Semiconductor Packaging Material Market Overview

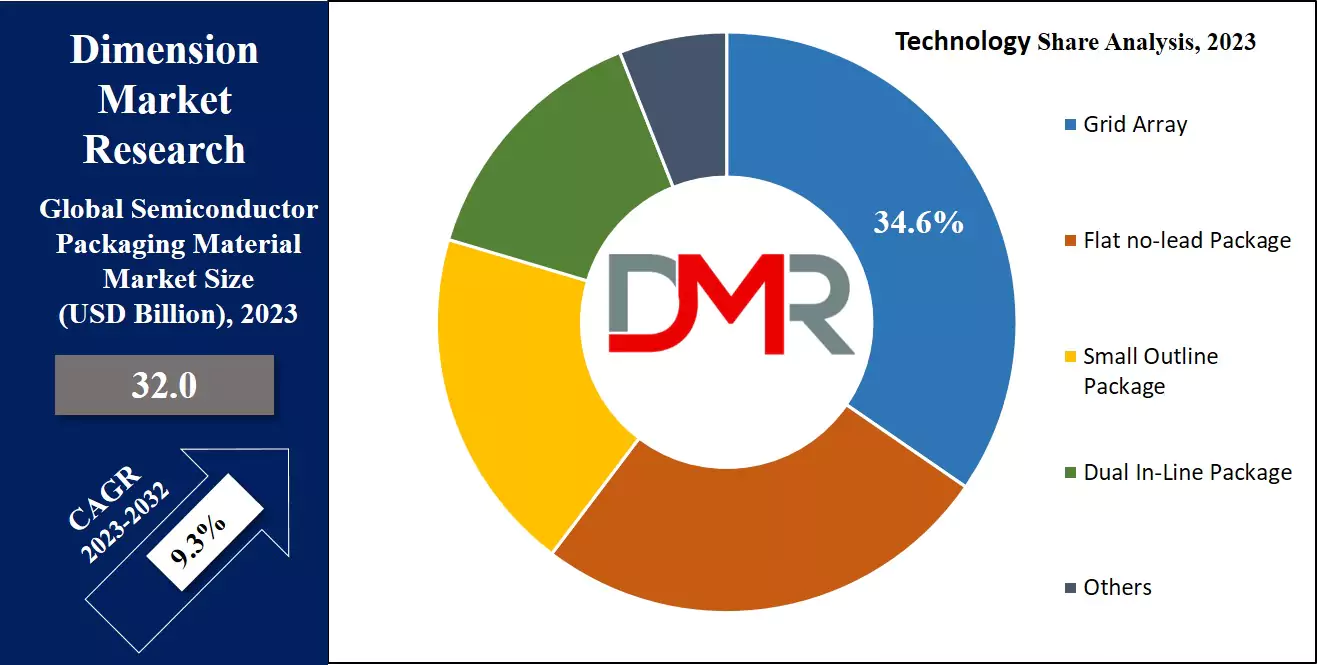

The Global Semiconductor Packaging Material Market is expected to reach a value of USD 32.0 billion in 2023, and it is further anticipated to reach a market value of USD 71.5 billion by 2032 at a CAGR of 9.3%.

Semiconductor packaging materials, like bonding wires, solder balls, substrates, lead frames, encapsulants, & underfill materials, play a vital role in safeguarding integrated circuits (ICs) from corrosion & damage, as they provide shock resistance, space efficiency, and low power consumption, these materials are widely used in the semiconductor industry to make sure the reliability & protection of integrated circuits.

The automotive industry's transition to electric vehicles (EVs) and autonomous driving technologies demands advanced semiconductor packaging capable of meeting higher performance and reliability requirements. Leading companies such as TSMC and Intel are making significant investments in automotive-grade semiconductor solutions.

Meanwhile, the growing adoption of

Artificial Intelligence (AI) and the

Internet of Things (IoT) is driving the need for innovative packaging technologies. These advancements require high integration levels and effective heat management, propelling the development of packaging solutions like Fan-Out Wafer Level Packaging (FO-WLP) and System-in-Package (SiP).

