Market Overview

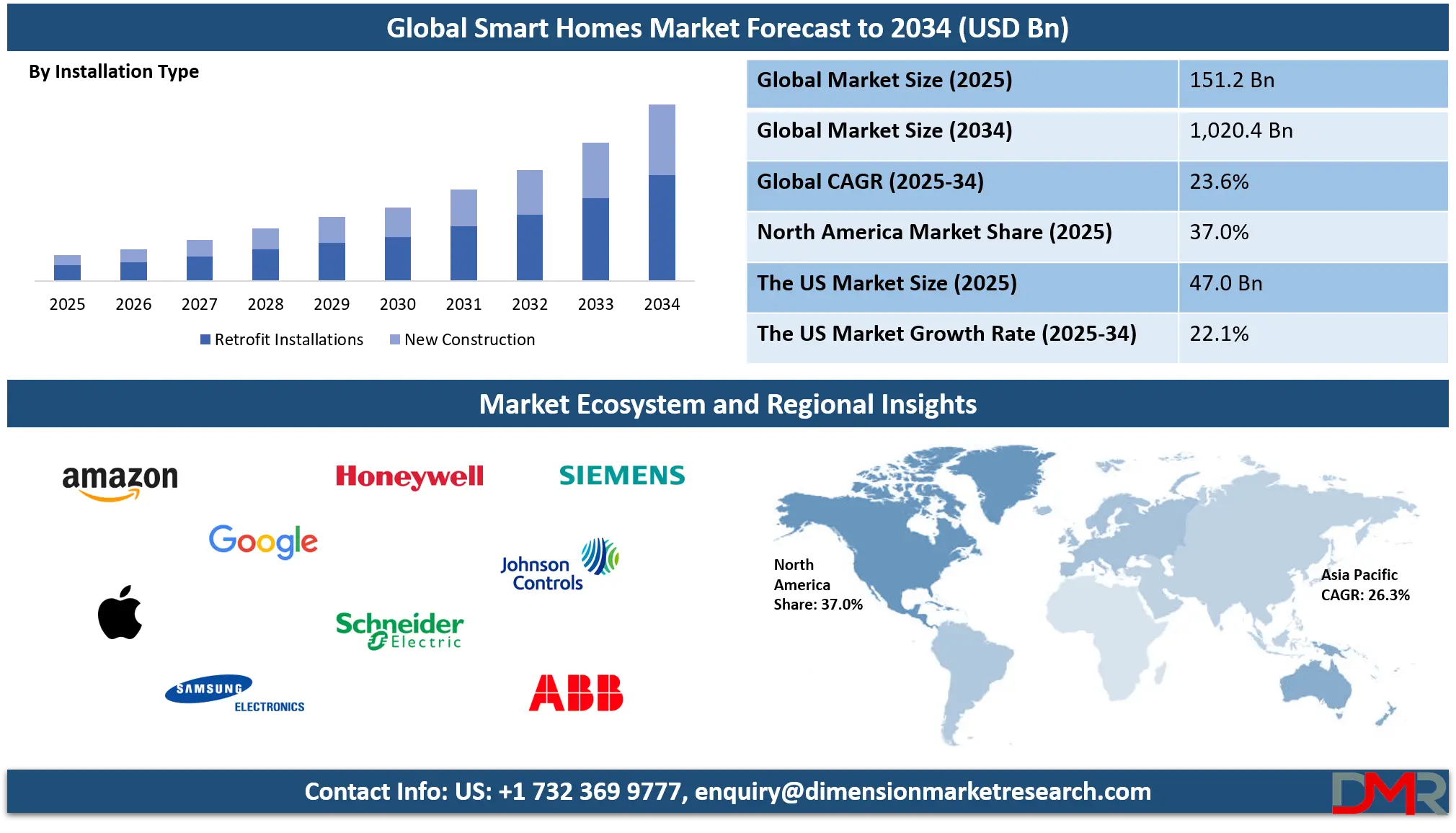

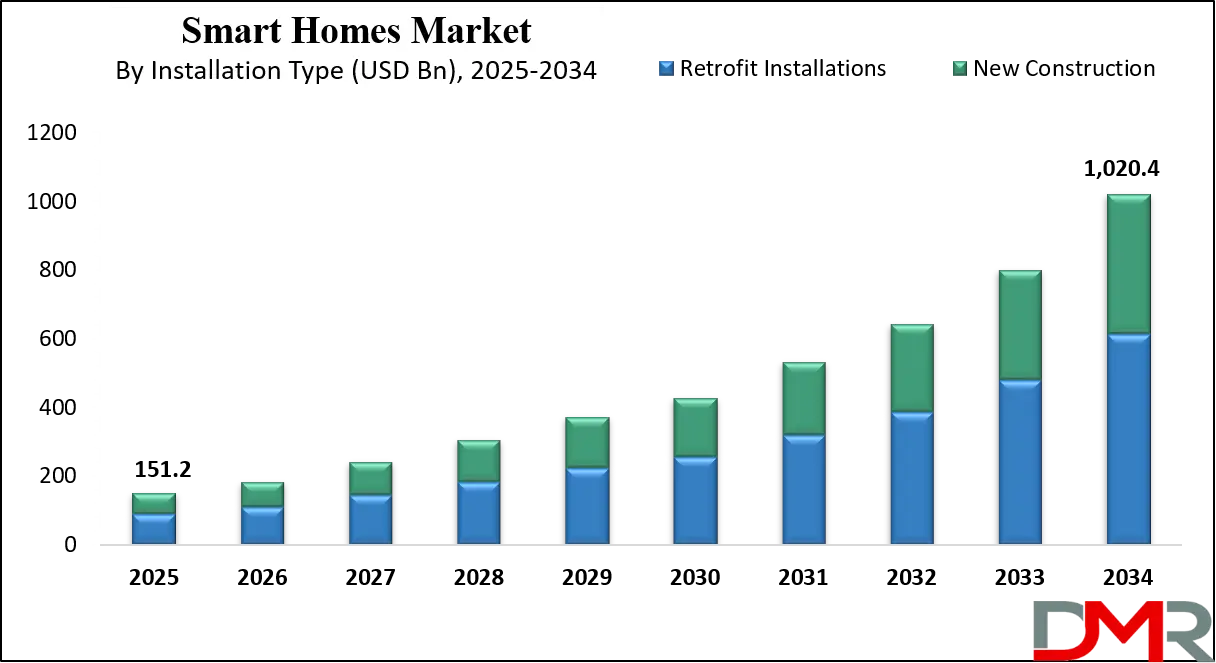

The global smart homes market is projected to reach USD 151.2 billion in 2025 and expand to USD 1,020.4 billion by 2034, registering a CAGR of 23.6% driven by rising adoption of connected devices, home automation, and IoT-enabled residential solutions.

A smart home is a residential setup that uses connected devices and advanced technologies to automate and control household systems for improved convenience, efficiency, security, and comfort. It integrates various components such as lighting, heating, ventilation, air conditioning, appliances, and security systems through wireless or wired networks that can be managed remotely via smartphones, voice assistants, or centralized platforms. These homes rely on sensors, artificial intelligence, and the Internet of Things to enable predictive functions like energy optimization, automated schedules, and real time monitoring, making daily living more seamless and resource efficient.

The global smart home market represents a rapidly evolving sector of the technology and housing industries, characterized by the adoption of connected solutions that enhance residential living. This market is driven by factors such as rising consumer demand for safety, energy efficiency, and digital lifestyle integration, along with growing penetration of broadband connectivity and smart devices. Smart home solutions today extend beyond basic automation, encompassing comprehensive ecosystems that bring together appliances, entertainment, wellness, and home management tools, thereby redefining the modern household experience.

Additionally, the market is gaining momentum due to continuous advancements in artificial intelligence, cloud computing, and 5G connectivity, which enable faster and more reliable communication between devices. The adoption is further supported by urbanization, government energy efficiency initiatives, and growing consumer awareness of sustainable living practices. As smart homes continue to evolve, the global market reflects not only a technology transformation but also a shift in consumer behavior, emphasizing personalized experiences, convenience, and proactive home management on a globally scale.

