Market Overview

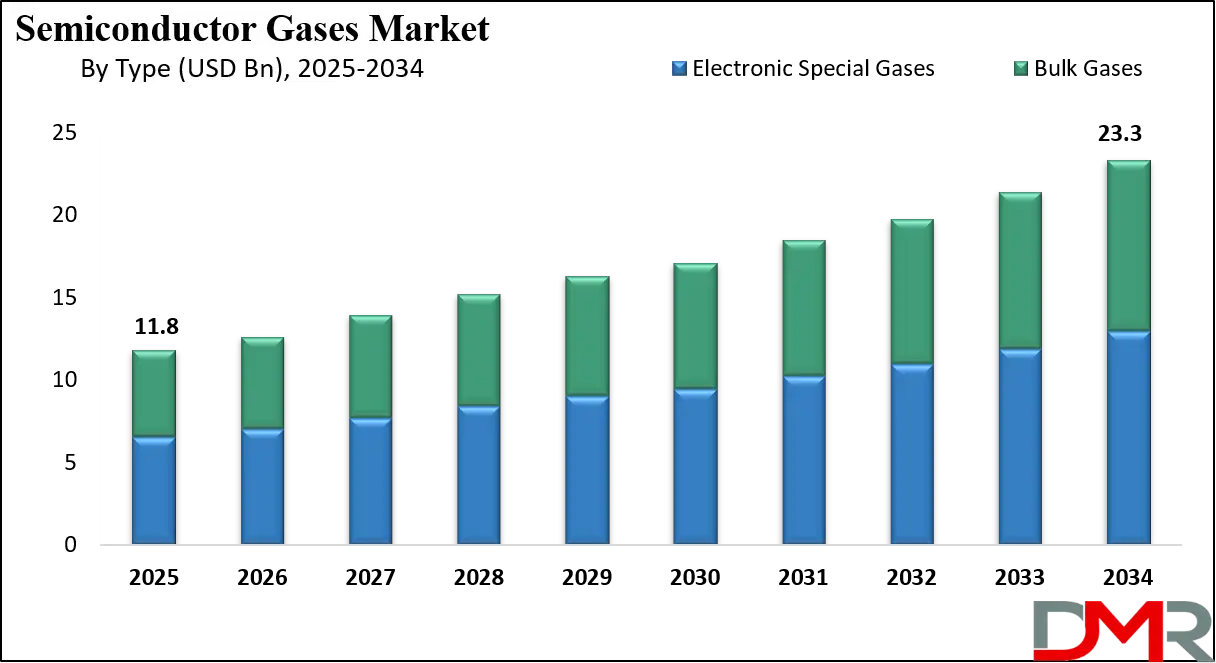

The Global Semiconductor Gases Market size is projected to reach USD 11.8 billion in 2025 and grow at compound annual growth rate of 7.9% to reach a value of USD 23.3 billion in 2034.

Semiconductor gases are special gases used in making chips and electronic devices. They play a key role in processes like cleaning, etching, deposition, and lithography inside semiconductor manufacturing equipment. These gases are highly pure and controlled, because even small impurities can damage circuits or reduce efficiency. They are delivered through cylinders, bulk supply systems, or on-site generation, depending on the scale of production.

ℹ

To learn more about this report –

Download Your Free Sample Report Here

In recent years, demand for semiconductor gases has been rising with the expansion of the electronics industry. The growth of smartphones, cloud computing, electric vehicles, and 5G networks has created a need for advanced chips, which in turn increases gas usage. Equipment manufacturers rely on these gases to support both mature nodes and next-generation semiconductor designs.

A major trend is the move toward smaller, more powerful chips, which require higher precision in gas usage. Specialty gases like fluorine, chlorine, and silane are gaining importance for their role in advanced processes. At the same time, sustainability concerns are shaping the industry, leading to research on low-emission gases and recycling systems.

ℹ

To learn more about this report –

Download Your Free Sample Report Here

Further, events in recent years, such as global chip shortages, supply chain disruptions, and trade tensions, have highlighted the importance of secure gas supplies. Semiconductor manufacturing equipment makers are working closely with gas suppliers to ensure stability and innovation. These developments underline how semiconductor gases have become central not only to production but also to technological progress globally.

The US Semiconductor Gases Market

The US Semiconductor Gases Market size is projected to reach USD 3.0 billion in 2025 at a compound annual growth rate of 7.4% over its forecast period.

