Market Overview

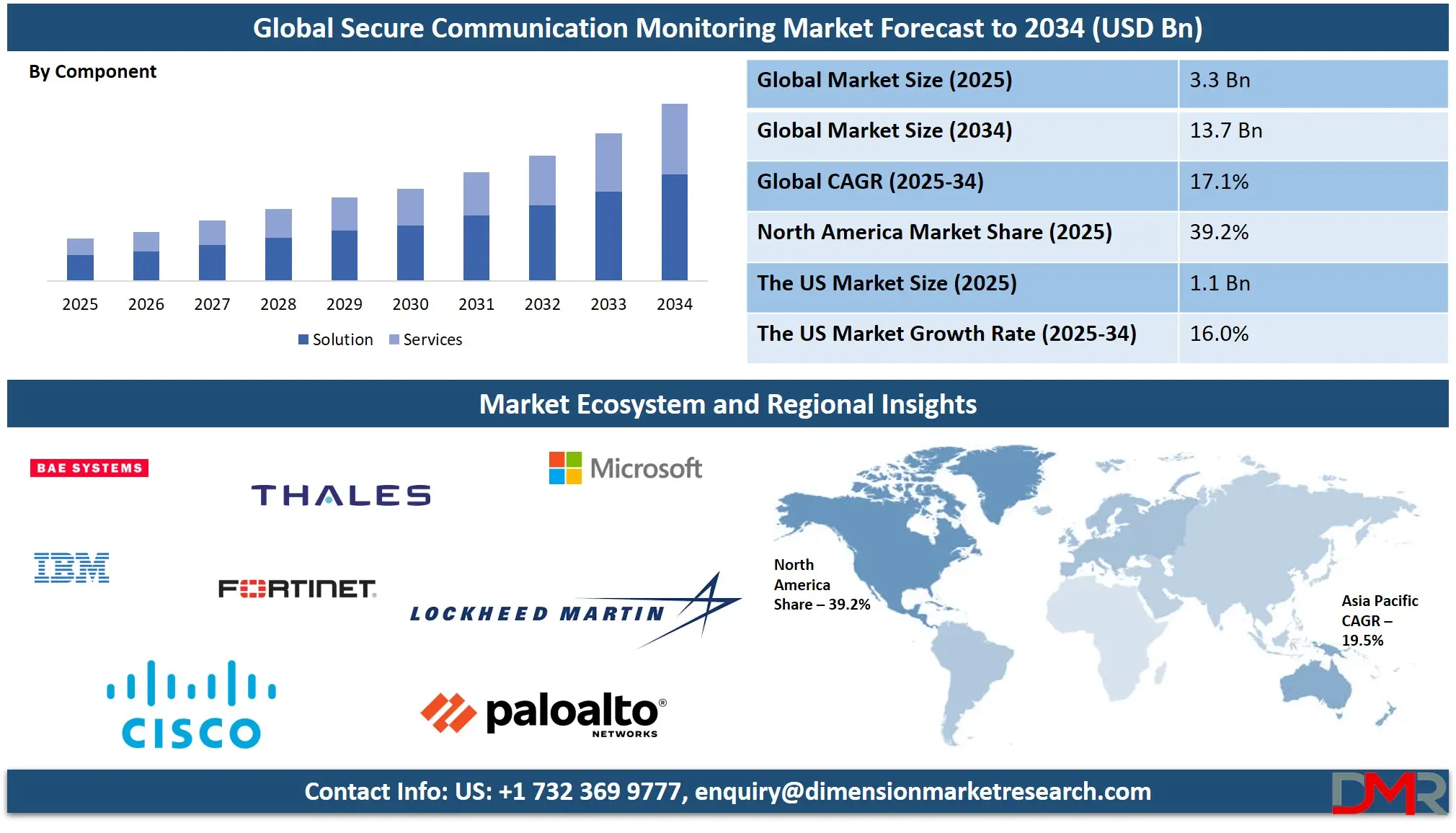

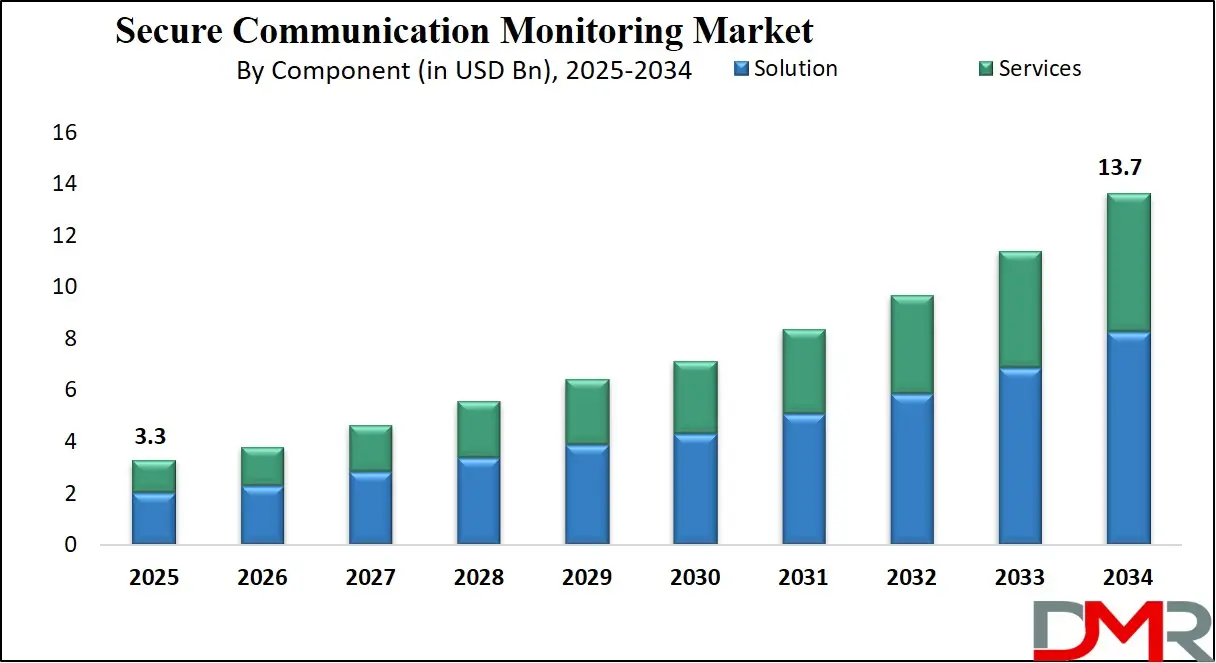

The Global Secure Communication Monitoring Market size is projected to reach USD 3.3 billion in 2025 and grow at a compound annual growth rate of 17.1% from there until 2034 to reach a value of USD 13.7 billion

Secure Communication Monitoring refers to the use of advanced tools and technologies to track, analyze, and safeguard the transmission of sensitive data across communication channels, including voice, email, messaging apps, and collaborative platforms. The objective is to detect potential security breaches, enforce compliance with regulations, and prevent data leakage in real time.

ℹ

To learn more about this report –

Download Your Free Sample Report Here

It is especially critical for sectors such as defense, finance, healthcare, and critical infrastructure, where information confidentiality and integrity are paramount. The monitoring often involves encryption management, metadata analysis, anomaly detection through AI, and integration with broader security information and event management (SIEM) systems.

The Secure Communication Monitoring market has experienced significant growth in recent years, driven by the rise in cyber threats, regulatory pressures, and digital transformation initiatives. The global shift to remote and hybrid work models during the COVID-19 pandemic exposed organizations to new vulnerabilities, increasing the demand for robust communication monitoring systems.

Government mandates, such as GDPR in Europe and HIPAA in the U.S., require organizations to ensure secure communication practices, further fueling market expansion. The financial services sector, in particular, has seen a surge in adoption due to strict compliance rules from bodies like FINRA and the SEC.

