Market Overview

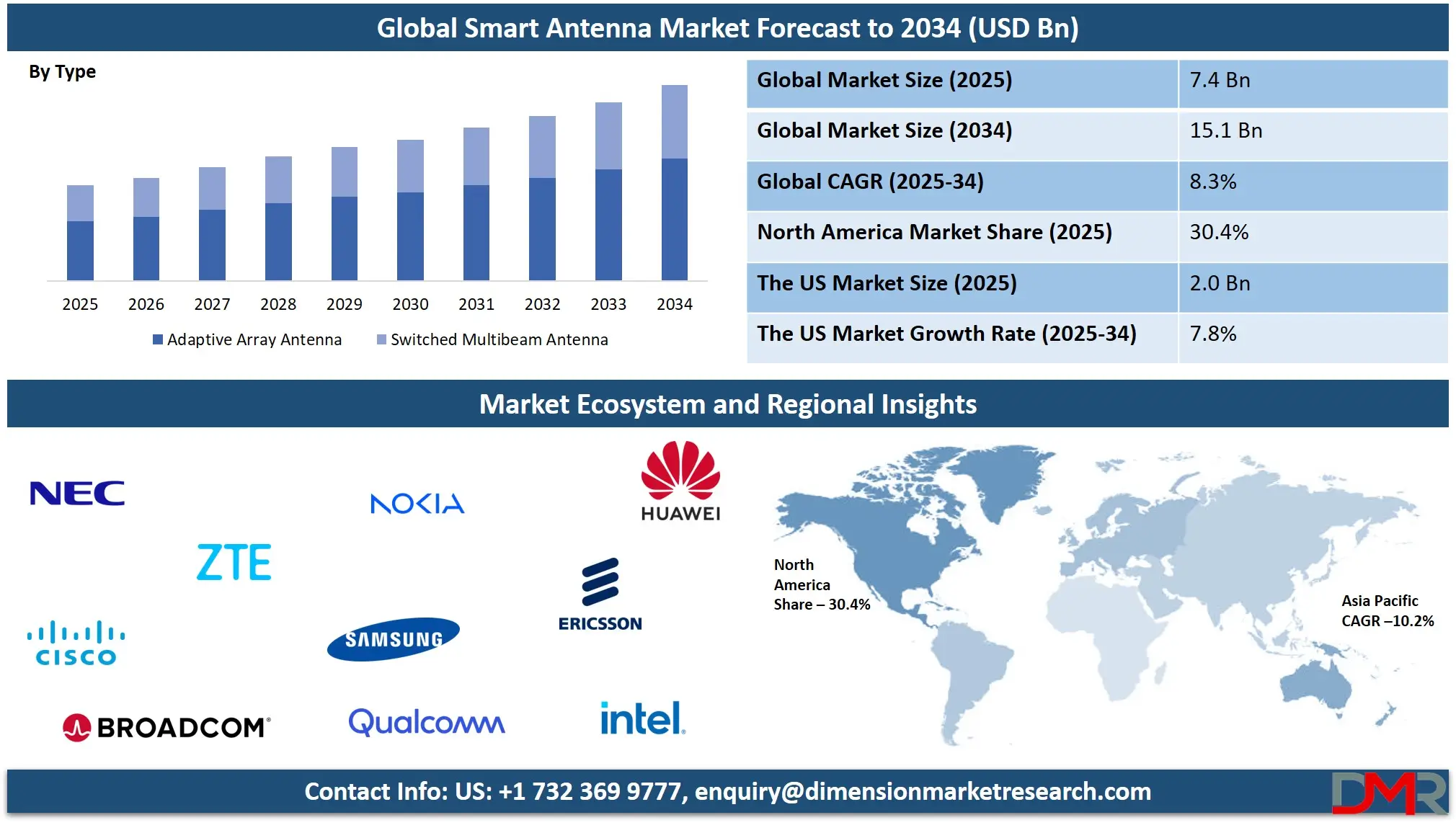

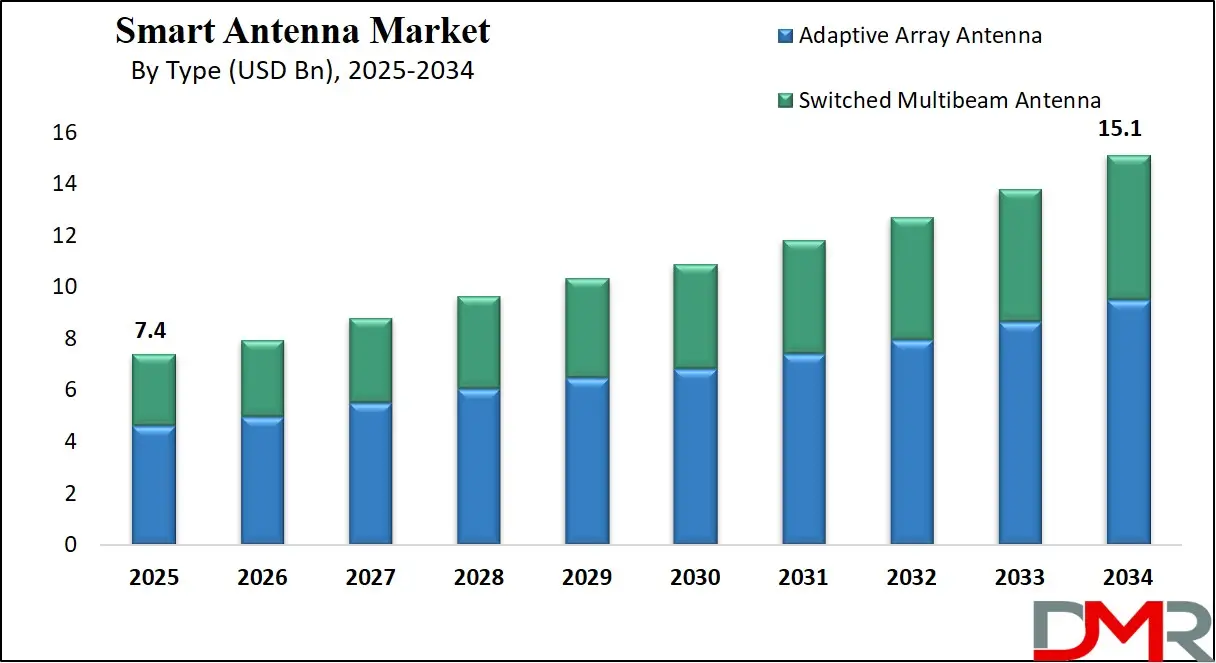

The Global Smart Antenna Market size is projected to reach USD 7.4 billion in 2025 and grow at a compound annual growth rate of 8.3% from there until 2034 to reach a value of USD 15.1 billion.

Smart antennas are advanced antenna systems that use signal processing technologies to improve wireless communication. Unlike traditional antennas, they can automatically adjust their signal direction, strength, and reception based on the environment. They are often used in mobile communication, Wi-Fi networks, satellite systems, and military applications. These antennas come in two major types: switched beam and adaptive arrays. The switched beam antenna selects the best beam from a predefined set, while the adaptive array adjusts in real-time to optimize the signal. This adaptability helps increase data rates, reduce interference, and extend coverage areas.

ℹ

To learn more about this report –

Download Your Free Sample Report Here

The growing demand for faster, more reliable wireless communication is a major driver for smart antennas. With more people using smartphones, streaming services, and connected devices, the pressure on networks is increasing. Smart antennas help manage this load by improving network efficiency. They are key to next-generation wireless technologies like

5G Services and are expected to play an important role in future systems such as 6G. Their ability to reduce dropped calls and maintain strong signals even in crowded or fast-moving environments adds to their appeal for both telecom providers and consumers.

Several technological trends are supporting the growth of smart antennas. These include the use of artificial intelligence and machine learning to optimize signal paths and beamforming. Additionally, the growth of the Internet of Things (IoT), smart cities, and connected vehicles is pushing the need for more dynamic and intelligent antenna systems. Developments in Massive MIMO (Multiple Input, Multiple Output) are also influencing the market, as smart antennas are often a part of these multi-antenna systems that enable higher data rates and better spectral efficiency.

In recent years, companies and research institutions have been investing heavily in smart antenna development. These investments aim to improve performance, reduce size and cost, and increase compatibility with newer wireless standards. For example, several telecom operators are integrating smart antennas into their 5G infrastructure to offer better service quality in urban areas. Researchers are also working on smart antennas for wearable technology and autonomous vehicles, indicating a wider scope of application.

ℹ

To learn more about this report –

Download Your Free Sample Report Here

Smart antennas have also become important in defense and aerospace industries. Their ability to maintain reliable communication in difficult environments such as mountains, oceans, or battlefields makes them valuable. Governments in different countries are funding projects that use smart antennas for secure and efficient communication, navigation, and surveillance. Drones and unmanned vehicles, both civilian and military, also use smart antennas to stay connected while moving through complex terrains.