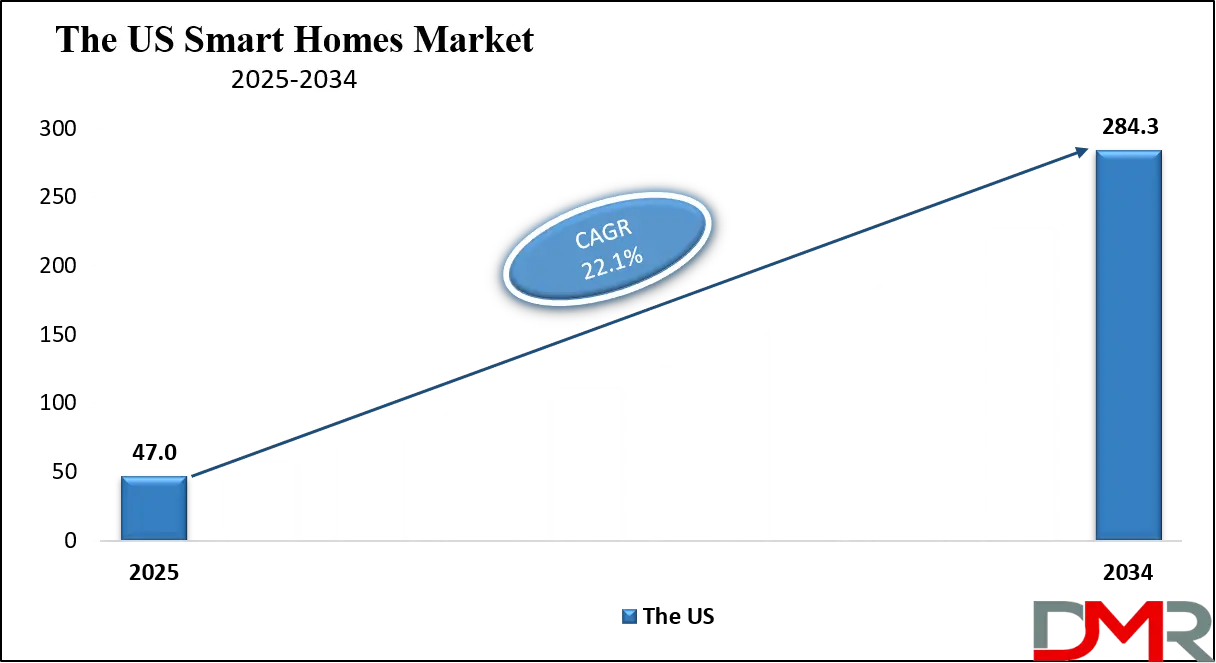

The US Smart Homes Market

The U.S. Smart Homes market size is projected to be valued at USD 47.0 billion by 2025. It is further expected to witness subsequent growth in the upcoming period, holding USD 284.3 billion in 2034 at a CAGR of 22.1%.

The US smart homes market is one of the most advanced and mature segments globally, fueled by high consumer awareness, widespread broadband penetration, and the rapid integration of connected devices into everyday life. American households increasingly adopt home automation solutions such as smart speakers, voice assistants, security and surveillance systems, connected appliances, and energy management platforms.

Strong demand is also influenced by lifestyle trends emphasizing convenience, personalization, and safety, with major technology companies like Amazon, Google, Apple, and ADT shaping the ecosystem through innovative devices and platforms. Additionally, the rise of wireless communication standards, seamless interoperability among devices, and growing affordability of IoT-enabled products continue to accelerate adoption across urban and suburban households in the United States.

Furthermore, the growth of the US smart home industry is supported by evolving consumer behavior and favorable infrastructure. Smart energy solutions, including intelligent thermostats and connected lighting systems, are gaining traction due to growing concerns about energy efficiency and sustainability.

The integration of artificial intelligence, cloud computing, and voice recognition technologies further enhances user experience by enabling predictive automation and real time control. With expanding e-commerce channels, subscription-based smart security services, and government initiatives encouraging energy-efficient housing, the US smart homes market is poised to maintain its leadership in revenue generation and innovation, offering vast opportunities for stakeholders across hardware, software, and services.

Europe Smart Homes Market

The European smart homes market is projected to reach approximately USD 27.2 billion in 2025, reflecting a strong adoption of connected devices and home automation technologies across the region. This growth is driven by growing consumer awareness about energy efficiency, home security, and convenience, alongside rising disposable incomes and the proliferation of smart devices such as thermostats, lighting systems, security cameras, and AI-enabled home assistants. Countries such as Germany, the UK, and France are leading the adoption curve due to robust IoT infrastructure, advanced broadband connectivity, and supportive regulatory policies promoting energy-efficient and smart living solutions.

The market is expected to expand at a CAGR of around 20.0% during the forecast period, highlighting the region’s rapid adoption of next-generation smart home technologies. The demand is further fueled by innovations in AI-driven automation, wireless communication protocols, and integrated home ecosystems that offer seamless interoperability among devices.

European consumers are increasingly prioritizing personalized and sustainable living experiences, prompting manufacturers and service providers to innovate solutions that combine convenience, security, and energy management. With continued urbanization and growing interest in connected lifestyles, Europe represents a key market for smart home growth in the global landscape.

Japan Smart Homes Market

The Japanese smart homes market is projected to reach approximately USD 6.5 billion in 2025, reflecting a strong uptake of connected devices and home automation technologies across residential properties. Growth is being driven by growing consumer demand for convenience, safety, and energy-efficient solutions, with smart security systems, automated lighting, intelligent HVAC controls, and AI-enabled home assistants becoming increasingly popular.

Urbanization, rising disposable income, and a tech-savvy population are supporting the adoption of innovative smart home products, while advanced broadband infrastructure and high smartphone penetration further enable seamless integration of IoT-enabled devices in households across the country.

The market is expected to expand at a robust CAGR of around 22.5% over the forecast period, indicating rapid growth and significant potential for further penetration. Key factors fueling this expansion include the integration of AI and machine learning into home automation, predictive energy management, and enhanced interoperability among devices.

Additionally, government initiatives promoting energy conservation and smart city projects encourage the adoption of connected solutions. With growing awareness of sustainability, security, and convenience, Japan continues to emerge as a high-growth market in the global smart homes landscape, attracting investments from both domestic and international technology companies.

Global Smart Homes Market: Key Takeaways

- Market Value: The global smart homes market size is expected to reach a value of USD 1,020.4 billion by 2034 from a base value of USD 151.2 billion in 2025 at a CAGR of 23.6%.

