Market Overview

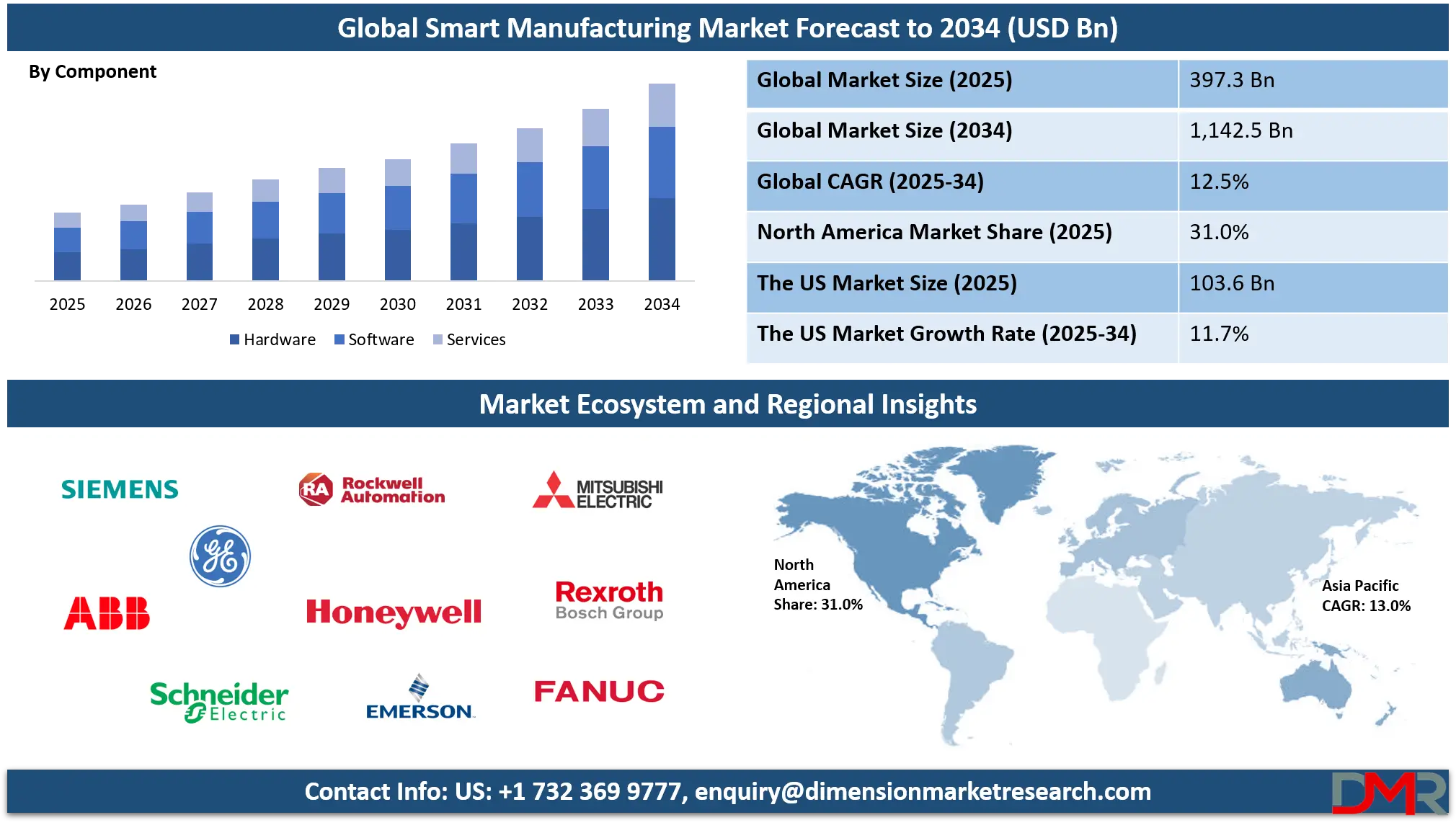

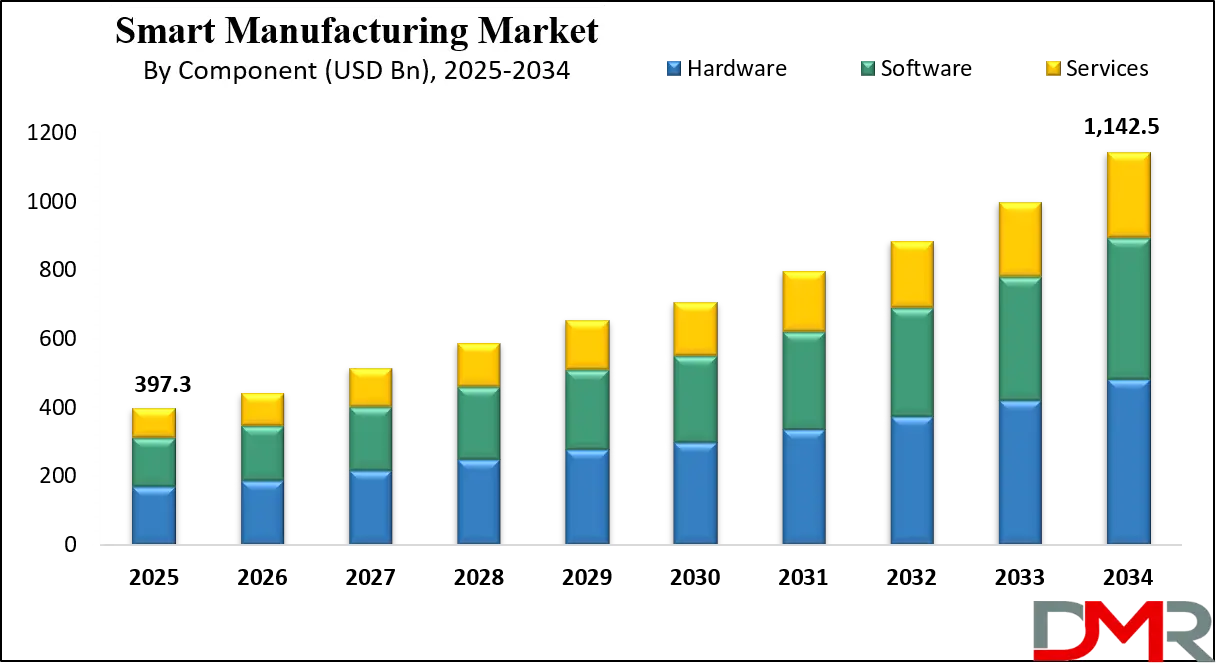

The Global Smart Manufacturing Market is projected to reach USD 397.3 billion in 2025 and grow to USD 1,142.5 billion by 2034, expanding at a CAGR of 12.5%. This growth is driven by increasing adoption of industrial automation, IIoT, AI-powered systems, and real-time data analytics across manufacturing industries.

Smart manufacturing refers to the integration of advanced technologies such as industrial IoT, artificial intelligence, robotics, and data analytics into manufacturing operations to create highly automated, data-driven production environments. It enables manufacturers to optimize supply chains, improve operational efficiency, and adapt to changing demands through real-time insights and machine-to-machine communication.

This digital transformation enhances decision-making, reduces downtime, and increases overall productivity by connecting physical production processes with intelligent digital systems. By adopting smart manufacturing practices, companies can achieve greater flexibility, enhanced quality control, and more sustainable production outcomes.

The global smart manufacturing market is experiencing significant momentum, driven by the rapid evolution of connected technologies and increasing demand for process automation across various industrial sectors. Manufacturers across automotive, aerospace, pharmaceuticals, and electronics industries are shifting toward smart factories that use predictive analytics, cloud computing, and digital twins to streamline production and enhance asset utilization. With the rise of Industry 4.0, the focus has shifted toward real-time data monitoring, remote diagnostics, and seamless communication between devices, making manufacturing ecosystems more resilient and agile.

