Smart Greenhouse is a breakthrough in farming technology that creates a microclimate for consistent plant growth with the help of sensor technology. It optimizes plant growth by adjusting the growing conditions automatically.

Therefore, even slight variations in these conditions help in generating automated actions that evaluate change and take corrective action, and also help in maintaining ideal conditions for plant growth.

Smart Greenhouse technology represents a major advancement in

Controlled Environment Agriculture, allowing for consistent monitoring and adjustment of internal conditions. With the integration of Precision Farming techniques and Crop Monitoring tools, growers can better manage inputs like light, nutrients, and temperature for optimal yield. The system’s embedded Sensor networks also facilitate real-time data analytics, creating a more resilient and sustainable farming ecosystem.

The global smart greenhouse market is experiencing rapid expansion due to the increasing demand for sustainable farming solutions. Utilizing modern technologies like IoT, AI, and climate control systems to maximize crop yield while minimizing resource usage - smart greenhouses help farmers address climate change impacts such as water scarcity and food insecurity while improving production yields and resource use efficiency.

Recent trends reveal an increasing adoption of automation and data analytics in greenhouse management. This growing integration of automation has been further supported by

Agricultural Robotics and Farm Management Software, which streamlines labor-intensive processes in Commercial Greenhouse operations. The combination of Smart Lighting systems and IoT Semiconductor components enhances greenhouse connectivity and responsiveness, helping operators maintain efficiency while reducing operational costs.

Through sensors and monitoring systems, farmers are now able to monitor soil conditions, temperatures, humidity levels and plant health in real time - improving productivity while providing precise adjustments that allow for higher efficiency in growing conditions.

Organic and locally-grown produce has also increased demand for smart greenhouses. Smart Greenhouses are increasingly being used alongside

Indoor Farming and Hydroponics solutions, especially in urban regions where space is limited.

The integration of Aquaponics and Hydroponics Systems and Equipment allows growers to cultivate diverse crops with efficient nutrient and water usage. This approach aligns with the rising global focus on Green Technology & Sustainability, improving productivity while reducing waste.

Consumers' desire for healthy, pesticide-free foods that support sustainable farming operations has prompted agricultural businesses to adopt smart farming technologies, creating opportunities for them to implement advanced greenhouse solutions into urban and commercial farming operations.

Government initiatives and private investments are driving the growth of the smart greenhouse market. Many countries are adopting policies to support agricultural innovation and sustainability, leading to groundbreaking technologies being created, as well as major players investing in smart greenhouse solutions to ensure continued market expansion and innovation in future years.

As per Statista, despite a surge in climate pledges, global greenhouse gas (GHG) emissions, including carbon dioxide and methane, continue to rise, reaching a record high of 53 billion metric tons of CO₂ equivalent in 2023. CO₂ emissions from fossil fuels also hit unprecedented levels, and atmospheric CO₂ concentrations are now over 50% higher than pre-industrial levels.

While progress has been made in combating climate change, more aggressive actions are needed. With current policies and measures in place by December 2023, global temperatures are expected to increase by 2.7°C by 2100, significantly surpassing the targets set by the Paris Agreement.

The US Smart Greenhouse Market

The US Smart Greenhouse Market is projected to reach USD 1.0 billion in 2024 at a compound annual growth rate of 9.8% over its forecast period.

The Greenhouse market in the US provides growth opportunities through development in precision agriculture, driven by the demand for sustainable and efficient food production. Innovations in AI, IoT, and renewable energy integration improve Greenhouse operations. In addition, increasing consumer preference for locally sourced, year-round produce and strong government assistance for sustainable farming practices further fuel market expansion.

Moreover, a key growth driver in the market is the rising demand for sustainable, high-efficiency farming technologies, helped by advancements in AI and IoT. However, a major restraint is the high initial investment required for Smart Greenhouse setup, which can be a barrier for smaller farms and limit broad adoption.

