Market Overview

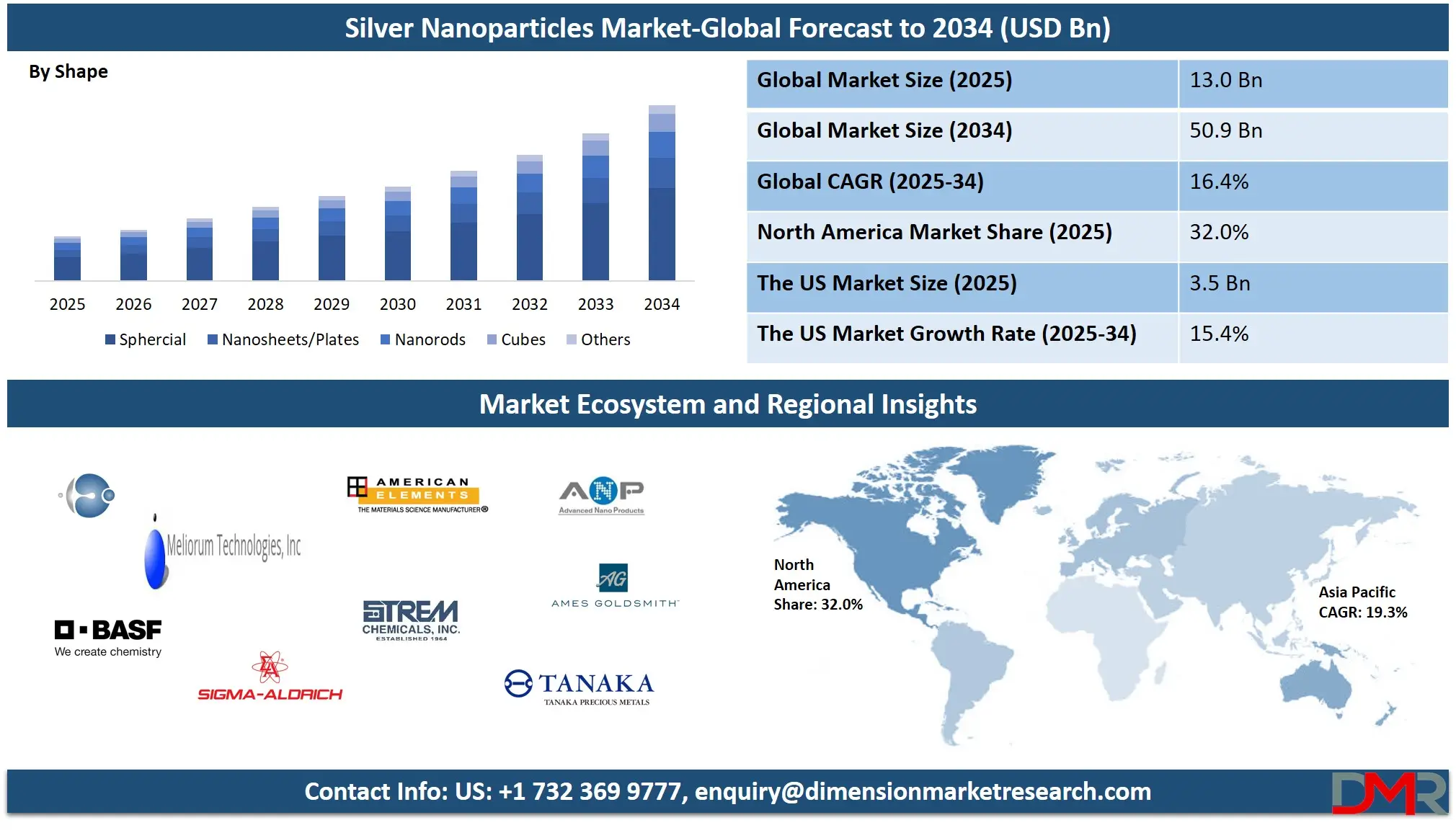

The Global Silver Nanoparticles Market is projected to reach USD 13.0 billion in 2025, growing at a CAGR of 16.4%, and is expected to surpass USD 50.9 billion by 2034. Market growth is driven by rising demand in antimicrobial coatings, nanomedicine, conductive inks, and advanced electronics, with growing adoption across healthcare, textiles, and food packaging industries.

ℹ

To learn more about this report –

Download Your Free Sample Report Here

Silver nanoparticles are ultra-small particles of silver that typically range in size from 1 to 100 nanometers. These particles exhibit remarkable physical, chemical, and biological properties that differ significantly from their bulk silver counterparts. Known for their potent antimicrobial activity, high electrical conductivity, and catalytic capabilities, silver nanoparticles have found widespread applications across diverse fields, including healthcare, electronics, food packaging, water purification, and textiles.

Their high surface-area-to-volume ratio enhances their reactivity and effectiveness, making them essential in modern nanotechnology applications, especially where miniaturization and enhanced performance are crucial. In recent years, their synthesis using green chemistry methods has gained attention, reflecting the growing demand for sustainable and eco-friendly nanomaterials.

The global silver nanoparticles market has witnessed significant growth over the past few years, primarily driven by the expanding demand in biomedical applications, conductive inks for printed electronics, and antimicrobial coatings for packaging and textiles.

The rising focus on infection control, especially in the post-pandemic world, has accelerated the adoption of silver-based antimicrobial agents in hospital environments, medical devices, and pharmaceutical formulations. Additionally, the increased investment in nanotechnology research, combined with innovations in synthesis methods, including chemical, biological, and physical processes, has bolstered market expansion and product diversification.

