Market Overview

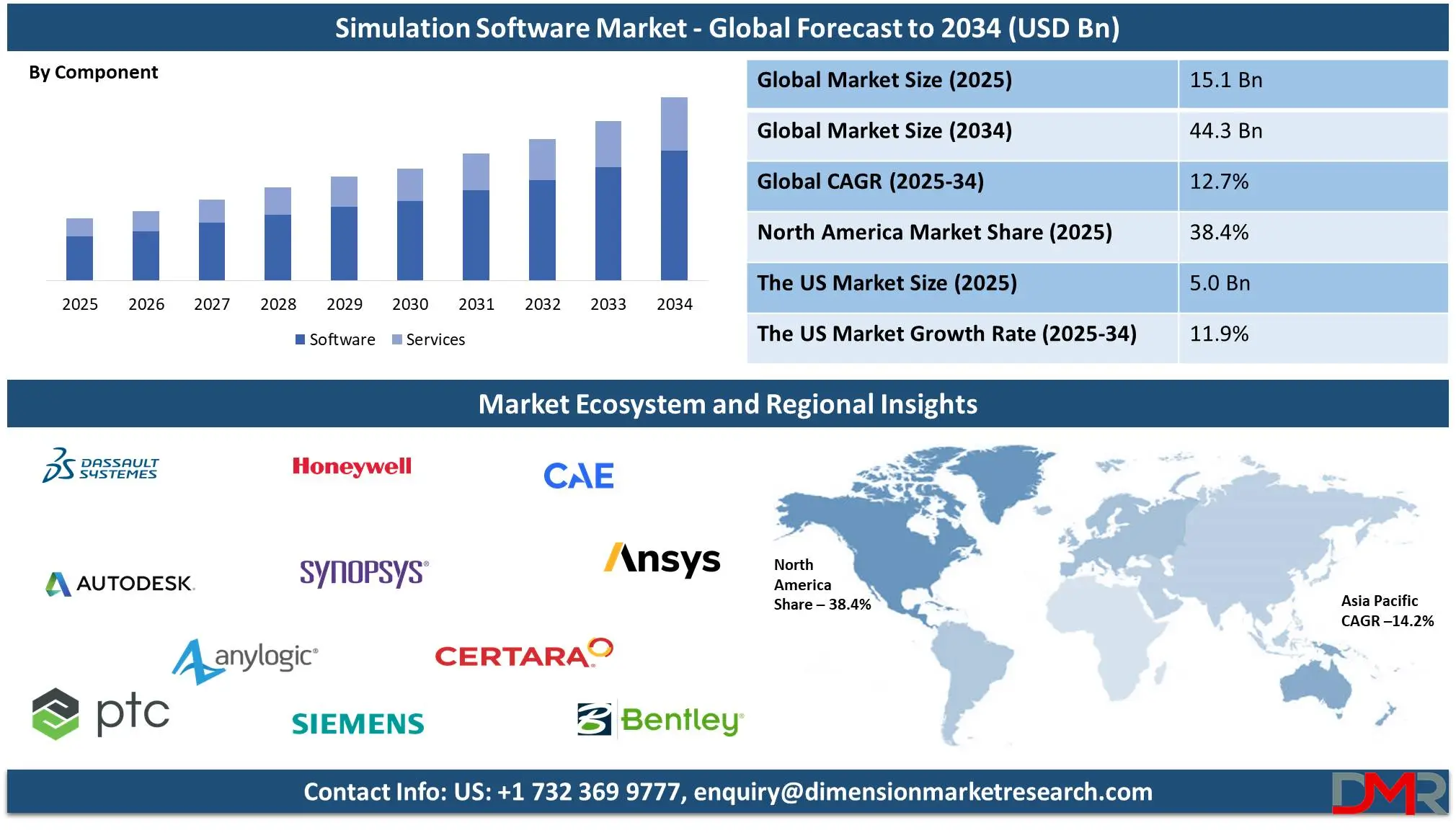

The Global Simulation Software Market is projected to reach

USD 15.1 billion in 2025 and grow at a compound annual growth rate of

12.7% from there until 2034 to reach a value of

USD 44.3 billion.

