmers can monitor soil moisture, crop health, weather patterns, and livestock movement across large, remote fields.

This real-time information helps in making better decisions about irrigation, fertilization, and harvesting, which improves crop yield and reduces waste. Satellite IoT also enables precision farming in rural areas where traditional networks are not available. As climate challenges grow and global food demand rises, smart agriculture is becoming a priority across both developed and developing regions. The ability to gather consistent, location-based insights makes satellite-enabled farming an essential part of the future agricultural landscape.

The Satellite IoT Market Report is segmented on the basis of the following:

By Frequency Band

- L-Band

- S-Band

- C-Band

- X-Band

- Ku-Band

- Ka-Band

- Others

By Satellite Type

- Low Earth Orbit (LEO) Satellites

- Less than 1,000 km

- 1,000–2,000 km

- Medium Earth Orbit (MEO) Satellites

- Geostationary Orbit (GEO) Satellites

By Service Type

- Direct-to-Satellite (DTS) Services

- Messaging

- Data Transfer

- Emergency Alerts

- Satellite Backhaul Services

- Cellular Backhaul

- SCADA Systems

- Store-and-Forward Services

- Delay-Tolerant Data

- Intermittent Data Logging

By Connectivity Technology

- Satellite Narrowband IoT (NB-IoT, LTE-M)

- LPWAN over Satellite

- Delay-Tolerant Messaging

- Satellite Broadband (5G, LTE, etc.)

- Real-Time Video

- High-Speed Data Services

By Application

- Asset Tracking & Monitoring

- Fleet Management

- Remote Equipment Monitoring

- Predictive Maintenance

- Industrial Systems

- Infrastructure

- Smart Agriculture

- Livestock Monitoring

- Precision Farming

- Environmental Monitoring

- Weather Forecasting

- Disaster Detection

- Maritime Monitoring

- Vessel Tracking

- Fishing Management

- Industrial IoT

- Factory Automation

- Remote Process Control

- Military & Defense

- Surveillance

- Mission-Critical Communication

- Others

Regional Analysis

Leading Region in the Satellite IoT Market

North America is leading the Satellite IoT market in 2025 with a share of 33.8%, driven by strong advancements in satellite technology, early adoption of IoT applications, and a robust network of private space companies. The region benefits from widespread demand across industries like agriculture, logistics, energy, defense, and environmental monitoring, which all rely on reliable connectivity in remote or hard-to-reach areas. With the US playing a major role, many firms in North America are launching low Earth orbit satellites and building hybrid connectivity solutions that link satellites with terrestrial networks.

Government support, defense programs, and public-private partnerships further fuel market growth. Canada also contributes through satellite-based communication systems, especially for its remote and northern communities. The presence of key infrastructure, skilled workforce, and ongoing investments in space and IoT innovation make North America a central hub for global expansion. As new use cases emerge and networks grow stronger, the region is expected to maintain its leadership in the Satellite IoT market.

ℹ

To learn more about this report –

Download Your Free Sample Report Here

Fastest Growing Region in the Satellite IoT Market

Asia Pacific is showing significant growth over the forecast period in the Satellite IoT market, supported by rapid industrial development, expanding smart agriculture, and rising demand for remote connectivity. Countries like China, Japan, India, and South Korea are investing in low Earth orbit satellites, small satellite constellations, and satellite-based communication systems to strengthen data coverage in rural and hard-to-reach regions. With growing interest in smart cities, environmental monitoring, and transport tracking, the need for reliable satellite IoT connectivity is increasing. Government programs, space missions, and private partnerships are boosting regional innovation. The region’s large population and diverse terrain make satellite-enabled IoT solutions both practical and necessary for sustainable growth.

By Region

North America

Europe

- Germany

- The U.K.

- France

- Italy

- Russia

- Spain

- Benelux

- Nordic

- Rest of Europe

Asia-Pacific

- China

- Japan

- South Korea

- India

- ANZ

- ASEAN

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Argentina

- Colombia

- Rest of Latin America

Middle East & Africa

- Saudi Arabia

- UAE

- South Africa

- Israel

- Egypt

- Rest of MEA

Competitive Landscape

The Satellite IoT market is becoming highly competitive as more companies, both old and new, enter the space to offer global connectivity solutions. Some focus on building and operating their own satellites, while others create devices and software that connect to these networks. A few specialize in serving specific industries like shipping, farming, or energy, while others aim to offer low-cost, wide-area coverage for general use. The competition is also driven by new technology, like small satellites and low-orbit systems, which make it easier and cheaper to offer IoT services from space. Companies are racing to expand their networks, form partnerships, and create flexible plans to attract customers who want real-time, reliable, and far-reaching IoT connections anywhere on Earth.

Some of the prominent players in the global Satellite IoT are:

- Iridium Communications Inc.

- ORBCOMM Inc.

- Inmarsat (part of Viasat)

- Viasat Inc.