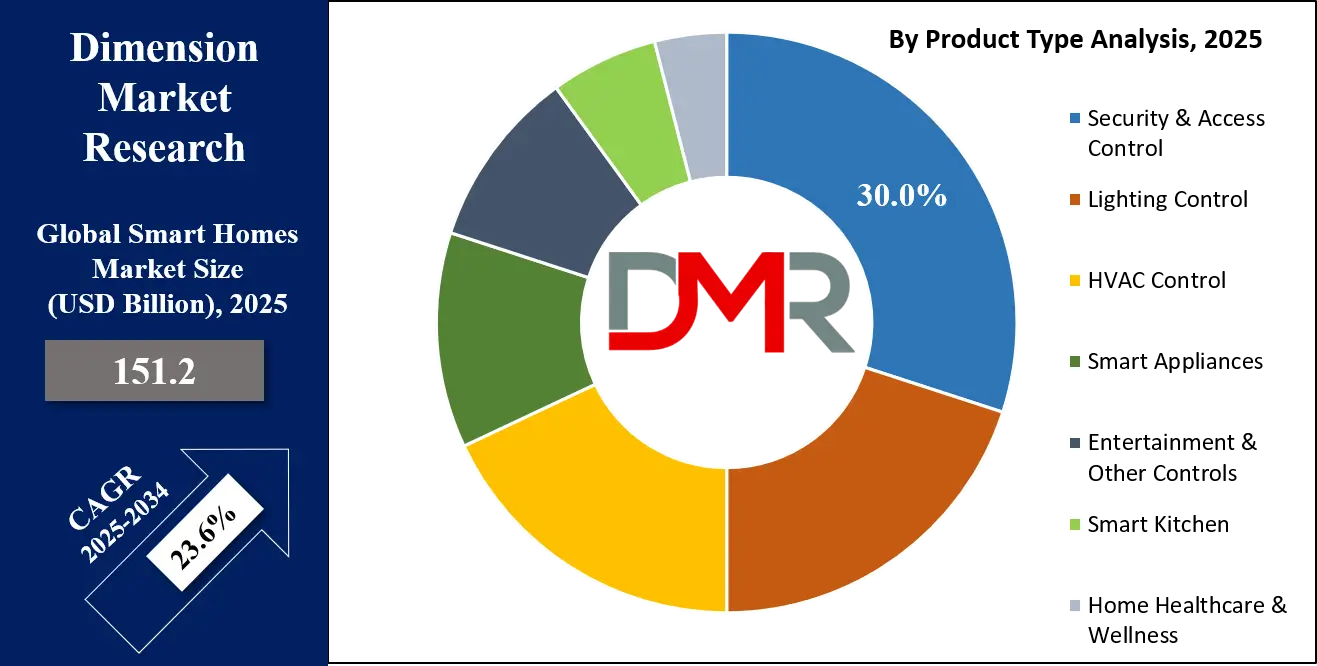

- By Product Type Analysis: Security & Access Control is anticipated to dominate the product type segment, capturing 30.0% of the total market share in 2025.

- By Installation Type Segment Analysis: Retrofit Installations are expected to maintain their dominance in the installation type segment, capturing 60.0% of the total market share in 2025.

- By Technology Segment Analysis: Wireless Technologies will dominate the technology segment, capturing 83.0% of the market share in 2025.

- By Housing Type Segment Analysis: Single-Family Homes will account for the maximum share in the housing type segment, capturing 65.0% of the total market value.

- By Sales Channel Segment Analysis: Online Sales will dominate the sales channel segment, capturing 70.0% of the market share in 2025.

- Regional Analysis: North America is anticipated to lead the global smart homes market landscape with 37.0% of total global market revenue in 2025.

- Key Players: Some key players in the global smart homes market include Amazon, Google (Alphabet), Apple, Samsung Electronics, Honeywell International, Schneider Electric, Siemens AG, Johnson Controls, ABB Ltd., LG Electronics, Panasonic Corporation, Philips (Signify), ADT Inc., Assa Abloy, Vivint Smart Home, Comcast (Xfinity Home), Netatmo (Legrand), Ring (Amazon), Ecobee, and Others.

Global Smart Homes Market: Use Cases

- Smart Security and Surveillance: Smart security systems in homes integrate connected cameras, motion sensors, door locks, and alarm systems to provide real time monitoring and remote access. Homeowners can receive instant alerts on smartphones or voice assistants when unusual activity is detected. These solutions enhance safety, enable remote surveillance, and often include AI-powered features like facial recognition and behavior analytics. This use case addresses rising consumer concerns for property protection and leverages IoT-enabled devices for a secure residential environment.

- Energy Management and Efficiency: Smart homes utilize intelligent thermostats, lighting controls, and energy monitoring devices to optimize power consumption and reduce utility costs. Homeowners can automate lighting schedules, remotely adjust heating and cooling, and track energy usage through mobile apps or cloud platforms. Integration with renewable energy sources such as solar panels is also common. This use case contributes to sustainability goals, lowers carbon footprint, and aligns with growing demand for eco-friendly residential solutions in urban and suburban markets.

- Home Automation and Convenience: Automation systems allow seamless control of multiple home devices, including appliances, entertainment systems, and lighting, through centralized platforms or voice assistants. Users can schedule routines, control devices remotely, and create personalized smart environments. AI-enabled platforms further enhance convenience by learning user behavior and predicting needs, such as pre-heating an oven or adjusting lighting based on occupancy. This use case highlights the lifestyle transformation potential of connected home ecosystems, emphasizing comfort and efficiency.