The US plays an important role in the semiconductor gases market, driven by its strong position in advanced semiconductor manufacturing and equipment development. With major investments in building new fabs and strengthening domestic chip supply under initiatives like the CHIPS Act, the US is boosting demand for both bulk and specialty gases. The country’s focus on leading-edge technologies, such as artificial intelligence, quantum computing, and 5G, requires ultra-pure gases for precision processes.

The US also acts as a hub for innovation, with suppliers and research institutions developing sustainable and high-performance gas solutions. Moreover, its regulatory frameworks and trade policies influence global supply chains, making the US a central player in shaping the market’s direction and competitiveness.

Europe Semiconductor Gases Market

Europe Semiconductor Gases Market size is projected to reach USD 2.9 billion in 2025 at a compound annual growth rate of 7.0% over its forecast period.

Europe holds a significant role in the semiconductor gases market, supported by its advanced research ecosystem, strong regulatory environment, and growing semiconductor manufacturing base. The region is home to key equipment producers and technology innovators, which rely heavily on ultra-pure gases for processes like etching, deposition, and chamber cleaning.

Europe’s commitment to sustainability and strict environmental standards is also pushing the development and adoption of greener gas solutions. With initiatives to expand semiconductor production capacity and reduce reliance on external supply chains, demand for specialty and bulk gases is set to rise. Additionally, Europe’s emphasis on collaboration between governments, academia, and industry positions it as a vital hub for innovation and sustainable growth in the market.

Japan Semiconductor Gases Market

Japan Semiconductor Gases Market size is projected to reach USD 1.4 billion in 2025 at a compound annual growth rate of 7.9% over its forecast period.

Japan plays a vital role in the semiconductor gases market, backed by its strong presence in materials science, precision manufacturing, and advanced semiconductor equipment. The country has long been a leader in producing specialty gases used for etching, deposition, and cleaning, supporting both domestic and international chipmakers. Japan’s semiconductor industry, particularly in memory and logic devices, relies on ultra-pure gases to maintain quality and efficiency.

The nation is also investing in next-generation technologies, such as advanced lithography and power semiconductors, which further increase gas demand. With a focus on reliability, innovation, and sustainability, Japan not only serves its domestic fabs but also acts as a key supplier to global semiconductor manufacturing hubs.

Semiconductor Gases Market: Key Takeaways

- Market Growth: The Semiconductor Gases Market size is expected to grow by USD 10.7 billion, at a CAGR of 7.9%, during the forecasted period of 2026 to 2034.

- By Type: The electronic special gases is anticipated to get the majority share of the Semiconductor Gases Market in 2025.

