Market Overview

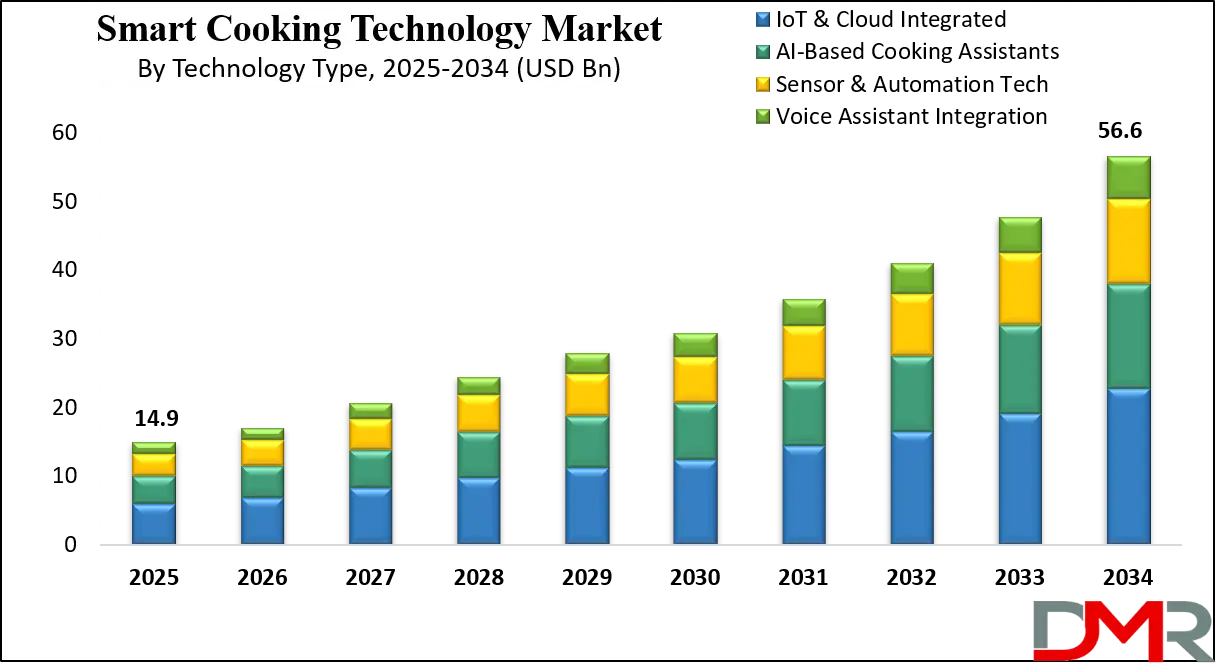

The global smart cooking technology market is projected to grow from an estimated USD 14.9 billion in 2025 to USD 56.6 billion by 2034, registering a robust CAGR of 16.0%, driven by growing adoption of IoT-enabled appliances, AI-powered cooking solutions, and rising consumer demand for connected kitchen devices.

Smart cooking technology refers to the integration of advanced digital tools and connected devices into traditional cooking appliances to enhance convenience, precision, and efficiency in food preparation. This technology leverages Internet of Things (IoT), artificial intelligence, and sensor automation to provide users with intelligent cooking solutions such as remote control via smartphones, real-time monitoring, and automated cooking processes.

Features like voice assistant compatibility, recipe customization, and energy-efficient heating methods are central to smart cooking devices, allowing consumers to achieve consistent results while saving time and reducing waste. By embedding smart connectivity and adaptive learning capabilities, these appliances transform ordinary kitchens into interactive and responsive environments that cater to modern lifestyle demands.

ℹ

To learn more about this report –

Download Your Free Sample Report Here

The global smart cooking technology market is witnessing rapid expansion, driven by growing consumer preference for connected home appliances that offer enhanced user experience and energy efficiency. Rising adoption of IoT-enabled devices, cloud computing, and AI-powered cooking assistants is revolutionizing traditional cooking methods, facilitating more personalized and automated culinary processes.

Moreover, urbanization, growing disposable incomes, and a shift towards healthier cooking practices contribute to the market’s momentum. Innovations such as induction-based cooking, smart ovens, and app-controlled cookware are gaining traction, enabling seamless integration into smart homes globally.

As digital transformation continues to reshape the kitchen appliance industry, the smart cooking technology market is expected to grow substantially across residential and commercial segments. Increasing investments in research and development, integrated with expanding e-commerce channels and consumer awareness about sustainable cooking solutions, further propel this market.

ℹ

To learn more about this report –

Download Your Free Sample Report Here

Additionally, strategic collaborations between technology providers and appliance manufacturers are fostering product advancements and broader market penetration. With evolving connectivity standards and AI advancements, the market is set to deliver more intelligent, efficient, and user-friendly cooking experiences globally in the coming years.

