Market Overview

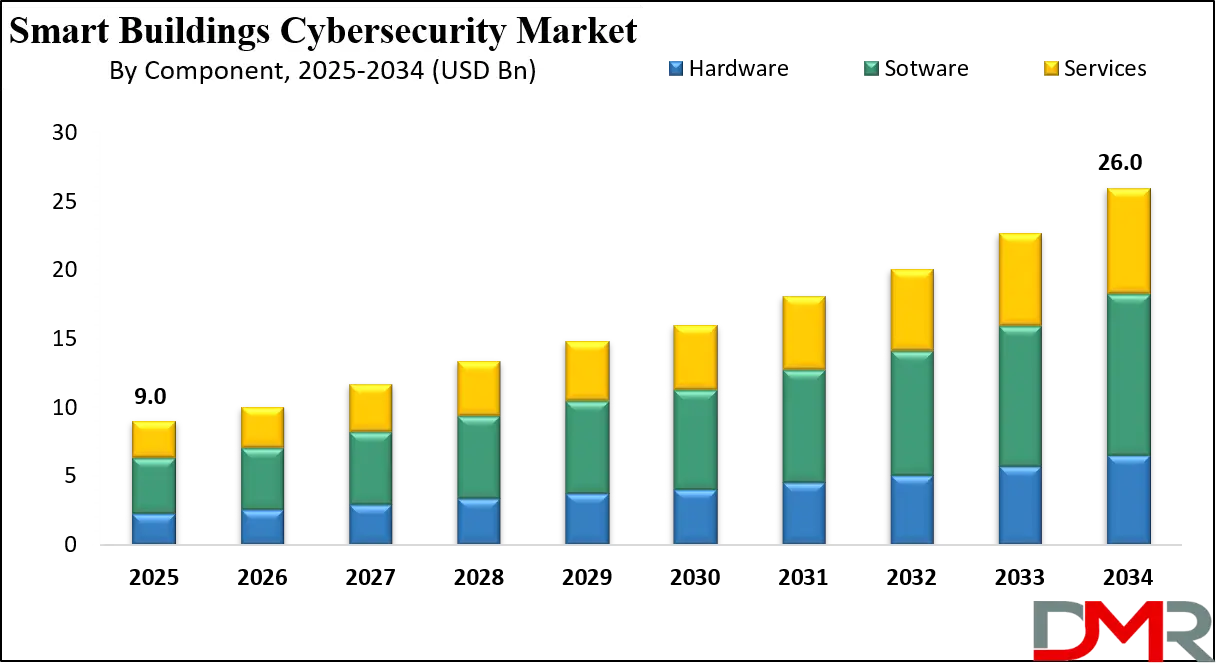

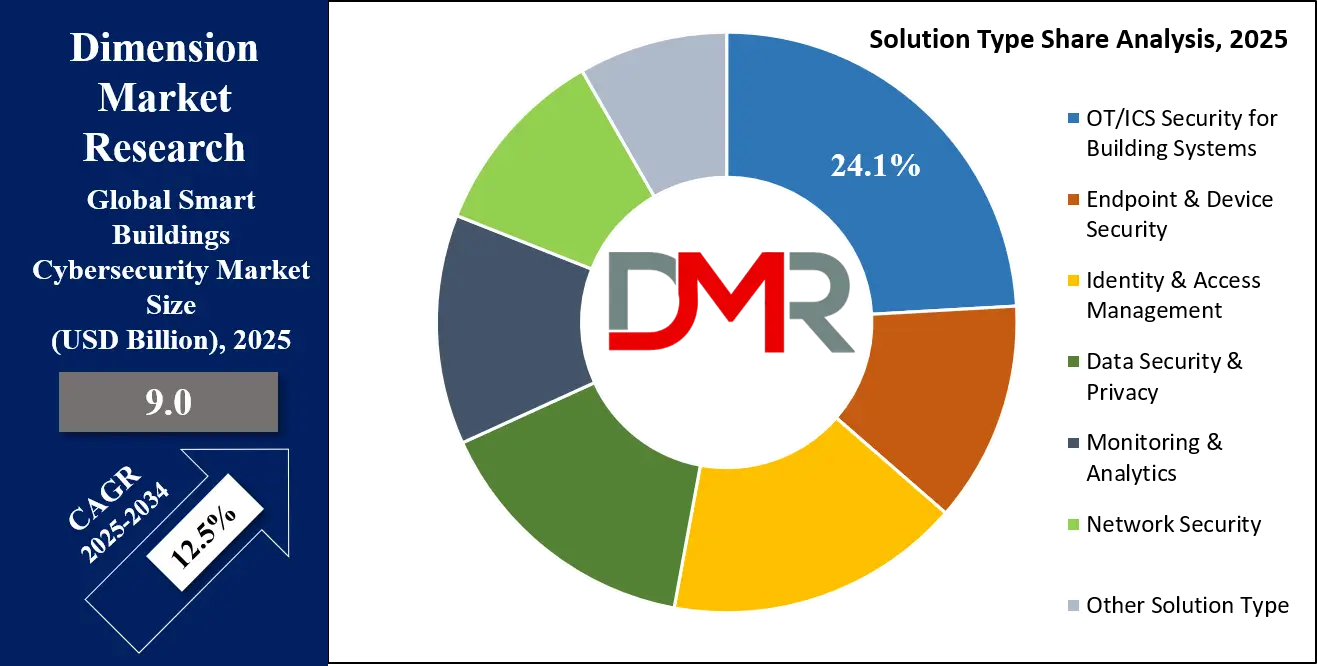

The Global Smart Buildings Cybersecurity Market is projected to reach USD 9.0 billion in 2025 and grow at a compound annual growth rate (CAGR) of 12.5% from 2025 to 2034, reaching a value of USD 26.0 billion by 2034.

This robust growth is driven by the increasing adoption of IoT devices, cloud-based building management systems (BMS), and connected infrastructure across commercial, industrial, and residential buildings. The rapid digitalization of HVAC, lighting, access control, and energy management systems has significantly expanded the attack surface in smart environments, fueling demand for network security, endpoint protection, identity and access management (IAM), and OT/ICS security solutions.