ℹ

To learn more about this report –

Download Your Free Sample Report Here

Simulation software is a digital tool that allows users to develop virtual models of real-world systems, processes, or environments. These models support businesses, engineers, and researchers in testing ideas, analyzing performance, and improving efficiency before making real-world changes. Industries like manufacturing, healthcare, automotive, and aerospace use simulation software to reduce risks, lower costs, and speed up innovation. By replicating real-world conditions in a controlled digital space, organizations can make better decisions without the risks of physical testing.

The demand for simulation software is rising as companies look for ways to cut costs and improve efficiency. Many industries rely on these tools to enhance product development, optimize operations, and train employees. The increasing use of automation, AI, and digital twins—virtual representations of physical objects—has further fueled this demand. Companies want solutions that can predict outcomes, identify flaws, and improve overall system performance. With technological advancements, businesses are integrating simulation into their workflows more than ever before.

New trends are shaping the future of simulation software. One key trend is the integration of AI and machine learning, allowing simulations to become more intelligent and accurate. Cloud-based simulation platforms are also gaining popularity, making software more accessible to businesses of all sizes. Another growing trend is the use of real-time simulations, which help industries react faster to changing conditions. Additionally, more companies are combining simulation software with augmented reality (AR) and virtual reality (VR) for advanced training and design processes.

Several important events have impacted the simulation software industry. Major technology companies have acquired simulation startups to expand their capabilities. Governments and organizations have invested in digital transformation, increasing the use of simulation tools in defense, healthcare, and infrastructure. The rise of autonomous vehicles has also driven demand for simulations that can safely test self-driving technology

Despite its benefits, simulation software faces some challenges. High costs, complexity, and the need for specialized skills can make adoption difficult for some businesses. However, as software becomes more user-friendly and affordable, more industries are expected to adopt it. Companies that invest in simulation can gain a competitive edge by improving decision-making, reducing risks, and accelerating innovation. The growing use of digital twins and AI-driven simulations presents new opportunities for businesses looking to improve efficiency.

The US Simulation Software Market

The US Simulation Software Market is projected to reach USD 5.0 billion in 2025 at a compound annual growth rate of 11.9% over its forecast period.

The U.S. simulation software market has strong growth opportunities due to increasing adoption in aerospace, automotive, and healthcare industries. The rise of AI, digital twins, and cloud computing enhances simulation capabilities, driving demand. Government investments in defense and infrastructure further boost market expansion. Growing focus on automation and predictive analytics also creates new opportunities for innovation and adoption.

The U.S. simulation software market is driven by rapid advancements in AI, digital twins, and cloud computing, enabling better predictive analysis and automation across industries like aerospace, healthcare, and automotive. Government investments in defense and infrastructure also fuel demand. However, high initial costs, complex implementation, and data security concerns act as restraints, limiting adoption for smaller businesses and organizations with limited technical expertise.

Simulation Software Market: Key Takeaways

- Market Growth: The Simulation Software Market size is expected to grow by 27.4 billion, at a CAGR of 12.7%, during the forecasted period of 2026 to 2034.

- By Component: The software segment is anticipated to get the majority share of the Simulation Software Market in 2025.

- By Application: Engineering design is expected to get the largest revenue share in 2025 in the Simulation Software Market.

- Regional Insight: North America is expected to hold a 38.4% share of revenue in the Global Simulation Software Market in 2025.

- Use Cases: Some of the use cases of Simulation Software include process optimization, training & skill development, and more.

Simulation Software Market: Use Cases:

- Product Design & Testing: Helps engineers simulate real-world conditions to test prototypes, reducing development time and costs.

- Training & Skill Development: Used in industries like aviation and healthcare for hands-on training in a risk-free environment.

- Process Optimization: Assists manufacturing and logistics companies in streamlining workflows, improving efficiency, and reducing waste.

- Risk Analysis & Decision Making: Enables businesses and governments to predict outcomes, assess risks, and make data-driven decisions.

Stats & Facts

- According to Vena Solutions, corporate profits saw a massive 45% increase between January and April 2023, largely due to the rising interest in AI models, highlighting AI's financial impact on businesses.

- As per DOIT Software Experts, the total data generated by IoT devices is expected to exceed 90 zettabytes by 2025, a significant jump from 64 zettabytes annually, fueled by the rapid growth of 23.8 billion connected devices.

- Vena Solutions states that 73% of companies spend excessive time on manual tasks that AI can automate, suggesting that automation could significantly enhance operational efficiency

- The U.S. economy incurs an annual loss of $3.1 trillion due to data inefficiencies, as per DOIT Software Experts, indicating the importance of proper data management strategies for businesses.

