Market Overview

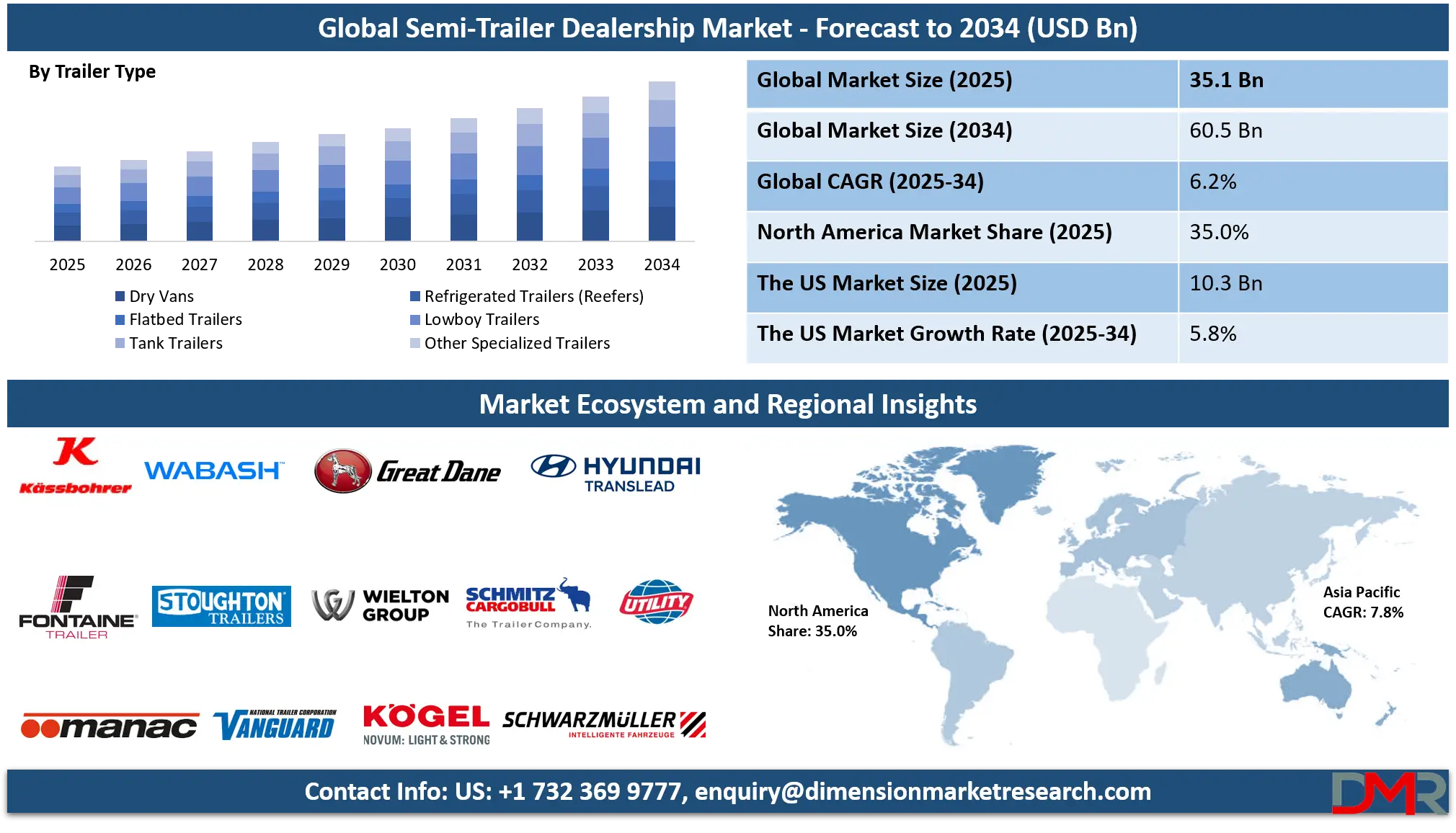

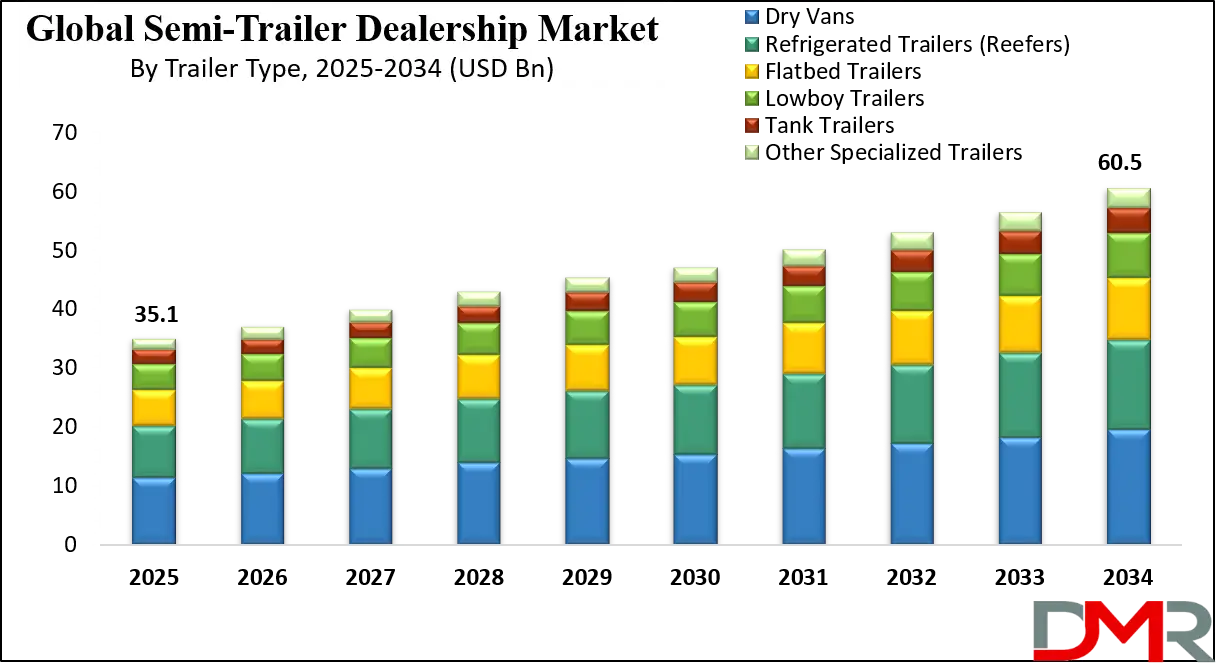

The global Semi-Trailer Dealership Market is projected to reach USD 35.1 billion in 2025 and is expected to expand at a compound annual growth rate (CAGR) of 6.2% from 2025 to 2034, reaching an estimated USD 60.5 billion by 2034. This trajectory is underpinned by the relentless expansion of global supply chains, the sustained boom in e-commerce fulfillment, and the continuous cycle of fleet modernization driven by technological and regulatory advancements.

Semi-trailer dealerships form the essential commercial and service backbone of the freight transportation industry, acting not just as sales points but as comprehensive lifecycle partners offering financing, bespoke modification, advanced telematics integration, and nationwide service networks.

ℹ

To learn more about this report –

Download Your Free Sample Report Here

The market is undergoing a significant transition from a product-centric to a service-centric model. Leading dealerships now function as integrated mobility providers, managing everything from flexible rental and full-service leasing programs to predictive maintenance powered by real-time data analytics. Key growth catalysts include increasingly stringent global emissions standards (e.g., Euro VII, EPA Phase 3), mandatory safety technology adoption (AEBS, Lane Departure Warning), and the economic imperative for fleets to adopt lightweight and aerodynamic designs to reduce Total Cost of Ownership (TCO).

