Self-adhesive labels are typically used to settle on bundling. These labels demonstrate the fundamental data about the item. They are additionally utilized for marketing purposes to get a handle on attention and attract buyers. These names are multifaceted frameworks and contain data imprinted at first glance.

Self-adhesive labels include three layers, mainly a discharge liner, a layer of cement, and the face material. A discharge liner is for the most part made out of paper, which has silicone covered on one side. They are broadly used in food & beverages, consumer durables, home & personal care products, pharmaceuticals, and retail labels.

The global self-adhesive labels market is experiencing significant growth, driven by increasing demand from key end-user industries such as food & beverage, pharmaceuticals, personal care, and consumer electronics.

The food industry, valued at USD 8.8 trillion in 2022, remains one of the largest consumers of self-adhesive labeling solutions, especially within food packaging and retail-ready packaging sectors. Manufacturers are focusing on developing advanced adhesives that can withstand varying environmental conditions while ensuring label durability and readability.

Similarly, the pharmaceutical and healthcare sectors are key drivers of market expansion. With global pharmaceutical sales reaching USD 1,186 billion in 2021, regulatory compliance and product authentication have become critical concerns. As a result, demand for tamper-evident, temperature-resistant, and RFID-integrated labels has increased, ensuring product safety and traceability.

As a result, demand for tamper-evident, temperature-resistant, and RFID-integrated labels has increased, ensuring product safety and traceability. The rising use of

pharmaceutical packaging and medical packaging films is also enhancing the role of smart, durable labeling in ensuring compliance and efficient healthcare distribution.

The personal care and cosmetics industry, valued at USD 564.44 billion in 2022, has also undergone a significant transformation in labeling requirements. The growing preference for sustainable and premium packaging is encouraging brands to adopt eco-friendly label materials and digital printing solutions for enhanced consumer appeal. The increasing use of cosmetic pigments and

organic pigments in high-end label designs adds visual impact, particularly for luxury skincare and beauty packaging.

Online and e-commerce shopping have led to an explosion of label demand, particularly self-adhesive ones. More products being shipped directly to consumers has increased the necessity for high-quality labeling solutions for packaging and shipping purposes; this trend can especially be observed within logistics and transport services where efficient labeling practices are key components of success.

Technological innovations in printing and labeling techniques are further fueling market expansion. Digital printing technologies now make for faster, more precise, and cost-effective label production - creating opportunities for customization, short run production and personalized labels making self-adhesive labels an appealing solution for businesses across different industries.

The US Market Overview

The US Self-Adhesive Labels Market is expected to reach USD 13.5 billion in 2024 at a CAGR of 5.9% over the forecast period.

In the US self-adhesive labels market, opportunities like the growing demand for eco-friendly and recyclable label materials, higher adoption of digital printing technologies, and the expansion of e-commerce.

Also, trends driving the market include the development of smart labels with RFID and QR codes, the rise in demand for personalized and customized labels, and advancements in sustainable and biodegradable labeling solutions.

Further, the US self-adhesive labels market is driven by higher demand from the food & beverage, retail, and

pharmaceutical sectors, along with development in printing technologies & rising e-commerce activities. However, market growth is restrained by fluctuating raw material costs, stringent environmental regulations, and competition from alternative labeling solutions like shrink sleeves and in-mold labels.

Key Takeaways

- Market Growth: The Self-Adhesive Labels Market size is expected to grow by USD 36.7 billion, at a CAGR of 6.3% during the forecasted period of 2025 to 2033.

- By Type: The release liner segment is expected to lead in 2024 with a major & is anticipated to dominate throughout the forecasted period.

- By Nature: The permanent label segment is expected to lead the Self-Adhesive Labels market in 2024.

