Market Overview

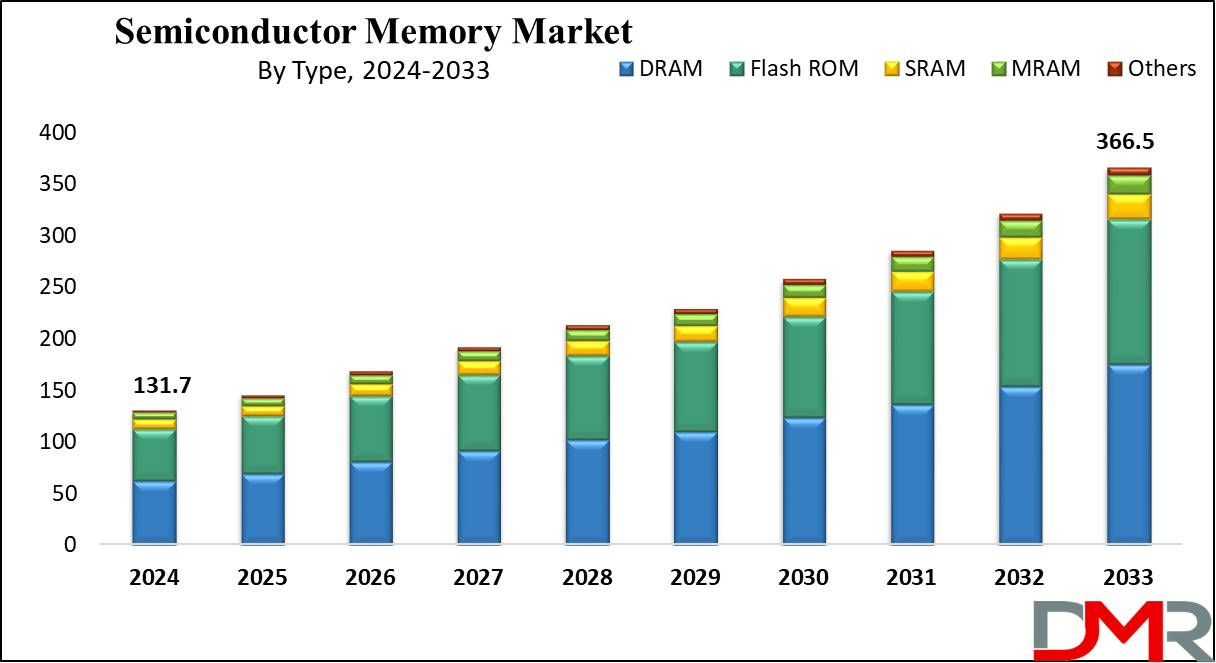

The Global Semiconductor Memory Market is expected to reach a value of USD 131.7 billion by the end of 2024, and it is further anticipated to reach a market value of USD 366.5 billion by 2033 at a CAGR of 12.0%.

Semiconductor memory acts as a foundational element in modern electronic devices, providing vital capabilities for data storage &retrieval. Containing ICs using semiconductor materials like silicon, it is categorized into volatile & non-volatile memory types. Volatile memory, which grows by dynamic random-access memory (DRAM), requires constant power for data retention, fitting temporary storage needs & facilitating quick data access.

ℹ

To learn more about this report –

Download Your Free Sample Report Here

Further, non-volatile memory, like flash memory, gets data even without power, making it well-suited for long-term storage & portable devices. With semiconductor memory usually across personal computers, smartphones, servers, & embedded systems, its role in allowing effective retrieval, data storage, and processing is dominant, driving development in many domains like AI, IoT, and cloud computing.

Further developments in semiconductor technology, refining processes, improving energy efficiency, & maximizing chip capacity, have led to advanced memory solutions customized for diverse industries. As companies eagerly adopt these innovations, they look to use fresh semiconductor chip products to improve the quality of their offerings & services. The large use of smartphones & portable devices has driven a need for growth for high-performance chips, focused on delivering smooth user experiences, quick app loading times, and efficient multitasking capabilities, mirroring the changing preferences & expectations of modern users.

Moreover, the expanding market is mainly driven by the dynamic adoption of memory-centric components in revolutionary products like wearables, smartphones, and electronic gadgets. In addition, the increasing dependency on the automotive & electronics sectors on semiconductor devices, like Flash ROM & DRAM, significantly increases the demand for integrated chips & gadgets. With a desire for smart devices, consumer electronics, smartphones, and workstations on the rise across the world, the

semiconductor market is experiencing high growth, offering many promising opportunities for business operations.