ℹ

To learn more about this report –

Download Your Free Sample Report Here

Rising concerns over data privacy, operational continuity, and regulatory compliance are accelerating investments in AI-powered threat detection, SIEM platforms, and zero-trust architectures. Major technology providers and integrators such as Siemens, Honeywell, Cisco, IBM, Schneider Electric, and Microsoft are incorporating machine learning, behavioral analytics, and automated response mechanisms to enhance system resilience.

Furthermore, the surge in cloud-based deployments, hybrid infrastructure models, and managed security services (MSSPs) is transforming how enterprises secure their smart building ecosystems.

With expanding smart city projects, heightened cybersecurity regulations, and the integration of AI and edge computing, the market is expected to see sustained momentum across North America, Europe, and Asia-Pacific. The convergence of operational technology (OT) and information technology (IT) will remain a key driver, reinforcing the role of cybersecurity as the backbone of the next-generation intelligent building infrastructure.

A key restraint on market progression is the substantial upfront financial investment required for implementing comprehensive cybersecurity protocols and the ongoing operational expenses for specialized personnel. Many building owners and operators grapple with justifying these costs against perceived risks. Compounding this issue is a pronounced lack of universal regulatory standards and security certification protocols for the vast ecosystem of IoT devices, leading to inconsistent security postures and vulnerabilities that can be easily leveraged in coordinated supply chain attacks.

ℹ

To learn more about this report –

Download Your Free Sample Report Here

The US Smart Buildings Cybersecurity Market

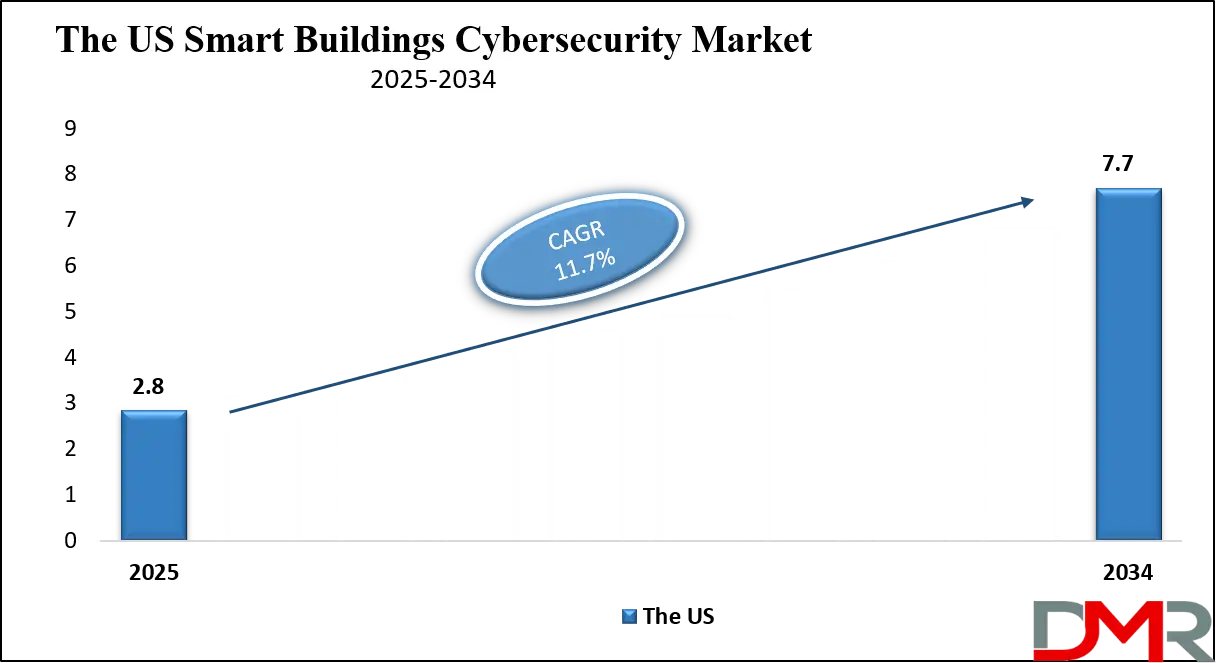

The US Smart Buildings Cybersecurity Market is projected to reach USD 2.8 billion in 2025 at a compound annual growth rate of 11.7% over its forecast period.

The United States represents a mature and rapidly advancing market for smart building cybersecurity, heavily influenced by federal initiatives and a high concentration of critical infrastructure. The U.S. Department of Energy emphasizes the role of smart building technologies in enhancing energy efficiency and grid resilience, which inherently requires securing these systems from cyber threats.

Federal buildings themselves are undergoing modernization, guided by mandates that prioritize security in building automation. Furthermore, the Cybersecurity and Infrastructure Security Agency (CISA) provides critical frameworks and alerts specifically addressing vulnerabilities in operational technology, which underpin smart building systems. CISA actively publishes guidance on securing IoT devices and industrial control systems, directly impacting how building operators and technology providers harden their defenses against nation-state actors and cybercriminals.

Demographic and economic advantages in the U.S. fuel this market. The country has a high urban population density, with a significant proportion of its populace residing and working in large, commercially owned structures that are prime candidates for automation. Government bodies like the U.S. Census Bureau track construction spending, indicating sustained investment in new, technologically advanced commercial and multi-unit residential buildings. This creates a vast installed base for cybersecurity solutions.

Additionally, initiatives from the National Institute of Standards and Technology (NIST) have been pivotal. The NIST Cybersecurity Framework and its specific work on cyber-physical systems, including buildings, provide a voluntary but widely adopted set of standards that shape procurement and risk management decisions across the public and private sectors, creating a consistent demand for compliant security products and services.

ℹ

To learn more about this report –

Download Your Free Sample Report Here

The Europe Smart Buildings Cybersecurity Market

The Europe Smart Buildings Cybersecurity Market is estimated to be valued at USD 1,350 million in 2025 and is further anticipated to reach USD 3,483 million by 2034 at a CAGR of 11.0%.