- Research by Vena Solutions reveals that three out of five business owners anticipate AI implementation will drive sales growth, making it a critical tool for future business success.

- DOIT Software Experts report that poor data quality costs companies between 15% and 25% of their revenue, underscoring the need for reliable data governance and quality control.

- According to DOIT Software Experts, 80% of business leaders acknowledge that data access improves decision-making, yet only 60% of them provide employees with such access.

- The banking industry could see a $340 billion boost due to advancements in Generative AI, as per Vena Solutions, reinforcing AI’s role in financial sector innovation.

- Staff utilizing AI have reported an 80% increase in productivity, according to Vena Solutions, showcasing AI’s potential to optimize workplace performance.

- DOIT Software Experts reveal that local economies could experience up to a 26% GDP increase by 2030 due to AI-driven advancements in various industries.

- A survey by Vena Solutions found that 73% of employers prioritize hiring AI talent, but the current talent pool is insufficient to meet growing industry demands.

- One company saw a 30% rise in customer satisfaction after integrating AI tools into their operations, demonstrating AI’s ability to enhance customer experience, according to Vena Solutions.

- 60% of businesses using AI lack ethical AI policies, and 74% fail to address bias concerns, which could lead to unintended consequences in AI decision-making, as noted by Vena Solutions.

Market Dynamic

Driving Factors in the Simulation Software Market

Increasing Adoption of Digital Twins and AI Integration

The growing use of digital twin technology and artificial intelligence (AI) is a major driver of the simulation software market. Digital twins create virtual replicas of physical systems, allowing businesses to test and optimize processes in real-time. AI enhances these simulations by improving accuracy, automating tasks, and predicting potential failures before they occur.

Industries like manufacturing, healthcare, and automotive benefit from these technologies by reducing operational costs and increasing efficiency. With companies investing in smart manufacturing and predictive maintenance, simulation software adoption continues to rise. The integration of AI also enables advanced analytics, making simulations more intelligent and effective for decision-making.

Rising Demand for Cost-Effective and Time-Saving Solutions

Businesses across various industries are turning to simulation software to reduce costs and speed up product development. Traditional methods of designing and testing products involve expensive prototypes and long trial periods. Simulation software eliminates these inefficiencies by allowing companies to test multiple scenarios virtually. This is particularly beneficial in sectors like aerospace, automotive, and energy, where precise testing is crucial. The ability to identify potential issues early in the design phase prevents costly errors and enhances overall productivity. As organizations focus on improving efficiency while cutting costs, the demand for simulation software continues to grow, driving market expansion.

Restraints in the Simulation Software Market

High Initial Investment and Implementation Costs

One of the major restraints in the simulation software market is the high initial investment required for purchasing and implementing these solutions. Advanced simulation software often comes with major costs for licensing, infrastructure, and skilled personnel to operate it effectively. Small and medium-sized enterprises (SMEs) may struggle to afford these expenses, limiting their adoption of simulation technology. In addition, integrating simulation software into existing business processes can be complex and time-consuming. Companies may need extensive training for employees to fully use the software, adding to operational costs. These financial and technical barriers slow down the widespread adoption of simulation software, particularly among smaller businesses with limited budgets.

Complexity and Lack of Skilled Professionals

The complexity of simulation software poses a significant challenge to its market growth. Many simulation tools require advanced technical knowledge to set up, run, and analyze results effectively. Industries relying on these solutions need skilled professionals with expertise in engineering, data analysis, and programming. However, the shortage of trained personnel makes it difficult for businesses to maximize the benefits of simulation technology. Without proper training, companies may face difficulties in interpreting simulation results, leading to errors in decision-making. This skills gap slows down adoption rates and may deter organizations from investing in simulation software. Addressing this issue requires better educational programs and training initiatives to equip professionals with the necessary expertise.

Opportunities in the Simulation Software Market

Growing Adoption of Cloud-Based Simulation Solutions

The major shift towards cloud-based simulation software presents a major opportunity for market growth. Cloud deployment offers businesses a cost-effective and scalable solution, eliminating the need for expensive hardware and infrastructure. Companies of all sizes, especially small and medium-sized enterprises (SMEs), can now access advanced simulation tools without large upfront investments.

