The global Semiconductor Foundry Market is currently experiencing robust expansion, propelled by rising consumer electronics demand for advanced semiconductor chips in various industries such as consumer electronics, automotive and telecommunications. Furthermore, as industries like 5G, AI and IoT expand, so does demand for complex yet efficient semiconductor solutions - further driving market dynamics forward.

Technological advancements such as the shift to smaller node processes (7nm, 5nm and below) are driving technological development forward. Leading foundries are investing heavily in R&D to support cutting-edge applications like high-performance computing and AI processing, while

electric vehicles and autonomous driving technologies have contributed significantly to demand for specialty chips that further diversify the market.

As countries adjust to supply chain disruptions and geopolitical considerations that encourage them to diversify manufacturing regions, investments are being made in expanding foundry capabilities across regions like the U.S., Europe, and Asia - creating new growth opportunities for both established players as well as new entrants to spur competition and innovation within the semiconductor industry.

As per statista In the first quarter of 2024, Taiwan Semiconductor Manufacturing Company (TSMC) secured the top position in the semiconductor foundry market, earning 18.85 billion U.S. dollars in revenue. In contrast, Samsung earned 3.36 billion U.S. dollars, highlighting a notable disparity in their market performance as TSMC continued to lead the global semiconductor industry.

Market Dynamic

The growing demand for portable, network-enabled devices equipped with multimedia features & internet connectivity is a driving force behind the growing need for efficient semiconductor foundry services. These services play a major role in meeting the requirements of IoT (

Internet of Things) systems, which process data for decision-making & allow seamless device-to-internet connections across different sectors like automotive, retail, medical, and electronics.

Further, the semiconductor foundry market is strengthening from government funding initiatives focused on advancing semiconductor technology in different countries, looking at businesses to reassess & improve their supply chain strategies to reduce vulnerabilities. In response, customers are exploring newer semiconductor foundry methodologies to meet power requirements.

While cutting-edge semiconductor foundry services & technologies are still in the early development stages, they hold the potential to generate significant revenue, offering better & improved chip connectivity & lower power consumption when compared to traditional counterparts. These advancements are anticipated to reshape the semiconductor foundry landscape.

Research Scope and Analysis

By Technology

The semiconductor foundry market is categorized by technology nodes like 10/7/5nm, 16/14nm, 20nm, 45/40nm, & others, of which 10/7/5nm emerges as the dominant segment in 2023, as it prevails owing to its speed & compactness, making it a preferred choice for manufacturing high-performance processors, advanced graphics cards, & cutting-edge chips.

The market's momentum is further driven by a growing demand for

artificial intelligence (AI), high-performance computing, consumer electronics, & wireless communication systems. These factors all together drive the growth of the 10/7/5nm technology node, reflecting the industry's dedication to pushing the boundaries of processing power & compact design to meet the needs of the present technology-driven world.

By Foundry Type

In terms of the foundry type, there are two key categories, which are pure play foundry & IDMs (Integrated Device Manufacturers). Among them, IDMs secures the largest market share in 2023, mainly owing to the growing utilization of integrated circuits (ICs) in several applications like consumer electronics, automotive, &

medical devices.

Furthermore, large investments made by major industry players in big research and development (R&D) initiatives focused on growing their product portfolios have become major drivers of market expansion, which emphasizes the continued dominance of IDMs in the industry, as their comprehensive approach to semiconductor manufacturing integrates with the growing demand for ICs across a large spectrum of high-end technologies & devices.