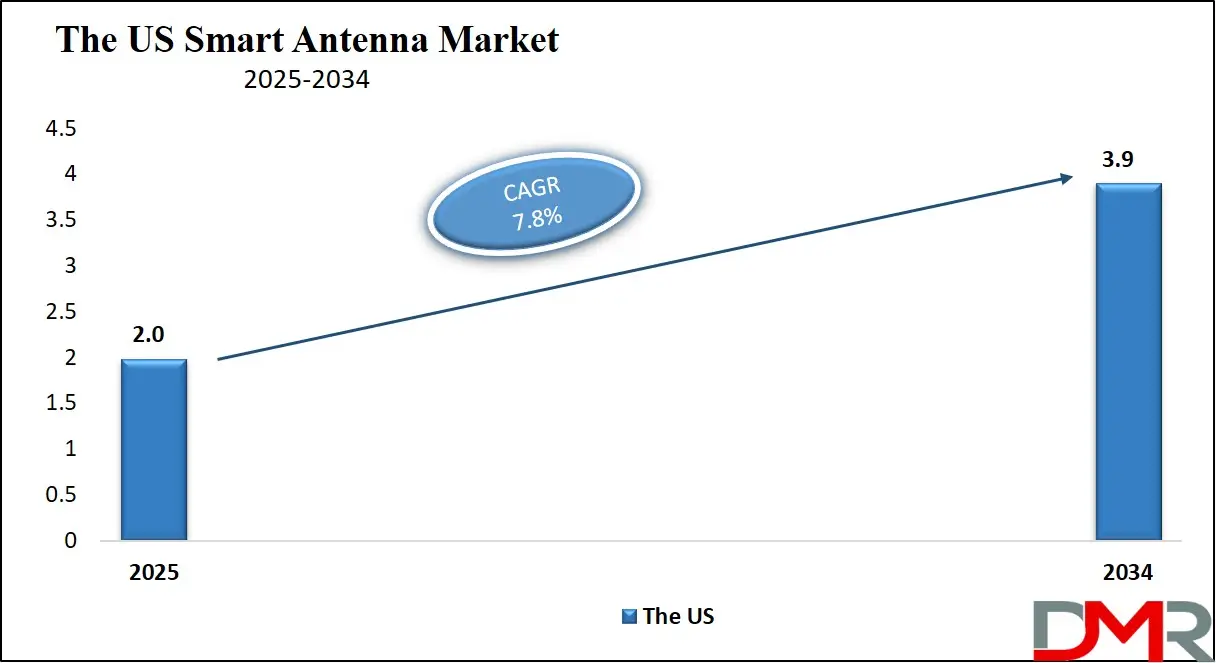

The US Smart Antenna Market

The US Smart Antenna Market size is projected to reach USD 2.0 billion in 2025 at a compound annual growth rate of 7.8% over its forecast period.

The US plays a leading role in the smart antenna market due to its strong technological base, advanced telecom infrastructure, and early adoption of 5G networks. With major research centers and innovation hubs, the US drives development in adaptive antenna technologies, AI-driven beamforming, and Massive MIMO systems.

The country’s large-scale investment in smart cities, defense communication, and connected vehicles creates steady demand for high-performance antennas. US-based companies and institutions are also at the forefront of collaborations, patents, and pilot projects that shape global antenna standards. Additionally, government support for defense and space technologies further boosts smart antenna adoption. This leadership in both commercial and defense sectors positions the US as a key driver in the growth and direction of the global market.

ℹ

To learn more about this report –

Download Your Free Sample Report Here

Europe Smart Antenna Market

Europe Smart Antenna Market size is projected to reach USD 1.5 billion in 2025 at a compound annual growth rate of 7.7% over its forecast period.

Europe holds a significant role in the smart antenna market through its strong focus on innovation, regulatory support, and advanced communication infrastructure. Many countries in Europe are actively investing in 5G deployment, smart transportation, and IoT-based solutions, all of which rely on efficient antenna systems. European research institutions and technology firms are contributing to the development of smart antenna technologies, especially in areas like beamforming, energy-efficient designs, and multi-device connectivity. The region is also involved in cross-border research projects and standard-setting initiatives that influence global practices.

Additionally, Europe’s growing interest in green and sustainable technologies encourages the development of energy-saving antenna systems. This combination of innovation, collaboration, and demand helps Europe remain a key player in shaping the smart antenna landscape.

Japan Smart Antenna Market

Japan Smart Antenna Market size is projected to reach USD 555.0 million in 2025 at a compound annual growth rate of 8.7% over its forecast period.

Japan plays an influential role in the smart antenna market, driven by its advanced electronics industry, strong research capabilities, and early adoption of next-generation wireless technologies. The country is known for its leadership in robotics, connected vehicles, and consumer electronics, all of which benefit from smart antenna integration. Japan’s telecom sector is actively deploying 5G networks and preparing for 6G, encouraging innovation in adaptive antennas and signal optimization.

Major technology firms and research institutions in Japan are heavily involved in developing compact, energy-efficient, and high-performance antenna systems. Additionally, the government supports smart infrastructure and digital transformation, creating more opportunities for smart antenna use in urban mobility, healthcare, and industrial automation. This positions Japan as a key contributor to global market advancements.