ℹ

To learn more about this report –

Download Your Free Sample Report Here

Regionally, North America and the Asia Pacific are dominating the silver nanoparticles industry, supported by strong R&D infrastructure, large-scale electronics manufacturing, and growing healthcare spending. Europe is showing a steady shift towards green synthesis technologies and regulatory compliance, while emerging markets in Latin America and the Middle East are gradually embracing nanomaterial solutions in water treatment and food safety.

The overall market trajectory is shaped by advancements in nanoscience, growing environmental awareness, and the rising trend of integrating nanoparticles into next-generation smart materials, biosensors, and wearable devices.

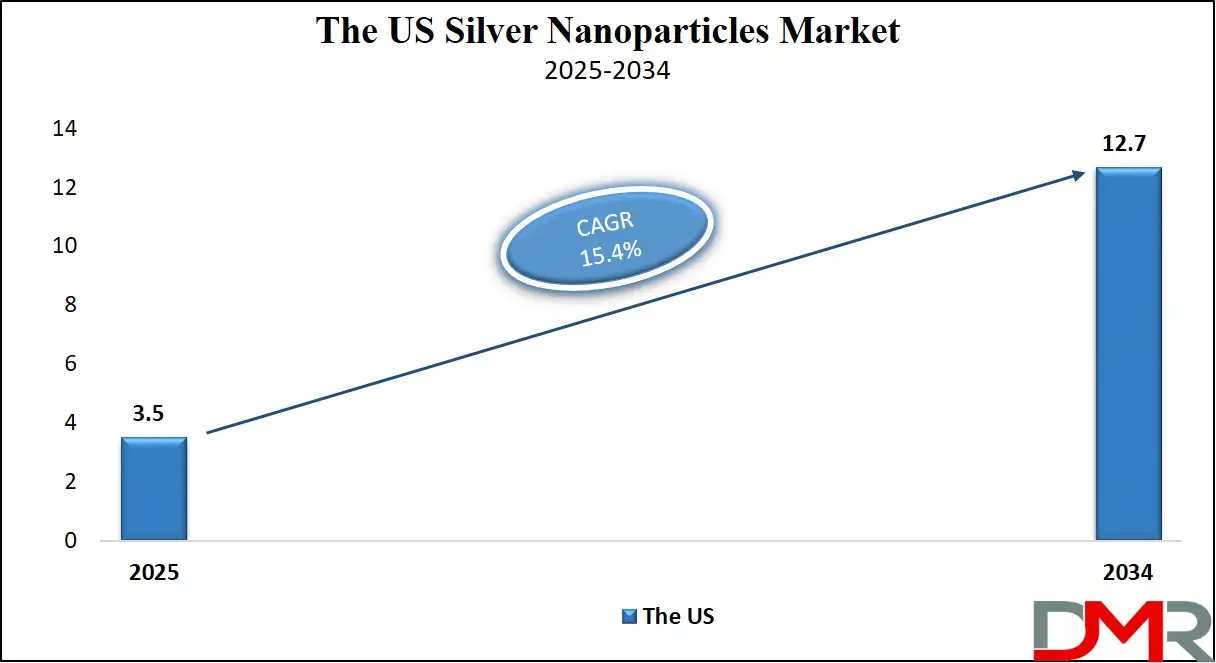

The US Silver Nanoparticles Market

The U.S. Silver Nanoparticles Market size is projected to be valued at USD 3.5 billion in 2025. It is further expected to witness subsequent growth in the upcoming period, holding USD 12.7 billion in 2034 at a CAGR of 15.4%.

The U.S. silver nanoparticles market is experiencing robust expansion, primarily driven by advancements in nanotechnology applications across healthcare, electronics, and environmental sectors.

The country remains a global leader in R&D investment, fostering innovation in nanoscale materials and their integration into high-performance products. Silver nanoparticles are widely utilized in the U.S. for their potent antimicrobial properties, making them essential in wound care, surgical instruments, and hospital surfaces.

The ongoing push for infection control and bio-safe materials in clinical settings has further elevated the role of these nanomaterials in medical device manufacturing and pharmaceutical formulations. Additionally, the emergence of personalized medicine and drug delivery systems continues to create new avenues for silver nanotechnology in biomedicine.

ℹ

To learn more about this report –

Download Your Free Sample Report Here

Beyond healthcare, the U.S. market also benefits from the growing incorporation of silver nanoparticles in printed electronics, conductive adhesives, and flexible circuits. These applications are gaining momentum due to the rapid proliferation of wearable devices, IoT infrastructure, and next-gen sensors.

The strong presence of nanomaterial manufacturers, research universities, and innovation-focused startups supports the domestic ecosystem for nanosilver development. Regulatory agencies in the U.S. are also shaping the market landscape by promoting safe and sustainable use of engineered nanomaterials.

Moreover, industries such as textiles and food packaging are leveraging nanosilver’s antimicrobial efficiency to enhance product functionality, shelf life, and consumer safety. This cross-sectoral demand positions the U.S. silver nanoparticles market as a critical hub for innovation and commercial application.

The Europe Silver Nanoparticles Market

The European silver nanoparticles market is projected to reach approximately USD 2.7 billion in 2025, driven by the region’s strong regulatory framework, technological maturity, and diverse industrial applications. European countries are at the forefront of integrating silver nanoparticles into healthcare, packaging, and environmental sectors, particularly in antimicrobial coatings, diagnostic devices, and sustainable food packaging.

The region has demonstrated a high level of adoption in hospital infection control practices and pharmaceutical innovations, where nanosilver plays a critical role. Germany, France, and the UK lead the way in both research and commercialization, benefiting from close collaboration between academia, startups, and established material science companies.