Artificial Intelligence and Machine Learning are playing an increasingly prominent role in secure communication monitoring by enabling predictive analytics, behavioral analysis, and automated threat response. There’s a notable trend toward integrating monitoring systems with zero-trust architectures, where every user and device must be authenticated continuously.

End-to-end encryption technologies are also evolving, and organizations are seeking tools that can monitor encrypted communications without compromising privacy or security. The use of natural language processing (NLP) to analyze communication context is another emerging trend.

As threats become more sophisticated, regulatory frameworks have evolved. In 2024, the EU introduced the Digital Operational Resilience Act (DORA), placing strict demands on financial institutions for monitoring digital communications.

Similarly, U.S. executive orders have emphasized the need for government agencies to adopt secure communication protocols. These legal frameworks are pushing organizations to invest in real-time monitoring solutions with auditability and reporting capabilities.

Looking ahead, Secure Communication Monitoring is set to become a cornerstone of enterprise and national cybersecurity strategies. As 5G, IoT, and cloud-native architectures proliferate, the complexity of communication channels will increase, making proactive monitoring indispensable.

ℹ

To learn more about this report –

Download Your Free Sample Report Here

Companies that fail to implement robust systems risk not only data breaches but also severe regulatory fines and reputational damage. Therefore, secure communication monitoring is transitioning from a compliance checkbox to a business-critical function, and organizations are embedding it into their broader risk management and digital transformation agendas.