Key Takeaways

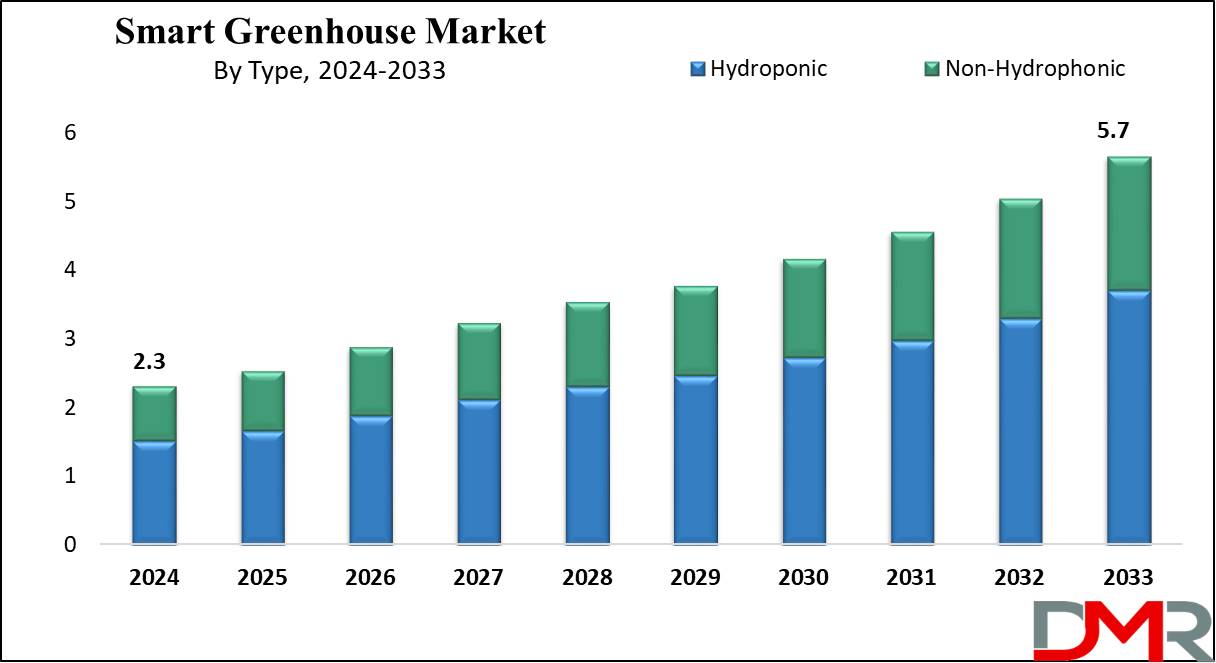

- Market Growth: The Smart Greenhouse Market size is expected to grow by 3.2 billion, at a CAGR of 10.4% during the forecasted period of 2025 to 2033.

- By Type: The Hydroponics segment is expected to lead in 2024 with a major & is anticipated to dominate throughout the forecasted period.