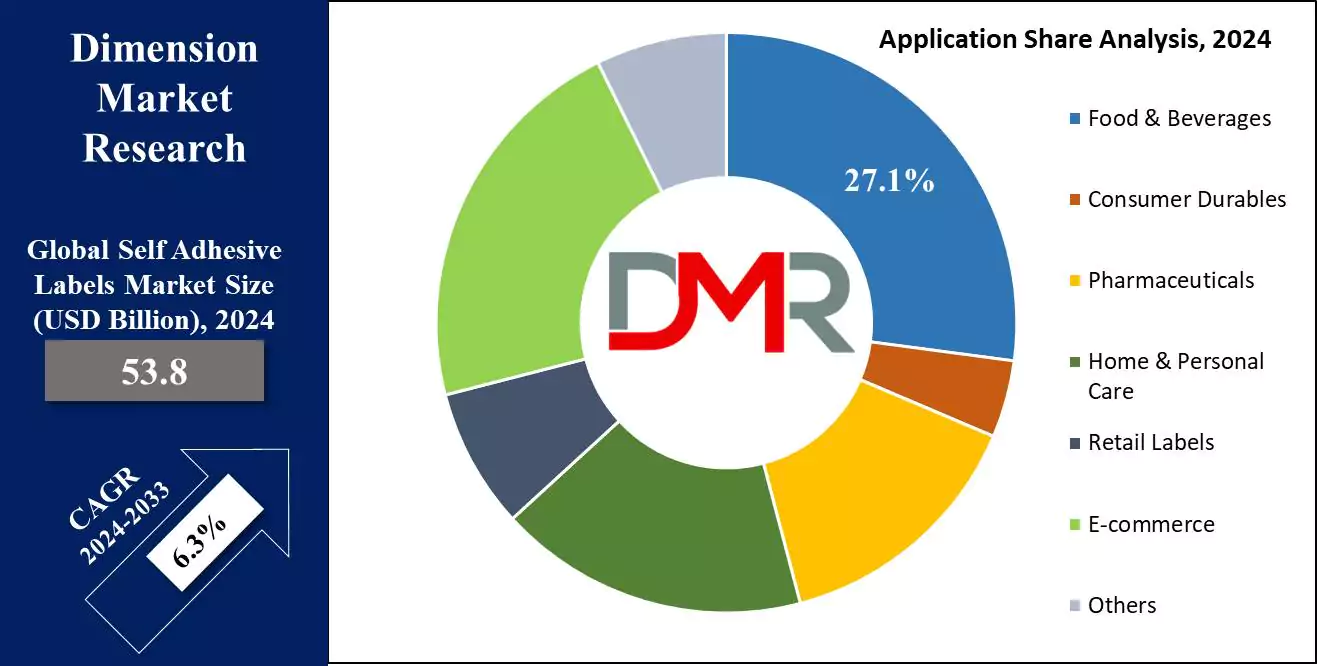

- By Application: The food & beverages segment is expected to get the largest revenue share in 2024 in the Self-Adhesive Labels market.

- Regional Insight: Asia Pacific is expected to hold a 40.2% share of revenue in the Global Self-Adhesive Labels Market in 2024.

- Use Cases: Some of the use cases of Self-Adhesive Labels include product labeling, asset tracking, and more.

Use Cases

- Product Labeling: Self-adhesive labels are broadly utilized in retail for branding and information purposes, like displaying product names, ingredients, barcodes, and pricing.

- Shipping and Logistics: They are important for labeling packages with shipping addresses, tracking information, and handling instructions, ensuring efficient & accurate delivery.

- Inventory Management: In warehouses and storerooms, self-adhesive labels assist in organizing and tracking inventory, like identifying items, shelves, and bins with unique identifiers.

- Asset Tracking: Businesses use these labels to tag & monitor company assets like equipment, tools, and devices, facilitating maintenance schedules & loss prevention.

Self-Adhesive Labels Market Dynamic

Driving Factors

E-commerce Expansion

The rapid expansion of online shopping has highly increased the need for shipping and logistics, driving the need for self-adhesive labels for packaging, addressing, and tracking purposes.

Technological Advancements

Innovations in printing technologies, materials, and adhesives are improving the functionality and versatility of self-adhesive labels, making them more durable, customizable, and suitable for various applications across numerous industries. The adoption of

packaging automation and industrial bulk packaging systems is also supporting consistent label application in large-scale manufacturing and automotive parts packaging processes.

