Market Overview

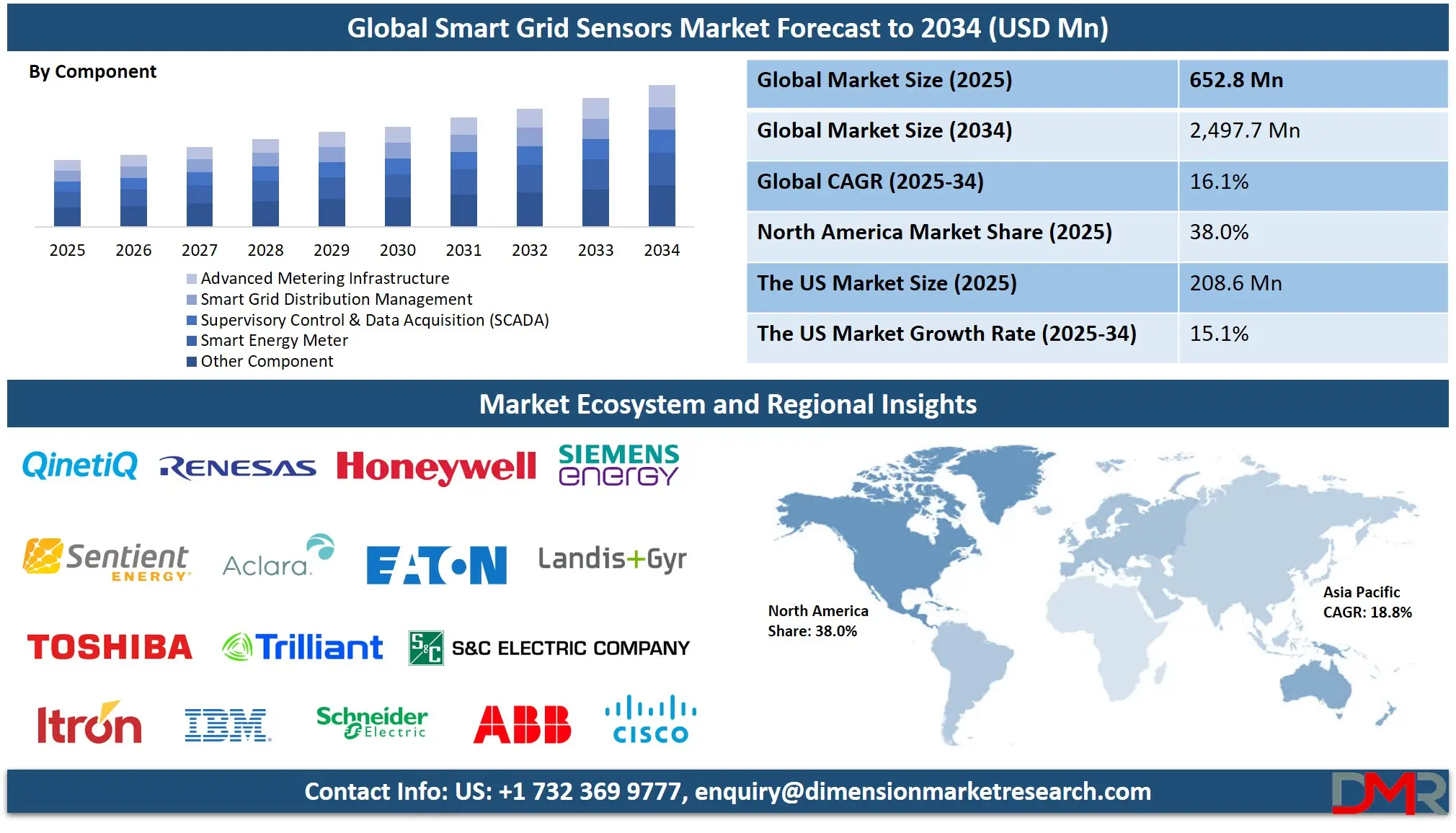

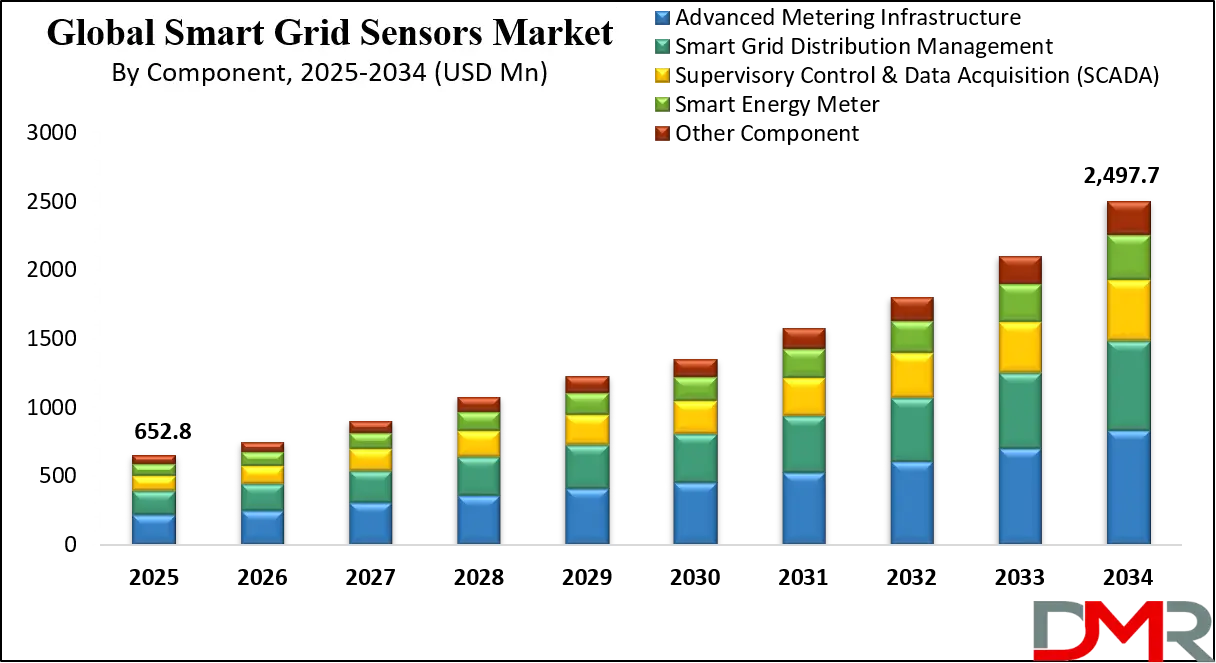

The Global Smart Grid Sensors Market is expected to reach USD 652.8 million by 2025 and expand at a compound annual growth rate (CAGR) of 16.1%, reaching an estimated USD 2,497.7 million by 2034.

