Market Overview

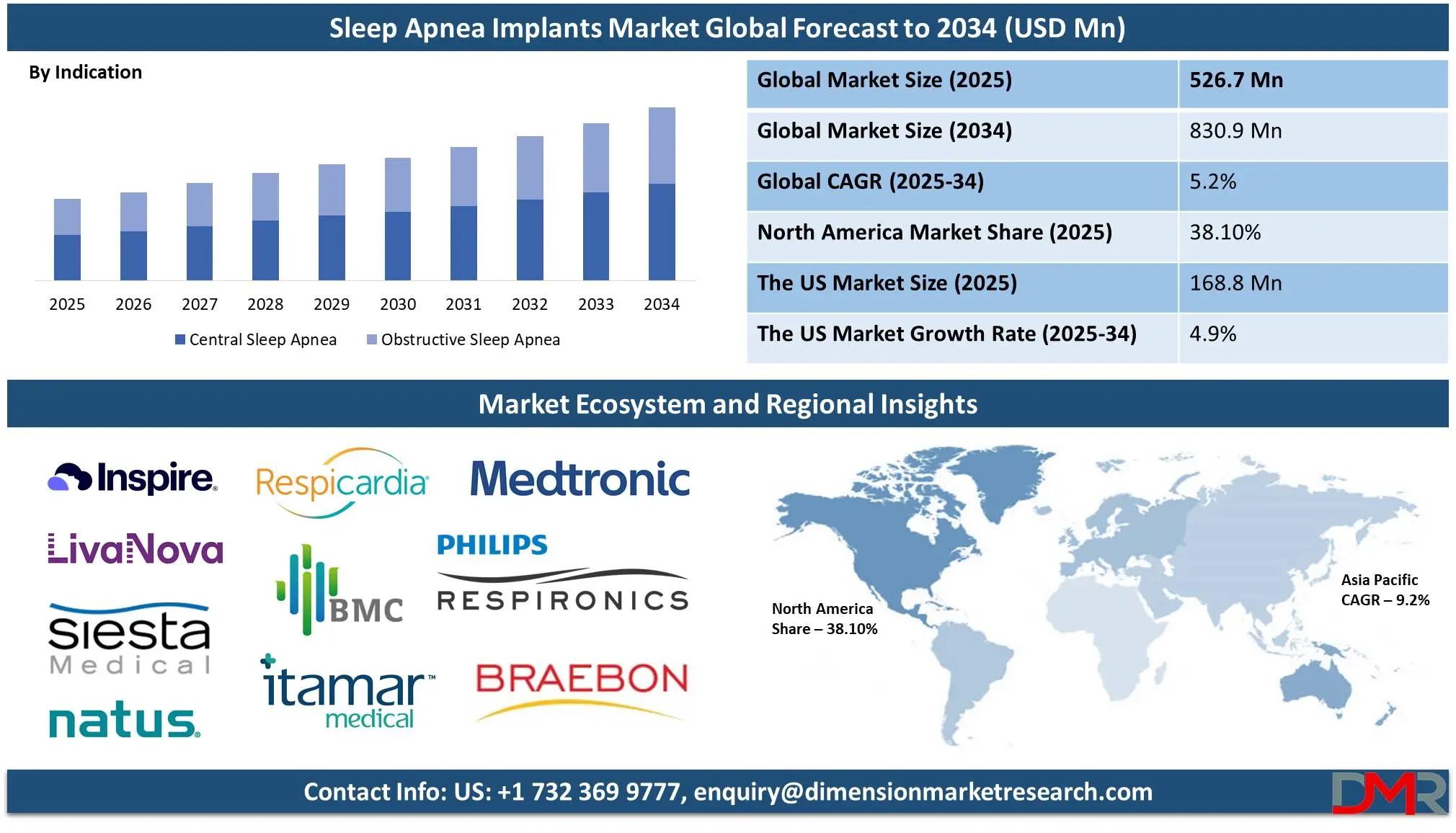

The Global Sleep Apnea Implants Market is predicted to be valued at USD 526.7 million in 2025 and is expected to grow to USD 830.9 million by 2034, registering a compound annual growth rate (CAGR) of 5.2% from 2025 to 2034.