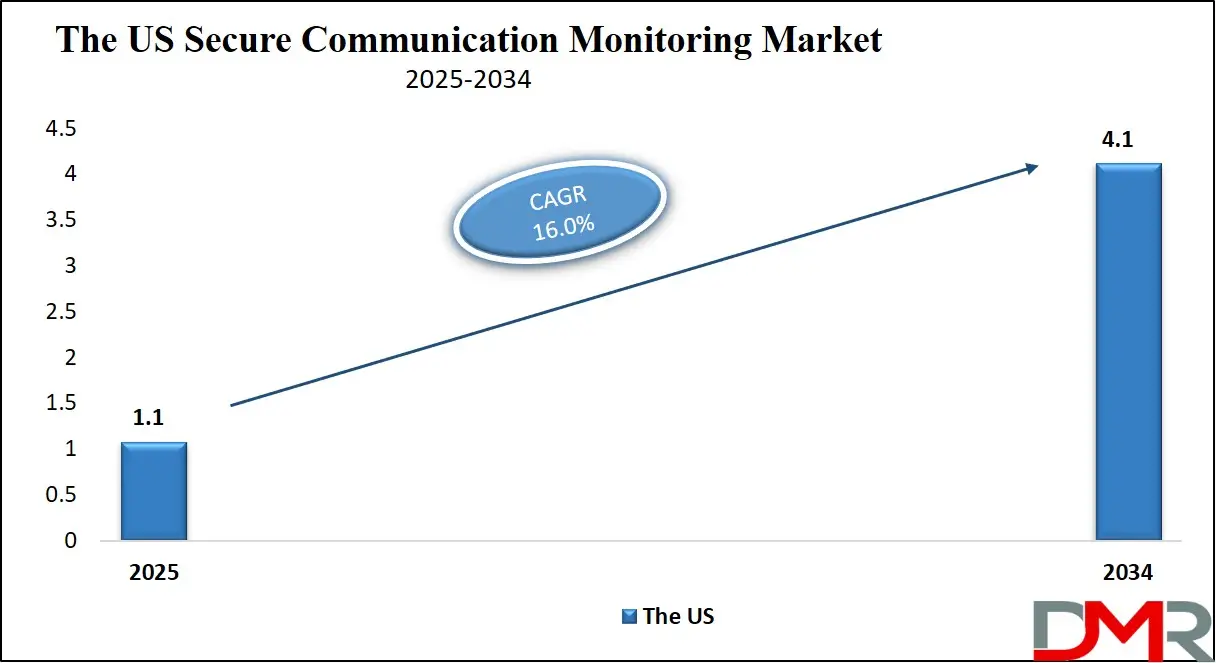

The US Secure Communication Monitoring Market

The US Secure Communication Monitoring Market size is projected to reach USD 1.1 billion in 2025 at a compound annual growth rate of 16.0% over its forecast period

The US plays a leading role in the secure communication monitoring market, driven by its advanced technology sector and stringent cybersecurity regulations. Many US organizations, especially in finance, government, and healthcare, prioritize secure communication to protect sensitive data and comply with strict laws. The US government actively supports cybersecurity initiatives, investing in research and development to advance monitoring technologies.

Additionally, the US is home to many innovators developing AI-powered tools and sophisticated encryption methods that set global standards. Growing concerns over cyber threats and data breaches in the US continue to push demand for robust monitoring solutions. Overall, the US influences market trends worldwide through technological innovation, regulatory frameworks, and significant investments in communication security.

ℹ

To learn more about this report –

Download Your Free Sample Report Here

Europe Secure Communication Monitoring Market

Europe Secure Communication Monitoring Market size is projected to reach USD 0.8 billion in 2025 at a compound annual growth rate of 15.7% over its forecast period.

Europe plays a crucial role in the secure communication monitoring market, largely driven by its strong focus on data privacy and regulatory compliance. The introduction of strict regulations like GDPR and the Digital Operational Resilience Act (DORA) has pushed organizations across Europe to adopt advanced monitoring solutions to safeguard sensitive communications and ensure legal compliance. European businesses, especially in finance, healthcare, and government sectors, are investing heavily in technologies that provide real-time threat detection and secure data exchange.

Additionally, Europe is fostering innovation through funding and collaboration between private companies and research institutions to develop next-generation security tools. This regulatory-driven demand, combined with technological advancements, positions Europe as a key player influencing global secure communication monitoring standards and practices.

Japan Secure Communication Monitoring Market

Japan Secure Communication Monitoring Market size is projected to reach USD 0.1 billion in 2025 at a compound annual growth rate of 19.1% over its forecast period.

Japan plays an important role in the secure communication monitoring market by focusing on advanced technology adoption and stringent cybersecurity practices. Japanese companies, especially in manufacturing, finance, and government sectors, prioritize secure communication to protect intellectual property and sensitive information from cyber threats. Japan’s government supports the development of cybersecurity infrastructure through policies and investments aimed at enhancing national security and resilience.

Collaboration between private firms and research institutions drives innovation in encryption and AI-powered monitoring solutions. While Japan faces increasing cyber risks similar to the US and Europe, it emphasizes a balanced approach that respects privacy while ensuring security. This focus on cutting-edge technology and regulation makes Japan a key contributor to the global secure communication monitoring market.