With a projected CAGR of 14.8% from 2025 to 2034, Europe’s growth trajectory is underpinned by growing investments in green synthesis technologies and stringent environmental compliance measures. The EU’s emphasis on sustainability is pushing companies to develop eco-friendly nanoparticle formulations, especially in the cosmetics, medical, and consumer goods sectors.

Additionally, advancements in printed electronics and smart textiles, where nanosilver enhances functionality and conductivity, are opening new commercial pathways. As awareness around nanotoxicity and consumer safety grows, Europe is expected to remain a benchmark for quality, regulation, and responsible innovation in the global silver nanoparticles market.

The Japan Silver Nanoparticles Market

Japan’s silver nanoparticles market is estimated to be valued at approximately USD 900 million in 2025, reflecting its strong foundation in advanced materials and nanotechnology innovation. The country's robust electronics and semiconductor industry plays a central role in driving demand, with silver nanoparticles widely used in conductive inks, printed sensors, and flexible electronic components.

Japanese firms are also actively integrating nanosilver into high-performance coatings and medical textiles, supporting applications in healthcare and infection control. Additionally, Japan’s aging population and advanced healthcare infrastructure continue to create demand for nanosilver-enabled solutions in wound care, diagnostics, and antimicrobial surfaces.

With a projected CAGR of 13.5% from 2025 to 2034, Japan’s growth is expected to be steady, supported by government-backed R&D initiatives and the country’s precision-driven approach to manufacturing. The emphasis on high-quality, durable, and miniaturized products positions silver nanoparticles as a key material for next-generation technologies in both consumer and industrial segments.

Moreover, growing interest in green synthesis and bio-compatible nanomaterials aligns with Japan’s environmental commitments and regulatory direction. As global demand for smart electronics, wearable devices, and sustainable healthcare solutions rises, Japan is set to retain its status as a high-value contributor to the silver nanoparticles market.

Global Silver Nanoparticles Market: Key Takeaways

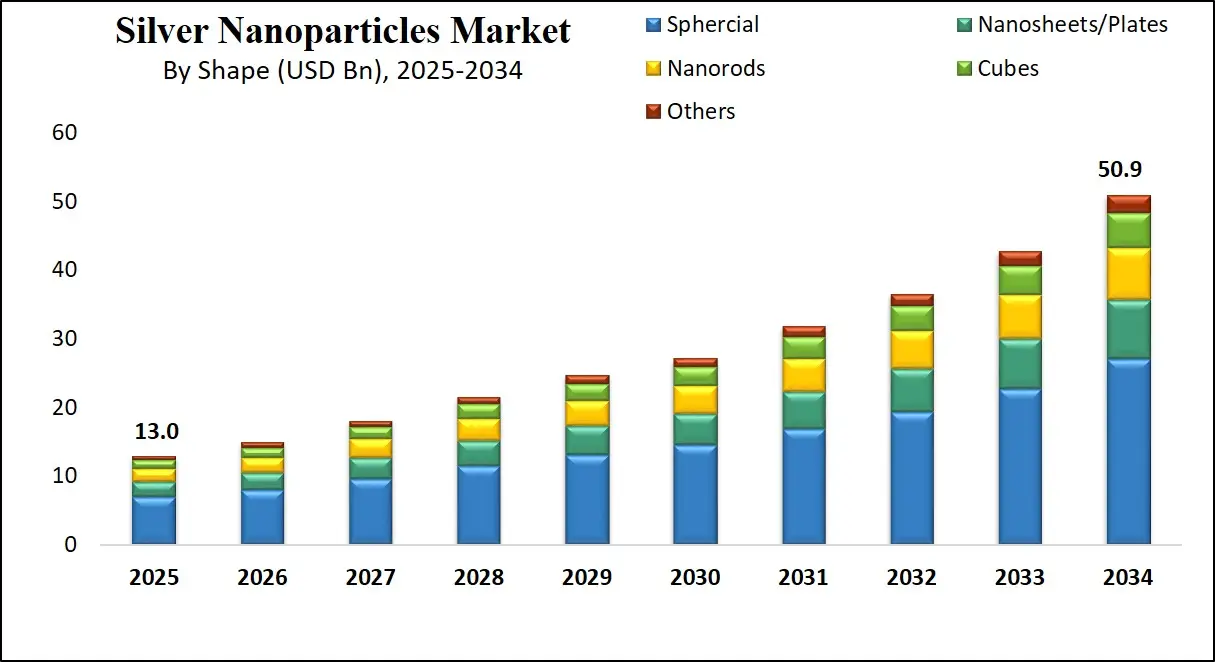

- Market Value: The global silver nanoparticles market size is expected to reach a value of USD 50.9 billion by 2034 from a base value of USD 13.0 billion in 2025 at a CAGR of 16.4%.