- Health and Wellness Monitoring: Connected devices in smart homes support health and wellness by tracking air quality, sleep patterns, and vital signs. Smart air purifiers, wearable integrations, and wellness-focused appliances provide insights that improve daily living conditions. For elderly or vulnerable residents, remote monitoring and alerts for medical emergencies are crucial. This use case leverages IoT sensors, AI analytics, and mobile connectivity to create safer, healthier, and more responsive living spaces, catering to an increasingly health-conscious consumer base.

Impact of Artificial Intelligence on the global Smart Homes market

Artificial intelligence is transforming the global smart homes market by enabling devices to learn user behavior, anticipate needs, and optimize home operations for enhanced comfort, convenience, and energy efficiency. AI-powered systems analyze data from connected devices such as thermostats, lighting, security cameras, and appliances to deliver predictive automation, personalized routines, and real-time decision-making. This integration not only improves security through intelligent monitoring and anomaly detection but also supports sustainability by optimizing energy consumption. As AI continues to advance, it drives innovation across home automation ecosystems, making smart homes more intuitive, responsive, and seamlessly integrated into daily life.

Global Smart Homes Market: Stats & Facts

United States – DOE, EIA, U.S. Census Bureau

- In 2023, 63% of U.S. households owned at least one smart home device (DOE).

- Smart thermostat adoption increased by 25% between 2023 and 2025 (EIA).

- Smart lighting system installations rose by 30% over the same period (EIA).

- In 2023, 58% of U.S. households reported owning at least one smart home device (Census Bureau).

- By 2025, U.S. household ownership of smart home devices is expected to reach 70% (DOE, Census Bureau).

Europe – European Commission, DCMS (UK), BMWi (Germany), French Ministry for the Ecological Transition

- In 2023, 50% of European households owned at least one smart home device (European Commission).

- By 2025, the figure is expected to reach 60% (European Commission).

- In 2023, 50% of UK households owned at least one smart home device (DCMS).

- By 2025, UK adoption is expected to rise to 60% (DCMS).

Japan – Ministry of Internal Affairs and Communications

- In 2023, smart home adoption in Japan was valued at ¥1.2 trillion.

- By 2025, adoption is projected to grow to ¥1.5 trillion.

Australia – Australian Bureau of Statistics, AER

- In 2023, 45% of Australian households owned at least one smart home device (ABS).

- By 2025, this is expected to rise to 55% (ABS).

- Smart meter adoption rose from 15% in 2023 to 25% by 2025 (AER).

Canada – CRTC, CSGF

- In 2023, 30% of Canadian households had smart home devices (CSGF).

- By 2025, this figure is projected to rise to 40% (CSGF).

Global Smart Homes Market: Market Dynamics

Global Smart Homes Market: Driving Factors

Rising Demand for Home Automation and Connected Devices

The growing adoption of smart appliances, voice-controlled assistants, and IoT-enabled devices is a major driver of the global smart homes market. Consumers are seeking convenience, seamless integration, and real-time control over household systems such as lighting, HVAC, and entertainment. This demand is fueled by urbanization, growing disposable income, and the popularity of connected lifestyles, encouraging manufacturers to develop comprehensive home automation ecosystems that enhance comfort, efficiency, and overall user experience.

Enhanced Security and Energy Efficiency Awareness

Awareness about residential safety and energy conservation is driving the adoption of smart home solutions. Intelligent security systems, smart locks, surveillance cameras, and energy management devices allow homeowners to monitor and control their homes remotely. The integration of AI, machine learning, and predictive analytics further optimizes energy consumption and reduces utility costs, aligning with sustainability initiatives and eco-friendly living practices, which strongly influence consumer purchasing decisions.

Global Smart Homes Market: Restraints

High Initial Costs of Smart Home Devices

Despite growing adoption, the high upfront investment required for smart appliances, automation hubs, and IoT-enabled systems can restrain market growth. Many consumers, especially in developing regions, are hesitant to install advanced home automation solutions due to price sensitivity, installation complexity, and ongoing maintenance costs, limiting the penetration of smart home technologies.

Data Privacy and Security Concerns

The proliferation of connected devices and cloud-based platforms raises concerns about data privacy, cyberattacks, and unauthorized access. Users are increasingly wary of sharing personal information and home activity data with third-party service providers. These security risks can slow adoption rates and prompt regulatory scrutiny, posing challenges for market players in ensuring secure and trustworthy smart home ecosystems.

Global Smart Homes Market: Opportunities

Integration of Artificial Intelligence and Machine Learning

The integration of AI and machine learning presents significant growth opportunities by enabling predictive automation, personalized user experiences, and intelligent energy management. AI-powered systems can analyze patterns in user behavior, optimize appliance performance, and provide proactive security alerts, opening new avenues for product innovation and service offerings in the smart homes market.

Expansion in Emerging Markets

Rising urbanization, growing smartphone penetration, and growing awareness of smart living solutions in emerging economies provide lucrative growth opportunities. Markets in Asia-Pacific, Latin America, and the Middle East are witnessing rapid adoption of connected home devices, driven by affordable IoT technologies, expanding internet infrastructure, and a shift toward digital lifestyles. These regions offer untapped potential for manufacturers and service providers.