Despite facing cyclical economic headwinds, volatile material costs, and a persistent industry-wide technician shortage, the market's fundamentals remain robust. The indispensable role of road freight in global commerce, coupled with supportive infrastructure development policies and the growing complexity of trailer technology, ensures that semi-trailer dealerships will remain critical, high-value intermediaries in the transportation ecosystem through 2034.

ℹ

To learn more about this report –

Download Your Free Sample Report Here

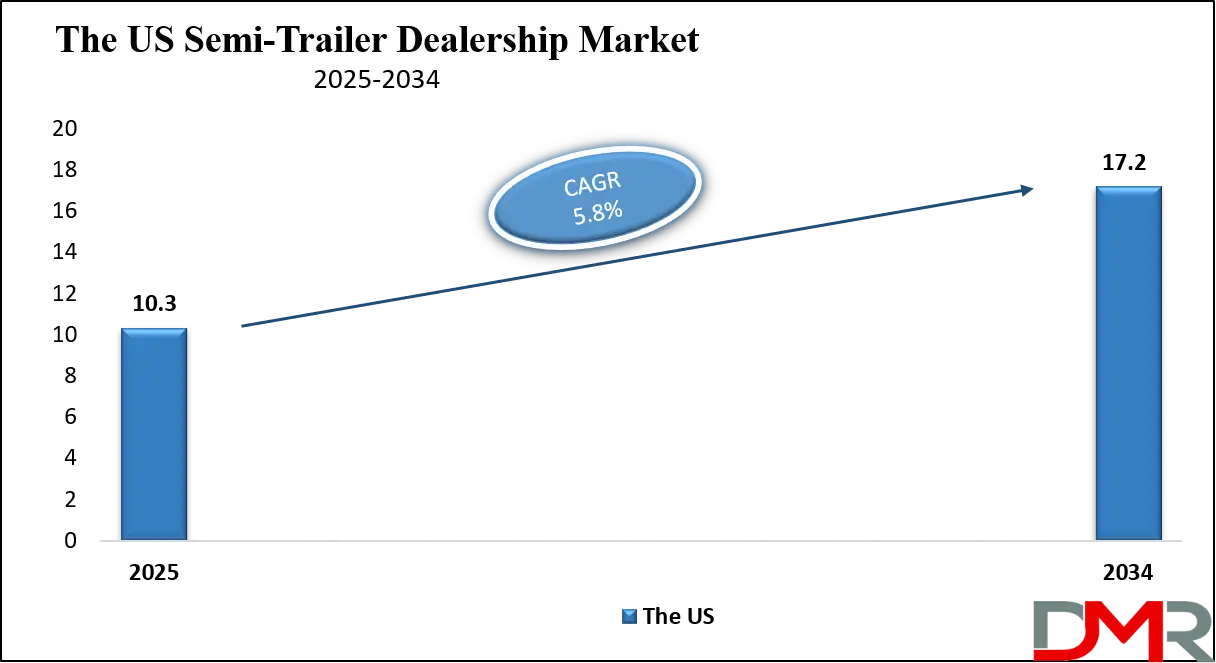

The US Semi-Trailer Dealership Market

The U.S. Semi-Trailer Dealership Market is projected to reach USD 10.3 billion in 2025 and grow at a CAGR of 5.8%, reaching USD 17.2 billion by 2034. As the world's largest and most sophisticated market, the U.S. is characterized by vast domestic freight volumes, a high rate of fleet turnover, and a mature, competitive landscape dominated by extensive OEM-authorized networks. Regulatory mandates, particularly the Environmental Protection Agency's (EPA) Greenhouse Gas Phase 3 rules and the Federal Motor Carrier Safety Administration's (FMCSA) evolving safety protocols, create a consistent, compliance-driven demand for new equipment.

