Market Overview

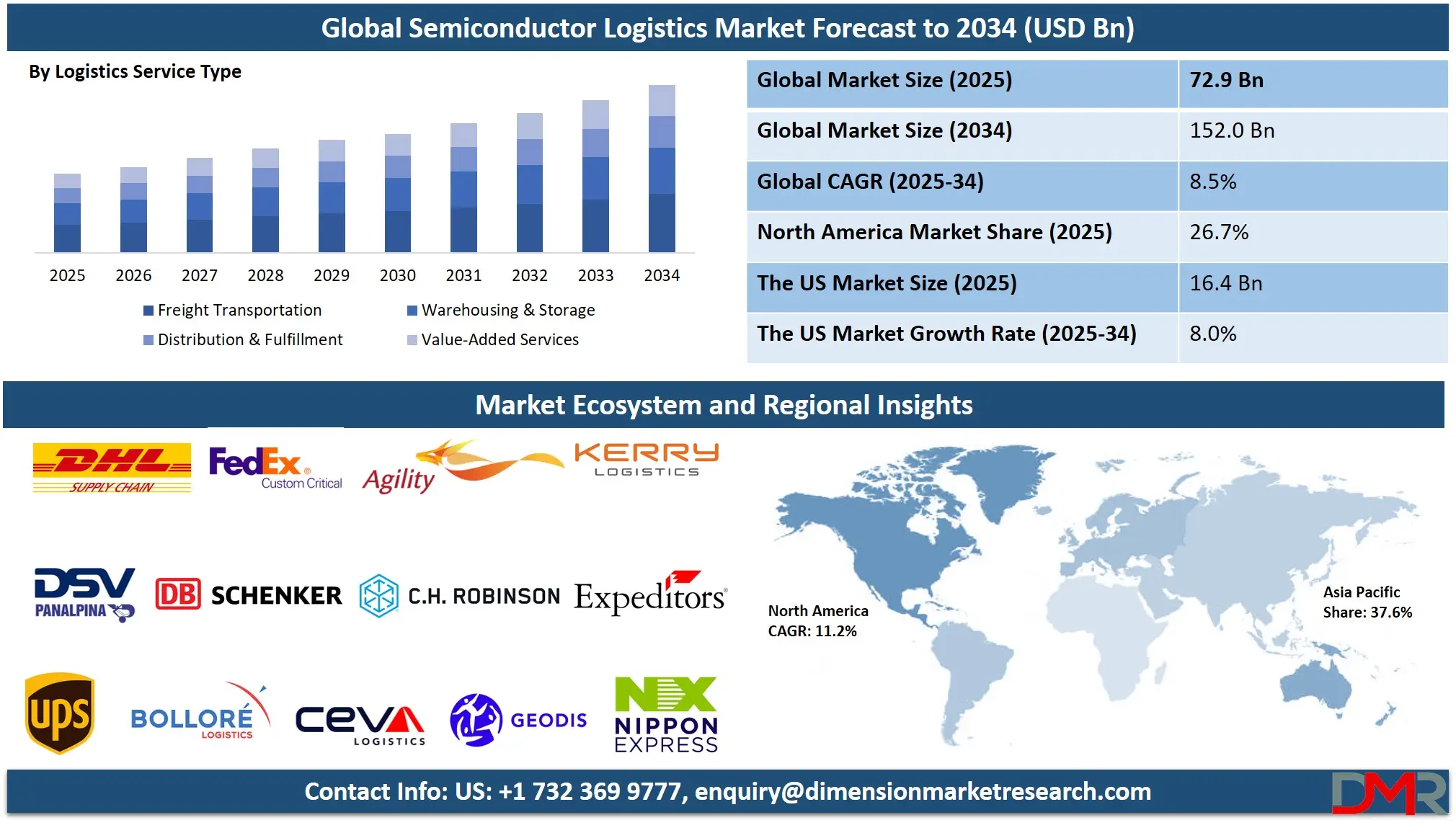

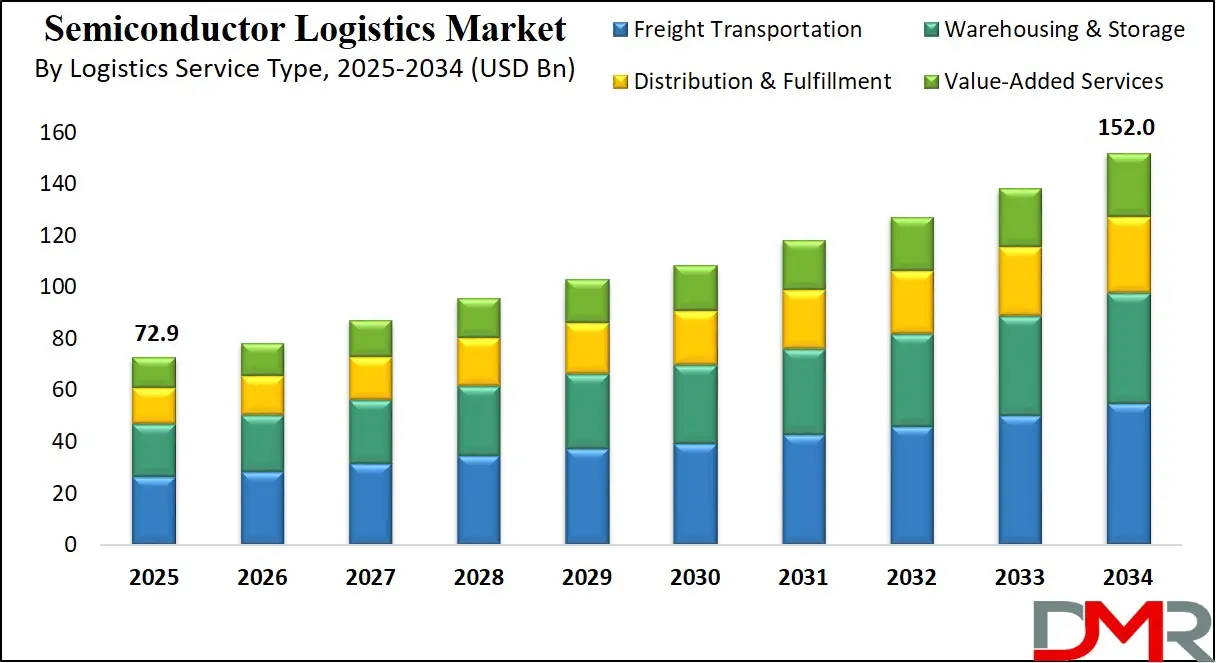

The Global Semiconductor Logistics Market is projected to reach USD 72.9 billion in 2025 and is expected to grow at a CAGR of 8.5% from 2025 to 2034, attaining a value of USD 152.0 billion by 2034. The market's robust growth is propelled by the exponential demand for semiconductors across consumer electronics, automotive, industrial automation, and AI/data centers, combined with the globalization and increasing complexity of semiconductor supply chains.

ℹ

To learn more about this report –

Download Your Free Sample Report Here

Semiconductor logistics enables the secure, efficient, and temperature-controlled movement of raw wafers, finished chips, and assembly materials across a globally dispersed network of fabs, OSAT facilities, and end customers. The model addresses critical challenges related to supply chain resilience, time-to-market pressures, and the high value and sensitivity of semiconductor cargo.

Technological advancements, including IoT-enabled tracking, blockchain for chain of custody, AI-driven predictive logistics, autonomous warehouse systems, and specialized cold chain solutions for sensitive components, are transforming the market into a more transparent, agile, and reliable ecosystem. Integration of machine learning algorithms for demand forecasting, route optimization, and risk mitigation is reshaping operational efficiency.

ℹ

To learn more about this report –

Download Your Free Sample Report Here

Growing industry initiatives promoting supply chain digitization, nearshoring strategies, and sustainability mandates further accelerate global adoption. However, barriers such as geopolitical tensions, trade restrictions, infrastructure gaps, soaring freight costs, and stringent regulatory compliance remain. Despite these challenges, the convergence of digital supply chain technologies, advanced analytics, and logistics infrastructure modernization positions semiconductor logistics as a central enabler of global electronics production through 2034.

