Market Overview

The Global Silicon Carbide Market is projected to reach

USD 5.7 billion in 2025 and grow at a compound annual growth rate of

33.7% from there until 2034 to reach a value of

USD 77.6 billion.

Silicon carbide (SiC) is a strong and heat-resistant material commonly found in electronic devices, mainly power devices. Developed by combining silicon with carbon at high temperatures, SiC can withstand higher voltages, temperatures, and switching speeds than its regular silicon counterpart, making it suitable for electric vehicles (EVs), renewable energy systems, industrial applications and many other uses. Due to its ability to reduce energy loss and enhance efficiency in these areas, many industries are shifting away from traditional silicon toward silicon carbide solutions.

Silicon carbide demand has experienced explosive growth over recent years. One major reason is electric vehicle manufacturing car makers need efficient power components for longer battery life and faster charging. Silicon carbide's ability to withstand high power makes it vital for modern EVs. Silicon carbide also plays an important role in renewable energy, specifically solar and wind power, which require efficient energy conversion solutions. with global industries striving to lower emissions globally, silicon carbide has become an invaluable component in creating energy-efficient solutions.

Industries and companies across many fields are investing in silicon carbide technology. Manufacturers have begun shifting toward larger wafers (200 mm) that are mainly efficient, which allow more chips to be produced at lower costs, helping industries produce silicon carbide components more efficiently. Governments are supporting Silicon Carbide manufacturing with funding and policies, like China securing its supply chains, with U.S. officials also working on safeguarding future technological independence with regards to energy sources like Silicon Carbide.

The latest events have demonstrated the importance of silicon carbide to global markets. Companies are expanding production facilities to keep up with increasing demand while the supply chain faces obstacles like material shortages and higher production costs. Governments have instituted policies designed to support local production while decreasing dependence on other countries for supply all these actions contribute towards creating more stable and reliable supplies of silicon carbide materials.

Future trends point towards Silicon Carbide continuing its rise. As industries strive for energy efficiency, its role as high-performance electronics will increase. Silicon carbide may become an essential part of electric grids, data centers, and industrial automation applications as it becomes more affordable and accessible through manufacturing process improvements, becoming an essential element of next-generation technologies.

Silicon carbide is transforming energy and electronics technology. Owing to its superior properties, this material makes itself indispensable to industries looking for durable yet efficient components, due to rapid advancements and rising investments, this revolutionary material promises to revolutionize power electronics solutions as well as energy solutions in years to come.

The US Silicon Carbide Market

The US Silicon Carbide Market is projected to reach USD 1.2 billion in 2025 at a compound annual growth rate of 31.6% over its forecast period.

The US Silicon carbide market has strong growth opportunities driven by growing EV adoption, renewable energy expansion, and semiconductor advancements. Government support, like the CHIPS Act, is boosting domestic SiC production. Increasing demand for SiC-based power electronics in AI data centers, industrial automation, and 5G networks further accelerates market expansion, positioning the US as a key player in SiC innovation.

Further, the market is driven by growth in EV adoption, renewable energy expansion, and government initiatives which support domestic semiconductor production. Demand for SiC-based power electronics in AI data centers, 5G networks, and industrial automation further fuels growth. However, challenges like high production costs, complex manufacturing processes, and supply chain constraints could slow market expansion despite increasing technological advancements.

Silicon Carbide Market: Key Takeaways

- Market Growth: The Silicon Carbide Market size is expected to grow by USD 8.2 billion, at a CAGR of 7.7% during the forecasted period of 2026 to 2034.

- By Device: The SiC Discrete Devices segment is anticipated to get the majority share of the Silicon Carbide Market in 2025.