Key Takeaways

- The Global Semiconductor Memory Market is expected to grow by 220.5 billion, at a CAGR of 12.0% during the forecasted period of 2025 to 2033.

- By Type, DRAM is expected to lead in 2024 with a share of 47.7% & is anticipated to dominate throughout the forecasted period.

- By Application, the consumer electronic segment is expected to get a major revenue share of 34.7 in 2024 in the semiconductor memory market.

- Asia Pacific is expected to hold a 44.6% share of revenue in the Global Semiconductor Memory Market in 2024.

- North America is also expected to show quick growth in the semiconductor memory market during the forecasted period from 2025 to 2033.

- Some of the use cases of Semiconductor Memory include access to memory allocation, data structures, and more.

Use Cases

- Memory Allocation: Pointers are used to dynamically allocate memory at runtime, allowing flexible memory management for many data structures & applications.

- Data Structures: Pointers support the implementation and manipulation of complex data structures like linked lists, trees, and graphs, optimizing memory usage & access patterns.

- Function Pointers: They enable dynamic function invocation, allowing event-driven programming paradigms and runtime polymorphism in software systems.

- Memory Management: Pointers play a critical role in managing memory efficiently, such as tasks like deallocation, garbage collection, and optimization of memory access patterns for performance enhancement.

Market Dynamic

The semiconductor memory market experiences strong growth due to various factors contributing to its expansion. Mainly, there is a growing high demand for better data storage & processing capabilities across diverse sectors like consumer electronics, automotive, healthcare, & enterprise storage. The increase of smartphones, tablets, and smart devices, along with the fast growth of cloud computing and big data analytics, strengthens the necessity for higher memory capacities & quick data access.

Moreover, constant developments in semiconductor technology play an important role by supporting the development of more specialized & efficient memory solutions. Further Innovations like 3D NAND flash memory & emerging non-volatile memory technologies like MRAM & RRAM offer better density, lower power consumption, and better performance, further driving the market growth.

Also, the growth in the adoption of AI, machine learning, and IoT applications increases the demand for semiconductor memory solutions capable of handling large data processing & storage needs. The higher deployment of autonomous vehicles, smart cities, and connected devices further enhances the demand for reliable & high-performance semiconductor memory solutions.

However, the semiconductor memory market experiences certain constraints that may restrain its growth. One significant restraint depends on the cyclical nature of the semiconductor industry, which is open to global economic conditions, geopolitical tensions, and market saturation. Fluctuations in need and oversupply can lead to price volatility & diminished profit margins for manufacturers.

In addition, the complexity and cost associated with developing advanced memory technologies create challenges, restraining rapid progress. Concerns regarding intellectual property & the necessity for strict quality control and reliability testing also provide challenging obstacles to market expansion.

Research Scope and Analysis

By Type

Categorized into SRAM, MRAM, DRAM, Flash ROM, and Others, the semiconductor memory market showcases a range of semiconductor memory types segment, where the DRAM is expected to lead the semiconductor memory market in 2024, capturing over 47.7% of the global revenue share. DRAM also known as Dynamic Random Access Memory is known for its fast data access speed and responsiveness, which plays a major role in contemporary computer systems. As a volatile semiconductor memory, it depends on a constant power source to retain stored data. Its unparalleled capability for quick read and write operations positions it as a core memory component in many computing devices, like computers, smartphones, servers, and more.

The easy data retrieval supported by DRAM allows efficient application operation, making users experience smooth multitasking across several industries, from high-performance computing to gaming &

artificial intelligence. During evolving technology landscapes, the DRAM market sustains its vitality, fueled by growing demand for resilient computing systems, data-centric applications, and the expanding universe of mobile devices & cloud-driven services.

Further, the Flash ROM segment is expected to experience rapid growth and is expected to grow significantly. Also known as NAND Flash or Flash memory, Flash ROM provides a non-volatile semiconductor memory known for securing data even in the absence of a power supply. Its reliability & convenience in data storage have rendered its importance across several electronic devices, from smartphones & tablets to USB drives and SSDs (solid-state drives).

Flash ROM's role expands to applications requiring constant data storage, like operating systems, system configurations, and user data. The growth in cloud-based services & the expanding lead of big data applications have increased the need for efficient storage solutions, further showcasing Flash ROM's significance. Its exceptional speed and reliability have positioned it as the preferred choice for data storage in data centers, thereby improving cloud service performance & expediting data processing capabilities.

By Application

The consumer electronics sector is anticipated to lead the semiconductor memory market in 2024, commanding about 34.7% of the global revenue share. In the fast-changing landscape of consumer electronics, the need for memory solutions with the ability to meet growing data needs remains dominant. Further, current developments, marked by the introduction of higher-density chips & improved memory architectures, play a major role in addressing these demands, which allow consumer electronics manufacturers to deliver advanced innovations, ensuring a competitive edge in a fast-paced market.