The European smart buildings cybersecurity landscape is fundamentally shaped by robust regulatory frameworks and ambitious sustainability goals. The cornerstone is the EU's Network and Information Security (NIS2) Directive, which expands the scope of critical sectors to include energy providers and digital infrastructure, compelling entities to manage cybersecurity risks in their supply chains and report significant incidents.

This directly mandates a higher security posture for smart buildings that form part of this infrastructure. Concurrently, the Cybersecurity Act establishes an EU-wide certification framework for ICT products, services, and processes, which will increasingly apply to Building Management Systems and IoT devices, creating a standardized and high-trust market for certified technologies across member states.

Europe's demographic and strategic advantages provide a strong foundation for market growth. The European Commission’s "Renovation Wave" strategy aims to double renovation rates to improve energy efficiency, inherently driving the integration of smart, connected systems that require protection. The EU Agency for Cybersecurity (ENISA) plays a central role in building capacity and knowledge, publishing threat landscapes and best practices that inform national-level policies. With a highly urbanized population and a high density of historical and modern commercial real estate, the demand for retrofitting existing structures with smart technologies is immense.

This, combined with Europe's strong data protection regime under the General Data Protection Regulation (GDPR), which imposes strict rules on the security of systems processing personal data, creates a powerful regulatory and economic impetus for investing in advanced cybersecurity for smart buildings.

The Japan Smart Buildings Cybersecurity Market

The Japan Smart Buildings Cybersecurity Market is projected to be valued at USD 340 million in 2025. It is further expected to witness subsequent growth in the upcoming period, holding USD 1,496 million in 2034 at a CAGR of 12.0%.

Japan's smart buildings cybersecurity market is propelled by a unique confluence of demographic pressures and national strategic initiatives. The Japanese government, through the Ministry of Land, Infrastructure, Transport and Tourism (MLIT), actively promotes the development of "smart wellness housing" and sustainable buildings to address the needs of its super-aging society.

These initiatives integrate advanced IoT and automation for remote monitoring and energy management, creating a critical need to secure these systems from cyber threats that could disrupt essential services for vulnerable populations. Furthermore, Japan’s national cybersecurity strategy, overseen by the National Center of Incident Readiness and Strategy for Cybersecurity (NISC), emphasizes the protection of critical infrastructure, which includes the operational technology controlling large commercial and residential complexes.

Japan’s demographic reality offers a distinct advantage for targeted cybersecurity solutions. The country faces a chronic labor shortage and a rapidly aging populace, accelerating the adoption of building automation to reduce operational manpower and enhance efficiency. This demographic challenge is a key driver for the "Society 5.0" vision, which aims to create a human-centered society that integrates cyberspace and physical space.

As part of this, the Japanese Industrial Standards Committee (JISC) works on aligning standards for IoT and cybersecurity. The high concentration of population in metropolitan areas like Tokyo and Osaka, coupled with Japan's leadership in technology manufacturing, results in a dense landscape of advanced, interconnected buildings. This makes the market highly receptive to sophisticated, automated cybersecurity solutions that can operate with minimal human intervention, aligning with national goals for resilience and technological integration.

Global Smart Buildings Cybersecurity Market: Key Takeaways

- Global Market Size Insights: The Global Smart Buildings Cybersecurity Market size is estimated to have a value of USD 9.0 billion in 2025 and is expected to reach USD 26.0 billion by the end of 2034.

- The Global Market Growth Rate: The market is growing at a CAGR of 12.5 percent over the forecasted period of 2025.

- The US Market Size Insights: The US Smart Buildings Cybersecurity Market is projected to be valued at USD 2.8 billion in 2025. It is expected to witness subsequent growth in the upcoming period as it holds USD 7.7 billion in 2034 at a CAGR of 11.7%.