Restraints

Environmental Concerns

Growing awareness and regulations regarding environmental sustainability & waste management create challenges for the self-adhesive labels market, as traditional labels mostly use non-recyclable materials and adhesives. Manufacturers are increasingly focusing on

biodegradable packaging solutions and developing recyclable paper packaging material to meet green compliance standards and consumer expectations.

Volatility in Raw Material Prices

Fluctuations in the prices of raw materials like paper, plastics, and adhesives can impact production costs and profit margins, thereby impacting the growth of the market.

Opportunities

Sustainable Label Solutions

An increase in the consumer and regulatory demand for eco-friendly products is driving opportunities for the development and adoption of sustainable self-adhesive labels made from recyclable, biodegradable, or compostable materials. Additionally, industries such as animal healthcare packaging, halal packaging, and baby

food packaging are adopting environmentally friendly label technologies to strengthen brand trust and compliance with sustainability norms.

Smart Label Technology

The integration of technologies like RFID (Radio-Frequency Identification) and NFC (Near Field Communication) into self-adhesive labels is creating new possibilities for inventory management, anti-counterfeiting, and better consumer engagement.

Trends

Digital Printing Advancements

The adoption of digital printing technologies is growing, providing greater flexibility, customization, and shorter turnaround times for self-adhesive labels, which meets the increasing demand for personalized and small-batch label production. The use of paper dyes,

specialty chemicals, and electronic chemicals and materials in printing inks and coatings enhances durability and print quality, especially for premium packaging applications.

Eco-friendly Labels

There is a growing trend towards using environmentally friendly materials and adhesives in self-adhesive labels. Companies are highly focused on producing labels that are recyclable, biodegradable, or made from renewable resources to meet sustainability goals and consumer preferences.

Self-Adhesive Labels Market Research Scope and Analysis

By Type

The release liner segment is expected to lead the self-adhesive labels market in 2024, capturing the largest market share. Also known as backing or carrier, release liners protect labels & keep them safe until use.

Made from materials like poly-coated paper, paper, films, and metalized paper, they come in two major types: paper and PET film. PET liners, made from polyester film, are preferred in manufacturing due to their ability to handle fast labeling and wet conditions.

Thinner than paper liners, PET liners enable more labels per roll, decreasing machine downtime and costs associated with roll damage or breakage, which, along with increased use of release liners in various product labeling applications, are driving the growth of this segment in the self-adhesive labels market.

By Nature

The permanent label segment is expected to lead the self-adhesive labels market in 2024, driven by their high use in many industries like construction, pharmaceuticals, and shipping. Known for their durability and high-temperature resistance, permanent labels are also water-resistant, making them suitable for the food & beverage industry.

The medical industry depends largely on high-quality permanent labels for products like medical equipment, laboratory specimens, and pharmaceutical safety labels. The integration of pharmaceutical temperature controlled packaging solutions and

temperature-controlled packaging solutions ensures these labels maintain integrity during transportation and storage under regulated conditions.

By Technology

Flexography plays an important role in the growth of the self-adhesive labels market by providing an efficient and versatile printing method that meets the large demand for quality and speed, which is ideal for producing large volumes of labels quickly and affordability, making it suitable for industries like food & beverages, pharmaceuticals, and logistics. Further, flexography provides high-quality print on various substrates, like paper, plastic, and metallic films, enabling vibrant and durable labels.

Its ability to use fast-drying inks and accommodate constant roll-to-roll printing further improves productivity and reduces turnaround times. As businesses look to meet strict labeling standards and adapt to market demands, the advanced capabilities of flexography in delivering precise, durable, and attractive labels contribute highly to the expansion of the self-adhesive labels market.

By Application

The food & beverages segment is anticipated to dominate the self-adhesive labels market in 2024, driven by a growing global population and a switch towards ready-to-use and packaged food products due to faster lifestyles and rising economic wealth. Strict government regulations need detailed food labeling, like shelf life, nutritional content, manufacturing and expiry dates, and manufacturer information, which grows with the demand for high-quality labels.

In addition, the rising adoption of convenience foods and beverages, along with intensified market competition and the expansion of food delivery services, further enhances the need for self-adhesive labels in the food and beverages industry.