In addition to improving operational efficiency, the smart manufacturing market is being propelled by the need to reduce operational costs and meet sustainability goals. Governments and regulatory bodies around the world are promoting the adoption of intelligent manufacturing through initiatives supporting digital infrastructure and green production. Emerging economies in Asia Pacific are becoming hotspots for smart factory investments due to their expanding industrial base and supportive policy frameworks. As manufacturers increasingly prioritize cyber-physical systems, edge computing, and autonomous decision-making, the smart manufacturing industry is poised for long-term growth and innovation.

The US Smart Manufacturing Market

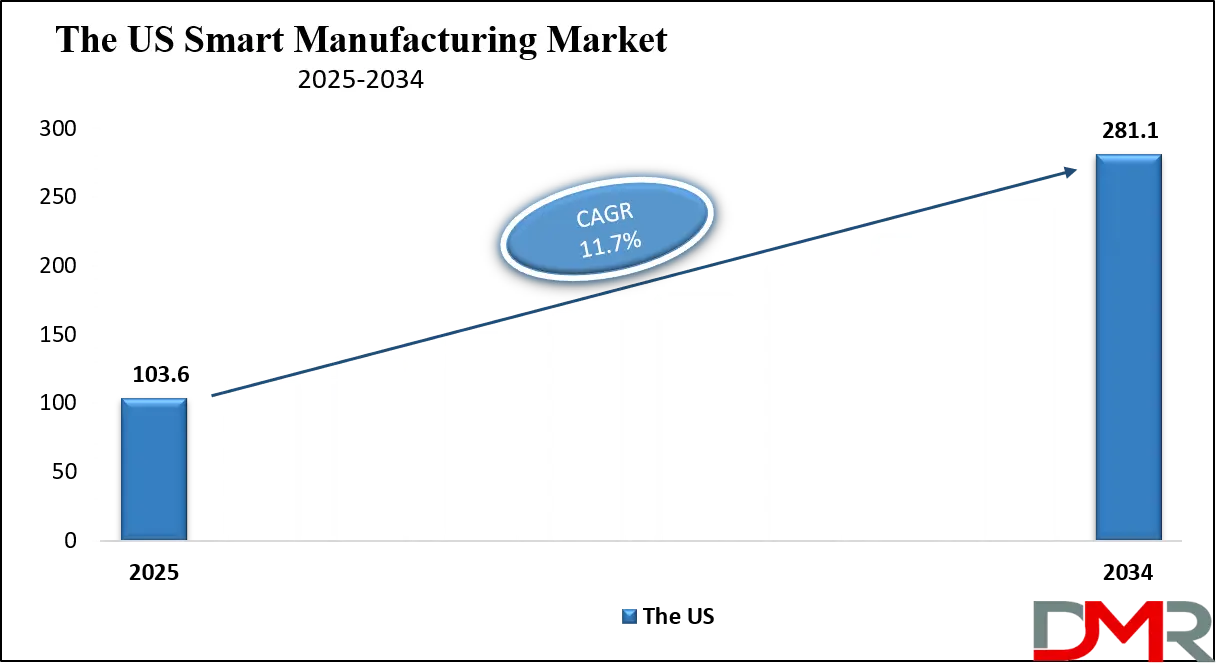

The U.S. Smart Manufacturing Market size is projected to be valued at USD 103.6 billion in 2025. It is further expected to witness subsequent growth in the upcoming period, holding USD 281.1 billion in 2034 at a CAGR of 11.7%.

The US smart manufacturing market is witnessing robust growth due to the country’s strong industrial base, early adoption of advanced manufacturing technologies, and significant investments in digital transformation. American manufacturers are increasingly implementing technologies such as industrial IoT, AI-driven analytics, robotics, and cloud-based MES (Manufacturing Execution Systems) to enhance productivity, reduce operational costs, and maintain global competitiveness.

