Market Overview

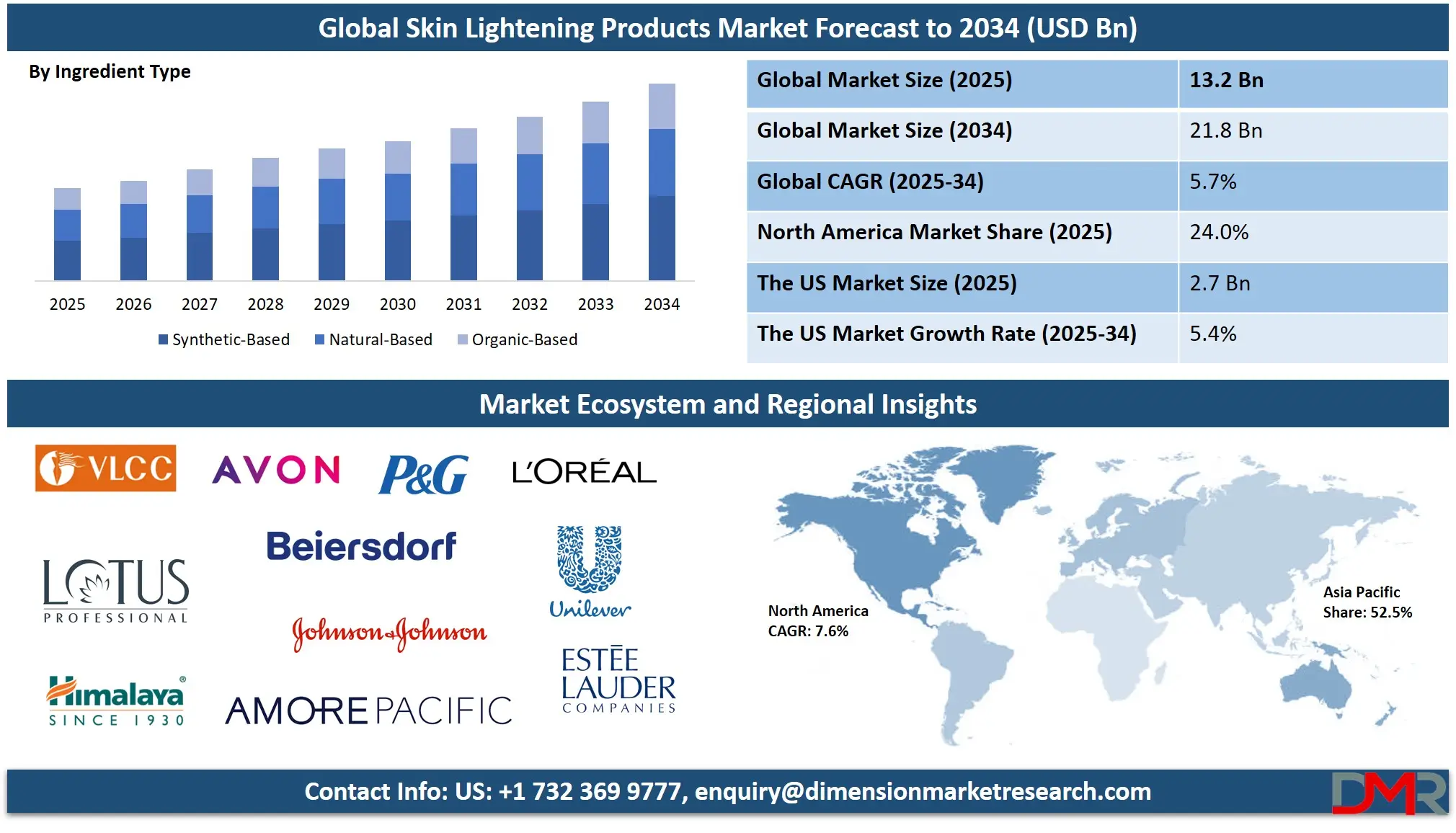

The Global Skin Lightening Products Market is projected to reach USD 13.2 billion in 2025 and grow at a compound annual growth rate of 5.7% from there until 2034 to reach a value of USD 21.8 billion.

The global skin lightening products market is gaining traction as consumers across regions seek solutions for achieving even skin tone, minimizing hyperpigmentation, and enhancing overall skin radiance. Societal perceptions of beauty, cultural preferences for fairer skin, and increasing awareness of skin conditions such as melasma and post-inflammatory hyperpigmentation are fueling demand. A major shift toward self-care and personalized beauty routines has intensified interest in targeted skincare, making skin lightening products a regular part of many consumers’ regimens.

ℹ

To learn more about this report –

Download Your Free Sample Report Here

One of the most significant trends reshaping this market is the transition from chemical-based formulations to plant-derived and clean-label ingredients. Consumers are increasingly looking for transparency, safety, and natural efficacy in skincare products. This demand has driven the formulation of products with botanical actives like licorice extract, kojic acid, niacinamide, vitamin C, and arbutin, offering skin-brightening benefits without harmful side effects.

Despite growing consumer interest, the market faces restraints due to strict government regulations regarding banned or restricted ingredients like hydroquinone, mercury, and corticosteroids. These rules are designed to prevent adverse health outcomes and have encouraged manufacturers to invest in research for safer alternatives, including organic and biotechnology-enhanced ingredients.

