Market Overview

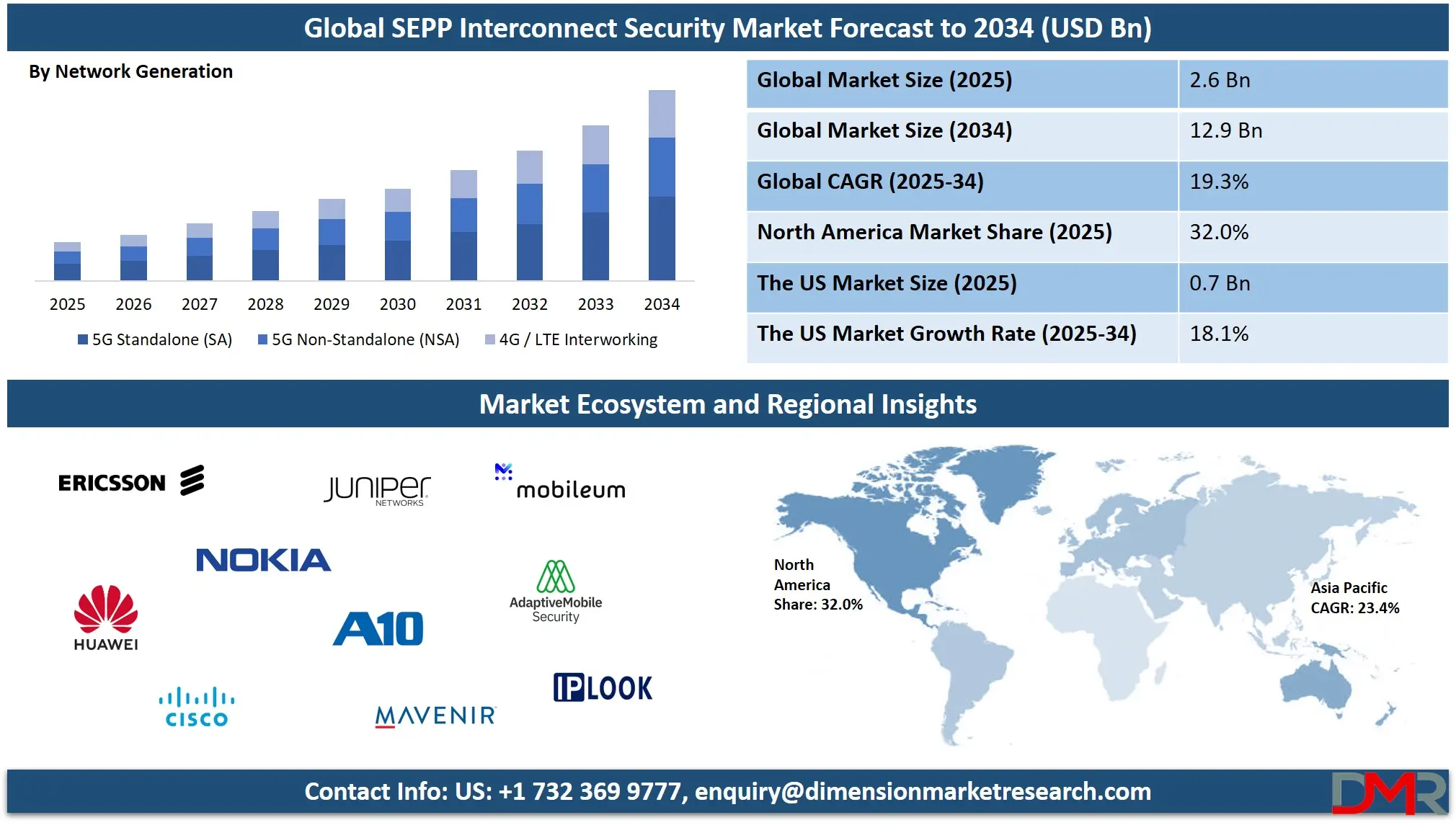

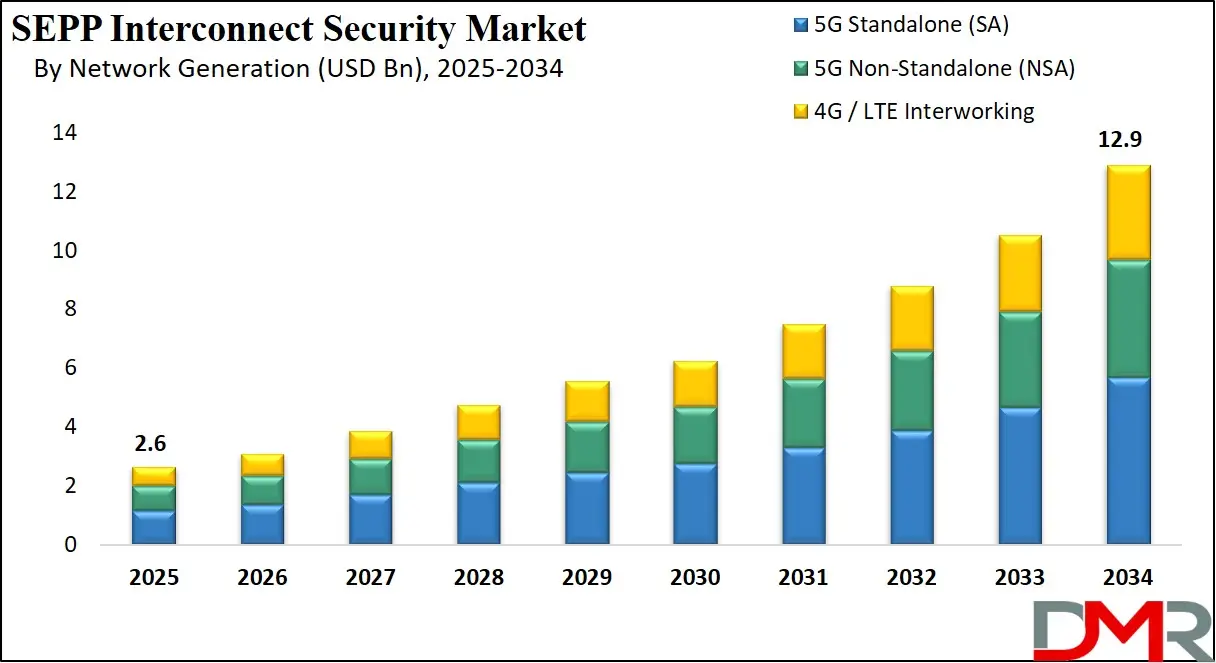

The Global SEPP Interconnect Security Market is projected to be valued at approximately USD 2.6 billion in 2025 and is expected to reach USD 12.9 billion by 2034, expanding at a CAGR of 19.3%, driven by rising 5G standalone deployments, increasing inter operator traffic, growing roaming security requirements, and wider adoption of 3GPP compliant network security solutions.

SEPP interconnect security refers to the security framework built around the Security Edge Protection Proxy defined under 3GPP standards to protect inter network communication in 5G environments. It acts as a controlled security gateway between public land mobile networks by enforcing authentication authorization message filtering and encryption for service based interfaces.

ℹ

To learn more about this report –

Download Your Free Sample Report Here

SEPP interconnect security prevents signaling attacks data leakage and unauthorized access by inspecting and validating network traffic exchanged between operators especially during roaming and inter operator service exposure. It plays a critical role in safeguarding network slicing APIs and service based architecture communications while ensuring regulatory compliance and secure cross border data exchange.