In this market the refrigerated trailer segment is experiencing accelerated growth due to the expansion of cold chains for pharmaceuticals and gourmet food delivery. A significant trend is the rapid adoption of composite-material and aerodynamic trailers by large fleets seeking to maximize payload and fuel efficiency. Dealerships are evolving into full-service partners, offering embedded telematics and fleet management software subscriptions, mobile maintenance units for on-site repairs, and sophisticated residual value-backed leasing packages. The presence of a large owner-operator segment further diversifies the market, demanding flexible financing and a robust secondary market facilitated by dealerships.

ℹ

To learn more about this report –

Download Your Free Sample Report Here

The Europe Semi-Trailer Dealership Market

The Europe Semi-Trailer Dealership Market is projected to be valued at approximately USD 12.8 billion in 2025 and is projected to reach around USD 21.5 billion by 2034, growing at a CAGR of about 5.5% from 2025 to 2034. Europe's market remains defined by its intense regulatory framework, advanced intermodal transport integration, and a strong commitment to sustainability and technical excellence. The European Green Deal and its ambitious target of a 90% reduction in transport emissions by 2050 continue to drive stringent CO2 standards for heavy-duty vehicles, positioning dealerships as essential facilitators in the gradual fleet transition toward electric-ready and ultra-efficient trailers.

National specialization persists as a key characteristic. Germany and the Benelux region remain hubs for high-tech, specialized, and telematics-equipped trailers, while markets in Eastern Europe continue to show strong demand for robust, value-oriented models suited for regional haulage. Dealerships are vital in promoting and servicing technologies like aerodynamic side-skirts, electric-powered refrigeration units (eTRUs) for urban zero-emission zones, and trailers designed for bimodal rail-road transport.

The aftermarket service segment is a core strength, with dealerships performing mandatory Periodic Technical Inspections (PTI), Digital Tachograph compliance services, and cabin upgrades. However, a slower-than-anticipated economic recovery, high interest rates impacting fleet investment, and a more gradual regulatory implementation timeline have moderated the pace of fleet renewal.

The Japan Semi-Trailer Dealership Market

The Japan Semi-Trailer Dealership Market is anticipated to be valued at approximately USD 1.8 billion in 2025 and is expected to attain nearly USD 3.6 billion by 2034, expanding at a CAGR of about 7.9% during the forecast period. Japan's market is characterized by its unique constraints of limited land, dense urban infrastructure, and an unparalleled focus on precision engineering, quality, and operational efficiency. Growth is propelled by the critical need to modernize an aging logistics fleet, stringent national environmental targets, and the pressing demand to alleviate a severe shortage of commercial drivers through automation and efficiency gains.

The nationwide enforcement of the 2025 revised Safety Standards for Commercial Vehicles and Japan's commitment to its Green Growth Strategy and 2050 Carbon Neutrality goal are catalyzing a significant fleet renewal cycle. These regulations mandate advanced safety features and promote the adoption of low-emission and fuel-efficient transport solutions, systematically retiring older, less compliant trailers. Furthermore, Japan's "Logistics Efficiency Act" provides subsidies and tax incentives for fleets that invest in standardized, high-efficiency, and environmentally friendly equipment, directly stimulating demand through dealership channels.

Global Semi-Trailer Dealership Market: Key Takeaways

- Market Growth from Logistics Expansion: The market is set to expand significantly from USD 35.1 billion in 2025 to USD 60.5 billion by 2034 (CAGR 6.2%), primarily driven by global trade recovery, e-commerce growth, and the ongoing need for fleet modernization and regulatory compliance.

- Asia-Pacific as the Growth Engine: The APAC region will exhibit the highest CAGR, fueled by massive infrastructure spending, rising domestic consumption, and government policies aimed at logistics modernization in China, India, and Southeast Asia.

- Product Diversification Beyond Standard Vans: While dry vans remain dominant, specialized segments like refrigerated trailers (for cold chain logistics), flatbeds (for construction), and lightweight composite trailers are growing faster, demanding more technical expertise from dealerships.

- From Sales Outlet to Full-Service Partner: The competitive edge is shifting from mere vehicle sales to providing integrated solutions including financing, insurance, telematics, preventive maintenance, and resale services, creating long-term customer relationships.

- The Rise of Digital and Used Equipment Channels: Online platforms for trailer sales, parts, and comparison shopping are gaining traction. Certified pre-owned (CPO) programs are becoming a significant revenue stream, addressing demand from cost-conscious small fleets.

Global Semi-Trailer Dealership Market: Use Cases

- E-commerce Fulfillment Centers: Dealerships supply large fleets of high-cube, durable dry vans and customized last-mile delivery trailers to major e-commerce and logistics companies, often coupled with full-service maintenance agreements.

- Cold Chain Logistics for Pharmaceuticals: Specialized dealerships provide temperature-controlled, double-walled refrigerated trailers with advanced monitoring systems to pharmaceutical and food logistics companies, ensuring compliance with strict safety standards.

- Heavy Haul & Construction Projects: Dealerships serving the construction sector supply and maintain specialized equipment like extendable flatbeds, lowboy trailers for machinery transport, and bulk cement tankers, supported by on-site service capabilities.

- Agricultural Supply Chain: In farming regions, dealerships provide grain hoppers, livestock carriers, and refrigerated trailers for produce, offering seasonal financing and pre-harvest maintenance packages.