The US Smart Cooking Technology Market

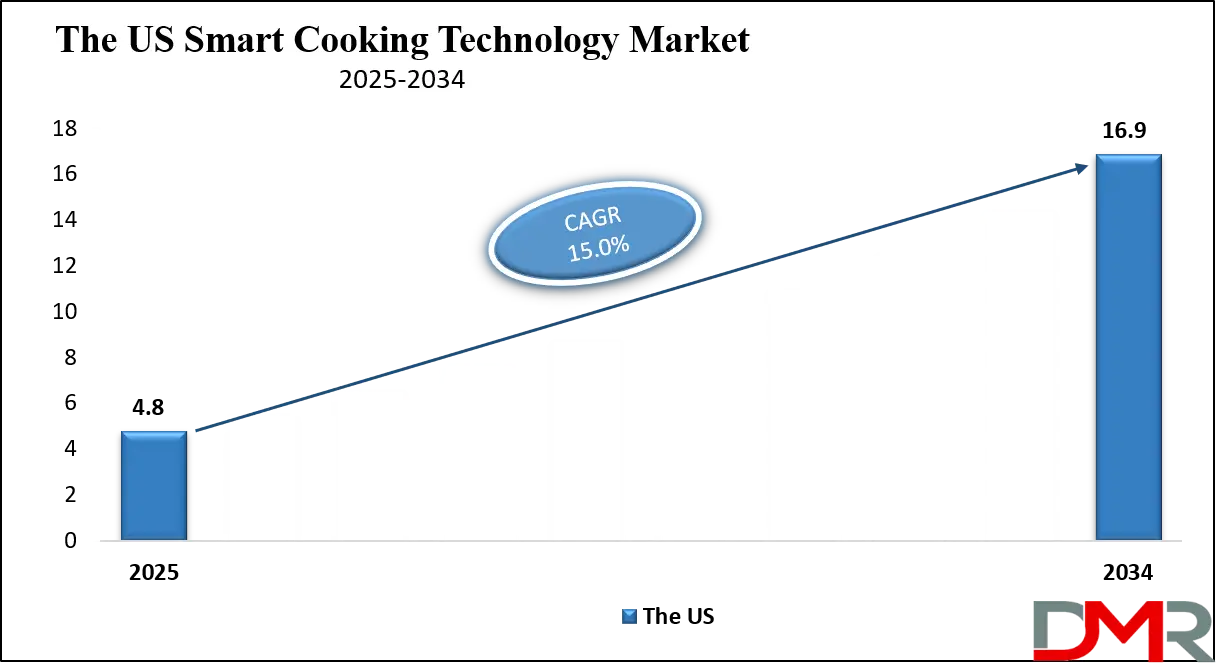

The U.S. Smart Cooking Technology Market size is projected to be valued at USD 4.8 billion in 2025. It is further expected to witness subsequent growth in the upcoming period, holding USD 16.9 billion in 2034 at a CAGR of 15.0%.

The U.S. smart cooking technology market is characterized by the rapid adoption of innovative kitchen appliances that integrate connectivity and automation to enhance cooking efficiency and convenience. Consumers favor smart ovens, induction cooktops, and connected cookware that offer real-time monitoring, remote control through mobile apps, and voice assistant compatibility.

This shift is driven by the growing trend toward smart homes, where seamless integration of Internet of Things (IoT) devices enables users to manage multiple household functions effortlessly. Additionally, the focus on energy-efficient and precise cooking solutions aligns with the growing awareness of sustainable living and healthier meal preparation in the U.S. market.

Furthermore, the U.S. market benefits from a strong presence of technology-savvy consumers and a well-established retail ecosystem, including online platforms, specialty stores, and large electronics chains, which facilitate easy access to advanced smart cooking products. The market also sees continuous innovation fueled by collaborations between appliance manufacturers and tech companies, resulting in enhanced AI-based cooking assistants and sensor-driven automation features.

Commercial segments such as restaurants and food service providers are gradually incorporating smart cooking technologies to improve operational efficiency and maintain consistency in food quality. Overall, the U.S. smart cooking technology market is poised for sustained growth driven by evolving consumer lifestyles and technological advancements.

ℹ

To learn more about this report –

Download Your Free Sample Report Here

The Europe Smart Cooking Technology Market

Europe smart cooking technology market is poised for substantial growth, with an estimated market share of approximately USD 3.7 billion in 2025. This growth is driven by growing consumer demand for advanced kitchen appliances that offer convenience, energy efficiency, and connectivity. European consumers are progressively adopting smart ovens, induction cooktops, and other digital cooking

devices that can be controlled remotely via smartphones and integrated with home automation systems. The region’s emphasis on sustainable living and energy conservation also encourages the adoption of eco-friendly smart cooking technologies, which reduce power consumption and optimize cooking processes. Moreover, rising urbanization and the growing trend of smart homes across key European countries such as Germany, France, and the UK contribute to expanding the market footprint.

In addition to consumer demand, the European market benefits from strong innovation ecosystems and government initiatives aimed at promoting digital transformation and smart appliance adoption. Leading manufacturers in the region are investing heavily in research and development to introduce AI-enabled cooking assistants, IoT connectivity, and cloud-based platforms that enhance user experience and appliance interoperability.

Specialty retailers and e-commerce platforms are also playing a crucial role in making smart cooking technology more accessible to a wider audience. With continuous advancements and growing awareness about the benefits of intelligent cooking solutions, Europe is expected to maintain a steady CAGR of around 14.6%, solidifying its position as a key market within the global smart cooking technology landscape.

The Japan Smart Cooking Technology Market

Japan smart cooking technology market is expected to reach approximately USD 0.3 billion in 2025, reflecting steady growth driven by the country’s strong affinity for cutting-edge technology and innovation. Japanese consumers are known for their early adoption of advanced home appliances, and this trend extends to smart cooking devices that offer precision, convenience, and connectivity. The popularity of AI-powered cooking assistants, IoT-enabled ovens, and smart induction cooktops aligns with Japan’s culture of efficiency and technological sophistication.

Additionally, the aging population and growing focus on health-conscious cooking are encouraging demand for appliances that simplify meal preparation while promoting healthier eating habits.

The market growth in Japan is also supported by continuous advancements in digital cooking technologies from local manufacturers who integrate AI, sensors, and automation into their product offerings. Government initiatives aimed at promoting smart home technologies and energy efficiency further boost market expansion.

Moreover, Japan’s well-developed e-commerce infrastructure and high internet penetration facilitate widespread accessibility and adoption of smart cooking appliances. With a projected CAGR of around 13.2%, the Japanese market is poised to maintain a solid trajectory, contributing significantly to the Asia-Pacific region’s overall growth in smart cooking technology.