ℹ

To learn more about this report –

Download Your Free Sample Report Here

The sleep apnea implant market is experiencing steady growth on a global level driven by rising sleep apnea rates and demand for minimally invasive treatment. It is estimated that over 936 million individuals worldwide are suffering from obstructive sleep apnea (OSA), with a significant number remaining undiagnosed. Hypoglossal nerve stimulators and palatal implants are increasingly used because they are effective in treating moderate to severe OSA. Technological advancements in the form of smart implantable products with remote monitoring are improving patient compliance and treatment efficacy.

The market is also witnessing a trend towards personalized medicine with augmented use of custom-fit implants. Further research on biodegradable materials for palatal implants is expanding treatment avenues for patients with minor to moderate sleep apnea. The incorporation of artificial intelligence (AI) in sleep monitoring is also proving to be crucial for enhancing treatment efficiency. However, constraints like costly implantation and the need for skilled professionals for implantation are inhibiting widespread adoption. Despite these limitations, growing awareness and favorable reimbursement policies in developed markets are poised to spur market growth.

Market demand is driven by increasing health expenditure and the growing geriatric population susceptible to sleep apnea. Outpatient surgical procedure growth is driven by the demand for low-cost treatments, which is creating a favorable environment for market development. Emerging markets in Asia-Pacific and Latin America offer vast potential with improved health infrastructure and rising disposable income. Strategic collaborations among key players for innovative products are also poised to fuel market development.

The sleep apnea implants market is poised to expand on the back of increasing clinical trials that establish long-term implant efficacy. North America dominates in terms of market share driven by higher diagnosis rates and a large company presence. Europe and Asia-Pacific are witnessing increasing adoption driven by enhanced health access. Advances in technology combined with approvals and increased patient awareness are set to fuel market expansion and establish sleep apnea implants as a key treatment for this widespread sleep disorder.

The US Sleep Apnea Implants Market

The US Sleep Apnea Implants Market is projected to be valued at USD 168.8 million in 2025. It is expected to witness subsequent growth in the upcoming period as it holds USD 259.3 million in 2034 at a CAGR of 4.9%.

The United States sleep apnea implant market is the largest in the world and is fuelled by higher diagnosis rates, advanced health infrastructure, and the strong presence of key manufacturers. Over 30 million Americans are estimated to be suffering from sleep apnea and nearly 80.0% remain undiagnosed. Growth is fuelled by rising patient awareness and frustration with traditional CPAP therapy. The country is also witnessing phenomenal growth in hypoglossal nerve stimulators that are receiving FDA approvals and widespread adoption with their non-intrusive nature and excellent treatment efficacy.

The U.S. has a robust demographic advantage with a large and growing older population that is heavily susceptible to sleep apnea. Rising obesity rates, a key OSA risk factor, are also a key driver with over 42% of U.S. adults obese. Favorable reimbursement policies are also driving market growth with sleep apnea implants made more accessible to a greater patient population. Government sleep disorder awareness programs and funding for advanced treatment techniques are also aiding the market.

The market is projected to remain on top with sustained product innovation, clinical trials that prove long-term efficacy, and increasing health expenditure. North America holds over 40% of the global sleep apnea implants market share with the U.S. dominating it. With leaders such as Inspire Medical Systems, Medtronic, and Respicardia, there is rapid technological advancement and widespread distribution of products with the U.S. as the center for innovation in treating sleep apnea.

Global Sleep Apnea Implants Market: Key Takeaways

- Global Market Size Insights: The Global Sleep Apnea Implants Market size is estimated to have a value of USD 526.7 million in 2025 and is expected to reach USD 830.9 million by the end of 2034.

- The US Market Size Insights: The US Sleep Apnea Implants Market is projected to be valued at USD 168.8 million in 2025. It is expected to witness subsequent growth in the upcoming period as it holds USD 259.3 million in 2034 at a CAGR of 4.9%.

- Regional Market Insights: North America is expected to have the largest market share in the Global Sleep Apnea Implants Market with a share of about 38.10% in 2025.

- Key Players Insights: Some of the major key players in the Global Sleep Apnea Implants Market are Inspire Medical Systems, Respicardia, Inc., Medtronic Plc, LivaNova PLC, ZOLL Medical Corporation, Nyxoah SA, Siesta Medical Inc., LinguaFlex, ResMed, Philips Respironics, Fisher & Paykel Healthcare, SomnoMed, Compumedics Limited, and many others.

- The Global Market Growth Rate Insights: The market is growing at a CAGR of 5.2 percent over the forecasted period of 2025.