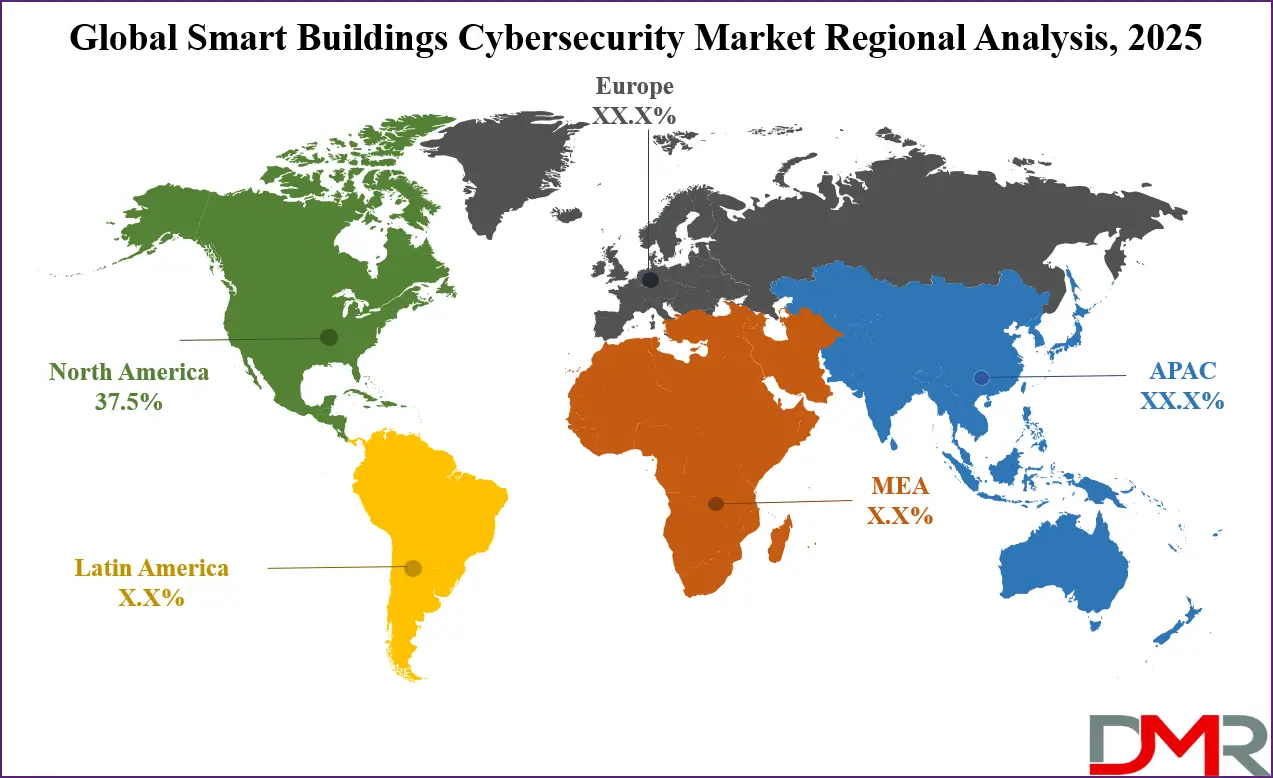

- Regional Insights: North America is expected to have the largest market share in the Global Smart Buildings Cybersecurity Market with a share of about 37.5% in 2025.

- Key Players: Some of the major key players in the Global Smart Buildings Cybersecurity Market are Siemens AG, ABB Ltd., Cisco Systems, Inc., Honeywell International Inc., Schneider Electric SE, Johnson Controls International plc, IBM Corporation, Microsoft Corporation, Fortinet, Inc., and many others.

Global Smart Buildings Cybersecurity Market: Use Cases

- Financial District High-Rise: A threat actor gains access to a bank's Building Management System through a vulnerable HVAC unit, manipulating data center environmental controls to trigger a costly overheating shutdown. AI-driven network monitoring detects the anomalous command patterns and isolates the compromised subsystem, preventing financial and data loss while maintaining core business operations seamlessly.

- University Campus Network: A sprawling university campus secures its interconnected smart labs, libraries, and lecture halls by implementing a zero-trust model. Every student and IoT device must continuously authenticate and is granted minimal access privileges. This containment strategy successfully prevents a ransomware infection in a dormitory network from spreading to critical research facilities housing sensitive intellectual property.

- Government Facility Access Control: A state-level government building thwarts a sophisticated phishing attack targeting its IT staff. The attempted breach, aimed at hijacking the digital access control system, is neutralized by behavioral analytics software that flags the unusual login attempt and location, automatically enforcing multi-factor authentication and alerting the security operations center for immediate investigation.

- Regional Hospital Infrastructure: A regional hospital proactively defends its life-critical infrastructure by segmenting its network. Patient entertainment Wi-Fi is completely isolated from the networks controlling medical devices and building operations. This network segmentation proves vital when a common IoT device is infected, containing the malware and ensuring uninterrupted power and climate control for surgical wards and ICUs.

- Smart City Transportation Hub: A major airport utilizing predictive analytics on its integrated building systems identifies a strange data flow from its baggage handling OT network to an external server. The system autonomously initiates protective measures, blocking the connection and safeguarding passenger data and logistics operations from a potentially devastating supply chain attack originating from a third-party vendor.

Global Smart Buildings Cybersecurity Market: Stats & Facts

U.S. Cybersecurity and Infrastructure Security Agency (CISA)

- CISA's list of Known Exploited Vulnerabilities (KEV) catalogues over 900 vulnerabilities that have active exploitation.

- Critical Manufacturing and Energy are among the top sectors reporting cybersecurity incidents to CISA.

- CISA's Shields Up initiative, launched due to geopolitical tensions, highlights ongoing cyber threats to critical infrastructure.

- Alerts from CISA frequently warn of vulnerabilities in IoT devices and industrial control systems commonly used in building automation.

U.S. National Institute of Standards and Technology (NIST)

- The NIST Cybersecurity Framework (CSF) 2.0 explicitly includes governance as a core function, emphasizing organizational oversight of cyber risk.

- NIST's National Vulnerability Database (NVD) has recorded over 190,000 Common Vulnerabilities and Exposures (CVEs).

- NIST Special Publication 800-82 provides a guide to securing Industrial Control Systems, which are integral to smart building operations.

U.S. Department of Energy (DOE)

- The DOE estimates that commercial buildings consume about 35% of the total U.S. electricity.

- DOE's Better Buildings Initiative has partnered with over 900 organizations covering 14% of the U.S. commercial building footprint.

- The Grid Modernization Initiative, led by the DOE, focuses on enhancing the security and resilience of the energy grid, which interacts with smart buildings.

U.S. Department of Homeland Security (DHS)

- The DHS Science and Technology Directorate invests in research for securing control systems against cyber threats.

- DHS reports have historically identified the communications sector and critical manufacturing as dependent on secure operational technology.

U.S. Federal Bureau of Investigation (FBI)

- The FBI's Internet Crime Complaint Center (IC3) received a record 880,000 complaints in a recent year, with potential losses exceeding USD12.5 billion.

- The FBI has issued numerous Private Industry Notifications (PINs) warning of ransomware attacks targeting the critical infrastructure sector.

EU Agency for Cybersecurity (ENISA)

- ENISA's Threat Landscape report identifies ransomware as the prime cyber threat in the EU.

- The report notes that threat actors are increasingly targeting supply chains as an attack vector.

- ENISA states that over 70% of SMEs in the EU would be significantly affected by a serious cyber incident.

European Commission

- The European Commission's Renovation Wave strategy aims to at least double the annual energy renovation rate of buildings by 2030.

- The EU's Horizon Europe program has allocated significant funding for research into secure digital technologies.

United Kingdom National Cyber Security Centre (NCSC)

- The NCSC handled a significant number of incidents in the last year, with many requiring a cross-government response.

- The NCSC's Active Cyber Defence programme removes millions of online commodity threats annually.

- The NCSC provides specific guidance on deploying IoT devices securely in enterprise environments.

Government of Japan

- Japan's "Digital Garden City Nation Concept" aims to leverage digital technology to address regional challenges, including in infrastructure.

- The National Center of Incident Readiness and Strategy for Cybersecurity (NISC) coordinates national cybersecurity policy and incident response.

- Japan's Strategic Energy Plan sets targets for reducing energy consumption in buildings.

International Energy Agency (IEA)

- The IEA reports that buildings are responsible for over 30% of global final energy consumption.

