Market Overview

Global Sleep Apnea Devices Market will reach the figure of USD 4.8 Billion in 2024 while it is further anticipated that the market will reach the value of USD 8.9 Billion of 2033 at a CAGR of 7.1%.

This market offers medical devices and tools developed for sleep-disordered breathing, including obstructive sleep apnea, a condition whereby, during sleep, one experiences breathing disruptions. Within this marketplace, diagnostic tools include home sleep test apparatus, pulse oximeters, and other respiratory care devices. Additionally, demand is growing for sleep apnea implants, oral appliances, and wearable medical devices that are designed to improve treatment compliance.

This rising demand for sleep apnea devices has caused significant growth across healthcare delivery channels, including hospitals, sleep clinics, and home healthcare services. The rapid expansion of this market is due to the increasing prevalence of obstructive sleep apnea, improved awareness, advancements in digital health and telemedicine, and the growing popularity of home healthcare solutions worldwide.

As per the NCOA, the Sleep Apnea Device Market is driven by alarming statistics: 39 million U.S. adults and 936 million globally are estimated to have obstructive sleep apnea (OSA). Among patients, up to 94% experience snoring, a common symptom. Untreated OSA can result in severe complications such as cardiovascular, kidney, and metabolic disorders, highlighting the importance of chronic disease management.

Approximately 33 million U.S. adults could benefit from CPAP machines, a solution even used by President Joe Biden. Snoring regularly affects 44% of males and 28% of females, with 70% of bed partners reporting this issue. Diagnosis rates are notably higher among adults aged 50–70, emphasizing market demand for both therapeutic devices and remote patient monitoring solutions.

In recent developments, Philips has agreed to halt U.S. sales of its CPAP and BiPAP machines as part of a tentative settlement addressing product safety concerns. This decision followed a global recall due to hazardous foam deterioration in this medical equipment.

Concurrently, Apple has received FDA approval for a wearable technology feature in its latest Apple Watch models, enabling sleep apnea detection using accelerometer data for remote health monitoring. These events highlight the industry's shift towards healthcare IT, mHealth, and the integration of smart healthcare products into sleep health solutions.

Key Takeaways

- The Global Sleep Apnea Device Market is projected to reach a value of USD 4.8 billion in 2024.

- The Global Sleep Apnea Device Market is anticipated to grow with a CAGR of 7.1% during the forecast period (2024-2033).