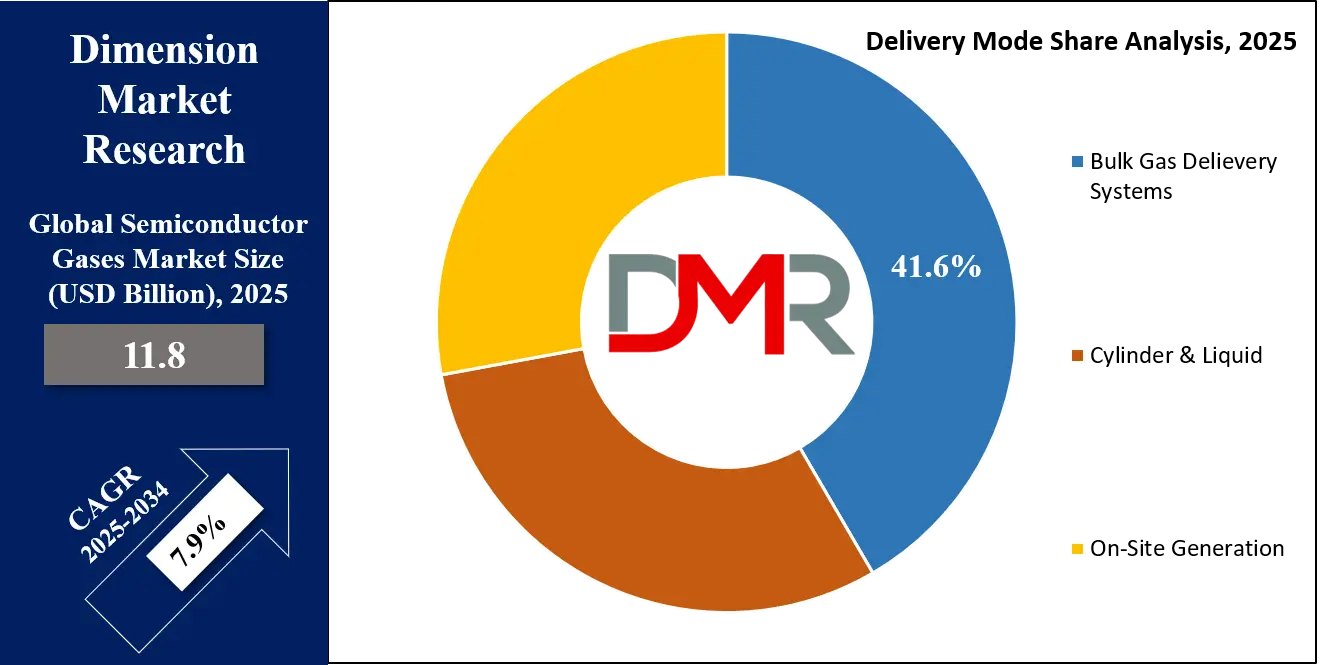

- By Delivery Mode: The bulk gas delivery systems is expected to get the largest revenue share in 2025 in the Semiconductor Gases Market.

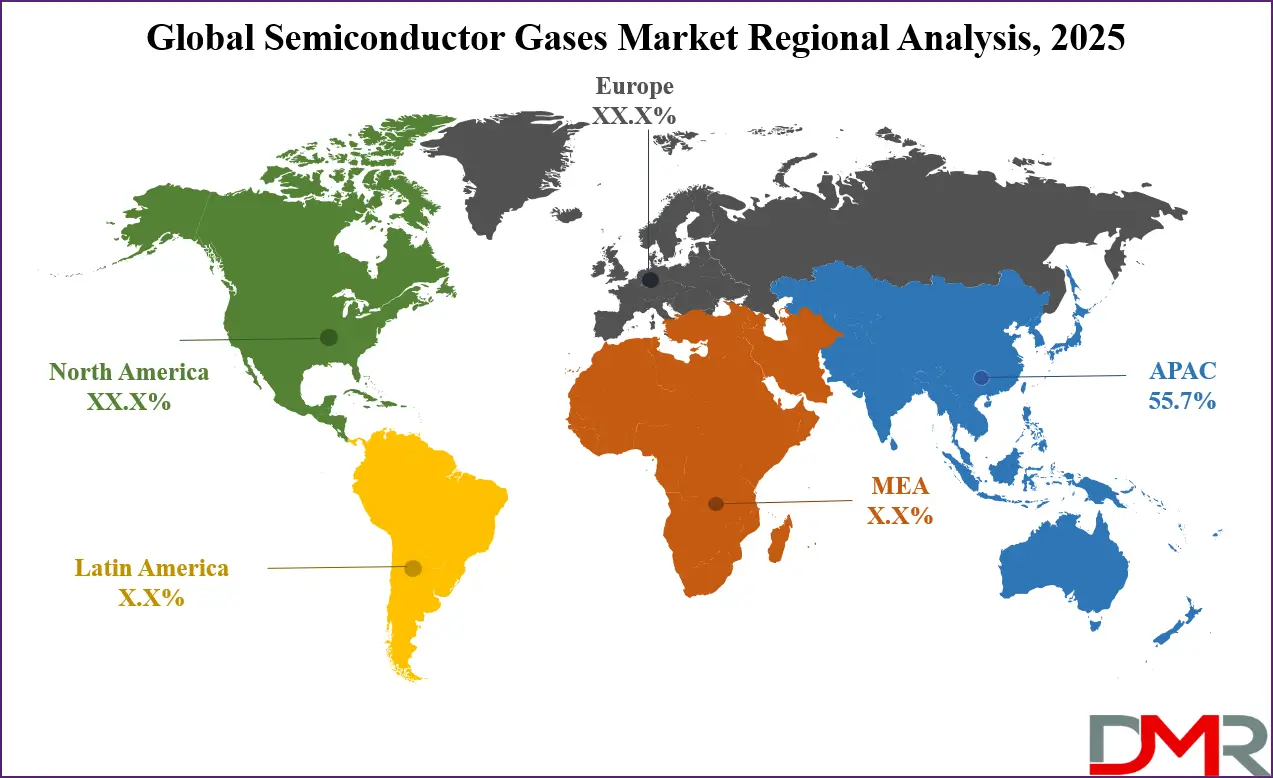

- Regional Insight: Asia Pacific is expected to hold a 55.7% share of revenue in the Global Semiconductor Gases Market in 2025.

- Use Cases: Some of the use cases of Semiconductor Gases includes etching processes, chamber cleaning, and more.