Cloud-based simulations also enable real-time collaboration, allowing teams to work from different locations efficiently. Industries such as automotive, healthcare, and manufacturing benefit from this flexibility, enhancing productivity and innovation. Additionally, the integration of AI and big data with cloud-based simulations improves accuracy and decision-making. As more companies embrace cloud technology, the demand for cloud-driven simulation software continues to rise.

Rising Demand for Simulation in Autonomous Systems and Smart Technologies

The growing focus on autonomous vehicles, smart cities, and advanced robotics is creating new opportunities for the simulation software market. Self-driving cars and drones require extensive virtual testing before real-world deployment to ensure safety and efficiency. Simulation software allows developers to test various scenarios, reducing risks and improving system performance. In smart city planning, governments use simulation tools to optimize traffic flow, energy consumption, and urban development. Additionally, industries like healthcare and defense are leveraging simulations for advanced research and operational planning. As technology continues to evolve, the demand for high-precision simulation software in these emerging fields will drive market expansion.

Trends in the Simulation Software Market

Integration of AI and Machine Learning in Simulations

A major recent trend in the simulation software market is the integration of artificial intelligence (AI) and machine learning (ML). These technologies enhance simulation accuracy by automating processes, identifying patterns, and predicting outcomes with greater precision. AI-powered simulations enable faster data processing, allowing businesses to test multiple scenarios efficiently.

Industries such as aerospace, healthcare, and manufacturing benefit from AI-driven simulations for design optimization and predictive maintenance. Machine learning algorithms continuously improve simulations by learning from past data, making them more reliable over time. This advancement reduces human intervention, lowers costs, and increases efficiency. As AI and ML continue to evolve, their role in simulation software will further expand, driving innovation across industries.

Growing Use of Digital Twin Technology

The adoption of digital twin technology is rapidly increasing, transforming the simulation software market. Digital twins create virtual replicas of physical assets, enabling real-time monitoring, testing, and optimization. Industries like automotive, energy, and smart manufacturing are leveraging digital twins to enhance operational efficiency and reduce downtime.

By simulating real-world conditions, companies can predict system failures and improve maintenance strategies. The integration of IoT and big data with digital twins further enhances their capabilities, making simulations more dynamic and data-driven. This trend is helping businesses improve decision-making, lower costs, and boost productivity. As digital transformation accelerates, the demand for digital twin-based simulations continues to grow, shaping the future of the market.

Research Scope and Analysis

By Component Analysis

The software segment in 2025 will lead the simulation software market, holding over 71% market share, driven by its essential role across various industries and its use to design, test, and optimize products without physical prototypes, saving both time and costs. Sectors such as automotive, aerospace, healthcare, and manufacturing depend heavily on advanced software solutions for increased efficiency and innovation.

AI, cloud computing, and digital twins further drive demand. Software upgrades and user-friendly interfaces make software accessible to businesses of all sizes. As industries move towards automation and virtual testing, simulation technology remains key in supporting market expansion over the coming years.

Services have experienced rapid expansion during the forecast period as more companies depend on consulting, training, and support to optimize the benefits of simulation software. Businesses requiring simulation tools need expert guidance to incorporate them effectively, creating greater demand for implementation and maintenance services. Customization services also play a vital role, helping businesses tailor software to their requirements.

As more companies adopt simulation technology, technical support and training become essential in ensuring efficient operation and efficacy. Cloud simulation models drive further service demand, while industries focused on digital transformation will further necessitate professional assistance to optimize simulation capabilities for maximum effectiveness.

By Deployment Analysis

In 2025, on-premise deployment will dominate the simulation software market with a 62.7 percent market share due to demand from industries seeking tight data security, customization, and control over their systems. The defense, aerospace and healthcare sectors favor on-premise solutions to secure sensitive data while meeting stringent regulatory standards. Large enterprises with complex simulation needs often invest in dedicated infrastructure to ensure reliable performance and seamless integration into existing systems.

On-premise deployment provides greater control over software updates and security measures, making it a favorable option for companies handling confidential information. Even as cloud solutions gain in popularity, many organizations still prefer on-premise deployment for its stability, privacy, and ability to manage large simulations without internet dependency. This strong demand ensures on-premise solutions remain an integral component of simulation software market growth.