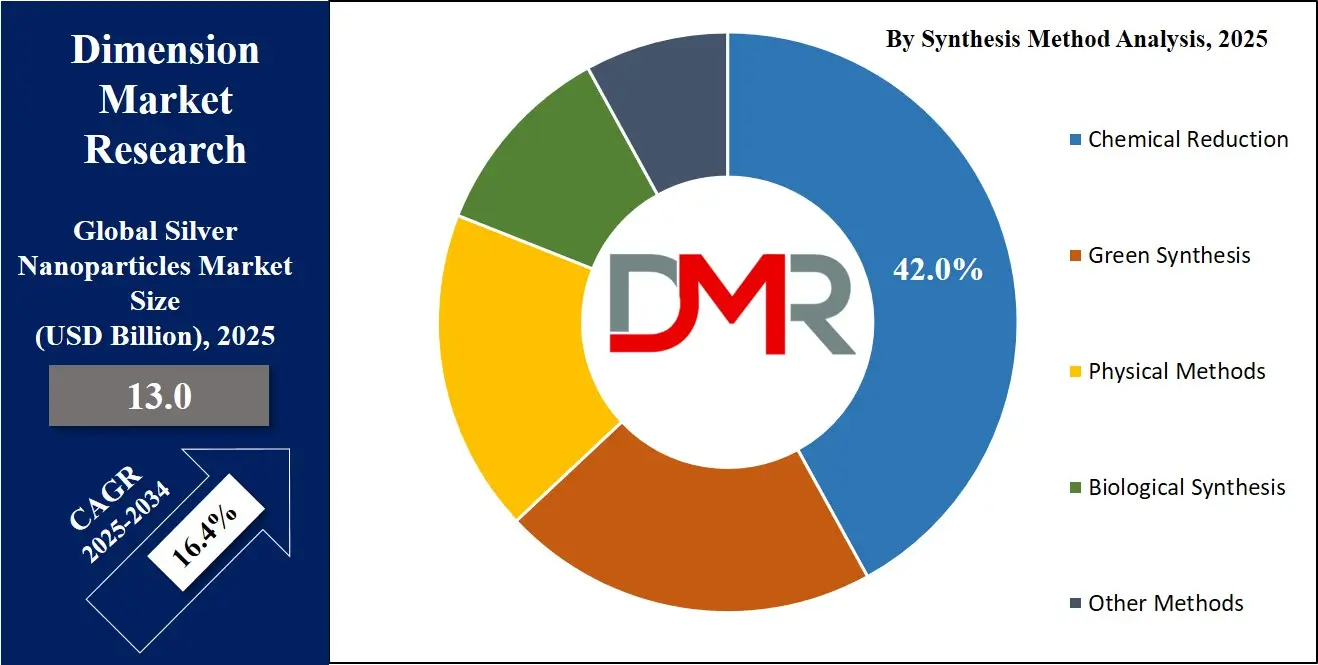

- By Synthesis Method Segment Analysis: Chemical Reduction is anticipated to dominate the synthesis method segment, capturing 42.0% of the total market share in 2025.

- By Shape Segment Analysis: Spherical shape is poised to consolidate its dominance in the shape segment, capturing 53.0% of the total market share in 2025.

- By Particle Size Segment Analysis: 11–50 nm particle size is expected to maintain its dominance in the particle size segment, capturing 46.0% of the total market share in 2025.

- By Application Segment Analysis: Healthcare & Pharmaceuticals applications will dominate the application segment, capturing 31.0% of the market share in 2025.

- By End User Industry Segment Analysis: The Medical & Healthcare industry will capture the major share in the end user industry, capturing 33.0% of the total market share in 2025.

- Regional Analysis: North America is anticipated to lead the global silver nanoparticles market landscape with 32.0% of total global market revenue in 2025.

- Key Players: Some key players in the global silver nanoparticles market are NanoComposix, Meliorum Technologies, BASF SE, Sigma-Aldrich (Merck), American Elements, Strem Chemicals, Tanaka Holdings, Advanced Nano Products, Ames Goldsmith, Cnano Technology, NovaCentrix, Applied Nanotech Holdings, ABC Nanotech, and Others.

Global Silver Nanoparticles Market: Use Cases

- Antimicrobial Coatings in Healthcare and Medical Devices: Silver nanoparticles are widely adopted in the healthcare sector due to their strong antimicrobial properties. These nanoparticles are used to coat surgical tools, wound dressings, hospital surfaces, and implantable devices to prevent infections and ensure patient safety. Their effectiveness against a broad range of pathogens, including drug-resistant bacteria, has made them a staple in modern infection control strategies. The medical device industry continues to integrate nanosilver into catheters, orthopedics, and diagnostic equipment, helping reduce hospital-acquired infections and improve overall hygiene standards. This use case is expected to expand with growing concerns about cross-contamination and post-operative infections.

- Printed Electronics and Flexible Circuitry: Silver nanoparticles play a critical role in enabling the next generation of printed and flexible electronics. Thanks to their high electrical conductivity and thermal stability, they are essential in the development of conductive inks used in RFID tags, sensors, flexible displays, and wearable devices. These inks can be printed using techniques like inkjet or screen printing, reducing manufacturing costs and allowing for lightweight, compact device designs. As demand for IoT devices and smart textiles increases, manufacturers are turning to nanosilver-based materials to meet the needs of flexible and stretchable electronics with reliable performance.

- Food Packaging and Preservation: In the food industry, silver nanoparticles are being incorporated into active packaging materials to extend shelf life and inhibit microbial growth. These nanomaterials can be embedded into biodegradable films or polymer coatings to provide a protective barrier against spoilage organisms and pathogens. This application is particularly relevant for fresh produce, meat, dairy, and ready-to-eat meals where contamination risk is high. With growing emphasis on food safety, shelf stability, and eco-friendly packaging solutions, silver nanoparticles are helping brands enhance product quality while reducing food waste and spoilage-related losses.

- Water Treatment and Filtration Systems: Water treatment is another significant use case where silver nanoparticles offer exceptional value. Integrated into filtration systems and purification membranes, they provide long-lasting antimicrobial action against bacteria, viruses, and protozoa. These systems are especially useful in areas lacking access to reliable municipal water sources, including rural or disaster-affected regions. Unlike conventional disinfection methods that rely on harsh chemicals, silver nanoparticle-based solutions are more sustainable and require less frequent replacement. The growing demand for safe, decentralized water purification technologies is expected to further boost their adoption in both household and industrial setups.

Impact of Artificial Intelligence Silver Nanoparticles Market

Artificial intelligence is advancing the silver nanoparticles market by optimizing both research and manufacturing processes, transforming how these tiny particles are designed, produced, and applied.