Global Sleep Apnea Implants Market: Use Cases

- Severe Obstructive Sleep Apnea Treatment: Patients with severe OSA that is not responsive to CPAP therapy benefit from hypoglossal nerve stimulation implants. They maintain airway patency by stimulating tongue muscles to increase airflow reduce apnea events and lead to enhanced quality of sleep and day-to-day function.

- Elderly Patients with CPAP Intolerance: For many older individuals, CPAP therapy is uncomfortable to use or is difficult to use daily. Sleep apnea implants such as palatal implants and hypoglossal nerve stimulators provide an alternative that provides constant airway support without external equipment and with increased compliance and quality of life.

- Postoperative Sleep Apnea Management: Patients undergoing operations that impact airway function, for instance, maxillofacial or bariatric surgery, are prone to developing sleep apnea. Implants like flexible tongue retractor systems keep airway closure from occurring during sleep and are hence a good treatment for post-operative apnea.

- Athletes and Active Individuals: Athletes with sleep apnea are prone to reduced oxygenation with compromised athletic performance and recovery. Sleep apnea implants offer a non-invasive therapy that maintains airway patency and allows for enhanced oxygenation, recovery, and athletic performance in sports with high endurance.

- Pediatric Sleep Apnea Cases: In exceptional cases, children with congenital abnormalities or anatomical airway obstruction are susceptible to sleep apnea. Minimally invasive bone screw systems are used to maintain airway structures in proper position and are a potential treatment for children who do not improve with standard treatment.

Global Sleep Apnea Implants Market: Stats & Facts

- Sleep Foundation claims that sleep apnea occurs twice as frequently in men as it does in women. American Academy of Sleep Medicine (AASM) indicates that severe sleep apnea is common in men. Sleep Foundation reports that women complain of generalized symptoms like headaches, drowsiness, and insomnia while men complain of snoring, choking, or gasping. AASM indicates that menopause increases a woman's risk for sleep apnea. Sleep Foundation claims that men with sleep apnea are more prone to cardiovascular disease.

- AASM states that people older than 65 are twice as prone to sleep apnea compared to middle age. Sleep Foundation estimates that 50.0% of people older than 65 can experience mild sleep apnea and that 20% can experience moderate to severe sleep apnea. AASM estimates that 1.0-6.0% of children are affected with obstructive sleep apnea (OSA) and 1.0-5.0% with central sleep apnea (CSA).

- Asian people are found to be at higher risk for sleep apnea due to anatomical causes. African Americans, Native Americans, and Hispanics are said to be at higher risk by the Sleep Foundation, usually due to obesity. Journal of Clinical Sleep Medicine indicates that African Americans are more susceptible to sleep apnea-induced hypertension. Sleep Foundation states that snoring is more prevalent in Hispanics.

- AASM indicates that obesity is present in 40.0% of patients with sleep apnea. Sleep Foundation indicates that obesity-hypoventilation syndrome is present in 20.0% of obese OSA patients. AASM indicates that sleep apnea is present in 15-20.0% of obese pregnant women. Sleep Foundation indicates that BMI is less significant with increasing age in sleep apnea.

- AASM states that over 25.0% of pregnant women develop sleep apnea during the third trimester. Sleep Foundation reports that 40.0% of patients with congestive heart failure (CHF) are also suffering from central sleep apnea (CSA). AASM reports that up to 40.0% of those with Parkinson’s Disease are suffering from sleep apnea. Sleep Foundation states that genetic causes are responsible for 40.0% of sleep apnea severity (AHI score).

- The Wisconsin Sleep Cohort Study states that heavy drinking is associated with a 25.0% increase in sleep apnea. Sleep Foundation states that smokers are 34.0% more prone to sleep apnea than nonsmokers. AASM states that chronic opioid use significantly increases OSA and CSA risks.

- The Journal of Clinical Sleep Medicine states that snoring occurs in 94.0% of OSA. Sleep Foundation states that 58.0% of patients are found to be abnormally sleepy on diagnosis. Journal of Clinical Sleep Medicine states that morning headaches occur in 30.0% of those with OSA. Sleep Foundation states that attention deficits occur in 95.0% of those with moderate to severe sleep apnea.