Opportunities lie in e-commerce growth, particularly as digital channels become the primary medium for beauty product discovery. Social media influence, celebrity endorsements, and region-specific product lines are also widening the market scope. Moreover, growing awareness in male grooming, multicultural skincare needs, and dermatology-led product development are enhancing future growth prospects in the global skin lightening segment.

The US Skin Lightening Products Market

The US Skin Lightening Products Market is projected to reach USD 2.7 billion in 2025 at a compound annual growth rate of 4.3% over its forecast period.

In the United States, the market for skin-lightening products is growing steadily due to rising awareness of skincare, multicultural beauty needs, and a strong presence of dermatologically endorsed product lines. America’s diverse population, including African American, Hispanic, and Asian communities, has created a wide base of consumers seeking targeted skincare to address melanin-related conditions such as dark patches, acne scarring, and uneven tone.

According to public demographic data, over 40% of the U.S. population comprises ethnic minorities, many of whom are more prone to pigmentation concerns. This drives the need for inclusive formulations designed to address darker skin tones while offering safety and efficacy. Many American consumers are also educated and ingredient-conscious, prioritizing transparency, cruelty-free labels, and dermatologist-approved products.

The regulatory oversight by federal agencies like the Food and Drug Administration (FDA) impacts product development and availability. Ingredients such as hydroquinone are heavily scrutinized, and the industry has responded with innovation in botanical alternatives. As such, the trend in the U.S. leans toward cleaner, safer, and science-backed formulations that appeal to both men and women.

Digitalization and e-commerce have further expanded market reach, with beauty influencers, skincare forums, and online dermatology consultations playing a major role in consumer purchase behavior. Consumers now research ingredients extensively and rely on peer reviews before buying. There is also a rising demand for minimalist yet effective formulations, often incorporating antioxidants, vitamins, and natural lightening compounds. With growing awareness around sun protection, many skin lightening products in the U.S. are also bundled with SPF, emphasizing skin health alongside aesthetics.

The European Skin Lightening Products Market

The European Skin Lightening Products Market is estimated to be valued at USD 1.80 billion in 2025 and is further anticipated to reach USD 2.62 billion by 2034 at a CAGR of 4.3%.

The European skin lightening products market is guided by a blend of high regulatory standards, evolving beauty norms, and a growing inclination toward ethical skincare. While the cultural perception of fair skin varies across the continent, there is increasing demand for products that enhance brightness, reduce pigmentation, and promote even-toned, healthy skin.

Europe’s aging population, especially in Western countries like Germany, France, and Italy, has become a key driver of demand for products addressing age spots, dullness, and photoaging. Pigmentation control is often part of anti-aging routines, with consumers seeking multi-functional products that combine whitening, hydration, and wrinkle prevention.

Regulatory bodies in Europe maintain rigorous product safety measures under cosmetics regulations. Harmful agents such as mercury and high-concentration hydroquinone are banned, prompting manufacturers to focus on clinically tested, safer compounds like alpha arbutin, vitamin C, and fermented botanicals. This stringent landscape has, in turn, elevated the quality and safety profile of available products, making European consumers some of the most discerning globally.

Consumers in Europe are also highly environmentally conscious and prefer cruelty-free, vegan-certified, and sustainably packaged products. Demand for "clean beauty" is growing, and many brands are responding with transparent labelling and dermatologically approved claims. Markets in Eastern Europe, where there is still a cultural tilt toward lighter skin ideals, are experiencing faster growth in this segment.

Retail distribution is dominated by pharmacies and beauty specialty stores, but online platforms are increasingly popular due to convenience, product variety, and access to international brands. Innovation, regulation, and sustainability continue to define Europe's skin lightening market evolution.

The Japan Skin Lightening Products Market

The Japan Skin Lightening Products Market is projected to be valued at USD 492 million in 2025. It is further expected to witness subsequent growth of 5.1% CAGR over the forecast period.

In Japan, the skin lightening products market is culturally entrenched and technologically advanced. The aesthetic ideal of “bihaku,” or luminous white skin, continues to influence consumer behavior, especially among women. Japanese beauty philosophy places high value on skin clarity, even tone, and a youthful glow, creating sustained demand for products that promise brightening and translucency.

The country’s aging population, with one of the highest life expectancies globally, has led to greater consumption of anti-aging skincare products that double as tone correctors. Older consumers seek solutions for age spots and sun-induced pigmentation, while younger consumers use skin lightening items as part of their preventive skincare regimen. Both demographics prioritize safety, efficacy, and scientific backing.

Japanese consumers are exceptionally brand-loyal and well-versed in skincare ingredients. This has led to the dominance of cosmeceutical brands and formulations infused with biotechnology, fermented extracts, and traditional herbs. Formulations typically avoid aggressive chemicals and emphasize long-term skin health over temporary brightening. Light textures like emulsions, gels, and lotions are preferred due to the climate and skincare layering routines.

The regulatory framework in Japan is strict but innovation-friendly. Skincare products are often classified under quasi-drug categories, allowing active ingredients for whitening, such as tranexamic acid and vitamin C derivatives, to be used under controlled conditions. Japanese companies are also global pioneers in sun protection, often combining SPF with brightening benefits.

Retail channels include department stores, convenience stores, and increasingly, mobile e-commerce platforms. Influenced by beauty influencers, seasonal product launches, and continuous R&D, Japan remains a sophisticated and mature skin lightening market.

Global Skin Lightening Products Market: Key Takeaways

- Global Market Size Insights: The Global Skin Lightening Products Market size is estimated to have a value of USD 13.2 billion in 2025 and is expected to reach USD 21.8 billion by the end of 2034.