AI algorithms analyze vast datasets from experiments and simulations to predict optimal synthesis conditions, such as particle size, shape, and concentration, that enhance antimicrobial efficacy or catalytic performance. Machine learning techniques expedite the design of functionalized nanoparticles tailored for targeted drug delivery, environmental remediation, and sensor applications.

In production, AI-driven process monitoring improves yield consistency and reduces waste, while predictive maintenance minimizes downtime in fabrication plants. As AI continues to integrate with nanotechnology, developers can expect smarter innovation cycles, more efficient scale-up, and accelerated deployment of silver nanoparticle-based solutions across healthcare, industrial, and environmental sectors.

Global Silver Nanoparticles Market: Stats & Facts

-

National Institute of Standards and Technology (NIST)

- NIST released a standardized freeze-dried, polymer-coated silver nanoparticle reference material for environmental, health, and safety research.

- Silver nanoparticles are recognized as the most widely used nanomaterial in consumer products, including socks, fabrics, and coatings.

-

U.S. Consumer Product Safety Commission (CPSC)

- In January 2025, CPSC published a technical assessment on children’s consumer products regarding potential exposure to silver nanoparticles.

- The assessment highlighted presence in toys, baby bottles, and antimicrobial coatings in products marketed for hygiene and health benefits.

-

National Institute for Occupational Safety and Health (NIOSH / CDC)

- NIOSH reported that nanoscale silver particles caused early-stage lung inflammation and liver hyperplasia in laboratory rats.

- A Recommended Exposure Limit (REL) of 0.9 μg/m³ (TWA) was proposed for respirable silver nanoparticles (<100 nm), significantly lower than the 10 μg/m³ limit for total silver dust and fumes.

-

U.S. Environmental Protection Agency (EPA)

- The EPA classifies certain silver nanoparticles as pesticides when used for antimicrobial purposes.

- Products like washing machines or air purifiers using nanosilver coatings must comply with the Federal Insecticide, Fungicide, and Rodenticide Act (FIFRA).

-

Employment and Social Development Canada

- Canadian guidelines state that engineered nanoparticles, including silver, pose occupational hazards primarily through inhalation, skin contact, and eye exposure.

- No specific exposure limits have been set in Canada; instead, a precautionary, case-by-case approach is encouraged in workplace settings.

-

Health Canada

- In vitro studies from Health Canada revealed that uncoated silver nanoparticles can increase oxidative stress and impair immune system function in both human and mouse cells.

- Coated nanoparticles showed comparatively lower but still measurable toxicity.

- Health Canada recommends a diverse approach in nanoparticle toxicity testing, including use of multiple species and endpoints.

-

U.S. National Nanotechnology Initiative (NNI)

- The 2022 Economic Census identified over 1,600 U.S.-based companies engaged in nanotechnology R&D, employing over 207,000 people.

- These companies collectively generated approximately USD 44.5 billion in annual revenue, a portion of which is attributed to silver nanoparticle applications.

-

Canada Labour Program & CSA Z12885

- Canada's Labour Program encourages the use of the CSA Z12885 standard for occupational safety involving engineered nanomaterials.

- A control banding approach is recommended to assess exposure risks and implement preventive measures based on toxicity and reactivity.

-

Environmental Exposure Estimates (U.S. Waste Systems)

- An estimated 251 million tubes of toothpaste sold annually in the U.S. contain nanosilver, contributing approximately 3.9 tonnes of silver nanoparticles to wastewater systems each year.

- Environmental models show that 63–91% of silver nanoparticles from consumer products end up in landfills, 7% in water bodies, and roughly 1.5% in the atmosphere.

Global Silver Nanoparticles Market: Market Dynamics

Global Silver Nanoparticles Market: Driving Factors

Rising Demand for Advanced Antimicrobial Solutions

The surge in healthcare-associated infections and antibiotic resistance has intensified the demand for silver nanoparticles as powerful antimicrobial agents. These nanoparticles are incorporated into wound care products, surgical tools, and hospital surfaces due to their ability to eliminate bacteria, viruses, and fungi at the molecular level. The enhanced efficacy of nanosilver in controlling microbial contamination is accelerating its adoption across clinical settings, pharmaceutical applications, and sterilization technologies.

Growth in Flexible Electronics and Printed Devices

The growing popularity of flexible, lightweight electronics, such as wearable health monitors, RFID tags, and foldable smartphones, is fueling the use of conductive inks formulated with silver nanoparticles. These inks allow manufacturers to print electronic circuits on non-traditional substrates like plastic and fabric without compromising performance. With ongoing innovation in printable electronics and roll-to-roll manufacturing, the demand for nanosilver-based conductive materials continues to expand.

Global Silver Nanoparticles Market: Restraints

Environmental and Toxicological Concerns

Despite their effectiveness, silver nanoparticles raise concerns related to environmental persistence and potential toxicity. When disposed of improperly, these nanoparticles may accumulate in water systems and soil, posing risks to aquatic organisms and ecosystems. Moreover, the lack of standardized toxicity assessments and long-term safety studies presents regulatory hurdles and public skepticism, particularly in applications involving food contact and consumer products.

High Production Costs and Scalability Issues

Producing high-purity silver nanoparticles with uniform size and stability remains a costly and technically complex process. Many synthesis methods, especially those offering precise control over morphology and dispersion, require expensive equipment, chemicals, and stringent manufacturing environments. This limits the mass adoption of nanosilver in cost-sensitive sectors and challenges companies aiming for commercial scalability and consistent quality assurance.