Semiconductor Gases Market: Use Cases:

- Etching Processes: Semiconductor gases are mainly used for etching, where they remove specific layers of material from silicon wafers to develop precise circuit patterns. Gases like fluorine and chlorine-based compounds help achieve high accuracy in shaping microstructures, which is critical for advanced chip designs.

- Deposition Processes: In chipmaking, gases like silane and ammonia are used to deposit thin films on wafers, forming the layers needed for transistors and circuits. These gases allow uniform coatings, ensuring the performance and reliability of semiconductor devices.

- Chamber Cleaning: Semiconductor equipment needs regular cleaning to maintain purity and avoid contamination. Gases like nitrogen trifluoride are used to clean chambers efficiently, reducing downtime and improving overall production yield.

- Doping and Lithography Support: Specialty gases are applied in doping, where they alter the electrical properties of silicon to create n-type or p-type materials. They also support lithography steps, helping define circuit patterns more precisely for advanced nodes in modern electronics.

Market Dynamic

Driving Factors in the Semiconductor Gases Market

Rising Demand for Advanced Electronics

The growing adoption of advanced electronics across industries is one of the strongest drivers for the semiconductor gases market. Smartphones, cloud data centers, electric vehicles, and 5G-enabled devices all rely on high-performance chips, which need specialized gases during production. As chip designs move toward smaller nodes with higher transistor density, the role of ultra-pure gases becomes even more important. These gases ensure accuracy in processes like etching, deposition, and cleaning, which are critical for device performance. Consumer expectations for faster, smarter, and energy-efficient products continue to push manufacturers toward innovation. This directly increases the reliance on gases that enable precision and reliability.

Expansion of Semiconductor Manufacturing Facilities

The global push to build new semiconductor fabs is another major driver for the semiconductor gases market. Governments and companies are investing heavily in domestic chip production to reduce supply chain risks, especially after recent shortages. New manufacturing plants in regions like North America, Asia, and Europe require a steady supply of bulk and specialty gases from the start.

These facilities not only boost immediate demand but also create long-term contracts for gas suppliers, ensuring stable growth. As fabs scale up production for memory chips, logic devices, and power electronics, the requirement for high-purity gases continues to rise. This expansion strengthens market opportunities and drives innovation in gas delivery systems.

Restraints in the Semiconductor Gases Market

High Production and Purification Costs

One of the major restraints in the semiconductor gases market is the high cost involved in producing and purifying these gases to meet ultra-high purity standards. Even the smallest impurity can damage semiconductor wafers, so suppliers must invest in advanced purification technologies and strict quality controls. These processes are energy-intensive and require specialized infrastructure, which adds to overall costs.

Smaller players often struggle to compete due to these financial barriers, limiting market diversity. Additionally, fluctuations in raw material prices further impact production expenses. As a result, maintaining profitability while ensuring quality becomes a constant challenge for suppliers.

Supply Chain Disruptions and Geopolitical Risks

Another restraint affecting the semiconductor gases market is the vulnerability of its supply chain to global disruptions and geopolitical issues. Events such as trade restrictions, export controls, or regional conflicts can limit the flow of critical gases to key semiconductor hubs. During recent years, shortages highlighted the dependency on a few regions for both gases and chip manufacturing.

Transportation delays, pandemic-related shutdowns, and political tensions have further added risks to timely deliveries. This uncertainty forces manufacturers to secure backup suppliers or build local storage systems, which increases costs. Overall, instability in supply chains acts as a hurdle to smooth market growth.

Opportunities in the Semiconductor Gases Market

Growth of Green and Sustainable Semiconductor Gases

A major focus on environmental sustainability is creating new opportunities for semiconductor gas suppliers. Traditional gases used in etching and cleaning processes often have high global warming potential, leading to stricter regulations worldwide, which is driving research and development of eco-friendly alternatives with lower emissions. Suppliers investing in sustainable gases can gain a competitive edge, as chipmakers are under pressure to meet carbon reduction goals. Recycling and reclamation technologies for gases also open fresh revenue streams. As the industry moves toward greener manufacturing, demand for innovative solutions in gas formulation and delivery is expected to rise significantly.

Expansion in Emerging Semiconductor Hubs

The rapid development of semiconductor industries in emerging regions is another major opportunity for the semiconductor gases market. Countries in Southeast Asia, the Middle East, and parts of Eastern Europe are investing in building new fabs and strengthening their electronics sectors. These markets offer untapped potential for gas suppliers to expand their footprint and secure long-term contracts.