Cloud deployment is set to witness rapid expansion over the forecast period as businesses seek more cost-effective and scalable solutions. Cloud computing allows companies to access simulation software from any location, eliminating costly hardware costs. Small and midsized businesses alike can reap the benefits of cloud-based models for small business, as they offer lower upfront costs and easy updates. Industry sectors like automotive, manufacturing, and research increasingly adopt cloud simulation for collaboration purposes as well as real-time data analysis.

AI and IoT technologies have provided an additional boost to cloud adoption, making simulations more accessible to more companies than ever before. With remote work becoming an integral component of modern workplaces and digital transformation initiatives underway in most organizations today, cloud deployment continues to spread - driving innovation and growth within the simulation software market.

By Application Analysis

In terms of application, engineering design will lead the simulation software market in 2025 with a 34.7% share, driven by the demand for accurate, cost-effective, and time-saving product development. Industries like automotive, aerospace, and manufacturing depend on simulation software to design, test, and optimize products before physical production. Engineers use these tools to analyze materials, structures, and system performance, minimizing the risk of failure and enhancing efficiency.

The growing adoption of digital twins and AI-powered simulations further enhances design accuracy. With the growth in demand for innovative and sustainable solutions, companies invest heavily in simulation software to streamline workflows and reduce development costs. As industries continue to focus on precision and efficiency, engineering design remains a crucial application, ensuring steady market growth and technological advancements in simulation software.

Further, Training and education are experiencing significant growth over the forecast period as more industries and academic institutions adopt simulation software for skill development. Sectors like healthcare, aviation, and manufacturing use simulations to train professionals in a safe, controlled environment.

Virtual training reduces risks, lowers costs, and enhances learning experiences through real-time practice. Educational institutions integrate simulation tools into their curriculum to prepare students for real-world challenges. The rise of VR and AI-powered simulations makes training more immersive and effective. As businesses and universities prioritize hands-on learning, the demand for simulation software in training and education continues to grow, making it a key factor in the expansion of the simulation software market.

By Industry Vertical Analysis

Based on industry vertical, aerospace and defense will be holding 22.9% of the simulation software market due to their need for precision, safety, and cost reduction. Aircraft manufacturers and defense organizations rely on simulation software to design, test, and optimize complex systems before real-world implementation. Simulation programs help in analyzing aerodynamics, fuel efficiency, structural integrity, and more while eliminating costly physical prototypes. Military applications leverage simulations for mission planning, pilot training, and battlefield strategy purposes, improving preparedness and safety.

AI and digital twin technologies further increase accuracy and efficiency. As aerospace and defense continue pushing technological limits forward, demand for advanced simulation tools grows - becoming one of the key drivers behind expanding the simulation software market share.

Further, Education and research are experiencing explosive growth over the next several years as universities and institutions integrate simulation software into learning and innovation initiatives. Researchers use simulations to test theories, analyze data, and develop new technologies in fields like engineering, medicine, and environmental science.

Educational institutions increasingly turn to simulation tools as hands-on learning aids, giving their students practical experience without costly laboratory setup costs. Virtual labs, AI-powered models, and cloud simulations make learning more engaging and accessible than ever. As demand for advanced education and advanced research increases, simulation software's use in academia continues to rise, playing an essential role in shaping future innovations while contributing to the expansion of the simulation software market.

By End User Analysis

Enterprises will hold a 72.9% share in the simulation software market, driven by the growing need for efficiency, cost reduction, and innovation across industries. Large businesses in automotive, aerospace, healthcare, and manufacturing use simulation software to design, test, and optimize products before production. This reduces development time, minimizes errors, and lowers costs.

The rise of AI, cloud computing, and digital twins further enhances simulation capabilities, making them essential for enterprises aiming to stay competitive. Companies also use simulations for training employees, improving decision-making, and predicting future trends. With digital transformation becoming a priority, enterprises continue investing in advanced simulation solutions to boost productivity and innovation, ensuring strong market growth.

Further, government and defense sectors are experiencing significant growth over the forecast period as they increasingly rely on simulation software for strategic planning, training, and operational efficiency. Military forces use simulations for battlefield scenarios, mission planning, and pilot training, improving preparedness and safety. Governments invest in simulation technology for infrastructure planning, disaster management, and policy testing.

Defense agencies benefit from AI-powered simulations to enhance decision-making and resource allocation. The rising focus on cybersecurity and national security also drives the demand for advanced simulation tools. As governments and defense organizations continue to modernize operations, simulation software becomes a critical tool, contributing to the expansion of the market.