Smart Antenna Market: Key Takeaways

- Market Growth: The Smart Antenna Market size is expected to grow by USD 7.2 billion, at a CAGR of 8.3%, during the forecasted period of 2026 to 2034.

- By Type: The adaptive array antenna segment is anticipated to get the majority share of the Smart Antenna Market in 2025.

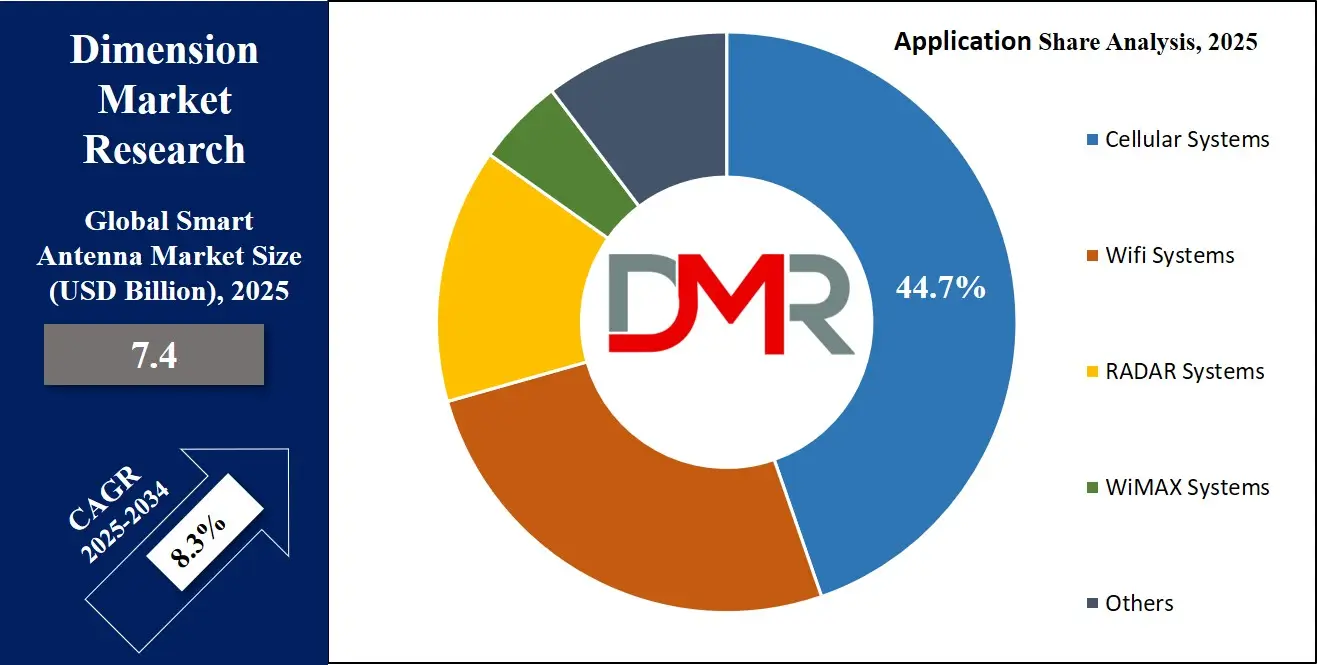

- By Application: The cellular systems segment is expected to get the largest revenue share in 2025 in the Smart Antenna Market.

- Regional Insight: Asia Pacific is expected to hold a 37.9% share of revenue in the Global Smart Antenna Market in 2025.

- Use Cases: Some of the use cases of Smart Antenna include satellite communication, connected vehicles, and more.

Smart Antenna Market: Use Cases

- Telecommunications Networks: Smart antennas are widely used in mobile and wireless networks to improve signal strength and reduce call drops. They help manage network traffic by directing signals where needed, especially in crowded urban areas. This ensures better coverage and faster data speeds for users.

- Connected Vehicles: In the automotive sector, smart antennas enable real-time communication between vehicles and infrastructure. They support features like navigation updates, traffic alerts, and autonomous driving by maintaining stable connections even at high speeds. This improves both safety and driving experience.

- Military and Defense: Smart antennas are used in defense systems for secure and reliable communication across remote or hostile environments. They help track targets, manage battlefield data, and support drone operations by resisting interference and jamming. Their adaptive nature ensures mission success.

- Satellite Communication: Smart antennas play a key role in maintaining strong, uninterrupted satellite links for broadcasting, navigation, and internet services. They automatically adjust their direction to follow moving satellites, improving accuracy and reducing signal loss. This is especially useful for ships, aircraft, and remote regions.