Simultaneously, the trend toward miniaturization in electronics is increasing the demand for compact and efficient packaging solutions. This shift is accelerating the adoption of 3D packaging technologies, which enable the integration of multiple functionalities within limited space.

Additionally, the development of advanced materials such as organic substrates and innovative encapsulation resins is unlocking opportunities for creating more efficient and durable packaging. For example, in 2023, Amkor Technology introduced new advanced substrate materials designed to enhance thermal performance and reliability, further supporting the industry's evolving needs.

Semiconductor Packaging Material Market Key Takeaways

- The Global Semiconductor Packaging Material Market is expected to reach a value of USD 32.0 billion in 2023.

- The Market anticipated to reach a market value of USD 71.5 billion by 2032 at a CAGR of 9.3%.

- By Material, the Organic substrate takes the lead in 2023 & is anticipated to dominate throughout the forecasted period.

- In addition, the bonding wire segment is expected to have significant growth over the forecasted period.

- By Type, Flip Chip takes the lead & drive the market in 2023

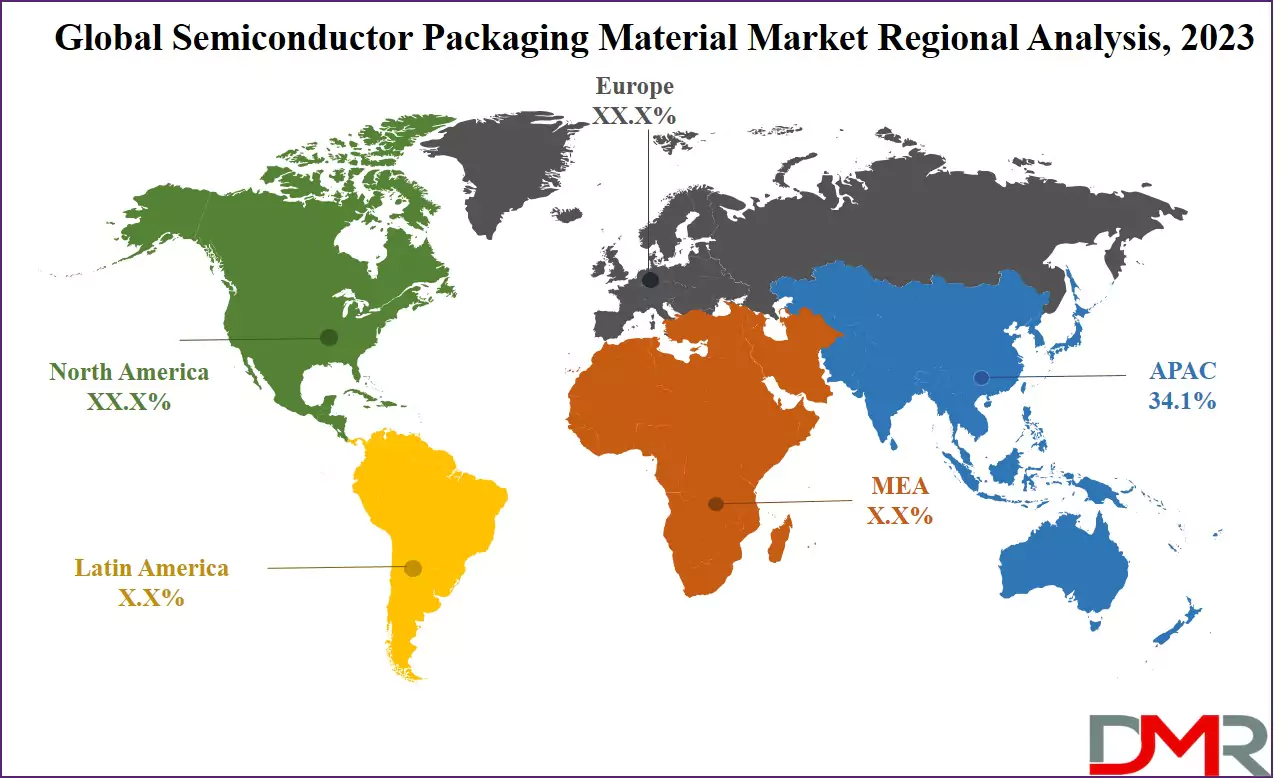

- Asia Pacific has a 34.1% share of revenue in the Global Semiconductor Packaging Material Market in 2023

Semiconductor Packaging Material Market Use Cases

- IC Protection: Packaging materials safeguard integrated circuits from physical, thermal, and environmental damage.