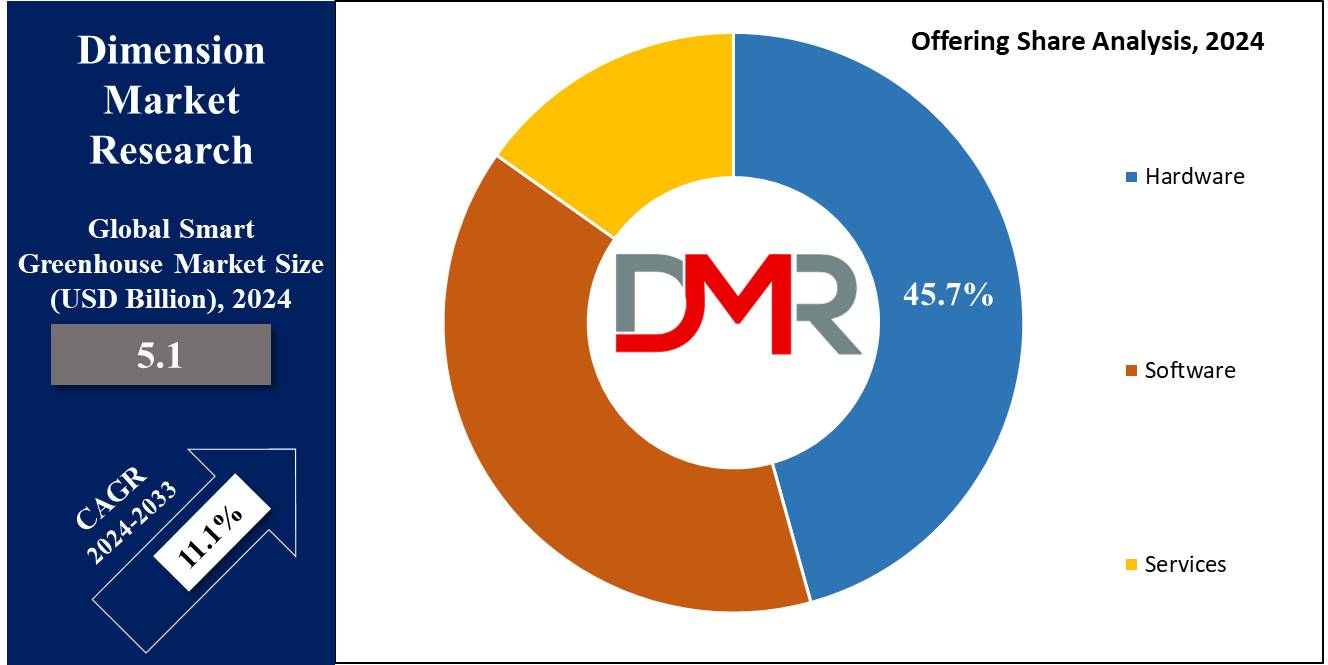

- By Offering: The hardware segment is expected to lead the Smart Greenhouse market in 2024.

- By End User: The commercial growers segment is expected to get the largest revenue share in 2024 in the Smart Greenhouse market.

- Regional Insight: North America is expected to hold a 46.4% share of revenue in the Global Smart Greenhouse Market in 2024.

- Use Cases: Some of the use cases of Smart Greenhouse include precision irrigation, energy efficiency, and more.

Use Cases

- Automated Climate Control: Monitors and adjusts temperature, humidity, and CO2 levels to optimize plant growth, minimizing manual intervention and ensuring constant crop quality.

- Precision Irrigation: Uses soil moisture sensors & weather data to automate and optimize watering schedules, store water, and prevent over-irrigation.

- Energy Efficiency: Integrates renewable energy sources and smart lighting systems to minimize energy consumption, improving sustainability.

- Remote Monitoring and Management: Enables farmers to monitor and control Greenhouse conditions from anywhere through mobile apps or cloud platforms, improving flexibility and real-time decision-making.

Market Dynamic

Driving Factors

Rising Demand for Sustainable Agriculture

The adoption of Smart Greenhouses also supports

Agriculture Biotechnology advancements, incorporating Biostimulant and Agricultural Inoculants applications to enhance plant resilience and soil health. These technologies work alongside Water and Wastewater Treatment Equipment to optimize irrigation and nutrient cycles, contributing to sustainable and eco-efficient crop management systems.

Technological Advancements

The convergence of Edge Computing and Smart Homes Systems is revolutionizing Smart Greenhouse management by enabling faster data processing at the device level. The combination of Industrial Automation and AI in Food Processing helps optimize climate control and lighting in

Greenhouse Horticulture, while Energy Storage technologies ensure uninterrupted operations in remote or off-grid agricultural environments.