Global Smart Homes Market: Trends

Voice-Controlled and AI-Enabled Home Assistants

Smart speakers and voice-controlled assistants are becoming a central part of home automation, allowing users to control lighting, appliances, security systems, and entertainment with voice commands. Integration with AI enables predictive actions, contextual recommendations, and seamless inter-device communication, reflecting a shift toward hands-free, intuitive home management.

Sustainable and Energy-Efficient Smart Homes

There is a growing trend toward eco-friendly smart homes equipped with energy-efficient appliances, intelligent lighting, smart thermostats, and renewable energy integration. Consumers are increasingly adopting solutions that reduce electricity consumption, lower carbon footprints, and support green building practices, driving innovation in energy management and sustainable home automation solutions.

Global Smart Homes Market: Research Scope and Analysis

By Product Type Analysis

In the global smart homes market, Security and Access Control is anticipated to dominate the product type segment, capturing approximately 30% of the total market share in 2025. This leadership is driven by rising concerns over residential safety and growing adoption of connected devices that enhance home security. Consumers are increasingly investing in IoT-enabled surveillance cameras, smart locks, alarm systems, and motion sensors that allow real-time monitoring and remote access through smartphones or centralized platforms.

Artificial intelligence and machine learning are further enhancing these systems by enabling predictive threat detection, facial recognition, and behavioral analytics, offering proactive measures against potential security breaches. The growing emphasis on protecting family members, valuable assets, and private information has made security solutions a cornerstone of smart home adoption, particularly in developed regions where high disposable income and technology awareness support the deployment of advanced security ecosystems.

Lighting Control is another crucial segment within the smart homes market, providing homeowners with enhanced convenience, energy efficiency, and customization of their living spaces. Connected lighting systems allow users to automate schedules, adjust brightness, and control lights remotely using mobile applications or voice assistants. Advanced solutions integrate occupancy sensors and adaptive technologies that respond to natural light, presence, or time of day, reducing energy wastage while improving comfort and ambiance.

The adoption of energy-efficient LED lighting, combined with intelligent controls, supports sustainability goals and aligns with growing consumer interest in eco-friendly living. As lifestyles become more digital and connected, lighting control systems are evolving beyond basic automation to offer integrated experiences that complement other smart home devices, contributing to a cohesive and energy-conscious residential environment.

By Installation Type Analysis

In the global smart homes market, retrofit installations are expected to maintain their dominance in the installation type segment, capturing around 60% of the total market share in 2025. This prominence is largely driven by the large existing housing stock globally that requires upgrading to incorporate smart technologies.

Homeowners and property developers are increasingly adopting retrofit solutions to integrate connected devices such as smart lighting, security systems, HVAC controls, and home automation platforms without the need for complete structural changes. The flexibility and cost-effectiveness of retrofitting make it an attractive option for urban and suburban households seeking to modernize their homes.

Additionally, retrofit installations benefit from the growing availability of wireless technologies, IoT-enabled devices, and plug-and-play smart solutions, allowing seamless integration with minimal disruption. This trend is further reinforced by consumer awareness of energy efficiency, convenience, and enhanced security, which drives demand for upgrading traditional homes into connected, intelligent living spaces.

New construction, on the other hand, represents homes that are built with smart technologies integrated from the ground up. In this segment, smart home solutions are embedded into the design and infrastructure of the house, allowing for optimized wiring, system compatibility, and complete automation across appliances, lighting, HVAC, and security.

Developers can implement advanced IoT ecosystems and AI-driven controls during construction, resulting in fully connected and energy-efficient residences. This approach ensures better interoperability between devices and offers homeowners a seamless and intuitive experience from the moment they move in. Although new construction currently holds a smaller share compared to retrofit installations, it is growing steadily as consumer demand for smart living spaces rises, particularly in regions with rapid urbanization and new housing projects, providing opportunities for innovative, fully integrated smart homes.

By Technology Analysis

In the global smart homes market, wireless technologies are expected to dominate the technology segment, capturing approximately 83% of the market share in 2025. The widespread adoption of wireless solutions is driven by their ease of installation, flexibility, and compatibility with a wide range of smart devices. Consumers increasingly prefer Wi-Fi, Bluetooth, Zigbee, and Z-Wave enabled systems for controlling lighting, security, HVAC, and entertainment devices because these technologies allow seamless integration without extensive cabling or structural modifications.

Wireless solutions also support remote monitoring and management through smartphones, voice assistants, and cloud-based platforms, enhancing convenience, energy efficiency, and home security. The combination of reduced installation complexity, lower costs, and growing consumer demand for connected lifestyles makes wireless technologies the preferred choice for both retrofit and new construction smart home projects.

Wired technologies, on the other hand, are implemented through physical connections such as Ethernet or specialized low-voltage wiring to link smart devices and systems. These solutions offer higher reliability, reduced latency, and better network stability, making them suitable for large or premium residential setups where performance and uninterrupted connectivity are critical.