- Electrical Interconnection: Materials like bonding wires and substrates enable stable electrical connections between the chip and external components.

- Thermal Management: Thermal interface materials help dissipate heat from high-performance chips to ensure device reliability.

- Advanced Packaging: Materials support technologies like 3D packaging and System-in-Package (SiP) for compact, high-speed electronics.

- Automotive Electronics: Specialized materials are used to package chips in vehicles, ensuring durability under extreme conditions.

- Consumer & IoT Devices: Miniaturized, flexible packaging materials enable lightweight, low-power devices like wearables and sensors.

Semiconductor Packaging Material Market Dynamic

The semiconductor packaging materials market is experiencing an increased demand for organic substrates, mainly utilized as foundational layers in printed circuit boards (PCBs). These materials contribute to enhanced electrical performance & high reliability, reducing overall PCB weight while improving dimensional control and functionality, where the growth in demand for organic substrate materials in semiconductor packaging is a major driver for market growth.

Further many e-commerce industries are switching towards sustainable packaging solutions for semiconductor devices, focusing on reducing

plastic waste, which is anticipated to impact the semiconductor packaging materials market positively, promoting stronger & more environmentally conscious designs.

However, the semiconductor packaging materials market experiences challenges owing to the fluctuation in raw material prices and disturbances in raw material transportation

since the pandemic has hindered the market's growth, emphasizing the industry's sensitivity to external impacts.

Driver

Rising demand for smaller, faster and more energy-efficient semiconductor devices is driving growth in the semiconductor packaging material market. Consumer electronics such as smartphones, wearables,

military wearables and laptops demand compact yet high-performance chips which necessitate innovative packaging materials. Automotive technologies like electric vehicles (EVs) and autonomous driving systems depend on advanced semiconductors, leading to increased material demand.

With 5G technology and IoT adoption increasing worldwide, the demand for reliable packaging materials to enhance thermal and electrical performance is rising exponentially. To meet industry requirements for high-tech applications, more sophisticated semiconductor packaging materials must be developed to enhance thermal and electrical performance.

Trend

Innovative packaging technologies such as fan-out wafer-level packaging (FOWLP) and System-in-Package (SiP) are rapidly redefining the semiconductor packaging material market, offering enhanced performance, reduced form factors and enhanced thermal management compared to conventional techniques. FOWLP supports higher input/output (I/O) density, making it suitable for mobile and wearable devices; SiP offers integrated multiple functions for streamlining complex electronics like IoT devices and automotive systems.

As manufacturers prioritize miniaturization and performance enhancement, material innovations such as low-loss substrates and advanced encapsulants are becoming more widely adopted within the semiconductor industry. This trend indicates an emphasis on reaching higher functionality and efficiency within semiconductor devices.

Restraint

The high cost associated with developing and implementing advanced semiconductor packaging materials presents a formidable barrier to market growth. Organic substrates, advanced resins, and underfill encapsulants are vital elements in achieving increased performance, but their production and adoption require significant investments.

Small and mid-sized companies frequently face financial restraints when adopting advanced materials, restricting market accessibility. Furthermore, transitioning from traditional packaging technologies to advanced packaging solutions incurs additional financial costs - creating barriers in price-sensitive markets that prevent widespread adoption of innovative semiconductor packaging solutions.

Opportunity

Artificial Intelligence, High Performance Computing (HPC), and data centers all present lucrative opportunities for semiconductor packaging material markets. These technologies require reliable semiconductors capable of withstanding heavy computational loads, necessitating advancements in packaging materials.