The global smart grid sensors market is undergoing a significant transformation, driven by the increasing demand for efficient energy management and the integration of renewable energy sources. Smart grid sensors, which encompass voltage and temperature sensors, outage detection systems, and other monitoring tools, play a crucial role in enhancing the reliability and efficiency of power grids. These sensors enable real-time monitoring and control, facilitating the optimization of energy distribution and consumption. The market is experiencing robust growth, with advancements in sensor technologies and communication networks contributing to the expansion of smart grid infrastructures worldwide.

Key trends influencing the market include the adoption of

Internet of Things (IoT) technologies, the development of advanced metering infrastructure (AMI), and the increasing emphasis on grid modernization. IoT integration allows for seamless communication between devices, enabling predictive maintenance and reducing operational costs. AMI systems provide utilities with detailed insights into energy usage patterns, facilitating demand response strategies and improving customer engagement. Grid modernization initiatives aim to replace aging infrastructure with smart technologies, enhancing grid resilience and accommodating the growing demand for electricity.

However, the market faces several challenges, including high initial investment costs, cybersecurity concerns, and regulatory hurdles. The deployment of smart grid sensors requires substantial capital investment, which can be a barrier for utilities, especially in developing regions. Cybersecurity threats pose risks to the integrity and reliability of smart grids, necessitating robust security measures.

Additionally, varying regulatory frameworks across regions can complicate the implementation of standardized solutions. Despite these challenges, the market presents significant growth opportunities. The increasing focus on sustainable energy practices and the need for efficient grid management create a favorable environment for the adoption of smart grid sensors.

Governments and utilities are investing in smart grid projects to enhance energy security and reduce carbon emissions. As technology advances and costs decrease, the adoption of smart grid sensors is expected to accelerate, leading to a more resilient and efficient global energy infrastructure.

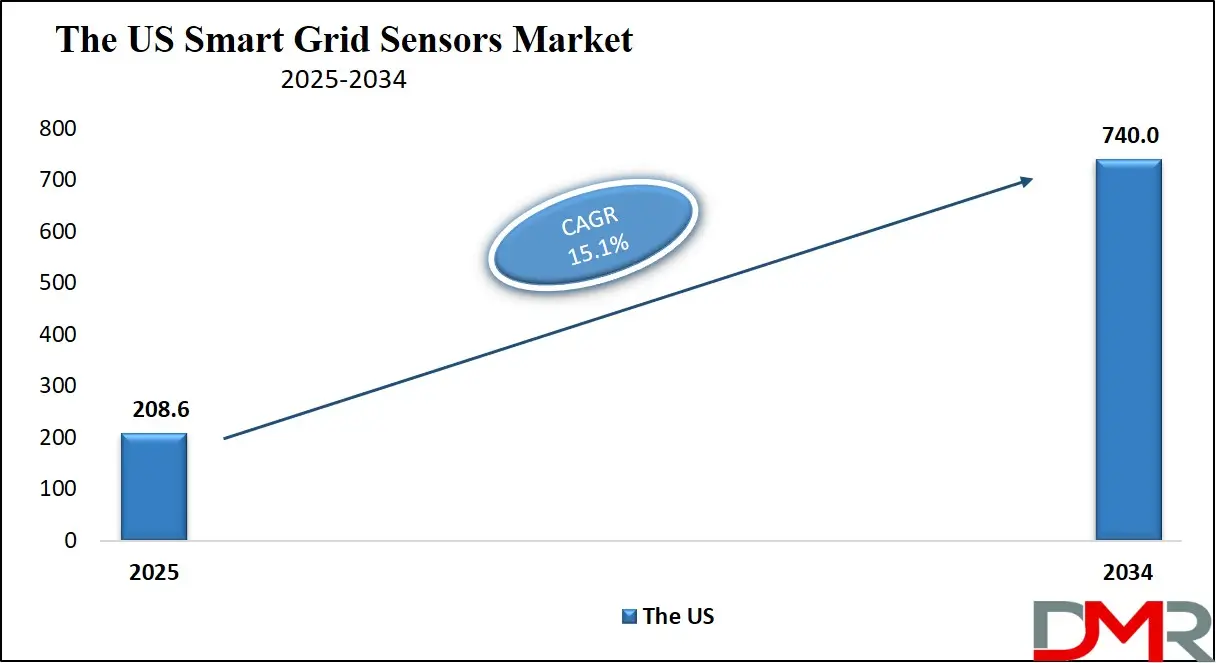

The US Smart Grid Sensors Market

The US Smart Grid Sensors Market is projected to reach USD 208.6 million in 2025 at a compound annual growth rate of 15.1% over its forecast period.

The United States is at the forefront of smart grid sensor adoption, driven by federal and state initiatives aimed at modernizing the nation's aging power infrastructure. The U.S. Department of Energy (DOE) has been instrumental in promoting smart grid technologies through funding programs and research initiatives. For instance, the DOE's Smart Grid Investment Grant program has allocated substantial funds to support the deployment of advanced metering infrastructure and sensor systems across various states. These efforts are part of a broader strategy to enhance grid reliability, integrate renewable energy sources, and improve energy efficiency.

Demographically, the U.S. benefits from a diverse energy landscape, with a mix of urban and rural areas presenting unique challenges and opportunities for smart grid implementation. Urban centers, characterized by dense populations and high energy consumption, are ideal candidates for deploying advanced sensor networks to manage demand and optimize energy distribution. Conversely, rural areas can leverage smart grid technologies to improve service reliability and reduce operational costs. The varying energy needs across these regions necessitate tailored solutions, further driving the demand for smart grid sensors.

In addition to federal support, state-level policies and incentives play a crucial role in accelerating the adoption of smart grid technologies. Many states have established renewable energy standards and energy efficiency goals that encourage utilities to invest in smart grid infrastructure. These policies not only promote environmental sustainability but also stimulate economic growth by fostering innovation and creating jobs in the clean energy sector.