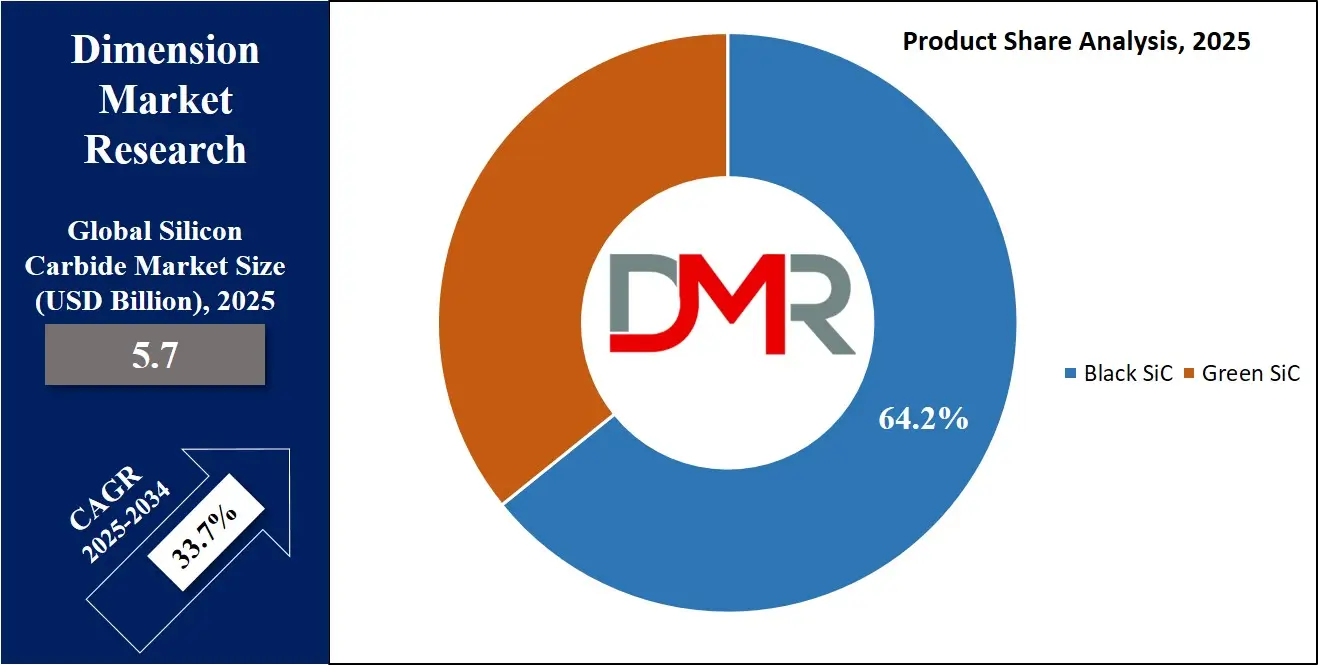

- By Product: The Black SiC segment is expected to get the largest revenue share in 2025 in the Silicon Carbide Market.

- Regional Insight: Asia Pacific is expected to hold a 51.7% share of revenue in the Global Silicon Carbide Market in 2025.

- Use Cases: Some of the use cases of Silicon Carbide include EVs, renewable energy, and more.

Silicon Carbide Market: Use Cases

- Electric Vehicles (EVs): Silicon carbide is used in EV power electronics, like inverters and chargers, to improve energy efficiency, minimize heat loss, and allow quick charging, resulting in longer driving range and better performance.

- Renewable Energy: It is vital in solar inverters and wind power systems, where it supports in converting energy more efficiently, minimizing power loss and enhancing overall system reliability.

- Industrial Power Systems: Silicon carbide is mainly used in high-power industrial applications, like motor drives, power supplies, and automation, allowing for smaller, more efficient, and heat-resistant components.

- Aerospace & Defense: Its ability to withstand extreme temperatures and radiation makes it ideal for space exploration, radar systems, and military-grade power electronics, ensuring reliable performance in harsh environments.

Stats & Facts

- Wolfspeed reports that 200mm silicon carbide wafers increase chip production by 80% per wafer and expand applications by 20%, making them ideal for EVs, renewable energy, and power electronics due to improved efficiency, heat resistance, and cost-effectiveness.

- USGS states that in 2023, six U.S. facilities east of the Mississippi River produced silicon materials for steel, aluminum, semiconductors, and solar industries, while efforts are being made to reduce reliance on imports and strengthen domestic supply chains.