Global Silver Nanoparticles Market: Opportunities

Expansion in Nanomedicine and Targeted Drug Delivery

Silver nanoparticles are gaining momentum in the field of nanomedicine, particularly for targeted drug delivery and theranostics. Their small size, functionalizability, and bioavailability make them suitable carriers for site-specific therapeutic agents. With ongoing research into nanosilver-based cancer treatments, antimicrobial gels, and biosensors, pharmaceutical companies have a unique opportunity to develop next-gen therapeutics and diagnostic systems using silver nanomaterials.

Adoption of Sustainable Packaging Solutions

As sustainability becomes a critical concern for manufacturers and consumers, the incorporation of silver nanoparticles into biodegradable and recyclable packaging materials offers a dual benefit: enhanced antimicrobial protection and reduced environmental impact. This is especially relevant for the food and beverage industry, where smart packaging solutions can reduce spoilage and waste. The integration of nanosilver in compostable films and eco-friendly containers is emerging as a lucrative avenue.

Global Silver Nanoparticles Market: Trends

Shift Toward Green Synthesis Techniques

A significant market trend is the movement toward green synthesis of silver nanoparticles using plant extracts, microorganisms, and natural polymers. These eco-friendly methods eliminate the use of hazardous chemicals and minimize toxic by-products, aligning with regulatory preferences and sustainable manufacturing goals. Companies are investing in biogenic nanoparticle production as it offers a cleaner, scalable, and socially responsible alternative.

Integration in Smart Textiles and Wearables

The application of silver nanoparticles in smart fabrics is expanding, driven by demand for antimicrobial clothing, self-cleaning uniforms, and sensor-integrated textiles. Sportswear brands and healthcare apparel manufacturers are embedding nanosilver into fibers to offer odor control, infection resistance, and real-time physiological monitoring. This convergence of nanotechnology and wearable innovation is shaping a new frontier in functional clothing and e-textile development.

Global Silver Nanoparticles Market: Research Scope and Analysis

By Synthesis Method Analysis

Chemical reduction is expected to lead the synthesis method segment of the silver nanoparticles market, accounting for approximately 42.0% of the total market share in 2025. This method remains the most widely adopted due to its scalability, cost-effectiveness, and relative simplicity in producing large quantities of nanoparticles with controlled size and shape.

It involves the reduction of silver salts using chemical reducing agents like sodium borohydride or hydrazine in the presence of stabilizers or surfactants. The resulting nanoparticles exhibit uniformity and high purity, which makes this technique ideal for industrial applications in electronics, healthcare, and coatings. The method also offers versatility, allowing for the production of various shapes and sizes suitable for specific end-use requirements.

ℹ

To learn more about this report –

Download Your Free Sample Report Here

On the other hand, green synthesis is gaining traction as a sustainable and environmentally friendly alternative to conventional chemical routes. This approach utilizes natural reducing agents derived from plant extracts, microorganisms, enzymes, or biodegradable polymers, eliminating the need for toxic chemicals and harsh reaction conditions. Green synthesis aligns with growing regulatory pressure and corporate sustainability goals, especially in regions with strict environmental standards.

Although still emerging in terms of industrial-scale adoption, this method is being explored actively for biomedical, food packaging, and cosmetic applications where biocompatibility and eco-safety are essential. As research advances and scalability improves, green synthesis holds the potential to become a competitive and responsible choice within the broader silver nanoparticles market.

By Shape Analysis

Spherical silver nanoparticles are expected to maintain their dominant position in the shape segment, accounting for approximately 53.0% of the total market share in 2025. This dominance is attributed to the ease and consistency of synthesizing spherical particles using conventional methods such as chemical reduction. Their uniform geometry offers a high surface area-to-volume ratio and stable colloidal behavior, making them ideal for a wide range of applications.

Spherical nanoparticles are especially favored in antimicrobial coatings, medical devices, textiles, and conductive inks due to their predictable interaction with biological systems and consistent dispersion in various solvents. Their production is also more cost-effective and scalable compared to other complex shapes, reinforcing their widespread commercial usage across both mature and emerging industries.

Nanosheets and nanoplate-shaped silver particles represent a smaller yet rapidly evolving segment of the market. These two-dimensional structures offer unique optical, electrical, and catalytic properties that differ significantly from their spherical counterparts. Due to their flat morphology and anisotropic surface characteristics, nanosheets are particularly valuable in advanced applications such as plasmonic sensors, surface-enhanced Raman scattering (SERS), and transparent conductive films.

Their high aspect ratio enhances electron transport and surface reactivity, making them suitable for use in next-generation electronics and energy storage systems. Although their synthesis is more complex and less scalable, ongoing research is focused on optimizing production techniques to harness their full potential in high-performance and niche applications.

By Particular Size Analysis

The 11–50 nm particle size range is expected to retain its dominance in the particle size segment, capturing around 46.0% of the global market share in 2025. This specific size range strikes a favorable balance between reactivity, stability, and ease of handling, which makes it highly versatile across multiple applications. Silver nanoparticles within this size bracket exhibit strong antimicrobial efficiency while maintaining structural integrity in formulations, making them ideal for use in coatings, textiles, medical devices, and electronics.

Additionally, this range is optimal for achieving uniform dispersion in composite materials and inks, enhancing conductivity and functional performance. Manufacturers also prefer this size segment due to its process compatibility and reduced risk of aggregation during synthesis and storage.

On the other hand, silver nanoparticles in the 1–10 nm range, although smaller in market share, offer superior surface reactivity due to their high surface-area-to-volume ratio. These ultra-small nanoparticles demonstrate heightened biological activity and are particularly effective in biomedical and pharmaceutical applications, such as targeted drug delivery, biosensing, and anti-cancer treatments.