The US Semiconductor Logistics Market

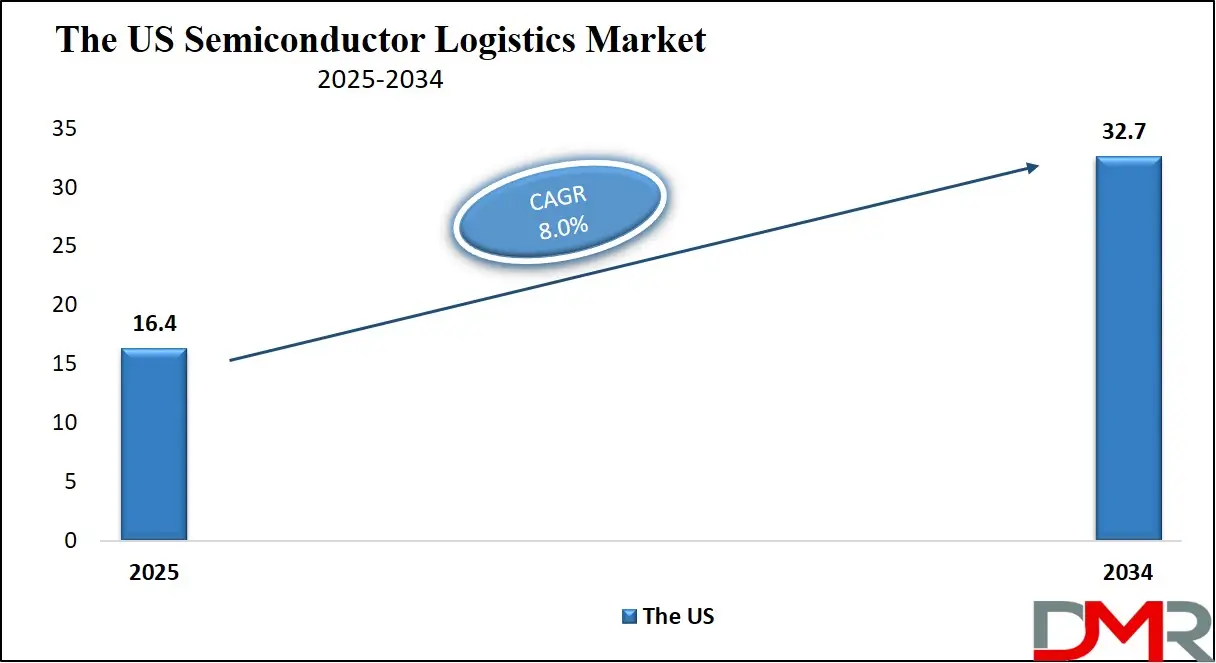

The U.S. Semiconductor Logistics Market is projected to reach USD 16.4 billion in 2025 and grow at a CAGR of 8.0%, reaching USD 32.7 billion by 2034. The U.S. leads global adoption due to its advanced manufacturing base, significant CHIPS Act investments, and the presence of major fabless companies, IDMs, and OEMs requiring sophisticated logistics networks.

ℹ

To learn more about this report –

Download Your Free Sample Report Here

The CHIPS and Science Act is fueling massive investments in domestic semiconductor manufacturing, creating unprecedented demand for construction logistics, equipment transportation, and ongoing materials supply chain support. Major logistics providers and tech firms are expanding dedicated semiconductor vertical capabilities to serve new fab clusters in Arizona, Texas, and Ohio.

U.S. regulations on export controls and sourcing requirements add layers of complexity, necessitating logistics partners with expertise in trade compliance, controlled goods handling, and secure transportation. The rapid growth of AI chip production and advanced packaging further demands specialized logistics for high-value, sensitive shipments. The integration of real-time visibility platforms, warehouse automation, and drone-based inventory management continues to redefine the U.S. semiconductor logistics landscape, positioning the country as a global leader in high-tech supply chain innovation.

The Europe Semiconductor Logistics Market

The Europe Semiconductor Logistics Market is projected to be valued at approximately USD 10.5 billion in 2025 and is projected to reach around USD 22.1 billion by 2034, growing at a CAGR of about 8.6% from 2025 to 2034. Europe's market is anchored by strong automotive and industrial manufacturing sectors, EU-level semiconductor sovereignty strategies, and government-supported investments in microelectronics.

The European Chips Act aims to double the EU's global market share by 2030, driving demand for logistics supporting new and expanded fabs, R&D centers, and testing facilities. Countries such as Germany, France, Ireland, and the Netherlands are key hubs, requiring resilient inbound logistics for raw materials and outbound logistics for finished components to global customers.

Europe's focus on sustainability and green logistics is shaping market trends, with increasing demand for carbon-neutral transportation, optimized multimodal routes, and circular economy services for semiconductor recycling and reuse. The region's advanced digital infrastructure, cross-border trade frameworks, and investment in autonomous freight and smart warehouses support the adoption of next-generation logistics solutions, making Europe a critical and advanced region for semiconductor supply chain operations.

The Japan Semiconductor Logistics Market

The Japan Semiconductor Logistics Market is anticipated to be valued at approximately USD 6.3 billion in 2025 and is expected to reach around USD 12.6 billion by 2034, expanding at a CAGR of about 8.0% during the forecast period. Japan's leadership in semiconductor materials, equipment manufacturing, and niche chip production drives a highly specialized logistics demand.

The Japanese government's support for semiconductor industry revitalization, coupled with partnerships with global players like TSMC and Rapidus, is accelerating fab construction and upgrades. This creates significant demand for project logistics for delicate equipment, cleanroom-grade transportation, and just-in-time delivery for manufacturing lines.

Japan's excellence in precision engineering, robotics, and quality management extends to its logistics sector, featuring highly automated warehouses, sophisticated inventory systems, and impeccable handling protocols for sensitive components. The concept of "Monozukuri" (manufacturing excellence) integrated with "Logistics 4.0" is fostering innovation in IoT-based asset tracking, AI for supply chain risk management, and seamless integration between production and distribution networks. Japan's emphasis on reliability, precision, and technological integration positions it as a high-growth innovator in specialized semiconductor logistics.

Global Semiconductor Logistics Market: Key Takeaways

- Strong Global Market Growth Outlook: The Global Semiconductor Logistics Market is expected to be valued at USD 72.9 billion in 2025 and is projected to reach USD 152.0 billion by 2034, showcasing robust expansion supported by booming semiconductor demand and complex global supply chains.

- Steady CAGR Driven by Supply Chain Digitization: The market is expected to grow at a steady CAGR of 8.5% from 2025 to 2034, fueled by the adoption of digital supply chain platforms, IoT visibility, AI/ML optimization, and the critical need for resilience and agility.

- Strong Growth Trajectory in the United States: The U.S. Semiconductor Logistics Market stands at USD 16.4 billion in 2025 and is projected to reach USD 32.7 billion by 2034, expanding at a CAGR of 8.0% due to reshoring investments, CHIPS Act funding, and advanced manufacturing growth.

- Asia-Pacific Maintains Regional Dominance: Asia-Pacific is expected to capture the largest global market share, supported by its role as the world's semiconductor manufacturing hub, dense network of fabs and OSATs, and massive volume of component movements.

- Rapid Advancement in Logistics Technologies: Innovations including blockchain-enabled traceability, AI-powered demand sensing, autonomous mobile robots (AMRs) in warehouses, and temperature/ humidity-controlled smart containers are significantly enhancing efficiency, security, and visibility.