- The US Market Size Insights: The US Skin Lightening Products Market is projected to be valued at USD 2.7 billion in 2025. It is expected to witness subsequent growth in the upcoming period as it holds USD 4.3 billion in 2034 at a CAGR of 5.4%.

- Regional Insights: Asia Pacific is expected to have the largest market share in the Global Skin Lightening Products Market with a share of about 52.5% in 2025.

- Key Players: Some of the major key players in the Global Skin Lightening Products Market are L’Oréal, Unilever, Procter & Gamble, Shiseido, Beiersdorf, Estée Lauder, Johnson & Johnson, Amorepacific, Avon, Kao, Himalaya, and many others.

- The Global Market Growth Rate: The market is growing at a CAGR of 5.7 percent over the forecasted period of 2025.

Global Skin Lightening Products Market: Use Cases

- Correcting Hyperpigmentation: Consumers use skin lightening products to address skin concerns such as dark spots, melasma, and discoloration caused by sun exposure or hormonal imbalances. These formulations help in achieving a more uniform complexion and are often recommended in dermatology to reduce post-acne scars and pigmentation-related issues.

- Pre-Bridal and Special Occasion Skincare: In many cultures, particularly in Asia and the Middle East, skin lightening products are used as part of beauty routines leading up to weddings or special events. These products help brighten skin tone and reduce blemishes to deliver a radiant and even-toned appearance during celebrations.

- Skin Tone Maintenance for Urban Professionals: Urban working professionals, exposed to pollution and UV rays, use skin lightening serums and creams as part of their daily skincare to manage skin dullness, environmental pigmentation, and maintain an even, refreshed look. The emphasis is often on natural, dermatologically tested, and non-irritating products.

- Post-Pregnancy Skincare: Women dealing with hormonal skin changes after pregnancy often turn to skin lightening products to minimize melasma and patchy pigmentation. Formulations with gentle, non-toxic ingredients are favored to cater to sensitive skin while promoting clarity and glow.

- Skincare for Men: Men’s grooming is evolving to include skin brightening products that target uneven tone caused by shaving, outdoor work, or sports. Lightweight formulations like gels and foams are preferred, helping men maintain skin clarity without appearing overdone or feminine.

Global Skin Lightening Products Market: Stats & Facts

World Health Organization (WHO)

- 77% of Nigerian women use skin-lightening products regularly, making Nigeria one of the highest consumers globally.

- 61% of Indian women report using fairness creams as part of their skincare routine.

- 40% of Chinese women regularly use skin-whitening products for beauty and skin tone uniformity.

- In countries like the Philippines, South Korea, and Malaysia, around 50% of people use skin-lightening agents, often starting in their teens.

- WHO has officially banned mercury in cosmetic products, classifying it as a hazardous substance with serious neurological and renal risks.

United States Food and Drug Administration (FDA)

- In 2020, the FDA banned over-the-counter products containing hydroquinone, citing links to cancer and ochronosis.

- The FDA mandates that the mercury content in cosmetics must be under 1 ppm (parts per million) for safety.

- The FDA has routinely seized illegal imports of creams exceeding mercury limits, particularly from Asia and Latin America.

Centers for Disease Control and Prevention (CDC)

- The CDC has reported multiple mercury poisoning cases from whitening creams in California, Minnesota, and Texas.

- In one California case, a cream was found to contain 6,000 times the safe mercury limit, leading to severe health complications.

African Union & National Governments

- Countries including Ghana, Nigeria, South Africa, and Rwanda have enacted bans or strict regulations on products containing mercury and hydroquinone.

- Ghana’s FDA seized over 10,000 units of illegal skin-lightening products in 2022.

- NAFDAC (Nigeria) issued public safety warnings in 2021 about imported creams lacking official approval.

European Commission – SCCS (Scientific Committee on Consumer Safety)

- The SCCS limits kojic acid concentrations in creams to 1%, citing risks of skin irritation and overexposure.

- Ingredients like arbutin and deoxyarbutin are flagged for further safety testing before EU-wide cosmetic use.

- Hydroquinone remains banned for use in non-prescription skincare throughout the European Union.

Government of India – Ministry of AYUSH and CDSCO

- 60 %+ of India's facial skincare segment is comprised of fairness and skin-whitening products.

- CDSCO requires warning labels on products containing potentially harmful skin-lightening agents.

- The Ministry of AYUSH promotes natural alternatives like turmeric, sandalwood, and saffron as traditional, safe options.

Government of Pakistan – Pakistan Council of Scientific and Industrial Research (PCSIR)

- A national PCSIR survey revealed that 56 %+ of local creams exceed WHO’s safe mercury limits.

- In 2021, 10 out of 15 tested brands were found to contain banned or toxic ingredients.

Government of Kenya – Kenya Bureau of Standards (KEBS)

- In 2020, KEBS banned 6 popular foreign skin-whitening creams for containing excessive mercury levels.

- KEBS implemented new compliance checks to monitor imports and domestic sales of cosmetic products.

Government of the Philippines – Food and Drug Administration

- Since 2019, over 60 illegal whitening products, mostly from China, Taiwan, and Hong Kong, have been banned.

- Some products contained mercury levels as high as 44,000 ppm, far above international safety thresholds.

Government of Malaysia – Ministry of Health

- Malaysia’s MOH maintains a public database of more than 100 banned whitening products for consumer awareness.