The global SEPP interconnect security market represents the commercial ecosystem of technologies solutions and services designed to secure 5G interconnect traffic between telecom operators enterprises and service providers globally. Market growth is primarily driven by rapid 5G standalone deployments rising international roaming traffic increasing exposure of core networks and stricter telecom security regulations. Mobile network operators are investing heavily in SEPP platforms to protect service based interfaces signaling protocols and API driven communications as networks become more virtualized and cloud native.

ℹ

To learn more about this report –

Download Your Free Sample Report Here

From a global perspective the market is shaped by advancements in 5G core architecture cloud native security solutions and the convergence of signaling firewalls with interconnect security platforms. North America and Europe currently lead adoption due to early 5G rollouts and regulatory maturity while Asia Pacific is emerging as a high growth region supported by large subscriber bases and expanding cross border connectivity. The market also benefits from increasing demand for threat detection policy enforcement and secure roaming management across multi-vendor and multi generation network environments.

The US SEPP Interconnect Security Market

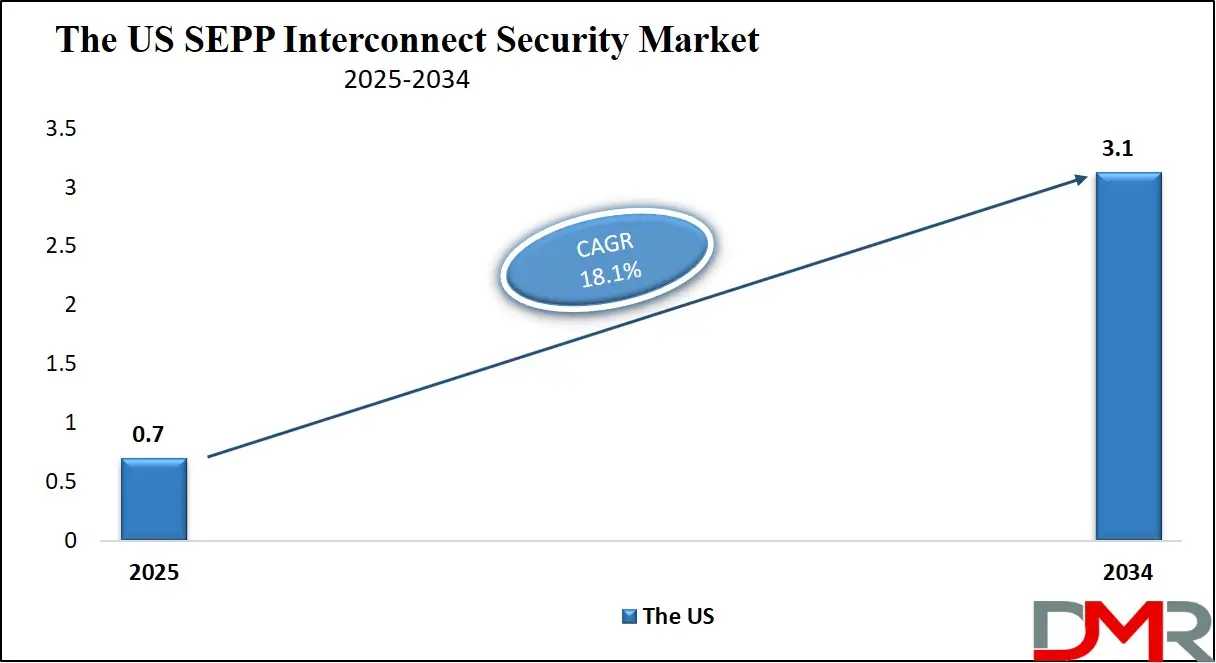

The U.S. SEPP Interconnect Security market size is projected to be valued at USD 0.7 billion by 2025. It is further expected to witness subsequent growth in the upcoming period, holding USD 3.1 billion in 2034 at a CAGR of 18.1%.