The Self-Adhesive Labels Market Report is segmented on the basis of the following:

By Type

By Nature

- Permanent

- Removable

- Repositionable

By Technology

- Flexography

- Digital Printing

- Lithography

- Screen Printing

- Gravure

- Letterpress

- Offset

By Application

- Food & Beverages

- Consumer Durables

- Pharmaceuticals

- Home & Personal Care

- Retail Labels

- E-commerce

- Others

How Does Artificial Intelligence Contribute To Improve Self-Adhesive Labels Market ?

- Automated Quality Control: Defect Detection: AI-powered vision systems inspect labels for printing errors, misalignment, or defects in real time, reducing waste and ensuring high-quality production.

- Smart Label Customization: Personalized Printing: AI enables on-demand, data-driven label customization based on consumer preferences, improving branding and marketing efforts.

- Supply Chain Optimization: Demand Forecasting: AI analyzes sales patterns to predict label demand, reducing overproduction and optimizing inventory management.

- Sustainable Material Usage: AI-driven Material Selection: AI helps manufacturers choose eco-friendly adhesives and materials, minimizing environmental impact and ensuring regulatory compliance.

- Enhanced Anti-counterfeiting Measures: AI-powered Authentication: Smart labels integrated with AI and blockchain technology enhance traceability, ensuring product authenticity and security in industries like pharmaceuticals and luxury goods.

Self-Adhesive Labels Market Regional Analysis

Asia Pacific region is expected to lead the self-adhesive labels market, holding the largest share of

40.2% in 2024, which is expected to continue, driven by the region's growing population, urbanization, and industrial development.

As the consumer base & disposable income grow, the need for a wide range of consumer goods, from personal care products to pharmaceuticals, is also increasing, which expands the need for self-adhesive labels to provide vital product information, pricing, and regulatory compliance. Further, the expanding industries in the region are driving the growth of the self-adhesive labels market.

Further, North America is expected to experience significant growth in the self-adhesive labels market during the forecast period, which is mainly due to the higher demand for consumer goods, supported by higher per capita income and the presence of economically stable countries.

Also, the region's strong industrial and manufacturing sectors further contribute to market expansion. The growing number of major industries and manufacturing companies in North America is supporting the demand for self-adhesive labels, driving market growth in the region.

Increased emphasis on supply chain management and cross-border e-commerce logistics is further reinforcing the need for precise and durable labeling in shipping, warehousing, and industrial distribution activities.

By Region

North America

Europe

- Germany

- The U.K.

- France

- Italy

- Russia

- Spain

- Benelux

- Nordic

- Rest of Europe

Asia-Pacific

- China

- Japan

- South Korea

- India

- ANZ

- ASEAN

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Argentina

- Colombia

- Rest of Latin America

Middle East & Africa

- Saudi Arabia

- UAE

- South Africa

- Israel

- Egypt

- Rest of MEA

Self-Adhesive Labels Market Competitive Landscape

The self-adhesive labels market is highly competitive, with various players competing to innovate and enhance product offerings. Key factors driving competition include developments in printing technologies, sustainability efforts, and the ability to meet different industry needs.

Companies are focusing on improving label durability, customization options, and eco-friendly materials to gain a competitive edge. In addition, market players are expanding their geographic presence and investing in R&D to meet the increase in demand across sectors like food and beverages, pharmaceuticals, and logistics.

Some of the prominent players in the Global Self-Adhesive Labels Market are:

- 3M

- UPM

- Mondi

- Avery Dennison Corporation

- HERMA

- Asteria Group

- Optimum Group

- Symbio Inc

- H.B. Fuller Company

- LINTEC Corporation

- Other Key Players

Recent Developments

- In May 2024, UPM Raflatac launched its innovative new wave paper label material compatible with recycling. It is the first RecyClass-certified paper label material to obtain a Letter of Compatibility for use on rigid high-density polyethylene (HDPE) and polypropylene (PP) containers. The test results confirm the compatibility even for natural & white material streams, which need the highest purity of recyclate from the recycling processes, which represents a major step forward in the recycling of rigid plastic packaging, helping brand owners constantly make the shift towards enhanced circularity.