Secure Communication Monitoring Market: Key Takeaways

- Market Growth: The Secure Communication Monitoring Market size is expected to grow by USD 9.9 billion, at a CAGR of 17.1%, during the forecasted period of 2026 to 2034.

- By Component: The solution segment is anticipated to get the majority share of the Secure Communication Monitoring Market in 2025.

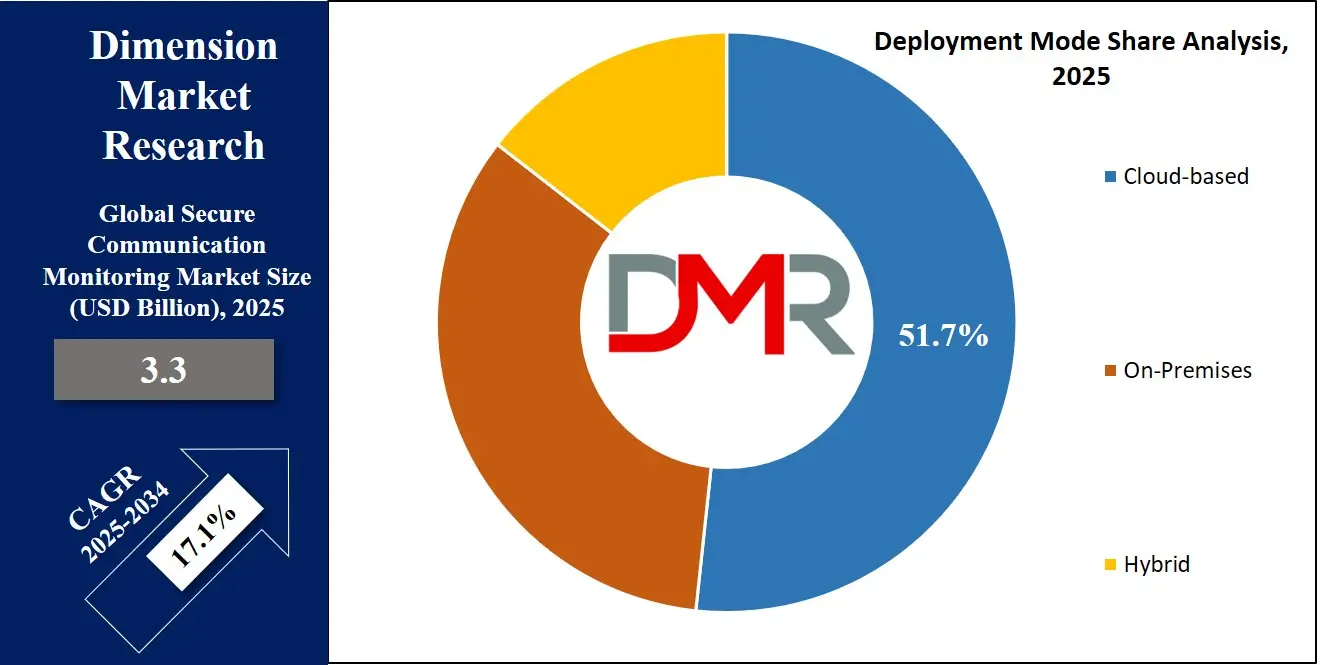

- By Deployment Mode: The cloud-based segment is expected to get the largest revenue share in 2025 in the Secure Communication Monitoring Market.

- Regional Insight: North America is expected to hold a 39.2% share of revenue in the Global Secure Communication Monitoring Market in 2025.

- Use Cases: Some of the use cases of Secure Communication Monitoring include healthcare data protection, corporate policy enforcement, and more.

Secure Communication Monitoring Market: Use Cases

- Financial Services Compliance Monitoring: Financial institutions use secure communication monitoring to ensure employees follow strict regulatory rules. This includes reviewing emails, chat messages, and calls to detect insider trading, fraud, or misconduct. Automated alerts help compliance teams act quickly to prevent violations and avoid costly penalties.

- Healthcare Data Protection: Hospitals and clinics monitor communication channels to protect patient health information and comply with data privacy laws like HIPAA. Secure communication monitoring helps detect unauthorized sharing of medical data and ensures staff only access necessary patient records. This reduces the risk of data breaches and enhances patient trust.

- Government and Defense Security: Agencies use secure communication monitoring to safeguard classified information shared through voice, video, or messaging platforms. It helps detect potential espionage, insider threats, or policy breaches. Continuous monitoring supports national security by ensuring sensitive communications remain confidential and traceable.

- Corporate Policy Enforcement: Companies monitor internal communications to enforce workplace policies, prevent harassment, and stop data leakage. By scanning for inappropriate content or sensitive file transfers, organizations maintain a safe and professional environment. This also protects intellectual property and ensures compliance with internal rules and external regulations.