Government-backed initiatives like Manufacturing USA and advanced manufacturing tax incentives are further accelerating the deployment of intelligent systems, digital twins, and cyber-physical infrastructure. With a focus on smart factories and connected supply chains, the US is rapidly transforming traditional production models into data-centric, automated ecosystems.

Additionally, the surge in demand for real-time monitoring, predictive maintenance, and advanced process control across sectors like automotive, aerospace, and electronics is fueling the adoption of smart manufacturing solutions. The integration of 5G connectivity, edge computing, and AI-powered decision-making is enabling US manufacturers to optimize throughput and minimize downtime.

Sustainability goals, coupled with a skilled tech-savvy workforce and a rise in reshoring efforts, are also contributing to the sector’s expansion. As the US continues to lead in innovation, the smart manufacturing landscape is expected to evolve further, with a growing emphasis on interoperability, secure data exchange, and scalable digital infrastructure.

Europe Smart Manufacturing Market

Europe's smart manufacturing market is expected to be valued at USD 103.2 billion in 2025. This strong regional positioning stems from Europe's mature industrial base, widespread adoption of Industry 4.0 practices, and strong policy support for digital transformation in manufacturing. Countries like Germany, the UK, and France are leading innovation in industrial automation, robotics, and advanced data analytics to enhance production efficiency and sustainability.

Initiatives such as "Made in Europe 2030" and the EU’s Digital Decade policy are accelerating the integration of smart technologies across sectors like automotive, aerospace, pharmaceuticals, and heavy machinery, where precision, compliance, and operational agility are essential.

The market is projected to grow at a compound annual growth rate (CAGR) of 11.2% from 2025 to 2034, driven by increasing investments in AI-powered manufacturing systems, digital twins, and cyber-physical infrastructure. European manufacturers are prioritizing the deployment of interconnected systems that leverage real-time data for predictive maintenance, energy optimization, and quality control.

Furthermore, the region's emphasis on sustainability and green manufacturing is fostering demand for smart solutions that reduce energy consumption and carbon emissions. With a highly skilled workforce, advanced R&D capabilities, and strong public-private partnerships, Europe is poised to remain a key driver in shaping the global smart manufacturing landscape.

Japan Smart Manufacturing Market

Japan's smart manufacturing market is projected to reach USD 17.8 billion in 2025. This position is underpinned by Japan’s long-standing reputation as a leader in precision engineering, robotics, and factory automation. The country has made significant advancements in integrating cyber-physical systems, real-time monitoring, and lean production methodologies across sectors such as automotive, electronics, and industrial machinery.

Japanese firms are increasingly adopting smart manufacturing solutions to address labor shortages, improve product quality, and enhance operational efficiency. Key corporations like FANUC, Mitsubishi Electric, and Yokogawa are at the forefront of this transformation, enabling the deployment of intelligent machines, edge computing, and AI-powered control systems.

With an estimated CAGR of 10.1% from 2025 to 2034, Japan's smart manufacturing market is set to experience steady growth driven by increasing investments in digital technologies, government-backed initiatives, and strategic partnerships across the manufacturing value chain. Programs such as the “Connected Industries” initiative are facilitating collaboration between manufacturing firms and technology providers to build resilient, data-driven production environments.

Additionally, Japan's focus on sustainability, quality improvement, and real-time decision-making is accelerating the adoption of IoT, digital twins, and autonomous systems. As Japan continues to modernize its industrial infrastructure, it remains a key contributor to innovation and competitiveness within the global smart manufacturing ecosystem.

Global Smart Manufacturing Market: Key Takeaways

- Market Value: The global smart manufacturing market size is expected to reach a value of USD 1,142.5 billion by 2034 from a base value of USD 397.3 billion in 2025 at a CAGR of 12.5%.

- By Component Segment Analysis: Hardware components are anticipated to dominate the component segment, capturing 42.0% of the total market share in 2025.

- By Deployment Mode Segment Analysis: On-Premise mode will dominate the deployment mode segment, capturing 57.0% of the market share in 2025.

- By Enterprise Size Segment Analysis: Large Enterprises are expected to maintain their dominance in the enterprise size segment, capturing 67.0% of the total market share in 2025.