- Rental & Leasing Hubs: Large dealerships operate extensive rental fleets, providing short-term solutions for seasonal shippers, project-based contractors, and companies testing new trailer types before purchase.

Global Semi-Trailer Dealership Market: Stats & Facts

U.S. Department of Transportation (DOT) / Bureau of Transportation Statistics (BTS)

- The United States has over 13 million registered single-unit and combination trucks in operation.

- Combination trucks (tractor-trailer units) represent roughly 20–25% of all registered trucks.

- Trucks transport over 70% of domestic freight tonnage by weight in the U.S.

- Truck freight accounts for over 60% of total freight value moved nationally.

- Annual truck freight movement exceeds 10 trillion ton-miles.

- The trucking sector generates hundreds of billions of dollars in freight services annually (measured via freight value movement).

- Heavy trucks travel over 300 billion vehicle miles per year on U.S. highways.

- Combination trucks average over 60,000 miles per year, significantly higher than light vehicles.

- The National Transportation Statistics program tracks long-term growth in heavy truck registrations since 1960.

- Freight truck volumes closely track industrial output and manufacturing activity.

Federal Highway Administration (FHWA)

- FHWA designates a National Network of highways where standard semi-trailers up to 53 feet are allowed without permits.

- All states permit 48–53 foot semi-trailers on approved freight corridors.

- Semi-trailers account for the largest share of pavement wear due to axle loads.

- Combination trucks consume more than 25 billion gallons of fuel annually.

- Highway freight investment planning is heavily influenced by semi-trailer traffic density.

Federal Motor Carrier Safety Administration (FMCSA)

- The U.S. has over 780,000 registered interstate motor carriers, many operating semi-trailers.

- Approximately 97% of motor carriers operate 20 or fewer power units, driving demand for dealership sales and service.

- Over 50% of fatal large-truck crashes involve tractor-semi-trailer combinations.

- The average age of trucks in carrier fleets has been increasing, supporting replacement demand for trailers.

- FMCSA data shows steady growth in registered power units over the last decade.

U.S. Census Bureau Vehicle Inventory and Use Survey (VIUS)

- The majority of heavy trucks are used for for-hire or private freight hauling, not personal use.

- Long-haul operations dominate semi-trailer usage in terms of miles traveled.

- Manufacturing, wholesale trade, and construction are the largest users of semi-trailers.

- Diesel remains the primary fuel for over 95% of heavy trucks.

U.S. Department of Energy (EIA Energy Information Administration)

- Heavy-duty trucks account for over 20% of all U.S. transportation energy consumption.

- Freight trucking is one of the fastest-growing sources of transportation fuel demand.

American Association of State Highway and Transportation Officials (AASHTO)

- Freight demand is projected to increase significantly by 2050, driving trailer fleet expansion.

- State DOTs identify trucking as critical infrastructure for economic competitiveness.

Global Semi-Trailer Dealership Market: Market Dynamic

Driving Factors in the Global Semi-Trailer Dealership Market

Explosive Growth of E-commerce and Omnichannel Retail

The paradigm shift to online shopping has fundamentally redefined freight logistics, creating unprecedented demand for specialized trailer solutions. This is not merely a volume increase but a qualitative transformation in required assets. The rise of next-day and same-day delivery mandates has spurred demand for lightweight, high-cube dry vans with reinforced floors and side doors for rapid parcel loading/unloading. The direct-to-consumer grocery and meal-kit sector is driving a boom in multi-temperature refrigerated trailers with precise humidity and atmospheric control. Furthermore, the proliferation of urban distribution centers necessitates a fleet of smaller, maneuverable straight trucks and pup trailers for the final mile.

Stringent Global Safety and Environmental Mandates

Governments worldwide are enacting a new generation of regulations that serve as powerful, non-negotiable market catalysts. In Europe, the General Safety Regulation (GSR) and Euro VII emission standards collectively mandate a suite of advanced technologies including Advanced Emergency Braking Systems (AEBS), Lane Departure Warning Systems (LDWS), Tire Pressure Monitoring Systems (TPMS), and drastically reduced NOx and particulate matter emissions. In North America, the EPA’s Phase 3 Greenhouse Gas (GHG) standards and evolving FMCSA safety rules are having a similar effect. These regulations render a significant portion of the existing trailer fleet obsolete. Dealerships become the critical gateway for fleet operators to access compliant technology.

Restraints in the Global Semi-Trailer Dealership Market

Capital Intensity and Economic Sensitivity

The semi-trailer market is inherently capital-intensive. A single new high-specification refrigerated trailer or specialized heavy hauler can represent a six or seven-figure investment. This financial gravity makes the market acutely sensitive to macroeconomic conditions. Increases in central bank interest rates directly raise the cost of inventory financing for dealerships and the cost of loans/leases for customers, suppressing demand.

Downturns in the broader freight economy, signaled by falling freight rates (as measured by indices like the Cass Freight Index or Drewry’s World Container Index), immediately cause fleets to delay or cancel capital expenditure. For dealerships, this translates into ballooning inventory carrying costs on expensive assets, compressed cash flow, and heightened risk of customer defaults on existing financing agreements.

Supply Chain Volatility and Margin Compression

The globalized nature of trailer manufacturing has created a fragile, interconnected supply chain. Disruptions whether from geopolitical tensions, trade policy shifts, or regional lockdowns can halt the flow of critical components. The global semiconductor shortage has impacted telematics and advanced safety systems. Shortages of specialized axles, braking components, and refrigeration compressors lead to extended lead times, from months to over a year for custom orders. Simultaneously, volatile input costs for high-tensile steel, aluminum, and composite materials create severe pricing uncertainty. Dealerships are caught in a margin vise: they face pressure from manufacturers passing on cost increases, while also facing intense price resistance from customers.