- Untreated sleep apnea is three times more likely to lead to death, as per AASM. Sleep Foundation states that sleep apnea is responsible for a rise of 71.0% in cardiovascular disease and 48.0% in coronary heart disease. AASM states that sleep apnea is 86.0% more likely to lead to stroke. Sleep Foundation states that sleep apnea is present in 83.0% of Type 2 Diabetic patients. AASM states that 47.0% of patients with sleep apnea also have a mental health disorder such as anxiety or depression.

- 8 million people use CPAP equipment on a nightly basis with a compliance rate of 80.0% for users. AASM indicates that CPAP therapy reduces premature death by 61.0% and heart failure by 77.0%. Sleep Foundation indicates that oral appliances are used with a compliance rate of 90.0% and reduce breathing events by 86.0% among users. AASM indicates that uvulopalatopharyngoplasty (UPPP) is used with a success rate of 80.0% for specific instances. Sleep Foundation indicates that 30,000 people use nerve-stimulating implants to treat OSA.

- AASM states that adults with OSA spend 1.8 times more on healthcare costs before diagnosis. Sleep Foundation highlights that treating sleep apnea could save USD 11.1 billion annually in collision costs. AASM reports that CPAP therapy improves job productivity and reduces burnout.

Global Sleep Apnea Implants Market: Market Dynamic

Driving Factors in the Global Sleep Apnea Implants Market

Rising Prevalence of Sleep Apnea and Growing Awareness

The increasing global prevalence of sleep apnea is a primary driver of the sleep apnea implants market. According to the American Academy of Sleep Medicine, over

936 million people worldwide suffer from obstructive sleep apnea (OSA), with many remaining undiagnosed. Factors such as obesity, an aging population, and lifestyle changes contribute to the rising incidence of sleep apnea.

Additionally, public health initiatives and awareness campaigns are educating patients about the risks of untreated sleep apnea, including cardiovascular diseases, diabetes, and cognitive impairment. As more patients seek treatment, the demand for effective alternatives to CPAP therapy, such as sleep apnea implants, continues to grow. The improved diagnosis rate due to advancements in home sleep testing and AI-powered diagnostic tools is further boosting market growth.

Favorable Reimbursement Policies and Increased Insurance Coverage

The expansion of reimbursement coverage for sleep apnea implants is significantly driving market growth. Many developed countries, including the United States and several European nations, have introduced favorable reimbursement policies for implant-based sleep apnea treatments. Insurance providers are recognizing the long-term cost-effectiveness of implants compared to continuous CPAP machine usage, hospital readmissions due to untreated sleep apnea, and associated comorbidities.

In addition, government healthcare programs are integrating implant procedures into coverage plans, making them more accessible to patients. As reimbursement policies continue to expand and simplify the approval process for implant-based therapies, more patients will opt for these advanced solutions, driving market penetration and revenue growth for manufacturers.

Restraints in the Global Sleep Apnea Implants Market

High Cost of Sleep Apnea Implants and Surgical Procedures

One of the most significant challenges in the sleep apnea implants market is the high cost associated with implant devices and the surgical implantation process. The total cost of a sleep apnea implant procedure, including the device, surgery, and follow-up care, can range from $20,000 to $40,000, making it unaffordable for many patients, particularly in low- and middle-income countries.

While insurance coverage has improved in several regions, many patients still face out-of-pocket expenses that limit accessibility. Additionally, the high cost of R&D and regulatory approvals further increases the overall price of implants. Unless manufacturers find ways to reduce costs through economies of scale or innovative production methods, affordability will remain a significant barrier to market expansion.

Limited Awareness and Hesitancy Toward Surgical Solutions

Despite the growing awareness of sleep apnea and its risks, many patients remain hesitant to undergo surgical interventions, preferring non-invasive treatments like CPAP therapy, oral appliances, or lifestyle modifications. Fear of complications, surgical risks, and post-implantation discomfort deter many individuals from opting for implant-based solutions. Additionally, there is a lack of trained specialists in certain regions, making it difficult for patients to access proper consultation and treatment.

Healthcare providers also play a critical role in influencing treatment choices, and many still prioritize CPAP therapy due to its long-established efficacy. Overcoming this challenge requires extensive patient education campaigns, improved communication about the long-term benefits of implants, and increased efforts to train healthcare professionals in implant-based sleep apnea treatments.