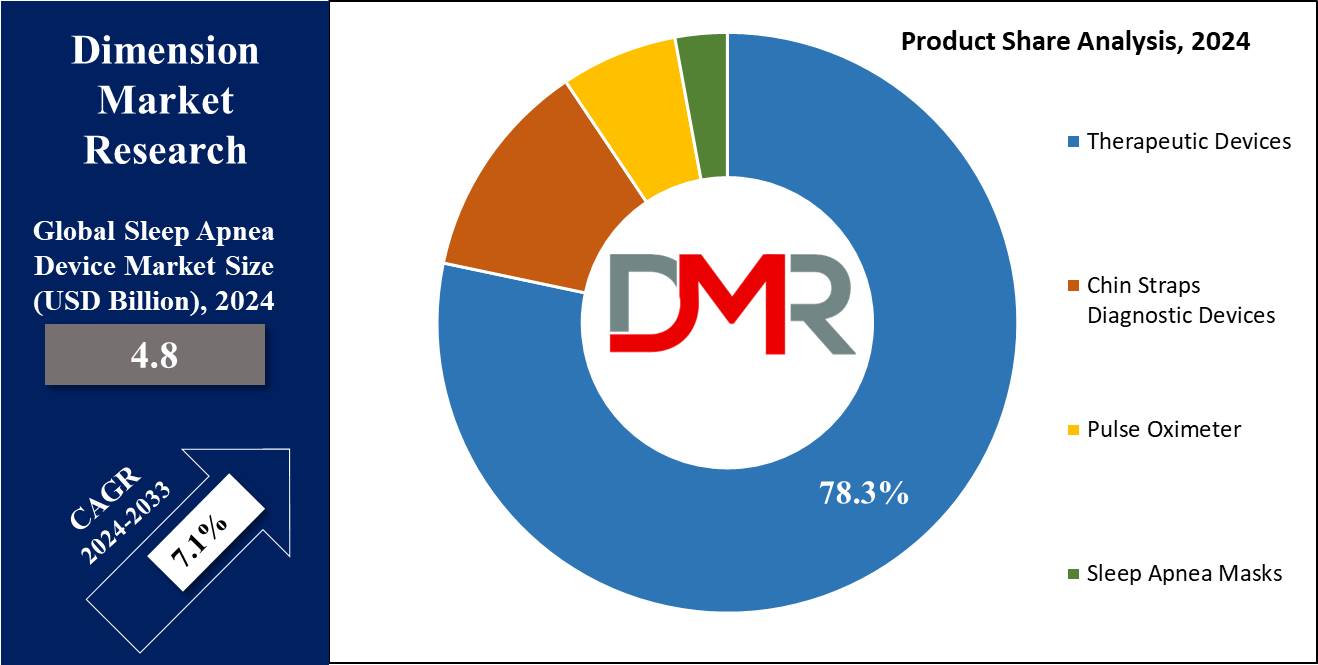

- Based on product, Therapeutic devices dominate this segment as they hold 78.3% of the market share in 2024.

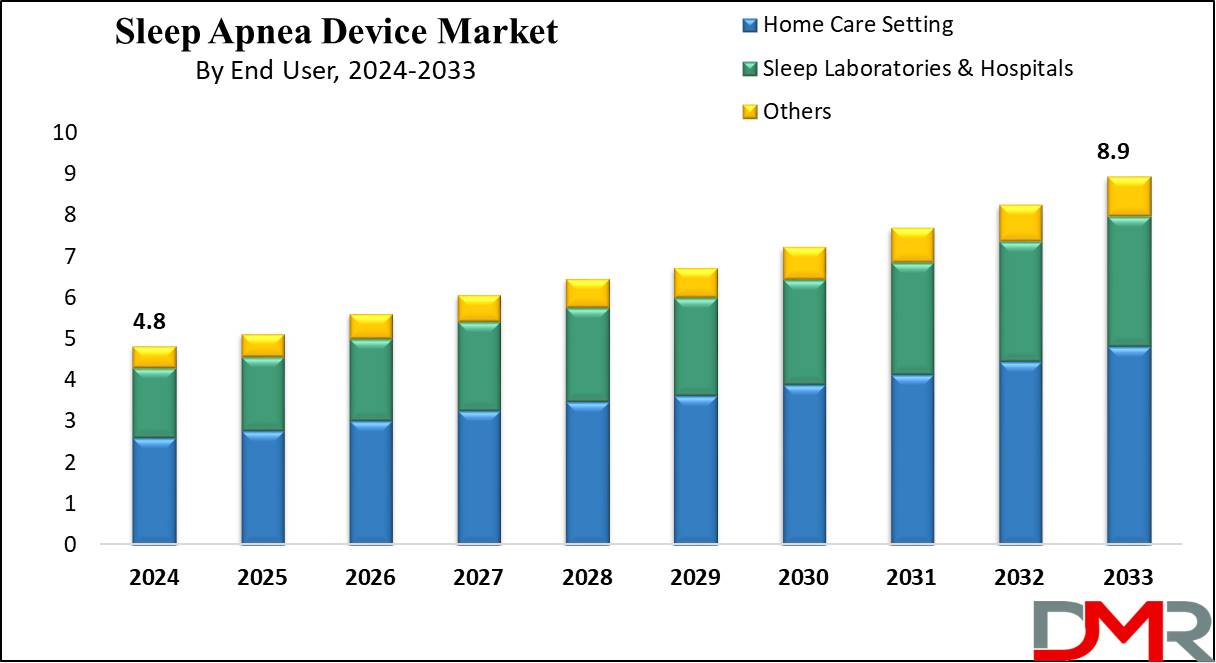

- The global sleep apnea device market is segmented by end-users, with home care settings emerging as the dominant choice for patients, as it holds 53.9% of the market share in 2024.