The US SEPP interconnect security market is witnessing strong growth as mobile network operators accelerate the deployment of 5G standalone core networks and expand service based architecture environments. Rising inter operator data exchange increasing domestic and international roaming traffic and heightened concerns around signaling security are driving demand for SEPP solutions across major telecom networks.

ℹ

To learn more about this report –

Download Your Free Sample Report Here

US operators are prioritizing SEPP platforms to secure inter PLMN communication protect network slicing interfaces and ensure secure API exposure in cloud native 5G cores. The presence of advanced telecom infrastructure early adoption of virtualized network functions and strong focus on regulatory compliance further support market expansion.

From a technology and adoption standpoint the US market is characterized by high uptake of cloud native SEPP deployments integration with signaling firewalls and alignment with broader telecom cybersecurity frameworks. Telecom providers are increasingly deploying SEPP as part of end to end core network security stacks to mitigate signaling attacks prevent data leakage and manage cross network trust relationships.

Growing investments in private 5G networks edge computing and secure interconnect services across enterprise and government sectors are also contributing to sustained demand. As 5G traffic volumes continue to rise the US SEPP interconnect security market is expected to remain a key contributor to global revenue growth driven by innovation regulatory readiness and large scale network modernization initiatives.

Europe SEPP Interconnect Security Market

The Europe SEPP interconnect security market is projected to reach approximately USD 700 million in 2025, reflecting the region’s significant investment in 5G network security and inter operator signaling protection. The market growth is driven by the rapid deployment of 5G standalone networks across major European countries, increasing international roaming traffic, and the need for compliance with stringent EU telecom security regulations. Telecom operators in the region are focusing on deploying robust SEPP solutions to secure service based architecture interfaces, manage interconnect traffic efficiently, and prevent signaling attacks that could compromise subscriber data or network integrity.

The market is also supported by the rising adoption of cloud native and virtualized SEPP platforms, which allow operators to scale security operations efficiently and integrate with multi vendor 5G core networks. Investments in AI‑enabled threat detection, real‑time anomaly monitoring, and automated policy enforcement are further enhancing the capability of SEPP solutions in Europe. As operators continue to modernize their networks and expand inter operator and roaming connectivity, the Europe SEPP interconnect security market is expected to grow at a CAGR of 17.5%, slightly below the global growth rate, reflecting both mature network infrastructure and continued innovation in secure network operations.

Japan SEPP Interconnect Security Market

The Japan SEPP interconnect security market is projected to reach approximately USD 160 million in 2025, reflecting the country’s proactive investments in 5G standalone networks and advanced telecom security infrastructure. Japanese telecom operators are prioritizing the deployment of SEPP solutions to secure inter operator signaling, protect service based architecture interfaces, and manage both domestic and international roaming traffic. The market growth is supported by the high adoption of 5G technology, stringent regulatory requirements, and the need to safeguard critical network functions against signaling attacks, unauthorized access, and data breaches.

Japan’s market is also being driven by the increasing implementation of cloud native and virtualized SEPP platforms, which provide flexibility, scalability, and enhanced operational efficiency. Operators are integrating AI‑enabled threat detection, real‑time traffic monitoring, and automated policy enforcement into their security frameworks to address evolving risks in high-speed 5G networks. With the combination of robust regulatory support, technological innovation, and growing 5G traffic volumes, the Japan SEPP interconnect security market is expected to grow at a strong CAGR of 21.4%, outpacing many mature markets and highlighting the region’s emphasis on secure, next-generation network operations.

Global SEPP Interconnect Security Market: Key Takeaways

- Rapid Growth Driven by 5G Standalone Deployments: The market growth is fueled by widespread 5G standalone deployments, rising inter operator traffic, network slicing, and API-based communications, driving demand for SEPP platforms to secure signaling and roaming interfaces efficiently.

- North America and Asia Pacific Lead Adoption: North America leads with 32.0% market share due to early 5G adoption and advanced telecom infrastructure. Asia Pacific shows strong growth driven by expanding subscribers, roaming traffic, and cloud-native SEPP platform investments.

- Software and Cloud-Native SEPP Solutions Gain Momentum: Software dominates with 55.0% share, offering flexibility, scalability, and automation. Cloud-native architectures enable multi-vendor integration, efficient orchestration, and real-time threat management, reflecting the industry’s shift toward virtualized, software-driven security solutions.

- AI Integration Enhances Threat Detection and Automation: AI enhances SEPP solutions by enabling predictive threat detection, anomaly identification, automated policy enforcement, and adaptive security, reducing false positives and improving response efficiency for both domestic and international roaming traffic.

- Expanding Enterprise and Private 5G Interconnect Security: Private 5G networks in enterprises and industrial sectors increase demand for SEPP solutions, securing API communication, interconnect signaling, and data exchange, while supporting mobility, critical infrastructure connectivity, and regulatory compliance.

Global SEPP Interconnect Security Market: Use Cases

- Inter Operator Roaming Security: SEPP interconnect security is used to protect roaming traffic exchanged between mobile network operators. It secures inter PLMN communication by encrypting service based interfaces validating signaling messages and enforcing access control policies. This use case helps prevent signaling attacks roaming fraud and unauthorized data exposure in 5G standalone roaming environments.

- Secure Service Based Architecture Communication: SEPP secures service based architecture interactions between 5G core network functions across operator domains. It enables safe API exposure message integrity and authentication for inter operator communication. This supports network slicing cloud native deployments and secure exchange of control plane traffic.

- Cross Border Interconnect Protection: Telecom operators deploy SEPP to safeguard cross border interconnect traffic and manage trust relationships with external networks. It enforces security policies monitors signaling exchanges and supports regulatory compliance in high traffic international network environments.