Market Dynamic

Driving Factors in the Smart Antenna Market

Rising Demand for High-Speed Wireless Communication

One of the main factors driving the smart antenna market is the increasing need for fast, stable, and high-capacity wireless communication. With more people using smartphones, video streaming, online gaming, and cloud-based services, traditional antenna systems often struggle to keep up. Smart antennas improve network performance by focusing signal strength in specific directions, reducing interference and increasing bandwidth.

As 5G networks continue to roll out globally, the need for advanced antenna solutions grows stronger. These antennas are also essential for handling the data traffic created by connected devices in Smart Homes Systems, offices, and public places. The shift towards seamless digital connectivity makes smart antennas an important tool for telecom providers. This demand is expected to grow further with future 6G planning already underway.

Expansion of Connected and Smart Devices Across Industries

The growing adoption of smart devices in different industries is another major driver for the smart antenna market. Applications such as connected vehicles, smart factories, remote healthcare, and autonomous drones rely on real-time data transfer and reliable communication. Smart antennas help achieve this by maintaining steady connections and adapting to changing environments, even when the devices are in motion.

As industries move toward automation and the Internet of Things (IoT), the number of connected devices is increasing rapidly. Each device requires strong and clear communication, which smart antennas provide more effectively than traditional ones. Their use in harsh or mobile conditions, such as in defense, aerospace, or maritime sectors, adds further value. This wide and growing range of use cases continues to boost market growth.

Restraints in the Smart Antenna Market

High Cost and Complex Integration

One of the major restraints in the smart antenna market is the high cost of development, production, and deployment. Smart antennas involve advanced technologies like digital signal processing, beamforming, and multiple input/output systems, which can be expensive to design and manufacture. Integrating these antennas into existing infrastructure also requires specialized knowledge and compatible systems, adding to the overall cost and complexity. For smaller telecom operators or industries with limited budgets, these costs can be a barrier to adoption.

Additionally, maintenance and upgrades of smart antenna systems require skilled professionals, which may not be readily available in all regions. This slows down the pace of adoption, especially in developing countries or remote areas where budgets and technical resources are limited.

Technical Challenges and Signal Interference Issues

Smart antennas rely on advanced algorithms and precise control of signal direction and strength, which makes them sensitive to technical limitations. Environmental factors such as physical obstacles, weather conditions, and electromagnetic interference can reduce their performance. In dense urban areas with many buildings or competing signals, smart antennas may struggle to maintain optimal beamforming and tracking.

There are also compatibility challenges with older network systems, which may not support smart antenna technology. Delays in standardization across regions and industries create further difficulties in large-scale deployment. These technical barriers, combined with the need for continuous updates to keep up with fast-changing wireless standards, act as significant restraints for the market’s growth and adoption rate.

Opportunities in the Smart Antenna Market

Growth of 5G and Future 6G Networks

The global rollout of 5G networks presents a significant opportunity for the smart antenna market. Smart antennas are a key part of 5G infrastructure, enabling faster data transfer, lower latency, and higher user capacity through technologies like beamforming and Massive MIMO. As telecom providers expand their 5G coverage, demand for advanced antenna systems continues to grow.

Furthermore, research into 6G networks is already underway, with even higher performance expectations. Smart antennas will play a central role in supporting these next-generation networks by enabling ultra-fast, reliable, and energy-efficient communication. Their ability to dynamically adjust to changing network conditions makes them ideal for future wireless ecosystems. This evolving demand creates long-term growth opportunities across regions and industries.

Expansion of IoT and Smart Infrastructure Projects

The rapid increase in connected devices through the Internet of Things (IoT) creates new opportunities for smart antennas. Smart homes, smart cities, industrial automation, and connected healthcare systems rely on continuous and stable wireless communication. Smart antennas enhance these networks by improving coverage, reducing signal loss, and adapting to multiple device connections at once.

Governments and private companies are heavily investing in smart infrastructure projects to support digital transformation. In such environments, smart antennas offer better network efficiency and reliability, especially in complex or high-density areas. Their integration into transportation systems, energy grids, and public safety networks opens up diverse application areas. This shift toward digital, intelligent infrastructure boosts demand for flexible and high-performance antenna systems.

Trends in the Smart Antenna Market

AI‑Driven Beamforming and Adaptive Arrays

One of the key trends in the smart antenna market is the growing use of artificial intelligence and machine learning to control signal direction and optimize performance. These advanced systems can learn from their surroundings and adjust the antenna’s behavior in real time. This helps reduce signal interference, improves clarity, and ensures stronger connections in busy or changing environments.

AI-driven beamforming is becoming more common in both mobile networks and fixed wireless systems. It also helps manage power use more efficiently. The antennas can automatically find the best signal path, making them ideal for complex urban settings or high-speed communication. This trend supports more reliable and responsive wireless networks.