The convergence of supportive government policies, technological advancements, and demographic factors positions the U.S. as a leader in the global smart grid sensors market. As utilities continue to modernize their infrastructure and integrate renewable energy sources, the demand for smart grid sensors is expected to grow, driving further innovation and investment in the sector.

The Europe Smart Grid Sensors Market

The Europe Smart Grid Sensors Market is estimated to be valued at USD 97.9 million in 2025 and is further anticipated to reach USD 344.5 million by 2034 at a CAGR of 15.0%.

Europe is actively advancing the deployment of smart grid sensors as part of its commitment to achieving a sustainable and resilient energy system. The European Union (EU) has set ambitious targets for reducing greenhouse gas emissions and increasing the share of renewable energy in the energy mix. To meet these objectives, the EU has been investing in smart grid technologies, including the widespread installation of smart meters and sensors. By 2024, it is projected that nearly 225 million smart electricity meters and 51 million smart gas meters will be installed across the EU, representing a significant portion of the energy infrastructure.

Demographically, Europe benefits from a high level of urbanization and a strong emphasis on environmental sustainability. Urban areas, with their dense populations and complex energy demands, are prime candidates for the implementation of smart grid sensors. These sensors enable utilities to monitor and manage energy consumption in real-time, facilitating demand-side management and enhancing grid stability. Moreover, the EU's regulatory framework encourages the adoption of smart grid technologies by providing incentives and setting standards that promote interoperability and data privacy.

The integration of renewable energy sources, such as wind and solar, into the European grid necessitates advanced monitoring and control systems. Smart grid sensors play a pivotal role in balancing supply and demand, ensuring the reliability of the grid despite the intermittent nature of renewable energy. Additionally, the aging energy infrastructure in many parts of Europe underscores the need for modernization through the deployment of smart grid technologies.

In conclusion, Europe's strategic investments, supportive policies, and demographic advantages create a conducive environment for the growth of the smart grid sensors market. As the region continues to prioritize sustainability and energy efficiency, the demand for smart grid sensors is expected to increase, driving innovation and contributing to the realization of a smart, green energy future.

The Japan Smart Grid Sensors Market

The Japan Smart Grid Sensors Market is projected to be valued at USD 39.2 million in 2025. It is further expected to witness subsequent growth in the upcoming period, holding USD 139.7 million in 2034 at a CAGR of 16.0%.

Japan is making significant strides in the adoption of smart grid technologies, driven by the need to enhance energy efficiency and integrate renewable energy sources into the national grid. The Japanese government has been actively promoting smart grid initiatives through various policies and programs aimed at modernizing the country's energy infrastructure. These efforts are part of a broader strategy to achieve energy security, reduce carbon emissions, and foster innovation in the energy sector.

Demographically, Japan's aging population and high urbanization rates present both challenges and opportunities for smart grid implementation. Urban areas, with their high energy consumption and complex infrastructure, benefit from the deployment of smart grid sensors that enable real-time monitoring and efficient energy management. Additionally, the integration of renewable energy sources, particularly solar and wind, into the grid requires advanced sensor technologies to ensure stability and reliability.

The Japanese market is also characterized by a strong emphasis on technological innovation and research and development. Collaborations between government agencies, utilities, and private enterprises have led to the development and deployment of cutting-edge smart grid solutions. These innovations not only enhance the performance of the energy grid but also contribute to the country's leadership in smart grid technologies on the global stage.

In summary, Japan's proactive policies, demographic factors, and commitment to technological advancement position the country as a significant player in the smart grid sensors market. As the nation continues to modernize its energy infrastructure and integrate renewable energy sources, the demand for smart grid sensors is expected to grow, driving further innovation and contributing to a sustainable energy future.

Global Smart Grid Sensors Market: Key Takeaways

- Global Market Size Insights: The Global Smart Grid Sensors Market size is estimated to have a value of USD 652.8 million in 2025 and is expected to reach USD 2,497.7 million by the end of 2034.

- The Global Market Growth Rate: The market is growing at a CAGR of 16.1 percent over the forecasted period of 2025.

- The US Market Size Insights: The US Smart Grid Sensors Market is projected to be valued at USD 208.6 million in 2025. It is expected to witness subsequent growth in the upcoming period as it holds USD 740.0 million in 2034 at a CAGR of 15.1%.

- Regional Insights: North America is expected to have the largest market share in the Global Smart Grid Sensors Market with a share of about 38.0% in 2025.

- Key Players: Some of the major key players in the Global Smart Grid Sensors Market are General Electric Company (GE Grid Solutions), ABB Limited, Siemens Energy, Schneider Electric SE, Itron, Incorporated, and many others.

Global Smart Grid Sensors Market: Use Cases

- Real-Time Grid Monitoring: Smart grid sensors continuously collect voltage, current, and temperature data, enabling utilities to monitor the health of transmission and distribution networks. This allows for rapid detection of anomalies, minimizing outages and improving operational reliability across the grid.

- Predictive Maintenance: Sensors detect early signs of equipment degradation or faults, allowing utilities to perform maintenance proactively. By predicting transformer failures, line overloads, or substation issues, utilities reduce downtime, optimize asset life, and lower operational costs.

- Demand Response Management: Advanced metering sensors track consumption patterns in residential, commercial, and industrial settings. Utilities leverage this data to implement demand response programs, balancing supply and demand, reducing peak loads, and enhancing energy efficiency.

- Renewable Energy Integration: Smart sensors monitor fluctuations from solar panels, wind turbines, and other renewable sources. By providing real-time data on generation and grid conditions, they facilitate stable integration of renewables, optimizing energy distribution and minimizing power fluctuations.

- Outage Detection and Restoration: Outage detection sensors identify faults in real-time across distribution networks. Utilities can automatically dispatch repair crews, isolate affected sections, and restore service faster, improving reliability indices and reducing customer downtime.

Global Smart Grid Sensors Market: Stats & Facts

U.S. Department of Energy (DOE)

- A DOE report found that utilities participating in the SGIG program reported a 20-30% reduction in outage duration due to improved monitoring and fault isolation from smart grid devices.

- The DOE's Grid Modernization Initiative states that advanced sensors and controls can improve transmission capacity by up to 40% without building new lines.

- The Office of Electricity estimates that a fully modernized grid could reduce the economic costs of power outages by USD 49 billion per year by 2030, a goal heavily reliant on sensor data.