- By 2030, Wolfspeed predicts that 1200V/100A MOSFET die costs on 200mm wafers will be 54% lower than 2022 levels on 150mm wafers, making high-power semiconductors more affordable for EVs, industrial automation, and renewable energy.

- From 2019-2022, USGS reports that Russia supplied 38% of U.S. ferrosilicon imports, while silicon metal was sourced from Brazil (35%), Canada (25%), and Norway (13%), emphasizing continued foreign dependency for key materials.

- EV manufacturers increased their use of 200mm silicon carbide components by 400% from 2023 to 2024, with an additional 75% growth expected by the end of 2025, according to Wolfspeed, accelerating the adoption of efficient power electronics.

- USGS estimates that U.S. silicon metal and ferrosilicon production in 2023 declined from 2022 levels, while spot market prices dropped by 50% by September 2023, despite global production remaining stable.

- 200mm silicon carbide wafers improve efficiency, durability, and thermal performance, making them critical for EVs, industrial automation, and high-power electronics, according to Wolfspeed, with benefits including faster charging and extended battery life.

- China dominated global silicon material production in 2023, accounting for over 70%, while Russia, Brazil, and Norway remained key producers, according to USGS, reinforcing China’s stronghold in the market.

- Scaling to 200mm wafers significantly lowers production costs, enabling more affordable EV powertrains and renewable energy systems, according to Wolfspeed, while improving performance and supply chain efficiency.

- A USD 2.5 billion U.S. investment in a solar supply chain facility in Georgia was announced in January 2023, marking the first U.S. solar-grade wafer production since 2016, according to USGS, aimed at boosting domestic solar manufacturing.

- Automakers are accelerating the shift to 200mm silicon carbide technology, benefiting from faster charging, greater energy efficiency, and better power handling, supporting EVs, grid-level storage, and high-performance applications, per Wolfspeed.

- USGS confirms that a U.S. company restarted an idle polysilicon production facility in Washington in late 2023, enhancing domestic solar-grade silicon supply and reinforcing clean energy production.

- Silicon carbide semiconductors enable compact, efficient, and highly reliable power devices, making them crucial for next-generation EVs, AI-driven computing, industrial automation, and electric grids, per Wolfspeed.

- Ferrosilicon accounted for nearly 60% of total global silicon production in 2023, with China, Russia, and Norway leading production, according to USGS, underscoring China’s dominance over silicon-based industries.

- Wolfspeed highlights that automakers are rapidly transitioning to 200mm silicon carbide components, benefiting from cost reductions, better thermal management, and increased durability for high-power applications.

- USGS reports that the U.S. is prioritizing domestic silicon manufacturing to reduce reliance on foreign suppliers, particularly for high-purity semiconductor-grade silicon, which is crucial for microchips and solar panels.

- Silicon carbide semiconductor adoption is accelerating, driving advancements in EV battery technology, solar inverters, data centers, and energy-efficient computing, per Wolfspeed, helping industries achieve better performance and sustainability.

- In September 2023, the U.S. Department of Commerce implemented CHIPS Act regulations, restricting funding from benefiting adversarial nations to protect domestic semiconductor production and national security, per USGS.

Market Dynamic

Driving Factors in the Silicon Carbide Market

Rising Demand for Electric Vehicles (EVs) and Renewable Energy

The transformation toward electric mobility and clean energy solutions is a major driver for Silicon Carbide growth. EV manufacturers prefer Silicon Carbide over traditional silicon due to its higher efficiency, faster charging, and lower energy loss, which supports extend battery life and driving range. Similarly, solar and wind power systems require high-performance inverters that convert energy more efficiently, minimizing waste and improving overall system reliability. As governments around the push for carbon neutrality and energy efficiency, the demand for silicon carbide in these sectors is expected to surge.

Advancements in Semiconductor Manufacturing and Expanding Industrial Applications

The move toward larger 200-mm silicon carbide wafers is minimizing production costs while growing chip output, making the technology more accessible to industries. Industrial sectors, like automation, aerospace, and high-power electronics, are adopting silicon carbide for its durability, heat resistance, and energy efficiency. In addition, government initiatives and funding for domestic semiconductor production are further accelerating the market. With industries seeking smaller, more powerful, and more efficient components, silicon carbide is becoming a key material for next-generation power electronics.