- The IEA's Net Zero by 2050 scenario requires a massive scale-up of energy efficiency in buildings.

- The IEA tracks the growing energy consumption from the increasing number of connected devices.

World Economic Forum

- The WEF's Global Risks Report consistently ranks cybersecurity failures and critical infrastructure disruption as top global risks.

- The WEF has established a Centre for Cybersecurity to foster a global response to cyber threats.

International Organization for Standardization (ISO) & International Electrotechnical Commission (IEC)

- The ISO/IEC 27001 standard is an internationally recognized benchmark for information security management systems.

- The ISO/IEC 27002 provides guidelines for organizational information security standards and practices.

Global Smart Buildings Cybersecurity Market: Market Dynamic

Driving Factors in the Global Smart Buildings Cybersecurity Market

Escalating Cyber-Physical Threat Landscape

The primary growth driver is the escalating frequency and sophistication of targeted cyber-physical attacks on critical infrastructure, which now explicitly includes commercial and governmental buildings. High-profile incidents, such as ransomware campaigns that deliberately disable a building's environmental controls or lock down its digital access systems, have demonstrated the severe tangible financial and operational impacts. These events are moving cybersecurity from a niche technical concern to a central board-level business risk.

This heightened awareness among building owners, operators, and corporate tenants is creating a powerful market pull for robust, integrated security solutions. The potential for massive revenue loss, irreparable reputational damage, and significant legal liability in the event of a breach is compelling organizations to allocate larger portions of their capital and operational expenditures to proactively secure their smart building ecosystems.

Stringent Government Regulations and Compliance Mandates

Stringent and rapidly evolving government regulations and compliance mandates are acting as a powerful external driver for market expansion. Legislative initiatives like the EU's NIS2 Directive and the U.S. government's reinforced focus on critical infrastructure protection through CISA guidelines are legally obligating building operators in key sectors to adhere to strict cybersecurity standards and reporting requirements.

Furthermore, stringent data protection regulations like the GDPR impose heavy fines for breaches that compromise personal data, which is extensively collected by smart building systems through Wi-Fi analytics, access logs, and occupancy sensors. This mounting regulatory pressure effectively transforms cybersecurity from a voluntary best practice into a non-negotiable compliance necessity, thereby ensuring a consistent and growing demand for solutions and services that help organizations meet these legal requirements and avoid devastating financial penalties.

Restraints in the Global Smart Buildings Cybersecurity Market

High Cost and Implementation Complexity

A major restraint on market growth is the significant cost and operational complexity associated with implementing and managing a comprehensive cybersecurity program. This includes not only the substantial upfront capital expenditure for advanced security software, hardware, and network redesign but also the ongoing and often higher operational costs for hiring and retaining specialized security personnel capable of managing both IT and OT environments.

Many building owners and facility managers, particularly those with older building stock or smaller real estate portfolios, face severe budget constraints and struggle to demonstrate a clear, quantifiable return on investment for proactive cybersecurity measures, often viewing it as a pure cost center rather than a business value driver.

Lack of Universal IoT Security Standards

The market is also critically hindered by the absence of universal security standards and certification for the vast, fragmented, and rapidly evolving IoT device ecosystem. A typical smart building incorporates thousands of devices from sensors to controllers sourced from hundreds of different manufacturers, each with wildly varying levels of built-in security. The absence of mandatory, industry-wide security protocols leads to profoundly inconsistent security postures, with many low-cost devices possessing well-documented vulnerabilities like hard-coded passwords, unpatchable firmware, and insecure communication channels.

Opportunities in the Global Smart Buildings Cybersecurity Market

AI and Machine Learning-Powered Security Platforms

A substantial growth opportunity exists in the development and deployment of advanced AI and Machine Learning-powered security platforms. The sheer, overwhelming volume of data generated by thousands of interconnected IoT sensors and building systems makes manual monitoring and traditional threat detection methods entirely impractical. AI-driven solutions can autonomously analyze this data in real-time to establish nuanced behavioral baselines for every connected device and user, enabling them to identify subtle, anomalous activities that signify a stealthy zero-day attack or an advanced persistent threat.

Integration with Global Smart City Projects

The rapid global expansion of national-level smart city projects presents a massive, long-term opportunity for smart buildings cybersecurity vendors. Municipal and national governments worldwide are investing billions in interconnected urban infrastructure, where commercial, governmental, and residential smart buildings act as critical nodes within a larger, city-wide network. These expansive, integrated city-scale networks are inherently high-value targets for cyberattacks, creating an urgent and complex need for interoperable and scalable cybersecurity frameworks that can protect the entire digital ecosystem.

Trends in the Global Smart Buildings Cybersecurity Market

IT and OT Network Convergence Reshapes Security Architectures

The convergence of Information Technology and Operational Technology networks is a dominant trend, fundamentally reshaping security postures. Traditionally, OT systems managing physical building functions like HVAC, power, and elevators were air-gapped and relied on proprietary, isolated protocols. Modern smart buildings, however, integrate these systems with corporate IT networks for data analytics and centralized control, inadvertently erasing this defensive boundary and exposing previously isolated critical infrastructure to a broader range of cyber threats.

Strategic Adoption of Zero-Trust Architecture

Another significant trend is the strategic adoption of a Zero-Trust Architecture, moving beyond the outdated "castle-and-moat" security assumption. In a zero-trust model, no device or user, whether inside or outside the network perimeter, is implicitly trusted. Access is granted on a per-session basis after strict identity verification, and the principle of least privilege is enforced for every access attempt to any building system or data point. This approach is particularly effective in mitigating risks from insider threats, compromised user credentials, and lateral movement by attackers who have breached the initial network defenses.

Global Smart Buildings Cybersecurity Market: Research Scope and Analysis

By Component Analysis

Within the component segment, Software is projected to be the dominant and most critical sub-segment. While hardware provides the foundational appliances for network enforcement and specialized gateways for protocol translation, services are essential for implementation and ongoing management. It is the software that delivers the core intelligence and adaptive capabilities required for modern security. The smart building environment is characterized by a vast and heterogeneous mix of devices and protocols, making static, hardware-only defenses insufficient.