- The Pacific Northwest National Laboratory (PNNL), funded by DOE, developed open-source standards for grid sensors that have been adopted by over 100 utilities and vendors to ensure interoperability.

U.S. Energy Information Administration (EIA)

- As of 2022, over 103 million advanced metering infrastructure (AMI) meters were installed in the United States, covering approximately 69% of all electricity customers.

- Investor-Owned Utilities (IOUs) have the highest penetration of smart meters at 78% of their customers, compared to 32% for cooperatives and 22% for municipal utilities.

- The EIA's Annual Electric Power Industry Report tracks the deployment of over 2,500 Phasor Measurement Units (PMUs) on the U.S. transmission grid as of 2021.

National Institute of Standards and Technology (NIST)

- NIST's Framework and Roadmap for Smart Grid Interoperability Standards identifies over 75 standards that are critical for the operation and communication of smart grid sensors and devices.

- NIST's cybersecurity guidelines for the smart grid (NISTIR 7628) provide a framework for securing the vast network of sensors and data, which are estimated to generate thousands of data points per second for a medium-sized utility.

Federal Energy Regulatory Commission (FERC)

- FERC Order 1000 promotes the deployment of advanced transmission technologies, including sensors, by requiring transmission planners to evaluate them as non-wire alternatives to new construction.

- A FERC assessment found that the use of Dynamic Line Rating (DLR) sensors, which monitor real-time transmission capacity, can increase capacity by up to 30% on existing lines.

International Energy Agency (IEA)

- Global investment in digital electricity infrastructure, including smart meters and grid sensors, reached USD 56 billion in 2022.

- The IEA estimates that the global installed base of smart meters will exceed 1.5 billion units by 2024.

- According to the IEA, the use of smart grid technologies like advanced sensors could help integrate an additional 175 GW of variable renewable energy (wind and solar) into the grid by 2030.

European Commission

- The EU's Third Energy Package set a target for member states to equip at least 80% of electricity consumers with smart meters by 2024, where a positive economic assessment is confirmed.

- As of the end of 2022, over 60% of European consumers had a smart meter installed, with several member states like Italy, Finland, and Sweden exceeding 95% penetration.

- The European Commission's Joint Research Centre (JRC) has developed reference designs for low-cost grid sensors to support the deployment of over 200 million smart meters in Europe.

U.S. Environmental Protection Agency (EPA)

- The EPA's Green Power Partnership highlights that smart grid sensors are a key enabling technology for reducing greenhouse gas emissions by over 2 billion metric tons by 2030 through improved grid efficiency and renewable integration.

U.S. Cybersecurity and Infrastructure Security Agency (CISA)

- CISA's assessments of the critical infrastructure sector note that a typical utility's industrial control system (ICS) network may manage data from tens of thousands of field sensors, creating a significant attack surface that requires protection.

National Renewable Energy Laboratory (NREL)

- NREL research shows that distribution grid sensors can enable the hosting of over 300% more distributed solar energy on existing circuits by providing visibility for advanced management.

- NREL's analysis indicates that using sensor data for predictive maintenance can reduce distribution grid maintenance costs by approximately 25%.

Oak Ridge National Laboratory (ORNL)

- ORNL researchers have developed self-powered line sensors that can operate solely on the magnetic field from the transmission line, eliminating the need for batteries.

- ORNL's work on wide-area monitoring systems has demonstrated the ability to use PMU data to predict and prevent grid instability events in less than 100 milliseconds.

Lawrence Berkeley National Laboratory (LBNL)

- An LBNL study of SGIG projects found that the automatic fault detection and isolation capabilities from sensors reduced the number of customers affected by a fault by over 40% on average.

- LBNL research estimates that voltage optimization, enabled by sensor data from the grid edge, can achieve energy savings of 2-4% without affecting consumer equipment.

U.S. Federal Highway Administration (FHWA)

- The FHWA promotes the use of connected vehicle technology where streetlight and traffic signal sensors, which are often integrated with the smart grid for energy management, can communicate with vehicles to improve safety and traffic flow.

National Science Foundation (NSF)

- The NSF has funded research into next-generation "grid eye" sensors that use artificial intelligence to analyze data locally, reducing the data transmission burden by over 90% while still providing critical insights.

European Environment Agency (EEA)

- The EEA reports that smart metering is a cornerstone of the EU's energy efficiency goals, with the potential to help households reduce their electricity consumption by up to 3% through better information.

U.S. Geological Survey (USGS)

- The USGS collaborates with utilities to use sensor data from the grid to help detect and locate the epicenter of earthquakes more rapidly by tracking widespread power fluctuations.

Global Smart Grid Sensors Market: Market Dynamics

Driving Factors in the Global Smart Grid Sensors Market

Rising Demand for Energy Efficiency and Grid Modernization

The global push for energy efficiency and grid modernization is a major driver of the smart grid sensors market. Aging electrical infrastructure in developed and developing countries is being upgraded to integrate advanced sensor technologies that improve monitoring and control. Governments worldwide are investing heavily in smart grid programs to reduce transmission losses, prevent outages, and enhance the reliability of electricity supply.

Smart sensors provide real-time data on voltage, current, and temperature, enabling operators to optimize energy distribution, manage peak loads, and reduce operational costs. Additionally, the growing integration of distributed energy resources, such as solar and wind, requires advanced sensing solutions to maintain grid stability.

Government Initiatives and Supportive Policies

Government programs and regulations promoting smart grids and energy efficiency serve as a key growth driver for the market. In the United States, the Department of Energy supports smart grid investment grants and AMI deployment programs, while in Europe, the EU encourages smart meter rollouts and renewable energy integration. Similarly, India’s National Smart Grid Mission facilitates R&D, pilot projects, and workforce training in smart grid technologies. These policies incentivize utilities to adopt advanced sensors for monitoring energy consumption, outage detection, and predictive maintenance. Subsidies, tax benefits, and regulatory mandates reduce the financial burden of deploying smart grid technologies.

Restraints in the Global Smart Grid Sensors Market

High Initial Capital Investment

One of the primary restraints hindering the widespread adoption of smart grid sensors is the high initial capital investment required. Deploying advanced sensors, communication networks, and AMI systems involves significant expenditure for utilities, including costs for installation, maintenance, and workforce training. This financial burden is particularly challenging for utilities in developing regions, where budget constraints may delay or limit smart grid modernization projects.