- In 2023, 15 creams were withdrawn due to the presence of hydroquinone and tretinoin, both prescription-only agents.

Government of Japan – Ministry of Health, Labour and Welfare

- Only ingredients like arbutin, tranexamic acid, and vitamin C derivatives are allowed in over-the-counter whitening products.

- Japan’s quasi-drug classification system enforces strict pre-market evaluation and post-market surveillance for safety.

Government of South Korea – Ministry of Food and Drug Safety (MFDS)

- The use of niacinamide and arbutin is permitted under strict percentage regulations.

- Consumers can access online safety reports listing recalled or flagged cosmetic products, including lightening creams.

Government of China – National Medical Products Administration (NMPA)

- Since 2021, whitening products have required mandatory testing and registration before entering the Chinese market.

- NMPA has recalled over 500 batches of illegal whitening creams in two years and imposed heavy fines on violators.

Global Skin Lightening Products Market: Market Dynamic

Driving Factors in the Global Skin Lightening Products Market

Increasing Prevalence of Hyperpigmentation and Melasma Among Urban Populations

The escalating prevalence of hyperpigmentation, melasma, sunspots, and uneven skin tone, especially in urbanized and polluted environments, is a powerful driver for the global skin lightening products market. Exposure to environmental pollutants, UV radiation, blue light from screens, and oxidative stress has significantly contributed to the rise in pigmentation disorders, particularly in Asia-Pacific and Latin America.

In densely populated cities like Mumbai, Lagos, Jakarta, Manila, and São Paulo, dermatologists report growing cases of melanin overproduction among both men and women. Additionally, the stress of urban lifestyles, poor nutrition, and lack of adequate sleep exacerbate skin concerns, prompting a surge in demand for corrective and preventive skincare, particularly lightening agents.

Consumers seek products that not only offer cosmetic benefits but also functional dermatological outcomes such as protection against UV damage and regulation of melanin synthesis. Advanced formulations containing SPF, antioxidants, and melanin inhibitors like tranexamic acid are increasingly preferred. Urban consumers are also more digitally connected and exposed to aesthetic trends, making them highly responsive to skincare campaigns and innovations. These demographic and environmental factors are expected to keep demand strong across multiple age groups, especially in metropolitan areas where dermatological issues tied to skin tone irregularities are increasingly being addressed through daily skincare regimens.

Expanding Middle-Class Populations and Rising Disposable Incomes in Emerging Markets

The rapid growth of the middle class across regions such as Southeast Asia, Sub-Saharan Africa, and the Middle East is a pivotal force behind the global skin lightening products market. As disposable incomes rise, consumers in countries like Indonesia, Nigeria, Bangladesh, Egypt, and Vietnam are becoming more aspirational and image-conscious. These socio-economic transitions are increasing the affordability of premium skincare products, once considered a luxury.

Rising internet penetration and access to global beauty influencers via platforms like TikTok, YouTube, and Instagram further enhance beauty ideal adoption, particularly surrounding lighter, radiant, or even-toned skin. Moreover, an influx of global brands, coupled with aggressive regional marketing and celebrity endorsements, is helping to normalize and popularize skin-lightening products across economic strata.

Localization strategies such as introducing sachet formats, budget-friendly ranges, and culturally aligned messaging are making these products more accessible to mass-market consumers. E-commerce growth is also instrumental in reaching rural and semi-urban buyers, who are becoming key contributors to volume sales. Importantly, in these emerging economies, skin lightening is often associated with social mobility, marital prospects, and professional success, thereby further fueling demand. As purchasing power continues to climb, these markets are expected to experience double-digit growth in skin lightening product consumption over the next decade.

Restraints in the Global Skin Lightening Products Market

Regulatory Bans on Hydroquinone, Mercury, and Harmful Chemicals

The skin lightening market faces significant regulatory headwinds due to bans and restrictions on commonly used active ingredients like hydroquinone, mercury, and corticosteroids. These substances, historically prevalent in lightning creams, have been linked to adverse health effects such as skin thinning, kidney damage, mercury poisoning, and exogenous ochronosis. As a result, regulatory bodies such as the U.S. FDA, the European Commission, and national agencies across Africa and Asia have either banned or imposed stringent restrictions on their use. This regulatory scrutiny has led to product recalls, import seizures, and stricter labeling requirements, directly impacting product availability and consumer trust.

For instance, several countries have blacklisted popular international brands that failed to meet local safety guidelines. Moreover, transitioning from banned substances to safer, approved ingredients involves reformulation, additional clinical testing, and supply chain changes, which increase cost and time to market. These changes especially burden small and medium enterprises with limited R&D capacity. Regulatory compliance across multiple geographies is another challenge due to variations in allowed ingredient lists and permissible concentration levels. Such constraints limit innovation, delay product launches, and pose a major barrier for new entrants. Overall, these regulations, while necessary for public health, pose an operational and reputational risk for the industry.

Cultural Backlash and Ethical Concerns Regarding Colorism

A growing global backlash against colorism and the historical stigma surrounding skin-lightening products is a major reputational and ethical restraint for the market. Movements such as “Dark Is Beautiful,” “Unfair and Lovely,” and global protests against racial bias have amplified consumer awareness around the harmful sociocultural messages perpetuated by fairness products. Criticism is particularly sharp in South Asia and Africa, where advertisements have long equated lighter skin with beauty, success, and social value. Regulatory authorities are increasingly cracking down on marketing claims that reinforce such stereotypes. For example, in India, the Advertising Standards Council revised its guidelines to prohibit terms like “fair,” “white,” and “whitening.”