Dominant software solutions include centralized security platforms that offer unified visibility, threat detection, and policy management across both IT and OT networks. These platforms leverage artificial intelligence and machine learning for behavioral analytics to identify anomalies indicative of a zero-day attack or sophisticated breach that would evade signature-based tools.

Furthermore, identity and access management software, vulnerability management tools, and specialized applications for securing OT protocols like BACnet are all software-defined. The agility of software allows for rapid updates to counter new threats, its scalability is essential for building portfolios of any size, and its ability to integrate data from various hardware sensors and points consolidates the security posture. As the market evolves towards cloud-based security management and AI-driven operations, the reliance on sophisticated software will only intensify, solidifying its dominance in driving innovation and value within the component mix.

By Solution Type

The OT/ICS Security for Building Systems solution type is poised to be the dominant and fastest-growing sub-segment. While solutions like network security, endpoint protection, and identity management are foundational, they are often adaptations from traditional IT. In contrast, OT/ICS security is specifically tailored to address the unique and critical risks inherent in smart building operations. This dominance is driven by the escalating convergence of IT and OT networks, which exposes previously isolated systems like Building Management Systems, HVAC, elevators, and physical access controls to a wider range of cyber threats.

A successful attack on these systems can lead to immediate physical consequences such as loss of climate control, disabled elevators, or breached physical security making their protection paramount. OT/ICS security solutions are specialized to understand and monitor proprietary industrial protocols like BACnet, LonWorks, and Modbus, which standard IT security tools cannot decipher.

They provide passive asset discovery to identify every connected device, establish behavioral baselines for normal operational traffic, and detect anomalies that could indicate manipulation or sabotage. As the threat landscape increasingly targets critical infrastructure, the demand for these specialized, operational-technology-centric solutions that ensure business continuity and physical safety is outstripping the demand for more generalized IT security tools, making it the dominant focus for new investment.

ℹ

To learn more about this report –

Download Your Free Sample Report Here

By Deployment Mode

The Cloud-based deployment mode is poised to be increasingly dominant in the smart buildings cybersecurity market, particularly for new deployments and managed service offerings. While on-premises solutions remain relevant for highly secure government or defense facilities with strict data sovereignty requirements, the cloud model offers unparalleled advantages for the typical commercial building portfolio. Cloud-based security platforms provide centralized visibility and control across a distributed portfolio of buildings from a single pane of glass, eliminating the need to manage disparate on-premise consoles at each location.

This enables more efficient security operations and consistent policy enforcement. The scalability of the cloud is perfectly suited to the dynamic nature of smart buildings, where new IoT devices and sensors are frequently added; resources can be scaled elastically without procuring and installing new hardware.

Furthermore, cloud deployment facilitates access to advanced, resource-intensive capabilities like AI-driven threat analytics and global threat intelligence feeds that are continuously updated by the provider. This shifts the burden of maintenance and updates from the building operators often resource-constrained IT team to the security vendor, reducing operational overhead. The operational expenditure (OpEx) model of cloud services also lowers the initial capital barrier, making enterprise-grade security more accessible to a broader range of organizations, thus accelerating its adoption and dominance.

By Organization Size

Large Enterprises are expected to be the dominant end-users within the organization size segment. These organizations possess the financial resources, technical expertise, and strategic imperative to invest in comprehensive smart buildings cybersecurity programs. They typically own or manage extensive portfolios of high-value commercial real estate, such as corporate headquarters, skyscrapers, and large retail complexes, where a security breach could result in catastrophic financial, operational, and reputational damage.

The scale and complexity of their building systems, which often integrate thousands of devices from multiple vendors, necessitate a robust and layered security approach that includes advanced solutions like OT/ICS security, sophisticated SIEM systems, and 24/7 Security Operations Centers (SOCs).

Large enterprises are also more likely to be subject to stringent regulatory compliance mandates (e.g., GDPR, NIS2) and industry standards, which compel them to adopt formal cybersecurity frameworks. While the SME segment is growing rapidly due to the increased availability of cloud-based and managed services, large enterprises currently drive the bulk of market revenue due to their larger project sizes, higher spending per building, and greater need for integrated, enterprise-wide security governance.

By Application

Among the various applications, Building Automation & HVAC Systems are projected to represent the most dominant and critical segment requiring cybersecurity protection. The Building Automation System (BAS) is the central nervous system of a smart building, controlling its core operational functions, including heating, ventilation, air conditioning, lighting, and plumbing. The compromise of a BAS can have immediate and severe physical and economic consequences, from creating uninhabitable conditions for occupants to causing massive energy waste and equipment damage.

HVAC systems are also particularly attractive targets for ransomware attacks because disabling them can quickly force a business to pay a ransom to restore normal operations. Furthermore, HVAC units have been historically used as entry points in major cyberattacks due to often being internet-connected with weak security postures.

Securing this application is foundational; if the BAS is compromised, it can serve as a pivot point to attack other connected systems, such as access control or fire safety. Therefore, a significant portion of cybersecurity investment is directed towards hardening the BAS, segmenting its network from corporate IT, monitoring its proprietary protocols for anomalies, and ensuring the integrity of its control logic, making it the undisputed dominant application within the market.

By End User

The Commercial Buildings segment is expected to be the dominant end-user in the smart buildings cybersecurity market. This category encompasses a wide range of high-value, high-occupancy properties, including corporate office towers, retail spaces, shopping malls, and business parks. The economic imperative for cybersecurity in these buildings is immense. Building owners and operators are directly responsible for ensuring tenant safety, operational continuity, and asset protection.

A cyber incident that disrupts building operations can lead to significant financial losses from tenant downtime, legal liabilities, and a severely damaged reputation that impedes the ability to attract and retain high-value tenants. Furthermore, commercial buildings are at the forefront of adopting smart technologies to enhance energy efficiency, reduce operational costs, and improve the occupant experience, which simultaneously expands their attack surface.