Innovative techniques like 3D stacking, hybrid bonding and heat dissipation materials are necessary in meeting such stringent standards for these high-demand applications. Cloud computing, big data analytics and edge computing all exacerbate the demand for innovative packaging materials. Companies investing in research and development to meet this rapidly expanding market segment could find great success capitalizing on this rapidly developing segment of the market.

Semiconductor Packaging Material Market Research Scope and Analysis

By Material

In the semiconductor packaging market organic substrate segment leads the revenue share in 2023, as known for its affordability, organic substrates, mainly composed of fiberglass-reinforced epoxy resins (FR-4), provide an economical alternative to ceramic or laminate substrates. Further, the adaptability enables easy customization in terms of layer count, thickness, & size, meeting specific application needs. Also, ongoing R&D contributes to developments in organic substrate materials, improving their capabilities.

Further, the bonding wire segment is projected to be the fastest-growing in the semiconductor packaging market. With a growing need for smaller, densely packed semiconductor chips in growing powerful electronic devices, bonding wire technology assists fine-pitch interconnections, allowing higher integration & functionality in a compact form factor.

The affordability of bonding wire in comparison to alternatives like Through-Silicon Vias (TSVs) or Fan-Out Wafer Level Packaging (FO-WLP) further increases its popularity, especially in applications where cost sensitivity is a significant consideration.

By Type

In terms of type, the semiconductor packaging material market includes flip chips, embedded DIE, fan-in WLP, and fan-out WLP. Among these, flip chip stands out as the largest segment in 2023, which includes attaching a semiconductor die to a substrate or carrier with the bond pad side facing downward. The electrical connection is established via a conductive bump on the die bond pad.

Flip chip technology possesses a superior I/O count in comparison to alternative connectivity methods. Its prominence in the market is owing to the efficiency of this process in improving connectivity, allowing for a higher number of I/O connections, which makes it a preferred choice for semiconductor packaging, reflecting its significance in meeting the needs of modern electronic applications requiring increased I/O capabilities.

By Technology

The semiconductor packaging material market, categorized by technology, includes grid array, small outline package, flat no-leads package, dual in-line package, and others, where the grid array emerged as the leading technology in 2023, capturing the largest market share, which stands out by providing more interconnection pins in comparison to traditional dual in-line or flat packages.

The grid array technology not only provides significant size benefits over conventional surface mount packages but also provides advantages like enhanced circular speed, a compact footprint, & better handleability.

Further, its dominance highlights its popularity in meeting the need for efficient semiconductor packaging, mainly in applications where maximizing interconnection pins & optimizing size are important considerations for technological developments. Also, the diverse packaging technologies and grid array's prominence reflect its ability to deliver better performance & size efficiency, making it a popular choice in the dynamic landscape of semiconductor packaging.

ℹ

To learn more about this report –

Download Your Free Sample Report Here

By End User

The semiconductor packaging material market is leading the consumer electronics segment in 2023, a trend expected to persist throughout the forecast period, as the expansion of the global market for consumer electronics, including laptops, tablets, game consoles, smartphones, & more, drives a strong need for semiconductor chips.

Further, different devices with different capabilities require different semiconductor chips like memory chips, microprocessors, sensors, & power management components, which allows innovation & specialization in the semiconductor packaging industry, essential for meeting the changing needs of consumer electronics.

Further, manufacturers in this segment constantly experience the challenge of balancing high-performance standards with affordability, prompting the adoption of effective semiconductor packaging techniques to enhance yield rates, lower material usage, and optimize chip layouts.

Further, the IT & telecom segment emerges as the fastest-growing in the semiconductor packaging market during the projected period, as the increase in usage of smartphones, IoT devices, & the advent of technologies like 5G drive unprecedented data traffic, demanding advanced communication systems & networks.

