Silicon Photonics is an emerging field that uses photonic devices to increase data processing & transfer within microchips. It holds silicon as the medium for data transmission. Manufacturers are adopting this technology to improve data center performance, particularly with the growing need for faster data transfer speeds driven by 5G technology, 5g Services & increased bandwidth demand. This innovation promises more efficient data traffic routing & cost-effective transformation of 5G networks.

ℹ

To learn more about this report –

Download Your Free Sample Report Here

The Silicon Photonics Market is witnessing rapid expansion due to rising demand for high-speed data transmission and optical communication systems. Silicon photonics provides an effective solution for dealing with bandwidth limitations across data centers, telecom networks, and cloud computing environments; additionally, 5G networks and AI technologies further accelerate this demand for advanced photonic solutions.

Recent technological innovations, including integrating silicon photonic chips with traditional electronics, have drastically enhanced the efficiency and scalability of optical interconnects. These advancements help reduce power consumption while increasing performance; furthermore, there has been increasing interest among manufacturers in creating photonic devices for quantum computing that could unlock additional processing power capabilities.

The Silicon Photonics Market growth opportunities are propelled by demand for eco-friendly and energy-saving solutions. Silicon-based photonic devices have many distinct advantages over other materials in terms of cost and scalability. Furthermore, edge computing, along with autonomous vehicles,

electric vehicles and sensors, has opened new pathways for silicon photonics use and expanded its market potential across various industries.

The Silicon Photonics Market will be prominently featured at events like the Silicon Photonics Conference 2024 and Photonics West. These conferences will focus on the latest advancements in silicon photonics technology, exploring its applications in data centers, telecommunications, and high-performance computing. Experts will discuss innovations driving the market's growth and future opportunities.

As per statista Data communication is expected to contribute 393.5 million U.S. dollars to the global silicon photonics market in 2021, while the telecommunications sector is projected to generate 317 million U.S. dollars in the same period. These figures underline the growing importance of both industries in the expansion of silicon photonics technology worldwide.