Their ability to penetrate biological membranes and interact at the cellular level makes them valuable for advanced therapeutic formulations. However, challenges such as stability, controlled synthesis, and potential cytotoxicity have limited their large-scale commercial adoption. Despite this, continued research and innovation are expected to unlock new use cases for these ultra-fine particles, especially in precision medicine and diagnostics.

By Application Analysis

Healthcare and pharmaceutical applications are projected to lead the application segment in the silver nanoparticles market, accounting for approximately 31.0% of the total share in 2025. This dominance is driven by the widespread use of silver nanoparticles in antimicrobial coatings, wound care dressings, drug delivery systems, surgical instruments, and diagnostic tools.

Their proven effectiveness against a broad spectrum of pathogens, including antibiotic-resistant bacteria, makes them highly suitable for use in hospitals, clinics, and medical device manufacturing.

Additionally, silver nanoparticles are being integrated into pharmaceutical formulations for their anti-inflammatory and antimicrobial properties, further expanding their clinical relevance. The growing focus on infection prevention, especially in post-pandemic healthcare systems, continues to boost their adoption across therapeutic and preventive healthcare solutions.

Electronics and semiconductors form another significant segment in this market, driven by the growing demand for nanosilver in conductive inks, sensors, printed circuits, and transparent electrodes. Silver nanoparticles are favored in this domain due to their exceptional electrical conductivity, thermal stability, and compatibility with flexible and miniaturized electronic components.

They are widely used in the production of RFID tags, touchscreens, solar cells, and wearable electronics. With the rapid advancement of smart devices, 5G technology, and Internet of Things (IoT) infrastructure, the integration of silver nanoparticles into flexible and printed electronics is expected to rise significantly.

Although the electronics segment holds a slightly smaller share than healthcare, its growth trajectory is strong, driven by continuous innovation and demand for high-performance, nano-enabled materials.

By End User Industry Analysis

The medical and healthcare industry is set to capture the largest share in the end-user industry segment of the silver nanoparticles market, accounting for approximately 33.0% of the total market in 2025. This is primarily due to the growing reliance on nanosilver for its antimicrobial, antiviral, and wound-healing properties.

Hospitals and healthcare providers are integrating silver nanoparticles into a range of products, including surgical masks, dressings, catheters, implants, and surface disinfectants, to combat hospital-acquired infections and improve patient outcomes. The ongoing shift toward advanced wound management, integrated with the rising incidence of chronic diseases and post-operative complications, is also contributing to this trend.

Moreover, the integration of silver nanoparticles in drug formulations, nanocarriers, and diagnostic devices continues to strengthen their role in the medical field, particularly as healthcare systems prioritize infection prevention and personalized medicine.

The electronics industry represents another key end user of silver nanoparticles, driven by their excellent electrical conductivity, thermal stability, and nanoscale performance. These properties make silver nanoparticles a critical component in the development of printed electronics, conductive inks, flexible displays, and integrated circuits.

As demand increases for miniaturized and flexible devices, such as wearable tech, RFID sensors, OLED panels, and solar cells, the use of nanosilver in electronic applications is expanding rapidly.

The industry benefits from the ability of silver nanoparticles to support high-speed, low-cost manufacturing processes, especially in the context of roll-to-roll and additive printing technologies. This end-use segment is expected to experience strong growth in parallel with global advances in smart electronics, 5G infrastructure, and consumer demand for high-efficiency, compact devices.

The Silver Nanoparticles Market Report is segmented based on the following

By Synthesis Method

- Chemical Reduction

- Green Synthesis

- Physical Methods

- Biological Synthesis

- Other Methods

By Shape

- Spherical

- Nanosheets/Plates

- Nanorods

- Cubes

- Others

By Particle Size

- 1-10 nm

- 11-50 nm

- 51-100 nm

- >100 nm

By Application

- Healthcare & Pharmaceuticals

- Electronics & Semiconductors

- Textiles

- Food & Beverages Packaging

- Cosmetics & Personal Care

- Water Treatment

- Others

By End User Industry

- Medical & Healthcare

- Electronics Industry

- Textile Industry

- Food Industry

- Personal Care & Cosmetics

- Water Treatment Plants

- Others

Global Silver Nanoparticles Market: Regional Analysis

Region with the Largest Revenue Share

North America is projected to lead the global silver nanoparticles market in 2025, contributing approximately 32.0% of the total global market revenue. This regional dominance is driven by strong research and development capabilities, early adoption of nanotechnology across industries, and robust demand from sectors such as healthcare, electronics, and food packaging.

The presence of major nanomaterial manufacturers, integrated with advanced healthcare infrastructure and strict infection control protocols, has fueled the integration of silver nanoparticles in medical and pharmaceutical applications. Additionally, the region’s thriving electronics industry and rising investment in nano-enabled technologies for sensors, conductive inks, and flexible circuits further solidify North America's leadership in the global market.

ℹ

To learn more about this report –

Download Your Free Sample Report Here

Region with significant growth

The Asia-Pacific region is expected to witness the most significant growth in the silver nanoparticles market over the coming years, driven by rapid industrialization, expanding electronics manufacturing, and growing healthcare expenditure across countries like China, India, South Korea, and Japan.

The region's strong presence in consumer electronics production, integrated with rising demand for antimicrobial solutions in medical and textile applications, is accelerating the adoption of nanosilver technologies.

Moreover, supportive government policies promoting nanotechnology research, the growth of smart manufacturing, and growing awareness of advanced materials in sectors like food packaging and water purification are positioning the Asia-Pacific as a key growth engine for the global market.

By Region

North America

Europe

- Germany

- The U.K.