Global Smart Cooking Technology Market: Key Takeaways

- Market Value: The global smart cooking technology market size is expected to reach a value of USD 56.6 billion by 2034 from a base value of USD 14.9 billion in 2025 at a CAGR of 16.0%.

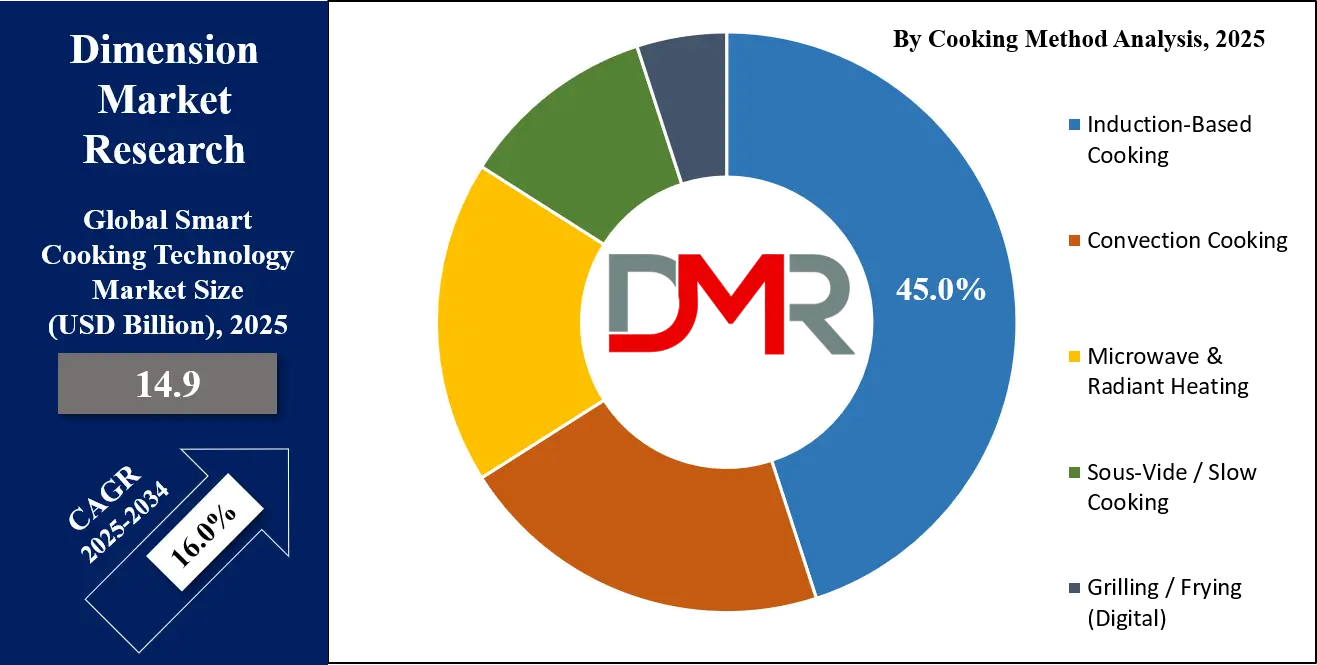

- By Cooking Method Segment Analysis: Induction-Based Cooking methods are poised to consolidate their dominance in the cooking method segment, capturing 45.0% of the total market share in 2025.

- By Product Type Segment Analysis: Smart Ovens are anticipated to maintain their dominance in the product type segment, capturing 35.0% of the total market share in 2025.

- By Connectivity Segment Analysis: Wi-Fi-enabled devices are expected to maintain their dominance in the connectivity segment, capturing 51.0% of the total market share in 2025.

- By Technology Segment Analysis: IoT & Cloud Integrated technologies will lead in the technology segment, capturing 40.0% of the market share in 2025.

- By Distribution Channel Segment Analysis: Online Retail channels are poised to consolidate their market position in the distribution channel segment, capturing 49.0% of the total market share in 2025.

- By Application Segment Analysis: The Residential Use industry is anticipated to maintain its dominance in the application segment, capturing 64% of the total market share in 2025.