Opportunities in the Global Semi-Trailer Dealership Market

The Massive Certified Pre-Owned (CPO) and Remarketing Segment

The regulatory-driven acceleration of fleet renewal cycles is creating a golden age for the high-quality used trailer market. As large fleets replace 3–5-year-old trailers with the latest compliant models, a steady stream of well-maintained, technologically relevant assets enters the secondary market. For forward-thinking dealerships, this represents a massive opportunity to build a verticalized CPO business. This involves establishing a rigorous, brand-backed certification process that includes: full mechanical and structural inspections, refurbishment of wear items (flooring, doors, lights), software updates for telematics, and the offering of extended warranties.

Integration of Advanced Digital and Data Services

The modern trailer is a data-generating asset, equipped with sensors for location, temperature, door status, cargo weight, and component health. This data deluge creates a transformative service opportunity beyond traditional maintenance. Progressive dealerships are developing proprietary or white-labeled data analytics platforms. These platforms can offer fleet managers predictive fuel efficiency reports based on aerodynamics and tire pressure data, utilization analytics to optimize fleet size, automated compliance reporting for safety inspections and hours-of-service, and predictive maintenance alerts that forecast component failures before they cause downtime.

Trends in the Global Semi-Trailer Dealership Market

The Rise of the "Dealer-as-a-Service" (DaaS) Model

The industry is witnessing a fundamental shift from asset ownership to "usership." In response, leading dealerships are creating integrated subscription packages. A DaaS contract might include: the trailer itself (via lease), full-coverage insurance, 24/7 nationwide roadside assistance with guaranteed response times, scheduled preventive maintenance with loaner assets provided, tire management and replacement, and full telematics/data service access all for a single, predictable monthly fee. This model is immensely attractive to fleets as it converts volatile, unpredictable CapEx and OpEx into a fixed operational cost, freeing up capital and administrative resources.

Hyper-Specialization by Trailer Type and Vertical

To combat margin erosion in highly competitive generalist markets, dealerships are pursuing deep vertical integration. This means becoming the undisputed expert in a narrow domain. For example, a dealership might specialize exclusively in chemical tankers, developing expertise in lining materials, cleaning protocols, safety certifications (like ISO Tank standards), and the specific regulatory landscape for hazardous materials transport. Another might focus on livestock carriers, mastering ventilation systems, animal welfare regulations, and specialized cleaning and sanitation services.

Global Semi-Trailer Dealership Market: Research Scope and Analysis

By Trailer Type Analysis

Dry Vans are projected to maintain their dominant revenue share, due to their irreplaceable role as the standard intermodal container of the road. Innovation is relentless, focusing on Total Cost of Ownership (TCO). This includes the adoption of advanced composite materials and wide-body aluminum extrusions to shed hundreds of pounds, directly increasing payload and fuel economy.

Aerodynamic integrations like side skirts, nose cones, and wheel covers are becoming standard. Internally, features like LED lighting systems, e-track and logistics track systems for versatile cargo securing, and lightweight, impact-resistant composite flooring are key selling points. For dealerships, this segment is the volume engine; success depends on inventory turnover speed, competitive financing offers, and a highly efficient parts and service department to support the vast number of units on the road.

Refrigerated Trailers represent the pinnacle of technological complexity and service revenue potential. Growth is directly tied to the globalization of the cold chain for pharmaceuticals, premium foods, and biotechnology. Dealerships in this segment must function as masters of climate control, requiring certified technicians for complex refrigeration units (from brands like Carrier Transicold and Thermo King), expertise in foam-in-place polyurethane insulation techniques, and knowledge of controlled atmosphere systems.

The sales process is consultative and lengthy, involving precise temperature mapping and compliance with standards like GDP (Good Distribution Practice) for pharmaceuticals. The real profitability, however, lies in the aftermarket: long-term preventive maintenance contracts, emergency repair services, and the sale of high-margin parts like compressors and evaporator coils make this segment the cornerstone of a dealership's service profitability.

By Ownership Type

In the ownership type segment, New Trailers are the dominant category, commanding the largest revenue share and serving as the primary growth engine for dealership networks globally. This dominance is structurally inherent and driven by several converging forces. Firstly, stringent and rapidly evolving global safety and emissions regulations, such as the EU's General Safety Regulation (GSR) and the U.S. EPA's Phase 3 Greenhouse Gas standards, create a non-negotiable compliance mandate. Fleet operators, especially large logistics and commercial entities, are compelled into accelerated replacement cycles to access the latest technology-laden, fuel-efficient, and legally compliant assets, which are exclusively available as new units.

Secondly, the relentless expansion of e-commerce and modern logistics demands specialized equipment from high-cube dry vans to advanced multi-temperature reefers that is often only available through new OEM production to meet specific operational specifications. Financially, robust captive financing from OEMs and attractive incentives, such as the U.S. Investment Tax Credit (ITC) for certain clean commercial vehicles, lower the barrier to acquiring new assets.

While the Certified Pre-Owned (CPO) segment is the fastest-growing category due to its value proposition and the influx of high-quality off-lease units, and the broader Used Trailer market provides critical liquidity, neither challenges the fundamental primacy of New Trailers.