Key Takeaways

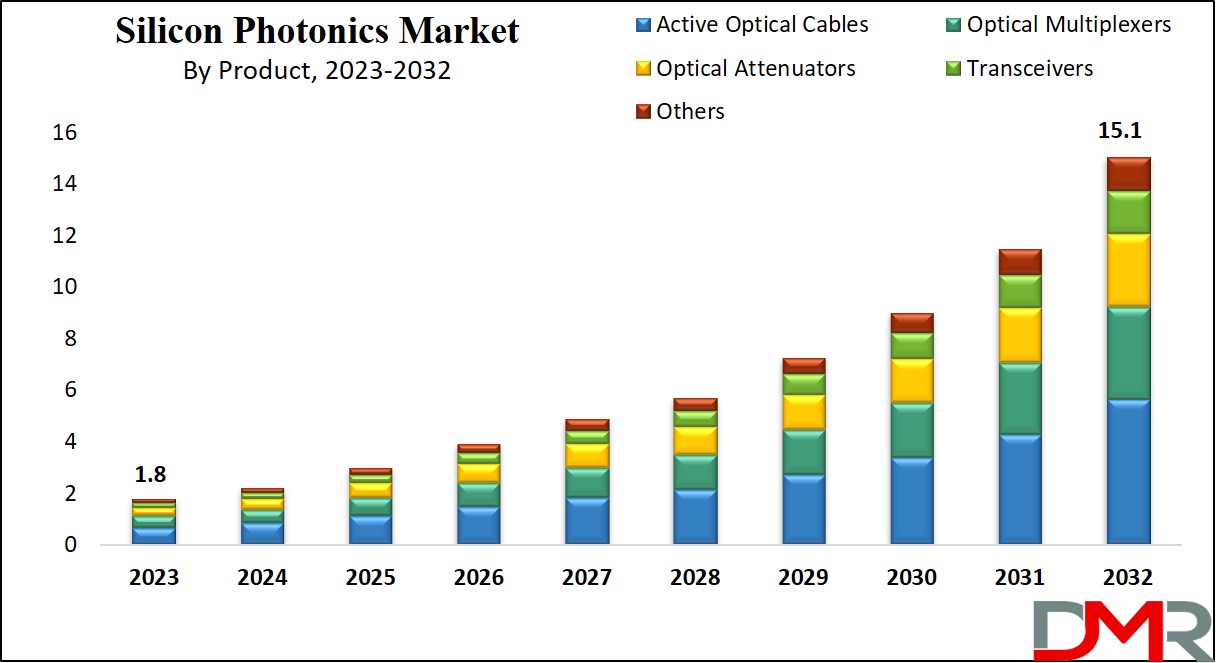

- Strong Market Growth: The Global Silicon Photonics Market is valued at USD 1.8 billion in 2023 and is projected to reach USD 15.1 billion by 2032, expanding at a CAGR of 26.7%. Growth is fueled by demand for high-speed data transmission, 5G adoption, cloud computing, and AI-driven applications.

- Component Insights: WDM (Wavelength-Division Multiplexing) Filters hold a leading position in 2023, enabling efficient multi-channel data transfer on a single silicon chip. Innovations focus on reducing insertion loss, improving integration density, and expanding wavelength ranges to meet data-intensive needs.

- Product Insights: Active Optical Cables (AOCs) dominate the market in 2023 due to their cost-effectiveness, scalability, and easy deployment for high-performance computing and storage. Meanwhile, optical multiplexers are expected to witness significant growth, supporting enhanced WDM systems.

- Application Landscape: The IT & telecom sector is the largest revenue contributor, driven by rising data center deployments, cloud computing, and 5G networks. Healthcare, defense, and consumer electronics are also adopting silicon photonics for biosensing, imaging, and high-speed secure communications.

- Regional Outlook: North America leads with 49.2% market share in 2023, supported by strong R&D, presence of leading companies, and integration of silicon photonics in telecom and HPC systems. Asia-Pacific is the fastest-growing region, driven by heavy investments in China, Japan, and South Korea, along with large-scale manufacturing capabilities.

Use Cases

- Data Centers & Cloud Computing: Silicon photonics enables ultra-fast optical interconnects that improve bandwidth, reduce latency, and lower energy consumption, making it essential for hyperscale data centers and cloud infrastructure providers.

- 5G & Telecom Networks: Telecom operators adopt silicon photonic transceivers and WDM systems to support high-capacity, long-distance optical communication, ensuring seamless connectivity for 5G backhaul, metro, and core networks.

- Healthcare & Biosensing: Silicon photonic biosensors are increasingly used in medical diagnostics and imaging, enabling compact, accurate, and high-speed detection for applications like point-of-care testing, lab diagnostics, and advanced imaging systems.

- Quantum Computing & High-Performance Computing (HPC): Researchers and tech companies integrate silicon photonics into quantum processors and HPC systems to achieve massive parallel processing, faster data routing, and lower power usage.

- Autonomous Vehicles & Edge Computing: Silicon photonics supports LiDAR sensors, high-speed communication, and real-time data transfer in autonomous vehicles, while also enhancing edge computing devices with faster processing and improved efficiency.

Market Dynamic

Silicon photonics is enhancing medical diagnosis by allowing the development of high-speed diagnostic kits for use in various settings, including homes, labs, & point-of-care situations, which is driven by the fast, accurate, versatile, & compact nature of silicon photonic biosensors in analyzing a large range of substances.

Moreover, the majority of critical health information will depend on imaging data from hospitals, labs, & imaging centers. Further, silicon photonics technology is anticipated to fulfill the need for quick data transmission, resulting in a predicted growth in adoption & substantial market growth.

However, challenges arise in the market, particularly with shrinking & complex devices, due to thermal effects resulting from silicon's light absorption, potentially heating up the device and causing performance issues or failures. Integrating electronic & photonic devices on the same chip provides another concern, as heat from these components can impact their performance, while powerful laser sources may harm devices through thermal expansion, which restrains the growth of the overall market.

Research Scope and Analysis

By Component

In terms of components, the WDM (Wavelength-Division Multiplexing) Filters segment takes a leading position, contributing significantly to market share in 2023. It plays a major role by enabling the combination of a number of wavelength channels onto a single silicon chip, which is made possible through the unique compatibility of silicon with both electronic & photonic components, enabling the inclusion of these filters alongside other important photonic & electronic functions.