- Growing Complexity of Supply Chains Boosts Adoption: The increasing geographical dispersion of semiconductor production stages (from wafer to package to assembly), coupled with just-in-time manufacturing and high inventory costs, is driving sustained demand for specialized, integrated logistics solutions.

Global Semiconductor Logistics Market: Use Cases

- High-Value Chip Transportation: Secure, insured, and tracked movement of finished advanced semiconductors (e.g., AI/GPU chips) from fabrication plants to data center or OEM customers worldwide.

- Fab Construction & Tooling Logistics: Project logistics for the delivery of oversized, delicate, and ultra-clean semiconductor manufacturing equipment (e.g., EUV lithography machines) to new fabrication facilities.

- Spare Parts & MRO Logistics: Rapid, reliable logistics for critical spare parts and maintenance, repair, and operations (MRO) materials to ensure minimal downtime in continuous 24/7 semiconductor manufacturing.

- Reverse Logistics & Circular Economy: Managing the return, refurbishment, recycling, or responsible disposal of defective chips, used equipment, and materials to support sustainability goals and cost recovery.

- Warehousing & Inventory Management for WIP: Providing cleanroom-compatible or controlled-environment warehousing for work-in-progress (WIP) semiconductors, dies, and substrates at various stages of the supply chain.

Global Semiconductor Logistics Market: Stats & Facts

- The World Semiconductor Trade Statistics (WSTS) projects the global semiconductor market to reach USD 1.2 trillion by 2034, directly correlating to massive growth in the volume and value of goods requiring specialized logistics, with over 70% of manufacturing concentrated in Asia-Pacific.

- The CHIPS Act in the U.S. allocates over USD 52 billion for domestic semiconductor manufacturing, expected to generate billions in annual logistics spending for construction, equipment, and ongoing material flows over the next decade.

- Industry 4.0 surveys indicate that over 60% of semiconductor manufacturers plan to increase investment in supply chain visibility and IoT tracking technologies by 2027 to mitigate disruption risks and improve on-time delivery.

- The International Air Transport Association (IATA) reports that semiconductors and electronics account for over 35% of global air cargo revenue by value, underscoring the criticality of air freight for time-sensitive, high-value chip shipments.

- According to global logistics analyses, a single disruption at a key chokepoint (e.g., a port or trade lane) can cost the semiconductor industry over USD 100 million per day in delayed revenue, highlighting the strategic value of resilient logistics planning.

- Sustainability benchmarks show leading semiconductor companies targeting 40-50% reduction in supply chain emissions by 2030, driving demand for green logistics options, optimized transportation modes, and circular reverse logistics programs.

Global Semiconductor Logistics Market: Market Dynamics

Driving Factors in the Global Semiconductor Logistics Market

Exponential Growth in Semiconductor Demand

The relentless demand for chips from sectors like AI, electric vehicles, 5G/6G, and IoT is a primary driver. This demand creates immense volumes of raw materials (silicon wafers, gases, chemicals), finished chips, and sub-assemblies that must move swiftly and securely across continents. The capital-intensive, just-in-time nature of semiconductor manufacturing makes logistics efficiency and reliability not just a support function, but a critical competitive advantage.

Supply Chain Resilience and Geopolitical Rebalancing

Recent disruptions have exposed vulnerabilities in highly concentrated supply chains. This is driving a structural shift towards supply chain resilience, including nearshoring, friend-shoring, and multi-sourcing strategies. These strategies significantly increase the complexity and volume of logistics movements from multi-leg international freight to regional distribution creating growth opportunities for logistics providers capable of managing intricate, multi-modal networks.

Restraints in the Global Semiconductor Logistics Market

Geopolitical Tensions and Trade Policy Volatility

Export controls, tariffs, and shifting trade alliances create uncertainty and administrative burdens. Logistics providers must navigate a complex web of compliance requirements, licensing, and restricted party screenings, which can delay shipments, increase costs, and limit operational flexibility. Sudden policy changes can reroute entire supply chains overnight, posing a significant planning and execution challenge.

High Cost and Infrastructure Limitations

The need for specialized handling, including clean transportation, constant monitoring, security escort, and climate control, makes semiconductor logistics exceptionally costly. Furthermore, infrastructure gaps in certain regions, such as port congestion, limited air cargo capacity, or inadequate road networks for oversized equipment, can create bottlenecks. The capital expenditure required to develop advanced, semiconductor-grade logistics infrastructure is a significant barrier to entry and scaling.

Opportunities in the Global Semiconductor Logistics Market

Digital Integration and End-to-End Visibility

There is a substantial opportunity for logistics providers to offer fully integrated digital platforms that provide real-time, end-to-end visibility from the fab to the end customer. Integrating IoT sensors, blockchain for immutable records, and AI-driven analytics can offer predictive insights, automate documentation, and enhance security, creating a premium service differentiator in a market craving transparency.

Specialized Services for Advanced Packaging and Heterogeneous Integration

The trend towards advanced packaging (e.g., 2.5D, 3D ICs) and heterogeneous integration creates new logistics needs. These fragile, multi-chiplet assemblies require even more precise handling, electrostatic discharge (ESD) protection, and potentially customized packaging solutions. Developing specialized service lines for these next-generation products represents a high-value growth frontier.