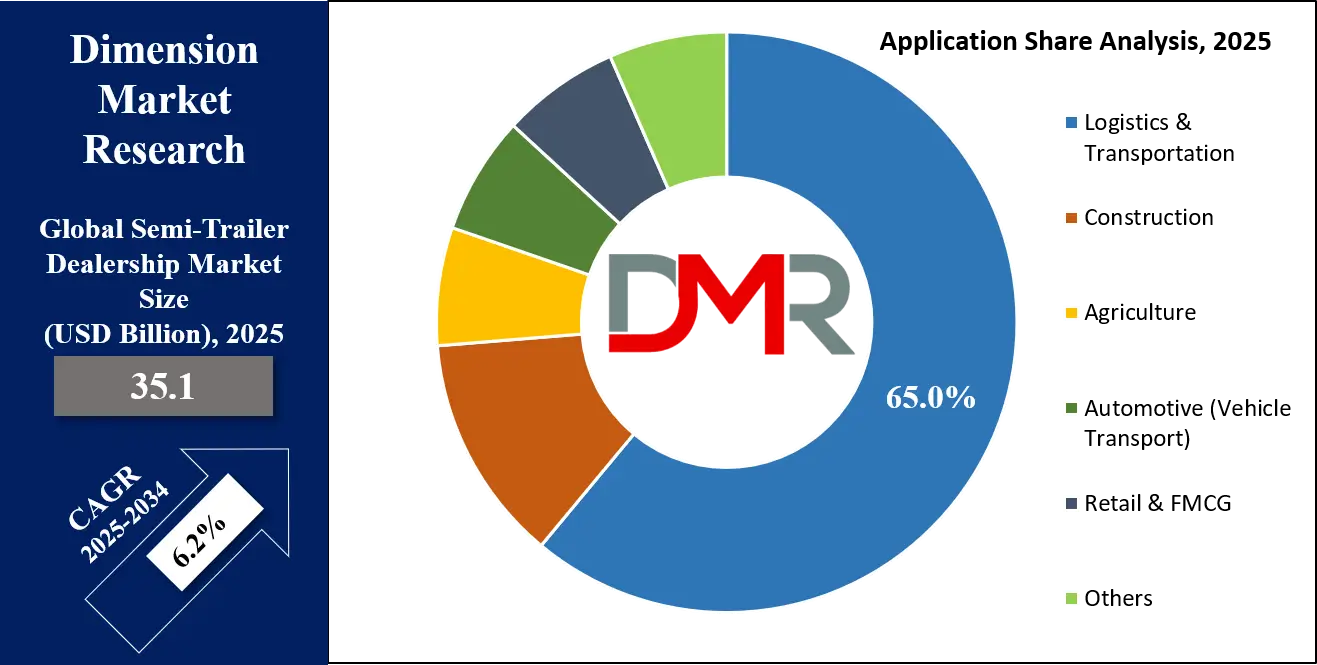

By Application Analysis

Logistics & Transportation is the unequivocal core, capturing over 65.0% of market revenue. This segment's demands shape the entire industry. Large Less-Than-Truckload (LTL) and Truckload (TL) carriers require dealerships that can handle massive, multi-unit orders with complex specifications, provide national account pricing, and support a nationwide service network with guaranteed uptime.

Their purchasing decisions are driven by hard data on TCO: fuel efficiency calculated to the tenth of a mile per gallon, maintenance cost per mile, trailer lifespan, and residual value at trade-in. Dealerships serving this sector must have sophisticated sales teams capable of financial modeling, dedicated national account managers, and a service operation that can perform fleet-wide inspections and repairs with military precision to minimize fleet downtime.

Construction & Heavy Industry is a highly cyclical, project-driven segment critical for dealerships with regional strength. Demand is for ultra-durable equipment: extendable flatbeds for long loads, multi-axle lowboy trailers for transporting excavators and cranes, dump trailers with high-tensile steel bodies, and concrete pumping trailers. Success here is not just about having the right inventory; it's about understanding local construction cycles, building deep relationships with general contractors and equipment rental yards, and offering unparalleled flexibility.

This includes short-term rental fleets, lease-to-own contracts aligned with project cash flows, and most importantly, mobile service trucks staffed with technicians who can perform major repairs on a remote job site to keep multi-million dollar projects on schedule. This segment rewards dealerships for reliability and responsiveness above all else.

ℹ

To learn more about this report –

Download Your Free Sample Report Here

By Sales Channel Analysis

OEM-Authorized Dealerships command the premium market, responsible for over 70% of revenue. Their value proposition is comprehensive and difficult to replicate. They offer exclusive access to the latest OEM models featuring proprietary technologies (e.g., Wabash's DuraPlate® composite panels, Great Dane's Trailers of the Future connectivity). They provide captive financing through the manufacturer's financial arm, often at subsidized rates to move inventory.

Their service bays are staffed with factory-certified master technicians with direct access to proprietary diagnostic tools and training. For large fleet customers, they provide a single point of accountability from specification and build to warranty, financing, and eventual trade-in. Their strength is in providing a seamless, low-risk, brand-assured experience, which is why they remain the channel of choice for large-scale, compliance-focused procurement.

Independent Dealerships & Online Platforms are the lifeblood of the secondary market and niche segments. Independent dealers thrive on agility and specialization. They can quickly source hard-to-find used or niche trailers, offer more personalized service, and often have more flexibility in financing through relationships with regional banks and credit unions.

Online marketplaces (e.g., Commercial Truck Trader, TruckPaper, MarketBook) have revolutionized this space by creating national, searchable inventories, transparent pricing history, and digital transaction tools. These platforms are essential for owner-operators, small fleets, and regional haulers seeking value, specific equipment (like a used logger or winch tractor), or looking to quickly dispose of assets. This channel's growth is fueled by increasing trust in online vehicle transactions and the sheer volume and variety of equipment flowing through the secondary market.