- Enterprise and Private 5G Interconnect Security: SEPP is increasingly used to secure interconnects between private 5G networks and public mobile networks. It protects API driven communication signaling interfaces and data exchange supporting enterprise mobility government networks and critical infrastructure connectivity.

Impact of Artificial Intelligence on the global SEPP Interconnect Security market

The impact of artificial intelligence on the global SEPP interconnect security market is transformative, as AI and machine learning technologies enhance the detection prevention and automated response capabilities of security edge protection solutions. Traditional SEPP implementations relied heavily on rule based filters and static policy enforcement to secure inter operator signaling traffic and inter PLMN interfaces.

With the integration of AI driven analytics and behavior based anomaly detection models SEPP platforms can now identify subtle patterns of malicious activity zero day threats and sophisticated signaling attacks that static systems might miss. This improves overall threat intelligence reduces false positives and enables real time adaptation to evolving attack vectors in roaming security and service based architecture traffic.

AI also contributes to operational efficiency and orchestration in the SEPP interconnect security market by automating incident response workflows and policy optimization across complex multi-vendor 5G core environments. Machine learning models can analyze large volumes of interconnect traffic to predict potential vulnerabilities prioritize risk mitigation and recommend security policy adjustments without manual intervention.

Furthermore AI enabled automation supports dynamic scaling of security controls in cloud native and virtualized deployments ensuring that performance and protection keep pace with fluctuating network loads. As telecom operators increasingly adopt AI driven SEPP solutions the market is expected to see accelerated innovation enhanced threat resilience and more autonomous security frameworks that align with the demands of modern 5G and future 6G network architectures.

Global SEPP Interconnect Security Market: Stats & Facts

- International Telecommunication Union (ITU) – Facts & Figures 2025 / Connectivity Reports

- In 2025 an estimated 6 billion people (around 75% of the world’s population) are online according to ITU connectivity estimates.

- 2.2 billion people remain offline in 2025 despite connectivity growth.

- 5G network coverage is estimated to reach 55% of the world population in 2025.

- 84% of people in high‑income countries have access to 5G in 2025.

- Only 4% of people in low‑income countries have 5G coverage in 2025.

- ITU Global Connectivity Report 2025

- Submarine cables carry over 99% of all international data flows globally.

- The median share of income needed for 5 GB of mobile broadband in 2025 is 40% less than in 2013.

- In 2025 only 14% of rural residents in low‑income countries are online.

- The urban‑rural gap for connectivity can exceed 30 percentage points in some regions.

- Estimated cost for a national ICT household survey is around USD 2–2.5 million per country.

- Ericsson Mobility / ITU Mobile Subscriptions Outlook (Informing Governments & Regulators)

- 5G subscriptions are expected to reach approximately 2.9 billion by end of 2025.

- 5G is projected to account for one‑third of all mobile subscriptions in 2025.

- Around 360 service providers have launched commercial 5G services globally by 2025.

- Western Europe and North America are expected to reach 5G subscription penetration above 55% by 2025.

- 4G subscriptions globally declined while 5G uptake increased in Q3 2025.

- 5G Americas / Regional 5G Deployment Insights (Industry + Governmental Data)

- Global 5G connections exceeded 2.4 billion by Q1 2025.

- 145 million new 5G subscriptions were added in early 2025.

- 5G is expected to represent one‑third of all mobile subscriptions by the end of 2025.

- There were 354 commercial 5G networks globally as of March 17, 2025.

- North America reached 77% population 5G coverage by early 2025.

- GSMA / ITU Combined Governmental Insight Data

- 5G connections globally reached 1.5 billion by end of 2023, four times faster than early 4G adoption.

- 261 operators in 101 countries offered commercial 5G services by early 2024.

- 47 5G Standalone networks were operational as of January 2024.

- Monthly global mobile data per connection was estimated at 12.8 GB in 2023.

- GSMA data suggests 5G connections could exceed 5.5 billion by 2030 — illustrating long‑term growth trends relevant for security planning.

- ITU Broadband / Connectivity Targets & Trends

- Globally, broadband subscriptions (fixed + mobile) reached 9.4 billion by end of 2024.

- In OECD countries, mobile broadband subscriptions were 1.9 billion by June 2024.

- OECD data shows fixed broadband median download speeds averaged 74.5 Mbps in cities in 2024.

- Within OECD countries, 5G urban‑rural connectivity divides remain pronounced as of 2024.

Global SEPP Interconnect Security Market: Market Dynamics

Global SEPP Interconnect Security Market: Driving Factors

Growing 5G Standalone Deployments and Interconnect Traffic

The rapid rollout of 5G standalone (SA) networks globally is increasing inter operator and roaming traffic volumes, creating a heightened need for robust interconnect security. As service based architecture and network slicing become mainstream, operators must secure signaling interfaces and API exchanges to protect control plane traffic and maintain network integrity. This surge in traffic is directly driving investments in SEPP solutions that can handle complex signaling security requirements and ensure seamless cross network connectivity.

Regulatory Compliance and Telecom Security Mandates

Governments and telecom regulators are mandating stricter security frameworks for mobile network operators to counter emerging threats. SEPP interconnect security addresses these mandates by providing mechanisms for authentication authorization encrypted communication and threat monitoring across interconnected networks. Compliance with international security standards and regulatory oversight related to data protection and secure roaming is compelling operators to adopt advanced SEPP platforms, boosting market growth.

Global SEPP Interconnect Security Market: Restraints

Integration Complexity with Legacy Systems

Many telecom networks continue to operate hybrid environments that include legacy 4G LTE systems alongside emerging 5G core architectures. Integrating SEPP solutions into these heterogeneous ecosystems can be technically challenging and resource intensive, requiring careful alignment with existing signaling firewalls, policy control functions and management systems. This complexity can slow deployment timelines and inflate implementation costs.