Leading brands are under pressure to rebrand or discontinue controversial lines, as seen when Unilever renamed “Fair & Lovely” to “Glow & Lovely.” Consumers and advocacy groups now demand ethical transparency, inclusive messaging, and real skincare benefits rather than color alteration. These shifts are forcing companies to undergo brand overhauls, invest in sensitivity training, and adapt product positioning to avoid social backlash. Failure to respond appropriately can lead to boycotts, PR crises, and reputational damage. As ethical consciousness grows among Gen Z and millennial consumers, aligning with evolving values is no longer optional but imperative.

Opportunities in the Global Skin Lightening Products Market

Male Grooming Market Adoption of Skin Lightening Products

The underpenetrated male grooming segment presents one of the most promising growth opportunities for the global skin lightening products market. While traditionally marketed toward women, skin lightening and brightening formulations are increasingly gaining traction among men, particularly in South Asia, Southeast Asia, and parts of the Middle East and Africa.

Shifting cultural norms, increasing media portrayal of male beauty, and the rise of male influencers have all contributed to this transformation. Men in urban centers are actively seeking skincare solutions that address tanning, pigmentation, acne scars, and uneven tone caused by sun exposure. Dedicated products such as fairness face washes, anti-spot gels, and night serums for men are emerging across price ranges.

Brands are customizing marketing campaigns with masculine packaging, celebrity endorsements, and performance-focused narratives. Furthermore, companies are leveraging male-centric grooming platforms and barbershop tie-ins to expand market reach. The rise of men-only salons and cosmetic clinics offering lightening treatments also reflects a behavioral shift. As societal taboos erode, male consumers are expected to increase their skincare spend, creating a multi-billion-dollar opportunity for brands willing to innovate with gender-sensitive and high-performance formulations. The convergence of male grooming and skin lightening could drive the next wave of growth, particularly in youth-dominated emerging markets.

Inclusive Beauty and Multicultural Product Lines for Diverse Skin Tones

The global shift toward inclusive beauty presents a substantial opportunity for growth in the skin lightening products market through the development of multicultural, tone-evening, and glow-enhancing formulations tailored to diverse skin tones. The traditional notion of “whitening” is increasingly being replaced by “brightening,” “radiance,” or “clarity,” reflecting consumer preferences for natural tone enhancement rather than skin tone alteration.

Brands now recognize the unique dermatological needs of consumers with medium to deep skin tones, particularly those in the African diaspora, Latin America, South Asia, and Southeast Asia. This awareness is driving innovations in pigment correction, anti-inflammatory ingredients, and products that support melanin-rich skin without bleaching effects.

Companies like Fenty Beauty and UOMA Beauty have paved the way for inclusive branding, and skincare brands are following suit. Formulating for hyperpigmentation, post-acne marks, and dullness without harsh chemicals opens new frontiers in dermatology-led skin tone management.

Furthermore, regulatory crackdowns on traditional “fairness” claims are prompting the industry to embrace a more ethical and inclusive language. This opportunity also extends to multicultural regions in Western markets such as the U.S., U.K., and Canada, where multi-ethnic consumers seek targeted, respectful skincare solutions. The inclusive beauty trend not only promotes diversity but also unlocks significant untapped consumer segments worldwide.

Trends in the Global Skin Lightening Products Market

Rise of Ingredient Transparency and Clean Beauty Formulations

The global skin lightening products market is witnessing a strong trend toward transparency in product ingredients and the rise of clean beauty standards. Increasing consumer awareness, fueled by digital literacy and social media scrutiny, has shifted demand from synthetic chemical-based formulations to natural, organic, and dermatologically tested ingredients.

Consumers, especially in developed markets like the U.S., U.K., and Japan, are actively reading ingredient labels and avoiding controversial components such as hydroquinone, parabens, and mercury. As a result, brands are focusing on botanically-derived active ingredients like vitamin C, niacinamide, licorice root extract, kojic acid, and alpha arbutin. Brands are also marketing their products using terms like “dermatologist-recommended,” “cruelty-free,” and “non-toxic.”

Certifications such as EWG Verified, Ecocert, and COSMOS are gaining traction as consumers seek credible assurance. Regulatory frameworks in Europe and Asia are pushing for greater product safety, which also propels this trend. This shift has compelled even established players to reformulate bestsellers and invest in R&D for clean-label products that meet both efficacy and ethical expectations.

As this trend matures, companies that demonstrate scientific validation and sustainability in their ingredient sourcing and manufacturing are expected to dominate consumer preference. Clean formulations not only satisfy safety concerns but also cater to the growing ethical consciousness among millennials and Gen Z consumers globally.

Personalization and AI-Driven Skincare Recommendations

Another major trend reshaping the global skin lightening products market is the adoption of artificial intelligence (AI) and personalized skincare solutions. With the proliferation of mobile apps, digital diagnostics, and AI-powered skin analysis tools, consumers are seeking hyper-personalized product recommendations tailored to their unique skin type, tone, and concerns.

Companies are investing in virtual consultations, quizzes, and machine learning platforms that evaluate skin conditions, detect hyperpigmentation levels, and generate real-time customized skincare regimens. For instance, some brands offer customized serums or creams with adjustable concentrations of actives like niacinamide or vitamin C, based on user inputs or AI analysis.