The Global Semi-Trailer Dealership Market Report is segmented on the basis of the following:

By Trailer Type

- Dry Vans

- Refrigerated Trailers (Reefers)

- Flatbed Trailers

- Lowboy Trailers

- Tank Trailers

- Other Specialized Trailers

By Ownership Type

- New Trailers

- Certified Pre-Owned (CPO)

- Used Trailers

By Application

- Logistics & Transportation

- Construction

- Agriculture

- Automotive (Vehicle Transport)

- Retail & FMCG

- Others

By Sales Channel

- OEM-Authorized Dealerships

- Independent Dealerships

- Online Sales Platforms

Impact of Artificial Intelligence in the Global Semi-Trailer Dealership Market

- Predictive Inventory Management: AI algorithms analyze local freight trends, seasonal patterns, and macroeconomic data to predict demand for different trailer types, helping dealerships optimize inventory levels, reduce carrying costs, and increase turnover.

- Dynamic Pricing for New and Used Equipment: Artificial Intelligence-powered pricing tools assess real-time market data, equipment specifications, condition reports (for used), and local demand to recommend optimal, competitive listing prices that maximize sales velocity and profit margins.

- AI-Powered Customer Service Chatbots: Dealership websites deploy chatbots to handle initial customer inquiries 24/7, schedule test drives or service appointments, provide basic financing pre-qualification, and direct complex queries to the right human sales or service agent.

- Predictive Maintenance for Dealer Service Bays: By integrating AI with telematics data from customer fleets, dealership service departments can proactively identify potential component failures (e.g., in brakes or refrigeration units) and schedule preventative repairs, increasing service revenue and customer loyalty.

- Enhanced Lead Scoring and Sales Forecasting: AI models analyze website behavior, inquiry history, and firmographic data to score sales leads more accurately, prioritizing high-intent prospects and enabling sales teams to focus their efforts, thereby improving conversion rates.

Global Semi-Trailer Dealership Market: Regional Analysis

Region with the Largest Revenue Share

North America is projected to dominate this market, holding over 35.0% of the market share in 2025. This leadership is built on the world's largest and most sophisticated freight transportation network, high fleet replacement rates, and a mature, consolidated dealership ecosystem. The region benefits from strong underlying demand from a robust consumer economy and cross-border trade (USMCA). A well-established culture of owner-operators and large, financially sophisticated fleets creates a diverse and active buyer base.

The regulatory environment, while stringent, provides a clear roadmap for fleet upgrades. Furthermore, the high penetration of financing and leasing makes new equipment accessible. North American dealerships are leaders in adopting digital sales tools and integrated service solutions, contributing to high revenue per transaction.

ℹ

To learn more about this report –

Download Your Free Sample Report Here

Region with the Highest CAGR

Asia-Pacific achieves the highest CAGR due to explosive growth in infrastructure, manufacturing output, and domestic consumption. Governments in China, India, and Southeast Asia are heavily investing in highway networks and logistics parks, creating massive demand for trailers. The market is transitioning from a focus on low-cost, basic models to higher-value, efficient, and specialized equipment. While the dealership network is less mature than in the West, it is rapidly consolidating and professionalizing. The growth is fundamentally driven by economic expansion and policy-led infrastructure modernization, representing a vast volume opportunity. However, challenges include intense price competition, a fragmented independent dealer landscape, and varying regulatory standards across countries.

By Region

North America

Europe

- Germany

- The U.K.

- France

- Italy

- Russia

- Spain

- Benelux

- Nordic

- Rest of Europe

Asia-Pacific

- China

- Japan

- South Korea

- India

- ANZ

- ASEAN

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Argentina

- Colombia

- Rest of Latin America

Middle East & Africa

- Saudi Arabia

- UAE

- South Africa

- Israel

- Egypt

- Rest of MEA

Global Semi-Trailer Dealership Market: Competitive Landscape

The competitive landscape is multifaceted, featuring global OEM networks, strong regional players, and independent dealers. OEM Captive Dealer Networks: Dominant players like Wabash National, Utility Trailer, Great Dane (China International Marine Containers), Schmitz Cargobull, and Krone control large, authorized dealership networks. Their strength lies in brand loyalty, proprietary technology, national account relationships, and comprehensive parts and service support.

Large Regional Dealer Groups: Independently owned but often multi-brand franchise groups operate across key freight corridors. Examples include Bruckner Truck Sales and TEC Equipment in the US, and Lamberet dealers in Europe. They compete on geographic coverage, deep local market knowledge, extensive service facilities, and a broad portfolio of brands and trailer types.

Independent & Used Equipment Specialists: These dealers focus on the secondary market, offering refurbished and certified pre-owned trailers. They thrive on agile sourcing, competitive pricing, and serving small fleets and owner-operators. Online platforms like TruckPaper and Commercial Trader are digitizing this segment.

The battleground is increasingly about value-added services. Winning dealerships provide one-stop-shop solutions: competitive financing/leasing, telematics and fleet management software, rapid parts availability, mobile maintenance, and robust resale/trade-in programs. Consolidation through mergers and acquisitions is ongoing as groups seek scale, geographic expansion, and service capability enhancement.

Some of the prominent players in the Global Semi-Trailer Dealership Market are:

- CIMC Vehicles (Group) Co., Ltd.

- Schmitz Cargobull AG

- Wabash National Corporation

- Hyundai Translead

- Krone Commercial Vehicle Group

- Utility Trailer Manufacturing Company

- Great Dane LLC

- Kögel Trailer GmbH

- Wielton S.A.