Additionally, the integration of sensors into existing legacy infrastructure often requires complex retrofitting, further increasing costs. While the long-term operational benefits and energy efficiency gains are substantial, the high upfront investment continues to be a critical barrier for widespread adoption, restraining market growth in price-sensitive regions.

Cybersecurity and Data Privacy Concerns

Cybersecurity threats and data privacy issues pose significant challenges to the adoption of smart grid sensors. As utilities collect vast amounts of real-time data from voltage, temperature, and outage detection sensors, there is an increased risk of cyber-attacks targeting critical infrastructure. Unauthorized access or manipulation of sensor data can disrupt electricity supply, compromise grid stability, and lead to financial losses.

Moreover, consumer concerns about data privacy may hinder the implementation of smart meters and home energy management systems. Utilities must invest in robust cybersecurity measures and compliance protocols to protect data integrity, which increases operational complexity and cost.

Opportunities in the Global Smart Grid Sensors Market

Integration with Renewable Energy Sources

The accelerating adoption of renewable energy sources such as solar, wind, and hydroelectric power presents significant opportunities for smart grid sensor providers. Integration of intermittent energy sources requires real-time monitoring to maintain grid stability and avoid power fluctuations. Advanced sensors, including voltage, temperature, and outage detection systems, facilitate accurate forecasting, load balancing, and automated control of distributed energy resources.

Utilities can leverage sensor data to optimize energy storage and ensure efficient energy distribution, reducing reliance on conventional fossil-fuel-based power generation. Additionally, governments promoting renewable energy adoption are investing in smart grid pilot programs, creating demand for sensor-based solutions.

Development of Smart Cities and Digital Infrastructure

The global trend toward smart city development presents significant growth potential for smart grid sensors. Urban centers are increasingly adopting intelligent energy management systems to monitor electricity usage, improve reliability, and support sustainable urbanization. Sensors embedded in distribution networks, AMI meters, and building management systems enable data-driven decision-making for energy efficiency and cost reduction.

Additionally, the convergence of IoT, artificial intelligence, and big data analytics allows city planners and utilities to implement predictive maintenance, fault detection, and automated grid operations. As governments invest in digital infrastructure and smart city projects to enhance livability and reduce carbon emissions, the demand for advanced sensing solutions within the power sector continues to rise, creating long-term market expansion opportunities.

Trends in the Global Smart Grid Sensors Market

Integration of IoT and Advanced Communication Technologies

The global smart grid sensors market is witnessing a significant trend in the integration of Internet of Things (IoT) and advanced communication technologies such as 5G and LPWAN (Low-Power Wide-Area Networks). These technologies enable seamless connectivity between grid components, allowing utilities to collect and analyze real-time data from voltage sensors, outage detection systems, and smart meters. IoT-enabled sensors facilitate predictive maintenance, reduce operational downtime, and enhance energy distribution efficiency.

Additionally, advanced communication protocols improve interoperability between devices, enabling better demand response management and automated control of distributed energy resources.

Adoption of Advanced Metering Infrastructure (AMI)

Another prominent trend is the rapid deployment of Advanced Metering Infrastructure (AMI), which combines smart meters, communication networks, and data management systems to provide detailed insights into electricity consumption patterns. AMI facilitates dynamic pricing, demand-side management, and energy optimization at the household and industrial levels. Utilities are leveraging AMI to improve operational efficiency, reduce non-technical losses, and enhance customer engagement by providing real-time feedback on energy usage.

AMI systems also enable remote monitoring and control, reducing the need for manual meter reading and ensuring accurate billing. As governments and utilities focus on modernizing aging grid infrastructure and promoting energy sustainability, AMI adoption has emerged as a critical trend, driving demand for advanced sensors and associated hardware and software solutions.

Global Smart Grid Sensors Market: Research Scope and Analysis

By Component Analysis

In the component segment, Advanced Metering Infrastructure (AMI) is clearly poised to dominate the global smart grid sensors market. AMI includes smart meters, communication networks, and data management platforms that collectively allow utilities to monitor electricity usage in real-time, detect outages, and optimize distribution. Unlike other components such as SCADA systems or standalone smart energy meters, AMI provides a comprehensive solution that integrates the entire data flow from customer premises to utility control centers.

technology enables utilities to implement dynamic pricing, load management, and predictive maintenance, reducing operational costs and minimizing energy losses. Regulatory mandates and energy efficiency programs in countries like the U.S., Germany, and India have accelerated the deployment of AMI, as governments encourage modernization of aging grid infrastructure.

, AMI provides consumers with actionable insights into energy usage, fostering engagement in demand response programs and enabling better management of peak loads. While SCADA and smart meters are essential for certain operational tasks, AMI’s holistic benefits, interoperability, and scalability make it the most widely adopted component. As utilities globally continue to modernize their grids and integrate renewable energy sources, AMI is expected to maintain dominance, supporting both operational efficiency and sustainability objectives across developed and emerging regions.