Restraints in the Silicon Carbide Market

High Production Costs and Complex Manufacturing Process

Despite its advantages, silicon carbide remains costly to produce due to the complex and time-consuming manufacturing process. The increase in high-quality silicon carbide wafers needs specialized equipment, extreme temperatures, and longer production cycles in comparison to traditional silicon. The transition to larger 200mm wafers supports reduce costs, but initial investment and processing difficulties remain a barrier. These factors make Silicon Carbide components costlier, limiting adoption in cost-sensitive industries and delaying widespread commercialization.

Limited raw material availability and supply chain constraints

The production of silicon carbide depends on high-purity silicon and carbon sources, which are not as widely available as traditional semiconductor materials. Additionally, China dominates the global supply chain, creating risks of trade restrictions, geopolitical tensions, and material shortages. Expanding domestic production in regions like the U.S. and Europe is underway, but setting up new facilities and securing raw materials takes time. These supply challenges can lead to price fluctuations, delays in production, and difficulties in meeting growing market demand.

Opportunities in the Silicon Carbide Market

Expansion in 5G, Data Centers, and AI-Powered Computing

The quick growth of 5G networks, cloud computing, and

artificial intelligence (AI) is driving demand for high-efficiency power electronics, where silicon carbide plays a crucial role. Its high thermal conductivity and power efficiency make it ideal for power supplies, cooling systems, and voltage regulators in data centers and telecom infrastructure. As digital transformation accelerates, silicon carbide adoption in server farms,

edge computing, and AI hardware will continue to rise, creating a significant growth opportunity for the market.

Government Support and Investments in Domestic Semiconductor Production

Many countries, like the U.S., Europe, and Japan, are expanding their investments in domestic semiconductor manufacturing to minimzie the reliance on imports, particularly from China. Programs like the CHIPS Act in the U.S. and similar initiatives worldwide are driving funding for silicon carbide research, production facilities, and supply chain development. These investments not only enhance local production capabilities but also create opportunities for new market entrants, technological advancements, and long-term cost reductions, making Silicon Carbide more accessible for various industries.

Trends in the Silicon Carbide Market

Shift Toward 200mm Silicon Carbide Wafers for Cost Reduction and Higher Efficiency

One of the most significant trends in the silicon carbide market is the transition from 150mm to 200mm wafers, allowing manufacturers to increase chip production per wafer while reducing costs, which is driven by the growth in demand for power semiconductors in EVs, renewable energy, and industrial applications. Leading companies are heavily investing in new fabrication plants and advanced manufacturing techniques to scale up 200mm wafer production. As a result, silicon carbide components are becoming more affordable, accelerating adoption across various industries.

Growing Adoption of Silicon Carbide in High-Performance Electric Vehicle (EV) Powertrains

Automakers are primarily integrating silicon carbide-based inverters and onboard chargers to enhance energy efficiency, range, and charging speed. Tesla, for example, has already implemented Silicon Carbide technology in its vehicles, inspiring other manufacturers to follow suit. As battery technology enhance, the combination of higher voltage systems (800V+) and silicon carbide power electronics is becoming the industry standard for next-generation EV platforms, which is expected to transform EV performance while helping automakers meet stricter efficiency and sustainability regulations worldwide.

Research Scope and Analysis

By Device Analysis

Silicon Carbide discrete devices play an essential role in driving market expansion, thanks to rising demand for power electronics with higher efficiency ratings. These devices, which include SiC diodes, MOSFETs and power modules are widely utilized in electric vehicles (EVs), renewable energy systems, industrial automation and high-performance computing environments.

Engineered components with their ability to manage higher voltages, minimize power loss and enhance energy efficiency are vital elements in next-generation technology. As industries increasingly move toward eco-friendly and high-power applications, SiC discrete devices are projected to reach 57.5 percent market share in 2025 and lead the Silicon Carbide market. Their increasing adoption ensures superior energy savings, faster charging speeds and increased reliability across various sectors.