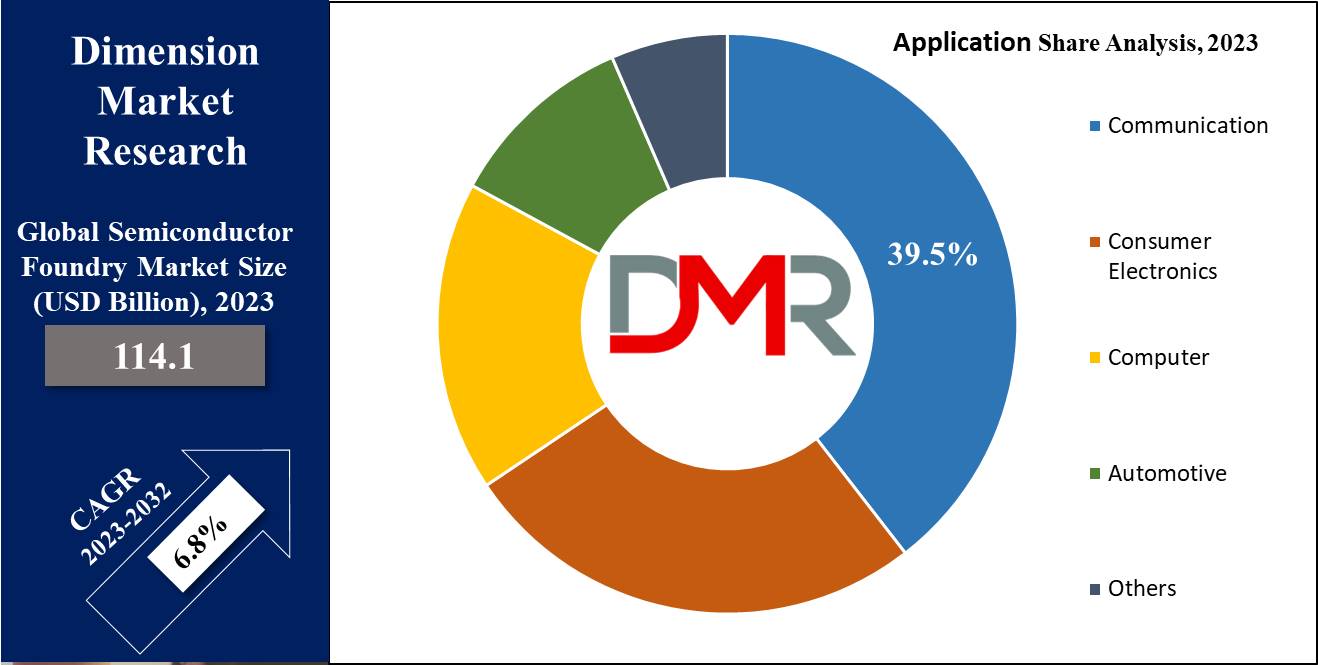

By Application

Based on the applications of the global semiconductor foundry market is categorized into communication, computer, consumer electronics, automotive, & others. Of all these, communication applications dominates the market share in 2023, mainly driven by the growing presence of consumer devices such as laptops, smartphones, tablets, and smartwatches.

This growth of gadgets, along with the rise in the need for high-speed data transmission & wireless communication, shows the growing trend of cloud computing & big data adoption. These factors together support the strong growth of the market, emphasizing the major role of the communication segment as it aligns with the changing technological landscape & the ever-increasing need for seamless, high-speed connectivity across a broad spectrum of devices & applications.

The Global Semiconductor Foundry Market Report is segmented on the basis of the following