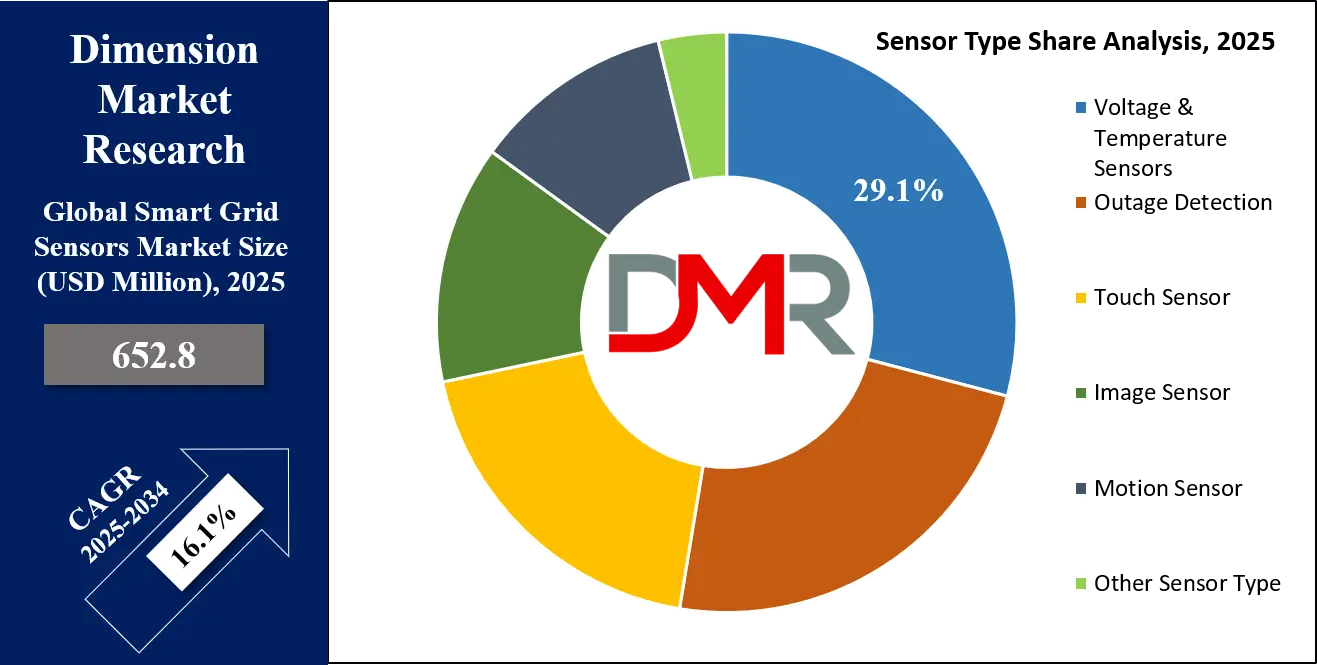

By Sensor Type Analysis

Within the sensor type segment, Voltage & Temperature Sensors are expected to dominate the market due to their critical role in ensuring grid reliability and preventing system failures. These sensors are installed across transmission and distribution networks, substations, and industrial facilities, continuously monitoring electrical parameters to detect anomalies and prevent equipment damage. Their ability to provide real-time data on voltage fluctuations, temperature rises, and other operational metrics allows utilities to implement predictive maintenance, reducing downtime and repair costs.

Although outage detection sensors, motion sensors, and image sensors are important, they often serve complementary roles, while voltage and temperature sensors form the backbone of grid monitoring. Advanced sensor technologies now offer high precision, wireless communication capabilities, and integration with IoT and AI platforms, enhancing operational efficiency and enabling automated decision-making.

Utilities rely on these sensors to maintain system stability, optimize energy distribution, and comply with regulatory safety standards. The increasing adoption of renewable energy sources, which introduces variability into the grid, further underscores the need for continuous voltage and temperature monitoring. With their essential function, reliability, and compatibility with modern grid solutions, voltage and temperature sensors dominate the sensor type segment globally.

By Solutions Analysis

In the solutions segment, Advanced Metering Infrastructure (AMI) is anticipated to lead over Smart Grid Distribution Management due to its comprehensive benefits for both utilities and end-users. AMI integrates smart meters, communication networks, and software platforms to provide detailed insights into electricity consumption patterns, enabling demand response, dynamic pricing, and optimized energy usage. Unlike Smart Grid Distribution Management, which primarily focuses on operational control and network optimization, AMI addresses multiple facets of the energy ecosystem, including consumer engagement and billing accuracy.

Regulatory mandates in the U.S., Europe, and Asia-Pacific have encouraged the widespread deployment of AMI, making it a standard solution in modern grids. Utilities can monitor system performance remotely, detect outages quickly, and plan maintenance effectively. Furthermore, AMI supports renewable energy integration by providing real-time data on supply and demand, assisting in balancing the grid.

Its scalability, interoperability, and ability to deliver actionable data to both utilities and consumers reinforce its market dominance. With energy efficiency initiatives gaining momentum worldwide and technology costs decreasing, AMI solutions are expected to continue leading the market, driving smarter, more reliable, and sustainable grid operations globally.

By Application Analysis

In the application segment, Industrial adoption is expected to dominate the smart grid sensors market due to the sector’s high energy consumption and critical reliance on an uninterrupted power supply. Industrial facilities, including manufacturing plants, chemical processing units, and large-scale production units, deploy voltage and temperature sensors, AMI, and outage detection systems to monitor energy usage, prevent downtime, and reduce operational costs. These applications demand high precision and reliability to ensure machinery and processes operate smoothly, making advanced sensing solutions indispensable.

Residential and commercial sectors also utilize smart grid sensors, but their energy demands and operational complexities are comparatively lower, resulting in slower adoption. The industrial sector benefits from predictive maintenance, load management, and real-time monitoring, which directly translate into improved efficiency and cost savings. Moreover, the integration of renewable energy and energy storage systems in industrial facilities requires advanced sensors for balancing supply and demand, enhancing sustainability.

Industrial energy management initiatives, coupled with government incentives for efficiency and emissions reduction, drive further investment in smart grid technologies. As industries globally continue to prioritize energy optimization and operational resilience, industrial applications are expected to maintain their dominance, supported by continuous advancements in sensor technology, IoT integration, and data analytics.

The Global Smart Grid Sensors Market Report is segmented on the basis of the following:

By Component

- Advanced Metering Infrastructure

- Smart Grid Distribution Management

- Supervisory Control & Data Acquisition (SCADA)

- Smart Energy Meter

- Other Component

By Sensor Type

- Voltage & Temperature Sensors

- Outage Detection

- Touch Sensor

- Image Sensor

- Motion Sensor

- Other Sensor Type

By Solutions

- Advanced Metering Infrastructure (AMI)

- Smart Grid Distribution Management

By Application

- Industrial

- Residential

- Commercial

- Other Application

Impact of Artificial Intelligence in the Global Smart Grid Sensors Market

- Predictive Maintenance: AI algorithms analyze real-time sensor data from voltage, temperature, and outage detection devices to predict equipment failures, allowing utilities to perform proactive maintenance, reduce downtime, and optimize operational efficiency across transmission and distribution networks globally.

- Demand Forecasting and Load Management: AI leverages historical and real-time energy consumption data from smart meters to forecast demand accurately, enabling utilities to balance load, prevent outages, and optimize grid operations while improving energy efficiency and minimizing operational costs.

- Renewable Energy Integration: AI processes variable data from solar panels, wind turbines, and other renewable sources, optimizing energy distribution and storage, ensuring grid stability, and facilitating seamless integration of renewables into conventional power networks.