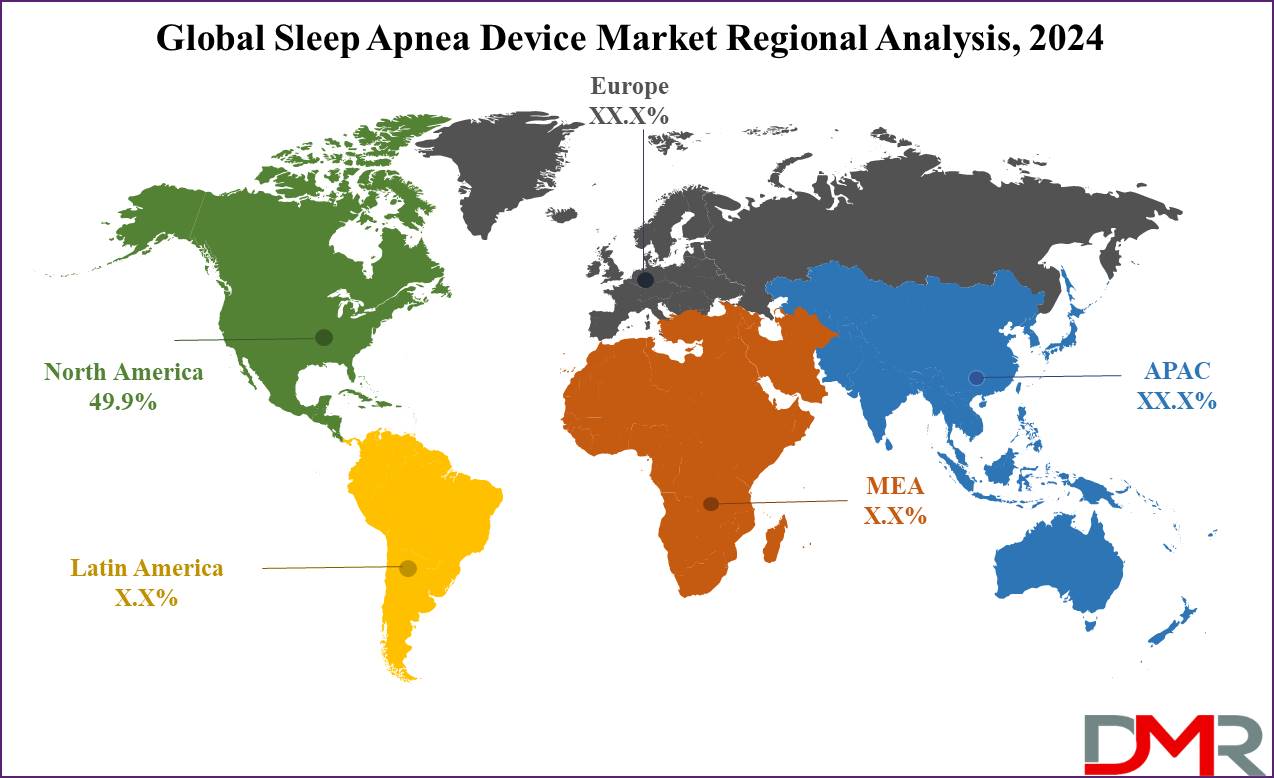

- North America holds a dominant position in the global sleep apnea device market as it 49.9% of the market share in 2024.

Use Cases

- By monitoring various physiological parameters set by sleep labs, healthcare professionals diagnose sleep disorders, including sleep apnea.

- A continuous positive airway pressure (CPAP) device delivers a continuous flow of air through a mask worn over the nose or nose and mouth, keeping the airway open during sleep.

- Bi-level positive airway pressure machines deliver two levels of air pressure, higher during inhalation & lower during exhalation, to patients with more complex sleep apnea or breathing difficulties.

- These are dental appliances like mandibular advancement devices that are worn during sleep to reposition the lower jaw and tongue, helping to keep the airway open.

- Software solutions are used in this market by healthcare providers to monitor patients' response to therapy, track treatment effectiveness, & adjust settings remotely.

Market Dynamic

The market dynamics of the global sleep apnea device market are shaped by various factors. The ongoing technological advancements in this market, including improvements in device portability and remote monitoring, drive the growth of this market by enhancing patient compliance.

The rising awareness & diagnosis rates contribute to a growth in the patient population, while the growing prevalence of sleep apnea. The market is influenced by factors such as obesity & the rise in the aging population.