Trends in the Global Semiconductor Logistics Market

Adoption of AI and Predictive Analytics

AI and machine learning are being deployed for predictive logistics management. Algorithms analyze vast datasets on weather, port congestion, flight schedules, and historical performance to predict delays, optimize routes in real-time, and proactively mitigate risks. This shifts logistics from a reactive to a proactive operational model.

Growth of Sustainable and Green Logistics

Sustainability is becoming a core procurement criterion. Trends include the adoption of carbon-neutral transportation options, optimization of loads to reduce trips, use of sustainable packaging materials, and development of circular reverse logistics programs for chip reuse and recycling. Providers offering verifiable green credentials are gaining a competitive edge.

Global Semiconductor Logistics Market: Research Scope and Analysis

By Logistics Service Type Analysis

Freight Transportation dominates this segment, accounting for the largest revenue share, with Air Freight as its cornerstone. The criticality of time-to-market for high-value semiconductors makes air transport indispensable for finished chips, prototypes, and urgent spare parts. While ocean freight handles bulk raw materials and cost-sensitive components, air freight's premium service and speed secure its leadership. Road Transportation is the dominant mode for regional distribution, final-mile delivery, and drayage to/from ports and airports, especially within manufacturing clusters in Asia-Pacific and North America. Major global integrated carriers (FedEx, UPS, DHL Express) and freight forwarders with dedicated air and road networks (Kuehne+Nagel, DB Schenker) are the primary forces. Warehousing & Storage, particularly Bonded and Controlled Environment Storage, is the second-largest sub-segment, led by global 3PLs like DHL Supply Chain and CEVA Logistics who operate specialized high-tech warehouses near fab clusters.

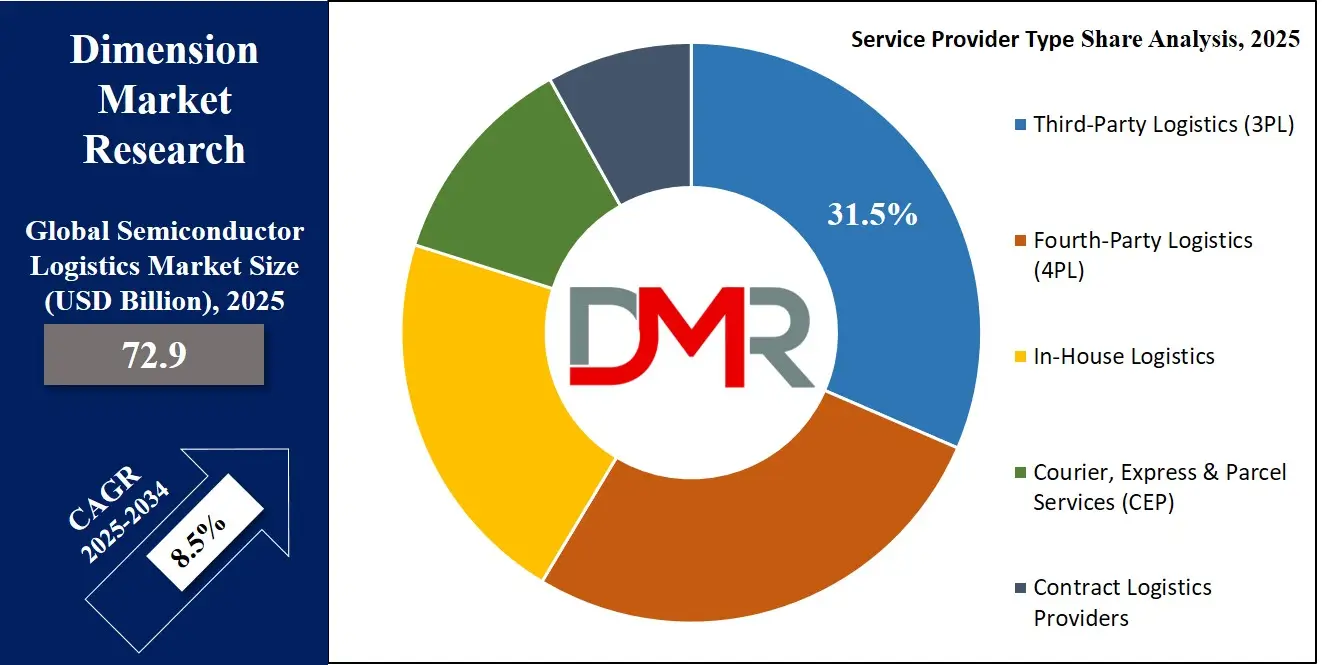

By Service Provider Type Analysis

Third-Party Logistics (3PL) providers, specifically Specialized Semiconductor 3PLs, overwhelmingly dominate this segment. The extreme complexity, capital requirements, and need for global scale make outsourcing to experts the predominant model. These specialized 3PLs offer integrated solutions combining transportation, warehousing, and value-added services tailored to semiconductor industry standards (cleanliness, ESD, security). Leading players like Kuehne+Nagel, DB Schenker, and Bolloré Logistics have dedicated technology sector divisions with deep domain expertise. Fourth-Party Logistics (4PL) providers are gaining traction for managing entire, multi-vendor supply chains for large IDMs and fabless companies. In-House Logistics is primarily utilized only by the very largest Integrated Device Manufacturers (IDMs) like Intel and Samsung, who operate their own substantial logistics arms due to their scale and vertical integration, but this remains a minority approach industry-wide.