- Anomaly and Fault Detection: AI-driven analytics detect irregularities in sensor readings, such as voltage spikes, temperature anomalies, or unexpected outages, allowing immediate corrective action, minimizing damage, and enhancing the reliability and resilience of smart grid infrastructure.

- Enhanced Consumer Energy Management: AI-enabled smart grid sensors provide consumers with personalized energy insights, enabling automated control, demand response, and optimized electricity usage, thereby reducing energy bills, supporting sustainability initiatives, and enhancing overall grid efficiency.

Global Smart Grid Sensors Market: Regional Analysis

Region with the Largest Revenue Share

North America is projected to dominate the smart grid sensors market with 38.0% of the total revenue by the end of 2025, due to a combination of advanced infrastructure, regulatory support, and strong government initiatives. The United States, in particular, has invested heavily in modernizing aging electrical grids through programs led by the Department of Energy (DOE) and the Smart Grid Investment Grant (SGIG) program.

These initiatives have facilitated widespread deployment of Advanced Metering Infrastructure (AMI), voltage and temperature sensors, and outage detection systems. Utilities in North America increasingly rely on real-time data from smart sensors to optimize energy distribution, reduce transmission losses, and implement predictive maintenance programs. The region benefits from a highly digitized grid network and strong adoption of Internet of Things (IoT) technologies, enabling automated monitoring and control of energy systems.

Furthermore, robust research and development ecosystems, coupled with early adoption of renewable energy sources, have driven the integration of smart sensors into grid operations. Consumer awareness of energy efficiency and demand response programs also fuels adoption, as smart meters and sensor-enabled applications empower households and industries to monitor and manage energy consumption effectively.

Additionally, North America’s strong presence of key market players, extensive government incentives, and supportive regulatory frameworks ensure a conducive environment for large-scale sensor deployment. These factors collectively reinforce North America’s position as the leading regional market for smart grid sensors, with continued investments projected to sustain its dominance in the foreseeable future.

Region with the Highest CAGR

Asia Pacific is projected to exhibit the highest compound annual growth rate (CAGR) in the smart grid sensors market, driven by rapid urbanization, industrial expansion, and rising electricity demand across countries such as China, India, Japan, and South Korea. Governments in the region are prioritizing grid modernization programs and renewable energy integration to meet sustainability targets and improve energy efficiency.

For instance, India’s National Smart Grid Mission promotes the deployment of Advanced Metering Infrastructure (AMI), smart meters, and advanced sensor technologies, while China is investing heavily in smart grid pilot projects and IoT-enabled energy solutions. The region’s expanding industrial base and rising population create significant demand for reliable and uninterrupted power supply, driving utilities to adopt voltage, temperature, and outage detection sensors.

Moreover, the Asia Pacific benefits from favorable government policies, subsidies, and incentives for smart meter installations, which accelerate market adoption. Technological advancements, including AI-enabled predictive analytics, IoT integration, and cloud-based monitoring platforms, further contribute to rapid growth.

Additionally, growing awareness of energy conservation and the need for smart city initiatives support investments in sensor-equipped grids. The combination of infrastructural development, supportive policies, increasing electricity consumption, and adoption of digital energy management solutions positions the Asia Pacific as the fastest-growing region, making it a highly lucrative market for smart grid sensor manufacturers and solution providers.

By Region

North America

Europe

- Germany

- The U.K.

- France

- Italy

- Russia

- Spain

- Benelux

- Nordic

- Rest of Europe

Asia-Pacific

- China

- Japan

- South Korea

- India

- ANZ

- ASEAN

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Argentina

- Colombia

- Rest of Latin America

Middle East & Africa

- Saudi Arabia

- UAE

- South Africa

- Israel

- Egypt

- Rest of MEA

Global Smart Grid Sensors Market: Competitive Landscape

The global smart grid sensors market is highly competitive, characterized by the presence of several key players focusing on technological innovation, strategic collaborations, and regional expansion. Leading companies such as Siemens AG, ABB Ltd., Schneider Electric SE, General Electric, Honeywell International, Landis+Gyr, Itron Inc., Eaton Corporation, Emerson Electric Co., Toshiba Corporation, Mitsubishi Electric, Wasion Group, Hitachi Ltd., Advantech Co. Ltd., S&C Electric Company, Toshiba T&D, Fuji Electric Co. Ltd., L&T Technology Services, Kamstrup A/S, and SmartSense dominate the market.

These companies are investing heavily in research and development to launch advanced sensors, AMI solutions, and integrated smart grid systems. Product innovation focuses on high-precision voltage and temperature sensors, outage detection systems, and AI-enabled monitoring solutions to enhance grid reliability and efficiency.

Strategic collaborations, joint ventures, and partnerships are common approaches to expand market presence and enter emerging regions such as the Asia Pacific and Latin America. Companies also engage in mergers and acquisitions to strengthen product portfolios and leverage regional expertise. Continuous technological upgrades, including IoT connectivity, predictive analytics, and cloud integration, enable companies to differentiate their offerings in a competitive environment.

Furthermore, players are focusing on regulatory compliance, cybersecurity solutions, and energy management services to address industry challenges and customer demands. The competitive landscape emphasizes innovation, regional expansion, and strategic alliances as key drivers for sustaining growth and maintaining market leadership in the rapidly evolving smart grid sensors industry.

Some of the prominent players in the Global Smart Grid Sensors Market are:

- General Electric Company (GE Grid Solutions)

- ABB Ltd.

- Siemens Energy AG

- Schneider Electric SE

- Itron, Inc.

- Cisco Systems, Inc.

- IBM Corporation

- Oracle Corporation

- Honeywell International Inc.

- Eaton Corporation plc

- Landis+Gyr Group AG

- Aclara Technologies LLC (Hubbell Incorporated)

- S&C Electric Company

- Trilliant Holdings, Inc.

- Sentient Energy, Inc. (Koch Engineered Solutions)

- Toshiba Corporation

- Renesas Electronics Corporation (Echelon Industries Corporation)

- QinetiQ Group PLC

- ARTECHE

- Grid20/20 Inc.

- Other Key Players

Recent Developments in the Global Smart Grid Sensors Market

Investments & Funding

- May 2024: Camus Energy, a provider of grid-aware distributed energy resource (DER) management software, raised USD 10 million in Series A extension funding. This investment, led by Wave Capital, will accelerate the deployment of its platform, which relies heavily on granular sensor data for managing rooftop solar, batteries, and EVs on the distribution grid.