This trend is particularly prominent among digitally native consumers in North America, East Asia, and parts of Western Europe. AI also enables continuous improvement through feedback loops and data collection, refining product recommendations over time.

Moreover, personalization is being combined with inclusive beauty approaches, offering solutions for a wide range of skin tones and ethnic backgrounds, an area where traditional skin lightening products often lacked nuance. This technological integration enhances consumer trust and engagement, promoting brand loyalty. Personalized product subscription models are also on the rise, creating recurring revenue for brands. As the AI skincare ecosystem evolves, it’s becoming a competitive differentiator for both startups and large corporations.

Global Skin Lightening Products Market: Research Scope and Analysis

By Product Type Analysis

Creams and lotions are projected to dominate the global skin lightening products market due to their widespread consumer acceptance, ease of application, and long-standing association with skincare routines. These products are often the first choice for consumers seeking to address hyperpigmentation, age spots, melasma, and uneven skin tone, as they offer direct topical application and visible results over time. Their creamy texture allows for better skin penetration, ensuring that the active ingredients such as hydroquinone, kojic acid, vitamin C, and retinoids reach deeper skin layers effectively.

Moreover, creams and lotions are perceived as gentle and nourishing, making them suitable for regular use across various skin types, including sensitive and dry skin. Their formulation flexibility also allows manufacturers to incorporate moisturizing agents, SPF protection, and anti-aging benefits, which further broadens their appeal. This multifunctionality has made creams and lotions the cornerstone of both daily skincare regimens and targeted treatment routines.

From a commercial standpoint, the wide availability of creams and lotions across all price points from drugstore brands to high-end skincare lines has democratized access and fueled mass-market penetration. Additionally, aggressive marketing, celebrity endorsements, and the growing influence of social media beauty trends have significantly boosted consumer interest in these products, particularly in Asia-Pacific, Africa, and the Middle East, where skin lightening products are in high demand.

Furthermore, the compact packaging and longer shelf life of creams and lotions make them convenient for both consumers and retailers, driving higher sales volumes across online and offline channels. Collectively, these factors solidify creams and lotions as the dominant product type within the skin lightening products market globally.

By Ingredient Type Analysis

Synthetic-based ingredients are expected to dominate the global skin lightening products market primarily due to their proven efficacy, cost efficiency, and widespread availability. Compounds like hydroquinone, arbutin, retinoids, and corticosteroids are widely utilized for their fast-acting depigmenting properties, offering visible results in a shorter time compared to natural alternatives. Among them, hydroquinone remains one of the most effective and extensively researched agents for treating hyperpigmentation and melasma, especially in prescription-based formulations.

Synthetic ingredients also allow for consistent and scalable manufacturing, giving producers greater control over potency, stability, and product shelf life. This precision enables skincare brands to deliver standardized solutions that meet regulatory requirements while still offering effective performance across different skin tones and conditions. Additionally, synthetic formulations are more resistant to oxidation and degradation, which ensures extended shelf life and reliability for end-users.

Another advantage lies in their integration into various product forms creams, serums, masks, and cleansers, making synthetic-based ingredients highly versatile and adaptable to consumer preferences. Due to this adaptability, synthetic formulations are well-suited for both over-the-counter (OTC) and dermatological products.

Despite growing consumer awareness about clean beauty and natural skincare, synthetic-based ingredients continue to dominate because of their unmatched performance in clinical results. This is particularly significant in emerging markets like India, China, Nigeria, and Indonesia, where consumers often prioritize visible outcomes over formulation origin.

Moreover, global cosmetic giants invest heavily in R&D to create safer synthetic alternatives with fewer side effects, which helps mitigate safety concerns while retaining efficacy. Thus, the combination of affordability, effectiveness, and technological advancement ensures that synthetic-based ingredients maintain dominance in the global skin lightening products landscape.

By Distribution Channel Analysis

Supermarkets and hypermarkets is poised to dominate the distribution channel segment in the global skin lightening products market due to their expansive reach, variety of product offerings, and consumer preference for hands-on product evaluation before purchase. These retail formats provide a one-stop-shop experience, allowing consumers to compare multiple skin lightening brands, ingredients, and price points under one roof, enhancing convenience and promoting impulse purchases.

In emerging and developed economies alike, supermarkets and hypermarkets serve as trusted retail environments where well-known brands prominently display their skin lightening lines alongside promotional offers, free samples, and discounts. This physical visibility plays a crucial role in influencing purchasing decisions, especially for first-time buyers or price-sensitive consumers. In addition, in-store beauty consultants and trial counters allow consumers to test products, seek personalized advice, and understand product efficacy and suitability for their skin type.

The dominance of this channel is also fueled by the strategic partnerships between multinational cosmetic brands and major retail chains such as Walmart, Carrefour, Tesco, and Big Bazaar. These collaborations ensure prominent shelf placement, dedicated beauty sections, and exclusive product launches that drive higher footfall and customer loyalty.

Moreover, supermarkets and hypermarkets benefit from bulk purchasing and distribution efficiencies, which translate into competitive pricing and regular stock availability, especially during seasonal promotions or festive periods. While e-commerce has gained traction, a large portion of the global consumer base, particularly in Asia-Pacific and Africa, continues to prefer offline purchases due to limited internet access or the desire to physically inspect products.

Therefore, the dominance of supermarkets and hypermarkets is underpinned by their accessibility, shopping experience, and tangible product exposure that online platforms struggle to replicate.