ℹ

To learn more about this report –

Download Your Free Sample Report Here

By Technology / Tracking Capability Analysis

Real-Time Tracking & Visibility Platforms currently represent the most widely adopted and dominant technological capability. The non-negotiable need for security and predictability for high-value shipments has made real-time GPS/RFID-based tracking a baseline expectation. Major 3PLs and carriers embed this in their core offerings. However, IoT-Enabled Logistics is the foundational technology driving this visibility and is poised for the highest growth, with sensors monitoring location, shock, temperature, and humidity in transit. AI & Machine Learning Optimization is rapidly becoming a key differentiator for leading providers, used for predictive logistics, dynamic routing, and warehouse efficiency. While Blockchain shows promise for provenance and compliance, its adoption is led by consortia and pilot programs rather than being a mass-market dominance. Technology leaders are often the large 3PLs investing heavily in digital transformation.

By Supply Chain Function Analysis

Inbound Logistics is the largest and most dominant segment by volume and complexity. It encompasses the massive, continuous flow of thousands of raw materials, specialty chemicals, silicon wafers, and sub-components from global suppliers to fabrication plants. The absolute requirement for just-in-time delivery to avoid fab line stoppages, coupled with the handling of hazardous materials, makes this the most critical and service-intensive function. It is dominated by global 3PLs with strong freight forwarding and materials management expertise. Outbound Logistics, involving the distribution of finished wafers to OSATs and packaged chips to customers, is the second-largest segment, characterized by high-value, time-sensitive shipments. In-Process Logistics within the fab (wafer handling, cleanroom transport) is a highly specialized niche, often managed by the fabs themselves or through tightly integrated facilities management partners.

By End User Analysis

Semiconductor Fabrication Plants (Fabs) & Foundries are the dominant end-users, commanding the largest share of logistics spending. As the multi-billion-dollar centers of production, their operations generate immense, non-stop demand for inbound material logistics, outbound wafer logistics, and specialized project logistics for equipment installation. Their scale and critical requirements make them the primary clients for top-tier specialized 3PLs. Outsourced Semiconductor Assembly and Test (OSAT) Providers (e.g., ASE, Amkor) rank as the second-largest segment. They act as pivotal hubs, requiring sophisticated inbound logistics for wafers from fabs and outbound logistics for finished chips to global customers, creating a high-velocity, coordinated logistics demand. Fabless Semiconductor Companies (e.g., Qualcomm, Nvidia) are major drivers of demand for premium outbound and distribution logistics, relying entirely on partners for the physical movement of their designed chips from foundry to customer.

The Global Semiconductor Logistics Market Report is segmented on the basis of the following:

By Logistics Service Type

- Freight Transportation

- Air Freight

- Ocean Freight

- Road Transportation

- Rail Transportation

- Warehousing & Storage

- Bonded Warehousing

- Cold/Controlled Environment Storage

- Customs-cleared Storage

- Distribution & Fulfillment

- Order Picking & Packing

- Last-Mile Delivery

- Value-Added Services

- Kitting & Sequencing

- Labeling & Documentation

- Reverse Logistics (returns & recycling)

- Quality & Compliance Testing

By Service Provider Type

- Third-Party Logistics (3PL)

- Standard 3PL

- Specialized Semiconductor 3PL

- Fourth-Party Logistics (4PL)

- In-House Logistics

- Courier, Express & Parcel Services (CEP)

- Contract Logistics Providers

By Technology / Tracking Capability

- IoT-Enabled Logistics

- AI & Machine Learning Optimization

- Blockchain-Based Supply Chain

- Real-Time Tracking & Visibility Platforms

- Automated Handling & Robotics

By Supply Chain Function

- Inbound Logistics

- In-Process Logistics

- Wafer handling within fabs

- Cleanroom logistics

- Outbound Logistics

- Finished goods to assembly/test

- Aftermarket/Field logistics

By End User

- Semiconductor Fabrication Plants (Fabs) & Foundries

- Outsourced Semiconductor Assembly and Test (OSAT) Providers

- Integrated Device Manufacturers (IDMs)

- Fabless Semiconductor Companies

- Semiconductor Equipment & Material Suppliers

- Electronics Manufacturing Services (EMS) & OEMs

Impact of Artificial Intelligence in the Global Semiconductor Logistics Market

- AI for Predictive Demand and Capacity Planning: AI models analyze market signals, production schedules, and order books to forecast logistics demand, enabling proactive allocation of cargo space, warehouse capacity, and transportation assets, reducing bottlenecks and costs.

- AI-Optimized Route and Load Planning: AI algorithms dynamically optimize shipping routes and container load planning by factoring in real-time data on weather, congestion, fuel costs, and delivery priorities, maximizing efficiency and minimizing transit times and emissions.

- AI-Powered Risk Management and Disruption Forecasting: AI systems monitor global events, news feeds, and sensor data to predict potential supply chain disruptions (geopolitical, natural disasters), allowing for preemptive rerouting and contingency planning.