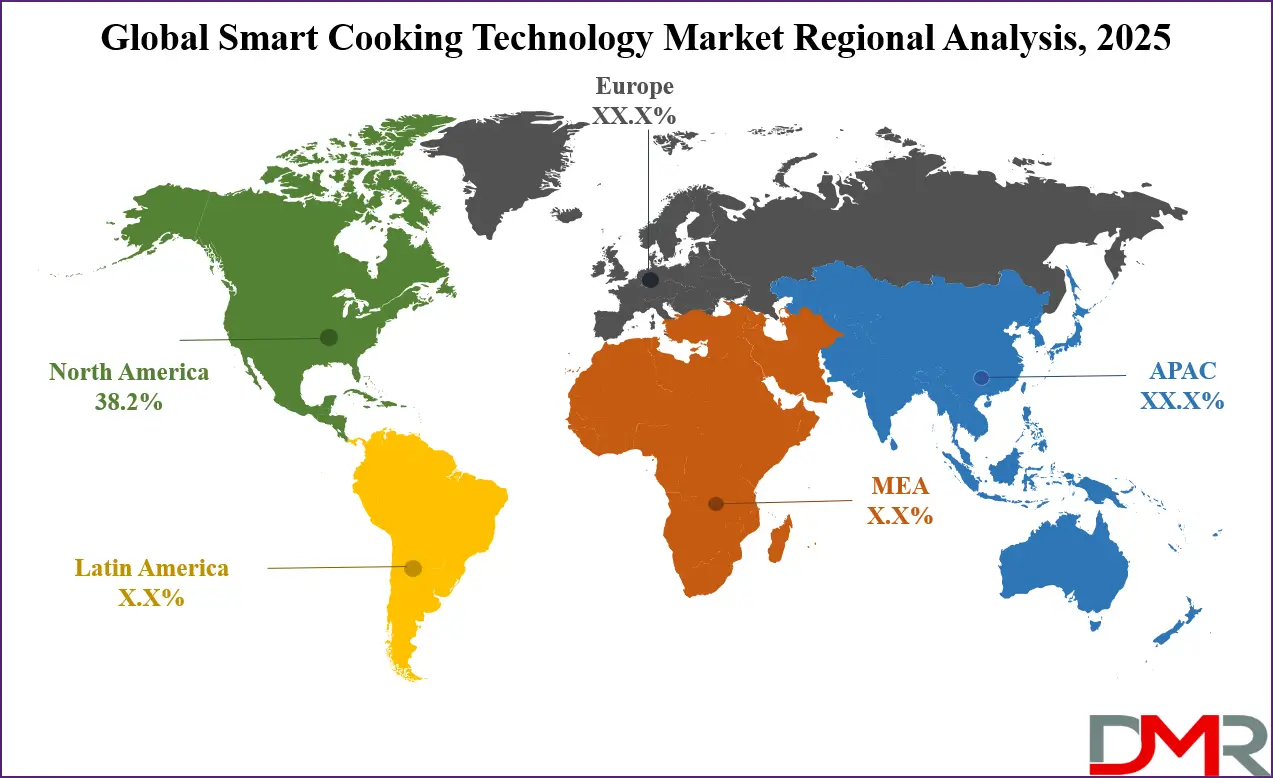

- Regional Analysis: North America is anticipated to lead the global smart cooking technology market landscape with 38.2% of total global market revenue in 2025.

- Key Players: Some key players in the global smart cooking technology market are Samsung Electronics, LG Electronics, Whirlpool Corporation, Panasonic Corporation, Electrolux AB, Haier Smart Home, Breville Group, GE Appliances, Bosch (BSH Hausgeräte GmbH), Miele & Cie. KG, Xiaomi Corporation, Tovala, June Life Inc., and Other Key Players.

Global Smart Cooking Technology Market: Use Cases

- Connected Home Kitchens for Enhanced Cooking Experience: Smart cooking technology is transforming residential kitchens into connected hubs that offer convenience, precision, and control. Devices such as smart ovens, induction cooktops, and app-enabled cookware allow users to remotely monitor cooking progress, adjust temperature settings, and receive notifications via smartphones. Integration with voice assistants like Alexa and Google Assistant further simplifies operation, enabling hands-free control. These connected home kitchens leverage IoT connectivity and cloud computing to provide personalized recipe recommendations and automated cooking programs. This use case addresses consumer demand for time-saving solutions, consistent meal quality, and energy-efficient cooking methods, aligning with the trend toward smart homes and digital lifestyles.

- Commercial Kitchens Improving Operational Efficiency: In the foodservice industry, smart cooking technology is adopted to optimize commercial kitchen operations. Restaurants, hotels, and catering services benefit from IoT-enabled appliances that ensure precise temperature control, reduce cooking errors, and maintain food safety standards. Automation and sensor technology streamline workflows, minimize energy consumption, and reduce food waste through better monitoring and data analytics. Real-time data from connected grills, ovens, and fryers helps kitchen staff manage multiple orders efficiently while maintaining consistent taste and texture. This use case highlights how digital cooking solutions improve productivity and support sustainability goals in the commercial food sector.

- Precision Cooking for Health-Conscious Consumers: Smart cooking devices like sous-vide machines, precision cookers, and sensor-equipped cookware enable users to achieve exact cooking temperatures and times, preserving nutrients and flavors. This technology appeals particularly to health-conscious consumers focused on nutrition and diet management. With AI-powered cooking assistants, users can customize meal plans, monitor calorie intake, and adjust cooking processes to meet specific dietary requirements. The ability to automate slow cooking and maintain consistent results also encourages home cooking, reducing reliance on processed foods and takeout. This use case underscores the growing interest in smart kitchen appliances that promote healthier eating habits through advanced cooking methods.

- Integration of AI and Machine Learning for Smart Recipe Adaptation: Artificial intelligence and machine learning are becoming core components in smart cooking technology, enabling adaptive cooking experiences. AI-based cooking assistants analyze user preferences, cooking history, and ingredient availability to suggest optimized recipes and cooking techniques. These systems learn from user feedback to improve future recommendations and can automatically adjust cooking parameters in real time. The integration of voice recognition and natural language processing enhances user interaction, making cooking more accessible to novices. This use case demonstrates how AI-driven innovation is revolutionizing culinary practices by personalizing the cooking process and simplifying complex tasks.

Global Smart Cooking Technology Market: Stats & Facts

U.S. Department of Energy (DOE)

- Residential kitchen appliances contribute approximately 13% of total residential energy consumption in the U.S.

- Adoption of energy-efficient cooking technologies has reduced average household cooking energy use by 8% since 2015.

- Induction cooktops are 20% more energy-efficient than traditional electric ranges.

- Smart appliances connected through IoT can reduce household energy use by up to 10%.

European Environment Agency (EEA)

- European households account for 25% of total residential energy consumption, with cooking appliances representing a significant portion.

- Energy-efficient smart cooking devices have the potential to lower CO2 emissions by 15% by 2030 in Europe.

- The average European kitchen has seen a 12% increase in smart appliance penetration since 2018.

- Nearly 60% of European consumers prefer kitchen appliances that offer remote control and automation features.

Japan Ministry of Economy, Trade and Industry (METI)

- Japan has a 35% penetration rate of smart kitchen appliances in urban households as of 2023.

- Energy-saving cooking devices contributed to a 9% reduction in household electricity demand in Japan between 2018 and 2023.

- Government incentives have led to a 22% increase in smart appliance sales annually since 2020.

- Integration of AI in cooking devices is forecasted to grow by 18% annually in Japan through 2027.