- Schwarzmüller Group

- Stoughton Trailers LLC

- Vanguard National Trailer Corp.

- Manac Inc.

- Fontaine Commercial Trailer, Inc.

- Kässbohrer Fahrzeugwerke

- MAC Trailer Manufacturing Inc.

- East Manufacturing Corporation

- Pitts Trailers

- Montracon Ltd.

- Lambert SAS

- Other Key Players

Recent Developments in the Global Semi-Trailer Dealership Market

- December 2025: Utility Trailer of Texas Expanded its dealership portfolio by adding SmithCo side-dump trailers, strengthening its construction and bulk-haul segment offerings.

- October 2025: Utility Trailer Sales of Southeast Texas & Utility Trailer Sales of Dallas Merged to form Utility Trailer of Texas, creating one of the largest semi-trailer dealership networks in Texas.

- September 2025: Great Dane Announced expansion of its North American dealer service and aftermarket support network to reduce fleet downtime.

- July 2025: Utility Trailer Manufacturing Company Rolled out upgraded refrigerated trailer technology across its authorized dealer network.

- June 2025: Schmitz Cargobull AG & GT Trailers Strengthened strategic collaboration through increased equity participation to expand European manufacturing and dealer coverage.

- May 2025: ACT Expo (Advanced Clean Transportation Expo) Hosted global semi-trailer manufacturers, dealers, and fleet operators to showcase zero-emission and smart trailer technologies.

- April 2025: Great Dane & Double A Utility Trailer Sales Announced dealership facility expansions to increase service bays, parts inventory, and customer support capacity.

- March 2025: Utility Trailer Manufacturing Company Consolidated regional dealers in Utah, Idaho, Nevada, and Washington into Mountain West Utility Trailer Inc.

- February 2025: Schmitz Cargobull AG Collaborated with multiple European dealer partners to standardize cross-border aftersales and fleet service operations.

- January 2025: Utility Trailer Manufacturing Company Completed a multi-state dealership merger in the western United States to expand geographic coverage and operational scale.

Report Details

| Report Characteristics |

| Market Size (2025) |

USD 35.1 Bn |

| Forecast Value (2034) |

USD 60.5 Bn |

| CAGR (2025–2034) |

6.2% |

| The US Market Size (2025) |

USD 10.3 Bn |

| Historical Data |

2019 – 2024 |

| Forecast Data |

2026 – 2034 |

| Base Year |

2024 |

| Estimate Year |

2025 |

| Report Coverage |

Market Revenue Estimation, Market Dynamics, Competitive Landscape, Growth Factors, etc. |

| Segments Covered |

By Trailer Type (Dry Vans, Refrigerated Trailers, Flatbed Trailers, Lowboy Trailers, Tank Trailers, Other Specialized Trailers), By Ownership Type (New Trailers, Certified Pre-Owned (CPO), Used Trailers), By Application (Logistics & Transportation, Construction, Agriculture, Automotive, Retail & FMCG, Others), By Sales Channel (OEM-Authorized Dealerships, Independent Dealerships, Online Sales Platforms) |

| Regional Coverage |

North America – US, Canada; Europe – Germany, UK, France, Russia, Spain, Italy, Benelux, Nordic, Rest of Europe; Asia-Pacific – China, Japan, South Korea, India, ANZ, ASEAN, Rest of APAC; Latin America – Brazil, Mexico, Argentina, Colombia, Rest of Latin America; Middle East & Africa – Saudi Arabia, UAE, South Africa, Turkey, Egypt, Israel, Rest of MEA |

| Prominent Players |

CIMC Vehicles (Group) Co., Ltd., Schmitz Cargobull AG, Wabash National Corporation, Hyundai Translead, Krone Commercial Vehicle Group, Utility Trailer Manufacturing Company, Great Dane LLC, Kögel Trailer GmbH, Wielton S.A., Schwarzmüller Group, Stoughton Trailers LLC, Vanguard National Trailer Corp., Manac Inc., Fontaine Commercial Trailer, Inc., Kässbohrer Fahrzeugwerke, MAC Trailer Manufacturing Inc., East Manufacturing Corporation, Pitts Trailers, Montracon Ltd., Lambert SAS., and Other Key Players |

| Purchase Options |

We have three licenses to opt for: Single User License (Limited to 1 user), Multi-User License (Up to 5 Users), and Corporate Use License (Unlimited User) along with free report customization equivalent to 0 analyst working days, 3 analysts working days, and 5 analysts working days respectively. |

Frequently Asked Questions

How big is the Global Semi-Trailer Dealership Market?

▾ The Global Semi-Trailer Dealership Market size is estimated to have a value of USD 35.1 billion in 2025 and is expected to reach USD 60.5 billion by the end of 2034.

What is the growth rate in the Global Semi-Trailer Dealership Market?

▾ The market is growing at a CAGR of 6.2 percent over the forecasted period of 2025 to 2034.

What is the size of the US Semi-Trailer Dealership Market?

▾ The US Semi-Trailer Dealership Market is projected to be valued at USD 10.3 billion in 2025. It is expected to reach USD 17.2 billion in 2034, growing at a CAGR of 5.8%.

Which region accounted for the largest Global Semi-Trailer Dealership Market?

▾ North America is expected to have the 35.0% of the market share in the Global Semi-Trailer Dealership Market, driven by its large, mature freight transportation sector and high fleet replacement rates.

Who are the key players in the Global Semi-Trailer Dealership Market?

▾ Some of the major key players are Wabash National Corporation, Utility Trailer Manufacturing Company, Great Dane, Schmitz Cargobull AG, and Krone Commercial Vehicle Group, among other OEMs and large dealer networks.