Silicon Carbide modules have experienced rapid expansion within the global Silicon carbide market due to rising consumer demand for power-dense and energy-saving solutions. SiC modules combine multiple SiC components into a single package, making them suitable for applications including electric vehicles (EVs), industrial power systems and renewable energy applications.

SiC modules' ability to handle high voltages, reduce heat production and enhance system performance makes them an attractive alternative to silicon-based modules. As industries shift toward compact yet high-efficiency designs, SiC modules are becoming indispensable components in next-generation power electronics systems - an area expected to experience strong growth during this forecast period and contribute towards advancements in sustainable energy and high performance electrical systems.

By Wafer Size Analysis

Up to 150mm wafer size segment will lead the Silicon Carbide market with a share of 87.3% in 2025, driven by its widespread use in power electronics and semiconductor applications. These wafers are critical for manufacturing SiC MOSFETs, diodes, and power modules, which are broadly used in electric vehicles (EVs), industrial automation, and renewable energy systems. Although larger 200mm wafers are gaining attention, 150mm wafers remain the industry standard due to their established production processes, cost-effectiveness, and high adoption across multiple sectors. With constant demand for efficient power solutions, this segment will continue to support the growth of Silicon Carbide technology across various high-performance applications.

Further, 150mm wafer size segment will see significant growth over the forecast period, driven by the growth in demand for higher efficiency and lower production costs in the Silicon Carbide market. The shift toward 200mm wafers allows manufacturers to produce more chips per wafer, reducing overall costs while improving performance, which is mainly important for industries like electric vehicles (EVs), renewable energy, and industrial power applications, where high-power and compact solutions are required. As companies invest in advanced manufacturing facilities, the adoption of larger SiC wafers will continue to grow, making them a key driver of next-generation power semiconductor technology.

By Product Analysis

Black SiC segment will lead the Silicon Carbide market with a share of 64.2% in 2025, driven by its broad usage in industrial applications. Black SiC is known for its high hardness, thermal resistance, and affordable, making it ideal for abrasives, grinding wheels, cutting tools, and refractory materials. It is commonly used in the automotive, construction, and steel industries, where durability and high-performance materials are vital. With the growth in demand for strong and heat-resistant materials, Black SiC continues to see strong adoption across manufacturing and heavy industries. Its availability and lower production costs compared to Green SiC further support its dominance in the Silicon Carbide market.

Moreover, the Green SiC segment will see significant growth over the forecast period, driven by its high purity and superior hardness in comparison to Black SiC. Green SiC is highly used in precision grinding, ceramics, and high-performance refractories, making it essential for industries like aerospace, electronics, and medical devices. Its ability to withstand extreme temperatures and produce ultra-fine finishes makes it a preferred material for specialized applications. As demand for high-quality abrasives and advanced ceramic components continues to rise, the Green SiC market is expected to expand, playing a key role in next-generation industrial and technological advancements.

ℹ

To learn more about this report –

Download Your Free Sample Report Here

By Vertical Analysis

Automotive segment will lead the Silicon Carbide market with a share of

34.9% in 2025, driven by the quick growth of electric vehicles (EVs) and the demandfor high-efficiency power electronics. Silicon carbide is broadly used in EV inverters, onboard chargers, and power modules, helping to enhance energy efficiency, extend driving range, and enable faster charging. As automakers shift toward 800V+ powertrains, silicon carbide is becoming vital for higher performance and reduced energy loss. With governments pushing for clean energy and emission reduction, the demand for SiC-based automotive components will constantly grow, making it a key driver of next-generation vehicle technology.

Also, the telecommunications segment will see significant growth over the forecast period, driven by the expansion of 5G networks, data centers, and high-speed communication systems. Silicon carbide is used in power amplifiers, signal transmitters, and energy-efficient power supplies, supporting telecom infrastructure handle higher frequencies, lower power losses, and better heat management. With the increase in the demand for faster and more reliable connectivity, telecom companies are adopting SiC-based components to improve network performance and energy efficiency. As global investments in fiber optics, satellite communications, and 5G technology continue to rise, Silicon Carbide will play a key role in enhancing telecommunication infrastructure.