National Institute of Standards and Technology (NIST), U.S.

- IoT-connected kitchen appliances have improved cooking accuracy by 25%, reducing food waste.

- Smart sensors in cooking devices help monitor and control energy consumption in real time, reducing waste by 15%.

- Voice-controlled smart ovens increased user satisfaction ratings by 30% in government-funded trials.

- NIST supports interoperability standards that facilitate the integration of smart cooking tech into home automation systems.

China Ministry of Industry and Information Technology (MIIT)

- China recorded a 40% growth in smart kitchen appliance production from 2019 to 2024.

- Smart cooking device exports grew by 28% annually over the last five years.

- Government regulations have improved the average energy efficiency of cooking appliances by 14% since 2020.

- Over 70% of new urban homes in China are pre-equipped with smart kitchen connectivity infrastructure.

South Korea Ministry of Trade, Industry and Energy (MOTIE)

- Smart cooking technology adoption in South Korean households reached 45% by 2023.

- Government programs supporting IoT appliance adoption contributed to a 12% reduction in kitchen-related energy consumption.

- 80% of surveyed consumers prefer AI-enabled cooking devices for meal customization.

- South Korea aims to increase smart kitchen appliance penetration to 60% by 2027.

UK Department for Business, Energy & Industrial Strategy (BEIS)

- The UK has seen a 15% annual increase in smart kitchen appliance adoption since 2019.

- Smart cooking devices reduced average residential cooking times by 10%, improving energy efficiency.

- Energy savings from smart appliance use are estimated to cut residential carbon emissions by 7% by 2030.

- Over 50% of UK households consider smart appliance connectivity a critical purchasing factor.

Australian Government Department of Industry, Science and Resources

- Smart kitchen appliance sales grew by 22% annually between 2020 and 2024.

- Energy-efficient cooking technologies reduced household energy demand by 6%.

- Over 65% of Australian consumers surveyed favored IoT-connected kitchen devices.

- Government rebates incentivize the adoption of smart cooking technology, growing uptake by 18% since 2021.

Canadian Natural Resources Canada (NRCan)

- Smart cooking appliances contributed to a 10% reduction in residential electricity consumption in Canada over five years.

- IoT-enabled kitchen devices are part of the government’s strategy to lower national greenhouse gas emissions by 30% by 2030.

- More than 40% of Canadian households own at least one smart cooking device.

- Energy Star-certified smart kitchen appliances increased by 25% in Canadian markets between 2018 and 2023.

Germany Federal Ministry for Economic Affairs and Energy (BMWi)

- Smart kitchen technology penetration increased by 18% annually from 2019 to 2024 in Germany.

- Energy-saving cooking devices account for a 13% reduction in household energy use.

- Over 70% of German consumers prioritize energy efficiency and smart functionality when purchasing kitchen appliances.

- Government incentives have boosted smart cooking tech R&D investment by 20% since 2020.

Global Smart Cooking Technology Market: Market Dynamics

Global Smart Cooking Technology Market: Driving Factors

Rising Consumer Demand for Connected Kitchen Appliances

The growing adoption of Internet of Things (IoT) technology in households is a major driver for the smart cooking technology market. Consumers seek seamless connectivity between kitchen devices and smartphones or voice assistants, allowing remote monitoring and control. Features like real-time cooking status updates, recipe integration, and energy-efficient operation attract tech-savvy users aiming for convenience and improved cooking precision. This demand fuels innovation in smart ovens, cooktops, and cookware, encouraging manufacturers to develop more intelligent and user-friendly products.

Growing Awareness of Health and Sustainable Cooking

As consumers become more health-conscious and environmentally aware, there is a rising preference for cooking methods that preserve nutrients and reduce energy consumption. Smart cooking devices that support precision cooking, such as sous-vide machines and sensor-driven appliances, help users prepare healthier meals with less waste. Additionally, energy-efficient induction cooktops and AI-based automation contribute to lowering carbon footprints in domestic and commercial kitchens. This shift towards sustainable and healthy cooking practices significantly propels market growth.

Global Smart Cooking Technology Market: Restraints

High Initial Investment and Product Costs

The advanced technology embedded in smart cooking appliances often translates to higher purchase prices compared to conventional kitchen equipment. This upfront cost can be a barrier for price-sensitive consumers, particularly in developing regions. Additionally, the need for compatible smartphones or home automation systems may deter potential buyers who are reluctant to invest in an integrated smart home ecosystem. Such cost concerns limit mass adoption despite growing interest.

Data Privacy and Security Concerns

With smart cooking devices relying heavily on IoT connectivity and cloud platforms, data privacy and cybersecurity become critical issues. Consumers worry about unauthorized access to personal data, including usage patterns and voice commands. The risk of cyberattacks on connected home devices can undermine trust in smart kitchen technology. Manufacturers must invest in robust security protocols and transparent privacy policies to address these concerns, but lingering doubts may slow market penetration.

Global Smart Cooking Technology Market: Opportunities

Expansion of E-commerce and Direct-to-Consumer Sales Channels

The rise of online retail platforms offers manufacturers and brands new avenues to reach a wider customer base globally. Digital marketplaces enable direct engagement with consumers, provide access to detailed product information, and facilitate easy comparison and purchase of smart cooking devices. Leveraging data analytics from online sales can also help companies tailor offerings and marketing strategies, thus accelerating growth and adoption in emerging and mature markets.

Integration of Artificial Intelligence and Machine Learning

Advancements in AI and machine learning present significant opportunities for the smart cooking market by enabling personalized cooking experiences and adaptive automation. AI-powered cooking assistants can analyze user preferences, optimize recipes, and adjust cooking parameters in real-time, enhancing ease of use and meal quality. Continuous improvements in voice recognition and natural language processing further enhance user interaction. This technological evolution is set to drive innovation and differentiate products in a competitive landscape.