- In May 2024, Beontag launched its innovative range of self-adhesive wine labels in the Latin American market, which represents a commitment to excellence through tech innovation for Beontag, along with the region’s globally celebrated winemaking traditions. Beontag’s Grass Natural label is made of up to 40% grass fiber combined with FSC-certified cellulose. Along with the White Martelé label, it develops a new standard in sophistication and moisture resistance.

- In March 2024, At Drupa 2024, Canon announced its plans to demonstrate its commitment to become a significant, trusted partner to the label and packaging markets, and show new digital press and product concepts that show its clear progress towards that goal, showcasing the importance of labels and packaging as strategic areas for growth, a dedicated zone on the Canon stand will feature live production of label, corrugated and folding carton applications.

- In September 2023, Manter by Fedrigoni Self-Adhesives introduced "The New In" catalog, a new collection of premium self-adhesive papers, which highlights Manter's large expertise in creative labeling, providing a journey through innovations in premium wine, liquor, and luxury labels. The collection is brought to life by six Spanish design studios. Each edition of the catalog will showcase a specific theme and will be developed by designers from a different country, showcasing different creative perspectives.

- In January 2023, LINTEC announced that the company created a permanent general-purpose hot-melt adhesive and is now utilizing it in a new label stock series named HVT, as it released three new products using this new adhesive: two synthetic paper-based and one water-resistant paper-based livestock products, which are intended to be useful across a wide range of applications, including various kinds of display labels.

Self-Adhesive Labels Market Report Details

|

Report Characteristics

|

| Market Size (2024) |

USD 53.8 Bn |

| Forecast Value (2033) |

USD 93.5 Bn |

| CAGR (2024-2033) |

6.3% |

| Historical Data |

2018 – 2023 |

| The US Market Size (2024) |

USD 13.5 Bn |

| Forecast Data |

2025 – 2033 |

| Base Year |

2023 |

| Estimate Year |

2024 |

| Report Coverage |

Market Revenue Estimation, Market Dynamics, Competitive Landscape, Growth Factors and etc. |

| Segments Covered |

By Type (Release Liner and Linerless) By Nature (Permanent, Removable, and Repositionable), By Technology (Flexography, Digital Printing, Lithography, Screen Printing, Gravure, Letterpress, and Offset), By Application (Food & Beverages, Consumer Durables, Pharmaceuticals, Home & Personal Care, Retail Labels, E-commerce, and Others) |

| Regional Coverage |

North America – The US and Canada; Europe – Germany, The UK, France, Russia, Spain, Italy, Benelux, Nordic, & Rest of Europe; Asia- Pacific– China, Japan, South Korea, India, ANZ, ASEAN, Rest of APAC; Latin America – Brazil, Mexico, Argentina, Colombia, Rest of Latin America; Middle East & Africa – Saudi Arabia, UAE, South Africa, Turkey, Egypt, Israel, & Rest of MEA |

| Prominent Players |

3M, UPM, Mondi, Avery Dennison Corporation, HERMA, Asteria Group, Optimum Group, Symbio Inc, H.B. Fuller Company, LINTEC Corporation, and Other Key Players |

| Purchase Options |

We have three licenses to opt for: Single User License (Limited to 1 user), Multi-User License (Up to 5 Users) and Corporate Use License (Unlimited User) along with free report customization equivalent to 0 analyst working days, 3 analysts working days and 5 analysts working days respectively. |

Frequently Asked Questions

The Global Self-Adhesive Labels Market size is expected to reach a value of USD 53.8 billion in 2024 and is expected to reach USD 93.5 billion by the end of 2033.

Asia Pacific is expected to have the largest market share in the Global Self-Adhesive Labels Market with a share of about 40.2% in 2024.

The Self-Adhesive Labels Market in the US is expected to reach USD 13.5 billion in 2024.

Some of the major key players in the Global Self-Adhesive Labels Market are 3M, UPM, Mondi, and others.

The market is growing at a CAGR of 6.3 percent over the forecasted period.