The Silicon Carbide Market Report is segmented on the basis of the following:

By Device

- SiC Discrete Devices

- SiC Modules

By Wafer Size

- Up to 150 mm

- More than 150 mm

By Product

By Vertical

- Automotive

- Energy & Power

- Industrial

- Transportation

- Telecommunications

- Others

Regional Analysis

Leading Region in the Silicon Carbide Market

Asia Pacific region will lead the Silicon Carbide market with a share of

51.7% in 2025, driven by strong growth in electric vehicles (EVs), renewable energy, and industrial manufacturing. Countries like China, Japan, and South Korea are heavily investing in semiconductor production and power electronics, boosting the demand for SiC-based components. The region is also a major hub for solar energy projects and 5G network expansion, where silicon carbide plays an importantrole in enhancing efficiency and performance. With government support, increasing EV adoption, and rapid industrialization, Asia Pacific is set to remain the dominant player in the global Silicon carbide market over the coming years.

Fastest Growing Region in the Silicon Carbide Market

North America region will see significant growth over the forecast period, driven by growth in investments in electric vehicles (EVs), renewable energy, and semiconductor manufacturing. The US and Canada are expanding their domestic chip production through government initiatives like the CHIPS Act, boosting the demand for silicon carbide components. Additionally, the region's focus on clean energy projects, industrial automation, and 5G infrastructure is enhancing the adoption of SiC-based power electronics. With strong support for technological advancements and sustainability, North America is set to become a key market for Silicon Carbide, driving innovation and industrial growth across multiple sectors.

By Region

North America

Europe

- Germany

- The U.K.

- France

- Italy

- Russia

- Spain

- Benelux

- Nordic

- Rest of Europe

Asia-Pacific

- China

- Japan

- South Korea

- India

- ANZ

- ASEAN

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Argentina

- Colombia

- Rest of Latin America

Middle East & Africa

- Saudi Arabia

- UAE

- South Africa

- Israel

- Egypt

- Rest of MEA

Competitive Landscape

The Silicon Carbide market is highly competitive, with key players focusing on technological advancements, capacity expansion, and strategic partnerships to strengthen their market position. Leading companies like STMicroelectronics, Infineon Technologies, and ON Semiconductor are investing in new manufacturing facilities and larger 200mm wafers to improve efficiency and reduce costs.

Competition is driven by the rising demand for SiC-based power electronics in electric vehicles (EVs), renewable energy, and industrial applications. As more industries shift toward high-performance and energy-efficient solutions, companies are racing to develop innovative and cost-effective Silicon Carbide products.

Some of the prominent players in the Global Silicon Carbide are:

- STMicroelectronics NV

- Toshiba Corp

- Infineon Technologies

- On Semiconductors

- Hitachi

- Saint Gobian

- Keith Company

- General Electric

- Norstel AB

- Littlefuse Inc

- Keyvest

- Fiven ASA

- Keith Company

- Morgan Advanced Materials

- Imerys

- Tokai Carbon Co Ltd

- NGK Insulators Ltd

- Five ASA

- Superior Graphite

- Other Key Players

Recent Developments

- In December 2024, onsemi announced its plans to acquire Qorvo’s Silicon Carbide Junction Field-Effect Transistor (SiC JFET) business, including its United Silicon Carbide subsidiary, for USD 115 million in cash, which strengthens onsemi’s EliteSiC power portfolio, enhancing energy efficiency and power density in AI data center power supply units. It also accelerates onsemi’s expansion into EV battery disconnects and solid-state circuit breakers (SSCBs). SiC JFETs offer low on-resistance, compatibility with standard drivers, faster development, lower energy use, and cost savings, benefiting power supply designers and data center operators.