Global Smart Cooking Technology Market: Trends

Adoption of Voice Assistant Integration in Kitchen Appliances

Voice-controlled smart cooking devices are becoming popular as consumers embrace hands-free operation for convenience and hygiene. Integration with digital assistants such as Amazon Alexa, Google Assistant, and Apple Siri allows users to control cooking appliances through voice commands, access recipes, and receive cooking tips. This trend aligns with the broader smart home movement and enhances the overall user experience by simplifying kitchen tasks.

Shift towards Sustainable and Energy-Efficient Cooking Solutions

Environmental concerns and rising energy costs have pushed manufacturers to develop smart cooking technologies that prioritize energy conservation. Innovations like induction-based cooking, sensor-driven heat regulation, and automated shutoff systems help reduce electricity consumption and carbon emissions. Consumers are attracted to appliances that not only deliver performance but also support green living initiatives, making sustainability a key trend shaping product development and market growth.

Global Smart Cooking Technology Market: Research Scope and Analysis

By Cooking Method Analysis

Induction-based cooking methods are set to dominate the global smart cooking technology market in 2025, accounting for approximately 45.0% of the total segment share. This dominance is largely driven by the growing consumer preference for faster, safer, and more energy-efficient cooking solutions. Induction cooktops use electromagnetic fields to heat pots and pans directly, significantly reducing heat loss and cooking time.

Their precise temperature control, ease of cleaning, and sleek design make them attractive in modern kitchens. Moreover, their compatibility with smart sensors and automation features aligns well with the evolving demand for connected cooking appliances in both residential and commercial settings.

Convection cooking, while not as dominant as induction, remains a critical part of the cooking method segment due to its effectiveness in evenly distributing heat throughout the cooking chamber. This method is widely used in smart ovens, which leverage built-in fans to circulate hot air, ensuring uniform cooking and better texture.

Convection cooking is especially popular for baking and roasting, offering improved efficiency and reduced cooking times compared to conventional thermal ovens. Smart ovens with convection capabilities often come integrated with programmable settings, AI-enhanced recipe guides, and connectivity features, catering to consumers who prioritize consistency and convenience in meal preparation.

ℹ

To learn more about this report –

Download Your Free Sample Report Here

By Product Type Analysis

Smart ovens are projected to lead the product type segment of the smart cooking technology market in 2025, capturing an estimated 35.0% of the overall share. Their popularity stems from their versatility and integration of advanced features such as voice assistant compatibility, remote monitoring, and AI-driven recipe customization. These ovens often come equipped with multiple cooking modes, including bake, roast, air-fry, and steam, allowing users to prepare a wide variety of dishes efficiently. The inclusion of touchscreens, internal cameras, and Wi-Fi connectivity enhances the user experience by enabling real-time progress tracking and guided cooking, making them particularly appealing to both tech-savvy consumers and busy households.

Smart cooktops are also gaining traction in the market due to their sleek design, energy efficiency, and precise heat control. These cooktops, often powered by induction technology, offer safety features such as child locks and automatic shut-off, as well as compatibility with mobile apps for remote operation.

Many smart cooktops are integrated with sensors that detect pan size and adjust heat output accordingly, helping to prevent overcooking or energy waste. Although their market share is slightly lower than that of smart ovens, they are becoming preferred in modern, space-conscious kitchens and are particularly popular among urban dwellers looking for compact and efficient cooking solutions.

By Connectivity Analysis

Wi-Fi-enabled devices are set to dominate the connectivity segment of the smart cooking technology market, projected to capture 51.0% of the total share in 2025. This strong position is attributed to their seamless integration with smart home ecosystems and the high level of convenience they offer users. Wi-Fi connectivity allows for remote monitoring, real-time alerts, cloud-based recipe updates, and firmware upgrades.

These devices can easily sync with smartphones, tablets, and voice assistants, enabling users to control cooking appliances from virtually anywhere. This makes them particularly attractive for consumers seeking advanced functionality and multi-device interoperability in their kitchens, further reinforcing their dominance across residential and commercial applications.

Bluetooth-enabled devices, while not as dominant as their Wi-Fi counterparts, still play a vital role in the connectivity landscape of smart cooking technology. These devices are typically used for short-range control and offer an easy, quick setup without the need for internet access. Bluetooth connectivity is often found in portable or entry-level smart cooking products such as precision cookers, digital thermometers, and certain types of grills and cooktops.

They are especially useful for users who prefer simple, direct device-to-device communication without relying on cloud services. Though more limited in range and functionality, Bluetooth-enabled appliances appeal to a budget-conscious segment of consumers looking for basic smart features in their kitchen setups.

By Technology Analysis

IoT and cloud-integrated technologies are expected to lead the technology segment of the smart cooking technology market, capturing approximately 40.0% of the total market share in 2025. Their growing dominance is driven by the seamless interoperability they offer across various smart devices and platforms. IoT integration enables real-time data exchange between cooking appliances, mobile apps, and cloud-based services, allowing users to receive status alerts, automate cooking processes, and access software updates remotely.

Cloud connectivity further enhances personalization by storing user preferences, cooking history, and curated recipe content, making the cooking experience more intelligent and responsive. These technologies are becoming a standard in next-generation smart kitchens, appealing to tech-savvy consumers and commercial operators alike who seek convenience, efficiency, and automation.

AI-based cooking assistants are also gaining traction as an emerging segment within smart cooking technology. These systems leverage artificial intelligence to deliver a highly personalized cooking experience by analyzing user behavior, dietary needs, and real-time appliance feedback. AI-enabled devices can recommend recipes based on ingredients available, suggest optimal cooking times, and even adapt to individual taste profiles.