Establishing local production and distribution facilities can help minimize dependency on traditional hubs while capturing growing demand. Partnerships with governments and regional manufacturers further enhance market presence. As global semiconductor supply chains diversify, emerging hubs present a valuable pathway for growth.

Trends in the Semiconductor Gases Market

Shift Toward Advanced Node Manufacturing

A key trend in the semiconductor gases market is the major shift toward advanced node manufacturing, where chips are designed with smaller geometries and higher transistor densities, which requires extremely precise etching, deposition, and cleaning processes that depend heavily on specialty gases. As device makers push for higher performance in applications like AI, 5G, and high-performance computing, demand for gases like fluorine, silane, and ammonia continues to grow. The trend also encourages suppliers to innovate in delivery systems that ensure a stable and contamination-free supply. Advanced nodes not only increase gas consumption but also drive the need for ultra-high purity standards.

Integration of On-Site Gas Generation Systems

Another important trend is the growing adoption of on-site gas generation systems by semiconductor manufacturers. Instead of depending solely on bulk deliveries or cylinders, fabs are increasingly investing in systems that can produce gases directly at the facility, which improves reliability, reduces transportation risks, and enhances flexibility during production surges. On-site generation also aligns with sustainability goals by minimizing waste and optimizing energy use. As fabs expand globally, especially in regions with limited supply infrastructure, this trend is gaining momentum. It creates opportunities for suppliers offering integrated gas production, monitoring, and recycling solutions.

Impact of Artificial Intelligence in Semiconductor Gases Market

- Optimized Gas Usage: Artificial Intelligence helps fabs analyze production data in real time, ensuring gases are used with maximum efficiency while minimizing waste and costs.

- Predictive Maintenance: AI-powered monitoring systems can detect issues in gas delivery equipment before failures occur, reducing downtime and ensuring smooth semiconductor production.

- Quality and Purity Control: AI algorithms enhance the ability to monitor gas purity levels, quickly spotting impurities that could impact chip quality and yield.

- Process Innovation: By simulating semiconductor processes, AI enables the design of advanced gas mixtures and delivery systems tailored for next-generation chip manufacturing.

- Sustainability Support: AI supports the development of greener practices by optimizing recycling, recovery, and usage of eco-friendly semiconductor gases.

Research Scope and Analysis

By Type Analysis

Electronic special gases will be leading the semiconductor gases market in 2025 with a share of 55.4%, driven by their critical role in advanced semiconductor manufacturing processes. These gases, which include fluorine-based, silane, and other specialty compounds, are essential for etching, deposition, doping, and cleaning steps that define chip performance and efficiency. With the push toward smaller nodes, high-performance computing, 5G applications, and electric vehicles, the precision offered by electronic special gases becomes even more important.

Their ultra-high purity ensures defect-free wafers, supporting mass production of next-generation chips. Growing demand for logic devices, memory chips, and power semiconductors further strengthens the use of these gases, making them central to the growth of the semiconductor gases market.

Further, bulk gases are expected to have significant growth over the forecast period in the semiconductor gases market, supported by their extended use in large-scale manufacturing. Gases like nitrogen, oxygen, hydrogen, and argon are essential for purging, inerting, and supporting stable environments during chip fabrication.

As new fabs are being set up globally, demand for bulk gases will expand, ensuring steady supply chains for critical operations. Their cost-effectiveness and ability to be delivered through on-site generation or bulk delivery systems add to their growing adoption. With the semiconductor industry scaling up to meet rising needs in the electronics and automotive sectors, bulk gases are set to be a key growth driver of the market.

By Function Analysis

Chamber cleaning is set to dominate the semiconductor gases market in 2025 with a share of 22.6%, as it plays a main role in maintaining purity and efficiency in chip manufacturing. During semiconductor production, residue and particles accumulate inside process chambers, which can contaminate wafers and reduce yield. Gases like nitrogen trifluoride and fluorine-based compounds are broadly used to clean these chambers, ensuring consistent quality and uninterrupted production cycles. With the rise of advanced nodes and complex chip designs, the need for precise and effective cleaning solutions continues to grow.

Meanwhile, lithography is expected to have significant growth over the forecast period in the semiconductor gases market, supported by its importance in defining fine circuit patterns on silicon wafers. This process requires specialty gases to aid in photoresist coating, exposure, and development, ensuring accuracy in advanced chip design.