Wired systems are often used in integrated home automation platforms, professional security installations, and high-end audio-visual networks. While wired technologies occupy a smaller share of the market compared to wireless, they remain relevant in scenarios where consistent performance, long-term durability, and interference-free communication are required, particularly in new construction projects designed for fully integrated smart ecosystems.

By Housing Type Analysis

In the global smart homes market, single-family homes are expected to account for the largest share in the housing type segment, capturing around 65% of the total market value. This dominance is driven by the availability of larger spaces, higher disposable incomes, and the ability to invest in comprehensive home automation solutions. Homeowners of single-family residences increasingly adopt smart security systems, lighting and HVAC controls, connected appliances, and entertainment solutions to enhance comfort, convenience, and energy efficiency.

These homes also provide greater flexibility for retrofitting or integrating advanced IoT and AI-powered technologies, enabling a seamless connected ecosystem that meets modern lifestyle demands. Additionally, the focus on personalized living experiences, home safety, and sustainability further fuels the adoption of smart home solutions in single-family properties.

Multi-family homes, such as apartments, condominiums, and co-living spaces, represent another important segment in the smart homes market. In these residential settings, smart home adoption is often driven by developers and property managers who integrate connected systems to offer enhanced security, energy management, and convenience to multiple residents.

Solutions commonly implemented include centralized access control, shared smart lighting and HVAC systems, and building-wide IoT networks that can be monitored and managed remotely. While multi-family homes currently account for a smaller portion of the market compared to single-family residences, the segment is growing steadily, especially in urban areas with high population density, new construction projects, and a rising demand for connected and efficient living spaces.

By Sales Channel Analysis

In the global smart homes market, online sales are expected to dominate the sales channel segment, capturing around 70% of the market share in 2025. The growth of e-commerce platforms, direct-to-consumer websites, and online marketplaces has made smart home devices more accessible to a wider audience. Consumers increasingly prefer purchasing connected devices, smart appliances, lighting systems, and security solutions online due to the convenience of doorstep delivery, detailed product information, reviews, and competitive pricing.

Additionally, online channels allow manufacturers and service providers to offer subscription-based services, software updates, and remote support, enhancing the overall customer experience. The ease of comparing products, accessing global brands, and leveraging digital promotions further drives the dominance of online sales in this market.

Offline sales, on the other hand, continue to play a significant role, particularly for consumers who prefer hands-on experience or require professional installation and support. Retail stores, specialty outlets, and authorized dealers provide the opportunity to physically inspect smart devices, seek expert guidance, and understand compatibility with existing home systems.

Installers and service providers also contribute to offline sales by offering customized solutions, setup, and maintenance services, which are particularly important for security systems, home automation hubs, and integrated smart ecosystems. While offline channels account for a smaller share compared to online, they remain critical for building consumer trust, addressing technical concerns, and supporting adoption among less tech-savvy users.

The Smart Homes Market Report is segmented on the basis of the following:

By Product Type

- Security & Access Control

- Lighting Control

- HVAC Control

- Smart Appliances

- Entertainment & Other Controls

- Smart Kitchen

- Home Healthcare & Wellness

By Installation Type

- Retrofit Installations

- New Construction

By Technology

- Wireless Technologies

- Wired Technologies

By Housing Type

- Single-Family Homes

- Multi-Family Homes

By Sales Channel

- Online Sales

- Offline Sales

Global Smart Homes Market: Regional Analysis

Region with the Largest Revenue Share

North America is anticipated to lead the global smart homes market, accounting for approximately 37% of total market revenue in 2025. The region’s dominance is driven by high consumer awareness, widespread adoption of connected devices, and strong presence of major technology players such as Amazon, Google, and Apple.

Advanced broadband infrastructure, growing disposable income, and a preference for smart living solutions contribute to the widespread implementation of home automation systems, including security, lighting, HVAC, and entertainment devices. Additionally, favorable government initiatives promoting energy efficiency and sustainability, along with early adoption of AI and IoT technologies, further strengthen North America’s position as the largest and most mature smart homes market globally.

Region with significant growth

The Asia-Pacific region is expected to witness significant growth in the global smart homes market over the coming years. Rapid urbanization, rising disposable incomes, and growing smartphone and internet penetration are driving the adoption of connected devices and home automation solutions in countries such as China, India, Japan, and South Korea.

Consumers in the region are increasingly investing in smart security systems, energy-efficient appliances, lighting controls, and AI-enabled home assistants to enhance convenience, comfort, and energy management. Additionally, government initiatives supporting smart city development, IoT infrastructure expansion, and sustainable living practices are fueling market growth, making Asia-Pacific one of the fastest-growing regions in the smart homes landscape.

By Region

North America

Europe

- Germany

- The U.K.