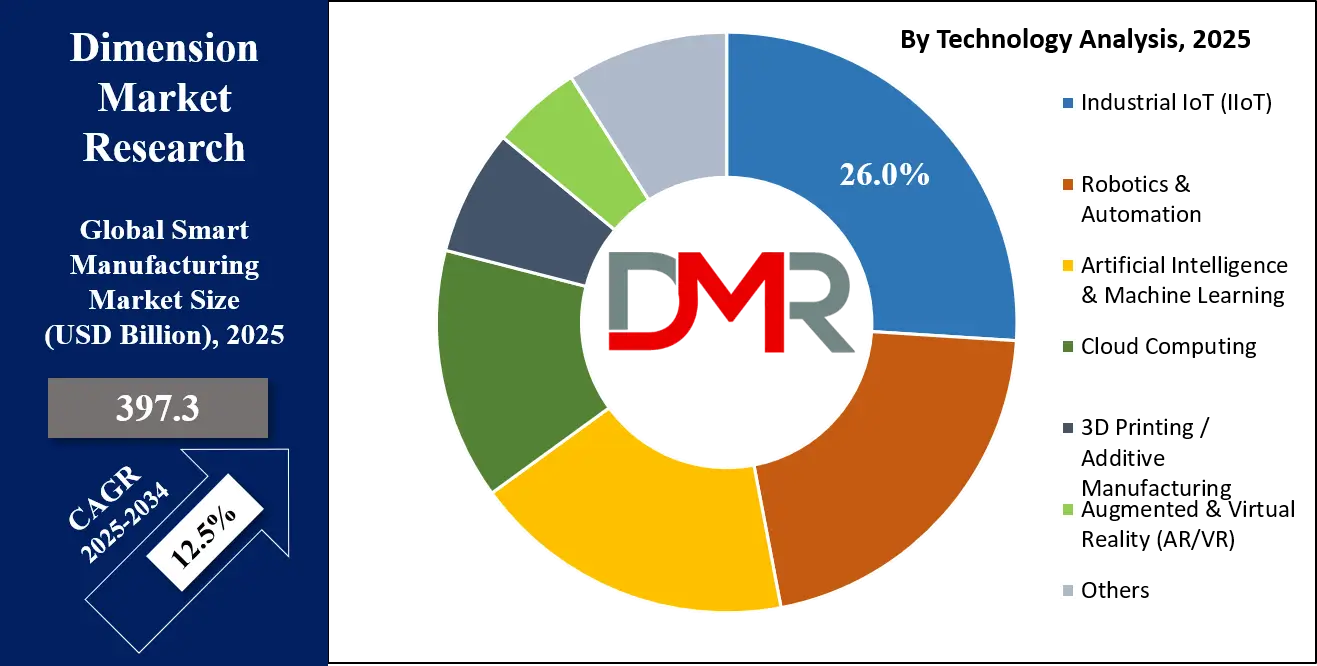

- By Technology Segment Analysis: Industrial IoT (IIoT) technologies are poised to consolidate their dominance in the technology segment, capturing 26.0% of the total market share in 2025.

- By Application Segment Analysis: Manufacturing Execution Systems (MES) applications will account for the maximum share in the application segment, capturing 19.0% of the total market value.

- By End-User Industry Segment Analysis: The automotive industry is expected to consolidate its dominance in the end-user industry segment, capturing 21.0% of the market share in 2025.

- Regional Analysis: North America is anticipated to lead the global smart manufacturing market landscape with 31.0% of total global market revenue in 2025.

- Key Players: Some key players in the global smart manufacturing market are Siemens AG, General Electric, ABB Ltd., Schneider Electric, Rockwell Automation, Honeywell, Emerson Electric, Mitsubishi Electric, Bosch Rexroth, FANUC, Yokogawa Electric, Cisco, IBM, and Others.

Global Smart Manufacturing Market: Use Cases

- Predictive Maintenance in Automotive Manufacturing: In the automotive sector, predictive maintenance powered by industrial IoT and AI is revolutionizing equipment management and reducing unexpected downtimes. By installing smart sensors on assembly lines and critical machinery, manufacturers can continuously monitor variables such as temperature, vibration, and pressure. These real-time data streams are analyzed using machine learning algorithms to detect anomalies and predict component failures before they occur. This approach minimizes unplanned maintenance, extends equipment lifespan, and significantly lowers operational costs. Leading automakers are integrating predictive analytics into their smart factories to maintain optimal uptime and streamline vehicle production cycles.

- Digital Twin for Process Optimization in the Aerospace Industry: Aerospace manufacturers are leveraging digital twin technology to create real-time, virtual replicas of aircraft components and complex manufacturing processes. These digital twins simulate production workflows, analyze performance, and forecast outcomes based on real-time data and historical insights. By integrating these systems with advanced PLM (Product Lifecycle Management) platforms, companies can optimize design iterations, reduce prototype development time, and enhance quality control. The aerospace industry benefits from this by accelerating time-to-market, ensuring regulatory compliance, and reducing costly rework or material waste. Smart manufacturing with digital twins supports high-precision and mission-critical production environments.

- Real-Time Quality Monitoring in Pharmaceutical Manufacturing: The pharmaceutical industry is adopting smart manufacturing to ensure compliance, product consistency, and safety through the use of real-time quality monitoring systems. With the integration of SCADA systems, AI-driven image recognition, and IoT-enabled sensors, manufacturers can continuously monitor key production parameters, including humidity, temperature, and chemical composition. These technologies enable immediate detection of deviations from standard protocols, allowing for instant corrective actions. Smart manufacturing platforms also streamline documentation and validation processes, aligning with stringent regulations from the FDA and EMA. This results in reduced batch failures, improved traceability, and efficient drug manufacturing.

- Smart Energy Management in Electronics Production: Electronics manufacturers are deploying smart energy management systems to optimize power usage and reduce carbon footprints in highly automated production facilities. By integrating IoT-enabled energy meters, cloud-based analytics platforms, and AI-driven control systems, companies gain visibility into real-time energy consumption patterns across machines and processes. These insights enable dynamic energy allocation, demand forecasting, and peak load management, which lowers utility costs and supports sustainability initiatives. Smart manufacturing in electronics also enhances production agility by synchronizing energy supply with automated production schedules, especially in semiconductor fabrication plants where energy demand is high.

Impact of Artificial Intelligence on the Smart Manufacturing Market

Artificial Intelligence (AI) is profoundly reshaping the smart manufacturing landscape by enabling data-driven decision-making, operational efficiency, and real-time process optimization. With the integration of AI technologies such as machine learning, computer vision, and natural language processing, manufacturers can automate complex tasks, predict equipment failures, and fine-tune production processes with minimal human intervention. AI enhances the capabilities of industrial IoT systems by analyzing massive volumes of sensor data to detect anomalies, optimize production flows, and ensure consistent product quality across manufacturing lines.

One of the most transformative impacts of AI in smart manufacturing is predictive maintenance, where intelligent algorithms forecast machinery failures before they occur, drastically reducing unplanned downtime and maintenance costs. AI-powered visual inspection systems are also revolutionizing quality control by detecting minute defects at speeds and accuracy levels far beyond human capability.

Additionally, AI drives demand forecasting and inventory optimization, helping manufacturers align production schedules with market needs, reduce waste, and enhance supply chain resilience. As AI continues to evolve, its integration with digital twins, edge computing, and cloud platforms will further accelerate the shift toward autonomous and adaptive manufacturing environments, making smart factories more agile, scalable, and competitive on a global scale.