They also house sensitive corporate and personal data collected through Wi-Fi, access logs, and other smart systems, making them subject to data protection regulations. The concentration of critical business functions and the high stakes involved in any disruption make the commercial sector the most mature and financially significant market for smart building cybersecurity solutions, driving a larger share of investment than more specialized segments like healthcare or education.

The Global Smart Buildings Cybersecurity Market Report is segmented on the basis of the following:

By Component

- Hardware

- Security Gateways

- Network Appliances

- Secure IOT Modules

- Software

- SIEM

- IDS/IPS

- Identity And Access Management

- Encryption Tools.

- Services

- Managed Security Services

- System Integration

- Risk Assessment

- Incident Response

By Solution Type

- Network Security

- Endpoint & Device Security

- Identity & Access Management

- Data Security & Privacy

- Monitoring & Analytics

- OT/ICS Security for Building Systems

- Other Solution Type

By Deployment Mode

- Cloud-based

- On-premises

- Hybrid

By Organization Size

- Large Enterprises

- Small & Medium-sized Enterprises (SMEs)

By Application

- Building Automation & HVAC Systems

- Lighting & Energy Management Systems

- Access Control & Video Surveillance

- Fire & Life Safety Systems

- Smart Metering & Utilities Management

By End User

- Commercial Buildings

- Residential Buildings

- Healthcare Facilities

- Educational Institutions

- Retail & Hospitality

- Industrial Facilities

- Government & Defense

- Data Centers

- Other End Users

Impact of Artificial Intelligence in the Global Smart Buildings Cybersecurity Market

- Automated Threat Detection & Faster Incident Response: AI (machine learning & anomaly detection) sifts large volumes of telemetry from HVAC, access control, cameras, and IoT sensors to spot unusual patterns (lateral movement, odd command sequences, anomalous device behaviour). That reduces mean-time-to-detect and enables automated containment (quarantine devices, revoke sessions), lowering dwell time and limiting damage.

- Predictive Vulnerability & Maintenance Prioritization: AI models can predict likely failure points and exploitable firmware/configuration weaknesses by correlating patch history, device telemetry, and threat intel. This lets ops teams prioritize high-risk devices and schedule proactive patching or firmware updates, improving resilience with fewer maintenance cycles.

- Context-Aware Identity & Access Control: Artificial Intelligence enriches IAM by using behavioural baselines (location, time, device posture, activity patterns) to apply dynamic access policies and step-up authentication when an engineer accesses BAS from an unusual network. This reduces over-permissive access while keeping legitimate workflows smooth for tenants and vendors.

- Reduced False Positives & Smarter Alert Triage: ML-powered correlation and enrichment reduce noisy alerts from heterogeneous building systems by grouping related events and assigning risk scores. Security teams and MSSPs can focus on high-confidence incidents, lowering operational cost and burnout while improving SOC efficiency.

- New Attack Surfaces And Adversary AI Arms Race: AI also expands the threat landscape: attackers can use ML to find weakly defended devices, craft more believable social-engineering, or evade anomaly detectors. Defenders must therefore invest in adversarial-robust models, continuous model validation, and human-in-the-loop review to avoid over-reliance on imperfect automation.

Global Smart Buildings Cybersecurity Market: Regional Analysis

Region with the Largest Revenue Share

North America, led by the United States, is projected to command a dominant position in the global smart buildings cybersecurity market with 37.5% of total revenue by the end of 2025, due to a powerful confluence of early technological adoption, stringent regulatory pressure, and a high concentration of critical infrastructure. The region has a mature and sophisticated commercial real estate sector that was among the first to widely integrate IoT and Building Management Systems, creating an extensive installed base requiring protection.

This early adoption means that many organizations have already experienced or witnessed the disruptive impact of cyber incidents, fostering a proactive security mindset and a willingness to invest in advanced solutions. Furthermore, the regulatory environment is a critical driver.

Initiatives from U.S. government bodies like the Cybersecurity and Infrastructure Security Agency (CISA), which provides binding operational directives for federal facilities, and the National Institute of Standards and Technology (NIST), whose frameworks are de facto standards for critical infrastructure, compel compliance and investment.

The presence of a dense ecosystem of leading cybersecurity vendors, major technology firms, and specialized OT security startups creates a vibrant market for innovation and services. This is complemented by a high level of cybersecurity awareness among corporate boards and building operators, who face significant legal and reputational risks from breaches. The combination of regulatory mandates, a mature threat landscape, and a strong economic capacity to invest in premium security solutions solidifies North America's leadership in this market.

ℹ

To learn more about this report –

Download Your Free Sample Report Here

Region with the Highest CAGR

The Asia Pacific region is poised to register the highest Compound Annual Growth Rate (CAGR) in the smart buildings cybersecurity market, fueled by unprecedented urban development, massive government-led digitalization initiatives, and a rapidly escalating awareness of cyber risks. The growth is primarily driven by the breakneck pace of smart city construction and building modernization in economic powerhouses like China, India, Singapore, and Japan.

National programs such as China's "Smart City Initiative" and India's "Smart Cities Mission" are creating a vast new ecosystem of connected buildings, which immediately generates a latent demand for cybersecurity. Initially, the focus in many projects was on functionality and deployment speed, but a series of high-profile cyberattacks on critical infrastructure across the region has sharply elevated the priority of security.

Governments are now introducing stricter data localization and cybersecurity laws, moving from voluntary guidelines to mandatory requirements for new developments. Furthermore, the demographic and economic trajectory of the region, with its massive urban migration and growing middle class, ensures continuous investment in new, technologically advanced commercial and residential infrastructure.

This creates a greenfield opportunity to embed cybersecurity from the ground up, unlike in more mature markets, where it is often a retrofit. The convergence of this massive new construction, rising threat awareness, and evolving regulatory frameworks creates a potent environment for explosive market growth.

By Region

North America

Europe

- Germany

- The U.K.