Opportunities in the Global Sleep Apnea Implants Market

Expansion into Emerging Markets with Rising Healthcare Expenditure

Emerging markets, particularly in Asia-Pacific, Latin America, and the Middle East, present lucrative growth opportunities for sleep apnea implant manufacturers. Rapid urbanization, rising disposable incomes, and improving healthcare infrastructure are enabling greater access to advanced sleep apnea treatments in these regions. Countries such as China, India, and Brazil are witnessing an increasing number of sleep disorder diagnoses due to greater awareness and the adoption of Westernized lifestyles, which contribute to obesity and sleep apnea prevalence.

Additionally, governments in these regions are investing heavily in healthcare infrastructure and promoting medical tourism, making sleep apnea implant procedures more accessible and affordable. Manufacturers that establish strong distribution networks, partner with local healthcare providers, and invest in patient education campaigns can gain a competitive edge in these high-potential markets.

Technological Innovations Leading to Next-Generation Sleep Apnea Implants

Continuous advancements in implant technology are opening new doors for market expansion. Next-generation sleep apnea implants are being designed to improve patient comfort, reduce surgical complexity, and enhance long-term efficacy. Key innovations include battery-free implants powered by external energy sources, bioresorbable materials for minimizing long-term foreign body reactions, and enhanced AI-based sensors for automatic adjustments based on sleep patterns.

Additionally, the development of smart implants that sync with wearable devices and mobile applications is allowing patients and clinicians to monitor treatment effectiveness in real-time. Companies investing in research and development to create more efficient and minimally invasive implant solutions will benefit from increased adoption rates and market expansion opportunities.

Trends in the Global Sleep Apnea Implants Market

Increasing Adoption of Hypoglossal Nerve Stimulation (HNS) Implants

The global sleep apnea implants market is witnessing a significant shift toward hypoglossal nerve stimulation (HNS) implants as an effective alternative for patients who cannot tolerate continuous positive airway pressure (CPAP) therapy. These implants work by stimulating the hypoglossal nerve to prevent airway collapse during sleep. The rise in minimally invasive surgical options and patient preference for long-term solutions over CPAP is driving HNS implant adoption.

Companies are focusing on research and development to enhance implant performance, reduce complications, and increase patient comfort. Additionally, technological advancements, such as wireless connectivity and smartphone integration, are improving patient compliance and facilitating remote monitoring by healthcare providers, further accelerating market expansion.

Integration of Artificial Intelligence (AI) and Remote Monitoring in Sleep Apnea Treatment

The incorporation of AI and remote monitoring solutions in sleep apnea implants is transforming patient care. AI-powered sleep tracking, combined with cloud-based data storage, enables continuous assessment of sleep patterns, treatment effectiveness, and real-time adjustments to implant stimulation settings. Wearable devices synchronized with sleep apnea implants are also gaining popularity, allowing clinicians to monitor patient progress remotely and make necessary modifications without requiring frequent hospital visits.

The emergence of AI-driven diagnostics for sleep disorders is further streamlining the identification of eligible patients for implant-based treatments. As AI capabilities continue to evolve, their integration into sleep apnea implants is expected to drive significant improvements in personalized therapy, patient adherence, and overall treatment outcomes.

Global Sleep Apnea Implants Market: Research Scope and Analysis

By Product Analysis

Hypoglossal neurostimulation implants are anticipated to dominate the sleep apnea market in this segment due to their efficiency in treating obstructive sleep apnea (OSA) and their minimally invasive nature compared to traditional treatment. Hypoglossal nerve stimulation is employed to activate the nerve that is in charge of controlling the movements of the tongue to prevent airway blockage during sleep. Hypoglossal neurostimulation differs from continuous positive airway pressure (CPAP) therapy in that it is a mask-free treatment that has been proven to increase patient compliance and comfort.

Along with this, clinical trials have also established that these devices reduce apnea-hypopnea index (AHI) scores by over 70%, and are hence amongst the best alternatives for CPAP. Patients and medical professionals alike are increasingly seeking minimally invasive and long-term treatments for this condition, fueling demand for hypoglossal neurostimulation. Further, advancements in technology with improved battery life and smart functions for personalized therapy adjustments have enhanced their market position.

Regulatory approvals by the U.S. FDA and other health organizations have expedited their adoption in North America and Europe. Rising rates of moderate to severe OSA and greater awareness of sleep apnea-related impacts such as cardiovascular disease and cognitive impairment are also driving market growth. Increased insurance coverage and reimbursement policies for these devices have also played an important role in making them leaders. With studies continuing to support their long-term benefits, hypoglossal neurostimulation devices are set to remain leaders in sleep apnea implants.