Global Smart Manufacturing Market: Stats & Facts

European Commission (JRC Advanced Manufacturing Study & Circular Economy Annex)

- Number of EU firms in advanced manufacturing rose from 1,900 in 2009 to 4,500 in 2023, representing just over 10% of global advanced manufacturing firms.

- 72% of all advanced manufacturing firms globally are located in China, the US, or the EU.

- Around 60% of the EU’s advanced manufacturing firms are concentrated in Germany, Spain, France, and Italy.

- Within EU advanced manufacturing, 3D printing accounts for 39% of technological activity, the highest among technologies.

- Circular economy traceability requirements are driving digital transformation across EU industrial value chains.

Germany (U.S. Trade Administration Report)

- By 2025, 84% of German manufacturers are projected to invest approximately EUR 10 billion (USD 10.52 billion) annually in smart manufacturing technologies.

- Sector-specific investments include: automotive (EUR 1.2 billion/year), machinery & plant engineering (EUR 1.5 billion/year), electronics/microelectronics (EUR 817 million/year), and metalworking (EUR 424 million/year).

U.S. Department of Energy (National Smart Manufacturing Strategic Plan)

- Smart manufacturing technologies are forecasted to enhance productivity, increase energy efficiency, minimize waste and defects, and generate new manufacturing jobs in the U.S.

- The sector enables real-time energy savings and the integration of manufacturing systems with the electric grid through smart demand response.

NIST / Manufacturing USA (CESMII Program)

- CESMII (Clean Energy Smart Manufacturing Innovation Institute) is one of 16 national institutes supporting the development of Industry 4.0 solutions in the U.S.

- CESMII focuses on standardized models, data contextualization, and system interoperability to scale smart manufacturing adoption.

- CESMII promotes a Smart Manufacturing Mindset™, leveraging industrial AI and secure data-sharing across operations.

Maryland Department of Commerce (DOE-Funded Initiative)

- The U.S. Department of Energy awarded USD 1.01 million to Maryland to support the implementation of smart manufacturing technologies across small and medium-sized enterprises (SMEs).

South Korea Ministry of Economy, Trade and Industry

- South Korea supported 1,240 SMEs in building smart factories. Results included:

- 27.6% reduction in defects

- 7.1% faster prototyping cycles

- 29.2% reduction in production costs

European Commission (Chips Act & Green Deal)

- The European Chips Act (2023) aims to increase EU semiconductor production from less than 10% to 20% of global output by 2030, supported by EUR 43 billion in investment.

- Under the European Green Deal, the EU estimates EUR 350 billion annually is needed in additional green industrial investments through 2030 to meet its decarbonization goals.

Global Smart Manufacturing Market: Market Dynamics

Global Smart Manufacturing Market: Driving Factors

Rising Adoption of Industrial IoT and Connected Devices

The widespread integration of industrial IoT (IIoT) devices is a major driver of smart manufacturing. These connected sensors and actuators enable real-time data collection, asset tracking, and condition monitoring across factory floors. The ability to gather and analyze granular data from machines allows manufacturers to optimize production efficiency, reduce waste, and proactively manage maintenance schedules. IIoT also facilitates machine-to-machine communication, driving automation and intelligent decision-making within manufacturing ecosystems.

Demand for Operational Efficiency and Cost Reduction

Manufacturers are under constant pressure to reduce production costs while improving throughput and quality. Smart manufacturing systems equipped with AI-driven analytics and automated control platforms help achieve these goals by minimizing manual intervention, reducing downtime, and enhancing overall process visibility. These technologies empower enterprises to streamline their operations, balance supply-demand fluctuations, and respond faster to market changes, thus gaining a competitive edge.

Global Smart Manufacturing Market: Restraints

High Capital Investment and Integration Complexity

Despite its benefits, smart manufacturing involves substantial initial capital expenditure, especially for small and mid-sized enterprises. The cost of implementing advanced robotics, digital twin platforms, cloud infrastructure, and AI-based systems can be prohibitive. Additionally, integrating new technologies with legacy systems often requires extensive customization, workforce training, and time, delaying return on investment.

Cybersecurity and Data Privacy Concerns

With the proliferation of cloud-connected devices and digital supply chains, manufacturers face growing concerns over data breaches, ransomware, and industrial espionage. The increased attack surface from interconnected systems makes cybersecurity a critical challenge. Inadequate protection of sensitive production data and trade secrets can result in reputational and financial losses, deterring many companies from fully embracing digital transformation.

Global Smart Manufacturing Market: Opportunities

Expansion of AI and Machine Learning Applications

The increasing integration of AI and machine learning algorithms in manufacturing offers significant growth potential. From predictive quality analytics to intelligent supply chain optimization, AI-driven platforms can unlock new levels of precision and agility. As AI becomes more accessible through open platforms and cloud services, even mid-sized manufacturers can leverage its capabilities to drive innovation and performance.

Government Incentives and Industry 4.0 Initiatives

Governments across the globe are launching policies and funding programs to accelerate digital transformation in manufacturing. Initiatives like Germany's Industrie 4.0, Made in China 2025, and Manufacturing USA in the United States are encouraging companies to adopt smart technologies. These supportive frameworks are boosting investments in automation, data integration, and cyber-physical systems, creating new opportunities for technology providers and manufacturers alike.

Global Smart Manufacturing Market: Trends

Rise of Edge Computing in Smart Factories

A growing trend is the adoption of edge computing for faster and more secure data processing. Instead of sending all data to centralized cloud servers, edge computing enables real-time analytics directly at the device or machine level. This not only reduces latency but also enhances data privacy and operational responsiveness, especially in time-sensitive manufacturing processes such as robotics, CNC machining, and real-time defect detection.