Further, the current trends in WDM filters for silicon photonics are centered on improving integration density to accommodate numerous wavelength channels on a single chip. These efforts aim at reducing insertion loss & crosstalk, thereby enhancing the filter's performance for enhanced efficiency & reliability.

Additionally, there is a push to expand the range of wavelengths, integrate more functionalities, & explore cost-effective manufacturing processes. Researchers are also looking at advanced material systems, like silicon nitride, to improve the performance of WDM filters. These collective trends are driving the evolution of silicon photonics technology, allowing the transmission of high-capacity data in compact & cost-effective systems.

ℹ

To learn more about this report –

Download Your Free Sample Report Here

By Product

Based on product, the market is categorized into, Active Optical Cables, Transceivers, Optical Multiplexers, Optical Attenuators, and more. In 2023, AOC (Active Optical Cables) takes the lead in terms of generating revenue. Active Optical Cables are handy at fast transferring large volumes of data across a wide range of distances via using silicon photonic technology.

Further AOCs have high cost-effectiveness when compared to conventional optical modules, & they provide a streamlined installation process, making them an opt choice for high-performance computing & storage applications.

Moreover, the optical multiplexers segment is anticipated to have significant growth in the coming future. Optical multiplexers & demultiplexers are important components within wavelength-division multiplexing systems, enabling the transmission of multiple wavelengths over a single optical fiber. The latest trends in this product category center on accomplishing more channels, compact designs, different insertion losses, & compatibility with several; wavelength bands.

By Application

In terms of application, the IT & telecom sector stands out as the major contributor to revenue in the silicon photonics market in 2023, which is particularly dominant in the data center industry, where the trends are geared towards achieving rapid data transfer speed, higher bandwidth capacity, better energy efficiency, & the ability to scale up.

Silicon photonics technology plays a major role in developing high-speed optical connections, optical switches, & other components that meet the need of growth in requirements for data-intensive applications like cloud computing, AI, &

big data analytics.

Further, telecom is another critical area where silicon photonics is making a significant impact. In the telecom sector, the companies aim to deploy silicon photonics-based devices for high-speed optical communications, both for long-haul & metro networks.

This industry is experiencing development in technologies like Wavelength WDM, optical amplifiers, & coherent transmission systems, which together allow higher data speeds, large transmission distances, & overall enhanced network performance.

The Global Silicon Photonics Market Report is segmented on the basis of the following:

By Component

- WDM Filters

- Optical Waveguides

- Optical Modulators

- Laser

- Photodetectors

By Product

- Active Optical Cables

- Transceivers

- Optical Multiplexers

- Optical Attenuators

- Others

By Application

- IT & Telecom

- Healthcare & Life Sciences

- Consumer Electronics

- Defense & Security

- Commercial

- Others

Regional Analysis

Among all the regions, North America leads the way in the market with a substantial

49.2% revenue share in 2023, mainly driven by the region's strong emphasis on developing & adopting silicon photonics technology, which is due to major investments in R&Ds, collaborations between educational & industrial sectors, and the presence of key silicon photonics companies.

North America has constantly integrated silicon photonics into data centers, telecom networks, & high-performance computing systems. It continues to be at the lead of silicon photonics innovation, with an aim of achieving high data speeds, enhanced energy efficiency, & high-end applications like quantum computing & sensing.

Meanwhile, the Asia Pacific region is the fastest-growing region due to the presence of many key players in the silicon photonics market. Countries such as China, Taiwan, Japan, & South Korea are making significant investments in the advancement of silicon photonics technology & its several applications, which is assisted by the establishment of research institutes, government-driven initiatives, & collaborative efforts to encourage innovation in silicon photonics.

The region also possesses a significant presence in the manufacturing & fabrication of silicon photonics components, contributing to affordability & scalability in this evolving market.

By Region

North America

Europe

- Germany

- The U.K.