Massive MIMO and Millimeter‑Wave Integration

Another important trend is the integration of smart antennas into massive MIMO and millimeter-wave technologies. Massive MIMO uses many small antenna elements to send and receive signals at the same time, increasing the system’s capacity and speed. When combined with millimeter-wave frequencies, smart antennas can deliver high-speed data even in dense environments.

These antennas can focus energy into narrow beams to overcome signal loss at higher frequencies. This combination supports more devices at once and improves signal accuracy over short distances. It’s especially useful in areas with high data demand, such as stadiums, cities, and industrial sites. The trend is shaping the foundation of advanced wireless networks.

Impact of Artificial Intelligence in Smart Antenna Market

- Real-Time Beamforming Optimization: AI helps smart antennas dynamically adjust beam direction and signal strength based on real-time user movement and environmental changes. This improves signal quality, reduces interference, and enhances overall communication reliability.

- Predictive Network Management: With AI, antenna systems can predict traffic patterns, user demand, and interference sources. This allows proactive adjustments in antenna behavior, leading to better network efficiency and smoother connectivity in high-density areas.

- Energy Efficiency Improvements: AI enables smart antennas to activate or deactivate specific elements based on actual data needs. This reduces power consumption, especially in large MIMO systems, and supports sustainable network operations.

- Self-Healing and Fault Detection: AI allows antenna systems to detect faults, performance drops, or disruptions early and adjust automatically. This minimizes downtime and enhances network stability without human intervention.

- Enhanced User Experience: By using AI to analyze user behavior and optimize signal delivery, smart antennas ensure faster data speeds, lower latency, and consistent performance across various applications like 5G, IoT, and smart homes.

Research Scope and Analysis

By Technology Analysis

MIMO, leading in 2025 with a share of 54.8%, is expected to be the dominant technology segment in the smart antenna market due to its ability to boost data transmission rates and improve spectrum efficiency. This technology uses multiple antennas at both the transmitter and receiver ends, allowing more data to be sent and received at the same time. It plays a crucial role in supporting high-speed wireless networks, especially in dense environments where demand for mobile data is high.

MIMO also enhances coverage, reduces signal interference, and supports real-time communication for IoT and 5G infrastructure. Its growing use in mobile communication, connected vehicles, and smart infrastructure is pushing its adoption further. The increasing need for reliable, high-capacity networks across urban and industrial settings makes MIMO a key driver in advancing smart antenna technology, particularly in regions focusing on digital expansion and next-generation network deployments.

SIMO, having significant growth over the forecast period, is gaining attention in the smart antenna market for its simplicity, cost-effectiveness, and energy efficiency. This technology uses a single transmitting antenna and multiple receiving antennas, making it suitable for smaller, low-power applications. SIMO is commonly used in wireless devices, remote sensors, and certain communication systems where reduced hardware complexity is important.

It helps improve signal reception and system reliability without the need for complex beamforming or multiple signal paths. As demand rises for compact and budget-friendly wireless solutions, especially in IoT networks and remote communication setups, SIMO is finding more applications. Its growing use in smart home devices, handheld electronics, and low-bandwidth communication makes it a supportive technology in the overall expansion of the smart antenna market.

By Type Analysis

Adaptive array antenna, leading in 2025 with a share of 62.6%, is set to play a central role in the growth of the smart antenna market due to its ability to dynamically adjust signal direction in real time. This type of antenna can detect the direction of incoming signals and automatically modify its beam pattern to focus on the best path, improving communication quality and reducing interference. Its flexibility makes it ideal for fast-changing environments like urban areas, high-speed trains, and connected vehicles.

Adaptive array antennas are widely used in advanced wireless systems, including 5G, where precision, signal clarity, and high capacity are essential. Their growing importance in satellite communication, military networks, and public safety systems is further expanding their adoption. As demand rises for intelligent, self-optimizing antennas, this segment continues to strengthen its position in the overall market landscape.

Switched multibeam, having significant growth over the forecast period, is gaining wider adoption in the smart antenna market for its reliable and efficient performance in structured network environments. This type of antenna uses a fixed set of beams and selects the most suitable one based on the signal's direction, offering a simpler yet effective way to manage coverage and reduce signal loss. Switched multibeam antennas are commonly used in base stations, broadcasting systems, and public Wi-Fi networks where stable connectivity is required.

Their ability to improve signal strength without the complexity of real-time beam steering makes them cost-effective and easy to deploy. With rising demand for wireless access in densely populated areas, along with growing investments in telecom infrastructure, switched multibeam antennas are becoming a practical choice in both urban and rural network expansion projects.