By Indication Analysis

Central sleep apnea (CSA) is projected to dominates the sleep apnea implant market because it is on the rise and necessitates specialized treatment. CSA is different from obstructive sleep apnea (OSA) in that it is a result of inappropriate signals by the brain to breathing muscles and calls for specialized treatment. Conventional CPAP is not effective for CSA patients and calls for implantable therapy such as phrenic nerve stimulators that restore normal breathing patterns.

Implantable phrenic nerve stimulation units that provide timed pulses of electricity to stimulate breathing are now considered to be the treatment of choice for CSA. Implants decrease apnea events by increasing synchrony between respiratory muscles and brain signals and are a treatment of choice for severe CSA. U.S. approval by the Food and Drug Administration for implantable neurostimulation for CSA has been a key driver of adoption, particularly for individuals with comorbid cardiovascular disease such as heart failure.

Another key stimulus for CSA leadership in sleep apnea implants is increasing awareness of its association with neurological diseases such as Parkinson’s and stroke. Increased awareness leads to increased diagnosis and referral for advanced treatment. Clinical trials have also validated CSA implants to reduce rates of hospitalization and improve quality of life. Increased demand for innovative, long-term, and personalized therapy for CSA, coupled with advancements in implant technology, has made it a leading segment in sleep apnea implants across the world.

By End-use

Hospitals are expected to dominate sleep apnea implants owing to advanced infrastructure, skilled health professionals, and the ability to handle complex implant procedures. As the principal health care center for surgical procedures, hospitals perform the majority of sleep apnea implant procedures to offer access to specialists, anesthesiologists, and post-operative staff. Advanced patient monitoring and follow-up care centers are also easily accessible.

The difference-maker is the growing number of patients with moderate to severe sleep apnea that require implantable therapy. With greater sleep disorder focus in the medical community, sleep centers in hospitals are increasingly including implantable therapy in treatment regimens. Hospitals also maintain ongoing partnerships with medical equipment firms to implement newly cleared implant products and perform clinical trials for innovative products.

Reimbursement policies that favor treatment in hospitals have also been instrumental in establishing them as market leaders. Implant sleep apnea therapy in accredited hospitals is covered by most insurance providers, making it more convenient for patients. Hospitals are also centers for patient referral for comorbid conditions such as cardiovascular disease, neurological disease, and obesity that increase the likelihood of them needing advanced sleep apnea therapy.

Due to the growing demand for efficient and long-term sleep apnea treatment, hospitals will continue to be leaders in providing comprehensive implant therapy options and will continue to dominate the sleep apnea implant market.

The Global Sleep Apnea Implants Market Report is segmented on the basis of the following

By Product

- Hypoglossal Neuro Stimulation Devices

- Implantable Pulse Generators (IPGs)

- Leads and Electrodes

- External Remote Control Devices

- Palatal Implants

- Soft Palate Stiffening Implants

- Polyethylene Terephthalate (PET) Fiber Implants

- Resorbable/Absorbable Palatal Implants

- Flexible Tongue Retractor System

- Bone Screw Systems

- Phrenic Nerve Stimulators

- Diaphragm Pacing Systems

- External Controllers and Battery Packs

- Implantable Electrodes

By Indication

- Central Sleep Apnea

- Obstructive Sleep Apnea

By End-use

- Hospitals

- Ambulatory surgical centers

- Specialty Clinics

Global Sleep Apnea Implants Market: Regional Analysis

Region with Highest Market Share in the Sleep Apnea Implants Market

The North American region is projected to dominate the sleep apnea implants market as it commands over

38.10% of the total revenue by the end of 2025 on a global scale due to its developed health infrastructure, higher awareness rates, and greater presence of major market players. It has a big patient pool for sleep apnea with over 30 million individuals suffering in the U.S. alone. This coupled with increasing diagnoses with improved screening programs and increased awareness regarding untreated sleep apnea risks has increased demand for implant products. Favorable reimbursement policies and widespread insurance coverage for sleep apnea implantation procedures also drive market growth.

Along with this, U.S. approvals for advanced implant technologies such as phrenic nerve stimulation and hypoglossal neurostimulation products are fueling faster adoption. Inspire Medical Systems, Respicardia, and Medtronic are some of the major companies that have heavily invested in North American R&D and commercialization. Special sleep centers and robust clinical study programs are also aiding market leadership. With a rise in demand for minimally invasive treatment and increased health expenditure, North America is set to continue to lead the sleep apnea implant market.