These factors collectively are one of the major drivers behind the market growth. The shift towards home-based care, facilitated by portable devices and telehealth solutions, reflects evolving patient preferences.

Regulatory factors, competitive landscape dynamics, and industry consolidation through mergers and acquisitions also play crucial roles. Reimbursement policies impact patient access, and ongoing research and development initiatives contribute to the introduction of innovative products, shaping the overall competitiveness of the global sleep apnea device market.

Research Scope and Analysis

By Product

Based on product, Therapeutic devices are projected to dominate this segment as they hold 78.3% of the market share in 2024. Therapeutic devices, particularly positive airway pressure (PAP) devices, occupy a dominant position in the sleep apnea device market due to their remarkable effectiveness in treating obstructive sleep apnea (OSA).

PAP devices, including CPAP, APAP, and Bi-PAP, offer a versatile solution applicable to a wide range of patients, from mild to severe cases. Their non-invasive nature enhances patient compliance, and the customizable treatment options, especially with APAP devices, contribute to optimized therapy efficacy.

Patients appreciate the comfort and tolerance of nasal devices and masks associated with PAP therapy, fostering long-term adherence to home-based treatment. The comprehensive approach of PAP therapy in addressing airway collapse and improving overall sleep quality, combined with physician endorsements and clinical guidelines, further solidifies the dominance of therapeutic devices in the sleep apnea market.

While diagnostic devices remain crucial, the widespread applicability and patient-centric features of PAP devices make them a primary choice in sleep apnea management.

By End User

The global sleep apnea device market is segmented by end-users, with home care settings emerging as the dominant choice for patients, as it holds 53.9% of the

market share in 2024.

It is attributed to the development of mobile and affordable devices, the innovation of instruments capable of remote monitoring and telehealth connectivity, as well as the increasing number of people with moderate and mild symptomatology who can be successfully treated at home.

The COVID-19 pandemic greatly contributed to the popularity of

home healthcare solutions among the huge population, which complies with the developing trend of patient-centered care, as well as ensuring ease of access to treatment.

While home care settings lead in this segment, sleep laboratories, and hospitals remain crucial for diagnosing and treating severe cases, highlighting the importance of tailoring the choice of care setting based on the severity of the condition, patient preferences, and specific treatment requirements.

The Sleep Apnea Device Market Report is segmented based on the following:

By Product

- Therapeutic Devices

- Positive Airway Pressure Devices

- Oral Devices

- Nasal Devices

- Chin Straps Diagnostic Devices

- Actigraphs

- Polysomnography Device

- Respiratory Polygraphs

- Cardiologists

- ENT Specialists

- Homecare Nurses

- Sleep Physicians

By End-User

- Home Care Setting

- Sleep Laboratories & Hospitals

- Others

Regional Analysis

North America is projected to lead the global sleep apnea market as it

holds 49.9% of the revenue

share in 2024 due to its higher contribution to various groundbreaking developments in the context of sleep apnea devices. Also, the higher prevalence of sleep apnea in the region is another factor that is boosting the growth of this market. The region fosters a robust healthcare infrastructure, particularly in the United States and Canada, which extensively supports the research and development of diagnosis & treatment plans centered on this market.

This region has witnessed a collective awakening among consumers where educational activities, screening programs, and advocacy efforts are the tools to educate individuals to seek a medical opinion on sleep disorders. Besides, there is comprehensive health insurance coverage for the people which effectively motivate the individuals.

By Region

North America

Europe

- Germany

- The U.K.

- France

- Italy

- Russia

- Spain

- Benelux

- Nordic

- Rest of Europe

Asia-Pacific

- China

- Japan

- South Korea

- India

- ANZ

- ASEAN

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Argentina

- Colombia

- Rest of Latin America

Middle East & Africa

- Saudi Arabia

- UAE

- South Africa

- Israel

- Egypt

- Rest of MEA

Competitive Landscape

The global sleep apnea device market has a competitive scenario with many major players providing innovative solutions like CPAP and BPAP devices, masks, and accessories to improve patient comfort as well as putting much emphasis on product stabilization to enhance the treatment plan and offer equipment that are effective to people with sleep apnea. Through Respicardia Inc. as a main actor, a novel implantable device, which is pharmacotherapy, is issued to fight central sleep apnea.