Skill Gap and Security Expertise Shortage

Deploying and managing advanced SEPP interconnect security solutions requires specialized expertise in 5G core protocols, signaling security and real time threat analysis. There is a notable shortage of trained cybersecurity professionals with deep understanding of telecom specific security requirements, which presents a barrier for operators seeking to optimize and maintain SEPP implementations. This talent gap can delay adoption and limit operational efficiency.

Global SEPP Interconnect Security Market: Opportunities

AI-Driven Threat Detection and Automation

There is significant opportunity for vendors to integrate artificial intelligence and machine learning capabilities into SEPP platforms to provide predictive threat detection, automated policy adjustment and anomaly identification in real time. AI enabled SEPP can enhance signaling security by identifying sophisticated attack patterns and reducing reliance on manual security workflows, offering operators more resilient interconnect protection and faster incident response.

Expansion of Private 5G and Enterprise Connectivity

As enterprises and industrial sectors adopt private 5G networks for mission critical applications, there is a growing need to secure interconnects between these private networks and public telecom cores. SEPP interconnect security solutions can be extended to protect API based communications, signaling pathways and cross domain data exchange, presenting a new revenue stream for solution providers targeting enterprise digital transformation and secure edge deployments.

Global SEPP Interconnect Security Market: Trends

Shift Toward Cloud Native and Virtualized SEPP Deployments

Telecom operators are increasingly favoring cloud native and containerized SEPP solutions over traditional hardware appliances to achieve greater scalability, flexibility and cost efficiency. This trend aligns with broader telco cloud initiatives where virtual network functions and microservices architectures are prioritized for agility in dynamic traffic environments and automated lifecycle management.

Convergence of SEPP with Comprehensive Telecom Security Platforms

Rather than standalone implementations, SEPP is increasingly being integrated into larger telecom security ecosystems that include signaling firewalls, policy control engines and threat intelligence modules. This convergence trend supports unified policy enforcement, centralized threat analytics and cohesive defense mechanisms across signaling, data and service based interfaces, enabling operators to streamline security operations across the 5G core and interconnect domains.

Global SEPP Interconnect Security Market: Research Scope and Analysis

By Component Analysis

By component analysis indicates that software components are anticipated to dominate the SEPP interconnect security market, capturing around 55.0% of the total market share in 2025. This dominance is driven by the increasing adoption of cloud native and virtualized SEPP solutions that enable flexible deployment across 5G standalone core networks.

Software based platforms allow telecom operators to implement advanced signaling security policy enforcement message filtering and API protection without heavy reliance on physical infrastructure. The ability to integrate seamlessly with service based architecture network slicing and orchestration systems further strengthens software adoption, as operators prioritize scalability faster upgrades and automated threat management in dynamic inter operator environments.

ℹ

To learn more about this report –

Download Your Free Sample Report Here

Hardware components continue to play a significant role in the market, particularly in high capacity telecom core networks where performance reliability and low latency processing are critical. Physical SEPP appliances are widely deployed in national and international interconnect gateways to handle large volumes of roaming traffic and signaling exchanges.

These hardware solutions are often preferred by operators with strict regulatory requirements and legacy infrastructure, as they provide dedicated processing power enhanced control and predictable performance. Although hardware adoption is gradually shifting toward virtualized alternatives, it remains an essential component for operators seeking robust and high throughput interconnect security deployments.

By Deployment Model Analysis

By deployment model analysis indicates that on‑premises deployments are anticipated to dominate the SEPP interconnect security market, capturing approximately 58.0% of the total market share in 2025. This preference is driven by telecom operators’ need for greater control, data sovereignty, and regulatory compliance in managing inter operator signaling and roaming traffic.

On‑premises SEPP solutions allow operators to deploy dedicated security gateways within their own network infrastructure, providing predictable performance, low latency processing, and direct integration with existing core network elements. Operators also benefit from enhanced visibility into traffic flows, customizable policy enforcement, and the ability to manage security operations internally without relying on third‑party cloud providers, making on‑premises solutions a critical choice for large-scale and mission-critical deployments.

Cloud deployments are gradually gaining traction in the SEPP interconnect security market, offering flexibility, scalability, and cost efficiency for telecom operators looking to modernize their security architecture. Cloud‑based SEPP solutions enable operators to virtualize signaling security functions, easily scale resources according to dynamic traffic demands, and integrate with cloud native 5G core networks and orchestration platforms.

While cloud deployments may face challenges related to latency, data privacy, and regulatory constraints, their ability to support rapid updates, automated threat detection, and centralized management makes them increasingly attractive for operators pursuing agile, software-defined network strategies.