Region with Highest CAGR in the Sleep Apnea Implants Market

The Asia-Pacific region is anticipated to exhibit the highest CAGR for sleep apnea implants due to increasing health awareness, increasing levels of disposable income, and increased access to advanced medical treatment. The region is witnessing increasing numbers of sleep apnea cases with rising obesity rates, population aging, and lifestyle changes. While diagnosis rates were lower in this region in the past, increasing initiatives to raise awareness regarding sleep disorders are driving increased adoption of implant therapy.

Urbanization and government health reforms in areas such as China, India, and Japan are contributing to the increased availability of specialized treatment centers. Along with this, there is significant investment by medical equipment companies across the globe to expand market share. Telemedicine and remote monitoring are also expanding patient access to sleep apnea treatment. Rising insurance coverage and increased demand for affordable and long-term treatment are set to fuel significant market growth in Asia-Pacific in the future.

By Region

North America

Europe

- Germany

- The U.K.

- France

- Italy

- Russia

- Spain

- Benelux

- Nordic

- Rest of Europe

Asia-Pacific

- China

- Japan

- South Korea

- India

- ANZ

- ASEAN

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Argentina

- Colombia

- Rest of Latin America

Middle East & Africa

- Saudi Arabia

- UAE

- South Africa

- Israel

- Egypt

- Rest of MEA

Global Sleep Apnea Implants Market: Competitive Landscape

The global sleep apnea implants market is highly competitive with key firms focusing on technological innovation, regulatory approvals, and strategic partnerships. Inspire Medical Systems, Zoll Medical subsidiary Respicardia, Medtronic, and Nyxoah are key firms with significant market share strong portfolios, and geographic presence. They spend heavily on R&D to enhance implant performance and patient compliance.

Strategic collaborations between leaders in industries and research centers have given rise to sophisticated implant and neurostimulation technologies. Mergers and acquisitions are also prevalent to expand companies' offerings and coverage. Emerging entrants, particularly in Asia-Pacific, are employing creative and inexpensive solutions to compete with established firms.

The market is also experiencing increased approvals and commercialization activities in North America and Europe. Companies are expanding clinical trials and gaining FDA and CE Mark approvals to create strong market positions. With the increased demand for effective and minimally invasive sleep apnea treatment products, competition among major players is going to increase.

Some of the prominent players in the Global Sleep Apnea Implants Market are

- Inspire Medical Systems

- Respicardia, Inc.

- Medtronic Plc

- LivaNova PLC

- ZOLL Medical Corporation

- Nyxoah SA

- Siesta Medical Inc.

- LinguaFlex

- ResMed

- Philips Respironics

- Fisher & Paykel Healthcare

- SomnoMed

- Compumedics Limited

- Drive DeVilbiss Healthcare

- BMC Medical Co., Ltd.

- Natus Medical Incorporated

- Braebon Medical Corporation

- Itamar Medical Ltd.

- Vyaire Medical

- Curative Medical Inc.

- Apex Medical Corp.

- Somnetics International, Inc.

- Other Key Players

Recent Developments in the Global Sleep Apnea Implants Market

2024

- March 2024: Inspire Medical Systems received FDA approval for its next-generation hypoglossal nerve stimulator, featuring AI-driven adaptive therapy to enhance treatment precision and patient outcomes in sleep apnea management.

- February 2024: Nyxoah SA secured CE Mark approval for the Genio® system expansion, allowing broader European market access for its minimally invasive neurostimulation therapy for obstructive sleep apnea.

- January 2024: Medtronic completed the acquisition of a sleep apnea implant startup, strengthening its neurostimulation portfolio and expanding its market footprint in advanced sleep disorder treatment solutions.

2023

- December 2023: Respicardia (Zoll Medical) partnered with major U.S. hospitals to expand clinical trials on phrenic nerve stimulation implants, improving treatment efficacy for central sleep apnea patients.

- November 2023: Inspire Medical Systems launched a direct-to-patient awareness campaign in North America, driving the adoption of hypoglossal nerve stimulation implants for obstructive sleep apnea treatment.

- October 2023: The Asia-Pacific Sleep Apnea Symposium showcased advanced implant technologies, underscoring the region’s growing market potential and adoption of innovative sleep apnea treatments.