- SES S.A.

- Eutelsat Communications S.A.

- Intelsat S.A.

- Thales Alenia Space

- Lockheed Martin Corporation

- SpaceX

- Amazon

- OneWeb

- Hughes Network Systems (EchoStar)

- Globalstar Inc.

- Skylo Technologies

- Myriota

- Swarm Technologies (SpaceX)

- Fleet Space Technologies

- Kepler Communications

- Astrocast

- Other Key Players

Recent Developments

- In June 2025, M2M One launched a new satellite connectivity service across Australia and New Zealand, offering a combined package of airtime and hardware tailored for remote industries. Branded as M2M One Satellite Airtime, it is positioned as Australia’s first industrial IoT satellite solution to integrate data plans with high-quality hardware. The service enables M2M channel partners to deliver satellite connectivity via networks like Iridium Communications and Inmarsat. It is designed for mission-critical applications needing reliable backup when terrestrial cellular networks are unavailable, targeting sectors such as mining, energy, agriculture, logistics, defence, and emergency services.

- In March 2025, Myriota launched HyperPulse, a non-terrestrial (NTN) narrowband IoT (NB-IoT) service using Viasat’s geostationary L-band network with dynamic leasing to scale connectivity. HyperPulse is the first solution to leverage this capability, with developer onboarding set for April. Meanwhile, Spanish rival Sateliot has closed a EUR 70 million Series B round, including EUR 10 million from Hyperion. This follows recent funding from the Spanish government, Global Portfolio, and the European Investment Bank. Both firms are building 5G Release 17-based LEO NB-IoT networks.

Report Details

| Report Characteristics |

| Market Size (2025) |

USD 1.3 Bn |

| Forecast Value (2034) |

USD 4.5 Bn |

| CAGR (2025–2034) |

15.1% |

| Historical Data |

2019 – 2023 |

| The US Market Size (2025) |

USD 0.4 Bn |

| Forecast Data |

2026 – 2034 |

| Base Year |

2024 |

| Estimate Year |

2025 |

| Report Coverage |

Market Revenue Estimation, Market Dynamics, Competitive Landscape, Growth Factors, etc. |

| Segments Covered |

By Frequency Band (L-Band, S-Band, C-Band, X-Band, Ku-Band, Ka-Band, and Others), By Satellite Type (Low Earth Orbit (LEO) Satellites, Medium Earth Orbit (MEO) Satellites, and Geostationary Orbit (GEO) Satellites), By Service Type (Direct-to-Satellite (DTS) Services, Satellite Backhaul Services, and Store-and-Forward Services), By Connectivity Technology (Satellite Narrowband IoT (NB-IoT, LTE-M) and Satellite Broadband (5G, LTE, etc.)), By Application (Asset Tracking & Monitoring, Predictive Maintenance, Smart Agriculture, Environmental Monitoring, Maritime Monitoring, Industrial IoT, Military & Defense, and Others) |

| Regional Coverage |

North America – US, Canada; Europe – Germany, UK, France, Russia, Spain, Italy, Benelux, Nordic, Rest of Europe; Asia-Pacific – China, Japan, South Korea, India, ANZ, ASEAN, Rest of APAC; Latin America – Brazil, Mexico, Argentina, Colombia, Rest of Latin America; Middle East & Africa – Saudi Arabia, UAE, South Africa, Turkey, Egypt, Israel, Rest of MEA |

| Prominent Players |

Iridium Communications Inc., ORBCOMM Inc., Inmarsat, Viasat Inc., SES S.A., Eutelsat Communications S.A., Intelsat S.A., Thales Alenia Space, Lockheed Martin Corporation, SpaceX, Amazon, OneWeb, Hughes Network Systems, Globalstar Inc., Skylo Technologies, Myriota, Swarm |

| Purchase Options |

We have three licenses to opt for: Single User License (Limited to 1 user), Multi-User License (Up to 5 Users), and Corporate Use License (Unlimited User) along with free report customization equivalent to 0 analyst working days, 3 analysts working days, and 5 analysts working days respectively. |

Frequently Asked Questions

How big is the Global Satellite IoT Market?

▾ The Global Satellite IoT Market size is expected to reach a value of USD 1.3 billion in 2025 and is expected to reach USD 4.5 billion by the end of 2034.

Which region accounted for the largest Global Satellite IoT Market?

▾ North America is expected to have the largest market share in the Global Satellite IoT Market, with a share of about 33.8% in 2025.

How big is the Satellite IoT Market in the US?

▾ The Satellite IoT Market in the US is expected to reach USD 400 million in 2025.

Who are the key Satellite IoT Market?

▾ Some of the major key players in the Global Satellite IoT Market include Iridium Communications Inc., ORBCOMM Inc., Inmarsat, and others

What is the growth rate in the Global Satellite IoT Market?

▾ The market is growing at a CAGR of 15.1 percent over the forecasted period.