- AI-Enhanced Warehouse Operations: AI drives automation in warehouses through smart robotics, computer vision for inventory checks, and predictive analytics for stock placement and picking paths, dramatically increasing accuracy and throughput.

- AI in Fraud Detection and Security Enhancement: AI analyzes shipment documentation and tracking patterns to detect anomalies indicative of theft, tampering, or fraudulent activity, enhancing the security of high-value semiconductor shipments.

Global Semiconductor Logistics Market: Regional Analysis

Region with the Largest Revenue Share

Asia-Pacific is projected to dominate the Global Semiconductor Logistics Market with the 37.6% market share in 2025, owing to its undisputed position as the global hub for semiconductor manufacturing, assembly, and testing. The region houses over 70% of the world's wafer fabrication capacity and an even larger share of OSAT operations, concentrated in Taiwan, South Korea, China, Japan, and Southeast Asia. This creates an unparalleled volume and frequency of logistics movements from raw materials into the region to finished components out to global consumers. The dense network of suppliers, fabs, and customers within Asia-Pacific itself also generates massive intra-regional logistics demand. Major global logistics players have established dedicated technology verticals and invested heavily in infrastructure in this region to serve this critical market, cementing its dominant revenue share.

ℹ

To learn more about this report –

Download Your Free Sample Report Here

Region with the Highest CAGR

North America holds a strong growth trajectory and is poised to achieve one of the highest CAGRs in semiconductor logistics. This is directly fueled by the CHIPS and Science Act, which is catalyzing hundreds of billions of dollars in public and private investment for new and expanded semiconductor manufacturing facilities across the United States and, to a lesser extent, Canada. The construction and subsequent operation of these new fabs generate a surge in demand for project logistics for oversize/overweight manufacturing equipment, inbound logistics for sustained flows of high-purity materials, and outbound logistics for newly produced chips. this wave of reshoring and capacity addition creates a greenfield opportunity for logistics providers, driving rapid market growth that outpaces the more established, albeit larger, Asia-Pacific base.

By Region

North America

Europe

- Germany

- The U.K.

- France

- Italy

- Russia

- Spain

- Benelux

- Nordic

- Rest of Europe

Asia-Pacific

- China

- Japan

- South Korea

- India

- ANZ

- ASEAN

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Argentina

- Colombia

- Rest of Latin America

Middle East & Africa

- Saudi Arabia

- UAE

- South Africa

- Israel

- Egypt

- Rest of MEA

Global Semiconductor Logistics Market: Competitive Landscape

The Global Semiconductor Logistics Market is highly competitive and fragmented, featuring a mix of global third-party logistics (3PL) giants, specialized freight forwarders, integrated carriers, and technology-driven logistics platforms. Leading global logistics firms DHL Supply Chain, Kuehne+Nagel, DB Schenker, DSV, and Expeditors dominate with their extensive global networks, dedicated technology sector verticals, and expertise in handling high-value, sensitive goods. These players compete by offering end-to-end integrated solutions combining transportation, warehousing, and advanced visibility technology.

Specialized freight forwarders with deep semiconductor expertise, such as Bolloré Logistics, Kerry Logistics, and Pilot Freight Services, are key players, often providing tailored services for oversized equipment transport and hazardous materials. Integrated carriers like UPS, FedEx, and FedEx Custom Critical are critical for time-sensitive, small-parcel air shipments of prototypes and finished chips.

Technology disruptors and startups are increasingly influential, offering digital freight marketplaces, blockchain-based track-and-trace platforms, and AI-driven logistics optimization software. The competitive landscape is characterized by strategic partnerships between logistics providers and semiconductor firms, mergers and acquisitions to gain specialized capabilities, and continuous investment in digitalization and sustainable logistics solutions.

Some of the prominent players in the Global Semiconductor Logistics Market are:

- DHL Supply Chain & Global Forwarding

- Kuehne+Nagel

- DB Schenker

- DSV Panalpina

- Expeditors International

- UPS

- FedEx (including FedEx Custom Critical)

- C.H. Robinson

- Bolloré Logistics

- Kerry Logistics

- Nippon Express

- CEVA Logistics (A CMA CGM Company)

- Agility Logistics

- GEODIS

- Pilot Freight Services

- Ryder System, Inc.

- XPO Logistics

- Hellmann Worldwide Logistics

- Sinotrans

- Yusen Logistics

- Other Key Players

Recent Developments in the Global Semiconductor Logistics Market

- November 2025: DHL launches Semiconductor Competence Center in Arizona

DHL inaugurated a dedicated Semiconductor Competence Center in Phoenix, Arizona, featuring cleanroom logistics capabilities, secure vaulting, and advanced tracking systems to support the growing cluster of new fabs in the region, offering tailored inbound and outbound solutions.

- October 2025: Kuehne+Nagel unveils AI-powered control tower for high-tech

Kuehne+Nagel presented its new AI-driven control tower platform at a major logistics expo, designed specifically for the semiconductor industry. The platform offers predictive disruption alerts, dynamic rerouting, and carbon footprint analytics for enhanced supply chain resilience.