As industries push for smaller and more powerful devices, lithography becomes more demanding, with extreme ultraviolet (EUV) technology creating new opportunities for gas usage. Semiconductor manufacturers rely heavily on high-purity gases to achieve the precision needed for modern logic and memory chips. With increasing adoption of advanced technologies, lithography gases are set to gain momentum, contributing strongly to the overall growth of the semiconductor gases market.

By Delivery Mode Analysis

Bulk gas delivery systems will dominate the semiconductor gases market in 2025 with a share of 41.6%, driven by its ability to supply large volumes of essential gases efficiently to semiconductor fabs. This delivery mode ensures a steady and reliable flow of gases like nitrogen, oxygen, hydrogen, and argon, which are critical for etching, deposition, and cleaning processes. With the growth in construction of mega fabs and rising production of advanced chips, a consistent bulk supply becomes essential to avoid downtime and maintain high yields.

The system also allows for cost-effective delivery over long distances, supporting global supply chains. As demand for semiconductors grows across consumer electronics, automotive, and industrial applications, bulk gas delivery systems are set to play a key role in the market’s expansion.

Also, on-site gas generation is expected to have significant growth over the forecast period in the semiconductor gases market, as it allows fabs to produce gases directly within their facilities. This approach improves reliability by minimizing dependency on external deliveries and transportation delays. It also helps maintain consistent gas purity levels, which is critical for high-precision processes like etching and deposition.

On-site systems reduce storage needs and lower operational risks while offering cost savings over the long term. With new semiconductor fabs being established globally and rising demand for advanced chips, on-site gas generation is gaining adoption. This delivery mode is set to become increasingly important, contributing strongly to the growth of the semiconductor gases market.

ℹ

To learn more about this report –

Download Your Free Sample Report Here

By Application Analysis

Integrated Circuits (ICs) Manufacturing will be leading the semiconductor gases market in 2025 with a share of 28.9%, driven by the ever-growing demand for high-performance chips across electronics, computing, and communication industries. IC production requires ultra-pure gases for critical processes such as etching, deposition, doping, and chamber cleaning, ensuring precision and reliability in wafer fabrication.

The push for smaller nodes, advanced logic devices, and higher transistor densities further increases the need for specialty and bulk gases. With semiconductor fabs expanding globally to meet rising demand in smartphones, data centers, automotive electronics, and AI applications, the consumption of semiconductor gases in IC manufacturing is set to rise significantly. This application remains a central driver of market growth, supporting both established and next-generation chip production worldwide.

Further, optoelectronics manufacturing is expected to have significant growth over the forecast period in the semiconductor gases market, supported by the rising adoption of devices that use light-based technologies. Applications such as LEDs, laser diodes, photodetectors, and optical sensors rely heavily on precise gas processes like deposition and etching to achieve high efficiency and performance.

Specialty gases ensure the quality and stability of materials used in these devices, which are increasingly applied in telecommunications, displays, automotive lighting, and consumer electronics. With global demand for faster, energy-efficient, and miniaturized optoelectronic devices increasing, semiconductor gases used in this sector are set to see strong growth. This trend highlights optoelectronics as an important driver for market expansion in the coming years.

By End User Analysis

Foundries will be dominating the semiconductor gases market in 2025 with a share of 45.6%, driven by their role in contract-based chip manufacturing for a wide range of clients. These facilities produce logic, memory, and specialty chips that require ultra-pure gases for processes like etching, deposition, chamber cleaning, and doping to ensure high performance and yield. The growth of advanced technologies such as artificial intelligence, 5G, electric vehicles, and high-performance computing is increasing the demand for semiconductor manufacturing, thereby boosting gas consumption in foundries.

Expansion of new fabrication plants in regions like the Asia Pacific, the US, and Europe further strengthens demand. Foundries’ reliance on consistent, high-quality gas supply makes them a key end user, playing a central role in driving the overall growth of the semiconductor gases market.

Integrated Device Manufacturers are expected to have significant growth over the forecast period in the semiconductor gases market, as they design and produce chips in-house for electronics, automotive, and industrial applications. These companies rely on specialty and bulk gases for precise manufacturing processes, including etching, deposition, and chamber cleaning, to ensure product quality and efficiency.

Increasing adoption of advanced semiconductor technologies, such as smaller nodes, power devices, and memory chips, is driving higher gas consumption. With growing investments in domestic fabs and in-house production capabilities, integrated device manufacturers are expanding their demand for reliable and high-purity gases. This end-user segment is set to contribute strongly to the growth of the semiconductor gases market in the coming years.