Integration of Sustainable and Energy-Efficient Technologies

Sustainability is becoming a core focus in smart manufacturing, with companies deploying energy-efficient machinery, renewable energy management systems, and carbon tracking tools. Smart energy monitoring, combined with green manufacturing practices, is helping industries meet regulatory requirements and environmental goals. This trend is reshaping investment strategies as businesses aim to reduce their carbon footprint while maintaining high production standards.

Global Smart Manufacturing Market: Research Scope and Analysis

By Component Analysis

In the component segment of the smart manufacturing market, hardware components are expected to lead with a substantial 42.0% share of the total market in 2025. This dominance is primarily attributed to the increasing deployment of physical devices such as sensors, controllers, industrial robots, programmable logic controllers (PLCs), human-machine interfaces (HMI), and actuators across smart factories and automated production lines.

These hardware components form the foundational layer of industrial automation systems, enabling real-time data collection, machine-level communication, and seamless interaction between equipment. With the rise of Industry 4.0 and the expansion of industrial IoT infrastructure, manufacturers are investing heavily in advanced hardware to digitize their operations, boost efficiency, and reduce human intervention.

Alongside hardware, the software segment is playing a crucial role in shaping the future of smart manufacturing. Software platforms such as manufacturing execution systems (MES), enterprise resource planning (ERP), SCADA systems, and AI-based analytics tools are increasingly being adopted to enhance decision-making and process control. These solutions help manufacturers manage production workflows, monitor quality, predict maintenance needs, and gain insights from large volumes of operational data.

As the market evolves, cloud-based and modular software architectures are gaining popularity due to their scalability, remote accessibility, and ease of integration with existing systems. While hardware provides the infrastructure, it is the software that transforms raw data into actionable intelligence, making it a critical enabler of agile and intelligent manufacturing operations.

By Deployment Mode Analysis

In the deployment mode segment of the smart manufacturing market, on-premise solutions are projected to dominate with 57.0% of the market share in 2025. This preference is largely due to the need for greater control, data security, and customization in industrial environments. Manufacturers operating in highly regulated sectors such as pharmaceuticals, aerospace, and defense often require on-premise systems to meet strict compliance standards and safeguard sensitive operational data. These deployments allow direct oversight of software and hardware infrastructure, minimizing external vulnerabilities and enabling real-time processing with minimal latency.

Additionally, legacy systems in traditional factories are often more compatible with on-premise configurations, making them a more practical and immediate choice for large-scale enterprises undergoing digital transformation.

On the other hand, cloud-based deployment is gaining significant momentum as manufacturers seek flexibility, scalability, and cost-efficiency. Cloud platforms offer remote access to manufacturing data and applications, enabling centralized monitoring and coordination across multiple facilities. This approach is especially beneficial for small and medium-sized enterprises (SMEs) that may lack the resources for extensive on-site IT infrastructure. Cloud-based solutions support faster implementation, real-time collaboration, and seamless software updates, which are essential for maintaining agile production workflows.

Moreover, with the integration of AI, machine learning, and big data analytics, cloud-based smart manufacturing systems are becoming more sophisticated, allowing companies to gain deeper insights and drive continuous improvement across the production cycle. While on-premise remains dominant, the cloud-based segment is expected to grow rapidly as concerns over security and data compliance are increasingly addressed by advanced cloud architectures.

By Enterprise Size Analysis

In the enterprise size segment of the smart manufacturing market, large enterprises are expected to retain their dominance by accounting for 67.0% of the total market share in 2025. These organizations typically have the financial strength, infrastructure, and strategic vision required to invest in advanced technologies such as industrial IoT, AI-powered analytics, robotics, and digital twin systems. Large enterprises often operate across multiple sites and regions, making the need for centralized control, real-time monitoring, and automated processes even more critical. Their commitment to improving operational efficiency, reducing production costs, and enhancing supply chain transparency has led to substantial investments in end-to-end smart manufacturing ecosystems.

Additionally, large manufacturers are more likely to adopt integrated platforms for predictive maintenance, quality control, and enterprise resource planning, giving them a significant edge in scalability and performance.

Meanwhile, small and medium-sized enterprises (SMEs) are gradually increasing their presence in the smart manufacturing market, though they currently account for a smaller share. SMEs often face budget constraints, limited IT infrastructure, and a lack of skilled personnel, which can hinder the adoption of complex automation systems. However, the growing availability of affordable, modular, and cloud-based smart manufacturing solutions is helping to bridge this gap.

These flexible technologies allow SMEs to start with specific applications, such as asset monitoring or production scheduling, and expand gradually as their operations grow. Government incentives, digital transformation grants, and rising competition are also pushing SMEs to embrace smart technologies to remain agile and competitive in both domestic and global markets. As awareness and access to innovation increase, the SME segment is expected to witness steady growth in the coming years.

By Technology Analysis

In the technology segment of the smart manufacturing market, industrial IoT (IIoT) is expected to hold a leading position, capturing 26.0% of the total market share in 2025. IIoT technologies play a pivotal role in connecting machines, devices, and systems across manufacturing environments, enabling real-time data exchange and process automation. By integrating smart sensors, connected devices, and communication protocols, IIoT allows manufacturers to monitor equipment health, optimize resource utilization, and enhance decision-making through data-driven insights.

This level of connectivity supports predictive maintenance, remote diagnostics, and agile production adjustments, making IIoT a foundational element in smart factory ecosystems. Its ability to improve transparency, traceability, and operational control continues to drive its widespread adoption across industries such as automotive, electronics, and energy.

Alongside IIoT, robotics and automation technologies are playing a critical role in transforming manufacturing operations. This segment encompasses industrial robots, collaborative robots (cobots), and automated guided vehicles (AGVs) that perform repetitive, high-precision tasks with speed and consistency. Robotics and automation help manufacturers reduce human error, enhance product quality, and increase throughput across production lines. The growing demand for mass customization, labor shortage challenges, and the push for cost-efficiency are accelerating the deployment of robotic systems across various manufacturing sectors.