In addition, the smooth integration of semiconductor chips with cloud-based services & data-driven applications revolutionizes the consumer electronics industry. Using remote server access for effective data storage & retrieval enhances user experiences while improving the interconnected ecosystem of devices & services. As consumer electronics constantly evolve, using the complete potential of semiconductor chips becomes essential for driving the success of the market.

Further, the IT & telecommunication segment is expected to show significant growth over the forecast period. The scalability of semiconductor memory is important in addressing the ever-expanding data demands within this sector. With the expansion of IoT, connected devices, and data-intensive applications, the flexible growth of chip capacities becomes necessary to meet these transforming requirements.

Moreover, semiconductor chips play a vital role in driving innovation in the IT & telecommunication domain. Integrating memory technologies easily with cloud computing & data analytics improves IT infrastructure capabilities, using real-time data analysis, AI-driven decision-making, and personalized user experiences. These advanced features, made by semiconductor memory, unlock new opportunities for businesses to deliver better services and applications, positioning them ahead in a competitive market landscape.

The Semiconductor Memory Market Report is segmented on the basis of the following:

By Type

- DRAM

- Flash ROM

- SRAM

- MRAM

- Others

By Application

- Consumer Electronics

- IT & Telecommunication

- Automotive

- Industrial

- Aerospace & Defense

- Medical

- Others

Regional Analysis

The Asia Pacific region is expected to be the leader in the global semiconductor memory market, commanding a market

share of 44.6% in 2024, which comes from many key drivers driving the market growth within the region. A major contributor is the region's fast economic expansion, along with a high consumer expenditure & electronic devices, which translated into higher sales of gadgets like laptops & smartphones, therefore driving the need for advanced semiconductor memory solutions to support memory-intensive products.

Furthermore, the higher adoption of cloud computing & data-centric applications across numerous industries further drives the need for high-performance memory solutions to meet large data processing needs. The growth of the Internet of Things (IoT) also played an important role, with IoT devices depending largely on memory for storage &processing, thereby boosting market growth.

Also, governmental investments in infrastructure development, mainly in the establishment of data centers & 5G networks, added impetus to the need for semiconductor memory solutions across the region.

Further, North America is expected for high growth, driven by its leading position in technological innovation. With a higher focus on R&D across many sectors, the region is experiencing a growth in the need for advanced semiconductor memory solutions, mainly to support advanced applications in AI,

machine learning, and data analytics.

In addition, the region's leading gaming and entertainment industry highlights the critical necessity of high-performance memory for delivering better gaming experiences and smooth content streaming. The ongoing adoption of cloud-based services & the establishment of data centers further increases the need for advanced semiconductor chip solutions capable of efficiently managing large data volumes.

Moreover, the increasing adoption of autonomous vehicles & smart transportation systems in North America also highlights the need for advanced memory solutions to ensure live data processing and prompt decision-making.

By Region

North America

Europe

- Germany

- The U.K.

- France

- Italy

- Russia

- Spain

- Benelux

- Nordic

- Rest of Europe

Asia-Pacific

- China

- Japan

- South Korea

- India

- ANZ

- ASEAN

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Argentina

- Colombia

- Rest of Latin America

Middle East & Africa

- Saudi Arabia

- UAE

- South Africa

- Israel

- Egypt

- Rest of MEA

Competitive Landscape

The semiconductor memory market is in the middle of the growing stage, as it is experiencing a high degree of innovation. Constant developments in semiconductor technologies, like the development of new memory architectures, increased storage capacities, and better performance, are prevalent. The industry is dynamic, with current efforts to enhance efficiency and introduce new solutions. Further, the mergers & acquisitions activities in the semiconductor memory market are comparatively less. While there may be collaborations & partnerships, major consolidation through mergers or acquisitions is less common.

Companies mostly focus on internal R&D along with strategic collaborations to drive innovation. Moreover, the semiconductor memory market faces a medium impact of regulations. Regulatory considerations in the case of intellectual property, export controls, and environmental regulations in the manufacturing process. Agreeing with these regulations is important for market players, but the overall impact is not as high as in some other industries.

Some of the prominent players in the global Semiconductor Memory Market are

- Toshiba Corp

- SK Hynix

- Micron Technology

- Taiwan Semiconductor

- IBM Corp

- Texas Corp

- Toshiba Corp

- NXP Semiconductors

- NVIDIA Corp

- Samsung Electronics

- Other Key Players

Recent Developments

- In October 2023, Sahasra Semiconductors announced that the company initiated the commercial production of the first Made in India memory chips, excelling even Micron. The company reportedly kicked off production at its semiconductor assembly, testing, & packaging unit located in Rajasthan's Bhiwadi district.