Restraints

High Initial Investment

The higher costs of setting up Smart Greenhouse systems, like advanced sensors, automation equipment, and renewable energy sources, can be a barrier for small and medium-sized farmers.

Complexity and Technical Challenges

The integration of many technologies and the need for technical expertise in managing & maintaining Smart Greenhouse systems can impact the adoption, mainly in regions with limited access to technical support and infrastructure.

Opportunities

Expansion into Emerging Markets

As awareness of sustainable farming practices grows, there is a major opportunity to launch Smart Greenhouse solutions in developing markets, where agriculture is a key economic sector, and modern farming techniques are in demand.

Integration with Vertical Farming

The combination of Smart Greenhouse technology with vertical farming can enhance space usage and crop production, mainly in urban areas, meeting the growing demand for locally sourced, fresh produce in densely populated cities.

Trends

Adoption of AI and Machine Learning

Smart Greenhouses are largely incorporating AI and

machine learning algorithms to predict crop diseases, optimize resource use, and automate decision-making processes, improving productivity and lowering waste.

Use of Renewable Energy Source

There is a major trend of integrating renewable energy sources, like solar panels and wind turbines, into Smart Greenhouse operations to reduce carbon footprints and improve energy efficiency, aligning with global sustainability goals.

Research Scope and Analysis

By Type

During the forecast period, the hydroponics segment is expected to capture a majority of the market share in the Smart Greenhouse industry, as the rising popularity of Hydroponic Smart Greenhouses is mostly due to their ability to produce nutrient-rich crops while using less space, a key factor driving growth in this segment.

However, the non-hydroponics segment is anticipated to experience the fastest growth during this period, owing to the environmentally friendly nature of non-hydroponic systems and the higher adoption of these Greenhouses by major industry players.

The combination of sustainability & higher interest from key stakeholders is driving the expansion of the Smart Greenhouse market within the non-hydroponics segment, making it a quickly emerging area of growth. As both hydroponic and non-hydroponic systems constantly evolve, their contributions are expected to highly influence the overall market dynamics.

By Offering

Based on the offering, the Smart Greenhouse market is divided into hardware, software, and services. In 2024, the hardware segment of the Smart Greenhouse market is expected to take the lead and maintain its dominance throughout the forecast period, which is due to the higher adoption of advanced technologies like sensors, actuators, and control systems, which are vital for creating intelligent, automated Greenhouse environments.

These hardware components allow real-time monitoring and management of key factors like temperature, humidity, and lighting, vital for optimizing plant growth. As the demand for precision farming and sustainable agriculture continues to grow, the need for reliable &efficient hardware solutions to assist these technologies is also expected to grow, as the growth in demand for advanced hardware is set to significantly boost the Smart Greenhouse hardware market, as more agricultural operations look to implement advanced systems that enhance productivity and sustainability.

By Component

In particular, HVAC Systems play a critical role in

Climate Risk Management, ensuring that temperature and humidity remain stable throughout the growing cycle. The inclusion of Agricultural ventilation fans and Water Testing Equipment also strengthens environmental control, safeguarding crops against extreme weather variability. This synergy enables growers to maintain consistency in production while conserving energy and water resources.

The ability of HVAC systems to improve the efficiency and effectiveness of Smart Greenhouse operations highlights their significant market position. As the demand for consistent, high-quality agricultural output constantly rises, the importance of HVAC systems in optimizing growing environments makes them a key driver of market growth, securing their leadership in this segment.

By End User

The Smart Greenhouse market is divided into Commercial Growers, Research & Educational Institutes, Retail Gardens, and Others in terms of end users and is expected to be led by the commercial growers segment during the forecast period.

Commercial growers are largely adopting smart greenhouse technologies to boost productivity, improve crop quality, and ensure consistent year-round production, which is important to address the increasing global demand for food. These advanced technologies allow for better control over environmental factors like humidity, temperature, and lighting, causing more efficient use of resources &reduced operational costs.