Additionally, the integration of AI and machine learning into robotic platforms is enabling adaptive behavior, real-time response, and safer human-robot collaboration, further expanding their use in dynamic production environments. While IIoT provides the digital infrastructure, robotics and automation deliver the physical execution, together forming a powerful combination that drives the future of smart manufacturing.

By Application Analysis

In the application segment of the smart manufacturing market, manufacturing execution systems (MES) are projected to hold the largest share, accounting for 19.0% of the total market value in 2025. MES solutions play a central role in bridging the gap between enterprise-level planning systems and plant-floor operations. These platforms provide real-time visibility into production activities, enabling manufacturers to monitor, track, document, and control the entire manufacturing process from raw materials to finished goods.

By integrating with ERP systems, MES helps optimize production scheduling, ensure quality compliance, manage labor resources, and reduce cycle times. The rising need for operational transparency, agility, and regulatory adherence across sectors like automotive, pharmaceuticals, and electronics has significantly boosted the demand for MES as a core component of smart factory infrastructure.

SCADA systems, or supervisory control and data acquisition systems, also form a vital part of the smart manufacturing landscape. These applications are used to monitor and control industrial processes by collecting real-time data from remote equipment and machinery. SCADA systems support decision-making by providing operators with detailed insights into system performance, fault detection, and equipment status across distributed facilities.

Their ability to enable centralized supervision, remote troubleshooting, and historical data logging makes them particularly valuable in industries like oil and gas, utilities, and chemical manufacturing. As smart factories continue to evolve, SCADA systems are being enhanced with advanced analytics, cloud integration, and cybersecurity features, allowing for greater scalability and efficiency in complex industrial environments. Together with MES, SCADA systems help manufacturers build a connected, responsive, and data-driven production ecosystem.

By End-Use Industry Analysis

In the end-user industry segment of the smart manufacturing market, the automotive industry is anticipated to maintain a leading position by capturing 21.0% of the total market share in 2025. Automotive manufacturers are at the forefront of adopting smart manufacturing technologies due to their continuous drive for operational efficiency, quality improvement, and mass customization. With increasing demand for electric vehicles, connected cars, and autonomous driving systems, automakers are leveraging industrial IoT, robotics, AI, and digital twins to enhance production precision, streamline supply chains, and accelerate time-to-market.

Smart factories in the automotive sector are characterized by high levels of automation, real-time monitoring, and flexible assembly lines that allow for rapid changes in product design and configuration. Additionally, predictive maintenance and energy optimization are widely implemented to reduce downtime and lower operational costs.

The electronics and semiconductor industry also plays a significant role in the adoption of smart manufacturing, driven by the need for precision, speed, and scalability in production processes. As the complexity of electronic components increases, manufacturers are embracing automation, machine learning, and advanced analytics to improve yield rates, reduce defects, and maintain quality control across micro-scale production environments.

Cleanroom automation, robotic wafer handling, and real-time equipment monitoring are becoming standard practices in semiconductor fabs. Furthermore, the rapid innovation cycle in consumer electronics requires highly agile and data-centric manufacturing systems that can respond to fluctuating demand and shortened product life cycles. The integration of smart manufacturing in this sector enables faster prototyping, enhanced process control, and improved supply chain visibility, helping companies stay competitive in a fast-paced global market.

The Smart Manufacturing Market Report is segmented on the basis of the following:

By Component

- Hardware

- Software

- Services

By Deployment Mode

By Enterprise Size

By Technology

- Industrial IoT (IIoT)

- Robotics & Automation

- Artificial Intelligence & Machine Learning

- Cloud Computing

- 3D Printing / Additive Manufacturing

- Augmented & Virtual Reality (AR/VR)

- Edge Computing

- Others

By Application

- Manufacturing Execution Systems (MES)

- SCADA Systems

- Enterprise Resource Planning (ERP)

- Product Lifecycle

- Inventory & Warehouse Management

- Quality Management Systems

- Predictive Maintenance

- Others

By End-Use Industry

- Automotive

- Electronics & Semiconductors

- Aerospace & Defense

- Food & Beverages

- Pharmaceuticals

- Metals & Mining

- Oil & Gas

- Chemicals

- Energy & Utilities

- Others

Global Smart Manufacturing Market: Regional Analysis

Region with the Largest Revenue Share

North America is expected to lead the global smart manufacturing market in 2025, accounting for 31.0% of the total market revenue. This regional dominance is fueled by the presence of technologically advanced manufacturing hubs, widespread adoption of industrial IoT, and strong investments in automation, AI, and data-driven manufacturing solutions. The United States, in particular, has seen significant government support through initiatives like Manufacturing USA and increasing private sector efforts to modernize legacy systems.

Key industries such as automotive, aerospace, and electronics are heavily investing in smart factory technologies to enhance productivity, ensure quality compliance, and maintain global competitiveness. Additionally, the region’s robust digital infrastructure and focus on innovation make it a key driver of next-generation manufacturing practices.

Region with significant growth

Asia Pacific is projected to witness the most significant growth in the smart manufacturing market over the coming years, driven by rapid industrialization, government-led digital transformation initiatives, and the rising adoption of automation technologies across emerging economies like China, India, and Southeast Asia. The region’s strong manufacturing base in sectors such as electronics, automotive, and consumer goods is fueling demand for industrial IoT, robotics, and AI-powered production systems. Strategic initiatives like China’s "Made in China 2025" and India’s "Digital India" are encouraging both local and global manufacturers to invest in smart factory solutions. Additionally, the growing presence of technology providers, cost-effective labor, and expanding infrastructure are positioning Asia Pacific as a key growth engine in the global smart manufacturing landscape.

By Region

North America

Europe

- Germany

- The U.K.