The Global Skin Lightening Products Market Report is segmented on the basis of the following

By Product Type

- Creams & Lotions

- Cleansers & Face Washes

- Masks & Peels

- Serums

- Gels & Foams

- Toners

- Others

By Ingredient Type

- Synthetic-Based

- Natural-Based

- Organic-Based

By Distribution Channel

- Supermarkets & Hypermarkets

- Convenience Stores

- Specialty Beauty Stores

- Pharmacies & Drugstores

- Online Retail Platforms

Global Skin Lightening Products Market: Regional Analysis

Region with the Largest Revenue Share

Asia-Pacific is projected to dominate the global skin lightening products market as it will command over 52.5% of the total revenue by the end of 2025, due to deeply rooted cultural beauty ideals, a high prevalence of melanin-related skin concerns, and a large, fast-growing population base. In countries like India, China, Japan, South Korea, Thailand, and Indonesia, fair and radiant skin is historically associated with youth, social status, and personal success. This societal inclination sustains strong demand across both urban and rural regions.

Additionally, the presence of regional skincare giants and culturally tailored product formulations has further fueled market penetration. Local and international brands frequently introduce new product lines with herbal ingredients, Ayurvedic influences, and K-beauty innovations that cater specifically to Asian skin tones and textures. The region’s expanding middle class, increasing disposable income, and beauty awareness also contribute to rising consumer spending on personal care.

Furthermore, the extensive distribution networks including hypermarkets, pharmacy chains, beauty specialty stores, and online platforms ensure broad product accessibility. Robust marketing through television, influencers, and social media further amplifies product visibility. As a result, Asia-Pacific continues to dominate the global skin lightening landscape in both volume and revenue.

Region with the Highest CAGR

North America is projected to register the highest CAGR in the global skin lightening products market due to shifting consumer preferences, greater awareness of skin tone disorders, and rising demand for inclusive beauty. Consumers in the U.S. and Canada are increasingly prioritizing skin health, opting for products that target hyperpigmentation, sun spots, melasma, and post-acne discoloration.

This surge is driven by a diverse and multicultural population, including African-American, Hispanic, and Asian communities, who seek effective yet safe tone-evening solutions. Regulatory constraints on harmful ingredients have led brands to develop innovative, clean-label, and dermatologically tested formulations that resonate with health-conscious consumers.

Additionally, digital platforms and AI-driven skincare consultations are empowering personalized product choices, particularly among millennials and Gen Z. The widespread adoption of e-commerce and D2C (Direct-to-Consumer) channels has enabled niche and emerging brands to scale quickly and reach underserved audiences. As consumer acceptance grows around gender-neutral and function-focused skincare, North America is set to sustain accelerated growth across both premium and mass-market segments.

By Region

North America

Europe

- Germany

- The U.K.

- France

- Italy

- Russia

- Spain

- Benelux

- Nordic

- Rest of Europe

Asia-Pacific

- China

- Japan

- South Korea

- India

- ANZ

- ASEAN

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Argentina

- Colombia

- Rest of Latin America

Middle East & Africa

- Saudi Arabia

- UAE

- South Africa

- Israel

- Egypt

- Rest of MEA

Global Skin Lightening Products Market: Competitive Landscape

The global skin lightening products market is highly competitive, with a mix of multinational corporations, regional powerhouses, and emerging niche brands. Key players such as L’Oréal, Unilever, Procter & Gamble, Beiersdorf, and Shiseido dominate the premium and mass-market segments through expansive product portfolios, global brand presence, and robust R&D investments. These companies leverage strong marketing campaigns, celebrity endorsements, and influencer partnerships to maintain brand visibility and consumer trust.

In Asia-Pacific, regional leaders like Amorepacific, Kao Corporation, Emami, and Himalaya capitalize on deep cultural understanding and herbal formulation expertise. Their localized product offerings often infused with traditional ingredients like turmeric, saffron, and licorice resonate with consumer preferences and regulatory norms.

The rise of clean beauty and skin-inclusive marketing has also paved the way for indie brands and startups to capture market share through innovation and personalization. E-commerce platforms such as Amazon, Tmall, and Nykaa have intensified competition by democratizing access to both local and international brands. Moreover, companies are adopting sustainable packaging, cruelty-free certifications, and eco-conscious branding to align with evolving consumer values. As the market continues to expand, strategic collaborations, clinical testing, and digital engagement will be critical for maintaining a competitive edge in this dynamic and evolving industry.

Some of the prominent players in the Global Skin Lightening Products Market are

- L’Oréal S.A.

- Unilever PLC

- Procter & Gamble Co. (P&G)

- Shiseido Company, Limited

- Beiersdorf AG

- Estée Lauder Companies Inc.

- Johnson & Johnson Services, Inc.

- Amorepacific Corporation

- Avon Products, Inc.

- Kao Corporation

- Himalaya Global Holdings Ltd.

- Emami Limited

- Lotus Herbals Pvt. Ltd.

- VLCC Health Care Limited

- Garnier (Brand of L’Oréal)

- Revlon, Inc.

- Oriflame Cosmetics AG

- Kanebo Cosmetics Inc.

- Pond’s

- Fair & Lovely

- Other Key Players

Recent Developments in Global Skin Lightening Products Market

- May 2025: Beauty İstanbul Exhibition 2025 was scheduled to take place from May 8 to 10, highlighting cosmetics, hairdressing, private labels, and skin care innovations. The event served as a hub for showcasing the latest in skin lightening and whitening solutions in a region seeing rising consumer interest.