Also, the integration of a variety of technologies on a single chip for 5G networks needs better packaging techniques to achieve functionality in a compact form factor. Also, the introduction of 5G technology, allows simultaneous connections of various devices at higher data rates with minimal latency and highlights the need for innovative semiconductor packaging techniques to support the escalating demands on the infrastructure.

The Semiconductor Packaging Material Market Report is segmented on the basis of the following:

By Material

- Organic Substrate

- Bonding Wire

- Leadframe

- Ceramic Package

- Die Attach Material

- Others

By Type

- Flip Chip

- Embedded DIE

- Fan-in WLP

- Fan-out WLP

By Technology

- Grid Array

- Small Outline Package

- Flat no-leads Package

- Dual In-Line Package

- Others

By End User

- Consumer Electronics

- Automotive

- Healthcare

- IT and Telecommunication

- Aerospace and Defense

- Others

How Does Artificial Intelligence Contribute To Improve Semiconductor Packaging Material Market ?

- Process Optimization: AI analyzes manufacturing data to optimize material usage, reduce waste, and enhance efficiency in packaging processes.

- Defect Detection and Quality Control: AI-powered image recognition detects microscopic defects in packaging materials, ensuring higher quality and reliability.

- Predictive Maintenance: AI predicts equipment failures and schedules maintenance, minimizing downtime and increasing production throughput.

- Material Innovation: AI accelerates the discovery and formulation of new packaging materials by simulating material properties and performance.

- Supply Chain Management: AI enhances forecasting and inventory management, ensuring timely availability of packaging materials and reducing lead times.

- Customization and Design Automation: AI enables rapid design of custom packaging solutions for specific semiconductor applications, improving time-to-market.

Semiconductor Packaging Material Market Regional Analysis

Asia Pacific claimed the largest revenue share at 34.1% in 2023, which is also expected to maintain dominance in the semiconductor packaging market throughout the forecasted period, as countries like Taiwan, China, South Korea, and Singapore have solidified their status as global semiconductor manufacturing hubs.

Further, investments in a skilled workforce, advanced technology, & advanced infrastructure have allowed an ecosystem favorable to the semiconductor supply chain. Also, reputed companies like TSMC, Samsung, and SK Hynix, headquartered in Asia, lead the sector in packaging technology, driving innovation & setting industry benchmarks.

Further, North America emerges as the fastest-growing market, driven by a vibrant landscape of leading research institutions, regional semiconductor businesses, and startups. Also, the region's commitment to technological innovation, along with high investments in R&D for semiconductor technology, creates an environment conducive to studying packaging methods, materials, & integration procedures.

Moreover, a collaborative ecosystem including research facilities, equipment manufacturers, semiconductor companies, & design studios, in North America allows for quick development and implementation of new packaging solutions, and growing innovation in the semiconductor packaging sector.

ℹ

To learn more about this report –

Download Your Free Sample Report Here

By Region

North America

Europe

- Germany

- The U.K.

- France

- Italy

- Russia

- Spain

- Benelux

- Nordic

- Rest of Europe

Asia-Pacific

- China

- Japan

- South Korea

- India

- ANZ

- ASEAN

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Argentina

- Colombia

- Rest of Latin America

Middle East & Africa

- Saudi Arabia

- UAE

- South Africa

- Israel

- Egypt

- Rest of MEA

Semiconductor Packaging Material Market Competitive Landscape

The semiconductor packaging material market shows moderate fragmentation due to multiple players offering packaging solutions. Further, to drive competition & expand market presence, companies include strategies like expanding operations, innovating products, and forming partnerships. With growing needs expected from emerging customers in sectors like Consumer Electronics & Automotive, competition is likely to intensify, allowing players to improve their strategies for sustained market growth.

In June 2023, Samsung Electronics responded to the rise in demand in the mobile and high-performance computing (HPC) chipset market by announcing the Multi-Die Integration (MDI) Alliance by collaborating with partner firms & key players in memory, substrate packaging, and testing, the initiative aims at developing next-generation packaging technology, which aligns with Samsung's commitment to ongoing development in the foundry ecosystem, as showcased by their partnership with Samsung Advanced Foundry Ecosystem (SAFE) partners.