In addition, because of their scale & potential for major returns on investment, commercial growers are in a stronger position to absorb the relatively high initial costs associated with setting up smart greenhouses, which gives them a competitive edge in enhancing agricultural outcomes and sustainability, further driving the adoption of smart greenhouse technologies within this segment.

The Smart Greenhouse Market Report is segmented based on the following:

By Type

- Hydroponic

- Non-Hydroponic

By Offering

- Hardware

- Software

- Services

By Component

- HVAC Systems

- LED Grow Lights

- Irrigation Systems

- Valves & Pumps

- Sensor & Control Systems

- Others

By End User

- Commercial Growers

- Research & Educational Institutes

- Retail Gardens

- Others

Regional Analysis

North America is set to lead the Global Smart Greenhouse market, capturing

over 46% of the market share in 2024, largely due to the broad adoption of advanced agricultural technologies across the region. North America's strong technological infrastructure, along with the challenges of climate change and the growing demand for year-round, locally sourced produce, has significantly fueled the market for Smart Greenhouses.

Moreover, the region's high focus on resource-efficient solutions and government support for sustainable farming practices also play major roles in driving this market. As a result, North America is rapidly adopting smart greenhouse technologies to improve agricultural productivity and crop quality, with a strong emphasis on precision agriculture.

Further, the Asia Pacific region is anticipated to take the lead in the smart greenhouse market during the forecast period and is growing significantly in existing times. The region is experiencing a high rate of technological adoption, supported by a large presence of innovative technology companies that are constantly advancing agricultural practices. In addition, the rapid population growth and urbanization in the Asia Pacific are driving the need for efficient and sustainable food production systems.

Smart Greenhouses address these needs by allowing high-density, year-round farming, mainly in urban areas where space is limited. Government support, through subsidies and incentives, is also a key factor, as many countries in the region constantly promote the adoption of smart farming technologies to ensure food security and sustainability.

By Region

North America

Europe

- Germany

- The U.K.

- France

- Italy

- Russia

- Spain

- Benelux

- Nordic

- Rest of Europe

Asia-Pacific

- China

- Japan

- South Korea

- India

- ANZ

- ASEAN

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Argentina

- Colombia

- Rest of Latin America

Middle East & Africa

- Saudi Arabia

- UAE

- South Africa

- Israel

- Egypt

- Rest of MEA

Competitive Landscape

The Smart Greenhouse market is highly competitive, with various players focusing on technological innovation to gain an edge. Companies are investing in advanced automation, AI-driven monitoring systems, and IoT integration to improve Greenhouse efficiency and crop yield. Also, strategic partnerships and collaborations are common, focused on expanding product offerings and market reach.

Moreover, the competition is also driven by a push towards sustainability, with many firms developing eco-friendly solutions. As the market includes, companies are highly differentiating themselves through advanced technology and customized solutions to meet different agricultural needs.

Some of the prominent players in the Global Smart Greenhouse are:

- Cultivar

- Kubo Greenhouse

- Prospiant

- Certhon Group

- Agra Tech

- Heliospectra AB

- Netafim Irrigation

- Argus Control System

- Sensaphone

- Lumigrow

- Other Key Players

Recent Developments

- In August 2024, Helle-Tech Oy and Bloemteknik unveiled a joint venture to launch modular adjustable LED fixtures designed mainly for high-wire and leafy green growers. Leveraging patent-pending technology, the Balance Platform allows growers to better PPFD on the vertical face of vine-growing crops by about 36 percent, without increasing energy consumption. By combining Helle-Tech’s expertise and experience with Bloem’s innovative engineering, the partnership focuses on redefining industry standards, as it highlights a commitment to sustainability and technological advancement, providing growers a competitive edge in the changing landscape of controlled environment agriculture.