By Applications Analysis

Cellular systems, leading in 2025 with a share of 44.7%, are expected to remain the dominant application area in the smart antenna market due to their essential role in mobile communication. As mobile data usage continues to rise, smart antennas help improve signal strength, coverage, and call quality across wide network areas. These antennas allow telecom providers to handle more users at once while reducing dropped connections and interference. In 5G networks, smart antennas enable faster data speeds and efficient spectrum use through technologies like beamforming and Massive MIMO.

Cellular systems benefit greatly from smart antennas in dense urban areas, where managing traffic and delivering strong signals is challenging. With the ongoing push for seamless connectivity and better network performance, cellular networks rely heavily on smart antenna systems to meet growing user expectations and support future advancements like 6G.

Wi-Fi systems, having significant growth over the forecast period, are becoming an increasingly important application for smart antennas as wireless internet demand grows in homes, offices, and public places. Smart antennas help Wi-Fi systems deliver stronger, faster, and more stable connections by focusing signals toward active devices and minimizing interference. This is especially useful in buildings with multiple users, thick walls, or high device density.

As smart homes, online learning, video streaming, and remote work continue to expand, there is a greater need for reliable indoor and short-range wireless communication. Smart antennas are being integrated into routers and access points to support better data transfer and seamless connectivity. Their use in commercial spaces, campuses, and public transport hubs is also increasing, driving adoption across various everyday environments.

ℹ

To learn more about this report –

Download Your Free Sample Report Here

The Smart Antenna Market Report is segmented on the basis of the following:

By Technology

- SIMO (Single Input, Multiple Output)

- MIMO (Multiple Input, Multiple Output)

- Single User MIMO (SU-MIMO)

- Multi User MIMO (MU-MIMO)

- MISO (Multiple Input, Single Output)

By Type

- Switched Multibeam Antenna

- Adaptive Array Antenna

- Analog Beamforming

- Digital Beamforming

- Hybrid Beamforming

By Application

- RADAR Systems

- Military RADAR

- Automotive RADAR

- Wi-Fi Systems

- Home/Residential Wi-Fi

- Enterprise Wi-Fi

- WiMAX Systems

- Cellular Systems

- Others

Regional Analysis

Leading Region in the Smart Antenna Market

Asia Pacific, leading in 2025 with a share of 37.9%, plays a major role in the growth of the smart antenna market due to its rapid adoption of advanced wireless technologies, increasing demand for high-speed internet, and growing investments in smart city projects. Countries like China, Japan, South Korea, and India are actively deploying 5G networks, boosting the need for adaptive and high-performance antenna systems. The region’s strong electronics manufacturing base and government-backed digitalization plans support the development and integration of smart antenna technologies across industries.

From telecom to transportation and defense, smart antennas are becoming essential for reliable and efficient communication. In addition, the rising number of connected devices and expanding use of IoT across urban and industrial areas are pushing the demand further. With a large population, increasing smartphone use, and strong infrastructure investments, Asia Pacific continues to drive innovation, manufacturing, and deployment in the smart antenna space, making it a global leader in this market.

ℹ

To learn more about this report –

Download Your Free Sample Report Here

Fastest Growing Region in the Smart Antenna Market

The Middle East and Africa (MEA) region is showing significant growth over the forecast period in the smart antenna market due to increasing investments in telecom infrastructure, digital transformation, and wireless communication technologies. Countries in the Gulf are focusing on 5G rollout, smart city initiatives, and expanding broadband coverage, which supports the rising use of beamforming antennas and MIMO systems.

As urbanization and mobile device penetration grow, there is greater demand for reliable signal transmission and high-capacity networks. In Africa, efforts to improve rural connectivity and expand mobile services are boosting interest in adaptive antennas and smart base stations. This growing adoption reflects MEA’s rising influence in the wireless communication landscape.

By Region

North America

Europe

- Germany

- The U.K.

- France

- Italy

- Russia

- Spain

- Benelux

- Nordic

- Rest of Europe

Asia-Pacific

- China

- Japan

- South Korea

- India

- ANZ

- ASEAN

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Argentina

- Colombia

- Rest of Latin America

Middle East & Africa

- Saudi Arabia

- UAE

- South Africa

- Israel

- Egypt

- Rest of MEA

Competitive Landscape

The smart antenna market is highly competitive, with numerous global and regional players continually striving to enhance their technology and expand their market presence. Companies compete by offering more efficient, compact, and cost-effective antenna systems that support the latest wireless standards. The focus is on innovation, especially in areas like beamforming, signal tracking, and integration with 5G and IoT networks.

Some players specialize in telecom applications, while others target defense, automotive, or satellite communication sectors. Strategic partnerships, product launches, and research collaborations are common as firms aim to stay ahead. The rising demand for high-speed connectivity and smart devices continues to drive companies to develop advanced solutions and strengthen their market position in this rapidly evolving sector.