The Simulation Software Market Report is segmented on the basis of the following:

By Component

- Software

- Computational Fluid Dynamics (CFD)

- Finite Element Analysis (FEA)

- Electromagnetic Field Simulation

- Others

- Services

- Consulting

- Training & Support

- Integration & Deployment

By Deployment

By Application

- Engineering Design

- Research & Development (R&D)

- Training & Education

- Gaming & Entertainment

- Others

By Industry Verticals

- Aerospace & Defense

- Automotive

- Healthcare & Pharmaceuticals

- Electronics & Semiconductor

- Energy & Utilities

- Industrial Manufacturing

- Education & Research

- Others

By End User

- Enterprises

- Academic & Research Institution

- Government & Defense

Regional Analysis

Leading Region in the Simulation Software Market

North America is projected to dominate the global simulation software market, capturing a

38.4% market share by 2025, driven by robust adoption across key industries such as aerospace, automotive, and healthcare. The regional market is expected to be valued at approximately

USD 5.7 billion. The region benefits from advanced technology, abundant skilled professionals, and large companies investing in digital transformation.

The U.S. and Canada play key roles in this growth story - businesses here use simulation software to increase efficiency, lower costs, and speed innovation. Strong government support and rising adoption of AI and cloud computing further drive market expansion. Industries like defense and manufacturing use simulation extensively for training purposes as well as product testing purposes, further driving demand.

North America remains at the forefront of simulation advancement with an abundance of tech giants and research institutions as driving forces in this sector. Furthermore, growing investments in smart technologies and digital twins keep North America on top of simulation advances, maintaining steady market growth throughout the region and making North America a key player in the global simulation software industry.

Fastest Growing Region in the Simulation Software Market

Asia Pacific will experience significant growth in the simulation software market over the coming years due to rapid industrialization, rising automation levels and rising demands for advanced technology. Countries like China, Japan and India are leading by example with their considerable investments in manufacturing, automotive and aerospace sectors. Businesses across Asia Pacific are turning to simulation software to increase efficiency, cut costs and enhance product development.

Businesses in these regions have taken an increasing interest in simulation technology as a means to boost efficiency, lower costs and enhance product development. Government initiatives encouraging digital transformation and smart factories have helped fuel market expansion; AI, IoT and cloud computing solutions have further contributed to its fast expansion; this region is quickly becoming one of the world's fastest-growing regions for simulation technology development.

By Region

North America

Europe

- Germany

- The U.K.

- France

- Italy

- Russia

- Spain

- Benelux

- Nordic

- Rest of Europe

Asia-Pacific

- China

- Japan

- South Korea

- India

- ANZ

- ASEAN

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Argentina

- Colombia

- Rest of Latin America

Middle East & Africa

- Saudi Arabia

- UAE

- South Africa

- Israel

- Egypt

- Rest of MEA

Competitive Landscape

The simulation software market is highly competitive, with many companies working to develop advanced and user-friendly solutions. Businesses are focusing on improving software capabilities by integrating AI, cloud computing, and real-time data processing to attract more users. The market is driven by industries such as aerospace, automotive, healthcare, and manufacturing, where accurate simulations are crucial for decision-making and cost reduction.

Companies are also investing in research and development to create more efficient and scalable solutions. Pricing strategies, software customization, and ease of use play a major role in competition. With increasing demand, new players are entering the market, while established firms are expanding their offerings to maintain a strong position. Partnerships, acquisitions, and technological advancements continue to shape the competitive landscape.

Some of the prominent players in the Global Simulation Software are:

- Dassault Systemes

- Honeywell

- CAE

- Autodesk

- Ansys

- Siemens Digital Industries Software

- PTC

- Bentley Systems

- Rockwell Automation

- Synopsys

- Certara

- AnyLogic

- SimScale

- MSC Software

- AVEVA

- Altair Engineering

- AGX Dynamics

- Other Key Players

Recent Developments

- In January 2025, Rheinmetall and Bohemia Interactive Simulations (BISim) announce the start of a strategic collaboration, which aims to promote the development of innovative simulation solutions that are crucial for modern combat training. The collaboration will take effect for the first time in the "Heavy Weapons Carrier" project by developing state-of-the-art gunnery and combat simulators for the training of the German Army's Medium Forces through the integration of BISim’s VBS4 and Blue IG products.