The Semiconductor Gases Market Report is segmented on the basis of the following:

By Type

- Electronic Special Gases (ESGs)

- Nitrogen Trifluoride (NF₃)

- Silane (SiH₄)

- Hydrogen Chloride (HCl)

- Carbon Tetrafluoride (CF₄)

- Ammonia (NH₃)

- Others (e.g., Phosphine, Arsine, Germane)

- Bulk Gases

- Nitrogen

- Oxygen

- Hydrogen

- Argon

- Helium

- Carbon Dioxide

By Function

- Deposition

- Etching

- Doping

- Lithography

- Chamber Cleaning

- Oxidation & Diffusion

By Delivery Mode

- Cylinder and Liquid

- Bulk Gas Delivery Systems

- On-site gas generation

By Application

- Integrated Circuits (ICs) Manufacturing

- Memory Devices Manufacturing

- Logic Devices Manufacturing

- Optoelectronics Manufacturing

- Sensors Manufacturing

- Discrete Semiconductors Manufacturing

By End-User

- Foundries

- Integrated Device Manufacturers (IDMs)

- Outsourced Semiconductor Assembly & Test (OSAT)

Regional Analysis

Leading Region in the Semiconductor Gases Market

Asia Pacific will be leading the semiconductor gases market in 2025 with a share of 55.7%, supported by its dominance in global semiconductor manufacturing and the rapid expansion of fabrication facilities. Countries like Taiwan, South Korea, China, and Japan are home to some of the largest chip producers and equipment makers, creating strong demand for bulk and specialty gases used in etching, deposition, cleaning, and doping processes.

The region benefits from well-established supply chains, skilled labor, and government-backed initiatives aimed at strengthening semiconductor independence and innovation. Growing adoption of 5G, electric vehicles, consumer electronics, and artificial intelligence is further increasing the need for advanced chips, thereby boosting gas consumption. With continuous investments in mega fabs and new production hubs, the Asia Pacific remains at the center of semiconductor innovation and production, making it the most crucial region for driving the overall growth of the semiconductor gases market during the forecast period.

ℹ

To learn more about this report –

Download Your Free Sample Report Here

Fastest Growing Region in the Semiconductor Gases Market

Latin America is set to show significant growth over the forecast period in the semiconductor gases market, supported by rising investments in electronics manufacturing, renewable energy projects, and automotive production. Countries like Brazil and Mexico are strengthening their role in global supply chains by attracting technology-driven industries that depend on advanced chips. This rising demand for semiconductors fuels the need for high-purity gases used in processes such as etching, deposition, and chamber cleaning.

Government initiatives to boost industrial infrastructure and foreign partnerships are further creating expansion opportunities. With growing digitalization, consumer electronics adoption, and smart manufacturing, Latin America is steadily emerging as an important contributor to the growth of the semiconductor gases market.

By Region

North America

Europe

- Germany

- The U.K.

- France

- Italy

- Russia

- Spain

- Benelux

- Nordic

- Rest of Europe

Asia-Pacific

- China

- Japan

- South Korea

- India

- ANZ

- ASEAN

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Argentina

- Colombia

- Rest of Latin America

Middle East & Africa

- Saudi Arabia

- UAE

- South Africa

- Israel

- Egypt

- Rest of MEA

Competitive Landscape

The semiconductor gases market is highly competitive, with a mix of global suppliers and regional players providing gases for different stages of chip production. Competition is shaped by the ability to deliver ultra-high purity products, reliable supply systems, and strong technical support to equipment makers. Companies focus on expanding production facilities near major chip manufacturing hubs, securing long-term contracts, and investing in research to develop safer and more sustainable gases. Partnerships with semiconductor manufacturers are common, as demand is closely linked to technology shifts. Innovation, supply chain strength, and environmental compliance are key factors driving market rivalry.

Some of the prominent players in the Global Semiconductor Gases are:

- Linde plc

- Air Liquide

- Air Products and Chemicals, Inc.

- Taiyo Nippon Sanso Corporation (TNSC)

- Messer Group GmbH

- Sumitomo Seika Chemicals Co., Ltd.

- Showa Denko K.K. (Resonac Holdings)

- Matheson Tri-Gas, Inc.

- Versum Materials (acquired by Merck KGaA)

- Merck KGaA (EMD Electronics)

- Praxair Technology, Inc. (part of Linde)

- Iwatani Corporation

- SK Materials Co., Ltd.

- Hyosung Corporation

- Fujian Shaowu Yongfei Chemical Co., Ltd.

- Huate Gas Co., Ltd.