By Technology

- 10/7/5 nm

- 16/14 nm

- 20 nm

- 45/40 nm

- Others

By Foundry Type

By Application

- Consumer Electronics

- Communication

- Computer

- Automotive

- Others

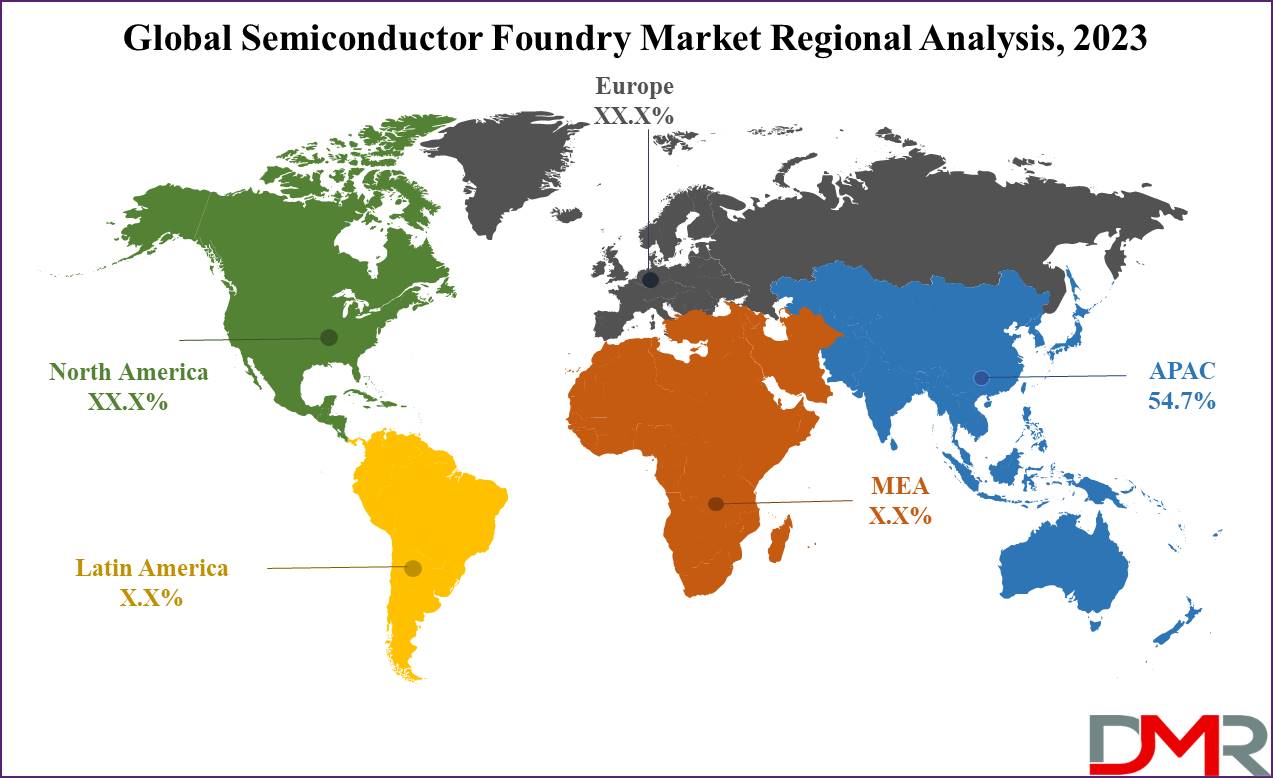

Regional Analysis

The Asia-Pacific region holds a significant share of the global semiconductor foundry market Size by contributing 54.7% of the total revenue in 2023, primarily owing to the presence of major companies like TSMC, Samsung Electronics, & more in countries like South Korea, Japan, Taiwan, & China. Taiwan plays a major role, possessing the largest share of foundries globally, & holds a major position in the semiconductor supply chain.

Further, the region also plays a major role in meeting the rising global demand by expanding production capacity & investing in advanced manufacturing technologies. In addition, China comes out as the region's biggest single-country market, driven by its domestic enterprises' dominance in electronics. Moreover, the Chinese government is also constantly encouraging the semiconductor industry via significant federal incentives. Additionally, India, with its large population, also emerges as one of the world's fastest-growing economies

By Region

North America

Europe

- Germany

- The U.K.

- France

- Italy

- Russia

- Spain

- Benelux

- Nordic

- Rest of Europe

Asia-Pacific

- China

- Japan

- South Korea

- India

- ANZ

- ASEAN

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Argentina

- Colombia

- Rest of Latin America

Middle East & Africa

- Saudi Arabia

- UAE

- South Africa

- Israel

- Egypt

- Rest of MEA

Competitive Landscape

The semiconductor foundry market, being highly concentrated, is experiencing strong competition among industry players to secure fabless vendor contracts & expand their market presence. These players are also constantly investing in enhancing their production capabilities.

Further, the key players in the industry face intense competition to expand their market share, with an aim on 5G & IoT as drivers for future production. Innovation, time-to-market, & performance are critical aspects for differentiation in this dynamic market, which is influenced by consolidation, technological advancements, & geopolitical factors, leading to market fluctuations.

For instance, in October 2022, US Senator Patrick Leahy partnered with GlobalFoundries to introduce a USD 30 million federal grant focused on growing the progress & manufacturing of GaN (advanced gallium nitride) on silicon semiconductors at GF's Fab facility in Vermont, which will allow GlobalFoundries to acquire necessary tools & expand the development and use of 200 mm GaN wafers for producing high-power chips, serving industries like electric vehicles, industrial motors, & energy applications.

Some of the prominent players in the Global Semiconductor Foundry Market are

- TSMC

- GlobalFoundries

- STMicroelectronics

- Semiconductor Manufacturing International Corp

- Samsung

- UMC

- X-Fab

- Tower Semiconductor Ltd

- Powerchip

- Magnachip

- Other Key Players

Recent Developments

- September 2025: Intel confirms that its upcoming 14A process node—designed for both internal and external foundry customers—will deliver 15–20% better performance-per-watt or 25–35% lower power consumption than its 18A predecessor. However, deployment will be cost-intensive due to reliance on ASML’s high-NA EUV tools, making external foundry customers critical for financial viability.

- Q2 2025: The global semiconductor foundry (2.0) market saw a record surge in revenue, with second-quarter revenue hitting US$41.7 billion—a 14.6% quarter-over-quarter increase, driven by strong demand across smartphones, PCs, and servers on both mature and advanced nodes.

- June 2025: SkyWater Technology finalizes its acquisition of Infineon’s Austin Fab 25, transforming the 200 mm facility into an open-access, pure-play U.S. foundry. This adds approximately 400,000 wafer starts per year, bolstering domestic capabilities for industrial, automotive, and defense-oriented semiconductors.

- March 2025: Reports emerge that TSMC proposed a joint venture to operate Intel’s foundry division, offering less than 50% ownership. This strategic pitch targeted major U.S. chip designers—including Nvidia, AMD, and Broadcom—as part of a broader push to revitalize U.S. manufacturing. Talks are ongoing and early-stage.