Some of the prominent players in the global Semiconductor Packaging Material Market are

Semiconductor Packaging Material Market Recent Developments

- In February 2023, Amkor Technology, Inc. & GlobalFoundries announced a strategic alliance, allowing GlobalFoundries to manufacture semiconductor wafers while Amkor's Porto facility in Portugal delivers OSAT services. Further, as a part of this collaboration, GlobalFoundries plans to relocate its 300mm Bump & Sort machines from Dresden to Amkor's Porto operations, together advancing development initiatives in Portugal.

- In May 2023, the Chinese government selected Tianshui Huatian Technology as one of the recipients of subsidies exceeding USD 1.75 billion, which is focused on supporting 190 locally listed semiconductor companies in 2022, allowing the government's commitment to support the domestic semiconductor industry through strategic financial assistance.

- In February 2022, Intel Corp entered a definitive agreement to acquire Tower Semiconductor for USD 53 per share in cash, totaling around USD 5.4 billion in enterprise value, which focuses on enhancing Intel's manufacturing capacity, global presence, & technology offerings, aligning with its IDM 2.0 strategy to meet growing industry demand.

Semiconductor Packaging Material Market Report Details

| Report Characteristics |

| Market Size (2023) |

USD 32.0 Bn |

| Forecast Value (2032) |

USD 71.5 B n |

| CAGR (2023-2032) |

9.3% |

| Historical Data |

2017 - 2022 |

| Forecast Data |

2023 - 2032 |

| Base Year |

2022 |

| Estimate Year |

2023 |

| Report Coverage |

Market Revenue Estimation, Market Dynamics, Competitive Landscape, Growth Factors and etc. |

| Segments Covered |

By Material (Organic Substrate, Bonding Wire, Leadframe, Ceramic Package, Die Attach Material, and Others) By Type (Flip Chip, Embedded DIE, Fan-in WLP, and Fan-out WLP), By Technology (Grid Array, Small Outline Package, Flat no-leads Package, Dual In-Line Package, and Others), By End User (Consumer Electronics, Automotive, Healthcare, IT and Telecommunication, Aerospace and Defense, and Others) |

| Regional Coverage |

North America – The US and Canada; Europe – Germany, The UK, France, Russia, Spain, Italy, Benelux, Nordic, & Rest of Europe; Asia- Pacific– China, Japan, South Korea, India, ANZ, ASEAN, Rest of APAC; Latin America – Brazil, Mexico, Argentina, Colombia, Rest of Latin America; Middle East & Africa – Saudi Arabia, UAE, South Africa, Turkey, Egypt, Israel, & Rest of MEA |

| Prominent Players |

Texas Instruments, TSMC Ltd, Samsung Electronics, Intel Corp, ASE Group, IBM Corp, Micron Technology, Amkor Technology, Fujitsu Ltd, Powertech Technology, and Other Key Players |

| Purchase Options |

We have three licenses to opt for: Single User License (Limited to 1 user), Multi-User License (Up to 5 Users), and Corporate Use License (Unlimited User) along with free report customization equivalent to 0 analyst working days, 3 analysts working days and 5 analysts working days respectively. |

Frequently Asked Questions

How big is the Global Semiconductor Packaging Material Market?

▾ The Global Semiconductor Packaging Material Market size is estimated to have a value of USD 32.0

billion in 2023 and is expected to reach USD 71.5 billion by the end of 2032.

Which region accounted for the largest Global Semiconductor Packaging Material Market?

▾ Asia Pacific has the largest market share for the Global Semiconductor Packaging Material Market with a

share of about 34.1% in 2023.

Who are the key players in the Global Semiconductor Packaging Material Market?

▾ Some of the major key players in the Global Semiconductor Packaging Material Market are Texas

Instruments, TSMC Ltd, Samsung Electronics, and many others.

What is the growth rate in the Global Semiconductor Packaging Material Market?

▾ The market is growing at a CAGR of 9.3 percent over the forecasted period.