- France

- Italy

- Russia

- Spain

- Benelux

- Nordic

- Rest of Europe

Asia-Pacific

- China

- Japan

- South Korea

- India

- ANZ

- ASEAN

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Argentina

- Colombia

- Rest of Latin America

Middle East & Africa

- Saudi Arabia

- UAE

- South Africa

- Israel

- Egypt

- Rest of MEA

Global Smart Buildings Cybersecurity Market: Competitive Landscape

The competitive landscape of the global smart buildings cybersecurity market is fragmented and dynamic, characterized by a diverse mix of players including established cybersecurity giants, specialized OT/IoT security firms, and major building automation vendors. Large, broad-spectrum cybersecurity companies like Cisco, Palo Alto Networks, and Fortinet leverage their extensive portfolio and global sales channels to offer integrated network security solutions that can be adapted for smart building environments.

They compete by emphasizing the ability to provide a unified security fabric covering both IT and OT networks. In parallel, a cohort of specialized vendors such as Claroty, Nozomi Networks, and Dragos has emerged, focusing exclusively on the OT and IoT space. These niche players offer deep expertise in proprietary industrial protocols and provide advanced threat detection tailored for building management and control systems, appealing to customers with complex, critical infrastructure.

The competition is further intensified by the active participation of legacy building automation and control system giants like Siemens, Honeywell, and Johnson Controls. These companies are increasingly embedding cybersecurity features directly into their own BMS and physical security products, offering a tightly integrated, vendor-specific security proposition. The market is also seeing strategic consolidation as larger entities acquire smaller specialists to rapidly gain technology and market share.

To differentiate themselves, players across all categories are focusing on developing AI-powered analytics platforms, offering managed detection and response services to address the skills gap, and forming strategic partnerships with system integrators to ensure seamless implementation. This intense competition is driving rapid innovation but also necessitates clear communication of unique value propositions in a crowded field.

Some of the prominent players in the Global Smart Buildings Cybersecurity Market are:

- Siemens AG

- ABB Ltd.

- Cisco Systems, Inc.

- Honeywell International Inc.

- Schneider Electric SE

- Johnson Controls International plc

- IBM Corporation

- Microsoft Corporation

- Fortinet, Inc.

- Palo Alto Networks, Inc.

- Check Point Software Technologies Ltd.

- Broadcom Inc.

- Trend Micro Incorporated

- Kaspersky Lab

- Darktrace Holdings Limited

- Dragos Inc.

- Claroty Ltd.

- Tenable Holdings, Inc.

- Rockwell Automation, Inc.

- Armis Security, Inc.

- Other Key Players

Recent Developments in the Global Smart Buildings Cybersecurity Market

2024

- May 2024: The inaugural Smart Building Cybersecurity Summit was held in Washington, D.C., convening experts from CISA, NIST, and private industry to establish best practices for protecting critical infrastructure.

- March 2024: Johnson Controls announced a major investment in its OpenBlue cybersecurity platform, specifically enhancing its managed detection and response services for building OT environments.

2023

- October 2023: Siemens and Palo Alto Networks announced a strategic collaboration to integrate their respective OT security and building automation solutions, offering customers a pre-validated reference architecture.

- September 2023: Specialized IoT security firm Armis acquired the OT security startup Tempered Networks to bolster its capabilities in secure remote access for critical environments, including smart buildings.

- June 2023: Honeywell launched its new Cybersecurity Risk Indicator tool, a cloud-based service designed to provide a continuous security health score for a building's operational technology assets.

2022

- November 2022: Cisco Systems completed its acquisition of Kenna Security, integrating risk-based vulnerability management technology into its portfolio to help prioritize threats in complex IoT and building networks.

- April 2022: Nozomi Networks partnered with Carrier Global Corporation to integrate its OT/IoT security monitoring directly into Carrier's Abound building management platform.

Report Details

| Report Characteristics |

| Market Size (2025) |

USD 9.0 Bn |

| Forecast Value (2034) |

USD 26.0 Bn |

| CAGR (2025–2034) |

12.5% |

| The US Market Size (2025) |

USD 2.8 Bn |

| Historical Data |

2019 – 2024 |

| Forecast Data |

2026 – 2034 |

| Base Year |

2024 |

| Estimate Year |

2025 |

| Report Coverage |

Market Revenue Estimation, Market Dynamics, Competitive Landscape, Growth Factors, etc. |

| Segments Covered |

By Component (Hardware, Software, Services), By Solution Type (Network Security, Endpoint & Device Security, Identity & Access Management, Data Security & Privacy, Monitoring & Analytics, OT/ICS Security for Building Systems, Other Solution Types), By Deployment Mode (Cloud-based, On-premises, Hybrid), By Organization Size (Large Enterprises, Small & Medium-sized Enterprises (SMEs)), By Application (Building Automation & HVAC Systems, Lighting & Energy Management Systems, Access Control & Video Surveillance, Fire & Life Safety Systems, Smart Metering & Utilities Management, Other Applications), By End User (Commercial Buildings, Residential Buildings, Healthcare Facilities, Educational Institutions, Retail & Hospitality, Industrial Facilities, Government & Defense, Data Centers, Other End Users) |

| Regional Coverage |

North America – US, Canada; Europe – Germany, UK, France, Russia, Spain, Italy, Benelux, Nordic, Rest of Europe; Asia-Pacific – China, Japan, South Korea, India, ANZ, ASEAN, Rest of APAC; Latin America – Brazil, Mexico, Argentina, Colombia, Rest of Latin America; Middle East & Africa – Saudi Arabia, UAE, South Africa, Turkey, Egypt, Israel, Rest of MEA |

| Prominent Players |

Siemens AG, ABB Ltd., Cisco Systems, Inc., Honeywell International Inc., Schneider Electric SE, Johnson Controls International plc, IBM Corporation, Microsoft Corporation, Fortinet, Inc., Palo Alto Networks, Inc., Check Point Software Technologies Ltd., Broadcom Inc., Trend Micro Incorporated, Kaspersky Lab, Darktrace Holdings Limited, Dragos Inc., Claroty Ltd., Tenable Holdings, Inc., Rockwell Automation, Inc., Armis Security, Inc., and Other Key Players |

| Purchase Options |

We have three licenses to opt for: Single User License (Limited to 1 user), Multi-User License (Up to 5 Users), and Corporate Use License (Unlimited User) along with free report customization equivalent to 0 analyst working days, 3 analysts working days, and 5 analysts working days respectively. |