- In July 2023, SK Hynix announced that the company is planning to consider India's semiconductor manufacturing incentive scheme & is in contact with the concerned government officials to build up a packaging facility in the country, as it is mainly involved in the manufacturing of memory chips like consumer and network memory, computing memory, and graphics memory.

- In June 2023, Micron Technology one of the leading semiconductor companies in the world announced its plans to build a new assembly & test facility in Gujarat, India, which will allow assembly & test manufacturing for both DRAM &NAND products and address the needs of domestic & international markets, where the construction of the new assembly and test facility in Gujarat is expected to begin in phases from 2023. Phase 1, which will contain 500,000 square feet of planned cleanroom space, to become operational in late 2024.

- In May 2023, NXP Semiconductors (NASDAQ: NXPI), announced that the company is building its collaboration with TSMC to provide the industry’s first automotive-embedded MRAM (Magnetic Random Access Memory) in 16 nm FinFET technology. As automotive companies switch to software-defined vehicles (SDVs), they are required to assist multiple generations of software upgrades on a single hardware platform. Bringing together NXP’s high-performance S32 automotive processors with quick & highly reliable next-generation non-volatile memory in 16 nm FinFET technology, which delivers the ideal hardware platform for this transition.

- In May 2023, NEO Semiconductor launched its ground-breaking technology, 3D X-DRAM, which is the first 3D NAND-like DRAM cell array of the world that is focused on solving DRAM's capacity bottleneck and replacing the entire 2D DRAM market.

- In January 2022, Samsung Electronics launched the world’s first in-memory computing based on MRAM (Magnetoresistive Random Access Memory), which demonstrates in-memory computing, by replacing the standard, ‘current-sum’ in-memory computing architecture with latest, ‘resistance sum’ in-memory computing architecture, which looks into the problem of small resistances of individual MRAM devices.

Report Details

| Report Characteristics |

| Market Size (2024) |

USD 131.7 Bn |

| Forecast Value (2033) |

USD 366.5 Bn |

| CAGR (2023-2032) |

12.0% |

| Historical Data |

2018 – 2023 |

| Forecast Data |

2024 – 2033 |

| Base Year |

2023 |

| Estimate Year |

2024 |

| Report Coverage |

Market Revenue Estimation, Market Dynamics, Competitive Landscape, Growth Factors and etc. |

| Segments Covered |

By Type (DRAM, Flash ROM, SRAM, MRAM, and Others), By Application (Consumer Electronics, IT & Telecommunication, Automotive, Industrial, Aerospace & Defense, Medical, and Others) |

| Regional Coverage |

North America – The US and Canada; Europe – Germany, The UK, France, Russia, Spain, Italy, Benelux, Nordic, & Rest of Europe; Asia- Pacific– China, Japan, South Korea, India, ANZ, ASEAN, Rest of APAC; Latin America – Brazil, Mexico, Argentina, Colombia, Rest of Latin America; Middle East & Africa – Saudi Arabia, UAE, South Africa, Turkey, Egypt, Israel, & Rest of MEA |

| Prominent Players |

Toshiba Corp, SK Hynix, Micron Technology, Taiwan Semiconductor, IBM Corp, Texas Corp, Toshiba Corp, NXP Semiconductors, NVIDIA Corp, and Samsung Electronics, and Other Key Players |

| Purchase Options |

We have three licenses to opt for: Single User License (Limited to 1 user), Multi-User License (Up to 5 Users), and Corporate Use License (Unlimited User) along with free report customization equivalent to 0 analyst working days, 3 analysts working days and 5 analysts working days respectively. |

Frequently Asked Questions

How big is the Global Semiconductor Memory Market?

▾ The Global Semiconductor Memory Market size is estimated to have a value of USD 131.7 billion in 2024 and is expected to reach USD 366.5 billion by the end of 2033.

Which region accounted for the largest Telecom Semiconductor Memory Market?

▾ Asia Pacific is expected to have the largest market share in the Global Semiconductor Memory Market with a share of about 44.6% in 2024.

Who are the key players in the Global Semiconductor Memory Market?

▾ Some of the major key players in the Global Semiconductor Memory Market are Toshiba Corp, SK Hynix, Micron Technology, and many others.

What is the growth rate in the Global Semiconductor Memory Market?

▾ The market is growing at a CAGR of 12.0 percent over the forecasted period.