- France

- Italy

- Russia

- Spain

- Benelux

- Nordic

- Rest of Europe

Asia-Pacific

- China

- Japan

- South Korea

- India

- ANZ

- ASEAN

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Argentina

- Colombia

- Rest of Latin America

Middle East & Africa

- Saudi Arabia

- UAE

- South Africa

- Israel

- Egypt

- Rest of MEA

Competitive Landscape

The competition in the market depends on various factors, like the strength of competitive tactics & how concentrated the market is among established players who have invested heavily in their products. While startups & emerging players experience the challenge of the requirement of significant investments, companies can expand by implementing strong competitive strategies. As a result, the level of competition within the market is steadily on the rise.

Like, in October 2022, Marvell Technology unveiled an advanced 3nm silicon platform, which includes essential components such as SerDes, Gen6 PHY, & PCIe, and is designed to work smoothly with Marvell's range of PHY, electro-optics, & 5G basebands, enhancing their overall product portfolio.

Some of the prominent players in the Global Silicon Photonics Market are

- Cisco System Inc

- Intel Corp

- Marvell Technology Group

- STMicroelectronics

- Molex Inc

- Mellanox Technologies

- GlobalFoundries

- Finisar Corp

- DAS Photonics

- Jupiter Networks

- Other Key Players

Recent Developments

- March 2025: A pioneering international research team unveiled the first electrically pumped Group IV laser directly grown on silicon wafers using silicon-germanium-tin layers. This key breakthrough integrates seamlessly with CMOS fabrication, offering low-power (~5 mA at 2 V) operation and marking a significant stride toward efficient, scalable photonic integrated circuits.

- March 2025: In related advances toward next-gen connectivity, TSMC achieved a milestone by integrating co-packaged optics (CPO) using micro-ring modulators fabricated with its 3 nm process. This enables optical interconnects achieving up to 1.6 terabit transmission, with broad implications for AI and high-performance computing architectures.

- March 2025: Lightwave Logic announced controlled availability of a process design kit (PDK) to integrate their proprietary electro-optic (EO) polymers into silicon photonic integrated circuits (Si-PICs)—a move to overcome bandwidth and efficiency limitations in high-speed data applications.

- May 2025: AMD acquired Enosemi, a Silicon Valley startup specializing in photonic integrated circuit IP. The acquisition strengthens AMD’s capabilities in silicon photonics and co-packaged optics for next-gen AI systems, positioning it as a full-stack AI solutions provider.

Report Details

| Report Characteristics |

| Market Size (2023) |

USD 1.8 Bn |

| Forecast Value (2032) |

USD 15.1 Bn |

| CAGR (2023-2032) |

26.7% |

| Historical Data |

2017 - 2022 |

| Forecast Data |

2023 - 2032 |

| Base Year |

2022 |

| Estimate Year |

2023 |

| Report Coverage |

Market Revenue Estimation, Market Dynamics, Competitive Landscape, Growth Factors and etc. |

| Segments Covered |

By Component (WDM Filters, Optical Waveguides, Optical Modulators, Laser, and Photodetectors), By Product (Active Optical Cables, Transceivers, Optical Multiplexers, Optical Attenuators, and Others), By Application (IT & Telecom, Healthcare & Life Sciences, Consumer Electronics, Defense & Security, Commercial, and Others) |

| Regional Coverage |

North America – The US and Canada; Europe – Germany, The UK, France, Russia, Spain, Italy, Benelux, Nordic, & Rest of Europe; Asia- Pacific– China, Japan, South Korea, India, ANZ, ASEAN, Rest of APAC; Latin America – Brazil, Mexico, Argentina, Colombia, Rest of Latin America; Middle East & Africa – Saudi Arabia, UAE, South Africa, Turkey, Egypt, Israel, & Rest of MEA |

| Prominent Players |

Cisco System Inc, Intel Corp, Marvel Technology Group, STMicroelectronics, Molex Inc, Mellanox Technologies, GlobalFoundries, Finisar Corp, DAS Photonics, Juipter Networks, and Other Key Players |

| Purchase Options |

We have three licenses to opt for: Single User License (Limited to 1 user), Multi-User License (Up to 5 Users), and Corporate Use License (Unlimited User) along with free report customization equivalent to 0 analyst working days, 3 analysts working days and 5 analysts working days respectively. |