The leading players in this sector are adopting organic and inorganic approaches continuously comprising cooperation, mergers, acquisitions, and innovations to strengthen their market positions and meet the ever-changing therapy requirements of patients. A competitive arena is unstable and is determined by prevailing market trends, new entrants, and competition among businesses in the fast-growing field of worldwide market of treatments for sleep apnea devices.

Some of the prominent players in the Global Sleep Apnea Device Market are:

- BMC Medical Co. Ltd.

- LivaNova PLC

- Cadwell Laboratories Inc.

- Fisher & Paykel Healthcare

- Invacare Corporation

- Itamar Medical Ltd

- Natus Medical Inc.

- Nihon Kohden

- Koninklijke Philips N.V.

- ResMed Inc.

- Teleflex Inc.

- Drive DeVilbiss International

- Other Key Players

Recent Developments

- In November 2023, Apnimed, Inc. and Shionogi & Co., Ltd. launched a joint venture Shionogi-Apnimed Sleep Science, LLC, to develop new drugs for obstructive sleep apnea and other sleep disorders.

- In October 2023, Samsung debuted a sleep apnea market with Galaxy Watch series that offers new sleep apnew feature, approved by Korea’s Ministry of Food and Drug Safety, aiming to detect early symptoms.

- In November 2022, ResMed and Verily revealed its new product Primasun, a solution to aid employers and healthcare providers in identifying individuals at risk for complex sleep disorders.

- In October 2022, Airway Management unveiled flexTAP, a premium oral appliance crafted in the lab, targeting snoring and mild to moderate obstructive sleep apnea, known for their extensively researched custom oral appliances.

Report Details

| Report Characteristics |

| Market Size (2024) |

USD 4.8 Bn |

| Forecast Value (2033) |

USD 8.9 Bn |

| CAGR (2023-2032) |

7.1% |

| Historical Data |

2018 – 2023 |

| Forecast Data |

2024 – 2033 |

| Base Year |

2023 |

| Estimate Year |

2024 |

| Report Coverage |

Market Revenue Estimation, Market Dynamics, Competitive Landscape, Growth Factors and etc. |

| Segments Covered |

By Product (Therapeutic Devices, Chin Straps Diagnostic Devices, Pulse Oximeter, and Sleep Apnea Masks), By End-User (Home Care Setting, Sleep Laboratories & Hospitals, and Others) |

| Regional Coverage |

North America – The US and Canada; Europe – Germany, The UK, France, Russia, Spain, Italy, Benelux, Nordic, & Rest of Europe; Asia- Pacific– China, Japan, South Korea, India, ANZ, ASEAN, Rest of APAC; Latin America – Brazil, Mexico, Argentina, Colombia, Rest of Latin America; Middle East & Africa – Saudi Arabia, UAE, South Africa, Turkey, Egypt, Israel, & Rest of MEA |

| Prominent Players |

BMC Medical Co. Ltd., LivaNova PLC, Cadwell Laboratories Inc., Fisher & Paykel Healthcare, Invacare Corporation, Itamar Medical Ltd, Natus Medical Inc., Nihon Kohden, Koninklijke Philips N.V., ResMed Inc., Teleflex Inc., Drive DeVilbiss International, and Other Key Players |

| Purchase Options |

We have three licenses to opt for: Single User License (Limited to 1 user), Multi-User License (Up to 5 Users), and Corporate Use License (Unlimited User) along with free report customization equivalent to 0 analyst working days, 3 analysts working days and 5 analysts working days respectively. |

Frequently Asked Questions

The Global Sleep Apnea Device Market is projected to reach a value of USD 4.8 billion in 2024.

The Global Sleep Apnea Device Market is anticipated to grow with a CAGR of 7.1% during the forecast period (2024-2033).

North America expected to dominate the Global Sleep Apnea Device Market with 49.9% of the total revenue share in 2024.

Some of the prominent players Global Sleep Apnea Device Market include BMC Medical Co. Ltd, LivaNova PLC, Cadwell Laboratories Inc., Fisher & Paykel Healthcare, Invacare Corporation, Itamar Medical Ltd, Natus Medical Inc., etc.