Market Dynamic

Driving Factors in the Secure Communication Monitoring Market

Rise in Remote Work and Hybrid Communication Channels

The global shift toward remote and hybrid work environments has significantly increased the number of digital communication platforms used by organizations. Employees now rely on emails, messaging apps, video conferencing, and collaborative tools to stay connected, often using multiple devices and networks.

This surge in digital communication has introduced new vulnerabilities, making it harder to track and secure sensitive information. As a result, companies are turning to secure communication monitoring solutions to detect data leakage, insider threats, and unauthorized access in real time. These tools provide visibility across channels and help ensure that security policies are enforced consistently, regardless of where employees work. The growing need to manage and secure distributed communications is a major factor fueling market demand.

Evolving Regulatory Requirements and Data Privacy Laws

With stricter regulations like GDPR, HIPAA, and the Digital Operational Resilience Act (DORA) taking effect worldwide, organizations are under immense pressure to ensure that their communication practices are compliant. These laws require continuous monitoring of data flows to prevent unauthorized disclosures and ensure auditability. Failing to meet these requirements can lead to significant fines, reputational damage, and legal action.

Secure communication monitoring tools help businesses stay compliant by providing real-time alerts, detailed logs, and automated reporting. As regulatory frameworks continue to expand across industries—especially in finance, healthcare, and government—the demand for these monitoring solutions is expected to grow. This regulatory pressure is a powerful driver behind the rapid adoption of secure communication technologies.

Restraints in the Secure Communication Monitoring Market

Privacy Concerns and Employee Resistance:

One of the key restraints in the secure communication monitoring market is the growing concern over privacy, mainly among employees. Monitoring communications, mainly in real time, can raise ethical and legal questions about surveillance and individual rights. Employees may feel that their messages or conversations are being watched, leading to discomfort, decreased morale, and pushback against such systems.

In regions with strict labor and privacy laws, companies must tread carefully to balance security needs with personal privacy. This challenge can delay adoption or lead to limited implementation of monitoring tools. Businesses must ensure transparency and establish clear policies to gain employee trust, which is not always easy or quick to achieve.

High Implementation Costs and Technical Complexity

Deploying secure communication monitoring solutions can involve significant upfront costs, especially for large enterprises with complex IT environments. These systems often require integration with multiple communication platforms, strong encryption management, AI-based analytics, and continuous updates to stay ahead of evolving threats.

Additionally, companies may need to hire or train specialized staff to manage and interpret the monitoring data effectively. For small and mid-sized businesses, these costs and technical demands can be a major barrier. The complexity of aligning monitoring tools with existing security infrastructure also makes implementation time-consuming and resource-intensive, which slows market growth among budget-constrained organizations.

Opportunities in the Secure Communication Monitoring Market

Integration with Artificial Intelligence and Automation:

The integration of AI and automation presents a major opportunity for the secure communication monitoring market. AI-driven systems can analyze large volumes of communication data in real time, identifying suspicious patterns, potential insider threats, and compliance violations with greater accuracy. Machine learning models improve over time, enabling proactive rather than reactive security.

Automation can further streamline incident response by triggering alerts and even taking pre-defined actions without human intervention. This reduces workload for security teams while increasing response speed and effectiveness. As organizations seek smarter, faster, and more scalable solutions, AI-powered monitoring tools are expected to gain strong traction. This shift opens new possibilities for innovation and product differentiation in the market.

Growing Demand in Emerging Markets and SMEs:

Emerging markets and small to mid-sized enterprises (SMEs) are increasingly recognizing the importance of secure communication monitoring as they digitalize operations and face growing cyber risks. With the rise of cloud-based and subscription-based monitoring tools, the barriers to entry for these businesses are gradually lowering. As cyber threats become more widespread and regulatory frameworks extend to new regions, SMEs are seeking affordable and easy-to-deploy solutions.

Vendors have a significant opportunity to cater to this untapped segment by offering simplified, scalable, and cost-effective platforms. The demand for flexible solutions in developing economies creates room for market expansion and long-term customer growth in previously underserved areas.

Trends in the Secure Communication Monitoring Market

AI-Driven Automation and Predictive Threat Intelligence

A significant trend in the secure communication monitoring market is the integration of Artificial Intelligence (AI) and Machine Learning (ML) to automate threat detection and response. These technologies enable systems to analyze vast amounts of communication data in real time, identifying anomalies and potential threats with greater accuracy.

AI-driven tools can predict and mitigate risks proactively, reducing the burden on human analysts and enhancing overall security effectiveness. This shift towards automation is driven by the increasing complexity of cyber threats and the need for rapid, efficient responses. As organizations continue to adopt AI-powered monitoring solutions, the market is expected to see substantial growth in this area.

Quantum-Resistant Encryption and Regulatory Compliance

The emergence of quantum computing poses a potential threat to traditional encryption methods, prompting the development of quantum-resistant cryptographic algorithms. Organizations are investing in post-quantum cryptography to safeguard sensitive communications against future quantum attacks. This trend is particularly relevant for sectors like finance and defense, where data security is paramount.