- September 2023: Fisher & Paykel Healthcare announced a USD 50 million investment in Australian research facilities, accelerating the development of next-generation sleep apnea implant technologies.

- August 2023: Apex Medical Corp partnered with a leading Japanese hospital system to enhance sleep apnea treatment solutions, expanding access to innovative implant technologies in Asia.

2022

- July 2022: LivaNova PLC collaborated with European sleep disorder centers to advance clinical research in implantable therapies, driving innovation in sleep apnea treatment solutions.

- June 2022: ResMed expanded its manufacturing capacity to meet rising global demand for implantable sleep apnea solutions, strengthening its market position.

- May 2022: SomnoMed developed a hybrid implant-oral appliance system, integrating advanced implant technology with traditional oral appliances to improve patient outcomes in sleep apnea management.

Report Details

|

Report Characteristics

|

| Market Size (2025) |

USD 526.7 Mn |

| Forecast Value (2034) |

USD 830.9 Mn |

| CAGR (2025-2034) |

5.2% |

| Historical Data |

2019 – 2024 |

| The US Market Size (2025) |

USD 168.8 Mn |

| Forecast Data |

2025 – 2033 |

| Base Year |

2024 |

| Estimate Year |

2025 |

| Report Coverage |

Market Revenue Estimation, Market Dynamics, Competitive Landscape, Growth Factors and etc. |

| Segments Covered |

By Product (Hypoglossal Neuro Stimulation Devices, Palatal Implants, Flexible Tongue Retractor System, Bone Screw Systems, Phrenic Nerve Stimulators), By Indication (Central Sleep Apnea, Obstructive Sleep Apnea), By End-use (Hospitals, Ambulatory Surgical Centers, Specialty Clinics) |

| Regional Coverage |

North America – The US and Canada; Europe – Germany, The UK, France, Russia, Spain, Italy, Benelux, Nordic, & Rest of Europe; Asia- Pacific– China, Japan, South Korea, India, ANZ, ASEAN, Rest of APAC; Latin America – Brazil, Mexico, Argentina, Colombia, Rest of Latin America; Middle East & Africa – Saudi Arabia, UAE, South Africa, Turkey, Egypt, Israel, & Rest of MEA |

| Prominent Players |

Inspire Medical Systems, Respicardia, Inc., Medtronic Plc, LivaNova PLC, ZOLL Medical Corporation, Nyxoah SA, Siesta Medical Inc., LinguaFlex, ResMed, Philips Respironics, Fisher & Paykel Healthcare, SomnoMed, Compumedics Limited, Drive DeVilbiss Healthcare, BMC Medical Co., Ltd., Natus Medical Incorporated, Braebon Medical Corporation, Itamar Medical Ltd., Vyaire Medical, Curative Medical Inc., Apex Medical Corp., Somnetics International, Inc., and Other Key Players |

| Purchase Options |

We have three licenses to opt for: Single User License (Limited to 1 user), Multi-User License (Up to 5 Users) and Corporate Use License (Unlimited User) along with free report customization equivalent to 0 analyst working days, 3 analysts working days and 5 analysts working days respectively. |

Frequently Asked Questions

How big is the Global Sleep Apnea Implants Market?

▾ The Global Sleep Apnea Implants Market size is estimated to have a value of USD 526.7 million in 2025 and is expected to reach USD 830.9 million by the end of 2034.

What is the size of the US Sleep Apnea Implants Market?

▾ The US Sleep Apnea Implants Market is projected to be valued at USD 168.8 million in 2025. It is expected to witness subsequent growth in the upcoming period as it holds USD 259.3 million in 2034 at a CAGR of 4.9%.

Which region accounted for the largest Global Sleep Apnea Implants Market?

▾ North America is expected to have the largest market share in the Global Sleep Apnea Implants Market with a share of about 38.10% in 2025.

Who are the key players in the Global Sleep Apnea Implants Market?

▾ Some of the major key players in the Global Sleep Apnea Implants Market are Inspire Medical Systems, Respicardia, Inc., Medtronic Plc, LivaNova PLC, ZOLL Medical Corporation, Nyxoah SA, Siesta Medical Inc., LinguaFlex, ResMed, Philips Respironics, Fisher & Paykel Healthcare, SomnoMed, Compumedics Limited, and many others.

What is the growth rate in the Global Sleep Apnea Implants Market in 2025?

▾ The market is growing at a CAGR of 5.2 percent over the forecasted period of 2025.