- France

- Italy

- Russia

- Spain

- Benelux

- Nordic

- Rest of Europe

Asia-Pacific

- China

- Japan

- South Korea

- India

- ANZ

- ASEAN

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Argentina

- Colombia

- Rest of Latin America

Middle East & Africa

- Saudi Arabia

- UAE

- South Africa

- Israel

- Egypt

- Rest of MEA

Global Smart Homes Market: Competitive Landscape

The global smart homes market features a highly competitive landscape, dominated by leading technology and consumer electronics companies such as Amazon, Google, Apple, Samsung, and Honeywell, alongside specialized security and automation providers like ADT, Vivint, and Ring. These players compete through product innovation, integration of AI and IoT technologies, strategic partnerships, and expansion of online and offline sales channels.

Continuous development of advanced connected devices, energy-efficient solutions, and seamless interoperability across smart home ecosystems drives differentiation. Additionally, emerging regional players and startups are entering the market with niche solutions, intensifying competition and fostering innovation in security, lighting, HVAC, and wellness-focused smart home applications globally.

Some of the prominent players in the global Smart Homes market are:

- Amazon

- Google (Alphabet)

- Apple

- Samsung Electronics

- Honeywell International

- Schneider Electric

- Siemens AG

- Johnson Controls

- ABB Ltd.

- LG Electronics

- Panasonic Corporation

- Philips (Signify)

- ADT Inc.

- Assa Abloy

- Vivint Smart Home

- Comcast (Xfinity Home)

- Netatmo (Legrand)

- Ring (owned by Amazon)

- Ecobee

- Bosch

- Other Key Players

Global Smart Homes Market: Recent Developments

- August 2025: Amazon introduced the Echo Show 5 (3rd Gen), featuring enhanced sound quality and a more compact design, catering to users seeking an affordable yet efficient smart display for their homes.

- July 2025: Google launched the Nest Hub Max in Chalk (2-Pack), offering improved voice recognition and a sleek design, aiming to provide users with a seamless smart home experience.

- June 2025: Apple acquired a leading smart lighting company to bolster its HomeKit ecosystem, enhancing its portfolio of home automation products and services.

- May 2025: Samsung Electronics announced the acquisition of a smart security startup, aiming to expand its presence in the home security segment and integrate advanced surveillance technologies into its product offerings.

Report Details

| Report Characteristics |

| Market Size (2025) |

USD 151.2 Bn |

| Forecast Value (2034) |

USD 1,020.4 Bn |

| CAGR (2025–2034) |

23.6% |

| The US Market Size (2025) |

USD 47.0 Bn |

| Historical Data |

2019 – 2024 |

| Forecast Data |

2026 – 2034 |

| Base Year |

2024 |

| Estimate Year |

2025 |

| Report Coverage |

Market Revenue Estimation, Market Dynamics, Competitive Landscape, Growth Factors, etc. |

| Segments Covered |

By Product Type (Security & Access Control, Lighting Control, HVAC Control, Smart Appliances, Entertainment & Other Controls, Smart Kitchen, Home Healthcare & Wellness), By Installation Type (Retrofit Installations, New Construction), By Technology (Wireless Technologies, Wired Technologies), By Housing Type (Single-Family Homes, Multi-Family Homes), and By Sales Channel (Online Sales, Offline Sales) |

| Regional Coverage |

North America – US, Canada; Europe – Germany, UK, France, Russia, Spain, Italy, Benelux, Nordic, Rest of Europe; Asia-Pacific – China, Japan, South Korea, India, ANZ, ASEAN, Rest of APAC; Latin America – Brazil, Mexico, Argentina, Colombia, Rest of Latin America; Middle East & Africa – Saudi Arabia, UAE, South Africa, Turkey, Egypt, Israel, Rest of MEA |

| Prominent Players |

Amazon, Google (Alphabet), Apple, Samsung Electronics, Honeywell International, Schneider Electric, Siemens AG, Johnson Controls, ABB Ltd., LG Electronics, Panasonic Corporation, Philips (Signify), ADT Inc., Assa Abloy, Vivint Smart Home, Comcast (Xfinity Home), Netatmo (Legrand), Ring (Amazon), Ecobee, and Others. |

| Purchase Options |

We have three licenses to opt for: Single User License (Limited to 1 user), Multi-User License (Up to 5 Users), and Corporate Use License (Unlimited User) along with free report customization equivalent to 0 analyst working days, 3 analysts working days, and 5 analysts working days respectively. |

Frequently Asked Questions

The global smart homes market size is estimated to have a value of USD 151.2 billion in 2025 and is expected to reach USD 1,020.4 billion by the end of 2034.

The US smart homes market is projected to be valued at USD 47.0 billion in 2025. It is expected to witness subsequent growth in the upcoming period as it holds USD 284.3 billion in 2034 at a CAGR of 22.1%.

North America is expected to have the largest market share in the global smart homes market, with a share of about 37.0% in 2025.

Some of the major key players in the global smart homes market are Amazon, Google (Alphabet), Apple, Samsung Electronics, Honeywell International, Schneider Electric, Siemens AG, Johnson Controls, ABB Ltd., LG Electronics, Panasonic Corporation, Philips (Signify), ADT Inc., Assa Abloy, Vivint Smart Home, Comcast (Xfinity Home), Netatmo (Legrand), Ring (Amazon), Ecobee, and Others.

The market is growing at a CAGR of 23.6 percent over the forecasted period.