- April 2024: Sequel Power, a company developing innovative grid monitoring hardware and analytics, secured USD 11 million in Series A funding. The funding is aimed at scaling the production of its unique, easily deployable sensors that provide real-time visibility into medium-voltage power lines.

Collaborations & Partnerships

- June 2024: Landis+Gyr and SP Group (Singapore) announced a strategic partnership to deploy an advanced grid analytics solution across Singapore's power network. The collaboration will utilize Landis+Gyr's grid sensors and analytics software to enhance fault detection, isolation, and restoration (FDIR) capabilities.

- March 2024: Itron and TSO (Transmission System Operator) of a major European country (name often undisclosed) entered a partnership to deploy Itron's IEEE 802.15.4g LR-WPAN network for distribution automation. This network will connect thousands of smart grid sensors to improve outage management and voltage optimization.

Expos & Conferences

- May 20-23, 2024: DISTRIBUTECH International (Orlando, Florida, USA). The largest annual transmission and distribution event in North America. Smart sensors and grid-edge intelligence were a central theme, with major exhibitors like Siemens, Hubbell, Sentient Energy, and AT&T showcasing the latest sensor technologies and communications solutions.

- April 2024: Hannover Messe (Hannover, Germany). A major industrial tech expo where companies like Siemens and GE Vernova showcased integrated digital grid solutions, featuring smart sensors as a core component of their Industrial IoT and energy automation portfolios.

Mergers & Acquisitions (M&A)

- October 2023: Hubbell Incorporated, a major electrical and utility solutions provider, completed the acquisition of Eclipse Automation, a systems integrator specializing in advanced manufacturing and robotics. This acquisition strengthens Hubbell's ability to manufacture and integrate complex sensing and grid automation systems.

- July 2023: Infosys acquired Lighthouse, a provider of IoT and smart grid analytics. While not a pure sensor play, this acquisition enhances Infosys's ability to provide data-driven grid management services that are dependent on sensor data inputs.

Collaborations & Partnerships

- November 2023: Siemens and Microsoft expanded their partnership to leverage the Azure Cloud and AI platform for Siemens' grid software suite, including applications that process data from millions of grid sensors for predictive maintenance and load forecasting.

- September 2023: Generac Grid Services (a subsidiary of Generac Power Systems) partnered with a Midwestern U.S. utility to deploy a virtual power plant (VPP) program. The project relies on smart meters and grid sensors to orchestrate distributed home batteries in response to grid conditions.

Expos & Conferences

- October 2023: European Utility Week (Enlit Europe) (Paris, France). A key event where European utilities and technology providers highlighted projects involving sensor-driven grid digitalization and cybersecurity.

- January 2023: IEEE Power & Energy Society Innovative Smart Grid Technologies (ISGT) Conference (Washington D.C., USA). An academic and industry conference where numerous research papers on next-generation sensor technologies, communication protocols (e.g., IEEE 802.15.4z), and data analytics were presented.

Report Details

| Report Characteristics |

| Market Size (2025) |

USD 652.8 Mn |

| Forecast Value (2034) |

USD 2,497.7 Mn |

| CAGR (2025–2034) |

16.1% |

| The US Market Size (2025) |

USD 208.6 Mn |

| Historical Data |

2019 – 2024 |

| Forecast Data |

2026 – 2034 |

| Base Year |

2024 |

| Estimate Year |

2025 |

| Report Coverage |

Market Revenue Estimation, Market Dynamics, Competitive Landscape, Growth Factors, etc. |

| Segments Covered |

By Component (Advanced Metering Infrastructure, Smart Grid Distribution Management, Supervisory Control & Data Acquisition (SCADA), Smart Energy Meter, and Other Component), By Sensor Type (Voltage & Temperature Sensors, Outage Detection, Touch Sensor¸Image Sensor, Motion Sensor, and Other Sensor Type), By Solutions (Advanced Metering Infrastructure (AMI), and Smart Grid Distribution Management), By Application (Industrial, Residential, Commercial, Other Application) |

| Regional Coverage |

North America – US, Canada; Europe – Germany, UK, France, Russia, Spain, Italy, Benelux, Nordic, Rest of Europe; Asia-Pacific – China, Japan, South Korea, India, ANZ, ASEAN, Rest of APAC; Latin America – Brazil, Mexico, Argentina, Colombia, Rest of Latin America; Middle East & Africa – Saudi Arabia, UAE, South Africa, Turkey, Egypt, Israel, Rest of MEA |

| Prominent Players |

General Electric Company (GE Grid Solutions), ABB Limited, Siemens Energy, Schneider Electric SE, Itron, Incorporated, Cisco Systems, Incorporated, International Business Machines Corporation (IBM), Oracle Corporation, Honeywell International Incorporated, Eaton Corporation plc, Landis+Gyr Group Aktiengesellschaft, Aclara Technologies LLC (Hubbell Incorporated), S&C Electric Company, Trilliant Holdings, Incorporated, Sentient Energy, Incorporated (Koch Engineered Solutions), Toshiba Corporation, Renesas Electronics Corporation (Echelon Industries Corporation), QinetiQ Group Public Limited Company, ARTECHE, Grid20/20, Incorporated., and Other Key Players |

| Purchase Options |

We have three licenses to opt for: Single User License (Limited to 1 user), Multi-User License (Up to 5 Users), and Corporate Use License (Unlimited User) along with free report customization equivalent to 0 analyst working days, 3 analysts working days, and 5 analysts working days respectively. |

Frequently Asked Questions

The Global Smart Grid Sensors Market size is estimated to have a value of USD 652.8 million in 2025 and is expected to reach USD 2,497.7 million by the end of 2034.

The market is growing at a CAGR of 16.1 percent over the forecasted period of 2025

The US Smart Grid Sensors Market is projected to be valued at USD 208.6 million in 2025. It is expected to witness subsequent growth in the upcoming period as it holds USD 740.0 million in 2034 at a CAGR of 15.1%.

North America is expected to have the largest market share in the Global Smart Grid Sensors Market with a share of about 38.0% in 2025.

Some of the major key players in the Global Smart Grid Sensors Market are General Electric Company (GE Grid Solutions), ABB Limited, Siemens Energy Aktiengesellschaft, Schneider Electric SE, Itron, Incorporated, and many others.