Additionally, evolving regulatory frameworks, such as the General Data Protection Regulation (GDPR) and the Digital Operational Resilience Act (DORA), are compelling organizations to enhance their communication monitoring capabilities to ensure compliance. These regulations mandate stringent data protection measures, driving the adoption of advanced monitoring solutions that can provide real-time alerts and comprehensive audit trails.

Research Scope and Analysis

By Component Analysis

Solution as a component is set to lead the secure communication monitoring market in 2025 with an estimated share of 60.4%, driving much of the market’s growth. These solutions include tools for real-time threat detection, data encryption, compliance management, and anomaly detection across various communication channels. Organizations are increasingly adopting these solutions to protect sensitive information, prevent data breaches, and meet regulatory requirements.

The rise of cloud-based platforms and AI-powered analytics in these solutions further boosts their effectiveness and popularity. As businesses face growing cyber risks and complex communication networks, demand for comprehensive, easy-to-use secure communication monitoring solutions is expected to rise sharply. This strong adoption of advanced technologies and scalable solutions is a key factor supporting market expansion in the coming years.

Services as a component of the secure communication monitoring market are expected to see significant growth over the forecast period. These services include consulting, system integration, maintenance, and managed monitoring, which help organizations implement and optimize their secure communication systems effectively.

Many businesses prefer to rely on expert service providers to handle complex deployments and ongoing support, ensuring their communication channels remain secure and compliant. As communication environments become more complex with cloud adoption and remote work, the need for professional services increases. This growing reliance on expert guidance and support is driving strong demand for secure communication monitoring services, making this segment a vital part of the market’s growth.

By Communication Type Analysis

Voice communication as a type is expected to hold a significant share of 34.7% in the secure communication monitoring market by 2025, playing a crucial role in its growth. Voice remains one of the most widely used communication methods in enterprises, especially for sensitive discussions in sectors like finance, healthcare, and government. The increasing use of VoIP, mobile calls, and unified communication platforms has made securing voice data more important than ever.

Organizations are adopting advanced monitoring tools that can analyze voice traffic for threats, compliance violations, and data leaks in real time. With the rise of remote work and global collaboration, securing voice communication helps prevent fraud and insider threats, making it a key area of investment. This growing focus on protecting voice channels will continue to drive the market forward.

Video communication is expected to have a significant growth in the secure communication monitoring market over the forecast period. The rise of video conferencing tools for remote meetings, training, and customer interactions has increased the volume of sensitive data shared visually and verbally.

This growth drives the need for secure monitoring solutions that can analyze video calls for unauthorized sharing, compliance breaches, and potential cyber threats. As businesses rely more on video platforms, especially in hybrid work environments, ensuring these communications are safe and meet regulatory standards becomes critical.

Enhanced video monitoring technologies, including AI-based content recognition and anomaly detection, are helping organizations protect their information. This expanding use of video communication is set to boost demand for secure communication monitoring solutions significantly.

By Deployment Mode Analysis

Cloud deployment is set to lead the secure communication monitoring market in 2025 with an estimated share of 51.7%, driving strong growth in the industry. The flexibility and scalability of cloud-based solutions make them highly attractive to organizations of all sizes, allowing easy access to monitoring tools without heavy upfront investment. Cloud platforms enable real-time analysis and storage of communication data, making it easier to detect threats and ensure compliance across dispersed teams and remote work environments.

The increasing adoption of cloud services for communication, collaboration, and data sharing is boosting demand for secure monitoring in the cloud. Additionally, cloud deployments offer seamless updates and integration with AI-powered analytics, helping businesses stay ahead of evolving cyber risks. This growing preference for cloud solutions is a key factor expanding the market’s reach.

Hybrid deployment is expected to experience significant growth in the secure communication monitoring market over the forecast period. Combining both on-premises and cloud-based systems, hybrid deployment offers businesses flexibility in managing sensitive communication data according to their security and compliance needs. Many organizations prefer hybrid models to keep critical information in-house while leveraging the cloud’s scalability for less sensitive monitoring tasks.

This approach helps balance control, cost, and performance, especially for large enterprises and regulated industries. As companies adopt hybrid communication platforms and remote work becomes more common, the demand for hybrid secure communication monitoring solutions will rise. The ability to customize deployment while ensuring data protection drives the growing interest in hybrid models.

ℹ

To learn more about this report –

Download Your Free Sample Report Here

By End User Industry Analysis

Government & defense as an end user are expected to hold a significant share of 28.6% in the secure communication monitoring market by 2025, playing a vital role in its growth. These sectors require robust communication security to protect national secrets, intelligence, and sensitive operations from cyber threats and espionage.