- April 2025: The 5th China International Consumer Products Expo, held from April 13 to 18, focused on luxury and daily-use consumer goods, where global beauty brands including those offering skin lightening creams and serums showcased AI-based and smart skincare solutions. In-Cosmetics Global 2025, concluding in Paris, introduced Givaudan's new brightening prebiotic Illuminyl 388 and Neuroglow, capturing momentum in microbiome and neuro-cosmetics for skin radiance.

- March 2025: Beauty Expo Taipei 2025, held from March 27 to 30, included over 275 exhibitors. Notably, Taiwan’s CHORUS presented "Sangsicle™," an advanced exosome-based ingredient for skin rejuvenation, developed in partnership with National Chung Hsing University, indicating rising biotech interest in whitening formulations.

- February 2025: Clarins initiated a partnership with the International Labour Organization to promote inclusive employment and social responsibility in the personal care and cosmetics sector, reflecting broader ethical shifts within skin care product development.

- November 2024: In-Cosmetics Asia 2024 was hosted in Bangkok, featuring over 600 exhibitors from 40+ countries. Noteworthy launches included FFJ-004 by Cosroma, a next-gen ingredient for moisture retention and pigmentation control, aligning with multifunctional skin lightening trends.

- September 2024: The Cosmetics Ingredients Expo in Chennai marked its inaugural edition with over 3,000 beauty professionals in attendance. The event emphasized sourcing innovations, sustainability, and ingredient transparency in skin lightening formulations, with strong participation from regional ingredient suppliers.

- August 2024: Clarins made a strategic investment by acquiring a botanical estate in the Gard region of France. The move aimed to bolster the brand’s raw material supply chain, specifically for high-efficacy plant-based ingredients used in its brightening and age-defying skincare lines.

- July 2024: Beautyworld Japan Nagoya was scheduled from July 14 to 16, catering to the growing Tokai regional market in Japan. The event connected domestic beauty retailers and international skin lightening brands looking to expand in Japan’s evolving skin tone correction segment.

Report Details

| Report Characteristics |

| Market Size (2025) |

USD 13.2 Bn |

| Forecast Value (2034) |

USD 21.8 Bn |

| CAGR (2025–2034) |

5.7% |

| Historical Data |

2019 – 2024 |

| The US Market Size (2025) |

USD 2.7 Bn |

| Forecast Data |

2025 – 2033 |

| Base Year |

2024 |

| Estimate Year |

2025 |

| Report Coverage |

Market Revenue Estimation, Market Dynamics, Competitive Landscape, Growth Factors, etc. |

| Segments Covered |

By Product Type (Creams & Lotions, Cleansers & Face Washes, Masks & Peels, Serums, Soaps, Gels & Foams, Bleaching Products, Toners, Others), By Ingredient Type (Synthetic-Based, Natural-Based, Organic-Based), By Distribution Channel (Supermarkets & Hypermarkets, Convenience Stores, Specialty Beauty Stores, Pharmacies & Drugstores, Online Retail Platforms |

| Regional Coverage |

North America – US, Canada; Europe – Germany, UK, France, Russia, Spain, Italy, Benelux, Nordic, Rest of Europe; Asia-Pacific – China, Japan, South Korea, India, ANZ, ASEAN, Rest of APAC; Latin America – Brazil, Mexico, Argentina, Colombia, Rest of Latin America; Middle East & Africa – Saudi Arabia, UAE, South Africa, Turkey, Egypt, Israel, Rest of MEA |

| Prominent Players |

L’Oréal, Unilever, Procter & Gamble, Shiseido, Beiersdorf, Estée Lauder, Johnson & Johnson, Amorepacific, Avon, Kao, Himalaya, Emami, Lotus Herbals, VLCC, Garnier, Revlon, Oriflame, Kanebo, Pond’s, Glow & Lovely, and Other Key Players |

| Purchase Options |

We have three licenses to opt for: Single User License (Limited to 1 user), Multi-User License (Up to 5 Users), and Corporate Use License (Unlimited User) along with free report customization equivalent to 0 analyst working days, 3 analysts working days, and 5 analysts working days respectively. |

Frequently Asked Questions

How big is the Global Skin Lightening Products Market?

▾ The Global Skin Lightening Products Market size is estimated to have a value of USD 13.2 billion in 2025 and is expected to reach USD 21.8 billion by the end of 2034.

What is the size of the US Skin Lightening Products Market?

▾ The US Skin Lightening Products Market is projected to be valued at USD 2.7 billion in 2025. It is expected to witness subsequent growth in the upcoming period as it holds USD 4.3 billion in 2034 at a CAGR of 5.4%.

Which region accounted for the largest Global Skin Lightening Products Market?

▾ Asia Pacific is expected to have the largest market share in the Global Skin Lightening Products Market with a share of about 52.5% in 2025.

Who are the key players in the Global Skin Lightening Products Market?

▾ Some of the major key players in the Global Skin Lightening Products Market are L’Oréal, Unilever, Procter & Gamble, Shiseido, Beiersdorf, Estée Lauder, Johnson & Johnson, Amorepacific, Avon, Kao, Himalaya, and many others.

What is the growth rate in the Global Skin Lightening Products Market in 2025?

▾ The market is growing at a CAGR of 5.7 percent over the forecasted period of 2025.