- September 2025: DB Schenker expands dedicated semiconductor airfreight network

DB Schenker announced the expansion of its guaranteed-capacity airfreight network on key trade lanes between Asia and the US/Europe, prioritizing semiconductor shipments with specialized handling and real-time visibility to address ongoing capacity constraints.

- August 2025: DSV completes acquisition of specialized tech logistics provider

DSV completed the acquisition of a niche logistics firm specializing in the transportation of sensitive semiconductor manufacturing equipment, strengthening its project logistics and heavy-lift capabilities for the fab construction boom.

- July 2025: UPS and a major semiconductor OEM announce strategic partnership

UPS entered a multi-year, global logistics partnership with a leading semiconductor manufacturer, integrating its smart logistics network with the OEM's production planning systems for synchronized, just-in-time material delivery and finished goods distribution.

- June 2025: New industry consortium forms for semiconductor supply chain standards

A consortium of major semiconductor makers and logistics providers was formed to develop industry-wide standards for digital documentation, chain-of-custody tracking, and security protocols, aiming to reduce complexity and improve interoperability.

- May 2025: Bolloré Logistics opens dedicated facility in Taiwan science park

Bolloré Logistics opened a state-of-the-art logistics center within a major Taiwanese science park, offering bonded warehousing, value-added services (kitting, sequencing), and seamless connectivity to nearby fabs and OSATs.

Report Details

| Report Characteristics |

| Market Size (2025) |

USD 72.9 Bn |

| Forecast Value (2034) |

USD 152.0 Bn |

| CAGR (2025–2034) |

8.5% |

| The US Market Size (2025) |

USD 16.4 Bn |

| Historical Data |

2019 – 2024 |

| Forecast Data |

2026 – 2034 |

| Base Year |

2024 |

| Estimate Year |

2025 |

| Report Coverage |

Market Revenue Estimation, Market Dynamics, Competitive Landscape, Growth Factors and etc. |

| Segments Covered |

By Logistics Service Type (Freight Transportation, Warehousing & Storage, Distribution & Fulfillment, Value-Added Services), By Service Provider Type (Third-Party Logistics (3PL), Fourth-Party Logistics (4PL), In-House Logistics, Courier, Express & Parcel Services (CEP), Contract Logistics Providers), By Technology / Tracking Capability (IoT-Enabled Logistics, AI & Machine Learning Optimization, Blockchain-Based Supply Chain, Real-Time Tracking & Visibility Platforms, Automated Handling & Robotics), By Supply Chain Function (Inbound Logistics, In-Process Logistics, Outbound Logistics), By End User (Semiconductor Fabrication Plants (Fabs) & Foundries, Outsourced Semiconductor Assembly and Test (OSAT) Providers, Integrated Device Manufacturers (IDMs), Fabless Semiconductor Companies, Semiconductor Equipment & Material Suppliers, Electronics Manufacturing Services (EMS) & OEMs) |

| Regional Coverage |

North America – The US and Canada; Europe – Germany, The UK, France, Russia, Spain, Italy, Benelux, Nordic, & Rest of Europe; Asia-Pacific – China, Japan, South Korea, India, ANZ, ASEAN, Rest of APAC; Latin America – Brazil, Mexico, Argentina, Colombia, Rest of Latin America; Middle East & Africa – Saudi Arabia, UAE, South Africa, Turkey, Egypt, Israel, & Rest of MEA |

| Prominent Players |

DHL Supply Chain & Global Forwarding, Kuehne+Nagel, DB Schenker, DSV Panalpina, Expeditors International, UPS, FedEx (including FedEx Custom Critical), C.H. Robinson, Bolloré Logistics, Kerry Logistics, Nippon Express, CEVA Logistics (a CMA CGM company), Agility Logistics, GEODIS, Pilot Freight Services, Ryder System, Inc., XPO Logistics, Hellmann Worldwide Logistics, Sinotrans, Yusen Logistics, and Other Key Players |

| Purchase Options |

We have three licenses to opt for: Single User License (Limited to 1 user), Multi-User License (Up to 5 Users) and Corporate Use License (Unlimited User) along with free report customization equivalent to 0 analyst working days, 3 analysts working days and 5 analysts working days respectively. |

Frequently Asked Questions

How big is the Global Semiconductor Logistics Market?

▾ The Global Semiconductor Logistics Market size is estimated to have a value of USD 72.9 billion in 2025 and is expected to reach USD 152.0 billion by the end of 2034.

What is the growth rate in the Global Semiconductor Logistics Market?

▾ The market is growing at a CAGR of 8.5 percent over the forecasted period of 2025 to 2034.

What is the size of the US Semiconductor Logistics Market?

▾ The US Semiconductor Logistics Market is projected to be valued at USD 16.4 billion in 2025. It is expected to witness subsequent growth, reaching USD 32.7 billion in 2034 at a CAGR of 8.0%.

Which region accounted for the largest Global Semiconductor Logistics Market?

▾ Asia-Pacific is expected to have the largest market share in the Global Semiconductor Logistics Market, driven by its concentration of semiconductor manufacturing.

Who are the key players in the Global Semiconductor Logistics Market?

▾ Some of the major key players in the Global Semiconductor Logistics Market are DHL Supply Chain, Kuehne+Nagel, DB Schenker, DSV, Expeditors International, UPS, FedEx, and many others.