- In September 2024, STMicroelectronics launched its fourth-generation STPOWER SiC MOSFET technology, setting new standards in power efficiency, density, and durability. Designed for automotive and industrial applications, it is mainly optimized for EV traction inverters, a key component in powertrains. The company plans to introduce further SiC innovations through 2027. Marco Cassis, President of Analog, Power & Discrete, MEMS, and Sensors Group, emphasized STMicroelectronics’ commitment to electric mobility and industrial efficiency, highlighting advancements in SiC devices, packaging, and power modules, along with a vertically integrated manufacturing strategy for performance and supply resilience.

- In September 2024, Wolfspeed, Inc introduced a 2300V baseplate-less SiC power module for 1500V DC Bus applications, enhancing efficiency, durability, and scalability in renewable energy, energy storage, and fast-charging sectors. Built on 200mm SiC wafers, the module improves power conversion. Further, the company also announced a partnership with EPC Power, which will integrate these modules into utility-grade solar and energy storage systems, ensuring high-performance controls, scalability, and system redundancy.

- In October 2023, DENSO CORPORATION, announced an investment of USD 500 million in Silicon Carbide LLC, Coherent Corp.’s SiC business, now an independent subsidiary. Specializing in SiC wafer production, this investment secures long-term stable supply for DENSO’s electrification components. With this move, DENSO acquires a 12.5% equity stake in Silicon Carbide LLC.

Report Details

| Report Characteristics |

| Market Size (2025) |

USD 5.7 Bn |

| Forecast Value (2034) |

USD 77.6 Bn |

| CAGR (2025–2034) |

33.7% |

| Historical Data |

2019 – 2024 |

| The US Market Size (2025) |

USD 1.2 Bn |

| Forecast Data |

2025 – 2033 |

| Base Year |

2024 |

| Estimate Year |

2025 |

| Report Coverage |

Market Revenue Estimation, Market Dynamics, Competitive Landscape, Growth Factors, etc. |

| Segments Covered |

By Device (SiC Discrete Devices and SiC Modules), By Wafer Size (Up to 150 mm and More than 150 mm), By Product (Greeen SiC and Black SiC), By Vertical (Automotive, Energy & Power, Industrial, Transportation, Telecommunications, and Others) |

| Regional Coverage |

North America – US, Canada;

Europe – Germany, UK, France, Russia, Spain, Italy, Benelux, Nordic, Rest of Europe;

Asia-Pacific – China, Japan, South Korea, India, ANZ, ASEAN, Rest of APAC;

Latin America – Brazil, Mexico, Argentina, Colombia, Rest of Latin America;

Middle East & Africa – Saudi Arabia, UAE, South Africa, Turkey, Egypt, Israel, Rest of MEA

|

| Prominent Players |

STMicroelectronics NV, Toshiba Corp, Infineon Technologies, On Semiconductors, Hitachi, Saint Gobian, Keith Company, General Electric, Norstel AB, Littlefuse Inc, Keyvest, Fiven ASA, Keith Company, Morgan Advanced Materials, Imerys, Tokai Carbon Co Ltd, NGK Insulators Ltd, Five ASA, Superior Graphite, and Other Key Players |

| Purchase Options |

We have three licenses to opt for: Single User License (Limited to 1 user),

Multi-User License (Up to 5 Users), and

Corporate Use License (Unlimited User) along with free report customization equivalent to

0 analyst working days, 3 analysts working days, and 5 analysts working days respectively.

|

Frequently Asked Questions

How big is the Global Silicon Carbide Market?

▾ The Global Silicon Carbide Market size is expected to reach a value of USD 5.7 billion in 2025 and is expected to reach USD 77.6 billion by the end of 2034.

Which region accounted for the largest Global Silicon Carbide Market?

▾ Asia Pacific is expected to have the largest market share in the Global Silicon Carbide Market with a share of about 51.7% in 2025.

How big is the Silicon Carbide Market in the US?

▾ The Silicon Carbide Market in the US is expected to reach USD 1.2 billion in 2025.

Who are the key players in the Global Silicon Carbide Market?

▾ Some of the major key players in the Global Silicon Carbide Market are STMicroelectronics NV, Toshiba Corp, Infineon Technologies, and others

What is the growth rate in the Global Silicon Carbide Market?

▾ The market is growing at a CAGR of 33.7 percent over the forecasted period.