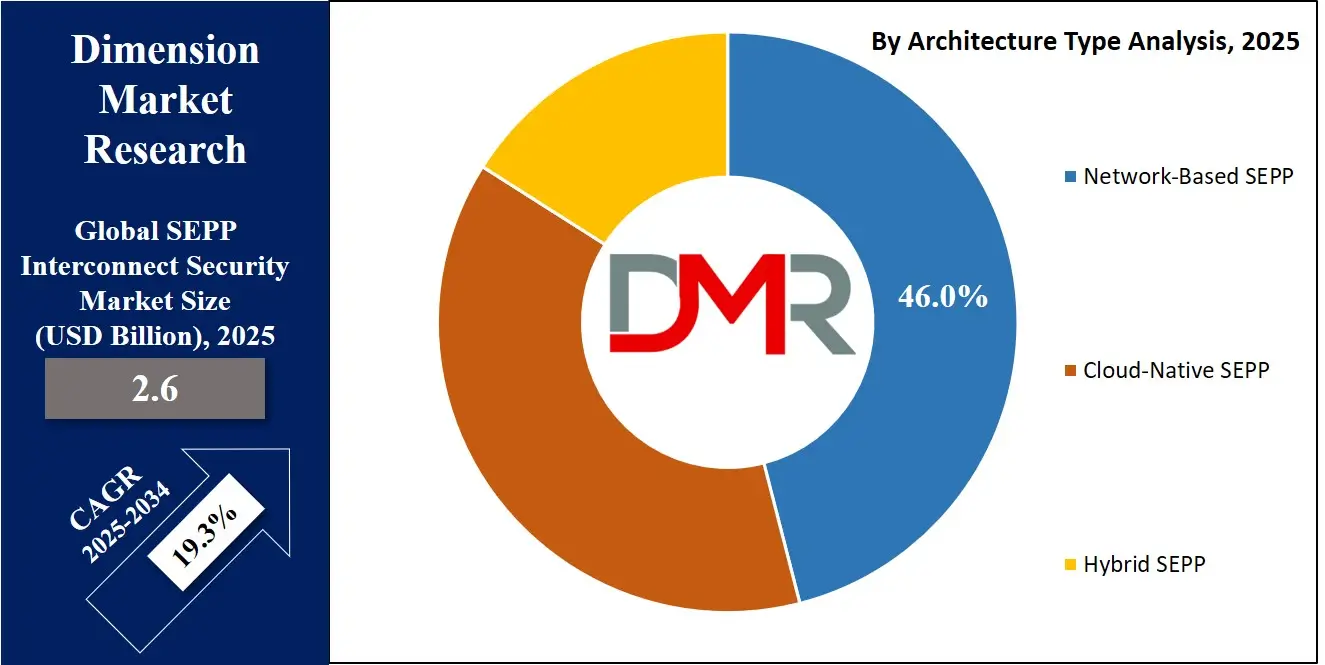

By Architecture Type Analysis

By architecture type analysis indicates that network‑based SEPP solutions are anticipated to dominate the architecture type segment, capturing around 46.0% of the total market share in 2025. Network‑based SEPP deployments are primarily preferred by telecom operators for securing inter PLMN signaling traffic, roaming communications, and interconnect interfaces in traditional and hybrid 4G/5G networks.

These solutions provide dedicated hardware and software integration at strategic points within the operator’s network, ensuring low latency processing, high reliability, and consistent enforcement of security policies. The ability to handle large volumes of signaling traffic, support regulatory compliance, and integrate seamlessly with legacy network elements makes network‑based SEPP a critical choice for operators requiring stable and high-performance interconnect security.

Cloud‑native SEPP architectures are gaining adoption as operators increasingly move toward virtualized and software-defined 5G core networks. These solutions leverage containerized microservices and orchestration platforms to provide scalable, flexible, and easily upgradable interconnect security.

Cloud‑native SEPP enables real-time policy enforcement, automated threat detection, and simplified management across multiple network domains without the need for extensive physical infrastructure. While they may face challenges such as latency considerations and regulatory compliance in certain regions, cloud‑native SEPP solutions are becoming essential for operators looking to implement agile, cost-efficient, and software-driven security frameworks in modern 5G deployments.

By Network Generation Analysis

By network generation analysis indicates that 5G Standalone (SA) networks are anticipated to dominate the network generation segment, capturing approximately 44.0% of the total market share in 2025. 5G SA deployments provide a fully independent 5G core network architecture that enables operators to implement service based architecture, network slicing, and advanced interconnect features with greater efficiency and control.

SEPP solutions in 5G SA environments are critical for securing inter operator signaling, managing roaming traffic, and protecting API based communications between network functions. The adoption of SA networks drives higher demand for robust interconnect security platforms as operators seek to safeguard control plane traffic, ensure regulatory compliance, and support high-performance, low-latency services across interconnected 5G networks.

5G Non-Standalone (NSA) networks continue to represent a significant portion of the market, capturing a substantial share as operators transition from 4G LTE infrastructures toward 5G capabilities. In NSA deployments, the 5G radio access network is integrated with the existing 4G core, which requires careful implementation of SEPP solutions to protect interconnect signaling between legacy and new network elements. SEPP in NSA environments helps secure roaming traffic, prevent signaling attacks, and maintain service continuity while operators gradually upgrade to standalone 5G cores. Although NSA networks do not offer the full capabilities of SA, they remain critical for ensuring backward compatibility and smooth network evolution, sustaining demand for interconnect security solutions in hybrid 4G/5G networks.

By Security Function Analysis

By security function analysis indicates that inter‑PLMN security is anticipated to dominate the network function segment, capturing approximately 34.0% of the total market share in 2025. Inter‑PLMN security focuses on protecting signaling and data exchanges between different public land mobile networks, which is critical for maintaining the integrity and confidentiality of inter operator communications.

SEPP solutions provide authentication, authorization, message filtering, and encryption to ensure that traffic crossing network boundaries is secure from interception, manipulation, or unauthorized access. This function is essential for safeguarding control plane traffic, enabling secure roaming, and maintaining compliance with 3GPP standards and telecom regulations, making it a priority for operators with high interconnect activity.

Roaming security also represents a significant portion of the SEPP market, addressing the protection of signaling and user data traffic exchanged during domestic and international roaming. SEPP solutions ensure that roaming traffic is authenticated, encrypted, and monitored to prevent fraud, unauthorized access, and signaling attacks that could compromise network performance or subscriber privacy.

This function is particularly important in regions with high cross‑border traffic and multiple roaming partners, as it helps operators maintain service continuity, protect sensitive subscriber information, and enforce consistent security policies across interconnected networks while supporting the growing demand for seamless 5G roaming services.