- France

- Italy

- Russia

- Spain

- Benelux

- Nordic

- Rest of Europe

Asia-Pacific

- China

- Japan

- South Korea

- India

- ANZ

- ASEAN

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Argentina

- Colombia

- Rest of Latin America

Middle East & Africa

- Saudi Arabia

- UAE

- South Africa

- Israel

- Egypt

- Rest of MEA

Global Silver Nanoparticles Market: Competitive Landscape

The global competitive landscape of the silver nanoparticles market is characterized by the presence of both established multinational corporations and specialized nanomaterials companies competing through innovation, strategic partnerships, and technology differentiation. Key players such as BASF SE, Sigma-Aldrich (Merck), and Tanaka Holdings dominate through extensive product portfolios and strong global distribution networks.

Meanwhile, niche players like NanoComposix, Meliorum Technologies, and Cytodiagnostics focus on customized solutions, advanced synthesis techniques, and high-purity nanoparticles tailored for biomedical, electronics, and research applications.

The market is witnessing increased R&D investment, particularly in green synthesis and biocompatible nanomaterials, as companies strive to address regulatory concerns and sustainability demands. Mergers, acquisitions, and collaborations with academic and industrial partners are further shaping the competitive dynamics, especially in high-growth regions like Asia-Pacific and North America.

Some of the prominent players in the global silver nanoparticles market are

- NanoComposix

- Meliorum Technologies

- BASF SE

- Sigma-Aldrich (Merck)

- American Elements

- Strem Chemicals

- Tanaka Holdings Co., Ltd.

- Advanced Nano Products Co., Ltd.

- Ames Goldsmith Corporation

- Cnano Technology

- NovaCentrix

- Applied Nanotech Holdings

- ABC Nanotech Co., Ltd.

- Nanoshel LLC

- BBI Solutions

- Nanostructured & Amorphous Materials, Inc.

- Innova Biosciences

- Cytodiagnostics Inc.

- SkySpring Nanomaterials

- US Research Nanomaterials, Inc.

- Other Key Players

Global Silver Nanoparticles Market: Recent Developments

- January 2025: CD Bioparticles introduced a new range of endotoxin-free silver nanoparticles, available in sizes from 10 to 100 nm with over 99% purity, targeting biomedical and life science applications.

- April 2025: DuPont unveiled its latest silver nanowire products in South Korea, aimed at enhancing conductivity in next-generation electronics and advanced displays.

- January 2024: Applied Nanotech, Inc. commissioned a new pilot plant in the U.S. to scale up production of its NanoFence technology, an antimicrobial coating formulation enhanced with silver nanoparticles.

Report Details

| Report Characteristics |

| Market Size (2025) |

USD 13.0 Bn |

| Forecast Value (2034) |

USD 50.9 Bn |

| CAGR (2025–2034) |

16.4% |

| Historical Data |

2019 – 2024 |

| The US Market Size (2025) |

USD 3.5 Bn |

| Forecast Data |

2025 – 2033 |

| Base Year |

2024 |

| Estimate Year |

2025 |

| Report Coverage |

Market Revenue Estimation, Market Dynamics, Competitive Landscape, Growth Factors, etc. |

| Segments Covered |

By Synthesis Method (Chemical Reduction, Green Synthesis, Physical Methods, Biological Synthesis, and Other Methods), By Shape (Spherical, Nanosheets/Plates, Nanorods, Cubes, and Others), By Particle Size (1–10 nm, 11–50 nm, 51–100 nm, and >100 nm), By Application (Healthcare & Pharmaceuticals, Electronics & Semiconductors, Textiles, Food & Beverages Packaging, Cosmetics & Personal Care, Water Treatment, and Others), and By End User Industry (Medical & Healthcare, Electronics Industry, Textile Industry, Food Industry, Personal Care & Cosmetics, Water Treatment Plants, and Others). |

| Regional Coverage |

North America – US, Canada; Europe – Germany, UK, France, Russia, Spain, Italy, Benelux, Nordic, Rest of Europe; Asia-Pacific – China, Japan, South Korea, India, ANZ, ASEAN, Rest of APAC; Latin America – Brazil, Mexico, Argentina, Colombia, Rest of Latin America; Middle East & Africa – Saudi Arabia, UAE, South Africa, Turkey, Egypt, Israel, Rest of MEA |

| Prominent Players |

NanoComposix, Meliorum Technologies, BASF SE, Sigma-Aldrich (Merck), American Elements, Strem Chemicals, Tanaka Holdings, Advanced Nano Products, Ames Goldsmith, Cnano Technology, NovaCentrix, Applied Nanotech Holdings, ABC Nanotech, and Others. |

| Purchase Options |

We have three licenses to opt for: Single User License (Limited to 1 user), Multi-User License (Up to 5 Users), and Corporate Use License (Unlimited User) along with free report customization equivalent to 0 analyst working days, 3 analysts working days, and 5 analysts working days respectively. |

Frequently Asked Questions

How big is the global silver nanoparticles market?

▾ The global silver nanoparticles market size is estimated to have a value of USD 13.0 billion in 2025 and is expected to reach USD 50.9 billion by the end of 2034.

What is the size of the US silver nanoparticles market?

▾ The US silver nanoparticles market is projected to be valued at USD 3.5 billion in 2025. It is expected to witness subsequent growth in the upcoming period as it holds USD 12.7 billion in 2034 at a CAGR of 15.4%.

Which region accounted for the largest global silver nanoparticles market?

▾ North America is expected to have the largest market share in the global silver nanoparticles market, with a share of about 32.0% in 2025.

Who are the key players in the global silver nanoparticles market?

▾ Some of the major key players in the global silver nanoparticles market are Deloitte, PwC, ET, KPMG, Accenture, IBM, BDO, Protiviti, FTI Consulting, and Others.

What is the growth rate of the global silver nanoparticles market?

▾ The market is growing at a CAGR of 16.4 percent over the forecasted period.