- France

- Italy

- Russia

- Spain

- Benelux

- Nordic

- Rest of Europe

Asia-Pacific

- China

- Japan

- South Korea

- India

- ANZ

- ASEAN

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Argentina

- Colombia

- Rest of Latin America

Middle East & Africa

- Saudi Arabia

- UAE

- South Africa

- Israel

- Egypt

- Rest of MEA

Global Smart Manufacturing Market: Competitive Landscape

The global competitive landscape of the smart manufacturing market is characterized by intense innovation, strategic collaborations, and technological advancement among leading players aiming to gain a competitive edge. Major companies such as Siemens AG, General Electric, ABB, Schneider Electric, and Rockwell Automation are continuously investing in R&D to enhance their digital manufacturing platforms, integrate AI, and expand their industrial IoT capabilities. These players are also engaging in mergers, acquisitions, and partnerships to strengthen their global presence and offer end-to-end smart factory solutions.

Meanwhile, tech giants like IBM, Cisco, Oracle, and SAP are bringing advanced analytics, cloud computing, and machine learning into manufacturing ecosystems, blurring the lines between IT and OT (operational technology). The market also features strong competition from regional players and niche providers offering customized solutions, particularly in Asia and Europe. As digital transformation accelerates, companies that deliver scalable, secure, and interoperable solutions are likely to shape the future of the smart manufacturing industry.

Some of the prominent players in the global smart manufacturing market are:

- Siemens AG

- General Electric (GE)

- ABB Ltd.

- Schneider Electric

- Rockwell Automation

- Honeywell International Inc.

- Emerson Electric Co.

- Mitsubishi Electric Corporation

- Bosch Rexroth AG

- FANUC Corporation

- Yokogawa Electric Corporation

- Cisco Systems, Inc.

- IBM Corporation

- Oracle Corporation

- SAP SE

- Intel Corporation

- Dassault Systèmes

- PTC Inc.

- 3D Systems Corporation

- Stratasys Ltd.

- Other Key Players

Global Smart Manufacturing Market: Recent Developments

Product Launches

- July 2025: ZKH Group officially commissioned its Taicang smart manufacturing base in China, setting a new benchmark for integrated R&D and production systems.

- June 2025: LG launched a new smart factory solutions business built on its 60+ global manufacturing sites, focusing on intelligent manufacturing optimization.

Mergers & Acquisitions

- July 2025: Industry metrology specialist FARO received shareholder approval to merge with AMETEK, consolidating its position in precision manufacturing.

- July 2025: Synopsys finalized its acquisition of Ansys for USD 35 billion, creating an end-to-end design and simulation powerhouse for industrial and electronics markets.

Funding & Investments

- July 2025: Defense-tech manufacturer Hadrian secured a USD 260 million debt and equity infusion to build a 270,000 sq ft robotic factory focused on aerospace and defense components.

- July 2025: Composite manufacturing startup Fabheads raised USD 10 million in debt and equity from Accel to scale its advanced materials production capabilities.

Report Details

| Report Characteristics |

| Market Size (2025) |

USD 397.3 Bn |

| Forecast Value (2034) |

USD 1,142.5 Bn |

| CAGR (2025–2034) |

12.5% |

| The US Market Size (2025) |

USD 103.6 Bn |

| Historical Data |

2019 – 2024 |

| Forecast Data |

2026 – 2034 |

| Base Year |

2024 |

| Estimate Year |

2025 |

| Report Coverage |

Market Revenue Estimation, Market Dynamics, Competitive Landscape, Growth Factors, etc. |

| Segments Covered |

By Component (Hardware, Software, and Services), By Deployment Mode (On-Premise and Cloud-Based), By Enterprise Size (Large Enterprises and SMEs), By Technology (Industrial IoT, Robotics & Automation, AI & ML, Cloud Computing, 3D Printing, AR/VR, Edge Computing, and Others), By Application (MES, SCADA Systems, ERP, Product Lifecycle, Inventory & Warehouse Management, Quality Management Systems, Predictive Maintenance, and Others), and By End-Use Industry (Automotive, Electronics & Semiconductors, Aerospace & Defense, Food & Beverages, Pharmaceuticals, Metals & Mining, Oil & Gas, Chemicals, Energy & Utilities, and Others). |

| Regional Coverage |

North America – US, Canada; Europe – Germany, UK, France, Russia, Spain, Italy, Benelux, Nordic, Rest of Europe; Asia-Pacific – China, Japan, South Korea, India, ANZ, ASEAN, Rest of APAC; Latin America – Brazil, Mexico, Argentina, Colombia, Rest of Latin America; Middle East & Africa – Saudi Arabia, UAE, South Africa, Turkey, Egypt, Israel, Rest of MEA |

| Prominent Players |

Siemens AG, General Electric, ABB Ltd., Schneider Electric, Rockwell Automation, Honeywell, Emerson Electric, Mitsubishi Electric, Bosch Rexroth, FANUC, Yokogawa Electric, Cisco, IBM, and Others. |

| Purchase Options |

We have three licenses to opt for: Single User License (Limited to 1 user), Multi-User License (Up to 5 Users), and Corporate Use License (Unlimited User) along with free report customization equivalent to 0 analyst working days, 3 analysts working days, and 5 analysts working days respectively. |

Frequently Asked Questions

The global smart manufacturing market size is estimated to have a value of USD 397.3 billion in 2025 and is expected to reach USD 1,142.5 billion by the end of 2034.

The US smart manufacturing market is projected to be valued at USD 103.6 billion in 2025. It is expected to witness subsequent growth in the upcoming period as it holds USD 281.1 billion in 2034 at a CAGR of 11.7%.

North America is expected to have the largest market share in the global smart manufacturing market, with a share of about 31.0% in 2025.

Some of the major key players in the global smart manufacturing market are Siemens AG, General Electric, ABB Ltd., Schneider Electric, Rockwell Automation, Honeywell, Emerson Electric, Mitsubishi Electric, Bosch Rexroth, FANUC, Yokogawa Electric, Cisco, IBM, and Others.

The market is growing at a CAGR of 12.5 percent over the forecasted period.