By Traffic Type Analysis

By traffic type analysis indicates that international roaming traffic is anticipated to dominate the traffic type segment, capturing approximately 39.0% of the total market share in 2025. The growth of international roaming traffic is driven by the increasing mobility of subscribers across borders and the expansion of 5G standalone networks globally.

SEPP solutions play a critical role in securing inter operator signaling, authenticating roaming sessions, and encrypting service based interface communications to prevent fraud, unauthorized access, and signaling attacks. Protecting international roaming traffic ensures uninterrupted service delivery, compliance with global telecom regulations, and secure exchange of control plane data between different public land mobile networks.

Domestic interconnect traffic also represents a substantial portion of the market, focusing on the secure exchange of signaling and user data within a country between multiple operators or service providers. SEPP solutions for domestic interconnect enforce access control policies, monitor signaling flows, and protect against internal network threats that could affect service quality or data integrity.

This function is essential for maintaining reliable inter operator communication, supporting network slicing, and ensuring that high volume domestic signaling traffic is processed securely and efficiently, particularly in densely populated regions with complex operator ecosystems.

By Organization Size Analysis

By organization size analysis indicates that large enterprises are anticipated to dominate the organization size segment, capturing approximately 72.0% of the total market share in 2025. Large telecom operators and network service providers invest heavily in SEPP interconnect security solutions to protect their extensive 5G core networks, inter operator signaling, and roaming traffic.

These organizations have complex network infrastructures, high subscriber volumes, and strict regulatory compliance requirements, which necessitate robust security frameworks capable of managing high-capacity traffic, enforcing access control policies, and integrating with service based architectures. The scale and criticality of their networks make large enterprises the primary adopters of advanced SEPP platforms to ensure secure, reliable, and low-latency interconnect communications.

SMEs also represent a growing segment in the SEPP interconnect security market, capturing a smaller portion of the total market share. Smaller telecom operators, private network providers, and enterprise networks are increasingly adopting SEPP solutions to secure signaling interfaces, manage limited interconnect traffic, and protect data exchange with public mobile networks.

While budget constraints and limited IT security resources may slow adoption compared to large enterprises, cloud native and managed SEPP offerings provide SMEs with scalable, cost-effective security options. These deployments help SMEs enhance network reliability, safeguard enterprise mobility, and comply with basic regulatory requirements while gradually integrating into the broader interconnect security ecosystem.

By End User Analysis

By end user segment analysis indicates that telecom operators are anticipated to dominate the end user segment, capturing approximately 53.0% of the total market share in 2025. Telecom operators are the primary adopters of SEPP interconnect security solutions because they handle the majority of inter operator signaling and roaming traffic, which requires robust protection against fraud, unauthorized access, and signaling attacks.

These operators implement SEPP platforms to secure inter PLMN communication, enforce authentication and authorization policies, and ensure the integrity of control plane traffic across 5G standalone and hybrid network environments. Their large-scale networks, high subscriber volumes, and regulatory obligations make telecom operators the key drivers of market growth in the SEPP interconnect security domain.

Enterprises also form a notable segment of the market, using SEPP solutions to secure private networks, enterprise mobility, and connectivity with public telecom infrastructures. Companies deploying private 5G networks, industrial IoT systems, or mission-critical applications rely on SEPP to protect API-based communications, interconnect signaling, and data exchanges.

While their adoption levels are smaller compared to telecom operators, enterprises benefit from scalable, cloud-native, and managed SEPP solutions that allow secure integration with public networks, support compliance, and enhance overall network reliability. This segment is expected to grow steadily as enterprises expand digital transformation initiatives and increase reliance on secure interconnect traffic for business operations.

The SEPP Interconnect Security Market Report is segmented on the basis of the following:

By Component

- Software

- Hardware

- Services

By Deployment Model

By Architecture Type

- Network-Based SEPP

- Cloud-Native SEPP

- Hybrid SEPP

By Network Generation

- 5G Standalone (SA)

- 5G Non-Standalone (NSA)

- 4G / LTE Interworking

By Security Function

- Inter-PLMN Security

- Roaming Security

- Message Filtering

- Threat Detection

By Traffic Type

- International Roaming

- Domestic Interconnect

- API / SBA Traffic

- Enterprise Interconnect

By Organization Size

By End User

- Telecom Operators

- Enterprises

- Managed Services Providers

- Others

Global SEPP Interconnect Security Market: Regional Analysis

Region with the Largest Revenue Share

North America is anticipated to lead the global SEPP interconnect security market, capturing approximately 32.0% of total market revenue in 2025. The region’s dominance is driven by early 5G standalone deployments, high volumes of international roaming traffic, and advanced telecom infrastructure that requires robust interconnect security solutions.

ℹ

To learn more about this report –

Download Your Free Sample Report Here

Telecom operators in North America are investing heavily in SEPP platforms to protect inter operator signaling, secure service based architecture interfaces, and comply with stringent regulatory and cybersecurity standards. The presence of major network operators, rapid adoption of cloud native and virtualized network functions, and a strong focus on innovation and threat mitigation collectively contribute to North America’s leading position in the global market.

Region with significant growth

The Asia Pacific region is expected to witness significant growth in the SEPP interconnect security market over the forecast period. Rapid 5G network expansion, increasing mobile subscriber base, and rising international roaming traffic are driving demand for robust interconnect security solutions across the region.

Telecom operators in countries such as China, Japan, and South Korea are investing in SEPP platforms to secure signaling traffic, protect service based architecture interfaces, and ensure compliance with evolving regulatory standards. Additionally, the growing adoption of cloud native and virtualized 5G core networks, along with the expansion of enterprise and private 5G deployments, is further accelerating market growth in Asia Pacific, positioning it as a high-potential region in the global landscape.

By Region

North America

Europe

- Germany

- The U.K.