Some smart ovens and cooktops now feature built-in cameras and sensors that, combined with AI algorithms, help adjust cooking parameters on the fly to prevent undercooking or overcooking. Though still evolving, AI-based assistants are redefining home cooking by reducing user effort and growing precision, making them an attractive component in advanced kitchen ecosystems.

By Distribution Channel Analysis

Online retail channels are poised to solidify their dominance in the distribution channel segment of the smart cooking technology market, expected to account for 49.0% of the total market share in 2025. This growth is largely fueled by the convenience, wide product availability, and competitive pricing offered by e-commerce platforms. Consumers prefer shopping for smart cooking appliances online due to access to detailed specifications, user reviews, video demonstrations, and doorstep delivery.

In addition, online channels often provide attractive deals, financing options, and bundle packages that appeal to both first-time buyers and tech enthusiasts. The rise of direct-to-consumer strategies by brands and the integration of augmented reality for product previews are further enhancing the online buying experience, making digital platforms a key driver of sales in this market.

Specialty stores, while holding a smaller share, continue to play a significant role in shaping consumer decisions within the smart cooking appliance segment. These stores offer personalized customer service, expert product demonstrations, and hands-on experience that help educate consumers about the functionality and benefits of advanced cooking technologies. Shoppers looking for tailored guidance or those new to smart appliances often turn to specialty outlets for trusted recommendations and in-depth comparisons.

Additionally, partnerships between premium brands and specialty retailers help position high-end products in a curated environment, reinforcing brand perception and product value. Despite growing online competition, specialty stores remain important touchpoints for building consumer confidence and providing post-purchase support.

By Application Analysis

Residential use is projected to dominate the application segment of the smart cooking technology market, capturing 64% of the total share in 2025. This leadership is attributed to the growing demand for convenience, personalization, and energy-efficient solutions in home kitchens. Consumers are integrating smart cooking appliances such as connected ovens, induction cooktops, and smart cookware that can be monitored and controlled via mobile apps or voice commands.

The ability to automate cooking processes, receive alerts, and follow interactive recipes has made these appliances popular among busy households and health-conscious individuals. The rising adoption of smart home ecosystems and the influence of digital lifestyles are further accelerating the use of intelligent cooking technologies in residential settings.

Commercial use, while smaller in market share, is emerging as a significant growth area driven by the need for operational efficiency, consistency, and customer engagement in foodservice establishments. Restaurants, cafes, cloud kitchens, and catering services are adopting smart cooking equipment to streamline workflows, reduce human error, and maintain food quality standards.

These appliances offer features like real-time monitoring, automated temperature control, and integration with inventory and kitchen management systems. In fast-paced commercial kitchens, such capabilities improve turnaround time and reduce waste, while also enabling remote supervision and predictive maintenance. As the foodservice industry continues to digitize, commercial adoption of smart cooking technologies is expected to gain steady momentum.

The Smart Cooking Technology Market Report is segmented on the basis of the following:

By Cooking Method

- Induction-Based Cooking

- Convection Cooking

- Microwave & Radiant Heating

- Sous-Vide/ Slow Cooking

- Grilling/ Frying (Digital)

By Product Type

- Smart Ovens

- Smart Cooktops

- Connected Microwaves

- Smart Cookware & Utensils

- Precision Cookers

- Smart Grills & Fryers

- Others

By Connectivity

- Wi-Fi Enabled Devices

- Bluetooth Enabled Devices

- Other Protocols

By Technology

- IoT & Cloud Integrated

- AI-Based Cooking Assistants

- Sensor & Automation Tech

- Voice Assistant Integration

By Distribution Channel

- Online Retail

- Specialty Stores

- Supermarkets/Hypermarkets

- Direct Sales

By Application

- Residential Use

- Commercial Use

Global Smart Cooking Technology Market: Regional Analysis

Region with the Largest Revenue Share

North America is set to dominate the global smart cooking technology market in 2025, capturing a significant 38.2% share of the total market revenue. This leadership is driven by widespread consumer adoption of advanced kitchen appliances, high disposable incomes, and strong technological infrastructure supporting IoT and smart home integrations. The region benefits from the presence of major manufacturers and early adopters who prioritize convenience, energy efficiency, and connectivity in cooking devices.

Additionally, growing awareness around sustainable and health-conscious cooking practices further fuels demand for smart ovens, cooktops, and connected cookware, solidifying North America’s position as the leading market in this sector.

ℹ

To learn more about this report –

Download Your Free Sample Report Here

Region with significant growth

TThe Asia-Pacific region is expected to register the highest compound annual growth rate in the smart cooking technology market, driven by rapid urbanization, rising disposable incomes, and increasing consumer awareness about smart home appliances. Countries like China, India, Japan, and South Korea are witnessing accelerated adoption of connected kitchen devices due to expanding e-commerce platforms and government initiatives promoting digitalization and energy-efficient technologies.

Additionally, the growing middle-class population and a shift towards convenience-based cooking solutions are propelling demand for AI-powered cooking assistants, IoT-enabled ovens, and smart cooktops, making Asia-Pacific the fastest-growing region in this market.

By Region

North America

Europe

- Germany

- The U.K.

- France

- Italy

- Russia

- Spain

- Benelux

- Nordic

- Rest of Europe

Asia-Pacific

- China

- Japan

- South Korea

- India

- ANZ

- ASEAN

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Argentina

- Colombia

- Rest of Latin America

Middle East & Africa

- Saudi Arabia

- UAE

- South Africa

- Israel

- Egypt

- Rest of MEA

Global Smart Cooking Technology Market: Competitive Landscape

The global smart cooking technology market features a highly competitive landscape characterized by the presence of numerous established multinational corporations and innovative startups striving to enhance their product portfolios and technological capabilities. Key players focus on continuous research and development to introduce advanced features such as AI-based cooking assistants, IoT and cloud integration, and voice-controlled functionalities that cater to evolving consumer demands. Strategic partnerships, collaborations, and mergers are common as companies seek to expand their geographic reach and strengthen distribution channels across both online and offline platforms.