Some of the prominent players in the global Smart Antenna are:

- Qualcomm

- Huawei Technologies Co., Ltd.

- Intel Corporation

- Broadcom Inc.

- Samsung Electronics Co., Ltd.

- Cisco Systems, Inc.

- Ericsson

- Nokia Corporation

- ZTE Corporation

- NEC Corporation

- Keysight Technologies

- Analog Devices, Inc.

- Texas Instruments Incorporated

- NXP Semiconductors

- STMicroelectronics

- Infineon Technologies AG

- Skyworks Solutions, Inc.

- Renesas Electronics Corporation

- Anokiwave

- CommScope

- Other Key Players

Recent Developments

- In July 2025, Ericsson launched its first India-made antenna, aimed at global markets, with commercial rollout and international shipments beginning in July. Announced by India’s Telecom Ministry, the antenna is produced in collaboration with VVDN Technologies at facilities in Manesar, Haryana. The passive antenna is locally sourced, engineered, and manufactured, marking a milestone in Ericsson’s India-based production. Designed to transmit electromagnetic waves, it serves as a key link between wireless signals and electrical systems and is expected to support the evolution of 6G technologies, including sub-terahertz and centimeter wave bands.

- In March 2025, Quectel Wireless Solutions introduced the YFCX001WWAH, a 5G transparent antenna designed to enhance connectivity while blending seamlessly into device designs. Meeting the growing demand for high-performance, space-efficient antennas, it combines transparency, efficiency, and adaptability. Using nanoscale fabrication and advanced materials, the antenna delivers a strong signal transmission with over 85% transparency. Its ultra-thin profile, just 0.123mm thick, allows easy integration into glass, plastic, and composite surfaces. Ideal for space-limited applications, it removes the need for bulky external antennas while supporting seamless 5G performance.

Report Details

| Report Characteristics |

| Market Size (2025) |

USD 7.4 Bn |

| Forecast Value (2034) |

USD 15.1 Bn |

| CAGR (2025–2034) |

8.3% |

| The US Market Size (2025) |

USD 2.0 Bn |

| Historical Data |

2019 – 2023 |

| Forecast Data |

2026 – 2034 |

| Base Year |

2024 |

| Estimate Year |

2025 |

| Report Coverage |

Market Revenue Estimation, Market Dynamics, Competitive Landscape, Growth Factors, etc. |

| Segments Covered |

By Technology (SIMO (Single Input, Multiple Output), MIMO (Multiple Input, Multiple Output), MISO (Multiple Input, Single Output)), By Type (Switched Multibeam Antenna and Adaptive Array Antenna), By Application (RADAR Systems, Wi-Fi Systems, WiMAX Systems, Cellular Systems, and Others) |

| Regional Coverage |

North America – US, Canada; Europe – Germany, UK, France, Russia, Spain, Italy, Benelux, Nordic, Rest of Europe; Asia-Pacific – China, Japan, South Korea, India, ANZ, ASEAN, Rest of APAC; Latin America – Brazil, Mexico, Argentina, Colombia, Rest of Latin America; Middle East & Africa – Saudi Arabia, UAE, South Africa, Turkey, Egypt, Israel, Rest of MEA |

| Prominent Players |

Qualcomm, Huawei Technologies Co., Ltd., Intel Corporation, Broadcom Inc., Samsung Electronics Co., Ltd., Cisco Systems, Inc., Ericsson, Nokia Corporation, ZTE Corporation, NEC Corporation, Keysight Technologies, Analog Devices, Inc., Texas Instruments Incorporated, NXP Semiconductors, STMicroelectronics, Infineon Technologies AG, Skyworks Solutions, Inc., Renesas Electronics Corporation, Anokiwave, CommScope, and Other Key Players |

| Purchase Options |

We have three licenses to opt for: Single User License (Limited to 1 user), Multi-User License (Up to 5 Users), and Corporate Use License (Unlimited User) along with free report customization equivalent to 0 analyst working days, 3 analysts working days, and 5 analysts working days respectively. |

Frequently Asked Questions

How big is the Global Smart Antenna Market?

▾ The Global Smart Antenna Market size is expected to reach a value of USD 7.4 billion in 2025 and is expected to reach USD 15.1 billion by the end of 2034.

Which region accounted for the largest Global Smart Antenna Market?

▾ Asia Pacific is expected to have the largest market share in the Global Smart Antenna Market, with a share of about 37.9% in 2025.

How big is the Smart Antenna Market in the US?

▾ The Smart Antenna Market in the US is expected to reach USD 2.0 billion in 2025.

Who are the key Smart Antenna Market?

▾

Who are the key Smart Antenna Market?

What is the growth rate in the Global Smart Antenna Market?

▾ The market is growing at a CAGR of 8.3 percent over the forecasted period.