Increasing cyberattacks on government networks and the need for compliance with strict security regulations drive the adoption of advanced monitoring solutions. Real-time surveillance of voice, video, and data communications helps detect insider threats and unauthorized access.

Investments in AI-driven analytics and encryption technologies enhance secure communication in defense systems. The growing emphasis on safeguarding critical infrastructure and maintaining operational security will continue to boost demand for secure communication monitoring in government and defense sectors.

Healthcare as an end user is expected to see significant growth in the secure communication monitoring market over the forecast period. Protecting patient data and complying with regulations like HIPAA are critical concerns for healthcare providers.

Secure communication monitoring helps detect unauthorized sharing of sensitive medical information across emails, messaging, and telehealth platforms. With the rise of digital health records and remote consultations, healthcare organizations increasingly rely on monitoring tools to safeguard data and maintain trust.

The need to prevent data breaches, fraud, and insider threats drives investment in advanced security solutions. As healthcare technology advances, demand for reliable and compliant communication monitoring is expected to grow steadily.

The Secure Communication Monitoring Market Report is segmented based on the following:

By Component

-

Solutions

- Network Encryption

- Endpoint Security

- Intrusion Detection Systems (IDS)

- Unified Threat Management (UTM)

- Services

- Professional Services

- Managed Services

By Communication Type

- Voice Communication

- Video Communication

- Text/Message Communication

- Data Communication

By Deployment Mode

- On-Premise

- Cloud-Based

- Hybrid

By End User Industry

- Government & Defense

- BFSI (Banking, Financial Services, and Insurance)

- Healthcare

- IT & Telecom

- Energy & Utilities

- Manufacturing

- Transportation & Logistics

- Retail & E-commerce

- Others

Regional Analysis

Leading Region in the Secure Communication Monitoring Market

North America will be leading the secure communication monitoring market in 2025 with a share of 39.2%, showing strong demand across industries like finance, defense, healthcare, and government.

The region’s growth is driven by the rising number of cyber threats, strict data protection laws, and the high adoption of digital communication tools. The US plays a major role in this growth with heavy investments in cybersecurity and the presence of top tech companies offering advanced monitoring solutions.

Canada is also contributing through its focus on data privacy and secure digital infrastructure. The region's leadership is further supported by ongoing innovation, strong regulatory frameworks, and increasing awareness of communication risks.

Cloud-based security tools and AI-driven monitoring systems are gaining popularity, helping organizations stay ahead of threats. As remote work and hybrid models remain common, the need for real-time monitoring continues to rise. North America’s focus on both security and compliance keeps it at the forefront of this fast-growing market.

ℹ

To learn more about this report –

Download Your Free Sample Report Here

Fastest Growing Region in the Secure Communication Monitoring Market

Asia Pacific is showing significant growth in the secure communication monitoring market over the forecast period due to rising cybersecurity threats, increased digital transformation, and growing awareness about data protection. Countries like China, India, Japan, and South Korea are investing heavily in secure communication tools to protect sensitive business and government data.

The expansion of remote work and cloud-based services has increased the need for real-time communication monitoring and data encryption. With strong economic development and rapid adoption of digital communication technologies, the region is seeing higher demand for secure messaging, threat detection systems, and compliance monitoring. This steady progress is estimated to continue, making the Asia Pacific a major growth area in the global market.

By Region

North America

Europe

- Germany

- The U.K.

- France

- Italy

- Russia

- Spain

- Benelux

- Nordic

- Rest of Europe

Asia-Pacific

- China

- Japan

- South Korea

- India

- ANZ

- ASEAN

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Argentina

- Colombia

- Rest of Latin America

Middle East & Africa

- Saudi Arabia

- UAE

- South Africa

- Israel

- Egypt

- Rest of MEA

Competitive Landscape

The secure communication monitoring market is highly competitive, with many players offering a wide range of solutions to meet growing cybersecurity and compliance demands. Companies compete by focusing on advanced features like real-time threat detection, AI-based analysis, and integration with cloud services. Some providers specialize in specific sectors like finance or healthcare, while others offer broader solutions for all industries.

The rise in remote work and strict data protection laws has pushed many organizations to invest in secure communication tools, increasing competition even further. Innovation, ease of use, and strong customer support are key ways companies try to stand out. As cyber threats grow more complex, the market is expected to keep expanding, with more advanced and user-friendly solutions being developed.

Some of the prominent players in the global Secure Communication Monitoring are:

- Cisco Systems

- Palo Alto Networks

- Fortinet

- IBM Corporation

- Microsoft Corporation

- Thales Group

- BAE Systems

- Lockheed Martin

- Raytheon Technologies

- Northrop Grumman

- Broadcom (Symantec)

- McAfee

- Trend Micro

- Check Point Software

- Trellix

- Sophos

- Kaspersky

- F-Secure

- Darktrace

- CrowdStrike

- Other Key Players

Recent Developments

- In April 2025, Aliro announced the live deployment of its entanglement-based quantum network, delivering Quantum-Powered Security™ to protect data, voice, and video communications. Using the principles of quantum physics, mainly entanglement, this technology establishes provably secure communication channels that go beyond traditional, math-based encryption. The solution offers unmatched protection against current cyber threats and future risks, including those from quantum computing. Aliro’s breakthrough ensures long-term security for organizations facing rapidly evolving digital threats in a quantum-ready world.