- Suzhou Jinhong Gas Co., Ltd.

- Zhejiang Kaiheng Electronic Gas Co., Ltd.

- ADEKA Corporation

- OCI Company Ltd.

- Other Key Players

Recent Developments

- In July 2025, Air Liquide secured a contract to construct advanced industrial gas production units in “Silicon Saxony,” Dresden, Germany. Through this agreement, the company will provide substantial volumes of high-purity gases directly at the manufacturing facility of a leading semiconductor industry client.

- On May 15, 2025, India launched the green light for its sixth semiconductor manufacturing facility, a joint venture between HCL and Foxconn, under the India Semiconductor Mission. The central government noted that five more semiconductor units are already in advanced stages of construction. As part of its strategy to boost domestic chip production, India is actively encouraging foreign investments to support the development and design of semiconductor fabs, ATMP units, and associated infrastructure.

Report Details

| Report Characteristics |

| Market Size (2025) |

USD 11.8 Bn |

| Forecast Value (2034) |

USD 23.3 Bn |

| CAGR (2025–2034) |

7.9% |

| The US Market Size (2025) |

USD 3.0 Bn |

| Historical Data |

2019 – 2024 |

| Forecast Data |

2026 – 2034 |

| Base Year |

2024 |

| Estimate Year |

2025 |

| Report Coverage |

Market Revenue Estimation, Market Dynamics, Competitive Landscape, Growth Factors, etc. |

| Segments Covered |

By Type (Electronic Special Gases (ESGs) and Bulk Gases), By Function (Deposition, Etching, Doping, Lithography, Chamber Cleaning, and Oxidation & Diffusion), By Delivery Mode (Cylinder and Liquid, Bulk Gas Delivery Systems, and On-site gas generation), By Application (Integrated Circuits (ICs) Manufacturing, Memory Devices Manufacturing, Logic Devices Manufacturing, Optoelectronics Manufacturing, Sensors Manufacturing, and Discrete Semiconductors Manufacturing), By End-User (Foundries, Integrated Device Manufacturers (IDMs), and Outsourced Semiconductor Assembly & Test (OSAT)) |

| Regional Coverage |

North America – US, Canada; Europe – Germany, UK, France, Russia, Spain, Italy, Benelux, Nordic, Rest of Europe; Asia-Pacific – China, Japan, South Korea, India, ANZ, ASEAN, Rest of APAC; Latin America – Brazil, Mexico, Argentina, Colombia, Rest of Latin America; Middle East & Africa – Saudi Arabia, UAE, South Africa, Turkey, Egypt, Israel, Rest of MEA |

| Prominent Players |

Linde plc, Air Liquide, Air Products and Chemicals, Inc., Taiyo Nippon Sanso Corporation (TNSC), Messer Group GmbH, Sumitomo Seika Chemicals Co., Ltd., Showa Denko K.K., Matheson Tri-Gas, Inc., Versum Materials, Merck KGaA (EMD Electronics), Praxair Technology, Inc., Iwatani Corporation, SK Materials Co., Ltd., Hyosung Corporation, Fujian Shaowu Yongfei Chemical Co., Ltd., Huate Gas Co., Ltd., Suzhou Jinhong Gas Co., Ltd., Zhejiang Kaiheng Electronic Gas Co., Ltd., ADEKA Corporation, OCI Company Ltd., and Other Key Players

|

| Purchase Options |

We have three licenses to opt for: Single User License (Limited to 1 user), Multi-User License (Up to 5 Users), and Corporate Use License (Unlimited User) along with free report customization equivalent to 0 analyst working days, 3 analysts working days, and 5 analysts working days respectively. |

Frequently Asked Questions

How big is the Global Semiconductor Gases Market?

▾ The Global Semiconductor Gases Market size is expected to reach a value of USD 11.8 billion in 2025 and is expected to reach USD 23.3 billion by the end of 2034.

Which region accounted for the largest Global Semiconductor Gases Market?

▾ Asia Pacific is expected to have the largest market share in the Global Semiconductor Gases Market, with a share of about 55.7% in 2025.

How big is the Semiconductor Gases Market in the US?

▾ The Semiconductor Gases Market in the US is expected to reach USD 3.0 billion in 2025.

Who are the key Semiconductor Gases Market?

▾ Some of the major key players in the Global Semiconductor Gases Market are Linde, Air Liquide, Messer, and others

What is the growth rate in the Global Semiconductor Gases Market?

▾ The market is growing at a CAGR of 7.9 percent over the forecasted period.