- In September 2024, SimScale GmbH announced a suite of enhancements designed to deepen its support of real-time, simulation-driven design for the automotive sector. It is a fully cloud-native simulation platform that works with leading manufacturers, suppliers, and OEMs to ship better products faster while reducing R&D costs and increasing engineering innovation in a globally competitive landscape. Automotive companies use SimScale to design & optimize their products using a broad spectrum of analysis capabilities, including mechanical, thermal, CFD, and electromagnetics.

- In June 2024, Siemens Digital Industries Software today launched Solido™ Simulation Suite software, an integrated suite of AI-accelerated SPICE, Fast SPICE, and mixed-signal simulators designed to help customers dramatically accelerate critical design and verification tasks for their next-generation analog, mixed-signal, and custom IC designs. Built on the foundation of Siemens’ industry-proven, foundry-certified Analog FastSPICE (AFS) platform, Solido Sim incorporates three innovative new simulators: Solido™ SPICE software, Solido™ FastSPICE software and Solido™ LibSPICE software, along with Siemens’ market-proven AFS platform, ELDO™ software, and Symphony™ software.

- In September 2022, Altair announced the latest updates to its simulation portfolio, Simulation 2022.1. These updates allow more efficient, innovative products by applying advanced simulation, cloud-based computing, and optimization for cleaner, more sustainable product lifecycles. Simulation 2022.1 supports companies in meeting corporate social responsibility (CSR) objectives, driving better, earlier design decisions, and bringing the power of open-source technology to users around the world.

Report Details

| Report Characteristics |

| Market Size (2025) |

USD 15.1 Bn |

| Forecast Value (2034) |

USD 44.3 Bn |

| CAGR (2025-2034) |

12.7% |

| Historical Data |

2019 – 2024 |

| The US Market Size (2025) |

USD 5.0 Bn |

| Forecast Data |

2025 – 2033 |

| Base Year |

2024 |

| Estimate Year |

2025 |

| Report Coverage |

Market Revenue Estimation, Market Dynamics, Competitive Landscape, Growth Factors and etc. |

| Segments Covered |

By Component (Software and Services), By Deployment (On-Premises and Cloud), By Application (Engineering Design, and Research & Development (R&D), Training & Education, and Gaming & Entertainment, and Others), By Industry Verticals (Aerospace & Defense, Automotive, Healthcare & Pharmaceuticals, Electronics & Semiconductor, Energy & Utilities, Industrial Manufacturing, Education & Research, and Others), By End User (Enterprises, Academic & Research Institution, and Government & Defense) |

| Regional Coverage |

North America – The US and Canada; Europe – Germany, The UK, France, Russia, Spain, Italy, Benelux, Nordic, & Rest of Europe; Asia- Pacific– China, Japan, South Korea, India, ANZ, ASEAN, Rest of APAC; Latin America – Brazil, Mexico, Argentina, Colombia, Rest of Latin America; Middle East & Africa – Saudi Arabia, UAE, South Africa, Turkey, Egypt, Israel, & Rest of MEA

|

| Prominent Players |

Dassault Systemes, Honeywell, CAE, Autodesk, Ansys, Siemens Digital Industries Software, PTC, Bentley Systems, Rockwell Automation, Synopsys, Certara, AnyLogic, SimScale, MSC Software, AVEVA, Altair Engineering, AGX Dynamics, and Other Key Players |

| Purchase Options |

We have three licenses to opt for: Single User License (Limited to 1 user), Multi-User License (Up to 5 Users) and Corporate Use License (Unlimited User) along with free report customization equivalent to 0 analyst working days, 3 analysts working days and 5 analysts working days respectively. |

Frequently Asked Questions

How big is the Global Simulation Software Market?

▾ The Global Simulation Software Market size is expected to reach a value of USD 15.1 billion in 2025 and is expected to reach USD 44.3 billion by the end of 2034.

Which region accounted for the largest Global Simulation Software Market?

▾ North America is expected to have the largest market share in the Global Simulation Software Market, with a share of about 38.4% in 2025.

Who are the key players in the Global Simulation Software Market?

▾ Some of the major key players in the Global Simulation Software Market are Dassault Systemes, Honeywell, CAE, and others

What is the growth rate in the Global Simulation Software Market?

▾ The market is growing at a CAGR of 12.7 percent over the forecasted period.