- In April 2025, SuperCom secured a new contract with a well-established service provider based in the Midwest. This partnership is set to support SuperCom’s entry into three new U.S. states—Wisconsin, Minnesota, and Michigan—leveraging the provider’s strong regional presence. The agreement is also expected to boost SuperCom’s momentum toward broader nationwide expansion, enhancing its reach and impact across the U.S. market in key strategic locations.

- In March 2025, SES and SpeQtral have signed an MoU to jointly develop an interoperable Optical Ground Station (OGS) for long-distance satellite-based Quantum Key Distribution (QKD) between Asia and Europe, which will support connectivity between current and future QKD satellite missions, expanding access and diversity in long-distance QKD services. The project also includes integration with Singapore’s fibre-QKD network, enabling future customers to link terrestrial and satellite QKD systems, paving the way for practical and scalable global QKD connectivity once operational.

- In October 2024, Airtel Business, the B2B division of Bharti Airtel, has partnered with global cybersecurity leader Fortinet to launch ‘Airtel Secure Internet’—a next-generation internet security solution. Tailored to protect Internet Lease Line (ILL) circuits, the solution combines Airtel’s reliable connectivity with Fortinet’s advanced firewall technology. It delivers end-to-end cyber protection through Airtel’s Security Operations Centre and Fortinet’s SOAR platform. This fully managed service offers businesses strong, real-time defence against evolving cyber threats with enhanced security and seamless threat response capabilities.

Report Details

| Report Characteristics |

| Market Size (2025) |

USD 3.3 Bn |

| Forecast Value (2034) |

USD 13.7 Bn |

| CAGR (2025–2034) |

17.1% |

| Historical Data |

2019 – 2024 |

| The US Market Size (2025) |

USD 1.1 Bn |

| Forecast Data |

2025 – 2033 |

| Base Year |

2024 |

| Estimate Year |

2025 |

| Report Coverage |

Market Revenue Estimation, Market Dynamics, Competitive Landscape, Growth Factors, etc. |

| Segments Covered |

By Component (Solutions and Services), By Communication Type (Voice Communication, Video Communication, Text/Message Communication, and Data Communication), By Deployment Mode (On-Premise, Cloud-Based, and Hybrid), By End User Industry (Government & Defense, BFSI, Healthcare, IT & Telecom, Energy & Utilities, Manufacturing, Transportation & Logistic, Retail & E-commerce, and Others) |

| Regional Coverage |

North America – US, Canada; Europe – Germany, UK, France, Russia, Spain, Italy, Benelux, Nordic, Rest of Europe; Asia-Pacific – China, Japan, South Korea, India, ANZ, ASEAN, Rest of APAC; Latin America – Brazil, Mexico, Argentina, Colombia, Rest of Latin America; Middle East & Africa – Saudi Arabia, UAE, South Africa, Turkey, Egypt, Israel, Rest of MEA |

| Prominent Players |

Cisco Systems, Palo Alto Networks, Fortinet, IBM Corporation, Microsoft Corporation, Thales Group, BAE Systems, Lockheed Martin, Raytheon Technologies, Northrop Grumman, Broadcom (Symantec), McAfee, Trend Micro, Check Point Software, Trellix, Sophos, Kaspersky, F-Secure, Darktrace, CrowdStrike, and Other Key Players |

| Purchase Options |

We have three licenses to opt for: Single User License (Limited to 1 user), Multi-User License (Up to 5 Users), and Corporate Use License (Unlimited User) along with free report customization equivalent to 0 analyst working days, 3 analysts working days, and 5 analysts working days respectively. |

Frequently Asked Questions

How big is the Global Secure Communication Monitoring Market?

▾ The Global Secure Communication Monitoring Market size is expected to reach a value of USD 3.3 billion in 2025 and is expected to reach USD 13.7 billion by the end of 2034.

Which region accounted for the largest Global Secure Communication Monitoring Market?

▾ North America is expected to have the largest market share in the Global Secure Communication Monitoring Market, with a share of about 39.2% in 2025.

How big is the Secure Communication Monitoring Market in the US?

▾ The Secure Communication Monitoring Market in the US is expected to reach USD 1.1 billion in 2025

Who are the key players in the Global Secure Communication Monitoring Market?

▾ Some of the major key players in the Global Secure Communication Monitoring Market are Cisco Systems, Thales, BAE Systems, and others

What is the growth rate in the Global Secure Communication Monitoring Market?

▾ The market is growing at a CAGR of 17.1 percent over the forecasted period.