- France

- Italy

- Russia

- Spain

- Benelux

- Nordic

- Rest of Europe

Asia-Pacific

- China

- Japan

- South Korea

- India

- ANZ

- ASEAN

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Argentina

- Colombia

- Rest of Latin America

Middle East & Africa

- Saudi Arabia

- UAE

- South Africa

- Israel

- Egypt

- Rest of MEA

Global SEPP Interconnect Security Market: Competitive Landscape

The global SEPP interconnect security market is highly competitive, characterized by rapid technological innovation and continuous development of advanced signaling security solutions. Vendors are focusing on enhancing software capabilities, integrating AI-driven threat detection, and offering cloud native and virtualized SEPP platforms to meet the growing demands of 5G standalone networks.

The market landscape is shaped by investments in research and development, strategic partnerships, and the expansion of managed security services to provide scalable, flexible, and compliant interconnect security solutions. Continuous emphasis on performance, reliability, and automation, along with the need to address evolving signaling threats and cross-network vulnerabilities, drives intense competition and encourages differentiation through innovation and customized security offerings.

Some of the prominent players in the global SEPP Interconnect Security market are

- Ericsson

- Nokia

- Huawei

- Cisco Systems

- Juniper Networks

- A10 Networks

- Mobileum

- AdaptiveMobile Security

- Mavenir

- ZTE Corporation

- BroadForward

- IPLOOK

- Nomios Group

- Oracle Communications

- Syniverse

- teleSys Software

- Titan.ium Platform

- TOMIA

- Cumucore

- Ingate Systems

- Other Key Players

Global SEPP Interconnect Security Market: Recent Developments

- December 2025: ServiceNow announced a USD 7.75 billion acquisition of a cybersecurity company to enhance its threat detection and security workflow capabilities amid rising digital threats and AI‑driven security demands.

- October 2025: A NATO cybersecurity centre verified a major 5G SEPP solution for securing interconnect roaming communications across allied networks to safeguard sensitive battlefield and research data.

- October 2025: A global roaming services company commercially launched its 5G Standalone roaming signaling service powered by an advanced SEPP gateway, enabling scalable secure roaming for mobile operators and IoT providers.

- August 2025: A cybersecurity company secured USD 70 million in investment to build advanced autonomous security platforms focused on real‑time threat mitigation across dynamic network environments.

- August 2025: A telecommunications and AI security partnership agreement was announced to co‑develop an AI‑driven cybersecurity platform targeting telecom security innovation.

Report Details

| Report Characteristics |

| Market Size (2025) |

USD 2.6 Bn |

| Forecast Value (2034) |

USD 12.9 Bn |

| CAGR (2025–2034) |

19.3% |

| The US Market Size (2025) |

USD 0.7 Bn |

| Historical Data |

2019 – 2024 |

| Forecast Data |

2026 – 2034 |

| Base Year |

2024 |

| Estimate Year |

2025 |

| Report Coverage |

Market Revenue Estimation, Market Dynamics, Competitive Landscape, Growth Factors and etc. |

| Segments Covered |

By Component (Software, Hardware, Services), By Deployment Model (On-Premises, Cloud), By Architecture Type (Network-Based, Cloud-Native, Hybrid), By Network Generation (5G SA, 5G NSA, 4G/LTE), By Security Function (Inter-PLMN, Roaming, Message Filtering, Threat Detection), By Traffic Type (International Roaming, Domestic Interconnect, API/SBA, Enterprise Interconnect), By Organization Size (Large Enterprises, SMEs), and By End User (Telecom Operators, Enterprises, Managed Services Providers, Others) |

| Regional Coverage |

North America – The US and Canada; Europe – Germany, The UK, France, Russia, Spain, Italy, Benelux, Nordic, & Rest of Europe; Asia-Pacific – China, Japan, South Korea, India, ANZ, ASEAN, Rest of APAC; Latin America – Brazil, Mexico, Argentina, Colombia, Rest of Latin America; Middle East & Africa – Saudi Arabia, UAE, South Africa, Turkey, Egypt, Israel, & Rest of MEA |

| Prominent Players |

Ericsson, Nokia, Huawei, Cisco Systems, Juniper Networks, A10 Networks, Mobileum, AdaptiveMobile Security, Mavenir, ZTE Corporation, BroadForward, IPLOOK, Nomios Group, Oracle Communications, Syniverse, teleSys Software, Titan.ium Platform, and Others |

| Purchase Options |

We have three licenses to opt for: Single User License (Limited to 1 user), Multi-User License (Up to 5 Users), and Corporate Use License (Unlimited User), along with free report customization equivalent to 0 analyst working days, 3 analyst working days, and 5 analyst working days respectively. |

Frequently Asked Questions

How big is the global SEPP Interconnect Security market?

▾ The global SEPP Interconnect Security market size is estimated to have a value of USD 2.6 billion in 2025 and is expected to reach USD 12.9 billion by the end of 2034.

What is the size of the US SEPP Interconnect Security market?

▾ The US SEPP Interconnect Security market is projected to be valued at USD 0.7 billion in 2025. It is expected to witness subsequent growth in the upcoming period as it holds USD 3.1 billion in 2034 at a CAGR of 18.1%.

Which region accounted for the largest global SEPP Interconnect Security market?

▾ North America is expected to have the largest market share in the global SEPP Interconnect Security market, with a share of about 32.0% in 2025.

Who are the key players in the global SEPP Interconnect Security market?

▾ Some of the major key players in the global SEPP Interconnect Security market are Ericsson, Nokia, Huawei, Cisco Systems, Juniper Networks, A10 Networks, Mobileum, AdaptiveMobile Security, Mavenir, ZTE Corporation, BroadForward, IPLOOK, Nomios Group, Oracle Communications, Syniverse, teleSys Software, Titan.ium Platform, and Others.