- In August 2024, Skytree launched the Stratus Hub following its recently announced decentralized Direct Air Capture (DAC) product Stratus. The Stratus Hub will act as a plug-and-play configuration for a variety of carbon dioxide removal & storage or usage projects. These projects are for markets like cement, fuels & chemicals, food & beverage, and Greenhouses along with sequestration in empty oil/gas fields or through mineralization in geological formations.

- In August 2024, The U.S. Department of Agriculture (USDA) announced that it plans to build the Greenhouse Gas Technical Assistance Provider and Third-Party Verifier Program Advisory Council and is looking for nominations for Council membership. USDA announced in a Federal Register, that the new Council will be authorized by the Growing Climate Solutions Act (GCSA).

- In May 2024, KUBO introduced the world’s first CO2-negative Greenhouse producing fresh vegetables with minimal fossil energy and lower costs. Developed by, the Greenhouse launched at the GreenTech RAI event in Amsterdam, where the innovation aligns with the Greenhouse horticulture sector’s responsibility for food security and CO2 reduction. Also, KUBO’s new Greenhouse technology highly reduces energy, water, and pesticide use, eliminating the need for extra CO2.

- In September 2023, Lumiforte and Rui Xue Global announced that the companies will be signing a memorandum of understanding (MOU) to launch a joint venture (JV) headquartered in Beijing. The new company will plan to provide local production, storage, transportation, and delivery services to its customers, initially targeting wholesalers & distributors within the greater China area, also it will be a leading coating platform for Greenhouses serving clients in China and at a later stage other Asian countries, providing affordable, competitive, and sustainable products to multiple end markets.

Report Details

|

Report Characteristics

|

| Market Size (2024) |

USD 2.3 Bn |

| Forecast Value (2033) |

USD 5.7 Bn |

| CAGR (2024-2033) |

10.4% |

| Historical Data |

2018 – 2023 |

| The US Market Size (2024) |

USD 1.0 Bn |

| Forecast Data |

2025 – 2033 |

| Base Year |

2023 |

| Estimate Year |

2024 |

| Report Coverage |

Market Revenue Estimation, Market Dynamics, Competitive Landscape, Growth Factors and etc. |

| Segments Covered |

By Type (Hydroponic and Non-Hydroponic), By Offering (Hardware, Software, and Services), By Component (HVAC Systems, LED Grow Lights, Irrigation Systems, Valves & Pumps, Sensor & Control Systems, and Others), By End User (Commercial Growers, Research & Educational Institutes, Retail Gardens, and Others) |

| Regional Coverage |

North America – The US and Canada; Europe – Germany, The UK, France, Russia, Spain, Italy, Benelux, Nordic, & Rest of Europe; Asia- Pacific– China, Japan, South Korea, India, ANZ, ASEAN, Rest of APAC; Latin America – Brazil, Mexico, Argentina, Colombia, Rest of Latin America; Middle East & Africa – Saudi Arabia, UAE, South Africa, Turkey, Egypt, Israel, & Rest of MEA |

| Prominent Players |

Cultivar, Kubo Greenhouse, Prospiant, Certhon Group, Agra Tech, Heliospectra AB, Netafim Irrigation, Argus Control System, Sensaphone, Lumigrow, and Other Key Players |

| Purchase Options |

HVMN Inc., Thync Global Inc., Apple Inc., Fitbit Inc., TrackmyStack, OsteoStrong, The ODIN, Thriveport LLC, Muse, Moodmetric, and Other Key Players |

Frequently Asked Questions

The Global Smart Greenhouse Market size is expected to reach a value of USD 2.3 billion in 2024 and is expected to reach USD 5.7 billion by the end of 2033.

North America is expected to have the largest market share in the Global Smart Greenhouse Market with a share of about 46.4% in 2024.

The Smart Greenhouse Market in the US is expected to reach USD 1.0 billion in 2024.

Some of the major key players in the Global Smart Greenhouse Market are Cultivar, Kubo Greenhouse, Prospiant, Certhon Group, and others.

The market is growing at a CAGR of 10.4 percent over the forecasted period.