Additionally, differentiation through energy-efficient designs, user-friendly interfaces, and smart connectivity options remains central to gaining a competitive edge. Leading companies also invest heavily in marketing and customer education to boost adoption rates and capitalize on the growing trend toward connected and automated kitchen solutions globally.

Some of the prominent players in the global smart cooking technology market are:

- Samsung Electronics

- LG Electronics

- Whirlpool Corporation

- Panasonic Corporation

- Electrolux AB

- Haier Smart Home

- Breville Group

- GE Appliances

- Bosch (BSH Hausgeräte GmbH)

- Miele & Cie. KG

- Xiaomi Corporation

- Tovala

- June Life, Inc.

- Sub-Zero Group, Inc.

- Sharp Corporation

- Koninklijke Philips N.V.

- Anova Culinary

- Gourmia

- Robam Appliances

- Instant Brands

- Other Key Players

Global Smart Cooking Technology Market: Recent Developments

Product Launches

- May 2024: LG Electronics unveiled its AI-powered smart oven under the LG ThinQ brand, featuring adaptive cooking algorithms and integrated camera monitoring for precision cooking experiences.

- February 2024: Samsung launched its enhanced Bespoke AI Oven, equipped with intelligent recognition for various food types, smart recipe recommendations, and seamless smartphone integration through SmartThings.

Mergers and Acquisitions

- January 2024: Breville Group acquired ChefSteps, a company known for its Joule sous-vide technology, to strengthen its position in connected precision cooking solutions.

- September 2023: Haier Smart Home completed the acquisition of a majority stake in Italy-based SMEG, aiming to expand its premium smart kitchen appliance offerings globally.

Funding and Investments

- August 2023: June Life, Inc., a startup behind the June smart oven, raised USD 20 million in a Series C round led by Valor Equity Partners to scale its AI-enabled cooking technology and expand product lines.

- April 2023: Tovala secured USD 30 million in funding from Comcast Ventures and new investors to accelerate the development of its smart oven and meal delivery integration, targeting urban tech-savvy households.

Report Details

| Report Characteristics |

| Market Size (2025) |

USD 14.9 Bn |

| Forecast Value (2034) |

USD 56.6 Bn |

| CAGR (2025–2034) |

16.0% |

| The US Market Size (2025) |

USD 4.8 Bn |

| Historical Data |

2019 – 2024 |

| Forecast Data |

2026 – 2034 |

| Base Year |

2024 |

| Estimate Year |

2025 |

| Report Coverage |

Market Revenue Estimation, Market Dynamics, Competitive Landscape, Growth Factors, etc. |

| Segments Covered |

By Cooking Method (Induction-Based Cooking, Convection Cooking, Microwave & Radiant Heating, Sous-Vide/Slow Cooking, Grilling/Frying (Digital)), By Product Type (Smart Ovens, Smart Cooktops, Connected Microwaves, Smart Cookware & Utensils, Precision Cookers, Smart Grills & Fryers, Others), By Connectivity (Wi-Fi Enabled Devices, Bluetooth Enabled Devices, Other Protocols), By Technology (IoT & Cloud Integrated, AI-Based Cooking Assistants, Sensor & Automation Tech, Voice Assistant Integration), By Distribution Channel (Online Retail, Specialty Stores, Supermarkets/Hypermarkets, Direct Sales), and By Application (Residential Use, Commercial Use) |

| Regional Coverage |

North America – US, Canada; Europe – Germany, UK, France, Russia, Spain, Italy, Benelux, Nordic, Rest of Europe; Asia-Pacific – China, Japan, South Korea, India, ANZ, ASEAN, Rest of APAC; Latin America – Brazil, Mexico, Argentina, Colombia, Rest of Latin America; Middle East & Africa – Saudi Arabia, UAE, South Africa, Turkey, Egypt, Israel, Rest of MEA |

| Prominent Players |

Samsung Electronics, LG Electronics, Whirlpool Corporation, Panasonic Corporation, Electrolux AB, Haier Smart Home, Breville Group, GE Appliances, Bosch (BSH Hausgeräte GmbH), Miele & Cie. KG, Xiaomi Corporation, Tovala, June Life Inc., and Other Key Players |

| Purchase Options |

We have three licenses to opt for: Single User License (Limited to 1 user), Multi-User License (Up to 5 Users), and Corporate Use License (Unlimited User) along with free report customization equivalent to 0 analyst working days, 3 analysts working days, and 5 analysts working days respectively. |

Frequently Asked Questions

How big is the global smart cooking technology market?

▾ The global smart cooking technology market size is estimated to have a value of USD 14.9 billion in 2025 and is expected to reach USD 56.6 billion by the end of 2034.

What is the size of the US smart cooking technology market?

▾ The US smart cooking technology market is projected to be valued at USD 4.8 billion in 2025. It is expected to witness subsequent growth in the upcoming period as it holds USD 16.9 billion in 2034 at a CAGR of 15.0%.

Which region accounted for the largest global smart cooking technology market?

▾ North America is expected to have the largest market share in the global smart cooking technology market, with a share of about 38.2% in 2025.

Who are the key players in the global smart cooking technology market?

▾ Some of the major key players in the global smart cooking technology market are Samsung Electronics, LG Electronics, Whirlpool Corporation, Panasonic Corporation, Electrolux AB, Haier Smart Home, Breville Group, GE Appliances, Bosch (BSH Hausgeräte GmbH), Miele & Cie. KG, Xiaomi Corporation, Tovala, June Life Inc., and Other Key Players.

What is the growth rate of the global smart cooking technology market?

▾ The market is growing at a CAGR of 16.0 percent over the forecasted period.